双语会计

会计双语6

Terms --Accounting Basis

Accounting system

Accrual basis

Cash basis

are recognized when cash is collected; Expenses are recognized when cash is paid for the Accounting goods and services. English

Revenues Text

Revenues are recognized when earned; Expenses are recognized when goods and services areText used.

Revenue principle

Matching principle

收入确认原则

Timing issues •Time period assumption •Fiscal and calendar years •Accrual-vs.cashbasis •accounting •Recognizing revenues and expenses

Accounting English

Accounting English

• Media Vision Technology 公司 是一个为计算机 制造声音和动画 技术的公司,它 曾被指控通过操 纵一个虚拟的货 舱隐藏已经计入 销售收入的销货 退回清单。

Accounting English

• 出版商Pengnin USA说在过去的许多年里 它都少披露了费用,因为它没报告预付款 顾客的折扣。

Oct.31 Insurance expense prepaid insurance (to record insurance expired) 50

会计双语教学中存在的问题及对策探析

会计双语教学中存在的问题及对策探析摘要:为适应教学模式的国际化发展,许多高校在某些专业上采用了双语教学模式,本文以黑龙江外国语学院会计专业为背景详细的阐述了会计双语教学的含义和会双语教学中存在的问题及对策。

关键词:会计双语教学问题对策双语教学的模式有很多,对于会计专业而言,采用的双语教学模式为汉语与英语的教学模式。

这种模式也可以理解为会计专业语言与相关的英语会计语言模式。

采用这种模式教学的最终目的是将学生培养成既可以熟练的掌握会计专业知识又可以用英语进行会计知识交流的综合型人才。

对于黑龙江外国语学院来说,其学院的人才培养模式就是采用的专业+外语的人才培养模式,英语专业的师资力量、外教教师队伍和实践教学基地与其他同等院校相比都处于领先地位。

所以采用双语教学模式是非常容易且可行的。

但在会计专业双语教学的过程中还是存在着许多问题,这也是学院迫切需要解决的。

1 会计双语教学的含义很多人认为,双语教学就是将学生的专业知识用英语在讲述一遍,这样的理解是不对的,双语教学的模式有很多,不只限于英语。

也可以理解为是除专业语言以外的第二种语言,这里所说的第二种语言起到的应是辅助的作用。

双语教学的目的是让学生将另外一种语言作为工具,用另外一种视觉来理解自己的专业知识。

所以,双语教学的意义是为了使学生更好的、以多种角度、多方面信息来看待和学习自己的专业。

为使自己能成为综合型人才打下夯实的基础。

2 会计双语教学中存在的问题2.1 综合型教师较少无论是黑龙江外国语学院的英语专业教师还是会计专业教师,教师的教学水平都是毋庸置疑的。

但学校里综合型教师的教师队伍和师资力量相对较弱。

这里的综合型教师是指既可以掌握会计专业知识又可以教授学生英语知识的教师。

因为综合型教师相对较少,学校为了可以开展双语教学模式只能采取专业知识由会计专业教师来讲解,而相关的英语知识由英语教师来讲。

但这样的教学方式达到的教学效果并不明显,因为,会计知识和英语知识是在两堂课进行讲解的,这就缺乏了课堂的连贯性,给学生们的印象也不是很深刻,学生会觉得只不过上了一节专业课和一节英语课罢了,两节课之间没什么太大关系。

会计双语5

7.Prepare a trial balance and explain its purposes

Accounting English

The recording process

Steps in the The recording The Account The trial balance recording process Process illustrated

Retained earning Cr. +

Assets Dr. + Cr. _

liabilities Dr. _ Cr. +

dividend revenues expenses _ _ Dr. Cr.+ Dr. _ _ + Cr. + Dr. Cr. + _

Accounting English

Do it

•Ddbit and •Journal credit •ledger •Debit and credit procedure •Stockholders’ equity relationships •Expansion of equation Summary illustration of Journalizing and posting •Limitations of a trial balance •Locating errors •Use of dollar signs

Retained earning statement

Accounting English

5.1.4 Expansion of the basic equation

Assets

=

liabilities+

Common stock Dr. _ Cr. + + Dr. _

会计专业双语教学实践与探索

一

往 往 亲睐综 合素 质高 的毕 业 生 。会计 专业采 取双 语教 学模 式 ,是 素质 教育

进 一 步 深化 的需 要 。 通过 这 种 模 式 ,

为 了保 证教 学 任 务 的 圆满 完 成 ,

必须 要有 充 足的教 学课 时 。但大 部分

学 校 的 双 语 教 学 课 时 不 足 。 以 笔 者 所

可 以使 学生 在掌 握基 本会 计 专业 术语

的基 础上 ,了解 国外 财务 会计 理 论 的

在 的学校 为例 ,学校 把会 计 双语 教学

安排 在基 础会计 课程 学 完之 后 ,课 时

一

、

会 计 专 业 双 语 教 学 的 意 义

计专业教学模 式的基础上 ,全面推 行双语教 学模 式 ,这是培养 高素质复合型会计人才的现 实需要 ,也是适应企业国际化发展 的必然要 求。

关键词 :高等教 育 ; 会 计专业 ;双语教 学 ;实践与探 索

双语 教 学 是 通 过 采 用 双语 授课 、

( 二)有利 于培养满足 国际需要 的 会计双语人才 近年 来 ,大 量 中国公 司 开始 涉 足

了解 和熟 练使用 国际会 计准 则 的高 素 质会 计人 才 。因此 ,高 等教 育肩 负着 培养 双语 人才的使命 。

( 三) 有利于提 高会计专 业学生 的

能 力 。从 学 生角度 看 ,有 的认 为接 受

双 语教 学只要 掌握 一些 会计 英文 术语 即可 ,不必学习 国外会计 准则和实 务 。 还 有的 学生 忽略 了培养 运用 英语 进行 会计交流的能力 。这就使教 学过程 和 目 的偏离 了方 向,无 法达到预期 的效果 。 ( 二)教学课时普遍不够

双语版管理会计第十章

Quantity variance $800 unfavorable

Price variance $170 favorable

10-19

Quick Check

Zippy

Recall that the standard quantity for 1,000 Zippies is 1,000 × 1.5 pounds per Zippy = 1,500 pounds.

Hanson’s materials quantity variance (MQV) and Hanson’s materials price variance (MPV) for last week was:?

10-18

Quick Check

Zippy

Standard Quantity Actual Quantity

Materials price variance

MPV = (AQ × AP) – (AQ × SP) = AQ(AP – SP) = 210 kgs ($4.90/kg – $5.00/kg) = 210 kgs (– $0.10/kg) = $21 F

10-15

Responsibility for Materials Variances

Standard Rate per Hour

Standard Hours per Unit

通常使用单一的 标准工资率反映企业

多种工资标准.

确定单个产品耗费 的人工小时

10-5

Setting Variable Manufacturing Overhead Standards 制定变动制造费用标准

Price Standard

You purchased cheap material, so my people had to use more of it.

会计双语教学探析

( 湛江师范学 院法政学院 广东 湛江 5 44 ) 2 0 8

摘 要 : 文认 为, 着全球 经济一体 化进程的不 断深入会 计专业人 才也 正在从 原来单一会计人 才成 为既懂英语 、 本 随 精通 电脑 , 又熟悉 国际会计准则的复合型人 才。 而高校作 为会计教学的前沿 阵地 . 双语教 学势在 必行且任 重而道远 会计 关键 词 : 计 会 双语 教 学

仍很薄弱 , 表现在阅读英语专业 文献的速度 、 理解水平和取舍信息的能力不理想。这是 因为 : 一是使用机会太少 , 加之专业英语 的考

试较少 , 使得广大学生使用英语 的机会更是大大减少 , 二是在英语学 习过程中侧重 于语法分析和书面习题 , 忽视 了英语的实用性。 而 进行会计 双语教学 , 恰好可以作 为英语教学的补充 , 一方面扩大学生 的专业英语词 汇量 , 另一方 面提高学生的英语运用能力。如 : 会

纪英 国会计界带领全球会计 发展 , 再到 2 0世纪 , 随着美国资本与商 品的流动 , 把会计推进到现代会计时代的同时 , 也取得 了全球会 计的领导地位。通过会计双语教学 , 引进发达国家( 尤其是美 国) 的会计教材 , 有利于丰富学生 的会计知识 , 接触国际会计前沿 , 加强 学生对 国外先进知识体系的吸收 , 国际化思考方法的借鉴 , 并为深入研究打下 良好 基础 。同时 , 也有利于形成国际化 的会计操作思 维。 国际会计准则委 员会(A C)因其立 足于全球化 的资本市场 , IS , 增加会计信息可 比性 , 已被全球大多数 国家认同和接受 。0 6年 现 20 我国企业会计准则体系的修订 , 也足 与围际会计准则并轨 的一个举措 。在会计双语教学 中通过国际会计准则的学习, 使学生掌握国 际会计 的处理方法 , 国际化的会计操作思维 , 了解 拓宽学生国际化视角。 ( ) 二 增强英语的运用能 力 根据教学大纲要求 , 高中程度可 以掌握英语词汇 2 0 5 0个左右 , 加之大学英语的学习 , 掌握 的英语词 汇可以达到 4 0 5 0个左右 , 就这种程度而言 , 应该可以进行英语资料的阅读和专业知识讨论 , 实际上绝大多数的学生英语运用能力 但

会计专业双语教学的SWOT分析

科技经济市场界发生的物理过程既看不见又摸不着也是瞬间即失,如果采用动画慢放的方式,这些就一目了然了。

人造地球卫星的发射、运转、接收过程是相当漫长的且无法进行实验观察,采用挂图进行讲解是定态的,采用动画快放的方式进行,学生就有一种身临其境的真实感。

当然选择和使用教学媒体的目的,是为了促进学生的学习,实现一定的教学目标,所选的媒体要能有效实现相应的教学事件和教学目标。

否则媒体选择和使用只是“作秀”,毫无实用价值,不能促进学生的思维,反而会影响教学效果。

参考文献:[1]加涅(美).皮连生等译.教学设计原理———当代心理科学名著译丛[M].华东师范大出版社,2004.[2]王嘉毅.课程与教学设计[M].高等教育出版社,2007.[3]朱美健,张军朋.谈物理课堂教学设计[J].物理教学探讨,2007,15(8):35-38.[4]Kenneth D,Moore.中学教学方法[M].中国轻工业出版社,2005.[5]吴剑藩.创新性物理教学设计[J].浙江教育学院学报,2001,3(2):106-108.SWOT分别代表strengths(优势)、weaknesses(劣势)、opport-unities(机会)、threats(威胁)。

SWOT分析通过对优势、劣势、机会和威胁加以综合评估与分析得出结论,然后再调整企业资源及企业策略,来达成企业的目标。

本文借助SWOT分析会计专业双语教学,大力发挥有利于会计双语教学发展的因素,去除或尽量减少不利因素的影响,抓住机遇迎接挑战,促进会计专业双语教学不断提高与完善,适应我国经济化发展的需求。

1会计专业双语教学面临的机遇和威胁进入21世纪的今天,经济、社会、科技等诸多方面的迅速发展,我国社会的国际化程度越来越高。

世界经济一体化进程的加快,国际间的交往日益频繁,企业所处的环境更为开放和动荡,对人才的期许越来越高,对国际化的人才需求越来越迫切。

会计工作作为企业管理的重要组成部分,更是需要既懂专业外语能力又强的人才。

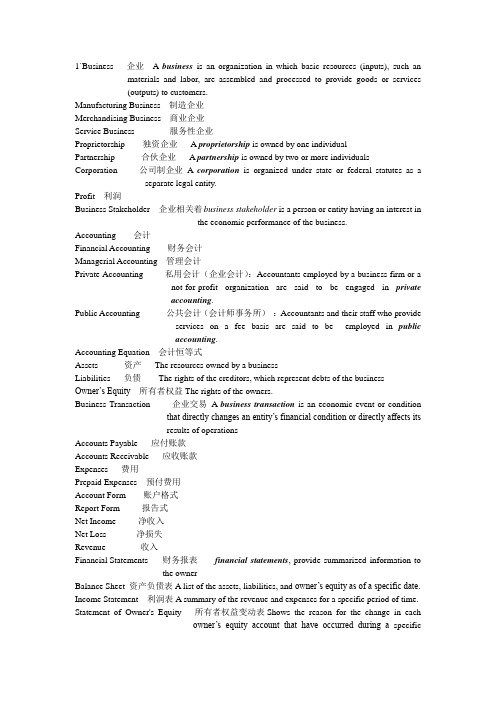

西方财务会计双语单词

1`Business 企业 A business is an organization in which basic resources (inputs), such an materials and labor, are assembled and processed to provide goods or services(outputs) to customers.Manufacturing Business 制造企业Merchandising Business 商业企业Service Business 服务性企业Proprietorship 独资企业 A proprietorship is owned by one individualPartnership 合伙企业 A partnership is owned by two or more individuals Corporation 公司制企业A corporation is organized under state or federal statutes as a separate legal entity.Profit 利润Business Stakeholder 企业相关着business stakeholder is a person or entity having an interest inthe economic performance of the business.Accounting 会计Financial Accounting 财务会计Managerial Accounting 管理会计Private Accounting 私用会计(企业会计):Accountants employed by a business firm or anot-for-profit organization are said to be engaged in privateaccounting.Public Accounting 公共会计(会计师事务所):Accountants and their staff who provideservices on a fee basis are said to be employed in publicaccounting.Accounting Equation 会计恒等式Assets 资产The resources owned by a businessLiabilities 负债The rights of the creditors, which represent debts of the business Owner’s Equity所有者权益The rights of the owners.Business Transaction 企业交易A business transaction is an economic event or conditionthat directly changes an entity’s financial condition or directly affects itsresults of operationsAccounts Payable 应付账款Accounts Receivable 应收账款Expenses 费用Prepaid Expenses 预付费用Account Form 账户格式Report Form 报告式Net Income 净收入Net Loss 净损失Revenue 收入Financial Statements 财务报表financial statements, provide summarized information tothe ownerBalance Sheet 资产负债表A list of the assets, liabilities, and owner’s equity as of a specific date. Income Statement 利润表A summary of the revenue and expenses for a specific period of time. Statement of Owner's Equity 所有者权益变动表Shows the reason for the change in eachowner’s equity account that have occurred during a specificperiod of time.Generally Accepted Accounting Principles (GAAP) 公认会计原则Statement of Cash Flows 现金流量表A summary of the cash receipts and disbursements for a specific period of time.Certified Public Accountant (CPA) 注册会计师2`Account 账户An account is a separate record to show the increase and decrease of each financial statement item.Ledger 分类账A group of accounts for a business entity is called a ledgerChart of Accounts 科目表A list of the accounts in the ledger is called a chart of account Revenues 收入类账户Expenses 资产消耗Drawing 提款账户Balance of the Account 账户余额Debits 借方金额Credits 贷方金额T Account T 型帐 An account can be drawn to resemble the letter T, it is called a T account. Double-Entry Accounting 复式记账会计Journal Entry 日记账分录Journal 日记账Journalizing 日记簿记账2Posting 过账Two-Column Journal 二栏式日记账Unearned Revenue 预收收入The liability created by receiving the cash in advance of providing the service is called unearned revenve.Trial Balance 试算平衡3`Cash Basis 现今制(收付实现制)period in which cash is received or paidAccrual Basis 应计制(权责发生制)period in which they are earnedAdjusting Process 调整程序Accruals 应计项目Deferrals 递延项Deferred Expenses 递延费用(预付费用)have been initially recorded as assets but areexpected to become expensesAccrued Expenses 应计费用(accrued liabilities)Deferred Revenues 递延收入(预收收入)have ben initially recorded as liability bu areexpected to become revenuesAccrued Revenues 应计收入(accrued assets)Prepaid Expenses 预付费用Adjusting Entries 调整账户Unearned Expenses 预收费用?Adjusted Trial Balance 调整试算平衡Accumulated Depreciation累计折旧Depreciation 折旧Book Value of the Asset 资产账面价值Depreciation Expense 折旧费用Contra Accounts 备抵账户accumulated depreciation accountsFixed Assets 固定资产(plant assets)4`Accounting Cycle 会计循环Work Sheet 工作底稿Current Assets 流动资产Cash and other assets that are expected to be converted into cash,sold, or used up usually in less than a year are current assets.Current Liabilities 流动负债Long-Term Liabilities 长期负债Post-Closing Trial Balance 结账后试算表Closing Entries 结账分录Real Account 实账户Temporary Accounts (Nominal Accounts ) 虚账户(类似过渡账户)Income Summary 损益表(反应某一特定时期收入费用状况的报表)5`Accounting System 会计系统General Ledger 总分类账Accounts Payable Subsidiary Ledger 应付账款明细账Accounts Receivable Subsidiary Ledger 应收账款明细账Purchases Journal 赊购日记账The purchases journal is designed for recording allpurchases on account.Cash Payments Journal 现金支出日记账Revenue Journal 赊销日记账Cash Receipts Journal 现金收入日记账All transactions that involve the receipt of cash arerecorded in the cash receipts journalSpecial Journals 特种日记账Controlling Account 控制账户General Journal 普通日记账6` Multiple-Step Income Statement 多步式损益表Single-Step Income Statement 单步式损益表Sales 销售额Sales Discounts 销售折扣Sales Returns & Allowances 销售退回及折让Purchase 购买额Purchase Discount 购货折扣Purchase Returns & Allowances 购货退回或折让Periodic Method 实地盘存制Perpetual Method 永续盘存制Merchandise Inventory 商品存货Cost of Merchandise Sold 商品销售成本Gross Profit 毛利润Administrative Expenses管理费用Selling Expenses 销售费用Income from Operations 营业收入Other Expense 其他费用Other Income 其他收益Invoice 发票Credit Memorandum 贷项通知单Debit Memorandum 借项通知单FOB Destination 目的地交货FOB Shipping Point 船上交货Trade Discounts 商业折扣7` Cash 现金Bank Reconciliation 银行存款余额调节表Check 支票Remittance advice 汇款通知Transactions register 交易登记册(交易账簿)Deposit ticket 存款票据Signature card 签名卡Drawee 付款人Drawer 发票人Payee 收款人8` Accounts Receivable 应收账款Notes Receivable 应收票据Allowance Method 备抵法Uncollectible Accounts Expense 坏账损失Direct Write-Off Method 直接冲销法Aging the Receivables 应收账款账龄分析法Net Realizable Value 可变现价值Maturity Value 到期价值Promissory Note 本票9`Inventory 存货Periodic Inventory System 实地盘存制Perpetual Inventory System 永续盘存制Average Cost Method 加权平均法First-in, First-out (FIFO) Method 先进先出法Last-in, First-out (LIFO) Method 后进先出法Lower-of-Cost-or-Market (LCM) Method 成本与市价孰低法Gross Profit Method 毛利率法Retail Inventory Method 零售价法10`Fixed assets 固定资产损失Depreciation 折旧Residual Value 剩余价值Book Value 账面价值Accelerated Depreciation Method 加速折旧法Straight-Line Method 直线法Declining-Balance Method 余额递减法Units-of-Production Method 工作量法Trade-in Allowance 交换折价Depletion 折耗Amortization 摊销Intangible Assets 无形资产Copyright 版权Patents 专利Goodwill 商誉Trademark 商标Boot 补价(附得利益)11`Discount 折价Discount Rate 贴现率Proceeds 应收票据贴现率Gross Pay 毛工资Net Pay 净薪资Payroll 薪酬Defined Contribution Plan 确定投入计划Defined Benefit Plan 确定收益计划12`Stock 股份Stockholders 股东Stockholders’Equity 股东权益Retained Earnings 留存收益Paid-in Capital 实收资本Common Stock 普通股Preferred Stock 优先股Par 平价Cumulative Preferred Stock 累积优先股Nonparticipating Preferred StockStated Value 设定价值Outstanding Stock发行在外股票Premium 溢价Treasury Stock 库藏股票Stock Split 股票分割Cash Dividend 现金股利Stock Dividend 股票股利。

国际会计(双语)国际会计(双语)学习指南

Study guide for international accountingCHAPTER 1Introduction to international accountingLEARNING OBJECTIVES:1.To identify and understand the importance of the eight factors that has asignificant influence on accounting development.2.To understand the definition of IA of this textbook.3.To be familiar with the detailed contents of IACHAPTER OUTLINEDevelopment of IAEight factors▪Sources of Finance–In countries with strong equity markets, Disclosures are extensive to meet the requirements of widespread public ownership.–in credit-based systems where bans are the dominant source of finance, accounting focuses on creditor protection through conservative accounting measurements. Development of IA▪Legal System. The legal system determines how individuals and institutions interact. ▪Taxation . tax legislation effectively determines accounting standards because companies must record revenues and expenses in their accounts to claim them for tax purposes.▪Political and Economic Ties. Accounting ideas and technologies are transferred through conquest, commerce, and similar forces.Development of IA▪Inflation. Inflation distorts historical cost accounting and affects the tendency of a country to incorporate price changes into the accounts.▪Level of Economic Development. This factor affects the types of business transactions conducted in an economy and determines which ones are most prevalent. Development of IA▪Education Level. Highly sophisticated accounting standards and practices are useless if they are misunderstood and misused.▪Culture. Cultural variables underlie nations’ institutional arrangements (such as legal systems)Definition of IAInternational accounting can be viewed in terms of the accounting issues uniquely confronted by companies involved in international business. It also can be viewed more broadly as the study of how accounting is practiced in each and every country around the world, learning about and comparing the differences in financial reporting and other accounting practices that exist across countries.Definition of IAThis book is designed to be used in a course that attempts to provide an overview of the broadly defined area of international accounting, and that focuses on the International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) and some international hot topics.Detailed Contents on IA▪International accounting is a well-established specialty area within accounting and has two major dimensions:▪Comparative: Examining how and why accounting principles differ from country to country▪Pragmatic: accounting for the operational problems and issues encountered by individuals and firms in international business.Detailed Contents on IA▪L. Radebaugh and S. Gray (1993, p. 9) also write that the study of international accounting involves two major areas:▪descriptive/comparative accounting and the accounting dimensions of international transactions/multinational enterprises.▪principally covers the problems encountered by multinational corporations: Financial reporting problems, translation of foreign currency financial statements, information systems, budgets and performance evaluation, audits, and taxes.Objectives of Research on IA▪Global Harmonization. As business entities increasingly operate in multiple counties, they encounter the cost of dealing with diversity in financial reporting requirements. ▪Financial Reporting in Emerging Economics. As ever increasing amounts of capital are invested in countries with emerging economics, the quality of financial reporting in these countries is coming under the microscope.Objectives of Research on IA▪Social and Environmental Reporting. One of the consequences of the globalization of business enterprises is that companies now have stakeholders not just in their home country but in all the countries where they operate.CHAPTER 2International accounting harmonizationLEARNING OBJECTIVES:1. Recognize the arguments for and against harmonization.2. Identify the pressures for and the obstacles to harmonization.3. Become familiar with the main organizations involved in harmonization.CHAPTER OUTLINEHistory and Recent Developments▪Prior to 1960, there was little effort devoted to the international harmonization of accounting standards. Efforts have been made by a number of organizations to reduce the differences between accounting systems since then.Main International Bodies InvolvedPrinciples-Based vs. Rules-Based Approaches▪Principles-based standards represent the best approach for guiding financial reporting and standard setting, of any given transaction.▪Rules-based standards provide companies the opportunity to structure transactions to meet the requirements for particular accounting treatments.Obstacles to Harmonization▪Differences in the regulatory framework .▪The "true and fair view" .▪The various interpretation of fundamental principle .▪A binding tax accounting linkLikely future trends▪The convergence of IAS and national accounting standards is, and always has been one of the IASB's key objectives. Three basic future roles exist for the IASB:✓Producing standards for those countries that have no standards of their own✓Assisting in the reduction of diverse national practices✓Acting as an umbrella organizing for national standard settersImplication▪The demand of international capital markets helps to drive harmonization. IASB has become more cognizant of the need to work with national standard setters and bring them into membership of IASB, which may be possible to eliminate the differences between national and international standards. The current agreement could then be viewed as the first step in a much longer process.IASB ( International Accounting Standards Board)▪IASB's responsibilities:✓Develop and issue International Financial Reporting Standards and Exposure Drafts, and✓Approve Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC).CHAPTER 3ACCOUNTING FOR FOREIGN CURRENCYLEARNING OBJECTIVES:▪ 1. Provide an overview of foreign exchange markets and define related terminology.▪ 2. Describe the different types of foreign exchange exposure and exchange difference.▪ 3. Understand some of the more common foreign currency transactions. CHAPTER OUTLINEAccounting for Foreign Currency Transactions▪a transaction that requires payment or receipt (settlement) in a foreign currency is called a foreign currency transaction.▪Exchange difference is the difference resulting from reporting the same number of units of a foreign currency in the reporting currency at different exchange rates. Accounting for Foreign Currency Transactions▪Importing or Exporting of Goods or Services✓At the date the transaction is first recognized.✓At each balance sheet date that occurs between the transaction date and the settlement date.✓At the settlement date.Accounting for Foreign Currency Transactions▪Recognition of Exchange Differences✓the single- transaction approach✓the two- transaction approachHedging Foreign Exchange Rate Risk▪A derivative instrument may be defined as a financial instrument that by its terms at inception or upon occurrence of a specified event, provides the holder (or writer) with the right (or obligation) to participate in some or all of the price changes of another underlying value of measure, but does not require the holder to own or deliver the underlying value of measure.Hedging Foreign Exchange Rate Risk▪two broad categories✓Forward-based derivatives, such as forwards, futures, and swaps, in which either party can potentially have a favorable or unfavorable outcome, but not both simultaneously (e.g., both will not simultaneously have favorable outcomes).✓Option-based derivatives, such as interest rate caps, option contracts, and interest rate floors, in which only one party can potentially have a favorable outcome and it agrees to a premium at inception for this potentiality; the other party is paid the premium, and can potentially have only an unfavorable outcome.Hedging Foreign Exchange Rate Risk▪Forward Exchange Contracts▪Options▪Fair Value Hedge – Using a Forward Contract▪Hedging an Identifiable Foreign Currency Commitment Using a Forward Contract (A Fair Value Hedge)▪Hedging a Forecasted Transaction Using an Option (Cash Flow Hedge) Translation Of Foreign Financial Statements▪Derivation of the Issue of Foreign Currency Translation✓Translation exposure, sometimes also called accounting exposure, refers to gains or losses caused by the translation of foreign currency assets and liabilities into the currency of the parent company for accounting purposes.✓The choice of any method for the translation of the financial statements of a foreign business operation involves two basic questions:(i) how shall foreign currency financial statements be translated——in particular what exchange rates are to be used for different assets/liabilities/equity accounts?(ii) how and when shall foreign exchange gains or losses be recognized?CHAPTER 4Business combinationsLEARNING OBJECTIVES:•(1)Understand the economic motivations underlying business combinations.•(2)Learn about the alternative forms of business combinations, from both the legal and accounting perspectives.•(3)Introduce concepts of accounting for business combinations;•(4)emphasizing the purchase method.•(5)See how firms make cost allocatCHAPTER OUTLINE4.1 The Accounting Concept of Business Combinations4.2 The Legal Form of Business Combinations4.3 Reasons for Business Combinations4.4 Accounting for Business Combinations Under the Purchase Method4.5 The measurement of Goodwill and ControversyCHAPTER 5Consolidated financial statementsLEARNING OBJECTIVES:•(1)Recognize the benefits and limitations of consolidated financial statements.•(2)Understand the requirements for inclusion of a subsidiary in consolidated financial statements.•(3)Apply the consolidation concepts to parent company recording of the investment in a subsidiary at the date of acquisition.•(4)Allocate the excess of the fair value over the book value of the subsidiary at the date of acquisition.CHAPTER OUTLINE5.1 Demand from IAS 275.2 The adjustment of Intercompany Transactions5.3 Parent Company Recording and Consolidated Statement of financialposition at Acquisition Date5.4 Subsequent Statement of financial positionCHAPTER 6Accounting for changing priceLEARNING OBJECTIVES:▪ 1. Explain basic concepts relating to inflation accounting. Understand the distinction between changes in the general level of prices in an economy, which affect the purchasing power of the measuring unit, and changes in the prices of specific assets and liabilities, which affect balance sheet valuations and income measurement.▪ 2. Explain the underlying thoughts and methods of dealing with inflation.▪ 3. Restate conventional financial statements based on historical costs to a common measuring unit.CHAPTER OUTLINEDefects of historical cost accounting▪The results of comparison of performance and position statements over time will be unreliable, because amounts are not valued in terms of common units.▪Borrowings are shown in monetary terms, but in a time of rising prices a gain is actually made (or a loss in times of falling prices) at the expense of the lender as, in real terms, the value of the loan has decreased or increased.▪Conversely, gains arising from holding assets are not recognized.▪Depreciation writes off the historical cost over time, but, where asset values are low (because based on outdated historical costs), depreciation will be correspondingly lower, so that a realistic charge for asset consumption is not matched against revenue in the performance statements.Overview of Accounting for changing prices▪Changing prices affect financial reports in two principal ways:✓Measuring unit problem✓Valuation problemAccounting Measurement Alternatives▪Acquisition Cost/Nominal Dollar Accounting▪Acquisition Cost/Constant Dollar Accounting▪Current Cost/Nominal Dollar Accounting▪Current Cost/Constant Dollar AccountingRestatement of Monetary and Non-monetary Items▪A monetary item is a claim receivable or payment in a specified number of dollars, regardless of changes in the purchasing power of the dollar.▪A non-monetary item is any asset, liability, or shareholders’ equity account that has no claim to or for a specified number of dollars.Evaluation of Acquisition Cost/Constant Dollar Accounting▪When compared with current-cost accounting (discussed next), constant-dollar accounting carries a higher level of objectivity. Independent accountants can examine canceled checks, invoices, and other documents to verify acquisition-cost valuations and transaction dates. The restatements to constant dollars use general price indexes published by governmental bodies.Evaluation of Current Cost/Nominal Dollar Accounting▪Current-cost accounting measures performance and financial position in terms of the current market prices. Managers likely make decisions in terms of current costs, not out-of-date acquisition costs. Thus, for assessing management’s actions, current-cost financial statements provide information on the same basis that management used to make decisions.▪Critics note two shortcomings of current cost/nominal dollar accounting:✓auditors cannot as easily verify current-replacement-cost valuations as they can acquisition-cost valuations.✓the use of nominal dollars means that the measuring unit underlying current-replacement-cost valuations varies across time.CHAPTER 7Accounting for financial instrumentLEARNING OBJECTIVES:1. Examine budgeting and performance evaluation issues for international firms.2. Discuss global risk management tools and strategies including multinational capitalbudgeting and foreign exchange risk management.3. Identify the main constituents of cross-border transfer pricing policies, define thetransfer pricing methods, and consider the issues in devising a transfer pricing strategy.4. Recognize the critical role of information technology systems in the effectiverecording, processing and dissemination of financial and managerial accounting information.CHAPTER OUTLINE1 Challenge for the accounting profession2 Accounting and Reporting for Financial Instruments: International Developments ▪In the process of completing the most recent series of amendments, the IASB conducted an extensive due process, which began in 2001 and included the following: ▪(1) Conducting numerous board deliberations prior to the June 2002 exposure drafts;2.1 Overview of IAS 32▪The following are the major U.S. standards that address financial instruments accounting and reporting:▪(1) SFAS 107, Disclosures About Fair Value of Financial Instruments.▪(2) SFAS 133, Accounting for Derivative Financial Instruments and Hedging Activities.▪(3) SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.▪(4) SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Debt and Equity.2.2 Overview of IAS 392.3 Recognition and Derecognition of Financial Assets and Liabilities2.4 Hedge Accounting Guidance2.5 Impairment of Financial Instruments2.6 Convergence with U.S. GAAP3 Financial instruments3.1 Illustration of Traditional Financial Instrument3.2 Illustration of Derivative Financial Instrument4 DERIV ATIVES USED FOR HEDGING▪SFAS No. 133 established accounting and reporting standards for derivative financial instruments used in hedging activities. Special accounting is allowed for two types of hedges—fair value and cash flow hedges.4.1 Fair Value Hedge4.2 Illustration of Interest Rate Swap4.3 Cash Flow Hedge5 OTHER REPORTING ISSUES▪Additional issues of importance are as follows:▪(1) The accounting for embedded derivatives.▪(2) Qualifying hedge criteria.▪(3) Disclosures about financial instruments and derivatives.Chapter 8 financial reporting in different countriesLearning objectives:•Identify the major policy-setting bodies and their role in the standard-setting process.•Appreciate US GAAP .•Understand convergence of US GAAP to IFRSs.Chapter outline:Parties Involved in Standard SettingSecurities and Exchange CommissionAmerican Institute of CPAsFinancial Accounting Standards BoardFinancial Accounting Standards BoardDue ProcessTypes of PronouncementsGovernmental Accounting Standards Board Generally Accepted Accounting PrinciplesIssues in Financial ReportingIssues in Financial ReportingConceptual FrameworkDevelopment of Conceptual FrameworkChapter 9 corporate governanceLearning objectives:1.describe the definition of corporate governance2.describe some corporate governance theory3.describe the principle of corporate governance chapter outline:2 What is corporate governance?3 Corporate governance theoryPrincipal-agent theoryClassical Stewardship Theory3.3 Modern Stewardship Theory3.4 Stakeholder TheoryPrinciples of corporate governanceCorporate governance modelsMechanisms and controls of corporate governance Features of poor corporate governance。

浅析我国高校双语财务会计教学

教 学研 究

2 0 1 3 年0 5 月

浅ቤተ መጻሕፍቲ ባይዱ我 国高校双语财务会计教 学

李 艺

( 长江师范学院经济与工商管理 学院 ,重庆

【 摘 要 】双语教学是高校教学语言改革的一项新措施 , 使 培 养双 语人 才 的重 要途 径 。 目前 ,我 国很 多 高校 都积 极 实施 和 推 广双 语教 学。 随着会 计 界 的 国际 交流 与合作 日益频 繁 ,会 计 专 业开展 双语 教 学是 高校 的 必然选 择 。本 文对 我 国财务会 计 教 学 的情 况 进行 分析 ,针 对 发现 的 实 际 问题 提 出完善 的建议 , 为进一 步提 高双语 教 学质量提 供 参考和 借鉴 。

4 0 4 1 O 0 )

【 关键 词 】高校教育;双语教学;财务会计

引言 双语 教学作 为一种新 的教学模 式 ,成 为我 国高等 教育 与国 际接 轨 ,迎 接新世 纪挑战 的重要措 施 。特 别是我 国加 入W T O 以 后 ,不 同行 业 的人 们 需 要 与 世 界 不 同 国家 和 地 区 的 企业进行 交流 ,迫切 需要 外语 角几能 力的复合 型人才 。随 着 我 国会 计 国际化进程 的不 断加快 ,将 专业英 语教学 引入 会 计专业 已经刻 不容缓 ,这将 大大提升 学生 的专业 能力和 执业 水平 。 1 、会计双语教 学的含义与 目标 双 语教 学 的解释 是 “ T h e U S e o f t h e S e c o n d o r

f o r e i g n l a n g u a g e i n s c h o o l f o r t h e t e a c h i n g f o r t h e

国际会计(双语)国际会计(双语)大纲

《国际会计》(双语)课程教学大纲课程编号:02133制定单位:会计学院制定人(执笔人):宋京津,王宏*******制定(或修订)时间:2011年8月26日江西财经大学教务处《国际会计》(双语)课程教学大纲一、课程总述本课程大纲是以2011年国际会计(双语)本科专业人才培养方案为依据编制的。

二、教学时数分配三、单元教学目的、教学重难点和内容设置Study guide for international accountingCHAPTER 1Introduction to international accountingLEARNING OBJECTIVES:1.To identify and understand the importance of the eight factors that has asignificant influence on accounting development.2.To understand the definition of IA of this textbook.3.To be familiar with the detailed contents of IACHAPTER OUTLINEDevelopment of IAEight factors▪Sources of Finance–In countries with strong equity markets, Disclosures are extensive to meet the requirements of widespread public ownership.–in credit-based systems where bans are the dominant source of finance, accounting focuses on creditor protection through conservative accounting measurements. Development of IA▪Legal System. The legal system determines how individuals and institutions interact.▪Taxation . tax legislation effectively determines accounting standards because companies must record revenues and expenses in their accounts to claim them for tax purposes.▪Political and Economic Ties. Accounting ideas and technologies are transferred through conquest, commerce, and similar forces.Development of IA▪Inflation. Inflation distorts historical cost accounting and affects the tendency of a country to incorporate price changes into the accounts.▪Level of Economic Development. This factor affects the types of business transactions conducted in an economy and determines which ones are most prevalent.Development of IA▪Education Level. Highly sophisticated accounting standards and practices are useless if they are misunderstood and misused.▪Culture. Cultural variables underlie nations’ institutional arrangements (such as legal systems)Definition of IAInternational accounting can be viewed in terms of the accounting issues uniquely confronted by companies involved in international business. It also can be viewed more broadly as the study of how accounting is practiced in each and every country around the world, learning about and comparing the differences in financial reporting and other accounting practices that exist across countries.Definition of IAThis book is designed to be used in a course that attempts to provide an overview of the broadly defined area of international accounting, and that focuses on the International Financial Reporting Standards (IFRSs) issued by International Accounting Standards Board (IASB) and some international hot topics.Detailed Contents on IA▪International accounting is a well-established specialty area within accounting and has two major dimensions:▪Comparative: Examining how and why accounting principles differ from country to country▪Pragmatic: accounting for the operational problems and issues encountered by individuals and firms in international business.Detailed Contents on IA▪L. Radebaugh and S. Gray (1993, p. 9) also write that the study of international accounting involves two major areas:▪descriptive/comparative accounting and the accounting dimensions of international transactions/multinational enterprises.▪principally covers the problems encountered by multinational corporations: Financial reporting problems, translation of foreign currency financial statements, information systems, budgets and performance evaluation, audits, and taxes.Objectives of Research on IA▪Global Harmonization. As business entities increasingly operate in multiple counties, they encounter the cost of dealing with diversity in financial reporting requirements.▪Financial Reporting in Emerging Economics. As ever increasing amounts of capital are invested in countries with emerging economics, the quality of financial reporting in these countries is coming under the microscope. Objectives of Research on IA▪Social and Environmental Reporting. One of the consequences of the globalization of business enterprises is that companies now have stakeholders not just in their home country but in all the countries where they operate.CHAPTER 2International accounting harmonizationLEARNING OBJECTIVES:1. Recognize the arguments for and against harmonization.2. Identify the pressures for and the obstacles to harmonization.3. Become familiar with the main organizations involved in harmonization. CHAPTER OUTLINEHistory and Recent Developments▪Prior to 1960, there was little effort devoted to the international harmonization of accounting standards. Efforts have been made by a number of organizations to reduce the differences between accounting systems since then.Main International Bodies InvolvedPrinciples-Based vs. Rules-Based Approaches▪Principles-based standards represent the best approach for guiding financial reporting and standard setting, of any given transaction.▪Rules-based standards provide companies the opportunity to structure transactions to meet the requirements for particular accounting treatments.Obstacles to Harmonization▪Differences in the regulatory framework .▪The "true and fair view" .▪The various interpretation of fundamental principle .▪ A binding tax accounting linkLikely future trends▪The convergence of IAS and national accounting standards is, and always has been one of the IASB's key objectives. Three basic future roles exist for the IASB:✓Producing standards for those countries that have no standards of their own✓Assisting in the reduction of diverse national practices✓Acting as an umbrella organizing for national standard settersImplication▪The demand of international capital markets helps to drive harmonization. IASB has become more cognizant of the need to work with national standard setters and bring them into membership of IASB, which may be possible to eliminate the differences between national and international standards. The current agreement could then be viewed as the first step in a much longer process.IASB ( International Accounting Standards Board)▪IASB's responsibilities:✓Develop and issue International Financial Reporting Standards and Exposure Drafts, and✓Approve Interpretations developed by the International Financial Reporting Interpretations Committee (IFRIC).CHAPTER 3ACCOUNTING FOR FOREIGN CURRENCYLEARNING OBJECTIVES:▪ 1. Provide an overview of foreign exchange markets and define related terminology.▪ 2. Describe the different types of foreign exchange exposure and exchange difference.▪ 3. Understand some of the more common foreign currency transactions. CHAPTER OUTLINEAccounting for Foreign Currency Transactions▪ a transaction that requires payment or receipt (settlement) in a foreign currency is called a foreign currency transaction.▪Exchange difference is the difference resulting from reporting the same number of units of a foreign currency in the reporting currency at different exchange rates. Accounting for Foreign Currency Transactions▪Importing or Exporting of Goods or Services✓At the date the transaction is first recognized.✓At each balance sheet date that occurs between the transaction date and the settlement date.✓At the settlement date.Accounting for Foreign Currency Transactions▪Recognition of Exchange Differences✓the single- transaction approach✓the two- transaction approachHedging Foreign Exchange Rate Risk▪A derivative instrument may be defined as a financial instrument that by its terms at inception or upon occurrence of a specified event, provides the holder (or writer) with the right (or obligation) to participate in some or all of the price changes of another underlying value of measure, but does not require the holder to own or deliver the underlying value of measure.Hedging Foreign Exchange Rate Risk▪two broad categories✓Forward-based derivatives, such as forwards, futures, and swaps, in which either party can potentially have a favorable or unfavorable outcome, but not both simultaneously (e.g., both will not simultaneously have favorable outcomes).✓Option-based derivatives, such as interest rate caps, option contracts, and interest rate floors, in which only one party can potentially have a favorable outcome and itagrees to a premium at inception for this potentiality; the other party is paid the premium, and can potentially have only an unfavorable outcome.Hedging Foreign Exchange Rate Risk▪Forward Exchange Contracts▪Options▪Fair Value Hedge – Using a Forward Contract▪Hedging an Identifiable Foreign Currency Commitment Using a Forward Contract (A Fair Value Hedge)▪Hedging a Forecasted Transaction Using an Option (Cash Flow Hedge) Translation Of Foreign Financial Statements▪Derivation of the Issue of Foreign Currency Translation✓Translation exposure, sometimes also called accounting exposure, refers to gains or losses caused by the translation of foreign currency assets and liabilities into the currency of the parent company for accounting purposes.✓The choice of any method for the translation of the financial statements of a foreign business operation involves two basic questions:(i) how shall foreign currency financial statements be translated——in particular what exchange rates are to be used for different assets/liabilities/equity accounts?(ii) how and when shall foreign exchange gains or losses be recognized?CHAPTER 4Business combinationsLEARNING OBJECTIVES:•(1)Understand the economic motivations underlying business combinations.•(2)Learn about the alternative forms of business combinations, from both the legal and accounting perspectives.•(3)Introduce concepts of accounting for business combinations;•(4)emphasizing the purchase method.•(5)See how firms make cost allocatCHAPTER OUTLINE➢ 4.1 The Accounting Concept of Business Combinations➢ 4.2 The Legal Form of Business Combinations➢ 4.3 Reasons for Business Combinations➢ 4.4 Accounting for Business Combinations Under the Purchase Method ➢ 4.5 The measurement of Goodwill and ControversyCHAPTER 5Consolidated financial statementsLEARNING OBJECTIVES:•(1)Recognize the benefits and limitations of consolidated financial statements.•(2)Understand the requirements for inclusion of a subsidiary in consolidated financial statements.•(3)Apply the consolidation concepts to parent company recording of the investment in a subsidiary at the date of acquisition.•(4)Allocate the excess of the fair value over the book value of the subsidiary at the date of acquisition.CHAPTER OUTLINE➢ 5.1 Demand from IAS 27➢ 5.2 The adjustment of Intercompany Transactions➢ 5.3 Parent Company Recording and Consolidated Statement of financial position at Acquisition Date➢ 5.4 Subsequent Statement of financial positionCHAPTER 6Accounting for changing priceLEARNING OBJECTIVES:▪ 1. Explain basic concepts relating to inflation accounting. Understand the distinction between changes in the general level of prices in an economy, which affect the purchasing power of the measuring unit, and changes in the prices of specific assets and liabilities, which affect balance sheet valuations and income measurement.▪ 2. Explain the underlying thoughts and methods of dealing with inflation.▪ 3. Restate conventional financial statements based on historical costs to a common measuring unit.CHAPTER OUTLINEDefects of historical cost accounting▪The results of comparison of performance and position statements over time will be unreliable, because amounts are not valued in terms of common units.▪Borrowings are shown in monetary terms, but in a time of rising prices a gain is actually made (or a loss in times of falling prices) at the expense of the lender as, in real terms, the value of the loan has decreased or increased.▪Conversely, gains arising from holding assets are not recognized.▪Depreciation writes off the historical cost over time, but, where asset values are low (because based on outdated historical costs), depreciation will becorrespondingly lower, so that a realistic charge for asset consumption is not matched against revenue in the performance statements.Overview of Accounting for changing prices▪Changing prices affect financial reports in two principal ways:✓Measuring unit problem✓Valuation problemAccounting Measurement Alternatives▪Acquisition Cost/Nominal Dollar Accounting▪Acquisition Cost/Constant Dollar Accounting▪Current Cost/Nominal Dollar Accounting▪Current Cost/Constant Dollar AccountingRestatement of Monetary and Non-monetary Items▪ A monetary item is a claim receivable or payment in a specified number of dollars, regardless of changes in the purchasing power of the dollar.▪ A non-monetary item is any asset, liability, or shareholders’ e quity account that has no claim to or for a specified number of dollars.Evaluation of Acquisition Cost/Constant Dollar Accounting▪When compared with current-cost accounting (discussed next), constant-dollar accounting carries a higher level of objectivity. Independent accountants can examine canceled checks, invoices, and other documents to verify acquisition-cost valuations and transaction dates. The restatements to constant dollars use general price indexes published by governmental bodies. Evaluation of Current Cost/Nominal Dollar Accounting▪Current-cost accounting measures performance and financial position in terms of the current market prices. Managers likely make decisions in terms of current costs, not out-of-date acquisition costs. Thus, for asses sing management’s actions, current-cost financial statements provide information on the same basis that management used to make decisions.▪Critics note two shortcomings of current cost/nominal dollar accounting:✓auditors cannot as easily verify current-replacement-cost valuations as they can acquisition-cost valuations.✓the use of nominal dollars means that the measuring unit underlying current-replacement-cost valuations varies across time.CHAPTER 7Accounting for financial instrumentLEARNING OBJECTIVES:1. Examine budgeting and performance evaluation issues for international firms.2. Discuss global risk management tools and strategies including multinational capitalbudgeting and foreign exchange risk management.3. Identify the main constituents of cross-border transfer pricing policies, define thetransfer pricing methods, and consider the issues in devising a transfer pricing strategy.4. Recognize the critical role of information technology systems in the effectiverecording, processing and dissemination of financial and managerial accounting information.CHAPTER OUTLINE1 Challenge for the accounting profession2 Accounting and Reporting for Financial Instruments: International Developments▪In the process of completing the most recent series of amendments, the IASB conducted an extensive due process, which began in 2001 and included the following:▪(1) Conducting numerous board deliberations prior to the June 2002 exposure drafts;2.1 Overview of IAS 32▪The following are the major U.S. standards that address financial instruments accounting and reporting:▪(1) SFAS 107, Disclosures About Fair Value of Financial Instruments.▪(2) SFAS 133, Accounting for Derivative Financial Instruments and Hedging Activities.▪(3) SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities.▪(4) SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Debt and Equity.2.2 Overview of IAS 392.3 Recognition and Derecognition of Financial Assets and Liabilities2.4 Hedge Accounting Guidance2.5 Impairment of Financial Instruments2.6 Convergence with U.S. GAAP3 Financial instruments3.1 Illustration of Traditional Financial Instrument3.2 Illustration of Derivative Financial Instrument4 DERIV ATIVES USED FOR HEDGING▪SFAS No. 133 established accounting and reporting standards for derivative financial instruments used in hedging activities. Special accounting is allowed for two types of hedges—fair value and cash flow hedges.4.1 Fair Value Hedge4.2 Illustration of Interest Rate Swap4.3 Cash Flow Hedge5 OTHER REPORTING ISSUES▪Additional issues of importance are as follows:▪(1) The accounting for embedded derivatives.▪(2) Qualifying hedge criteria.▪(3) Disclosures about financial instruments and derivatives.Chapter 8 financial reporting in different countriesLearning objectives:•Identify the major policy-setting bodies and their role in the standard-setting process.•Appreciate US GAAP .•Understand convergence of US GAAP to IFRSs.Chapter outline:Parties Involved in Standard SettingSecurities and Exchange CommissionAmerican Institute of CPAsFinancial Accounting Standards BoardFinancial Accounting Standards BoardDue ProcessTypes of PronouncementsGovernmental Accounting Standards BoardGenerally Accepted Accounting PrinciplesIssues in Financial ReportingIssues in Financial ReportingConceptual FrameworkDevelopment of Conceptual FrameworkChapter 9 corporate governanceLearning objectives:1.describe the definition of corporate governance2.describe some corporate governance theory3.describe the principle of corporate governancechapter outline:2 What is corporate governance?3 Corporate governance theoryPrincipal-agent theoryClassical Stewardship Theory3.3 Modern Stewardship Theory3.4 Stakeholder TheoryPrinciples of corporate governanceCorporate governance modelsMechanisms and controls of corporate governance Features of poor corporate governance。

双语中级会计第七章

LOGO

Repurchase the stocks

One 备抵账户: Treasury stock

+

-

LOGO

Retire the stocks 注销股票

If repurchase price>par value 当回购价>面值 时 , debit the ―common stock‖ and ―additional contributed capital‖, credit the ―treasury stock‖, then record the remaining amount as ―retained earnings‖. If repurchase price<par value 当回购价<面值 时 , debit the ―common stock‖, credit the ―treasury stock‖, then record the remaining amount as ―additional contributed capital‖.

LOGO

Repurchase the stocks 回购股票

When the company buys back stocks, both cash and shareholders’ equity are decreased, then the company becomes smaller 当公司回 购股票时,现金和股东权益均减少,公司规模即缩小. Exp. Alta Vena Company buys back 2,000 shares of its own common stocks for $9,000. (which it had originally sold for $8,000) Dr. Treasury stock 9,000 Cr. Cash 9,000 Shares repurchased and not retired are referred to as treasury stock 被回购而未被注销 的股票被称为“库存股”.

会计专业双语教学的SWOT分析

会计专业双语教学的SWOT分析SWOT分析是一种对企业或机构进行分析的管理工具,它可以帮助我们识别出潜在的优势、劣势、机会和威胁。

在会计专业双语教学方面,我们同样可以通过SWOT分析来了解它的优势、劣势、机会和威胁。

本文将对以会计专业为主题的双语教学进行SWOT分析,以期有助于教育者了解此类教育模式的优缺点,提高教育质量。

一、优势1. 提高学生英语水平。

在计算机技术的发展和全球化层面的展开背景下,双语教学能够帮助学生学习并掌握英语语言的技能和知识,提高他们在英语方面的能力。

2. 强化学生的会计专业知识。

以双语教育为主题的课程,能够让学生在外语环境下更加深入地了解专业知识。

这种课程能够相互补充,提高他们的理解能力,增强会计专业的应用能力。

3. 提升学生的跨文化意识。

跨文化意识是现代社会中重要的一冠,它有助于个人在不同国家、不同地区和不同文化背景下的交流和合作。

在双语教育中,学生可以更好地接触到不同的文化,增强跨文化意识。

二、劣势1. 开放的类和特定的常规学期无法兼得。

在许多大学和高等学校中,双语教学通常被视为一种选修课程,属于开放的“选修”类型。

开放的课程可以给许多年级的学生带来便利,但是,如果将其归为特定的常规学期,它可能会给学生带来困惑和压力。

2. 学生的英语水平差异。

在双语教育中,学生的英语水平有很大的差异,一些学生难以理解课程内容,这可能会影响他们的学习效果和兴趣。

3. 应用领域不广泛。

在实际应用中,双语教学主要应用于古典语言、文学和社会科学等领域。

会计专业尚未得到广泛应用的推广和普及,因此大多数学生无法真正受益于这种教育模式。

三、机会1. 国际化教育大势。

随着全球化的加速,许多教育界开始致力于提高学生的国际化水平。

以双语教育为主,可以提高学生的国际化能力,这也为教育机构提供了一个新的机会。

2. 教育改革带来的机会。

在教育改革的过程中,采用新的教育模式和方法,有望为学生提供更多的选择和机会。

国际会计(双语)课程Case 3

Case 3Aaron Duley, the CEO of Nickel Corporation was discussing with his CFO, Michael Cucciare, on whether the company should adopt IASs for financial reporting purposes. Nickel Corporation is based in a country that permits the use of IASs or domestic GAAP.“Michael, reporting under our domestic GAAP is much more costly to the company than reporting under IASs. I understand that fewer disclosures are required under IASs. Moreover, IASs provide more choices when it comes to applying accounting method to our financial statements to produce the most favorable results. And, to be honest with you, the company is going to have to report its first operating loss in over 15 years if we continue to report under our current domestic GAAP. I certainly don’t want that to happen while I’m CEO.”“ I hear you Aaron, but converting to IASs might look bad to investors. What if the public finds out that we were trying to hide the operating loss or switched to IASs to manipulate the bottom line? That could prove even more costly in the long run while saving the company pennies now.”Questions:1.Background introduction.2.Should the company prepare this year’s financial statements in accordance to its domesticGAAP or IASs?3.In your opinion, is there anything ethically wrong with the CEO’s rationale for the adoption ofIASs? Explain.4.As the company’s auditor, would you agree to the switch to IASs?5.。

基础会计(双语)教案

课程教案2014—2015学年第二学期课程名称:会计英语课程性质:必修课授课班级:涉外会计授课教师:杨舒教师所属系(部):商贸系总学时:40周学时:2Part 1 Basic of accounting1. What is accounting and its role in BusinessAccounting branches2. Financial statements⏹Balance sheet⏹Income statement⏹Statement of cash flows⏹Statement of changes in equityAssets⏹Assets are valuable resources owned by the entity.⏹Liabilities and equity show the sources of assets.Liabilities⏹Liabilities are the entity’s obligations to outside parties who have furnished resources.⏹Creditors—who have a claim against the assets in the amount shown as the liabilities.Equity⏹Paid-in capital: provided by equity investors⏹Retained earnings: generated from profits⏹Equity investors have only a residual claim.3. Concepts that govern all accounting (会计核算的基本概念)(1) The dual-aspect concept复式记帐概念The fundamental accounting equation:Assets = Liabilities + Equity复式记帐特点✓在两个或两个以上相互联系的账户中记录一项经济业务,以反映资金运动的来龙去脉。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

• 2:第一个模块介绍了国际和美国会计准则的发展历史和准 则制定的程序以及相关财务会计的基本原则; • 第二个模块介绍了财务报告体系的内容以及资产负债表、 利润表以及现金流量表的主要内容; • 第三个模块介绍了资产的确认和计量,包括现金、存货、 固定资产、无形资产和投资; • 第四个模块介绍了负债和权益的确认和计量,包括短期负 债、债券、衍生金融工具等; • 第五个模块介绍了收入和费用的确认和计量,包括收入的 确认、所得税费用以及年金费用; • 第六个模块介绍了一些特殊交易的会计处理,如租赁和会 计变更; • 第七个部分是商业案例,包括具体的上市公司的案例,以 及如何将前六个模块的知识运用到具体的案例中。

• 1)One of the most important functions of accounting is to accumulate and report financial information that shows an organization’s financial position and the results of its operations to its interested users. • 会计的最重要的职能之一是汇集和报告某 个企业财务状况和经营成果的财务信息, 并把这些信息提供给利益相关者。

Dividend(股利) Liquidation(清算) Amortization (摊销) Budget(预算)

2、会计英语的句法特点及翻译方法

• 2.1 句子结构简洁明确 • 会计英语的句子要陈述事实,力求准确直 白,因此较多使用非谓语动词、介词短语, 不定式短语等来代替句子中的定语从句、 状语从句。句子结构紧密且简洁明了。

• 2)Equal debits and credit have been recorded for transactions. • 译文:将所有交易的借方和贷方都记录帐 上。 • 解析:汉语中较少使用被动语态,因此在 将被动句翻译成汉语时,多译成无人称 句.将原来的主语转译成宾语。

• 2.3 使用复杂长句 • 会计英语是用严密的逻辑推理形式来表述的.为 了说明原理的内在特征和相互之间的联系.以及 会计本身的复杂性和综合性。会计英语文献中也 较多使用复杂的长句式。这类句子中常包括多个 从句或包括多重修饰成分.一层叠一层,使得整 个句子从表面上看错综复杂.而实际上形成一个 树型结构。在翻译时通常先要找到句子的主 干.然后再层层分析,理顺各成分彼此之间的联 系.才能准确、通顺地翻译原文。还可根据具体 情况采用顺译、倒译、分译、增译、省译等翻译 方法

Accounting

主讲:王千红

Welcome to my class

计殿 会堂

Essentials of Accounting

Middle of the financial accounting

Senior Accounting

Foreign Enterprises

Sino-foreign Joint Ventures

Tiny English

• Don,t worry too much about the ambiguous future; • Just make effort for the explicit present.

每日口语学习

How’s the project going? 项目进展得怎么样? Great! We’re way ahead of schedule. 非常好!我们要提前完工了。

职业发展

ACCA 14门全部通过的全科合格证书

ACCA 中国会计论坛共策会计国际化:追求卓越 互鉴共赢

课程学习要求

• • • • •

48学时

1、平时出勤10分 2、课堂双语表现10分 3、两次翻译作业10分 4、英文案例分析、讨论(以小组为单位)20分 5、期末考试 50分

课程介绍(Course Introduction)

• 1:accounting process

Capture transaction data on source documents Journalize transaction

Prepare post-closing trial balance

Post transaction to the ledger

• 2.2 大量使用被动语态 • 会计英语文献主要是客观地陈述理论及会计事 务.力求准确地表达事物的本质与特征.因此会 计英语文献通常使用非人称的语气来作客观阐述, 较多地使用被动句。由于被动句可以省略施动者。 因此当施动者是上文已提到的、显而易见的、或 是无关紧要的时候。就可省略。在达到客观性的 同时,又使传递的信息简洁化,利于信息的传递。

•

Accounting Standard for Business Enterprises

IFRS

1999年我国第一次遭受外国反倾销调查至今,国外对 我国发起的反倾销调查已有500余起,且近两年呈增长 趋势,每年都在30起以上,多时可达40―50起。有关 部门估算,中国出口产品遭受国外反倾销每年平均损失 800多亿人民币。排除其他因素,懂得国际会计准则的 人才匮乏是主要的原因。

profit after tax loss on sales sales on credit terms deposit on bank goods on hand

名词+介词短语

• Gross profit • Indirect cost • Intangible asset

• accounts receivable • accounts payable

• 2)At the end of April,accumuIated depreciation would have a balance of $375,representing three month’s accumulated depreciation. • (解析:现在分词作定语.相当于一个非限 制性定语从句。对整个主句加以补充说明, 可顺译为并列分句。) • 译文:到4月末,累计折旧将会有375美元 余额。代表3个月的累计折旧数额。

Tiny English

会计英语的特点和翻译

1、会计英语的词汇特点及翻译方法 2、会计英语的句法 • • •

book value Cash balance Money order Check stub Work sheet

名词+名词

• • • • •

• 1)When an asset is disposed of ,the related original cost and accumulated depreciation are removed from the accounts. • 译文:当要清理某项资产时,要将有关的原始 成本和累计折旧从该帐户注销。

合成形容词+名词

1.2缩略词

Dr. Cr. Bal. Depn. Doc. N.S.F

•

1.3 一词多义与单义性

Claim

GE (要求、索取、声称、断言) EBE ( 债权、求偿权、索赔)

Outstanding GE(杰出的) Outstanding check EBE(未对付的支票)

• • • •

形容词+名词

名词+形容词

• • • • •

beginning inventory closing procedure accrued revenue semifinished parts fixed assets

分词+名词

• • • •

break –even point straight-line method long-term asset cost-benefit data

Prepare trial balance Journalize and post adjusting entries Prepare financial statements

Journalize and post closing entries

Prepare adjusted trial balance

• 例如: • 1)Bankers and other Creditors must consider the financial strength of a business before permitting it to borrow funds.

• 译文:银行和其他的债权人在允许企业贷 款前,必须先考察这家企业的财务实力。