ca_exm_tx1_2007-03

安利达 720P 无线数字安防摄像头 LW3211 系列快速启动指南说明书

LW3211 SERIES QUICK START GUIDE

Getting Started

This system comes with the following components: 1x wireless camera 1x wireless receiver 1x antenna for camera 1x antenna for receiver 2x power adapters (for camera and receiver) 1x camera mounting kit 1x receiver mounting kit

NOTE: The camera and receiver have already been paired out of the box. If for some reason the pairing is lost, follow these steps to pair up the camera and receiver.

A. Installing the Camera

1 Mount the camera to the wall or ceiling using the included screws. Use the included anchors as needed.

NOTE: If you run the cables along the wall / ceiling, you must run the cable through the cable notch on the base. This will keep the camera base flush to the wall / ceiling when mounted.

Turck电感式传感器NI10-EM18-Y1X-H1141说明书

T 04:38:33+02:00型号NI10-EM18-Y1X-H1141货号1006261额定工作距离Sn 10 mm 安装方式非齐平实际测量范围ð (0,81 x Sn) mm修正系数37#钢 = 1; 铝 = 0.3; 不锈钢= 0.7; 黄铜 = 0.4重复精度ð 2 满量程的 %温度漂移10 %磁滞1…10 %环境温度-25…+70 °C 输出性能2线, NAMUR 开关频率0.5 kHz电压Nom. 8.2 VDC 无激励电流损耗ï 2.1 mA 激励电流损耗ð 1.2 mA认证依据KEMA 02 ATEX 1090X 内置 电感(L ) / 电容 (C )150 nF / 150 µH防爆标志防爆标识为II 1 G/Ex ia IIC T6/II 1 D Ex ia D 20 T115°C Da(最大 U = 20 V, I = 20 mA, P = 200 mW)设计圆柱螺纹, M18 x 1尺寸52 mm外壳材料不锈钢型, V2A (1.4301)感应面材料塑料, PBT 最大扭矩25 Nm连接接插件, M12 x 1防震动性55 Hz (1 mm)防冲击性30 g (11 ms)防护等级IP67MTTF 6198 years 符合SN 29500 (Ed.99) 40 °C认证开关状态指示LED指示灯 黄sATEX 防爆认证II 组设备,设备等级1G. 可用于气体危险0区sATEX 防爆认证II组设备,设备等级1D,可应用于粉尘危险2区s 满足SIL2和IEC61508标准s M18 x 1圆柱螺纹s 不锈钢1.4301s 2线直流, nom. 8.2 VDCs输出遵循本安型DIN EN 60947-5-6(NAMUR)标准sM12 x 1接插件接线图功能原理电感式传感器以非接触和无磨损的方式检测金属物体。

V8A02解决方案用户手册V2.1

V8A02解决方案用户手册V2.1目录1. 文档说明 (6)1.1版本说明 (6)1.2专有名词 (6)2. 方案简介 (8)2.1方案概述 (8)2.2 功能特点 (8)2.2.1 支持DVI数据源输入 (8)2.2.2 支持宽屏等多种DVI输入分辨率 (8)2.2.3 发送卡超大带载 (8)2.2.4 功能强大的配套软件 (8)2.2.5 智能在线检测 (8)2.2.6 高刷新频率 (8)2.2.7 高灰度等级 (9)2.2.8 支持各种像素类型 (9)2.2.9 灵活支持各种模组 (9)2.2.10 多样的端口设置功能 (9)2.2.11箱体色度调整 (9)2.2.12 逐点校正功能 (9)2.2.13 集成测试功能 (9)2.2.14 联机配置数据 (9)2.2.15 智能维修 (10)2.2.16 环路备份功能 (10)2.2.17 在线升级固件安全可靠 (10)2.2.18 支持低电压输入 (10)2.2.19 配备指示灯及控制面板接口 (10)2.2.20 支持远距离传输 (10)2.2.21 支持音频传输及电源控制 (10)2.2.22 提供完整的二次开发接口 (10)2.2.24 支持内建PWM恒流 (10)2.2.25 支持低亮度高保真 (10)2.3产品清单 (11)3. 应用概述 (12)3.1 典型应用 (12)3.2 环路备份 (13)3.3 多发送卡 (14)4. 功能详解 (15)4.1 模组支持能力 (15)4.1.1 模组行、列数1~128以内任意 (16)4.1.2 模组数据类型 (16)4.1.3 模组内每扫描串移长度 (17)4.1.4 虚拟模组LED灯点位置多种排列方式 (17)4.2 箱体连接设置 (17)4.2.1 箱体内模组级联方式 (17)4.2.2 端口扩展 (18)4.2.3 端口对开 (19)4.2.4 端口逆序 (20)4.2.5 端口偏移 (20)4.2.6 箱体带载高度、宽度 (20)4.2.7 箱体显示起始的行、列位置 (21)4.2.8 箱体无信号输入时显示内容设置 (21)4.2.9 箱体级联数量 (21)4.2.10 箱体色度调整 (21)4.2.11 箱体逐点色度校正 (22)4.2.12 箱体测试功能 (22)4.3 屏体参数调节 (23)4.3.1 多个LED屏设置 (23)4.3.3 虚拟LED屏的实效果 (24)4.3.4 LED屏亮度调节 (25)4.3.5 LED屏对比度调节 (26)4.3.6 LED屏色温调节 (26)4.3.7 关闭LED屏显示 (27)4.3.8 锁定LED屏内容 (27)4.3.9 LED屏环境监控 (27)4.4 显示性能参数说明 (30)4.4.1 灰度等级 (30)4.4.2 刷新频率 (31)4.4.3 亮度效率 (31)4.4.4 最小OE (31)4.5 发送卡带载 (31)4.6 在线检测 (34)4.7 系统升级 (34)4.8 智能维修 (36)4.8.1 接收卡更换 (36)4.8.2模组替换 (37)5. 使用说明 (39)5.1 连接硬件 (39)5.1.1 发送卡安装方法 (39)5.1.2 接收卡安装方法 (39)5.1.3 多功能卡安装方法 (39)5.2 安装软件 (40)5.2.1 配置要求 (40)5.2.2 安装步骤 (40)5.3 系统设置 (40)5.3.1 显卡设置 (40)5.3.2系统设置 (43)6. 附录 (55)6.1 设备推荐型号 (55)6.1.1 DVI复制器 (55)6.2 选用线缆清单 (55)6.2.1 HDMI转DVI线缆 (55)6.2.2 音频线 (56)6.2.3 双绞线 (56)6.2.4 光纤 (56)1. 文档说明1.1版本说明版本日期说明V2.0 2013-01-09 升级自1.71版本V2.1 2013-07-15 新增接收卡产品1.2专有名词以下是本文中使用的专用术语及解释,便于读者更好的理解文章内容。●软件一系列按照特定顺序组织的计算机数据和指令的集合,本文中特指在计算机上运行的应用软件。

CAN通信控制器SJA1000

1 错误;

0 正常; 1 发送;SJA1000正在发送一个报文 0 空闲;没有报文在发送中 1 接收;SJA1000正在接收一个报文 0 空闲;没有报文在接收中

中断寄存器(IR)

1、中断寄存器用作中断源的识别;

2、当寄存器的一位或多位被置位时 ,/INT引脚有效 (低),引起中断;

3、中断寄存器对微控制器来说是只读存储器;

位 地址过滤

7

6

5

4

3

2

1

0

10

标识符字节1 ID.10 ID.9 ID.8 ID.7 ID.6 ID.5 ID.4 ID.3

描述符

11

标识符字节2 ID.2 ID.1 ID.0 RTR DLC.3 DLC.2 DLC.1 DLC.0

12

TX数据1

13

TX数据2

14

TX数据3

15

TX数据4

数据

16

TX数据5

1 出现;一个报文将被发送 0 空缺;无动作

位

符号

名称

值

CMR.7

-

CMR.6

-

CMR.5

-

-

- 保留

-

- 保留

-

- 保留

功

能

状态寄存器(SR)

状态寄存器的内容反映SJA1000的状态。状态寄存器对微 控制器来说是只读存储器。提供给用户以查询的方式来处理数据 传输。 各个位的功能如下:

位 SR.3 SR.2

ir1ti发送中断11发送缓冲器状态从逻辑00至逻辑11跳变释放总线且跳变释放总线且发送中断使能位被置为逻辑11使能时此位被置位表示发送完成使能时此位被置位表示发送完成00微控制器的任何读访问可自动清除此位ir0ri接收中断11当接收fifo不空且接收中断使能位被置为逻辑11使能时此位被置位表示有数据待接收00微控制器的任何读访问可自动清除此位位符号名称值功能ir7保留ir6保留ir5保留ir4iwui唤醒中断11退出睡眠模式时此位被置位00微控制器的任何读访问可自动清除此位ir3doi数据溢出中断数据溢出中断11当数据溢出中断使能被置为逻辑11使能时一旦数据溢出状态位使能时一旦数据溢出状态位001跃变此位即被置位跃变此位即被置位00微控制器的任何读访问可自动清除此位发送缓冲区用来存储微控制器要发送的一个报文

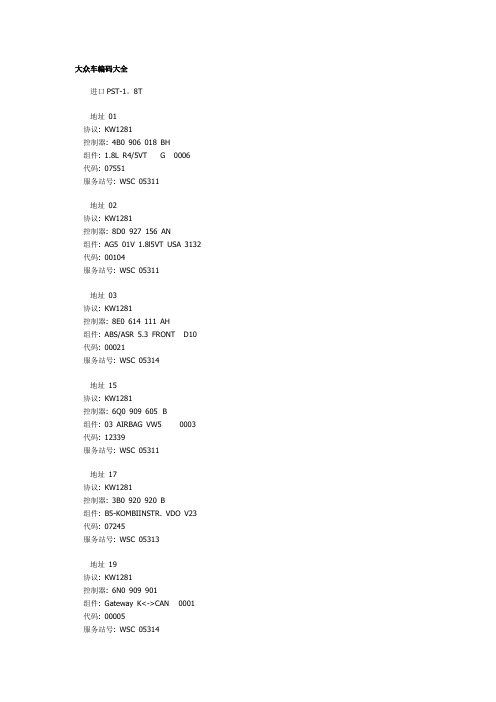

大众车编码大全

大众车编码大全进口PST-1。

8T地址01协议: KW1281控制器: 4B0 906 018 BH组件: 1.8L R4/5VT G 0006代码: 07551服务站号: WSC 05311地址02协议: KW1281控制器: 8D0 927 156 AN组件: AG5 01V 1.8l5VT USA 3132 代码: 00104服务站号: WSC 05311地址03协议: KW1281控制器: 8E0 614 111 AH组件: ABS/ASR 5.3 FRONT D10 代码: 00021服务站号: WSC 05314地址15协议: KW1281控制器: 6Q0 909 605 B组件: 03 AIRBAG VW5 0003 代码: 12339服务站号: WSC 05311地址17协议: KW1281控制器: 3B0 920 920 B组件: B5-KOMBIINSTR. VDO V23 代码: 07245服务站号: WSC 05313地址19协议: KW1281控制器: 6N0 909 901组件: Gateway K<->CAN 0001 代码: 00005服务站号: WSC 05314地址33协议: ????控制器: OBD-II/EOBD, 关键词:0808地址3F协议: KW1281控制器:地址56协议: KW1281控制器: 1J0 035 180 B组件: Radio DE2 0003代码: 04043服务站号: WSC 22503国产A6 2。

8Address 01: EngineProtocol: KW1281Controller: 3B0 907 551 BF Component: 2.8L V6/5V G 0001 Coding: 04552Shop #: WSC 00000Address 02: Auto TransProtocol: KW1281Controller: 4B0 927 156 AJ Component: AG5 01V 2.8l5V USA 3132 Coding: 00014Shop #: WSC 00000Address 03: ABS BrakesProtocol: KW1281Controller: 3B0 614 111 Component: ABS/ASR 5.3 FRONT D00 Coding: 00031Shop #: WSC 00000Address 08: Auto HVACProtocol: KW1281Controller: 4B0 820 043 AF Component: A6-Klimavollautomat D65 Coding: 00160Shop #: WSC 00000Address 15: AirbagsProtocol: KW1281Controller: 4B0 959 655 GComponent: Airbag Front+Seite 2001Coding: 00004Shop #: WSC 00000Address 17: InstrumentsProtocol: KW1281Controller: 4C0 920 930 AComponent: C5-KOMBIINSTR. VDO D09 Coding: 00162Shop #: WSC 04010Address 25: ImmobilizerProtocol: KW1281Controller: Bit teA dre ssComponent: e 17 eingebenAddress 33: OBD-IIProtocol: ????Controller: OBD-II/EOBD, Protocol Keyword: $0808Address 35: Centr. LocksProtocol: KW1281Controller: 4B0 962 258 EComponent: Zentralverrieg.,DWA D34Coding: 04718Shop #: WSC 00004Address 36: Seat Mem. DrvrProtocol: KW1281Controller: 4B0 959 760 AComponent: Sitzmemory D05Address 45: Inter. MonitorProtocol: KW1281Controller: 4B0 951 178 AComponent: Innenraumueberw. D04Coding: 00001Shop #: WSC 00000Address 56: RadioProtocol: KW1281Controller: 4C0 035 186Component: Radio D02 Coding: 00207Shop #: WSC 00000Address 76: Park AssistProtocol: KW1281Controller: 4B0 919 283 P? Component: arkingsystem A6 RDW D18 Coding: 01106Shop #: WSC 00000宝来1.8T全车编码地址01协议: KW1281控制器: 06A 906 032 LD组件: 1.8L R4/5VT 0001代码: 04530服务站号: WSC 00000地址02协议: KW1281控制器: 01M 927 733 LL组件: AG4 Getriebe 01M 4956代码: 00000服务站号: WSC 00000地址03协议: KWP2000控制器: 1C0 907 379 K组件: ASR FRONT MK60 0103代码: 0021505服务站号: WSC 00000地址08协议: KW1281控制器: 3B1 907 044 C组件: CLIMATRONIC C 2.0.0代码: 11000服务站号: WSC 00000地址15控制器: 1C0 909 601组件: 2K AIRBAG VW51 0004代码: 12875服务站号: WSC 00000地址17控制器: 1J5 920 826 A组件: KOMBI+WEGFAHRSP VDO V04 代码: 05122服务站号: WSC 00000地址19控制器: 6N0 909 901组件: Gateway K<->CAN 0001代码: 00006服务站号: WSC 00000地址46控制器: 1C0 959 799 C组件: 18 Komfortger醫HLO 0003 代码: 00259服务站号: WSC 00000途安2。

河南电信―车载动态取证系统_

车载动态取证系统

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

简述

贝尔车载监控产品,以视音频处理和分析为核心, 结合车辆稽查、GPS定位、无线网络传输、行车信息 记录等技术,专为解决车辆视频监控需求,致力于人 人享有安全轻松的公共生活环境。 根据应用需求,我们的车载产品分为两大系列— —车载DVR和车载动态取证系统

远程地图定位

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

远程回放行车轨迹

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

录像回放与分析

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

证据检索与处理

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

本地监控画面

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

产品速求 车载动态取证系统为贝尔有限公司最新推出的一套完整的执 法取证专用系统。 采用国际领先的数字视音频编解码技术和具有自主知识产权 的车牌识别算法,同时结合车牌比对、雷达测速、GPS定位、夜 间补光、车载PTZ控制等技术,组成了一套先进高端的车载动态 取证系统。满足各种行车状况下全天候执法取证工作的需求,可 应用于交警执法、警用取证、运管稽查、治安维护及其他各种动 态取证领域,是建设“平安城市”、打造“平安社会”强有力的 工具之一。

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

技术特点

● 其他

车载PTZ控制 视频预览去抖处理 硬盘+主机减振 数字水印技术 宽幅电源方案 硬盘SMART技术 电磁兼容处理 ……

中国电信河南省集团公司 荆门电信分公司网络维护中心交换组

关注细节 — 车载环境下如何保证工作稳定性?

摄像机地址码

6 011000 23 111010 40 000101 57 100111

7 111000 24 000110 41 100101 58 010111

8 000100 25 100110 42 010101 59 110111

第7位 OFF ON OFF ON

第8位 OFF OFF ON ON

K2的1、2、3、4位拨码开关用于设置协议类型,如下表:本解码器随机提供下表组合协议,也可按用户要求将其它放入协议。

编号 1,2,3,4 位 协议

1 100000 18 010010 35 110001 52 001011

2 010000 19 110010 36 007 101001 54 011011

4 001000 21 101010 38 011001 55 111011

*本解码板采用AC24V供电,请选择正确的供电电压。

技术指标

电气指标

供电电源: 24V±10% AC? 50/60HZ? 35W(1.5A) 。

云台驱动:24VAC/0.5A 。

镜头驱动:室内型: ±12V 100mA 。

摄像机供电:12V 700mA 。

通讯连接方式:本机采用RS485总线控制方式,波特率为1200bps、2400bps、4800bps、9600bps可调。

8 1 1 1 0 HY

9 0 0 0 1 M800-CIA

10 1 0 0 1 PANASONIC

11 0 1 0 1 LILIN

12 1 1 0 1 KRE-301

13 0 0 1 1 WISDOM

伊泰克产品客户问题集锦

伊泰克产品客户问题及回复1.伊泰克哪些产品支持专线?伊泰克工业监控Modem支持专线同时也支持开机自动拨号,33.6K以上速率产品同时支持专线备份拨号和循环拨号。

伊泰克支持专线产品如下:TD-1414VDC、TD-1414、TD-2834、TD-3366、TD-336VDC、TD-3366VDC、TD-3612VDC、TD-3624VDC、TD-3612DCII、TD-3624DCII、TD-3648DC、TD-5612VDC伊泰克不支持专线产品:TD-144、TD-288、TD-336、TD-336VOYi、TD-56000、TD-56000II、TD-56KVOYi2.开机自动专线Modem设置:二线专线Modem简单设置:呼叫方:AT&L1&D5S0=0&W&W1应答方:AT&L1&D5S0=1&W&W1四线专线Modem简单设置(伊泰克产品仅有TD-3624DCII产品支持二线/四线专线):呼叫方:AT&L2&D5S0=0&W&W1应答方:AT&L2&D5S0=1&W&W13.开机自动拨号Modem设置:上电几秒后自动拨出由A T&Z0所存储的电话号码,若正常连接后断线,则Modem重新拨出此号码呼叫方:AT&Z0=TN(N=电话号码)(TD-3612DCII、TD-3624DCII、TD-5612VDC、TD-3648DC、DM3604II) 产品AT指令:AT&L0&I1&D5S0=0&W&W1除上述五种产品外其他支持专线产品设置以下A T指令:AT&L0&D5S0=0&W&W1应答方:AT&L0&D5S0=1&W4.开机循环拨号Modem设置:上电几秒后自动依次循环拨出由AT&Z0、AT&Z1、AT&Z2、AT&Z3所存储的电话号码,若正常连接后断线,则Modem重新依次循环拨出此四个号码:呼叫方:AT&Z0=N、A T&Z1=N、AT&Z2=N、AT&Z3=N(N=电话号码)AT&L0&I2&D5S0=0&W应答方:AT&L0&D5S0=1&W5.专线拨号备份:使用自动拨号备份功能需进行下列设置:相连的两台Modem均打开自动拨号备份功能。

SJA1000数据手册_引脚图_参数

DC CHARACTERISTICS

AC CHARACTERISTICS

AC timing diagrams Additional AC information

PACKAGE OUTLINES

SOLDERING

Introduction DIP Soldering by dipping or by wave Repairing soldered joints SO Reflow soldering Wave soldering Repairing soldered joints

ERROR MANAGEMENT

LOGIC

9 XTAL1

10 XTAL2

OSCILLATOR

RE1 Block diagram.

2000 Jan 04

4

Philips Semiconductors

Stand-alone CAN controller

Product specification

SJA1000

5 PINNING

SYMBOL

PIN

DESCRIPTION

AD7 to AD0 ALE/AS CS RD/E WR CLKOUT

VSS1 XTAL1 XTAL2 MODE

VDD3 TX0 TX1 VSS3 INT

RST

VDD2 RX0, RX1

VSS2 VDD1

2, 1, 28 to 23 3 4 5 6 7

DEFINITIONS

LIFE SUPPORT APPLICATIONS

2000 Jan 04

2

Philips Semiconductors

Stand-alone CAN controller

很全的路由器默认初始密码集合.txt

WST的RT1080http://192.168.0.1username:rootpasswordtp://10.0.0.2username:adminpassword:conexant

password:broadmax

长虹ch-500Ehttp://192.168.1.1username:rootpassword:root

重庆普天CPADSL03http://192.168.1.1username:rootpassword:root

台湾突破EA110RS232:38400[url]http://192.168.7.1username:SLpsw:SL

sunrise的SR-DSL-AEhttp://192.168.1.1username:adminpassword:0000

sunrise的DSL-802E_R3Ahttp://10.0.0.2username:admin

password:epicrouter

username:userpassword:password

username:userpassword:password

全向qxcomm1688http://192.168.1.1高端设置密码是:qxcommsuport

全向qxcomm1680http://192.168.1.1用户:qxcomm1680密码:qxcomm1680

实达

实达ADSL2110-EHaddress:192.168.10.1user:adminpwd:starnetadsl

全向QL168010.0.0.2,用户名admin密码是qxcomm1680,管理员密码是qxcommsupport

电脑耗材

台 个 个 套 套 个 套 套 个 个 块 根 个 米

1 3 1 1 1 1 1 1 1 5 2 4 273 419

电脑配件库存状况表

序号 01 010001 010002 02 020001 020002 02000304 04 040001 040002 05 050001 050002 050003 050004 050005 050006 050007 050008 06 060001 07 070001 070002 070003 070004 070005 070006 070007 070008 070009 08 080001 080002 080003 080004 080005 09 090001 090002 10 100001 100002 100003 11 110001 110002 110003 110004 12 120001 名称 电源 SUPERMICRO PWS-865-PQ电源 SUPERMICRO SP650-RP电源 CPU E5410 CPU INTEL i7 950 CPU INTEL i7 970 CPU 硬盘 SATA 硬盘 500G SATA 硬盘 1TB SATA 硬盘 2TB 数帅移动网盘 主板 X58A-UD3R主板 X7DWA-N主板 散热器 S90F 散热风扇 cooler master散热器 黄铜色散热器 Bushless风扇 V12内存散热器 D39267-002散热器 S2N-6FMCS-L7-GP散热器 S2N-PLMH6-07-GP散热器 刻录机 DVR-219CH刻录机 陈列卡 3220阵列卡 3300阵列卡 4320阵列卡 8300阵列卡 8350阵列卡 1204阵列卡 39160SCSI卡 3860QSCSI卡 5K0CT05501ML阵列线 网卡 Lopstar TE-100TXE Rev 1.3网卡 Qxcomm 56K网卡 PC2-X双口网卡 897654双口网卡 0H092P双网卡 显示器 戴尔2211显示器 戴尔2311显示器 软件 雷特字幕 江民杀毒软件 FreeEdit DV LE 2.0编辑软件 鼠标键盘 戴尔键盘 戴尔鼠标 雷特鼠键套装 DELL无线鼠标 鼠标垫 机箱 SC733TQ-665B机箱 数量 个 个 个 个 个 块 块 块 套 块 块 个 个 个 个 个 个 个 个 台 块 块 块 块 块 块 块 块 根 块 块 块 块 块 台 台 套 套 套 个 个 套 个 个 台 1 2 1 4 0 1 36 0 1 4 1 1 3 2 8 2 2 1 7 0 1 3 32 1 4 2 1 1 2 1 1 1 3 1 1 5 23 2 1 3 0 4 1 40 14 备注

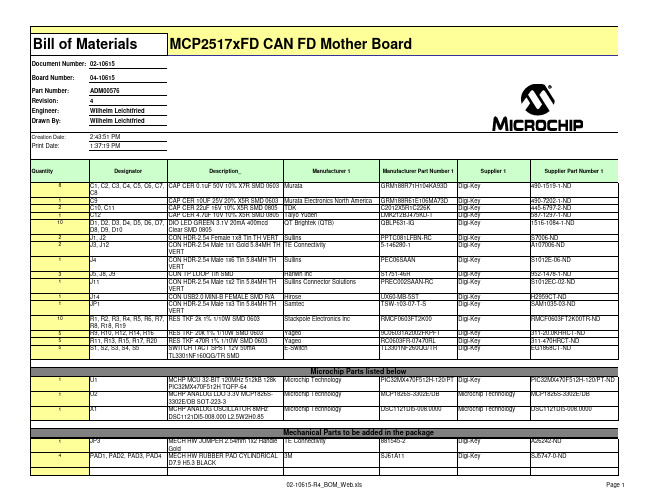

MCP2517xFD CAN FD母板商品说明书

PIC32MX470F512H-120/PT Digi-Key

PIC32MX470F512H TQFP-64

U2

MCHP ANALOG LDO 3.3V MCP1826S- Microchip Technology

MCP1826S-3302E/DB

Microchip Technology

3302E/DB SOT-223-3

Bill of Materials

Document Number: 02-10615

Board Number:

04-10615

Part Number: Revision: Engineer: Drawn By:

ADM00576 4 Wilhelm Leichtfried Wilhelm Leichtfried

Digi-Key Digi-Key

Digi-Key

Digi-Key Digi-Key

Digi-Key Digi-Key

Digi-Key

Digi-Key Digi-Key Digi-Key

Microchip Parts listed below

U1

MCHP MCU 32-BIT 120MHz 512kB 128k Microchip Technology

02-10615-R4_BOM_Web.xls

Page 2

CON HDR-2.54 Male 1x1 Gold 5.84MH TH TE Connectivity

5-146280-1

VERT

CON HDR-2.54 Male 1x2 Tin 5.84MH TH Sullins Connector Solutions

PREC002SAAN-RC

阿尔卡特程控交换机使用说明

ALCATEL PBX

程序管理及使用手册

Shanghai Xundi

交换机功能板简介

主控板 (板上有CPU、硬盘、内存条等主 控设备) eZ32、eZ32-2 模拟用户板 ,板上有32个模拟用户端口 通过交换机后板电缆经配线架接普通电话机 UA32、eUA32 数字用户板 板上有32个数字用户端口, 通 过交换机后板电缆接ALCATEL的数字设备, 如:4019话机、4029话机、4039话机及其 他数字设.) NDDI2-2 模拟中继板板上有8个模拟中继端口, 通过 交换机后板电缆接电信中继. CUP7-2

Shanghai Xundi

OXE交换机系统数据管理

OXE交换机(以下简称“系统”)提供以太网联接和串口联接两种方式:

以太网联接可用Telnet命令(如: ’ 10.197.45.60 ’为系统IP地址)。

Telnet 10.197.45.60

串口联接可用Terminal-终端仿真方式(串口速率9600、数据位8位、无

Shanghai Xundi

分机管理

Shelf Dect system System Translator Categories Attendant Users 分机管理 Profiled Users Set Profiles Groups Abbreviated Numbering Phone Book Entities Trunk Groups External Services Inter-Nodes Links X25 DATA Applications Specific Telephone Services

中国电信2011年240V直流电源设备[汇编]

![中国电信2011年240V直流电源设备[汇编]](https://img.taocdn.com/s3/m/3074be3ccdbff121dd36a32d7375a417866fc1bb.png)

中国电信2011年240V直流电源设备集中采购标书文件项目二附件二技术规范书招标人:中国电信集团公司/中国电信股份有限公司招标代理机构:中捷通信有限公司二○一一年十一月目录1. 概述 (1)1.1. 定义 (1)1.2. 必须满足的技术标准/规范 (3)2. 主要技术要求 (5)2.1. 系统规格 (5)2.2. 环境条件 (5)2.3. 系统总体 (6)182.4. 交流配电屏.................................................................................................................232.5. 整流模块.....................................................................................................................2.6. 直流总配电屏 (25)2.7. 直流二级配电屏 (30)352.8. 监控模块.....................................................................................................................372.9. 外观与结构.................................................................................................................382.10. 包装与标志.................................................................................................................2.11. 节能环保.....................................................................................................................3940 3. 技术服务要求 .............................................................................................................................3.1. 设备检验.....................................................................................................................403.1.1. 工程技术协调会 (40)403.1.2. 出厂检验.................................................................................................................423.1.3. 供货 .........................................................................................................................42 3.1.4. 到货检验.................................................................................................................43 3.1.5. 到货抽检.................................................................................................................45 3.2. 工程服务.....................................................................................................................3.2.1. 安装调测服务(交钥匙工程) (45)3.2.2. 督导调测服务 (46)48 3.2.3. 督导服务.................................................................................................................48 3.3. 设备验收.....................................................................................................................48 3.3.1 初验 .............................................................................................................................49 3.3.2. 试运行.....................................................................................................................50 3.3.3. 终验 .........................................................................................................................51 3.4. 保修 .............................................................................................................................3.4.1. 保修期.....................................................................................................................51 3.4.2. 设备巡检服务 (51)52 3.4.3 故障件修理.................................................................................................................3.4.4. 故障响应及技术支持服务 (53)56 3.4.5 备件供应.....................................................................................................................57 3.4.6. 技术文件.................................................................................................................3.4.7. 软件补丁.................................................................................................................57 3.4.8. 特殊情况下的服务 (57)3.4.9. 电子文档提供服务 (58)3.4.10. 资料共享.................................................................................................................5858 3.5. 技术培训.....................................................................................................................3.5.1. 现场培训.................................................................................................................5859 3.5.2. 其它培训.................................................................................................................3.6. 其它服务要求 (60)1. 概述1.1. 定义1.本规范书为中国电信2011年240V直流电源设备项目二集中采购标书文件的技术要求和供货要求,提供给240V直流电源供应商(投标方)进行技术应答和报价书之用。

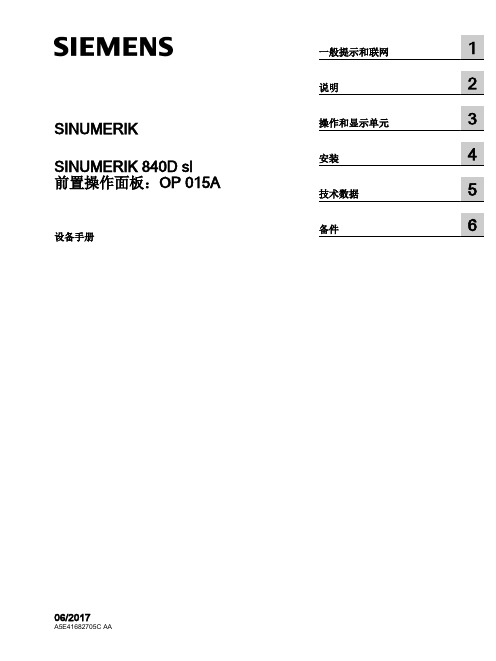

SINUMERIK SINUMERIK 840D sl 前置操作面板:OP 015A 设备手册 06

1.4 1.4.1 1.4.1.1 1.4.1.2 1.4.1.3 1.4.1.4 1.4.2 1.4.2.1 1.4.2.2 1.4.2.3 1.4.2.4 1.4.2.5 1.4.2.6 1.4.2.7 1.4.2.8 1.4.2.9 1.4.2.10

联网................................................................................................................................40 系统设置.........................................................................................................................40 采用 SINUMERIK solution line 时的设置........................................................................40 设备网络中的系统启动....................................................................................................42 精简型客户端单元(TCU)............................................................................................43 出厂预设置......................................................................................................................44 调试 TCU........................................................................................................................46 操作 TCU 主菜单............................................................................................................46 操作其他 TCU 菜单.........................................................................................................49 在设备网络中注册 TCU..................................................................................................61 校准触摸面板..................................................................................................................64 连接 SIMATIC Thin Client 触摸面板...............................................................................66 配置 SIMATIC Thin Client 触摸面板...............................................................................67 文件“config.ini”中的设置...............................................................................................69 文件“tcu.ini”中的设置....................................................................................................72 采用 TCU 时的置换机制.................................................................................................79 通过 PLC 禁止 TCU 之间的切换.....................................................................................81

mcp2515sja1000通讯调试记录

MCP2515 SJA1000通讯调试记录一、CAN总线CAN是控制器局域网络(ControllerArea Network, CAN)的简称,是由研发和生产汽车电子产品著称的德国BOSCH公司开发了的,并最终成为国际标准(ISO 11898)。

SJA1000是飞利浦公司一款并行接口的CAN 协议控制器,为了减少IO口资源占用,Microchip推出SPI 接口CAN协议控制器,型号:MCP2515。

这两款芯片都支持CANV2.0B 技术规范,能发送和接收标准和扩展数据帧以及远程帧。

CAN电平:CAN数据格式:标准帧扩展帧远程帧(省略)二、原理图2.1、MCP2515的原理图2.2、SJA1000的原理图三、调试思路3.1、SPI接口调试3.2、CAN接口调试第一步:配置CLKOUT输出(CANCTRL寄存器配置CLKEN 和分频系数),通过示波器观察CLKOUT引脚输出。

确认MCP2515受控。

第二步:环路测试(自发自收)首先MCP2515配置成环路模式,下面是验证环路测试1、配置RXB0禁止滤波屏蔽标识符功能1、收发功能是否正常。

验证:RXB0接收数据(可以读取接收缓冲区获取)和发送数据对比,是否一致。

2、开启CANINTE.TX0IE、CANINTE.RX0IE中断,监测/INT和/RX0B 引脚电平变化。

理论上:1)成功发送数据,TXB0CTRL.TXREQ由1变成0和/INT引脚产生中断,且CANINTF.TX0IF发送中断标志位置1。

2)成功接收数据,/INT引脚产生中断,且CANINTF.RX0IF发送中断标志位置1。

同时RX0BF引脚出现低电平(前提使能RX0BF 接收缓冲区满中断引脚,BFPCTRL.BxBFE和BFPCTRL.BxBFM 置1)2、配置RXB0使能滤波屏蔽标识符功能(11位标准标识符)1、发送两组数据帧:先发送不符合滤波码的数据帧,然后发送符合滤波码的数据帧。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

CGA-CANADATAXATION 1 EXAMINATIONMarch 2007Time: 3 HoursNotes:1. This examination is based on the Canadian Income Tax Act (ITA) with Regulations (CCH 82nd Edition).2. Round all calculations to the nearest dollar, except price per share.3. The following items, applicable to the 2006 taxation year, are provided for reference:Federal Income Tax Rates — 20062006 Taxable Income Federal Marginal Tax Rate15.25%$36,378Upto–$72,756 22%$36,379$118,285 26%–$72,757andover 29%$118,286Personal Tax Credits 20061. Single status taxpayer (paragraph 118(1)(c))............................................................................................................. $ 1,3482. Married status taxpayer (paragraph 118(1)(a))Same as for single status taxpayer under (1) above,creditspousalof.................................................................................................................... 1,145 withanadditionalThe additional spousal credit is reduced if spouse’s net income exceeds (768)3. Eligible dependant status taxpayer (paragraph 118(1)(b))Same as for married status taxpayer in (2) above.4. Infirm dependants 18 years of age or older (paragraph 118(1)(d)) (600)The credit is reduced if dependant’s net income exceeds......................................................................................... 5,5805. Taxpayer is 65 years of age or over (subsection 118(2)) (620)6. Medical expenses credit (subsection 118.2(1))The maximum reduction for purposes of the credit........................................................................................... 1,8847. Caregiver — parent/grandparent (maximum) (paragraph 118(1)(c.1)) (600)The credit is reduced if dependant’s net income exceeds.........................................................................................13,4308. Education credit for each qualifying month (paragraph 118.6(2)(a)) (61)9. Education credit for each qualifying month (paragraph 118.6(2)(b)) (18)Marks130 QuestionSelect the best answer for each of the following unrelated items. Answer each of these items in yourexamination booklet by giving the number of your choice. For example, if the best answer for item (a)is (1), write (a)(1) in your examination booklet. If more than one answer is given for an item, that item willnot be marked. Incorrect answers will be marked as zero. Marks will not be awarded for explanations.Note:2 marks eacha. Which of the following statements is true regarding corporate income tax returns?1) A Canadian controlled private corporation (CCPC) must file an income tax return within 6months of its taxation year end only if it has taxable income.2) A CCPC must file an income tax return within 6 months of its taxation year end even if it has notaxable income.3) A public corporation must file an income tax return within 4 months of its taxation year end evenif its taxable income is nil and it has a loss for the year.4) A CCPC must file an income tax return within 4 months of its taxation year end if it has notaxable income and has no financial transactions during the year.b. Which of the following statements is correct regarding the penalty for failing to file a required incometax return?1) The person is subject to a penalty of 10% of the unpaid tax plus 2% of the unpaid tax per month toa maximum of 24 months.2) The person is subject to a penalty of 5% of the unpaid tax plus 1% of the unpaid tax per month toa maximum of 24 months.3) The person is subject to a penalty of 10% of the unpaid tax plus 1% of the unpaid tax per month toa maximum of 12 months.4) The person is subject to a penalty of 5% of the unpaid tax plus 1% of the unpaid tax per month toa maximum of 12 months.c. Which of the following statements is true regarding an individual’s status as a resident of Canada fortax purposes?1) An individual can only be a resident of Canada if he or she is present in the country for more than183 days.2) An individual can only be a resident of Canada if he or she is a citizen of Canada.3) An individual is deemed to be a resident of Canada if he or she maintains a dwelling place inCanada.4) An individual can be considered a resident throughout the year if he or she has a continuing stateof relationship with the country.d. There are several general objectives that are considered essential to a good tax system. The statement“individuals with income of $100,000 should proportionally pay more tax than those earning $40,000”is an example of which of the following general objectives?1) Neutrality2) Simplicity3) Competitiveness4) FairnessContinued...e. Chen moved to Canada from the United States in June 2006 and became a Canadian resident for taxpurposes. At the date of his arrival, he owned shares of YY Inc. (a U.S. public corporation) that had a market value of $30,000. The shares of YY were acquired in 2004 for $40,000. In August 2006, Chen acquired shares of CC Ltd. (a Canadian public corporation) for $10,000. In December 2006, he sold all of the YY shares for $38,000 and all of the CC shares for $4,000. Which of the following correctly describes the change to Chen’s net income for tax purposes in 2006 resulting from the sales of shares?1) Chen’s net income for tax purposes will not increase or decrease.2) Chen’s net income for tax purposes will increase by $1,000.3) Chen’s net income for tax purposes will decrease by $3,000.4) Chen’s net income for tax purposes will decrease by $4,000.f. Which of the following types of income is not taxable in Canada under Part I of the Income Tax Actwhen earned by a non-resident?1) Income from exercising a stock option2) Income from a grant or scholarship3) Taxable capital gain from the sale of real estate4) Dividends from a Canadian private corporationg. Gibb Inc. operates a large insurance company. It receives funds from clients who deposit money toearn interest to purchase life insurance. Gibb earns interest income from reinvesting the customer deposits in either bonds or loans to businesses. It also earns interest from customers who are late paying their premiums. Which of the following correctly describes the classification of the interest income earned by Gibb for tax purposes?1) All interest is classified as property income.2) The interest from overdue premiums is business income and all other interest is property income.3) The interest from overdue premiums and the interest from the business loan are business income,but the bond interest is property income.4) All interest is classified as business income.h. Which of the following sources of income is not subject to a withholding tax under Part XIII of theIncome Tax Act when earned by a non-resident?1) Taxable dividends from a Canadian public corporation2) Interest from a government of Canada bond3) Capital dividends from a CCPC4) Royaltiesi. HPO Inc. is a CCPC earning business and investment income. HPO owned shares in TT Ltd., also aCCPC. The TT shares cost $10,000 in 2001 and have a fair market value of $22,000. On December 31, 2006, HPO transferred the shares of TT to its sole shareholder, an individual, and treated the distribution as a dividend. Which of the following statements is correct regarding the transfer of the TT shares?1) HPO’s taxable income is increased by zero amount and the shareholder’s taxable income isincreased by $12,500.2) HPO’s taxable income is increased by $6,000 and the shareholder’s taxable income is increasedby $27,500.3) HPO’s taxable income is increased by $12,000 and the shareholder’s taxable income is increasedby $15,000.4) HPO’s taxable income is increased by zero amount and the shareholder’s taxable income isincreased by $10,000.Continued...j. Which of the following correctly describes the tax treatment of a net capital loss incurred by an individual?1) The loss can be carried back 3 years and forward 10 years and deducted against any source ofincome.2) The loss can be carried back 5 years and forward 20 years and deducted against taxable capitalgains.3) The loss can be carried back 3 years and forward indefinitely and deducted against taxable capitalgains.4) The loss can be carried back 5 years and forward 10 years and deducted against any source ofincome.k. Which of the following statements is true regarding salary/bonus versus dividend distributions from a CCPC to a shareholder/manager in the highest tax bracket?1) If the corporation earns active business income over $300,000, it is always better to pay adividend to take advantage of the dividend tax credit.2) If the corporation earns active business income over $300,000, a bonus should always be paid toreduce income to $300,000 whether or not the shareholder/manager needs the funds.3) If the corporation earns active business income over $300,000, and the shareholder/manager is notin need of additional funds, a bonus should only be paid if the avoidance of double taxationoutweighs the returns that can be made by retaining the funds in the corporation for reinvestment.4) If the corporation earns active business income over $300,000 and the shareholder/managerrequires additional funds, either a bonus or a dividend can be paid because corporate and personal income tax is integrated.l. Which of the following properties is not a listed personal property?necklace1) A2) An antique phonograph machine3) A rare coinmanuscriptantique4) Anm. Which of the following is not a traditional test to determine if an individual is an employee or an independent contractor?test1) Service2) Economic reality testtest3) Integrationtest4) Controln. Which of the following statements is true regarding an RRSP?1) A withdrawal to pay for medical expenses can be made on a tax-free basis.2) An individual’s net rental income will increase the contribution limit.3) An individual is not eligible to contribute to an RRSP after the age of 65.4) An individual’s unused contribution limit can be carried for a maximum of 5 years.o. The common voting shares of Reo Ltd., a CCPC, are owned 20% by Carl, 55% by Sheila, and 25% by Bear Ltd., a CCPC. Sheila also owns 40% of the voting shares of Bear. The remaining shares of Bear are owned 20% each by Henry, George, and Peter, who are not related to Carl or Sheila. Which of the following correctly describes the tax relationship between Reo and Bear?1) Reo and Bear are connected and related but not associated.2) Reo and Bear are associated, connected, and related.3) Reo and Bear are connected but not associated or related.4) Reo and Bear are not associated, related, or connected.245 QuestionTable Inc., a CCPC, operates a manufacturing and wholesale business. Financial statements for the yearended December 31, 2006 report a net income before tax of $524,000.You have been retained to determine the corporation’s income tax liability and provide advice on other taxmatters. You have gathered the information outlined in Exhibit 2-1.Required26 a. Under Part I of the Income Tax Act, calculate Table’s minimum net income for tax purposes andminimum taxable income for the 2006 taxation year.16 b. Based on your answer to part (a), calculate the minimum Part I, Part IV federal income tax, andRDTOH account for the 2006 taxation year (ignore surtaxes and do not calculate the general ratereduction).3 c. Briefly explain how tax can be minimized for the proposed dividend distribution in 2007 (Exhibit 2-1,item 7).EXHIBIT 2-1TABLE INC.2006 Financial Information1. Table’s net income for tax purposes is summarized as follows:Wholesale division income $ 190,000Manufacturing division income 222,000Net loss on sale of assets (20,000)Dividend income — Public companies 12,000Share of income of ZZ Ltd. 120,000$ 524,0002. Table owns 60% of the shares of ZZ Ltd. For ZZ’s year ended December 31, 2006, it reported netincome before tax of $200,000 and claimed the small business deduction on $160,000. ZZ paid adividend of $15,000 in 2006, of which $9,000 was received by Table. The dividend was not includedin income but was credited to the ZZ investment account on the balance sheet. At the time of thedividend, ZZ had RDTOH of $7,000.3. A review of Table’s 2005 corporate tax return provides the following information:Capitalaccount $ 8,000 dividendCumulative eligible capital 40,000 RDTOH 3,000 Undepreciated capital costClass10.1 17,00010 30,000Class12 10,000Class13 60,000Class43 180,000ClassContinued...4. On July 1, 2006, Table purchased a competitor’s business for $400,000, which included the following: Goodwill $ 100,000 equipment 20,000 ComputerInventory 240,000 Manufacturingequipment 40,000On September 1, 2006, Table purchased a new delivery truck for $60,000 and traded in an older truck valued at $20,000 that was originally purchased for $36,000. Table also sold a passenger vehicle for $12,000 that originally cost $32,000. A replacement vehicle was leased.Table occupies leased premises under a 10-year lease agreement with one renewable option of 5 years.The lease began on January 1, 2000 when leasehold improvements costing $80,000 were added.In August 2006, Table sold a parcel of land it had acquired to build a new warehouse when a new and more suitable site became available. Consequently, it sold the original parcel of land for $100,000(original cost $80,000) and leased the new property.5. Table’s income statement for the year ended December 31, 2006 included the following:68,000 Amortization $ Reserve for bad debts 22,000 Reserve for warranty obligations 8,000 bonuses 440,000 andSalariespromotion 14,000 andAdvertisingRepairs and maintenance 47,000At year end, salaries and bonus included a bonus payable of $40,000, which will be paid in4 installments of $10,000 each on March 15, June 15, September 15, and December 15, 2007.The reserve for warranty obligations relates to the purchase of the competitor’s business in 2006. At December 31, 2006, only $2,000 in warranty claims had been paid.Advertising and promotion include charitable donations of $5,000 and meals and drinks forentertainment purposes of $6,600.Repairs and maintenance include $7,000 for a utility connection for the recently acquired land.6. The company’s manufacturing and processing income for tax purposes in 2006 has been calculated tobe $230,000.7. No dividends were declared in 2006. However, Table intends to pay a dividend in 2007. The presidenthas asked for your advice on this matter as he wants to minimize the overall tax to the company and to the shareholders.25 Question3Susan is employed by J.P. Inc. She has requested your assistance in preparing her 2006 incometax return.Information regarding Susan’s financial activities for 2006 is outlined in Exhibit 3-1. Selected informationfrom her 2005 tax return is provided in Exhibit 3-2.Required19 a. Calculate Susan’s minimum net income for tax purposes in accordance with the format of Section 3 ofthe Income Tax Act, and her minimum taxable income for the 2006 taxation year. (Ignore the universalchild care benefit.)6 b. Based on your answer to part (a), calculate Susan’s minimum federal income tax for the 2006 taxationyear. Show all calculations.EXHIBIT 3-1SUSAN2006 Financial Information1. Susan’s salary in 2006 was $95,000. From this, J.P. deducted income tax of $24,000 and CPP and EIof $2,640. J.P. did not have a company pension plan. However, they contributed $6,000 to Susan’spersonal RRSP and $1,000 to a deferred profit sharing plan. J.P. also pays the premiums for privatemedical insurance ($1,000) and group term life insurance ($700).Susan uses a company car for both business and personal use. In 2006 she drove a total of 22,000 km,of which 16,000 km were for employment duties. J.P. purchased the automobile in 2005 for $44,000and its U.C.C. at the end of 2006 was $18,000. J.P. paid all the automobile operating costs, whichtotalled $2,400.J.P. also pays Susan a monthly travel allowance of $400 ($4,800 per year) for out-of-town travel foremployment purposes. In 2006, Susan spent $5,600 in travel costs for airfare and hotels. All mealswere paid directly by her manager who travelled with her.2. Susan owns shares in a private corporation left to her by her late husband. In 2006, she receiveddividends of $6,000 from the corporation. She also repaid a $20,000 loan to the corporation onDecember 31, 2006. She had borrowed the money from the company in 2004. In 2006, CRA indicatedthe loan period exceeded the permitted time limit and consequently assessed her with income of$20,000, being the amount of the loan. Susan had paid 5% interest annually to the corporation. Theloan had been used to purchase shares on the stock market.In December 2006, Susan sold 1,000 shares of XX Inc., a public company, for $20,000 ($20 pershare). Over the past 2 years her investment records showed the following transactions: Purchases:2004 — XX Inc. — 1,000 shares @ $8 $ 8,0002004 — PP Inc. — 1,000 shares @ $20 20,0002005 — XX Inc. — 1,000 shares @ $14 14,000Sales:2005 — PP Inc. — 1,000 shares @ $26 26,000Continued...3. Susan’s mother died in 2006. Susan received $20,000 from her mother’s life insurance policy and adiamond ring valued at $800. In 2004, her mother had gifted her a summer cottage valued at$120,000. In late 2006, Susan sold the diamond ring for $1,400 and the summer cottage for $110,000.4. Susan has 2 children. The 4-year-old daughter attends daycare. The 2006 daycare fees were $7,200.The 4-year-old earned $800 in interest from her grandmother’s estate. Her 16-year-old son also earned$800 from a summer job. In 2006 Susan paid dental fees of $3,800 for her son.EXHIBIT 3-2SUSANSelected 2005 Cantax SchedulesEND OF EXAMINATION 100TAXATION 1 [TX1]EXAMINATIONBefore starting to write the examination, make sure that it is complete and that there are no printing defects. This examination consists of 8 pages. There are 3 questions for a total of 100 marks.READ THE QUESTIONS CAREFULLY AND ANSWER WHAT IS ASKED.To assist you in answering the examination questions, CGA-Canada includes the following glossary of terms.GlossaryFrom David Palmer, Study Guide: Developing Effective Study Methods (Vancouver: CGA-Canada, 1996). Copyright David Palmer.Compare Examine qualities or characteristics thatresemble each other. Emphasize similarities,although differences may be mentioned. Contrast Comparebyobservingdifferences. Stressthe dissimilarities of qualities orcharacteristics. (Also Distinguish between) Criticize Express your own judgment concerning thetopic or viewpoint in question. Discuss bothpros and cons.Define Clearly state the meaning of the word orterm. Relate the meaning specifically to theway it is used in the subject area underdiscussion. Perhaps also show how the itemdefined differs from items in other classes. Describe Tellthewhole story in narrative form. Diagram Give a drawing, chart, plan or graphicanswer. Usually you should label a diagram.In some cases, add a brief explanation ordescription.Discuss This calls for the most complete and detailed answer. Examine and analyze carefully andpresent both pros and cons. To discussbriefly requires you to state in a fewsentences the critical factors.Evaluate This requires making an informed judgment.Your judgment must be shown to be basedon knowledge and information about thesubject. (Just stating your own ideas is notsufficient.) Cite authorities. Cite advantagesand limitations.Explain In explanatory answers you must clarify the cause(s), or reasons(s). State the "how" and"why" of the subject. Give reasons fordifferences of opinions or of results. Illustrate Make clear by giving an example, e.g., afigure, diagram or concrete example. Indicate Provide a short explanation.Interpret Translate, give examples of, solve, orcomment on a subject, usually making ajudgment on it.Justify Prove or give reasons for decisions orconclusions.List Present an itemized series or tabulation.Be concise. Point form is oftenacceptable. (Also Enumerate or Identify) Outline This is an organized description. Give ageneral overview, stating main andsupporting ideas. Use headings andsub-headings, usually in point form. Omitminor details.Prove Establish that something is true by citingevidence or giving clear logical reasons. Relate Show how things are connected with eachother or how one causes another,correlates with another, or is like another. Review Examine a subject critically, analyzingand commenting on the importantstatements to be made about it.State Present the main points in brief, clearsequence, usually omitting details,illustrations, or examples.Summarize Give the main points or facts in condensedform, like the summary of a chapter,omitting details and illustrations.Trace In narrative form, describe progress,development, or historical events fromsome point of origin.CGA-CANADATAXATION 1 EXAMINATIONMarch 2007SUGGESTED SOLUTIONSMarks Time: 3 Hours 130 QuestionNote:2 marks eachSources/Calculations:a. 2) Topic 1.4 (Level 1)b. 4) Topic 1.4 (Level 1)c. 4) Topic 1.9 (Level 1)d. 4) Topic 1.1 (Level 1)e. 2) Topic 10.1 (Level 1)1/2 (38,000 – 30,000) + 1/2 (4,000 – 10,000) = $1,000f. 4) Topic 10.2 (Level 1)g. 4) Topics 3.2 and 5.1 (Level 1)h. 2) Topic 10.3 (Level 1)i. 2) Topic 9.3 (Level 2)j. 3) Topic 7.2 (Level 1)k. 3) Topic 9.6 (Level 1)l. 2) Topic 6.4 (Level 1)m. 1) Topic 2.1 (Level 1)n. 2) Topic 5.8 (Level 1)o. 3) Topics 8.4 and 9.2 (Level 1)245 Question26 a. Minimum net income for tax purposes and taxable income:Net income per financial statements $ 524,000(Deduct):Add(1) Loss on sale of assets 20,000(1) Share of net income of ZZ Ltd. (120,000)(1) Dividend from ZZ Ltd. 9,000(1) Taxable capital gain on land – 1/2 (100,000 – 80,000) 10,000(2) CEC deduction — 7% (40,000) + 7% (3/4) 100,000 (8,050)(1) CCA — Class 10.1 — 1/2 (30%) 17,000 (2,550)(2) CCA — Class 10 — 30% (30,000) + (1/2 ) (30%) (60,000 – 20,000) (15,000)(1) CCA — Class 12 — 100% (10,000) (10,000)(2) CCA — Class 13 — lesser of (1/5) 80,000 = 16,000; 80,000 / (10 + 5) = 5,333 (5,333)(2) CCA — Class 43 — 30% (180,000) + (1/2) (30%) (40,000) (60,000)(1) CCA — Class 45 — 45% (1/2) (20,000) (4,500)(1) Amortization 68,000(1) Deferred bonus — beyond 180 days 20,000forwarranty obligations 8,000(1) Reservewarranty expense (2,000)(1) Actualdonations 5,000(1) Charitable(1) Entertainment meals — 50% (6,600) 3,300purposes 439,867taxforincome(2) NetDeduct:(2) Taxable dividends (12,000 + 9,000) (21,000)(5,000)donations(1) Charitable413,867income $TaxableNote:The 2 marks for net income for tax purposes are reduced if items that should be excluded from the calculation are incorrectlyincluded, such as capital loss on sale of truck, reserve for bad debts, and the utility connection.Continued...16 b. Federal tax:Part I tax:× $413,867 $ 157,26938%—Basicrate10%× $413,867 (41,387)—Abatement(2) 115,882Small business deduction (SBD) — 16% × least of:408,867income1 $ Activebusinessincome 413,867Taxable160,000) 140,000(300,000–limitBusiness× $140,000 (22,400)(2) 16%Additional refundable tax on investment income 62/3% × lesser of:Aggregate investment income — TCG (10,000) $ 10,000Taxable income less amount on which SBD is computed(413,867–140,000) 273,867(3) 62/3% × $10,000 667M&P deduction — 7% × lesser of:M&P income — Amount qualifying for SBD (230,000 – 140,000) $ 90,000Taxable income less amount on which SBD is computed(2) Minus investment income (413,867 – 140,000 – 10,000) 263,867 (6,300)87,849$1Active business income:Net income for tax purposes $ 439,867Deduct:gain (10,000)capitalTaxable9,000) (21,000)+Dividends(12,000408,867(2) $Parttax:IV3,000 (1) ZZ Ltd. — connected — 60% (5,000)2$331/3% × 12,000 4,000—(1) Other$ 7,0002ZZ’s refund: lesser of 1/3 (15,000) = 5,000 or RDTOH of $7,000RDTOH:Opening $ 3,000tax 7,000IV(1) PartRefundable portion of Part I tax — least of:262/3% × investment income (10,000 above) $ 2,667262/3% × taxable income less amount on which SBD is computed(413,867 – 140,000) 73,024tax 87,849 2,667I(2) Part12,667$3 c. Table should first utilize the capital dividend account to create a tax-free dividend. The balance in thecapital dividend account at December 31, 2006 is $18,000 (opening $8,000 + tax-free portion capitalgain $10,000). Also, the RDTOH balance is $12,667 and a taxable dividend of $38,000 would providea full refund (1/3× 38,000 = $12,667).25 Question319 a. Net income for tax purposes and taxable income:Section 3(a)Employmentincome:(1) Salary $ 95,000(1) RRSP contribution — benefit 6,000benefit 700 insurance(1) Life(1) Auto — standby charge 44,000 × 2% × 12 months = 10,560 × 6,000 / 20,000 km 3,168(1) Auto — operating benefit — 6,000 @ 22¢ 1,320allowance 4,800(1) Travel110,988(1) Less — travel expenses (5,600)105,388 income:Property× 1.25 $ 7,5006,000(1) Dividend—(1) Less interest expense — 20,000 × 5% (1,000) 6,500Section 3(b)Taxable capital gain:(1) Shares of XX Inc. — proceeds 1,000 × $20 $ 20,000(1) Less ACB (8,000 + 14,000) / 2,000 = $11 × 1,000 11,0009,000×1/24,5009,000—(1) TaxableNet gain from LPP1/2 (1,400 – 1,000 deemed) 200NIL 4,500(2) LPP loss — Cantax 200116,388 3(c)SectionOtherdeductions:of $7,000; $7,200 actual; 2/3 (105,388) = $70,258 (7,000)least(1) Childcare—(1) RRSP — limit by Cantax (5,000)104,388 3(d)Sectionloan (20,000)shareholder(1) Repaymentoftaxpurposes 84,388forincome(1) NetDeduct:(1) Net capital loss (limit to net taxable gains) (4,500)79,888income $ TaxableNote:The 1 mark for net income for tax purposes is reduced if items that should be excluded from the calculation are incorrectly includedsuch as DPSP, private health insurance, life insurance proceeds, child’s income, loss on summer cottage (personal use property).Continued...6 b.tax:Federal× 15.25% $ 5,548 $36,378× 22% 8,003 36,3787,132 × 26% 1,85479,888 15,405(1) $credits:Tax$7,500× 131/3% (1,000)—credit(1) Dividendtax(1) Individual (1,348)(1) Equivalent to spouse — (claim daughter) 1,145 – 15.25%* (800 – 768) (1,140)2,640× 15.25%* (403) —(1) CPP/EI× (3,800 – 1,884) (292)15.25%(1) Medical—$ 11,222 * Will accept rate applied to the lowest income bracket in the federal tax calculation.END OF SOLUTIONS 100。