富爸爸PPT

《富爸爸21世纪的生意》读书笔记思维导图PPT模板下载

第9章 资 产一:真 实世界的 生意教育

04

第10章 资产二: 个人发展 的捷径

05

第11章 资产三: 一群和你 有着共同 梦想和...

06

第12章 资产四: 网络的力 量

第13章 资产 五:可复制、

1

升级的生意模

式

第14章 资产 2

六:无与伦比 的领导力

3 第15章 资产

七:创造财富 的机制

目录

07 财商教育三部曲

09

欲购“富爸爸”产品, 请与我们联系

经济学家和教育专家

08 共同打造的少儿财商 教育... 《纽约时报》《商业

010 周刊》《华尔街日报》 《...

许多人梦想过上财务自由的生活,朝九晚五的上班下班肯定与这个梦想背道而驰。成功创业可能是实现梦想 的捷径,但是实现这个梦想的过程中,有人缺少创业激情,有人缺少启动资金,有人缺少创业能力……有没有一 种生意,能让你在不具备以上条件的情况下,也能帮你圆这个“创业梦”呢?“富爸爸”图书系列作者罗伯特·清 崎告诉我们:“一旦你懂得了金钱的运作方式,知道在21世纪你所能拥有的各种生意机会,你就可以开始过上你 梦想的生活。”他所谓的生意机会就是“网络营销”。“网络营销”是适合我们的创业模式。它是真实世界的生 意教育,是个人创富捷径。在这种生意模式下,你可以利用业余时间,凭借你的人际关系网的力量,和一群与你 有着共同梦想和价值观的朋友合作,不断扩大和发展你的团队,在追求梦想的过程中,打造你的领导力,实现梦 想,过上财务自由的生活。

出版人的话

献词

致谢

第一部分 掌握自己的未来

01

第1章 规 则已经变 了

02

第2章 硬 币的另一 面

03

第3章 你 生活在哪 个象限

财商富爸爸之财务自由之路PPT课件

安利--财务自由之路

财务安全 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

“S”的 第二种

安利--财务自由之路

财务自由 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

安利--财务自由之路

作者推荐 的道路

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

安利--财务自由之路

财务安全 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

“E”的 第一种

安利--财务自由之路

财务安全 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

“E”的 第二种

安利--财务自由之路

财务安全 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

“S”象限的话:“我的工资是1小时35美元。” “我的正常佣金是总价的6%。” “看起来我找不到想做这项工作并能把这项 工作做好的人。”

安利--财务自由之路

第一部分 现金流象限

不同的象限……不同的人们

“B”象限的话:“我正在找一个新总 裁来管理我的公司。”

“I”象限的话:“我的现金流是基于 内部收益率还是净收益率呢?”

有钱与富有的差别

支出

资产负债表

资产

负债

安利--财务自由之路

第一部分 现金流象限

不同的象限……不同的人们

收支平衡表 收入

有钱与富有的差别

支出

资产负债表

资产

负债

安利--财务自由之路

穷爸爸

学校

第一部分 现金流象限

人们为什么选择安全 而不选择自由?

安利--财务自由之路

富爸爸穷爸爸 (罗伯特·清崎)PPT模板

第一课 富人不 为钱工作

第一课 富人不为 钱工作

穷人和中产阶级为钱而工作。富 人让钱为他工作。

第一课 富人不为钱工作

决断性

世界发展正在变得越来越快。股市交易都以毫秒计。交易在几分钟内即可 上网。越来越多的人在竞争好买卖。所以你做出决定的速度越快,抓住机 会的可能性就越大——当然是在别人做决定之前。

休。

你为政府工作。政 府在你还未看到自 己的工资时就已拿 走了一部分,你努 力工作,其结果是 使政府的税收增加。 实际上大多数人每 年从1月到5月都是 在为政府白白工作。

你为银行工作。缴 了税后,你的最大 支出应该是抵押贷 款和信用卡账单了。

第二课 为什么要 教授财务知识

财富就是支撑一个人生存多长时 间的能力,或者说,如果我今天 停止工作,我还能活多久?

中产阶级购买自以为是资产的负债 分支主题

富人买入资产 分支主题

第二课 为什么要 教授财务知识

所得等级攀升 - 钱挣得越多,缴 税也越多

第二课 为什么要教授财务知识

日本人注重三种力量:剑、宝石和镜子。

9,300 Million

单击此处添加标题

单击此处输入你的正文,文字是您思想 的提炼,为了最终演示发布的良好效果, 请尽量言简意赅的阐述观点;根据需要 可酌情增减文字,以便观者可以准确理 解您所传达的信息。

第一课 富人不为钱工作

运用感情作长远打算,别让感情控制了思想

当情感占据上风时,理智就会下降

讨论学习环节

01

左脑时刻

尽管有一份高收入的工 作,像罗伯特的穷爸爸 一样的人仍只能勉强维 持着收支平衡。

02

右脑时刻

用一个新颖的、具有创 造性的方法去看待废弃 的连环画可以带来的商 机。

36富爸爸成人现金流游戏PPT课件

负债

1 MYT4U

2 200

3 20

动产包含:股票、共同基金、存单、金币等

21

l 出售动产

计算销售额: 销售额 = 股数x卖出价 以现金的方式从银行取得 销售款 例: 卖出MYT4U200股,售价$30 销售额=200×30=6,000

嫂子借钱 • 不动产:2室1厅、3室2厅、荒地 • 企 业:小企业(兼职办公司)

9

二、现金流游戏的组成部分

Ø 大买卖卡(42张)

• 建议手中持有美金6000元以上使用 • 不动产:3室2厅、多室公寓楼、土地 • 企 业:自动化企业、有限公司、洗车店、

购物商场、小旅馆、比萨饼店

10

二、现金流游戏的组成部分

经理 • 高收入职业:律师、飞机驾驶员、医生

12

二、现金流游戏的组成部分 Ø 财务报表

老 鼠 道 跑 圈

快 车 道

13

三、现金流游戏的规则

Ø 游戏开始前要做的事: l 在游戏板相应位置上放置好机会卡(小生意卡和大买卖卡)、市场风云卡和 额外支出卡 l选择您的游戏塑料件,包括老鼠、奶酪和代用筹码(每个人的各种塑料件必须 选用同样的颜色) l 发给每位玩家一张游戏记录卡(损益表/资产平衡表) l 每位玩家抽一张职业卡 l 每位玩家将职业卡上的信息抄录到各自的游戏记录卡上(财务上规范写法) l 同您的审计师(坐在您右边的玩家)见面,帮您审计

不必额外支付。

9 +240 1 2室公寓 2 8,000 3 50,000 4 2室公寓42,000

19

l 卖出不动产

游戏记录卡

市场风云卡

求购公寓房

公寓房不论大小,每套出价$45,000,使用自有 资金购买。﹝其纳税递延时间已过﹞

富爸爸穷爸爸

投资

资本

时间(天赋自 用),金钱 (自获自用)。

余销

生活,工作, 娱乐。

01

02

03

04

标的

健康(身体),知识 (大脑),社交(情 感),事业(理想)。

Байду номын сангаас

知识

工作技能(劳生 钱),投资技能 (钱生钱)。

02

一个

一个

01

把工资投资于资产项,再用资产 项为我生产出来的钱,购买我想

要的东西。

02

变富有的关键是拥有尽快将劳动 性收入转换成被动收入或投资组 合收入的能力。

的富人。

在投资方面大部分 人选择的是直接去 投资,而不是首先 投资于学习如何投

资。

其实你根本就不知 道什么价格才是

“合适”的,除非 有另一处同样的交 易作为参照。 做 买卖就是一场有趣 的游戏,已提出报 价之后,可能对方

就会说:成交。

06

资产

资产

01

02

03

04

05

我们唯一的也是 最重要的资产, 是我们的头脑。

财商的知识构成:

1、会计。 2、投资。 3、了解市场。 4、 法律。

感谢聆听

富爸爸穷爸爸

演讲人

2 0 2 0 - 11 - 2 4

目录

01. 概述 03. 名词 05. 投资 07. 数列

02. 一个 04. 认知 06. 资产

01

概述

概述

减少支出,避免背负过大的债务,将劳动性所得投入资 产项,再用资产项产出的现金流消费。

概述

最重的是大脑投资,先学投资知识(财商),再投资。

05

投资

投资

01

02

富爸爸财务自由之路读书笔记PPT课件

• P98营销系统、财会系统,以及销售系统、人力资源系统、法律系统等众多 系统,而这些系统都是企业生存和成功所必须的。

• 通常不是你了解的系统发生了问题,而是你并不熟悉的系统导致了你的失败。 • 所以,建立一个经得起考验的真正的商业系统并不容易,因为你忘记或者忽

视的系统将导致你破产和毁灭。这也是我很少投资于仅仅有新产品或新想法 的E或S的愿意。职业投资人愿意投资与被验证过的系统,并且这个系统要有 一个知道如何操作它的人。因此,如果银行只把钱贷给被验证过的真正的系 统,并寻找能够经营它们的人,那么你也应该做同样的事情,如果你想成为 一个聪明的投资者的话。 • p102 1.想要成功,你需要克服害怕被拒绝的心里,不必过多地考虑他人对 你的评价。 • 2.学会领导别人.与人和睦相处并激励他人的能力是一项非常宝贵的技能, 而这种技能完全是可以学会的。

理和会计师都是E或者S。换句话说,他们的收入来自他们的 专业工作,而不是来自他们所拥有的资产。

第2页/共25页

• P49 因此,从I象限挣钱的人的主要特点是把精力集中在用钱挣钱上。 • P51 对于投资者来说,投资是一种技能游戏。 • P57 “多元化”。寻求安全性的人们经常用“多元化”这个词。为什么?

• 我的有学问的爸爸经营特许经营店没有成功。尽管他购买的是一家有名的高 级冰激凌公司的特许经营权,而且系统非常完美,但我爸爸还是失败了。在 我看来,他失败的原因是他的合伙人都是E和S,不知道当事情变糟时应该做 什么,也不去向母公司寻求帮助。结果合伙人内部发生了争执,企业破产倒 闭。他们忘了,一个真正的B不只有一个系统就行,还需要有优秀的人去操 作这个系统。

因为多元化战略是一个“不亏损”的投资战略.但它并不是一个挣钱的投 资战略,成功的或者富有的投资者并不使用多元化投资战略。他们更注 重自己的努力。 • P58 我们相信,证券集中化的策略会使投资者考虑一系列问题,如企业 的实力、投资者在买进之前对企业财务状况的满意度,这样做反而可以 减少风险。 • 也就是说,巴菲特认为证券集中化或者说集中于几种投资而不是实行多 元化投资是一种更好的投资战略。他的理念是,集中化而不是多元化要 求你更聪明,在思想上和行动上更激进。他在文章中写到,普通投资者 避免波动是因为他们认为波动是有风险的,而“事实上,真正的投资者 喜欢波动”。 • P59 不要躲避风险,要学会如何驾驭风险。 • 敢于冒险的人改变着这个世界,几乎没有不冒任何风险就变富的人。 • P60 不管你如何决定,请记住这点,财务自由虽然自由,却来之不易。 这话总自由是有价的—但对我来说,它值这个价。最大的秘诀是:其实 走上财务自由之路不用花钱也不一定非要受过高等教育,甚至也没有太 大的风险。这种自由的价格是用我们的梦想、渴望和战胜一路上不停袭 来的失意的能力来计量的.你,愿意支付这个价格吗?

早会案例----富爸爸PPT优秀课件

——罗伯特•T•清崎和莎伦•L•莱希特合著

2021/6/3

1

买保险是资产还是负债

2021/6/3

2

〈富爸爸、穷爸爸〉第一个核心

观点就是资产和负债

什么是资产?——就是“能把钱放进你 口袋里的东西。

什么是负债?——就是“把钱从你口 袋里取走的东西”

2021/6/3

3

富人为什么越来越富,因为他们 只买进入资产,穷人为什么越来越穷, 因为他们只有支出,中产阶段为什么 不能突破财务困境,因为他们买进了 自认为是资产的负债。

2021/6/3

6

它主要提供储 蓄和保障功能,储蓄 功能当然是资产,直接 可以创造财富。

2021/6/3

7

投资型险种:

投资型险种主要提 供投资功能,显而易见是 资产,能够不断地提供收 入,实现现金循环。

2021/6/3

8

所以说:

人是钱为你工作, 穷人是你为钱干活。”

经营,原始收入有了,现在的问题是

如何把收入变成资产,把资产再变成

收入,实现钱为自己工作。

然而寿险是人脉的经营,做保险

的优势就在于可以在创造物质资产的

同时创造“人际资产”最终可将其转

化为物质财富。

2021/6/3

13

部分资料从网络收集整 理而来,供大家参考,

感谢您的关注!

现金原始动力还十分微弱,如果现在不为

钱而工作,永远也不会有钱为你工作的时

候和机会,打工不是你一辈子的目的,但

他是一段很好的时光。

保险不需要太多的投入,是真正的收

入起点:因为它青睐勤劳之人,原始收入

累计速度很快。 2021/6/3

12

还有一类业务伙伴可以比喻为植

富爸爸、穷爸爸_PPT

不要为金钱而工作

世界上到处都是精明,才华横溢,受过良好教育以 及很有天赋的人, 他们收入很低, 因为他们只有一项 技能, 只能努力工作

财商由四个方面的专门知识构成:

1. 2. 3. 4. 会计----财务知识, 你管理的钱越多,就越需要精确 投资----钱生钱的科学 市场营销----供给与需求的科学 法律----有效运营并爆炸性增长(走-飞)

工作到底是为了什麽!

富人与穷人的分歧:

面对一份廉价的工作: 穷人:1、接受,还要微笑,再找两份 等待可能永远不到的机会; 2、辞职,找高薪工作,以为可以解决问题; 富人:3、思考致富——工作到底为了什麽!

你如何选择?

穷人与中产阶级为钱工作:

很多人进大学受到很好的教育,为的是得到 一份高薪的工作,但还是为钱所困,原因是在 学校从未学习到关于钱的知识,而最大的问题 是——他相信工作就是为了钱。 害怕付不起帐单、没有足够的钱、挨饿等, 所以期望一份稳定的工作,拼命为钱工作,成 了钱的奴隶。如此度过一生。

为什麽要教授财务知识

种下一棵树 年复一年地浇灌 终有一天不再需要你的照料,可以自己生长 它的根已足够深 你可以开始享受它的树荫了 从长期来看,重要的不是你挣了多少钱 而是要看你能留下多少钱,以及留住了多久 关注你最大的财富----所受的教育 保持开放的头脑并不断学习 你将在这些变化中一天比一天富有 基础 6英寸厚的水泥板----盖郊区小屋 ----建造帝国大厦?!

规则1: 明白资产和负债的区别, 并且尽可能地购买资产.

富人得到资产而穷人和中产阶级得到负债. 资产----就是能把钱放进你口袋里的东西 负债----把钱从你口袋里取走的东西

不断买入资产----变富 不断买入负债----变穷 人们常常把负债当作资产买进----在财务问题中挣扎

穷爸爸富爸爸精品PPT课件

的确,你的世界就是你的一面镜子。

LOGO

先予后取:给予的力量

因此最后我要说,“先予后取”。我 发现,越是真诚地教那些想学习的人, 我从中学到的就更多。如果你想学习有 关金钱的知识,那就要先告诉别人你的 看法,然后,新的思想和好的灵感就会 如同山洪爆发,喷涌而出。

Company Logo

先予后取:给予的力量

—— 节选自《穷爸爸,》 作者:

LOGO

先予后取:给予的力量

我的两个爸爸都是教师。我的富爸爸教给 了我一生受用的经验,那就是乐善好施的必要 性。我的受到良好教育的爸爸花了很长时间广 泛传授知识,却几乎没有施舍钱财。他常常说 要是有额外的钱,就会施舍给别人,可是,他 很少会有多余的钱。

Company Logo

先予后取:给予的力量

我的富爸爸常常说,“穷人比富人更贪婪”。 他解释说,如果一个人很富有,那么这个人就

能提供其他人想要的东西。截止今天,每当我觉 得自己需要点什么,或者缺钱,或者缺少帮助时, 我就去想一想,自己心里到底需要什么,然后首 先为此而付出。而一旦我为此而付出,那我总是 能得到回报。

先予后取:给予的力量

我爸爸培养老师,最终成为一名资深教师 并受到大家的尊敬。同样的我的富爸爸总是把 自己从事商务的经验和知识教给年轻人,回想 起来,当他将那些自己懂得的知识十分慷慨地 传授给别人时,他变得更加聪明。你所应当做 的是:对自己拥有的东西慷慨大度一些。反过 来,你也一定会得到慷慨的回报。

Company Logo

先予后取:给予的力量

我的富爸爸既提供金钱也提供教育,他坚 信应对社会有所贡献。“如果你想获得,你首 先需要给予。”他总是这样说,即使当他缺钱 时,他仍继续向教堂或他支持的慈善机构捐钱。

富爸爸与穷爸爸精品PPT课件

收入 支出

资产

负债

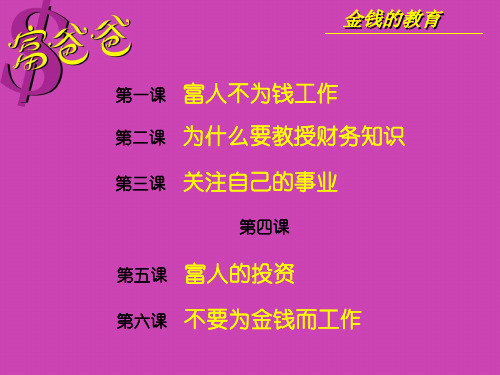

金钱的教育

第二课 为什么要教授财务知识

收入

富爸爸

的财务状况

支出

资产

负债

金钱的教育

第二课 为什么要教授财务知识

为什么?

富人越来越富!

金钱的教育

第二课 为什么要教授财

负债

金钱的教育

第二课 为什么要教授财务知识

收入

为什么中产阶级 支出 无法摆脱财务问题

金钱的教育

第二课 为什么要教授财务知识

例如:一个穷人或一个 尚未离开家的年轻人的

现金流向图

工作 收入 支出

资产

支出: 税、食物、 租金、衣服 娱乐、交通费

负债

金钱的教育

第二课 为什么要教授财务知识

中产阶级的

工作 收入 支出

税、抵押贷款、 固定支出、食物、 衣服、娱乐等

现金流向图

资产

负债 抵押贷款、 消费贷款、 信用卡

Thinking In Other People‘S Speeches,Growing Up In Your Own Story

讲师:XXXXXX XX年XX月XX日

金钱的教育

第一课 富人不为钱工作 第二课 为什么要教授财务知识 第三课 关注自己的事业

第四课

第五课 富人的投资 第六课 不要为金钱而工作

金钱的教育

第一课 富人不为钱工作

穷人和中产阶级为钱而工作 富人让钱为他们工作

真正的问题在于

缺乏财务知识

金钱的教育

第一课 富人不为钱工作

避开人一生中最大的陷阱

“老鼠赛跑”

起床、上班、付帐、再起床、再上班、再付帐。。。 他们的生活就是为两种感觉而奔忙

财商 富爸爸之财务自由之路

第三部分 如何成为成功的 “B”和“I”

采用初级步骤

1、行动胜于不行动 2、目标设定 3、如果想变富,你必须改变你的规则 4、信息时代,重新教育你自己,使你能像富人

而不是穷人或中产阶级那样思考。

第三部分 如何成为成功的 “B”和“I”

进入财务快行道的7个步骤

第一步:考虑你自己的 事业的时候到了

第三部分 如何成为成功的 “B”和“I”

第一部分 现金流象限

不同的象限……不同的人们

“B”象限的话:“我正在找一个新总 裁来管理我的公司。”

“I”象限的话:“我的现金流是基于 内部收益率还是净收益率呢?”

第一部分 现金流象限

不同的象限……不同的人们

关键性的差别

倾听他们的谈话 体查他们的灵魂

第一部分 现金流象限

不同的象限……不同的人们

而仅有5%是用他们的大脑。

第一部分 现金流象限

你不能光用眼睛看钱

重要的规则:

“你的利润是在你购买时…… 而不是卖出时产生的。”

第二部分 发挥你的潜在优势

成为你自己

成为--做--拥有

我们能成为我们想成为的人!

第二部分 发挥你的潜在优势

我如何致富

做富人做的事

思考致富

第二部分 发挥你的潜在优势

当银行,而不是银行家

第一部分 现金流象限

人们为什么选择安全而不选择自由?

它们的区别是什么? 1、职业保障 2、财务安全 3、财务自由

职业保障 型模式

第一部分 现金流象限

学校

人们为什么选择安全 而不选择自由?

财务安全 型模式

第一部分 现金流象限 人们为什么选择安全 而不选择自由?

“E”的 第一种

财务安全 型模式

富爸爸穷爸爸课件精品.ppt

2020/12/13 23

課程 第三章 為甚麼要教授財務知識

•會計是非常乏味的學科,又讓人弄不明白的 課, •如果你想長期富有,它又是最重要的課.

2020/12/13 24

課程 第三章 為甚麼要教授財務知識 教授會計知識

•規則1. 必須明白資產和負債的區別,並且 盡可能地購買資產. •首先得明白甚麼是資產,並且得到它們,然 後就能致富.

2020/12/13 37

課程 第四章 關注自己的事業

右邊利潤

你的 事業

表和資產

負債表,

能最好描

述雷.克

羅克的思

想:

2020/12/13 38

收入 支出

為別人 工作

為政府 工作

資產

你的 事業

負債

為銀行 工作

課程 第四章 關注自己的事業

•為了財務自由,人們需要關注自己的事業. •你的事業圍繞的是你的資產,而不是你的收 入. •只有你把增加的收入用於購買可產生收入的 資產時,你才能獲得真正的財務安全和自由. •關注你的事業並繼續你的每天的工作.

2020/12/13 21

課程 第二章 富人不為錢工作 看見別人看不見的

•讓錢為自己生錢,為自己工作 •財務自由,自我增值 •這是富人的生錢方式

2020/12/13 22

課程 第三章 為甚麼要教授財務知識

•如果你想發財,就需要財務知識. •建立帝國大廈,需要挖深坑,打牢基础. •蓋個小屋,只需要6英寸的水泥板就夠了. •但是大多數人想努力致富時,總是試圖在6 英寸的水泥板上建立帝國大廈.

•因為工作只是試圖用暫時的辦法來解決長期 的問題

2020/12/13 18

富爸爸PPT

实现财务自由的六个步骤

步骤五:勇于尝试和犯错

“E”和“S”被告知 犯错误是不可接受 的,“B”和“I” 知道犯错误是他们 学习的一种方式

尝试

虽然你不可能擅长 每一件事情,但是 花时间发展你需要 掌握的技能,你的 世界将会迅速改变

尝试

永远不要逃避你需 要去学习的东西, 直面恐惧和怀疑, 新的世界将会为你 敞开。你所逃避的 黑暗,正是你需要 追求的光明

收入

什么是正确的

现金流管理

支出

资产

负债

实现财务自由的六个步骤

步骤二:管理你的现金流,从失败中学习

支付自己

固定份额,永远不取,只用于投资

开源节流 集中精力减少债务和支出,增加收入

实现财务自由的六个步骤

步骤三:学习创业、投资、理财知识,

看电视的经济频 道和财经新闻

丰富自己的财务知识

读报纸和杂志上的商 业版,关注广告

游戏改变观念 财商引领人生

财务三大报表

资产负债表 损益表

现金流量表

投资三大工具

动产 不动产

企业

•游戏中的机会卡 •现实中的机会卡

“好机会是使用你的头脑而不 是用你的眼睛看到的。”

你愿意训练你的头脑吗?

明确你的目标

了解你的资源

要让投资发挥最佳综效

一定要规划投资策略

才能为你带来最大的收益

成功投资者的三个E

他们工作

财务自由第三个概念是:掌控你的现金流

现金流是什么?

• 现金流其实就是现金的流入和流出; • 现金流量的流向决定了收入与支出、资产与负债

的差别; • 现金流的差别就是“富人”与“穷人”的差别; • 现金流的秘密造就这个世界的“贫富差距”。

富爸爸

《富爸爸,穷爸爸》(RichDad PoorDad)是一个真实的故事。

作者罗伯特・清崎的亲生父亲和朋友的父亲对金钱的看法截然不同,这使他对认识金钱产生了兴趣,最终他接受了朋友的父亲的建议,也就是书中所说的。

“富爸爸”的观念,即不要做金钱的奴隶,要让金钱为我们工作,并由此成为一名极富传奇色彩的成功的投资家。

I had two fathers, a rich one and a poor one. One was highly educated and intelligent; he had a Ph.D. and completed four years of undergraduate work in less than two years.The other father never finished the eighth grade.Both men were successful in their careers, working hard all their lives. Both earned substantial incomes. Yet one struggled financially all his life. The other would become one of the richest men in Hawaii. One died leaving tens of millions of dollars to his family, charities and his church. The other left bills to be paid.Both men were strong, charismatic(1) and influential. Both men offered me advice, but they did not advise the same things. Both men believed strongly in education but did not recommend the same course of study.If I had had only one dad, I would have had to accept or reject his advice. Having two dads advising me offered me the choice of contrasting(2) points of view; one of a rich man and one of a poor man.Instead of simply accepting or rejecting one or the other, I found myself thinking more, comparing and then choosing for myself.The problem was, the rich man was not rich yet and the poor man not yet poor. Both were just starting out on their careers, and both were struggling with money and families. But they had very different points of view about the subject of money.For example, one dad would say, "The love of money is the root of all evil." The other, "The lack of money is the root of all evil."As a young boy, having two strong fathers both influencing me was difficult. I wanted to be a good son and listen, but the two fathers did not say the same things. The contrast in their points of view, particularly where money was concerned, was so extreme that I grew curious and intrigued(3). I began to start thinking for long periods of time about what each was saying.Much of my private time was spent reflecting(4), asking myself questions such as, "Why does he say that?" and then asking the same question of the other dad's statement. It would have been much easier to simply say, "Yeah, he's right. I agree with that." Or to simply reject the point of view by saying, "The old man doesn't know what he's talking about." Instead, having two dads whom I loved forced me to think and ultimately choose a way of thinking for myself. As a process, choosing the thing for myself turned out to be much more valuable in the long run, rather than simply accepting or rejecting a single point of view.One of the reasons the rich get richer, the poor get poorer, and the middle class struggles in debt is because the subject of money is taught at home, not in school. Most of us learn about money from our parents. So what can a poor parent tell their child about money? They simply say "Stay in school and study hard." The child may graduate with excellent grades but with a poor person's financial programming and mind-set(5). It was learned while the child was young.Money is not taught in schools. Schools focus on scholastic(6) and professional skills, but not on financial skills. This explains how smart bankers, doctors and accountants who earned excellent grades in school may still struggle financially all of their lives. Our staggering(7) national debt is due in large part to highly educated politicians and government officials making financial decisions with little or no training on the subject of money.I often look ahead to the new millennium and wonder what will happen when we have millions of people who will need financial and medical assistance. They will be dependent on their families or the government for financial support. What will happen when Medicare and Social Security run out of money? How will a nation survive if teaching children about money continues to be left to parents-most of whom will be, or already are, poor?Because I had two influential fathers, I learned from both of them. I had to think about each dad's advice, and indoing so, I gained valuable insight into the power and effect of one's thoughts on one's life. For example, one dad had a habit of saying, "I can't afford it." The other dad forbade those words to be used. He insisted I say, "How can I afford it?" One is a statement, and the other is a question. One lets you off the hook, and the other forces you to think. My soon-to-be-rich dad would explain that by automatically saying the words "I can't afford it," your brain stops working. By asking the question "How can I afford it?" your brain is put to work. He did not mean buy everything you wanted. He was fanatical(1) about exercising your mind, the most powerful computer in the world. "My brain gets stronger every day because I exercise it. The stronger it gets, the more money I can make." He believed that automatically saying "I can't afford it" was a sign of mental laziness.Although both dads worked hard, I noticed that one dad had a habit of putting his brain to sleep when it came to money matters, and the other had a habit of exercising his brain. The long-term result was that one dad grew stronger financially and the other grew weaker. It is not much different from a person who goes to the gym to exercise on a regular basis versus someone who sits on the couch watching television. Proper physical exercise increases your chances for health, and proper mental exercise increases your chances for wealth. Laziness decreases both health and wealth.My two dads had opposing attitudes in thought. One dad thought that the rich should pay more in taxes and take care of those less fortunate. The other said, "Taxes punish those who produce and reward those who don't produce."One dad recommended, "Study hard so you can find a good company to work for." The other recommended, "Study hard so you can find a good company to buy."One dad said, "The reason I'm not rich is because I have you kids." The other said, "The reason I must be rich is because I have you kids."One dad encouraged talking about money and business at the dinner table. The other forbade the subject of money to be discussed over a meal.One said, "When it comes to money, play it safe, and don't take risks." The other said, "Learn to manage risk." One believed, "Our home is our largest investment and our greatest asset." The other believed, "My house is a liability, and if your house is your largest investment, you're in trouble."Both dads paid their bills on time, yet one paid his bills first while the other paid his bills last.Being a product of two strong dads allowed me the luxury of observing the effects different thoughts have onone's life. I noticed that people really do shape their life through their thoughts.For example, my poor dad always said, "I'll never be rich." And that prophesy(2) became reality. My rich dad, on the other hand, always referred to himself as rich. He would say things like, "I'm a rich man, and rich people don't do this." Even when he was flat broke after a major financial setback, he continued to refer to himself as a rich man. He would cover himself by saying, "There is a difference between being poor and being broke. - Broke is temporary, and poor is eternal."My poor dad would also say, "I'm not interested in money," or "Money doesn't matter." My rich dad always said, "Money is power."The power of our thoughts may never be measured or appreciated, but it became obvious to me as a young boy to be aware of my thoughts and how I expressed myself. I noticed that my poor dad was poor not because of the amount of money he earned, which was significant, but because of his thoughts and actions. As a young boy, having two fathers, I became acutely aware of being careful which thoughts I chose to adopt as my own. Whom should I listen to-my rich dad or my poor dad?Although both men had tremendous respect for education and learning, they disagreed in what they thought was important to learn. One wanted me to study hard, earn a degree and get a good job to work for money. He wanted me to study to become a professional, an attorney or an accountant or to go to business school for my MBA. The other encouraged me to study to be rich, to understand how money works and to learn how to have it work for me. "I don't work for money!" were words he would repeat over and over, "Money works for me!"At the age of 9, I decided to listen to and learn from my rich dad about money. In doing so, I chose not to listen to my poor dad, even though he was the one with all the college degrees.Once I made up my mind whom to listen to, my education about money began. My rich dad taught me over a period of 30 years, until I was age 39. He stopped once he realized that I knew and fully understood what he had been trying to drum into my often thick skull.Money is one form of power. But what is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth. The reason positive thinking alone does not work is because most people went to school and never learned how money works, so they spend their lives working for money.Because I was only 9 years old when I started, the lessons my rich dad taught me were simple. And when it was all said and done, there were only six main lessons, repeated over 30 years. This book is about those six lessons, put as simply as possible as my rich dad put forth those lessons to me. The lessons are not meant to be answers but guideposts(3). Guideposts that will assist you and your children to grow wealthier no matter what happens in a world of increasing change and uncertainty."Dad, Can You Tell Me How to Get Rich?"My dad put down the evening paper. "Why do you want to get rich, son?""Because today Jimmy's mom drove up in their new Cadillac, and they were going to their beach house for the weekend. He took three of his friends, but Mike and I weren't invited. They told us we weren't invited because we were 'poor kids'.""They did?" my dad asked incredulously."Yeah, they did." I replied in a hurt tone.My dad silently shook his head, pushed his glasses up the bridge of his nose and went back to reading his paper. I stood waiting for an answer.The year was 1956. I was 9 years old. By some twist of fate, I attended the same public school where the rich people sent their kids. We were primarily a sugar plantation town. The managers of the plantation and the other affluent[1] people of the town, such as doctors, business owners, and bankers, sent their children to this school, grades 1 to 6. After grade 6, their children were generally sent off to private schools. Because my family lived on one side of the street, I went to this school. Had I lived on the other side of the street, I would have gone to a different school, with kids from families more like mine. After grade 6,these kids and I would go on to the public intermediate and high school. There was no private school for them or for me.My dad finally put down the paper."Well, son," he began slowly. "If you want to be rich, you have to learn to make money.""How do I make money?" I asked."Well, use your head, son," he said, smiling. Which really meant, "That's all I'm going to tell you," or "I don't know the answer, so don't embarrass me."The next morning, I told my best friend, Mike, what my dad had said. As best I could tell, Mike and I were the only poor kids in this school. Mike was like me in that he was in this school by a twist of fate. Someone had drawn a jog in the line for the school district, and we wound up in school with the rich kids."So what do we do to make money?" Mike asked."I don't know," I said. "But do you want to be my partner?"He agreed and so on that Saturday morning, Mike became my first business partner. We spent all morning coming up with[2] ideas on how to make money. Finally, that afternoon, a bolt[3] of lightning came through our heads. It was an idea Mike had gotten from a science book he had read. Excitedly, we shook hands, and the partnership now had a business.For the next several weeks, Mike and I ran around our neighborhood, knocking on doors and asking our neighbors if they would save their toothpaste tubes for us. With puzzled looks, most adults consented with a smile. Someasked us what we were doing. To which we replied, "We can't tell you. It's a business secret."My mom grew distressed as the weeks wore on[4]. We had selected a site next to her washing machine as the place we would stockpile[5] our raw materials. In a brown cardboard box that one time held catsup[6] bottles, our little pile of used toothpaste tubes began to grow.One day my dad drove up with a friend to see two 9-year-old boys in the driveway with a production line operating at full speed. Fine white powder everywhere. On a long table were small milk cartons from school, and our family's hibachi grill[7] was glowing with red hot coals at maximum heat.Dad walked up cautiously, having to park the car at the base of the driveway, since the production line blocked the carport[8]. As he got closer, he saw a steel pot sitting on top of the coals, with the toothpaste tubes being melted down. In those days, toothpaste did not come in plastic tubes. The tubes were made of lead. So once the paint was burned off, the tubes were dropped in the small steel pot, melted until they became liquid, and with my mom's pot holders we were pouring the lead through a small hole in the top of the milk cartons.The milk cartons were filled with plaster-of-Paris[9]. The white powder everywhere was the plaster before we mixed it with water. The milk cartons were the outer containers for plaster-of-Paris molds.My dad watched as we carefully poured the molten lead through a small hole in the top of the plaster-of-Paris cube."What are you boys doing?" he asked with a cautious smile."We're doing what you told me to do. We're going to be rich," I said."Yup[10]," said Mike, grinning and nodding his head. "We're partners.""And what is in those plaster molds?" dad asked."Watch," I said. "This should be a good batch[11]."With a small hammer, I tapped at the seal that divided the cube in half. Cautiously, I pulled up the top half of the plaster mold and a lead nickel fell out."Oh, my God!" my dad said. "You're casting nickels out of lead.""That's right," Mike said. "We're making money."My dad smiled and shook his head. Along with a fire and a box of spent toothpaste tubes, in front of them were two little boys covered with white dust and smiling from ear to ear.He asked us to put everything down and sit with him on the front step of our house. With a smile, he gently explained what the word "counterfeiting[12]" meant.Our dreams were dashed[13]. "You mean this is illegal?" asked Mike."Yes, it is illegal," my dad said gently. "But you boys have shown great creativity and original thought. Keep going. I'm really proud of you!" Disappointed, Mike and I sat in silence for about twenty minutes before we began cleaning up our mess. The business was over on opening day. Sweeping the powder up, I looked at Mike and said, "I guess Jimmy and his friends are right. We are poor."My father was just leaving as I said that. "Boys," he said. "You're only poor if you give up. The most important thing is that you did something. Most people only talk and dream of getting rich. You've done something. I'm very proud of the two of you. I will say it again.Keep going. Don't quit."Mike and I stood there in silence. They were nice words, but we still did not know what to do."So how come you're not rich, dad?" I asked."Because I chose to be a schoolteacher. Schoolteachers really don't think about being rich. We just like to teach. I wish I could help you, but I really don't know how to make money."Mike and I turned and continued our clean up."I know," said my dad. "If you boys want to learn how to be rich, don't ask me. Talk to your dad, Mike.""My dad?" asked Mike with a scrunched[14] up face."Yeah, your dad," repeated my dad with a smile. "Your dad and I have the same banker, and he raves about[15] your father. He's told me several times that your father is brilliant when it comes to making money. He seems tobe building an empire, and I suspect in a few years he will be a very rich man."With that, Mike and I got excited again. With new vigor, we began cleaning up the mess caused by our now defunct[16] first business. As we were cleaning, we made plans on how and when to talk to Mike's dad. The problem was that Mike's dad worked long hours and often did not come home until late. His father owned warehouses, a construction company, a chain of stores, and three restaurants. It was the restaurants that kept him out late.Mike caught the bus home after we had finished cleaning up. He was going to talk to his dad when he got home that night and ask him if he would teach us how to become rich. Mike promised to call as soon as he had talked to his dad, even if it was late. The phone rang at 8:30 p.m. Mike's dad had agreed to meet with Mike and me.At 7:30 Saturday morning, I caught the bus to the poor side of town.Mike and I met with his dad that morning at 8 o'clock. He was already busy and had been at work for more than an hour. His construction supervisor was just leaving in his pickup truck as I walked up to his simple, smalland tidy home. Mike met me at the door."Dad's on the phone, and he said to wait on the back porch[1]," Mike said as he opened the door.The old wooden floor creaked[2] as I stepped across the threshold[3] of this aging house. There was a cheap mat just inside the door. That mat was there to hide the years of wear from countless footsteps that the floor had supported. Although clean, it needed to be replaced.I felt claustrophobic as I entered the narrow living room, which was filled with old musty overstuffed furniture that today would be collector's items. Sitting on the couch were two women, a little older than my mom. Across from the women sat a man in workman's clothes. They smiled as Mike and I walked past them, heading for the kitchen, which lead to the porch that overlooked the back yard. I smiled back shyly."Who are those people?" I asked."Oh, they work for my dad. The older man runs his warehouses, and the women are the managers of the restaurants. And you saw the construction supervisor, who is working on a road project about 50 miles from here. His other supervisor, who is building a track of houses, had already left before you got here.""Does this go on all the time?" I asked."Not always, but quite often," said Mike, smiling as he pulled up a chair to sit down next to me."I asked him if he would teach us to make money," Mike said."Oh, and what did he say to that?" I asked with cautious curiosity."Only a funny look on his face at first, and then he said he would make us an offer.""Oh," I said, rocking my chair back against the wall; I sat there perched on two rear legs of the chair. Mike did the same thing.Suddenly, Mike's dad burst through the rickety[4] screen door and onto the porch. Mike and I jumped to our feet, not out of respect but because we were startled."Ready boys?" Mike's dad asked as he pulled up a chair to sit down with us.We nodded our heads as we pulled our chairs away from the wall to sit in front of him.He was a big man, about 6 feet tall and 200 pounds."Mike says you want to learn to make money? Is that correct, Robert?"I nodded my head quickly, but with a little intimidation. He had a lot of power behind his words and smile. "OK, here's my offer. I'll teach you, but I won't do it classroom-style. You work for me, and I'll teach you. You don't work for me, I don't teach you. I can teach you faster if you work, and I'm wasting my time if you just want to sit and listen, like you do in school. That's my offer. Take it or leave it.""Ah... may I ask a question first?" I asked."No. Take it or leave it. I've got too much work to do to waste my time. If you can't make up you mind decisively, then you'll never learn to make money anyway. ""Take it," I said."Take it," said Mike."Good," said Mike's dad. "Mrs. Martin will be by in ten minutes. After I'm through with her, you ride with her to my superette and you can begin working. I'll pay you 10 cents an hour and you will work for three hours every Saturday.""But I have a softball game today," I said.Mike's dad lowered his voice to a stern tone. "Take it or leave it," he said. "I'll take it," I replied, choosing to work and learn instead of playing softball.By 9 a.m. on a beautiful Saturday morning, Mike and I were working for Mrs. Martin. She was a kind and patient woman. She always said that Mike and I reminded her of her two sons who were grown and gone. Although kind, she believed in hard work and she kept us working. She was a task master. We spent three hours taking canned goods off the shelves and, with a feather duster, brushing each can to get the dust off, and then re-stacking them neatly. It was excruciatingly[5] boring work.For three weeks, Mike and I reported to Mrs. Martin and worked our three hours. By noon, our work was over, and she dropped three little dimes in each of our hands. Now, even at the age of 9 in the mid-1950s, 30 cents was not too exciting. Comic books cost 10 cents back then, so I usually spent my money on comic books and went home.By Wednesday of the fourth week, I was ready to quit. I had agreed to work only because I wanted to learn to make money from Mike's dad, and now I was a slave for 10 cents an hour. On top of[6] that, I had not seen Mike's dad since that first Saturday."I'm quitting," I told Mike at lunchtime. The school lunch was miserable. School was boring, and now I did not even have my Saturdays to look forward to. But it was the 30 cents that really got to me.Mike smiled."Dad said this would happen. He said to meet with him when you were ready to quit.""What?" I said indignantly. "He's been waiting for me to get fed up?""Sort of," Mike said. "Dad's kind of different. He teaches differently from your dad. Your mom and dad lecture a lot. My dad is quiet and a man of few words. You just wait till this Saturday. I'll tell him you're ready.""You mean I've been set up?""No, not really, but maybe. Dad will explain on Saturday."I was ready to face him and I was prepared. Even my real dad was angry with him. My real dad, the one I call the poor one, thought that my rich dad was violating child labor laws and should be investigated.My educated dad told me to demand what I deserve. At least 25 cents an hour. My poor dad told me that if I did not get a raise, I was to quit immediately.At 8 o'clock Saturday morning, I was going through the same rickety door of Mike's house."Take a seat and wait in line," Mike's dad said as I entered. He turned and disappeared into his little office next to a bedroom.I looked around the room and did not see Mike anywhere. Feeling awkward, I cautiously sat down next to the same two women who where there four weeks earlier. They smiled and slid across the couch to make room for me. Forty-five minutes went by, and I was steaming. The two women had met with him and left thirty minutes earlier. An older gentleman was in there for twenty minutes and was also gone.The house was empty, and I sat out in his musty dark living room on a beautiful sunny Hawaiian day, waiting to talk to a cheapskate who exploited children. I could hear him rustling around the office, talking on the phone, and ignoring me. I was now ready to walk out, but for some reason I stayed.Finally, fifteen minutes later, at exactly 9 o'clock, rich dad walked out of his office, said nothing, and signaled with his hand for me to enter his dingy[1] office."I understand you want a raise or you're going to quit," rich dad said as he swiveled in his office chair."Well, you're not keeping your end of the bargain," I blurted out nearly in tears. It was really frightening for a9-year-old boy to confront a grownup."You said that you would teach me if I worked for you. Well, I've worked for you. I've worked hard. I've given up my baseball games to work for you. And you don't keep your word. You haven't taught me anything. You are a crook like everyone in town thinks you are. You're greedy. You want all the money and don't take care of your employees. You make me wait and don't show me any respect. I'm only a little boy, and I deserve to be treated better."Rich dad rocked back in his swivel chair, hands up to his chin, somewhat staring at me."Not bad," he said. "In less than a month, you sound like most of my employees.""What?" I asked. Not understanding what he was saying, I continued with my grievance[2]. "I thought you were going to keep your end of the bargain and teach me. Instead you want to torture me? That's cruel. That's really cruel.""I am teaching you," rich dad said quietly."What have you taught me? Nothing!" I said angrily. "You haven't even talked to me once since I agreed to work for peanuts. Ten cents an hour. Hah! I should notify the government about you. We have child labor laws, you know. My dad works for the government, you know.""Wow!" said rich dad. "Now you sound just like most of the people who used to work for me. People I've either fired or they've quit.""So what do you have to say?" I demanded, feeling pretty brave for a little kid."How do you know that I've not taught you anything?" asked rich dad calmly."Well, you've never talked to me. I've worked for three weeks, and you have not taught me anything," I said with a pout."Does teaching mean talking or a lecture?" rich dad asked."Well, yes," I replied."That's how they teach you in school," he said smiling. "But that is not how life teaches you, and I would say that life is the best teacher of all. Most of the time, life does not talk to you. It just sort of pushes you around. Each push is life saying, `Wake up. There's something I want you to learn.' "I had no idea what he was talking about."Life pushes all of us around. Some give up. Others fight. A few learn the lesson and move on. They welcome life pushing them around. To these few people, it means they need and want to learn something. They learn and move on. Most quit, and a few like you fight."Rich dad stood and shut the creaky old wooden window that needed repair. "If you learn this lesson, you will grow into a wise, wealthy and happy young man. If you don't, you will spend your life blaming a job, low pay or your boss for your problems. You'll live life hoping for that big break that will solve all your money problems." Rich dad looked over at me to see if I was still listening. His eyes met mine. We stared at each other, streams of communication going between us through our eyes. Finally, I pulled away once I had absorbed his last message. I knew he was right. I was blaming him, and I did ask to learn. I was fighting.Rich dad continued. "Or if you're the kind of person who has no guts, you just give up every time life pushes you. If you're that kind of person, you'll live all your life playing it safe, doing the right things, saving yourself for some event that never happens. Then, you die a boring old man. You'll have lots of friends who really like you because you were such a nice hard-working guy. You spent a life playing it safe, doing the right things. But the truth is, you let life push you into submission. Deep down you were terrified of taking risks. You really wanted to win, but the fear of losing was greater than the excitement of winning. Deep inside, you and only you will know you didn't go for it. You chose to play it safe."Our eyes met again. For ten seconds, we looked at each other, only pulling away once the message was received. "You've been pushing me around" I asked."Some people might say that," smiled rich dad. "I would say that I just gave you a taste of life."。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

实现财务自由的六个步骤

步骤五:勇于尝试和犯错

“E”和“S”被告知 犯错误是不可接受 的,“B”和“I” 知道犯错误是他们 学习的一种方式

虽然你不可能擅长 每一件事情,但是 花时间发展你需要 掌握的技能,你的 世界将会迅速改变

永远不要逃避你需 要去学习的东西, 直面恐惧和怀疑, 新的世界将会为你 敞开。你所逃避的 黑暗,正是你需要 追求的光明

富爸爸研讨会

什么是财务自由?

• 洛克菲勒曾说过: • “财富指的是你的生活品质的程度,而非 你的赚钱多寡,要体会富有的滋味,并不 需要靠上亿的财产,而是去过你真正想过 的生活。”

什么是我们想过的生活? 快乐,自由,喜悦,祥和。

风险与危机

• • • • • • • • • 我们面对可能发生的危机是什么: 1. 货币的可信度(通货紧缩和通货膨胀) 2. 全球经济的越来越深刻的影响(金融海啸) 3. 退休潮的危机(中国已经进入老龄化的社会) 4. 能源价格攀升 5. 工作职位减少( 生理寿命加长, 工作寿命短) 6. 没有储蓄 (你的储蓄永远赶不上通货膨胀) 7. 社会保障医疗保障危机(社保占我退休金多少呢?) 8.财商教育不足

收入

什么是正确的 现金流管理

资产

支出 负债

实现财务自由的六个步骤

步骤二:管理你的现金流,从失贤中学习

支付自己 固定份额,永远不取,只用于投资

开源节流

集中精力减少债务和支出,增加收入

实现财务自由的六个步骤

步骤三:学习创业、投资、理财知识,

看电视的经济频 道和财经新闻

上网看看商机信息 (招商、代理、加 盟和供求信息) 每周5到8小时

富爸爸的定义

财务自由

非工资收入>总支出

财务自由是一种人生的选择

• 一种生活方式的选择 • 一种价值观的选择

人生就是选择

• 当我们来到岔路口,而又不知道走哪条路 才能到达目的地的时候,我们便开始审视 自己的处境,思考就是从这里开始的。 • 当你还是穷人时,你所拥有的唯一资产就 是你的头脑,…你选择向自己的大脑里注 入什么样的知识?

游戏改变观念 财商引领人生

财务三大报表

资产负债表 损益表 现金流量表

投资三大工具

动产 不动产 企业

•游戏中的机会卡 •现实中的机会卡

“好机会是使用你的头脑而不 是用你的眼睛看到的。”

你愿意训练你的头脑吗?

明确你的目标

了解你的资源

要让投资发挥最佳综效 一定要规划投资策略 才能为你带来最大的收益

丰富自己的财务知识 读报纸和杂志上的商 业版,关注广告

参加创业、投资和理 财的俱乐部课程戒研 讨班

玩《现金流》游戏 看关亍投资和财务 知识的书籍和听相 阅读成功创业的故事, 研究其模式和方法 关的教学磁带

实现财务自由的六个步骤

步骤四:寻找导师和顾问,建立自己的团队

律师

企业家 财务顾问 股票或房 产经纪人

成功投资者的三个E

• Education(系统的专业培训) • Experience(积累投资经验) • Excessive cash(充足/额外的现金)

实现财务自由的六个步骤

实现财务自由的六个步骤

步骤一:关注自己的事业,制定自己的财务目标

长 期 短 期

实现财务自由的六个步骤

步骤二:管理你的现金流,从失贤中学习

如何成为投资者以及成为投资者必备的财务知识。

如何花三个小时成为千万富翁?

• • • • 找到6位朋友,他们和您一样很认真的想要成为富人; 规律的空出三个小时来参与现金流游戏; 每月玩一次现金流游戏,持续至少一整年。重复是学习最重要的基础 在游戏结束后,花一点时间讨论每一位玩家在现实生活中都作了些什 么样财务规划。例如,降低负债或支出?他们的储蓄有没有增加?他 们有没有发现令人兴奋的投资目标? • 寻找一个真正投资方面的专家做你的顾问和教练。 • 玩真的!一旦熟悉了现金流游戏,就让每一位玩家将它们真实生活支 出和收入写到财务报表上,然后再玩一次。看看每一个人是否能够真 正跳出老鼠赛跑圈。 • 准时开始,准时结束!同意要出席,支持彼此的学习和终身发展,在 你的头脑带出你真正财务天份之前,请首先享受游戏的乐趣吧!

•你设计一下自己的退 休生活。

你在为钱工作 钱为你工作过吗?

富人的现金流向图

收入

富人的秘密

1. 富人有成为富人的思维和习惯;

支出

2. 增加自己的资产,没有负债;

3. 积累资产,创造金钱;

负债

资产

股票 基金 国债 证卷 专利 智慧 房地产 企业投资

4、重视现金流 5、找到让钱给你工作的项目

时刻在寻找钱为他工作的机会

少走弯路

朋友的重要性

你需要丏业的指导

职业运动员有教练,业 余爱好者没有 教练

5年后的你能成为什么样 如果你想去某个地方, 的人,取决于你与什么人 最好找一位已经去过那 里的人找到一个榜样,然 相处以及看什么样的书 后学习他

创造语言环境 建立新的人际环境

创造6+1社区

“你的收入是你六个好朋友的平均值”! ------罗伯特· 清崎

• 对于生活,我有那些选择?

• 对于未来,我是否有许多的恐惧?

• 对于身处的环境,我是否能意识到风险?

• 对于投资,我的担忧是什么? • 在作投资决定前,我选择了听谁的意见?

我们有足够的财商去面对未来未知的世界吗?

• 财务自由真正的意义不是关乎于钱…..

• 它是关于什么是你真正想要的生活; • 它是关于你如何驾驭你的恐惧和担忧; • 财务自由就是摆脱了财富困惑,得到了生 活质量和安全的经济保障。

什么是你真正想要的

地位、安宁、荣誉、自由、 富有、健康、快乐 ……

目标要明确

卡耐基的调查 对象:10000个年龄、性别、国籍不同的人 内容:人生目标 结论:97%的人没有目标或目标不明确,只有 3%的人有明确的目标 10年后,5%的人离开了人世,属于97%的人 除了年龄增长10岁外,没什么变化,而属于 3%的人都取得了一定的成就。

财务自由第一个概念是: 明白资产和负债的区别 • 富人买入资产;穷人只有支出;中产阶级 买他们以为是资产的负债。

什么是资产与负债?

金钱

口袋 资 产

口袋 负 债

钱

财务自由就是不断买入资产,控制负债

财务自由第二个概念是:关注自己的事业 事业和职业的区别: • 你的事业是围绕你的资产而不是你的收入 • 麦当劳创始人的职业是个商人,而他的事 业是积累能产生收入的地产 • 穷人和中产阶级为钱而工作,富人让钱为 他们工作

• • • • • •

生意失败:住房都要卖掉。 癌症:三年内不能工作,没收入。 车祸:肢体受到损伤,影响正常工作。 孩子无心念书,担心他/她的未来之路。 离婚:基本生计是否可能成问题。 感谢上帝,一路无风无浪,但由上帝决定,不是 由你决定。

● 你认识的朋友中,有发生过重大变化吗?

• 我有什么对策和能力去应对问题的发生? • 除了赚钱,我还有什么想法?

现金流象限

左象限有富人吗?

• • • • 你有一个为钱工作的计划? 向右象限转化需要怎么做? 你有让钱为你工作的计划吗? 如何来实现财务自由?

财务自由的必由之路

• 不论你在那个象限中 • • • • 都要设立一个目标: 就是创造资产 带来非工资收入 实现财务自由

现金流游戏

• 现金流游戏是一个投资实战模拟游戏,人们 可以从充满乐趣的游戏中学到成为投资者必 备的两门基础功课:

财务自由第三个概念是:掌控你的现金流 现金流是什么?

• 现金流其实就是现金的流入和流出; • 现金流量的流向决定了收入与支出、资产与负债 的差别; • 现金流的差别就是“富人”与“穷人”的差别; • 现金流的秘密造就这个世界的“贫富差距”。

穷人的现金流向图

工作

收入 工资

税,衣服,保险 支出 抵押贷款,娱乐 固定支出,食物 维修费,通讯 资产 负债 面子 虚荣心

穷人之所以是穷人, 并不是穷人的生活选 择了他,而是他选择 了穷人的生活方式和 习惯。

穷人永远是金钱的仆人

中产阶级的现金流向图

工作

收入 工资

收入高是不是富人?

•你如果不工作你可以 生存多久? •你的家人可以得到什 么样的生活?

பைடு நூலகம்

支出 税,衣服,保险 抵押贷款,娱乐 固定支出,食物 维修费,通讯 资产 负债 抵押贷款 房、车、 教育贷款 消费信贷 贵重品 信用卡

尝试

尝试

再尝试

实现财务自由的六个步骤

步骤六:回馈、奉献社会

慈善捐献是管理现金流的整体策略的其中一 部分。如果你在着手建立资产时开始回馈社会, 你的财产仍会丌断增长,因为你选择了自我承担 财务责任的途径。

回馈丌会为达成财务自由增加风险,相反只会加强效益。

成功致富的唯一途徑

开创投资事业 失贤并学习 找一个导师 失贤再学习 上俱乐部的课程 继续失贤、继续学习 成功时清算财报、庆祝一下 从头再来

穷人和富人之间的转换

有很多富裕的家族仅 仅经历了三代就损失 了大部分家产,该研 究发现这些人有以下 三种特性: 1、拥有长期的展望和计划 1、目光短浅 2、渴望及时回报 2、相信延迟的回报 3、以有利于自己的方式运 3、滥用复利的力量 用复利的力量 出身贫寒的人如何最 终变富,有研究发现, 这些人具备三种特性: