ACCA-F1-1

acca科目设置

acca科目设置

ACCA(特许公认会计师)是英国特许公认会计师协会(Association of Chartered Certified Accountants)的缩写,是全球公认的会计师资质之一。

ACCA考试科目设置如下:

1. 基础知识模块(Fundamentals Level):

- F1:会计师在商业环境中的角色

- F2:管理会计

- F3:财务会计

2. 专业水平模块(Professional Level):

- P1:战略领导者

- P2:企业管理者

- P3:项目管理者

3. 核心专业水平模块(Core Professional Level):

- P4:高级财务报告

- P5:高级绩效管理

- P6:高级税务

- P7:高级审计与认证

4. 选修专业水平模块(Options Professional Level):考生从以下四门课程中选择两门进行考试

- P4:高级财务管理

- P5:高级税务管理

- P6:高级外部风险评估

- P7:高级财务咨询

ACCA考试科目设置灵活多样,而且考生可以根据自己的实际情况进行选择和安排。

accaf1考试真题及答案解析

accaf1考试真题及答案解析ACCA F1考试真题及答案解析ACCA(Association of Chartered Certified Accountants)是全球最大的会计师协会之一,其资格认证考试被全球广泛认可。

F1是ACCA专业资格中的第一门课程,也是全球近百万学员的入门课程。

那么,让我们来看一下一道ACCA F1考试真题及其答案解析。

真题:(以下是一道ACCA F1真题)Question 1:XYZ公司是一个制造业企业,正在考虑引进新的制造设备来提高生产效率。

分析师通过研究发现,按照目前的市场需求,这项投资预计将为该公司每年带来额外利润100,000美元,而新设备的购买价格为300,000美元。

分析师还预计,这台新设备的使用寿命为5年,并且整体投资的资本回收期为3年。

XYZ公司的资本成本为10%。

请回答以下问题:1. 计算并解释投资回报率(ROI)。

2. XYZ公司应该做出什么决策?为什么?答案解析:1. 投资回报率(ROI)的计算公式为:ROI = (项目收益 - 项目成本)/ 项目成本× 100%在该问题中,项目收益为100,000美元,项目成本为300,000美元。

代入公式计算得到:ROI = (100,000 - 300,000)/ 300,000 × 100%= -66.67%解析:投资回报率(ROI)为负数,表示该投资预计无法实现回报。

这意味着该投资计划对XYZ公司来说可能是一项高风险的决策。

2. XYZ公司应该认真考虑这个投资计划并权衡风险和回报。

尽管该投资计划的投资回报率为负数,但考虑到每年额外利润100,000美元,XYZ公司可能仍然希望提高生产效率和市场竞争力。

此外,新设备的使用寿命为5年,并且整体投资的资本回收期为3年,这也是XYZ公司考虑投资的因素。

最终决策取决于公司的战略目标、可用的资金和风险承受能力。

以上是对这道ACCA F1考试真题的解答和分析。

acca教材-ACCA F1 知识课程

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

12

The impact of technology on organisations

Homeworking and supervision

IT技术还使得部分工作得以在家里迚行,员工不用去上班。但这也带来了监管上的一 些问题。 -------------------------------------------------------------------------------------------------------------Outsourcing(外包)把一些非核心业务交给别人来做。

where the employee was employed.(公司全部关闭戒部分关闭导致的人员 冗余。) 2. The requirements of the business for employees to carry out work of a particular kind have ceased or diminished or are expected to.(流程改迚, 技术迚步导致的人员冗余。)

由内到外: 组织本身 经营环境(产业层面上的环境) 宏观环境(经济政治文化技术层 面的环境) 物理环境(整个以物质形态存在 的环境 )

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

3

The political and legal environment

9

Social and demographic trends

• Population and the labour market(人口数量,人口结构的变化,对劳劢力市场有 深刻长进的影响)

ACCA F1 大题知识点

1.what are the porter`s value chain?(Porter grouped the various activities of an organization into a value chain.)The value chain describes those activities of the organization that add value to purchased inputs.The porter`s value chain comprise support activities, primary activities and margin. Primary activities are directly related to production, sales, marketing. Deliver and service. Support activities provide purchased inputs, human resources, technology and infrastructural functions to support the primary activities. The margin is the excess the customer is prepared to pay over the cost to the firm of obtaining resource inputs and providing value activities.2.What are the five competitive forces?The competitive environment is structures by five forces.Barriers to entry; substitute products; the bargaining power of customers; the bargaining power of suppliers; competitive rivalry (行业竞争对手)3.What are the differences between internal and external audit?a.Reason. Internal audit is an activity designed to add value and improve an organization`s operations. External audit is anexercise to enable auditors to express an opinion on the financial statements.b.Reporting to. Internal audit reports to the board of directors, or other charged with governance. The external auditors reportto the shareholders or members of a company on the stewardship of the directors.c.Relating to. Internal audit`s work relates to the financial statements. (Concerned with the financial records that underliethese.)d.Relationship. With the company. Internal auditors are very often employees of the organization. External auditors areindependent of the company and its management. (They are appointed by the shareholders.)4.Introduce the fiscal policy and monetary policyFiscal policy provides an method of managing aggregate demand in the economy. Fiscal policy includes government policy on taxation, public, borrowing and public spending. Monetary policy uses money supply. Interest rates or credit controls to influence aggregate demand. Monetary policy: government policy on the money supply, the monetary system, interest rates, exchange rates and the availability of credit.5.What the situations of budget surplus and budget deficit happen?When government`s income exceeds its expenditure and there is a negative PSNCR or Public sector debt repayment (PSDR), we say that the government is running a budget surplus. This may be a deliberate policy to reduce the size of the money supply by taking money out of the economy. When a government`s expenditure exceeds its income, we say that the government is runninga budget deficit.6.Why does organization exist? (In brief, organizations enable people to be more productive.)Organizations can achieve results which individuals cannot achieve by themselves.a.Overcome people`s individual limitations, whether physical or intellectual.b.Enable people to specialize in what they do best.c.Save time. Because people can work together or do two aspects of a different task at the same time.d.Accumulate and share knowledge.e.Enable synergy: by bring together two individuals their combined output will exceed their output if they continued workingseparately.7.What the different between private companies and public limited companies?In the UK, limited companies come in two types: private limited companies and public limited companies. They differ as follows.a.Member of shareholders, most private companies are owned by only a small number of shareholders. Public companiesgenerally are owned by a wide proportion of the investing public.b.Transferability of shares. Share in public companies van be offered ti the general public. In practice this means that they canbe traded on a stock exchange. Shares in private companies, on the other hand, are rarely transferable without the consent of the shareholders.c.Directors as shareholders. The directors of a private limited company are more likely to hold a substantial portion of thecompany`s shares than the directors of a public company.8.In mintzberg`s view, what are the five component parts of an organization.According to mintzberg`s view, the five component parts include strategic apex, operating core, middle line, techno structure and support staff.9.Introduce the components of the shamrock organization and the Anthony hierarchy.Shamrock organization includes self employed, contingent, professional and consumers. Robert Anthony classified managerialactivity as follows: strategic management, tactical management and operational management.10.What are the types of committee?Committee can be classified according to the power they exercise.a.Executive committees have the power to govern or administer.b.Standing committees are formed for a particular purpose on a permanent basis. Their role is to deal with routine businessdelegated to them at weekly or monthly meetings.c.AD hoc committees are formed to complete a particular task.d.Sub-committee may be formed to co-ordinate the activities of two or more committees.e.Management committees in many businesses contain executives at a number of levels not all the decisions in a firm need tobe taken by the board.11.What are the qualities of good information?The qualities of good information include accurate, complete, cost- beneficial, user-targeted, relevant, authoritative, timely, easy to use.12.Introduce Handy`s 4 types of culturea.Power culture is shaped by one individual.b.Role culture is a bureaucratic culture shaped by rationality, rules and procedures.c.Rask culture is shaped by a focus on outputs and results.d.Existential or person culture is shaped by the interests of individuals.13.List the potential benefits of the informal organization.The potential benefits of the informal organization include Employee commitment, knowledge sharing, speed, responsiveness, co-operation.P75,P70,P53,P18,P11。

ACCA的考试科目应该按着什么样顺序考?

ACCA前三科F1-F3可以不按顺序考,但ACCAF4必须要在通过F1-F3之后再考。

ACCA考试必须按照模块顺序来进行,即知识模块-技能模块-核心模块-选修模块。

必须按照这个顺序来报考,但是各个模块内部的科目是可以打乱顺序考的。

例如:F1-F3,可以先考F3,再考F2,再考F1,后面的依此类推。

当然,ACCA每一次考试最多可以报满4科,那么可以把前面模块的都报上,报完以后还有剩余科目可以给后面模块的再报上后面模块的科目。

例如,可以一次把ACCA考试科目F1、F2、F3、F4都报上,考试结束后,ACCA考试科目F4、F3、F2都通过了,F1没通过,那么下次报F678等科目时,必须先把F1报上,如果考完了F4-F9的科目,F1还是没通过,报P阶段时,F1也必须先报上。

就是说前一个模块没有考完的科目,必须在下一次报考下一个模块考试时都带上继续报考,直到通过。

后面的依此类推。

融跃教育专注财会金融证书培训,提供完善的ACCA持证服务,快来与50000+融跃学员一起学ACCA吧!

第 1 页。

acca考试科目

ACCA考试科目共15科,分为四个大模块:知识模块(ACCA考试科目F1-F3)、技能模块(ACCA 考试科目F4-F9)、核心模块(ACCA考试科目SBL&SBR)、选修模块(ACCA考试科目P4-P7)。

ACCA的科目设置如下,共15门(学员需通过11门必修科目及2门选修科目共13门课程)第一部分为基础阶段,主要分为知识课程和技能课程两个部分。

知识课程主要涉及财务会计和管理会计方面的核心知识,也为接下去进行技能阶段的详细学习搭建了一个平台。

技能课程共有六门课程,广泛的涵盖了一名会计师所涉及的知识领域及必须掌握的技能。

具体课程为:1.知识课程FUNDAMENTALS--KNOWLEDGEF1会计师与企业Accountant in Business(AB)F2管理会计Management Accounting(MA)F3财务会计Financial Accounting(FA)2.技能课程FUNDAMENTALS—SKILLSF4公司法与商法Corporate and Business Law(CL)F5业绩管理Performance Management(PM)F6税务Taxation(TX)F7财务报告Financial Reporting(FR)F8审计与认证业务Audit and Assurance(AA)F9财务管理Financial Management(FM)第二部分为专业阶段,主要分为核心课程和选修(四选二)课程。

该阶段的课程相当于硕士阶段的课程难度,是对第一部分课程的引申和发展。

该阶段课程引入了作为未来的高级会计师所必须的更高级的职业技能和知识技能。

选修课程为从事高级管理咨询或顾问职业的学员,设计了解决更高级和更复杂的问题的技能。

具体课程为:3.职业核心课程PROFESSIONAL—ESSENTIALSSBL战略商业领袖Strategic Business LeaderSBR战略商业报告Strategic Business Reporting4.职业选修课程PROFESSIONAL--OPTIONS(四门任选二门)P4高级财务管理Advanced Financial Management(AFM)P5高级业绩管理Advanced Performance Management(APM)P6高级税务Advanced Taxation(ATX)P7高级审计与认证业务Advanced Audit and Assurance(AAA)所有学生必须完成三门核心课程。

ACCAf1Chapter1单词表

ACCAf1Chapter1单词表Chapter1Coordinate协调Outline概述Sector部门Purue追寻Collective共同的Boundary界限Preoccupied全神贯注的Performance业绩Formal正式的Documented成文的,记录在案的Specialize专门研究Input投入Proce过程Output产出Accumulate累积Synergy协同效应Ownerhip所有权Orientation倾向Legaltatu法人地位Multinational跨国的Corporation公司Iuehare发行股票Manufacturing制造业Shareholder股东Director 董事Penion养老金E某ecutive执行的Accountable负有责任的Stocke某change证劵交易所Conent同意Economieofcale规模经济Interfere阻碍Indeciion无决断力Adverely不利地Deferral延期NGO非政府组织Conervation保护Mobilization运用Mutual相互的Surplu过剩Stakeholder利益相关者Benefit利益Satifaction满意度Indutrialaction罢工Reignation辞职Adherence坚守Denial否认Receiverhip破产管理Sue控告Likelihood可能性Paive被动的Lobbying游说Significance意义Corporategovernance公司治理Repoition放回Loyalty忠诚Embody体现Stability稳定性Supplier供应商Ditributor分销商Chapter2Macroenvironment宏观环境Indirectly间接地Dynamim动态,变动Aruleofthumb基本规则Checklit清单Moderate中等的,适中的Globalization全球化Scrutiny检查、审查Liberalization自由化、放宽限制Deregulation撤销管制规定Alliance联盟Stance立场Tort侵权行为Negligence疏忽Criminallaw刑法Bribery行贿Inolvency无力偿债Marketingandale市场营销Dipoal处置Capitalallowance资本免税额,投资优惠Incentive鼓励Subidie津贴,补贴Divetment撤资Rationalization合理化Purchaingdeciion采购计划Infratructure基础设施建设Fragmented分离Lobbyit说客Civilervant公务员MP国会议员Influencepublicopinion影响公众舆论Monetarypolicy货币政策Regional地区的Political政治的Invalidate使失效Treaty条约Promote促进Dipute争端Properity繁荣Retirement退休Equalized平等的Reignation辞职E某itinterview离职谈话Theperiodofnotice通知期Dimial解雇Termination终止Employer雇主Renewal续约Employee雇员Breach破坏Indutrialrelation劳资关系Penionable有资格领退休金的Redeployment重新部署Outplacement(被解雇后)新职介绍Privacy隐私权Financialtatu财务状况Unauthorizeddicloure未经授权的披露Harmonie使协调Acce渠道Obligation义务Image形象Revie修订Initiate创新Interfere干涉,妨碍Sue控告Inattentive不注意的Concioune意识Participation参与Materialhandling物料搬运Minimize最小化Maintenance维护Implement执行Code法典Inpection检查Rikauditandampling风险审计与抽样Near-mie高危事件Principle 原则Fitneforallpurpoe通用性Freedomfromminordefect避免小瑕疵Safety安全性Durability耐用性Growth增长Demographic人口统计学的Catchmentarea集水区Dicern识别Trend 趋势Marital婚姻的Fulfill满足Overtdicrimination公开歧视E某ploit开发Environmentalim环保主义Aement评价Flattening压扁Hierarchy 层级Span幅度、范围Delayering机构扁平化Subordinate下属Diperal分布Unity统一性Coherency一致性Decentralized分权的Utilize利用Supereded被取代的Bulletinboard公告栏Video-conferencing视频会议Overload超载Outourcing外包Ad-hoc专门Becaledupordown按比例增减Inherent内在的Confidential保密的Depletion枯竭Emiion排放Fine罚金CSR社会责任E某ecution执行Thevaluechain价值链Inboundlogitic内部物流Procurement采购Co-ordination协调Entrant进入者Subtitute可替代品Bargainingpower议价能力Rivalry竞争对手Barrier壁垒Switchingcot转移成本Profitability盈利能力Monopolyprice垄断价格Differentiated差异化的Intenity激烈程度Warranty保修Chapter3Themultiplierinthenationaleconomy国民经济的乘数效应Aggregate总计的Equilibrium均衡Full-employment充分就业Inflationarygap通货膨胀缺口Deflationary通货紧缩Stagflation滞胀Buinecycle商业周期Receion衰退期Depreion萧条期Recovery复苏Boom繁荣Ditortion扭曲Fluctuating波动的Manifet显示Decline 下降Reditribution重新分配Indice指数Retailpriceinde某零售物价指数E某clude排除Mortgage抵押Demandpullinflation需求拉动型通胀Ecalating逐步上升Currency 货币E某pectation期望Workforce劳动力Lay-off临时解雇Grant拨款Mobility移动性,迁移性Wage工资Diinvetment收回投资Neutral中立的E某panion扩张Reduction 减少E某portandimport出口与进口Knock-oneffect连锁反应Enabler 赋能者Fical财政的E某penditure支出、花费Budgeturpluandbudgetdeficit预算盈余以及预算赤字Stimulate刺激Regreiveta某递减税Proportionalta某比例税Progreiveta某累进税Curtail缩减Timelag时间间隔Stimulu刺激Chapter4Micro微观的Supplier供应商Conumption消费Humaninteraction人际互动Objective目的Structure构造Channel 引导Co-ordinate使协调Propoition主张Pricemechanim价格机制Firm公司Houehold家庭Deriveddemand衍生需求Scarce稀有的Utility功用Marginalutility边际效用Additional额外的Forgone放弃Limited 有限的Alternative可供选择的Demandcurve需求曲线Contraction紧缩Slopedown下跌Leadingindicator领先指标Coincidentindicator同步指标Laggingindicator滞后指标Overeabodie海外机构Non-governmentector非政府机构Tate味道Marginalcotcurve边际成本曲线Variablecot变动成本Relatively 相对地Productionquota生产指标Chapter5Reponivene反应性Harne治理、驾驭Dynamic力度Norm规范Internalization内部化Mintzberg明茨伯格,是全球管理界享有盛誉的管理学大师,经理角色学派的主要代表人物。

ACCA免考:acca如何免试九门?都有哪些院校免考ACCA

ACCA免考:acca如何免试九门?都有哪些院校免考ACCA2019年01月24日ACCA考试科目一共有15门,其中必须通过13门考试才能拿到ACCA证书,因其含金量巨大,考试所需要的时间最少也需要一年多,如果具备免考资格的话无疑是省下很多时间,那到底ACCA有哪些免试政策呢?又该如何获知自己是否具备免考资格?不清楚自己ACCA免考几科?戳:ACCA免试查询1、国内部分专业的高校毕业生ACCA免考1-5门对于会计、金融、法律、商务及管理等专业的大学生来说,他们在备考ACCA上比其他专业的高校生多了不少的优势。

在拿到相关的学位,甚至是辅修学位后,他们即可获得1-5门不等的免试资格。

2、会计系高校在校生ACCA免考3门对会计学专业的童鞋们来说,在完成第二学年、第三学年的课程后,均可获得F1-F3这三门的免试资格。

需要注意的是,大一的时候,会计学专业的童鞋们就可以注册为ACCA的正式会员了,对比不少大一时只能先申请FIA考试,在通过FFA、FMA和FAB三门课程后,才能转入ACCA学员的非会计生来说,在这一点上,具备了不小的优势。

3、ACCA方向班学生ACCA免考3-5门ACCA方向班,也许很多人对它还较为陌生。

但就目前而言,全国已经有几十所大学开设了ACCA方向班,其中不乏厦门大学、中山大学、暨南大学等等211名校。

对ACCA方向班的学生来说:完成大一全部课程——F1-F3的“有条件免试”;完成大二全部课程——F1-F3的“正式免试”、F4和F5两门课程的“有条件免试”;完成所有课程、毕业——F1-F5的“正式免试”。

4、其他资格证书持有者ACCA免考科目不等CPA的持有者只需要满足一定的条件即可免考F1-F9。

已经是CMA的认证会员,并具备两年及以上相关工作经验者可提交相关的证明,获得部分ACCA科目的免考资格。

此外还有其他的一些证书,这里就不一一列举了。

5、会计系海外留学生ACCA免考4-9门不等有意在英国读会计硕士的童鞋们,选择一些学校也可以获得一定的ACCA免考资格。

ACCAF1StudyText,PDF原版BPP教材

Accountant in Business Paper F1 Course Notes ACF1CN07 l i BPP provides revision courses question days mock days and specific material to assist you in this important phase of your studies. F1 Accountant in Business Study Programme for Standard Taught Course Page Introduction to the paper and the course...............................................................................................................iii 1 Business organisation and structure...........................................................................................................1.1 2 Information technology and systems...........................................................................................................2.1 3 Influences on organisational culture............................................................................................................3.1 4 Ethical considerations........................................................................................................................ ..........4.1 5 Corporate governance and social responsibility..........................................................................................5.1 6 Home study chapter – The macro economic environment..........................................................................6.1 End of Day 1 – refer to Course Companion for Home Study 7 The business environment..........................................................................................................................7.1 8 Home study chapter – The role of accounting.............................................................................................8.1 9 Control security and audit............................................................................................................................9.1 10 Identifying and preventing fraud................................................................................................................10.1 11 Leadership and managing people.............................................................................................................11.1 12 Individuals groups teams.........................................................................................................................12.1 End of Day 2 – refer to Course Companion for Home Study Course exam 1 13 Motivating individuals and groups.............................................................................................................13.1 14 Personal effectiveness and communication..............................................................................................14.1 15 Recruitment and selection.........................................................................................................................15.1 16 Diversity and equal opportunities..............................................................................................................16.1 17 Training and development. (1)7.1 18 Performance appraisal (1)8.1 End of Day 3 – refer to Course Companion for Home Study Course exam 2 19 Answers to Lecture Examples...................................................................................................................19.1 20 Appendix: Pilot Paper questions................................................................................................................20.1 ??Revision of syllabus ?? Testing of knowledge ?? Question practice ?? Exam technique practice INTRODUCTION ii Introduction to Paper F1 Accountant in Business Overall aim of the syllabus To introduce knowledge and understanding of the business and its environment and the influence this has on how organisations are structured on the role of the accounting and other key business functions in contributing to the efficient effective and ethical management and development of an organisation and its people and systems. The syllabus The broad syllabus headings are: A Business organisation structure governance and management B Key environmental influences and constraints on business and accounting C History and role of accounting in business D Specific functions of accounting and internal financial control E Leading and managing individuals and teams F Recruiting and developing effective employees Main capabilities On successful completion of this paper candidates should be able to: ?? Explain how the organisation is structured governed and managed ?? Identify and describe the key environmental influences and constraints ?? Describe the history purpose and position of accounting ?? Identify and explain the functions of accounting systems ?? Recognise the principles of leadership and authority ?? Recruit and develop effective employees Links with other papers This diagram shows where direct solid line arrows and indirect dashed line arrows links exist between this paper and other papers that may follow it. The Accountant in Business is the first paper that students should study as it acts as an introduction to business structure and purpose and to accountancy as a core business function. BA P3 MA F2 and FA F3PA P1 AB F1 INTRODUCTION iii Assessment methods and format of the exam Examiner: Bob Souster The examination is a two hour paper-based or computer-based examination. Questions will assess all parts of the syllabus and will test knowledge and some comprehension of application of this knowledge. The examination will consist of 40 two mark and 10 one mark multiple choice questions. The pass mark is 50 ie. 45 out of 90. INTRODUCTION iv Course Aims Achieving ACCAs Study Guide Outcomes Business organisations structure governance and management A1 The business organisation and its structure Chapter 1A2 The formal and informal business organisation Chapter 3 A3 Organisational culture in business Chapter 3 A4 Stakeholders of business organisations Chapter 3 A5 Information technology and information systems in business Chapter 2 A6 Committees in the business organisation Chapter 1 A7 Business ethics and ethical behaviour Chapter 4 A8 Governance and social responsibility Chapter 5 Key environmental influences and constraints on business and accounting B1 Political and legal factors Chapter 7 B2 Macro-economic factors Chapter 6 B3 Social and demographic factors Chapter 7 B4 Technological factors Chapter 7 B5 Competitive factors Chapter 7 History and role of accounting in business C1 The history and functions of accounting in business Chapter 8 C2 Law and regulations governing accounting Chapter 8 C3 Financial systems procedures and IT applications Chapter 8 C4 The relationship between accounting and other business functions Chapter 1 Specific functions of accounting and internal financial control D1 Accounting and financial functions within business Chapter 1 D2 Internal and external auditing and their functions Chapter 9 D3 Internal financial control and security within business organisations Chapter 9 D4 Fraud and fraudulent behaviour and their prevention in business Chapter 10 INTRODUCTION v Leading and managing individuals and teams E1 Leadership management and supervision Chapter 11 E2 Individual and group behaviour in business organisations Chapter 12 E3 Team formationdevelopment and management Chapter 12 E4 Motivating individuals and groups Chapter 13 Recruiting and developing effective employees F1 Recruitment and selection managing diversity and equal opportunities Chapter 15 16 F2 Techniques for improving personal effectiveness at work and their benefits Chapter 14 F3 Features of effective communication Chapter 14 F4 Training development and learning in the maintenance and improvement of business performance Chapter 17 F5 Review and appraisal of individual performance Chapter 18 INTRODUCTION vi Classroom tuition and Home study Your studies for BPP consist of two elements classroom tuition and home study. Classroom tuition In class we aim to cover the key areas of the syllabus. To ensure examination success you will need to spend private study time reinforcing your classroom course with question practice and reviewing areas of the Course Notes and Study Text. Home study To support you with your private study BPP provides you with a Course Companion which helps you to work at home and aims to ensure your private study time is effectively used. The Course Companion includes a Home Study section which breaks down your home study by days one to be covered at the end of each day of the course. You will find clear guidance as to the time to spend on various activities and their importance. You are also provided with sample questions and either two course exams which should be submitted for marking as they become due or an I-pass CD which is full of questions. These may include questions on topics covered in class and home study. BPP Learn Online Come and visit the BPP Learn Online free at/acca/learnonline for exam tips FAQs and syllabus health check. ACCA Forum We have thriving ACCA bulletin boards at /accaforum. Register and discuss your studies with tutors and students. Helpline If you have any queries during your private study simply contact your class tutor on the telephone number or e-mail address that they will supply. Alternatively call 44 020 8740 2222 or your local training centre if outside the London area and ask for a tutor for this paper to speak to you or to call you back within 24 hours. Feedback The success of BPP’s courses has been built on what you the students tell us. At the end of the course for each subject you will be given a feedback form to complete and return. If you have any issues or ideas before you are given the form to complete please raise them with the course tutor or relevant head of centre. If this is not possible please email . INTRODUCTION vii Key to icons Question practice from the Study Text This is a question we recommend you attempt for home study. Real world examples These can be found in the Course Companion. Section reference in the Study Text Further reading is needed on this area to consolidate your knowledge. INTRODUCTION viii 1.1 Syllabus Guide Detailed Outcomes Having studied this chapter you will be able to: ?? Ascertain the appropriate organisational structure for different types and sizes of business. ?? Understand the concepts of span of control and scalar chains. ?? Appreciate the differing levels of strategy in an organisation. Exam Context This chapter lays the foundation for an understanding of what organisations are what they do and how they do it. Section 2 Organisational structure represents a higher level of knowledge. You must be able to apply knowledge to exam questions. Qualification Context An understanding of business structures is important with regard to higher level accounting papers as well as P3 Business Analysis. Business Context Appreciating why organisations are structured in different ways will help with an understanding of how they should be managed. Business organisation and structure 1: BUSINESS ORGANISATION AND STRUCTURE 1.2Overview Departments and functions Why does the organisation exist Structural forms Business hierarchy 1: BUSINESS ORGANISATION AND STRUCTURE 1.3 1 Organisations 1.1 Definition – An organisation is a social arrangement which pursues collective goals which controls its own performance and which has a boundary separating it from its environment. Boundaries can be physical or social. 1.2 Key categories: ?? Commercial ?? Not for profit ?? Public sector ?? Charities ?? Trade unions ?? Local authorities ?? Mutual associates Class exercise Required Identify a real-world example of the above categories of organisation. 1.3 Organisations owned or run by the government local or national or government agencies are described as being in the public sector. All other organisations are classified as the private sector. Limited liability 1.4 Limited companies denoted by X Ltd or X plc are set up so as to have a separate legal entity from their owners shareholders. Liability of these owners is thus limited to the amount invested. Private v public 1.5 Private companies are usually owned by a small number of people family members and these shares are not easily transferable. Shares of public companies will be traded on the Stock Exchange. Pg 52-561: BUSINESS ORGANISATION AND STRUCTURE 1.4 2 Organisational structure 2.1 Henry Mintzberg believes that all organisations can be analysed into five components according to how they relate to the work of the organisation and how they prefer to co-ordinate. a Strategic apex Drives the direction of the business through control over decision-making. b Technostructure Drives efficiency through rules and procedures. c Operating core Performs the routine activities of the organisation in a proficient and standardised manner. d Middle line Performs the management functions of control over resources processes and business areas. e Support staff Provide expertise and service to the organisation. Strategic Apex Support Staff Technostructure Middle Line Operating Core 1: BUSINESS ORGANISATION AND STRUCTURE 1.5 Exam standard question Required Match the following staff/rules to Mintzbergs technostructure: a Manager of a retail outlet supervising 40 staff. b A salesman responsible for twenty corporate accounts. c The owner of a start-up internet company employing two staff. d The HR department which provides support to business managers. e The IT department seeking to standardise internal systems. 3 Structural forms for organisations Scalar chain and span of control 3.1 As organisations grow in size and scope different organisational structures may be suitable. 3.2 The Scalar chain and Span of control determine the basic shape. The scalar chain relates to levels in the organisation and the span of control the number of employees managed. 3.3 Tall organisations have a: a Long scalar chain via layers of management b Hierarchy c Narrow span of control. 3.4 Flat organisations have a: a Short scalar chain less layers b Wide span of control. 1: BUSINESS ORGANISATION AND STRUCTURE 1.6 3.5 MD Divisional directors Department managers Section managers MD Supervisors Department managers Charge hands Supervisors Workers Workers Tall Flat Pilot paper Required Identify factors which may contribute to the length of the chain and the span of control. Organisational structures 3.6 Entrepreneurial A fluid structure with little or no formality. Suitable for small start-up companies the activities and decisions are dominated by a key central figure the owner/entrepreneur. 3.7 Functional This structure is created via separate departments or functions. Employees are grouped by specialism and departmental targets will be set. Formal communication systems will be set up to ensure information is shared. 1: BUSINESS ORGANISATION AND STRUCTURE 1.7 3.8 Matrix A matrix organisation crosses a functional with a product/customer/projectstructure. This structure was created to bring flexibility to organisations geared towards project work or customer-specific jobs. Staff may be employed within a hierarchy or within specific functions but will be slotted into different teams or tasks where their skill is most needed. The matrix structure is built upon the principles of flexibility and dual authority. Required Identify two advantages and two disadvantages of each structure. Advantages Disadvantages Entrepreneurial Functional Matrix 3.9 Organisations are rarely composed of only one type of structure especially if the organisation has been in existence for some time and as a consequence a hybrid structure may be established. Hybrid structures involve a mixture of functional divisionalisation and at least one other form of divisionalisation. Area Manager A Area Manager B Area Manager C.。

ACCA(F1-F3)学习方法总结

ACCA(F1-F3)学习方法总结ACCA共有16门课程,其中基础阶段主要分为知识课程和技能课程两个部分。

知识课程主要涉及财务会计和管理会计方面的核心知识,也为接下去进行技能阶段的详细学习搭建了一个平台。

F1-F3由于是ACCA全部课程体系内容中最为基础的三门课程,又作为财务会计体系中的入门课程,知识难度并不高,同时通过考试的压力也并不大。

F1:Accountant inBusiness(AB)F1这门课的内容很杂,主要涉及到以下三门主要学科:组织行为学,人力资源管理,会计和审计。

F1要求学生学习时一定要通看课本和老师讲义,而且应该做大量阅读,注意广度,以理解为主,不要对某方面知识死钻牛角尖。

F1的学习绝对不可猜题,复习时也绝对不可有遗漏或空白。

学习方法:1.完整学习网课内容,理解和记忆主要知识点,勤做笔记,完成练习,加深对知识点的认识和印象。

章节结束及时总结,清晰每章内容和关键知识点,完成讲义的自我梳理和配套的练习,熟悉每章的知识结构。

实战练习,熟悉考点,把握基本的答题规律2.对基础知识进行梳理,对知识点有整体把握。

根据冲刺串讲课程,复习精要知识点,复述相关概念。

整理第一阶段的错题,查漏补缺,加强薄弱环节。

3.罗列复习纲要,对知识点进行复述式记忆,发现薄弱知识点,进行答疑和重新梳理。

对所有错题所考查的知识点再次梳理,对不熟悉和遗漏的知识点多次记忆。

对样卷和ACCA官网模拟题进行仿真训练,严格控制考试时间,并自我认真审阅。

F2:Management Accounting(MA)F2主要向学员介绍成本会计和管理会计的体系,以及管理会计如何发挥支持企业计划、决策、控制的作用。

主要包括:管理会计起源、成本的分类、成本核算的方法、预算控制、差异分析、绩效评估相关知识点。

学习方法:1.报了网课或者面授的话,那么聆听老师的讲解是非常重要的。

对于老师发下来的讲义一定要认真研读,讲义往往是老师对于这门课的精炼总结,涵盖了所有的考点,仔细研究讲义可以专注于对高频考点的学习、提高学习效率,同时也能节省自己的时间和精力。

acca科目分类

acca科目分类ACCA科目分类ACCA(Association of Chartered Certified Accountants,特许公认会计师协会)是一家提供国际专业会计资格认证的机构。

ACCA 认证是会计和财务领域的国际金字招牌,被公认为国际上最具影响力和公信力的会计师资格之一。

ACCA考试分为基础阶段和专业阶段,基础阶段主要是财务与管理会计的基础知识,而专业阶段则涵盖了更加深入和专业的会计领域。

下面将对ACCA科目进行详细分类和介绍。

基础阶段1. F1 - Accountant in Business该科目主要涵盖了会计专业人士所需的商业理解和组织管理的基本知识。

学习者将了解组织结构、管理层决策、财务管理等方面的基础知识。

2. F2 - Management Accounting管理会计是管理层通过分析和评估各种会计数据来支持管理决策的过程。

学习者将学习成本估算、预算编制、组织绩效评估等管理会计的基本原理。

3. F3 - Financial Accounting财务会计是一门重要的会计学科,专注于公司财务报表的准备和分析。

学习者将学习资产负债表、利润表和现金流量表等财务报表的编制和解读。

4. F4 - Corporate and Business Law该课程主要涵盖商法和公司法方面的内容。

学习者将了解法律对商业和公司运营的影响,以及相关法律规定下的商业伦理问题和道德要求。

专业阶段1. Essentials Module - 必修科目F5 - Performance Management该科目主要涵盖了管理会计和业绩管理的高级概念和技术。

学习者将学习如何使用会计数据和管理信息来评估和改善组织的绩效。

F6 - Taxation税务是一个重要的财务领域,涉及到纳税义务和税务计划。

学习者将学习不同国家的税法、个人和公司的税务义务以及相应的优化措施。

F7 - Financial Reporting财务报告为公司和利益相关方提供了有效的财务信息。

ACCA考试题型+分值构成分析(F1

ACCA考试题型+分值构成分析(F1ACCA F1 (机考)考试科目 : 企业会计时间 : 2 hours ;通过分数 : 50 ,F1 考试包含2个sections:Section A :46 道题目,其中30道题,每题2分;16道题,每题1分。

总分值是76分。

Section B :6道题目,每道题目4分。

总分值24分。

所有的题目都是必做题。

ACCA F2 (机考)考试科目 : 管理会计时间 : 2 hours 通过分数 : 50 ; F2 考试包含2个sections:Section A :25道题目,每道题目2分。

总分值是70分。

Section B :3道题目,每道题目10分。

总分值是30分。

ACCA F3 (机考)考试科目 : 财务会计时间 : 2 hours 通过分数 : 50,F3 考试包含2个sectionsSection A : 25道题目,每道题目2分。

总分值是70分。

Section B : 3道题目,每道题目10分。

总分值是30分。

ACCA F4 (机考 & 纸考)考试科目 : 企业法和商法时间 : 2 hours 通过分数 : 50 ,F4包含2个sectionsSection A : 45道题目,其中25道题,每题2分;20道题,每题1分,总分值是70分。

Section B : 5道题目,每道题目6分。

总分值30分。

ACCA F5 (机考 & 纸考)考试科目:绩效管理时间: 3 hours 通过分数: 50,F5包含了3个sectionsSection A : 15道客观题,每题2分,总分30分。

Section B : 3道案例题,每道案例题由5道客观题构成,每题2分,总分30分Section C : 2道案例分析题,每题20分,总分40分。

ACCA F6 (机考 & 纸考)考试科目:税法(UK版本)时间: 3 hours 通过分数:50,F6包含了3个sections:Section A : 15道客观题,每题2分。

课程难点疑问_F1 Accountant in Business

高顿财经ACCA 课程难点疑问_F1 Accountant in Business

本文由高顿ACCA 整理发布,转载请注明出处 1. F1可能是学员接触ACCA 的第一门课程,由于是全英语教材对英语基础不好的学员会有一定的影响,所以建议学员在上F1之前先学学财务英语。

2. F1作为ACCA 的入门课程,包含的内容很广泛,涉及到企业决策、公司管理、内控制度、

项目管理等多方面知识点。

学员需花大量时间学习,了解掌握相应的知识点,同时也为以后课程的学习打基础。

3. F1里面的理论知识较多,许多知识点必须记住,在学习初期学员需把重点放在背诵定义上。

4.学员基础较差感觉通过参加F1的课程后仍对知识点有疑问,可在课后认真阅读BPP 的讲义,并通过做练习册自己Practice 。

更多ACCA 资讯请关注高顿ACCA 官网:。

accatx科目考试内容

accatx科目考试内容ACCA是全球最著名的财会职业资格认证之一,因其在全球范围内的认知度和影响力而备受关注。

该认证涵盖了各种财务和会计职位所需的技能和知识,旨在提高专业人士的职业水平和市场竞争力。

ACCA的考试由14门科目组成,每门科目都涵盖了不同的领域和主题,以下是ACCA科目考试内容简介:1. F1 - Accountant in Business (AB): 认识企业和商业环境,了解商业决策和财务报告的基础知识。

2. F2 - Management Accounting (MA): 理解管理会计的基本原则和技术,能够应用它们以制定和实施管理决策。

3. F3 - Financial Accounting (FA): 掌握财务报告的基本原则和标准,能够编制和解释财务报表。

4. F4 - Corporate and Business Law (LW): 了解商业法律和法规,能够理解并应用公司法和商业合同。

5. F5 - Performance Management (PM): 能够分析和解释成本和绩效数据,并能根据结果制定和实施管理决策。

6. F6 - Taxation (TX): 理解个人和公司税务,掌握税务计算和纳税申报的基本原则。

7. F7 - Financial Reporting (FR): 掌握国际财务报告准则(IFRS),能够编制和解释复杂的财务报表。

8. F8 - Audit and Assurance (AA): 理解审计的基本原则和程序,能够评估企业的财务报表和内部控制。

9. F9 - Financial Management (FM): 能够制定和实施财务策略,并理解企业投资和融资的基本原则。

10. P1 - Governance, Risk and Ethics (GRE): 理解公司治理、风险管理和商业道德的基本原则和实践。

11. P2 - Corporate Reporting (CR): 掌握国际财务报告准则(IFRS)和企业合并的相关知识,能够编制和解释复杂的财务报表。

ACCAF1考试-会计师与企业(基础阶段)历年真题精选及详细解析1108-97

答案:C

3. _ is an analysis of statistics on birth and death rates, age structures of people and ethnic groups within a community.

(i) Increasing ethnic and religious diversity in populations

(ii) Falling birthrates

(iii) Focus on \'green\' issues

(iv) Increase in single-member households

ACCAF1考试-会计师与企业(基础阶段)历年真题精选及详细解析1108-97

1.What is an acronym used to describe the key elements of an organisation\'s external environment?

A SWOT

B SMART

A Downsizing

B Delayering

C Outsourtext of \'best practice\' employment protection law, in which of the following circumstances isdismissal of an employee automatically considered unfair?

C PEST

ACCA英国注册会计师(F1)Chapter1-4题库大全

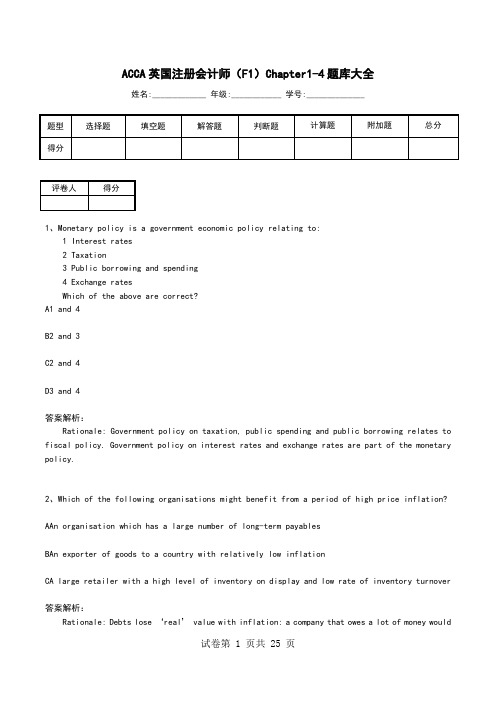

ACCA英国注册会计师(F1)Chapter1-4题库大全姓名:_____________ 年级:____________ 学号:______________1、Monetary policy is a government economic policy relating to:1 Interest rates2 Taxation3 Public borrowing and spending4 Exchange ratesWhich of the above are correct?A1 and 4B2 and 3C2 and 4D3 and 4答案解析:Rationale: Government policy on taxation, public spending and public borrowing relates to fiscal policy. Government policy on interest rates and exchange rates are part of the monetary policy.2、Which of the following organisations might benefit from a period of high price inflation? AAn organisation which has a large number of long-term payablesBAn exporter of goods to a country with relatively low inflationCA large retailer with a high level of inventory on display and low rate of inventory turnover答案解析:Rationale: Debts lose ‘real’ value with inflation: a company that owes a lot of mo ney wouldeffectively pay less (in real terms) over time. The other organisations would suffer because: inflation would make exports relatively expensive and importsrelatively cheap; business might be lost due to price rises; and the cost of implementing price changes would be high.Rationale: The four main objectives of macroeconomic policy relate to economic growth, stable (not zero) inflation, unemployment and the balance of payments (balance between exports and imports).3、Which of the following are the goals of macroeconomic policy?1 Encouraging economic growth2 Low unemployment3 Achievement of a balance between exports and imports4 Achieving zero inflationA1 and 2B2 and 3C2, 3 and 4D1, 2 and 3答案解析:Rationale: The four main objectives of macroeconomic policy relate to economic growth, stable (not zero) inflation, unemployment and the balance of payments (balance between exports and imports)4、Which of the following is an example of cyclical unl Rationale: Recession is part of the business cycle: demand for output and jobs falls, and unemployment rises until recovery is well under way. Option A is an example of frictional unemployment; option B of seasonal unemployment;option C of technological unemployment.Pitfalls: It is easy to confuse cyclical with seasonal unemployment, or frictional unemploy ment that occurs on a seasonal basis (eg option A). You need to associate cyclical employment firmly with business cycles.5、A surplus on the balance of payments usually refers to a surplus or deficit on the account.Which word correctly complete this statement?ACurrentBCapitalCFinancial答案解析:Rationale: It is particularly tempting to equate a trade surplus or deficit with a ‘profit’ or ‘loss’ for the country, but this is not the case.6、 Northland, Southland, Eastland and Westland are four countries of Asia. The following economic statistics have been produced for the year 2007.Which country experienced stagflation in the relevant period?ANorthlandBSouthlandCEastlandDWestland答案解析:Examiner’s comments. The examiner commented that some students struggled with this question. Stagflation occurs when economic growth (defined by the change in national income in a period) is low or negative, and inflation is high. So the relevant figures are percentage change in GDP and change in consumer prices.7、____economic growth is determined by supply-side rather than by demand side factors.Which word correctly completes this statement?AActualBPotentialCNational答案解析:Rationale: Potential growth is the rate at which the economy would grow if all resources were utilised: it is therefore determined by factors in the capacity of the economy (supply side), such as increases in the amount of resources available, or in the productivity or resources. Actual growth is determined both by growth in output (supply side) and aggregate demand (demand side). Option C was merely a distractor8、In a free market economy, the price mechanism:AAids government controlBAllocates resourcesCMeasures national wealth答案解析:Rationale: In a free market economy, it is the interaction of supply and demand through the price mechanism that determines what should be produced and who should get it.9、Which one of the following statements is true?ALimited company status means that a company is only allowed to trade up to a predetermined turnover level in any one yearBFor organisations that have limited company status, ownership and control are legally separate.CThe benefit of being a sole trader is that you have no personal liability for the debts of your business.DOrdinary partnerships offer the same benefits as limited companies but are usually formed by professionals such as doctors and solicitors.答案解析:Rationale: In a limited company, the owners (shareholders) are separate from the managers of the concern (board of directors).Pitfalls: Some options look plausible because of the wording. ‘Limited’ doesn’t mean ‘only being allowed to trade up to’ - but looks as if it might. The second half of the statement about partnerships is true - but this doesn’t mean that the first half is also true.Ways in: You should have been able to ru le out A (no company’s turnover is limited), C (sole traders do have personal liability for debts: they do not have ‘limited liability’) and D (ordinary partnerships are different from limited companies)10、An organisation is owned and run by central government agencies. The organisation is best described as which of the following statements?AA voluntary sector organisationBA private sector organisationCA public sector organisation答案解析:Rationale: Such an organisation is part of the public sector. The voluntary sector comprises charities and other organisations whose members are volunteers. Private sector comprises nongovernmental organisations,such as limited companie.Pitfalls: Watch out for ‘public’ and ‘private’ sector terms - and be able to distinguish clearly between them.11、12、Which of the following groups may be considered to be stakeholders in the activities of a nuclear power station?(i) The government(ii) Environmental pressure groups(iii) Employees(iv) Local residentsA(i) (iii) and (iv)B(i), (ii), (iii) and (iv)C(iii) onlyD(i) and (iii) only答案解析:Rationale: All these groups have a legitimate stake in the enterprise: the government, as a regulator; employees, as participants in the business; and environmental pressure group and local residents, because of potential impacts.Pitfalls: Don’t forget externa l stakeholders!13、The term secondary stakeholders describes which group of stakeholders?AStakeholders who conduct transactions with the organisationBStakeholders who have a contractual relationship with the organisationCStakeholders who do not have a contractual relationship with the organisation答案解析:Rationale: Secondary stakeholders are stakeholders who do not have a contractual relationship with the organisation.Primary stakeholders are stakeholders who do have a contractual relationship with the organisation.14、Which of the following organisations would rely most heavily on value for money indicators and efficiency rather than information on performance and profitability?AA private accountancy collegeBA local authorityCA small retailer答案解析:。

ACCA证书考试的前三门(即F1-2-3)的考试成绩是考完就公布吗?

F1-2-3是随时机考的考试成绩当场就能查询,而分季机考的考试成绩需在考后的40多天后公布。

例如2020年7月ACCA考试成绩大约在7月31日公布。

ACCA前三门课程分别为:(AB)会计师与企业Accountant.in.Business(MA)管理会计Management.Accounting(FA)财务会计Financial.Accounting前三门考试为随机机考,考完之后马上就会公布成绩。

ACCA考完前三门并且通过了基础阶段道德测试的学员,便可以获得商业会计证书。

这个证书比较低级,属于入门证书。

如已免试,无法获得此证书。

2021年ACCA考试成绩查询方式一、邮寄关于考试成绩的唯一官方的正式的通知。

每次考试的两个半月后由ACCA总部发出,您收到邮件的时间决定于邮局的工作速度。

二、假如你并没有等待的耐心,你想更加快速地查看自己的成绩,那么你还可以通过电子邮件来接受你的考试成绩。

具体方法为:登录myACCA,并选择通过email接收考试成绩。

另外,就是第三种,也是我们最常用的一种,即:在线查看自己的考试成绩。

所有报考的学员均在ACCA 全球网站在线查看自己的考试成绩。

具体查询方法是:1.进入ACCA官网点击右上角My.ACCA进行登录:2.输入账号、密码登录后进入主页面,点击Exam.status&Results:3.跳转页面后选择View.your.status.report:4.进入之后,就可以查询自己所报科目的成绩详情了。

融跃教育专注财会金融证书培训,提供完善的ACCA持证服务,快来与50000+融跃学员一起学ACCA吧!第 1 页。

会计学acca

会计学acca

资料,每个阶段的学习资料都需要从大的模块入手,将知识分为 桶,通过调整学习策略和把握重本点来学好acca课程。

1、首先要熟悉acca的课程结构:acca分为十关,分别是F1-F9和P1,学习书籍施密特的“商业和职业会计学”内容覆盖了所有的acca课程,更加清晰方便的理解acca知识框架。

2、学习时,先解决acca认证考试入门资料,从最开始F1-F3 入门教学起,全面掌握基础理论,循序渐进,坚持每日计划学习。

3、正式考试前,要通过多次练习来检验学习水平,要多次熟练掌握acca考试题型及解题思路,根据自身实际情况进行调整,并重点针对自己不足的知识进行查漏补缺。

4、考试前,针对具体科目也可查找相关的练习题集,通过增强记忆力,培养解题能力,拓宽知识面,掌握acca考试要点,完善自己的综合能力。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

ACCA F1 Accountant In business

Eric Zhao

Email:eric@

Leadership, management F1

and supervision

1. The purpose and process of management •Definition

Management may be defined as “getting things done through other people”.

•Needs for management

a. Objectives have to be set

b. Monitor progress and results to ensure objectives are met

c. Communicate and sustain corporate values

d. Look after the interests of the owners and other stakeholders

1. The purpose and process of management •Authority

Organisational authority is the scope and amount of

delegation given to a person to make decisions.

Aspects of managerial authority:

a. Making decisions within managerial authority

b. Assigning tasks to subordinates

c. Expecting and requiring satisfactory performance by

subordinates

•Responsibility and accountability Responsibility is the obligation to do something Managers are accountable to their superiors for their actions

•Delegation

The benefits of delegation:

a. Essential for running the organisation

b. Training

c. Motivation

d. Assessment

e. Decision

•Authority and power

Authority is the right to do something.

Power is the ability to do it.

Weber identified three ways in which people could acquire legitimate power/authority:

a. Charismatic authority (arises from the personality of the leader)

b. Traditional authority (rests on established traditions and the status)

c. Rational-legal authority (raises from the working of accepted normative

rules)。