金融英语复习参考题

金融英语复习参考题

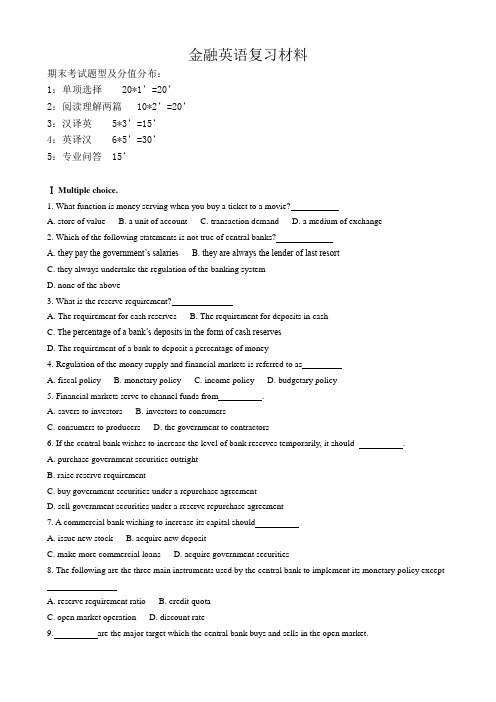

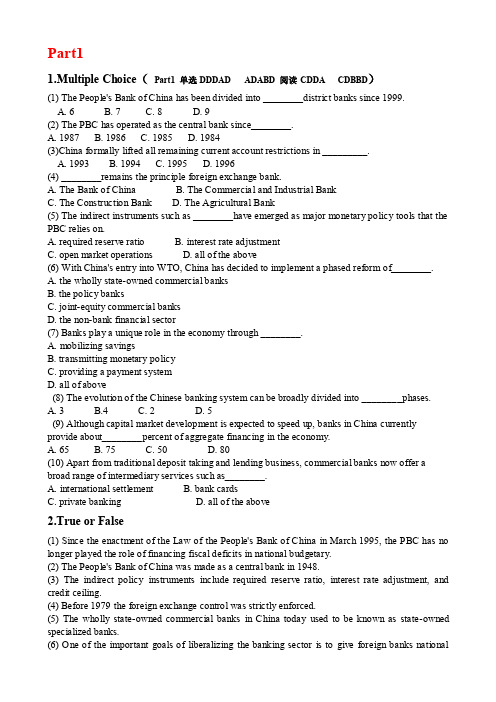

金融英语复习材料期末考试题型及分值分布:1:单项选择 20*1’=20’2:阅读理解两篇 10*2’=20’3:汉译英 5*3’=15’4:英译汉 6*5’=30’5:专业问答 15’Ⅰ Multiple choice.1. What function is money serving when you buy a ticket to a movie?A. store of valueB. a unit of accountC. transaction demandD. a medium of exchange2. Which of the following statements is not true of central banks?A. they pay the government’s salariesB. they are always the lender of last resortC. they always undertake the regulation of the banking systemD. none of the above3. What is the reserve requirement?A. The requirement for cash reservesB. The requirement for deposits in cashC. T he percentage of a bank’s deposits in the form of cash reservesD. The requirement of a bank to deposit a percentage of money4. Regulation of the money supply and financial markets is referred to asA. fiscal policyB. monetary policyC. income policyD. budgetary policy5. Financial markets serve to channel funds from .A. savers to investorsB. investors to consumersC. consumers to producersD. the government to contractors6. If the central bank wishes to increase the level of bank reserves temporarily, it should .A. purchase government securities outrightB. raise reserve requirementC. buy government securities under a repurchase agreementD. sell government securities under a reserve repurchase agreement7. A commercial bank wishing to increase its capital shouldA. issue new stockB. acquire new depositC. make more commercial loansD. acquire government securities8. The following are the three main instruments used by the central bank to implement its monetary policy exceptA. reserve requirement ratioB. credit quotaC. open market operationD. discount rate9. are the major target which the central bank buys and sells in the open market.A. financial institution bondsB. corporate bondsC. stocksD. government securities10. Financial intermediaries are institutionsA. that borrow funds from investors in productive facilitiesB. that act as middlemen in transferring funds from ultimate lenders to ultimate borrowersC. that lend funds to small saversD. all of the above11. Financial markets can be classified asA. debt and equity marketsB. primary and secondary marketC. money and capital marketsD. all of the above12. Commercial banks participate in the money market asA. lenders onlyB. borrowers onlyC. both lender and borrowersD. trustees only13. The major expense of commercial bank isA. wages and salariesB. dividend payments to stockholdersC. interest on depositsD. taxes14. Stocks are also referred to asA. securitiesB. equitiesC. sharesD. all of above15. Which of the following is not a type of bond?A. corporateB. treasuryC. EurodollarD. municipal16. Which of the following is a debt instrument found in the capital market?A.U.S. treasury billB. commercial paperC. residential mortgageD. demand deposit17. The foreign exchange market is organized asA. a physical marketB. a capital marketC. a speculative marketD. over-the-counter market18. Exchange control require the governmentA. to ensure that the foreign-exchange market is perfectly competitiveB. to stop buying foreign exchangeC. to sell more foreign exchange than it buysD. to balance inflows and outflows of foreign exchange at the current exchange rate19. The forward rate is calculated by adjusting the spot rate by aA. premiumB. discountC. marginD. difference20. When the U.S. real interest rate is low, owning U.S. assets is and so U.S. net foreign investment isA. more attractive…highB. more attractive…lowC. less attractive…highD. less attractive…low21.The main liability on a bank balance sheet is ______.A. depositsB. capital and reservesC. loans and overdraftsD. cash22. Why must the liabilities and assets of a bank be actively managed? ______.A. Because assets and liabilities are not evenly matched on the same time scaleB. Because assets and liabilities are evenly matchedC. Because the interbank market uses LIBORD. Because assets and liabilities can be underwritten23. Financial intermediaries by "borrowing short and lending long" find themselves in difficult financial situations becauseA. short-term rates are fallingB. long-term rates are risingC. deposits increase too rapidlyD. short-term rates rise relative to rates of their holdingsE. long-term rates rise more sharply than short-term rates24. Banks manage their assets considering ______.A. riskB. some optimum combination of the aboveC. earningsD. liquidity25. Indirect finance is also known as .A. financial intermediationB. intangible financeC. disintermediationD. the futures market26. Which of the following financial institutions have the most assets?A. life insurance companyB. private pension fundsC. commercial banksD. credit unions27. By purchasing government securities commercial banks are .A. borrowing from the governmentB. acquiring earning assetsC. making a “loan” to the governmentD. both B and C28. Which of the following financial intermediaries operate in primary securities markets?A. brokersB. dealersC. commercial banksD. investment banks29.Which of the following would be considered a disadvantage of allocating resources using a market system?A. Income will tend to be unevenly distributed.B. Significant unemployment may occur.C. The wastage of scarce economic resources cannot be prevented.D. A misallocation of resources may occur where there is a discrepancy between private and social costs.30. Which of the following is not a factor of production according to economists?A. LandB. LaborC. EntrepreneurshipD. Trademark31. Which of the following is not a function of money?A. To act as a medium of exchangeB. To act as a unit of accountC. To act as a store of valueD. To act as a means of paymentE. To provide a double coincidence of want.32. Legal tender includes .A. coins onlyB. notes onlyC. notes and coinsD. notes, coins and checks33. Commercial bank deposits with the central bank are part of the bank’sA. net worthB. demand depositsC. loan portfolioD. reserves34. The key factor limiting how much a commercial bank has immediately available to lend is the amount of itsA. demand depositsB. excess reservesC. vault cashD. savings deposits35. Which of the following central bank action would be appropriate to combat rapid inflation?A. A reduction in the discount rateB. A reduction in reserve requirementC. A cut in taxD. A sale of government securities36. A commercial bank wishing to increase its capital shouldA. issue new stockB. acquire new depositsC. make more commercial loansD. acquire government securities37. The price in the foreign market is calledA. the trade surplusB. the money priceC. the exchange rateD. the currency rate37. Monetary policy and policy are the two basic tools used by the government to influence the course of economic activity.A. accountingB. fiscalC. financialD.trade38. if the nominal rate of interest is 10 percent and the expected rate of inflation is 7 percent, the real rate of interest is .A.27 percentB. minus 3 percentC. plus 3 percentD. minus 27 plus39. A money market instrument usually used for import/export payment is known as .A. repurchase agreementB. EurodollarC. Certificate of depositD. Banker’s acceptance40. Bonds that can be changed to shares of common stock are said to be .A. callableB. general obligationC. convertibleD. zero-coupon41. Preferred stockholders receive .A. coupon paymentsB. fixed dividend paymentsC. variable dividend paymentsD. payment in the form of additional stock42. Bank manage their assets considering .A. riskB. liquidityC. earningsD. some optimum combination of the above43. Which of the following would be considered a loan secured by real estate?A. A credit card loanB. Subordinated debtC. Bank capitalD. A mortgage44. will be either the sole or the main source of a project loan repayment.A. capital fundsB. investment gainsC. the cash flow arising from the projectsD. all of the above45. In a syndicated loan, handles the negotiations with the borrower, prepares the relevant documentation and disburses the full amount of the loan to the borrower.A. the lead bankB. the accounting bankC. the participating bankD. the agent bank46. Repayment of a borrowing for working capital purposes usually comes from .A. profitsB. sale of fixed assetsC. cash flowD. capital introduced47. A loan agreement is normally prepared by and reviewed by .A. the lending bank’s legal counsel…the borrower’s attorneyB. the borrower’s attorney …the lending bank’s legal counselC. a third party other than the lending bank and the borrower… the lending bank’s legal counselD. none of the above48. For the most bank, are the largest and most obvious source of credit risk.A. guaranteesB. interbank transactionsC. loansD. equities49. A customer has deposited a gold watch with the bank for safe-keeping. This is an example ofA. lienB. pledgeC. bailmentD. mortgage50. A pledge provides a bank with .A. possession of the goodsB. rights over items held in safe custodyC. legal ownership of the goodsD. the ability to transfer interests in certain assets51. Which of the following is true of a mortgage?A. the mortgage retains possession of the mortgaged propertyB. the mortgagor retains possession of the mortgaged propertyC. the lender acquires the right to retain the mortgaged property until the mortgaged debt is repaidD. none of the above汉译英练习题:1.我们银行经办定期存款、活期存款和定活两便存款。

金融英语期末重点题

名词解释1、Financial market(金融市场)is a market in which financial assets (securities) such as stocks and bonds can be purchased or sold.2、Those participants that provide funds are called surplus units(盈余方).3、Participants that enter financial markets to obtain funds are called deficit units(赤字方)4、Those financial markets that facilitate the flow of short-term funds (with maturities of less than one year) are known as money markets(货币市场).5、Those that facilitate the flow of long-term funds are known as capital markets(资本市场).6、Primary markets(一级市场)facilitate the issuance of new securities. The issuance of new corporate stock or new treasury securities is a primary market transaction.7、Secondary markets(二级市场)facilitate the trading of existing securities. The sale of existing corporate stock or treasury security holdings by any business or individual is a secondary market transaction.8、liquidity(流动性), which is the degree to which securities can easily be liquidated (sold) without a loss of value.9、over-the-counter (OTC) market(场外市场), which is a telecommunications network.10、A secondary stock offering(二次发行)is a new stock offering by a specific firm whose stock is already publicly traded.11、Money Market Securities(货币市场证券)are debt securities that have a maturity of one year or less.12、Capital Market Securities(资本市场证券)securities with a maturity of more than one year are called Capital Market Securities.13、Bonds(债券)are long-term debt obligations issued by corporations and government agencies to support their operations. (Treasury notes and bonds).14、Mortgages(抵押贷款)are long-term debt obligations created to finance the purchase of real estate15、Stocks(股票)(also referred to as equity securities 股权类证券) are certificates representing partial ownership in the corporations that issued them. They are classified as capital market securities.16、Derivative securities(衍生证券)are financial contracts whose values are derived from the values of underlying assets (such as debt securities or equity securities).17、Speculation(投机): derivative securities allow an investor to speculate on movements in the underlying assets without having to purchase those assets.18 、Hedging(套期保值): Derivative securities can be used in a manner to generate gains if the value of the underlying assets declines.19、Foreign exchange rates(外汇汇率): is the price of one money in terms of another one.20、Mutual Funds(共同基金): they sell shares to surplus units and use the funds received to purchase a portfolio of securities.21、The Loanable Funds theory(可贷资金理论), commonly used to explain interest rate movements, suggests that the market interest rate is determined by the factors that control the supply of and demand for loanable funds.22、This relationship between interest rate and expected inflation is often referred to as the Fisher Effect(费舍效应).23、Crowding-out effect.(挤出效应)Given a certain amount of loanable funds supplied to the market( through saving), excessive government demand for these funds tends to “crowd out” the private demand (by consumer and corporation) for funds.24、Repurchase Agreements(购回协议)The Trading Desk purchases Treasury securities from government securities dealers with an agreement to sell back the securities at a specified date in the near future—to ensure adequate liquidity25、The Federal Reserve System (the Fed)(联邦储备系统), as the central bank of the United States, has the responsibility for conducting national monetary policy. 26、Commercial paper(商业票据)is a short-term debt instrument issued only by well-known creditworthy firms and is typically unsecured.27、Negotiable Certificates of Deposit (NCDs)(可转让存单)are issued by large commercial banks and other depository institutions as a short-term source of funds.28、Repo(回购)refers that one party sells securities to another with an agreement to repurchase the securities at a specified date and price.29、Federal funds(联邦基金)market allows depository institutions to effectively lend or borrow short-term funds from each other at the so-called federal funds rate.30、A banker’s acceptances(银行承兑)indicates thata bank accepts responsibility for a future payment. They are commonly used for international trade transactions.31、The U.S. dollar deposits in non-U.S. banks is called Eurodollar certificates of deposit or Eurodollar CDs(欧洲美元存款).32、Bond markets(债券市场)facilitate the flow of long-term debt from surplus units to deficit units.33、Bearer bonds(无记名债券): require the owner to clip coupons attacked to the bonds and send them to the issuer to receive coupon payments.34、Registered bonds(记名债券): require the issuer to maintain records of who owns the bond and automatically send coupon payments to the owners. 35、An initial public offering(首次公开募股)is a first-time of shares by a specific firm to the public.36、Over-the-Counter Market(场外交易市场):Trades through a telecommunications network37、Financial futures markets(金融期货市场)facilitate the trading of financial future contracts.38、financial futures contract(期货合约)is a standardized agreement to deliver or receive a specified amount of a specified financial instrument at a specified price and date.39、price movements of bond futures contracts Economic growth: employment, GDP, retail sales, industrial production, and consumer confidence40、A bond index futures contract allows for the buying and selling of a bond index for a specified price at a specifies date.41、Open Market OperationsThe buying and selling of government securities (through the Trading Desk) is referred to as open market operations.42、Stripped treasury bondsStripped Treasury BondsThe cash flows of bonds are commonly transformed(转化) by securities firms so that one security represents the principal payment only while a second security represents the interest payments1.depository institution(存款类金融机构):1Commercial Banks.2Saving institutions include savings and loan associations (S&Ls) and saving banks.3 Interaction between Savings Institutions and Other Financial Institutions. 4Credit unions(信用合作组织)2.Nondepository Financial Institutions(非存款类金融机构)1Finance Companies2Mutual Funds (共同基金)3 Securities firms4Insurance Companies 5 Pension Funds3.Depository institutions are popular financial institutions for the following reasons:They offer deposit accounts that can accommodate the amount and liquidity characteristics desired by most surplus units.Repackage funds received from deposits to provide loans of the size and maturity desired by deficit units. They act as a creditor.Accept the risk on loans provided.Have more expertise than individual surplus units in evaluating the creditworthiness of deficit unitsDiversify their loans among numerous deficit units and therefore can absorb defaulted loans better than individual surplus units could.4.Demand for loanable funds1)Household demand 2)Business demand 3)Government demand 4)Foreign demand 5)Aggregate demand5.The Fed has five major components:Federal Reserve district banks(联储地区银行)Member banksBoard of Governors(联邦储备理事会)Federal Open Market Committee (FOMC)Advisory committees(顾问委员会)6.The Fed can use three monetary policy tools to either increase or decrease the money supply:1)Open market operations2)Adjustments in the discount rate 3)Adjustments in the reserve requirement ratioparison of Monetary Policy Tools1)Open market operations are convenient and used without signaling the Fed’s intent ions.2)Adjustment to loans by adjusting discount rate is only temporary.3)Adjustment in the reserve requirement ratio can cause erratic (反复无常的)shifts in the money supply.6 M1 = Currency + checking depositsM2 = M1 + saving deposits, MMDAs, Eurodollars, small time depositsM3 = M2 + money market mutual funds, large time deposits, repurchase agreements8.popular money market securities are:Treasury bills, commercial paper, negotiable certificates of deposit, repurchase agreements, federal funds and banke r’s acceptances9.The reasons that the Eurodollar market are attractive for both depositors and borrowers:the spread between the rate banks pay and the rate they charge is relatively smallOnly governments and large corporations participate in this market—lower riskInvestors in the market avoid some costs (no deposit insurance, lower taxes, no government-mandated credit allocations)Eurodollar CDs are not subject to reserve requirements Less regulations and restrictions10.The purpose for call provisions(提前赎回条款): End up paying a higher rate when interest rates decline Retire bonds as required by a sinking-fund provision 11.Futures and forward contracts are similar in the following ways:Both are derivative securities for future delivery. The parties agree today on price and quantity for settlement in the future.Both are used to hedge currency risk, interest rate risk or commodity price risk.They differ in these ways:Forward contracts are private, customized定制contracts between a bank and its clients depending on the client’s needs (OTC). There is no secondary market for forward contracts since they are private contractual agreements.Forward contracts are settled at expiration. Futures contracts are continually settled (mark to market) Profits/losses for a futures contract accumulate on a daily basis unlike a forward contract where profits/losses are realized at once at contract expiration. Futures markets have daily price limits. If the settlement price changes by the daily price limit, trading is stopped until the next day.12.Risk of Trading Futures Contracts1)Market risk: refers to fluctuations in the value of the instrument as a result of market conditions. (wrong expectation)2)Basis risk: the position being hedged by the futures contracts is not affected in the same manner as the instrument underlying the futures contract.3)Liquidity risk: refers to potential price distortions dueto a lack of liquidity. (no traders)4)Credit risk: is the risk that a loss will occur because a counterparty defaults on the contract.5)Prepayment risk: refers to the possibility that the assets to be hedged may be prepaid earlier than their designated maturity.6)Operational risk: is the risk of losses as a result of inadequate management or controls.13 Foreign stock offerings in U.S.Advantages: enhance the global image, easily place the issue of new stock, obtain large amount of fund, diversifies the shareholder base, increase the liquidity, protect a firm against hostile takeovers(恶意收购) Disadvantages: stringent(严格的) regulations, entail some costs14、How does the Fed use the monetary policy tools to adjust the money supply?(1)When the Fed issues securities, the commercial banks purchase those that are most attractive. The total funds decrease and the money supply falls.When the Fed purchase securities, the total funds increase, which represents a loosening of money supply growth.(2)To increase the money supply, the Fed can authorized a reduction in the discount rate; to decrease the money supply, the Fed can increase the discount rate.(3)The lower the reserve requirement ratio, the greater the lending capacity of depository institutions, so a larger money supply.Money multiply15、What are the characteristics of corporate bonds?(1)The bond indenture, trustee(2)Sinking-Fund Provision(偿债基金准备)(3)Protective Covenants(保护条款)16、What is the relationship between the government demand for loanable funds and interest rate? (Explain by pictures)The federal government demand-for-loanable-funds schedule is Dg1, if new bills are passed that cause a net increase in the deficit of USD20 billion, the federal government demand for loanable funds will increaseby that amount. The new demand schedule is Dg2.17、What are the ways by which the money flows from individual surplus units to deficit units?a major type of financial intermediary is the depository institution which accepts deposits from surplus units and provides credit to deficit units through loans and purchases of securities.18、How does the level of tax, do you think, affect the demand of household for loanable funds (please explain by pictures)?An investment tax credit will increase the incentive to borrow,it increases the demand for loanable funds.。

国际金融英文版第十五版复习资料

前言学弟学妹们,当你们看到这篇复习资料的时候, 学长已经在文档上传的当天上午参加了国际金融的考试, 本复习资料主要针对对象为成都信息工程学院(CUIT)英语系大三学生, 且立足教材也基于托马斯·A ·普格尔(Thomas A. Pugel)先生所著国际金融英文版·第15版, 其他版本或者相似教材也可作为参考, 本资料的整理除了参考维基百科,百度百科以及MBA 智库百科,当然最重要的是我们老师的课件. 为了帮助同学们顺利通过考试, 当然是拿到高分, 希望此资料能够帮助你们节省时间, 达到高效复习的效果.外国语学院2011级,陈爵歌(Louis) 2014年1月6日晚于宿舍 Chapter 2Transnationality Index (跨国化指数)(TNI ) is a means of ranking multinational corporations that is employed by economists and politicians. (反映跨国公司海外经营活动的经济强度,是衡量海外业务在公司整体业务中地位的重要指标) Foreign assets to total assets(外国资产占总资产比)Foreign sales to total sales(海外销售占总销售)Foreign employees to total employees(外籍雇员占总雇员)跨国化指数的构成联合国跨国公司与投资司使用的跨国化指数由三个指标构成:国外资产对公司总资产的百分比;国外销售对公司总销售的百分比;国外雇员人数对公司雇员总人数的百分比关于TNI 的计算公式:International Economic Integration( 国际经济一体化)International economic integration refers to the extent and strength of real -sector and financial -sector linkages among national economies.(国际经济一体化是指两个或两个以上的国家在现有生产力发展水平和国际分工的基础上,由政府间通过协商缔结条约,让渡一定的国家主权,建立两国或多国的经济联盟,从而使经济达到某种程度的结合以提高其在国际经济中的地位)Real Sector(实际经济部门): The sector of the economy engaged in the production and sale of goods and services(指物质的、精神的产品和服务的生产、流通等经济活动。

金融考研英语二真题答案

金融考研英语二真题答案一、阅读理解Passage 11. C2. B3. APassage 24. D5. A6. CPassage 37. A 8. D 9. B二、完形填空10. C 11. D 12. B 13. B 14. C15. A 16. D 17. B 18. C 19. A20. D 21. C 22. A 23. B 24. D25. A 26. B 27. C 28. D 29. C30. B三、综合阅读填空31. F 32. G 33. D 34. E 35. C36. A 37. H 38. B 39. C 40. F41. G 42. H 43. E 44. D 45. A四、翻译46. 参加这个考试的人数远远超过了预期。

47. 因为她的资历和经验,她被任命为部门经理。

48. 金融市场的波动可能会导致投资者的损失。

49. 这个项目在规定的时间内完成了,这是我们的重要成绩之一。

50. 自从经济危机以来,许多公司都采取了削减开支的措施。

五、作文题目:中国金融市场的发展与挑战随着中国经济的迅速崛起,中国金融市场也经历了快速发展。

然而,在这一过程中,金融市场也面临着一些挑战。

本文将探讨中国金融市场的发展现状以及所面临的主要挑战。

首先,中国金融市场的发展取得了显著的成就。

中国已成为全球第二大经济体,具有庞大的消费市场和潜力巨大的投资机会。

在金融领域,中国的股票市场、债券市场和期货市场迅速增长,并与国际市场融合。

同时,中国还积极推动金融创新,包括在线支付、数字货币等,为经济发展提供了新的动力。

然而,中国金融市场也面临着一些挑战。

首先,金融风险是发展中国金融市场的主要威胁之一。

目前,中国金融市场对外开放程度的提高使得外部冲击因素增加,金融市场波动性加大。

其次,市场监管和风险防范体系仍然不完善,监管能力、监管水平等需要进一步提升。

此外,金融市场的不均衡发展也是一个问题,一些地区和行业相对较弱,与一线城市相比,发展水平还有差距。

《金融专业英语》习题答案

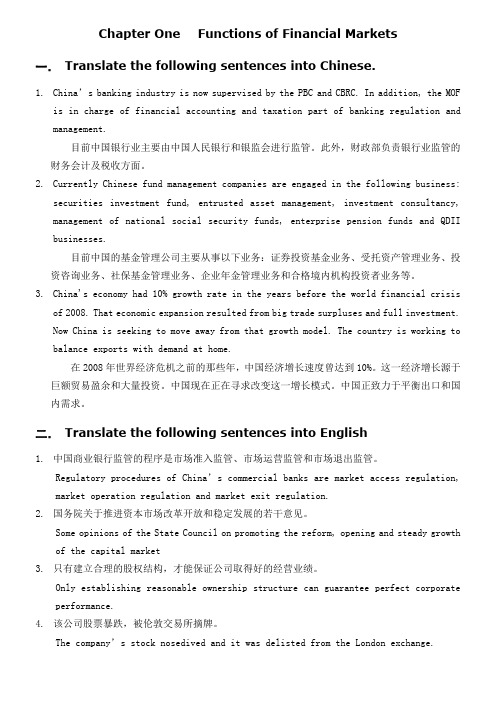

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOFis in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business:securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisisof 2008. That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

(金融保险类)金融英语模拟题集

Test2Part One ListeningSection One (10%)Directions: In this section you will hear 10 short statements. Each statement will be spoken only once. After each statement there will be a pause. During the pause, you must read the four suggested answers marked a, b, c and d, and decide which is the best answer.Now you will hear the example: She went to the bank with Mr. Smith.You will read:A. She went home. C.She went to the bank.B. She liked Mr. smith. D.She went to Mr. Smith's house. Statement C, "She went to the bank" is the closest in meaning to the statement "She went to the bank with Mr. Smith." Therefore, you should choose answerC. Now listen to the statements.1. A. Financial markets must support sound financial institutions.B. Sound financial institutions are made by financial markets.C. Financial markets should be backed by strong financial institutions.D. Financial markets are sound because of financial institutions.2. A. US dollar is going higher vs. Japanese Yen.B. US dollar is going higher vs. Pound Sterling.C. US dollar is going lower vs. Japanese Yen.D. US dollar is going lower vs. Deutsche Mark.3. A. Please remit us the bill amount through Barclay's bank on due date.B. Please claim the bill amount on Barclay's Bank on due date.C. Please pay the bill amount to Barclay's Bank.D. Please inform Barclay's Bank to reimburse us on due date.4. A. The People's Bank of China may not provide loans for organizations or individuals.B. The People's Bank of China may not give financial support to enterprises.C. The People's Bank of China may act as a financial guarantor for organizations or individuals.D. The People's Bank of China may not effect a financial guarantee for individuals or organizations..5. A. Policy is the only factor that affects stock prices.B. Policy is one factor that affects stock prices.C. Monetary policy is one of the factors that affect stock prices.D. Monetary policy is the only factor that affects stock prices..6. A. I wish to cash some cheques.B. I wish to cash some traveler's cheques.C. I wish to pay cash for my expenses here.D. I wish to pay for my traveller's cheques here7.A. The L/C will be confirmed by our bank.B. Our bank's agent will confirm the L/C.C. The credit will be opened by our bank's agent.D. Our branch in San Francisco will confirm the L/C.8.A. U.S. dollar is dearer.B. U.S. dollar is higher.C. Japanese yen is weaker.D. Japanese yen is stronger.9. A. The draft is a sight one.B. The draft is payable by Citibank.C. The bill is drawn on Citi Branch.D. The bill is not negotiable.10. A. We paid you early as required.B. Your documents came to us as required.C. Your documents have been correctly presented as required.D. You did not present the documents as required.S ection Two (10%)Directions: In this section, you will hear 10 short conversations. At the end of each conversation a question will be asked about what was said. Theconversations and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answerNow you will hear :M: Does our bank have a direct correspondent relationship with the Bradalys' Bank?W:No, we don't. So we have to advise this L/C via another bank.Q: Which of the following is right?Now you will read:A. We can advise this L/C to the Bradlays' Bank.B. The Bradlays' Bank is our correspondent.C. The L/C has to be advised by a third bank.D. We should advise this L/C by ourselves.From the conversation we know that we have to advise this L/C via another bank. The best answer is C. Therefore you should choose answer C.11. A. To apply for rolling over the loan for another period.B. To default on repayment.C. To repay it immediately.D. To apply for a new loan.2. A. 827.28 B. 829.19 C. 826.71 D. Not mentioned.13. A. He sold a house.B. He borrows some money from the man.C. He borrowed some money from the bank.D. He visited a new house.4. A. She pays a visit to the bank.B. She deals with a transaction with her customer.C. She wants to check Parks' cash and transactions of the day.D. She pays a visit to the Auditing Department.5.A. About remitting money. B. About getting a bill of exchange.C. About discounting a bill of exchange.D. About quotation of buying rate.16. A. she definitely accepted the request.B. She will not do what the man requested.C. She will use her car.D. She definitely refused the request.17. A. How to get a ticket to Paris. B. How to go to Paris.C. How to transfer money to Paris.D. How to fill the form.18. A. To open a current account. B. To open a savings account.C. To cash her cheques.D. To draw money from her savings account.19.A. 5% B. 3% C. 8% D. 6% 20. A. The interest rate will belowered B. The interest rate will be stable.C. The interest rate will increase.D. The interest rate will befloating.Section Three (10%)Directions: In this section, you will hear 3 short passages. At the end of each passage you will hear some questions about what was said. The passages and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answer Questions 21--23 are based on passage 121. A. 4:00 p.m. B. 5:30 p.m. C. 6:00 p.m. D. 6:30 p.m.22. A. He goes to concerts. B. He visits his friends.C. He meets his customers.D. He works at home.3. A. The bank's staff. B. The bank's location.C. The bank's long hours of services.D. The bank's balance sheet. Questions 24-26 are based on passage 224. A. Short term loans without guarantees by banks.B. Long term loans without guarantees by their respective governments.C. Long term loans under guarantees by their respective governments.D. Medium term loans under guarantees by their respective banks.25. A. International banks. B. industrial nations.C. Syndicates of international banks.D. Developed countries.26. A. Yes, they are. B. No, they are not.C. Yes, they are. They represent unusual risk to banks.D. No, they are not. They represent usual risk to banks.Questions 27-30 are based on Passage 327.A. 146 B. 159 C. 194 D. 16828. A. US$ 32.1 billion B. US$ 37.4billion.C. US$ 27.3 billion.D. US$ 4.8 billion.29. A. Allowing more foreign banks to do RMB business in Pudong.B. Extending the experimentation to Shenzhen.C. Increasing the limit on the RMB position of the foreign banks on acase-by-case basis.D. All of the above.30.A. To introduce new products and expertise.B. To improve efficiency in financial intermediation.C. To introduce more foreign capital into China.D. Both A and BPart two Reading Section One (10%)Directions: There are ten statements in this section. For each statement there are four choices marked A,B,C,D.You should choose the best answer.31. Which activities are not the investment banking activities?A. underwriting new issuesB. financial advisingC. dealing and brokingD. savings'taking32. ___________is the purchase of one company by another using mainly borrowed funds.A. A horizontal mergerB. A leveraged buyoutC. A vertical mergerD. A MBO33. The bill of lading is evidence of ownership. It thus functions as a ________.A. receipt for goodsB. contract for deliveryC. title documentD. negotiable instrument34. Liquidity ______________.A. is a measure of how quickly an item may be converted to foreign currenciesB. is a measure of how quickly an item may be converted to cashC. is a measure of how quickly an item may be converted to liabilitiesD. is a measure of how quickly an item may be converted to fixed capital 35.35.Among various worries concerning the internet banking, the first and foremost is the problem of __________.A. profitB. interestC. clientD. security36. According to the rules of debit and credit for balance sheet accounts ______________.A. decreases in asset, liabilities, and owner's equity accounts are recorded by debitsB. increases in liabilities and owner's equity accounts are recorded by creditsC. decreases in liabilities and asset are recorded by creditsD. increases in asset and owner's equity are recorded by debits37. _________ consist of a simultaneous sale or purchase of currency.A. Spot transactionsB. Forward transactionsC. Option forward transactionsD. Swap transaction38. Cash inflows from financing activities for a bank exclude: ________.A. receiving depositsB. issuance of equity securities (capital stock)C. issuance of debt securities ( bond, notes, mortgages)D. redemption of debt39. When a bank holds some valuables on behalf of its customer, the relationship between the bank and customer is ___________.A. debtor-----creditorB. bailor--------baileeC. principal-----agentD. trustor-------trustee40. The red clause documentary credit is often used as a method of ______.A. providing the seller with funds prior to shipmentB. providing the buyer with funds prior to shipmentC. providing the seller with funds after shipmentD. providing the buyer with funds after shipmentSection Two (10%)Directions: There are 10 blanks in the following passages. For each blanks there are four choices marked A, B, C, D. You should choose the best answer.Passage OneCommercial banks ___41______many functions, some central to their main role in the economy and others more peripheral. Although lending and deposit _____42______have been the epicenter of commercial banking, the last few years have witnessed a _______43_______in both the types and the volume of banking services. This surge has ____44____in part by government_____45_____,but most importantly by competitive pressures.41. A. do B. entailC. perform D. work42.A. allocating B. taking C. saving D. mobilizing43.A. increase B. improvement C. decrease D. surge44.A. been induced B. caused C. attributed D. been45.A. relaxation B. Control C. Regulation D. deregulationpassage TwoThere are generally several types of credits. A(n) "___46____" guarantees payment to the beneficiary, provided that the credit terms and conditions are met and the standing of the advising bank in the beneficiary's country is sound. A(n) " ____47______" may be cancelled at any time up to the moment the advising bank pays. This type of credit is ___48_____ favorable to the exporter. There is a risk that goods may be shipped and the credit revoked before documents are presented to the advising bank. A(n) "____49______" may not be cancelled or even amended without the consent of all the parties involved. This type of credit guarantees that no single party will revoke the contract already signed. A(n) "____50_____", like a commercial credit, is a promise by the issuer to honor the beneficiary's presentation of the credit.46.A. stand-by credit B. revocable credit C. irrevocable creditD. confirmed credit47.A. confirmed credit B. revocable credit C. irrevocable creditD. stand-by credit48.A. the most B. the least C. far D. much49. A. confirmed credit B. revocable credit C. irrevocable creditD. stand-by credit50.A. stand-by credit B. revocable credit C. irrevocable creditD. confirmed credits ection Three (10%)Directions: Read the following passages, and determine whether the sentences are "Right" or "wrong". If there is not enough information to answer " right" or "wrong''. choose "Doesn't say".Passage OneInternet banking has many advantages for banks. It is much cheaper to service a customer who makes contact only by phone, interactive TV, computer or other terminals, doing without the expensive branch network. Nevertheless, with Internet banking, customers do much of the basic data inputting themselves, further saving staff time of banks. Banks can invest the saved resources of human power and capital on utilizing the information of its customers when they are transacting, i. e. to route, analyze, and integrate data into meaningful patterns. Processed customer information is and will remain to be an invaluable asset of banks. And there is an element of self selection by higher earning customers - the Internet banking customers tend to be those who are relatively wealthy and generate the banks' profits. These advantages therefore suggest that the Internet is regarded as an increasingly important commercial tool by a growing number of banks.51. Internet banking services customers by phone, interactive TV, computer or other terminals.A. RightB.WrongC.Doesn't say52. Internet banking can save human power and capital.A.RightB.WrongC.Doesn't say53. Internet banking has many disadvantages for banks such as the risks and uncertainty of outcome.A.Righ tB.Wrong C .Doesn't sayPassage TwoRevocable credit is the one which can be amended or cancelled at any time, but the issuing bank is bound to pay drawing under the credit negotiated by the advising bank or the transmitting bank prior to the receipt by it of the notice of revocation or of amendment. An irrevocable credit, however, carries the irrevocable undertaking of the issuing bank to pay all drawings made in terms of the credit. Such a credit can only be amended or cancelled with the consent of all parties to it, that is the applicant, the issuing bank, the intermediary bank, if any, and the beneficiary.Where the confirmation of an intermediary bank is added to an irrevocable letter of credit, the credit is a confirmed credit, or more exactly, a confirmed irrevocable credit, and such a confirmation constitutes a definite undertaking ofthe confirming bank in addition to the undertaking of the issuing bank.54. A revocable credit can be amended in any circumstances.A. RightB. WrongC. Doesn't say55. An irrevocable confirmed credit gives the beneficiary a double assurance of payment.A. RightB. WrongC. Doesn't say56. An irrevocable credit cannot be cancelled.A. RightB. WrongC. Doesn't say57. Where the confirmation of intermediary bank is added to a revocable letter of credit, the credit is a confirmed revocable credit.A. RightB. WrongC. Doesn't sayPassage ThreeThe source of foreign exchange for overseas investment by domestic entities are subject to review by the SAFE before the application for such investment is filed with the relevant government agencies.Profits or other foreign exchange income of Chinese investors from their overseas investment must be remitted home within eight months after the close of each local accounting year and surrendered or kept in foreign exchange accounts in accordance with the regulations. Unless otherwise approved by the SAFE, Chinese investors may not divert foreign exchange receipts to any other purposes or keep them abroad. Whenever an enterprise winds up its overseas business, the investor shall repatriate all of the assets.58. SAFE is the abbreviation of the Stated Administration of Foreign Exchange.A. RightB. WrongC. Doesn't say59. When a corporation ends its overseas business, the investor shall repatriate all of the assets.A. RightB. WrongC. Doesn't say60. Chinese investors cannot divert foreign exchange receipts to any other purposes or keep them abroad.A.RightB.WrongC.Doesn't says ection Four (20%)Directions: There are 4 passages in this sections. Each passage is followed by some questions or unfinished statements. For each of them there are four choices marked A, B, C, D. You should choose the best answer.Passage OneA revolving documentary credit is one by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. The revolving documentary credit may be revocable or irrevocable, and may revolve in relation to time or value.In the case of a documentary credit that revolves in relation to time, e. g. which is initially available for up to USD15, 000. 00 per month during a fixedperiod of time, say, six months, the documentary credit is automatically available for USD15, 000. 00 each month irrespective of whether any sum was drawn during the previous month. A documentary credit of this nature can be cumulative or non-cumulative. If it is stated to be 'cumulative,'any sum not utilised during the first period carries over and may be utilised during a subsequent period. If it is 'non- cumulative,' any sum not utilised in a period ceases to be available, that is, it is not carried over to a subsequent period. It must be remembered that under this kind of documentary credit and following this example, the obligations of the issuing bank would be for USD90,000.00, i.e. six revolving periods each for USD15, 000. 00. Thus while the face value of the documentary credit is given as USD15, 000. 00 the total undertaking of the issuing bank is for the full value that might be drawn.In the case of a documentary credit that revolves in relation to value, the amount is reinstated utilisation within a given overall period of validity. The documentary credit may provide for automatic reinstatement immediately upon presentation of the specified documents, or it may provide for reinstatement only after receipt by the issuing bank of those documents or another stated condition.This kind of documentary credit involves the buyer and the banks in an incalculable liability. For that reason, it is not in common use. To maintain a degree of control, it would be necessary to specify the overall amount that may be drawn under the documentary credit. Such amount would have to be decided by the buyer and the seller to meet their requirements, and would have to be agreed to by the issuing bank.61. What's the correct definition of revolving documentary credit?A. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is reinstated without specific amendments to whichever kinds of credit the customer required.B. A revolving documentary credit is one by which, under the terms and conditions thereof, the tenor is extended without specific amendmentsto the documentary credit being required.C. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is renewed with specific amendments tothe documentary credit being required.D. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is reinstated without specific amendments to the documentary credit being required.62. "Ceases to" in Line 11 probably means __________________.A. "continue"B. "suspend to"C. "stop"D. "carry over"63. Which of the following statements is true?A. The revolving documentary credit may revolve according to the amount and time.B. A revolving documentary credit must be irrevocable.C. A revolving documentary credit must be revocable.D. The amount of a revolving documentary credit cannot be cumulated.64. When is the amount reinstated in the case of a documentary credit thatrevolves in relation to value?A. Just on presentation of specified documents.B. Only after the issuing bank receives those documents.C. Under the stated condition.D. All of above.65. The documentary credit that revolves in relation to value isn't commonlyused because ________.A. the overall amount that may be drawn under the documentary credit has been specifiedB. such credit involves the buyer and the bank in an incalculable liabilitiesC. it makes the issuing bank entail an incalculable liabilities.D. the documentary credit may provide for reinstatement immediately and automatically.Passage TwoPacking loan is a pre-shipment financing facility. The exporter can obtain packing loan from a bank when it receives the letter of credit issued in its favour. The money required is to finance the business between the commencement of the manufacturing process and the despatch of goods. This period is identical for the exporter. Usually, the finance available will not exceed 90% of the L/C amount. After shipment, the exporter can present the documents to a bank for negotiation, and repay the packing loan.For the security, the lending bank must keep in touch with the exporter, and urge them to dispatch the goods and present document in time. If the exporter fails to present documents after the expiry of the L/C, the bank will ask them to repay according to the terms of the loan agreement.66. The exporter can get packing loan from a bank when____________.A. the importer issues a L/C.B. the exporter presents the documents to the bankC. it receives the letter of credit issued in the exporter's favourD. it receives the letter of credit issued in the bank's favour67. "Commencement" in Line 3 probably means _______________.A. endingB. beginningC. implementationD. finish68. When does the exporter repay the packing loan?A. After shipment.B. Just after finishing the manufacturing process.C. Upon presentation of the documents to a bank for negotiation.D. Both A and C69. Which of the following statements is not true?A. Packing loan is a pre-shipment financing facility.B. The amount of packing loan will not exceed 90% of the L/C amount.C. Packing loan is just granted to the exporter.D. If the exporter fails to present documents after the expiry of the L/C, the bank will ask them to repay according to the terms of the L/C agreement. assage Three An option contract is a risk management or control tool designed to mitigate the effects of possible adverse movements in the price of a security or commodity. Depending upon the right acquired by the taker, options are divided into "calls" and "puts". A call option gives the taker (just the buyer of the option) the right (but not the obligation) to buy at a fixed price, while a put option confers upon him the right (but not the obligation) to sell at a fixed price. The fixed price at which the taker may buy or sell the underlying commodity or security, a procedure known as exercising the option, is called the striking price. If the striking price is identical to the current market price of the commodity or security (i.e. the prevailing price for delivery and payment on expiration date), the option is said to be at the money. When the striking price of a call option is lower than the current market price it is in the money. When it is higher than current market price it is out of the money. In contrast, the put option is in the money when the striking price is higher than the current market price or out of the money when the striking prices lower than the current market price.It will by now clear that there are two basic prices in an options contract, the price paid for the purchase of the actual option, which is the premium, and the fixed price at which the option may be exercised, which is the striking price. In turn, the price of the premium is itself made up of two component parts, the intrinsic value and extrinsic value (often known as the time value). Intrinsic value may be defined as the amount by which an option is in the money. The calculation of a proper time value for an option is far more complex. It is influenced by four different factors ----the duration of the option, the historical price volatility of the underlying commodity or security, current interest rates and the supply of and demand for the option.70. Depending on _________, options are divided into "calls" and "puts".A. the right acquired by the sellerB. the right acquired by the buyerC. the obligation acquired by the sellerD. the obligation acquired by the seller71. A put option_____________.A. gives the buyer the right to sell the underlying commodity at a fixed priceB. gives the seller the right to buy the underlying commodity at a fixed priceC. confers upon the seller the right to buy the underlying commodity at fixed price.D. confers upon the seller the right to sell the underlying commodity at fixed price.72. When the striking price of the put option is higher than the current market price, it is calledA. at the moneyB. in the moneyC. out of the moneyD. none of the money73. The premium in option_____________.A. is the striking price of the underlying commodityB. means the option is sold at par valueC. is just the margin that all option deals demandD. is the price of an option contract 74. Which of the following statement is not true?A. The premium consists of the intrinsic value and the extrinsic valueB. The extrinsic value is just the time value.C. The time value for an option is only influenced by the duration of the option and current interest rates.D. The intrinsic value is just the amount by which an option is in the money. assage FourOn the balance sheet, assets and liabilities are classified as either current or long-term to indicate their relative liquidity. Liquidity is a measure of how quickly an item may be converted to cash. Therefore cash is the most liquid asset. Account receivable is a relatively liquid asset because the business expects to collect the amount in cash in the near future. Supplies are less liquid than accounts receivable, and furniture and buildings are even less so. Users of financial statements are interested in liquidity because business difficulties often arise owing to a shortage of cash. Balance sheets list assets and liabilities in the order of their relative liquidity.Current Assets. Current assets are assets that are expected to be converted to cash, sold, or consumed during the next 12 months or within the business's normal operating cycle if longer than a year. The operating cycle is the time span during which (1) cash is used to acquire goods and services, and (2) these goods and services are sold to customers, who in turn pay for their purchases with cash. For most businesses, the operating cycle is a few months. A few types of business have operating cycles longer than a year. Cash Accounts Receivable, Notes receivable due within a year or less are current assets. Merchandising entities such as Sears, Penney's and K Mart have an additional current asset. Inventory. This account shows the cost of goods that are held for sale to customers.Long-term Assets. Long-term assets are all assets other than current assets. They are not held for sale, but rather they are used to operate the business. One category of long-term assets is plant assets, or fixed assets. Land, buildings, furniture and fixtures, and equipment are examples of plant assets.Financial statement users such as creditors are most interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more current it is. Liabilities that must be paid on the earliest future date create the greatest stain on cash. Therefore, the balance sheet lists liabilities in the order in which they are due. Knowing how many of a business's liabilities are current and how many are long-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications,。

金融英语试题及答案

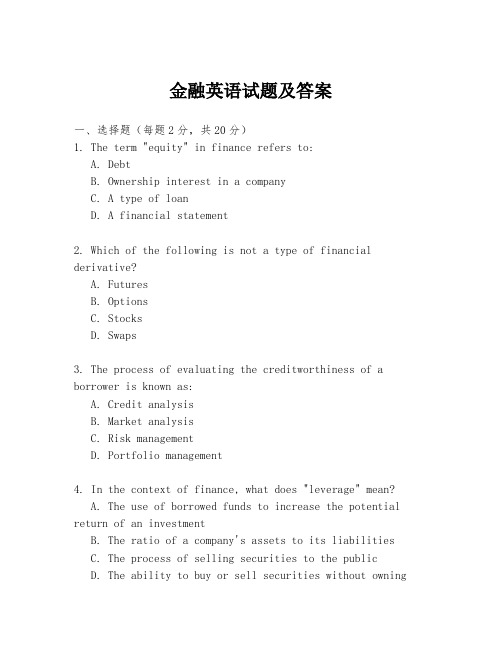

金融英语试题及答案一、选择题(每题2分,共20分)1. The term "equity" in finance refers to:A. DebtB. Ownership interest in a companyC. A type of loanD. A financial statement2. Which of the following is not a type of financial derivative?A. FuturesB. OptionsC. StocksD. Swaps3. The process of evaluating the creditworthiness of a borrower is known as:A. Credit analysisB. Market analysisC. Risk managementD. Portfolio management4. In the context of finance, what does "leverage" mean?A. The use of borrowed funds to increase the potential return of an investmentB. The ratio of a company's assets to its liabilitiesC. The process of selling securities to the publicD. The ability to buy or sell securities without owningthem5. A bond that pays no periodic interest but is issued at a discount to its face value is called:A. A zero-coupon bondB. A coupon bondC. A convertible bondD. A junk bond6. Which of the following is a measure of a company's ability to meet its short-term obligations?A. Current ratioB. Debt-to-equity ratioC. Return on equity (ROE)D. Earnings per share (EPS)7. The term structure of interest rates refers to the relationship between:A. The risk of an investment and its expected returnB. The maturity of a debt instrument and its yieldC. The size of a company and its market shareD. The economic cycle and the stock market performance8. A financial instrument that allows the holder to buy or sell an asset at a specified price within a specific time period is known as:A. A futureB. A forwardC. An optionD. A swap9. In finance, the term "carry trade" refers to:A. Borrowing money at a low interest rate to invest in a higher-yielding assetB. The practice of selling securities shortC. The strategy of buying and holding stocks for long periodsD. The process of hedging against currency fluctuations10. The primary market is where:A. Securities are first offered to the publicB. Securities are traded after they have been issuedC. Companies buy back their own sharesD. Investors can purchase commodities二、填空题(每空1分,共10分)11. The ________ is the difference between the bid price and the ask price of a security.12. A ________ is a financial institution that accepts deposits and provides loans.13. The ________ is the process of buying and selling securities on the same day.14. The ________ is the risk that the value of an asset will decrease due to market conditions.15. A ________ is a financial statement that shows a company's financial performance over a specific period.16. The ________ is the risk that a borrower will not repay a loan.17. A ________ is a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets.18. The ________ is the potential for an asset's value toincrease or decrease.19. The ________ is the process of determining the value of a business or business assets.20. A ________ is a financial instrument that represents ownership in a company.三、简答题(每题5分,共30分)21. Explain the concept of "leverage" in finance.22. What is the difference between a "mutual fund" and a "hedge fund"?23. Describe the role of a "stock exchange" in the financial markets.24. What is "risk management" and why is it important in finance?四、论述题(每题20分,共40分)25. Discuss the impact of "inflation" on different types of investments.26. Analyze the importance of "corporate governance" in ensuring the long-term success of a company.答案:一、1. B2. C3. A4. A5. A6. A7. B8. C9. A10. A二、11. Spread12. Bank13. Day trading14. Market risk15. Income statement16. Credit risk17. Mutual fund18. Volatility19. Valuation20. Stock三、21. Leverage in finance refers to the use of borrowed money to finance investments, with the goal of increasing potential returns. However, it。

《金融英语》试卷(I卷)

常熟理工学院2012〜2013学年第二学期20XX 级后续课《金融英语》考查试卷(I 卷)试题总分:Part I Listening Comprehension©' 25=50')Section A Short ConversationsListe n carefully and choose the best an swer to the questi on after each conv ersatio n.1. Which of the following is NOT among the four major commercial banks of China?A. Ba nk of China.B. China Co nstruction Ba nk.C. I ndustrial and Commercial Ba nk of Chi na.D. The People's Bank of Chi na.2. Which of the following is NOT mentioned in the dialog?A. China Mercha nts Ban k.B. I ndustrial Ba nk Co., Ltd.C. China Citic Bank.D. Chi na Min she ng Banking Corp. Ltd. 3. What is the man accord ing to the dialog?A. A bank man ager.B. A clerk of a foreig n bank.C. A uni versity stude nt.D. A teacher from a college.4. Which of the followi ng has the right to decide the preside nt of BOC?A. The shareholders.B. The shareholders' meet ing.C. The Board of Directors.D. The Preside nt Office.5. A. The man lost his checkbooks.B. The man lost his passport.C. The man lost his password.D. The man lost his passbook. 6. A. Hous ing loa n.B. Foreig n curre ncy loa n.C. Dollar loa n.D. Credit loa n. 7. A. Jan uary 24. B. February 31. C. Jan uary 25. D. February 26.8. A. Payme nt by dema nd drafts. B. Payme nt by collectio n.C. Payme nt by letters of credit.D. Payme nt by remitta nee. 9. A. To avoid problems aris ing from in flatio n.B. To preve nt possible fraud.C. To avoid problems aris ing from fluctuati ons of excha nge rate.D. To preve nt overdraw ing. 10. A. In spect ion certificate. B. Certificate of origi n. C. In sura nee policy. D. Bill of ladi ng.Section B Long ConversationListe n to the conv ersati on carefully and choose the best an swer to each of the questio ns below.11. Which of the following statements was mentioned in the magazine The Banker?A. BOC ranked the 9th amo ng the world's top 1,000 banks in 2007.B. BOC is one of the four big commercial banks of China.C. The developme nt of BOC is un believable.D. The top man ageme nt of BOC is young and effective. 12. What are the main sect ions un der the top man ageme nt of BOC?A. Corporate banking sect ion and retail banking sect ion.B. Security sect ion and supervisory sect ion.C. Operati onal sect ion and supervisory sect ion.D. Audit ing sect ion and in spect ion secti on. 13. Which do you think is NOT the duty of the supervisory section?A. Audit ing the ban k's acco un ts.B. Han dli ng gen eral affairs.C. Being resp on sible for the security of the ban k..D. Oversee ing the banking operati on. 14. What is the bus in ess scope of the operati onal secti on?A. Banking bus in ess.B. Gen eral bus in ess.C. Support ing bus in ess.D. All items men ti oned above.15. Which of the followi ng is NOT men ti oned among the bus in esses offered by BOC?A. Retail banking.B. Docume ntary letter of credit.C. On li ne banking or e-ba nking.D. Finan cial advisory service. Section C PassagesDirecti ons: In this sect ion, you will hear three short passages. At the end of each passage, you will hear some questi ons. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D. The n mark the corresp onding letter on the ANSWER SHEET with a si ngle line through the cen ter.Passage One16. A. 1992 B. 1993 C. 1994 D. 199517. A. The People's Bank of China. B. China Foreig n Excha nge Tradi ng Cen ter.C. I nter-ba nk Foreig n Excha nge Market.D. The State Admi nistratio n of Foreig n Excha nge.18. A. 1%0.3% C. 0.5% Passage Two19. A. High risk. B. A type of credit product. 20. A. Collateral loan. B. Educati on loa n.21. A.1952 B.1958 D. 0.4% C. High in terest. D . A ki nd of revolvi ng loa n C. Mortgage loa n. D . Commercial loa n. C.1962 D . 1968C. Public con fide nce in the in surers rema ined low.D. A rise in Tokyo stock helped improve the bala nce sheets of life in surers.Part II. Reading Comprehension (30 ')Section A (1 '*10=10 ')Directions: Each of the following sentences is provided with four choices. Choose the one that best completes the sentence.26. Although the compa ny showed a profit, the bala nce sheet looks in creas in gly .A. brightB. dimC. shallowD. fragile 27. _ money refers to curre ncy issued on the basis of ban k's credit in stead of gold reserve. A. Fair B. Fiduciary C. FixedD. Deposit 28. In creased flows of world capital inten sify finan cial competiti on among n ati ons. This trend places pressures on n ati onal gover nment to their domestic markets and liberalize intern ati onal capital moveme nts.A. removeB. settleC. deregulateD. con trol 29. Many finan cial tran sacti ons are _ sheet items such as in terest rate swaps and are not clearly ide ntified through the usual report ingcha nn els.A. zeroB. capitalC. off-bala nceD. major30. The ban kers _ the steel compa ny's new shares, which means the share issue will be sold to the ban kers in stead of the public directly. A. un derwrite B. un dercharge C. un dertakeD. un derestimate 31. With no in terest rate _ on deposits or restrict ions on maturities, banks can offer any deposit product customers dema nd. A. cutB. ceili ngsC. dema ndD. con tract 32. From ban k's perspective, liabilities have become more in terest elastic, so that small rate cha nges can produce large fluctuati ons in bala nces.A. outsta ndingB. outreach ingC. rema iningD. dema nding33. Checks are attractive because they are readily accepted and provide formal _______________ of payment. A. credit B. verificati onC. clarityD. collectio n 34. Normally, ____ capital loans are secured by accounts receivable or by pledges of inventory and carry a floating interest rate on theamounts actually borrowed aga inst the approved credit line.A. curre ntB. stockC. work ingD. Ion g-term35. Dealers in gover nment and private securities n eed short-term financing to purchase new securities and carry their exist ing portfolios ofsecurities un til those securities are sold to customers or reach ________ .A. bus in essB. marketsC. maturityD. objectiveSection B (2*10=20 * Directi ons: Read the passages and choose the right an swer for each questio n.Passage 1Text ?36. How many types of banks or banking in stitutio ns are men ti oned in the lecture?A. 5.B. 4.C. 52.D. 183.37. Which of the follow ing is NOT a join t-equity commercial bank? A. China Min she ng Ba nki ng Corp. Ltd. B. Bank of East Asia.C. China Citic Bank.D. Bank of Commun icati ons.38. How many bran ches and sub-bra nches have foreig n banks set up in China accord ing to the speaker?A. 264.B. 177.C. 183.D. 235. 39. Which of the follow ing was once ran ked amon gst the top three stron gest banks in Chin a's mainland?A. Chi na In dustrial Ba nk.B. Ba nk of East Asia.C. China Mercha nts Ba nk.D. Sha nghai Pudo ng Developme nt Ban k.40. Which of the following is a wholly foreign-owned bank?A. Chi na Min she ng Ba nki ng Corp., Ltd.B. Chi na Citic Bank.C. Hong Kong & Shan ghai Banking Corporati on Limited.D. China Export & Import Bank.Passage 2Liabilities are "outsider claims ” , whiche economic obligations, debts payable to outsiders. These outside parties are called creditors.Financial statement users such as creditors are interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more curre nt it is. Liabilities that must be paid on the earliest future date create the greatest stra in on cash. Therefore, the bala nce sheet lists liabilities in the order in which they are due. Knowing how many of a bus in ess's liabilities are curre nt and how many are Ion g-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications: current liabilities and Iong-term liabilities.Current liabilities are debts that are due to be paid with in one year or with the en tity's operati ng cycle. Notes payable due with in one year, salary 22. A. It is a ki nd of short-term loa n.C. It is supposed to pay back at one time.Passage Three23. A. A rise in Tokyo stock.B. It is also called bridge loa n. D. Its maturity exceeds five years.C. Negative spread.24. A. Rise. B. Fall. 25. A. The value of outsta nding policies went dow n. B. Japa n's life in sura nee firms. D. Japa nese life in surers' difficult situati on.C. Rema in un cha nged.D. Not sure. B. Life in surers' n egative spreads ten ded to grow small.payable, unearned reve nue, and in terest payable owed on no tes payable are curre nt liabilities.Long-term liabilities are those liabilities other than current ones.41. The liabilities are classified as current or Iong-term liabilities according to _ .A. the liquidity of the liabilityB. the future date when the liability must be paidC. the operati ng cycleD. one year42. Liabilities are __ .A. money borrowed from banksB. money received from creditorsC. "outsider claims ” which are economic obligations, debts payable to outsidersD. notes receivable43. Which of the followi ng is current liability?A. cashB. inventoryC. salary payableD. money from the bank44. Which of the following is Iong-term liability?A. debt payable due with 10 yearsB. inven toryC. unearned revenueD. note payable due withi n 6 mon ths45. For a note payable to be paid in in stallme nts with in 5 years, which of the follow ing stateme nts is correct?A. The first installment due within one year is a current liability.B. The first installment due within one year is a Iong-term liability.C. All the in stallme nts due are Ion g-term liabilities.D. All the in stallme nts due are curre nt liabilities.Part ill. Translation (2‘ *=10')Part IV. Writing (10 ')Directions: You are asked to write a report on Bank of China with 120 words to make the brief introduction of BOC s orga ni zati ons and developme nt.。

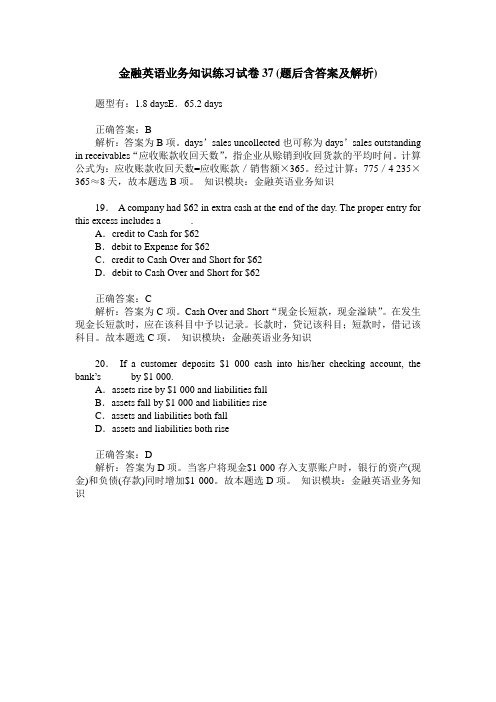

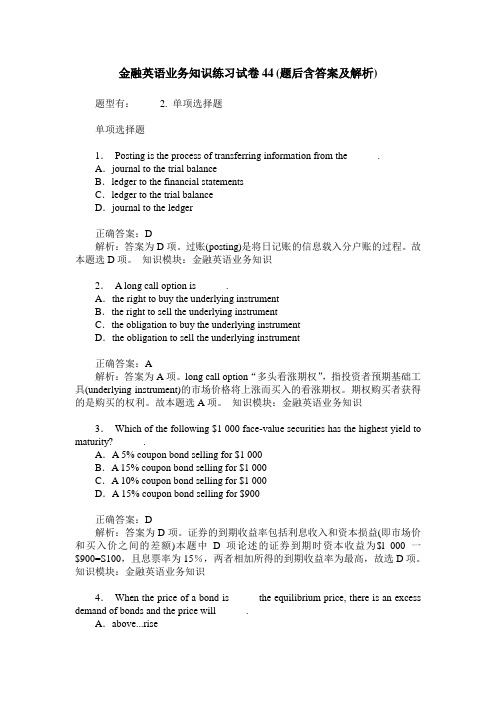

金融英语业务知识练习试卷6(题后含答案及解析)

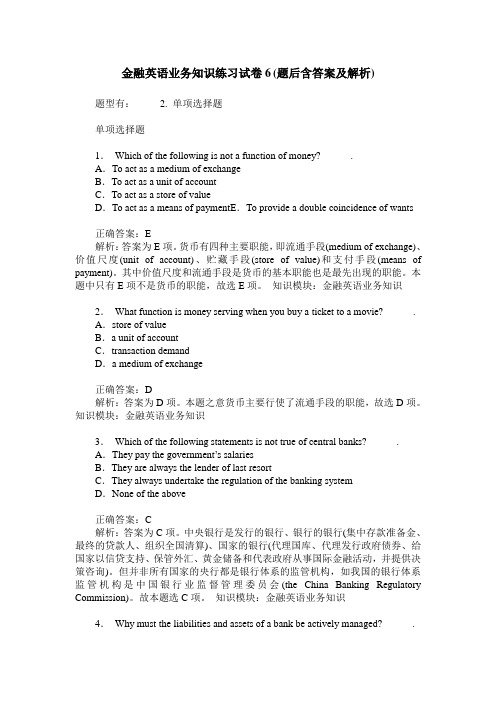

金融英语业务知识练习试卷6(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1.Which of the following is not a function of money?______.A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To act as a means of paymentE.To provide a double coincidence of wants正确答案:E解析:答案为E项。

货币有四种主要职能,即流通手段(medium of exchange)、价值尺度(unit of account)、贮藏手段(store of value)和支付手段(means of payment)。

其中价值尺度和流通手段是货币的基本职能也是最先出现的职能。

本题中只有E项不是货币的职能,故选E项。

知识模块:金融英语业务知识2.What function is money serving when you buy a ticket to a movie?______.A.store of valueB.a unit of accountC.transaction demandD.a medium of exchange正确答案:D解析:答案为D项。

本题之意货币主要行使了流通手段的职能,故选D项。

知识模块:金融英语业务知识3.Which of the following statements is not true of central banks?______.A.They pay the government’s salariesB.They are always the lender of last resortC.They always undertake the regulation of the banking systemD.None of the above正确答案:C解析:答案为C项。

金融英语练习题第二章

金融英语练习题第二章The Demand for Money1. Irving Fisher took the view that the institutional features of the economy which affect velocity change _____ over time so that velocity will be fairly _____ in the short run.A) rapidly; erratic B) rapidly; stableC) slowly; stable D) slowly; erraticAnswer: C2. If the money supply is 600 and nominal income is 3,000, the velocity of money isA) 5. B) 50. C) 1/5. D) undefined.Answer: A3. According to the quantity theory of money demand,A) an increase in interest rates will cause the demand for money to fall.B) a decrease in interest rates will cause the demand for money to increase.C) interest rates have no effect on the demand for money.D) an increase in money will cause the demand for money to fall.Answer: C3. The Cambridge approach to the demand for money did not rule out theA) effects of interest rates on the demand for money.B) effects of wealth on the demand for money.C) effects of income on the demand for money.D) effects of any of the above.Answer: D4. Velocity, over the business cycle, tends toA) rise during economic contractions. B) fall during economic expansion.C) stay constant. D) fall during economic contractions. Answer: D5. Keynes's liquidity preference theory indicates that the demand for moneyA) is purely a function of income, and interest rates have no effect on the demand for money.B) is purely a function of interest rates, and income has no effect on the demand for money.C) is both a function of income and interest rates.D) is both a function of government spending and income.Answer: C6. Keynes's argued that when interest rates were high relative to some normal value, people would expect bond prices to _____ so the quantity of money demanded would _____.A) increase; increase B) increase; decreaseC) decrease; decrease D) decrease; increaseAnswer: B7. Keynes's model of the demand for money suggests that velocity is _____ related to _____.A) positively; interest rates B) negatively; interest ratesC) positively; bond values D) positively; stock pricesAnswer: A8. The Baumol-Tobin analysis suggests that a decrease in the brokerage fee for buying and selling bonds will cause the demand for money to _____ and the demand for bonds to _____.A) increase; increase B) increase; decreaseC) decrease; decrease D) decrease; increaseAnswer: D9. Friedman's assumption that money and goods are substitutes indicates thatA) changes in the money supply have only indirect effects on aggregate spending.B) changes in the money supply may have a direct effect on aggregate spending.C) interest rates have no effect on money demand, implying the velocity is constant.D) both (b) and (c) of the above are true.Answer: B10. Irving Fisher's view that velocity is fairly constant in the short run transforms the equation ofexchange into theA) Cambridge theory of income determination.B) quantity theory of money.C) Keynesian theory of income determination.D) monetary theory of income determination.Answer: B11. In the 20th century, velocityA) has been quite stable over periods as long as a decade.B) has grown at a constant rate.C) has been quite volatile.D) both (a) and (b) of the above.Answer: C12. Because interest rates have substantial fluctuations, the _____ theory of the demand for moneyindicates that velocity has substantial fluctuations as well.A) classical B) Cambridge C) liquidity preference D) Pigouvian Answer: C13. In the Baumol-Tobin analysis, the transactions demandfor money isA) negatively related to the level of income.B) negatively related to the level of interest rates.C) positively related to the expected return on other assets.D) only (a) and (b) of the above.14. In the Baumol-Tobin analysis, the transactions demand for money isA) negatively related to the level of interest rates.B) negatively related to the expected return on other assets.C) positively related to the expected return on other assets.D) only (a) and (b) of the above.Answer: D15. The Baumol-T obin analysis suggests that an increase in the brokerage fee for buying andselling bonds will cause the demand for money to ________ and the demand for bonds to ________.A) increase; increase B) increase; decreaseC) decrease; increase D) decrease; decreaseAnswer: B16. If interest rates do not affect the demand for money, then velocity is _____ likely to be _____.A) more; stable B) more; unstable C) more; procyclical D) less; stable Answer: A17. People will want to buy more when theA) price level rises, because the interest rate rises.B) price level rises, because the interest rate falls.C) price level falls, because the interest rate rises.D) price level falls, because the interest rate falls.18. A decrease in U.S. interest rates leads toA) a depreciation of the dollar that leads to greater netexports.B) a depreciation of the dollar that leads to smaller net exports.C) an appreciation of the dollar that leads to greater net exports.D) an appreciation of the dollar that leads to smaller net exports.19. Other things the same, as the price level falls, a country's exchange rateA) and interest rates rise.B) and interest rates fall.C) falls and interest rates rise.D) rises and interest rates fall.20. Which of the following will both make people spend more?A) wealth and interest rates rise.B) wealth rises and interest rates fall.C) wealth falls and interest rates rise.D) wealth falls and interest rates fall.21. An increase in the interest rate causes investment toA) rise and the exchange rate to appreciate.B) fall and the exchange rate to depreciate.C) rise and the exchange rate to depreciate.D) fall and the exchange rate to appreciate.22. When taxes decrease, consumptionA) decreases as shown by a movement to the left along a given aggregate-demand curve.B) decreases as shown by a shift of the aggregate demand curve to the left.C) increases as shown by a movement to the right along agiven aggregate-demand curve.D) increases as shown by a shift of the aggregate demand curve to the right.23. When the money supply decreasesA) interest rates fall and so aggregate demand shifts right.B) interest rates fall and so aggregate demand shifts left.C) interest rates rise and so aggregate demand shifts right.D) interest rates rise and so aggregate demand shifts left.24. Aggregate demand shifts left when the governmentA) decreases taxes.B) cuts military expenditures.C) creates a new investment tax creditD) None of the above is correct.25. The long-run aggregate supply curve would shift right if the government were toA) increase the minimum-wage.B) make unemployment benefits more generous.C) raise taxes on investment spending.D) None of the above is correct.26. The long-run aggregate supply curve shifts right ifA) the price level rises.B) the price level falls.C) the capital stock increases.D) the capital stock decreases.答案:DABBDDDBDC27. Other things the same, if workers and firms expected prices to rise by 2 percent but instead they rise by 3 percent, thenA) employment and production rise.B) employment rises and production falls.C) employment falls and production rises.D) employment and production fall.28. Other things the same, an unexpected fall in the price level results in some firms havingA) lower than desired prices which increases their sales.B) lower than desired prices which depresses their sales.C) higher than desired prices which increases their sales.D) higher than desired prices which depresses their sales.29. If the price level rises above what was expected and nominal wages are fixed, thenA) production becomes less profitable so firms will hire fewer workers.B) production becomes less profitable so firms will hire more workers.C) production becomes more profitable so firms will hire fewer workers.D) production become more profitable so firms will hire more workers.30. Of the following theories, which is consistent with a vertical long-run aggregate supply curve?A) the sticky-wage theoryB) misperceptions theoryC) both the sticky-wage and misperceptions theories.D) neither the sticky-wage nor the misperceptions theory.31. The effects of a higher than expected price level are shown byA) shifting the short-run aggregate supply curve right.B) shifting the short-run aggregate supply curve left.C) moving to the right along a given aggregate supply curve.D) moving to the left along a given aggregate supply curve.32. An increase in the expected price level shifts theA) short-run and long-run aggregate supply curves left.B) the short-run but not the long-run aggregate supply curve left.C) the long-run but not the short-run aggregate supply curve left.D) neither the long-run nor the short-run aggregate supply curve left.33. Which of the following shifts the short-run aggregate supply curve to the right?A) a decrease in the actual price levelB) an increase in the actual price levelC) a decrease in the expected price levelD) an increase in the expected price level34. Which of the following shifts short-run aggregate supply right?A) an increase in the price levelB) an increase in the minimum wageC) a decrease in the price of oilD) more people migrate abroad than immigrate from abroad35. Other things the same, if the price level rises by 2% and people were expecting it to rise by 5%, then some firms haveA) higher than desired prices which increases their sales.B) higher than desired prices which depresses their sales.C) lower than desired prices which increases their sales.D) lower than desired prices which depresses their sales.答案:ADDDCBCCB。

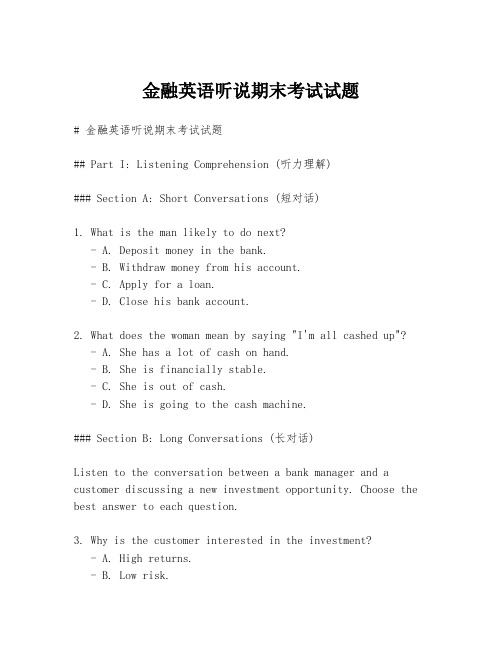

金融英语听说期末考试试题

金融英语听说期末考试试题# 金融英语听说期末考试试题## Part I: Listening Comprehension (听力理解)### Section A: Short Conversations (短对话)1. What is the man likely to do next?- A. Deposit money in the bank.- B. Withdraw money from his account.- C. Apply for a loan.- D. Close his bank account.2. What does the woman mean by saying "I'm all cashed up"? - A. She has a lot of cash on hand.- B. She is financially stable.- C. She is out of cash.- D. She is going to the cash machine.### Section B: Long Conversations (长对话)Listen to the conversation between a bank manager and a customer discussing a new investment opportunity. Choose the best answer to each question.3. Why is the customer interested in the investment?- A. High returns.- B. Low risk.- C. Tax benefits.- D. All of the above.4. What is the minimum investment required?- A. $10,000.- B. $20,000.- C. $30,000.- D. $50,000.### Section C: Passages (短文)Listen to the following passage about the impact oftechnology on the financial industry and answer the questions.5. What is the main topic of the passage?- A. The history of financial technology.- B. The benefits of financial technology.- C. The challenges of financial technology.- D. The future of financial technology.6. What does the speaker suggest about the future of banking? - A. It will be completely automated.- B. It will require more human interaction.- C. It will disappear completely.- D. It will merge with other industries.## Part II: Speaking (口语)### Section A: Picture Description (图片描述)Look at the picture showing a busy stock exchange. Describewhat you see and explain the importance of the stock exchange in the financial system.### Section B: Role Play (角色扮演)You are a financial advisor. Your client is considering investing in a start-up company. Discuss the potential risks and benefits of this investment.### Section C: Presentation (演讲)Prepare a short presentation on the topic of "The Role of English in International Finance." Discuss why English is important in the global financial community and provide examples.## Part III: Reading Comprehension (阅读理解)Read the following text about international trade and answer the questions.### Text: International Trade and Currency Exchange7. What is the primary purpose of currency exchange in international trade?- A. To facilitate the buying and selling of goods.- B. To protect domestic industries.- C. To regulate the flow of capital.- D. To control inflation.8. How does a strong domestic currency affect internationaltrade?- A. It makes imports cheaper.- B. It makes exports more expensive.- C. It encourages domestic production.- D. It discourages foreign investment.### Section B: Critical Reading (批判性阅读)Read the article about the recent economic downturn and its impact on the financial markets. Then, answer the following question.9. According to the article, what is the most significant impact of the economic downturn on the financial markets?- A. A decrease in consumer spending.- B. A rise in unemployment rates.- C. A drop in stock market values.- D. An increase in government regulations.## Part IV: Writing (写作)### Section A: Summary Writing (摘要写作)Summarize the main points of the article about economic downturn in no more than 100 words.### Section B: Essay Writing (论文写作)Write an essay discussing the role of financial literacy in personal finance management. Your essay should be at least 300 words long and include an introduction, body paragraphs,and a conclusion.请注意,以上内容仅为示例,实际考试内容可能会有所不同。

金融英语考试试题及答案

金融英语考试试题及答案金融英语是金融领域中不可或缺的一部分,对于从事金融行业的人士来说,掌握金融英语的知识非常重要。

为了帮助大家更好地备考金融英语考试,本文将为大家提供一些常见的金融英语考试试题及答案。