Chapter 9 Cash and Marketable Securities Management 现金和有价证券管理 财务管理(双语版) 教学课件

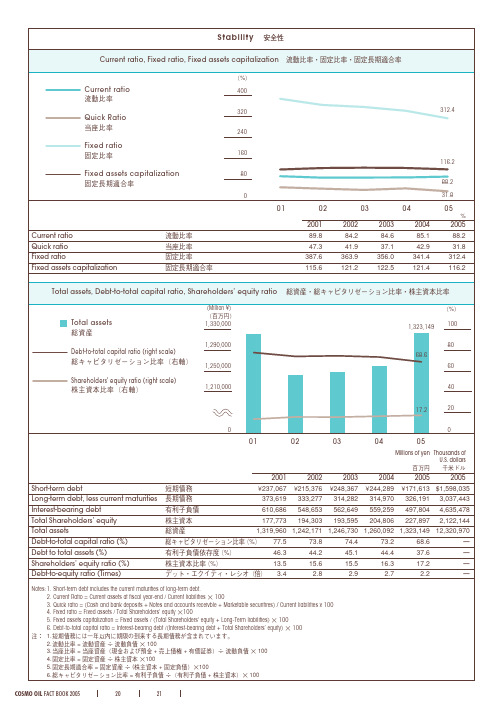

流动比率固定比率固定长期适合率

Total assets

1,330,000

1,323,149

100

1,290,000

80 68.6

Debt-to-total capital ratio (right scale)

1,250,000

60

Shareholders' equity ratio (right scale)

80 88.2 0 31.8

0102 2ຫໍສະໝຸດ 01 200203 2003

04 2004

05 2005

Current ratio Quick ratio Fixed ratio Fixed assets capitalization

Total assets, Debt-to-total capital ratio, Shareholders’ equity ratio

Stability

Current ratio, Fixed ratio, Fixed assets capitalization

Current ratio

400 312.4

320

Quick Ratio

240

Fixed ratio

160 116.2

Fixed assets capitalization

1,210,000 40

17.2 0

20

0

01

02

03

04

05

Millions of yen Thousands of U.S. dollars

2001 Short-term debt Long-term debt, less current maturities Interest-bearing debt Total Shareholders’ equity Total assets Debt-to-total capital ratio (%) Debt to total assets (%) Shareholders’ equity ratio (%) Debt-to-equity ratio (Times)

新编金融英语教程 Chapter6 Financial Markets

Overview of the Financial Markets

CONTENTS

6.1 L e a d - i n 6.2 K e y Po i n t s 6.3 L a n g u a g e N o t e s 6.4 F o l l o w - u p Ta s k s 6.5 E x t e n d e d Ta s k s

6.3 Language Notes

III. Sentences

1. Financial markets are typically defined by having transparent pricing, basic regulations on trading, costs and fees, and market forces determining the prices of securities that trade.

2. Financial markets can be classified as debt or equity markets, as primary or secondary markets, as exchanges and Over-the-Counter markets, as money or capital markets, or as spot or futures and forward markets.

discuss the various functions of the financial market.

6.2 Key Points

6.2.1 Definition of Financial Markets

¥$

Financial Markets

公司理财英文版第十九章二十章

Reasons for Holding Cash

• Speculative motive – hold cash to take advantage of unexpected opportunities

• Precautionary motive – hold cash in case of emergencies

• Transaction motive – hold cash to pay the day-to-day bills

• Trade-off between opportunity cost of holding cash relative to the transaction cost of converting marketable securities to cash for transactions

– Generated when a firm writes checks – Available balance at bank – book balance > 0

• Collection float

– Checks received increase book balance before the bank credits the account

2

The opportunity cost

12

of holding –C is –C ×

Opportunity Costs The investment income foregone when holding cash.

Trading costs

C*

Size of cash balance

19A-7

The BAT Model

Chapter 12 Cash and Marketable Securities

Classification of marketable 12-13 securities

Credit securities indicate the credit that is owned by the investors, namely, the claim to the principal and interest on maturity date.

12-3

What is Cash?

Coins Currency Money orders received from customers Checks Money deposited in banks

12-4

Compensating balance

In order to ensure a company’s credit-granting arrangement, a company is forced to keep a minimum amount in the bank account. The minimum is called compensating balance.

in customers

in

lenders

in investors

salaries out

out suppliers

out creditors

12-8

Positive and negative cash flow

A positive cash flow Inflow of cash > outflow of cash

12-1

CHAPTER 12

Cash and Marketable Securities

12-2

Learning objectives

风险、报酬与证券市场线

1

0

Den Bel Can Swi Spa UK Ire Neth USA Swe Aus Ger Fra Jap

It

2021/4/4

Corporate Finance

Country

14 Copyright © 2005 by zqf

理解贝塔系数

iM

iM

2

M

特定股票的贝塔1.5,表明该股票拥有市场1.5倍 的系统性风险(如利率上调市场平均损失10% ,而该股票损失15%)。

s2t.oMcka’rskeret triuskrnisto the

rmeetausrunreodnbtyhbeetma,arket

Expected stock

pthoerstefonlsiioti.vity to

market changes

return

+-10%

iM

iM 2

M

beta

- 10%

特定股票的贝塔0.5,表明该股票拥有市场一半 的系统性风险。

2021/4/4

Corporate Finance

15 Copyright © 2005 by zqf

1. Total risk =

市场组合与贝塔

diversifiable risk +

Байду номын сангаас

Bmeatrake-t Sriesknsitivity of a

R深= 1.8%+ 1.1* (12%- 1.8%)=13.02%

2021/4/4

Corporate Finance

18 Copyright © 2005 by zqf

本章概要与总结

1、风险分为系统性风险和非系统性风险。 3、非系统性风险通过多样化投资分散掉。 4、系统性风险用贝塔系数衡量。市场组合

chapter 9Cash and Marketable Securities Management(财务管理,Gregory A. Kuhlemeyer)

If cash balance reaches L, management intervenes by injecting C* dollars to return the cash balance to the target level C*.

9-15

Miller-Orr Model

Cash U*

9-11

Target Cash Balance

Carrying costs increase with the level of investment in current assets, and include the costs of maintaining economic value and opportunity costs. Shortage costs decrease with increases in the level of investment in current assets, and include trading costs and the costs related to being short of the current asset. For example, sales lost as a result of a shortage of finished goods inventory.

9-16

Miller-Orr Model

L set by thefirm

2 3 C L F R 4 U 3 C - 2 L 1 3

Avg.cash balance 4 C - L /3

9-17

Example

Assume L = $0, F = $10, i = 0.5% per month and the standard deviation of monthly cash flows is $2 000.

罗斯-公司理财-英文练习题-附带答案-第九章

CHAPTER 9Risk Analysis, Real Options, and Capital Budgeting Multiple Choice Questions:I. DEFINITIONSSCENARIO ANALYSISb 1. An analysis of what happens to the estimate of the net present value when you examinea number of different likely situations is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenDifficulty level: EasySENSITIVITY ANALYSISc 2. An analysis of what happens to the estimate of net present value when only onevariable is changed is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenDifficulty level: EasySIMULATION ANALYSISd 3. An analysis which combines scenario analysis with sensitivity analysis is called _____analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenDifficulty level: EasyBREAK-EVEN ANALYSISe 4. An analysis of the relationship between the sales volume and various measures ofprofitability is called _____ analysis.a. forecastingb. scenarioc. sensitivityd. simulatione. break-evenDifficulty level: EasyVARIABLE COSTSa 5. Variable costs:a. change in direct relationship to the quantity of output produced.b. are constant in the short-run regardless of the quantity of output produced.c. reflect the change in a variable when one more unit of output is produced.d. are subtracted from fixed costs to compute the contribution margin.e. form the basis that is used to determine the degree of operating leverage employed by afirm.Difficulty level: EasyFIXED COSTSb 6. Fixed costs:a. change as the quantity of output produced changes.b. are constant over the short-run regardless of the quantity of output produced.c. reflect the change in a variable when one more unit of output is produced.d. are subtracted from sales to compute the contribution margin.e. can be ignored in scenario analysis since they are constant over the life of a project.Difficulty level: EasyACCOUNTING BREAK-EVENc 7. The sales level that results in a project’s net income exactly equaling zero is called the_____ break-even.a. operationalb. leveragedc. accountingd. cashe. present valueDifficulty level: EasyPRESENT VALUE BREAK-EVENe 8. The sales level that results in a project’s net present value exactly equaling zero iscalled the _____ break-even.a. operationalb. leveragedc. accountingd. cashe. present valueDifficulty level: EasyII. CONCEPTSSCENARIO ANALYSISb 9. Conducting scenario analysis helps managers see the:a. impact of an individual variable on the outcome of a project.b. potential range of outcomes from a proposed project.c. changes in long-term debt over the course of a proposed project.d. possible range of market prices for their stock over the life of a project.e. allocation distribution of funds for capital projects under conditions of hard rationing.Difficulty level: EasySENSITIVITY ANALYSISb 10. Sensitivity analysis helps you determine the:a. range of possible outcomes given possible ranges for every variable.b. degree to which the net present value reacts to changes in a single variable.c. net present value given the best and the worst possible situations.d. degree to which a project is reliant upon the fixed costs.e. level of variable costs in relation to the fixed costs of a project.Difficulty level: EasySENSITIVITY ANALYSISc 11. As the degree of sensitivity of a project to a single variable rises, the:a. lower the forecasting risk of the project.b. smaller the range of possible outcomes given a pre-defined range of values for theinput.c. more attention management should place on accurately forecasting the future value ofthat variable.d. lower the maximum potential value of the project.e. lower the maximum potential loss of the project.Difficulty level: MediumSENSITIVITY ANALYSISc 12. Sensitivity analysis is conducted by:a. holding all variables at their base level and changing the required rate of returnassigned to a project.b. changing the value of two variables to determine their interdependency.c. changing the value of a single variable and computing the resulting change in thecurrent value of a project.d. assigning either the best or the worst possible value to each variable and comparing theresults to those achieved by the base case.e. managers after a project has been implemented to determine how each variable relatesto the level of output realized.Difficulty level: MediumSENSITIVITY ANALYSISd 13. To ascertain whether the accuracy of the variable cost estimate for a project will havemuch effect on the final outcome of the project, you should probably conduct _____analysis.a. leverageb. scenarioc. break-evend. sensitivitye. cash flowDifficulty level: EasySIMULATIONd 14. Simulation analysis is based on assigning a _____ and analyzing the results.a. narrow range of values to a single variableb. narrow range of values to multiple variables simultaneouslyc. wide range of values to a single variabled. wide range of values to multiple variables simultaneouslye. single value to each of the variablesDifficulty level: MediumSIMULATIONe 15. The type of analysis that is most dependent upon the use of a computer is _____analysis.a. scenariob. break-evenc. sensitivityd. degree of operating leveragee. simulationDifficulty level: EasyVARIABLE COSTSd 16. Which one of the following is most likely a variable cost?a. office rentb. property taxesc. property insuranced. direct labor costse. management salariesDifficulty level: EasyVARIABLE COSTSa 17. Which of the following statements concerning variable costs is (are) correct?I. Variable costs minus fixed costs equal marginal costs.II. Variable costs are equal to zero when production is equal to zero.III. An increase in variable costs increases the operating cash flow.a. II onlyb. III onlyc. I and III onlyd. II and III onlye. I and II onlyDifficulty level: MediumVARIABLE COSTSa 18. All else constant, as the variable cost per unit increases, the:a. contribution margin decreases.b. sensitivity to fixed costs decreases.c. degree of operating leverage decreases.d. operating cash flow increases.e. net profit increases.Difficulty level: MediumFIXED COSTSc 19. Fixed costs:I. are variable over long periods of time.II. must be paid even if production is halted.III. are generally affected by the amount of fixed assets owned by a firm.IV. per unit remain constant over a given range of production output.a. I and III onlyb. II and IV onlyc. I, II, and III onlyd. I, II, and IV onlye. I, II, III, and IVDifficulty level: MediumCONTRIBUTION MARGINc 20. The contribution margin must increase as:a. both the sales price and variable cost per unit increase.b. the fixed cost per unit declines.c. the gap between the sales price and the variable cost per unit widens.d. sales price per unit declines.e. the sales price minus the fixed cost per unit increases.Difficulty level: MediumACCOUNTING BREAK-EVENa 21. Which of the following statements are correct concerning the accounting break-evenpoint?I. The net income is equal to zero at the accounting break-even point.II. The net present value is equal to zero at the accounting break-even point.III. The quantity sold at the accounting break-even point is equal to the total fixed costs plus depreciation divided by the contribution margin.IV. The quantity sold at the accounting break-even point is equal to the total fixed costs divided by the contribution margin.a. I and III onlyb. I and IV onlyc. II and III onlyd. II and IV onlye. I, II, and IV onlyDifficulty level: MediumACCOUNTING BREAK-EVENb 22. All else constant, the accounting break-even level of sales will decrease when the:a. fixed costs increase.b. depreciation expense decreases.c. contribution margin decreases.d. variable costs per unit increase.e. selling price per unit decreases.Difficulty level: MediumPRESENT VALUE BREAK-EVENd 23. The point where a project produces a rate of return equal to the required return isknown as the:a. point of zero operating leverage.b. internal break-even point.c. accounting break-even point.d. present value break-even point.e. internal break-even point.Difficulty level: EasyPRESENT VALUE BREAK-EVENb 24. Which of the following statements are correct concerning the present value break-evenpoint of a project?I. The present value of the cash inflows equals the amount of the initial investment.II. The payback period of the project is equal to the life of the project.III. The operating cash flow is at a level that produces a net present value of zero.IV. The project never pays back on a discounted basis.a. I and II onlyb. I and III onlyc. II and IV onlyd. III and IV onlye. I, III, and IV onlyDifficulty level: MediumINVESTMENT TIMING DECISIONb 25. The investment timing decision relates to:a. how long the cash flows last once a project is implemented.b. the decision as to when a project should be started.c. how frequently the cash flows of a project occur.d. how frequently the interest on the debt incurred to finance a project is compounded.e. the decision to either finance a project over time or pay out the initial cost in cash.Difficulty level: MediumOPTION TO WAITe 26. The timing option that gives the option to wait:I. may be of minimal value if the project relates to a rapidly changing technology.II. is partially dependent upon the discount rate applied to the project being evaluated.III. is defined as the situation where operations are shut down for a period of time.IV. has a value equal to the net present value of the project if it is started today versus the net present value if it is started at some later date.a. I and III onlyb. II and IV onlyc. I and II onlyd. II, III, and IV onlye. I, II, and IV onlyDifficulty level: ChallengeOPTION TO EXPANDb 27. Last month you introduced a new product to the market. Consumer demand has beenoverwhelming and appears that strong demand will exist over the long-term. Given thissituation, management should consider the option to:a. suspend.b. expand.c. abandon.d. contract.e. withdraw.Difficulty level: EasyOPTION TO EXPANDc 28. Including the option to expand in your project analysis will tend to:a. extend the duration of a project but not affect the project’s net present value.b. increase the cash flows of a project but decrease the project’s net present value.c. increase the net present value of a project.d. decrease the net present value of a project.e. have no effect on either a project’s cash flows or its net present value.Difficulty level: MediumSENSITIVITY AND SENARIO ANALYSISd 29. Theoretically, the NPV is the most appropriate method to determine the acceptabilityof a project. A false sense of security can be overwhelm the decision-maker when theprocedure is applied properly and the positive NPV results are accepted blindly.Sensitivity and scenario analysis aid in the process bya. changing the underlying assumptions on which the decision is based.b. highlights the areas where more and better data are needed.c. providing a picture of how an event can affect the calculations.d. All of the above.e. None of the above.Difficulty level: MediumDECSION TREEa 30. In order to make a decision with a decision treea. one starts farthest out in time to make the first decision.b. one must begin at time 0.c. any path can be taken to get to the end.d. any path can be taken to get back to the beginning.e. None of the above.Difficulty level: MediumDECISION TREEc 31. In a decision tree, the NPV to make the yes/no decision is dependent ona. only the cash flows from successful path.b. on the path where the probabilities add up to one.c. all cash flows and probabilities.d. only the cash flows and probabilities of the successful path.e. None of the above.Difficulty level: MediumDECISION TREEe 32. In a decision tree, caution should be used in analysis becausea. early stage decisions are probably riskier and should not likely use the same discountrate.b. if a negative NPV is actually occurring, management should opt out of the project andminimize their loss.c. decision trees are only used for planning, not actually daily management.d. Both A and C.e. Both A and B.Difficulty level: MediumSENSITIVITY ANALYSISd 33. Sensitivity analysis evaluates the NPV with respect toa. changes in the underlying assumptions.b. one variable changing while holding the others constant.c. different economic conditions.d. All of the above.e. None of the above.Difficulty level: MediumSENSITIVITY ANALYSISd 34. Sensitivity analysis provides information ona. whether the NPV should be trusted, it may provide a false sense of security if allNPVs are positive.b. the need for additional information as it tests each variable in isolation.c. the degree of difficulty in changing multiple variables together.d. Both A and B.e. Both A and C.Difficulty level: MediumFIXED COSTSb 35. Fixed production costs area. directly related to labor costs.b. measured as cost per unit of time.c. measured as cost per unit of output.d. dependent on the amount of goods or services produced.e. None of the above.Difficulty level: MediumVARIABLE COSTSd 36. Variable costsa. change as the quantity of output changes.b. are zero when production is zero.c. are exemplified by direct labor and raw materials.d. All of the above.e. None of the above.Difficulty level: EasySENSITIVITY ANALYSISb 37. An investigation of the degree to which NPV depends on assumptions made about anysingular critical variable is called a(n)a. operating analysis.b. sensitivity analysis.c. marginal benefit analysis.d. decision tree analysis.e. None of the above.Difficulty level: EasySENSITIVITY AND SCENARIOS ANALYSISb 38. Scenario analysis is different than sensitivity analysisa. as no economic forecasts are changed.b. as several variables are changed together.c. because scenario analysis deals with actual data versus sensitivity analysis which dealswith a forecast.d. because it is short and simple.e. because it is 'by the seat of the pants' technique.Difficulty level: MediumEQUIVALENT ANNUAL COSTc 39. In the present-value break-even the EAC is used toa. determine the opportunity cost of investment.b. allocate depreciation over the life of the project.c. allocate the initial investment at its opportunity cost over the life of the project.d. determine the contribution margin to fixed costs.e. None of the above.Difficulty level: MediumBREAK-EVENb 40. The present value break-even point is superior to the accounting break-even pointbecausea. present value break-even is more complicated to calculate.b. present value break-even covers the economic opportunity costs of the investment.c. present value break-even is the same as sensitivity analysis.d. present value break-even covers the fixed costs of production, which the accountingbreak-even does not.e. present value break-even covers the variable costs of production, which the accountingbreak-even does not.Difficulty level: EasyABANDONMENTd 41. The potential decision to abandon a project has option value becausea. abandonment can occur at any future point in time.b. a project may be worth more dead than alive.c. management is not locked into a negative outcome.d. All of the above.e. None of the above.Difficulty level: EasyTYPES OF BREAK-EVEN ANALYSISd 42. Which of the following are types of break-even analysis?a. present value break-evenb. accounting profit break-evenc. market value break-evend. Both A and B.e. Both A and C.Difficulty level: EasyMONTE CARLO SIMULATIONc 43. The approach that further attempts to model real word uncertainty by analyzingprojects the way one might analyze gambling strategies is calleda. gamblers approach.b. blackjack approach.c. Monte Carlo simulation.d. scenario analysis.e. sensitivity analysis.Difficulty level: MediumMONTE CARLO SIMULATIONc 44. Monte Carlo simulation isa. the most widely used by executives.b. a very simple formula.c. provides a more complete analysis that sensitivity or scenario.d. the oldest capital budgeting technique.e. None of the above.Difficulty level: EasyOPTIONS IN CAPITAL BUDGETINGd 45. Which of the following are hidden options in capital budgeting?a. option to expand.b. timing option.c. option to abandon.d. All of the above.e. None of the above.Difficulty level: EasyIII. PROBLEMSUse this information to answer questions 46 through 50.The Adept Co. is analyzing a proposed project. The company expects to sell 2,500units, give or take 10 percent. The expected variable cost per unit is $8 and the expected fixed costs are $12,500. Cost estimates are considered accurate within a plus or minus 5 percent range. The depreciation expense is $4,000. The sale price is estimated at $16 aunit, give or take 2 percent. The company bases their sensitivity analysis on the expected case scenario.SCENARIO ANALYSISd 46. What is the sales revenue under the optimistic case scenario?a. $40,000b. $43,120c. $44,000d. $44,880e. $48,400Difficulty level: MediumSCENARIO ANALYSISd 47. What is the contribution margin under the expected case scenario?a. $2.67b. $3.00c. $7.92d. $8.00e. $8.72Difficulty level: MediumSCENARIO ANALYSISc 48. What is the amount of the fixed cost per unit under the pessimistic case scenario?a. $4.55b. $5.00c. $5.83d. $6.02e. $6.55Difficulty level: MediumSENSITIVITY ANALYSISb 49. The company is conducting a sensitivity analysis on the sales price using a salesprice estimate of $17. Using this value, the earnings before interest and taxes will be:a. $4,000b. $6,000c. $8,500d. $10,000e. $18,500Difficulty level: MediumSENSITIVITY ANALYSISb 50. The company conducts a sensitivity analysis using a variable cost of $9. The totalvariable cost estimate will be:a. $21,375b. $22,500c. $23,625d. $24,125e. $24,750Difficulty level: MediumUse this information to answer questions 51 through 55.The Can-Do Co. is analyzing a proposed project. The company expects to sell 12,000units, give or take 4 percent. The expected variable cost per unit is $7 and the expectedfixed cost is $36,000. The fixed and variable cost estimates are considered accuratewithin a plus or minus 6 percent range. The depreciation expense is $30,000. The tax rate is 34 percent. The sale price is estimated at $14 a unit, give or take 5 percent. Thecompany bases their sensitivity analysis on the expected case scenario.SCENARIO ANALYSISa 51. What is the earnings before interest and taxes under the expected case scenario?a. $18,000b. $24,000c. $36,000d. $48,000e. $54,000Difficulty level: MediumSCENARIO ANALYSISc 52. What is the earnings before interest and taxes under anoptimistic case scenario?a. $22,694.40b. $24,854.40c. $37,497.60d. $52,694.40e. $67,947.60Difficulty level: ChallengeSCENARIO ANALYSISb 53. What is the earnings before interest and taxes under the pessimistic case scenario?b. -$422.40c. -$278.78d. $3,554.50e. $5,385.60Difficulty level: ChallengeSENSITIVITY ANALYSISd 54. What is the operating cash flow for a sensitivity analysis using total fixed costs of$32,000?a. $14,520b. $16,520c. $22,000d. $44,520e. $52,000Difficulty level: MediumSENSITIVITY ANALYSISd 55. What is the contribution margin for a sensitivity analysis using a variable cost per unitof $8?a. $3b. $4c. $5d. $6e. $7Difficulty level: MediumVARIABLE COSTc 56. A firm is reviewing a project with labor cost of $8.90 per unit, raw materials cost of$21.63 a unit, and fixed costs of $8,000 a month. Sales are projected at 10,000 unitsover the three-month life of the project. What are the total variable costs of the project?a. $216,300b. $297,300c. $305,300d. $313,300e. $329,300Difficulty level: MediumVARIABLE COSTd 57. A project has earnings before interest and taxes of $5,750, fixed costs of $50,000, aselling price of $13 a unit, and a sales quantity of 11,500 units. Depreciation is $7,500.What is the variable cost per unit?a. $6.75c. $7.25d. $7.50e. $7.75Difficulty level: MediumFIXED COSTb 58. At a production level of 5,600 units a project has total costs of $89,000. The variablecost per unit is $11.20. What is the amount of the total fixed costs?a. $24,126b. $26,280c. $27,090d. $27,820e. $28,626Difficulty level: MediumFIXED COSTe 59. At a production level of 6,000 units a project has total costs of $120,000. The variablecost per unit is $14.50. What is the amount of the total fixed costs?a. $25,165b. $28,200c. $30,570d. $32,000e. $33,000Difficulty level: MediumCONTRIBUTION MARGINc 60. Wilson’s Meats has computed their fixed costs to be $.60 for every pound of meatthey sell given an average daily sales level of 500 pounds. They charge $3.89 perpound of top-grade ground beef. The variable cost per pound is $2.99. What is thecontribution margin per pound of ground beef sold?a. $.30b. $.60c. $.90d. $2.99e. $3.89Difficulty level: MediumCONTRIBUTION MARGINe 61. Ralph and Emma’s is considering a project with total sales of $17,500, total variablecosts of $9,800, total fixed costs of $3,500, and estimated production of 400 units. Thedepreciation expense is $2,400 a year. What is the contribution margin per unit?a. $4.50b. $10.50d. $19.09e. $19.25Difficulty level: MediumACCOUNTING BREAK-EVENa 62. You are considering a new project. The project has projected depreciation of $720,fixed costs of $6,000, and total sales of $11,760. The variable cost per unit is$4.20. What is the accounting break-even level of production?a. 1,200 unitsb. 1,334 unitsc. 1,372 unitsd. 1,889 unitse. 1,910 unitsDifficulty level: MediumACCOUNTING BREAK-EVENb 63. The accounting break-even production quantity for a project is 5,425 units. The fixedcosts are $31,600 and the contribution margin is $6. What is the projecteddepreciation expense?a. $700b. $950c. $1,025d. $1,053e. $1,100Difficulty level: MediumACCOUNTING BREAK-EVENd 64. A project has an accounting break-even point of 2,000 units. The fixed costs are$4,200 and the depreciation expense is $400. The projected variable cost per unit is$23.10. What is the projected sales price?a. $20.80b. $21.00c. $21.20d. $25.40e. $25.60Difficulty level: MediumACCOUNTING BREAK-EVENa 65. A proposed project has fixed costs of $3,600, depreciation expense of $1,500, and asales quantity of 1,300 units. What is the contribution margin if the projected level ofsales is the accounting break-even point?a. $3.92c. $4.50d. $4.80e. $5.00Difficulty level: MediumPRESENT VALUE BREAK-EVENc 66. A project has a contribution margin of $5, projected fixed costs of $12,000, projectedvariable cost per unit of $12, and a projected present value break-even point of 5,000units. What is the operating cash flow at this level of output?a. $1,000b. $12,000c. $13,000d. $68,000e. $73,000Difficulty level: MediumPRESENT VALUE BREAK-EVENa 67. Thompson & Son have been busy analyzing a new product. They have determined thatan operating cash flow of $16,700 will result in a zero net present value, which is acompany requirement for project acceptance. The fixed costs are $12,378 and thecontribution margin is $6.20. The company feels that they can realistically capture10 percent of the 50,000 unit market for this product. Should the company develop thenew product? Why or why not?a. yes; because 5,000 units of sales exceeds the quantity required for a zero net presentvalueb. yes; because the internal break-even point is less than 5,000 unitsc. no; because the firm can not generate sufficient sales to obtain at least a zero netpresent valued. no; because the project has an expected internal rate of return of negative 100percente. no; because the project will not pay back on a discounted basisDifficulty level: ChallengePRESENT VALUE BREAK-EVENe 68. Kurt Neal and Son is considering a project with a discounted payback just equal to theproject’s life. The projections include a sales price of $11, variable cost per unit of$8.50, and fixed costs of $4,500. The operating cash flow is $6,200. What is the break-even quantity?a. 1,800 unitsb. 2,480 unitsc. 3,057 unitsd. 3,750 unitse. 4,280 unitsDifficulty level: MediumDECISION TREE NET PRESENT VALUEb 69. At stage 2 of the decision tree it shows that if a project is successful, the payoff will be$53,000 with a 2/3 chance of occurrence. There is also the 1/3 chance of a $-24,000payoff. The cost of getting to stage 2 (1 year out) is $44,000. The cost of capital is15%. What is the NPV of the project at stage 1?a. $-13,275b. $-20,232c. $ 2,087d. $ 7,536e. Can not be calculated without the exact timing of future cash flows.Difficulty level: MediumUse the following to answer questions 70-71:The Quick-Start Company has the following pattern of potential cash flows with their planned investment in a new cold weather starting system for fuel injected cars.DECISION TREEa 70. If the company has a discount rate of 17%, what is the value closest to time 1 netpresent value?a. $ 48.6 millionb. $ 80.9 millionc. $108.2 milliond. $181.4 millione. None of the above.Difficulty level: ChallengeDECISION TREEb 71. If the company has a discount rate of 17%, should they decide to invest?a. yes, NPV = $ 2.2 millionb. yes, NPV = $ 21.6 millionc. no, NPV = $-1.9 milliond. yes, NPV = $ 8.6 millione. No, since more than one branch is NPV = 0 or negative you must reject.Difficulty level: ChallengeACCOUNTING BREAK-EVENe 72. The Mini-Max Company has the following cost information on their new prospectiveproject. Calculate the accounting break-even point.Initial investment: $700。

公司理财罗斯英文原书第九版第二章

Financial Statements and Cash Flow

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Key Concepts and Skills

Usually a separate section reports the amount of taxes levied on income.

$86 $43 $43

2-13

U.S.C.C. Income Statement

Total operating revenues Cost of goods sold Selling, general, and administrative expenses Depreciation Operating income Other income Eห้องสมุดไป่ตู้rnings before interest and taxes Interest expense Pretax income Taxes Current: $71 Deferred: $13 Net income Retained earnings: Dividends: $2,262 1,655 327 90 $190 29 $219 49 $170 84

Deferred taxes Long-term debt Total long-term liabilities $117 471 $588 $104 458 $562

Total assets

$1,879

$1,742

Stockholder's equity: Preferred stock $39 $39 Common stock ($1 par value) 55 32 Capital surplus 347 327 Accumulated retained earnings 390 347 Less treasury stock (26) (20) Total equity $805 $725 Total liabilities and stockholder's equity $1,879 $1,742

CashandNon-operatingAssets

Cash and Non-operating AssetsThe operating income is the income from operating assets, and the cost of capital measures the cost of financing these assets. When the operating cash flows are discounted to the present, you have valued the operating assets of the firm. Firms, however, often have significant amounts of cash and marketable securities on their books, as well as holdings in other firms and non-operating assets. The value of these assets should be added to the value of the operating assets to arrive at firm value. Some analysts prefer to consider the income from cash and marketable securities in their cash flows and adjust the discount rate1 to reflect the safety of these assets. When done right, this approach should yield the same firm value.Cash and Marketable SecuritiesFirms often hold substantial amounts in cash and other marketable securities. When valuing firms, you should add the value of these holdings to the value of the other operating assets to arrive at the firm value. In this section, you first consider how to deal with cash and near cash investments (such as government securities) and then consider holdings of more risky marketable securities.Cash and Near-cash InvestmentsInvestments in short-term government securities or commercial paper, which can be converted into cash quickly and with very low cost, are considered near-cash investments. When valuing a firm, you add the value of cash balances and near-cash investments to the value of operating assets.There is, however, one consideration that may affect how cash is treated. If a firm needs cash for its operations – an operating cash balance – you should consider such cash part of working capital requirements rather than as a source of additional value. Any cash and near-cash investments that exceed the operating cash requirements can be then added on to the value of operating assets. How much cash does a firm need for its operations?1 When a firm has cash and marketable securities the unlevered beta has to be adjusted downwards to reflect the safety of these assets.The answer depends upon both the firm, and the economy in which the firm operates. A small retail firm in an emerging market, where cash transactions are more common than credit card transactions, may require an operating cash balance that is substantial. In contrast, a manufacturing firm in a developed market may not need any operating cash. In fact, if the cash held by a firm is interest-bearing, and the interest earned on the cash reflects a fair rate of return2, you would not consider that cash to be part of working capital. Instead, you would add it to the value of operating assets to value the firm.Other Marketable SecuritiesMarketable securities can include corporate bonds, with default risk embedded in them, and traded equities, which have even more risk associated with them. As the marketable securities held by a firm become more risky, the choices on how to deal with them become more complex. You have three ways of accounting for marketable securities:•The simplest and most direct approach is to estimate the current market value of these marketable securities and add the value on to the value of operating assets. For firms valued on a going-concern basis, with a large number of holdings of marketablesecurities, this may be the only practical option.•The second approach is to estimate the current market value of the marketable securities and net out the effect of capital gains taxes that may be due if thosesecurities were sold today. This capital gains tax bite depends upon how much was paid for these assets at the time of the purchase and the value today. This is the best way of estimating value when valuing a firm on a liquidation basis.•The third and most difficult way of incorporating the value of marketable securities into firm value is to value the firms that issued these securities and estimate the value of these securities. This approach tends to work best for firms that have relatively few, but large, holdings in other publicly traded firms.Holdings in Other Firms2 Note that if the cash is invested in riskless assets such as treasury bills, the riskless rate is a fair rate of return.In this category, you consider a broader category of non-operating assets, where you look at holdings in other companies, public as well as private. You begin by looking at the differences in accounting treatment of different holdings, and how this treatment can affect the way they are reported in financial statements.Accounting TreatmentThe way in which these assets are valued depends upon the way the investment is categorized and the motive behind the investment. In general, an investment in the securities of another firm can be categorized as a minority, passive investment; a minority, active investment; or a majority, active investment, and the accounting rules vary depending upon the categorization.Minority, Passive InvestmentsIf the securities or assets owned in another firm represent less than 20% of the overall ownership of that firm, an investment is treated as a minority, passive investment. These investments have an acquisition value, which represents what the firm originally paid for the securities, and often a market value. Accounting principles require that these assets be sub-categorized into one of three groups - investments that will be held to maturity, investments that are available for sale and trading investments. The valuation principles vary for each.•For investments that will be held to maturity, the valuation is at historical cost or book value, and interest or dividends from this investment are shown in the income statement.•For investments that are available for sale, the valuation is at market value, but the unrealized gains or losses are shown as part of the equity in the balance sheet and not in the income statement. Thus, unrealized losses reduce the book value of the equity in the firm, and unrealized gains increase the book value of equity.•For trading investments, the valuation is at market value and the unrealized gains and losses are shown in the income statement.Firms are allowed an element of discretion in the way they classify investments and through this choice, in the way they value these assets. This classification ensures that firms such as investment banks, whose assets are primarily securities held in other firmsfor purposes of trading, revalue the bulk of these assets at market levels each period. This is called marking-to-market, and provides one of the few instances in which market value trumps book value in accounting statements.Minority, Active InvestmentsIf the securities or assets owned in another firm represent between 20% and 50% of the overall ownership of that firm, an investment is treated as a minority, active investment. While these investments have an initial acquisition value, a proportional share (based upon ownership proportion) of the net income and losses made by the firm in which the investment was made, is used to adjust the acquisition cost. In addition, the dividends received from the investment reduce the acquisition cost. This approach to valuing investments is called the equity approach.The market value of these investments is not considered until the investment is liquidated, at which point the gain or loss from the sale, relative to the adjusted acquisition cost is shown as part of the earnings in that period.Majority, Active InvestmentsIf the securities or assets owned in another firm represent more than 50% of the overall ownership of that firm, an investment is treated as a majority active investment3. In this case, the investment is no longer shown as a financial investment but is instead replaced by the assets and liabilities of the firm in which the investment was made. This approach leads to a consolidation of the balance sheets of the two firms, where the assets and liabilities of the two firms are merged and presented as one balance sheet. The share of the firm that is owned by other investors is shown as a minority interest on the liability side of the balance sheet. A similar consolidation occurs in the other financial statements of the firm as well, with the statement of cash flows reflecting the cumulated cash inflows and outflows of the combined firm. This is in contrast to the equity approach, used for minority active investments, in which only the dividends received on the investment are shown as a cash inflow in the cash flow statement.3 Firms have evaded the requirements of consolidation by keeping their share of ownership in other firms below 50%.Here again, the market value of this investment is not considered until the ownership stake is liquidated. At that point, the difference between the market price and the net value of the equity stake in the firm is treated as a gain or loss for the period.Valuing Cross Holdings in other FirmsGiven that the holdings in other firms can accounted for in three different ways, how do you deal with each in valuation?1.If the holdings are treated as minority, passive investments, and the investments arereported in the balance sheet at the original cost or book value, you would value the firm in which these holdings are, and consider the proportion of the value thatcomes from the holding. For instance, assume that a firm owns 20% of anotherfirm that has an estimated value of $ 500 million. The estimated value of thisholding is $ 100 million.2.If the holdings are minority, passive investments and the investments are recordedat market value, you have one of two choices. You can assume that the market iscorrect and use the assessed market value of these cross-held assets to value thefirm. Alternatively, you can value the companies in which the investments havebeen made and add the estimated value of the holdings to the value of operatingassets.3.If the holdings are minority active interests, you need to value the firms in whichthese holdings are, and add the proportion of that value to the value of theoperating assets of the firm.4.If the holdings are majority, active interests, the income statements areconsolidated. Consequently, the operating income of the firm includes the totaloperating income from the subsidiary, rather than the firm’s share of the subsidiary.You estimate the value of the subsidiary and add on the portion of the value thataccrues to the parent company. Where, you might ask, is the minority interest that you see on the parent company’s balance sheet? You do not use it directly, since it reflects the book value of the holdings of others in the subsidiaries rather thanmarket value.Other Non-Operating AssetsFirms can have other non-operating assets, but they are likely to be of less importance than those listed above. In particular, firms can have unutilized assets that do not generate cash flows and have book values that bear little resemblance to market values. An example would be prime real estate holdings that have appreciated significantly in value since the firm acquired them, but produce little if any cash flows. An open question also remains about overfunded pension plans. Do the excess funds belong to stockholders and, if so, how do you incorporate the effect into value?Unutilized AssetsThe strength of discounted cash flow models is that they estimate the value of assets based upon expected cash flows that these assets generate. In some cases, however, this can lead to assets of substantial value being ignored in the final valuation. For instance, assume that a firm owns a plot of land that has not been developed, and that the book value of the land reflects its original acquisition price. The land obviously has significant market value but does not generate any cash flow for the firm yet. If a conscious effort is not made to bring the expected cash flows from developing the land into the valuation, the value of the land will be left out of the final estimate.How do you reflect the value of such assets in firm value? An inventory of all such assets (or at least the most valuable ones) is a first step, followed up by estimates of market value for each of the assets. These estimates can be obtained by looking at what the assets would fetch in the market today or by projecting the cash flows that could be generated if the assets were developed and discounting the cash flows at the appropriate discount rate.The problem with incorporating unutilized assets into firm value is an informational one. Firms do not reveal their unutilized assets as part of their financial statements. While it may sometimes be possible to find out about such assets as investors or analysts, it is far more likely that they will be uncovered only when you have access to information about what the firm owns and uses.Pension Fund AssetsFirms with defined pension liabilities sometimes accumulate pension fund assets in excess of these liabilities. While the excess does belong to stockholders, they usuallyface a tax liability if they claim it. The conservative rule in dealing with overfunded pension plans would be to assume that the social and tax costs of reclaiming the excess funds are so large that few firms would ever even attempt to do it. The more realistic approach would be to add the after-tax portion of the excess funds into the valuation.cash.xls: There is a dataset on the web that summarizes the value of cash and marketable securities by industry group in the United States for the most recent quarter.。

金融英语 chapter_9

2020/2/10

.

5

2) Over-the-Counter Markets

Securities that are not listed on one of the exchanges trade in the over-the-counter market. This market is not organized in the sense of having a building where trading takes place. Rather, it is a linkage of many dealers and brokers who communicate with each other via telephone and computer terminals. The National Association of Securities Dealers Automated Quotation System (NSADAQ) shows bid and asked prices for thousands of OTC-traded securities on video screens hooked up to a central computer system.

2020/2/10

.

3

The capital markets have well-developed secondary markets. A secondary market is where the sale of previously issued securities takes place. There are two types of exchanges in the secondary market for capital securities: organized exchanges and over-the-counter (OTC) exchanges. Whereas most money market transactions originate over the phone, most capital market transactions occur in organized exchanges.

财务报表分析与证券估值英文课件 (9)

the income statement 2.Available-for-sale securities - mark to fair value - book realized gains and losses to income

+ Accumulated other comprehensive income + Earnings restatements due to change in accounting + Increase in equity from issuing stock options

Closing book value of equity (common, preferred, and noncontrolling equity)

The Governing Accounting Relation

Book value, beginning of period + Comprehensive income - Net payout to shareholders = Book value, end of period

Reformulated Statement of Common Stockholders’ Equity

3. Calculate comprehensive income = Net income + “Other comprehensive income”

– Earnings from accounting changes – Preferred dividends – Noncontrolling interest in earnings – Hidden dirty-surplus losses

公司理财罗斯英文原书第九版第十章

Annual Return Standard Deviation

10.5 Risk Statistics

There is no universally agreed-upon definition of risk. The measures of risk that we discuss are variance and standard deviation.

Chapter 10

Risk and Return: Lessons from Market History

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Key Concepts and Skills

Returns: Example

Dollar Return:

$327 gain

$300 $27

Time

0

1 Percentage Return:

-$4,500

$327 7.3% = $4,500

10.2 Holding Period Return

The holding period return is the return that an investor would get when holding an investment over a period of T years, when the return during year i is given as Ri:

Know how to calculate the return on an investment Know how to calculate the standard deviation of an investment’s returns Understand the historical returns and risks on various types of investments Understand the importance of the normal distribution Understand the difference between arithmetic and geometric average returns

公司理财英文版第九章ppt课件

9-8

Decision Criteria Test - NPV

– The second step is to estimate the required return for projects of this risk level.

– The third step is to find the present value of the cash flows and subtract the initial investment.

9-2Leabharlann Chapter Outline

• Net Present Value • The Payback Rule • The Discounted Payback • The Average Accounting Return • The Internal Rate of Return • The Profitability Index • The Practice of Capital Budgeting

• The difference between the market value of a project and its cost

• How much value is created from undertaking an investment?

– The first step is to estimate the expected future cash flows.

• Your required return for assets of this risk level is 12%.

9-6

NPV – Decision Rule

罗斯《公司理财》第9版精要版英文原书课后部分章节答案

CH5 11,13,18,19,2011.To find the PV of a lump sum, we use:PV = FV / (1 + r)tPV = $1,000,000 / (1.10)80 = $488.1913.To answer this question, we can use either the FV or the PV formula. Both will give the sameanswer since they are the inverse of each other. We will use the FV formula, that is:FV = PV(1 + r)tSolving for r, we get:r = (FV / PV)1 / t– 1r = ($1,260,000 / $150)1/112– 1 = .0840 or 8.40%To find the FV of the first prize, we use:FV = PV(1 + r)tFV = $1,260,000(1.0840)33 = $18,056,409.9418.To find the FV of a lump sum, we use:FV = PV(1 + r)tFV = $4,000(1.11)45 = $438,120.97FV = $4,000(1.11)35 = $154,299.40Better start early!19. We need to find the FV of a lump sum. However, the money will only be invested for six years,so the number of periods is six.FV = PV(1 + r)tFV = $20,000(1.084)6 = $32,449.3320.To answer this question, we can use either the FV or the PV formula. Both will give the sameanswer since they are the inverse of each other. We will use the FV formula, that is:FV = PV(1 + r)tSolving for t, we get:t = ln(FV / PV) / ln(1 + r)t = ln($75,000 / $10,000) / ln(1.11) = 19.31So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. Fro m now, you’ll wait:2 years + 19.31 years = 21.31 yearsCH6 16,24,27,42,5816.For this problem, we simply need to find the FV of a lump sum using the equation:FV = PV(1 + r)tIt is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get:FV = $2,100[1 + (.084/2)]34 = $8,505.9324.This problem requires us to find the FVA. The equation to find the FVA is:FVA = C{[(1 + r)t– 1] / r}FVA = $300[{[1 + (.10/12) ]360 – 1} / (.10/12)] = $678,146.3827.The cash flows are annual and the compounding period is quarterly, so we need to calculate theEAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get:EAR = [1 + (APR / m)]m– 1EAR = [1 + (.11/4)]4– 1 = .1146 or 11.46%And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.11462 + $1,360 / 1.11464 = $2,320.3642.The amount of principal paid on the loan is the PV of the monthly payments you make. So, thepresent value of the $1,150 monthly payments is:PVA = $1,150[(1 – {1 / [1 + (.0635/12)]}360) / (.0635/12)] = $184,817.42The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is:$240,000 – 184,817.42 = $55,182.58This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be:Balloon payment = $55,182.58[1 + (.0635/12)]360 = $368,936.5458.To answer this question, we should find the PV of both options, and compare them. Since we arepurchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is thesame as the interest rate of the loan. The PV of leasing is:PV = $99 + $450{1 – [1 / (1 + .07/12)12(3)]} / (.07/12) = $14,672.91The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is:PV = $23,000 / [1 + (.07/12)]12(3) = $18,654.82The PV of the decision to purchase is:$32,000 – 18,654.82 = $13,345.18In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be:$32,000 – PV of resale price = $14,672.91PV of resale price = $17,327.09The resale price that would make the PV of the lease versus buy decision is the FV of this value, so:Breakeven resale price = $17,327.09[1 + (.07/12)]12(3) = $21,363.01CH7 3,18,21,22,313.The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice thisproblem assumes an annual coupon. The price of the bond will be:P = $75({1 – [1/(1 + .0875)]10 } / .0875) + $1,000[1 / (1 + .0875)10] = $918.89We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PVA equation, it is common to abbreviate the equations as:PVIF R,t = 1 / (1 + r)twhich stands for Present Value Interest FactorPVIFA R,t= ({1 – [1/(1 + r)]t } / r )which stands for Present Value Interest Factor of an AnnuityThese abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key.18.The bond price equation for this bond is:P0 = $1,068 = $46(PVIFA R%,18) + $1,000(PVIF R%,18)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.06%This is the semiannual interest rate, so the YTM is:YTM = 2 4.06% = 8.12%The current yield is:Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61%The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter:Effective annual yield = (1 + 0.0406)2– 1 = .0829 or 8.29%20. Accrued interest is the coupon payment for the period times the fraction of the period that haspassed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $74/2 × 2/6 = $12.33And we calculate the clean price as:Clean price = Dirty price – Accrued interest = $968 – 12.33 = $955.6721. Accrued interest is the coupon payment for the period times the fraction of the period that haspassed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $68/2 × 4/6 = $22.67And we calculate the dirty price as:Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.6722.To find the number of years to maturity for the bond, we need to find the price of the bond. Sincewe already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P0P0 = $80/.0755 = $1,059.60Now that we have the price of the bond, the bond price equation is:P = $1,059.60 = $80[(1 – (1/1.072)t ) / .072 ] + $1,000/1.072tWe can solve this equation for t as follows:$1,059.60(1.072)t = $1,111.11(1.072)t– 1,111.11 + 1,000111.11 = 51.51(1.072)t2.1570 = 1.072tt = log 2.1570 / log 1.072 = 11.06 11 yearsThe bond has 11 years to maturity.31.The price of any bond (or financial instrument) is the PV of the future cash flows. Even thoughBond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is:P M= $1,100(PVIFA3.5%,16)(PVIF3.5%,12) + $1,400(PVIFA3.5%,12)(PVIF3.5%,28) + $20,000(PVIF3.5%,40)P M= $19,018.78Notice that for the coupon payments of $1,400, we found the PVA for the coupon payments, and then discounted the lump sum back to today.Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or:P N= $20,000(PVIF3.5%,40) = $5,051.45CH8 4,18,20,22,24ing the constant growth model, we find the price of the stock today is:P0 = D1 / (R– g) = $3.04 / (.11 – .038) = $42.2218.The price of a share of preferred stock is the dividend payment divided by the required return.We know the dividend payment in Year 20, so we can find the price of the stock in Year 19, one year before the first dividend payment. Doing so, we get:P19 = $20.00 / .064P19 = $312.50The price of the stock today is the PV of the stock price in the future, so the price today will be: P0 = $312.50 / (1.064)19P0 = $96.1520.We can use the two-stage dividend growth model for this problem, which is:P0 = [D0(1 + g1)/(R –g1)]{1 – [(1 + g1)/(1 + R)]T}+ [(1 + g1)/(1 + R)]T[D0(1 + g2)/(R –g2)]P0= [$1.25(1.28)/(.13 – .28)][1 – (1.28/1.13)8] + [(1.28)/(1.13)]8[$1.25(1.06)/(.13 – .06)]P0= $69.5522.We are asked to find the dividend yield and capital gains yield for each of the stocks. All of thestocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield.W: P0 = D0(1 + g) / (R–g) = $4.50(1.10)/(.19 – .10) = $55.00Dividend yield = D1/P0 = $4.50(1.10)/$55.00 = .09 or 9%Capital gains yield = .19 – .09 = .10 or 10%X: P0 = D0(1 + g) / (R–g) = $4.50/(.19 – 0) = $23.68Dividend yield = D1/P0 = $4.50/$23.68 = .19 or 19%Capital gains yield = .19 – .19 = 0%Y: P0 = D0(1 + g) / (R–g) = $4.50(1 – .05)/(.19 + .05) = $17.81Dividend yield = D1/P0 = $4.50(0.95)/$17.81 = .24 or 24%Capital gains yield = .19 – .24 = –.05 or –5%Z: P2 = D2(1 + g) / (R–g) = D0(1 + g1)2(1 + g2)/(R–g2) = $4.50(1.20)2(1.12)/(.19 – .12) = $103.68P0 = $4.50 (1.20) / (1.19) + $4.50 (1.20)2/ (1.19)2 + $103.68 / (1.19)2 = $82.33Dividend yield = D1/P0 = $4.50(1.20)/$82.33 = .066 or 6.6%Capital gains yield = .19 – .066 = .124 or 12.4%In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time.24.Here we have a stock with supernormal growth, but the dividend growth changes every year forthe first four years. We can find the price of the stock in Year 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Year 3 will be the dividend in Year 4, divided by the required return minus the constant dividend growth rate. So, the price in Year 3 will be:P3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Year 3, so:P0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.112 + $2.45(1.20)(1.15)(1.10)/1.113 + $65.08/1.113 P0 = $55.70CH9 3,4,6,9,153.Project A has cash flows of $19,000 in Year 1, so the cash flows are short by $21,000 ofrecapturing the initial investment, so the payback for Project A is:Payback = 1 + ($21,000 / $25,000) = 1.84 yearsProject B has cash flows of:Cash flows = $14,000 + 17,000 + 24,000 = $55,000during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is:B: Payback = 3 + ($5,000 / $270,000) = 3.019 yearsUsing the payback criterion and a cutoff of 3 years, accept project A and reject project B.4.When we use discounted payback, we need to find the value of all cash flows today. The valuetoday of the project cash flows for the first four years is:Value today of Year 1 cash flow = $4,200/1.14 = $3,684.21Value today of Year 2 cash flow = $5,300/1.142 = $4,078.18Value today of Year 3 cash flow = $6,100/1.143 = $4,117.33Value today of Year 4 cash flow = $7,400/1.144 = $4,381.39To find the discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is:Discounted payback = 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 yearsFor an initial cost of $10,000, the discounted payback is:Discounted payback = 2 + ($10,000 – 3,684.21 – 4,078.18)/$4,117.33 = 2.54 yearsNotice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Year 1 and Year 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Year 3 to get the fractional portion of the discounted payback.If the initial cost is $13,000, the discounted payback is:Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years6.Our definition of AAR is the average net income divided by the average book value. The averagenet income for this project is:Average net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325And the average book value is:Average book value = ($15,000,000 + 0) / 2 = $7,500,000So, the AAR for this project is:AAR = Average net income / Average book value = $1,836,325 / $7,500,000 = .2448 or 24.48%9.The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cashinflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA8%, 9) = $40,036.31At an 8 percent required return, the NPV is positive, so we would accept the project.The equation for the NPV of the project at a 20 percent required return is:NPV = –$138,000 + $28,500(PVIFA20%, 9) = –$23,117.45At a 20 percent required return, the NPV is negative, so we would reject the project.We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is:0 = –$138,000 + $28,500(PVIFA IRR, 9)IRR = 14.59%15.The profitability index is defined as the PV of the cash inflows divided by the PV of the cashoutflows. The equation for the profitability index at a required return of 10 percent is:PI = [$7,300/1.1 + $6,900/1.12 + $5,700/1.13] / $14,000 = 1.187The equation for the profitability index at a required return of 15 percent is:PI = [$7,300/1.15 + $6,900/1.152 + $5,700/1.153] / $14,000 = 1.094The equation for the profitability index at a required return of 22 percent is:PI = [$7,300/1.22 + $6,900/1.222 + $5,700/1.223] / $14,000 = 0.983We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI is less than one.CH10 9,13,14,17,18ing the tax shield approach to calculating OCF (Remember the approach is irrelevant; the finalanswer will be the same no matter which of the four methods you use.), we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = ($2,650,000 – 840,000)(1 – 0.35) + 0.35($3,900,000/3)OCF = $1,631,50013.First we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation = $560,000/5Annual depreciation = $112,000Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so:Aftertax salvage value = MV + (BV – MV)t cVery often the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes:Aftertax salvage value = MV + (0 – MV)t cAftertax salvage value = MV(1 – t c)We will use this equation to find the aftertax salvage value since we know the book value is zero.So, the aftertax salvage value is:Aftertax salvage value = $85,000(1 – 0.34)Aftertax salvage value = $56,100Using the tax shield approach, we find the OCF for the project is:OCF = $165,000(1 – 0.34) + 0.34($112,000)OCF = $146,980Now we can find the project NPV. Notice we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value.NPV = –$560,000 – 29,000 + $146,980(PVIFA10%,5) + [($56,100 + 29,000) / 1.105]NPV = $21,010.2414.First we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation charge = $720,000/5Annual depreciation charge = $144,000The aftertax salvage value of the equipment is:Aftertax salvage value = $75,000(1 – 0.35)Aftertax salvage value = $48,750Using the tax shield approach, the OCF is:OCF = $260,000(1 – 0.35) + 0.35($144,000)OCF = $219,400Now we can find the project IRR. There is an unusual feature that is a part of this project.Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We also must include the aftertax salvage value at the end of the project. The IRR of the project is:NPV = 0 = –$720,000 + 110,000 + $219,400(PVIFA IRR%,5) + [($48,750 – 110,000) / (1+IRR)5]IRR = 21.65%17.We will need the aftertax salvage value of the equipment to compute the EAC. Even though theequipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is:Both cases: aftertax salvage value = $40,000(1 – 0.35) = $26,000To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is:OCF = –$67,000(1 – 0.35) + 0.35($290,000/3) = –9,716.67NPV = –$290,000 – $9,716.67(PVIFA10%,3) + ($26,000/1.103) = –$294,629.73EAC = –$294,629.73 / (PVIFA10%,3) = –$118,474.97And the OCF and NPV for Techron II is:OCF = –$35,000(1 – 0.35) + 0.35($510,000/5) = $12,950NPV = –$510,000 + $12,950(PVIFA10%,5) + ($26,000/1.105) = –$444,765.36EAC = –$444,765.36 / (PVIFA10%,5) = –$117,327.98The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost.18.To find the bid price, we need to calculate all other cash flows for the project, and then solve forthe bid price. The aftertax salvage value of the equipment is:Aftertax salvage value = $70,000(1 – 0.35) = $45,500Now we can solve for the necessary OCF that will give the project a zero NPV. The equation for the NPV of the project is:NPV = 0 = –$940,000 – 75,000 + OCF(PVIFA12%,5) + [($75,000 + 45,500) / 1.125]Solving for the OCF, we find the OCF that makes the project NPV equal to zero is:OCF = $946,625.06 / PVIFA12%,5 = $262,603.01The easiest way to calculate the bid price is the tax shield approach, so:OCF = $262,603.01 = [(P – v)Q – FC ](1 – t c) + t c D$262,603.01 = [(P – $9.25)(185,000) – $305,000 ](1 – 0.35) + 0.35($940,000/5)P = $12.54CH14 6、9、20、23、246. The pretax cost of debt is the YTM of the company’s bonds, so:P0 = $1,070 = $35(PVIFA R%,30) + $1,000(PVIF R%,30)R = 3.137%YTM = 2 × 3.137% = 6.27%And the aftertax cost of debt is:R D = .0627(1 – .35) = .0408 or 4.08%9. ing the equation to calculate the WACC, we find:WACC = .60(.14) + .05(.06) + .35(.08)(1 – .35) = .1052 or 10.52%b.Since interest is tax deductible and dividends are not, we must look at the after-tax cost ofdebt, which is:.08(1 – .35) = .0520 or 5.20%Hence, on an after-tax basis, debt is cheaper than the preferred stock.ing the debt-equity ratio to calculate the WACC, we find:WACC = (.90/1.90)(.048) + (1/1.90)(.13) = .0912 or 9.12%Since the project is riskier than the company, we need to adjust the project discount rate for the additional risk. Using the subjective risk factor given, we find:Project discount rate = 9.12% + 2.00% = 11.12%We would accept the project if the NPV is positive. The NPV is the PV of the cash outflows plus the PV of the cash inflows. Since we have the costs, we just need to find the PV of inflows. The cash inflows are a growing perpetuity. If you remember, the equation for the PV of a growing perpetuity is the same as the dividend growth equation, so:PV of future CF = $2,700,000/(.1112 – .04) = $37,943,787The project should only be undertaken if its cost is less than $37,943,787 since costs less than this amount will result in a positive NPV.23. ing the dividend discount model, the cost of equity is:R E = [(0.80)(1.05)/$61] + .05R E = .0638 or 6.38%ing the CAPM, the cost of equity is:R E = .055 + 1.50(.1200 – .0550)R E = .1525 or 15.25%c.When using the dividend growth model or the CAPM, you must remember that both areestimates for the cost of equity. Additionally, and perhaps more importantly, each methodof estimating the cost of equity depends upon different assumptions.Challenge24.We can use the debt-equity ratio to calculate the weights of equity and debt. The debt of thecompany has a weight for long-term debt and a weight for accounts payable. We can use the weight given for accounts payable to calculate the weight of accounts payable and the weight of long-term debt. The weight of each will be:Accounts payable weight = .20/1.20 = .17Long-term debt weight = 1/1.20 = .83Since the accounts payable has the same cost as the overall WACC, we can write the equation for the WACC as:WACC = (1/1.7)(.14) + (0.7/1.7)[(.20/1.2)WACC + (1/1.2)(.08)(1 – .35)]Solving for WACC, we find:WACC = .0824 + .4118[(.20/1.2)WACC + .0433]WACC = .0824 + (.0686)WACC + .0178(.9314)WACC = .1002WACC = .1076 or 10.76%We will use basically the same equation to calculate the weighted average flotation cost, except we will use the flotation cost for each form of financing. Doing so, we get:Flotation costs = (1/1.7)(.08) + (0.7/1.7)[(.20/1.2)(0) + (1/1.2)(.04)] = .0608 or 6.08%The total amount we need to raise to fund the new equipment will be:Amount raised cost = $45,000,000/(1 – .0608)Amount raised = $47,912,317Since the cash flows go to perpetuity, we can calculate the present value using the equation for the PV of a perpetuity. The NPV is:NPV = –$47,912,317 + ($6,200,000/.1076)NPV = $9,719,777CH16 1,4,12,14,171. a. A table outlining the income statement for the three possible states of the economy isshown below. The EPS is the net income divided by the 5,000 shares outstanding. The lastrow shows the percentage change in EPS the company will experience in a recession or anexpansion economy.Recession Normal ExpansionEBIT $14,000 $28,000 $36,400Interest 0 0 0NI $14,000 $28,000 $36,400EPS $ 2.80 $ 5.60 $ 7.28%∆EPS –50 –––+30b.If the company undergoes the proposed recapitalization, it will repurchase:Share price = Equity / Shares outstandingShare price = $250,000/5,000Share price = $50Shares repurchased = Debt issued / Share priceShares repurchased =$90,000/$50Shares repurchased = 1,800The interest payment each year under all three scenarios will be:Interest payment = $90,000(.07) = $6,300The last row shows the percentage change in EPS the company will experience in arecession or an expansion economy under the proposed recapitalization.Recession Normal ExpansionEBIT $14,000 $28,000 $36,400Interest 6,300 6,300 6,300NI $7,700 $21,700 $30,100EPS $2.41 $ 6.78 $9.41%∆EPS –64.52 –––+38.714. a.Under Plan I, the unlevered company, net income is the same as EBIT with no corporate tax.The EPS under this capitalization will be:EPS = $350,000/160,000 sharesEPS = $2.19Under Plan II, the levered company, EBIT will be reduced by the interest payment. The interest payment is the amount of debt times the interest rate, so:NI = $500,000 – .08($2,800,000)NI = $126,000And the EPS will be:EPS = $126,000/80,000 sharesEPS = $1.58Plan I has the higher EPS when EBIT is $350,000.b.Under Plan I, the net income is $500,000 and the EPS is:EPS = $500,000/160,000 sharesEPS = $3.13Under Plan II, the net income is:NI = $500,000 – .08($2,800,000)NI = $276,000And the EPS is:EPS = $276,000/80,000 sharesEPS = $3.45Plan II has the higher EPS when EBIT is $500,000.c.To find the breakeven EBIT for two different capital structures, we simply set the equationsfor EPS equal to each other and solve for EBIT. The breakeven EBIT is:EBIT/160,000 = [EBIT – .08($2,800,000)]/80,000EBIT = $448,00012. a.With the information provided, we can use the equation for calculating WACC to find thecost of equity. The equation for WACC is:WACC = (E/V)R E + (D/V)R D(1 – t C)The company has a debt-equity ratio of 1.5, which implies the weight of debt is 1.5/2.5, and the weight of equity is 1/2.5, soWACC = .10 = (1/2.5)R E + (1.5/2.5)(.07)(1 – .35)R E = .1818 or 18.18%b.To find the unlevered cost of equity we need to use M&M Proposition II with taxes, so:R E = R U + (R U– R D)(D/E)(1 – t C).1818 = R U + (R U– .07)(1.5)(1 – .35)R U = .1266 or 12.66%c.To find the cost of equity under different capital structures, we can again use M&MProposition II with taxes. With a debt-equity ratio of 2, the cost of equity is:R E = R U + (R U– R D)(D/E)(1 – t C)R E = .1266 + (.1266 – .07)(2)(1 – .35)R E = .2001 or 20.01%With a debt-equity ratio of 1.0, the cost of equity is:R E = .1266 + (.1266 – .07)(1)(1 – .35)R E = .1634 or 16.34%And with a debt-equity ratio of 0, the cost of equity is:R E = .1266 + (.1266 – .07)(0)(1 – .35)R E = R U = .1266 or 12.66%14. a.The value of the unlevered firm is:V U = EBIT(1 – t C)/R UV U = $92,000(1 – .35)/.15V U = $398,666.67b.The value of the levered firm is:V U = V U + t C DV U = $398,666.67 + .35($60,000)V U = $419,666.6717.With no debt, we are finding the value of an unlevered firm, so:V U = EBIT(1 – t C)/R UV U = $14,000(1 – .35)/.16V U = $56,875With debt, we simply need to use the equation for the value of a levered firm. With 50 percent debt, one-half of the firm value is debt, so the value of the levered firm is:V L = V U + t C(D/V)V UV L = $56,875 + .35(.50)($56,875)V L = $66,828.13And with 100 percent debt, the value of the firm is:V L = V U + t C(D/V)V UV L = $56,875 + .35(1.0)($56,875)V L = $76,781.25c.The net cash flows is the present value of the average daily collections times the daily interest rate, minus the transaction cost per day, so:Net cash flow per day = $1,276,275(.0002) – $0.50(385)Net cash flow per day = $62.76The net cash flow per check is the net cash flow per day divided by the number of checksreceived per day, or:Net cash flow per check = $62.76/385Net cash flow per check = $0.16Alternatively, we could find the net cash flow per check as the number of days the system reduces collection time times the average check amount times the daily interest rate, minusthe transaction cost per check. Doing so, we confirm our previous answer as:Net cash flow per check = 3($1,105)(.0002) – $0.50Net cash flow per check = $0.16 per checkThis makes the total costs:Total costs = $18,900,000 + 56,320,000 = $75,220,000The flotation costs as a percentage of the amount raised is the total cost divided by the amount raised, so:Flotation cost percentage = $75,220,000/$180,780,000 = .4161 or 41.61%8.The number of rights needed per new share is:Number of rights needed = 120,000 old shares/25,000 new shares = 4.8 rights per new share.Using P RO as the rights-on price, and P S as the subscription price, we can express the price per share of the stock ex-rights as:P X = [NP RO + P S]/(N + 1)a.P X = [4.8($94) + $94]/(4.80 + 1) = $94.00; No change.b. P X = [4.8($94) + $90]/(4.80 + 1) = $93.31; Price drops by $0.69 per share.。

金融市场与金融机构基础(第9章)英文版答案