CoCo Bonds Valuation with equity - and Credit-Calibrated First Passage Structural Models

投资组合:可口可乐公司股票估值

………………………………………………最新资料推荐………………………………………投资组合案例三可口可乐公司股票估值120103班第19组陈明3112000110(执笔)陈润城3112000111(统筹策划)韦昭亦3212002283(资料收集)2014-12-01目录一、背景 (1)二、估值模型介绍 (1)1绝对估值模型 (1)2相对估值模型 (2)三、可口可乐公司股票估值 (3)4.1红利贴现模型估值 (3)4.2加权平均资本贴现模型估值 (3)4.3市盈率倍数法估值 (5)四、结果对比和分析 (6)附录 (7)一、背景可口可乐公司(The Coca-Cola Company)成立于1886年5月8日,总部设在美国乔亚州亚特兰大,是全球最大的饮料公司,拥有全球48%市场占有率以及全球前三大饮料的二项。

在很多国家的市场上都占有主导地位。

可口可乐公司的股价从1996年6月的每股45美元涨到1997年6月的每股70美元和很高的市盈率从截止到1997年8月的情况看,近来可口可乐公司的业务不断拓展,其利润能够稳定增长。

但是可口可乐公司的股价却是滑落到了58美元,为了判定可口可乐公司的当前股价,运用三种股票估值方法进行估算分析。

根据其结果和估值方法的优缺性判定可口可乐公司当前股价是被高估还是低估。

二、估值模型介绍1.绝对估值模型(一)股利贴现模型:简称DDM,是一种最基本的股票内在价值评价模型。

优点:(一)红利贴现估价模型简单、直观,使用简洁与快捷。

(二)可以更好的反映公司内在价值,强调公司创造未来现金流量和股利分配的能力而不仅仅是当前每股盈利状况。

缺点:它本身附加多种假设或限制条件,产生对它估价结果质疑。

除少数部分具有稳定高红利的股票使用其估计有效外,其他估计大有偏颇,模型缺乏普遍适用性。

计算公式:P = D×(1 + g)/( k — g)其中:P= 股票的内在价值= 1997年的红利Dm = 1998年预期红利率(1998年四个季度红利之和除以当前股价)g = 预期的红利增长率(二)加权平均资本成本贴现模型:即资本现金流贴现模型。

美股灰犀牛从股份回购到债务杠杆

19汇回非流动资产的税率降至8%,跨国企业汇回海外留存收益的动力加强,仅2018年一季度美国跨国企业的回流资金就超过了3000亿美元。

三是低利率环境下上市公司的债务融资。

次贷危机爆发后,美联储迅速将联邦基金利率降至零附近,投资级企业债收益率由次贷危机前的约6%震荡下行至2019年末的约2.5%,推动美国企业债务加速扩张。

2005年以来,非金融部门企业的债券净融资额连续攀升,而股权净融资额持续为负,表明新股发行规模远远低于股份回购和并购交易。

2009-2019年间,股权与债券净融资呈现出明显的负相关关系,意味着大量上市公司将发债募集资金用于股份回购和企业并购。

国际清算银行(BIS)的报告显示,在进行了股份回购的上市公司中,仅通过发债融资的公司比例由2009年的8%持续上升至2019年的26%,仅通过股权融资的公司比例由35%下滑至22%。

疫情期间美股回购的变化疫情期间,美国上市公司股份回购表现出了一些新特征,与过去总结的经验规律明显不同。

其一,股份回购规模下降,但美股逆势上涨。

2020年受疫情冲击,美国经济陷入衰退,企业经营面临困境,打击了上市公司的派息和回购意愿。

2020年美国上市公司回购总金额由2019年的8117亿美元大幅下降至4629亿美元,扣除股票发行量后,回购净额由2019年的6052亿美元下降至1278亿美元。

其中,标普500指数成分公司的回购金额由2020年一季度的1551亿美元大幅回落,二、三、四季度的平均回购金额约为850亿美元,为2014年以来的最低水平。

上市公司股份回购大幅萎缩,但美股依然在力度空前的政策刺激下逆势上涨。

美联储重返零利率并推出大规模量化宽松,市场流动性极度充裕。

低利率环境下,市场风险偏好提升,增量资金涌向回报率更高的风险资产,推动美股三大股指屡创新高。

2020年美股回购规模与股价走势背离,表明在货币宽松时期,上市公司的股份回购并非是影响美股涨跌的决定性因素。

ch07 Bonds and Their Valuation 财务管理基础课件

Using a financial calculator to value a bond

This bond has a $1,000 lump sum due at t = 10, and annual $100 coupon payments beginning at t = 1 and continuing through t = 10, the price of the bond can be found by solving for the PV of these cash flows.

CHAPTER 7 Bonds and Their Valuation

Key features of bonds Bond valuation Measuring yield Assessing risk

7-1

What is a bond?

A long-term debt instrument in which a borrower agrees to make payments of principal and interest, on specific dates, to the holders of the bond.

7-10

What is the value of a 10-year, 10% annual coupon bond, if kd = 10%?

0

1

k

VB = ?

100

2

...

100

n 100 + 1,000

VB ($11.10100)...($11.101000)($11.,101000)0 VB $90.91... $38.55 $385.5 VB $1,000

金融词汇英语翻译(U-Z)

金融词汇英语翻译(U-Z) Underlying 基础工具;所代表或相关的Underwriter 包销商;承销商Underwriting 包销 - [股市] 传统的做法是一或多家银行保证在某个数目日子里,按某固定价格担保购买若干数目的股份。

此类包销目前普遍被称为硬包销,相对于建立投资者购股意愿档案(Bookbuilding) 的做法,后者是一个要求投入努力的结构而非仅在 Bookbuilding 程序结束时。

包销商将买入发行没有售出的所有股票。

Underwriting syndicate 承销银团Undistributed profit 未分配利润Unilateral/bilateral agreement 单方面/双边协议Unit trust 单位信托Unlisted security 未上市证券Unsecured debt 无担保债务Upfront premium payment 一次清偿权利金Upfront payment/fee 首笔支付费用Upfront premium payment 一次清偿权利金Upside risk 上调风险US Financial Firm/Institution 美国金融公司/机构US Investment Bank 美国投资银行US GAAP 美国一般公认会计原则US Treasury 美国国库债券Use of proceeds 所得款项用途Utilization rate 利用率;使用率Valuation 估值Value-at-risk 风险值Value added tax 增值税Value investment 价值投资Vanilla bonds 纯债券Variable equity return 浮动股本回报 (率)Venture capital 创业资金;创业投资Vertical merger 垂直式合并Video conference 视像会议Volatility 波动率;波幅 - 一种基础工具之价格变化程度 (单非方向) 的测度。

基于Copula双变量模拟的CoCo债券定价

基于Copula双变量模拟的CoCo债券定价李平;尹菁华;来娜;黄光东【摘要】用Copula函数刻画公司股价与核心一级资本比率(core tier 1 ratio, CTR)的相关性,然后通过模拟股价和CTR,建立了或有可转换债券(CoCo)以及带期权条款的或有可转换债券(CoCoCo)的定价模型。

并将模型应用于塞浦路斯银行发行的CECS(convertible enhanced capital securities)债券,发现用Copula刻画股价与CTR相关性的定价结果与债券实际价格的差异优于假设两者独立时的结果。

最后结合国际上已发行的CoCo和CoCoCo债券的相关条款以及我国银监会对于减记债的基本要求,以交通银行为例设计了中国版的CoCo债券和CoCoCo债券,并依据所给模型对它们进行了数值计算。

%The correlation of stock price and core tier 1 ratio(CTR) is described by using a copula function. By simulating the stock price and CTR, the pricing models of CoCo bonds and CoCoCo bonds are established. The empirical study on the CECS(convertible enhanced capital securities) issued by Bank of Cyprus shows that the pricing results under the copula dependence structure are better than those assuming independent. Finally, combining with the relevant provisions of existing international CoCo and CoCoCo bonds and the basic requirements of China Banking Regulatory Commission for write-down debts, the Chinese version of CoCo and CoCoCo bonds for the Bank of Communications are designed as exsamples, and the numerical calculation based on the given pricing model is implemented.【期刊名称】《系统工程学报》【年(卷),期】2016(031)006【总页数】11页(P772-782)【关键词】CoCo债券;CoCoCo债券;核心一级资本比率;Clayton Copula【作者】李平;尹菁华;来娜;黄光东【作者单位】北京航空航天大学经管学院,北京100191;广发证券,广东广州510075;北京航空航天大学经管学院,北京100191;中国地质大学北京信息学院,北京100080【正文语种】中文【中图分类】TP273CoCo债券是2008年次贷危机后出现的新型债券品种,主要被银行用于补充资本金,对于银行系统的稳定有重要作用.2009年以来国际上已有多家银行发行CoCo债券,如劳埃德银行集团(Lloyds BankingGroup),塞浦路斯银行(The Bank of Cyprus)和西班牙毕尔巴鄂比斯开银行(Banco Bilbao Vizcaya Argentaria)等.CoCoCo债券是在CoCo债券的基础之上增加了转换期权条款,转股价格一般高于当前股价,因此当银行经营良好时,投资者可以获得超过普通债券的收益,所以CoCoCo债券的潜在回报要高于CoCo债券.塞浦路斯银行于2011–06–02发行并于2012–12–31触发减记条款的CECS是CoCoCo债券的典型代表.2012年以来,我国银监会先后发布了两份关于国内银行发行减记债的指导意见,允许国内银行发行减记债.从其特征来看,减记债可以看作是中国版的CoCo债券[1].根据指导意见,五大国有商业银行和兴业、光大、民生、平安等股份制银行,以及10余家城市商业银行和农村商业银行,均发行了减记型二级资本工具,发行总额超过4200亿元.平安银行于2014年3月发行了国内首只上市交易的减记债.由于巴塞尔委员会以及各国金融监管机构都对CoCo债券的设计提出了自己的要求,本文将把研究重点放在CoCo和CoCoCo债券的定价上.目前对CoCo债券定价的相关研究已经比较丰富.Madan等[2]在结构化定价模型的基础上使用4个相互独立的Levy过程同时对资产和负债的收益率进行模拟,更接近实际的同时也使得模型异常复杂;Barucci等[3]使用双时间段的结构化模型,对减记(writing down)前后资本构成各部分价值进行了分析;Pelger[4]在CoCo债券期限有限以及资产收益率服从跳扩散过程的假设下对CoCo债券进行了定价;Chen等[5]使用了带有两个跳跃过程的跳扩散模型,分别表示公司特有风险和市场风险;Pennacchi等[6]运用结构化模型为COERC(call option enhanced reverse convertible)这种带有看涨期权的CoCo债券进行定价.Yang等[7]给出了结构化模型下资产服从跳扩散过程时CCS(contingent convertible security)资产价值的闭式解;Spiegeleer等[8]提出了CoCo债券定价的股权衍生品模型及信用衍生品模型,将期权定价方法及信用风险度量方法应用到CoCo债券定价中;Brandt等[9]采用信用衍生品方法为CoCo 债券定价,计算出CoCo债券的信用风险溢价,利用现金流折现公式得到CoCo债券的定价公式; Cheridito等[10]采用信用衍生品定价模型,假设CoCo债券触发服从时变的泊松过程,从而给出CoCo债券的定价公式,并在此基础进行CoCo债券的风险分析;Corcuera等[11]应用权益衍生品定价方法,给出了息票可取消的CoCo债券的定价公式,结果表明,息票可取消的CoCo债券可以改善Hillion等[12]认为的转换条款会带来的死亡螺旋情况;Veiteberg等[13]提出使用股价与核心一级资本比率(CTR)双变量来估计CoCo债券价格.国内相关研究方面,王晓林等[14]针对市场的不完备性对CoCo债券进行了设计和定价,并研究了包含CoCo债券的公司最优资本结构.秦学志等[15]用债转股概率刻画CoCo债券的触发点,建立了基于不同触发点的CoCo债券的银行最优资本结构模型.秦学志等[16]利用二叉树模型给出了离散时间下或有可转债定价公式,并将其推广到连续时间情形.由于CoCoCo债券出现得更晚,因此研究文献很少.Girolamo等[17]首次对CoCoCo债券进行了详细介绍和定量分析:在股权衍生品模型下,假设股价波动服从Heston模型,无风险利率满足Hull-White模型,然后对CoCoCo债券进行了定价.Girolamo等认为,CoCoCo债券可以给投资者向上的获利空间,对投资者的吸引力要优于普通的CoCo债券,同时可以降低银行的融资成本.目前已有的关于CoCo和CoCoCo债券定价的研究文献存在的主要问题在于,没有恰当地度量股价与核心一级资本比率(CTR)之间的相关性.结构化模型以及股权衍生品模型均使用公司的市场价值来度量CoCo债券的价值.但是已有的CoCo债券均使用核心一级资本比率(CTR)作为减记指标,而CTR是以财务数据为基础进行计算的.于是上述三种模型就隐含了市场价值与CTR高度相关的假设,而Veiteberg[13]则假设了股价与核心资本比率相互独立,走向另一个极端.本文作者通过对国内16家上市银行股价与核心一级资本比率的相关性进行分析,发现不同银行的相关系数的绝对值从0.04到0.95不等,因此单个银行简单地假设独立或高度相关并不能反映真实情况.此外,股价与CTR独立的假设没有考虑到二者的尾部相关性问题.当危机出现时,资金会偏好资本充足率较高的更安全的银行,这会带来资本充足率指标与股价在极端事件下的正相关性.CoCo债券的设计正是为了应对这种情况的出现,因而在考虑减记概率以及CoCo债券的相关风险时不能忽略资本充足率与股价的尾部相关性.刻画变量间尾部相关性的Copula理论在信用衍生品定价中有诸多应用.Li[18]用Copula函数刻画资产间的违约相关性;Hull等[19]运用因子Copula模型对NDS(nthto default swaps)进行定价;艾春荣等[20]将债券的流动性和违约风险及两种风险的相关性引入到公司债券定价中,并用Copula数刻画不同相关结构下公司债券的收益率和风险变化;周孝华等[21]应用Copula函数处理多元资产间的相关性;Li等[22]用动态Copula刻画了公司资产之间的动态违约相关性,然后对BDS(basket default swap)进行了定价.本文引入Copula函数来刻画核心一级资本比率CTR与股价之间的相关性,并建立CoCo和CoCoCo债券的定价模型.在实证研究部分,用Kolmogorov-Smirnov检验进行最优Copula函数的选取.检验结果表明,Clayton Copula与经验Copula的拟合效果最好.然后用估计的参数和Clayton Copula对将来的股价和CTR进行Monte Carlo模拟,并对塞浦路斯银行发行的CoCoCo债券做实证定价检验.最后根据我国银监会的要求与金融市场的现状,以交通银行为例设计了中国版的CoCo 和CoCoCo债券(即减记债),并进行数值定价计算.2.1 核心一级资本比率(CTR)的边缘分布Serjantov[23]以核心一级资本比率(CTR)为因变量上一期的CTR与均值的差值为自变量进行回归检验,发现二者具有显著的负相关关系,而且银行的CTR具有一定的均值回复特性.他还发现CTR的变化值的历史数据具有尖峰厚尾的特性,因此用带跳跃的Vasicek模型[24]来刻画CTR的变化率x(t)如下其中αC是CTR的均值回复参数,θC是CTR的目标值,σC1是x(t)的波动率,W(t)是维纳过程,JC(t)表示CTR变化率x(t)的跳跃部分,用于刻画CTR的厚尾,NC(t)是强度为λC的泊松过程,是独立同分布的随机变量.假设在一个时间段中最多只有一次跳跃发生,即N(t)=1,并参考Ball等[25],假设在[t,t+dt]时间段中发生跳跃的概率Q=λCdt,不发生跳跃的概率为1-Q.假设跳跃的幅度服从正态分布由于假设了每一个时间段中只有一次跳跃发生,因而模型中刻画的跳跃其实是时间段内多次跳跃相互作用后的结果,而且当时间段分割得足够多时,认为使用正态分布进行近似刻画是合理的.2.2 股价的边缘分布刻画股价收益率分布的模型有很多,Heston[26]提出的随机波动率模型由于较好地平衡了度量误差与计算速度,在期权定价中应用广泛.为了更好地描述股价收益率厚尾的特征,本文在Heston模型中加入跳跃成分.因此,股价的变化可表示为其中µS1与v(t)分别是股价的期望收益率和方差,z1(t)和z2(t)是相关系数为ρS的两个维纳过程,JS(t)表示股价的跳跃部分,并且z1(t)与JS(t)相互独立.这里跳跃发生的次数NS(t)是强度为λS的泊松过程,是独立同分布的随机变量;与刻画CTR的变动相似,这里仍假设在一段时间内最多发生一次跳跃,跳跃的幅度服从正态分布项表示在正常的价格波动下股价的预期外收益,JS(t)表示股价非正常波动下的收益. 2.3 Copula函数的选择本文采用Kolmogorov-Smirnov检验进行最优Copula函数的选取.Kolmogorov-Smirnov检验用于检验两样本是否服从相同的分布,此处用于检验拟合出的Copula与经验Copula是否为同一分布,并用检验的P值作为不同拟合模型的判别标准:P值越大,说明拟合效果越好,然后用极大似然法估计Copula的参数.2.4 CoCo和CoCoCo债券定价模型Serjantov考虑了CoCo债券同时发生减记和违约的情况,并使用Copula函数刻画二者之间的相关性.然而就CoCo债券的作用来看,它的目的主要是为高等级债权人提供损失的缓冲,保障银行经营的稳健.因此在实际发行中,Basel银行监管委员会及我国银监会都要求在减记条款中加入监管层指定的条款,即当监管机构认定银行陷入危机需要救助时,可以要求CoCo债券进行减记.基于此,假设减记事件始终发生在银行违约之前.因此,一个本金为N,到期日为T的CoCo债券的价格为其中ti,i=1,2,...,n为付息时间,ci为息票,B(ti)、B(T)及B(t,t+Δt)为贴现因子,Δt为两次付息之间的时间间隔,Ptr和Pntr分别表示CoCo债券发生和未发生减记的概率,Rtr表示减记时的回收额,在数值上等于减记时得到的股票的价值与减记债票面价值的比值.由上式可以看出,CoCo债券的价值由未减记时普通债券的息票和本金的现值及减记时回收的本金或转换出的股票的现值两部分构成.特别地,CoCoCo债券的理论价格为其中Pntr,nc、Ptr,nc及Pntr,c分别表示CoCoCo债券既未减记也未转股的概率、发生减记但未行使转股权的概率及未减记但发生转股的概率,Rtr,nc与Rntr,c分别表示减记但未行使转股权和行使转股权但未减记时的回收额.由上式可知,CoCoCo债券的价值由三部分构成:CoCoCo债券既未减记也未转股时作为普通债券的息票和本金的现值、减记时回收的本金或转换出的股票的现值、以及根据转换期权条款转换成的股票的现值.由于转股权的行使对应银行经营良好的情况,而减记对应了银行经营陷入危机的情况,因而这里没有考虑二者同时发生的情况.塞浦路斯银行于2011–06–02发行,2011–06–10上市交易,并于2012–12–31触发减记条款的CECS(convertible enhanced capital securities)是到目前为止唯一触发减记条款的CoCoCo债券,因此本节选取该产品作为实证研究对象来检验模型的定价效果.实证研究中使用了塞浦路斯银行的股价、银行核心一级资本比率以及减记债的相关历史数据,数据来源于Bloomberg终端.由于CECS的条款较为复杂,本文模型不能详尽地考虑所有条款,因而做了以下简化假设:由于CECS的息票取消条款以银行或中央银行的决定作为判断标准,很难使用定量模型进行刻画,因此模型中未考虑这一条款对价格的影响.单从这一点考虑,模型的理论价格应该高于实际价格.为了专注于CTR与股票价格之间的Copula相关性,模型假设无风险利率是常数.考虑到CECS使用6个月Euribor(欧元银行同业拆借利率)作为基准利率,因此模型中将使用定价日前一段时间6个月Euribor作为无风险利率.计算减记概率时,在用蒙特卡罗法模拟出的CTR路径的基础上,根据CECS的减记条款“核心一级资本比率CTR小于5%”计算出减记概率.CECS是无期限的CoCoCo债券,即若CECS没有减记或行权,CECS将一直存续.这里应用模型时只对价格估计日之后的40年时间进行模拟,若在模拟结果中40年后仍未减记或行权,则假设CoCoCo债券按照减记条款转换为普通股.CECS条款中减记时的转换价格为减记日前5日按成交量加权平均的股票价格,由于交易量数据难以获得,所以在估计时使用减记日前5日收盘价的简单平均作为减记的转换价格.在考虑转换期权的行使时间时,假设股票支付的股利为0.在每一个行权期间内,转换期权与美式期权十分相似.因为对于标的为不支付股利股票的美式看涨期权,不应提前行使期权,所以假设只在每个行权期间的最后一天行使期权.进一步假设,若在某个行权期间的最后一天转换期权的内在价值大于0,即股价高于行权价格,持有人将行使期权,而不会等到下一个行权期.3.1 模型参数估计首先基于历史数据进行参数估计,在不同参数下分别模拟过去一段时间的股价及CTR,并计算与历史数据的欧氏距离,距离最小时的参数即为最优参数.利用此方法得到最优参数估计值如表1和表2.随后应用Kolmogorov-Smirnov检验选择最优Copula,备选的Copula包括高斯Copula,t-Copula,Clayton Copula, Frank Copula和Gumbel Copula,检验结果如表3.根据检验结果发现Clayton Copula 是最优选择.最后用极大似然估计法得到Clayton Copula的参数θCl为1.116.3.2 实证定价结果和敏感度分析本节对塞浦路斯银行的CECS进行实证定价,然后对参数进行敏感度分析.3.2.1 实证定价结果根据CECS的条款,该CECS的面值为100,票面利率为前10次付息按6.5%固定利率,之后按照6个月Euribor+3%作为年化利率,每6个月更新一次.首次付息日为2011–12–31,然后每年6月30日及12月31日付息.减记条款为下列两项之一:1)CTR(实行Basel III之前)或普通股权一级资本比率(实行Basel III之后)低于5%;2)塞浦路斯中央银行认定塞浦路斯银行不能满足资本充足率要求.强制转换价格使用触发减记前5日的平均收盘价,但不高于3.3 EUR,且不低于1.0 EUR.行权价格为3.30 EUR.在参数估计的基础上,先应用Clayton Copula和式(1),式(2)模拟塞浦路斯银行的将来股价和CTR,进而根据减记条款计算减记概率和行权概率,然后由式(4)计算CECS 的价格,计算结果如表4及图1所示.为了比较,同时也给出了假设CTR与股价独立时的定价结果.由图1可以看出,用Clayton Copula度量CTR和股价相关性时得到的价格要明显低于假设二者独立时的CECS价格,其主要原因在于,相比于假设二者相互独立,使用Clayton Copula度量相关性时更好地估计了两者的尾部风险,因此估计出的减记概率要高出很多,而两种假设下对于行权概率的估计结果差别不大.为了更好地比较两种相关性假设下的计算结果,在表5中给出了塞浦路斯银行CECS的理论价格与市场价格的百分比偏差,如下表5.由表5可以看出,与市场价格相比,假设独立时的理论价格相对高估:除2011–12–31对价格的估计比较准确外,其余各点与市场价格的偏差均在20%以上.由此可以认为,假设股价与CTR相互独立时估计出的理论价格与市场价格偏差过大,不能反映CECS的实际风险水平.使用Clayton Copula计算出的理论价值在多数时间与市场价格比较接近,而2011–12–31及2012–03–31两次估计的理论价格和市场价格的偏离较大,在30%以上.造成这一现象的原因在于,在这段时间CTR出现了小幅上涨,而股价跌幅较大,二者的走势出现了背离.CECS的市场价格在这段时间受CTR的变动影响较大,并没有出现大幅下跌.当使用Clayton Copula考虑了CTR与股价之间的相关性时,股价的大幅下跌增大了模型对减记概率的估计,使得模型的理论价格低于市场价格.Copula模型由于使用股价数据获得了市场对塞浦路斯银行未来的悲观预期,早于其他投资者预判了CECS的减记风险,而市场价格过于依赖于财报中发布的CTR 数据,低估了减记风险.3.2.2 模型对参数的敏感性分析本节对定价模型中的参数进行敏感性分析,主要是对最优参数值上下变动50%进行分析.图2与图3为CECS实证定价结果以及减记概率对于θS,ρS,θC和θCl四个参数的敏感性分析结果.可以看出,定价结果以及减记概率对θS和ρS的变动均是敏感的,而对θC和θCl的变动并不敏感,其他未画出图像的参数与θC和θCl结果类似,敏感性不高.θS表示股价波动率的长期回复均值,股价的波动率从长期来看围绕这一均值波动.θS减小(增大)会使得估计出的股价出现大幅波动的概率减小(增大).由于在发行日塞浦路斯银行的CTR距离减记值较远,股价波动率的降低也造成了CTR估计值的波动率降低,使得减记概率大幅下降.因此在θS减小时会使得模型估计的价格变高.ρS反映的是股价率波动率与股价收益率之间的相关性.由式(2),ρS增大(减小)时,股价收益率波动率与股价收益率产生同向变动的概率增大(减小),这使得股价收益率获得正向大幅波动和较小波动的概率增大(减小),这意味着尖峰厚尾特征更加明显(不明显),并且正向的厚尾要大于负向的厚尾.因此模型估计减记概率随ρS增大而减小,估计价格随ρS增大而增大.这里的敏感性分析结果与3.2.1节的实证定价分析结果一致,即定价结果受到股价的影响较大,而受到CTR变动的影响较小.这也是股价与CTR出现走势背离时模型定价结果与市场价格出现背离的原因.3.2 节选取塞浦路斯银行发行的CECS作为实证研究对象,检验了本文模型的定价效果,并进行了模型的参数的敏感性分析.这一节将借鉴国际上CoCo债券与CoCoCo债券的发行经验,并结合国内市场的实际情况,进行中国版CoCo和CoCoCo债券(减记债)的设计与定价,计算方法与实证定价中使用的方法相同.虽然平安银行于2014年3月发行了国内首只上市交易的减记债,但该减记债的设计比较简单,没有使用CTR作为减记指标,因此不将其作为研究对象,而是结合国际上已发行的CoCo和CoCoCo债券的条款以及中国银监会对减记债的要求,设计一款新的银行减记债,并对其进行定价.4.1 中国版CoCo和CoCo Co债券条款设计表6给出了参考国际上已发行的CoCo和CoCoCo债券的相关条款,以及银监会对于减记债的基本要求设计的一款中国交通银行CoCoCo债券(减记债).该表主要包括三部分:基本条款、减记条款和期权转换条款.如果没有第三部分的期权转换条款,该债券就是CoCo债券.假设该减记债为其他一级资本工具的监管范围,设定减记事件时直接使用了银监会的要求,而没有加入更多的减记条件.在银行的选择标准上,本文选取市场化程度相对较高且在国内市场有一定影响力的上市银行.交通银行是中国第一家全国性的国有股份制商业银行,已在香港联交所和上海证券交易所两地上市,是国内最大的股份制银行.在设定转换期权条款时,参考中国工商银行和中国银行发行的可转债相关条款,使用交通银行过去3年历史价格的75%分位数作为行权价格,发行3年后可行使转换期权,并且每年6月及12月最后一个交易日为期权的行权日.由于不发放股利的美式看涨期权不应该提前行权,而我国股市的红利发放并不在6月和12月,因而行权日是6月和12月整月还是最后一个交易日本质上没有区别.在票面利率的设定上,由于在实际发行中一般是招标发行,即票面利率由市场决定,因此将对不同的票面利率进行试算,然后计算出减记债平价发行的票面利率.4.2 参数估计下面用交通银行上市以来的股价数据及财务数据对交通银行的CTR和股价的边缘分布进行参数估计,数据来源于万得数据库,估计结果如表7和表8所示.然后用Kolmogorov-Smirnov检验来选择最优Copula,结果如表9.检验结果显示,Clayton Copula的拟合效果最好,与第3节的实证结果一致.θCl的极大似然估计值为0.033 5.4.3 交通银行CoCo和CoCoCo债券定价这一部分将在不同票面利率下,计算4.1节中设计的交通银行CoCo和CoCoCo债券的价格.假设减记债的面值为100元,票面利率为3%,选用最新一日(2014–03月–13)的国债收益率曲线作为定价中的贴现率,并假设收益率曲线在减记债持续期内不发生变化.先用4.2节中估计的参数和Clayton Copula,对交通银行的将来股价和CTR进行10万次Monte Carlo模拟,然后根据模型路径和减记事件的设定得到减记概率为30.2%,行权概率为25.3%,预期持续期为2 208 d.进而分别由公式(3)和(4)得到票面利率为3%时所设计的交通银行CoCo和CoCoCo债券的理论价格分别为52.5元和107.3元.由于票面利率的变动并不影响减记概率、行权概率以及预期持续期,因而在计算不同票面利率下的减记债价格时没有再进行更多的Monte Carlo模拟,而是在3%票面利率下的理论价格的基础上,用息票的预期折现价值对理论价格进行调整.在持续期为2 208 d时,1%息票的折现值为5.51元.这样可以得到CoCo和CoCoCo债券平价发行时的票面利率分别为10.30%和1.68%.表10给出了对于是否考虑转换期权的交通银行减记债(分别对应于CoCo债券和CoCoCo债券)的计算结果,即CoCoCo债券包含表6中的全部条款,CoCo债券包含基本条款和减记条款两部分.因为CoCoCo债券比普通的可转债多了不利于债券持有者的减记条款,而比CoCo 债券多了有利于债券持有者的期权转换条款,所以从理论上讲,CoCoCo债券的票面利率应该高于同一银行发行的可转债的票面利率,而低于同一银行发行的CoCo债券的票面利率,而CoCo债券的票面利率应高于同一银行发行的普通债券.由表10可以看出,模型估计的CoCoCo债券票面利率(1.68%)高于当前市场上上市银行可转债的平均票面利率(1.03%),而低于模型估计的CoCo债券票面利率(10.3%);与此同时,模型估计的CoCo债券票面利率(10.3%)高于交通银行普通债券的平均利率(5.62%),与理论预期相符.从以上对比可知,CoCoCo债券的利率要远低于普通债券及CoCo债券.可以认为,CoCoCo型减记债在为银行补充资本金的同时,还可以以较低成本进行融资,而CoCo债券的发行将给银行带来较大的利息支出压力.从这点来看,发行CoCoCo债券将是比CoCo债券更好的选择.这里对于资金成本的讨论仅为初步讨论,并没有将转换期权成本以及不同到期期限对利率的影响考虑进来.本文应用Clayton Copula对股价与CTR两个变量间的相关性进行了刻画,建立了CoCo和CoCoCo债券的定价模型,然后分别对塞浦路斯银行的CECS以及所设计的中国交通银行减记债进行了定价和敏感度分析.以往的研究认为,由于CTR数据频率低并且易人为操纵,CTR对未来风险的估计精确度比股价数据要差很多.使用Copula函数将两变量联系起来为CTR数据的使用带来以下优点:一方面可以用较精确的股价数据对CTR的估计进行修正,另一方面,当CTR没有新数据到达时,可以利用股价的变动将市场观点考虑到对减记概率的估计中来.实证结果显示,使用Copula刻画股价与CTR之间的相关性得到的定价结果明显好于假设二者独立时的结果,并且当CTR与股价走势出现背离时,使用Copula刻画相关性可以提前预判银行的风险,而市场价格则过于看重减记指标CTR的变动,低估了当时的减记风险.在数值分析中,使用交通银行的数据进行了虚拟发行定价.结果显示,CoCoCo债券由。

CFA考试《CFA一级》历年真题精选27(附详解)

CFA考试《CFA一级》历年真题精选27(附详解)1、Given the following portfolio data, the portfolio return is closest to:【单选题】A.8.2%.B.10.0%.C.10.8%.正确答案:C答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle0.45 × 16 + 0.25 × 12 + 0.30 × 2 = 10.80.2、The following table represents the history of an investment in a company:The investor does not reinvest the dividends that he receives. Assuming no taxes on dividends, the time-weighted rate of return on this investment is closest to:【单选题】A.1.93%.B.2.40%.C.2.57%.正确答案:B答案解析:“Discounted Cash Flow Applications”, Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA2013 Modular Level I, Vol. 1, Reading 6, Section 3, 3.2Study Session 2-6-c, dCalculate and interpret a holding period return (total return).Calculate and compare the money-weighted and time-weighted rates of return of a portfolio and evaluate the performance of portfolios based on these measures.B is correct. First, calculate the portfolio value at the beginning and end of each period and the dividends received over the three years:Then, calculate the holding period return (HPR) for the three years by using the following formula:The time-weighted return (TWR) is found by taking the geometric mean of the three holding period returns:3、An analyst gathered the following information about a company:Which of the following statements best describes the company’s price-to-earnings ratio (P/E)? Compared with the company’s trailing P/E, the P/E based on the Gordon growth dividend discount model is:【单选题】A.the same.B.higher.C.lower.正确答案:C答案解析:The P/E based on the Gordon growth dividend discount model is lower:Section 54、Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?【单选题】A.FCFE is a measure of the firm’s dividend paying capacity.B.FCFE models provide more accurate valuations than the dividend discount models.C.A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.正确答案:B答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFAA is correct. FCFE is a measure of the firm’s dividend paying capacity.5、An analyst gathers the following information about two companies in the same industry:What is the most appropriate conclusion regarding investors’ expectations? Compared to Company B, Company A has:【单选题】A.higher intrinsic value as reflected by its higher market price.B.higher sustainable growth as reflected by its higher return on equity.C.lower future investment opportunities due to its lower price-to-book ratio.正确答案:C答案解析:“Overview of Equity Securities” Ryan C. Fuhrmann, CFA, and Asjeet S. Lamba, CFA6、The following table shows changes to the number of common shares outstanding for a company during 2012:To calculate earnings per share for 2012, the company’s weighted average number of shares outstanding is closest to:【单选题】A.215,000.B.315,000.C.430,000.正确答案:C答案解析:The weighted average number of shares outstanding is time weighted:Section 6.27、The yield on a U.S. Treasury STRIPS security is also known as the Treasury:【单选题】A.spot rate.B.yield spread.C.forward rate.正确答案:A答案解析:“Understanding Yield Spreads”, Frank J. Fabozzi, CFAA is correct because a STRIPS security is a zero-coupon bond with no default risk and therefore represents the appropriate discount rate for a cash flow certain to be received at the maturity date for the STRIPS.8、The most likely impact of adding commodities to a portfolio of equities and bonds is to:【单选题】A.increase riskB.enhance return.C.reduce exposure to inflation.正确答案:C答案解析:“Investing in Commodities,” Ronald G. Layard-LieschingC is correct. Over the long term, commodity prices are closely related to inflation and, therefore, including commodities in a portfolio of equities and bonds will reduce its exposure to inflation.9、An analyst does research about inventory methods.A company with no initialinventory on hand made the following purchases of inventory in 2011:At the end of 2011, the company had 5 000 units of inventory on hand.Undera periodic inventory system, ending inventory using the weighted average costmethod is closest to:【单选题】A.$ 43 000 less than using the FIFO method.B.$ 32 000 more than using the FIFO method.C.$ 43 000 more than using the FIFO method.正确答案:A答案解析:average price of one unit = (7 000 × $ 76 + 10 100 × $ 80 + 8 000 × $ 91)/(7 000 + 10 100+ 8 000) = $ 82.4。

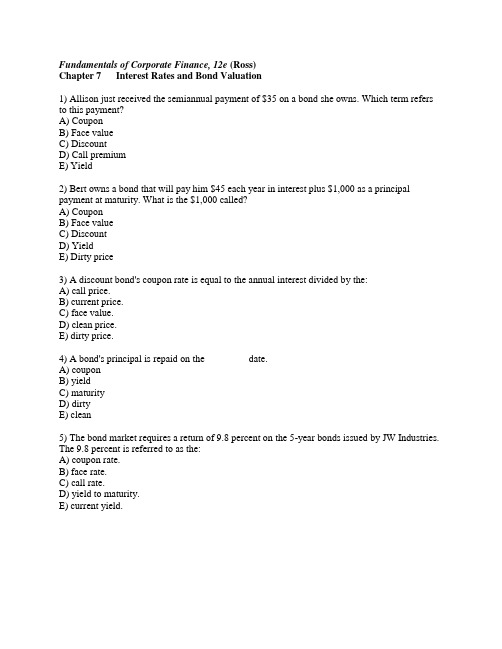

公司理财精要版原书第12版习题库答案Ross12e_Chapter07_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 7 Interest Rates and Bond Valuation1) Allison just received the semiannual payment of $35 on a bond she owns. Which term refers to this payment?A) CouponB) Face valueC) DiscountD) Call premiumE) Yield2) Bert owns a bond that will pay him $45 each year in interest plus $1,000 as a principal payment at maturity. What is the $1,000 called?A) CouponB) Face valueC) DiscountD) YieldE) Dirty price3) A discount bond's coupon rate is equal to the annual interest divided by the:A) call price.B) current price.C) face value.D) clean price.E) dirty price.4) A bond's principal is repaid on the ________ date.A) couponB) yieldC) maturityD) dirtyE) clean5) The bond market requires a return of 9.8 percent on the 5-year bonds issued by JW Industries. The 9.8 percent is referred to as the:A) coupon rate.B) face rate.C) call rate.D) yield to maturity.E) current yield.6) The current yield is defined as the annual interest on a bond divided by the:A) coupon rate.B) face value.C) market price.D) call price.E) par value.7) A $1,000 par value corporate bond that pays $60 annually in interest was issued last year. Which one of these would apply to this bond today if the current price of the bond is $996.20?A) The bond is currently selling at a premium.B) The current yield exceeds the coupon rate.C) The bond is selling at par value.D) The current yield exceeds the yield to maturity.E) The coupon rate has increased to 7 percent.8) Which one of these equations applies to a bond that currently has a market price that exceeds par value?A) Market value < Face valueB) Yield to maturity = Current yieldC) Market value = Face valueD) Current yield > Coupon rateE) Yield to maturity < Coupon rate9) All else constant, a bond will sell at ________ when the coupon rate is ________ the yield to maturity.A) a premium; less thanB) a premium; equal toC) a discount; less thanD) a discount; higher thanE) par; less than10) DLQ Inc. bonds mature in 12 years and have a coupon rate of 6 percent. If the market rate of interest increases, then the:A) coupon rate will also increase.B) current yield will decrease.C) yield to maturity will be less than the coupon rate.D) market price of the bond will decrease.E) coupon payment will increase.11) Which one of the following applies to a premium bond?A) Yield to maturity > Current yield > Coupon rateB) Coupon rate = Current yield = Yield to maturityC) Coupon rate > Yield to maturity > Current yieldD) Coupon rate < Yield to maturity < Current yieldE) Coupon rate > Current yield > Yield to maturity12) Which one of the following relationships applies to a par value bond?A) Yield to maturity > Current yield > Coupon rateB) Coupon rate > Yield to maturity > Current yieldC) Coupon rate = Current yield = Yield to maturityD) Coupon rate < Yield to maturity < Current yieldE) Coupon rate > Current yield > Yield to maturity13) Which one of the following relationships is stated correctly?A) The coupon rate exceeds the current yield when a bond sells at a discount.B) The call price must equal the par value.C) An increase in market rates increases the market price of a bond.D) Decreasing the time to maturity increases the price of a discount bond, all else constant.E) Increasing the coupon rate decreases the current yield, all else constant.14) Round Dot Inns is preparing a bond offering with a coupon rate of 6 percent, paid semiannually, and a face value of $1,000. The bonds will mature in 10 years and will be sold at par. Given this, which one of the following statements is correct?A) The bonds will become discount bonds if the market rate of interest declines.B) The bonds will pay 10 interest payments of $60 each.C) The bonds will sell at a premium if the market rate is 5.5 percent.D) The bonds will initially sell for $1,030 each.E) The final payment will be in the amount of $1,060.15) A newly issued bond has a coupon rate of 7 percent and semiannual interest payments. The bonds are currently priced at par. The effective annual rate provided by these bonds must be:A) 3.5 percent.B) greater than 3.5 percent but less than 7 percent.C) 7 percent.D) greater than 7 percent.E) less than 3.5 percent.16) The price sensitivity of a bond increases in response to a change in the market rate of interest as the:A) coupon rate increases.B) time to maturity decreases.C) coupon rate decreases and the time to maturity increases.D) time to maturity and coupon rate both decrease.E) coupon rate and time to maturity both increase.17) Which one of the following bonds is the least sensitive to interest rate risk?A) 3-year; 4 percent couponB) 3-year; 6 percent couponC) 5-year; 6 percent couponD) 7-year; 6 percent couponE) 7-year; 4 percent coupon18) As a bond's time to maturity increases, the bond's sensitivity to interest rate risk:A) increases at an increasing rate.B) increases at a decreasing rate.C) increases at a constant rate.D) decreases at an increasing rate.E) decreases at a decreasing rate.19) You own a bond that pays an annual coupon of 6 percent that matures five years from now. You purchased this 10-year bond at par value when it was originally issued. Which one of the following statements applies to this bond if the relevant market interest rate is now 5.8 percent?A) The current yield to maturity is greater than 6 percent.B) The current yield is 6 percent.C) The next interest payment will be $30.D) The bond is currently valued at one-half of its issue price.E) You will realize a capital gain on the bond if you sell it today.20) You expect interest rates to decline in the near future even though the bond market is not indicating any sign of this change. Which one of the following bonds should you purchase now to maximize your gains if the rate decline does occur?A) Short-term; low couponB) Short-term; high couponC) Long-term; zero couponD) Long-term; low couponE) Long-term; high coupon21) A premium bond that pays $60 in interest annually matures in seven years. The bond was originally issued three years ago at par. Which one of the following statements is accurate in respect to this bond today?A) The face value of the bond today is greater than it was when the bond was issued.B) The bond is worth less today than when it was issued.C) The yield to maturity is less than the coupon rate.D) The coupon rate is less than the current yield.E) The yield to maturity equals the current yield.22) Which one of these statements is correct?A) Most long-term bond issues are referred to as unfunded debt.B) Bonds often provide tax benefits to issuers.C) The risk of a company financially failing decreases when the company issues bonds.D) All bonds are treated equally in a bankruptcy proceeding.E) A debenture is a senior secured debt.23) Hot Foods has an investment-grade bond issue outstanding that pays $30 semiannual interest payments. The bonds sell at par and are callable at a price equal to the present value of all future interest and principal payments discounted at a rate equal to the comparable Treasury rateplus .50 percent. Which one of the following correctly describes this bond?A) The bond rating is B.B) Market value is less than face value.C) The coupon rate is 3 percent.D) The bond has a "make whole" call price.E) The interest payments are variable.24) Last year, Lexington Homes issued $1 million in unsecured, noncallable debt. This debt pays an annual interest payment of $55 and matures six years from now. The face value is $1,000 and the market price is $1,020. Which one of these terms correctly describes a feature of this debt?A) Semiannual couponB) Discount bondC) NoteD) Trust deedE) Collateralized25) Callable bonds generally:A) grant the bondholder the option to call the bond any time after the deferment period.B) are callable at par as soon as the call-protection period ends.C) are called when market interest rates increase.D) are called within the first three years after issuance.E) have a sinking fund provision.26) An example of a negative covenant that might be found in a bond indenture is a statement that the company:A) shall maintain a current ratio of 1.1 or higher.B) cannot lease any major assets without bondholder approval.C) must maintain the loan collateral in good working order.D) shall provide audited financial statements in a timely manner.E) shall maintain a cash surplus of $100,000 at all times.27) Protective covenants:A) apply to short–term debt issues but not to long–term debt issues.B) only apply to privately issued bonds.C) are a feature found only in government–issued bond indentures.D) only apply to bonds that have a deferred call provision.E) are primarily designed to protect bondholders.28) Which one of these is most apt to be included in a bond's indenture one year after the bond has been issued?A) Current yieldB) Written record of all the current bond holdersC) List of collateral used as bond securityD) Current market priceE) Price at which a bondholder can resell a bond to another bondholder29) Road Hazards has 12-year bonds outstanding. The interest payments on these bonds are sent directly to each of the individual bondholders. These direct payments are a clear indication that the bonds can accurately be defined as being issued:A) at par.B) in registered form.C) in street form.D) as debentures.E) as callable bonds.30) A bond that is payable to whomever has physical possession of the bond is said to be in:A) new–issue condition.B) registered form.C) bearer form.D) debenture status.E) collateral status.31) Jason's Paints just issued 20-year, 7.25 percent, unsecured bonds at par. These bonds fit the definition of which one of the following terms?A) NoteB) DiscountedC) Zero–couponD) CallableE) Debenture32) A note is generally defined as:A) a secured bond with an initial maturity of 10 years or more.B) a secured bond that initially matures in less than 10 years.C) any bond secured by a blanket mortgage.D) an unsecured bond with an initial maturity of 10 years or less.E) any bond maturing in 10 years or more.33) A sinking fund is managed by a trustee for which one of the following purposes?A) Paying bond interest paymentsB) Early bond redemptionC) Converting bonds into equity securitiesD) Paying preferred dividendsE) Reducing bond coupon rates34) A bond that can be paid off early at the issuer's discretion is referred to as being which type of bond?A) Par valueB) CallableC) SeniorD) SubordinatedE) Unsecured35) A $1,000 face value bond can be redeemed early at the issuer's discretion for $1,030, plus any accrued interest. The additional $30 is called the:A) dirty price.B) redemption value.C) call premium.D) original–issue discount.E) redemption discount.36) A deferred call provision:A) requires the bond issuer to pay the current market price, minus any accrued interest, should the bond be called.B) allows the bond issuer to delay repaying a bond until after the maturity date should the issuer so opt.C) prohibits the issuer from ever redeeming bonds prior to maturity.D) prohibits the bond issuer from redeeming callable bonds prior to a specified date.E) requires the bond issuer pay a call premium that is equal to or greater than one year's coupon should the bond be called.37) A call–protected bond is a bond that:A) is guaranteed to be called.B) can never be called.C) is currently being called.D) is callable at any time.E) cannot be called at this point in time.38) The items included in an indenture that limit certain actions of the issuer in order to protect a bondholder's interests are referred to as the:A) trustee relationships.B) bylaws.C) legal bounds.D) trust deed.E) protective covenants.39) Which one of the following statements concerning bond ratings is correct?A) Investment grade bonds are rated BB or higher by Standard & Poor's.B) Bond ratings assess both interest rate risk and default risk.C) Split-rated bonds are called crossover bonds.D) The highest rating issued by Moody's is AAA.E) A "fallen angel" is a term applied to all "junk" bonds.40) A "fallen angel" is a bond that has moved from:A) being publicly traded to being privately traded.B) being a long-term obligation to being a short-term obligation.C) being a premium bond to being a discount bond.D) senior status to junior status for liquidation purposes.E) investment grade to speculative grade.41) Bonds issued by the U.S. government:A) are considered to be free of interest rate risk.B) generally have higher coupons than comparable bonds issued by a corporation.C) are considered to be free of default risk.D) pay interest that is exempt from federal income taxes.E) are called "munis."42) Treasury bonds are:A) issued by any governmental agency in the U.S.B) issued only on the first day of each fiscal year by the U.S. Department of Treasury.C) bonds that offer the best tax benefits of any bonds currently available.D) generally issued as semiannual coupon bonds.E) totally risk free.43) Municipal bonds:A) are totally risk free.B) generally have higher coupon rates than corporate bonds.C) pay interest that is federally tax free.D) are rarely callable.E) are free of default risk.44) The break-even tax rate between a taxable corporate bond yielding 7 percent and a comparable nontaxable municipal bond yielding 5 percent can be expressed as:A) .05/(1 − t*) = .07.B) .05 − (1 − t*) = .07.C) .07 + (1 − t*) = .05.D) .05 (1 − t*) = .07.E) .05 (1 + t*) = .07.45) A zero coupon bond:A) is sold at a large premium.B) pays interest that is tax deductible to the issuer at the time of payment.C) can only be issued by the U.S. Treasury.D) has more interest rate risk than a comparable coupon bond.E) provides no taxable income to the bondholder until the bond matures.46) Which one of the following risks would a floating-rate bond tend to have less of as compared to a fixed-rate coupon bond?A) Real rate riskB) Interest rate riskC) Default riskD) Liquidity riskE) Taxability risk47) The collar of a floating-rate bond refers to the minimum and maximum:A) call periods.B) maturity dates.C) market prices.D) coupon rates.E) yields to maturity.48) Last year, you purchased a TIPS at par. Since that time, both market interest rates and the inflation rate have increased by .25 percent. Your bond has most likely done which one of the following since last year?A) Decreased in value due to the change in inflation ratesB) Experienced an increase in its bond ratingC) Maintained a fixed real rate of returnD) Increased in value in response to the change in market ratesE) Increased in value due to a decrease in time to maturity49) Recently, you discovered a convertible, callable bond with a semiannual coupon of 5 percent. If you purchase this bond you will have the right to:A) force the issuer to repurchase the bond prior to maturity.B) convert the bond into equity shares.C) defer all taxable income until the bond matures.D) convert the bond into a perpetuity paying 5 percent.E) have the principal amount adjusted for inflation.50) Samantha owns a reverse convertible bond. At maturity, the principal amount will be repaid in:A) shares of stock.B) cash while the interest is paid in shares of stock.C) the form of a newly issued bond.D) either shares of stock or a newly issued bond.E) either cash or shares of stock.51) Nadine is a retired widow who is financially dependent upon the interest income produced by her bond portfolio. Which one of the following bonds is the least suitable for her to own?A) 6-year, high-coupon, put bondB) 5-year TIPSC) 10-year AAA coupon bondD) 5-year floating rate bondE) 7-year income bond52) Al is retired and his sole source of income is his bond portfolio. Although he has sufficient principal to live on, he only wants to spend the interest income and thus is concerned about the purchasing power of that income. Which one of the following bonds should best ease Al's concerns?A) 6-year coupon bondsB) 5-year TIPSC) 20-year coupon bondsD) 5-year municipal bondsE) 7-year income bonds53) Kurt has researched T-Tek and believes the firm is poised to vastly increase in value. He has decided to purchase T-Tek bonds as he needs a steady stream of income. However, he still wishes that he could share in the firm's success along with the shareholders. Which one of the following bond features will help him fulfill his wish?A) Put provisionB) Positive covenantC) WarrantD) Crossover ratingE) Call provision54) A bond that has only one payment, which occurs at maturity, defines which one of these types of bonds?A) DebentureB) CallableC) Floating-rateD) JunkE) Zero coupon55) A highly illiquid bond that pays no interest but might entitle its holder to rental income from an asset is most apt to be a:A) NoNo bond.B) put bond.C) contingent callable bond.D) structured note.E) sukuk.56) Which one of the following is the price at which a dealer will sell a bond?A) Call priceB) Asked priceC) Bid priceD) Bid–ask spreadE) Par value57) If you sell a bond with a coupon of 6 percent to a dealer when the market rate is 7 percent, which one of the following prices will you receive?A) Call priceB) Par valueC) Bid priceD) Asked priceE) Bid–ask spread58) The difference between the price that a dealer is willing to pay and the price at which he or she will sell is called the:A) equilibrium.B) premium.C) discount.D) call price.E) spread.59) A bond is quoted at a price of $1,011. This price is referred to as the:A) call price.B) face value.C) clean price.D) dirty price.E) maturity price.60) Rosita paid a total of $1,189, including accrued interest, to purchase a bond that has 7 of its initial 20 years left until maturity. This price is referred to as the:A) quoted price.B) spread price.C) clean price.D) dirty price.E) call price.61) U. S. Treasury bonds:A) are highly illiquid.B) are quoted as a percentage of par.C) are quoted at the dirty price.D) pay interest that is federally tax-exempt.E) must be held until maturity.62) A six-year, $1,000 face value bond issued by Taylor Tools pays interest semiannually on February 1 and August 1. Assume today is October 1. What will be the difference, if any, between this bond's clean and dirty prices today?A) No differenceB) One months' interestC) Two months' interestD) Four months' interestE) Five months' interest63) Today, June 15, you want to buy a bond with a quoted price of 98.64. The bond pays interest on January 1 and July 1. Which one of the following prices represents your total cost of purchasing this bond today?A) Clean priceB) Dirty priceC) Asked priceD) Quoted priceE) Bid price64) Which one of the following rates represents the change, if any, in your purchasing power as a result of owning a bond?A) Risk-free rateB) Realized rateC) Nominal rateD) Real rateE) Current rate65) Which one of the following statements is correct?A) The risk-free rate represents the change in purchasing power.B) Any return greater than the inflation rate represents the risk premium.C) Historical real rates of return must be positive.D) Nominal rates exceed real rates by the amount of the risk-free rate.E) The real rate must be less than the nominal rate given a positive rate of inflation.66) The Fisher effect primarily emphasizes the effects of ________ on an investor's rate of return.A) defaultB) market movementsC) interest rate changesD) inflationE) the time to maturity67) You are trying to compare the present values of two separate streams of cash flows that have equivalent risks. One stream is expressed in nominal values and the other stream is expressed in real values. You decide to discount the nominal cash flows using a nominal annual rate of 8 percent. What rate should you use to discount the real cash flows?A) 8 percentB) EAR of 8 percent compounded monthlyC) Comparable risk-free rateD) Comparable real rateE) Nominal rate minus the risk-free rate68) Real rates are defined as nominal rates that have been adjusted for which of the following?A) InflationB) Default riskC) Accrued interestD) Interest rate riskE) Both inflation and interest rate risk69) Interest rates that include an inflation premium are referred to as:A) annual percentage rates.B) stripped rates.C) effective annual rates.D) real rates.E) nominal rates.70) The Fisher effect is defined as the relationship between which of the following variables?A) Default risk premium, inflation risk premium, and real ratesB) Nominal rates, real rates, and interest rate risk premiumC) Interest rate risk premium, real rates, and default risk premiumD) Real rates, inflation rates, and nominal ratesE) Real rates, interest rate risk premium, and nominal rates71) The pure time value of money is known as the:A) liquidity effect.B) Fisher effect.C) term structure of interest rates.D) inflation factor.E) interest rate factor.72) Which one of the following premiums is compensation for the possibility that a bond issuer may not pay a bond's interest or principal payments as expected?A) Default riskB) TaxabilityC) LiquidityD) InflationE) Interest rate risk73) The interest rate risk premium is the:A) additional compensation paid to investors to offset rising prices.B) compensation investors demand for accepting interest rate risk.C) difference between the yield to maturity and the current yield.D) difference between the market interest rate and the coupon rate.E) difference between the coupon rate and the current yield.74) A Treasury yield curve plots Treasury interest rates relative to:A) market rates.B) comparable corporate bond rates.C) the risk-free rate.D) inflation rates.E) time to maturity.75) Which one of the following risk premiums compensates for the inability to easily resell a bond prior to maturity?A) Default riskB) TaxabilityC) LiquidityD) InflationE) Interest rate risk76) The taxability risk premium compensates bondholders for which one of the following?A) Yield decreases in response to market changesB) Lack of coupon paymentsC) Possibility of defaultD) A bond's unfavorable tax statusE) Decrease in a municipality's credit rating77) Which bond would you generally expect to have the highest yield?A) Risk-free Treasury bondB) Nontaxable, highly liquid bondC) Long-term, high-quality, tax-free bondD) Short-term, inflation-adjusted bondE) Long-term, taxable junk bond78) Which one of the following statements is false concerning the term structure of interest rates?A) Expectations of lower inflation rates in the future tend to lower the slope of the term structure of interest rates.B) The term structure of interest rates includes both an inflation premium and an interest rate risk premium.C) The term structure of interest rates and the time to maturity are always directly related.D) The real rate of return has minimal, if any, effect on the slope of the term structure of interest rates.E) The interest rate risk premium increases as the time to maturity increases.79) The yields on a corporate bond differ from those on a comparable Treasury security primarily because of:A) interest rate risk and taxes.B) taxes and default risk.C) default and interest rate risks.D) liquidity and inflation rate risks.E) default, inflation, and interest rate risks.80) The 7 percent bonds issued by Modern Kitchens pay interest semiannually, mature in eight years, and have a $1,000 face value. Currently, the bonds sell for $987. What is the yield to maturity?A) 6.97 percentB) 6.92 percentC) 6.88 percentD) 7.22 percentE) 7.43 percent81) You own a bond that pays $64 in interest annually. The face value is $1,000 and the current market price is $1,021.61. The bond matures in 11 years. What is the yield to maturity?A) 6.12 percentB) 6.22 percentC) 6.46 percentD) 6.71 percentE) 5.80 percent82) New Homes has a bond issue with a coupon rate of 5.5 percent that matures in 8.5 years. The bonds have a par value of $1,000 and a market price of $1,022. Interest is paid semiannually. What is the yield to maturity?A) 6.36 percentB) 6.42 percentC) 5.61 percentD) 5.74 percentE) 5.18 percent83) Oil Wells offers 5.65 percent coupon bonds with semiannual payments and a yield to maturity of 6.94 percent. The bonds mature in seven years. What is the market price per bond if the face value is $1,000?A) $949.70B) $929.42C) $936.48D) $902.60E) $913.4884) Roadside Markets has 8.45 percent coupon bonds outstanding that mature in 10.5 years. The bonds pay interest semiannually. What is the market price per bond if the face value is $1,000 and the yield to maturity is 7.2 percent?A) $1,199.80B) $999.85C) $903.42D) $1,091.00E) $1,007.5285) Luxury Properties offers bonds with a coupon rate of 8.8 percent paid semiannually. The yield to maturity is 11.2 percent and the maturity date is 11 years from today. What is the market price of this bond if the face value is $1,000?A) $850.34B) $896.67C) $841.20D) $846.18E) $863.3086) Redesigned Computers has 6.5 percent coupon bonds outstanding with a current market price of $548. The yield to maturity is 13.2 percent and the face value is $1,000. Interest is paid annually. How many years is it until these bonds mature?A) 17.84 yearsB) 14.19 yearsC) 17.41 yearsD) 16.16 yearsE) 18.32 years87) World Travel has 7 percent, semiannual, coupon bonds outstanding with a current market price of $1,023.46, a par value of $1,000, and a yield to maturity of 6.72 percent. How many years is it until these bonds mature?A) 12.26 yearsB) 12.53 yearsC) 18.49 yearsD) 24.37 yearsE) 25.05 years88) A 13-year, 6 percent coupon bond pays interest semiannually. The bond has a face value of $1,000. What is the percentage change in the price of this bond if the market yield to maturity rises to 5.7 percent from the current rate of 5.5 percent?A) −1.79 percentB) −1.38 percentC) −1.64 percentD) 1.79 percent。

罗斯公司理财第九版第十八章课后答案对应版

第十八章:杠杆企业的股价与资本预算1、调整的净现值法(APV)如下:(UCF t=无杠杆企业项目第期流向权益所有者的现金流量R0=无杠杆企业项目的资本成本)2、APV 法用权益资本成本折现现金流得到无杠杆项目的价值,然后加上负债的节税现值,得到有杠杆情况下的项目价值;而WACC 法则将UCF 按R WACC折现,而R WACC 低于R0 。

3、FTE 法使用的是LCF,而其它两种方法使用的是UCF。

4、WACC 法在计算现金流量时使用的是无杠杆企业的现金流量,没有包含利息,但是在计算加权平均成本的时候包含了利息成本。

若在计算现金流时要把利息的支付包括进去,可使用FTF 法。

5、无杠杆企业的贝塔值可以用杠杆的贝塔来衡量,它是企业业务风险的衡量标准;另外,企业的金融风险也可以由贝塔值来衡量。

6.a. The maximum price that the company should be willing to pay for the fleet of cars with all-equity funding is the price that makes the NPV of the transaction equal to zero. The NPV equation for the project is:NPV = –Purchase Price + PV[(1 – t C )(EBTD)] + PV(Depreciation Tax Shield)If we let P equal the purchase price of the fleet, then the NPV is:NPV = –P + (1 – .35)($140,000)PVIFA13%,5 + (.35)(P/5)PVIFA13%,5Setting the NPV equal to zero and solving for the purchase price, we find:0 = –P + (1 – .35)($140,000)PVIFA13%,5 + (.35)(P/5)PVIFA13%,5P = $320,068.04 + (P)(0.35/5)PVIFA13%,5 = $320,068.04 + .2462P.7538P = $320,068.04 则P = $424,609.54b. The adjusted present value (APV) of a project equals the net present value of the project if it were funded completely by equity plus the net present value of any financing side effects.In this case, the NPV of financing side effects equals the after-tax present value of the cash flows resulting from the firm‘s debt, so:APV = NPV(All-Equity) + NPV(Financing Side Effects)So, the NPV of each part of the APV equation is:NPV(All-Equity) = –Purchase Price + PV[(1 – t C )(EBTD)] + PV(Depreciation Tax Shield) The company paid $395,000 for the fleet of cars. Because this fleet will be fully depreciated over five years using the straight-line method, annual depreciation expense equals: Depreciation = $395,000/5 = $79,000So, the NPV of an all-equity project is:NPV = –$395,000 + (1 – 0.35)($140,000)PVIFA13%,5 + (0.35)($79,000)PVIFA13%,5NPV = $22,319.49NPV(Financing Side Effects)The net present value of financing side effects equals the after-tax present value of cash flows resulting from the firm‘s debt, so:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Payments)Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt R B. So, the NPV of the financing side effects are:NPV = $260,000 – (1 – 0.35)(0.08)($260,000)PVIFA8%,5 – [$260,000/(1.08)⌒5] = $29,066.93 So, the APV of the project is:APV = NPV(All-Equity) + NPV(Financing Side Effects)APV = $22,319.49 + 29,066.93 = $51,386.427. a. In order to value a firm‘s equity using the flow-to-equity approach, discount the cash flows available to equity holders at the cost of the firm‘s levered equity. The cash flows to equity holders will be the firm‘s net income. Remembering that the company has three stores, we find:Sales $3,600,000COGS 1,530,000G & A costs 1,020,000Interest 102,000EBT $948,000Taxes 379,200NI $568,800Since this cash flow will remain the same forever, the present value of cash flows available to the firm‘s equity holders is a perpetuity. We can discount at the levered cost of equity, so, the value of the company‘s equity is: PV(Flow-to-equity) = $568,800 / 0.19 = $2,993,684.21b. The value of a firm is equal to the sum of the market values of its debt and equity, or:V L = B + SWe calculat ed the value of the company‘s equity in part a, so now we need to calculate the value of debt. The company has a debt-to-equity ratio of 0.40, which can be written algebraically as: B / S = 0.40We can substitute the value of equity and solve for the value of debt, doing so, we find:B / $2,993,684.21 = 0.40 则B = $1,197,473.68So, the value of the company is: V = $2,993,684.21 + 1,197,473.68 = $4,191,157.898. a. In order to determine the cost of the firm‘s debt, we need to find the yield to maturity on its current bonds. With semiannual coupon payments, the yield to maturity in the company‘s bonds is: $975 = $40(PVIFA R%,40) + $1,000(PVIF R%,40) 则R = .0413 or 4.13%Since the coupon payments are semiannual, the YTM on the bonds is:YTM = 4.13%× 2 = 8.26%b. We can use the Capital Asset Pricing Model to find the return on unlevered equity. According to the Capital Asset Pricing Model:R0 = R F + βUnlevered(R M – R F) = 5% + 1.1(12% – 5%) = 12.70%Now we can find the cost of levered equity. According to Modigliani-Miller Proposition II with corporate taxesR S = R0 + (B/S)(R0 – R B)(1 – t C) = .1270 + (.40)(.1270 – .0826)(1 – .34) = .1387 or 13.87% c. In a world with corporate taxes, a firm‘s weighted average cost of capital is equal to:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SThe problem does not provide either the debt-value ratio or equity-value ratio. However, the firm‘s debt-equity ratio of is: B/S = 0.40Solving for B: B = 0.4SSubstituting this in the debt-value ratio, we get: B/V = .4S / (.4S + S) = .4 / 1.4 = .29And the equity-value ratio is one minus the debt-value ratio, or: S/V = 1 – .29= .71So, the WACC for the company is: R WACC = .29(1 – .34)(.0826) + .71(.1387)R WACC = .1147 or 11.47%9. a. The equity beta of a firm financed entirely by equity is equal to its unlevered beta. Since each firm has an unlevered beta of 1.25, we can find the equity beta for each. Doing so, we find:North PoleβEquity = [1 + (1 – t C)(B/S)] βUnlevered = [1 + (1 – .35)($2,900,000/$3,800,000](1.25) = 1.87 South PoleβEquity = [1 + (1 – t C)(B/S)]βUnlevered = [1 + (1 – .35)($3,800,000/$2,900,000](1.25) = 2.31b. We can use the Capital Asset Pricing Model to find th e required return on each firm‘s equity. Doing so, we find:North Pole: R S = R F + βEquity(R M – R F) = 5.30% + 1.87(12.40% – 5.30%) = 18.58%South Pole: R S = R F + βEquity(R M – R F) = 5.30% + 2.31(12.40% – 5.30%) = 21.73%10. First we need to find the aftertax value of the revenues minus expenses. The aftertax value is: Aftertax revenue = $3,800,000(1 – .40) = $2,280,000Next, we need to find the depreciation tax shield. The depreciation tax shield each year is: Depreciation tax shield = Depreciation(t C) = ($11,400,000 / 6)(.40) = $760,000Now we can find the NPV of the project, which is:NPV = Initial cost + PV of depreciation tax shield + PV of aftertax revenueTo find the present value of the depreciation tax shield, we should discount at the risk-free rate, and we need to discount the aftertax revenues at the cost of equity, so:NPV = –$11,400,000 + $760,000(PVIFA6%,6) + $2,280,000(PVIFA14%,6) = $1,203,328.43 11. a. The company has a capital structure with three parts: long-term debt, short-term debt, and equity. Since interest payments on both long-term and short-term debt are tax-deductible, multiply the pretax costs by (1 – t C) to determine the aftertax costs to be used in the weighted average cost of capital calculation. The WACC using the book value weights is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = ($3 / $19)(.035)(1 – .35) + ($10 / $19)(.068)(1 – .35) + ($6 / $19)(.145)R WACC = 0.0726 or 7.26%b. Using the market value weights, the company‘s WACC is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = ($3 / $40)(.035)(1 – .35) + ($11 / $40)(.068)(1 – .35) + ($26 / $40)(.145)R WACC = 0.1081 or 10.81%c. Using the target debt-equity ratio, the target debt-value ratio for the company is:B/S = 0.60 则B = 0.6SSubstituting this in the debt-value ratio, we get: B/V = .6S / (.6S + S) = .6 / 1.6 = .375And the equity-value ratio is one minus the debt-value ratio, or: S/V = 1 – .375 = .625We can use the ratio of short-term debt to long-term debt in a similar manner to find the short-term debt to total debt and long-term debt to total debt. Using the short-term debt to long-term debt ratio, we get: STD/LTD = 0.20 则STD = 0.2LTDSubstituting this in the short-term debt to total debt ratio, we get:STD/B = .2LTD / (.2LTD + LTD) = .2 / 1.2 = .167And the long-term debt to total debt ratio is one minus the short-term debt to total debt ratio, or: LTD/B = 1 – .167 = .833Now we can find the short-term debt to value ratio and long-term debt to value ratio by multiplying the respective ratio by the debt-value ratio. So:STD/V = (STD/B)(B/V) = .167(.375) = .063And the long-term debt to value ratio is:LTD/V = (LTD/B)(B/V) = .833(.375) = .313So, using the target capital structure we ights, the company‘s WACC is:R WACC = (w STD)(R STD)(1 – t C) + (w LTD)(R LTD)(1 – t C) + (w Equity)(R Equity)R WACC = (.06)(.035)(1 – .35) + (.31)(.068)(1 – .35) + (.625)(.145) = 0.1059 or 10.59%d. The differences in the WACCs are due to the different weighti ng schemes. The company‘s WACC will most closely resemble the WACC calculated using target weights since future projects will be financed at the target ratio. Therefore, the WACC computed with target weights should be used for project evaluation12.略13. The adjusted present value of a project equals the net present value of the project under all-equity financing plus the net present value of any financing side effects. First, we need to calculate the unlevered cost of equity. According to Modigliani-Miller Proposition II with corporate taxes: R S = R0 + (B/S)(R0 – R B)(1 – t C).16 = R0 + (0.50)(R0 – 0.09)(1 – 0.40) 则R0 = 0.1438 or 14.38%Now we can find the NPV of an all-equity project, which is:NPV = PV(Unlevered Cash Flows)NPV = –$21,000,000 + $6,900,000/1.1438 + $11,000,000/(1.1438)2 + $9,500,000/(1.1438)3 NPV = –$212,638.89Next, we need to find the net present value of financing side effects. This is equal the aftertax present value of cash flows resulting from the firm‘s debt. So:NPV = Proceeds – Aftertax PV(Interest Payments) – PV(Principal Payments)Each year, an equal principal payment will be made, which will reduce the interest accrued during the year. Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt, so the NPV of the financing effects are:NPV = $7,000,000 – (1 – .40)(.09)($7,000,000) / (1.09) – $2,333,333.33/(1.09)– (1 – .40)(.09)($4,666,666.67)/(1.09)⌒2 – $2,333,333.33/(1.09)⌒2– (1 – .40)(.09)($2,333,333.33)/(1.09)⌒3 – $2,333,333.33/(1.09)⌒3 = $437,458.31So, the APV of project is: APV = NPV(All-equity) + NPV(Financing side effects)APV = –$212,638.89 + 437,458.31 = $224,819.4214. a. To calculate the NPV of the project, we first need to find the company‘s WACC. In a world with cor porate taxes, a firm‘s weighted average cost of capital equals:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SThe market value of the company‘s equity is:Market value of equity = 6,000,000($20) = $120,000,000So, the debt-value ratio and equity-value ratio are:Debt-value = $35,000,000 / ($35,000,000 + 120,000,000) = .2258Equity-value = $120,000,000 / ($35,000,000 + 120,000,000) = .7742Since the CEO believes its current capital structure is optimal, these values can be used as thetarget weight s in the firm‘s weighted average cost of capital calculation. The yield to maturity of the company‘s debt is its pretax cost of debt. To find the company‘s cost of equity, we need to calculate the stock beta. The stock beta can be calculated as:β= 标准差S,M / 方差M = .036 / .202 = 0.90Now we can use the Capital Asset Pricing Model to determine the cost of equity. The Capital Asset Pricing Model is: R S = R F + β(R M – R F) = 6% + 0.90(7.50%) = 12.75%Now, we can calculate the company‘s WACC, which is:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R S = .2258(1 – .35)(.08) + .7742(.1275)R WACC = .1105 or 11.05%Finally, we can use the WACC to discount the unlevered cash flows, which gives us an NPV of: NPV = –$45,000,000 + $13,500,000(PVIFA11.05%,5) = $4,837,978.59b. The weighted average cost of capital used in part a will not change if the firm chooses to fund the project entirely with debt. The weighted average cost of capital is based on optimal capital structure weights. Since the current capital structure is optimal, all-debt funding for the project simply implies that the firm will have to use more equity in the future to bring the capital structure back towards the target15. a. Since the company is currently an all-equity firm, its value equals the present value of its unlevered after-tax earnings, discounted at its unlevered cost of capital. The cash flows to shareholders for the unlevered firm are:EBIT $83,000Tax 33,200Net income $49,800So, the value of the company is: V U = $49,800 / .15 = $332,000b. The adjusted present value of a firm equals its value under all-equity financing plus the net present value of any financing side effects. In this case, the NPV of financing side effects equals the after-tax present value of cash flows resulting from debt. Given a known level of debt, debt cash flows should be discounted at the pre-tax cost of debt, so:NPV = Proceeds – Aftertax PV(Interest payments)NPV = $195,000 – (1 – .40)(.09)($195,000) / 0.09 = $78,000So, using the APV method, the value of the company is:APV = V U + NPV(Financing side effects) = $332,000 + 78,000 = $410,000The value of the debt is given, so the value of equity is the value of the company minus the value of the debt, or: S = V – B = $410,000 – 195,000 = $215,000c. According to Modigliani-Miller Proposition II with corporate taxes, the required return of levered equity is:R S = R0 + (B/S)(R0 – R B)(1 – t C)R S = .15 + ($195,000 / $215,000)(.15 – .09)(1 – .40) = .1827 or 18.27%d. In order to value a firm‘s equity using the flow-to-equity approach, we can discount the cash flows available to equity holders at the cost of the firm‘s levered equity. First, we need to calculate the levered cash flows available to shareholders, which are:EBIT $83,000Interest 17,550EBT $65,450Tax 26,180Net income $39,270So, the value of equity with the flow-to-equity method is:S = Cash flows available to equity holders / R S = $39,270 / .1827 = $215,00016.. Since the company is not publicly traded, we need to use the industry numbers to calculate the industry levered return on equity. We can then find the industry unlevered return on equity, and re-lever the industry return on equity to account for the different use of leverage. So, using the CAPM to calculate the industry levered return on equity, we find:R S = R F + β(MRP) = 5% + 1.2(7%) = 13.40%Next, to find the average cost of unlevered equity in the holiday gift industry we can use Modigliani-Miller Proposition II with corporate taxes, so:R S = R0 + (B/S)(R0 – R B)(1 – t C) =.1340 = R0 + (.35)(R0 – .05)(1 – .40)R0 = .1194 or 11.94%Now, we can use the Modigliani-Miller Proposition II with corporate taxes to re-lever the return on equity to account for this company‘s debt-equity ratio. Doing so, we find:R S = R0 + (B/S)(R0 – R B)(1 – t C) = .1194 + (.40)(.1194 – .05)(1 – .40) = .1361 or 13.61% Since the project is financed at the firm‘s target debt-equity ratio, it must be discounted at the company‘s weighted average cost of capital. In a world with corporate taxes, a firm‘s weighted average cost of capital equals: R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R S So, we need the debt-value and equity-value ratios for the company. The debt-equity ratio for the company is: B/S = 0.40 则B = 0.40SSubstituting this in the debt-value ratio, we get: B/V = .40S / (.40S + S) = .40 / 1.40 = .29 And the equity-value ratio is one minus the debt-value ratio, or: S/V = 1 – .29 = .71So, using the capital structure weights, the company‘s WACC is:R WACC = [B / (B + S)](1 – t C)R B + [S / (B + S)]R SR WACC = .29(1 – .40)(.05) + .71(.1361) = .1058 or 10.58%Now we need the project‘s cash flows. The cash flows increase for the first five years before leveling off into perpetuity. So, the cash flows from the project for the next six years are: Year 1 cash flow $80,000.00Year 2 cash flow $84,000.00Year 3 cash flow $88,200.00Year 4 cash flow $92,610.00Year 5 cash flow $97,240.50Year 6 cash flow $97,240.50So, the NPV of the project is:NPV = –$475,000 + $80,000/1.1058 + $84,000/1.1058⌒2 + $88,200/1.1058⌒3 +$92,610/1.1058⌒4 + $97,240.50/1.1058⌒5 + ($97,240.50/.1058)/1.1058⌒5 = $408,125.67。

公司理财精要版原书第12版英文版最新精品课件Ross_12e_PPT_Ch24

OPTION VALUATION

Copyright © 2019 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

• Similar to paying an insurance premium to protect against potential loss

• Trade-off between the amount of protection and the price that you pay for the option

EXAMPLE: FINDING THE CALL PRICE

• You have looked in the financial press and found the following information:

▪ Current stock price = $50 ▪ Put price = $1.15 ▪ Exercise price = $45 ▪ Risk-free rate = 5% ▪ Expiration in 1 year

• Call + PV(E)

▪ PV(E) will be worth E at expiration of the option ▪ If S < E, let call expire and have investment, E ▪ If S ≥ E, exercise call using the investment and have S

▪ PV = 100e-0.08(3/12) = 98.02

浅谈我对CoCo债的理解

浅谈我对CoCo债的理解一、什么是CoCo债券,及其产生背景CoCo债是由银行发行的欧元应急可转债,全名为“应急可转换资本工具”,允许银行在一定情形下无责地不支付债券利息而将债券强制转为普通股或者进行债券本金减记,是风险级别较高的金融机构债券,08年金融危机后其被设计推出,目的是在银行陷入危机的时候,通过债转股或债券本金减值来提高银行资本充足率、补充流动性。

该债券允许银行不支付债券利息同时又免于违约。

当银行陷入困境时,CoCo债券可以转换为普通股,或者进行债券本金减值,从而在危机时刻为银行提供缓冲,与此同时,CoCo债券的投资者将遭受损失。

银行陷入困境时,比如资本充足率低于被认为危险的水平(所谓“应急”),银行可以停止支付CoCo债券利息。

如果财务状况进一步恶化,银行可以强行让CoCo债券持有人承担损失。

该债券可以变得一文不值,也可以转换为普通股(即所谓“可转换”)。

二、CoCo债风险与收益特征近年CoCo债券越来越普及,原因是CoCo债券可获监管机构视为银行补充一级资本的认可工具之一,因此又称为“额外一级资本”;另一方面,由于CoCo债的风险较一般债券为高,因此其孳息率亦较高,据巴克莱指出,CoCo债券去年回报率约7%,对于面临负利率的专业机构投资者而言相当具吸引力。

根据彭博报道,目前欧洲银行发行CoCo债的规模约有900亿美元。

穆迪报告指,截至去年CoCo债发行规模最大者为瑞信,接近193亿美元。

而直到近期,面对欧洲银行业惨淡亏损的业绩,追逐高回报率的投资者才感到危机。

“大到不能倒”的德银在去年第三季度的税后亏损达到了60.24亿欧元,远超雷曼兄弟2008年二季度亏损的39亿美元。

而就在今年1月28日,德银宣布2015年第四季度继续亏损21亿欧元,整个2015年德银亏损68亿欧元。

高盛表示,自2008年金融海啸以来,欧洲银行“去杠杆”并不如美资银行积极,加上欧洲银行大多数都依赖保留盈余来作为满足资本要求的途径,故一旦盈利下跌,其资本水平势将受到影响。

IFRS 2

IFRS 2, Share-based Payment, applies when a company acquires or receives goods and services for equity-based payment. These goods can include inventories, property, plant and equipment, intangible assets, and other non-financial assets. There are two notable exceptions: shares issued in a business combination, which are dealt with under IFRS 3, Business Combinations; and contracts for the purchase of goods that are within the scope of IAS 32 and IAS 39. In addition, a purchase of treasury shares would not fall within the scope of IFRS 2, nor would a rights issue where some of the employees are shareholders.Examples of some of the arrangements that would be accounted for under IFRS 2 include call options, share appreciation rights, share ownership schemes, and payments for services made to external consultants based on the company’s equity capital.Recognition of share-based paymentIFRS 2 requires an expense to be recognised for the goods or services received by a company. The corresponding entry in the accounting records will either be a liability or an increase in the equity of the company, depending on whether the transaction is to be settled in cash or in equity shares. Goods or services acquired in a share-based payment transaction should be recognised when they are received. In the case of goods, this is obviously the date when this occurs. However, it is often more difficult to determine when services are received. If shares are issued that vest immediately, then it can be assumed that these are in consideration of past services. As a result, the expense should be recognised immediately.Alternatively, if the share options vest in the future, then it is assumed that the equity instruments relate to future services and recognition is therefore spread over that period.Equity-settled transactionsEquity-settled transactions with employees and directors would normally be expensed and would be based on their fair value at the grant date. Fair value should be based on market price wherever this is possible. Many shares and share options will not be traded on an active market. If this is the case then valuation techniques, such as the option pricing model, would be used. IFRS2 does not set out which pricing model should be used, but describes the facto rs that should be taken into account. It says that ‘intrinsic value’ should only be used where the fair value cannot be reliably estimated. Intrinsic value is the difference between the fair value of the shares and the price that is to be paid for the shares by the counterparty.The objective of IFRS 2 is to determine and recognise the compensation costs over the period in which the services are rendered. For example, if a company grants share options to employees that vest in the future only if they are still employed, then the accounting process is as follows:•The fair value of the options will be calculated at the date the options are granted.•This fair value will be charged to profit or loss equally over the vesting period, with adjustments made at each accounting date to reflect thebest estimate of the number of options that will eventually vest.•Shareholders’ equity will be increased by an amount equal to the charge in profit or loss. The charge in the income statement reflects the number of options vested. If employees decide not to exercise theiroptions, because the share price is lower than the exercise price, thenno adjustment is made to profit or loss. On early settlement of anaward without replacement, a company should charge the balance that would have been charged over the remaining period.EXAMPLE 1A company issued share options on 1 June 20X6 to pay for the purchase of inventory. The inventory is eventually sold on 31 December 20X8. The value of the inventory on 1 June 20X6 was $6m and this value was unchanged up to the date of sale. The sale proceeds were $8m. The shares issued have a market value of $6.3m.How will this transaction be dealt with in the financial statements?AnswerIFRS 2 states that the fair value of the goods and services received should be used to value the share options unless the fair value of the goods cannot be measured reliably. Thus equity would be increased by $6m and inventory increased by $6m. The inventory value will be expensed on sale. Performance conditionsSchemes often contain conditions which must be met before there is entitlement to the shares. These are called vesting conditions. If the conditions are specifically related to the market price of the company’s shares then such conditions are ignored for the purposes of estimating the number of equity shares that will vest. The thinking behind this is that these conditions have already been taken into account when fair valuing the shares. If the vesting or performance conditions are based on, for example, the growth in profit or earnings per share, then it will have to be taken into account in estimating the fair value of the option at the grant date.EXAMPLE 2A company grants 2,000 share options to each of its three directors on 1 January 20X6, subject to the directors being employed on 31 December20X8. The options vest on 31 December 20X8. The fair value of each option on 1 January 20X6 is $10, and it is anticipated that on 1 January 20X6 all of the share options will vest on 30 December 20X8. The options will only vest if the company’s share price reaches $14 per share.The share price at 31 December 20X6 is $8 and it is not anticipated that it will rise over the next two years. It is anticipated that on 31 December 20X6 only two directors will be employed on 31 December 20X8.How will the share options be treated in the financial statements for the year ended 31 December 20X6?AnswerThe market-based condition (ie the increase in the share price) can be ignored for the purpose of the calculation. However the employment condition must be taken into account. The options will be treated as follows:2,000 options x 2 directors x $10 x 1 year / 3 years = $13,333Equity will be increased by this amount and an expense shown in profit or loss for the year ended 31 December 20X6.Cash-settled transactionsCash-settled share-based payment transactions occur where goods or services are paid for at amounts that are based on the price of the company’s equity instruments. The expense for cash settled transactions is the cash paid by the company.As an example, share appreciation rights entitle employees to cash payments equal to the increase in the share price of a given number of the company’s shares over a given period. This creates a liability, and the recognised cost is based on the fair value of the instrument at the reporting date. The fair value of the liability is re-measured at each reporting date until settlement. EXAMPLE 3Jay, a public limited company, has granted 300 share appreciation rights to each of its 500 employees on 1 July 20X5. The management feel that as at 31 July 20X6, the year end of Jay, 80% of the awards will vest on 31 July 20X7. The fair value of each share appreciation right on 31 July 20X6 is $15.What is the fair value of the liability to be recorded in the financial statements for the year ended 31 July 20X6?Answer300 rights x 500 employees x 80% x $15 x 1 year / 2 years = $900,000Deferred tax implicationsIn some jurisdictions, a tax allowance is often available for share-based transactions. It is unlikely that the amount of tax deducted will equal the amount charged to profit or loss under the standard. Often, the tax deduction is based on the option’s intrinsic value, which is the difference between the fair value and exercise price of the share. A deferred tax asset will therefore arise which represents the difference between a tax base of the employee’s services received to date and the carrying amount, which will effectively normally be zero. A deferred tax asset will be recognised if the company has sufficient future taxable profits against which it can be offset.For cash settled share-based payment transactions, the standard requires the estimated tax deduction to be based on the current share price. As a result, all tax benefits received (or expected to be received) are recognised in the profit or loss.EXAMPLE 4A company operates in a country where it receives a tax deduction equal to the intrinsic value of the share options at the exercise date. The company grants share options to its employees with a fair value of $4.8m at the grant date. The company receives a tax allowance based on the intrinsic value ofthe options which is $4.2m. The tax rate applicable to the company is 30% and the share options vest in three-years’ time.AnswerA deferred tax asset would be recognised of:$4.2m @ 30% tax rate x 1 year / 3 years = $420,000The deferred tax will only be recognised if there are sufficient future taxable profits available.DisclosureIFRS 2 requires extensive disclosures under three main headings: •Information that enables users of financial statements to understand the nature and extent of the share-based payment transactions thatexisted during the period.•Information that allows users of financial statements to understand how the fair value of the goods or services received, or the fair value of theequity instruments which have been granted during the period, wasdetermined.•Information that allows users of financial statements to understand the effect of expenses, which have arisen from share-based paymenttransactions, on the entity’s profit or loss in the period.。

2021~2022 CFA二级笔记29-固收-含权债券估值

CFA二级笔记29-固收-含权债券估值图片版第一部分:第二部分:第三部分:文字版:1.可赎回债券和可售回债券A.含权债券估值(重点)i.含权债券估值思路Valuing Bonds with Embedded Option➢The basic process to value a bond withembedded option is similar to thevaluation of straight bond➢However, the following two points aredifferentOnlybinomial interest rate tree model is applicable(含权债券只能用二叉树估值), valuation with spot rates is non-available any moreNeed to check at each node to(二叉树每个节点判断是否行权)determinewhether theEmbedded option will be exercised or not●Call rule: the value of callable bond is the lower of the call price and the calculated price if the bond isnot called(取行权价格和计算价格小值)●Put rule: the value of putable bond is the higher of thePut price and the calculated price if thebond is not put (取行权价格和计算价格大值)例题Example of Callable Bond➢Using theinterest rate tree below, calculate the value for a 2-year, 7% annual-pay bond, which has a parvalue of $100 and callable at $100 atthe end of year 1三个问题1.Will the following features influence themodel We just used?European-style option,指定时间行权American-style option,在某段时间内任意一点都可行权,考试不考Bermudan-style option,百慕大期权,多个指定时间行权2.What is the value of the option which isembedded in the bond?含权债券的期权价值=不含权债券和含权债券只差3. Compared with the method we used in CFALevel II Derivatives, what is the keydifference?期权里的债券期权,行权不影响债券,最终的期权价值根据二叉树每个节点的期权价值折现回来这里的含权债券,行权会影响债券(行权后债券的债务关系结束),最终的期权价值根据含权债券和不含权债券价值钆差得到B.利率波动性利率二叉树的利率构建公式:注意,默认时间间隔为一年,则t=1,如果时间间隔为半年,则t=0.5Effects of Interest Rate Volatility(利率波动性的影响)➢The value of a straight bond isunaffected by changes in theVolatility of interest rate(利率波动性对不含权债券没有影响,因为不含权债券估值可用spot rate法,spot rate在期初决定不会变)另外,注意下,利率波动性对利率二叉树中间的点没有影响,只是影响利率的离散程度,即周边的点➢Interest rate volatility affects thevalue of a callable or putableBond(利率波动性会影响含权债券)The values of call and put options increasewhen interest rateVolatility increasesAs interest rate volatility increases, thevalue of the callableBond decreases(当利率波动性增加时,期权价值增加,可赎回债券价值减少)As interest rate volatility increases, thevalue of the putableBond increases(当利率波动性增加时,期权价值增加,可售回债券价值增加)C.OAS(option-adjustment spread)i.OAS概念和计算Spread 分三种:1)nominal spread,点对点,比如swap spread,I-spread,G-spread等2)Z-spread,线对线(即期利率曲线)3)OAS,树对树(二叉树)OAS定义式,含权债券的利率减去期权价值百分比OAS计算式:When valuing risky bond with the interestrate tree generatedfrom government spot curve, the model doesnot producearbitrage-free price (typically higher thanmarket price) Option-adjusted spread (OAS) is theconstant spread that, when added to allthe one-period forward rates on the interest rate tree, makes the model priceof the bond equal to its market priceOAS是风险调整项,如果按照无风险即期利率估值得到的是无风险价格,而市场是具有避险情绪的,市场价格往往低于估值(低价才能吸引别人来投资),这时候需要对利率进行调高,调高部分就是OAS。

CHAPTER7 Bonds and Their Valuation (《财务管理基础》PPT课件)

Putable bond – allows holder to sell the bond back to the company prior to maturity.

Issue date – when the bond was issued. Yield to maturity - rate of return earned on

a bond held until maturity (also called the “promised yield”).

7-4

Similar to amortization on a term loan. Reduces risk to investor, shortens

average maturity. But not good for investors if rates decline

after issuance.

The discount rate (ki ) is the opportunity cost of capital, and is the rate that could be earned on alternative investments of equal risk.

ki = k* + IP + MRP + DRP + LP

VB = ?

100

2

...

100

n 100 + 1,000

7-11

USING A FINANCIAL CALCULATOR TO VALUE A BOND

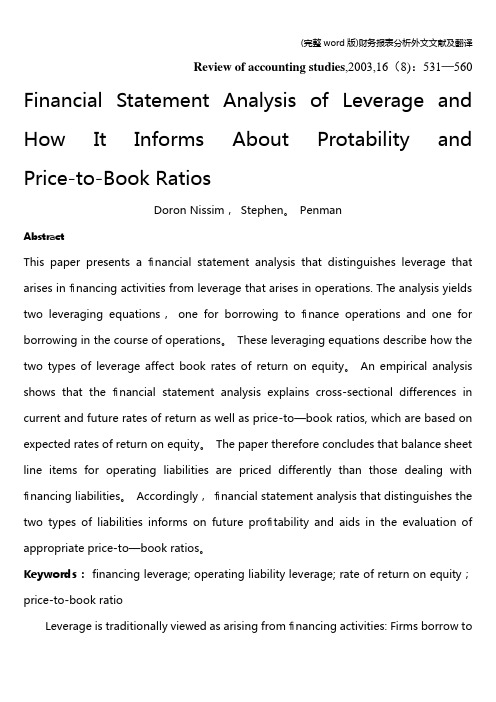

(完整word版)财务报表分析外文文献及翻译

Review of accounting studies,2003,16(8):531—560 Financial Statement Analysis of Leverage and How It Informs About Protability and Price-to-Book RatiosDoron Nissim,Stephen。

PenmanAbstractThis paper presents a financial statement analysis that distinguishes leverage that arises in financing activities from leverage that arises in operations. The analysis yields two leveraging equations,one for borrowing to finance operations and one for borrowing in the course of operations。

These leveraging equations describe how the two types of leverage affect book rates of return on equity。

An empirical analysis shows that the financial statement analysis explains cross-sectional differences in current and future rates of return as well as price-to—book ratios, which are based on expected rates of return on equity。

The paper therefore concludes that balance sheet line items for operating liabilities are priced differently than those dealing with financing liabilities。

公司理财精要版原书第12版教师手册RWJ_Fund_12e_IM_Chapter24