How To Convert Foreign Currency Returns Into Australian Dollar Returns

现代大学英语精读3 复习 总结

English S ummary PhrasesPart I学术生活 academic l ife民族认同 ethnic i dentity种族歧视 racial p rejudice伦理道德观念 ethical v alues政治上的成熟 political m aturity认同危机 identity c risis基因工程 genetic e ngineering偶然事件 chance e vents青少年阶段 adolescence s tage每日工作日程 daily a genda功能独立 functional i ndependence异性 the o pposite s ex生活方式 a w ay o f l ife获得知识 to a cquire k nowledge给这个词下定义 to d efine t he w ord对这种对待感到反感 to r esent t he t reatment确立自己的身份 to e stablish t heir i dentity使学生感到沮丧 to f rustrate t he s tudents宣战 to d eclare w ar拖着脚步 to d rag o ne’s f eet对结果进行评估 to e valuate t he r esult对知识进行加工 to p rocess k nowledge缩小差距 to n arrow t he g ap扩大业务 to e xpand b usiness装配汽车 to a ssemble c ars提出事实 to p resent f actsPart I I决定今天到此为止 to c all i t a d ay获得利益 to m ake p rofit改进性能 to i mprove p erformance停学 to q uit s chool做一笔交易 to m ake a d eal变本加厉重新开始 to s tart a gain w ith a v engeance 注册登记成立一家公司 to i ncorporate a c ompany组装一辆汽车 to a ssemble a c arto g ross(top/net) 10 m illion d ollars营业额达(总数超/纯利达)一千万美元开发产品 to d evelop p roducts营销产品 to m arket p roducts从中得到教训 to d raw a l esson f rom i t实现梦想 to r ealize a d ream捐钱 to d onate m oney游手好闲,不务正业 to f ool a round经济前景 business(economic) p rospects竞争优势 a c ompetitive e dge营业执照 business l icense库存和管理费 inventory a nd o verheads按客户需要配置的电脑 custom-‐made(personalized) c omputers 库存过多 surplus s tock/excess i nventory销售定额 a s ales q uota增值 added v alue零售价格 a r etail p rice千载难逢的机会 the o pportunity o f a l ifetime春假 spring r ecess财务和管理 finance a nd a dministration直销 direct m arketing会计基础 accounting b asics可以退货的保证 a m oney-‐back g uarantee现场服务 on-‐site s ervice市中心 a c ivic c enter犹太人集中的社区 the J ewish c ommunity终端用户 end u sersPart I II继续去写她的东西 to r esume h er w riting流露他的真情 to b etray h is t rue f eelings引起巨大愤怒 to a rouse g reat a nger出自己的洋相 to m ake a f ool o f o neself通知相关的所有人 to i nform e veryone c oncerned问讯 to m ake i nquires遭受巨大痛苦 to s uffer a t errible p ain扔一块石头 to p itch a s tone(因为重要)专门去做某事 to m ake a p oint o f d oing s omething侵犯我的隐私 t o i nfringe o n m y p rivacy放弃研究 to a bandon t he r esearch上一个新项目 to l aunch a n ew p roject重新做人 to s tart o ne’s l ife a fresh采纳一种新方法 to a dopt a n ew m ethod挑起激烈的反应 to p rovoke a v iolent r eaction找回自己丢失的车 to r ecover o ne’s m issing c ar涉及到和各种人打交道 to i nvolve d ealing w ith a ll k inds o f p eoplePart I V将人民币换成外币 t o c onvert C NY i nto f oreign c urrency寻找真理 to s eek t he t ruth抛掉旧的传统 to d iscard t he o ld t raditions讽刺人的虚荣 to s atirize h uman v anity在那岛上住人 to i nhabit t hat i sland钦佩他们的勇气 to a dmire t heir c ourage玩忽职守 to n eglect o ne’s d uty逃避后果 to e scape t he c onsequences挡路 to b lock o ne’s w ay毁掉名誉 to r uin o ne’s r eputation年久失修的防御工事 neglected f ortificationsa s quatter’s h ut擅自占用土地的人搭建的临时简陋房子容易变质的东西 perishable g oods社会习俗 conventions o f s ociety摇摇晃晃、头重脚轻的酒鬼 tottering d runks当前的风云人物 the m an o f t he h our英雄人物 heroic f igures一种带有使命感的神态 an a ir o f d estiny看人时如火一般的眼光 a w ar s care雨点般的石头 a s hower o f s tones一小撮捣乱分子 a h andful o f t rouble-‐makersPart V塑造年轻人的心灵 to m old y oungsters’ t hinking涂上黄油 to s pread b utter污染环境 to c ontaminate t he e nvironment缓和口气 to m odify t he t one造成未曾料到的伤害 to w ork u nknown h arm创造奇迹 to w ork m iracles获得权力 to a cquire p ower抛弃朋友 to d esert o ne’s f riends放弃这一城市 to d esert t he c ity解决这一争端 to s ettle t he d ispute解决这一问题* to s ettle t he m atter赏心悦目 to d elight t he e ye侵入那个国家 to i nvade t hat c ountry侵犯某人隐私 to i nvade o ne’s p rivacy挖一口井 to s ink a w ell严酷的现实 harsh r eality空气污染 air c ontamination致命武器 lethal w eapons人工合成材料 synthetic m aterials事先的调查 advance i nvestigation生死攸关的斗争 a l ife-‐and-‐death s truggle外来物种 introduced s pecies自然保护区 natural r eserves农业的精耕细作 intensification o f a gricultureParagraphsPart IADuring t his t ime, s tudents a re g oing t hrough a n i dentity c risis a nd a re e ndeavoring t o find o ut w ho t hey a re a nd w hat t heir s trengths a nd w eaknesses a re. T hey h ave, o f course, p lenty o f b oth. I t i s i mportant t o k now h ow p eople p erceive t hemselves a s well a s h ow o thers p erceive t hem. A ccording t o p iers a nd l andau, i n a n a rticle discussing t he t heories o f E rik H. E rickson i n i nternational e ncyclopedia o f s ocial sciences (1979), i dentity i s d etermined b y g enetic e ndowment (what i s i nherited from p arents), s haped b y e nvironment, a nd i nfluenced b y c hance e vents. P eople a re influenced b y t heir e nvironment a nd, i n t urn, i nfluence t heir e nvironment. H ow people s ee t hemselves i n b oth r oles i s u nquestionably a p art o f t heir i dentity.BProbably o ne o f t he m ost s tressful m atters f or y oung c ollege s tudents i s e stablishing their f uture s exual i dentity, w hich i ncludes r elating t o t he o pposite s ex a nd projecting t heir f uture r oles a s m en o r w omen. E ach m ust d efine h er o f h is s exual identity i n a f eminine o r m asculine r ole. T hese a re e xciting t imes y e f rustrating t imes. Probably n othing c an m ake s tudents f eel l ower o r h igher e motionally t han t he w ay they a re r elating t o w homever t hey a re h aving a r omantic r elation w ith. F or e xample, when I w as w orking w ith a y oung c ollege s tudent, h e b ounced i nto m y o ffice o nce with a s mile o n h is f ace a nd e xcitement i n h is v oice. T he y oung m an d eclared, “I’ve just h ad t he b est d ay o f m y l ife!” h e w ent o n t o e xplain h ow h e h ad m et a n extraordinary y oung w oman a nd h ow t his r elationship w as a ll h e h ad d reamed a romantic r elationship s hould b e. T hat s ame y oung m an c ame i nto m y o ffice l ess t han a w eek l ater, d ragging h is f eet w ith a d ismayed, d ejected l ook o n h is f ace. H e s at down i n t he s ame c hair, s ighed d eeply, a nd d eclared,” I’ve j ust h ad t he w orst d ay o f my l ife!” h e a nd t he y oung w oman h ad j ust h ad a n a rgument, a nd t heir r elationship was n o l onger g oing w ell. T hus, t he w ay s tudents a re r elating t o t hose o f t he opposite s ex h as a d efinite i nfluence o n t heir e motions.Part I IADell k new t hat I BM r equired i ts d ealers t o t ake a m onthly q uota o f P Cs, i n m ost c ases more t han t hey c ould s ell. H e a lso k new t hat h olding e xcess i nventory w as c ostly. S o he b ought d ealers' s urplus s tock a t c ost. B ack i n h is d orm r oom, h e a dded f eaturesto i mprove p erformance. T he s ouped-‐up m odels f ound e ager b uyers. S eeing t he hungry m arket, D ell p laced l ocal a dvertisements o ffering h is c ustomized c omputers at 15 p ercent o ff r etail p rice. S oon h e w as s elling t o b usinesses, d octors' o ffices a nd law f irms. T he t runk o f h is c ar w as h is s tore; h is r oom t ook o n t he a ppearance o f a small f actory.BThe q uarters h e s hared w ith t wo r oommates l ooked l ike a c ombat z one-‐ b oxes p iledhigh, c omputer b oards a nd t ools s cattered a round. O ne d ay h is r oommates h eaped all h is e quipment i nto a p ile, p reventing D ell f rom e ntering h is r oom. I t w as t ime t o come t o g rips w ith t he m agnitude o f w hat h e h ad c reated. T he b usiness w as n ow grossing m ore t han $ 50 000 a m onth.Part I IIAMr. C rowther, f or h is p art, h ad a lso s uffered s ome d istraction. T hought h e w as pretending t o r ead, h e w as a ctually u nable t o d o s o. F or a ll h is a ppearance o f indifference, t he s ight o f a w ell-‐to-‐do g entleman p itching a s uitcase f rom t he window o f a m oving t rain h ad s urprised h im v ery m uch. B ut h e h ad n ot b etrayed h is surprise. T he f ellow w as o bviously c ounting o n h im f or a v iolent r eaction, a nd s o M r. Crowther m ade a p oint o f n ot r eacting. W hether t he t hing w as a p ractical j oke o r n ot, Mr. C rowther c onsidered i t a n a nnoying i nfringement o f h is p rivacy. I t w as a s i f t he fellow h ad b urst a p aper b ag i n t he h ope o f m aking h im j ump. W ell, h e w asn't g oing to j ump, h e w asn't g oing t o g ive t hat f ellow t he s atisfaction. I f t he f ellow i magined that t o t hrow a s uitcase o ut o f t he w indow g ave h im s ome s ort o f i mportance, w ell, he w as m istaken.BMr. H arraby-‐Ribston t ook t he d isclosure r emarkably w ell. H e d id, i t's t rue, f linch a nd turn a l ittle p ale, b ut i n a f ew m oments h e h ad r ecovered h imself." T hank y ou, s ir," he s aid; a nd l et m e s ay h ow m uch I a ppreciate y our o penness. I n f act, y ou t empt m e to b e e qually f rank w ith y ou. L et m e c onfess, t hen, t hat a s a m atter o f f act I h aven't left m y w ife, f or t he s imple r eason t hat I'm a b achelor. I g row v egetables o n r ather a large s cale a nd o nce a w eek b usiness t akes m e t o L ondon. A s f or t he m atter o f t he suitcase , I h ave s ome f riends w hose h ouse w e p assed a f ew m iles b ack a nd e very week I f ill a s uitcase w ith v egetables, b ring i t w ith m e, a nd t hrow i t o ut o f t he carriage-‐window a s t he t rain p asses t heir h ouse. I t r olls d own t he e mbankment a nd lands u p a gainst t heir r ailings. I t's a p rimitive m ethod, I k now, b ut i t s aves p ostage and y ou c an h ave n o i dea h ow m uch e ntertaining c onversation i t p rovokes w ith m y fellow-‐passengers. Y ou, i f I m ay s ay s o, a re n o e xception."Part I VAOnly t wenty, A lexander w as f ar o lder a nd w iser t han h is y ears. L ike a ll M acedonians he l oved d rinking, b ut h e c ould u sually h andle i t; a nd t oward w omen h e w as n obly restrained a nd c hivalrous. L ike a ll M acedonians h e l oved f ighting; h e w as a magnificent c ommander, b ut h e w as n ot m erely a m ilitary a utomaton. H e c ould think. A t t hirteen h e h ad b ecome a p upil o f t he g reatest m ind i n G reece, A ristotle who g ave h im t he b est o f G reek c ulture. H e t aught A lexander p oetry: t he y oung prince s lept w ith t he I liad u nder h is p illow a nd l onged t o e mulate A chilles, w ho brought t he m ighty p ower o f A sia t o r uin. H e t aught h im p hilosophy, i n p articular t he shapes a nd u ses o f p olitical p ower a nd h e t aught h im t he p rinciples o f s cientific research: d uring h is i nvasion o f t he P ersian d omains A lexander t ook w ith h im a l argecorps o f s cientists, a nd s hipped h undreds o f z oological s pecimens b ack t o G reece f or study. I ndeed, i t w as f rom A ristotle t hat A lexander l earned t o s eek o ut e verything strange w hich m ight b e i nstructive.BNow, A lexander w as i n C orinth t o t ake c ommand o f t he L eague o f G reek S tates, which, h is f ather P hilip h ad c reated a s a d isguise f or t he N ew M acedonian O rder. H e was w elcomed a nd h onored a nd f lattered. H e w as t he m an o f t he h our, o f t he century: h e w as u nanimously a ppointed c ommander-‐in-‐chief o f a n ew e xpedition against o ld, r ich, c orrupt A sia. N early e veryone c rowded t o C orinth i n o rder t o congratulate h im, t o s eek e mployment w ith h im, e ven s imply t o s ee h im. O nly Diogenes, a lthough h e l ived i n C orinth, d id n ot v isit t he n ew m onarch. W ith t hat generosity w hich A ristotle h ad t aught h im , A lexander d etermined t o c all u pon Diogenes.Part VAAnother f actor i n t he m odern i nsect p roblem i s t he s preading o f t housands o f different k inds o f o rganisms f rom t heir n ative h omes. S ome h undred m illion y ears ago, f looding s eas c ut m any l and b ridges b etween c ontinents a nd l iving t hings f ound themselves c onfined i n w hat a n e cologist c alls “colossal s eparate n ature r eserves”. There, i solated f rom o thers o f t heir k ind, t hey d eveloped m any n ew s pecies. W hen some o f t he l and m asses w ere j oined a gain, a bout 15 m illion y ears a go, t hese species b egan t o m ove o ut i nto n ew t erritories-‐-‐-‐a m ovement t hat i s n ot o nly s till i n progress b ut i s n ow r eceiving c onsiderable a ssistance f rom m an.BIt i s n ot m y c ontention t hat c hemical i nsecticides m ust n ever b e u sed. I d o c ontend that w e h ave p ut p oisonous a nd b iologically p otent c hemicals i ndiscriminately i nto the h ands o f p ersons l argely o r w holly i gnorant o f t heir p otentials f or h arm. W e h ave subjected e normous n umbers o f p eople t o c ontact w ith t hese p oisons, w ithout t heir consent a nd o ften w ithout t heir k nowledge. I c ontend, f urthermore, t hat w e h ave allowed t hese c hemicals t o b e u sed w ith l ittle o r n o a dvance i nvestigation o f t heir effect o n s oil, w ater, w ildlife, a nd m an h imself. F uture g enerations a re u nlikely t o forgive o ur l ack o f c oncern f or t he i ntegrity o f t he n atural w orld t hat s upports a ll l ife.TranslatePart I1) 她打算申请那个学术工作。

企业外币换汇流程及手续

企业外币换汇流程及手续英文回答:Foreign currency exchange is a common process for businesses that engage in international trade or have operations in different countries. The process and procedures for currency exchange may vary depending on the specific requirements of the company and the country involved. Here, I will outline a general overview of the steps and formalities involved in the foreign currency exchange process.1. Determine the currency needs: The first step is to assess the currency requirements of the business. This includes identifying the currencies needed for international transactions, such as payments to suppliers or receipt of funds from overseas customers.2. Research exchange rates: It is important to stay updated on the current exchange rates for the currenciesinvolved. This can be done by consulting financial news sources, online currency converters, or contacting a foreign exchange service provider.3. Choose a foreign exchange service provider: There are various options for exchanging foreign currency, including banks, specialized currency exchange companies, and online platforms. It is advisable to compare the rates and fees offered by different providers to ensure the best deal.4. Provide necessary documentation: In order to comply with legal and regulatory requirements, businesses may need to provide certain documents to complete the currency exchange. This may include identification documents, proof of business registration, and supporting documents for the specific transaction.5. Complete the exchange transaction: Once all the necessary documentation is in order, the business can proceed with the exchange transaction. This can be done by visiting a physical exchange location or by using an onlineplatform. The business will need to provide the amount and type of currency to be exchanged, and the service provider will facilitate the transaction at the prevailing exchange rate.6. Keep records: It is important to maintain accurate records of all foreign currency exchange transactions for accounting and auditing purposes. This includes keeping copies of exchange receipts, transaction confirmations, and any other relevant documentation.Example: As a business owner, I recently needed to exchange US dollars into euros to pay a supplier in Germany.I researched the current exchange rates and compared the rates offered by different banks and currency exchange companies. After choosing a reputable exchange service provider, I provided the necessary documentation, including my passport and proof of business registration. I completed the exchange transaction online, specifying the amount ofUS dollars to be exchanged and receiving the equivalent amount in euros at the prevailing exchange rate. I received a transaction confirmation and kept a copy for my records.中文回答:外币换汇是一种常见的流程,适用于从事国际贸易或在不同国家开展业务的企业。

银行英语会话第3课-兑换外币 Foreign Exchange

银行英语会话第3课:兑换外币Foreign Exchange导读:本文银行英语会话第3课:兑换外币Foreign Exchange,仅供参考,如果觉得很不错,欢迎点评和分享。

Lesson 3 Foreign Exchange兑换外币Key Sentences重点句型Today's exchange rate of RMB to USD is 812 RMB yuan equal to 100 US dollars.今天的汇率是812元人民币兑100美元.What kind of foreign currency have you got?What's the exchange rate today?您持有什么外币?今天的汇率是多少?What kind of currency do you want to change?您想换哪一种外币?Please keep check the money and keep the exchange memo.Sorry you've filled a wrong account number Please refill it.请点清钞票,保存好水单.抱歉,您的账户不对,请重新填写.What is the equivalent of five dollars in RMB yuan?五美元相当于人民币多少元?We list the exchange rate issued by the People's Bank of China every morning.我们是根据每天早上中国银行发布的汇率挂牌的.What are you going to convert,bank notes or traveller's checks?你要兑换什么,是现钞还是旅行支票?Dialogue 1 A:Excuse me.B:Can I help you?对话1 劳驾.您要什么服务?A:I want to change some US dollars into RMB.我想把美元换成人民币.B:Of course.当然行.We are an authorized foreign exchange bank and can change them for you.我们是指定经营外汇业务的银行.可以为您兑换.How much do you want to change?您要换多少?A:Let me see.Fifty US dollars.B:Very well,sir.让我想想,五十美金.好的,先生.Notes I want to change some US dollars into RMB.我想把美元换成人民币.动词change译为兑换或换成零钱,例如Where can I change my dollars for pounds?请问我可在哪儿将美元兑换成英镑。

外贸英语Lesson_8

Set time/place (2)

Good, …is good for me. Let’s make it. Terrific, i’ll be there on time. See you then. Sounds good to me. Seems suitable for me. Yes, good to me.

Questions 1. What food does Mr. Brown like, Chinese food or Western food? 2. What dishes does Mr. Brown order?

3. Ordering Dishes

chopstick mineral water

You are being too modest. 您太客气了。 Discover 发现; 碰见; 撞见; 获得知识 As he discovered, she had a brilliant mind... 正如他所发现的,她冰雪聪明。

Considerate adj.体贴的,体谅的; 深思熟虑; 到; 慎重 I think he's the most charming, most considerate man I've ever known... 我觉得他是我所认识的最有魅力并且最为体贴 的男士。

Questions 1. How much does Mr. Brown need to pay for his meal? 2. Does the waitress accept traveller’s checks?

Lesson 13

Make an appointment 约会 Dialogue 1. Recover 恢复 He is recovering from a knee injury... 他的膝伤正在康复。

国际会计准则第 21号外汇汇率变动的影响【外文翻译】

本科毕业论文(设计)外文翻译题目外币报表折算方法分析及中国的选择初探专业会计学外文题目Effect of Changes in Exchage Rates of Foreign Currencies 外文出处International Accounting Standard No 21 (IAS 21)外文作者International Accounting Standards Board原文:International Accounting Standard No 2 (IAS 2)Effect of changes in exchange rates of foreign currenciesObjectiveAn institution may conduct business abroad in two different ways. You can make transactions in foreign currency or may have business abroad. In addition, the entity may file its financial statements in a foreign currency. The purpose of this rule is to prescribe how they are incorporated in the financial statements of an entity, foreign currency transactions and business abroad, and how to convert the financial statements to the presentation currency of choice.The main problems that arise are the type or types of change to use and how to report on the effects of changes in exchange rates within the financial statements.DefinitionsOne group is the group formed by the parent and all its subsidiaries.Net investment in a foreign operation is the amount that corresponds to the participation of the entity that submitted their financial statements in the net assets of that business.Foreign currency (or currency) is any currency other than the functional currency of the entity.Functional currency is the currency of the primary economic environment in which the entity operates.Presentation currency is the currency in which the financial statements are presented.Business abroad is an entity dependent partner, joint venture or branch of the reporting entity, whose activities are based or carried out in a country or a currency different from those of the reporting entity.Currency monetary items are kept in cash and assets and liabilities to be received or paid by a fixed or determinable amount of monetary units.Exchange rate is the ratio of exchange between two currencies.End exchange rate is the rate of existing cash on the balance sheet date.Exchange rate spot is the exchange rate used in transactions with immediate delivery.Fair value is the amount for which an asset could be exchanged, canceled or a liability,among stakeholders and duly informed in a transaction conducted at arm's length.Initial Recognition1. A foreign currency transaction is any transaction whose value is called or requires winding up in a foreign currency, including those in which the entity:(a) buys or sells goods or services whose price is denominated in a foreign currency;(b) lends or borrows funds, if the amounts are set to charge or pay in a foreign currency(c) acquires or disposes provides another avenue for assets or liabilities incurred or liquidation, provided that these operations are denominated in foreign currencies.2. Any foreign currency transaction is recorded at the time of its initial recognition,using the functional currency, by applying to the amount in foreign currency exchange spot at the date of the transaction between the functional currency and foreign currency.The date of the transaction is the date on which the transaction meets the conditions for recognition in accordance with International Financial Reporting Standards. For practical reasons, often using an exchange rate closer to existing at the time of the transaction, for example, may be used for weekly or monthly average rate for all transactions that take place at that time In each of the classes of foreign currency used by the entity.However, it is not appropriate to use average rates if during the interval, the changes have fluctuated significantly.Financial information on the dates of the balance sheets post3. At each balance sheet date:(a) monetary items in foreign currencies are converted using the exchange rate of closure;(b) the non-monetary foreign currency being valued in terms of historical cost, will be converted using the exchange rate on the date of the transaction; and(c) the non-monetary foreign currency being valued at fair value, will be converted using the exchange rates of the date it was determined that fair value.4. To determine the amount of an item is taken into account, in addition, other rules that apply. For example, tangible assets can be valued in terms of historical cost or revalued amount, in accordance with IAS 16 Property, plant and equipment. Regardless of whether it has determined the amount by using the historical cost or revalued amount,provided that this amount has been established in foreign currency is converted to the functional currency using the rules set out in this Standard.Recognition of exchange differences5.Exchange differences that arise in the settlement of monetary items, or to convert monetary items at rates different from those used for its initial recognition, have already occurred during the year or in previous financial statements, are recognized in the outcome of year in which they appear.See a difference when you have change monetary items as a result of a transaction in foreign currency, and there is a change in the exchange rate between the date of the transaction and the settlement date. When the transaction is settled in the same year in which they occurred, the entire exchange difference will be recognized in that period.However, when the transaction is settled in a later period, the exchange difference recognized in each period, until the settlement date, will be determined from the change that has occurred in the exchange rate for each year. When recognized directly in equity gain or loss on a non-monetary, any exchange difference, including in such losses or gains were also recognized directly in equity. By contrast, when the gain or loss on a non-monetary recognition in profit or loss, any exchange difference, including in such losses or gains, was also recognized in profit or loss.6. Exchange differences arising on a monetary item that forms part of the netinvestment in a business of the foreign entity, are recognized in profit or loss of the separate financial statements of the reporting entity or in the separate financial statements of business abroad, as appropriate. Financial statements containing the business abroad and the reporting entity (for example,the consolidated financial statements if the business abroad is a dependent), such exchange differences are recognized initially as a separate component of equity,and subsequently recognized in the outcome when it becomes available or disposed of by other means business abroad.When a monetary item is part of the net investment, carried out by the reporting entity in a foreign operation, and is denominated in the functional currency of the reporting entity,an exchange difference arises in the separate financial statements of the business abroad.When the entity bears its records and ledgers in a currency other than their functional currency and proceed to prepare their financial statements, will convert all amounts to the functional currency, as set out in paragraphs 1 to 26.As a result, will produce the same amounts, in terms of functional currency, which would have been earned if the items were originally recorded in the functional currency. For example, monetary items are translated into the functional currency using the exchange rates of closure, and nonmonetary items which are valued at historical cost, will be converted using the exchange rate at the date of the transaction that created its appreciation.7. The results and financial position of an entity whose functional currency is not in accordance with the currency of a hyperinflationary economy, translated into the presentation currency, should it be different, using the following procedures:(a) the assets and liabilities of each balance sheet presented (i.e., including comparative figures), will be converted at the rate of closure on the date of the corresponding stock;(b) revenue and expenses for each profit and loss accounts (i.e., including comparative figures), will become the exchange rates at the date of each transaction; and(c) all exchange differences arising out of this, it is recognized as a separate component of equity.8. Often, for the conversion of items of income and expenditure, is used for practical purposes an approximate rate, representative of changes in the dates of transactions,such as the average exchange rate of the period. However, when exchange rates have changed significantly, it is inappropriate to use the average rate for the period.9. Exchange differences referred to in paragraph (c) of paragraph 39 are listed by:(a) The conversion of expenditure and revenue to the exchange rates of the dates oftransactions, and of the assets and liabilities at the rate of closure. These differencesappear to change both the expenditure items and revenue recognized in the results, as recognized by the directly in equity.(b) Conversion of assets and liabilities to an early Net-end exchange rate that is different from the type used in the previous closing. Such exchange differences are not recognized in profit or loss because of the variations in exchange rates have little or no direct effect on cash flows arising from current and future activities. When the above exchange differences relating to a business abroad that while consolidating, is not involved in its entirety, the cumulative exchange differences arising from the conversion that is attributable to the minority stake, will be allocated to it and be recognized as part of the minority interest in the consolidated balance sheet.10. When the entity's functional currency is that of a hyperinflationary economy, it will restate its financial statements before implementing the conversion method set out in paragraph 42, according to IAS 29 Financial reporting in hyperinflationary economies, except the comparative figures, in the case of conversion to the currency of a hyperinflationary economy.When the economy in question ceases to be hyperinflationary and the entity ceases to restate its financial statements in accordance with IAS 29, used as the historic costs to be converted to the presentation currency, the amounts restated according to the level of prices on the date that the entity ceased to do this restatement.11. When converting to a presentation currency, the results and financial position of a foreign operation, as a preliminary step to their inclusion in the financial statements of the reporting entity, whether through consolidation, or using the proportional consolidation method of Participation will apply paragraphs 45 to 47, in addition to the provisions of paragraphs 38 to 10.The incorporation of the results and financial position of a foreign operation to the reporting entity will follow the normal procedures of consolidation, such as the elimination of intra-group transactions and balances of a dependent (see IAS 27 States Consolidated and separate financial and IAS 31 Interests in joint ventures). However, an asset (or liability) intragroup money, either short or long term, it may not be eliminated against the corresponding liability (or asset) Intra, without showing the results of changes in exchange rates within the states Consolidated Financial. This is because the monetary item represents a commitment to convert one currency into another, which exposes the reporting entity at a loss or gain on exchange fluctuations between the currencies. In line with this, in the consolidated financial statements of the reporting entity, the exchange difference should continue to be recognized in profit or loss, or, if they arise from the circumstances described in paragraph 32, is classified as a component of equity until the disposition or disposal by other means business abroad.12. When the financial statements of business abroad and the reporting entity are referred to different dates, he often produces additional financial statements with the same date as this one. When it is not, IAS 27 allows the use of different dates of submission, provided that the difference is not greater than three months, and have performed the appropriate adjustments to reflect the effects of significant transactions and other events that occurred between the dates reference. In this case, the assets and liabilities of the business abroad will be converted at the rate of the balance sheet date business abroad.It was also carried out the appropriate adjustments for significant variations in exchange rates until the balance sheet date of the reporting entity, in accordance with IAS 27.Disposition or disposal by other means of a foreign13. To alienate or otherwise dispose of a foreign operation, exchange differences deferred as a component of shareholders' equity, related to that business abroad, be recognized in the results at the same time they recognize the outcome of the alienation or disposition.It may have all or part of their participation in a business abroad through the sale,liquidation, recovery of capital contributed or neglect. The receipt of a dividend will be part of this provision only if it constitutes a recovery in investment, for example when it is paid from income in prior years to the acquisition. In the case of disposal or partial disposal, only included in the result of the exercise, the proportionate share of the difference in accumulated corresponding conversion. The correction of the value of a business abroad will not constitute a sale or partial disposal. Accordingly, at the time of accounting for this correction, shall not be recognized in profit or loss accrued no difference conversion.Source:(Excerpt from)International Accounting Standard No 21 (IAS 21),International Accounting Standards Board 1993译文:国际会计准则第21号外汇汇率变动的影响(1993年12月修订)目的企业可以用两种方式从事对外的活动。

前台英语-货币兑换)

Currency Exchange兑换外币Exchange 兑换1. What kind of currency do you want? 你要哪种货币?U.S.dollars。

美元。

In what denominations? 要什么面值的?Seven tens.7张10元的。

2. Can you change me some money, please? 能否请给我兑换一些钱?Ok. What would you like to change? 你想兑换成什么货币?Japanese Yen.日元。

Ok。

Please tell me hoe much you want to change? 好的,请告诉我你要换多少?1500RMB。

1500人民币。

3. I’d like to know if you could change this money back into U.S. dollars for me.我想知道能否把这笔钱兑换成美元。

Yes. We offer exchanges of many kinds of currencies.可以。

我们提供多种币种的兑换服务。

Oh, by the way, would you like to give me some small notes?哦,顺便说一下,给我一些小票好吗?Of course.当然可以。

Exchange rate汇率1. Could you tell me what today’s exchange rate for U.S. dollars is? 请问今天美元的汇率是多少?Dollar in cash is equivalent to 6.9 Chinese yuan.1美元兑换6.9块人民币。

All right, I want to change 10000 Yuan.行,我想换1万元人民币。

Ok. Would you kindly sign the exchange form, your name and address? 好的,请在兑换单上签字,写出你的名字和地址,好吗?Ok。

英语兑换货币

兑换货币常用句型兑换货币常用句型Please tell me how much you want to change.请告诉我你要换多少。

How much of the remittance do you want to convert into Japanese yen? 你要把多少汇款换成日圆?What kind of currency do you want?要哪种货币?What's it you wish to change?你有什么要换的?What kind of currency do you want to change?要换哪种货币?In what denominations?要什么面值的?Please tell me what note you want.请告诉我要什么钞票。

Will seven tens be all right?7张10元的可以吗?Is it in traveler's cheques?换旅行支票吗?I'd like to know how I shall give it to you.我想知道如何付钱给你。

How would you like it?你要什么面额的?Would you kindly sign the exchange form, giving your name and address? 请在兑换单上签字,写出你的姓名和地址,好吗?Can you change me some money, please?能否请你给我兑换一些钱?Here it is, some French francs, Swiss francs, American dollars and a few Dutch guilders.这些就是:一些法国法郎,瑞士法郎,美圆和一些荷兰盾。

Would you please give me seven five-pound notes, four pound notes and four ten-shilling notes, and the rest in small change.请你给我7张5镑纸币,4张1镑纸币,4张10先令纸币,剩下的要零票。

外籍人员来华支付指南英文版

外籍人员来华支付指南英文版English version:1. Payment through Foreign Currency Account.Open a Foreign Currency Account (FCA) with a Chinese bank.Deposit foreign currency into the FCA.Make payments in foreign currency from the FCA.2. Payment through RMB Account.Open a Chinese RMB account with a Chinese bank.Convert foreign currency into RMB and deposit it into the RMB account.Make payments in RMB from the RMB account.3. Payment through Credit Card.Use a credit card that is accepted in China.Make payments in RMB or foreign currency as per the credit card's terms and conditions.4. Payment through Mobile Payment (WeChat Pay, Alipay)。

Register for WeChat Pay or Alipay using a Chinesemobile phone number.Link a Chinese bank account or foreign currency account to the mobile payment app.Make payments by scanning QR codes or using NFC.5. Payment through UnionPay Card.Obtain a UnionPay card from a Chinese bank or a foreign bank that issues UnionPay cards.Make payments in RMB or foreign currency as per the card's terms and conditions.6. Payment through Bank Transfer (SWIFT)。

旅游中兑换外币的英语说法

旅游中兑换外币的英语说法旅游中兑换外币的英语说法导语:去国外旅游你就要将本国货币兑换成别国货币,这时候你该怎么表达自己的.意思呢。

今天就为你准备了如何兑换外币的旅游英语,希望对你有帮助。

第一句: I want to change some RMB into American dollars.我想把人民币兑换成美元。

A: Excuse me. Do you exchange foreign money?请问你们兑换外币吗?B: Yes. What kind of currency do you want?是的,你要兑换什么货币?A: I want to change some RMB into American dollars.我想把人民币兑换成美元。

第二句: I want to exchange my dollars for pounds.我想把美元换成英镑。

A: What can I do for you?您需要什么帮助吗?B: I want to exchange my dollars for pounds.我想把美元兑换成英镑。

A: What's the amount you'd like to exchange?您想要换多少?B: I'd like to exchange $200.我想兑换200美元。

其他表达法:I'd like to convert the unused US dollars back into RMB.我想把没用完的美元换成人民币。

I'd like to change some foreign currency. 我想换外币。

赎回外币的基本流程

赎回外币的基本流程When it comes to the process of redeeming foreign currency, there are several important steps that individuals need to follow. First and foremost, it is crucial to determine which currency needs to be redeemed and the amount that needs to be exchanged. This can be done by checking the current exchange rate for the desired currency and calculating the total amount that needs to be redeemed. Once this information is gathered, the next step is to find a reputable foreign exchange provider or bank that offers currency redemption services. It is important to choose a provider that offers competitive exchange rates and low fees to ensure that you get the most value for your money.在赎回外币的流程中,有几个重要的步骤需要遵循。

首先,最关键的是确定需要兑换的外币种类和金额。

这可以通过查看所需货币的当前汇率,计算需要兑换的总金额来完成。

获取这些信息后,下一步是找到一家信誉良好的外汇提供商或银行,他们提供外币赎回服务。

选择一家提供具有竞争力的汇率和低费用的提供商至关重要,以确保您能获得最大价值。

赎回外币的基本流程

赎回外币的基本流程英文回答:Redemption Process of Foreign Currency.The redemption process of foreign currency is the act of converting foreign currency back into the domestic currency. This process is typically done through a bank or other financial institution. The basic steps involved in the redemption process of foreign currency are as follows:1. Inquire about the exchange rate. The first step is to inquire about the exchange rate between the foreign currency and the domestic currency. This can be done by contacting a bank or other financial institution.2. Calculate the amount to redeem. Once the exchange rate has been determined, the next step is to calculate the amount of foreign currency that needs to be redeemed. This is done by multiplying the amount of foreign currency bythe exchange rate.3. Obtain the redemption form. The next step is to obtain a redemption form from the bank or other financial institution. This form will typically require the following information:Name.Address.Contact information.Amount of foreign currency to be redeemed.Type of domestic currency to be received.4. Submit the redemption form. Once the redemption form has been completed, it must be submitted to the bank or other financial institution. The form will typically be processed within a few days.5. Receive the domestic currency. Once the redemption form has been processed, the domestic currency will be received. This can be done by cash, check, or wire transfer.中文回答:外币赎回基本流程。

常见个人外汇业务办理指南英文版

常见个人外汇业务办理指南英文版Foreign exchange, or forex, is the process of converting one currency into another for various purposes, such as commerce, trading, or tourism. For individuals and personal use, there are several common foreign exchange transactions that can be carried out. This guide will provide an overview of some of the most prevalent personal forex activities and how to navigate them.One of the primary reasons individuals engage in foreign exchange is for travel purposes. When visiting a foreign country, it is necessary to convert your domestic currency into the local currency of that destination. This allows you to make purchases, pay for accommodations, and handle other financial matters while abroad. The process of exchanging currency for travel is relatively straightforward. You can visit your bank or a currency exchange office prior to your trip and swap your home country's currency for the foreign currency you require. Alternatively, you can wait until you arrive at your destination and exchange money at the airport, hotel, or a local bank or exchange bureau. It is important to be aware of any fees associated with these currency exchanges, as well as thecurrent exchange rate, to ensure you are getting the best value for your money.Another common personal foreign exchange activity is sending money internationally. Whether it is transferring funds to family members in another country, paying for online purchases from a foreign vendor, or making investments overseas, the ability to move money across borders is essential. There are various methods for conducting international money transfers, such as wire transfers, money remittance services, or even using peer-to-peer payment platforms. Each option has its own fees, processing times, and specific requirements, so it is crucial to research and select the most suitable approach based on your needs and the destination of the funds.Individuals may also engage in foreign exchange for investment purposes. This could involve trading currencies on the forex market, speculating on exchange rate fluctuations, or diversifying a investment portfolio by including assets denominated in foreign currencies. While forex trading can be a complex and risky endeavor, there are educational resources and platforms available that allow individuals to participate in the currency markets, either actively or through passive investment vehicles. It is essential to thoroughly understand the mechanics of forex trading and the associated risks before committing any capital.Foreign exchange is also relevant for those who earn income in a currency that differs from their home country's currency. This could be the case for individuals who work remotely for an employer based in another nation, receive royalties or freelance payments from foreign clients, or have investments that generate returns in a foreign currency. In such situations, the individual must convert the foreign-earned income into their domestic currency, either on a regular basis or as needed. This process requires awareness of exchange rates, potential conversion fees, and tax implications.Additionally, some individuals may need to engage in foreign exchange when making major purchases or investments outside of their home country. For example, buying real estate in a foreign market, investing in overseas securities, or even making large personal purchases while traveling internationally may necessitate converting funds from one currency to another. These types of transactions often involve larger sums of money, so it is crucial to carefully research the applicable exchange rates, fees, and any legal or regulatory requirements.In conclusion, foreign exchange plays a significant role in the daily lives of many individuals, whether it is for travel, international money transfers, investment purposes, or managing income earned in a foreign currency. Understanding the various personal forextransactions, the associated processes, and the factors to consider can help ensure that individuals are able to effectively and efficiently navigate the world of currency conversion. By being informed and proactive, people can make the most of their foreign exchange needs and maximize the value they receive from these financial activities.。

个人境外收入换汇流程

个人境外收入换汇流程英文回答:When it comes to the process of converting personal overseas income into local currency, there are a few steps that need to be followed. Firstly, it is important to havea bank account in the local country where the income is earned. This account will be used to receive the funds from abroad. Once the funds are received, the next step is to initiate the currency exchange. This can be done throughthe bank or a licensed currency exchange service. The exchange rate will be determined at the time of the transaction and may vary depending on the market conditions. After the currency exchange is completed, the funds will be deposited into the local bank account and can be accessed and used as needed.中文回答:当涉及将个人境外收入换成当地货币的流程时,需要遵循几个步骤。

首先,需要在所在国家开立一家银行账户,用于接收来自海外的资金。

一旦资金到账,下一步就是进行货币兑换。

可以通过银行或持有许可的货币兑换服务进行兑换。

外币折算会计处理举例说明

外币折算会计处理举例说明英文回答:Foreign currency translation is an accounting process used to convert financial statements denominated in aforeign currency into the reporting currency of the company. This is necessary when a company operates in multiple countries or has foreign subsidiaries. The purpose of this process is to provide a clear and accurate representationof the company's financial position and performance.There are several steps involved in the foreigncurrency translation process. First, the financial statements of the foreign subsidiary are prepared in the local currency. These statements are then translated into the reporting currency using the appropriate exchange rate. The exchange rate used can vary depending on the method chosen by the company, such as the current rate method or the temporal rate method.Let's take an example to illustrate this process. Suppose a US-based company has a subsidiary in Japan. The subsidiary prepares its financial statements in Japanese yen (JPY). The US company needs to translate these statements into US dollars (USD) for reporting purposes.In this case, the subsidiary's financial statements would be prepared in JPY, including the balance sheet, income statement, and cash flow statement. The exchange rate used for translation would be the spot rate on the date of the financial statements. The spot rate is the current exchange rate at which one currency can be exchanged for another.Once the financial statements are prepared in JPY, the next step is to translate them into USD. The exchange rate used for translation can have a significant impact on the reported figures. For example, if the spot rate is 100 JPY/USD, and the subsidiary has assets worth 10,000 JPY, the translated value in USD would be $100.After the translation is complete, the financialstatements are then consolidated with the parent company's financial statements. This involves combining thetranslated figures with the parent company's figures to provide a comprehensive view of the company's financial position and performance.Foreign currency translation can have a significant impact on a company's financial statements. Fluctuations in exchange rates can result in gains or losses, which are recorded in the income statement. These gains or losses are referred to as foreign currency translation adjustments.In conclusion, foreign currency translation is an important accounting process for companies operating in multiple countries. It involves converting financial statements from the local currency to the reporting currency using the appropriate exchange rate. This process ensures that the company's financial position and performance are accurately reflected in the reporting currency.中文回答:外币折算是一种会计处理过程,用于将以外币计价的财务报表转换为公司的报告货币。

银行货币兑换的英语口语

银行货币兑换的英语口语1A:Excuse me.Can I buy Chinese yuan with American dollars?B:Certainly.What's the amount you want to change?A:200 US dollars.B:Please fill in the exchange memo and show me your passport.A:Is that all right?B:Well.Remember to sign your name on the memo.A:Here you are.B:Here is the money, and also your passport and exchange memo.Please check it.A:It's right.B:By the way,keep your exchange memo safe.You may convert the unused RMB back into foreign currency when you leave China.A:I see.Thanks for the information.B:Not at all.A:请问我可以用美元兑换人民币吗?B:当然可以。

您要换多少?A:200美元。

B:请填写兑换单,出示您的护照。

A:这样行吗?B:噢。

别忘了在兑换单上签名。

A:给您。

B:给您钱,还有护照和兑换水单。

请核点一下。

A:没错。

B:顺便提一下,保管好您的兑换单,离开中国时您可以把未用完的人民币兑换成外币。

A:我明白了。

谢谢您提醒。

B:不客气。

2A:What can I do for you?B:Yes.I'd like to change some US dollars.What’s today's rate of US dollars to RMB?A:It's 826.44 RMB per hundred US dollars.B:How much would you like to change?A:200 US dollars total.B:Please fill out the exchange form.A:All right.B:Would you mind showing me your passport?A:Here it is.B:Please wait a moment.I will do it for you as soon as possible.A:您想办理什么业务?B:我想兑换一些美元。

foreign-currency-exchange-外币兑换

第13页,共21页。

2.Ask the guest how much he wants to change and receive

the money from the guest.

How much would you like to change? 您想要换多少?

4) If we change large amounts, we’ll run out of cash supply and be unable to serve our other guests. 如果我们兑换大额款项,我们就会用光现 金而无法满足其他顾客了。

第20页,共21页。

Thanks

第21页,共21页。

第16页,共21页。

5.Tell the amount and give the money to the

guest.

What denominations would you like? 您要什么面值的货币?

Here/The sum is ...Yuan. Please count it.

这是... 元,请点一下。

问 兑 换 金 额 并 接 收

查 看 客 人 的 护 照

率外

币

填 写 外 汇 兑 换 水 单

告 知 客 人 兑 换 后 的 金 额

要 求 客 人 清 点 所 兑 换 的 钱

给 客 人 收 据 并 告 知 要 妥 善 保

管

第11页,共21页。

New words & Expressions

currency 货币 foreign currency 外币 exchange 交换 souvenir 纪念品 exchange rate 兑换率 receipt 收据 exchange memo 兑换水单 total sum 总数,总额 permanent 永久的 denomination 货币的面额/面值 cash a check 兑现支票

国外旅游兑换货币时的英语口语及常用句型

国外旅游兑换货币时的英语口语及常用句型出国旅游,要去银行兑换货币了怎么用英语表达呢?以下是小编为你准备的出国旅游英语中兑换货币时的常用句型,供你学习参考。

Please tell me how much you want to change.请告诉我你要换多少。

How much of the remittance do you want to convert into Japanese yen?你要把多少汇款换成日圆?What kind of currency do you want?要哪种货币?What's it you wish to change?你有什么要换的?What kind of currency do you want to change?要换哪种货币?In what denominations?要什么面值的?Please tell me what note you want.请告诉我要什么钞票。

Will seven tens be all right?7张10元的可以吗?Is it in traveler's cheques?换旅行支票吗?I'd like to know how I shall give it to you.我想知道如何付钱给你。

How would you like it?你要什么面额的?Would you kindly sign the exchange form, giving your name and address?请在兑换单上签字,写出你的姓名和地址,好吗?Can you change me some money, please?能否请你给我兑换一些钱?Here it is, some French francs, Swiss francs, American dollars and a few Dutch guilders.这些就是:一些法国法郎,瑞士法郎,美圆和一些荷兰盾。

外汇市场主要有两个作用一是将一个国家的货币转换成另

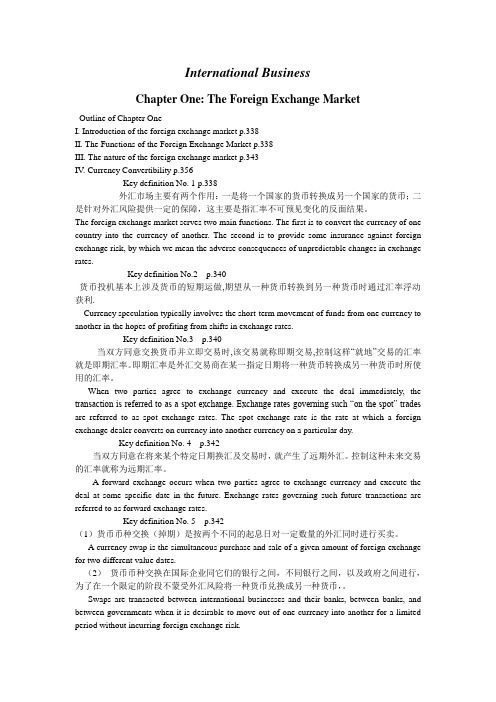

International BusinessChapter One: The Foreign Exchange MarketOutline of Chapter OneI. Introduction of the foreign exchange market p.338II. The Functions of the Foreign Exchange Market p.338III. The nature of the foreign exchange market p.343IV. Currency Convertibility p.356Key definition No. 1 p.338外汇市场主要有两个作用:一是将一个国家的货币转换成另一个国家的货币;二是针对外汇风险提供一定的保障,这主要是指汇率不可预见变化的反面结果。

The foreign exchange market serves two main functions. The first is to convert the currency of one country into the currency of another. The second is to provide some insurance against foreign exchange risk, by which we mean the adverse consequences of unpredictable changes in exchange rates.Key definition No.2 p.340货币投机基本上涉及货币的短期运做,期望从一种货币转换到另一种货币时通过汇率浮动获利.Currency speculation typically involves the short-term movement of funds from one currency to another in the hopes of profiting from shifts in exchange rates.Key definition No.3 p.340当双方同意交换货币并立即交易时,该交易就称即期交易,控制这样“就地”交易的汇率就是即期汇率。

货币兑换英语

货币兑换Please tell me how much you want to change. 请告诉我你要换多少;What kind of currency do you wantWhat kind of currency do you want to change 要哪种货币What's it you wish to change你有什么要换的How would you like it要什么面值的Please tell me what note you want.请告诉我要什么钞票;I'd like to know how I shall give it to you.我想知道如何付钱给你;Will seven tens be all right7张10元的可以吗Is it in traveler's cheques换旅行支票吗Would you kindly sign the exchange form, giving your name and address请在兑换单上签字,写出你的姓名和地址,好吗Can you change me some money, please能否请你给我兑换一些钱 Would you please give me seven five-pound notes, four pound notes and four ten-shilling notes, and the rest in small change. 请你给我7张5镑纸币,4张1镑纸币,4张10先令纸币,剩下的要零票; Would you mind giving me the six pence in coppers劳驾给我6便士的铜币;I'd like to know if you could change this money back into . dollars for me.我想知道能否把这笔兑回成美圆;Could you change these French francs for me能给我兑换这些法国法郎吗Can you give me 100 dollars in Swiss francs能否给我100美圆的瑞士法郎I'd like some coins for this note.我想把这张纸币换成硬币;I'd like to break this 50 dollar note.我想把这张50美圆纸币换开;Five twenties and ten singles, please.请给我5张20元和10张一元的;I need 300 dollars in 100-dollar cheques.我要300美圆票面为100美圆的支票;I hope you'll give me ten traveler's cheques of 100 dollars each. 我希望给我10张面额为100美圆的旅行支票;In fives, please.请给我5元票面的;Could you give me some small notes给我一些小票好吗 Useful Words and Phrases currency, money 货币 money changing 兑换货币 an exchange form 兑换单 bank note 钞票 note of large denomination 大票 note of smalldenomination 小票 small change 零钱 subsidiary money 辅币nickel piece 镍币 plastic currency notes 塑料钞票convertible money 可兑换黄金纸币。

关于外汇兑换的常用英语口语

【导语】英语学习在于应⽤,⽇常英语⼝语对话则是为实⽤了,实⽤英语⽇常⼝语属于⾮正式⼝语。

平时多去英语⾓,多与⼈⽤英语聊天,创造多的情景对话,以下是由整理的关于外汇兑换的常⽤英语⼝语,⼀起来学习⼀下。

【篇⼀】关于外汇兑换的常⽤英语⼝语 A: Can I help you? B: Yes, please. Can I cash this check here? A: No, I am afraid you can't. This is a crossed check,not negotiable, which means you can't cash this check right away. B: Oh, dear. What should I do with the check then? A: Well, you have to pay the check into your account first. A:我能帮你什么忙吗? B:我在这⼉能兑换这张⽀票吗? A:恐怕不能。

这是⼀张画线⽀票,不能流通,这意味着你不能马上兑现。

B:哦,天啊。

那么我该怎么做? A:你⾸先得把⽀票转账到你的户头上。

【篇⼆】关于外汇兑换的常⽤英语⼝语 A: Could you change some money for me? I need some US dollars. B: Certainly. What kind of currency have you got? A: Chinese yuan. By the way, what is the exchange rate today? B: One US dollar in cash is equivalent to 6.83 yuan. A:你给我换些钱好吗?我需要⼀些美元。

B:当然可以。

你有哪国的货币? A:中国⼈民币。

顺便问⼀下,今天的兑换率是多少? B:现⾦1美元相当于6.83元⼈民币。