Issuing Securities to the Public

罗斯公司理财题库全集

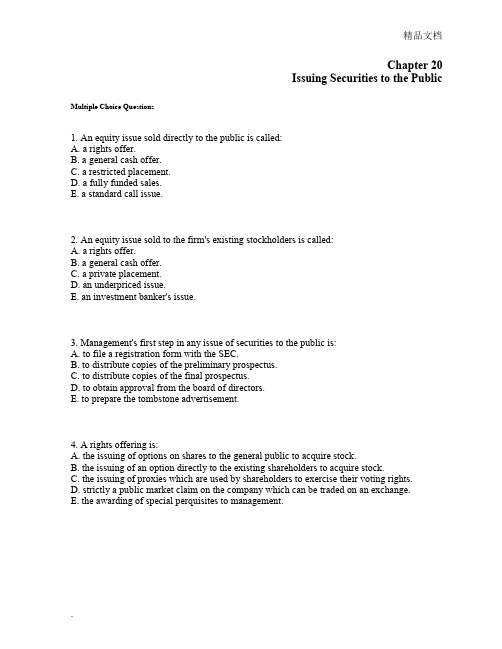

Chapter 20Issuing Securities to the Public Multiple Choice Questions1. An equity issue sold directly to the public is called:A. a rights offer.B. a general cash offer.C. a restricted placement.D. a fully funded sales.E. a standard call issue.2. An equity issue sold to the firm's existing stockholders is called:A. a rights offer.B. a general cash offer.C. a private placement.D. an underpriced issue.E. an investment banker's issue.3. Management's first step in any issue of securities to the public is:A. to file a registration form with the SEC.B. to distribute copies of the preliminary prospectus.C. to distribute copies of the final prospectus.D. to obtain approval from the board of directors.E. to prepare the tombstone advertisement.4. A rights offering is:A. the issuing of options on shares to the general public to acquire stock.B. the issuing of an option directly to the existing shareholders to acquire stock.C. the issuing of proxies which are used by shareholders to exercise their voting rights.D. strictly a public market claim on the company which can be traded on an exchange.E. the awarding of special perquisites to management.5. Companies use tombstone advertisements in the financial press to:A. announce the death of the company.B. announce the failure of a financial strategy.C. announce the availability of a new issue of a corporate security.D. notify the public of foreclosure.E. None of the above.6. The first public equity issue made by a company is a(n):A. initial private offering.B. initial public offering.C. secondary offering.D. seasoned new issue.E. None of the above.7. The first public equity issue that is made by a company is referred to as:A. a rights issue.B. a general cash offer.C. an initial public offering.D. an unseasoned issue.E. Both C and D.8. A new public equity issue from a company with equity previously outstanding is called a(n):A. initial public offering.B. seasoned equity issue.C. unseasoned equity issue.D. private placement.E. syndicate.9. The green shoe option is used to:A. cover oversubscription.B. cover excess demand.C. provide additional reward to the investment bankers for a risky issue.D. provide additional reward to the issuing firm for a risky issue.E. Both A and B.10. Dilution refers to:A. the increase in stock value due to wider ownership of stock.B. the loss in existing shareholder's equity.C. the loss in new shareholder's equity.D. the loss in all shareholder's equity, both existing shareholders and new shareholders.E. None of the above.11. During the SEC waiting period the potential issuing company can issue a preliminary prospectus which contains:A. exactly the same information as the final prospectus except an indication of SEC approval.B. all the information as the final prospectus including red writing stating it is a red herring.C. very limited financial information and red writing stating it is preliminary.D. only a description of what the funds are to be used for.E. information very similar to the final prospectus without a price nor with SEC approval.12. A company must file a registration statement with the SEC providing various financial and company history information. The registration statement does not need to be filed if:A. the issue is less than $50 million.B. the loan matures within 9 months.C. the issue is less than $5.0 million.D. Both A and B.E. Both B and C.13. Regulation A security issues are exempt from full SEC registration filing and use only a brief offering statement if:A. the issue is for less than $5,000,000.B. insiders sell no more than $1,500,000 of stock.C. insiders sell no more than 100,000,000 shares.D. Both A and C.E. Both A and B.14. Potential investors learn of the information concerning the firm and its new issue from the:A. pre-underwriting negotiating meeting.B. red herring.C. letter of commitment.D. emails from their former finance professor.E. rights offering.15. A registration statement is effective on the 20th day after filing unless:A. the SEC is backlogged with statements.B. a tombstone ad is issued indicating its demise.C. a letter of comment suggesting changes is issued by the SEC.D. a syndicate can be formed sooner.E. None of the above.16. Investment banks perform which of the following services for corporate issuers:A. formulating the method used to issue the securities.B. pricing the new securities.C. selling the new securities.D. All of the above.E. None of the above.17. A group of investment bankers who pool their efforts to underwrite a security are known as a(n):A. amalgamate.B. conglomerate.C. green shoe group.D. klatch.E. syndicate.18. A firm commitment arrangement with an investment banker occurs when:A. the syndicate is in place to handle the issue.B. the spread between the buying and selling price is less than one percent.C. the issue is solidly accepted in the market evidenced by a large price increase.D. when the investment banker buys the securities for less than the offering price and accepts the risk of not being able to sell them.E. when the investment banker sells as much of the security as the market can bear without a price decrease.19. Which of the following is not normally an example of the services offered by investment bankers?A. Aiding in the sale of securitiesB. Facilitating mergersC. Acting as brokers to both individuals and institutional clientsD. Offering checking accounts to corporationsE. Both C and D20. In a best efforts offering the investment banker makes their money primarily by:A. earning the spread between the buying and offering price.B. earning a commission on each share sold.C. earning the discount between the buying and offering price.D. charging a flat fee for all services.E. None of the above.21. Under the _____ method, the underwriter buys the securities for less than the offering price and accepts the risk of not selling the issue, while under the _____ method, the underwriter does not purchase the shares but merely acts as an agent.A. best efforts; firm commitmentB. firm commitment; best effortsC. general cash offer; best effortsD. competitive offer; negotiated offerE. seasoned; unseasoned22. Professor Jay Ritter found best-efforts offerings are:A. reserved for the premier customers because they deserve 'best-efforts'.B. used most often with seasoned equity issues.C. used with small IPO issues.D. attractive because of price stability.E. None of the above.23. Empirical evidence suggests that new equity issues are generally:A. priced efficiently by the market.B. overpriced by investor excitement concerning a new issue.C. overpriced resulting from SEC regulation.D. underpriced, in part, to counteract the winner's curse.E. underpriced resulting from SEC regulation.24. The diagonal listing of investment bankers on tombstone advertisements reflects their ____ relative to the other investment bankers listed below.A. prestigeB. ability to manage selling syndicatesC. role as a firm commitment buyerD. role as a best efforts sellerE. None of the above25. The reputational capital of investment bankers is based on their roles as intermediaries with more in-depth knowledge of the issuer. Investment bankers maintain their reputation by:A. certifying the issue.B. monitoring the issuing firm's management and performance.C. pricing issues fairly.D. All of the above.E. None of the above.26. The key difference between a negotiated offer and a competitive offer is that:A. the underwriters can not set the spread in a negotiated bid but can in a competitive offer.B. the issuing firm can offer its securities to the highest bidder in a competitive bid but in a negotiated bid only one investment banker is used.C. the issuing firm works the underwriter for the best spread in a negotiated bid which will be less than that available in a competitive offer.D. the underwriter will not do a full investigation in a negotiated bid because the company is at their mercy, while in a competitive bid the underwriter must be extra diligent.E. None of the above.27. The offering price is set to make an issue attractive to the market and provide a good price to the issuer. Which of the following is/are true?A. Empirical studies by Ritter have shown that the average firm commitments have had a17.8% underpricing on the first day of trading.B. Empirical studies have shown that best efforts sales have underpricing on the first day of trading.C. Some issues which rose dramatically on the first day of trading were viewed as successfully priced by the underwriter because it helped build a long-term investment base.D. All of the above.E. None of the above.28. Empirical evidence suggests that upon announcement of a new equity issue, current stock prices generally:A. drop, perhaps because the new issue reflects management's view that common stock is currently overvalued.B. remain about the same since an efficient market anticipates a new equity issue.C. increase, perhaps because the issues are associated with positive NPV projects.D. increase, because the market supply is always less than demand.E. increase, because underwriters exercise their green shoe option.29. Underpricing can possibly be explained by:A. oversubscription of an issue.B. strong demand by investors.C. undersubscription of an issue.D. Both B and C.E. Both A and B.30. Debt capacity is often given as a reason for the value of the stock falling when equity is issued. The reason for this is:A. the high issue costs of a debt offering must be paid by the shareholders.B. the priority position of the equity is lowered.C. management has information that the probability of default has risen, limiting the debt capacity and causing the firm to raise equity capital.D. All of the above.E. None of the above31. A study by Lee, Lockhead, Ritter, and Zhao that examined the underwriting discount and other direct costs of going public with a debt or equity offering, found:A. the direct expenses are higher for equity than debt offerings.B. substantial economies of scale are prevalent.C. underpricing, on average, is similar in magnitude to total direct expenses.D. All of the above.E. None of the above.32. The six components that make up the total costs of new issues are:A. the spread; other direct expenses such as filing fees; indirect expenses such as management time; economies of scale; abnormal returns and the Green Shoe option.B. the discount; other direct expenses such as filing fees; indirect expenses such as management time; due diligence costs; abnormal returns and the Green Shoe option.C. the spread; other direct expenses such as filing fees; indirect expenses such as management time; abnormal returns; underpricing and the Green Shoe option.D. the spread; other direct expenses such as filing fees; economies of scale; due diligence costs; abnormal returns and underpricing.E. None of the above.33. In comparison to debt issuance expenses, the total direct costs of equity issues are:A. considerably less.B. about the same.C. meaningless.D. considerably greater.E. None of the above.34. To determine the value of a rights offering, the stockholder needs to know the following two pieces of information in addition to the current stock price:A. the subscription price and the number of rights needed to acquire a new share.B. the amount of new equity to be raised and the number of rights needed to acquire a new share.C. the amount of new equity to be raised and standby fee.D. the detachment date and the subscription price.E. None of the above.35. Assuming everything else is constant, when a stock goes ex-rights its price should:A. decrease since the stockholder is losing an option.B. increase since the corporation no longer has the right to force the stockholder to convert.C. remain the same since an efficient market would anticipate this change.D. move up or down depending on whether a small investor wanted to exercise his/his rights.E. None of the above.36. If a shareholder or investor wants to acquire new stock under a rights plant they must:A. acquire new stock in the market to get a controlling fraction of shares to be eligible for rights.B. simply pay a registration fee and turn in the subscription price.C. acquire the correct rights per share desired, then turn the rights and the total subscription price into the subscription agent.D. acquire the correct rights and wait for the company to send you the stock.E. call their broker and sell some CBOE options to make any money.37. Which of the following statements is true?A. The subscription price is generally above the old stock price.B. The subscription price is generally above the ex-rights price.C. The subscription price is generally below the old stock price.D. Both A and B.E. Both B and C.38. A shareholder who has rights is:A. always better off to exercise the rights.B. always better off to sell the rights into the market.C. able to exercise their rights or sell them.D. never in the same ownership position again with rights.E. None of the above.39. A standby underwriting arrangement provides the:A. company with methods to cancel the offering.B. company with an alternate investment banker if there is conflict between the issuer and the agent.C. investment banker with an oversubscription privilege to ensure profits are earned.D. company with an alternative avenue of sale to ensure success of the rights offering.E. investment bankers with an added syndication for the rights offering.40. Professor Clifford W. Smith, in evaluating issuance costs from underwritten issues, rights issues with standby underwriting, and a pure rights issues, found that 90% of the issues are underwritten, which was the most expensive method. This is done because:A. investment bankers know more than CFOs and they may buy the issue at an agreed upon price and disburse the funds sooner.B. investment bankers can increase the price received by increasing confidence in the issue, and they will buy the issue at an agreed upon price and disburse the cash sooner.C. investment bankers provide other services including price counseling, increasing public confidence, and providing funds to the issuer sooner.D. investment bankers know how to price the issue, and would not need to set as low as a price as the subscription price and provide price counseling.E. None of the above.41. Corporations use the shelf registration method of security sales because:A. preregistered securities can be quickly brought to market.B. the main registration process is eliminated for up to two years.C. their stock is below investment grade.D. Both A and B.E. Both B and C.42. In terms of costs of issuing equity, Professor Clifford W. Smith finds that the ranking of methods, from cheapest to most expensive, is:A. rights issue with standby underwriting, equity issue with underwriting, pure rights issue.B. pure rights issue, rights issue with standby underwriting, equity issue with underwriting.C. pure rights issue, preferred stock and debt issue with underwriting for an IPO, rights issue with standby underwriting.D. equity issue with underwriting, rights issue with standby underwriting, pure rights issue.E. equity issue with underwriting, pure rights issue, rights issue with standby underwriting.43. Arguments to explain why most equity issues are underwritten versus sold through a rights offering are:A. underwriters buy at an agreed upon price and bear some risk of selling the issue.B. cash proceeds are available sooner in underwriting and the issue is available to a wider market.C. investment bankers can provide market advice and certify the issue for potential investors.D. All of the above.E. None of the above.44. Corporations are allowed to use the shelf registration method if they:A. are rated investment grade and have aggregate market stock value of more than $150 million.B. have not violated the 1934 Securities Act in the past 12 months.C. have not defaulted on its debt in the past 3 years.D. All of the above.E. None of the above.45. Arguments against the use of the shelf-registration are:A. only technology and manufacturing-based firms can use it.B. less current information available to investors might raise the cost of debt.C. possible market overhang from future issues depressing price.D. Both A and C.E. Both B and C.46. The market for venture capital refers to the:A. private financial marketplace for servicing small, young firms.B. bond markets.C. market for selling rights to individuals who already own shares.D. market for selling equity securities for firms with equity already outstanding.E. None of the above.47. Rule 144A provides the framework for the issuance of private securities to qualified institutional investors. To buy private securities, institutional investors:A. must be willing to hold a less liquid security and manage a fund.B. must be willing to make a market in the security and be a primary market dealer.C. must be a limited partner in the issue and willing to reduce the illiquidity of the security.D. must be willing to hold a less liquid security and have $100 million under management.E. None of the above.48. Venture capitalists provide financing for new firms from the seed and start-up stage all the way to mezzanine and bridge financing. In exchange for financing, entrepreneurs give:A. a high interest rate debt instrument and control.B. an equity position and usually board of director positions.C. up the right to have an initial public offering.D. control to a court appointed trustee.E. the venture capitalists jobs as CEOs and CFOs.49. An IPO of a firm formerly financed by venture capital is carried out for what primary purposes?A. Insiders can sell their shares or cash outB. Generate cash to pay down bank indebtednessC. To establish a market value for the equity and provide funds for operationsD. All of the above.E. None of the above.50. Which of the following is not one of the four main functions that underwriters provide?A. Risk bearingB. MarketingC. Auditing the financial statementsD. CertificationE. Monitoring51. Types of dilution include:A. dilution of percentage ownershipB. dilution of market shareC. dilution of book value and earnings per shareD. A and CE. All of the above52. The Wordsmith Corporation has 10,000 shares outstanding at $30 each. They expect to raise $150,000 by a rights offering with a subscription price of $25. How many rights must you turn in to get a new share?A. 0.60B. 1.20C. 1.67D. 2.00E. Insufficient data to determine53. Assuming everything else is constant, if a stock's old price is $25 and the ex-rights or new stock price is $19, then the value of the right is:A. $-6.B. $6.C. impossible to determine without the subscription price.D. impossible to determine without the number of rights needed to buy one share.54. The LaPorte Corporation has a new rights offering that allows you to buy one share of stock with 3 rights and $20 per share. The stock is now selling ex-rights for $26. The price rights-on is:A. $22.00B. $24.00C. $26.00D. $28.00E. impossible to determine without the cum-rights price.55. Regional Power wants to raise $10 million in new equity. The subscription price is $20. There are currently 3 million shares outstanding, each with 1 right. How many rights are needed to purchase 1 share?A. 1B. 3C. 5D. 6E. 856. The Overland Corporation intends to issue 50,000 new shares to raise funds for expansion of current plant facilities. The current share price is $40 and there are 500,000 shares outstanding. The number of rights needed to buy a share of stock should be:A. 1B. 10C. 40D. 400E. indeterminate without the subscription price.57. The Schroeder Corporation has 20,000 shares outstanding at $20 each. They expect to raise $200,000 by a rights offering with a subscription price of $25. How many rights must you turn in to get a new share?A. 1.25B. 1.50C. 2.00D. 2.50E. Insufficient data to determine58. Assuming everything else is constant, if a stock's old price is $40 and the ex-rights or new stock price is $32, then the value of the right is:A. $-8.B. $8.C. impossible to determine without the subscription price.D. impossible to determine without the number of rights needed to buy one share.59. The Holly Corporation has a new rights offering that allows you to buy one share of stock with 4 rights and $25 per share. The stock is now selling ex-rights for $30. The price rights-on is:A. $21.00B. $25.00C. $30.00D. $31.25E. impossible to determine without the cum-rights price.60. Bradley Power wants to raise $40 million in new equity. The subscription price is $25. There are currently 5 million shares outstanding, each with 1 right. How many rights are needed to purchase 1 share?A. 1.000B. 3.000C. 3.125D. 4.525E. 6.52561. The Shields Corporation intends to issue 100,000 new shares to raise funds for expansion of current plant facilities. The current share price is $20 and there are 500,000 shares outstanding. The number of rights needed to buy a share of stock should be:A. 1B. 5C. 20D. 50E. indeterminate without the subscription price.62. For a particular stock the old stock price is $20, the ex-rights price is $15, and the number of rights needed to buy a new share is 2. Assuming everything else constant, the subscription price is ______ .A. $5B. $13C. $17D. $18E. $20Essay QuestionsThe Holyoke Corporation has 120,000 shares outstanding with a current market price of $8.10 per share. The company needs to raise an additional $36,000 to finance new expenditures, and has decided on a rights issue. The issue will allow current stockholders to purchase one additional share for 20 rights at a subscription price of $6 per share.63. Calculate the ex-rights price that would make a new stockholder indifferent between buying shares at the old stock price and exercising the rights or buying the shares ex-rights.64. If the ex-rights price were set at $7.90, would you as a potential new stockholder choose to buy shares ex-rights or buy shares at the old price and exercise your rights?65. Suppose that the company was also considering structuring the rights issue to allow for an additional share to be purchased for 10 rights at a subscription price of $3. Prove that a stockholder with 100 shares would be indifferent between purchasing a new share for 10 rights at $3 or purchasing a new share for 20 rights at $6.66. Explain the advantages of a shelf-registration to an issuer. How can timeliness of disclosure and a potential market overhang work against a shelf-registration?67. The evidence on IPO sales is varied from issue to issue, but there are three common themes; underpricing, underperformance, and the reasons for going public. Explain these three themes.68. The Direct Interactive Publishing Company is planning to raise $200 million dollars in new capital. There are currently 50 million shares outstanding with an estimated market price of $60 each. The corporate officers are debating whether to use a rights offering (with or without a standby underwriting) or have the issue fully underwritten. The company is currently listed on a regional exchange and plans to list on a national exchange after the security issue. List and explain three advantages/disadvantages of each method.69. Discuss what a Dutch auction is and how it works.70. Lamar Inc. is attempting to raise $5,000,000 in new equity with a rights offering. The subscription price will be $40 per share. The stock currently sells for $50 per share and there are 250,000 shares outstanding. How many rights are needed to buy a new share?71. Lamar Inc. is attempting to raise $5,000,000 in new equity with a rights offering. The subscription price for the 125,000 new shares will be $40 per share. The stock currently sells for $50 per share and there are 250,000 shares outstanding. What will the price per share be if all rights are exercised?Chapter 20 Issuing Securities to the Public Answer KeyMultiple Choice Questions1. An equity issue sold directly to the public is called:A. a rights offer.B. a general cash offer.C. a restricted placement.D. a fully funded sales.E. a standard call issue.Difficulty level: EasyTopic: EQUITY ISSUEType: DEFINITIONS2. An equity issue sold to the firm's existing stockholders is called:A. a rights offer.B. a general cash offer.C. a private placement.D. an underpriced issue.E. an investment banker's issue.Difficulty level: EasyTopic: RIGHTS OFFERType: DEFINITIONS3. Management's first step in any issue of securities to the public is:A. to file a registration form with the SEC.B. to distribute copies of the preliminary prospectus.C. to distribute copies of the final prospectus.D. to obtain approval from the board of directors.E. to prepare the tombstone advertisement.Difficulty level: EasyTopic: SECURITY ISSUANCEType: DEFINITIONS4. A rights offering is:A. the issuing of options on shares to the general public to acquire stock.B. the issuing of an option directly to the existing shareholders to acquire stock.C. the issuing of proxies which are used by shareholders to exercise their voting rights.D. strictly a public market claim on the company which can be traded on an exchange.E. the awarding of special perquisites to management.Difficulty level: MediumTopic: RIGHTS OFFERINGType: DEFINITIONS5. Companies use tombstone advertisements in the financial press to:A. announce the death of the company.B. announce the failure of a financial strategy.C. announce the availability of a new issue of a corporate security.D. notify the public of foreclosure.E. None of the above.Difficulty level: EasyTopic: NEW ISSUANCEType: DEFINITIONS6. The first public equity issue made by a company is a(n):A. initial private offering.B. initial public offering.C. secondary offering.D. seasoned new issue.E. None of the above.Difficulty level: EasyTopic: INITIAL PUBLIC OFFERINGType: DEFINITIONS7. The first public equity issue that is made by a company is referred to as:A. a rights issue.B. a general cash offer.C. an initial public offering.D. an unseasoned issue.E. Both C and D.Difficulty level: MediumTopic: INITIAL PUBLIC OFFERINGType: DEFINITIONS8. A new public equity issue from a company with equity previously outstanding is called a(n):A. initial public offering.B. seasoned equity issue.C. unseasoned equity issue.D. private placement.E. syndicate.Difficulty level: EasyTopic: SEASONED EQUITY OFFERINGType: DEFINITIONS9. The green shoe option is used to:A. cover oversubscription.B. cover excess demand.C. provide additional reward to the investment bankers for a risky issue.D. provide additional reward to the issuing firm for a risky issue.E. Both A and B.Difficulty level: MediumTopic: GREEN SHOE PROVISIONType: DEFINITIONS。

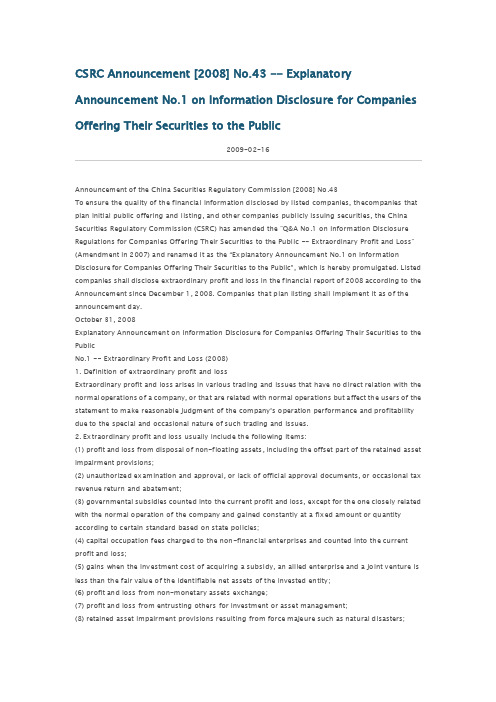

公开发行证券的公司信息披露解释性公告第1号——非经常性损益(2008)(英文版)

CSRC Announcement [2008] No.43 -- Explanatory Announcement No.1 on Information Disclosure for Companies Offering Their Securities to the Public2009-02-16Announcement of the China Securities Regulatory Commission [2008] No.43To ensure the quality of the financial information disclosed by listed companies, thecompanies that plan initial public offering and listing, and other companies publicly issuing securities, the China Securities Regulatory Commission (CSRC) has amended the "Q&A No.1 on Information Disclosure Regulations for Companies Offering Their Securities to the Public -- Extraordinary Profit and Loss" (Amendment in 2007) and renamed it as the “Explanatory Announcement No.1 on Information Disclosure for Companies Offering Their Securities to the Public”, which is hereby promulgated. Listed companies shall disclose extraordinary profit and loss in the financial report of 2008 according to the Announcement since Dec ember 1, 2008. Companies that plan listing shall implement it as of the announcement day.October 31, 2008Explanatory Announcement on Information Disclosure for Companies Offering Their Securities to the PublicNo.1 -- Extraordinary Profit and Loss (2008)1. Definition of extraordinary profit and lossExtraordinary profit and loss arises in various trading and issues that have no direct relation with the normal operations of a company, or that are related with normal operations but affect the users of the statement to make reasonable judgment of the company’s operation performance and profitability due to the special and occasional nature of such trading and issues.2. Extraordinary profit and loss usually include the following items:(1) profit and loss from disposal of non-floating assets, including the offset part of the retained asset impairment provisions;(2) unauthorized examination and approval, or lack of official approval documents, or occasional tax revenue return and abatement;(3) governmental subsidies counted into the current profit and loss, except for the one closely related with the normal operation of the company and gained constantly at a fixed amount or quantity according to c ertain standard based on state policies;(4) capital occupation fees charged to the non-financ ial enterprises and counted into the current profit and loss;(5) gains when the investment cost of acquiring a subsidy, an allied enterprise and a joint venture is less than the fair value of the identifiable net assets of the invested entity;(6) profit and loss from non-monetary assets exchange;(7) profit and loss from entrusting others for investment or asset management;(8) retained asset impairment provisions resulting from force majeure such as natural disasters;(9) profit and loss from debt reorganization(10) enterprises’ reorganization fees, such as staffing expenses and integration fees;(11)profit and loss that exceeds the fair value in transaction with unfair price;(12) current net profit and loss of the subsidies established by merger of enterprises under unified control from the beginning of the period to the merger day;(13) profit and loss on contingency that has no relation with the normal operation of the company;(14) profit or loss from change in fair value by holding tradable financial assets and liabilities, and investment income from disposal of tradable financial assets and liabilities as well as salable financial assets, excluding the effective hedging businesses related with the normal operations of the company;(15) switch-bac k of impairment provisions of accounts receivable that have undergone impairment test alone;(16) profit and loss from outward entrusted loaning;(17) profit and loss from the change of investment property’s fair value by follow-up measurement in fair value mode;(18) impact on the current profit and loss by one-off adjustment to the current profit and loss according to the requirements of the tax as well as accounting laws and rules;(19) custody fees of entrusted operation;(20) other non-operating income and expenses besides the above items; and(21) other items that conform to the definition of extraordinary profit and loss.3. Companies shall, when compiling prospectus, periodic al reports or application materials of securities issue, by referring to the definition of extraordinary profit and loss, take into full consideration the relations and sustainability of relevant profit and loss with the normal operation of the companies, so as to make reasonable judgment and full disclosure with regard to their actual conditions.4. Companies shall add necessary notes to the content of significant extraordinary profit and loss items besides disclosing the items and amounts of extraordinary profit and loss.5. If companies define the extraordinary profit and loss items listed herein as recurring profit and loss items based on the “other items that conform to the definition of extraordinary profit and loss” as well as the nature and characteristics of their normal operational business, they shall make separate explanations in the notes.6. If the profits and losses of a small number of shareholders or their income taxes are affected, the companies shall, when calculating the financial indicators related with extraordinary profit and loss, deduct relevant data.7. C ertified public accountants shall, when issuing audit or examination reports for financial reports in companies’ prospectus, periodical reports and application materials for securities issue, pay due attention to the extraordinary profit and loss items, amounts and notes, and verify the truthfulness, accuracy, completeness and reasonableness of the disclosed extraordinary profit and loss as well as the explanations.8. Listed companies shall disclose extraordinary profit and loss in their financial reports of 2008 according to the Announcement sinc e December 1, 2008. Companies that plan listing shall implement it as of the announc ement day.文- 汉语汉字编辑词条文,wen,从玄从爻。

博迪的投资学第一章练习题(英)

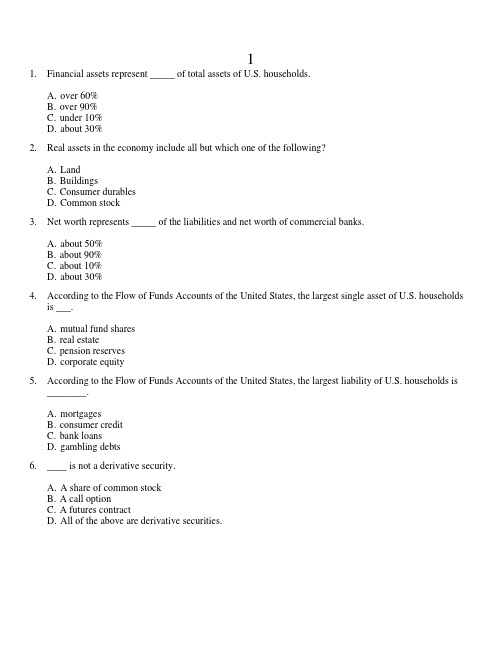

11.Financial assets represent _____ of total assets of U.S. households.A. over 60%B. over 90%C. under 10%D. about 30%2.Real assets in the economy include all but which one of the following?A. LandB. BuildingsC. Consumer durablesD. Common stock worth represents _____ of the liabilities and net worth of commercial banks.A. about 50%B. about 90%C. about 10%D. about 30%4.According to the Flow of Funds Accounts of the United States, the largest single asset of U.S. householdsis ___.A. mutual fund sharesB. real estateC. pension reservesD. corporate equity5.According to the Flow of Funds Accounts of the United States, the largest liability of U.S. households is________.A. mortgagesB. consumer creditC. bank loansD. gambling debts6.____ is not a derivative security.A. A share of common stockB. A call optionC. A futures contractD. All of the above are derivative securities.7.According to the Flow of Funds Accounts of the United States, the largest financial asset of U.S.households is ____.A. mutual fund sharesB. corporate equityC. pension reservesD. personal trusts8.Active trading in markets and competition among securities analysts helps ensure that __________.I. security prices approach informational efficiencyII. riskier securities are priced to offer higher potential returnsIII. investors are unlikely to be able to consistently find under- or overvalued securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and III9.The material wealth of society is determined by the economy's _________, which is a function of theeconomy's _________.A. investment bankers, financial assetsB. investment bankers, real assetsC. productive capacity, financial assetsD. productive capacity, real assets10.Which of the following is not a money market security?A. U.S. Treasury billB. Six month maturity certificate of depositC. Common stockD. Banker's acceptance11.__________ assets generate net income to the economy and __________ assets define allocation of incomeamong investors.A. Financial, financialB. Financial, realC. Real, financialD. Real, real12.Which of the following are financial assets?I. Debt securitiesII. Equity securitiesIII. Derivative securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and III13.__________ are examples of financial intermediaries.A. Commercial banksB. Insurance companiesC. Investment companiesD. All of the above are financial intermediaries14.Asset allocation refers to the _________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific assets within each asset classD. none of the answers define asset allocation15.Which one of the following best describes the purpose of derivatives markets?A. Transferring risk from one party to anotherB. Investing for a short time period to earn a small rate of returnC. Investing for retirementD. Earning interest income16.__________ was the first to introduce mortgage pass-through securities.A. Chase ManhattanB. CiticorpC. FNMAD. GNMA17.Security selection refers to the ________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific securities within each asset classD. top down method of investing18._____ is an example of an agency problem.A. Managers engage in empire buildingB. Managers protect their jobs by avoiding risky projectsC. Managers over consume luxuries such as corporate jetsD. All of the answers provide examples of agency problems19._____ is a mechanism to mitigate potential agency problems.A. Tying income of managers to success of the firmB. Directors defending top managementC. Anti takeover strategiesD. Straight voting method of electing the board of directors20.__________ are real assets.A. BondsB. Production equipmentC. StocksD. Commercial paper21.__________ portfolio construction starts with selecting attractively priced securities.A. Bottom-upB. Top-downC. Upside-downD. Side-to-side22.In a capitalist system capital resources are primarily allocated by ____________.A. governmentsB. the SECC. financial marketsD. investment bankers23. A __________ represents an ownership share in a corporation.A. call optionB. common stockC. fixed-income securityD. preferred stock24.The value of a derivative security _________.A. depends on the value of other related securityB. affects the value of a related securityC. is unrelated to the value of a related securityD. can only be integrated by calculus professors25. A bond issue is broken up so that some investors will receive interest payments while others will receiveprincipal payments. This is an example of _________.A. bundlingB. credit enhancementC. securitizationD. unbundling26.__________ portfolio management calls for holding diversified portfolios without spending effort orresources attempting to improve investment performance through security analysis.A. ActiveB. MomentumC. PassiveD. Market timing27.Financial markets allow for all but which one of the following?A. Shift consumption through time from higher income periods to lowerB. Price securities according to their riskinessC. Channel funds from lenders of funds to borrowers of fundsD. Allow most participants to routinely earn high returns with low risk28.Financial intermediaries exist because small investors cannot efficiently _________.A. diversify their portfoliosB. gather informationC. monitor their portfoliosD. all of the answers provide reasons why29.Methods to encourage managers to act in shareholders' best interest includeI. Threat of takeoverII. Proxy fights for control of the Board of DirectorsIII. Tying managers' compensation to stock price performanceA. I onlyB. I and II onlyC. II and III onlyD. I, II and III30.Firms that specialize in helping companies raise capital by selling securities to the public are called_________.A. pension fundsB. investment banksC. savings banksD. REITs31.In securities markets, there should be a risk-return trade-off with higher-risk assets having _________expected returns than lower-risk assets.A. higherB. lowerC. the sameD. Can't tell from the information given32.__________ are an indirect way U.S. investors can invest in foreign companies.A. ADRsB. IRAsC. SDRsD. CPCs33.Security selection refers to _________.A. choosing specific securities within each asset-classB. deciding how much to invest in each asset-classC. deciding how much to invest in the market portfolio versus the riskless assetD. deciding how much to hedge34.An example of a derivative security is _________.A. a common share of General MotorsB. a call option on Intel stockC. a Ford bondD. a U.S. Treasury bond35.__________ portfolio construction starts with asset allocation.A. Bottom-upB. Top-downC. Upside-downD. Side-to-side36.Which one of the following firms falsely claimed to have a $4.8 billion bank account at Bank of Americaand vastly understated its debts, eventually resulting in the firm's bankruptcy?A. WorldComB. EnronC. ParmalatD. Global Crossing37.Debt securities promise _________.I. a fixed stream of incomeII. a stream of income that is determined according to a specific formulaIII. a share in the profits of the issuing entityA. I onlyB. I or II onlyC. I and III onlyD. II or III only38.The Sarbanes-Oxley Act tightened corporate governance rules by requiring all but which one of thefollowing?A. Required corporations to have more independent directorsB. Required the CFO to personally vouch for the corporation's financial statementsC. Required that firms could no longer employ investment bankers to sell securities to the publicD. The creation of a new board to oversee the auditing of public companies39.The success of common stock investments depends on the success of _________.A. derivative securitiesB. fixed income securitiesC. the firm and its real assetsD. government methods of allocating capital40.The historical average rate of return on the large company stocks since 1926 has beenA. 5%B. 8%C. 12%D. 20%41.The average rate of return on U.S. Treasury bills since 1926 was _________.A. 0.5%B. 2.4%C. 3.8%D. 6.0%42.An example of a real asset is _________.I. a college educationII. customer goodwillIII. a patentA. I onlyB. II onlyC. I and III onlyD. I, II and III43.The 2002 law designed to improve corporate governance is titled theA. Pension Reform ActB. ERISAC. Financial Services Modernization ActD. Sarbanes-Oxley Act44.Which of the following is not a financial intermediary?A. a mutual fundB. an insurance companyC. a real estate brokerage firmD. a savings and loan company45.The combined liabilities of American households represent approximately __________ percent ofcombined assets.A. 11%B. 21%C. 25%D. 33%46.In 2008 real assets represented approximately __________ percent of the total asset holdings of Americanhouseholds.A. 37%B. 42%C. 48%D. 55%47.In 2008 mortgages represented approximately __________ percent of total liabilities and net worth ofAmerican households.A. 12%B. 15%C. 28%D. 42%48.Liabilities equal approximately _____ of total assets for nonfinancial U.S. businesses.A. 10%B. 25%C. 44%D. 75%49.Which of the following is not an example of a financial intermediary?A. Goldman SachsB. Allstate InsuranceC. First Interstate BankD. IBM50.Real assets represent about ____ of total assets for financial institutions.A. 1%B. 15%C. 25%D. 40%51.Money Market securities are characterized by ________.I. maturity less than one yearII. safety of the principal investmentIII. low rates of returnA. I onlyB. I and II onlyC. I and III onlyD. I, II and III52.After much investigation an investor finds that Intel stock is currently under priced. This is an example of______.A. asset allocationB. security analysisC. top down portfolio managementD. passive management53.After considering current market conditions an investor decides to place 60% of their funds in equities andthe rest in bonds. This is an example ofA. asset allocationB. security analysisC. top down portfolio managementD. passive management54.Suppose an investor is considering one of two investments which are identical in all respects except forrisk. If the investor anticipates a fair return for the risk of the security they invest in they can expect toA. earn no more than the Treasury bill rate on either securityB. pay less for the security that has higher riskC. pay less for the security that has lower riskD. earn more if interest rates are lower55.The efficient markets hypothesis suggests that _______.A. active portfolio management strategies are the most appropriate investment strategiesB. passive portfolio management strategies are the most appropriate investment strategiesC. either active or passive strategies may be appropriate, depending on the expected direction of the marketD. a bottom up approach is the most appropriate investment strategy56.In a perfectly efficient market the best investment strategy is probably a/anA. active strategyB. passive strategyC. asset allocationD. market timing57.An important trend that has changed the contemporary investment market is _________.A. financial engineeringB. globalizationC. securitizationD. all three of the other answers58.Securitization refers to the creation of new securities by _________.A. selling individual cash flows of a security or loanB. repackaging individual cash flows of a security or loan into a new payment patternC. taking an illiquid asset and converting it into a marketable securityD. selling financial services overseas as well as in the U.S.59.Brady bonds were an example of _________.A. securitizationB. mortgagizationC. bundlingD. pass through securities60.Individuals may find it more advantageous to purchase claims from a financial intermediary rather thandirectly purchasing claims in capital markets becauseI. intermediaries are better diversified than most individualsII. intermediaries can exploit economies of scale in investing that individual investors cannotIII. intermediated investments usually offer higher rates of return than direct capital market claimsA. I onlyB. I and II onlyC. II and III onlyD. I, II and III61.Surf City Software Company develops new surf forecasting software. It sells the software to Microsoft inexchange for 1000 shares of Microsoft common stock. Surf City Software has exchanged a _____ asset fora _____ asset in this transaction.A. real, realB. financial, financialC. real, financialD. financial, real62.Stone Harbor Products takes out a bank loan. It receives $100,000 and signs a promissory note to pay backthe loan over 5 years.A. A new financial asset was created in this transaction.B. A financial asset was traded for a real asset in this transaction.C. A financial asset was destroyed in this transaction.D. A real asset was created in this transaction.63.Which of the following firms was not engaged in a major accounting scandal between 2000 and 2005?A. General ElectricB. ParmalatC. EnronD. WorldCom64.Accounting scandals can often be attributed to a particular concept in the study of finance known as theA. agency problemB. risk - return trade - offC. allocation of riskD. securitization65.An intermediary that pools and manage funds for many investors is called a/an ______.A. investment companyB. savings and loanC. investment bankerD. ADR66.Financial institutions that specialize in assisting corporations in primary market transactions are called_______.A. mutual fundsB. investment bankersC. pension fundsD. globalization specialists67.WEBS allow investors to _______.A. invest in U.S. mortgage backed securitiesB. invest in an individual foreign stockC. invest in a portfolio of foreign stocksD. avoid any exposure to foreign exchange risk68.In 2008 the largest corporate bankruptcy in the U.S. history involved the investment banking firm of______.A. Goldman SachsB. Lehman BrothersC. Morgan StanleyD. Merrill Lynch69.The inability of shareholders to influence the decisions of managers, despite overwhelming shareholdersupport, is a breakdown in what process or mechanism?A. AuditingB. Public financeC. Corporate governanceD. Public reporting70.Real assets are ______.A. are assets used to produce goods and servicesB. always the same as financial assetsC. always equal to liabilitiesD. claims on company's income71. A major cause of mortgage market meltdown in 2007 and 2008 was linked to ________.A. globalizationB. securitizationC. negative analyst recommendationsD. online trading72.In recent years the greatest dollar amount of securitization occurred for which type loan?A. Home mortgagesB. Credit card debtC. Automobile loansD. Equipment leasing73.The process of securitizing poor quality bank loans made to developing nations resulted in the creation of__________.A. Pass-throughsB. Brady bondsC. WEBSD. FHLMC participation certificates74.U.S. Treasury bonds pay interest every six months and repay the principal at maturity. The U.S.Treasury routinely sells individual interest payments on these bonds to investors. This is an example of ___________.A. unbundlingB. bundlingC. securitizationD. security selection75.An investment advisor has decided to purchase gold, real estate, stocks, and bonds in equal amounts. Thisdecision reflects which part of the investment process?A. Asset allocationB. Investment analysisC. Portfolio analysisD. Security selection1 Key1.Financial assets represent _____ of total assets of U.S. households.A. over 60%B. over 90%C. under 10%D. about 30%Bodie - Chapter 01 #1Difficulty: Easy2.Real assets in the economy include all but which one of the following?A. LandB. BuildingsC. Consumer durablesD. Common stockBodie - Chapter 01 #2Difficulty: Easy worth represents _____ of the liabilities and net worth of commercial banks.A. about 50%B. about 90%C. about 10%D. about 30%Bodie - Chapter 01 #3Difficulty: Medium 4.According to the Flow of Funds Accounts of the United States, the largest single asset of U.S.households is ___.A. mutual fund sharesB. real estateC. pension reservesD. corporate equityBodie - Chapter 01 #4Difficulty: Medium 5.According to the Flow of Funds Accounts of the United States, the largest liability of U.S. households is________.A. mortgagesB. consumer creditC. bank loansD. gambling debtsBodie - Chapter 01 #5Difficulty: Medium6.____ is not a derivative security.A. A share of common stockB. A call optionC. A futures contractD. All of the above are derivative securities.Bodie - Chapter 01 #6Difficulty: Easy 7.According to the Flow of Funds Accounts of the United States, the largest financial asset of U.S.households is ____.A. mutual fund sharesB. corporate equityC. pension reservesD. personal trustsBodie - Chapter 01 #7Difficulty: Medium8.Active trading in markets and competition among securities analysts helps ensure that __________.I. security prices approach informational efficiencyII. riskier securities are priced to offer higher potential returnsIII. investors are unlikely to be able to consistently find under- or overvalued securitiesA. I onlyB. I and II onlyC. II and III onlyD. I, II and IIIBodie - Chapter 01 #8Difficulty: Hard 9.The material wealth of society is determined by the economy's _________, which is a function of theeconomy's _________.A. investment bankers, financial assetsB. investment bankers, real assetsC. productive capacity, financial assetsD. productive capacity, real assetsBodie - Chapter 01 #9Difficulty: Medium10.Which of the following is not a money market security?A. U.S. Treasury billB. Six month maturity certificate of depositC. Common stockD. Banker's acceptanceBodie - Chapter 01 #10Difficulty: Medium11.__________ assets generate net income to the economy and __________ assets define allocation ofincome among investors.A. Financial, financialB. Financial, realC. Real, financialD. Real, realBodie - Chapter 01 #11Difficulty: Medium12.Which of the following are financial assets?I. Debt securitiesII. Equity securitiesIII. Derivative securitiesA. I onlyB. I and II onlyC. II and III onlyD.I, II and IIIBodie - Chapter 01 #12Difficulty: Hard13.__________ are examples of financial intermediaries.A. Commercial banksB. Insurance companiesC. Investment companiesD. All of the above are financial intermediariesBodie - Chapter 01 #13Difficulty: Easy14.Asset allocation refers to the _________.A.allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC. choice of specific assets within each asset classD. none of the answers define asset allocationBodie - Chapter 01 #14Difficulty: Easy15.Which one of the following best describes the purpose of derivatives markets?A.Transferring risk from one party to anotherB. Investing for a short time period to earn a small rate of returnC. Investing for retirementD. Earning interest incomeBodie - Chapter 01 #15Difficulty: Medium16.__________ was the first to introduce mortgage pass-through securities.A. Chase ManhattanB. CiticorpC. FNMAD. GNMABodie - Chapter 01 #16Difficulty: Easy17.Security selection refers to the ________.A. allocation of the investment portfolio across broad asset classesB. analysis of the value of securitiesC.choice of specific securities within each asset classD. top down method of investingBodie - Chapter 01 #17Difficulty: Medium18._____ is an example of an agency problem.A. Managers engage in empire buildingB. Managers protect their jobs by avoiding risky projectsC. Managers over consume luxuries such as corporate jetsD. All of the answers provide examples of agency problemsBodie - Chapter 01 #18Difficulty: Easy19._____ is a mechanism to mitigate potential agency problems.A. Tying income of managers to success of the firmB. Directors defending top managementC. Anti takeover strategiesD. Straight voting method of electing the board of directorsBodie - Chapter 01 #19Difficulty: Hard20.__________ are real assets.A. BondsB. Production equipmentC. StocksD. Commercial paperBodie - Chapter 01 #20Difficulty: Easy21.__________ portfolio construction starts with selecting attractively priced securities.A. Bottom-upB. Top-downC. Upside-downD. Side-to-sideBodie - Chapter 01 #21Difficulty: Easy22.In a capitalist system capital resources are primarily allocated by ____________.A. governmentsB. the SECC. financial marketsD. investment bankersBodie - Chapter 01 #22Difficulty: Easy23. A __________ represents an ownership share in a corporation.A. call optionmon stockC. fixed-income securityD. preferred stockBodie - Chapter 01 #23Difficulty: Easy24.The value of a derivative security _________.A.depends on the value of other related securityB. affects the value of a related securityC. is unrelated to the value of a related securityD. can only be integrated by calculus professorsBodie - Chapter 01 #24Difficulty: Easy 25. A bond issue is broken up so that some investors will receive interest payments while others willreceive principal payments. This is an example of _________.A. bundlingB. credit enhancementC. securitizationD.unbundlingBodie - Chapter 01 #25Difficulty: Easy 26.__________ portfolio management calls for holding diversified portfolios without spending effort orresources attempting to improve investment performance through security analysis.A. ActiveB. MomentumC.PassiveD. Market timingBodie - Chapter 01 #26Difficulty: Easy27.Financial markets allow for all but which one of the following?A. Shift consumption through time from higher income periods to lowerB. Price securities according to their riskinessC. Channel funds from lenders of funds to borrowers of fundsD. Allow most participants to routinely earn high returns with low riskBodie - Chapter 01 #27Difficulty: Moderate28.Financial intermediaries exist because small investors cannot efficiently _________.A. diversify their portfoliosB. gather informationC. monitor their portfoliosD. all of the answers provide reasons whyBodie - Chapter 01 #28Difficulty: Easy29.Methods to encourage managers to act in shareholders' best interest includeI. Threat of takeoverII. Proxy fights for control of the Board of DirectorsIII. Tying managers' compensation to stock price performanceA. I onlyB. I and II onlyC. II and III onlyD. I, II and IIIBodie - Chapter 01 #29Difficulty: Easy 30.Firms that specialize in helping companies raise capital by selling securities to the public are called_________.A. pension fundsB.investment banksC. savings banksD. REITsBodie - Chapter 01 #30Difficulty: Easy 31.In securities markets, there should be a risk-return trade-off with higher-risk assets having _________expected returns than lower-risk assets.A. higherB. lowerC. the sameD. Can't tell from the information givenBodie - Chapter 01 #31Difficulty: Easy32.__________ are an indirect way U.S. investors can invest in foreign companies.A. ADRsB. IRAsC. SDRsD. CPCsBodie - Chapter 01 #32Difficulty: Easy33.Security selection refers to _________.A. choosing specific securities within each asset-classB. deciding how much to invest in each asset-classC. deciding how much to invest in the market portfolio versus the riskless assetD. deciding how much to hedgeBodie - Chapter 01 #33Difficulty: Easy34.An example of a derivative security is _________.A. a common share of General MotorsB. a call option on Intel stockC. a Ford bondD. a U.S. Treasury bondBodie - Chapter 01 #34Difficulty: Easy35.__________ portfolio construction starts with asset allocation.A. Bottom-upB. Top-downC. Upside-downD. Side-to-sideBodie - Chapter 01 #35Difficulty: Easy 36.Which one of the following firms falsely claimed to have a $4.8 billion bank account at Bank ofAmerica and vastly understated its debts, eventually resulting in the firm's bankruptcy?A. WorldComB. EnronC. ParmalatD. Global CrossingBodie - Chapter 01 #36Difficulty: Medium37.Debt securities promise _________.I. a fixed stream of incomeII. a stream of income that is determined according to a specific formulaIII. a share in the profits of the issuing entityA. I onlyB.I or II onlyC. I and III onlyD. II or III onlyBodie - Chapter 01 #37Difficulty: Medium 38.The Sarbanes-Oxley Act tightened corporate governance rules by requiring all but which one of thefollowing?A. Required corporations to have more independent directorsB. Required the CFO to personally vouch for the corporation's financial statementsC. Required that firms could no longer employ investment bankers to sell securities to the publicD. The creation of a new board to oversee the auditing of public companiesBodie - Chapter 01 #38Difficulty: Medium39.The success of common stock investments depends on the success of _________.A. derivative securitiesB. fixed income securitiesC. the firm and its real assetsD. government methods of allocating capitalBodie - Chapter 01 #39Difficulty: Easy40.The historical average rate of return on the large company stocks since 1926 has beenA. 5%B. 8%C.12%D. 20%Bodie - Chapter 01 #40Difficulty: Medium41.The average rate of return on U.S. Treasury bills since 1926 was _________.A. 0.5%B. 2.4%C. 3.8%D. 6.0%Bodie - Chapter 01 #41Difficulty: Medium42.An example of a real asset is _________.I. a college educationII. customer goodwillIII. a patentA. I onlyB. II onlyC. I and III onlyD. I, II and IIIBodie - Chapter 01 #42Difficulty: Medium43.The 2002 law designed to improve corporate governance is titled theA. Pension Reform ActB. ERISAC. Financial Services Modernization ActD. Sarbanes-Oxley ActBodie - Chapter 01 #43Difficulty: Easy44.Which of the following is not a financial intermediary?A. a mutual fundB. an insurance companyC. a real estate brokerage firmD. a savings and loan companyBodie - Chapter 01 #44Difficulty: Medium 45.The combined liabilities of American households represent approximately __________ percent ofcombined assets.A. 11%B.21%C. 25%D. 33%Bodie - Chapter 01 #45Difficulty: Medium 46.In 2008 real assets represented approximately __________ percent of the total asset holdings ofAmerican households.A. 37%B. 42%C. 48%D. 55%Bodie - Chapter 01 #46Difficulty: Medium。

金融英语第五章答案

Chapter 5Ⅰ. Answer the following questions in English.1.How do central banks earn money?It is a bank that can lend to other banks in times of need. And then make a profit.2. What is primary responsibility of central bank?Its primary responsibility is to maintain the stability of the national currency and money supply, but more active duties include controlling subsidized-loan interest rates, and acting as a lender of last resort1to the banking sector during times of financial crisis (private banks often being integral to the national financial system ).3. What is central bank's primary liability?A central bank's primary liabilities are the currency outstanding, and these liabilities are backed by the assets the bank owns.4. What is open market operations?Open market operations are the means of implementing monetary policy by which a central bank controls its national money supply by buying and selling government securities, or other financial instruments. Monetary targets, such as interest rates or exchange rates, are used to guide this implementation.5. What are the functions of legal reserve requirements?legal reserve requirements were introduced to reduce the risk of banks overextending themselves and suffering from bank runs, as this could lead to knock-on effects on other banks.6. What is mean about M1 and M2 ?Currency and bank reserves together make up the monetary base,calledM1 and M2.7. Why do central banks establish reserve requirements for other banks? Because it plays a important role in market.8. Does the lower interest rate stimulate economy development?Low interest rates tend to stimulate borrowing from the banking system. This expansion of credit causes an expansion of the supply of money, through the money creation process in a fractional reserve banking system. This in turn leads to an unsustainable "monetary boom" during which the "artificially stimulated" borrowing seeks out diminishing investment opportunities. This boom results in widespread malinvestments8, causing capital resources to be" misallocated into areas that would not attract investment if the money supply remained stable.Ⅱ. Fill in the each blank with an appropriate word or expression.1. Through open market operations, a central bank influences themoney supply_ in an economy directly. Each time it buys securities, exchangingmoney for the security, it _raises_____ the money supply. Conversely, selling of securities lowers the money supply.2. Central banks generally earn___ money by __issuing___ currencynotes and "selling" them to the public for interest-bearing assets, such as governmentbonds.3. Typically a central bank __controls____ certain types of short-term interest rates.These _influence_____ the stock and bond markets as well as mortgage and otherinterest rates.4. All banks are required to _hold_____ a certain percentage of their assets ascapital, a rate which may be _established_______ by the central bank or the bankingsupervisor.5. The mechanism to move the market towards a "target rate" is generally to __lend____ money or borrow money in theoretically unlimited quantities,until the targeted market rate is sufficiently _close_______ to the target.6. Most countries control bank mergers and are wary of concentration in this industry _due to_____ the danger of groupthink and runaway lending bubbles based on___ a single point of failure, the credit culture of the few large banks.Ⅲ. Translate the following sentences into English.1.中国人民银行运用的货币政策工具包括准备金率、中央银行基准利率、再贴现率、中央银行贷款、公开市场操作和其他由国务院规定的政策工具。

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of financial instrument?A. StockB. BondC. DerivativeD. Commodity2. The term "leverage" in finance refers to:A. The use of borrowed funds to increase the potential return of an investment.B. The amount of money invested in a project.C. The process of buying and selling securities.D. The risk associated with a particular investment.3. What does the acronym "IPO" stand for?A. International Public OfferingB. Initial Public OfferingC. Internal Private OfferingD. International Private Offering4. The primary market is where:A. Securities are issued for the first time to the public.B. Securities are traded after they have been issued.C. Companies buy back their own securities.D. Investors sell their securities to other investors.5. A bear market is characterized by:A. A prolonged period of falling prices.B. A period of economic growth.C. A period of high inflation.D. A period of low unemployment.6. The term "risk management" in finance involves:A. Predicting future market trends.B. Identifying potential risks and taking steps tomitigate them.C. Maximizing returns on investments.D. Managing the day-to-day operations of a financial institution.7. A "blue chip" stock refers to:A. A stock that is considered to be of high quality and carries a lower risk.B. A stock that is traded on a blue-colored chip.C. A stock that is considered to be very risky.D. A stock that is traded on a major stock exchange.8. The process of "short selling" involves:A. Borrowing securities and selling them in the hope of buying them back at a lower price.B. Selling securities that the investor does not own.C. Buying securities with the expectation that their price will increase.D. Holding securities for a long period of time.9. What is the role of a "broker" in finance?A. To provide financial advice to clients.B. To facilitate the buying and selling of securities between investors.C. To manage a company's financial transactions.D. To underwrite securities for companies.10. The "efficient market hypothesis" suggests that:A. Stock prices fully reflect all available information.B. It is possible to consistently beat the market by picking individual stocks.C. Investors are irrational and make poor decisions.D. The market is always undervalued.二、填空题(每题1分,共10分)11. The _______ is the process by which a company raisescapital by issuing shares to the public for the first time. 12. A _______ is a financial contract that obligates thebuyer to purchase an asset or the seller to sell an asset ata predetermined future date and price.13. The _______ is the market where existing securities are bought and sold.14. The _______ is a measure of the risk of an investment compared to the return it is expected to generate.15. When the stock market is experiencing a significant and sustained increase in prices, it is known as a _______ market.16. A _______ is a financial institution that acceptsdeposits and provides various types of loans to customers. 17. The _______ is a measure of the ability of a company to pay its current debts with its current assets.18. A _______ is a financial statement that shows a company's financial performance over a period of time.19. The _______ is a type of investment strategy that focuseson long-term growth potential.20. An _______ is a financial instrument that derives its value from an underlying asset.三、简答题(每题5分,共30分)21. Explain the difference between a "mutual fund" and a "hedge fund".22. Describe the concept of "diversification" in investment.23. What is "inflation" and how does it affect the value of money?24. Discuss the role of "central banks" in the economy.四、论述题(每题20分,共20分)25. Discuss the impact of globalization on the financial markets and provide examples to support your argument.五、案例分析题(每题20分,共20分)26. Analyze a recent financial crisis and discuss the factors that contributed to it, the impact it had on the global economy, and the lessons that can be learned from it.答案:一、选择题1-5 D A B A A6-10 B A A B A二、填空题11. Initial Public Offering (IPO)。

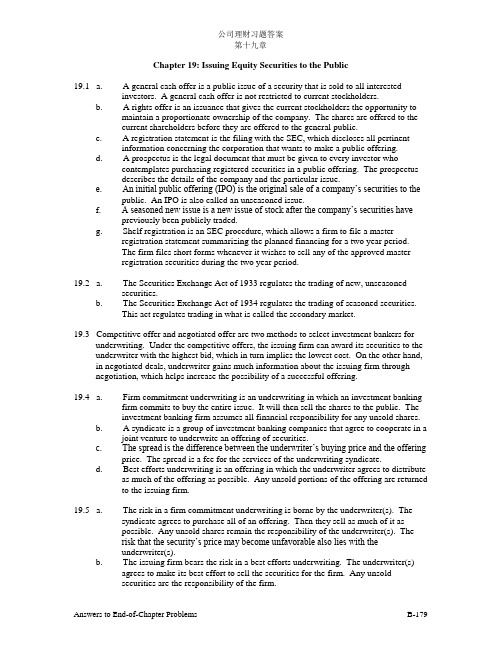

罗斯《公司理财》英文习题答案DOCchap019

公司理财习题答案第十九章Chapter 19: Issuing Equity Securities to the Public19.1 a. A general cash offer is a public issue of a security that is sold to all interestedinvestors. A general cash offer is not restricted to current stockholders.b. A rights offer is an issuance that gives the current stockholders the opportunity tomaintain a proportionate ownership of the company. The shares are offered to thecurrent shareholders before they are offered to the general public.c. A registration statement is the filing with the SEC, which discloses all pertinentinformation concerning the corporation that wants to make a public offering.d. A prospectus is the legal document that must be given to every investor whocontemplates purchasing registered securities in a public offering. The prospectusdescribes the details of the company and the particular issue.e. An initial public offering (IPO) is the original sale of a company’s securities to thepublic. An IPO is also called an unseasoned issue.f. A seasoned new issue is a new issue of stock after the company’s securities havepreviously been publicly traded.g. Shelf registration is an SEC procedure, which allows a firm to file a masterregistration statement summarizing the planned financing for a two year period.The firm files short forms whenever it wishes to sell any of the approved masterregistration securities during the two year period.19.2 a. The Securities Exchange Act of 1933 regulates the trading of new, unseasonedsecurities.b. The Securities Exchange Act of 1934 regulates the trading of seasoned securities.This act regulates trading in what is called the secondary market.19.3 Competitive offer and negotiated offer are two methods to select investment bankers forunderwriting. Under the competitive offers, the issuing firm can award its securities to the underwriter with the highest bid, which in turn implies the lowest cost. On the other hand, in negotiated deals, underwriter gains much information about the issuing firm throughnegotiation, which helps increase the possibility of a successful offering.19.4 a. Firm commitment underwriting is an underwriting in which an investment bankingfirm commits to buy the entire issue. It will then sell the shares to the public. Theinvestment banking firm assumes all financial responsibility for any unsold shares.b. A syndicate is a group of investment banking companies that agree to cooperate in ajoint venture to underwrite an offering of securities.c. The spread is the difference between the underwriter’s buying price and the offeringprice. The spread is a fee for the services of the underwriting syndicate.d. Best efforts underwriting is an offering in which the underwriter agrees to distributeas much of the offering as possible. Any unsold portions of the offering are returnedto the issuing firm.19.5 a. The risk in a firm commitment underwriting is borne by the underwriter(s). Thesyndicate agrees to purchase all of an offering. Then they sell as much of it aspossible. Any unsold shares remain the responsibility of the underwriter(s). Therisk that the security’s price may become unfavorable also lies with theunderwriter(s).b. The issuing firm bears the risk in a best efforts underwriting. The underwriter(s)agrees to make its best effort to sell the securities for the firm. Any unsoldsecurities are the responsibility of the firm.19.6 In general, the new price per share after the offering is:P = (market value + proceeds from offering) / total number of sharesi. At $40 P = ($400,000 + ($40 x 5,000)) / 15,000 =$40ii. At $20 P = ($400,000 + ($20 x 5,000)) / 15,000 = $33.33iii. At $10 P = ($400,000 + ($10 x 5,000)) / 15,000 = $3019.7 The poor performance result should not surprise the professor. Since he subscribed to everyinitial public offering, he was bound to get fewer superior performers and more poorperformers. Financial analysts studied the companies and separated the bad prospects from the good ones. The analysts invested in only the good prospects. These issues becameoversubscribed. Since these good prospects were oversubscribed, the professor received a limited amount of stock from them. The poor prospects were probably under-subscribed, so he received as much of their stock as he desired. The result was that his performance was below average because the weight on the poor performers in his portfolio was greater than the weight on the superio r performers. This result is called the winner’s curse. The professor “won” the shares, but his bane was that the shares he “won” were poorperformers.19.8 There are two possible reasons for stock price drops on the announcement of a new equityissue:i. M anagement may attempt to issue new shares of stock when the stock is over-valued, that is, the intrinsic value is lower than the market price. The price drop isthe result of the downward adjustment of the overvaluation.ii. W ith the increase of financial distress possibility, the firm is more likely to raise capital through equity than debt. The market price drops because it interprets theequity issue announcement as bad news.19.9 The costs of new issues include underwriter’s spread, direct and indirect expenses, negativeabnormal returns associated with the equity offer announcement, under-pricing, and green-shoe option.19.10 a. $12,000,000/$15 = 800,000b. 2,400,000/800,000 = 3c. The shareholders must remit $15 and three rights for each share of new stock theywish to purchase.19.11 a. In general, the ex-rights price isP = (Market value + Proceeds from offering) / Total number of sharesP = ($25 x 100,000 + $20 x 10,000) / (100,000 + 10,000) = $24.55b. The value of a right is the difference between the rights-on price of the stock andthe ex-rights price of the stock. The value of a right is $0.45 (=$25 - $24.55).Alternative solution:The value of a right can also be computed as:(Ex-rights price - Subscription price) / Number of rights required to buy a share ofstockValue of a right = ($24.55 - $20) / 10 = $0.45c. The market value of the firm after the issue is the number of shares times the ex-rights price.Value = 110,000 x $24.55 $2,700,000 (Note that the exact ex-rights price is$24.5454.)公司理财习题答案第十九章d. The most important reason to offer rights is to reduce issuance costs. Also, rightsofferings do not dilute ownership and they provide shareholders with moreflexibility. Shareholders can either exercise or sell their rights.19.12 The value of a right = $50 - $45 = $5The number of new shares = $5,000,000 / $25 = 200,000The number of rights / share = ($45 - $25) / $5 = 4The number of old shares = 200,000 x 4 = 800,00019.13 a. Assume you hold three shares of the company’s stock. The value of your holdingsbefore you exercise your rights is 3 x $45 = $135. When you exercise, you mustremit the three rights you receive for owning three shares, and ten dollars. You haveincreased your equity investment by $10. The value of your holdings is $135 + $10= $145. After exercise, you own four shares of stock. Thus, the price per share ofyour stock is $145 / 4 = $36.25.b. The value of a right is the difference between the rights-on price of the stock andthe ex-rights price of the stock. The value of a right is $8.75 (=$45 - $36.25).c. The price drop will occur on the ex-rights date. Although the ex-rights date isneither the expiration date nor the date on which the rights are first exercisable, it isthe day that the price will drop. If you purchase the stock before the ex-rights date,you will receive the rights. If you purchase the stock on or after the ex-rights date,you will not receive the rights. Since rights have value, the stockholder receivingthe rights must pay for them. The stock price drop on the ex-rights day is similar tothe stock price drop on an ex-dividend day.19.14 a. Stock price (ex-right) = (13+2) / (1+0.5) = $10Subscription price = 2 / 0.5 = $4Right’s price = 13-10 = $3= (10-4) / 2 = $3b. Stock price (ex-right) = (13+2) / (1+0.25) = $12Subscription price = 2 / 0.25 = $8Right’s price = 13-12 = $1= (12-8) / 4 = $1c. The stockholders’ wealth is the same between the two arrangements.19.15 If the interest of management is to increase the wealth of the current shareholders, a rightsoffering may be preferable because issuing costs as a percentage of capital raised is lower for rights offerings. Management does not have to worry about underpricing becauseshareholders get the rights, which are worth something. Rights offerings also preventexisting shareholders from losing proportionate ownership control. Finally, whether the shareholders exercise or sell their rights, they are the only beneficiaries.19.16 Reasons for shelf registration include:i. Flexibility in raising money only when necessary without incurring additional issuancecosts.ii. As Bhagat, Marr and Thompson showed, shelf registration is less costly than conventional underwritten issues.iii. Issuance of securities is greatly simplified.19.17 Suppliers of venture capital can include:i. Wealthy families / individuals.ii. Investment funds provided by a number of private partnerships and corporations.iii. Venture capital subsidiaries established by large industrial or financial corporations.iv. “Angels” in an informal venture capital market.19.18 The proceeds from IPO are used to:i. exchange inside equity ownership for outside equity ownershipii. finance the present and future operations of the IPO firms.19.19 Basic empirical regularities in IPOs include:i. underpricing of the offer price,ii. best-efforts offerings are generally used for small IPOs and firm-commitment offerings are generally used for large IPOs,iii. the underwriter price stabilization of the after market and,iv. that issuing costs are higher in negotiated deals than in competitive ones.。

mba fa 《financial accounting》 习题答案4