财务会计概念与应用英文版Lecture 2

英文版财务会计PPT 1(1)

英文版财务会计PPT 1(1)

Claims to the Assets

• Liabilities – economic obligations payable to an individual or organization outside the business

Owner’s Equity

OWNER’S EQUITY

INCREASES

OWNER’S EQUITY DECREASES

Owner Investments

Owner Withdrawals

Owner’s Equity

Revenues

Expenses

英文版财务会计PPT 1(1)

Revenues

• Amounts earned by delivering goods or services to customers

英文版财务会计PPT 1(1)

Decision Makers

• Individuals • Businesses • Investors • Creditors • Taxing Authorities

英文版财务会计PPT 1(1)

Financial vs. Managerial Accounting

Entity Concept

• Accounting Entity – organization that stands apart as a separate economic unit

英文版财务会计PPT 1(1)

Reliability (Objectivity) Principle

财务会计英语课件

财务会计英语课件一、引言在当今全球化的商业环境中,掌握英语已成为财会专业人士必备的技能之一。

财务会计英语课件是为了帮助学生更好地理解和应用财务会计领域的专业英语而设计的。

通过本课件,学生可以了解国际财务报告准则(IFRS)和美国通用会计准则(GAAP)的核心概念,掌握财务报表的编制和分析,以及理解财务管理和税务方面的知识。

二、课程目标1、增强学生对国际财务报告准则和美国通用会计准则的理解和应用能力;2、提高学生编制和分析财务报表的能力;3、培养学生的财务管理意识和技能;4、帮助学生了解税务方面的知识和法规。

三、课程内容1、财务会计基础知识:介绍财务会计的基本概念、目标和作用;2、财务报表:详细讲解资产负债表、利润表和现金流量表的编制和分析;3、财务管理:介绍财务决策、投资管理、筹资管理和营运资金管理等方面的知识;4、税务:讲解所得税、增值税和其他主要税种的基本概念和计算方法。

四、教学方法本课件采用多种教学方法,包括:1、理论讲解:通过专业英语词汇、短语和句子的讲解,帮助学生理解和应用财务会计知识;2、案例分析:通过实际案例的分析和讨论,让学生更好地理解财务会计知识在实践中的应用;3、小组讨论:鼓励学生分组讨论,共同解决问题,提高团队合作能力;4、自我评估:通过自我评估测试,让学生了解自己的学习进度和不足之处,以便更好地提高学习效果。

五、结论财务会计英语课件是帮助学生掌握专业英语和财务会计知识的有效工具。

通过本课件的学习,学生可以更好地了解国际财务报告准则和美国通用会计准则的核心概念,提高编制和分析财务报表的能力,掌握财务管理和税务方面的知识。

本课件采用多种教学方法,可以帮助学生更好地理解和应用所学知识,提高学习效果。

一、引言中级财务会计课程是会计学专业的一门重要课程,它涵盖了企业财务报表的编制和分析、会计要素的确认和计量、会计科目的运用和核算等内容。

本篇文章将围绕中级财务会计课件进行探讨,帮助读者更好地理解和学习这门课程。

财务会计-会计学原理英文版第21版第二章 精品

Double-entry accounting is useful in analyzing and processing transactions. Analysis of each transaction

follows these four steps.

A1

Analyzing Transactions

Unearned Revenue

C2

Equity Accounts

Owner’s Capital

Owner’s Withdrawals

Equity Accounts

Revenues

Expenses

C2 The Account and its Analysis

Revenues and owner’s contributions increase equity. Expenses and owner’s withdrawals decrease equity.

C3 Ledger and Chart of Accounts

The ledger is a collection of all accounts for an information system. A company’s size and diversity of operations affect the number of accounts needed.

A1

Analyzing Transactions

A1

Analyzing Transactions

A1

Analyzing Transactions

A1

Analyzing Transactions

P2

The chart of accounts is a list of all accounts and includes an identifying number for each account.

中级财务会计英文版95页PPT

Balance Sheet Format

Equity Classifications

Capital Stock

Other Contributed Capital

Owners’ Equity

Retained

Earnings

Chapter 3-14

Treasury Stock

Statement of Changes in Stockholders’ Equity

Chapter 3-18

Contingent Liabilities and Assets

No or No

Chapter 3-19

Loss

Probable (?)

Yes

and

Reasonably

estimated (?)

Yes

Reasonably possible

Disclosure

Report amount in financial statements

Balance Sheet Format

Liability Classifications

Accounts Payable

Short-term Notes Payable

Current Liabilities

Collections in advance of unearned revenue

Chapter 3-11

(Owner’s Equity)

Balance Sheet

Basic Accounting Identity

A = L + OE

Chapter 3-5

Balance Sheet

Basic Definitions - SFAC No. 6

财务管理财务会计会计学基础双语讲义

财务管理财务会计会计学基础双语讲义choiceshehas?Suchaswhichpany?4.向学生介绍所选教材的特点及使用方法,让学生掌握正确的学习方法,便于学生课后自学,提高学习效果。

Textbook:IntroductionHowtousethisbook参见part1.ppt第二课程段:教师讲解(60分钟)1.以教材内容为主讲授相关概念,注意讲授中尽量结合日常生活中的事例,使抽象的概念变得浅显易懂。

KeyTerms:accounting,financialstatement,balancesheet,accountingelement,assets,liabilities,equity,accountingequation,thedual-aspectconcept,creditor,investor,themoney-measurementconcept,theentityconcept.2.依据教材特点,边讲边练。

从1-1至1-55,共55小段。

具体内容参见教材及幻灯片。

第三课程段:学生实战(35分钟)1.对教材中出现的实例,由学生自己动手解决问题。

如:1-15,1-16,1-20,1-22,1-23,1-28,1-35,1-36,1-44,etc.2.教师提供部分练习素材,供学生讨论、练习。

并找两名同学在黑板上练习。

3.教师总结本章重点、难点,再次讲解学生在实务练习中存在的问题。

第四课程段:布置课后作业(10分钟)Homework:✶ReviewPart1✶CompletePosttext1onpage229byyourself✶Checktheansweronpage245.✶ReviewPart1again.✶Doexercises1to4.✶PleasepreparingPart2.Exercise11.Junehasabusinesswithassetsintheamountof$60,000andliabilitiesthattotal$35,000.Whatistheamountofherowner’sequity?2.Black’sbusinesshasassetsof$80,000andowner’sequityof$42,000.How mucharetheliabilitiesofhispany?3.SharlaKnox’shasabusinesswithliabilitiesthattotal$21,000andowner ’sequityintheamountof$72,000.Whatisthetotaloftheassets?Exercise2DanPike’spanyhasthefollowingaccountbalanceasofOctober31,2001:Cash$25,000AccountsPayable$5,000Equipment50,000DanPike,capital100,000Automobile36,780DanPike,Drawing15,000Retainedearnings21,780Required:PrepareabalancesheetinaccountformasofOctober31,2001.Exercise3ThetotalassetsandtotalliabilitiesofToys“R”UsInc.andEsteeLauderCompaniesInc.follow.Toys‘‘R’UsEsteeLauderCompanies(in millions) (in millions)Assets$8,003$3,219Liabilities4,5851,867Required:Determinethestockholders’equityofeachpany.Exercise4Determinethemissingamounts(inmillions)forthe2001balancesheets(sum marizedbelow)forTheLimitedInc.,FederalExpressCorporation,andEastmanKodakCo.FederalEastmanThe Limited Express KodakAssets$4,088(b)$13,362Liabilities(a)$5,32310,468Stockholders’equity2,3174,248(C)Part2MoreAbouttheBalanceSheet所需课时:3课时授课时间:2005.9.2910.10课程目标:1.理解并掌握以下会计原则:---持续经营原则---资产计价原则成本(历史成本)市价(公允价格)2.进一步了解和认识资产负债表3.明确资产负债表各具体项目的含义--课程设计:第一课程段:复习前章要点(20分钟)1.会计的定义及特点2.资产负债表的基本要素3.会计基本要素的概念4.会计等式5.3个会计原则第二课程段:教师讲解(70分钟)1以教材内容为主讲授相关概念,并结合企业是计和日常生活中的实例,使抽象的概念变得浅显易懂。

《会计英语—财务会计(双语版·第四版)》教师教学课件全编

内部信息使用者 外部信息使用者 税务会计 税务筹划 所得税申报表 偿债能力 清偿 偿债能力 流入 流出

例:an inflow of bank deposits 银行存款的增加

Reading Comprehension

Main Ideas 1.Definition of Accounting

企业 企业 公司 商号 涉及 与…有关 (普遍)通用的 标准 提高 放大 感兴趣 回报 报酬 回收 收回 财务状况 财务进展

internal users external users tax accounting tax planning income tax return debt-paying ability liquidity cash flow inflow

of future cash flows. d. Information that is useful in making investment and credit decisions.

5. Which of the following are important factors in ensuring the integrity of accounting information?

a. Your personal life. b. The business of your friend, who plans to be a farmer. c. The business life of another friend, who plans a career in sales.

a. Institutional factors, such as standards for preparing information. b. Professional organizations, such as the American Institute of CPAs.

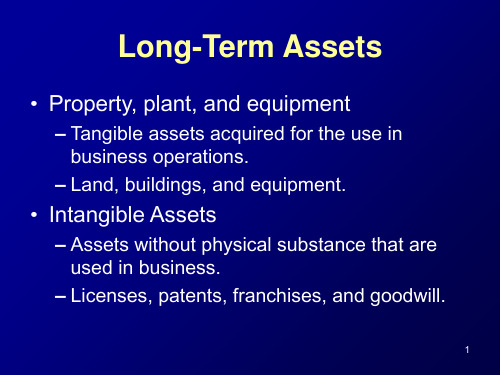

财务会计概念与应用英文版Lecture933页

•A simple rental agreement.

•A leasing transaction that is recorded as a purchase by the lessee.

5

Classifying Leases

• A lease is classified as a capital lease if it is non-cancelable and meets one of the following criteria:

1. Lease transfers ownership of the asset. 2. Lease contains a bargain purchase option. 3. Lease term is equal to 75% or more of the

• Include costs incurred to acquire the asset and getting it ready for its intended use.

– Sales tax, shipping, installation, and other costs.

Fork Lift. . . . . . . . . . . . . . . . . . . . . . . . 12,500 Cash. . . . . . . . . . . . . . . . . . . . . . . . Notes Payable. . . . . . . . . . . . . . . .

help companies generate future cash flows. – Involves comparing the cost of the asset to

《财务会计英语讲座》课件

Debit - An entry made on the left side of an account to record increases in assets or decreases in liabilities

Credit - An entry made on the right side of an account to record decreases in assets or increases in liabilities

Liability - Obligations of the entity arising from past events, the settlement of which is expected to result in an output from the entity of resources embodying economic benefits

Financial analysis is essential for decision making, as it allows management to identify opportunities for improvement, assessment risk, and make informed decisions about investment, financing, and other financial decisions

It is essential to maintain proper accounting records to ensure compliance with legal and regulatory requirements

Daily accounting processing requires attention to detail and a high level of accuracy to ensure the integrity and reliability of financial information

Module 2 财务会计入门英幻灯片PPT

LO 2:

Debits and Credits Summary

Review Question

Debits: a. increase both assets and liabilities. b. decrease both assets and liabilities. c. increase assets and decrease liabilities. d. decrease assets and increase liabilities.

4/8 Paid insurance in advance for 6 months, $1800.

16/8 Received $9000 from clients for services rendered in August.

27/8 Paid secretary $500 salary for August.

$10,000 8,000

$3,000

Transaction #2

Balance

$15,000

LO 1: The Account

If Credits are greater than Debits, the account will have a credit balance.

Transaction #1

• The increase or decrease to an account is recorded with a debit or a credit, depending on the account.

• For each recordable event, total dollar debits must equal total dollar credits.

Module2财务会计入门英

性。

构成和数量。

财务报表的分析方法与指标

比率分析法是通过计算各种财务 比率来揭示企业财务状况和经营 成果的方法,例如流动比率、速 动比率、存货周转率等。

比较分析法是通过将企业的财务 数据与行业平均水平或标准值进 行比较,来评估企业的财务状况 和经营成果。

财务报表的分析方法包括比率分 析法、趋势分析法、比较分析法 和因素分析法等。

账簿登记

根据记账凭证,登记各类明细账和总账,确 保账目准确无误。

记账凭证编制

根据审核无误的原始凭证,编制记账凭证, 记录经济业务。

财务报表编制

根据账簿记录,编制资产负债表、利润表和 现金流量表等财务报表。

纳税申报与税款缴纳

税务登记与变更

纳税申报

依法进行税务登记,并办理税务变更手续 。

按照税收法规要求,及时申报纳税,确保 税款缴纳无误。

CHAPTER 02

会计要素与会计科目

资产类科目

现金及银行 存款

应收账款

固定资产

无形资产

存货 其他资产

负债类科目

短期借款

其他负债 应付职工薪酬

应付账款 长期借款

所有者权益类科目

01

股本/实收资本

02

资本公积

03

盈余公积

04

未分配利润

收入类科目

主营业务收入 营业外收入

其他业务收入 投资收益

费用类科目

目的

财务会计的主要目的是为企业外 部的利益相关者提供关于企业财 务状况、经营成果和现金流量的 信息,帮助他们做出经济决策。

财务会计的基本原则

可靠性

财务会计必须提供真实、客观 、可验证的信息,不得有重大

误导性。

相关性

财务会计概念与应用英文版Lectu(2)

Property Tax Payable none

Correct balances 1,000

1,000

12/31/09 Property Tax Expense 1,000 Property Tax Payable 1,000

9

Example: Prepaid Expenses

On July 1, 2021, Apex Inc. pays $3,600 for one year’s rent in advance (covering July 1, 2021, to June 30, 2021). On December 31, 2021, an adjustment will be needed. What is the adjusting entry?

Rent Receivable

Rent Revenue

Original entry

none

none

Correct balances 500

500

12/31/09 Rent Receivable 5ample: Unrecorded Liabilities

Protege Inc. is assessed property taxes of $1,000 for

4

The Matching Principle

• All costs and expenses incurred in generating revenues must be recognized in the same reporting period as the related revenues.

2021, but will not make this payment until January 5,

lecture 2

Accounting Equation

A1

Accounting Equation

EQUITY Assets

=

Байду номын сангаас

Liabilities

+

Equity

A1

Assets

Cash Accounts Receivable Notes Receivable

Vehicles

Resources owned or controlled by a company

J. Scott invests $20,000 cash to start the business. The accounting equation will change: (1) Cash (asset) (2) Owner Capital (equity)

A2

Transaction Analysis

Paid salaries of $800 to employees. The accounts involved are: (1) Cash (asset) (2) Salaries expense (equity)

Remember that the balance in the salaries expense account actually increases. But, equity decreases because expenses reduce equity.

实收资本 资本公积 盈余公积 本年利润 利润分配 ……

生产成本 制造费用 劳务成本 …..

主营业务收入 其他业务收入 投资收益 营业外收入 主营业务成本 主营业务税金 其他业务支出 营业费用 管理费用 财务费用 所得税 ……

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

What Are the Fundamental Concepts and Assumptions?

• Going Concern Assumption

• Monetary Measurement Concept

• Arm’s-Length Transactions • Cost Principle • Separate Entity Concept

13

External Audits

Audit Report

– Issued by an independent CPA firm.

– Verifies financial statements have been prepared according to GAAP.

14

External Auditor vs. Management

10

Statement of Cash Flows

• Reports categorized cash inflows and outflows

Operating Activities

Day-to-day activities

Investing Activities

Buying and selling long-term assets

2

Components of a Balance Sheet

• Assets

– Cash, inventory, accounts receivable, buildings

• Liabilities

– Accounts payable, taxes payable, mortgage payable

3. Disclosure of important information that is not recognized in the financial statements.

4. Supplementary information required by the Financial Accounting Standards Board (FASB) or the Securities and Exchange Commission (SEC).

Total assets

$340

Owners’ Equity

Paid-in Capital Retained earnings Total liabilities and owners’ equity

Must Equal

Classified and Comparative Balance Sheets

16

Cash Flow Statement Balance Sheet 12/31/09

$ 110,000 4,975,000 $5,085,000

Balance Sheet 12/31/08

Cash Other Total $ 80,000 4,550,000 $4,630,000

Income Statement

Financing Activities

Cash obtained or repaid to owners or creditors

11

Financial Statement Articulation

Cash--Op. Act. $ 973,000 Cash--Inv. Act. (1,188,000) Cash--Fin. Act. 245,000 Net increase $ 30,000 Beg. cash 80,000 End. cash $ 110,000

8

Other Items on the Income Statement

• Earnings per share Net Income (Net Loss) # of Shares of Stock Outstanding

– The amount of earnings related to each share of stock.

• Classified balance sheet

– Distinguishes between current and long-term assets and liabilities. – Listed in decreasing order of liquidity.

• Comparative balance sheet

R/E 12/31/08 $ 760,000 Net income 864,600 Dividends (400,000) R/E 12/31/09 $1,224,600

Liabilities $2,860,400 Cap. stock 1,000,000 R/E 1,224,600 Total $5,085,000

Owners and managers want the most favorable results possible. • Bank credit • Bonuses • Public stock price CPA firms have economic incentives to perform credible audits. • Reputation • Lawsuits 15

12

Notes to Financial Statements

1. Summary of significant accounting policies.

2. Additional information about the summary totals found in the financial statements.

• Owners’ Equity

– Paid-in capital, retained earnings

3

Accounting Equation

Assets = Liabilities + Owners’ Equity

Resources Sources of Financing

Resources to use to generate revenues

=

Creditors’ claims against resources

+

Owners’ claims against resources

4

Sample Balance Sheet

Assets Liabilities

$ 50 150 $200 $100 40 $140 $340

5

Cash $ 40 Accounts payable Accounts receivable 100 Notes payable Land 200

– Which is better?

• Only records assets/liabilities that can be quantified.

– Reputation

• Wal-Mart’s name • Great CEO

7

The Income Statement

Revenues Increase in a company’s resources from the sale of goods or services. Expenses Costs incurred in the normal course of business to generate revenues. Net Income or (Net Loss) Revenues - Expenses

Beginning retained earnings + Net income – Dividends Ending retained earnings

• The total amount investedof profits

• Gains (losses)

– Money made or lost on activities outside the normal operation of a business.

9

Statement of Retained Earnings

• Shows the change in retained earnings over the period of time.

1

Primary Financial Statements

• The Balance Sheet (Statement of Financial Position) • Income Statement (Statement of Earnings)

• Statement of Cash Flows

Chapter 2

Financial Statements: An Overview

Albrecht, Stice, Stice, Swain

COPYRIGHT © 2008 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star logo, and South-Western are trademarks used herein under license.

– Presents two years of balance sheet information. – Helps users identify significant changes.

6

Limitations of the Balance Sheet

• Book value vs. market value.

Revenues $12,443,000 Expenses 11,578,400 Net income $ 864,600

Liabilities $2,970,000 Cap. stock 900,000 R/E 760,000 Total $4,630,000