会计学原理练习题

会计学原理测试题及答案

会计学原理测试题及答案一、选择题(每题2分,共20分)1. 会计的基本职能是什么?A. 监督和核算B. 预测和决策C. 计划和控制D. 组织和管理答案:A2. 资产负债表反映的是企业的:A. 经营成果B. 财务状况C. 现金流量D. 利润分配答案:B3. 会计要素中的“负债”是指:A. 企业拥有的资源B. 企业欠下的债务C. 企业的收入D. 企业的支出答案:B4. 会计的基本假设包括:A. 会计分期、货币计量、持续经营B. 会计主体、会计分期、货币计量C. 会计主体、持续经营、货币计量D. 持续经营、会计分期、会计政策答案:C5. 会计信息的质量要求中,要求会计信息应当具有:A. 及时性B. 相关性C. 可靠性D. 可比性答案:C6. 会计核算的基本前提包括:A. 会计主体、会计分期、货币计量、权责发生制B. 会计主体、会计分期、持续经营、权责发生制C. 会计主体、会计分期、货币计量、历史成本D. 会计主体、持续经营、货币计量、历史成本答案:B7. 会计政策变更的会计处理方法包括:A. 追溯调整法和未来适用法B. 直接调整法和追溯调整法C. 未来适用法和直接调整法D. 历史成本法和公允价值法答案:A8. 会计估计变更的会计处理方法通常是:A. 追溯调整法B. 未来适用法C. 直接调整法D. 历史成本法答案:B9. 会计报表的编制原则包括:A. 真实性、合法性、完整性B. 真实性、合法性、及时性C. 真实性、准确性、完整性D. 真实性、准确性、及时性答案:C10. 会计核算的基本原则包括:A. 权责发生制原则、历史成本原则、配比原则B. 权责发生制原则、公允价值原则、配比原则C. 历史成本原则、公允价值原则、配比原则D. 权责发生制原则、历史成本原则、持续经营原则答案:A二、判断题(每题1分,共10分)1. 会计的基本职能是监督和核算。

(对)2. 会计信息的质量要求不包括可靠性。

(错)3. 会计要素中的“负债”是指企业拥有的资源。

会计学原理试题含答案

会计学原理试题含答案会计学原理试题含答案会计学原理(含答案)一、单项选择题1、会计的基本职能是( B )A、控制与监督B、反映与监督C、反映与核算D、与分析2、会计的对象是指( C )A、资金的投入与退出B、企业的各项经济活动C、社会再生产过程中发生的、能用货币表现的经济活动D、预算资金运动3、下列不属于会计核算方法的是( B )A、成本计算与复式记账B、错账更正与评估预测C、设置账户与填制审核会计凭证D、编制报表与登记账簿4、划分会计期间的前提是( B )A、会计主体B、持续经营C、会计分期D、货币计量5、将一个会计期间的收入和与其相关的成本费用配合进行比较的原则是( D )A、可比性原则B、可靠性原则C、可理解性原则D、配比原则6、企业对于融资租入的固定资产一方面作为企业的自有固定资产加以核算,另一方面作为企业的一项长期负债加以,这符合(C )原则。

A、可靠性B、相关性C、实质重于形式D、重要性7、各企业单位处理会计业务的方法和程序在不同会计期间要保持前后一致,不得随意变更,这符合( B )原则。

A、相关性B、可比性C、可理解性D、重要性8、复式记账法的问世,标志着( B )A、现代会计的开端B、近代会计的形成C、会计成为一种独立的职能D、会计学科的不断完善9、在权责发生制下,下列货款中应列作本期收入的是( A )A、本月销售商品,货款尚未收到B、本月预收下月货款,存入银行C、本月收到上月应收账款,存入银行D、本月收到上月多付给供货单位的预付货款,存入银行10、企业充分预计损失,不得多计收益的做法,遵循的是( A )A、谨慎原则的要求B、权责发生制原则的要求C、重要性原则的要求D、实质重于形式原则的要求11、导致产生本期与非本期概念的会计核算基本前提是( C )A、会计主体B、持续经营C、会计分期D、货币计量12、由过去的交易或事项形成并由企业拥有或者控制的资源,该资源预期会给企业带来经济利益是指( A )A、资产B、负债C、所有者权益D、收入13、下列选项中符合资产定义的是( C )A、经营租赁的设备B、计划购买的材料C、购入的某项设备D、现金短缺14、企业从净利润中提取盈余公积,会引起( D )A、资产内部的变化B、资产与所有者权益同时增加C、负债增加,所有者权益减少D、所有者权益内部的变化15、下列交易事项中,会使会计等式的资产和权益两方同时增加的是( A )A、收到投资人的投资款存入银行B、购买原材料一批,以银行存款支付C、以现金偿付欠人的款项D、以现金支付购入固定资产的运杂费用16、下列选项中会引起收入增加是( A )A、销售原材料B、销售生产用固定资产C、出售无形资产D、罚款净收入17、权责发生制所强调的是( D )A、财务状况的真实性B、会计信息的有用性C、提供信息的及时性D、经营成果计算的正确性18、权责发生制和收付实现制等不同的记账基础是建立在一个基本前提基础上的,这个基本前提是( A )A、会计分期假设B、会计主体假设C、货币计量假设D、持续经营假设19、在会计年度内,如把收益性支出当作资本性支出处理了,则会( D )A、本年度虚增资产、收益B、本年度虚减资产、虚增收益C、本年度虚增资产、虚减收益D、本年度虚减资产、虚减收益20、我国企业会计准则规定,企业在对会计要素进行计量时,一般应当采用( C )计量属性A、公允价值B、重围价值C、历史成本D、可变现净值21、借贷记账法试算平衡所依据的基本原理是( C )A、平行登记B、会计基本前提C、会计等式D、一贯性原则22、复式记账法与单式记账法相比较,下列说法中正确的是(B )A、两者都有利于检查账户记录的正确性B、复式记账法能清晰地反映经济业务的过程和结果C、两者都有一套完整的账户体系D、两者的账户都有相互对应关系23、下列账户中,期末无余额的是( B )A、生产成本B、营业外收入C、应付职工薪酬D、盈余公积24、下列业务中,引起一项资产增加,另一项资产减少的是(A )A、用银行存款归还长期借款B、收到所有者投入的设备C、企业以固定资产向外单位投资D、用盈余公积金弥补职工福利费25、下列费用中,应计入产品成本的是( A )A、提取的车间管理人员福利费B、医务和福利人员的工资C、职工劳动保险费D、广告费26、通过“累计折旧”账户对“固定资产”账户进行调整,反映固定资产的( A )A、净值B、增加价值C、减少价值D、原始价值27、ABC公司用盈余公积弥补亏损时,正确的处理的是( C )A、借记“本年利润”科目,贷记“利润分配——未分配利润”科目B、借记“利润分配——未分配利润”科目,贷记“本年利润”科目C、借记“盈余公积”科目,贷记“利润分配——盈余公积补亏”科目D、无需会计处理28、下列固定资产中只需在备查簿中进行登记的固定资产是(B )A、融资租入的固定资产B、经营租入的固定资产C、赊购的固定资产D、正在安装的固定资产29、导致权责发生制假设的产生,以及预提、摊销等会计处理方法运用的会计基本前提或原则的是( C )A、谨慎性原则B、历史成本原则C、会计分期假设D、货币计量假设30、企业发生某年度可供投资者分配的利润是指( D )A、本年净利润B、本年净利润减提取的盈余公积C、年初未分配利润加本年净利润D、年初未分配利润加本年净利润减提取的盈余公积31、债权债务结算账户的借方余额或贷方余额表示( B )A、债权的实际余额B、债权和债务增减变动后的差额C、债务的实际余额D、债权和债务的实际余额之和32、“制造费用”按用途和结构分类属于( D )A、成本计算账户B、收入账户C、财务成果账户D、集合分配账户33、企业在生产经营过程中发生的费用,有些是需要由几个会计期间共同承担的,为了正确计算各个会计期间的损益,需要按照权责发生制的要求,即要按照受益的原则严格划分费用的归属期,为此需要设置( B )A、成本计算账户B、跨期摊提账户C、财务成果账户D、集合分配账户34、不单独设置“预收账款”账户的企业,发生预收货款业务应记入的账户是( A )A、应收账款B、应付账款C、其他应收款D、其他应付款35、关于调整账户,下列说法错误的是( B )A、调整账户与被调整账户反映的经济内容相同B、调整账户与被调整账户的用途和结构相同C、被调整账户反映会计要素的原始数据,调整账户反映的是同一要素的调整数字D、调整方式取决于被调整账户与调整账户的余额是在同一方向还是在相反方向36、企业年初所有者权益总额为2000万元,年内接受投资160万元,本年实现利润总额500万元,所得税税率25%,按10%提取公积金,决定向投资人分配利润100万元。

会计学原理练习题库(附答案)

会计学原理练习题库(附答案)一、单选题(共39题,每题1分,共39分)1.我国的企业会计准则体系包括基本准则、具体准则、应用指南和解释公告等。

2006年2月15日,财政部发布了( )。

A、《小企业会计准则》B、《事业单位会计准则》C、《行政单位会计准则》D、《企业会计准则》正确答案:D2.企业发生因债权人撤销而无法支付的应付账款时,应将其计入( )。

A、资本公积B、其他应付款C、营业外收入D、营业外支出正确答案:C3.可以不附原始凭证的记账凭证是( )。

A、以现金发放工资的记账凭证B、从银行提取现金的记账凭证C、更正错误的记账凭证D、职工临时性借款的记账凭证正确答案:C4.“预付账款”科目所属明细科目如有贷方余额,应在资产负债表( )项目中反映。

A、预收账款B、应收账款C、预付款项D、应付账款正确答案:D5.下列各项中应该由会计科目贷方核算的是()。

A、资产的增加额B、资产的减少额C、费用的增加额D、所有者权益的减少额正确答案:B6.盘亏的固定资产应该通过( )科目核算。

A、固定资产清理B、材料成本差异C、以前年度损益调整D、待处理财产损溢正确答案:D7.一般来说,单位撤销、合并、改变隶属关系时,要进行()。

A、实地盘点B、局部清查C、技术推算D、全面清查正确答案:D8.下列属于期间费用的是()。

A、生产费用B、制造费用C、财务费用D、营业成本正确答案:C9.某公司2014年初资产总额5 000 000元,负债总额2 000 000元,当年接受投资者投资500 000元,从银行借款1 000 000元。

该公司2014年末所有者权益应为( )元。

A、3B、2C、1D、5正确答案:A10.会计账簿暂由本单位财务会计部门保管(),期满之后,由财务会计部门编造清册移交本单位的档案部门保管。

A、5年B、10年C、3年D、1年正确答案:D11.下列不通过制造费用核算的是( )。

A、车间的办公费B、生产用设备的日常修理费用C、车间的折旧费D、车间的机物料消耗正确答案:B12.()是指企业的投资者按照企业章程、合同或协议的约定,实际投入企业的资本金以及按照有关规定由资本公积、盈余公积等转增资本的资金。

《会计学原理》习题(附答案)

习题班练习友情提醒有些科目暂时可能不太熟悉,大家刚起步,这是很正常的,随着学习的深入,大家一定能够掌握的,考必过祝大家学习愉快。

(一)根据下列经济业务编制会计分录1.销售产品一批,货款24470元,收到转帐支票一张已送存银行。

2.购入材料一批,货款18000元,另有外地运费700元,均已通过银行付清,材料已验收入库。

3.用转帐支票购买办公用品一批,共计450元。

4.收到B公司偿还前欠货款35000元,已存入银行存款户。

5.以转帐支票支付前欠A公司材料采购款16000元。

6.职工张华出差借款2000元,以现金付讫。

7.以转帐支票支付所属技工学校经费50000元。

8.张华报销差旅费1500元,余款500元退回现金。

9.以转帐支票预付明年上半年财产保险费8000元。

10.职工李军报销医药费600元,以现金付讫。

11.预提本月银行借款利息3200元。

12.以银行存款偿还银行借款100000元。

13.计算分配本月应付职工工资40000元,其中生产工人工资30000元,车间管理人员工资3000元,厂部管理人员工资7000元。

14.以银行存款50000元购入生产设备一台,另以现金200元支付装卸搬运费。

15.以银行存款缴纳企业所得税18000元。

(二)B公司为增值税一般纳税企业,适用的增值税税率为17%,本月发生购销业务如下:1.购入原材料一批,增值税专用发票上注明的价款为80 000元,增值税额为13 600元。

该批原材料已经验收入库,货款已用银行存款支付(原材料按实际成本进行日常核算,下同)。

2.在建工程领用生产用库存原材料20 000元,应由该批原材料负担的增值税额为3 400元。

3.销售产品一批,增值税专用发票上注明的价款为50 000元,增值税额为8 500元,产品已发出,成本40 000元,收到购货方签发并承兑的商业汇票。

(该项销售符合收入确认的条件)。

4.公司将自己生产的产品用于在建工程,产品成本为57 000元,计税价格60 000元。

会计学原理试题及答案

会计学原理试题及答案一、选择题1.会计学的基本任务是什么?– A. 经济决策 B. 资产管理 C. 资产评估 D. 数据分析–正确答案:A. 经济决策2.以下哪个不是会计核算的基本假设?– A. 主体独立性 B. 会计期间 C. 财务复杂性 D. 持续经营–正确答案:C. 财务复杂性3.账户的基本要素包括三个方面,分别是什么?– A. 借方、贷方、余额 B. 资产、负债、所有者权益 C. 现金、存货、应收账款 D. 支出、收入、利润–正确答案:B. 资产、负债、所有者权益4.以下哪个科目属于资产类科目?– A. 负债 B. 罚款支出 C. 应付账款 D. 现金–正确答案:D. 现金二、填空题1.会计等式是指资产等于_____________减进项减增项。

–正确答案:负债加所有者权益2.借方增加的项目称为___________,贷方增加的项目称为_____________。

–正确答案:借方为借,贷方为贷3.会计核算的时间周期是___________。

–正确答案:会计期间4.2019年1月1日,公司购买了一台机器,总成本为100,000元,使用寿命10年,剩余寿命8年,这个机器的净值为____________。

–正确答案:80,000元三、简答题1.解释会计的基本假设是什么?–答:会计的基本假设是对会计核算和财务报告的一些基本事实和条件进行假设和规定。

主要包括主体独立性、会计期间、持续经营等。

主体独立性是指企业应当被看作与所有者和外部世界相分开的独立个体,独立做出决策。

会计期间是指企业将经济活动划分为若干个时间段进行核算和报告。

持续经营是指企业将会计核算和财务报告基于企业连续经营的假设。

2.简述会计等式的基本原理。

–答:会计等式是会计核算的基础,其基本原理是资产等于负债加所有者权益。

按照这个原理,财务报表上的所有资产都同时对应着某个来源或责任。

资产表示企业所拥有的资源或对外的债权,负债表示企业对外的债务,所有者权益表示企业属于所有者的权益。

会计学原理练习题[含答案]

![会计学原理练习题[含答案]](https://img.taocdn.com/s3/m/a25e0eb768dc5022aaea998fcc22bcd126ff42fd.png)

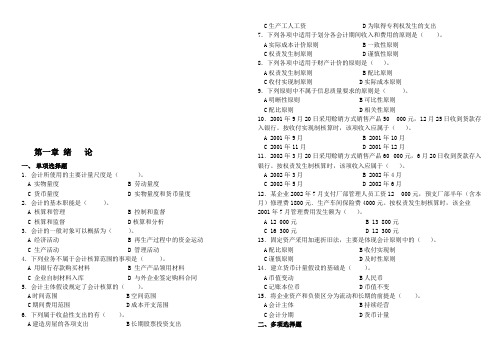

WORD格式第一章绪论一、单项选择题1.会计所使用的主要计量尺度是(C)。

A 实物量度B 劳动量度C 钱币量度D 实物量度和钱币量度2.会计的基本职能是(C)。

A 核算和管理B 控制和监察C 核算和监察D 核算和剖析3.会计的一般对象能够归纳为B)(。

A 经济活动B 重生产过程中的资本运动C 生产活动D 管理活动4.以下业务不属于会计核算范围的事项是(D)。

A 用银行存款购置资料B 生产产品领用资料C 公司自制资料入库D 与外公司签订购料合同5.会计主体假定规定了会计核算的B )。

(A 时间范围B 空间范围C 期间花费范围D 成本开销范围6.以下属于利润性支出的有( C )。

A 建筑房子的各项支出B 长久股票投资支出C 生产工人薪资D 为获得专利权发生的支出.以下各项中合用于区分各会计期间收入和花费的原则7是(C)。

A 实质成本计价原则B 一致性原则C 权责发生制原则D 慎重性原则.以下各项中合用于财富计价的原则是8(D)。

A 权责发生制原则B 配比原则C 收付实现制原则D 实质成根源则.以下原则中不属于信息质量要求的原则是9(C)。

A 清晰性原则B 可比性原则C 配比原则D 有关性原则10. 2001年9月20日采纳赊销方式销售产品50000元,12月25日收到货款存入银行。

按收付实现制核算时,该项收入应属于(D)。

A2001年 9月B2001年10月C2001 年 11月D2001年12月11. 2002年3月20日采纳赊销方式销售产品60000元,6月20日收到货款存入银行。

按权责发生制核算时,该项收入应属于(A)。

A2002年 3 月B2002 年 4月C2002年 5 月D2002年 6月12.某公司 2002年 7 月支付厂部管理人员薪资12000元,预付厂部半年(含本月)维修费1800元.生产车间保险)费4000 元。

按权责发生制核算时,该公司2001年 7 月管理花费发生额为(D。

(完整版)会计学原理练习题含答案,推荐文档

A 资产

B 收入

C 费用

D 利润

第一章 绪 论

一、 单项选择题

1.会计所使用的主要计量尺度是(

)。

A 实物量度 B 劳动量度

C 货币量度 D 实物量度和货币量度

2.会计的基本职能是( )。

A 核算和管理 B 控制和监督

C 核算和监督 D 核算和分析

3.会计的一般对象可以概括为( )。

C 少计费用

D 多计费用

E 多计净收益入

C 费用

D 负债

E 所有者权益

7.下列各项属于动态会计要素的是(

)。

A 资产

B 收入

C 费用

D 利润

E 所有者权益

8.反映企业财务状况的会计要素有( )

A 资产

B 收入

C 费用

D 负债

E 所有者权益

9.反映企业经营成果的会计要素有( )

A 建造房屋的各项支出

B 长期股票投资支出

C 生产工人工资

D 为取得专利权发生的支出

7.下列各项中适用于划分各会计期间收入和费用的原则是( )。

A 实际成本计价原则

B 一致性原则

C 权责发生制原则

D 谨慎性原则

8.下列各项中适用于财产计价的原则是( )。

A 权责发生制原则

B 配比原则

C 收付实现制原则

12.某企业 2002 年 7 月支付厂部管理人员工资 12 000 元,预支厂部半年(含本

月)修理费 1800 元.生产车间保险费 4000 元。按权责发生制核算时,该企业

2001 年 7 月管理费用发生额为( )。

A 12 000 元

B 13 800 元

C 16 300 元

会计学原理》练习题及参考答案

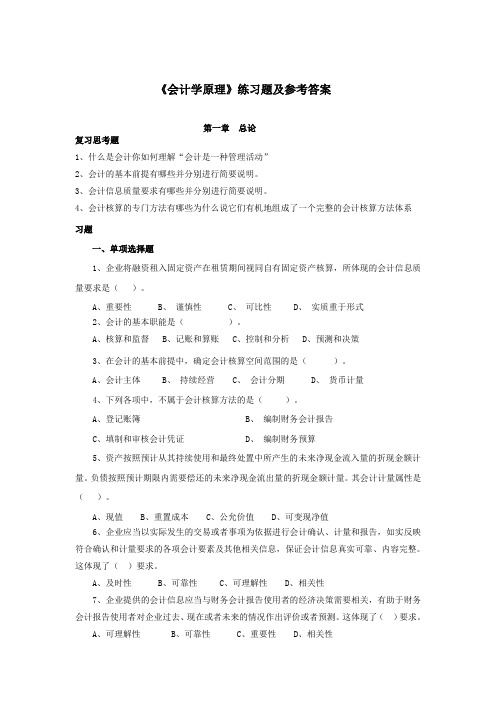

《会计学原理》练习题及参考答案第一章总论复习思考题1、什么是会计你如何理解“会计是一种管理活动”2、会计的基本前提有哪些并分别进行简要说明。

3、会计信息质量要求有哪些并分别进行简要说明。

4、会计核算的专门方法有哪些为什么说它们有机地组成了一个完整的会计核算方法体系习题一、单项选择题1、企业将融资租入固定资产在租赁期间视同自有固定资产核算,所体现的会计信息质量要求是()。

A、重要性B、谨慎性C、可比性D、实质重于形式2、会计的基本职能是()。

A、核算和监督B、记账和算账C、控制和分析D、预测和决策3、在会计的基本前提中,确定会计核算空间范围的是()。

A、会计主体B、持续经营C、会计分期D、货币计量4、下列各项中,不属于会计核算方法的是()。

A、登记账簿B、编制财务会计报告C、填制和审核会计凭证D、编制财务预算5、资产按照预计从其持续使用和最终处置中所产生的未来净现金流入量的折现金额计量。

负债按照预计期限内需要偿还的未来净现金流出量的折现金额计量。

其会计计量属性是()。

A、现值B、重置成本C、公允价值D、可变现净值6、企业应当以实际发生的交易或者事项为依据进行会计确认、计量和报告,如实反映符合确认和计量要求的各项会计要素及其他相关信息,保证会计信息真实可靠、内容完整。

这体现了()要求。

A、及时性B、可靠性C、可理解性D、相关性7、企业提供的会计信息应当与财务会计报告使用者的经济决策需要相关,有助于财务会计报告使用者对企业过去、现在或者未来的情况作出评价或者预测。

这体现了()要求。

A、可理解性B、可靠性C、重要性D、相关性8、企业提供的会计信息应当清晰明了,便于财务会计报告使用者理解和使用。

这体现了()要求。

A、可靠性B、相关性C、重要性D、可理解性9、资产按照其正常对外销售所能收到现金或者现金等价物的金额扣减该资产至完工时估计将要发生的成本、估计的销售费用以及相关税费后的金额计量。

其会计计量属性是()。

会计学原理练习题及参考答案(全五套)

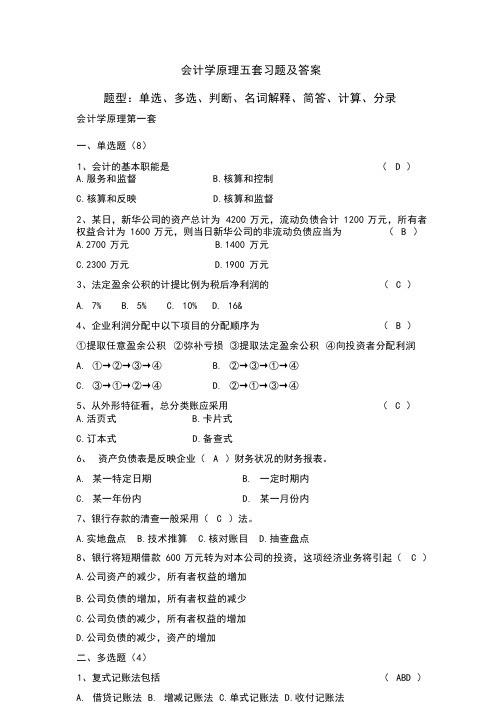

会计学原理五套习题及答案题型:单选、多选、判断、名词解释、简答、计算、分录会计学原理第一套一、单选题(8)1、会计的基本职能是( D )A.服务和监督B.核算和控制C.核算和反映D.核算和监督2、某日,新华公司的资产总计为 4200 万元,流动负债合计 1200 万元,所有者权益合计为 1600 万元,则当日新华公司的非流动负债应当为( B )A.2700 万元 B.1400 万元C.2300 万元D.1900 万元3、法定盈余公积的计提比例为税后净利润的( C )A. 7%B. 5%C. 10%D. 16&4、企业利润分配中以下项目的分配顺序为( B )①提取任意盈余公积②弥补亏损③提取法定盈余公积④向投资者分配利润A. ①→②→③→④B.②→③→①→④C. ③→①→②→④D.②→①→③→④5、从外形特征看,总分类账应采用( C )A.活页式B.卡片式C.订本式D.备查式6、资产负债表是反映企业( A )财务状况的财务报表。

A. 某一特定日期B. 一定时期内C. 某一年份内D. 某一月份内7、银行存款的清查一般采用( C )法。

A.实地盘点B.技术推算C.核对账目D.抽查盘点8、银行将短期借款 600 万元转为对本公司的投资,这项经济业务将引起( C )A.公司资产的减少,所有者权益的增加B.公司负债的增加,所有者权益的减少C.公司负债的减少,所有者权益的增加D.公司负债的减少,资产的增加二、多选题(4)1、复式记账法包括(ABD )A. 借贷记账法B. 增减记账法C.单式记账法D.收付记账法2、工业企业下列项目记入营业外支出的有(ABCE )A 罚款支出B 固定资产盘亏C 公益性捐赠D 租入固定资产租金E 非常损失3、账簿扉页上的内容包括。

(ABD )A.启用日期B.账簿起止页数C.账户目录D.账簿交接时间4、以下按原始凭证填制手续不同划分的有(ABD )A.累计凭证B.一次原始凭证C. 自制原始凭证D.汇总原始凭证三、判断题(6)1、记账凭证账务处理程序的特点是直接根据记账凭证逐笔登记总分类账,是最基本的账务处理程序。

会计学原理试题库(附答案)

会计学原理试题库(附答案)一、单选题(共30题,每题1分,共30分)1、下列各项中,()反映企业在一定会计期间经营成果。

A、现金流量表B、资产负债表C、财务状况变动表D、利润表正确答案:D2、会计核算上所使用的一系列的会计处理方法和原则都是建立在()前提的基础上。

A、货币计量B、持续经营C、会计分期D、会计主体正确答案:B3、利润表中的“本期金额”栏内各项数字一般应根据损益类科目的( )填列。

A、期初余额B、期末余额C、累计发生额D、本期发生额正确答案:D4、用银行存款支付销售商品广告费500元,该业务的正确会计分录为( )。

A、借:管理费用贷:银行存款 500B、借:销售费用贷:银行存款 500C、借:银行存款贷:财务费用 500D、借:财务费用贷:银行存款 500正确答案:B5、在借贷记账法下,资产类账户的期末余额一般在( )。

A、在借方,也可以在贷方B、借方C、贷方D、无余额正确答案:B6、下列资产项目中,属于非流动资产项目的是( )。

A、交易性金融资产B、长期待摊费用C、存货D、应收票据正确答案:B7、下列不属于财务会计报告基本要求的是( )。

A、按正确的会计基础编制B、已持续经营为基础编制各项目之间的金额不得相互抵销C、至少应当提供所有列报项目上一个可比会计期间的比较数据D、严格审核会计账簿的记录和有关资料正确答案:D8、资产、负债、所有者权益三要素是企业资金运动的( )。

A、静态表现B、动态表现C、综合表现D、ABC均正确正确答案:A9、下列各项中,属于企业对外提供的反映企业某一特定日期财务状况和某一会计期间经营成果、现金流量情况的书面文件是()。

A、报表附注B、利润表C、财务报表D、资产负债表正确答案:C10、某企业6月初的资产总额为15万元,负债总额为5万元。

6月份发生下列业务:取得收入共计6万元,发生费用共计4万元,则6月底该企业的所有者权益总额为()。

A、10万元B、12万元C、17万元D、16万元正确答案:B11、某企业期末“应付账款”账户为贷方余额26万元,其所属明细账户的贷方余额合计为33万元,所属明细账户的借方余额合计为7万元;“预付账款”账户为借方余额15万元,其所属明细账户的借方余额合计为20万元,所属明细账户的贷方余额合计为5万元。

会计学原理习题(附参考答案)

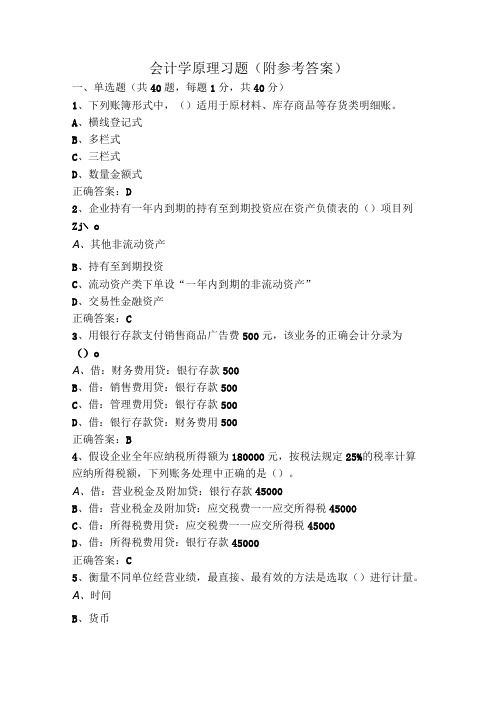

会计学原理习题(附参考答案)一、单选题(共40题,每题1分,共40分)1、下列账簿形式中,()适用于原材料、库存商品等存货类明细账。

A、横线登记式B、多栏式C、三栏式D、数量金额式正确答案:D2、企业持有一年内到期的持有至到期投资应在资产负债表的()项目列Zj∖oA、其他非流动资产B、持有至到期投资C、流动资产类下单设“一年内到期的非流动资产”D、交易性金融资产正确答案:C3、用银行存款支付销售商品广告费500元,该业务的正确会计分录为()oA、借:财务费用贷:银行存款500B、借:销售费用贷:银行存款500C、借:管理费用贷:银行存款500D、借:银行存款贷:财务费用500正确答案:B4、假设企业全年应纳税所得额为180000元,按税法规定25%的税率计算应纳所得税额,下列账务处理中正确的是()。

A、借:营业税金及附加贷:银行存款45000B、借:营业税金及附加贷:应交税费一一应交所得税45000C、借:所得税费用贷:应交税费一一应交所得税45000D、借:所得税费用贷:银行存款45000正确答案:C5、衡量不同单位经营业绩,最直接、最有效的方法是选取()进行计量。

A、时间B、货币C、劳动D、实物正确答案:B6、以“资产=负债+所有者权益”这一会计等式作为编制依据的财务报表是()。

A^利润表B、所有者权益变动表C、资产负债表D、现金流量表正确答案:C7、下列账簿中,不需要每年进行更换的账簿是()。

A、现金日记账B、银行存款日记账C、总账D、固定资产明细账正确答案:D8、中期账务报表可以不提供的报表是()。

A、资产负债表B、利润表C、所有者权益变动表D、现金流量表正确答案:C9、记账凭证的填制是由()完成的。

A、主管人员Bs会计人员C、出纳人员D、经办人员正确答案:B10、公司支付银行存款30000元购入不需安装的生产用设备一台(不考虑相关税费),应编制会计分录为()oA、借:银行存款30000贷:固定资产30000B、借:固定资产30000贷:银行存款30000C、借:在建工程30000贷:银行存款30000D、借:银行存款30000贷:原材料30000正确答案:B11、一般来说,单位撤销、合并、改变隶属关系时,要进行()oA、局部清查B、实地盘点C、技术推算D、全面清查正确答案:D12、根据《企业会计制度》规定,下列各项中,属于其他货币资金的有()。

会计学原理试题及答案

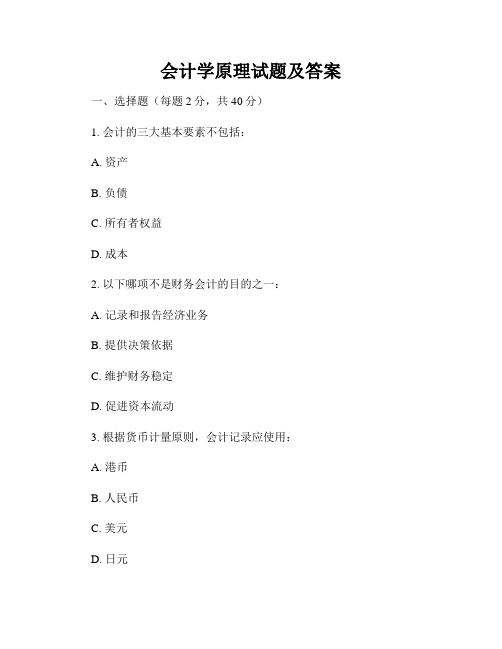

会计学原理试题及答案一、选择题(每题2分,共40分)1. 会计的三大基本要素不包括:A. 资产B. 负债C. 所有者权益D. 成本2. 以下哪项不是财务会计的目的之一:A. 记录和报告经济业务B. 提供决策依据C. 维护财务稳定D. 促进资本流动3. 根据货币计量原则,会计记录应使用:A. 港币B. 人民币C. 美元D. 日元4. 以下哪个不属于会计核算的基本假设:A. 业务实体假设B. 持续经营假设C. 期末假设D. 归属性原则5. 财务会计信息的主要用户群体不包括:A. 员工B. 管理者C. 投资者D. 债权人6. 公司按照现金收支的时间顺序记录经济业务属于以下原则之一:A. 会计实体假设B. 货币计量原则C. 会计持续经营假设D. 会计成本原则7. 按照会计实体假设,业务主体和:A. 自身的所有者是划分B. 结账日期是划分C. 采购日期是划分D. 销售日期是划分8. 公司A向公司B购买了一批商品,应在以下哪个账户上记录:A. 库存账户B. 贷方账户C. 供应商账户D. 收入账户9. 关于会计方程式,以下哪个表达式是正确的:A. 资产 = 负债 - 所有者权益B. 负债 = 资产 - 所有者权益C. 所有者权益 = 负债 - 资产D. 资产 = 所有者权益 - 负债10. 财务报表中的资产按照以下哪个顺序排列:A. 流动资产 - 固定资产 - 长期投资B. 固定资产 - 流动资产 - 长期投资C. 长期投资 - 固定资产 - 流动资产D. 长期投资 - 流动资产 - 固定资产二、简答题(每题10分,共20分)1. 解释会计的三要素是什么,它们之间的关系是什么?会计的三要素包括资产、负债和所有者权益。

它们之间的关系可以用以下公式表示:资产 = 负债 + 所有者权益。

资产代表着公司拥有的资源和权益,负债代表着公司对外部债权人的债务,所有者权益代表着公司对所有者的权益。

这个公式反映了公司资源的来源和运用情况,其中资产是通过负债和所有者权益融资的。

《会计学原理》练习题

《会计学原理》练习题一、单项选择题:1.会计主体假设规定了会计核算的( B )。

A. 时间范围B. 空间范围C. 期间费用范围D. 成本开支范围2.下列资产属于企业的长期资产的有( A )。

A.无形资产 B.应收票据C.原材料 D.预收账款3.资产类账户的结构与所有者权益账户的结构( B )。

A.完全一致 B. 相反C.基本相同 D. 无关4.在借贷记账法下,负债、所有者权益账户贷方表明( A )。

A. 负债、所有者权益增加B. 资产、成本和费用增加C. 负债、所有者权益减少D. 资产、损益减少5.“期间费用”账户期末应( D )。

A. 有借方余额B. 有贷方余额C. 余额有时在借方,有时在贷方D. 无余额6.下列不属于原始凭证基本内容的是( C )。

A.填制日期 B. 经济业务内容C. 应借应贷科目D. 有关人员签章7.总分类账簿应采用( C )外表形式。

A. 活页式B. 卡片式C. 订本式D. 备查式8.下列各项中适用于划分各会计期间收入和费用的原则是( C )。

A. 实际成本计价原则B. 一致性原则C. 权责发生制原则D. 谨慎性原则9.会计科目是( A )。

A. 账户的名称B. 账簿的名称C. 报表项目的名称D. 会计要素的名称10.资产负债表中资产的排列顺序是( A )。

A. 项目流动性B. 项目重要性C. 项目收益性D. 项目时间性11.下列会计假设的意义在于确定了会计核算的对象和空间范围( A )。

A、会计主体B、持续经营C、会计分期D、货币计量12.企业摊销年初预付应由本月负担的房屋租金时,应贷记( D )帐户。

A、管理费用B、财务费用C、营业费用D、待摊费用13.某企业2002年6月1日A商品库存200件,本月购入500件,销售600件;月末盘存90件,A商品每件单位成本12元,在实地盘存制下,本期销货成本为( 610乘12 )。

A、5100B、6200C、7200D、732014.本期“制造费用”30000元,A产品生产工人工资42000元,B产品生产工人工资18000元,分配标准是生产工人工资,A产品应分摊的制造费用为(算一下)元。

会计学原理练习题含答案

会计学原理练习题含答案一、单选题(共40题,每题1分,共40分)1、下列不通过制造费用核算的是()。

A、车间的机物料消耗B、车间的办公费C、车间的折旧费D、生产用设备的日常修理费用正确答案:D2、某外商投资企业,业务收支以美元为主,也有少量的人民币,根据《会计法》规定,为方便会计核算,该单位应采用()作为记账本位币。

A、美元B、人民币或美元C、人民币D、欧元正确答案:A3、银行存款日记账与银行对账单之间的核对属于( )。

A、账实核对B、账证核对C、账账核对D、余额核对正确答案:A4、收入、费用和利润三要素是企业资金运动的()。

A、静态表现B、动态表现C、综合表现D、ABC均正确正确答案:B5、某企业2014年2月1日销售商品一批,售价为20 000元,销售过程中发生运费200元、装卸费1 200元。

则该企业应确认的收入为()元。

A、20 000B、23 400C、19 600D、22 932正确答案:A6、增值税一般纳税人购进生产用机器设备所支付的增值税款应记入( )。

A、固定资产B、在建工程C、物资采购D、应交税费正确答案:D7、“利润分配”科目归属于()。

A、资产要素B、负债要素C、利润要素D、所有者权益要素正确答案:D8、资产、负债、所有者权益三要素是企业资金运动的()。

A、静态表现B、动态表现C、综合表现D、ABC均正确正确答案:A9、关于会计账簿的登记要求,错误的是( )。

A、账簿记录中的日期,应该填写原始凭证上的日期B、在登记各种账簿时,应按页次顺序连续登记,不得隔页、跳行C、在不设借贷等栏的多栏式账页中,登记减少数可以使用红色墨水D、对于没有余额的账户,应在“借或贷”栏内写“平”字,并在“余额”栏用“θ”表示正确答案:A10、公司支付银行存款30 000元购入不需安装的生产用设备一台(不考虑相关税费),应编制会计分录为( )。

A、借:在建工程贷:银行存款 30 000B、借:银行存款贷:原材料 30 000C、借:固定资产贷:银行存款 30 000D、借:银行存款贷:固定资产 30 000正确答案:C11、按清查时间划分,单位发生贪污盗窃、营私舞弊等事件时所进行的清查属于( )。

(完整word版)《会计学原理》练习题

第一章总论一、单项选择题1、会计从本质上说是一种( C )。

A、信息系统B、工作方法C、管理活动D、计算工具2、在商品经济条件下,会计的对象是社会再生产过程中的( ).A、资金运动B、物资流通C、经济业务D、经济活动3、会计的任务是由( )的客观要求所决定的。

A、企业领导B、经济管理C、上级部门D、国家4、会计核算的基本前提中,为会计工作规定了活动空间范围的是()。

A、会计主体B、继续经营C、会计分期D、货币计量5、保证不同会计主体之间会计指标口径一致的会计核算一般原则是( )。

A、一致性原则B、可比性原则C、真实性原则D、相关性原则6、《企业会计准则》规定,企业应采用()为记账的基础。

A、收付实现制B、现金制C、权责发生制D、历史成本7、( )是对会计内容进行分类核算和监督的一种专门方法。

A、复式记账B、登记账簿C、财产清查D、设置账户8、( )是记录经济业务、明确经济责任,作为记账依据的书面证明。

A、会计账户B、会计账簿C、会计凭证D、会计报表二、多项选择题1、会计的基本职能是( AE )。

A、核算B、控制C、预测D、决策E、监督2、工业企业的生产经营活动,分为()等过程。

A、供应B、生产C、流能D、销售E、消费3、下列属于会计核算方法的有()。

A、填制凭证B、编制报表C、登记账簿D、单式记账4、会计核算的基本前提包括()。

A、会计主体B、历史成本C、会计分期D、继续经营E、货币计量5、会计核算的一般原则中,属于总体性要求的原则包括().A、真实性原则B、可比性原则C、及时性原则D、一致性原则E、谨慎性原则6、会计核算的一般原则中,( )属于对会计要素确认、计量要求的原则.A、权责发生制原则B、配比原则C、划分收益性支出与资本性支出原则D、重要性原则E、实际成本原则7、配比原则要求将企业的收入与其相关的()相互配比.A、利润B、成本C、费用D、资产E、负债三、判断题1、会计的对象总的来说是社会再生产过程中的经济活动。

会计学原理练习题及答案

会计学原理练习题及答案会计学原理练习题及答案第一部分基本概念□理论题△单项选择题1)会计的总体目标是()。

A.进行价值管理B. 提高经济效益C. 提供会计信息D. 控制和指导经济活动2)会计的基本职能是()。

A. 核算与监督B. 分析与考核C. 预测和决策D. 核算与预测3)会计对象是企业再生产过程中的()。

A. 实物运动B. 资产C. 资金运动D. 收入4)会计主体从( )上对会计核算范围进行了有效的界定。

A. 空间B. 时间C. 空间和时间D. 内容5)下列各项中属于划分各会计期间收入和费用的会计处理方法是()A. 一致性原则B. 配比原则C. 谨慎性原则D. 权责发生制原则6)()是指过去的交易或事项形成并由企业拥有或控制的,预期将会给企业带来经济利益的资源。

A. 会计对象B. 资产C. 会计要素D. 资金7)资产、负债和所有者权益三要素是企业资金运动的()。

A. 动态表现B. 静态表现C. 综合表现D. 以上都不对8)我国《企业会计准则》明确规定了()大会计要素。

A. 六B. 八C. 十D. 十二9)反映静态三要素之间关系的会计等式是()。

A.收入-费用=利润B. 资产=负债+权益C. 资产=负债+所有者权益D. 资产+费用=负债+所有者权益10)我国龙门账产生于()。

A.清代B.明末清初C.唐宋时期D.西周时期参考答案:1、B2、A3、C4、A5、D6、B7、B8、A9、C 10、B△多项选择题1)会计可以采用( )计量单位。

A. 货币量度B. 实物量度C. 劳动量度D. 价值指标E.会计计量2)会计的特点包括()。

A. 从价值量上反映B.连续性C.完整性D.系统性E.以会计凭证为依据13)会计核算的基本前提包括 ( )。

A. 会计主体B. 持续经营C. 会计分期D. 货币计量E. 币值稳定4)作为会计要素的收入,包括( )。

A. 主营业务收入B. 营业外收入C.其他业务收入D. 投资收益E. 资本公积5)资产的特点可归纳为( )。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

True / False Questions1. Accounting records are also referred to as the books. TRUE3. Preparation of a trial balance is the first step in the analyzing and recording process. FALSE4. Source documents provide evidence of business transactions and are the basis for accounting entries. TRUE5. Items such as sales tickets, bank statements, checks, and purchase orders are source documents. TRUE6. An account is a record of increases and decreases in a specific asset, liability, equity, revenue, or expense item. TRUE7. A customer's promise to pay is called an account payable to the seller. FALSE9. As prepaid expenses are used, the expired costs of the assets become expenses. TRUE10. Land and buildings are generally recorded in the same ledger account. FALSe13. Cash withdrawn by the owner of a proprietorship should be treated as an expense of the business. FALSE15. The chart of accounts is a list of all the accounts used by a company and includes an identification number assigned to each account. TRUE16. An account balance is the difference between the debits and credits for an account including any beginning balance. TRUE18. In a double-entry accounting system, the total amount debited must always equal the total amount credited. TRUE19. Increases in liability accounts are recorded as debits. FALSE20. Debits increase asset and expense accounts. TRUE21. Credits always increase account balances. FALS23. Double entry accounting requires that each transaction affect, and be recorded in, at least two accounts. TRUE24. A revenue account normally has a debit balance. FALSE25. Accounts are normally decreased by debits. FALSE26. The owner's withdrawal account normally has a credit balance since it is an equity account.FALSE28. An owner's capital account normally has a debit balance. FALSE29. A debit entry is always favorable. FALSE30. A transaction that decreases an asset account and increases a liability account must also affect one or more other accounts. TRUE31. A transaction that increases an asset and decreases a liability must also affect one or more other accounts. TRUE34. If a company purchases land paying cash, the journal entry to record this transaction will include a debit to Cash. FALSEIf a company provides services to a customer on credit the selling company should credit Accounts Receivable. FALSEWhen a company bills a customer for $600 for services rendered, the journal entry to record this transaction will include a $600 debit to Services Revenue. FALSE37. The debt ratio helps to assess the risk a company has of failing to pay its debts and is helpful to both its owners and creditors. TRUE38.38. The higher a company's debt ratio is, the higher the risk of a company not being able to meet its obligations.TRUEThe debt ratio is calculated by dividing total assets by total liabilities.FALSE40. A company that finances a relatively large portion of its assets with liabilities is said to have a high degree of financial leverage. TRUE41. If a company is highly leveraged, this means that it has relatively low risk of not being able to repay its debt.FALSE42. Hamilton Industries has liabilities of $105 million and total assets of $350 million. Its debt ratio is 40.0%.FALSE$105 million/$350 million = 30.0%43. High financial leverage is always bad for a company's owners.FALSE44. A compound journal entry affects no more than two accounts.FALSE45. Posting is the transfer of journal entry information to the ledger.TRUE46. Transactions are first recorded in the ledger.FALSE47. The journal is known as a book of original entry.TRUE48. A journal gives a complete record of each transaction in one place, and shows the debits and credits for each transaction.TRUEAICPA FN: Decision MakingDifficulty: EasyLearning Objective: C149. The journal is known as the book of final entry because financial statements are prepared from it.FALSEAICPA FN: Decision MakingDifficulty: HardLearning Objective: C150. A trial balance that balances is not proof of complete accuracy in recording transactions. TRUEAICPA FN: Decision MakingDifficulty: EasyLearning Objective: P251. The trial balance is a list of all accounts and their balances at a point in time taken from the ledger.TRUEAICPA FN: Decision MakingDifficulty: EasyLearning Objective: P252. Generally, the ordering of accounts in a trial balance typically follows their identification number from the chart of accounts, that is, assets first, then liabilities, then owner's capital and withdrawals, followed by revenues and expenses.TRUEAACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: P253. The trial balance can serve as a replacement for the balance sheet, since debits must equal with credits.FALSEAACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: P254. A trial balance that is in balance is proof that no errors were made in journalizing the transactions, posting to the ledger, and preparing the trial balance.FALSEAICPA FN: Decision MakingDifficulty: MediumLearning Objective: P255. If cash was incorrectly debited for $100 instead of correctly credited for $100, the cash account is out of balance by $100.FALSEAACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: P256. The balance sheet provides a link between beginning and ending income statements. FALSEAICPA FN: Decision MakingDifficulty: MediumLearning Objective: P357. The heading on each financial statement lists the three W's – Who (the name of the organization), What (the name of the statement), and Where (the organization's address) FALSEDifficulty: MediumLearning Objective: P358. An income statement reports the revenues earned less expenses incurred by a business overa period of time.TRUEDifficulty: MediumLearning Objective: P359. The balance sheet reports the financial position of a company at a point in time.TRUEDifficulty: MediumLearning Objective: P3Multiple Choice Questions60. The accounting process begins with:A. Analysis of business transactions and source documents.B. Preparing financial statements and other reports.C. Summarizing the recorded effect of business transactions.D. Presentation of financial information to decision-makers.E. Preparation of the trial balance.AICPA FN: Decision MakingDifficulty: EasyLearning Objective: C161. A sales invoice:A. Is a type of source document.B. Is used by sellers to record the sale.C. Is used by buyers to record purchases.D. Gives rise to an entry in the accounting process.E. All of these.AICPA FN: Decision MakingDifficulty: EasyLearning Objective: C262.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C263. Source documents:A. Include the ledger.B. Are the sources of accounting information.C. Must be in electronic form.D. Are based on accounting entries.E. Include the chart of accounts.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C264. Various types of documents and other papers that companies use when they conduct their business:A. Are called source documents.B. Can include sales tickets.C. Are the source of information for recording accounting entries.D. Can be in electronic form.E. All of these.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C265. A record of the increases and decreases in a specific asset, liability, equity, revenue, or expense is a(n):A. Journal.B. Posting.C. Trial balance.D. Account.E. Chart of accounts.AICPA FN: Decision MakingDifficulty: EasyLearning Objective: C367. The account used to record the transfers of assets from a business to its owner is:A. A revenue account.B. The owner's withdrawals account.C. The owner's capital account.D. An expense account.E. A liability account.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C369. Unearned revenues are:A. Revenues that have been earned and received in cash.B. Revenues that have been earned but not yet collected in cash.C. Liabilities created when a customer pays in advance for products or services before the revenue is earned.D. Recorded as an asset in the accounting records.E. Increases to owners' capital.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C370. Prepaid expenses are:A. Payments made for products and services that do not ever expire.B. Classified as liabilities on the balance sheet.C. Decreases in equity.D. Assets that represent prepayments of future expenses.E. Promises of payments by customers.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C371. A written promise to pay a definite sum of money on a specified future date is a(n):A. Unearned revenue.B. Prepaid expense.C. Credit account.D. Note payable.E. Account receivable.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C372. A collection of all accounts and their balances used by a business is called a:A. Journal.B. Book of original entry.C. General Journal.D. Balance column journal.E. Ledger.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C373. A ledger is:A. A record containing increases and decreases in a specific asset, liability, equity, revenue, or expense item.B. A journal in which transactions are first recorded.C. A collection of documents that describe transactions and events entering the accounting process.D. A list of all accounts with their debit balances at a point in time.E. A record containing all accounts and their balances used by a company.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C474. A list of all accounts and the identification number assigned to each account used by a company is called a:A. Source document.B. Journal.C. Trial balance.D. Chart of accounts.E. General Journal.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C475. The numbering system used in a company's chart of accounts:A. Is the same for all companies.B. Is determined by generally accepted accounting principles.C. Depends on the source documents used in the accounting process.D. Typically begins with balance sheet accounts.E. Typically begins with income statement accounts.AICPA FN: Decision MakingDifficulty: MediumLearning Objective: C476. A debit is:A. An increase in an account.B. The right-hand side of a T-account.C. A decrease in an account.D. The left-hand side of a T-account.E. An increase to a liability account.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: EasyLearning Objective: C577. The right side of a T-account is a(n):A. Debit.B. Increase.C. Credit.D. Decrease.E. Account balance.79. A credit is used to record:A. A decrease in an expense account.B. A decrease in an asset account.C. An increase in an unearned revenue account.D. An increase in a revenue account.E. All of these.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: C580. A simple account form widely used in accounting as a tool to understand how debits and credits affect an account balance is called a:A. Withdrawals account.B. Capital account.C. Drawing account.D. T-account.E. Balance column sheet.AICPA FN: Decision MakingDifficulty: EasyLearning Objective: C5AACSB: AnalyticAICPA FN: Decision MakingDifficulty: EasyLearning Objective: C582.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: C583. Of the following accounts, the one that normally has a credit balance is:A. Cash.B. Office Equipment.C. Sales Salaries Payable.D. Owner, Withdrawals.E. Sales Salaries Expense.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: C584. A debit is used to record:A. A decrease in an asset account.B. A decrease in an expense account.C. An increase in a revenue account.D. An increase in the balance of an owner's capital account.E. An increase in the balance of the owner's withdrawals account.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: C585. A credit entry:A. Increases asset and expense accounts, and decreases liability, owner's capital, and revenue accounts.B. Is always a decrease in an account.C. Decreases asset and expense accounts, and increases liability, owner's capital, and revenue accounts.D. Is recorded on the left side of a T-account.E. Is always an increase in an account.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: C586. Double-entry accounting is an accounting system:A. That records each transaction twice.B. That records the effects of transactions and other events in at least two accounts with equal debits and credits.C. In which each transaction affects and is recorded in two or more accounts but that could include two debits and no credits.D. That may only be used if T-accounts are used.E. That insures that errors never occur.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: C587.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: EasyLearning Objective: A188. Management Services, Inc. provides services to clients. On May 1, a client prepaid Management Services $60,000 for 6-months services in advance. Management Services' general journal entry to record this transaction will include aA. Debit to Unearned Management Fees for $60,000.B. Credit to Management Fees Earned for $60,000.C. Credit to Cash for $60,000.D. Credit to Unearned Management Fees for $60,000.E. Debit to Management Fees Earned for $60,000.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: EasyLearning Objective: A189. Wisconsin Rentals purchased office supplies on credit. The general journal entry made by Wisconsin Rentals will include a:A. Debit to Accounts Payable.B. Debit to Accounts Receivable.C. Credit to Cash.D. Credit to Accounts Payable.E. Credit to Wisconsin Rentals, Capital.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: EasyLearning Objective: A190. An asset created by prepayment of an expense is:A. Recorded as a debit to an unearned revenue account.B. Recorded as a debit to a prepaid expense account.C. Recorded as a credit to an unearned revenue account.D. Recorded as a credit to a prepaid expense account.E. Not recorded in the accounting records until the earnings process is complete.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A191. Robert Haddon contributed $70,000 in cash and land worth $130,000 to open a new business, RH Consulting. Which of the following general journal entries will RH Consulting make to record this transaction?A.B.C.D.E.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A192.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A193. On September 30, the Cash account of Value Company had a normal balance of $5,000. During September, the account was debited for a total of $12,200 and credited for a total of $11,500. What was the balance in the Cash account at the beginning of September?A. A $0 balance.B. A $4,300 debit balance.C. A $4,300 credit balance.D. A $5,700 debit balance.E. A $5,700 credit balance.Beg. Bal. + $12,200 - $11,500 = $5,000Beg. Bal. $4,300 debitAACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A194. On April 30, Holden Company had an Accounts Receivable balance of $18,000. During the month of May, total credits to Accounts Receivable were $52,000 from customer payments. The May 31 Accounts Receivable balance was $13,000. What was the amount of credit sales during May?A. $ 5,000.B. $47,000.C. $52,000.D. $57,000.E. $32,000.$18,000 + Credit Sales - $52,000 = $13,000Credit Sales = $47,000AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A195. During the month of February, Hoffer Company had cash receipts of $7,500 and cash disbursements of $8,600. The February 28 cash balance was $1,800. What was the January 31 beginning cash balance?A. $700.B. $1,100.C. $2,900.D. $0.E. $4,300.Beg. Bal. + $7,500 - $8,600 = $1,800Beg. Bal. = $2,900AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A196. The following transactions occurred during July:1. Received $900 cash for services provided to a customer during July.2. Received $2,200 cash investment from Barbara Hanson, the owner of the business.3. Received $750 from a customer in partial payment of his account receivable which arose from sales in June.4. Provided services to a customer on credit, $375.5. Borrowed $6,000 from the bank by signing a promissory note.6. Received $1,250 cash from a customer for services to be rendered next year.What was the amount of revenue for July?A. $ 900.B. $ 1,275.C. $ 2,525.D. $ 3,275.E. $11,100.Revenues = $900 (1) + $375 (4) = $1,275AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A197. If Tim Jones, the owner of Jones Hardware proprietorship, uses cash of the business to purchase a family automobile, the business should record this use of cash with an entry to:A. Debit Salary Expense and credit Cash.B. Debit Tim Jones, Salary and credit Cash.C. Debit Cash and credit Tim Jones, Withdrawals.D. Debit Tim Jones, Withdrawals and credit Cash.E. Debit Automobiles and credit Cash.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A198. Zed Bennett opened an art gallery and as a dealer completed these transactions:1. Started the gallery, Artery, by investing $40,000 cash and equipment valued at $18,000.2. Purchased $70 of office supplies on credit.3. Paid $1,200 cash for the receptionist's salary.4. Sold a painting for an artist and collected a $4,500 cash commission on the sale.5. Completed an art appraisal and billed the client $200.What was the balance of the cash account after these transactions were posted?A. $12,230.B. $12,430.C. $43,300.D. $43,430.E. $61,430.$40,000 (1) - $1,200 (3) + $4,500 (4) = $43,300AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A199. At the beginning of January of the current year, Thomas Law Center's ledger reflected a normal balance of $52,000 for accounts receivable. During January, the company collected $14,800 from customers on account and provided additional services to customers on account totaling $12,500. Additionally, during January one customer paid Thomas $5,000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be:A. $54,700.B. $49,700.C. $2,300.D. $54,300.E. $49,300.$52,000 beginning balance - $14,800 of collections + $12,500 of additional services on credit = $49,700.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A1100. During the month of March, Cooley Computer Services made purchases on account totaling $43,500. Also during the month of March, Cooley was paid $8,000 by a customer for services to be provided in the future and paid $36,900 of cash on its accounts payable balance. If the balance in the accounts payable account at the beginning of March was $77,300, what is the balance in accounts payable at the end of March?A. $83,900.B. $91,900.C. $6,600.D. $75,900.E. $4,900.Beginning balance of $77,300 + $43,500 of purchases on account - $36,900 of payments on account = $83,900.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A1101. On January 1 of the current year, Bob's Lawn Care Service reported owner's capital totaling $122,500. During the current year, total revenues were $96,000 while total expenses were $85,500. Also, during the current year Bob withdrew $20,000 from the company. No other changes in equity occurred during the year. If, on December 31 of the current year, total assets are $196,000, the change in owner's capital during the year was:A. A decrease of $9,500.B. An increase of $9,500.C. An increase of $30,500.D. A decrease of $30,500E. Impossible to determine from the information provided.During the year, revenues were $96,000 while expenses were $85,500 and withdrawals were $20,000. Since there were no other changes in equity, equity must have decreased by $9,500. AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A1102. Andrea Conaway opened Wonderland Photography on January 1 of the current year. During January, the following transactions occurred and were recorded in the company's books:1. Conaway invested $13,500 cash in the business.2. Conaway contributed $20,000 of photography equipment to the business.3. The company paid $2,100 cash for an insurance policy covering the next 24 months.4. The company received $5,700 cash for services provided during January.5. The company purchased $6,200 of office equipment on credit.6. The company provided $2,750 of services to customers on account.7. The company paid cash of $1,500 for monthly rent.8. The company paid $3,100 on the office equipment purchased in transaction #5 above.9. Paid $275 cash for January utilities.Based on this information, the balance in the cash account at the end of January would be:A. $41,450.B. $12,225C. $18,700.D. $15,250.E. $13,500.(1) $13,500 - (3) $2,100 + (4) 5,700 - (7) $1,500 - (8) $3,100 - (9) $275 = $12,225AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A1103. Based on the information included in Question #102, the balance in the Andrea Conaway, Capital account reported on the Statement of Owner's Equity at the end of the month would be:A. $31,400.B. $39,200.C. $31,150.D. $40,175.E. $30,875.(1) $13,500 + (2) $20,000 + (4) $5,700 + (6) $2,750 - (7) $1,500 - (9) $275 = $40,175.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A1104. The debt ratio is used:A. To measure the relation of equity to expenses.B. To reflect the risk associated with a company's debts.C. Only by banks when a business applies for a loan.D. To determine how much debt a firm should pay off.E. All of these.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A2105. Which of the following is the formula used to calculate the debt ratio?A. Total Equity/Total Liabilities.B. Total Liabilities/Total Equity.C. Total Liabilities/Total Assets.D. Total Assets/Total Liabilities.E. Total Equity/Total Assets.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A2106. Which of the following statements is incorrect?A. Higher financial leverage involves higher risk.B. Risk is higher if a company has more liabilities.C. Risk is higher if a company has higher assets.D. The debt ratio is one measure of financial risk.E. Lower financial leverage involves lower risk.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A2107. Stride Rite has total assets of $425 million. Its total liabilities are $110 million. Its equity is $315 million. Calculate the debt ratio.A. 38.6%.B. 13.4%.C. 34.9%.D. 25.9%.E. 14.9%.$110 million/$425 million = 25.9%AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A2108. Stride Rite has total assets of $385 million. Its total liabilities are $100 million and its equity is $285 million. Calculate its debt ratio.A. 35.1%.B. 26.0%.C. 38.5%.D. 28.5%.E. 58.8%.$100 million/$385 million = 26.0%AACSB: AnalyticAICPA FN: Decision MakingDifficulty: MediumLearning Objective: A2109. Which of the following statements describing the debt ratio is false?A. It is of use to both internal and external users of accounting information.B. A relatively high ratio is always desirable.C. The dividing line for a high and low ratio varies from industry to industry.D. Many factors such as a company's age, stability, profitability and cash flow influence the determination of what would be interpreted as a high versus a low ratio.E. The ratio might be used to help determine if a company is capable of increasing its income by obtaining further debt.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A2110. At the end of the current year, Norman Company reported total liabilities of $300,000 and total equity of $100,000. The company's debt ratio on the last year-end was:A. 300%.B. 33.3%C. 75.0%.D. $400,000.E. Cannot be determined from the information provided.On the last year-end, total liabilities were $300,000 and total equity was $100,000. That means total assets were $400,000. Therefore, the debt to assets ratio was $300,000 / $400,000 or 75.0%.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A2111. At the beginning of the current year, Taunton Company's total assets were $248,000 and its total liabilities were $175,000. During the year, the company reported total revenues of $93,000, total expenses of $76,000 and owner withdrawals of $5,000. There were no other changes in owner's capital during the year and total assets at the end of the year were $260,000. Taunton Company's debt ratio at the end of the current year is:A. 70.6%.B. 67.3%.C. 32.7%.D. 48.6%.E. Cannot be determined from the information provided.If total assets were $248,000 and total liabilities were $175,000, total equity was $73,000 at the beginning of the period. Add to that figure $93,000 of revenues during the year and subtract $76,000 of expenses and $5,000 of withdrawals during the year and equity obviously ended the year at $85,000. If total assets at the end of the year were $260,000 and total equity was $85,000, total liabilities were $175,000. Thus, the debt ratio was $175,000 / $260,000 = 67.3%.AACSB: AnalyticAICPA FN: Decision MakingDifficulty: HardLearning Objective: A2112. The process of transferring general journal information to the ledger is:A. Double-entry accounting.B. Posting.C. Balancing an account.D. Journalizing.E. Not required unless debits do not equal credits.AICPA FN: Decision MakingDifficulty: EasyLearning Objective: P1。