Chap019 Financial Statement Analysis 博迪投资学课件

financial report 和financial statement analysis -回复

financial report 和financial statementanalysis -回复Financial Report:A financial report is a document that provides a comprehensive overview of a company's financial performance. It includes information on the company's income, expenses, assets, liabilities, and equity. Financial reports are typically prepared and presented to shareholders, investors, and other stakeholders to help them better understand the company's financial health and make informed decisions.Financial reports are prepared using generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS). These principles ensure that the financial information is consistent, comparable, and reliable. The main components of a financial report include the income statement, balance sheet, statement of cash flows, and statement of shareholders' equity.The income statement, also known as the profit and loss statement, shows the company's revenues, expenses, and net profit or loss over a specific period. It provides an overview of the company'sprofitability and how efficiently it is managing its operations. The balance sheet presents the company's assets, liabilities, and shareholders' equity at a specific point in time. It reflects the financial position of the company and helps investors assess its ability to meet its financial obligations.The statement of cash flows provides information on the cash inflows and outflows from the company's operating, financing, and investing activities. It helps stakeholders understand the company's liquidity and cash flow management. Finally, the statement of shareholders' equity shows the changes in the company's shareholders' equity over a given period. It includes information on dividends, share issuances, and net income.Financial Statement Analysis:Financial statement analysis is the process of examining a company's financial statements to assess its financial health and performance. It involves analyzing the information provided in the financial reports and using various techniques and ratios to gain insights into the company's profitability, liquidity, solvency, and efficiency.One commonly used ratio in financial statement analysis is the profitability ratio, which measures a company's ability to generate profits. Examples of profitability ratios include the gross profit margin, operating profit margin, and net profit margin. These ratios assess the company's ability to control costs, manage pricing, and generate sufficient profits.Liquidity ratios, on the other hand, assess a company's ability to meet its short-term financial obligations. Examples of liquidity ratios include the current ratio and the quick ratio. These ratios indicate whether a company has enough current assets to cover its current liabilities. A high liquidity ratio suggests that a company is financially stable and can easily meet its short-term obligations.Solvency ratios evaluate a company's long-term financial stability by comparing its debt to its equity. Examples of solvency ratios include the debt-to-equity ratio and the interest coverage ratio. These ratios show whether a company has a sustainable capital structure and can meet its debt obligations in the long run.Efficiency ratios measure how effectively a company is utilizing itsresources. Examples of efficiency ratios include the inventory turnover ratio, the accounts receivable turnover ratio, and the asset turnover ratio. These ratios provide insights into a company's inventory management, collection of accounts receivable, and overall asset utilization.In addition to ratios, financial statement analysis may also involve trend analysis, common-size analysis, and benchmarking. Trend analysis involves comparing financial data over multiple periods to identify patterns and potential areas of concern. Common-size analysis involves expressing financial data as a percentage of a base figure to facilitate comparisons. Benchmarking involves comparing a company's financial performance to that of its competitors or industry standards to identify areas for improvement.In conclusion, financial reports provide a comprehensive overview of a company's financial performance, while financial statement analysis involves analyzing the information presented in these reports to assess a company's financial health and performance. By understanding these concepts and utilizing various techniques and ratios, stakeholders can make informed decisions and gain valuableinsights into a company's financial standing.。

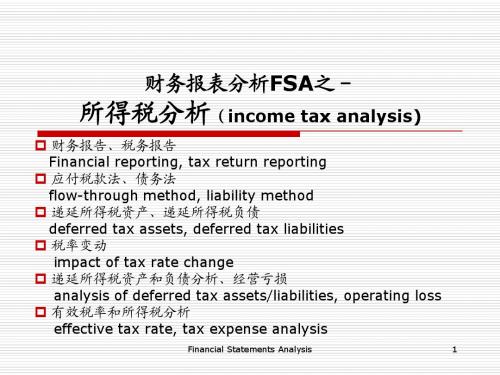

Financial_Statements_Analysis_课件(第九章)所得税分析

Financial Statements Analysis

16

递延所得税负债:负债还是所有者权益? 递延所得税负债:负债还是所有者权益?

课本304) Deferred tax liabilities: liability or equity? (课本 课本

Financial Statements Analysis 1

财务报告VS税务报告 财务报告VS税务报告P291 VS

会计收益、应税收益:不同经济概念,遵循不同原则, 规范不同对象,体现不同要求;差异不可避免

Financial Statements Analysis

2

税务报告、 税务报告、财务报告(参见课本P292 BOX 9-1)

应税所得( income) 应税所得(taxable income) 应交所得税( payable) 应交所得税(tax payable)=当期应税所得*适用所得税税率 已缴所得税( paid):当期和以前会计期间所得税支 ):当期 已缴所得税(income tax paid):当期 付和返还(payments or refunds ) ( 税损移前扣减(tax (taxcarryback)、税损移后扣减(tax税损移前扣减(tax-loss carryback)、税损移后扣减(tax-loss carryforward): ):当期经营亏损,向上转抵3 年,所得税返还; carryforward): 向下结转15 年,抵减以后年度所得税 所得税减免额( credit) 所得税减免额(tax credit):directly reduce tax payables 税前利润( income) 税前利润(pretax income) 所得税费用( expenses): ):当期应交所得税和递延所 所得税费用(income tax expenses): 得税费用(include tax payables and deferred income tax ( expenses) expenses)

financial report 和financial statement analysis -回复

financial report 和financial statementanalysis -回复什么是财务报告和财务报表分析。

1. 引言(150字):财务报告和财务报表分析是财务管理和决策过程中的两个关键概念。

财务报告是描述一个组织的财务状况和业绩的文件。

财务报表分析则是利用这些财务报表数据进行分析和解读,以帮助决策者做出明智的商业决策。

2. 财务报告的重要性(300字):财务报告是为了满足不同利益相关方的信息需求而准备的。

它提供了有关组织财务状况和业绩的信息,帮助管理层、股东、投资者、债权人和监管机构等对组织的财务状况进行评估。

财务报告通常包括资产负债表、利润表、现金流量表和所有者权益变动表。

这些报表提供了组织的财务数据,用于分析和监控财务绩效。

3. 财务报表分析的意义(400字):财务报表分析是通过对财务报表数据的解读和比较,评估组织的财务状况和业绩。

对于投资者而言,财务报表分析是投资决策的关键工具。

它可以帮助投资者了解公司的运营状况、盈利能力和风险水平,进而做出是否投资的决策。

对于管理层而言,财务报表分析可以协助他们了解公司的财务绩效,并根据分析结果调整商业战略和运营决策。

财务报表分析可以采取多种方法,包括比率分析、趋势分析和垂直分析等。

比率分析是通过计算和比较不同财务指标之间的关系,评估公司的财务绩效。

这些比率包括盈利能力比率、偿债能力比率、流动性比率和市场价值比率等。

趋势分析则是通过比较多个会计期间的财务数据,发现和评估财务变化的趋势。

垂直分析则是将不同财务指标与相关基准进行比较,用于评估公司在行业中的地位。

财务报表分析提供了一种量化评估公司财务状况和业绩的方法,帮助决策者更好地了解公司的财务风险和潜在机会。

然而,财务报表分析也有其限制。

首先,财务报表本身可能受到潜在偏见和误导。

其次,财务报表分析只提供了过去和当前的数据,对于预测未来的业绩有限。

因此,在进行财务报表分析时,需要综合考虑其他方面的信息,如行业和市场趋势、管理层的实力和公司的竞争优势等。

financial statement analysis framework

financial statement analysis framework一、引言财务报表分析框架是理解企业财务状况、评估企业绩效和预测未来发展的重要工具。

此框架旨在提供一种系统的方法,帮助分析者理解财务报表各部分之间的关系,识别潜在的风险和机会,为企业决策提供有力支持。

二、财务报表概述财务报表是企业财务状况的总结,主要包括资产负债表、利润表和现金流量表。

资产负债表反映企业在某一特定日期的财务状况,即资产、负债和所有者权益的情况;利润表反映企业的经营绩效,即收入、费用和利润的情况;现金流量表则提供关于企业现金流入和流出的信息。

三、分析框架的构建1. 资产负债表分析:关注资产、负债的结构和组成,以及变化趋势。

通过对资产和负债的种类、性质和来源的分析,可以了解企业的资产创造能力和债务结构。

2. 利润表分析:关注收入、费用和利润的构成,以及变化趋势。

利润表分析有助于识别企业的盈利能力、成本控制和潜在的竞争优势。

3. 现金流量表分析:关注现金流入和流出的主要来源和用途,以及变化趋势。

现金流量表分析有助于评估企业的流动性、偿付能力和应对风险的能力。

4. 会计政策与分析方法:理解并分析企业的会计政策,选择适当的分析方法(如趋势分析、比率分析、结构分析等)进行财务报表分析。

四、风险与机会识别通过财务报表分析,可以识别潜在的风险和机会。

风险包括流动性风险、信用风险、运营风险等,机会则包括市场机会、投资机会和战略机会等。

这些信息对于企业决策具有重要参考价值。

五、局限性及改进建议财务报表分析存在一定的局限性,如会计政策的选择和运用、报表粉饰的可能等。

为克服这些局限性,建议采取以下措施:1. 充分理解并尊重企业的会计政策,选择适合的分析方法;2. 关注报表粉饰的可能,利用多种信息来源进行交叉验证;3. 结合非财务信息进行综合分析,以更全面地了解企业的经营状况;4. 定期对财务报表进行复核和更新,以应对企业内外部环境的变化。

Financial statement Analysis 第二章

EPS

50p

4m

1.2m

5.2m

o.48m

2.48m

47.7p

Rights Issue – What Price?

Existing New shares shares

Pre new issue @ £2 @£2.50 4m -

Total shares

4m

Existing earnings

10m x 20% = 2m 2m 2m

£20 £3 £23

£4 to £3.83

Effect on shareholder wealth

Pre Rights issue

Wealth = 5 shares at £4 = £20

Ex rights issue

6 shares at £3.83 = Paid for rights =

Equity

Internally generated funds From owners – shares Reinvested profits

Debt

External funds Bank loans Debentures Lease finance Short term credit

share capital All of benefits to existing shareholders

Rights Issues – What price?

ABC plc has the following capital structure:

Share Capital (£1 shares) £4m Retained Earnings 6m 10m The directors propose to raise an additional £2.4m from a rights issue. They expect to continue to earn a return (after tax) on equity capital of 20%. If the current market price of a share is £4 what price should they issue the new shares at?

FinancialStatementAnalysis第十一版教学设计

Financial Statement Analysis第十一版教学设计1. 前言随着经济的发展和金融市场的变化,越来越多的人开始关注财务报表,并通过对其进行分析来评估企业的价值和投资潜力。

因此,财务报表分析已经成为金融和会计领域的一个重要领域。

本教学设计是为了帮助学生了解财务报表分析的基本原理和技术,并为学生提供实际的分析工具和技能,以便他们可以在实践中应用这些知识。

2. 教学目标通过本课程的学习,学生应该能够:1.审阅财务报表,了解其结构、内容和表示方法;2.运用会计和金融原理,理解和解释财务报表的重要性和含义;3.使用常见的财务指标和分析技术,评估企业的经营绩效和财务状况;4.分析和预测企业的未来表现,为投资决策提供基础。

3. 教学内容和方法3.1 教学内容本课程的教学内容包括以下几个方面:3.1.1 财务报表的基础知识这部分内容主要介绍财务报表的结构和内容,包括资产负债表、利润表和现金流量表等。

同时,讲解会计准则和政策,以及如何识别和解释报表的不同元素。

3.1.2 财务分析的基本原理和技术这部分内容包括各种财务分析技术的介绍和应用,如比率分析、趋势分析和计算各种财务指标等。

此外,还将讲解如何对财务数据进行分类和处理,以及如何评估企业的财务状况和经营绩效。

3.1.3 企业价值分析这部分内容将涉及企业价值的概念和计算方法,包括现金流量贴现模型、股息贴现模型和相对估值法等。

此外,还将讨论如何将财务分析技术应用于企业价值分析中,以及如何预测企业的未来表现。

3.2 教学方法本课程采用多种教学方法,包括讲座、案例分析、小组讨论、演示和提问等。

3.2.1 讲座讲座是主要的教学方法,通过教师的授课,介绍财务报表的基本知识和财务分析技术的基本原理和应用。

讲座中将包括大量实例和案例,以帮助学生更好地理解和应用知识。

3.2.2 案例分析和小组讨论本课程将选择一些实际的企业财务报表案例,邀请学生对其进行分析和解释,并通过小组讨论形式进行反馈和总结。

FinancialStatementAnalysis第十一版教学设计 (2)

Financial Statement Analysis 第十一版教学设计一、前言《Financial Statement Analysis》(第十一版)是一本财务报表分析方面的经典教材,本教学设计是基于该教材的教学设计。

二、教学目标1.了解财务报表分析的基础概念和原则;2.学会运用财务报表分析工具分析公司财务报表;3.培养财务分析的思维能力和判断能力,为投资决策提供理论和实践基础。

三、教学内容1.财务报表分析基础概念和原则2.财务报表分析工具——比率分析(1)流动比率、速动比率、现金比率(2)应收账款周转率、存货周转率(3)固定资产周转率、总资产周转率(4)利润率、毛利率、净利率(5)股东权益回报率、资产回报率3.财务报表分析工具——财务预测(1)趋势分析法(2)比率分析法(3)实际应用案例4.财务报表分析工具——现金流量分析(1)现金流量表(2)现金流量量化分析(3)自由现金流5.财务报表分析实践案例分析(1)选择一家上市公司或者一家知名公司进行财务报表分析(2)撰写分析报告四、教学方法本课程采取大课堂讲解与小组讨论相结合的教学方法,教师通过大课堂讲解,介绍财务报表分析的基础概念和原则,然后将学生分为小组,每组选择一家公司进行财务分析案例分析,并将分析结果进行小组讨论和报告汇报。

在教学过程中,教师将结合现实案例进行分析,让学生充分体验财务分析的实际应用价值。

五、考核与评分1.学生在小组中完成的案例分析报告占最终成绩的70%。

2.课堂参与和小组汇报占最终成绩的30%。

六、教学资源1.教师PPT2.教材—《Financial Statement Analysis》(第十一版)3.案例教学材料4.电脑及实用软件七、参考资料1.《财务报表分析》王永林著,大连理工大学出版社。

2.《财务报表分析与应用》李志刚著,清华大学出版社。

3.《会计信息的质量审核理论与实践》王晓峰著,中国人民大学出版社。

Financial Statements Analysis

0.8 0.8

1 1.667

1 0.6

Somdet 0.018 t

Normal year

Nodett

0.06

0.6 0.6

Hale Waihona Puke 1 0.680.1 0.1

1 1

1 1.667

1 1.134

Somdet 0.068 t

Good year

Nodett

0.09

0.6 0.6

1 0.787

0.125 0.125

1.2 1.2

Value Investing: The Graham Technique

How to use these ratios?

1. Pick a benchmark: ratios of the same firm in different years; ratios of different firms in the same industry For example: /p/sum_conameu.html

Major Financial statements

Major Financial statements

2.the balance sheet ( 资产负债表): 反映公司 的财务现状. Assets=Liability+shareholders' equity current assets+ fixed assets+intangible fixed assets=current liability+long term debt+common stock + preferred stock+ retained earnings If all items are express as a percentage of total assets, it is called a common size balance sheet.

财务报表分析FinancialStatementAnalysis

$900,000 (300,000) $600,000 (240,000) $360,000

則賺取利息倍數為多少?

財務報表分析的限制 :

不適合的資料: 以會計年度期末的財務資料來評估整年 度的財務狀況可能並不適合。

不同的會計準則及方法: 可能會阻礙比較性,因不同國家編製財 務報表的準則可能不同,限制了財務分 析的使用。

習題演練

下列何項非屬短期償債能力的衡量指標: (1)存貨週轉率 (2)流動比率 (3)應收款項週轉率 (4)利息保障倍數

習題演練

甲公司91年到93年之毛利分別為 $10,000,$11,000及$12,500,若以91年為基 期,則92年及93年之百分比為(1)10%及 25%(2)22%及25%(3)220%及250%(4)110% 及125%

習題演練

丙公司之損益表資訊如下: 減除利息前之稅前純益 減:利息費用 餘額 減:所得稅費用 稅後淨利

財務報表分析的工具

水平分析:又稱趨勢分析(trend analysis), 是用來評估在一段期間內一連串財務報表 資料的技術。

垂直分析:又稱共同比分析(common size analysis),以一基準金額的百分比來表達 財務報表上每個項目的技術。

比率分析:表達財務報表選定資料項目間的 關係。

水平分析

1 、比較不同公司多份資產負債表或多份損 益表之間財務資訊。

2、比較同公司不同期間多份資產負債表或 多份損益表之間財務資訊。

垂直分析

1、資產負債表分析:選定基準數為總資產或 負債與股東權益總合

2、損益表分析:選定基(Liquidity Ratios)=>衡量公司 償還短期到期債務及支付未預期現金需 求的能力。

财务分析-Chapter2-of-financial-statement-analysis-分析目的

分析方法

平衡分析法

比率分析法

因素分析法

结构分析法

比较分析法

趋势分析法

系统分析法 综合分析法

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

比 率

1. 最受欢迎, 应用最广泛。

分

2. 必须代表经济上重要的关系。

析

法

3. 揭示重要关系, 提供比较基础。

盈利能力

人

短期信用(偿债能力) 长期信用(偿债、获利能力)

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

投

1. 向企业提供资金以获得企业所有权的风险,

资

不确定性和回报(不存在偿还的承诺)的人。

者

2. 投资报酬率(获利能力)

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

◆ 短期流动性 ◆ 资金流量 ◆ 资本结构和长期偿债能力 ◆ 投资报酬率 ◆ 资产利用率 ◆ 经营业绩

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

2.2 分析方法

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

经

营

者

(管理当局)

1. 被企业所有者雇佣的(或其代表), 对企业资产 和负债实施有效管理的个人组成。

2. 财务指标、 盈利能力、 未来持续发展的可能性。 3. 经理人员可以获取外部使用人无法得到的内部信息 。

财务分析-Chapter2-of-financial-statement-analysis-分析 目的和方法

CHAPTER19FINANCIALSTATEMENTANALYSIS

CHAPTER 19: FINANCIAL STATEMENT ANALYSIS1. ROE = Net profits/Equity = Net profits/Sales × Sales/Assets × Assets/Equity= Net profit margin × Asset turnover × Leverage ratio= 5.5% × 2.0 × 2.2 = 24.2%2.ROA = ROS × ATOThe only way that Crusty Pie can have an ROS higher than the industry average and an ROA equal to the industry average is for its ATO to be lower than the industry average.3. ABC’s Asset turnover must be above the industry average.4. ROE = (1 – Tax rate) × [ROA + (ROA – Interest rate)Debt/Equity]ROE A > ROE BFirms A and B have the same ROA. Assuming the same tax rate and assuming that ROA > interest rate, then Firm A must have either a lower interest rate or a higher debt ratio.5. SmileWhite has higher quality of earnings for the following reasons:•SmileWhite amortizes its goodwill over a shorter period than doesQuickBrush. SmileWhite therefore presents more conservative earningsbecause it has greater goodwill amortization expense.•SmileWhite depreciates its property, plant and equipment using an accelerated depreciation method. This results in recognition of depreciation expensesooner and also implies that its income is more conservatively stated.•SmileWhite’s bad debt allowance is greater as a percent of receivables.SmileWhite is recognizing greater bad-debt expense than QuickBrush. Ifactual collection experience will be comparable, then SmileWhite has themore conservative recognition policy.6. a. EquityAssetsAssets Sales Sales profits Net Equity profits Net ROE ××=== Net profit margin × Total asset turnover × Assets/equity %92.90992.0140,5510Sales profits Net ===66.1100,3140,5Assets Sales ==41.1200,2100,3Equity Assets ==b. %2.2341.166.1%92.9200,2100,3100,3140,5140,5510ROE =××=××= c.g = ROE × plowback = 23.2% × %1.1696.160.096.1%2.23=−×=7.a. Palomba Pizza StoresStatement of Cash FlowsFor the year ended December 31, 1999Cash Flows from Operating Activities Cash Collections from Customers $250,000 Cash Payments to Suppliers (85,000) Cash Payments for Salaries (45,000) Cash Payments for Interest(10,000)Net Cash Provided by Operating Activities$110,000Cash Flows from Investing ActivitiesSale of Equipment 38,000 Purchase of Equipment (30,000) Purchase of Land(14,000)Net Cash Used in Investing Activities(6,000)Cash Flows from Financing ActivitiesRetirement of Common Stock (25,000) Payment of Dividends(35,000)Net Cash Used in Financing Activities (60,000) Net Increase in Cash44,000 Cash at Beginning of Year 50,000Cash at End of Year$94,000b. The cash flow from operations (CFO) focuses on measuring the cash flowgenerated by operations and not on measuring profitability. If used as a measureof performance, CFO is less subject to distortion than the net income figure.Analysts use the CFO as a check on the quality of earnings. The CFO thenbecomes a check on the reported net earnings figure, but is not a substitute fornet earnings. Companies with high net income but low CFO may be usingincome recognition techniques that are suspect. The ability of a firm to generatecash from operations on a consistent basis is one indication of the financialhealth of the firm. For most firms, CFO is the “life blood” of the firm. Analystssearch for trends in CFO to indicate future cash conditions and the potential forcash flow problems.Cash flow from investing activities (CFI) is an indication of how the firm isinvesting its excess cash. The analyst must consider the ability of the firm tocontinue to grow and to expand activities, and CFI is a good indication of theattitude of management in this area. Analysis of this component of total cash flowindicates the type of capital expenditures being made by management to eitherexpand or maintain productive activities. CFI is also an indicator of the firm’sfinancial flexibility and its ability to generate sufficient cash to respond tounanticipated needs and opportunities. A decreasing CFI may be a sign of aslowdown in the firm’s growth.Cash flow from financing activities (CFF) indicates the feasibility of financing, thesources of financing, and the types of sources management supports. Continueddebt financing may signal a future cash flow problem. The dependency of a firmon external sources of financing (either borrowing or equity financing) maypresent problems in the future, such as debt servicing and maintaining dividendpolicy. Analysts also use CFF as an indication of the quality of earnings. It offersinsights into the financial habits of management and potential future policies.8. a. CF from operating activities = $260 – $85 – $12 – $35 = $128b.CF from investing activities = –$8 + $30 – $40 = –$18c. CF from financing activities = –$32 – $37 = –$699. a. QuickBrush has had higher sales and earnings growth (per share) than SmileWhite.Margins are also higher. But this does not mean that QuickBrush is necessarily abetter investment. SmileWhite has a higher ROE, which has been stable, whileQuickBrush’s ROE has been declining. We can see the source of the difference inROE using DuPont analysis:Component DefinitionQuickBrushSmileWhite Tax burden (1 – t) Net profits/pretax profits 67.4% 66.0%Interest burden Pretax profits/EBIT 1.000 0.955Profit margin EBIT/Sales 8.5% 6.5%Asset turnover Sales/Assets 1.42 3.55Leverage Assets/Equity1.471.48ROE Netprofits/Equity12.0%21.4%While tax burden, interest burden, and leverage are similar, profit margin and assetturnover differ. Although SmileWhite has a lower profit margin, it has a far higherasset turnover.Sustainable growth = ROE × plowback ratioROE PlowbackratioSustainablegrowth rateLudlow’sestimate ofgrowth rateQuickBrush 12.0% 1.00 12.0% 30%SmileWhite 21.4% 0.34 7.3% 10%Ludlow has overestimated the sustainable growth rate for both companies.QuickBrush has little ability to increase its sustainable growth – plowback alreadyequals 100%. SmileWhite could increase its sustainable growth by increasing itsplowback ratio.b. QuickBrush’s recent EPS growth has been achieved by increasing book value pershare, not by achieving greater profits per dollar of equity. A firm can increaseEPS even if ROE is declining as is true of QuickBrush. QuickBrush’s book valueper share has more than doubled in the last two years.Book value per share can increase either by retaining earnings or by issuing newstock at a market price greater than book value. QuickBrush has been retaining allearnings, but the increase in the number of outstanding shares indicates that it hasalso issued a substantial amount of stock.10. a. ROE = operating margin × interest burden × asset turnover × leverage × tax burdenROE for Eastover (EO) and for Southampton (SHC) in 2002 are found as follows:profit margin = Sales EBITSHC: EO: 145/1,793 = 795/7,406 = 8.1% 10.7% interest burden =EBIT profitsPretax SHC: EO: 137/145 = 600/795 = 0.95 0.75 asset turnover =Assets SalesSHC: EO: 1,793/2,104 =7,406/8,265 =0.85 0.90leverage =EquityAssetsSHC: EO: 2,140/1,167 =8,265/3,864 = 1.80 2.14 tax burden =profitsPretax profitsNet SHC: EO: 91/137 = 394/600 =0.66 0.66 ROESHC: EO:7.8% 10.2%b.The differences in the components of ROE for Eastover and Southampton are as follows: Profit marginEO has a higher marginInterest burden EO has a higher interest burden because its pretax profits area lower percentage of EBIT Asset turnover EO is more efficient at turning over its assets Leverage EO has higher financial leverageTax Burden No major difference here between the two companiesROEEO has a higher ROE than SHC, but this is only in part due to higher margins and a better asset turnover -- greater financial leverage also plays a part.c. The sustainable growth rate can be calculated as: ROE times plowback ratio.The sustainable growth rates for Eastover and Southampton are as follows:ROEPlowback ratio* Sustainable growth rate Eastover 10.2%0.36 3.7% Southampton 7.8%0.58 4.5%The sustainable growth rates derived in this manner are not likely to be representative of future growth because 2002 was probably not a “normal” year. For Eastover, earnings had not yet recovered to 1999-2000 levels;earnings retention of only 0.36 seems low for a company in a capital intensive industry. Southampton’s earnings fell by over 50 percent in 2002 and its earnings retention will probably be higher than 0.58 in the future. There is a danger, therefore, in basing a projection on one year’s results, especially for companies in a cyclical industry such as forest products.*Plowback = (1 – payout ratio)EO:Plowback = (1 – 0.64) = 0.36SHC: Plowback = (1 – 0.42) = 0.5811. a. The formula for the constant growth discounted dividend model is:gk )g 1(D P 00−+=For Eastover:20.43$08.011.008.120.1$P 0=−×=This compares with the current stock price of $28. On this basis, it appears that Eastover is undervalued.b. The formula for the two-stage discounted dividend model is:333322110)k 1(P )k 1(D )k 1(D )k 1(D P +++++++=For Eastover: g 1 = 0.12 and g 2 = 0.08 D 0 = 1.20D 1 = D 0 (1.12)1 = $1.34 D 2 = D 0 (1.12)2 = $1.51 D 3 = D 0 (1.12)3 = $1.69 D 4 = D 0 (1.12)3(1.08) = $1.8267.60$08.011.082.1$g k D P 243=−=−=03.48$)11.1(67.60$)11.1(69.1$)11.1(51.1$)11.1(34.1$P 33210=+++=This approach makes Eastover appear even more undervalued than was the case using the constant growth approach.c.Advantages of the constant growth model include: (1) logical, theoretical basis; (2) simple to compute; (3) inputs can be estimated.Disadvantages include: (1) very sensitive to estimates of growth; (2) g and k difficult to estimate accurately; (3) only valid for g < k; (4) constant growth is an unrealistic assumption; (5) assumes growth will never slow down; (6) dividend payout must remain constant; (7) not applicable for firms not paying dividends. Improvements offered by the two-stage model include:(1) The two-stage model is more realistic. It accounts for low, high, or zero growth in the first stage, followed by constant long-term growth in the second stage.(2) The model can be used to determine stock value when the growth rate in the first stage exceeds the required rate of return.12. a.In order to determine whether a stock is undervalued or overvalued, analysts often compute price-earnings ratios (P/Es) and price-book ratios (P/Bs); then, these ratios are compared to benchmarks for the market, such as the S&P 500 index. The formulas for these calculations are:Relative P/E = P/E of specific companyP/E of S&P 500 Relative P/B = P/B of specific companyP/B of S&P 500To evaluate EO and SHC using a relative P/E model, Mulroney can calculate thefive-year average P/E for each stock, and divide that number by the 5-yearaverage P/E for the S&P 500 (shown in the last column of Table 19E). This gives the historical average relative P/E. Mulroney can then compare the average historical relative P/E to the current relative P/E (i.e., the current P/E on eachstock, using the estimate of this year’s earnings per share in Table 19F, divided by the current P/E of the market).For the price/book model, Mulroney should make similar calculations, i.e., divide the five-year average price-book ratio for a stock by the five year average price/book for the S&P 500, and compare the result to the current relative price/book (using current book value). The results are as follows:P/E modelEO SHC S&P500 5-year average P/E 16.56 11.9415.20 Relative 5-year P/E 1.09 0.79 Current P/E17.50 16.0020.20 Current relative P/E 0.87 0.79 Price/Book modelEO SHC S&P500 5-year average price/book 1.52 1.10 2.10 Relative 5-year price/book 0.72 0.52 Current price/book1.62 1.492.60 Current relative price/book 0.620.57From this analysis, it is evident that EO is trading at a discount to its historical 5-year relative P/E ratio, whereas Southampton is trading right at its historical 5-year relative P/E. With respect to price/book, Eastover is trading at a discount toits historical relative price/book ratio, whereas SHC is trading modestly above its5-year relative price/book ratio. As noted in the preamble to the problem (seeproblem 10), Eastover’s book value is understated due to the very low historicalcost basis for its timberlands. The fact that Eastover is trading below its 5-yearaverage relative price to book ratio, even though its book value is understated,makes Eastover seem especially attractive on a price/book basis.b. Disadvantages of the relative P/E model include: (1) the relative P/E measuresonly relative, rather than absolute, value; (2) the accounting earnings estimatefor the next year may not equal sustainable earnings; (3) accounting practicesmay not be standardized; (4) changing accounting standards may makehistorical comparisons difficult.Disadvantages of relative P/B model include: (1) book value may beunderstated or overstated, particularly for a company like Eastover, which hasvaluable assets on its books carried at low historical cost; (2) book value maynot be representative of earning power or future growth potential; (3) changingaccounting standards make historical comparisons difficult.13.The following table summarizes the valuation and ROE for Eastover and Southampton:Southampton EastoverStock Price $28.00 $48.00Constant-growth model $43.20 $29.002-stage growth model $48.03 $35.50Current P/E 17.50 16.00Current relative P/E 0.87 0.795-year average P/E 16.56 11.94Relative 5 year P/E 1.09 0.79Current P/B 1.62 1.49Current relative P/B 0.62 0.575-year average P/B 1.52 1.10Relative 5 year P/B 0.72 0.52Current ROE 10.2% 7.8%Sustainable growth rate 3.7% 4.5%Eastover seems to be undervalued according to each of the discounted dividendmodels. Eastover also appears to be cheap on both a relative P/E and a relative P/Bbasis. Southampton, on the other hand, looks according to each of the discounteddividend models and is slightly overvalued using the relative price/book model. Ona relative P/E basis, SHC appears to be fairly valued. Southampton does have aslightly higher sustainable growth rate, but not appreciably so, and its ROE is lessthan Eastover’s.The current P/E for Eastover is based on relatively depressed current earnings, yetthe stock is still attractive on this basis. In addition, the price/book ratio forEastover is overstated due to the low historical cost basis used for the timberlandassets. This makes Eastover seem all the more attractive on a price/book basis.Based on this analysis, Mulroney should select Eastover over Southampton.14. a. Net income can increase even while cash flow from operations decreases.This can occur if there is a buildup in net working capital -- for example,increases in accounts receivable or inventories, or reductions in accountspayable. Lower depreciation expense will also increase net income but canreduce cash flow through the impact on taxes owed.b. Cash flow from operations might be a good indicator of a firm's quality ofearnings because it shows whether the firm is actually generating the cashnecessary to pay bills and dividends without resorting to new financing. Cashflow is less susceptible to arbitrary accounting rules than net income is.15. $1,200Cash flow from operations = sales – cash expenses – increase in A/RIgnore depreciation because it is a non-cash item and its impact on taxes isalready accounted for.16. a Both current assets and current liabilities will decrease by equal amounts. Butthis is a larger percentage decrease for current liabilities because the initialcurrent ratio is above 1.0. So the current ratio increases. Total assets arelower, so turnover increases.17. a Cost of goods sold is understated so income is higher, and assets (inventory)are valued at most recent cost so they are valued higher.18. a Since goods still in inventory are valued at recent versus historical cost.19. b Dividend has no effect on interest payments, earnings, or debt, but will reduceequity, at least minimally.20.20052009(1) Operating margin = Operating income – DepreciationSales%5.6542338=−%8.6979976=−(2) Asset turnover =SalesTotal Assets21.2245542=36.3291979=(3) Interest Burden =[Op Inc – Dep] – Int ExpenseOperating Income – Depreciation914.03383338=−−−1.0(4) Financial Leverage =Total AssetsShareholders Equity54.1159245=32.1220291=(5) Income tax rate =Income taxesPre-tax income%63.403213=%22.556737=Using the Du Pont formula:ROE = [1.0 – (5)] × (3) × (1) × (2) × (4)ROE(2005)=0.5937× 0.914 × 0.065 × 2.21 × 1.54 = 0.120 = 12.0%ROE(2009)=0.4478× 1.0 × 0.068 × 3.36 × 1.32 = 0.135 = 13.5%(Because of rounding error, these results differ slightly from those obtained bydirectly calculating ROE as net income/equity.)b. Asset turnover measures the ability of a company to minimize the level ofassets (current or fixed) to support its level of sales. The asset turnoverincreased substantially over the period, thus contributing to an increase inthe ROE.Financial leverage measures the amount of financing other than equity,including short and long-term debt. Financial leverage declined over theperiod, thus adversely affecting the ROE. Since asset turnover rosesubstantially more than financial leverage declined, the net effect was anincrease in ROE.。

Financial Statement Analysis (3)

Obligations not payable within one year or the operating cycle, whichever is longer.

Liabilities

Alternative Classification

Operating Liabilities

Obligations that arise from operating activities--examples are accounts payable, unearned revenue, advance payments, taxes payable, postretirement liabilities, and other accruals of operating expenses Obligations that arise from financing activities--examples are short- and long-term debt, bonds, notes, leases, and the current portion of long-term debt

Interest and Principal Components of MLP Interest $ 800 664 517 358 186 $2,525 Principal $ 1,705 1,841 1,988 2,147 2,319 $10,000 Total $ 2,505 2,505 2,505 2,505 2,505

Leases

Frequency of Capital and Operating Leases

Leases

Accounting for Leases – An Illustration

Chap019财务报表分析

– Accounting earnings and economic earnings are not always the same thing!

– 重要:会计盈利和经济盈利不总是一样的

INVESTMENTS | BODIE, KANE, MA2RCUS

19-3

Financial Statements财务报表

19-22

Table 19.9 Summary of Key Financial Ratios关键财务指标的总结

INVESTMENTS | BODIE, KANE, MA22RCUS

19-23

Table 19.9 Summary of Key Financial Ratios关键财务指标的总结

INVESTMENTS | BODIE, KANE, MA23RCUS

• ROE与ROA的关系由基本利率决定

INVESTMENTS | BODIE, KANE, MA11RCUS

19-12

Table 19.5 Impact of Financial Leverage on ROE财务杠杆的影响

INVESTMENTS | BODIE, KANE, MA12RCUS

19-13

19-24

Figure 19.1 DuPont Decomposition for HewlettPackard惠普公司的杜邦分解:时间线

INVESTMENTS | BODIE, KANE, MA24RCUS

19-25

Economic Value Added经济增加值

• EVA is the difference between return on assets (ROA) and the opportunity cost of capital (k), multiplied by the capital invested in the firm.

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

• Statement of Cash Flows

19-3

19-4

19-5

Table 19.3 Statement of Cash Flows for Hewlett-Packard, 2006

19-6

Accounting Versus Economic Earnings

• Economic earnings – Sustainable cash flow that can be paid to stockholders without impairing productive capacity of the firm

19-20

Table 19.12 Key Financial Ratios of Growth Industries, Inc

19-21

Table 19.13 Growth Industries Statement of Cash Flows ($ thousands)

19-22

Comparability Problems

• ROA: measures the profitability for all contributors of capital

• Leverage has a significant effect on profitability measures

19-8

Table 19.4 Nodett’s Profitability over the Business Cycle

Equity + Debt Equity

Interest

rate x

Debt Equity

(1 -

Tax

rate)ROA+(ROA-

Interest

rate)

Debt Equity

19-11

Decomposition of ROE

ROE = Net Profit

x Pretax Profit

• Purchase common stocks at less then their working-capital value

• Give no weight to plant or other fixed assets • Deduct all liabilities in full from assets

ROE Net profit EBIT- Interest - Taxes (1- Taxrate)(EBIT- Interest)

Equity

Equity

Equity

(1 -

Tax

rate)(ROAx

Assets) - (Interest Equity

rate

x

Debt)

(1- Taxrate)ROAx

• Intangibles – treatment varies widely

19-24

Figure 19.2 Adjusted Versus Reported Price-Earnings Ratios

19-25

The Graham Technique

• Careful analysis of a firm’s financial statements could turn up bargain stocks

• Accounting Differences – Inventory Valuation – Depreciation

• Inflation and Interest Expense • Fair Value Accounting • Quality of Earnings • International Accounting Conventions

Overview

• Purpose • Tools Used

– Statement analysis – Ratio analysis • Limitations

19-2

Financial Statements

• Balance Sheet – Common Sized – Trend or Indexed

CHAPTER 19

Financial Statement Analysis

McGraw-Hill/Irwin

Investments, 8th edition

Bodie, Kane and Marcus

Slides by Susan Hine

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

19-13

Table 19.7 Differences between Profit Margin and Asset Turnover across Industries

19-14

Table 19.8 Growth Industries Financial Statements, 2004 – 2007 ($ thousands)

19-23

International Accounting Differences

• Reserves – many other countries allow more flexibility in use of reserves

• Depreciation – US allows separate tax and reporting presentations

19-26

• EVA is also called residual income • EVA can be positive or negative for firms that

have positive earnings

19-19

Table 19.11 Economic Value Added, 219.9 Summary of Key Financial Ratios: Leverage, Asset Utilization, Liquidity, Profitability and

Market Price

19-16

Figure 19.1 DuPont Decomposition for Hewlett-Packard

• Accounting earnings – Affected by conventions regarding the valuation of assets

19-7

Profitability Measures

• ROE: measures the profitability for contributors of equity capital

19-9

Table 19.5 Impact of Financial Leverage on ROE

19-10

ROE, ROA and Leverage

R O E = ( 1 -T a x r a te ) R O A + ( R O A -I n te r e s tr a te )E D q e u b it t y

19-17

Table 19.10 Financial Ratios for Major Industry Groups

19-18

Economic Value Added

• Difference between return on assets (ROA) and the opportunity cost of capital (k)

EBIT Sales

x

x

Assets x

Pretax Profit

EBIT

Sales Assets Equity

(1)

x

(2)

x (3) x (4) x (5)

Tax x Interest

Burden

Burden

x Margin x Turnover x Leverage

19-12

Table 19.6 Ratio Decomposition Analysis for Nodett and Somdett