ACCA2010年12月份考试真题(P1)

ACCA p3_2010_12月_问题que

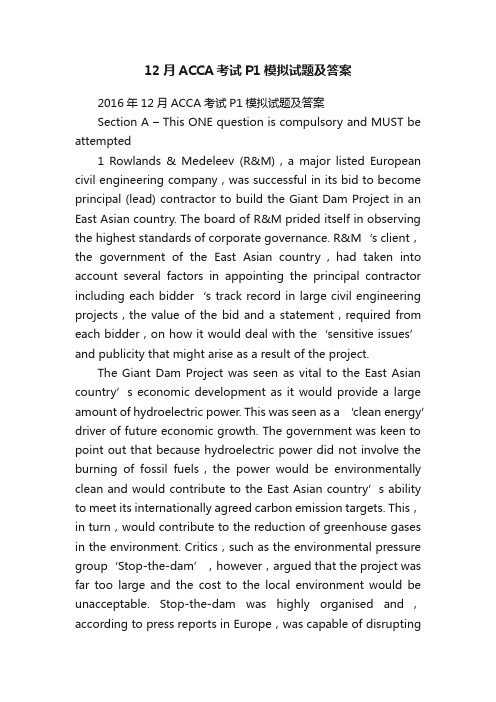

Professional Level – Essentials Module The Association of Chartered Certifi ed Accountants Business AnalysisWednesday 15 December 2010Time allowedReading and planning: 15 minutesWriting: 3 hoursThis paper is divided into two sections:Section A – This ONE question is compulsory and MUST be attemptedSection B – TWO questions ONLY to be attemptedDo NOT open this paper until instructed by the supervisor.During reading and planning time only the question paper maybe annotated. You must NOT write in your answer booklet untilinstructed by the supervisor.This question paper must not be removed from the examination hall.P a p e r P 3This is a blank page.The question paper begins on page 3.2Section A – This ONE question is compulsory and MUST be attemptedThe following information should be used when attempting question 11IntroductionShoal plc is a well-known corporate organisation in the fi sh industry. It owns 14 companies concerned with fi shing and related industries.This scenario focuses on three of these companies:ShoalFish Ltd – a fi shing fl eet operating in the western oceansShoalPro Ltd – a company concerned with processing and canning fi shShoalFarm Ltd – a company with saltwater fi sh farms.Shoal plc is also fi nalising the purchase of the Captain Haddock chain of fi sh restaurants.ShoalFishShoal plc formed ShoalFish in 2002 when it bought three small fi shing fl eets and consolidated them into one fl eet.The primary objective of the acquisition was to secure supplies for ShoalPro. 40% of the fish caught by ShoalFish are currently processed in the ShoalPro factories. The rest are sold in wholesale fi sh markets. ShoalFish has recorded modest profits sinc e its formation but it is operating in a c hallenging market-plac e. The western oc eans where it operates have suffered from many years of over-fishing and the government has rec ently introduc ed quotas in an attempt to conserve fi sh stocks.ShoalFish has 35 boats and this makes it the sixth largest fl eet in the western oceans. Almost half of the total number of boats operating in the western oceans are individually owned and independently operated by the boat’s captain.Recent information for ShoalFish is given in Figure 1.ShoalProShoalPro was acquired in 1992 when Shoal plc bought the assets of the T revarez Canning and Processing Company.Just after the ac quisition of the c ompany, the government dec lared the area around T revarez a ‘zone of industrial assistance’. Grants were made available to develop industry in an attempt to address the economic decline and high unemployment of the area. ShoalPro benefited from these grants, developing a major fish processing and canning capability in the area. However, despite this initiative and investment, unemployment in the area still remains above the average for the country as a whole.ShoalPro’s modern fac ilities and relatively low c osts have made it attrac tive to many fishing c ompanies. The fish received from ShoalFish now accounts for a declining percentage of the total amount of fi sh processed and canned in its factories in the T revarez area. Recent information for ShoalPro is given in Figure 1.ShoalFarmShoalFarm was acquired in 2004 as a response by Shoal plc to the declining fi sh stocks in the western oceans. It owns and operates saltwater fish farms. These are in areas of the ocean close to land where fish are protected from both fi shermen and natural prey, such as sea birds. Fish stocks can be built up quickly and then harvested by the fi sh farm owner. Shoal plc originally saw this acquisition as a way of maintaining supply to ShoalPro.Operating costs at ShoalFarm have been higher than expected and securing areas for new fi sh farms has been diffi cult and has required greater investment than expected. Recent information for ShoalFarm is given in Figure 1.3[P.T.O.All fi gures in $mShoalFish 2007 2008 2009T urnover of market sector 200·00 198·50 190·00T urnover of ShoalFish 24·00 23·50 21·50profit 1·20 1·10 1·05GrossShoalPro 2007 2008 2009T urnover of market sector 40·00 40·10 40·80T urnover of ShoalPro 16·00 16·20 16·50Grossprofit 1·60 1·65 1·75ShoalFarm 2007 2008 2009T urnover of market sector 10·00 11·00 12·00T urnover of ShoalFarm 1·00 1·10 1·12profit 0·14 0·14 0·15GrossFigure 1: Financial data on individual companies 2007–2009Captain HaddockThe Captain Haddock chain of restaurants was founded in 1992 by John Dory. It currently operates one hundred and thirty restaurants in the country serving high quality fi sh meals. Much of Captain Haddock’s success has been built on the quality of its food and service. Captain Haddock has a tradition of recruiting staff directly from schools and universities and providing them with excellent training in the Captain Haddock academy. The academy ensures that employees are aware of the ‘Captain Haddock way’ and is dedicated to the continuation of the quality service and practices developed by John Dory when he launched the fi rst restaurant. All management posts are fi lled by recruiting from within the company, and all members of the Captain Haddock board originally joined the company as trainees. In 1999 the Prime Minister of the country identifi ed Captain Haddock academy as an example of high quality in-service training. In 2000, Captain Haddock became one of the thirty best regarded brands in the country.In the past few years, the fi nancial performance of Captain Haddock has declined signifi cantly (see Figure 2) and the company has had difficulty in meeting its bank covenants. This decline is partly due to economic recession in the country and partly due to a disastrous diversifi cation into commercial real estate and currency dealing. The chairman and managing director of the company both resigned nine months ago as a result of concern over the breaking of banking covenants and shareholder criticism of the diversification policy. Some of the real estate bought during this period is still owned by the company. In the last nine months the company has been run by an interim management team, whilst looking for prospective buyers. At restaurant level, employee performance still remains relatively good and the public still highly rate the brand. However, at a recent meeting one of the employee representatives called for a management that can ‘effectively lead employees who are increasingly demoralised by the decline of the company’. Shoal plc is currently fi nalising their takeover of the Captain Haddock business. The company is being bought for a notional $1 on the understanding that $15 million is invested into the company to meet short-term cash fl ow problems and to improve liquidity. Shoal plc’s assessment is that there is nothing fundamentally wrong with the company and that the current fi nancial situation is caused by the failed diversifi cation policy and the cost of fi nancing this. The gross profi t margin in the sector averages 10%.Captain Haddock currently buys its fi sh and fi sh products from wholesalers. It is the intention of Shoal plc to look at sourcing most of the dishes and ingredients from its own companies; specifi cally ShoalFish, ShoalPro and ShoalFarm. Once the takeover is complete (and this should be within the next month), Shoal plc intends to implement signifi cant strategic change at Captain Haddock so that it can return to profi tability as soon as possible. Shoal plc has implemented strategic change at a number of its acquisitions. The company explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success of any planned change programme depends on an understanding of the context in which the change is taking place.Captain Haddock (all fi gures in $m)2007 2008 2009T urnover 115·00 114·50 114·00)Gross profi t (loss) 0·20 (5·10 ) (6·20Figure 2: Financial information for Captain Haddock 2007–20094Required:(a) In the context of Shoal plc’s corporate-level strategy, assess the contribution and performance of ShoalFish,ShoalPro and ShoalFarm. Your assessment should include an analysis of the position of each company in the Shoal plc portfolio. (15 marks)(b) Shoal plc explicitly recognises that there is no ‘one right way’ to manage change. It believes that the success ofany planned change programme will depend on a clear understanding of the context within which change will take place.(i) Identify and analyse, using an appropriate model, the contextual factors that will infl uence how strategicchange should be managed at Captain Haddock. (13 marks)Professional marks will be awarded in part (b)(i) for the identifi cation and justifi cation of an appropriatemodel.(2 marks)(ii) Once the acquisition is complete, Shoal plc wish to quickly turnaround Captain Haddock and return it to profi tability.Identify and analyse the main elements of strategic change required to achieve this goal. (8 marks)Professional marks will be awarded in part (b)(ii) for the cogency of the analysis and for the overallrelevance of the answer to the case study scenario.(2 marks)(c) Portfolio managers, synergy managers and parental developers are three corporate rationales for adding value.Explain each of these separate rationales for adding value and their relevance to understanding the overall corporate rationale of Shoal plc. (10 marks)(50 marks)5[P.T.O.Section B – TWO questions ONLY to be attempted2IntroductionTMP (The Management Press) is a specialist business publisher; commissioning, printing and distributing books on fi nancial and business management. It is based in a small town in Arcadia, a high-cost economy, where their printing works were established fi fty years ago. 60% of the company’s sales are made through bookshops in Arcadia. In these bookshops TMP’s books are displayed in a custom-built display case specifically designed for TMP. 30% of TMP’s sales are through mail order generated by full-page display advertisements in magazines and journals. Most of these sales are to customers based outside Arcadia. The fi nal 10% of sales are made through a newly established website which offers a restricted range of books. These books are typically very specialised and are rarely featured in display advertising or stocked by general bookshops. The books available on the website are selected to avoid conflict with established supply channels. Most of the online sales are to customers based in Arcadia. High selling prices and high distribution costs makes TMP’s books expensive to buy outside Arcadia.Business changesIn the last decade costs have increased as the raw materials (particularly timber) used in book production have become dearer. Paper is extremely expensive in Arcadia and the trees used to produce it are becoming scarcer. Online book sellers have also emerged who are able to discount prices by exploiting economies of scale and eliminating bookshop costs. In Arcadia, it is estimated that three bookshops go out of business every week. Furthermore, the infl uential journal ‘Management Focus’, one of the journals where TMP advertised their books, also recently ceased production. TMP itself has suffered three years of declining sales and profi ts. Expenditure on marketing has been reduced signifi cantly in this period and further reductions in the marketing budget are likely because of the weak fi nancial position of the company.Overall, there is increasing pressure on the company to increase profi t margins and sales.Despite the poor fi nancial results, the directors of TMP are keen to maintain the established supply channels. One of them, the son of the founder of the company, has stated that ‘bookshops need all the help they can get and management journals are the heart of our industry’.However, the marketing director is keen for the company to re-visit its business model. He increasingly believes that TMP’s conventional approach to book production, distribution and marketing is not sustainable. He wishes to re-examine certain elements of the marketing mix in the context of the opportunities offered by e-business.A young marketing graduate has been appointed by the marketing director to develop and maintain the website.However, further development of the website has not been sanctioned by the Board. Other directors have given two main reasons for blocking further development of this site. Firstly, they believe that the company does not have suffi cient expertise to continue developing and maintaining its own website. It is solely dependent on the marketing graduate. Secondly, they feel that the website will compete with the established supply channels which they are keen to preserve.However, the marketing director is convinced that investing in e-business is essential for the survival of TMP. ‘We need to consider what unique opportunities it offers for pricing the product, promoting the product, placing the product and providing physical evidence of the quality of the product. Finally, we might even re-defi ne the product itself’. He feels if the company fails to grasp these opportunities, then one of its competitors will, and ‘that will be the end of us’.Required:(a) Determine the main drivers for the adoption of e-business at TMP and identify potential barriers to itsadoption. (5 marks)(b) Evaluate how e-business might help TMP exploit each of the five elements of the marketing mix (price,product, promotion, place and physical evidence) identifi ed by the marketing director. (20 marks)(25 marks)6Frigate Limited is based in the country of Egdon. It imports electrical components from other countries and distributes them throughout the domestic market. The company was formed twenty years ago by Ron Frew, who now owns 80% of the shares. A further 10% of the company is owned by his wife and 5% each by his two daughters.Although he has never been in the navy, Ron is obsessed by ships, sailing and naval history. He is known to everyone as ‘The Commander’ and this is how he expects his employees to address him. He increasingly spends time on his own boat, an expensive motor cruiser, which is moored in the local harbour twenty minutes drive away. When he is not on holiday, Ron is always at work at 8.00 am in the morning to make sure that employees arrive on time and he is also there at 5.30 pm to ensure that they do not leave early. However, he spends large parts of the working day on his boat, although he can be contacted by mobile telephone. Employees who arrive late for work have to immediately explain the circumstances to Ron. If he feels that the explanation is unacceptable then he makes an appropriate deduction from their wages. Wages, like all costs in the company, are closely monitored by Ron.Employees, customers and suppliersFrigate currently has 25 employees primarily undertaking sales, warehousing, accounts and administration. Although employees are nominally allocated to one role, they are required to work anywhere in the company as required by Ron.They are also expected to help Ron in personal tasks, such as booking holidays for his family, fi lling in his personal tax returns and organising social events.Egdon has laws concerning minimum wages and holidays. All employees at Frigate Ltd are only given the minimum holiday allocation. They have to use this allocation not only for holidays but also for events such as visiting the doctor, attending funerals and dealing with domestic problems and emergencies. Ron is particularly infl exible about holidays and work hours. He has even turned down requests for unpaid leave. In contrast, Ron is often away from work for long periods, sailing in various parts of the world.Ron is increasingly critical of suppliers (‘trying to sell me inferior quality goods for higher prices’), customers (‘moaning about prices and paying later and later’) and society in general (‘a period working in the navy would do everyone good’). He has also been in dispute with the tax authority who he accused of squandering his ‘hard-earned’ money.An investigation by the tax authority led to him being fi ned for not disclosing the fact that signifi cant family expenditure (such as a holiday for his daughters overseas) had been declared as company expenditure.Company accountantIt was this action by the tax authority that prompted Ron to appoint Ann Li as company accountant. Ann had previously worked as an accountant in a number of public sector organisations, culminating in a role as a compliance offi cer in the tax authority itself. Ron felt that ‘recruiting someone like Ann should help keep the tax authorities happy. After all, she is one of them’.Ann was used to working in organisations which had formal organisational hierarchies, specialised roles and formal controls and systems. She tried to install such formal arrangements within Frigate. As she said to Ron ‘we cannot have everyone working as if they were just your personal assistants. We need structure, standardised processes and accountability’. Ron resisted her plans, at fi rst through delaying tactics and then through explicit opposition, tearing up her proposed organisational chart and budget in front of other employees. ‘I regret the day I ever made that appointment’, he said. After six months he terminated her contract. Ann returned to the tax authority as a tax inspector.Required:The cultural web allows the business analyst to explore ‘the way things are done around here’.(a) Analyse Frigate Ltd using the cultural web or any other appropriate framework for understanding organisationalculture. (15 marks)(b) U sing appropriate organisation configuration stereotypes identified by Henry Mintzberg, explain how anunderstanding of organisation configuration could have helped predict the failure of Ann Li’s proposed formalisation of structure, controls and processes at Frigate Ltd. (10 marks)(25 marks)7[P.T.O.The Institute of Administrative Accountants (IAA) has a professional scheme of examinations leading to certifi cation.The scheme consists of six examinations (three foundation and three advanced) all of which are currently assessed using conventional paper-based, written examinations. The majority of the candidates are at the foundation level and they currently account for 70% of the IAA’s venue and invigilation costs.There are two examination sittings per year and these sittings are held in 320 centres all over the world. Each centre is administered by a paid invigilation team who give out the examination paper, monitor the conduct of the examination and take in completed scripts at the end. Invigilators are also responsible for validating the identity of candidates who must bring along appropriate identifi cation documents. At over half of the centres there are usually less than ten candidates taking the foundation level examination and no candidates at all at the advanced level. However, the IAA strives to be a world-wide examination body and so continues to run examinations at these centres, even though they make a fi nancial loss at these centres by doing so.Recent increases in invigilation costs have made the situation even worse. However, the principles of equality and access are important to the IAA and the IAA would like to increase the availability of their examinations, not reduce it. Furthermore, the IAA is under increased fi nancial pressure. The twice-yearly examination schedule creates peaks and troughs in cash fl ow which the Institute fi nds increasingly hard to manage. The Institute uses its $5m loan and overdraft facility for at least four months every year and incurred bank charges of $350,000 in the last fi nancial year.ExaminationsAll examinations are set in English by contracted examiners who are paid for each examination they write. All examinations are three-hour, closed-book examinations marked by contracted markers at $10 per script. Invigilators send completed scripts directly to markers by courier. Once scripts have been marked they are sent (again by courier) to a centralised IAA checking team who check the arithmetic accuracy of the marking. Any marking errors are resolved by the examiner. Once all marks have been verified, the examination results are released. This usually takes place16 weeks after the examination date and candidates are critical of this long delay. The arithmetic checking of scriptsand the production of examination results places signifi cant demands on IAA full-time administrative staff, with many being asked to work unpaid overtime. The IAA also employs a signifi cant number of temporary staff during the results processing period.E-assessmentThe new head of education at the IAA has suggested e-assessment initiatives at both the foundation and advanced levels.He has suggested that all foundation level examinations should be assessed by multiple-choice examinations delivered over the Internet. They can be sat anytime, anyday, anywhere. ‘Candidates can sit these examinations at home or at college. Anywhere where there is a personal computer and a reliable broadband connection.’Advanced-level examinations will continue to be held twice-yearly at designated examination centres. However, candidates will be provided with personal computers which they will use to type in their answers. These answers will then be electronically sent to markers who will use online marking software to mark these answers on the screen.The software also has arithmetic checking facilities that mean that marks are automatically totalled for each question.‘100% arithmetic accuracy of marking is guaranteed.’He has also suggested that there is no need to make a formal business case for the adoption of the new technology.‘Its justifi cation is so self-evident that defi ning a business case, managing benefi ts and undertaking benefi ts realisation would just be a pointless exercise. It would slow us down at a time when we need to speed up.’Required:(a) Evaluate the perceived benefi ts and costs of adopting e-assessment at the IAA. (15 marks)(b) Explain why establishing a business case, managing benefi ts and undertaking benefi ts realisation are essentialrequirements despite the claimed ‘self-evident’ justifi cation of adopting e-assessment at the IAA.(10 marks)(25 marks)End of Question Paper8。

ACCA F5 2010年12月真题答案

Actual volume

750 650

Sales price Variance

$ 15,000 A

6,500 A ––––––– 21,500 A –––––––

Sales volume contribution variance = (actual sales volume – budgeted sales volume) x standard margin

Cost of sales Cost of sales has decreased by 19·2% in 2010. This must be considered in relation to the decrease in turnover as well. In 2009, cost of sales represented 72·3% of turnover and in 2010 this figure was 63·7%. This is quite a substantial decrease. The reasons for it can be ascertained by, firstly, looking at the freelance staff costs.

It can also be seen from the non-financial performance indicators that 20% of students in 2010 are students who have transferred over from alternative training providers. It is likely that they have transferred over because they have heard about the improved service that AT Co is providing. Hence, they are most likely the reason for the increased market share that AT Co has managed to secure in 2010.

2010年12月大学英语A级考试真题

√

B. They dance well. C. They look strong.

D. They appear friendly.

6 A. In a store.

B. In a company. C. In a travel agency.

√

D. In a bank.

7 A. Opening an account.

√

B. 280 dollars.ቤተ መጻሕፍቲ ባይዱD. 300 dollars.

10 A. 2 percent. C. 4 percent.

√

B. 3 percent. D. 5 percent.

11. What is John Wilson?

general manager He is the __________________ of a

interested to be ( interest ) __________ in them.

36. In the author's opinion, which of

the following is vital for a company to be successful? A. Specialized knowledge. B. Highly-skilled staff.

D. To build up their own confidence.

40. What is the best title of the passage?

√

A. Team Building B. Problem Solving C. Communication Skills D. Company Management

A. hiring employees with special talent

2010年12月高等学校英语应用能力考试B级真题及完整解析

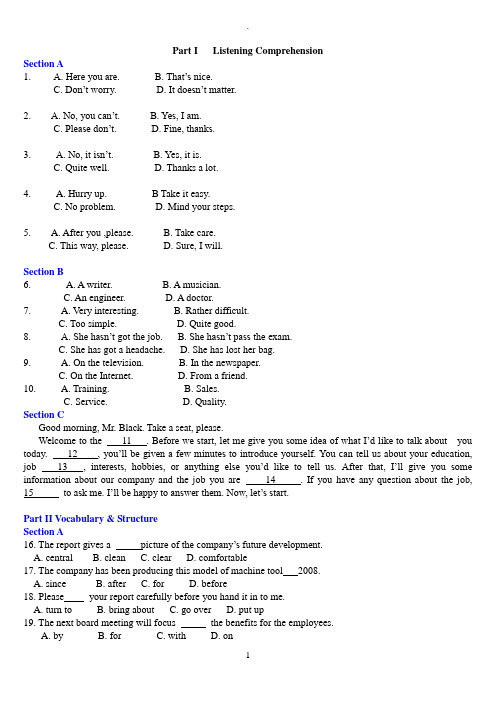

Part I Listening ComprehensionSection A1. A. Here you are. B. That’s nice.C. Don’t worry.D. It doesn’t matter.2. A. No, you can’t. B. Yes, I am.C. Please don’t.D. Fine, thanks.3. A. No, it isn’t. B. Yes, it is.C. Quite well.D. Thanks a lot.4. A. Hurry up. B Take it easy.C. No problem.D. Mind your steps.5. A. After you ,please. B. Take care.C. This way, please.D. Sure, I will.Section B6. A. A writer. B. A musician.C. An engineer.D. A doctor.7. A. Very interesting. B. Rather difficult.C. Too simple.D. Quite good.8. A. She hasn’t got the job. B. She hasn’t pass the exam.C. She has got a headache.D. She has lost her bag.9. A. On the television. B. In the newspaper.C. On the Internet.D. From a friend.10. A. Training. B. Sales.C. Service.D. Quality.Section CGood morning, Mr. Black. Take a seat, please.Welcome to the 11 . Before we start, let me give you some idea of what I’d like to talk about you today. 12 , you’ll be given a few minutes to introduce yourself. You ca n tell us about your education, job 13 , interests, hobbies, or anything else you’d like to tell us. After that, I’ll give you some information about our company and the job you are 14 . If you have any question about the job, 15 to a sk me. I’ll be happy to answer them. Now, let’s start.Part II Vocabulary & StructureSection A16. The report gives a picture of the company’s future development.A. centralB. cleanC. clearD. comfortable17. The company has been producing this model of machine tool 2008.A. sinceB. afterC. forD. before18. Please your report carefully before you hand it in to me.A. turn toB. bring aboutC. go overD. put up19. The next board meeting will focus the benefits for the employees.A. byB. forC. withD. on20. Breakfast can be to you in your room for an additional charge.A. eatenB. servedC. usedD. made21. If more money had been invested, we a factory in Asia.A. will set upB. have set upC. would have set upD. had set up22. Even in small companies, computers are a(n) tool.A. naturalB. essentialC. carefulD. impossible23. We were excited to learn that the last month’s sales by 30%.A. had increasedB. increaseC. are increasingD. have increased24. your name and job title, the business card should also include your telephone number and address.A. As far asB. In addition toC.In spite ofD.As a result of25. Have you read our letter of December 18, in we complained about the quality of your product?A. thatB. whereC. whatD. whichSection B26. Could you tell me the (different) between American and British English in business writing?27. John is the (good) engineer we have ever hired in our department.28. The people there were really friendly and supplied us with a lot of (use) information.29. You’d better (give) me a call before you come to visit us.30. Greenpeace is an international (organize) that works to protect the environment.31. The final decision (make) by the team leader early next week.32. Have you ever noticed any (improve) in the work environment of our factory?33. We can arrange for your car to (repair) within a reasonable period of time.34. It was only yesterday that the chief engineer (email) us the details information about the project.35. We have received your letter of May 10th, (inform) us of the rise of the price.2008年12月说明:假定你是JKM公司的Thomas Black, 刚从巴黎(Paris)出差回来,请给在巴黎的Jane Costa小姐写一封感谢信。

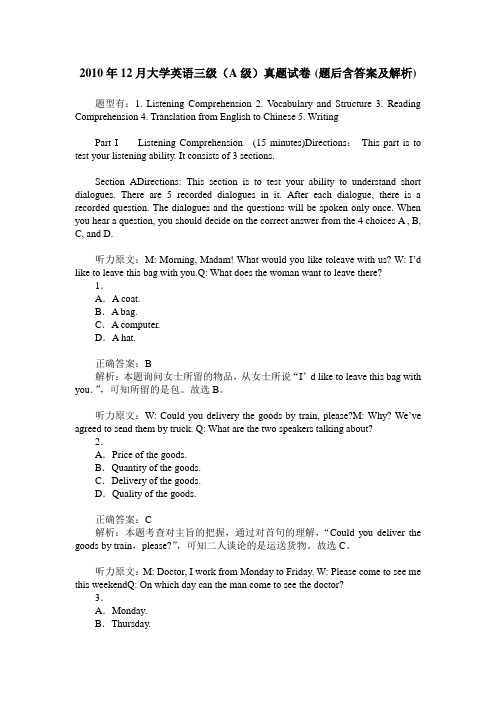

2010年12月大学英语三级(A级)真题试卷(题后含答案及解析)

2010年12月大学英语三级(A级)真题试卷(题后含答案及解析)题型有:1. Listening Comprehension 2. V ocabulary and Structure 3. Reading Comprehension 4. Translation from English to Chinese 5. WritingPart I Listening Comprehension (15 minutes)Directions:This part is to test your listening ability. It consists of 3 sections.Section ADirections: This section is to test your ability to understand short dialogues. There are 5 recorded dialogues in it. After each dialogue, there is a recorded question. The dialogues and the questions will be spoken only once. When you hear a question, you should decide on the correct answer from the 4 choices A , B, C, and D.听力原文:M: Morning, Madam! What would you like toleave with us? W: I’d like to leave this bag with you.Q: What does the woman want to leave there?1.A.A coat.B.A bag.C.A computer.D.A hat.正确答案:B解析:本题询问女士所留的物品,从女士所说“I’d like to leave this bag with you.”,可知所留的是包。

2010年12月份ACCA考试真T(F7)

2010年12月份ACCA(国际注册会计师)考试真题(F7)ALL FIVE questions are compulsory and MUST be attempted1On1June2010,Premier acquired80%of the equity share capital of Sanford.The consideration consisted of two elements:a share exchange of three shares in Premier for every five acquired shares in Sanford and the issue of a$1006%loan note for every50 0shares acquired in Sanford.The share issue has not yet been recorded by Premier,but t he issue of the loan notes has been recorded.At the date of acquisition shares in Premier had a market value of$5each and the shares of Sanford had a stock market price of $3·50each.Below are the summarized draft financial statements of both companies.Statements of comprehensive income for the year ended30September2010Statements of financial position as at30September2010The following information is relevant:(i)At the date of acquisition,the fair values of Sanford‘s assets were equal to their c arrying amounts with the exception of its property.This had a fair value of$1·2million below its carrying amount.This would lead to a reduction of the depreciation charge(in cost of sales)of$50,000in the post-acquisition period.Sanford has not incorporated this value change into its entity financial statements.Premier‘s group policy is to revalue all properties to current value at each year end.On 30September2010,the value of Sanford’s property was unchanged from its value at ac quisition,but the land element of Premier‘s property had increased in value by$500,000 as shown in other comprehensive income.(ii)Sales from Sanford to Premier throughout the year ended30September2010had consistently been$1million per month.Sanford made a mark-up on cost of25%on these sales.Premier had$2million.(at cost to Premier)of inventory that had been supplied i n the post-acquisition period by Sanford as at30September2010.(iii)Premier had a trade payable balance owing to Sanford of$350,000as at30Sep tember2010.This agreed with the corresponding receivable in Sanford‘s books.(iv)Premier‘s investments include some available-for-sale investments that have increas ed in value by$300,000during the year.The other equity reserve relates to these invest ments and is based on their value as at30September2009.There were no acquisitions or disposals of any of these investments during the year ended30September2010.(v)Premier‘s policy is to value the non-controlling interest at fair value at the date of acquisition.For this purpose Sanford’s share price at that date can be deemed to be repr esentative of the fair value of the shares held by the non-controlling interest.(vi)There has been no impairment of consolidated goodwillRequired:(a)Prepare the consolidated statement of comprehensive income for Premier for the y ear ended30September2010.(b)Prepare the consolidated statement of financial position for Premier as at30Septe mber2010.The following mark allocation is provided as guidance for this question:(a)9marks(b)16marks(25marks)2The following trial balance relates to Cavern as at30September2010:The following notes are relevant:(i)Cavern has accounted for a fully subscribed rights issue of equity shares made on 1April2010of one new share for every four in issue at42cents each.The company pa id ordinary dividends of3cents per share on30November2009and5cents per share o n31May2010.The dividend payments are included in administrative expenses in the trial balance.(ii)The8%loan note was issued on1October2008at its nominal(face)value of $30million.The loan note will be redeemed on30September2012at a premium which gives the loan note an effective finance cost of10%per annum.(iii)Non-current assets:Cavern revalues its land and building at the end of each accounting year.At30Septembe r2010the relevant value to be incorporated into the financial statements is$41·8million. The building‘s remaining life at the beginning of the current year(1October2009)was 18years.Cavern does not make an annual transfer from the revaluation reserve to retaine d earnings in respect of the realization of the revaluation surplus.Ignore deferred tax on t he revaluation surplus.Plant and equipment includes an item of plant bought for$10million on1October 2009that will have a10-year life(using straight-line depreciation with no residual value).P roduction using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life.The present value of these costs using a discount r ate of10%at1October2009was$4million.Cavern has not provided any amount for t his future decontamination cost.All other plant and equipment is depreciated at12·5%per annum using the reducing balance method.No depreciation has yet been charged on any non-current asset for the year ended30 September2010.All depreciation is charged to cost of sales.(iv)The available-for-sale investments held at30September2010had a fair value of $13·5million.There were no acquisitions or disposals of these investments during the yea r ended30September2010.(v)A provision for income tax for the year ended30September2010of$5·6million is required.The balance on current tax represents the under/over provision of the tax lia bility for the year ended30September2009.At30September2010the tax base of Caver n‘s net assets was$15million less than their carrying amounts.The movement on deferre d tax should be taken to the income statement.The income tax rate of Cavern is25%.Required:(a)Prepare the statement of comprehensive income for Cavern for the year ended30 September2010.(b)Prepare the statement of changes in equity for Cavern for the year ended30Septe mber2010.(c)Prepare the statement of financial position of Cavern as at30September2010.Notes to the financial statements are not required.The following mark allocation is provided as guidance for this question:(a)11marks(b)5marks(c)9marks(25marks)3Hardy is a public listed manufacturing company.Its summarized financial statement s for the year ended30September2010(and2009comparatives)are:I n c o m e s t a t e m e n t s f o r t h e y e a r e n d e d30S e p t e m b e r:Statements of financial position as at30September:The following information has been obtained from the Chairman's Statement and the notes to the financial statements:'Market conditions during the year ended30September2010proved very challenging d ue largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values.Hardy has not been immune from these effects and our properties have suffered impairment losses of$6million in the year.' The excess of these losses over previous surpluses has led to a charge to cost of sal es of$1·5million in addition to the normal depreciation charge.'Our portfolio of investments at fair value through profit or loss has been'marked to market'(fair valued)resulting in a loss of$1·6million(included in administrative expense s).'There were no additions to or disposals of non-current assets during the year.'In response to the downturn the company has unfortunately had to make a number o f employees redundant incurring severance costs of$1·3million(included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.' 'The difficulty in the credit markets has meant that the finance cost of our variable r ate bank loan has increased from4·5%to8%.In order to help cash flows,the company made a rights issue during the year and reduced the dividend per share by50%.' 'Despite the above events and associated costs,the Board believes the company's unde rlying performance has been quite resilient in these difficult times.'Required:Analyze and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided.Your analysis should be supported by profitability,liquidity and gearing and other ap propriate ratios(up to10marks available).(25marks)4(a)IAS8Accounting Policies,Changes in Accounting Estimates and Errors contain s guidance on the use of accounting policies and accounting estimates.Required:Explain the basis on which the management of an entity must select its accounting p olicies and distinguish,with an example,between changes in accounting policies and chan ges in accounting estimates.(5marks)(b)The directors of Tunshill are disappointed by the draft profit for the year ended30 September2010.The company's assistant accountant has suggested two areas where she b elieves the reported profit may be improved:(i)A major item of plant that cost$20million to purchase and install on1October2 007is being depreciated on a straight-line basis over a five-year period(assuming no resi dual value).The plant is wearing well and at the beginning of the current year(1October 2009)the production manager believed that the plant was likely to last eight years in total (i.e.from the date of its purchase).The assistant accountant has calculated that,based on a n eight-year life(and no residual value)the accumulated depreciation of the plant at30Sep tember2010would be$7·5million($20million/8years x3).In the financial statements for the year ended30September2009,the accumulated depreciation was$8million($20mil lion/5years x2).Therefore,by adopting an eight-year life,Tunshill can avoid a depreciati on charge in the current year and instead credit$0·5million($8million–$7·5million)to the income statement in the current year to improve the reported profit.(5marks) (ii)Most of Tunshill's competitors value their inventory using the average cost(AVCO) basis,whereas Tunshill uses the first in first out(FIFO)basis.The value of Tunshill's in ventory at30September2010(on the FIFO basis)is$20million;however on the AVCO basis it would be valued at$18million.By adopting the same method(AVCO)as its co mpetitors,the assistant accountant says the company would improve its profit for the year ended30September2010by$2million.Tunshill‘s inventory at30September2009was reported as$15million,however on the AVCO basis it would have been reported as$1 3·4million.(5marks)Required:Comment on the acceptability of the assistant accountant‘s suggestions and quantify h ow they would affect the financial statements if they were implemented under IFRS.Ignor e taxation.Note:the mark allocation is shown against each of the two items above.(15marks)5Manco has been experiencing substantial losses at its furniture making operation wh ich is treated as a separate operating segment.The company‘s year end is30September. At a meeting on1July2010the directors decided to close down the furniture making op eration on31January2011and then dispose of its non-current assets on a piecemeal basis.Affected employees and customers were informed of the decision and a press announce ment was made immediately after the meeting.The directors have obtained the following i nformation in relation to the closure of the operation:(i)On1July2010,the factory had a carrying amount of$3·6million and is expecte d to be sold for net proceeds of$5million.On the same date the plant had a carrying a mount of$2·8million,but it is anticipated that it will only realize net proceeds of$500, 000.(ii)Of the employees affected by the closure,the majority will be made redundant at cost of$750,000,the remainder will be retrained at a cost of$200,000and given work in one of the company's other operations.(iii)Trading losses from1July to30September2010are expected to be$600,000an d from this date to the closure on31January2011a further$1million of trading losses are expected.Required:Explain how the decision to close the furniture making operation should be treated in Manco‘s financial statements for the years ending30September2010and2011.Your an swer should quantify the amounts involved.(10marks)。

2010年12月ACCA考试考官报告(P1)(2)

2010年12月ACCA考试考官报告(P1)(2)本文由高顿ACCA整理发布,转载请注明出处Specific CommentsQuestion OneThe case in section A (question 1) was about ZPT,an internet communications company,which was involved in a number of false accounting and fraudulent activities.The a uditor,JJC,was complicit in the situation.A similar situation happened in ‘real life’ some years ago and so some candidates may have been familiar with some of the issues already.This does show the value of studying current cases from the business news in preparing for P1 exams as 'real life’ themes are sometimes borrowed in framing exam case studies.Part (a) contained two components,parts (i) and (ii).The first was a bookwork task to explain the factors that might lead institutional investors to seek to intervene directly in a company they hold shares in.This was not a requirement to define ‘institutional shareholders’ as some candidates did (scoring nothing for their efforts in doing so).The content should have been well-known to any well-prepared candidate.Many were able to gain some marks for part (a) even if they couldn’t get all six marks.For part(a)(ii),candidates had to study the case to see which factors applied to ZPT.There were three such factors mentioned in the case and candidates had to us e these to ‘construct the case’ which means to produce arguments in favour of investor intervention because of the identified weaknesses.Part (b) asked about absolutist and relativist ethics.I often put a substantive ethics requirement from section E of the study guide into question 1 and this paper was no exception.Shazia Lo was an accountant at ZPT who accepted a bribe to keep quiet about the company’s fraudulent accounting.The question asked candidates to distinguish between absolutism and relativis m and then to critically evaluate Shazia Lo’s behaviour from these two perspectives for a total of 10 marks.This means that both perspectives had to be discussed in considering Shazia Lo’s behaviour.From an absolutist perspective,it is obvious that no accountant should ever be complicit in bribery,fraud or mis-statement.From a relativist perspective and this is where the case raises an interesting ethical conundrum,it maybe right in some circumstances to show compassion and to carefully consider theconsequences of actions,not merely their legality.Shazia used the money not to enrich herself but to pay for medical treatment for her mother.This in no way excuses her actions but it does raise the issue of trading one ethical good (upholding her professional and legal duties) against another (assisting in the medical care of her mother).There were three requirements in part (c) and all parts were done poorly overall.What surprised me about this is that all parts are clearly ‘core’ areas in the P1 study guid e and whilst some candidates addressed the questions correctly and scored highly,many did not.Just to clarify what the questions meant,(a) was about the consequences of bad governance,(b) was about the case in favour of mandatory (rather than voluntary) IC reporting,and (c) was about the contents of an internal control report.None of these should have been a struggle for a well-prepared P1 candidate.In part (c)(i),it seems that many candidates saw the first part of the requirement but ignored the secon d part.So they described the nature of ‘sound corporate governance’ whilst neglecting the second part which was to do this ‘by assessing the consequences of the corporate governance failures ay ZPT’.This question is essentially probing the main purpose of corporate governance: without sound corporate governance,companies go bust,employees lose their jobs,investors lose their investments and can be financially ruined,and a number of other terrible outcomes.So the ‘consequences of CG failure’ was often overlooked by candidates,which meant that they failed to gain those marks.Part (c)(ii) was concerned with the debate over the mandating of internal control reporting.Some candidates correctly identified that this debate had taken place in the United States some years ago over section 404 of Sarbanes Oxley (although it wasn’t necessary to know this to gain the marks).The point of having this requirement in the question was to highlight that poor internal controls were in part responsible for the situation at ZPT and that mandatory reporting to an agreed reporting framework would have made it much more difficult for the IC failures to have occurred.The accountability created by having to report on internal controls could have made it much more difficult for the ZPT management to have got away with the bad practice that they did.Part (c)(iii) was about the contents of such a report.The marking team allowed some latitude here but the essential components should have included,in all cases,an acknowledgement statement (whose job is it?),a description of the processes (how is IC done?),it should be accurate and reliable,and,specifically,it should explain any particular IC weaknesses.The professional marks were awarded for framing the answer to the three components of part (c) in the form of a speech by a legislator.There was some evidence of improvement in candidate’s taking this seriously and setting out their answer accordingly,but others made errors like setting it out as a memo or letter,or else by using bullet points (in a speech?) or unlinked statements.I would again reinforce the importance of being prepared to answer in a variety of ways because these four marks really can make a difference between a pass and a fail.更多ACCA资讯请关注高顿ACCA官网:。

ACCA201012份考试真题(P1)

考试真题(P1)Section A - This ONE question is compulsory and MUST be attempted1 In the 2009 results presentation to analysts,the chief executive of ZPT,a global internet communications company,announced an excellent set of results to the waiting audience.Chief executive Clive Xu announced that, compared to 2008,sales had increased by 50%,profi ts by 100% and total assets by 80%.The dividend was to be doubled from the previous year.He also announced that based on their outstanding performance,the executive directors would be paid large bonuses in line with their contracts.His own bonus as chief executive would be $20 million.When one of the analysts asked if the bonus was excessive,Mr Xu reminded the audience that the share price had risen 45% over the course of the year because of his efforts in skilfully guiding the company.He said that he expected the share price to rise further on the results announcement,which it duly did. Because the results exceeded market expectation,the share price rose another 25% to $52.Three months later,Clive Xu called a press conference to announce a restatement of the 2009 results.This was necessary,he said,because of some 'regrettable accounting errors'.This followed a meeting between ZPT and the legal authorities who were investigating a possible fraud at ZPT.He disclosed that in fact the fi gures for 2009 were increases of 10% for sales,20% for profi ts and 15% for total assets which were all signifi cantly below market expectations.The proposed dividend would now only be a modest 10% more than last year.He said that he expected a market reaction to the restatement but hoped that it would only be a short-term effect.The first questioner from the audience asked why the auditors had not spotted and corrected the fundamental accounting errors and the second questioner asked whether such a disparity between initial and restated results was due to fraud rather than'accounting errors'.When a journalist asked Clive Xu if he intended to pay back the $20 million bonus that had been based on the previous results,Mr Xu said he did not.The share price fell dramatically upon the restatement announcement and,because ZPT was such a large company,it made headlines in the business pages in many countries.Later that month,the company announced that following an internal investigation,there would be further restatements,all dramatically downwards,for the years 2006 and 2007.This caused another mass selling of ZPT shares resulting in a fi nal share value the following day of $1.This represented a loss of shareholder value of $12 billion from the peak share price.Clive Xu resigned and the government regulator for businessordered an investigation into what had happened at ZPT.The shares were suspended by the stock exchange.A month later, having failed to gain protection from its creditors in the courts,ZPT was declared bankrupt. Nothing was paid out to shareholders whilst suppliers received a fraction of the amounts due to them. Some non-current assets were acquired by competitors but all of ZPT‘s 54,000 employees lost their jobs,mostly with little or no termination payment.Because the ZPT employees’ pension fund was not protected from creditors,the value of that was also severely reduced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.The government investigation found that ZPT had been maintaining false accounting records for several years. This was done by developing an overly-complicated company structure that contained a network of international branches and a business model that was diffi cult to understand.Whereas ZPT had begun as a simple telecommunications company,Clive Xu had increased the complexity of the company so that he could 'hide' losses and mis-report profi ts. In the company‘s reporting,he also substantially overestimated the value of future customer supply contracts.The investigation also found a number of signifi cant internal control defi ciencies including no effective management oversight of the external reporting process and a disregard of the relevant accounting standards.In addition to Mr Xu,several other directors were complicit in the activities although Shazia Lo,a senior qualifi ed accountant working for the fi nancial director,had been unhappy about the situation for some time.She had approached the fi nance director with her concerns but having failed to get the answers she felt she needed,had threatened to tell the press that future customer supply contract values had been intentionally and materially overstated(the change in fair value would have had a profi t impact)。

2010年12月份ACCA考试真T(F7)

2010年12月份ACCA(国际注册会计师)考试真题(F7)ALL FIVE questions are compulsory and MUST be attempted1 On 1 June 2010, Premier acquired 80% of the equity share capital of Sanford. The consideration consisted of two elements: a share exchange of three shares in Premier for every five acquired shares in Sanford and the issue of a $100 6% loan note for every 50 0 shares acquired in Sanford. The share issue has not yet been recorded by Premier, but t he issue of the loan notes has been recorded. At the date of acquisition shares in Premier had a market value of $5 each and the shares of Sanford had a stock market price of $3·50 each. Below are the summarized draft financial statements of both companies.Statements of comprehensive income for the year ended 30 September 2010Statements of financial position as at 30 September 2010The following information is relevant:(i)At the date of acquisition, the fair values of Sanford‘s assets were equal to their c arrying amounts with the exception of its property. This had a fair value of $1·2 million below its carrying amount. This would lead to a reduction of the depreciation charge (in cost of sales) of $50,000 in the post-acquisition period. Sanford has not incorporated this value change into its entity financial statements.Premier‘s group policy is to revalue all properties to current value at each year end.On 30 September 2010, the value of Sanford’s property was unchanged from its value at ac quisition, but the land element of Premier‘s property had increase d in value by $500,000 as shown in other comprehensive income.(ii)Sales from Sanford to Premier throughout the year ended 30 September 2010 had consistently been $1 million per month. Sanford made a mark-up on cost of 25% on these sales. Premier had $2 million. (at cost to Premier) of inventory that had been supplied i n the post-acquisition period by Sanford as at 30 September 2010.(iii)Premier had a trade payable balance owing to Sanford of $350,000 as at 30 Sep tember 2010. This agreed with the corre sponding receivable in Sanford‘s books.(iv)Premier‘s investments include some available-for-sale investments that have increas ed in value by $300, 000 during the year. The other equity reserve relates to these invest ments and is based on their value as at 30 September 2009.There were no acquisitions or disposals of any of these investments during the year ended 30 September 2010.(v)Premier‘s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sanf ord’s share price at that date can be deemed to be repr esentative of the fair value of the shares held by the non-controlling interest.(vi)There has been no impairment of consolidated goodwillRequired:(a) Prepare the consolidated statement of comprehensive income for Premier for the y ear ended 30 September 2010.(b) Prepare the consolidated statement of financial position for Premier as at 30 Septe mber 2010. The following mark allocation is provided as guidance for this question:(a) 9 marks(b) 16 marks(25 marks)2 The following trial balance relates to Cavern as at 30 September 2010:The following notes are relevant:(i)Cavern has accounted for a fully subscribed rights issue of equity shares made on1 April 2010 of one new share for every four in issue at 42 cents each. The company pa id ordinary dividends of3 cents per share on 30 November 2009 and 5 cents per share o n 31 May 2010.The dividend payments are included in administrative expenses in the trial balance.(ii)The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective finance cost of 10% per annum.(iii)Non-current assets:Cavern revalues its land and building at the end of each accounting year. At 30 Septembe r 2010 the relevant value to be incorporated into the financial statements is $41·8 million. The building‘s remaining life at the beginning of the current year (1 October 2009) was18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realization of the revaluation surplus. Ignore deferred tax on t he revaluation surplus.Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life(using straight-line depreciation with no residual value).P roduction using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount r ate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for t his future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010.All depreciation is charged to cost of sales.(iv)The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the yea r ended 30 September 2010.(v)A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax lia bility for the year ended 30 September 2009.At 30 September 2010 the tax base of Caver n‘s net assets was $15 million less than their carrying amounts. Th e movement on deferre d tax should be taken to the income statement. The income tax rate of Cavern is 25%.Required:(a)Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.(b)Prepare the statement of changes in equity for Cavern for the year ended 30 Septe mber 2010.(c)Prepare the statement of financial position of Cavern as at 30 September 2010.Notes to the financial statements are not required.The following mark allocation is provided as guidance for this question:(a) 11 marks(b) 5 marks(c) 9 marks(25 marks)3 Hardy is a public listed manufacturing company. Its summarized financial statement s for the year ended 30 September 2010(and 2009 comparatives) are:I n c o m e s t a t e m e n t s f o r t h e y e a r e n d e d30S e p t e m b e r:Statements of financial position as at 30 September:The following information has been obtained from the Chairman's Statement and the notes to the financial statements:'Market conditions during the year ended 30 September 2010 proved very challenging d ue largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values. Hardy has not been immune from these effects and our properties have suffered impairment losses of $6 million in the year.' The excess of these losses over previous surpluses has led to a charge to cost of sal es of $1·5 million in addition to the normal depreciation charge.'Our portfolio of investments at fair value through profit or loss has been 'marked to market' (fair valued) resulting in a loss of $1·6 million (included in administrative expense s).'There were no additions to or disposals of non-current assets during the year.'In response to the downturn the company has unfortunately had to make a number o f employees redundant incurring severance costs of $1·3million (included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.' 'The difficulty in the credit markets has meant that the finance cost of our variable r ate bank loan has increased from 4·5% to 8%.In order to help cash flows ,the company made a rights issue during the year and reduced the dividend per share by 50%.' 'Despite the above events and associated costs, the Board believes the company's unde rlying performance has been quite resilient in these difficult times.'Required:Analyze and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided.Your analysis should be supported by profitability, liquidity and gearing and other ap propriate ratios (up to 10 marks available).(25 marks)4 (a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors contain s guidance on the use of accounting policies and accounting estimates.Required:Explain the basis on which the management of an entity must select its accounting p olicies and distinguish, with an example, between changes in accounting policies and chan ges in accounting estimates. (5 marks)(b)The directors of Tunshill are disappointed by the draft profit for the year ended 30 September 2010.The company's assistant accountant has suggested two areas where she b elieves the reported profit may be improved:(i)A major item of plant that cost $20 million to purchase and install on 1 October 2 007 is being depreciated on a straight-line basis over a five-year period (assuming no resi dual value).The plant is wearing well and at the beginning of the current year(1 October 2009)the production manager believed that the plant was likely to last eight years in total (i.e. from the date of its purchase).The assistant accountant has calculated that, based on a n eight-year life(and no residual value)the accumulated depreciation of the plant at 30 Sep tember 2010 would be $7·5 million($20 million/8 years x 3).In the financial statements forthe year ended 30 September 2009,the accumulated depreciation was $8 million ($20 mill ion/5 years x 2).Therefore, by adopting an eight-year life, Tunshill can avoid a depreciatio n charge in the current year and instead credit $0·5 million($8 million –$7·5 million)to t he income statement in the current year to improve the reported profit.(5 marks) (ii)Most of Tunshill's competitors value their inventory using the average cost (AVCO) basis, whereas Tunshill uses the first in first out (FIFO) basis. The value of Tunshill's in ventory at 30 September 2010(on the FIFO basis) is $20 million; however on the AVCO basis it would be valued at $18 million. By adopting the same method (AVCO) as its co mpetitors, the assistant accountant says the company would improve its profit for the year ended 30 September 2010 by $2 million. Tunshill‘s inventory at 30 September 2009 was reported as $15 million, however on the AVCO basis it would have been reported as $1 3·4 million. (5 marks)Required:Comment on the acceptability of the assistant accountant‘s suggestions and quantify h ow they would affect the financial statements if they were implemented under IFRS. Ignor e taxation.Note: the mark allocation is shown against each of the two items above.(15 marks)5 Manco has been experiencing substantial losses at its furniture making operation wh ich is treated as a separate operating segment. The company‘s year end is 30 September . At a meeting on 1 July 2010 the directors decided to close down the furniture making op eration on 31 January 2011 and then dispose of its non-current assets on a piecemeal basis. Affected employees and customers were informed of the decision and a press announce ment was made immediately after the meeting. The directors have obtained the following i nformation in relation to the closure of the operation:(i)On 1 July 2010, the factory had a carrying amount of $3·6 million and is expected to be sold for net proceeds of $5 million. On the same date the plant had a carrying a mount of $2·8 million, but it is anticipated that it will only realize net proceeds of $500, 000.(ii)Of the employees affected by the closure, the majority will be made redundant at cost of $750,000,the remainder will be retrained at a cost of $200,000 and given work in one of the company's other operations.(iii)Trading losses from 1 July to 30 September 2010 are expected to be $600,000 an d from this date to the closure on 31 January 2011 a further $1 million of trading losses are expected.Required:Explain how the decision to close the furniture making operation should be treated in Manco‘s financial statements for the years ending 30 September 2010 and 2011. Your an swer should quantify the amounts involved. (10 marks)。

ACCA考试F4公司法与商法China真题2010年12月_真题-无答案

ACCA考试F4公司法与商法(China)真题2010年12月(总分100,考试时间180分钟)ALL TEN questions **pulsory and MUST be attempted** relation to the Civil Procedure Law of China:(a) explain the term exclusive jurisdiction; (2 marks)(b) state the major legal characteristics of exclusive jurisdiction, in terms of: (i) the basis of exclusive jurisdiction; and (4 marks) (ii) the effect of the rule of exclusive jurisdiction. (4 marks)** relation to the Property Law of China:(a) explain the term right of lien; (4 marks)(b) state THREE conditions to be met for a party to claim the right of lien. (6 marks)** relation to the Labour Contract Law of China:(a) state the various powers of the labour administration in exercising its supervisory and examining functions; (2 marks)(b) state any FOUR kinds of situations under which the labour administration may issue administrative orders to an employer for violations of Labour Contract Law. (8 marks)** relation to the Contract Law of China:(a) explain the term termination of contract; (2 marks)(b) explain and distinguish between termination of contract and dissolution of contract. (8 marks)** relation to the Company Law of China:(a) state the basic rules regarding the shareholders of: (i) a general limited **pany; (2 marks) (ii) a sole-person limited **pany and a wholly state-**pany; and (2 marks) (b) state the requirements for capital of: (i) a general limited **pany; (2 marks) (ii) a sole-person limited **pany; and (2 marks) (iii) a company with exclusive state-ownership. (2 marks)** relation to the Enterprises Bankruptcy Law of China, state the legal effect of the acceptance of an application for bankruptcy by the court:(a) in terms of the preservative measures against the assets of the debtor; (4 marks)(b) in terms of the enforcement procedure against the relevant debtor; (4 marks)(c) in terms of pending legal actions against a debtor. (2 marks)** relation to the Securities Law of China:(a) explain the term sponsor in underwriting securities; (2 marks)(b) state the objective of the legislation to set up the system of sponsorship in underwriting securities; (2 marks)(c) state the various legal liabilities of a sponsor, in providing professional services, for his wrongdoings or failure to perform his functions. (6 marks)8.In 2009 Mr Lee and the **mittee entered into a contract for the management of land, under which he obtained the right to manage the contracted piece of land in a small mountain for 30 years. The contract was duly registered with the relevant government authority in light of the Property Law.One day when Mr Lee was planting trees on the mountain, he accidentally found a small coal mine in the mountain. Having discovered this information many villagers rushed to the mountain to exploit coal for sale. Mr Lee demanded the villagers stop the exploitation of coal, on the ground that he has been a legitimate holder of the right of management of land. Therefore, he should be a lawful holder of right to the coal mine under the land. On the other hand, the villagers refused to accept Mr Lee’s position and insisted that Mr Lee’s right to management of land would not extend to natural resources under the land. They held that the coal mine should be **mon property of the villagers as a whole and they were entitled to dig coal.Since Mr Lee and the villagers could not reach a settlement themselves, they filed a lawsuit against each other before the court for the determination of right.Required:Answer the following questions in accordance with the relevant provisions of the Property Law of China, and give reasons for your answer:(a) describe what kind of property right Mr Lee has held regarding the mountain; (2 marks)(b) describe who should hold the ownership of the coal mine in the mountain; (4 marks)(c) state how the court should deal with the claim brought by Mr Lee for damages against villagers because some of the trees in the land were destroyed by villagers in digging coal. (4 marks)9.Natural Gas Company (Gas Company) and Yaowa Glass Company (Yaowa Company) entered into a supply contract. The major terms and conditions of the contract were that Gas Company would provide a minimum 4,000 of natural gas daily for a period of five years at a fixed price; it should give a written notice five days in advance where it reduces the quantity of supply; Yaowa Company would provide a sum of RMB 100,000 yuan as a deposit for the performance of the contract. Yaowa Company paid the deposit pursuant to the supply contract upon the conclusion of the contract.Gas Company has been in decline since the beginning of 2010. In order to achieve extra profit, Gas Company sold more natural gas to other customers at a higher price by reducing the quantity of supply to Yaowa Company. One day Gas Company suddenly stopped providing natural gas to Yaowa Company without a notice in advance, which resulted in serious damage to the equipment of the latter.Due to unsuccessful negotiation between the two parties, Yaowa Company intended to seek the assistance from the people’s court.Required:Answer the following questions in accordance with the relevant provisions of the Contract Law of China, and give your reasons for your answer:(a) explain the legal nature of the deposit under the contract law, and state whether a claim for a refund of twice the amount of the deposit should be supported by the court; (4 marks) (b) state whether a claim requiring specific performance of contract by Gas Company should be supported by the court where the Yaowa Company has already requested a refund of twice the amount of the deposit. (6 marks)10.Kingmart Joint Stock Company (Kingmart Company) was a listed joint **pany listing in Shanghai Securities Exchange, with total assets of RMB 500 million yuan; while Dahua LimitedLiability Company’s (Dahua Company) registered capital was RMB 160 million yuan. At the end of 2009 the board of directors of Kingmart Company adopted a special board of directors’ resolution to merge with Dahua Company in a form of merger by absorption. After **pletion of the merger plan Dahua Company would be dissolved.For the purpose of carrying forward the merger plan, Kingmart Company and Dahua Company should take some procedural steps before the merger plan could be implemented and settle the credit and/or debt of these **panies with other parties.Required:Answer the following questions in accordance with the relevant provisions of the Company Law, and give reasons for your answer:(a) state the relevant voting requirement by the general shareholders’ meeting; (3 marks)(b) state the relevant rules with respect to public notice; (3 marks)(c) state how to deal with Dahua Company’s debts of RMB 500,000 yuan owed to a local electricity plant. (4 marks)。

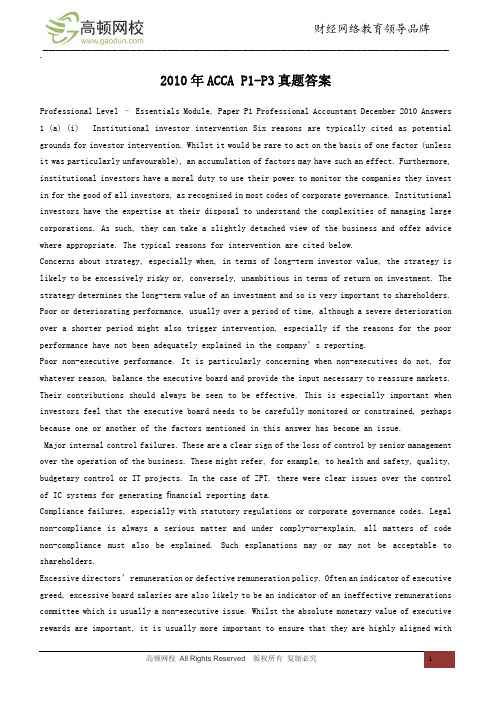

2010年ACCAP1-P3真题答案