深圳市深宝实业股份有限公司2010年第一季度季度报告

2010年中国上市公司100强

航天信息股份有限公司入选中国上市公司100强航天信息股份有限公司是集技、工、贸于一体的具有现代化企业管理机制的高新技术企业。

由中国航天科工集团公司等十二家中国航天领域的知名企业和科研院所在原航天金穗高技术有限公司、原北京航天金卡电子工程公司和北京航天斯大电子有限公司的基础上于2000年11月1日共同发起成立。

今年是航天信息成立10周年,航天信息迎来双喜。

10月30日,巴菲特杂志联合世界企业竞争力实验室、世界经济学人周刊共同主办的2010年第七届“中国上市公司100强”排行榜隆重揭晓,航天信息股份有限公司首次进入中国上市公司100强,排名第50位。

十年来,公司依托航天的技术优势、人才优势和组织大型工程的丰富经验,以信息安全为主业,致力于计算机系统应用的开发、生产、系统集成和推广应用。

公司拥有自己的核心技术和创新团队,建立了覆盖全国的强大的渠道和服务体系,设立了信息安全、智能商务、RFID等博士后工作站,具备信息产业部计算机系统集成一级资质,承担了“金税工程”、“金卡工程”、“金盾工程”等国家重点工程,是国家大型信息化工程和电子政务领域的主要参与者。

2003年7月11日,公司在国内A股市场挂牌上市,成为国内最具实力的IT上市公司之一。

公司秉承“以人为本,协同创新”的理念,始终坚持以顾客是上帝、顾客满意为目标,采用高技术手段,依托Call Center、公司网站等信息平台,为用户提供优质高效的服务。

公司在全国31个省、市、自治区和5个计划单列市建立了36家省级服务单位、700余家基层服务单位,从业人员万余人,服务网络遍布全国各地。

为保证技术服务人员具备全面的技术素质,公司不断加强对各级技术服务人员的培训和考核,建立了完善的认证管理体系,在服务人员中形成良性竞争,做到服务产品标准化、服务人员专业化、服务行为规范化、服务管理职业化,努力为客户提供至诚至善的服务。

在技术竞争日益激烈的今天,公司不断加大对研发技术的投入,壮大企业的研发实力。

深赛格B:2010年第一季度报告全文(英文版) 2010-04-29

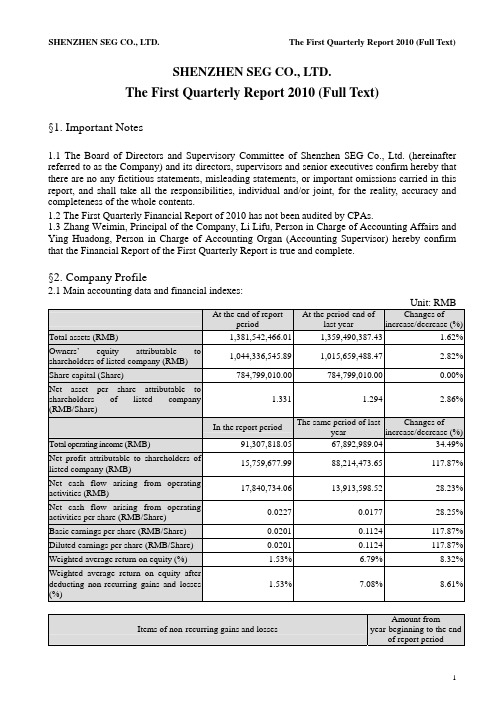

SHENZHEN SEG CO., LTD.The First Quarterly Report 2010 (Full Text)§1. Important Notes1.1 The Board of Directors and Supervisory Committee of Shenzhen SEG Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives confirm hereby that there are no any fictitious statements, misleading statements, or important omissions carried in this report, and shall take all the responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents.1.2 The First Quarterly Financial Report of 2010 has not been audited by CPAs.1.3 Zhang Weimin, Principal of the Company, Li Lifu, Person in Charge of Accounting Affairs and Ying Huadong, Person in Charge of Accounting Organ (Accounting Supervisor) hereby confirm that the Financial Report of the First Quarterly Report is true and complete.§2. Company Profile2.1 Main accounting data and financial indexes:Unit: RMBAt the end of reportperiod At the period-end oflast yearChanges ofincrease/decrease (%)Total assets (RMB) 1,381,542,466.011,359,490,387.43 1.62% Owners’ equity attributable toshareholders of listed company (RMB)1,044,336,545.891,015,659,488.47 2.82% Share capital (Share) 784,799,010.00784,799,010.00 0.00% Net asset per share attributable toshareholders of listed company(RMB/Share)1.331 1.2942.86%In the report period The same period of lastyearChanges ofincrease/decrease (%)Total operating income (RMB) 91,307,818.0567,892,989.04 34.49% Net profit attributable to shareholders oflisted company (RMB)15,759,677.99-88,214,473.65 -117.87% Net cash flow arising from operatingactivities (RMB)17,840,734.0613,913,598.52 28.23% Net cash flow arising from operatingactivities per share (RMB/Share)0.02270.0177 28.25% Basic earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Diluted earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Weighted average return on equity (%) 1.53%-6.79% 8.32% Weighted average return on equity afterdeducting non-recurring gains and losses(%)1.53%-7.08% 8.61%Items of non-recurring gains and lossesAmount from year-beginning to the end of report periodOther non-operating income and expenditure except for the aforementioned items 97,850.12 Influenced amount of income tax -21,527.03Influenced amount of minority shareholders’ equity -31,864.37Total 44,458.72 Explanations of items of significant non-recurring gains and losses1. Other non-operating income and expenditure except for the aforementioned items:mainly the damages for breach of contract received by the Company;2. Influenced amount of income tax: the influenced amount of deductible income tax increased due to the profit increase because of the aforementioned item;;3. Influenced amount of minority shareholders’ equity: this item increased due to the increase of the aforementioned No.1 item of controlling subsidiary of the Company.2.2 Total number of shareholders at the end of the report period and shares held by the top ten shareholders without restricted conditionsUnit: Share Total number of shareholdersat the end of report period59,152Particulars about the shares held by the top ten tradable shareholders without restricted conditionsFull name of shareholder Amount of tradable shares withoutrestricted conditions held at the endof report periodType of sharesSHENZHEN SEG GROUP CO., LTD. 237,359,666 RMB ordinary shares GUANGZHOU FODAK ENTERPRISEGROUP CO., LTD.18,880,334 RMB ordinary shares Yang Zhihui 12,582,734 RMB ordinary shares Taifook Securities CompanyLimited-Account Client5,758,103 Domestically listed foreign shares Gong Qianhua 5,560,967 Domestically listed foreign shares Zeng Ying 4,280,048 Domestically listed foreign shares Zhu Wei 4,066,739 RMB ordinary shares Tang Lizhu 3,796,200 RMB ordinary shares SHANGHAI QILE ECONOMIC ANDTRADE CO., LTD.2,754,330 RMB ordinary shares Cao Xianhua 2,702,000RMB ordinary shares§3. Significant Events3.1 Particulars about material changes in items of main accounting statement and financial index, and explanations of reasons√Applicable □InapplicableI. Balance sheet itemItem Mar. 31, 2010 Dec. 31, 2009 Balance Proportion ofchanges % Inventory 1,919,437.27 5,886,392.39 -3,966,955.12 -67.39% Construction in progress 9,776,526.68 26,192,075.55 -16,415,548.87 -62.67% Staff salaries payable 1,172,559.95 4,261,476.99 -3,088,917.04 -72.48% 1. Inventory: decreased by RMB 3.97 million with a fall of 67.39% over the end of last year, which was mainly because the inventories of the Company decreased in the report period.2. Construction in progress: decreased by RMB 16.42 million with a fall of 62.67% over the end of last year. Its reason was that the construction in progress of the subsidiary Changsha SEG Development Co., Ltd. (hereinafter referred to as Changsha SEG) was completed and thentransferred into fixed assets in the report period.3. Staff salaries payable: decreased by RMB 3.09 million with a fall of 72.48% over the end of last year. Its reason was that the Company paid the staff for salaries in the report period.II. Income statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Operating income 91,307,818.0567,892,989.0423,414,829.01 34.49% Operating cost 56,496,489.2231,746,485.6924,750,003.53 77.96% Operating tax and extras 3,724,614.303,012,887.52711,726.78 23.62% Sales expense 1,370,260.25906,378.64463,881.61 51.18% Losses from devaluation ofassets--1,500,000.001,500,000.00 -100.00% Investment gains -3,029,152.47-115,823,698.14112,794,545.67 -97.38% Operating profit 23,529,850.53-85,166,016.78108,695,867.31 -127.63% Non-operating income 139,079.301,620,912.10-1,481,832.80 -91.42% Non-operating expenditure 41,229.18100,985.93-59,756.75 -59.17% Total profits 23,627,700.65-83,646,090.61107,273,791.26 -128.25% Income tax expense 5,951,587.042,313,487.223,638,099.82 157.26% Net profit 17,676,113.61-85,959,577.83103,635,691.44 -120.56% Net profit attributable toowners of parent company15,759,677.99-88,214,473.65103,974,151.64 -117.87% Basic earnings per share 0.0201-0.11240.1325 -117.87% Diluted earnings per share 0.0201-0.11240.1325 -117.87% Other consolidated income 12,964,835.24-574,782.6813,539,617.92 -2355.61% Total consolidated income 30,640,948.85-86,534,360.52117,175,309.37 -135.41% Total consolidated incomeattributable to owners ofparent company28,677,057.42-88,896,727.63117,573,785.05 -132.26% 1. Operating income: increased by RMB 23.41 million with an increase of 34.49% over the same period of last year. The main reasons were i. In the report period, Changsha SEG and Changsha Hotel of Shenzhen Mellow Orange Business Hotel Management Co., Ltd. (hereinafter referred to as Mellow Orange Hotel) started operation which increased the operating income of the Company; ii. Income from Buy-it Store increased compared with the same period of last year.2. Operating cost: increased by RMB 24.75 million with an increase of 77.96% over the same period of last year. The main reason was the increase of operating income caused the increase of operating cost accordingly.3. Operating tax and extras: increased by RMB 710,000 with an increase of 23.62% over the same period of last year. The main reason was the increase of operating income caused the increase ofoperating tax and extras accordingly.4. Sales expense: increased by RMB 460,000 with an increase of 51.18% over the same period of last year. The main reason was the increase of operating income caused the increase of sales expense accordingly.5. Losses from devaluation of assets: no losses from devaluation of assets occurred in the report period, whereas that was RMB -1.5 million in the same period of last year. The main reasons was part of account receivable which had been withdrawn losses of bad debts in the same period of last year was taken back through lawsuit.6. Investment gains: increased by RMB 112.79 million over the same period of last year. The main reason was the losses of Shenzhen SEG Samsung Co., Ltd. (hereinafter referred to as SEG Samsung) in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year.7. Operating profit: increased largely over the same period of last year. The main reasons were the losses of SEG Samsung in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year causing a large decrease in investment losses.8. Non-operating income: decreased by RMB 1.48 million with a decrease of 91.42% over the same period of last year. The main reasons were the Company switched back the account payable which it did not need to pay in the same period of last year, but no such switch-back occurred in the report period.9. Total profits: increased largely over the same period of last year. The main reason was the same as that of Item 7.10. Income tax expense: increased by RMB 3.64 million with an increase of 157.26% over the same period of last year. The main reason was the profit payable of this report year went up and income tax rate of this report year in Shenzhen also grew.11. Net profit: increased largely over the same period of last year. The main reason was the same as that of Item 7.12. Net profit attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Item 7.13. Basic earnings per share: increased largely over the same period of last year. The main reasons were the same with Item 7.14. Diluted earnings per share: increased largely over the same period of last year. The main reason was the same as that of Item 7.15. Other consolidated income: increased by RMB 13.54 million largely over the same period of last year. The main reason was in the report period, SEG Samsung in which the Company holds 22.45% of its equity received the financial support funds amounting to RMB 56 million from its shareholder Samsung Corning Investment Co., Ltd., thus RMB 12.57 million was added into other consolidated income of the Company.16. Total consolidated income: increased largely over the same period of last year. The main reasons were the same as that of Items 7 and 15.17. Total consolidated income attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Items 7 and 15.III. Cash flow statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Other cash receivedrelating to operating activities64,583,939.9735,621,486.0928,962,453.88 81.31% Cash paid to/for staff andworkers11,883,672.359,605,770.002,277,902.35 23.71%Other cash paid relating to53,590,151.5031,135,749.7322,454,401.77 72.12% operating activitiesCash received from0.002,198,720.24-2,198,720.24 -100.00% recovering investmentNet cash received from15,444.00141,500.00-126,056.00 -89.09% disposal of fixed, intangible andother long-term assetsNet cash received from disposal0.0034,229,363.41-34,229,363.41 -100.00% of subsidiaries and other unitsCash paid for purchasing fixed,4,591,584.05701,547.003,890,037.05 554.49% intangible and other long-termassetsCash paid for investment 0.0053,030,000.00-53,030,000.00 -100.00% 1. Other cash received relating to operating activities: increased by RMB 28.96 million with an increase of 81.31% over the same period of last year. The main reasons were i. items of newly-opened Changsha SEG and Mellow Orange Hotel in the report period and newly-increased Buy-it Store in last May increased; ii. The general cashing business was developed in the electronic market, so the goods payment received on behalf of merchants increased.2. Cash paid to/for staff and workers: increased by RMB 2.28 million with an increase of 23.71% over the same period of last year. The main reasons were in the report period, Changsha SEG and Mellow Orange Hotel started operations, and the staff in Buy-it Store added increasing the salaries payable to the staff of the three companies.3. Other cash paid relating to operating activities: increased by RMB 22.45 million with an increase of 72.12% over the same period of last year. The main reasons were i. items of Changsha SEG and Mellow Orange Hotel newly-opened in the report period and Buy-it Store newly-increased last year increased; ii. The general cashing business was developed in the electronic market, the goods payment returning to merchants increased.4. Cash received from recovering investment: decreased by RMB 2.2million over the same period of last year. The main reason was in the same period of last year, the Company reduced the shares of Shenzhen Zero-Seven Co., Ltd. held by the Company amounting to 530,000, but no such sales occurred in the report period.5. Net cash received from disposal of fixed, intangible and other long-term assets: decreased by RMB 130,000 with a decrease of 89.09% over the same period of last year. The main reasons was the amount of fixed assets disposal in the same period of last year was bigger.6. Net cash received from disposal of subsidiaries and other units: decreased by RMB 34.23 million over the same period of last year. The main reasons was in the same period of last year, the Company received the equity account on selling former subsidiaries Shenzhen SEG Communications Co., Ltd, but no such sales of subsidiary occurred in the report period.7. Cash paid for purchasing fixed, intangible and other long-term assets: increased by RMB 3.89 million with an increase of 554.49% over the same period of last year. The main reasons were: the newly-opened Changsha SEG and Mellow Orange Hotel purchased fixed assets in the report period, thus the item increased.8. Cash paid for investment: decreased by RMB 55.03 million over the same period of last year. The main reason was in the same period of last year, the Company purchased 46 percent of the equity of Changsha SEG, but no such expenditure of equity acquisition occurred in the report period.3.2 Analysis and explanation of significant events and their influence and solutions□Applicable √Inapplicable3.3 Implementations of commitments by the Company, shareholders and actual controller√Applicable □InapplicableItem of CommitmentsPromiseeContent of commitmentsImplementationCommitments on Share Merger ReformInapplicable ----Commitments on share restricted tradeInapplicable ----Commitments made in Acquisition Report or Reports on Change in EquityInapplicable ----Commitments made in MaterialAssets ReorganizationInapplicable----Commitments made in issuanceShenzhen SEG Group Co., Ltd. Article 5 of the Equity Transfer Agreement which the Company had signed with SEG Group at the time of the Company’s listing stipulated: SEG Group permits the Company, as well as its subsidiaries of theCompany and affiliated companies to use the 8 registered trademarks that SEG Group has presently registered at the StateTrademark Office; italso permits theCompany to take the aforesaid trademarks and symbols that are similar to these marks as the symbol of the Company, as well as to use the aforesaid symbols or symbols that are similar to these symbols during the operation process; the Company doesn’t have to pay SEG Group any fee for the use of the aforesaidtrademarks or symbols.In the report period, this commitmentwas still executed according to thecommitment.Other commitments (includingadditional commitments)Shenzhen SEG Group Co., Ltd. According to the problem of “Yourcompany’s existing same industry competition in theelectronic market business with SEGIn the report period, controllingshareholder abided by the above commitment.Group” pointed outby Shenzhen Securities Regulatory Bureau in 2007 at the spot investigation of the Company, the Company received written Commitment Letter from SEG Group on Sep.14, 2007 and the content was as follows: our Group has similar business in Shenzhen electronic market with Shenzhen SEG Co., Ltd. (Shenzhen SEG), and the business was resulted by history and it has objective market developmentbackground. The Group made commitment: For the future, we do not operate on the market which is similar to Shenzhen SEG singly in the same city. The aforesaid matters have been disclosed in Securities Times ,China Securities Journal and Hong Kong Wen Wei Po and Juchao Website dated Sep. 18, 2007. In the report period, the holding company observed the above commitment.3.4 Estimation of accumulative net profit from the beginning of the year to the end of next report period to be a loss probably or the warning of its material change compared with the same period of last year and explanation of its reason √Applicable □InapplicableFore-notice of performances Carry-back of lossesYear-beginning to the end of next report period The same period oflast yearChange of increase/decrease (%)Estimated amount ofaccumulative net profit(RMB’0000)Approximately 1,600.00to2,700.00-14,608.35 -- -- Basic earnings per share(RMB/Share)Approximately 0.0204 to -0.1861 -- --0.0344Explanations onfore-notice ofperformances(1) SEG Samsung in which the Company holds its equity is predicted to suffer aloss accumulatively from RMB 30 million to RMB 50 million from year-beginning toend of next report period;(2) The performance prediction has not been pre-audited by CPAs.3.5 Other significant events which need explanations3.5.1 Particulars about securities investment □Applicable √Inapplicable3.5.2 Registration form of receiving research, communication and interview in the report periodDate Place Way ObjectsDiscussed main contents andsupplied materials Jan. 6, 2010 Office of the Company Telephone communication Investors Basic information of theCompany Feb. 12, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Mar. 26, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Apr. 7, 2010Office of the CompanyEnquire in written formSecurities DailyGot to know relevant public information of the Company3.5.3 Explanations of other significant events √Applicable □InapplicableThe net profit attributable to owners of parent company disclosed in the 1st quarterly report 2009 was RMB 2.85 million, but that of the same period of last year disclosed in the report was RMB -88.21 million, with the change amount of RMB -91.06 million. The reason for such change was the net profit attributable to owners of parent company of SEG Samsung in which the Company holds 22.45% of its equity disclosed in the 1st quarterly report 2009 was RMB-122 million, whereas that of the same period of last year disclosed in 1st quarterly report 2010 was RMB -504 million. The Company calculated the investment gains from SEG Samsung based on equity method, which caused the investment losses of the same period of last year disclosed in this report of the Company increased by RMB 91.06 million over that disclosed in the 1st quarterly report of 2009.3.6 Particulars about derivatives investment □Applicable √Inapplicable3.6.1 Particulars about derivatives investment held at the end of report period □Applicable √Inapplicable§4. Appendix4.1 Balance sheetPrepared by Shenzhen SEG Co., Ltd. March 31, 2010 Unit: RMBBalance at period-end Balance at year-beginning Items Consolidation Parent Company Consolidation Parent Company Current assets:Monetary funds 498,955,096.86372,852,381.52485,135,270.94 375,350,393.53 SettlementprovisionslentCapitalTransactionassetfinancereceivableNotesAccounts receivable 17,234,225.88400,000.0018,130,631.40 1,134,357.47 Accounts paid in advance 20,037,842.341,081,095.0018,404,268.08 8,035,295.00 receivableInsurancereceivablesReinsuranceContract reserve ofreinsurance receivableInterest receivable 2,460,821.922,460,821.922,460,821.92 2,460,821.92Dividend receivableOther receivables 12,042,162.4945,095,461.3911,971,998.74 45,306,466.00 Purchase restituted financeassetInventories 1,919,437.275,886,392.39 Non-current asset duewithin one yearassetsOthercurrentTotal current assets 552,649,586.76421,889,759.83541,989,383.47 432,287,333.92 Non-current assets:Granted loans and advancesFinance asset available for4,229,970.093,548,500.003,843,571.87 3,304,100.00 salesHeld-to-maturityinvestmentLong-term accountreceivableLong-term equity129,274,947.39310,372,446.43119,732,099.86 300,829,598.90 investmentInvestment property 438,740,452.42345,143,558.87442,502,999.44 347,797,315.91 Fixed assets 210,589,972.7523,031,843.38189,516,718.30 23,314,450.93 Construction in progress 9,776,526.6826,192,075.55materialEngineeringDisposal of fixed assetassetbiologicalProductiveOil and gas assetIntangible assets 4,681,177.38610,581.394,756,432.31 651,865.38 Expense on Research andDevelopmentGoodwill 10,328,927.8210,328,927.82Long-term expenses to be 13,684,505.73961,414.0213,041,779.82 1,165,451.06apportionedDeferred income tax asset 7,586,398.995,994,015.937,586,398.99 5,994,015.93 assetnon-currentOtherTotal non-current asset 828,892,879.25689,662,360.02817,501,003.96 683,056,798.11 Total assets 1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 Current liabilities:Short-termloansLoan from central bankAbsorbing deposit andinter-bank depositborrowedCapitalTransaction financialliabilitiespayableNotesAccounts payable 7,716,840.382,149,017.128,225,509.02 2,178,169.12Accounts received in90,214,246.1242,701,579.41105,563,890.39 65,801,272.52 advanceSelling financial asset ofrepurchaseCommission charge andcommission payableWage payable 1,172,559.9524,450.874,261,476.99 2,065,724.98 Taxes payable 26,095,556.9526,470,386.0424,421,758.66 24,773,634.49 payableInterestDividend payable 921,420.73153,403.29921,420.73 153,403.29 Other accounts payable 95,328,850.9637,415,008.7786,454,289.91 41,932,495.62 payablesReinsuranceInsurance contract reserveagencySecurity trading ofSecurity sales of agencyNon-current liabilities duewithin 1 yearliabilitiescurrentOtherTotal current liabilities 221,449,475.09108,913,845.50229,848,345.70 136,904,700.02 Non-current liabilities:loansLong-termpayableBondspayableLong-termaccountSpecial accounts payableliabilitiesProjectedDeferred income tax liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 non-currentliabilitiesOtherTotal non-current liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 Total liabilities 244,419,509.72109,460,971.21253,008,379.99 137,451,825.73 Owner’s equity (or shareholders’equity):Paid-in capital (or sharecapital)784,799,010.00784,799,010.00784,799,010.00 784,799,010.00 Capital public reserve 409,833,425.36407,164,608.41396,922,482.95 394,348,208.41 Less: Treasury stocksReasonable reserveSurplus public reserve 102,912,835.67102,912,835.67102,912,835.67 102,912,835.67 Provision of general riskRetained profit -252,672,245.53-292,785,305.44-268,431,923.52 -304,167,747.78 Balance difference offoreign currency translation-536,479.61-542,916.63Total owner’s equity attributableto parent company1,044,336,545.891,002,091,148.641,015,659,488.47 977,892,306.30 Minority shareholders’ interests 92,786,410.4090,822,518.97Total owner’s equity 1,137,122,956.291,002,091,148.641,106,482,007.44 977,892,306.30 Total liabilities and owner’sequity1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 4.2 Profit statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Total operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 Including: Operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 InterestincomeInsurancegainedCommission charge andcommission incomeII. Total operating cost 64,748,815.0510,069,765.9037,235,307.68 6,271,611.87 Including: Operating cost 56,496,489.228,821,226.1931,746,485.69 6,224,508.93 InterestexpenseCommission charge andcommission expenseCash surrender valueNet amount of expense ofcompensationNet amount of withdrawalof insurance contract reserveBonus expense of guaranteeslipReinsuranceexpenseOperating tax and extras 3,724,614.301,652,232.843,012,887.52 1,426,154.86 Sales expenses 1,370,260.25906,378.64Administration expenses 6,914,893.783,749,113.976,753,654.36 3,527,096.41 Financial expenses -3,757,442.50-4,152,807.10-3,684,098.53 -3,406,148.33Losses of devaluation of asset -1,500,000.00-1,500,000.00Add: Changing income offair value (Loss is listed with“-”)Investment income (Loss is-3,029,152.47-3,029,152.47-115,823,698.14 -115,823,699.14 listed with “-”)Including: Investmentincome on affiliated companyand joint ventureExchange income (Loss islisted with “-”)III. Operating profit (Loss is23,529,850.5315,446,866.52-85,166,016.78 -93,782,529.51 listed with “-”)Add: Non-operating income 139,079.30300.001,620,912.10 1,486,477.57Less: Non-operating41,229.18100,985.93expenseIncluding: Disposal loss ofnon-current assetIV. Total Profit (Loss is listed23,627,700.6515,447,166.52-83,646,090.61 -92,296,051.94 with “-”)Less: Income tax 5,951,587.044,064,724.182,313,487.22 450,000.00V. Net profit (Net loss is listed17,676,113.6111,382,442.34-85,959,577.83 -92,746,051.94 with “-”)Net profit attributable to15,759,677.9911,382,442.34-88,214,473.65 -92,746,051.94 owner’s equity of parentcompanyMinority shareholders’ gains1,916,435.622,254,895.82and lossesVI. Earnings per sharei. Basic earnings per share 0.02010.0145-0.1124 -0.1182 ii. Diluted earnings per share 0.02010.0145-0.1124 -0.1182 VII. Other consolidated income 12,964,835.2412,816,400.00-574,782.68 -682,253.97 VIII. Total consolidated income 30,640,948.8524,198,842.34-86,534,360.51 -93,428,305.91 Total consolidated income28,677,057.4224,198,842.34-88,896,727.62 -93,428,305.91 attributable to owners of parentcompanyTotal consolidated income1,963,891.432,362,367.11attributable to minorityshareholders4.3 Cash flow statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Cash flows arising fromoperating activities:Cash received from selling76,838,162.928,489,484.2877,509,335.13 16,793,838.47 commodities and providinglabor servicesNet increase of customerdeposit and inter-bank depositNet increase of loan fromcentral bankNet increase of capitalborrowed from other financialinstitutionCash received fromoriginal insurance contract feeNet cash received fromreinsurance businessNet increase of insuredsavings and investmentNet increase of disposal oftransaction financial assetCash received from interest,commission charge andcommissionNet increase of capitalborrowedNet increase of returnedbusiness capitalWrite-back of tax receivedOther cash receivedrelating to operating activities64,583,939.9735,796,951.0335,621,486.09 34,108,393.77 Subtotal of cash inflowarising from operating activities141,422,102.8944,286,435.31113,130,821.22 50,902,232.24 Cash paid for purchasingcommodities and receivinglabor service34,506,524.285,428,566.4833,515,780.98 4,689,090.60Net increase of customerloans and advancesNet increase of deposits incentral bank and inter-bankCash paid for originalinsurance contractcompensationCash paid for interest,commission charge andcommissionCash paid for bonus ofguarantee slipCash paid to/for staff andworkers11,883,672.355,234,585.349,605,770.00 4,602,269.51 Taxes paid 23,601,020.7018,545,462.2824,959,921.99 18,464,019.40 Other cash paid relating tooperating activities53,590,151.5017,876,799.3431,135,749.73 14,893,005.25Subtotal of cash outflowarising from operating activities123,581,368.8347,085,413.4499,217,222.70 42,648,384.76Net cash flows arisingfrom operating activities17,840,734.06-2,798,978.1313,913,598.52 8,253,847.48II. Cash flows arising frominvesting activities:Cash received from recovering investment 2,198,720.242,198,720.24Cash received frominvestment income5,270,590.49 Net cash received from 15,444.00141,500.00。

深市主板上市公司2010年一季报主要财务指标

1.32

0.02

000513

丽珠集团

12662.44

0.43

7.69

0.57

000514

渝 开 发

2192.02

0.0346

3.37

0.03

000516

开元控股

2353.36

0.06

2.56

0.4

000517

荣安地产

138.75

0.0013

1.5645

-0.2274

000518

*ST生物

237.51

0.0023

0.6942

-0.0069

000519

银河动力

330.67

0.017

1.79

-0.1411

000520

长航凤凰

6.0118

0.4756

000099

中信海直

3614.39

0.0704

2.977

0.0531

000150

宜华地产

106.90

0.0033

2.2466

-0.13

000151

中成股份

754.28

0.025

3.03

-0.32

000155

川化股份

-3207.90

-0.07

3.69

-0.15

000156

*ST 嘉瑞

华天酒店

1790.20

0.032

2.32

0.07

000429

粤高速A

13026.93

0.1

2.97

0.14

000430

*ST张股

-463.40

-0.02

-0.19

2010年度宝安区纳税百强企业名单

2010年度宝安区纳税百强企业名单下面是经典歌词100句,朋友们可以享受下,不需要的朋友可以下载后编辑删除!!谢谢!!林夕经典歌词1、若只是喜欢,何必夸张成爱。

——林2、擦光所有火柴难令气氛像从前闪耀,至少感激当日陪着我开甜蜜的玩笑。

——《失恋太少》3、你是千堆雪我是长街,怕日出一到彼此瓦解。

——《邮差》4、谁能告诉我,要有多坚强,才敢念念不忘。

——《当时的月亮》王菲5、我愿意做你的老师,示范着执子之手如何解释,不愿为深奥的感情变白痴。

——《诗人的情人》方大同6、有一梦便造多一梦,直到死别都不觉任何阵痛,趁冲动能换到感动,这愉快黑洞苏醒以后谁亦会扑空。

——《梦死醉生》张国荣7、谁能改变人生的长度,谁知道永恒有多么恐怖,但现实往往比命运还残酷,只是没有人愿意认输。

——《无间道》8、似等了一百年忽已明白,即使再见面,成熟地表演,不如不见。

——《不如不见》9、在有生的瞬间能遇到你,竟花光所有运气。

——《明年今日》10、害怕悲剧重演我的命中命中,越美丽的东西我越不可碰。

其实我再去爱惜你又有何用,难道这次我抱紧你未必落空?——《暗涌》11、黑了倦眼都侧耳倾听,让我做只路过蜻蜓,留下能被怀念过程,虚耗着我这便宜生命。

——《路过蜻蜓》张国荣12、如除我以外在你心,还多出一个人,你瞒住我,我亦瞒住我,太合衬。

原来我非不快乐,只我一人未发觉若无其事原来是最狠的报复。

——《想哭》13、闭起双眼我最挂念谁眼睛张开身边竟是谁。

——《人来人往》14、我想知如何用爱换取爱,如何赤足走过茫茫深海,超乎奇迹以外。

当赤道留住雪花,眼泪融掉细沙,你肯珍惜我吗?——《当这地球没有花》15、那日我狂哭不止,曾经差一点想过死,多少艰辛不可告人,多少光阴都因为等。

——《奇迹》16、爱若难以放进手里,何不将这双手放进心里。

——《人来人往》17、剪影的你轮廓太好看,凝住眼泪才敢细看。

——《约定》18、但凡未得到,但凡是过去,总是最登对。

——《似是故人来》19、无论热恋中失恋中,都永远记住第一戒,别要张开双眼。

茶饮料重点企业(深宝、康师傅、统一、娃哈哈)竞争力分析

茶饮料重点企业(深宝、康师傅、统一、娃哈哈)竞争力分析一、深圳市深宝实业股份有限公司(一)企业基本情况分析深圳市深宝实业股份有限公司成立于 1975年,前身为宝安县罐头厂。

公司于 1991年 12月改制为股份有限公司,并于 1992年 12月在深圳证券交易所主板上市(股票简称:深深宝A、深深宝B,股票代码:000019,200019),是中国食品饮料行业首家上市公司。

公司拥有多家全资、控股、参股企业,目前已形成“深宝”、“三井”、“金雕”、“聚芳永”等四大品牌,并拥有茶叶及天然植物原料、软包装饮品及调味品等三个产品系列的专业化运营。

公司凭借雄厚的研发能力,先进的设备和技术,不断创新的经营管理理念,在茶叶深加工及植物提取行业中达到领先水平,下属深圳市深宝华城科技有限公司拥有自主知识产权专利技术十余项,为国家级高新技术企业,在国内茶饮料市场上享有良好的知名度和美誉度,现已通过了多家国内及全球知名品牌食品饮料公司的质量和采购认证,成为其主要的茶叶及天然植物原料供应商。

公司确立了“天然、绿色、健康”的茶产业为未来发展方向,成为国内首家以茶产业为主业的上市公司。

公司将以茶叶精深加工为核心,以建设天然健康产品和服务一体化的产业链为目标,积极向茶园种植和体验基地以及终端产品两头延伸。

(二)企业发展历程分析1975 公司创建,其前身为生产罐头和果汁饮料的宝安县自罐头厂 1981 公司与美国百事国际集团签订协议合作兴办深圳市饮乐汽水厂,从事百事系列碳酸饮料灌装生产.成为中国大陆首家生产百事系列碳酸饮料的中美合作企业 1983 三井食品厂投产,生产三井牌蚝油等调味品。

也是产利乐软包装饮料的企业之一1992 公司股票在深交所挂牌上市,成为中国食品饮料行业首家上市公司。

1996 与美国百事完成自合作经营到合资经营的过渡,成立深圳百事饮料公司1999 深圳市农产品股份有限公司成为公司第一大控股股东2002 投资控股深圳市深宝华城食品有限公司,进入茶叶与天然植物萃取加工领域2004 深宝华城深圳总厂在深圳横岗深宝工业城落成,拉开了深宝公司的茶产业规模化、现代化生产研发的序幕,树立了其行业领头羊的地位2006 公司成功启动并顺利完成股权分置改革工作2007公司下属的深宝华城科技有限公司投资控股江西省婺源源县聚芳永茶业有限公司2008 婺源县聚芳永茶业有限公司新厂落成.次年新线投产2009 公司增持婺源县聚芳永茶叶有限公司股份2010 惠州深宝物流园一期工程调昧品和软饮科生产基地建成投产2011 公司成功实施股票非公开发行工作(四)企业经营情况分析2012年上半年,深圳市深宝实业股份有限公司实现营业收入1.14亿元,比上年同期减少18.51%;实现净利润 8886.74万元,比上年同期增加1921.39%。

建信核心精选股票型证券投资基金2010年第1季度报告

建信核心精选股票型证券投资基金2010年第1季度报告2010年3月31日基金管理人:建信基金管理有限责任公司基金托管人:中国工商银行股份有限公司报告送出日期:2010年4月20日§1 重要提示基金管理人的董事会及董事保证本报告所载资料不存在虚假记载、误导性陈述或重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

基金托管人中国工商银行股份有限公司根据本基金合同规定,于2010年4月16日复核了本报告中的财务指标、净值表现和投资组合报告等内容,保证复核内容不存在虚假记载、误导性陈述或者重大遗漏。

基金管理人承诺以诚实信用、勤勉尽责的原则管理和运用基金资产,但不保证基金一定盈利。

基金的过往业绩并不代表其未来表现。

投资有风险,投资者在作出投资决策前应仔细阅读本基金的招募说明书。

本报告中财务资料未经审计。

本报告期自2010年1月1日起至3月31日止。

§2 基金产品概况§3 主要财务指标和基金净值表现3.1主要财务指标单位:人民币元注:1、本期已实现收益指基金本期利息收入、投资收益、其他收入(不含公允价值变动损益)扣除相关费用后的余额,本期利润为本期已实现收益加上本期公允价值变动损益。

2、所述基金业绩指标不包括持有人认购或交易基金的各项费用,计入费用后实际收益水平要低于所列数字。

3.2基金净值表现3.2.1本报告期基金份额净值增长率及其与同期业绩比较基准收益率的比较3.2.2自基金合同生效以来基金累计净值增长率变动及其与同期业绩比较基准收益率变动的比较建信核心精选股票型证券投资基金累计份额净值增长率与业绩比较基准收益率历史走势对比图(2008年11月25日至2010年3月31日)注:本报告期,本基金的投资组合比例符合基金合同的要求。

§4 管理人报告4.1基金经理(或基金经理小组)简介4.2报告期内本基金运作遵规守信情况说明本报告期内,本基金管理人不存在损害基金份额持有人利益的行为。

宝钢股份2010年1季度季报

宝山钢铁股份有限公司6000192010年第一季度报告目录§1 重要提示.....................................................................0- 3 -§2 公司基本情况.................................................................0- 3 -§3 重要事项.....................................................................0- 4 -§4 附录.........................................................................0- 8 -§1 重要提示1.1 本公司董事会、监事会及其董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

1.2 如有董事未出席董事会,应当单独列示其姓名未出席董事姓名 未出席董事职务 未出席董事的说明 被委托人姓名伏中哲 董事 工作原因 马国强1.3 公司第一季度财务报告未经审计。

1.4公司负责人姓名 董事长何文波主管会计工作负责人姓名 副总经理陈缨会计机构负责人(会计主管人员)姓名 财务部部长吴琨宗公司负责人董事长何文波、主管会计工作负责人副总经理陈缨及会计机构负责人(会计主管人员)财务部部长吴琨宗声明:保证本季度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标币种:人民币本报告期末 上年度期末 本报告期末比上年度期末增减(%)总资产(百万元) 209,214.42201,142.78 4.01所有者权益(或股东权益)(百万元) 99,022.1795,136.90 4.08归属于上市公司股东的每股净资产(元/股) 5.65 5.43 4.08年初至报告期期末 比上年同期增减(%)经营活动产生的现金流量净额(百万元) 3,177.18 -78.20每股经营活动产生的现金流量净额(元/股)0.18 -78.20报告期 年初至报告期期末本报告期比上年同期增减(%)归属于上市公司股东的净利润(百万元) 3,930.093,930.09 4,316.65基本每股收益(元/股) 0.22 0.22 4,316.65扣除非经常性损益后的基本每股收益(元/股)0.22 0.22 34,029.57稀释每股收益(元/股) 0.22 0.22 4,316.65加权平均净资产收益率(%) 4.05 4.05 上升3.95个百分点扣除非经常性损益后的加权平均净资产收益率(%)3.94 3.94 上升3.93个百分点扣除非经常性损益项目和金额:单位:百万元 币种:人民币项目 金额非流动资产处置损益 -15除上述各项之外的其他营业外收入和支出 150所得税影响额 -34合计 1012.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股 报告期末股东总数(户) 673,081前十名无限售条件流通股股东持股情况股东名称(全称) 期末持有无限售条件流通股的数量种类宝钢集团有限公司 12,953,517,441人民币普通股中国建设银行-银华核心价值优选股票型证券投资基金150,000,002人民币普通股UBS AG(瑞士银行) 68,948,145人民币普通股中国工商银行-上证50交易型开放式指数证券投资基金61,714,558人民币普通股兴业银行股份有限公司-兴业趋势投资混合型证券投资基金54,997,000人民币普通股华润深国投信托有限公司-重阳3期证券投资集合资金信托计划50,203,245人民币普通股交通银行-易方达 50指数证券投资基金50,173,933人民币普通股中国工商银行-建信优化配置混合型证券投资基金47,999,590人民币普通股上海国际信托有限公司-T-020436,800,713人民币普通股招商银行股份有限公司-光大保德信优势配置股票型证券投资基金35,040,854人民币普通股§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用 □不适用2010年一季度,世界经济进一步复苏,国内宏观经济环境整体稳定,钢材需求进一步好转,部分行业进入需求旺季,国内钢铁企业产销规模和出口订单逐步回升。

根据调查结果测算家庭平均消费率在左右城家庭消

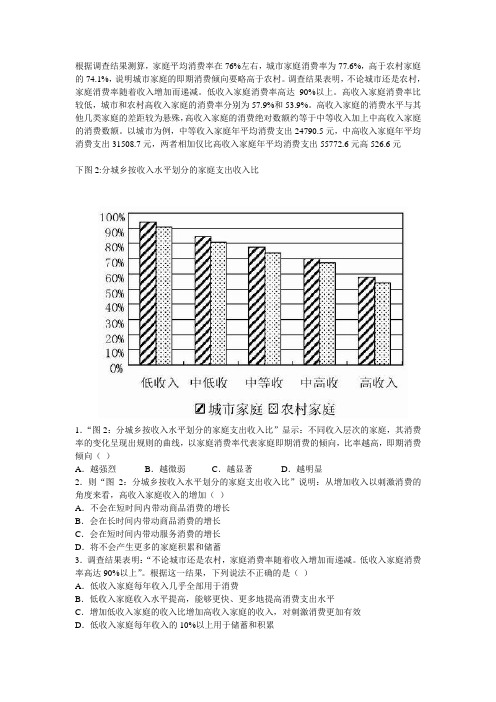

根据调查结果测算,家庭平均消费率在76%左右,城市家庭消费率为77.6%,高于农村家庭的74.1%,说明城市家庭的即期消费倾向要略高于农村。

调查结果表明,不论城市还是农村,家庭消费率随着收入增加而递减。

低收入家庭消费率高达90%以上。

高收入家庭消费率比较低,城市和农村高收入家庭的消费率分别为57.9%和53.9%。

高收入家庭的消费水平与其他几类家庭的差距较为悬殊,高收入家庭的消费绝对数额约等于中等收入加上中高收入家庭的消费数额。

以城市为例,中等收入家庭年平均消费支出24790.5元,中高收入家庭年平均消费支出31508.7元,两者相加仅比高收入家庭年平均消费支出55772.6元高526.6元下图2:分城乡按收入水平划分的家庭支出收入比1.“图2:分城乡按收入水平划分的家庭支出收入比”显示:不同收入层次的家庭,其消费率的变化呈现出规则的曲线,以家庭消费率代表家庭即期消费的倾向,比率越高,即期消费倾向()A.越强烈 B.越微弱 C.越显著 D.越明显2.则“图2:分城乡按收入水平划分的家庭支出收入比”说明:从增加收入以刺激消费的角度来看,高收入家庭收入的增加()A.不会在短时间内带动商品消费的增长B.会在长时间内带动商品消费的增长C.会在短时间内带动服务消费的增长D.将不会产生更多的家庭积累和储蓄3.调查结果表明:“不论城市还是农村,家庭消费率随着收入增加而递减。

低收入家庭消费率高达90%以上”。

根据这一结果,下列说法不正确的是()A.低收入家庭每年收入几乎全部用于消费B.低收入家庭收入水平提高,能够更快、更多地提高消费支出水平C.增加低收入家庭的收入比增加高收入家庭的收入,对刺激消费更加有效D.低收入家庭每年收入的10%以上用于储蓄和积累4.高收入家庭消费率比较低,意味着城市和农村高收入家庭每年收入的()A.20%以上用于储蓄和积累B.30%以上用于储蓄和积累C.40%以上用于储蓄和积累D.50%以上用于储蓄和积累5.拉动内需,促进城乡居民消费是重要对策,为此投资的重点应该是加大就业、教育、医疗、住房、社会保障等领域的投资力度,最关键的措施是()A.认清当前我国家庭消费所处发展阶段,促消费保增长保就业B.改革和完善住房、医疗和教育制度体系,解决家庭正常消费的后顾之忧C.完善城乡均等的公共服务体系,减少农村家庭公共服务消费支出比例D.理顺收入分配关系,重点帮扶农村和低收入家庭提高收入水平1.【解析】A。

深深宝A:关于公司非公开发行涉及重大关联交易的公告(修订版) 2010-10-22

证券代码:000019、200019 证券简称:深深宝A、B 公告编号:2010-25深圳市深宝实业股份有限公司关于公司非公开发行涉及重大关联交易的公告(修订版)本公司及董事会全体成员保证信息披露的内容真实、准确和完整,没有虚假记载、误导性陈述或者重大遗漏。

重要提示1、公司于2010年8月26日召开的第七届董事会第六次会议审议通过了本次非公开发行股票相关事宜,并于2010年8月27日公告了《深圳市深宝实业股份有限公司2010年度非公开发行股票预案》。

2、公司本次非公开发行股票主要补充事项如下:本次非公开发行相关事宜已获国有资产监督管理部门《关于深圳市深宝实业股份有限公司2010年度非公开发行股票预案的批复》(深国资局[2010]210号、深国资局[2010]211号)批准。

本次非公开发行募集资金投资项目之一为收购深宝华城48.33%股权项目,德正信以2010年4月30日为评估基准日,对公司拟以非公开发行股票方式购买深宝华城48.33%股权所涉及的深宝华城之股东部分权益价值进行了评估并出具了《关于深圳市深宝华城科技有限公司股权受让项目股东部分权益价值评估报告》(德正信综评报字[2010]第031号),该等资产评估结果已经国有资产监督管理部门备案(备案编号:深国资局评备[2010]013号)。

本次非公开发行募集资金投资项目之一为“茶及天然植物研发中心项目”已经婺源县发展和改革委员会婺发改字[2010]148号文《关于婺源县聚芳永茶业有限公司聚芳永茶及饮料植物研发中心建设项目备案的通知》备案。

本次非公开发行募集资金投资项目之一为“调味品生产线扩建项目”已获得惠州市惠城区发展和改革局备案,项目备案证《广东省企业基本建设投资项目备案证》(备案项目编号101302146000197号),正在按照国家有关规定办理项目环境评估报告。

2010年10月20日,公司与林逸香女士、夏振忠先生、曹丽君女士、郑玲娜女士签订了《关于非公开发行A股股票的认购协议的补充协议》及《资产购买协议的补充协议》。

腾讯公布2010年第一季度兼全年财务报告

未来,我们将通过提高基本社区功能和推出满足用户多样化需求的SNS应用,持续提升SNS平台的用户价值。另外,我们正在加大力度将“QQ空间”拓展至无线平台,进一步扩大其覆盖和使用范围。就“QQ秀”而言,本季度包月用户数有所增长,是由于我们推行免费体验及增加免费项目吸引新用户,并将其中部分用户转化为付费用户所致。用户黏性也因个性化功能改进和推出包年套餐而增加。

网络广告业务

2010年第一季度,我们的网络广告业务受不利的季节性因素影响,因为广告活动通常在中国春节假期期间减少。季度内,我们持续发展跨平台以及用户定位广告解决方案,以彰显我们在市场上差异化特色。展望未来,我们将提升我们作为主流及具影响力的媒体形象、加强销售组织架构和利用我们的平台实力进一步改进我们的广告产品以实现长期增长。

2010年第二季度和第三季度,我们将借2010上海世博会和世界杯加大内容投入以及广告和推广活动,以提升我们的媒体影响力和行业地位。作为此策略的一部分,我们已向中国网络电视台购入播放权以向用户诚度和黏性提升的推动,“QQ会员”用户数稳步增长,主要因为捆绑了更多增值服务以及线上和线下生活特权所致。由于SNS应用日益流行,“QQ空间”的活跃账户数比上一季度增长10.4%至第一季度末的4.280亿。

财报显示,腾讯第一季度总收入为人民币42.261亿元(6.191亿美元),比上一季度增长14.6%,比去年同期增长68.7%。公司权益持有人应占盈利为人民币17.832亿元(2.612亿美元),比上一季度增长18.3%,比去年同期增长72.2%。

2010年第一季度业绩摘要:

总收入为人民币42.261亿元(6.191亿美元),比上一季度增长14.6%,比去年同期增长68.7%。

网络游戏业务受益于有利的季节性因素,主要几款中型休闲游戏和MMOG推出资料片并在假期做推广。“QQ游戏”也受益于游戏内推广,最高同时在线账户数增至680万。

1德恒律师事务所关于深圳市深宝实业股份有限公司

德恒律师事务所 关于深圳市深宝实业股份有限公司 股权分置改革之 法律意见书 德恒深法意字〔2006〕第036号 致:深圳市深宝实业股份有限公司 北京市德恒律师事务所深圳分所(以下称“本所”)接受深圳市农产品股份有限公司(以下称“农产品”)和深圳市投资控股有限公司(以下称“投资控股”)的委托,担任深圳市深宝实业股份有限公司(以下称 “深深宝”或“公司”)股权分置改革事宜(以下称 “股权分置改革事宜”)的特聘专项法律顾问,并指派刘震国律师、周文莉律师(以下称“本所律师”)就公司股权分置改革的有关事宜出具本法律意见书(以下称“本法律意见书”)。

本所律师谨依据《中华人民共和国证券法》(以下称“《证券法》”)、《中华人民共和国公司法》(以下称“《公司法》”)、《上市公司股权分置改革的指导意见》(以下称“《指导意见》”)、《上市公司股权分置改革管理办法》(以下称“《管理办法》”)、《上市公司股权分置改革业务操作指引》(以下称“《操作指引》”)、《关于上市公司股权分置改革中国有股股权管理问题的通知》(以下称“《通知》”)等国家有关法律、法规、规范性文件的有关规定,按照律师行业公认的业务标准、道德规范,本着勤勉、尽责的工作原则,审查了公司提供的相关文件资料,询问了有关人员,对股权分置改革事宜的相关法律问题进行了审查。

公司保证已经提供了为本所律师出具本法律意见书所必需的、完整的、真实的原始书面材料、副本材料、或者口头证言,有关副本材料或者复印件与原件一致。

公司已保证且本所律师在出具法律意见时已假设,公司提供的文件资料和所作的陈述与说明是完整和真实的,且一切足以影响本法律意见书的事实和文件均已向本所律师披露,且上述文件资料和所作的陈述与说明没有虚假、伪造或重大遗漏。

本所依据本法律意见书出具日以前已经发生或存在的事实,以及中国现行法律、法规和规范性文件发表法律意见。

在本法律意见书中对有关会计报表、审计报告、保荐意见中某些内容的引述,并不表明本所律师对这些内容的真实性、准确性、合法性作出任何判断或保证。

深发展A:2010年年度报告

深圳发展银行股份有限公司2010年年度报告目录第一节重要提示 (1)第二节公司基本情况简介 (2)第三节财务数据和业务数据摘要 (3)第四节管理层讨论与分析 (6)第五节股本变动及股东情况 (36)第六节董事、监事、高级管理人员和员工情况 (41)第七节公司治理结构 (55)第八节股东大会情况简介 (59)第九节董事会报告 (60)第十节监事会报告 (68)第十一节重要事项 (71)第十二节财务报告 (78)第十三节董事、高级管理人员关于2010年年度报告的书面确认意见 (160)第十四节备查文件 (240)第一节重要提示本行董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。

本行第八届董事会第二次会议审议了2010年年度报告正文及摘要。

参加本次董事会会议的董事共15人。

本次董事会会议一致同意此报告。

安永华明会计师事务所和安永会计师事务所分别根据国内和国际审计准则对本行2010年度财务会计报告进行了审计,并出具了标准无保留意见的审计报告。

本行董事长肖遂宁、行长理查德·杰克逊(Richard Jackson)、副行长兼首席财务官陈伟、会计机构负责人李伟权保证2010年年度报告中财务报告的真实、完整。

第二节公司基本情况简介(一)法定中文名称:深圳发展银行股份有限公司(简称:深圳发展银行,下称“本行”)法定英文名称:Shenzhen Development Bank Co., Ltd.(二)法定代表人:肖遂宁(三)董事会秘书:徐进证券事务代表:吕旭光联系地址:中国广东省深圳市深南东路5047号深圳发展银行大厦深圳发展银行董事会秘书处联系电话:(0755)82080387传真:(0755)82080386电子邮箱:dsh@(四)注册地址:中国广东省深圳市办公地址:深圳市深南东路5047号深圳发展银行大厦邮政编码:518001国际互联网网址:电子邮箱:dsh@(五)本行选定信息披露报刊:《中国证券报》、《证券时报》、《上海证券报》登载年度报告的中国证监会指定互联网网址:本行年度报告备置地点:本行董事会秘书处(六)本行股票上市交易所:深圳证券交易所股票简称:深发展A股票代码:000001(七)本行其他有关资料首次注册登记日期:1987年12月22日最近一次变更注册登记日期:2010年8月4日注册地点:深圳市罗湖区深南东路5047号企业法人营业执照注册号:440301103098545税务登记号码:国税440300192185379;地税440300192185379本行聘请的境内会计师事务所:安永华明会计师事务所办公地点:北京市东城区东长安街1号东方广场安永大楼(东三办公楼)16层本行聘请的境外会计师事务所:安永会计师事务所办公地点:香港中环金融街8号国际金融中心2期18楼(八)本报告分别以中、英文两种文字编制,在对两种文本的理解上发生歧义时,以中文文本为准。

2010 年度业绩及2011 年一季度业绩情况简析--深

深交所多层次资本市场上市公司2010年年度业绩及2011年一季度业绩情况简析截至2011年4月30日,深交所1270家上市公司如期披露了2010年年报或年报数据,其中主板公司485家,中小板公司576家,创业板公司209家。

统计数据显示,深交所上市公司2010全年实现营业收入36,817.06亿元,同比增长34.78%;实现归属于上市公司股东的净利润2,486.34亿元,同比增长38.08%。

尽管2010年宏观经济形势存在诸多不确定因素,深交所各板块上市公司业绩仍然实现稳步增长。

一、深交所上市公司2010年总体业绩情况1、总体业绩增长明显2010年,深交所各板块上市公司业绩保持平稳增长势头。

主板485家公司共计实现营业收入26,678.62亿,同比增长35.20%;实现净利润1,508.13亿元,同比增长42.10%。

中小板576家上市公司平均实现营业收入16.12亿元,同比增长33.29%;平均实现净利润1.44亿元,同比增长32.53%。

超过90%的中小板公司实现营业收入增长;近80%的中小板公司实现营业收入、净利润双增长。

创业板上市公司2010年实现平均营业收入4.09亿元,同比增长38.02%,92%的创业板公司实现营业收入同比增长;平均净利润为0.71亿元,较上年增长31.2%,85%的创业板公司实现净利润同比增长。

2010年,深交所上市公司整体盈利能力较2009年度大幅提高,同时亏损面进一步缩小。

2、业绩增长源于主营,非经常性损益占比下降2010年,主板公司扣除非经常性损益后的净利润同比增加56.86%,超出净利润增幅14.76个百分点;非经常性损益占当期净利润比例为13.06%,同比下降8.22个百分点。

披露年报的中小板公司扣除非经常性损益后的平均净利润为1.35亿元,非经常性损益占净利润比例为6.25%,同比减少2个百分点。

创业板公司主业突出,利润总额中九成以上来源于主营业务;投资收益、营业外收支净额及公允价值变动损益等非经常性项目占当期利润总额比例分别仅为0.2%、8.7%与0.7%。

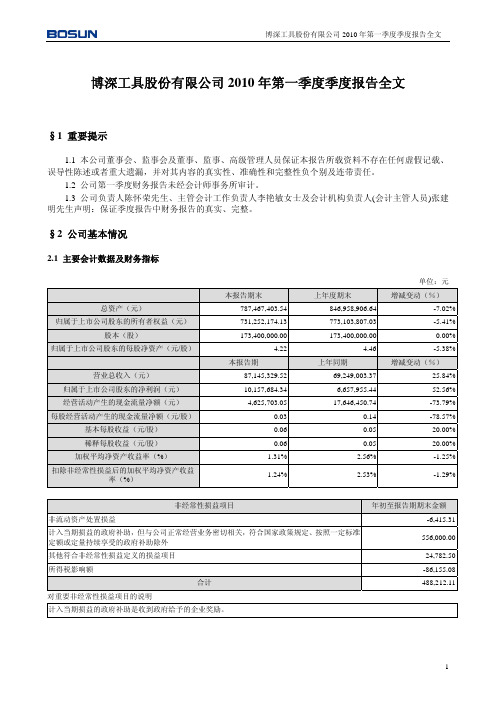

博深工具:2010年第一季度报告全文 2010-04-23

博深工具股份有限公司2010年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司负责人陈怀荣先生、主管会计工作负责人李艳敏女士及会计机构负责人(会计主管人员)张建明先生声明:保证季度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)787,467,403.54846,958,906.64 -7.02%归属于上市公司股东的所有者权益(元)731,252,174.13773,103,807.03 -5.41%股本(股)173,400,000.00173,400,000.00 0.00%归属于上市公司股东的每股净资产(元/股) 4.22 4.46 -5.38%本报告期上年同期增减变动(%)营业总收入(元)87,145,329.5269,249,003.37 25.84%归属于上市公司股东的净利润(元)10,157,684.346,657,955.44 52.56%经营活动产生的现金流量净额(元)4,625,703.0517,646,450.74 -73.79%每股经营活动产生的现金流量净额(元/股)0.030.14 -78.57%基本每股收益(元/股)0.060.05 20.00%稀释每股收益(元/股)0.060.05 20.00%加权平均净资产收益率(%) 1.31% 2.56% -1.25%扣除非经常性损益后的加权平均净资产收益1.24%2.53% -1.29%率(%)非经常性损益项目年初至报告期期末金额非流动资产处置损益-6,415.31计入当期损益的政府补助,但与公司正常经营业务密切相关,符合国家政策规定、按照一定标准556,000.00定额或定量持续享受的政府补助除外其他符合非经常性损益定义的损益项目24,782.50所得税影响额-86,155.08合计488,212.11对重要非经常性损益项目的说明计入当期损益的政府补助是收到政府给予的企业奖励。

沪深股票2010年报时间表(各市按日期排序)

四川圂达 铜陵有色 *ST 豫能 诚志股份 中银绒业 釐马股份 于南白药 闽闽东 广弘控股 鄂武商A 华东医药 福星股份 中国重汽 杭汽轮B 国际实业 南天信息 *ST 釐果 宏源证券 深 赛 格 深基地B 泸 天 化 古云贡酒 宁通信B 广济药业 风华高科 四川九洲 华北高速 北斱国际 山 航B 广州友谊 东斱电子 深赤湾A 浙江震元 鲁 泰A 亐 粮 液 峨眉山A 鞍钢股份 建峰化巟 仁和药业 中福实业 滨海能源 湖南投资 烟台冰轮 桑德环境

2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-22 2011-03-23 2011-03-23 2011-03-23 2011-03-23 2011-03-23 2011-03-23 2011-03-24 2011-03-24 2011-03-24 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-25 2011-03-26 2011-03-26 2011-03-26 2011-03-26 2011-03-26 2011-03-26 2011-03-26 2011-03-26 2011-03-26

2011-02-26 2011-02-26 2011-02-28 2011-02-28 2011-02-28 2011-02-28 2011-03-01 2011-03-01 2011-03-01 2011-03-02 2011-03-02 2011-03-02 2011-03-02 2011-03-02 2011-03-02 2011-03-03 2011-03-04 2011-03-04 2011-03-04 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-05 2011-03-07 2011-03-08 2011-03-08 2011-03-08 2011-03-08 2011-03-08 2011-03-08 2011-03-08 2011-03-08 2011-03-09 2011-03-10 2011-03-10 2011-03-10 2011-03-10

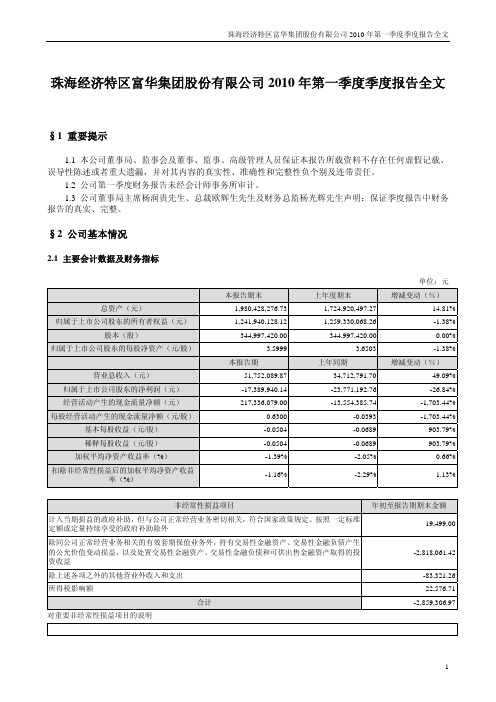

粤 富 华:2010年第一季度报告全文 2010-04-30

珠海经济特区富华集团股份有限公司2010年第一季度季度报告全文§1 重要提示1.1 本公司董事局、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司董事局主席杨润贵先生、总裁欧辉生先生及财务总监杨光辉先生声明:保证季度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)1,980,428,276.731,724,920,497.27 14.81%归属于上市公司股东的所有者权益(元)1,241,940,128.121,259,330,068.26 -1.38%股本(股)344,997,420.00344,997,420.00 0.00%归属于上市公司股东的每股净资产(元/股) 3.5999 3.6503 -1.38%本报告期上年同期增减变动(%)营业总收入(元)51,752,089.8734,712,791.70 49.09%归属于上市公司股东的净利润(元)-17,389,940.14-23,771,192.76 -26.84%经营活动产生的现金流量净额(元)217,336,079.00-13,554,385.74 -1,703.44%每股经营活动产生的现金流量净额(元/股)0.6300-0.0393 -1,703.44%基本每股收益(元/股)-0.0504-0.0689 903.79%稀释每股收益(元/股)-0.0504-0.0689 903.79%加权平均净资产收益率(%)-1.39%-2.05% 0.66%扣除非经常性损益后的加权平均净资产收益-1.16%-2.29% 1.13%率(%)非经常性损益项目年初至报告期期末金额计入当期损益的政府补助,但与公司正常经营业务密切相关,符合国家政策规定、按照一定标准19,499.00定额或定量持续享受的政府补助除外除同公司正常经营业务相关的有效套期保值业务外,持有交易性金融资产、交易性金融负债产生-2,818,061.42的公允价值变动损益,以及处置交易性金融资产、交易性金融负债和可供出售金融资产取得的投资收益除上述各项之外的其他营业外收入和支出-83,321.26所得税影响额22,576.71合计-2,859,306.97对重要非经常性损益项目的说明除同公司正常经营业务相关的有效套期保值业务外,持有交易性金融资产、交易性金融负债产生的公允价值变动损益,以及处置交易性金融资产、交易性金融负债和可供出售金融资产取得的投资收益-282万元主要是指公司本报告期证券投资损益,包括处置交易性金融资产投资收益-187万元,公允价值变动损益-94万元。

2010年第一季度季度报告全文

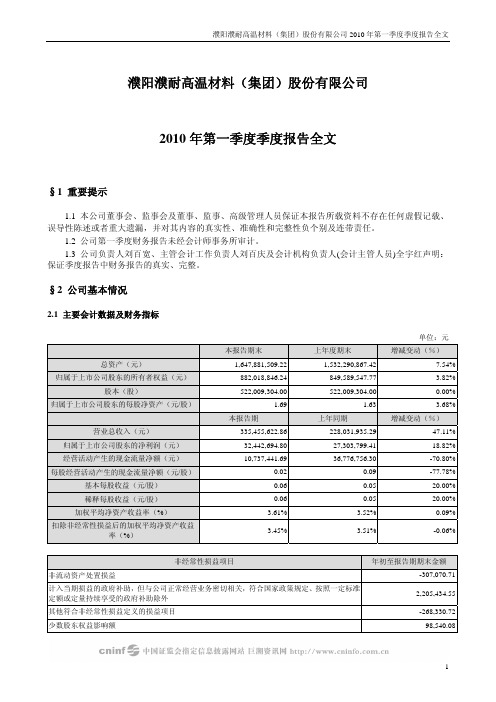

濮阳濮耐高温材料(集团)股份有限公司2010年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司负责人刘百宽、主管会计工作负责人刘百庆及会计机构负责人(会计主管人员)全宇红声明:保证季度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)1,647,881,509.221,532,290,867.42 7.54%归属于上市公司股东的所有者权益(元)882,018,846.24849,589,547.77 3.82%股本(股)522,009,304.00522,009,304.00 0.00%归属于上市公司股东的每股净资产(元/股) 1.69 1.63 3.68%本报告期上年同期增减变动(%)营业总收入(元)335,455,622.86228,031,935.29 47.11%归属于上市公司股东的净利润(元)32,442,694.8027,303,799.41 18.82%经营活动产生的现金流量净额(元)10,737,441.6936,776,756.30 -70.80%每股经营活动产生的现金流量净额(元/股)0.020.09 -77.78%基本每股收益(元/股)0.060.05 20.00%稀释每股收益(元/股)0.060.05 20.00%加权平均净资产收益率(%) 3.61% 3.52% 0.09%扣除非经常性损益后的加权平均净资产收益3.45% 3.51% -0.06%率(%)非经常性损益项目年初至报告期期末金额非流动资产处置损益-307,070.71计入当期损益的政府补助,但与公司正常经营业务密切相关,符合国家政策规定、按照一定标准2,205,434.55定额或定量持续享受的政府补助除外其他符合非经常性损益定义的损益项目-268,330.72少数股东权益影响额98,540.08所得税影响额-275,270.30合计1,453,302.90对重要非经常性损益项目的说明本期非经常性损益主要是濮耐集团下属全资子公司-濮阳市濮耐功能材料有限公司收到的财政拨款199万元2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股报告期末股东总数(户)17,411前十名无限售条件流通股股东持股情况股东名称(全称)期末持有无限售条件流通股的数量种类中国工商银行-汇添富均衡增长股票型证券9,630,111人民币普通股投资基金_中国工商银行-汇添富价值精选股票型证券投2,599,850人民币普通股资基金交通银行-中海优质成长证券投资基金2,415,474人民币普通股光大证券股份有限公司1,708,068人民币普通股中国工商银行-汇添富策略回报股票型证券1,304,429人民币普通股投资基金中国银行-海富通股票证券投资基金_ 1,285,938人民币普通股全国社保基金六零三组合999,979人民币普通股广发证券-交行-广发集合资产管理计划(3850,081人民币普通股号)车衡军815,314人民币普通股汇添富基金公司-上海银行-海通添富牛1515,252人民币普通股号资产管理计划§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用提示:以下带*号的指标的变化幅度较大,主要应考虑本期合并报表范围内增加了“云南濮耐昆钢高温耐材有限公司”。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

深圳市深宝实业股份有限公司2010年第一季度季度报告

二〇一〇年四月

深圳市深宝实业股份有限公司

20201010年第一季度季度报告

§1重要提示

1.1本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2没有董事、监事、高级管理人员对本季度报告内容的真实性、准确性、完整性无法保证或存在异议。

1.3出席本次董事会会议的董事应到9名,实到8名,董事陈少群先生因工作原因未能出席会议,委托董事长郑煜曦先生代为表决。

1.4本季度财务报告未经审计。

1.5本公司董事长郑煜曦先生、总经理彭鹰先生及财务总监曾素艳女士声明:保证季度报告中财务报告的真实、完整。

§2公司基本情况

2.1主要会计数据及财务指标

单位:(人民币)元

非经常性损益项目说明:

政府收地补偿主要系本期收到政府收回公司位于横岗街道荷坳社区G08511-4(6)宗地剩余土地使用权的补偿款。

2.2报告期末股东总人数及前十名无限售条件股东持股情况表

报告期末,股东总数22,124户,其中A股股东17,641户,B股股东4,483户。

§3重要事项

3.1公司主要会计报表项目、财务指标大幅度变动的情况及原因

√适用□不适用

单位:(人民币)元1、资产负债项目

项目期末数期初数增减变动原因

交易性金融资产375,000.00210,000.0078.57%报告期末公司所持股票海国实市值增加所致

短期借款107,500,000.00149,000,000.00-27.85%报告期内归还短期借款所致

应付账款24,159,902.3416,236,290.9048.80%报告期内购买原材料增加所致

其他应付款15,640,237.0733,983,676.35-53.98%报告期内支付惠州新厂项目工程款长期借款108,500,000.0049,000,000.00121.43%报告期内银行长期借款增加所致2、损益项目

项目2010年1-3月2009年1-3月

增减变动原因

财务费用2,653,067.101,026,989.83158.33%本期银行借款增加,利息支出增加所致

投资收益(6,852,362.15)(1,685,203.94)-306.62%报告期内深圳百事净利润较上年同期大幅减少,公司所获投资收益大幅减少

归属于母公司股

东的净利润

(11,359,265.69)(7,081,035.05)-60.42%报告期内公司投资收益大幅减少

3.2重大事项进展情况及其影响和解决方案的分析说明

□适用√不适用

3.3公司、股东及实际控制人承诺事项履行情况

√适用□不适用

注:公司持股5%以上股东或实际控制人无自愿追加股份限售承诺的情况。

3.4预测年初至下一报告期期末的累计净利润可能为亏损或者与上年同期相比发生大幅度变动的警示及原因说明

□适用√不适用

3.5其他需说明的重大事项

3.5.1证券投资情况

√适用□不适用

3.5.2报告期接待调研、沟通、采访等活动情况表

□适用√不适用

3.5.3向控股股东或其关联方提供资金、违反规定程序对外提供担保的情况

□适用√不适用

3.5.4报告期重大合同情况

□适用√不适用

3.5.5公司大股东及其一致行动人在报告期提出或实施股份的增持计划□适用√不适用

3.5.6其他重大事项的说明

□适用√不适用

3.6衍生品投资情况

□适用√不适用

§4附录

4.1资产负债表

4.2利润表

4.3现金流量表

4.4审计报告

审计意见:未经审计

深圳市深宝实业股份有限公司

董事长:郑煜曦

二○一○年四月二十日。