第十一章财务分析课后答案

财务分析课后测试答案

财务分析课后测试答案一、选择题1. 以下哪项不是财务分析的目的?A. 评估企业的偿债能力B. 评估企业的盈利能力C. 评估企业的市场份额D. 评估企业的运营效率答案:C. 评估企业的市场份额解析:财务分析的目的是评估企业的偿债能力、盈利能力和运营效率,以便帮助投资者、债权人和管理层做出决策。

市场份额是市场营销的范畴,与财务分析的目的不直接相关。

2. 下列哪项不是财务分析的方法?A. 横向分析B. 纵向分析C. 相对分析D. 现金流量分析答案:D. 现金流量分析解析:横向分析、纵向分析和相对分析都是财务分析的常用方法,而现金流量分析是财务报表分析的一部分,主要用于评估企业的现金流量状况。

3. 以下哪个指标用于评估企业的偿债能力?A. 资产负债率B. 资本回报率C. 总资产周转率D. 销售净利率答案:A. 资产负债率解析:资产负债率是用于评估企业的偿债能力的重要指标,它反映了企业负债与资产的比例关系,可以帮助投资者和债权人判断企业的债务风险。

4. 以下哪个指标用于评估企业的盈利能力?A. 存货周转率B. 销售毛利率C. 应收账款周转率D. 总资产周转率答案:B. 销售毛利率解析:销售毛利率是用于评估企业的盈利能力的重要指标,它反映了企业每一单位销售额中的毛利润占比,可以帮助投资者和管理层判断企业的盈利水平。

5. 以下哪个指标用于评估企业的运营效率?A. 销售净利率B. 总资产周转率C. 负债比率D. 资本回报率答案:B. 总资产周转率解析:总资产周转率是用于评估企业的运营效率的重要指标,它反映了企业每一单位资产所创造的销售额,可以帮助投资者和管理层判断企业的运营效率。

二、简答题1. 请简要解释财务分析的目的和意义。

答:财务分析的目的是评估企业的偿债能力、盈利能力和运营效率,以便帮助投资者、债权人和管理层做出决策。

财务分析的意义在于提供了对企业财务状况的全面了解,可以帮助投资者判断是否值得投资、债权人评估债务风险、管理层改进经营策略。

《财务管理》配套课后习题详细版答案第十一章,,财务控制

《财务管理》配套课后习题详细版答案第十一章,,财务控

制

第十一章财务控制一、快速测试(一)单项选择题 1. B 2. D (二)多项选择题 1. CD 3. ABCD (三)判断题1.√ 2. √ (四)思考讨论题略二、实训(一)计算分析题 1.(1)利润中心边际奉献总额=110-50=60(万元)(2)利润中心负责人可控利润总额=60-20=40(万元)(3)利润中心可控利润总额=40-12=28(万元) 2. (1) 工程 A 投资中心 B 投资中心追加投资前追加投资后追加投资前追加投资后投资额 50 100 100 150 息税前利润 4 8.6 15 20.5 息税前利润率 8% 8.6% 15% 13.67% 剩余收益 -1 -1.4 5 5.5 根据追加投资前的资料可以计算该企业规定的总资产息税前利润率,即:

4-50×规定的总资产息税前利润率=-1 所以规定的总资产息税前利润率=10% 8.6%=8.6/100×100% -1.4=8.6-100×10%13.67%=20.5/150×100% 5.5=20.5-150×10%(2)由于 A 投资中心追加投资后剩余收益降低,所以 A 投资中心不应追加投资;

B 投资中心追加投资后剩余收益提高,所以应向 B 投资中心追加投资。

(二)案例分析题【答案与解析】(1)净利润和 EVA 存在差异的主要原因是计算净利润时没有扣除股权资本本钱,而计算EVA 时扣除了股权资本本钱,并且对合理调整了会计报表的一些工程。

(2)①提高企业资金的使用效率;②优化企业资本结构;③鼓励经营管理者,实现股东财富的保值增值;④引导企业做大做强主业,优化资源配置。

第十一章财务分析课后答案

第十一章财务分析思考练习一、单项选择题1.A 2.C 3.B 4.C 5.D 6.A 7.A 8.D9.A 10.B 11.C 12.D 13.B 14.C 15.D二、多项选择题1.CD 2.AD 3.ABC 4.BC 5.ABCD 6.ABC 7.BCD 8.ABD9.ABCD 10.BD 11.BCD 12.ABC 13.BC 14.ABCD 15.BC三、判断题1-5.××××× 6-10.√×√×× 11-15.×√×√×四、计算题1.(1)年末流动负债余额=270/3=90万元(2)年末速动资产余额=90×1.5=135万元年末存货余额=270-135=135万元平均存货余额=(145+135)/2=140万元(3)本年销售成本=140×4=560万元(4)平均应收账款=平均速动资产=(125+135)/2=130万元应收账款周转率=960/130=7.3846(次)360/7.3846=48.75(天)2.(1)应收账款周转率:应收账款平均余额=(期初应收账款+期末应收账款) ÷2=(12+10)÷2=11(万元)应收账款周转率=主营业务收入净额÷应收账款平均余额=77÷11=7 (次)(2)总资产周转率:`1因为:存货周转率=主营业务收入净额÷存货平均余额=主营业务收入净额÷[(期初存货+期末存货) ÷2]所以:期末存货=2×主营业务收入净额÷存货周转率-期初存货=2×77÷7-8=14(万元)因为:期末速动比率=(期末流动资产-期末存货)÷期末流动负债×100%期末流动比率=期末流动资产÷期末流动负债×100%所以,可得以下两个方程:150%=(期末流动资产-14)÷期末流动负债200%=期末流动资产÷期末流动负债解方程可得期末流动资产为56(万元)因此,期末资产总额=56+50=106(万元)最后,计算总资产周转率:总资产周转率=主营业务收入净额÷资产平均占用额=主营业务收入÷[(期初资产+期末资产)÷2]=77÷[(80+106)÷2]=0.83(次)(3)总资产净利率:净利润=主营业务收入×主营业务净利率=77×10%=7.7(万元) 总资产净利率=净利润÷平均资产总额=净利润÷[(期初资产+期末资产) ÷2]=7.7÷[(80+106)÷2]×100%=8.28%3.(1)2004年年初的股东权益总额=400×3=1200(万元)2004年年初的资产总额=1200+400=1600(万元)2004年年初的资产负债率=400/(400+1200)×100%=25%(2)2004年年末的股东权益总额=1200+1200×50%=1800(万元)2004年年末的负债总额=1800/(1-40%)×40%=1200(万元)2004年年末的资产总额=1800+1200=3000(万元)2004年年末的产权比率=1200/1800×100%=66.67%(3)总资产净利率=300/[(1600+3000)/2] ×100%=13.04%使用平均数计算的权益乘数=[(1600+3000)/2]/[(1200+1800)/2]=1.53 平均每股净资产=[(1200+1800)/2]/普通股总数=1500/600=2.5(元/股) 每股收益=净利润/普通股股数=300/600=0.5(元/股)2004年末的市盈率=普通股每股市价/普通股每股收益=5/0.5 =10 (4)2005年的每股收益=净利润/普通股总数=400/600=0.67(元/股)因为05年末企业保持04年末的资金结构和04年的资本积累率,所以2005年年末的股东权益=1800×(1+50%)=2700(万元)因为资产负债率=40%,所以2005年年末的资产总额=2700/(1-40%)=4500(万元)2005年的总资产平均额=(3000+4500)/2=3750(万元)2005年的总资产净利率=净利润/平均总资产=400/3750×100%=10.67%2005年使用平均数计算的权益乘数=[(3000+4500)/2]/[(1800+2700)/2]=1.67 2005年的平均每股净资产=[(1800+2700)/2]/600=3.75(元/股)每股收益变动额=0.67-0.5=0.172004年的每股收益=13.04%×1.53×2.5=0.5替代总资产净利率:10.67%×1.53×2.5=0.41替代权益乘数:10.67%×1.67×2.5=0.45替代平均每股净资产:10.67%×1.67×3.75=0.67所以:总资产净利率变动的影响额=0.41-0.5=-0.09权益乘数变动的影响额=0.45-0.41=0.04平均每股净资产变动的影响额=0.67-0.45=0.22案例实战案例1(1)05年资产周转率=4300/[(1560+1430)÷2]=2.88次05年销售利润率=4.7%05年权益乘数=2.3906年总资产周转率=3800/[(1659+1596)÷2]=2.33次06年销售利润率=2.6%06年权益乘数=2.5005年权益净利率=4.7%×2.88×2.39=32.35%06年权益净利率=2.6%×2.33×2.50=15.15% 下降了17.2%销售利润率变动的影响:(2.6%-4.7%)×2.88×2.39=-14.45%资产周转率变动的影响:2.6%×(2.33-2.88)×2.39=-3.42%权益乘数变动的影响:2.6%×2.33×(2.5-2.39)=0.67%合计=-14.45%+(-3.42%)+0.67%=-17.2%评价:①该公司权益净利率比上年下降,主要原因是运用资产的获利能力下降,其中资产周转率和销售利润率均下降。

财务管理 第11章 财务控制(含答案解析)

第十一章财务控制一、单项选择题1.下列哪项不属于内部控制的基本要素()。

A.外部环境B.风险评估C.控制措施D.信息与沟通2.()是影响、制约企业内部控制制度建立与执行的各种内部因素的总称,是实施内部控制的基础。

A.内部环境B.治理结构C.内部审计机制D.外部环境3.内部环境是影响、制约企业内部控制制度建立与执行的各种内部因素的总称,是实施内部控制的基础。

内部环境不包括()。

A.宏观政策B.组织机构设置与权责分配C.人力资源政策D.内部审计4.风险评估是及时识别、科学分析影响企业战略和经营管理目标实现的各种不确定因素并采取应对策略的过程,是实施内部控制的重要环节和内容。

风险评估主要包括()。

A.目标设定、风险监测、风险分析和风险应对B.目标设定、风险识别、风险分析和风险应对C.风险识别、风险分析、风险应对和风险控制D.目标设定、风险识别、风险分析和风险控制5.信息与沟通,是及时、准确、完整地收集与企业经营管理相关的各种信息,并使这些信息以适当的方式在企业有关层级之间进行及时传递、有效沟通和正确应用的过程,是实施内部控制的()。

A.基础B.重要环节和内容C.具体方式和载体D.重要条件6.()实施内部控制的具体方式和载体。

A.风险评估B.控制措施C.信息与沟通D.监督检查7.()是实施内部控制的重要保证。

A.风险评估B.控制措施C.信息与沟通D.监督检查8.下列说法正确的是()。

A.内部控制制度一经制定不得变更B.内部控制制度应在兼顾全面的基础上突出重点C.为保证内部控制制度有效性,可以不考虑成本效益原则D.内部控制制度能够为内部控制目标的实现提供绝对保证9.下列哪项不是内部控制的基本原则()。

A.合法性B.成本效益C.灵活性D.适应性10.()是内部控制的一个重要组成部分,是内部控制的核心,是内部控制在资金和价值方面的体现。

A.质量控制B.财务控制C.成本控制D.过程控制11.财务控制的主要内容是控制()。

财务报表分析与运用 杰拉尔德 课后答案英文版第十一章

Chapter 11 SolutionsOverview:Problem Length Problem #s{S} 1 - 4, 9, 11, 12, 15, 16, 21, 22{M} 5, 7, 8, 10, 13, 14, 17, 18, 20, 23, 24 {L} 6, 19, 251.{S}(i) Interest expense = 12% x $10,000 (beginning balance oflease obligation) = $1,200.(ii)The lease obligation will be reduced by $100 ($1,300 - $1,200) leaving an obligation of $9,900.(iii)Cash from Operations will be reduced by the interest payment of $1,200. Cash from investing activities willnot be affected. (However, the firm will report thecapi tal lease as a “noncash investment and financingactivity.” Cash from financing will be reduced by theamount of the principal payment of $100.(iv)Under an operating lease there is no lease obligation on the balance sheet. The only effect on income isRent Expense of $1,300. Similarly, CFO is reduced by$1,300. (CFI and CFF are not affected).2.{S}(i) In a take-or-pay arrangement, a company contracts tobuy or pay for a certain amount of a supplier’scommodity at a predetermined price over a stated timeperiod. The company, by entering the contract, incursan economic liability. However, since it is only acontract, no accounting liability is recorded on thebalance sheet – it is off balance sheet.(ii) In a sale of receivable, a company “sells” its receivables to a third-party, usually a financialinstitution. Typically, the sale is made at adiscounted price from the face value and the sellermay retain some or all of the default risk. The sale,in substance, is a financing arrangement with thereceivables being used as collateral. However, underGAAP, the transaction is treated as a sale and thedebt does not appear on the balance sheet.(iii)A joint venture represents an investment of 50% or less by one company (the “investor”) in anothercompany. Under GAAP, since ownership is not over 50%,the assets and liabilities of the joint venture neednot be consolidated with the parent’s assets andliabilities. Hence, any debt taken on by the jointventure remains off balance sheet even when theinvestor is liable for the debt.11-13.{S} Effect of choice of interest rate on lessee:4.{S}a. Pallavi must capitalize the lease because the leaseagreement contains a bargain purchase option. Notethat the lease also meets one other capitalizationcriterion: The present value of minimum lease paymentsexceeds 90% of the fair market value of the equipment(see part b for computations).b. The fair market value of the asset is $125,000. Thepresent value of the MLPs is $127,785 (at 8%, thelower of the lessee and lessor rates); the asset mustbe capitalized at the (lower) fair market value. (Notethat the lease obligation is the sum of the presentvalues of the MLPs and the bargain purchase option –the latter is not provided.)11-2c.Leases must be capitalized at the lesser of thepresent value of lease payments or the fair value ofthe lease; in this case, the lease must be capitalizedat the fair value of $125,000.d. The existence of the bargain purchase option requiresdepreciation over the estimated economic life of theasset rather than the (shorter) lease term.e. The option creates the presumption that the asset willbe held past the expiration date of the lease.Otherwise it must be assumed that use of the assetwill revert to the lessor at expiration, requiring thelessee to depreciate the leased asset over the(shorter) lease term.5.{M}a. The following states the effects of Tolrem using thecapital lease method as compared with the operatinglease method.(i) Cash from operations is higher as only theinterest portion of lease expense is deductedfrom operating cash flows; total lease expense isdeducted for operating leases.(ii) Financing cash flow is lower for capital lease, as part of lease rental is treated asamortization of liability and classified asfinancing cash outflow.(iii)Investing cash flow is not affected by the lease treatment. However, the firm will report capitalleases in the statement of cash flows (or afootnote) as noncash investment activities.(iv) Net cash flow reflects the actual rental payment and is unaffected by the financial reportingtreatment of the lease.(v) Debt/equity ratio is higher for capital lease, as it records the present value of minimum leasepayments as debt and reduces net income (andtherefore equity) in first year.(vi) Interest coverage ratio is usually (not always) lower for capital lease method, which reportsinterest expense but also higher EBIT, see (vii).For coverage ratios well above 1.0, the ratiowill decline. If the increase in interest expenseexceeds the increase in EBIT, the ratio willdecline even for firms with very low coverageratios.11-3(vii)Operating income is lower for operating lease because the total lease payment is an operatingexpense; for capital lease, interest portion oflease expense is nonoperating.(viii)Net income is higher for operating lease; total lease expense (interest plus depreciation) ishigher for capital lease.(ix) Deferred tax assets are higher for capital lease;as lease treatment for tax purposes is unaffectedby accounting choice, capital lease will generatea deferred tax asset as taxable income (operatinglease) exceeds pretax income (capital lease).(x) Taxes paid are unaffected by choice of method.(xi) Pretax return on assets is higher for operating leases as pretax income is higher and no assetsare reported as the result of the lease; acapital lease reduces income and reports leaseassets. Post-tax return on assets is higher forthe same reasons.(xii)Pretax return on equity: both pretax income and equity are higher for operating than for capitalleases. The higher pretax income should increasethe ratio in all but exceptional cases. Post-taxreturn on equity should be higher for same reason.However as increase in post-tax income equals(for first year) increase in equity, there may bemore exceptional cases.b. Net income (viii) will be lower for the operatinglease after the "crossover" point. As total net income over the life of the lease is unaffected by the accounting choice, higher net income (operating lease) in the early years must be offset by lower net income in later years.c. Consistent use of the operating lease method in placeof capitalization will not change the direction of the effects shown in part A, but will increase their magnitude. In aggregate, new leases will keep Tolrem from reaching the crossover point for net income, keeping net income and return ratios higher than if the leases were capitalized.11-46.{L}a. and b.4 payment annuity of $10,000 per year at 8%). Assuming zero residualvalue, depreciation = $43,121/5 = $8,624.2Interest expense = 8% x ($43,121 - $10,000) = $2,650Caramino's EBIT is $1,376 higher; Aglianico reportsrental expense but no depreciation expense since itdoes not record an asset. Because total lease expense(depreciation plus interest) is higher than the leaserental, Caramino's EBT is lower by $1,274. After adeferred income tax offset of $510, Caramino's netincome is $764 lower.Caramino's deferred tax debit (asset) results from thedifference between financial reporting (capital lease)and tax reporting (operating lease). The $1,274 timingdifference results in a deferred tax debit of $1,274x .40 = $510c. andd. Comparison of Cash Flow Statementshave been collected by the end of the year.11-5Caramino reports higher cash from operations by $10,000. Since the tax rate is 40%, Aglianico (operating lease firm) reports aftertax operating cash outflow of $6,000. Caramino (capital lease firm) pays no interest but, since it uses the operating lease method for taxes, receives a tax deduction of $4,000 for the annual payment of $10,000. Caramino's aftertax operating cash inflow is $4,000.The difference ($6,000 + $4,000 = $10,000) is recorded by Caramino as a financing cash outflow; this is the amount of the lease payment considered a reduction of the capitalized lease liability for 2002. [Note that the lease payment made on January 1, 2002 has no interest component; there is no accrued interest as the lease has just begun. Interest accrued during the year will be paid January 1, 2003.]e. There is no impact on investing cash flow for eitherfirm. Caramino would report the present value of the capital lease as a noncash investment activity.f. The net cash outflow for each firm is the leasepayment of $10,000 less the tax deduction of $4,000 (40% tax rate). Only the classification of cash flow components is affected by the lease method used.g. By using the capital lease method, Caramino reportshigher debt and lower income. However the firm also reports higher cash from operations. The choice of method may reflect different debt covenants or simplya preference among financial characteristics.11-67.(M) a. Since it is the first year:Capital lease obligations $2,596,031Repayment of capital lease obligations 3,969Capital lease at inception $2,600,000b. Amortization expense =$2,600,000 - $2,479,570 = $120,430Assuming the asset is being amortized on a straightline basis over the lease term, the lease term =$2,600,000/$120,430 = 21.6 or 22 yearsTotal expense = interest + amortization =$120,430 + $223,733 = $344,163c. CFO was reduced by the interest expense of $223,733and CFF was reduced by the “repayment of capital leaseobligations” of $ 3,969d. Free cash flows should be reduced by $2,600,000 – the“cost” of the leased asset.e. (i) Lease expense would be lease payment =$223,733 + $3,969 = $227,702(ii) CFO would be reduced by lease payment of $227,702f. Using 1999 payment only: $223,733/$2,600,000 = 8.6%Using all the payments, we have exact MLP’s for thesix years 1999 –2004. The “thereafter” MLP’s totaling$4,596 thousand are spread over 16 years; i.e. $287.25thousand/year. Equating this stream to the presentvalue of $2,600,000 yields a rate (IRR) of 9.3%.The two methods yield rates within “range” of eachother especially when we consider that the ratederived from the first method is typically downwardbiased.11-78.{M}a. The adjustment involves the addition of the interestcomponent of minimum lease payments to stated interestexpense. The adjustment reflects a partial, de factocapitalization of operating leases.(i)Unadjusted Ratio of Earnings to Fixed Charges:Pretax earnings $ 2,363,646Interest on indebtedness 68,528Earnings before interest and taxes (EBIT) $ 2,432,174Fixed Charges:Interest on indebtedness $ 68,528Unadjusted Ratio of Earnings to Fixed Charges 35.5X(ii) The unadjusted ratio is almost four times the adjusted ratio. Note: the SEC rule that governsthis calculation assumes that the interestcomponent is one-third of the MLP. The trueinterest component may be higher or lower,changing the coverage ratio.b. Reported debt-to-equity = $550,000/$2,233,303 = 0.25c. Calculation of amounts adjusted for leasecapitalization:The Limited, Inc.1999 Working Capital Position and Capitalization Table1 Working capital is reduced by the principal component of the 2000MLPs calculated as$436,670 = [($643,828 - (.06 x $3,452,628)],where $3,452,628 is the present value calculated in note 2 below.2 Present value of MLPs using an interest rate of 6%. The “thereafter”MLPs are spread using the constant rate assumption; ($502,880 in 2005and 2006 and $422,102 in 2007).11-89.{S} Note: all amounts in $millionsa. Debt to equity = ($2,416 + $235)/$4,448 = 0.60b. (i) Interest portion of 2001 payment = $63-$39 = $24Therefore interest rate = $24/$235 = 10.2%(ii)Using the constant rate assumption yields theThe IRR that equates the above to $235 is 7.9%c. Under the constant rate assumption, the payment streamto be discounted at 10.2% isThe present value is $7,435d. Adjusted debt-to-equity is($2,416 + $235 + $7,435)/$4,448 = 2.27The adjustment increases the ratio almost four-fold.The real effect is greater as equity would be lower ifDelta had capitalized its operating leases at theirinception.e. After adjustment, both AMR’s and Delta’s ratios are atsimilar levels of 2.3x.Had the lower rate been used, the present value ofDelta’s operating lease would be significantly higheras would its debt-to-equity ratio.f. The adjustments are appropriate for two reasons(1)To obtain the appropriate levels of the ratio foreach firm. For both companies, the reported ratiosunderstate their financial leverage.(2)For comparison purposes. Before adjustment,Delta’s ratio at 0.6x is 50% lower than AMR’s 0.9x.After adjustment, that superiority is removed asboth firms have similar ratios.11-910.{M}a. The following MLP stream is assumed (€ million):At a rate of 7%, the present value is €505.3 millio nb. (i) €1,294/€14,145 = 0.09(ii)(€1,294 + €505)/€14,145 = 0.13c.Another assumption would be to find a decline ratefrom the initial payment of €166.5 such that the sumof the years 2 to 5 payments using that decline rateequals €275.2; i.e. solve for d i n the followingequation(d + d2 + d3 + d4 ) x €166.5 = €275.2The above can be solved by trial and error and thesolution is d = 67.66% with a MLP stream of €112.6,€76.2, €51.5 and €34.9.Using this MLP stream would increase the present valueof the operating lease obligation.11.{S}a. We use the constant rate assumption, yielding thefollowing payment stream (€ millions)At a discount rate of 7%, the present value is €12,543.b. (i) Reported debt-to-equity = €1,294/€14,145 = 0.09Adjusted for part a:(€1,294 + €12,543)/€14,145 = 0.98(ii) Adjusting for operating leases as well(€1,294 + €12,543 + €505)/€14,145 = 1.0111-1012.{S}a. The cash outflow of $25.6 million represents thedecrease in the balance of sold but uncollectedreceivables ($192.8 - $167.2). It represents netcollections (by Arkla as the firm continues to servicethe receivables) of receivables sold; amountscollected from previously sold receivables were paidto the purchasers of those receivables.b. Receivables sold but uncollected as of 12/31/93 can bededuced to be:Outstanding 3/31/94 $118.7 millionDecrease during quarter 107.7Outstanding 12/31/93 $226.4 millionc. The required adjustments to Arkla's CFO for quartersended:March 31, 1994 March 31, 1995 Cash outflow $107.7 $25.6These amounts are the decrease in receivables soldduring the respective quarters. The adjustment isrequired because the cash flow was recognized when thereceivables were sold rather than when customers paid.This adjustment produces a measure of CFO based onwhen the receivables were collected.13.{S} All amounts in $millionsa. (i) Current ratio was increased by 15% from 1.61 to1.86 as a result of receivable sale.Reported = $686/$369 = 1.86Adjusted = ($686 + $153.1)/($369 + $153.1) = 1.61 (ii) & (iii)Average receivables as reported =.5($546 + $312) = $429Adjusting for sale of receivables would increaseaverage receivables by.5($153.1 + $115) = $134 to $563Reported turnover = $2,951/$429 = 6.88# of days = 365/6.88 = 53 daysAdjusted turnover = $2,951/$563 = 5.24# of days = 365/5.24 = 70 daysAs a result of the receivable sale the cash cyclelooked better than it really was by (70 –53) =17 days and the receivables turnover “improved”from 5.24 to 6.8811-11b. Reported debt/equity = $1,096/$950 = 1.15Debt should be adjusted upwards by the receivablessold to ($1,096 + $153.1 =) $1,249.1 with a resultantdebt to equity ratio of $1,249.1/$950 = 1.31.c. Reported cash flow from operations increased by $154million from ($96) million to $58 million. Theseamounts were inflated by the increase in receivablessold and should be adjusted by that increase:Adjusted CFO 1998 = ($96) – ($115 – $103.3) = ($107.7)Adjusted CFO 1999 = $58 - ($153.1 – $115) = $19.9After removing the effects of the receivable sales,CFO increased by $127.6 million from ($107.7) millionto $19.9 million. The actual level and trend in CFO isconsiderably lower than the amounts reported.14.{M}a.11-12The sale of receivables allowed the company to show an improved receivable turnover and cash cycle; the improvement was more significant for 1999 as the amount of receivables sold increased and sales declined.b. The effect on the current ratio is minimal as the sameamount is added to both numerator and denominator of the ratio and that ratio is close to 1. The debt-to-equity ratio adjustment is more significant in 1999 due to the increase in receivables sold and the lower equity amount.c. As the calculation below indicates, both the level andtrend in CFO are overstated as a result of the sale of receivables.11-1315.{S}a. The cash from investment amounts are equivalent to thechange in the “Receivables sold by Funding topurchaser”. (Reca ll that 1997 was the first year ofreceivable sales.)b.receivable balances 17% to 21% less than their actuallevels.c. The sale of receivables should be reported as cashfrom financing as they are, in effect, borrowings(using receivables as collateral).16.{S} Aluminum producers that have take-or-pay contracts forenergy and/or bauxite have converted significantvariable costs into fixed costs. Therefore, theirmarginal costs are much lower than if these contractshad not been entered into. Under these conditions,aluminum producers will continue production as long asrevenue exceeds marginal costs, even though they losemoney based on total costs.17.{M}a. By transferring receivables to a (unconsolidated)subsidiary, Lucent removed the receivables from itsreceivable balance and reported them as “Investments,”a somewhat different asset category. Analyticaladjustment is required to eliminate the artificialreported “improvements” in receivables turnover, thecurrent ratio and the cash cycle.b. The adjustment requires adding $700 million (inaddition to the balance of uncollected receivables) tothe 1999 accounts receivable and current assets. Theeffect is to increase the growth in receivables,reduce the receivable turnover and increase the numberof days receivables outstanding. This adjustmentreinforces the conclusion (see text page 381) thatLucent’s receivables growth outpaced the growth insales. On the other hand, the adjustment improves the1999 current ratio.11-14Note: The bold values indicate which amounts were altered from Exhibit 11-4. The Exhibit 11-4 amounts for those items affected by the adjustment are shown in parentheses.11-1518.{M}a. Debt should be increased by:$ 20 million (present value of operating lease)5 (guarantee)7 (present value of take-or-pay agreement)$ 32 millionThere is no effect on equity as each obligation isoffset by a corresponding asset:Leased assets for operating leaseReceivable for Crockett's obligation to repay debtSupply agreementThe recomputed debt-to-equity ratio is:($12 + $32)/$20 = 2.2X as compared to .6X beforeadjustmentb. Additional interest expense is:Lease (effective interest rate is about 18%).18 x $20 = $3.6 millionBond guarantee .10 x 5 = 0.5Total $ 4.1 millionBefore adjustment, the interest expense is $1.0 millionand the times interest earned ratio is 5.0, implyingEBIT of $5.0 million.After adjustment, the ratio is:($5.0 + $4.1)/($1.0 + $4.1) = 1.78XNo adjustment has been made for the take-or-paycontract, as it does not affect 1993 interest expense.Adjustments in future years will be based on theimplicit interest rate of 21%.c. Reasons for entering into off-balance-sheet obligations:1. Avoidance of or mitigation of the risk of violatingdebt covenant restrictions.2. Leased assets revert to lessor after eight years,limiting risk of obsolescence.3. Guarantee of Crockett's debt may lower interestcosts, increasing profitability of investment.4. Contract with PEPE secures source of supply andpossibly advantageous pricing.11-16d. Additional information needed for full evaluation:1. (Lease) Useful life of leased assets; conditionsunder which lease can be canceled; nature ofleased assets.2. (Guarantee) Financial condition of Crockett; bondcovenants.3. (Take-or-pay) Alternate sources of supply;quantity to be purchased relative to total needs;price provisions of contract.19.{L}a. As the table below indicates, the declining paymentassumption using a 92% declining rate (the averagerate over the first five years (2000 - 2004)) is agood approximation for JC Penney. The present value is$3,320; a deviation of one-half of one percent fromthe stated present value of $3,302. If the constantpayment assumption is made, the error is about fourpercent.11-17b. Using only the first year payment: Payment = $66 andcurrent portion = $16; therefore interest portion = $50 and interest rate = $50/$417 =12%.Using all payments:Constant payment assumption implies MLP’s of $54 from 2004 through 2017 and $12 in 2018. Equating this payment stream to $417 yields an IRR of 11.8%For the declining payment assumption, we would use a declining rate of 95%, the average of (2000 - 2004).Using this rate yields an IRR of 10.44%The rate seems to be between 10.4%-12%. Given that two of the methods yield estimates closer to the high end of the range, using a rate of approximately 11.5% would be an appropriate estimate.c. The rate used by Sears is somewhat higher than that ofJ.C. Penney. That may be a function of (1)higher credit rating for Penney, (2)differing risk characteristics of the leased properties, or (3) Sears leases were entered into in periods of higher interest rates.d. Given the rapid decline over the first four years, wechoose to use the declining payment assumption. Usinga decline rate of .86 (the average over the first fiveyears) and a discount rate of 11.5% (from part b), the present value of the operating leases is $1,375 million.11-1820.{M} Adjusting for the operating lease results in adeterioration of the ratios in each case.* Year 2000 MLP = $352. Interest portion is equal to 11.5% x $1,325 = $158; Therefore, current portion of debt = $352 -$158 = $194** Present Value of operating leases as calculated in Problem 19 part d.† Assumes interest this year (1999) is approximately equal to next year’s (2000) interest levels.Note: No adjustment is made for pretax income, which maybe higher or lower depending on the age” of the lease.The earlier (later) in the lease term, expense is higher(lower) for the capital lease. On average the expense isidentical.As we do not know the relative age of theleases we assume no change.11-1921.{S} Sears’ MDA reports securitized (credit card) balancessold of $6,579 and $6,626 million in 1999 and 1998respectively. Adjusting for these balances (in 1999)requires adding $6,579 to accounts receivable andcurrent liabilities (assuming the debt is short-term)and increasing CFO by ($6,626 – $6,579) $47 million. Asthe table below indicates, the impact on these threeratios is considerable.22.{S} The adjusted ratios are poorer than those based on Sears’reported data. The adjustment for securitization ofreceivables accounts for far more of the impact than theoperating leases.Note: See problems 11-19, 11-20, and 11-21 for explanation of these adjustments11-2023.{M}a. Using th e constant rate assumption (MLP’s of $59million from 2004 - 2017 and $8 million in 2018), theimplicit interest rate is 4.19%.Note that Texaco has not guaranteed all of this lease.The total present value of the guaranteed portion ofthe lease is approximately ($336/44%) $764 million.b. The rate is somewhat lower than the 5% - 5.5% ratecalculated for Texaco in the chapter (page 385).c. Equilon may have less debt (in relation to theirassets) than Texaco, or the nature of its business (orof the leased assets) may be operationally less risky.The leases may have been entered into when interestrates were especially low.Assets are higher because inventory is replaced with (higher) receivables because of the recognition of manufacturing profit. Assets remain higher throughout the lease term.Revenues are higher in Year 1 as the sales-type lease recognizes a sale whereas the operating lease method does not. In later years, interest revenue from the sales-type lease should be lower than lease revenue for the operating lease. This effect is more pronounced over time; in year 9, interest income is low given the small remaining receivable.The revenue effect increases the asset turnover ratio in the first year. But the revenue effect reduces turnover in the ninth year.11-21Expenses are higher in year 1 due to the recognition of cost of goods sold. In later years, there is no expense for the sales-type lease; the operating lease method reports depreciation expense in every year, however.Initial period income and income-related ratios are higher for the sales-type lease because the sale (and income) is recognized at the inception of the lease. In later years, however, income is higher for the operating lease.Income taxes paid are the same since the lease cannot be considered a completed sale for tax purposes.Cash from operations is higher for the first year due to recognition of the sale (the investment in the lease is classified as an investing cash outflow). In later years the operating lease method shows higher cash from operations as rental income exceeds the interest income recorded for the sales-type lease (income taxes paid are the same).[See Exhibit 11-8 and the accompanying text for further explanation of these effects.]25.{L}a. The present value of the minimum lease paymentsreceivable of $170,271 (at 10%, the lower of lesseeand lessor rates) is more than 90% of the fair marketvalue of $185,250. Therefore, the lessee, Baldes,should capitalize the lease. It would be useful toknow whether the lessee has guaranteed the residualvalue of the leased asset.b. Leased assets $ 170,271Long-term lease obligation 167,298Current portion of lease obligation 2,973Total lease obligation $ 170,271Note that there are no income or cash flow statementeffects at the inception of the lease.11-2211-23c. (i) Balance sheet effects of capital lease:No impact on balance sheet if operating lease method applied. [Deferred tax assets reflecting the difference between total expense under the two methods would also be reported.](ii) Income statement effects of capital lease:1Interest expense for: 2001 = .10 x $170,271 2002 = .10 x $167,298 2Deprecation expense = $170,271/20 for each yearThe income statement would show lease expense of $20,000 each year under the operating lease method.(iii) Statement of cash flow effects of capital lease:The operating lease method reports $20,000 cash outflow from operations for each year.。

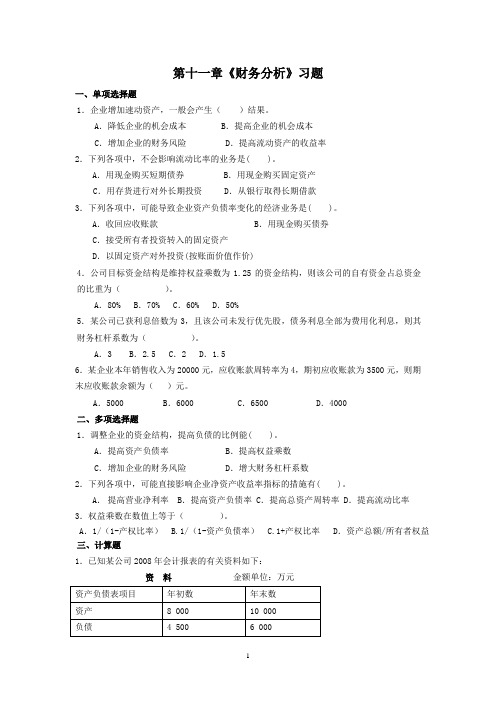

第十一章《财务分析》习题

第十一章《财务分析》习题一、单项选择题1.企业增加速动资产,一般会产生()结果。

A.降低企业的机会成本 B.提高企业的机会成本C.增加企业的财务风险 D.提高流动资产的收益率2.下列各项中,不会影响流动比率的业务是( )。

A.用现金购买短期债券 B.用现金购买固定资产C.用存货进行对外长期投资 D.从银行取得长期借款3.下列各项中,可能导致企业资产负债率变化的经济业务是( )。

A.收回应收账款 B.用现金购买债券C.接受所有者投资转入的固定资产D.以固定资产对外投资(按账面价值作价)4.公司目标资金结构是维持权益乘数为1.25的资金结构,则该公司的自有资金占总资金的比重为()。

A.80% B.70% C.60% D.50%5.某公司已获利息倍数为3,且该公司未发行优先股,债务利息全部为费用化利息,则其财务杠杆系数为()。

A.3 B.2.5 C.2 D.1.56.某企业本年销售收入为20000元,应收账款周转率为4,期初应收账款为3500元,则期末应收账款余额为()元。

A.5000 B.6000 C.6500 D.4000二、多项选择题1.调整企业的资金结构,提高负债的比例能( )。

A.提高资产负债率 B.提高权益乘数C.增加企业的财务风险 D.增大财务杠杆系数2.下列各项中,可能直接影响企业净资产收益率指标的措施有( )。

A.提高营业净利率 B.提高资产负债率 C.提高总资产周转率 D.提高流动比率3.权益乘数在数值上等于()。

A.1/(1-产权比率) B.1/(1-资产负债率) C.1+产权比率 D.资产总额/所有者权益三、计算题1.已知某公司2008年会计报表的有关资料如下:资料金额单位:万元要求:(1)计算杜邦财务分析体系中的下列指标(凡计算指标涉及资产负债表项目数据的,均按平均数计算):①净资产收益率;②总资产净利率(保留三位小数);③销售净利率;④总资产周转率(保留三位小数);⑤权益乘数。

财务分析报告课后答案(3篇)

第1篇一、报告概述本报告旨在通过对某公司财务报表的分析,评估其财务状况、经营成果和现金流量,为投资者、管理层和债权人提供决策依据。

报告内容主要包括以下几个方面:1. 公司概况2. 财务报表分析3. 财务状况综合评价4. 风险与挑战二、公司概况某公司成立于2000年,主要从事某行业产品的研发、生产和销售。

公司总部位于我国某一线城市,业务范围覆盖全国,并在海外市场设有分支机构。

经过多年的发展,公司已成为该行业的领军企业。

三、财务报表分析1. 资产负债表分析(1)资产结构分析从资产负债表可以看出,公司资产总额为XX亿元,其中流动资产XX亿元,非流动资产XX亿元。

流动资产中,货币资金、应收账款和存货分别占流动资产的XX%、XX%和XX%。

非流动资产中,固定资产和无形资产分别占非流动资产的XX%和XX%。

(2)负债结构分析公司负债总额为XX亿元,其中流动负债XX亿元,非流动负债XX亿元。

流动负债中,短期借款、应付账款和预收账款分别占流动负债的XX%、XX%和XX%。

非流动负债中,长期借款和递延收益分别占非流动负债的XX%和XX%。

2. 利润表分析(1)营业收入分析公司营业收入为XX亿元,同比增长XX%。

其中,主营业务收入为XX亿元,同比增长XX%;其他业务收入为XX亿元,同比增长XX%。

(2)成本费用分析公司营业成本为XX亿元,同比增长XX%。

其中,主营业务成本为XX亿元,同比增长XX%;其他业务成本为XX亿元,同比增长XX%。

销售费用、管理费用和财务费用分别为XX亿元、XX亿元和XX亿元,同比增长XX%、XX%和XX%。

(3)利润分析公司净利润为XX亿元,同比增长XX%。

其中,主营业务利润为XX亿元,同比增长XX%;其他业务利润为XX亿元,同比增长XX%。

3. 现金流量表分析(1)经营活动现金流量分析公司经营活动现金流量为XX亿元,同比增长XX%。

其中,销售商品、提供劳务收到的现金为XX亿元,同比增长XX%;收到其他与经营活动有关的现金为XX亿元,同比增长XX%。

《财务分析》课后习题答案

2.2 因素分析解:1)单位产品材料成本分析分析对象:89-86=+3因素分析:1)单耗变动影响=(11-12)×3=-3(元)单价变动影响=11×(4-3)+10×(4.5-5)=11-5=+6(元)可见,丙产品单位材料成本上升主要是A材料价格上涨幅度较大造成的。

其实A材料单耗和B材料单价的变动对材料成本降低都起了较大作用。

2)单位产品直接人工成本分析分析对象: 27-20=+7(元)因素分析效率差异影响=(18-20)×1=-2(元)工资差异影响=18×(1.5-1)=+9(元)可见,企业人工费用上升主要是由于小时工资率提高引起的,而企业生产效率并没下降。

效率提高使单位产品人工成本降低了2元。

2.3 会计分析方法解:1)编制资产负债表水平分析表并评价如下:资产负债表水平分析表┏━━━━━━━━━┯━━━┯━━━┳━━━┯━━━┓┃资产│年末数│年初数┃变动量│变动率┃┠─────────┼───┼───╂───┼───┨┃流动资产││┃│┃┃应收账款│ 4071 │ 3144 ┃ +927 │ +29.5┃┃存货│ 3025 │ 2178 ┃ 847 │ 38.9┃┃流动资产合计│ 8684 │ 6791 ┃+1893 │ +27.9┃┃固定资产││┃│┃┃固定资产原值│15667 │13789 ┃+1878 │ +13.6┃┃固定资产净值│ 8013 │ 6663 ┃ 1350 │ 20.3┃┃无形及递延资产│ 6267 │ 1244 ┃ 5023 │ 403.8┃┃资产总计│22964 │14698 ┃+8266 ┃ +56.2┃┃流动负债││┃│┃┃应付帐款│ 5277 │ 3614 ┃+1663 │+46.0 ┃┃流动负债合计│ 5850 │ 4140 ┃ 1710 │ 41.3 ┃┃长期负债││┃│┃┃长期借款│ 7779 │ 2382 ┃+5397 │ 226.6┃┃负债合计│16184 │ 8685 ┃+7499 │ +86.3┃┃所有者权益││┃│┃┃实收资本│ 6000 │ 5000 ┃1000.0│ 20.0┃┃所有者权益合计│ 6780 │ 6013 ┃ +767 │ +12.8┃┃负债加所有者权益│22964 │ 14698┃+8266 │+ 56.2┃┗━━━━━━━━━┷┻━━┷━━┷┻━━━┳━━━┛从资产负债表的水平分析表中可看出,2010年企业总资产比2009年增加了8266万元,增长率为56.2%;资产的增加从占用形态看,主要是无形资产增加,应引起重视;资产增加从来源看,主要是由于负债的增加,•特别是长期负债的增加引起的,负债比上年增长了86.3%;所有者权益比上年也有增加,增长率为12.8%。

财务分析习题

第十一章财务分析一、单项选择题1、下列属于短期偿债能力指标的是()A、资产负债率B、速动比率C、利息保障倍数D、产权比率2、下列属于长期偿债能力指标的是()A、资产负债率B、流动比率C、现金比率D、速动比率3、一般认为,生产企业合理的流动比率是()A、1B、2C、20%以上D、至少应大于14、一般认为,速动比率()较合适A、为1B、为2C、在20%以上D、大于15、利息保障倍数()A、大于20%为好B、应等于1C、应等于2D、至少应大于16、评价企业财务结构是否稳健的指标是()A、速动比率B、流动比率C、现金比率D、产权比率7、衡量企业偿付借款利息能力的指标是()A、资产负债率B、现金比率C、利息保障倍数D、流动比率8、反映企业应收账款管理效率的指标是()A、应收账款周转率B、存货周转率C、存货周转天数D、现金比率9、衡量企业全部资产使用效率的指标是()A、应收账款周转率B、存货周转率C、固定资产周转率D、总资产周转率10、()是杜邦分析中的核心指标。

A、总资产报酬率B、总资产周转率C、净资产收益率D、销售利润率11、下列不反映获取现金能力的指标是()A、销售现金比率B、每股营业现金净流量C、全部资产现金回收率D、现金营运指数12、杜邦分析法主要用于()A、偿债能力分析B、营运能力分析C、盈利能力分析D、财务状况综合分析13、某企业流动资产为10万元,其中存货4万元,待摊费用0.5万元,流动负债6万元,应收账款1.5万元,则流动比率为()A、0.67B、0.92C、1D、1.6714、某企业流动资产为10万元,其中存货4万元,待摊费用0.5万元,流动负债6万元,应收账款1.5万元,则速动比率为()A、0.67B、0.92C、1D、1.6715、在计算利息保障倍数时,分母的“利息费用”指()A、财务费用中的利息支出B、全部财务费用C、本期发生的全部应付利息D、计入固定资产的资本化利息16、某企业当年销售收入净额为150万元,年初和年末应收账款余额分别为20万元和25万元,则应收账款周转天数为()A、6.67次B、7.5次C、6次D、54天17、某企业年销售收入净额为150万元,销售成本为120万元,年初和年末存货余额分别为40万元和50万元,则存货周转天数为()A、3.33次B、2.67次C、108天D、135天18、某企业年销售收入净额为150万元,年初和年末流动资产余额分别为80万元和85万元,则流动资产周转次数为()A、1.8次B、1.82次C、1.88次D、1.76次19、某企业净利润为500万元,所得税费用为234万元,利息支出为300万元,年初和年末资产总额分别为5250万元和6250万元,则总资产报酬率为()A、8.70%B、12.77%C、17.98%D、8.00%20、某企业净利润为500万元,所得税费用为234万元,利息支出为300万元,年初和年末所有者权益分别为3000万元和3250万元,则净资产收益率为()A、16.67%B、15.38%C、16.00%D、33.09%二、判断题1.相关比率反映部分与总体的关系。

财务会计学教材课后练习答案(第11、12、13、14章)

财务会计学教材课后练习答案(第11、12、13、14章)第⼗⼀章收⼊、费⽤与利润第1题:(1)2007.12.5:借:银⾏存款 180万贷:预收账款 180万借:发出商品 380万贷:库存商品 380万2007.12.31不确认收⼊2008.1.31:借:预收账款 702万贷:主营业务收⼊ 600万应交税费-应缴增值税(销项税额) 102万借:主营业务成本 380万贷:发出商品 380万(2)2007.12.10:借:应收票据 35.1万贷:主营业务收⼊ 30万应交税费-应交增值税(销项税额)5.1万借:主营业务成本 16万贷:库存商品 16万(3)2007.12.15:借:银⾏存款 23.4万贷:其他应付款 20万应交税费-应交增值税(销项税额)3.4万借:发出商品 15万贷:库存商品 15万2007.12.31,确认应计提的财务费⽤:借:财务费⽤ 750贷:其他应付款 7502008.2.15:借:财务费⽤ 2250贷:其他应付款 2250借:库存商品 15万贷:发出商品 15万借:其他应付款 20.3万应交税费-应交增值税(进项税额)3.451万贷:银⾏存款 23.751万第2题:2007.12.15:借:银⾏存款 100万贷:预收账款 100万2007年12.31:确认收⼊=500×50%-0=250万确认劳务成本=400×50%-0=200万借:预收账款 250万贷:主营业务收⼊ 250万借:主营业务成本 200万贷:劳务成本 200万第3题:(1)2007.1.1.:借:固定资产清理 800万累计折旧 200万贷:固定资产 1000万借:长期股权投资-成本 950万贷:固定资产清理 800万营业外收⼊ 150万持有30%股权,有重⼤影响,采⽤权益法核算。

2007年:借:长期股权投资–损益调整 90万贷:投资收益 90万借:应收股利 60万贷:长期股权投资-损益调整 60万2008年:借:长期股权投资–损益调整 120万贷:投资收益 120万借:应收股利 90万贷:长期股权投资-损益调整 90万(2)2008年应纳额所得税=800-300×30%=710万应纳所得税额=710×25%=177.5万当期所得税费⽤=177.5万长期股权投资账⾯价值=950+90-60=980万长期股权投资计税基础=950万应纳税暂时性差异=30万递延所得税负债=30×25%=7.5万元借:所得税费⽤ 177.5万贷:应交税费-应缴企业所得税 177.5万借:所得税费⽤ 7.5万贷:递延所得税负债 7.5万2009年:2009年应纳额所得税=1000-400×30%=880万应纳所得税额=880×25%=220万当期所得税费⽤=220万长期股权投资账⾯价值=980+120-90=1010万长期股权投资计税基础=950万应纳税暂时性差异=60万递延所得税负债=60×25%-7.5=7.5万元借:所得税费⽤ 220万贷:应交税费-应缴企业所得税 220万借:所得税费⽤ 7.5万贷:递延所得税负债 7.5万第⼗⼆章财务报表第1题:资产负债表编制单位:A公司 20X6年12⽉31⽇单位:元第2题:做出相关业务的账务处理:(1)借:应付票据 200 000贷:银⾏存款 200 000(2)借:材料采购—甲材料 300 000应交税费—应交增值税(进项税额) 51 000 贷:银⾏存款 351 000 (3)借:原材料—⼄材料 190 000材料成本差异 10 000贷:材料采购—⼄材料 200 000(4)借:银⾏存款 468贷:其他货币资⾦—银⾏汇票 468借:材料采购 199 600 应交税费—应缴增值税(进⾏税额) 33 932 贷:其他货币资⾦—银⾏汇票 233 532 借:原材料 200 000贷:材料采购 199 600材料成本差异 400(5)借:应收账款 702 000贷:主营业务收⼊ 600 000应交税费—应交增值税(销项税额) 102 000(6)借:银⾏存款 33 000贷:交易性⾦融资产 30 000投资收益 3 000(7)借:固定资产 172 940应交税费—应交增值税(进项税额) 29 060贷:银⾏存款 202 000 (8)借:⼯程物资 300 000 应交税费—应交增值税(进项税额) 51 000贷:银⾏存款 351 000 (9)借:在建⼯程 656 000贷:应付职⼯薪酬 456 000应交税费—应交耕地占⽤税 200 000(10)借:在建⼯程 300 000贷:应付利息 300 000(11)借:固定资产 2 800 000贷:在建⼯程 2 800 000(12)借:固定资产清理 40 000累计折旧 360 000贷:固定资产 400 000借:固定资产清理 1 000贷:银⾏存款 1 000借:银⾏存款 1 600贷:固定资产清理 1 600借:营业外⽀出 39 400贷:固定资产清理 39 400(13)借:银⾏存款 800 000贷:长期借款 800 000 (14)借:应收账款 1 638 000 贷:主营业务收⼊ 1 400 000 应交税费—应交增值税(销项税额)238 000 (15)借:银⾏存款 400 000贷:应收票据 400 000(16)借:银⾏存款 60 000贷:投资收益 60 000(17)借:固定资产清理 500 000累计折旧 300 000贷:固定资产 800 000借:银⾏存款 600 000贷:固定资产清理 600 000借:固定资产清理 100 000贷:营业外收⼊ 100 000(18)借:财务费⽤ 43 000贷:应付利息 43 000(19)借:短期借款 500 000应付利息 25 000贷:银⾏存款 525 000(20)借:应付职⼯薪酬 1 000 000贷:银⾏存款 1 000 000 (21)借:⽣产成本 627 000制造费⽤ 22 800管理费⽤ 34 200贷:应付职⼯薪酬 684 000 (22)借:⽣产成本 1 500 000贷:原材料 1 400 000低值易耗品 100 000(23)借:⽣产成本 70 000贷:材料成本差异 70 000(24)借:制造费⽤ 180 000贷:银⾏存款 180 000 (25)借:银⾏存款 102 000贷:应收账款 102 000(26)借:销售费⽤ 40 000贷:银⾏存款 40 000 (27)借:长期借款 2 000 000贷:银⾏存款 2 000 000(28)借:库存商品 2 564 800贷:⽣产成本 2 564 000(29)借:应收票据 585 000贷:主营业务收⼊ 500 000 应交税费—应交增值税(销项税额)85 000 (30)借:银⾏存款 545 000财务费⽤ 40 000贷:应收票据 585 000(31)借:管理费⽤ 100 000贷:银⾏存款 100 000(32)借:营业税⾦及附加 4 000贷:应交税费—应交城市维护建设税 4 000(33)借:应交税费—应交增值税(已交税⾦) 200 000应交税费—应交教育费附加 4 000 贷:银⾏存款 204 000 (34)借:主营业务成本 1 500 000贷:库存商品 1 500 00(35)借:制造费⽤ 160 000管理费⽤ 40 000贷:累计折旧 200 000(36)借:资产减值损失 1 800贷:固定资产减值准备 1 800(37)借:管理费⽤ 140 000贷:累计摊销 140 000(38)借:资产减值损失 1 800贷:坏账准备 1 800(39)借:所得税费⽤ 204 798贷:应交税费—应交企业所得税 204 798 (40)借:投资收益 63 000主营业务收⼊ 2 500 000营业外收⼊ 100 000贷:本年利润 2 663 000借:本年利润 2 042 400贷:营业外⽀出 39 400主营业务成本 1 500 000管理费⽤ 314 200销售费⽤ 40 000财务费⽤ 83 000资产减值损失 61 800营业税⾦及附加 4 000借:本年利润 204 798贷:所得税费⽤ 204 798(41)借:利润分配—提取盈余公积 41 580.20 贷:盈余公积 41 580.20 (42)借:利润分配—未分配利润 41580.20贷:利润分配—提取盈余公积 41 580.20 借:本年利润 415 802贷:利润分配—未分配利润 415 800(43)借:应交税费—应交企业所得税 204 798贷:银⾏存款注:资产负债表和利润表excel表中第3题(略)第⼗三章资产负债表⽇后事项第1题:(1)资产负债表⽇后事项中的调整事项(2)会计处理:借:以前年度损益调整 40万贷:预计负债 40万借:递延所得税资产 10万贷:以前年度损益调整 10万借:利润分配-未分配利润 30万贷:以前年度损益调整 30万借:盈余公积 3万贷:利润分配-未分配利润 3万第⼗四章会计变更和差错更正第1题:按照账龄分析法,2006年12⽉31⽇坏账准备的余额为288万(1200×10%+200×20%+120×30%+80×100%),所以应当补提坏账准备280万借:利润分配—未分配利润 210万递延所得税资产 70万贷:应收账款-(坏账准备) 280万借:盈余公积 21万贷:利润分配–未分配利润 21万第2题:(1)2007年B公司应采⽤未来适⽤法处理该会计估计变更,2007年应提折旧=(1600-60)/(12-4)=192.5万元借:管理费⽤ 192.5万贷:累计折旧 192.5万(2)按照原来的会计估计,每年折旧240万元,⾄2007年年初已计提1.5年,累计折旧360万,办公楼净值为840万未来适⽤法下2007年折旧⾦额=840×3.5/(3.5+2.5+1.5+0.5)=367.5万元借:管理费⽤ 367.5万贷:累计折旧 367.5万第3题:(1)借:⽆形资产 1600万贷:以前年度损益调整 1600万借:以前年度损益调整 240万贷:累计摊销 240万借:以前年度损益调整 340万贷:应交税费-应交企业所得税 340万借:以前年度损益调整 1020万贷:利润分配-未分配利润 1020万借:利润分配-未分配利润 102万贷:盈余公积 102万(2)对第⼀笔差错不调整,对第⼆笔差错调整如下’; 借:其他业务收⼊ 400万贷:以前年度损益调整 100万其他业务成本 300万借:以前年度损益调整 25万贷:应交税费-应交企业所得税 25万借:以前年度损益调整 75万贷:利润分配-未分配利润 75万借:利润分配-未分配利润 7.5万贷:盈余公积 7.5万。

财务分析课后测试答案

财务分析课后测试答案1. 什么是财务分析?财务分析是通过对企业财务数据的收集、整理和分析,以评估企业的财务状况和经营绩效,帮助决策者做出正确的经济决策。

2. 财务分析的目的是什么?财务分析的目的是为了帮助企业管理者和投资者评估企业的财务状况、经营绩效和投资价值,从而做出合理的经济决策。

3. 财务分析的方法有哪些?财务分析的方法主要包括比率分析、趋势分析和财务比较分析。

比率分析通过计算各种财务比率,如流动比率、资产负债比率等,来评估企业的财务状况。

趋势分析通过比较不同时间点的财务数据,来分析企业的财务发展趋势。

财务比较分析则是通过比较不同企业或不同时间点的财务数据,来评估企业的相对财务状况。

4. 请解释流动比率和资产负债比率的含义及计算方法。

流动比率是指企业流动资产与流动负债之间的比例关系,用于评估企业偿付短期债务的能力。

流动比率的计算公式为:流动比率 = 流动资产 / 流动负债。

一般来说,流动比率越高,说明企业偿付短期债务的能力越强。

资产负债比率是指企业负债总额与资产总额之间的比例关系,用于评估企业负债的规模和偿债能力。

资产负债比率的计算公式为:资产负债比率 = 负债总额 / 资产总额。

一般来说,资产负债比率越低,说明企业负债规模越小,偿债能力越强。

5. 请列举至少三种财务比率,并解释其含义。

(1) 利润率:利润率是指企业净利润与销售收入之间的比例关系,用于评估企业销售利润的能力。

利润率的计算公式为:利润率 = 净利润 / 销售收入。

利润率越高,说明企业销售利润能力越强。

(2) 资产周转率:资产周转率是指企业销售收入与资产总额之间的比例关系,用于评估企业资产利用效率。

资产周转率的计算公式为:资产周转率 = 销售收入 /资产总额。

资产周转率越高,说明企业资产利用效率越高。

(3) 应收账款周转率:应收账款周转率是指企业销售收入与应收账款之间的比例关系,用于评估企业应收账款的回收速度。

应收账款周转率的计算公式为:应收账款周转率 = 销售收入 / 应收账款。

财务分析课后习题答案

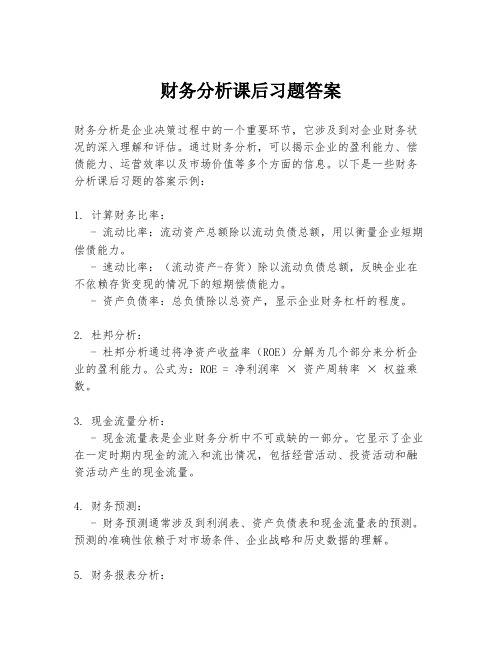

财务分析课后习题答案财务分析是企业决策过程中的一个重要环节,它涉及到对企业财务状况的深入理解和评估。

通过财务分析,可以揭示企业的盈利能力、偿债能力、运营效率以及市场价值等多个方面的信息。

以下是一些财务分析课后习题的答案示例:1. 计算财务比率:- 流动比率:流动资产总额除以流动负债总额,用以衡量企业短期偿债能力。

- 速动比率:(流动资产-存货)除以流动负债总额,反映企业在不依赖存货变现的情况下的短期偿债能力。

- 资产负债率:总负债除以总资产,显示企业财务杠杆的程度。

2. 杜邦分析:- 杜邦分析通过将净资产收益率(ROE)分解为几个部分来分析企业的盈利能力。

公式为:ROE = 净利润率× 资产周转率× 权益乘数。

3. 现金流量分析:- 现金流量表是企业财务分析中不可或缺的一部分。

它显示了企业在一定时期内现金的流入和流出情况,包括经营活动、投资活动和融资活动产生的现金流量。

4. 财务预测:- 财务预测通常涉及到利润表、资产负债表和现金流量表的预测。

预测的准确性依赖于对市场条件、企业战略和历史数据的理解。

5. 财务报表分析:- 对财务报表的分析包括对利润表、资产负债表和现金流量表的详细审查,以及对这些报表中数字背后含义的解释。

6. 风险评估:- 企业在进行财务分析时,需要评估与财务相关的各种风险,包括信用风险、市场风险、流动性风险等。

7. 价值评估:- 价值评估是确定企业或其资产的公平市场价值的过程。

这通常涉及到对企业未来现金流的预测和折现。

8. 案例分析:- 通过分析真实企业的财务报表,可以更深入地理解财务分析的实际应用。

案例分析通常包括对企业财务状况的评估、问题识别和解决方案建议。

在进行财务分析时,重要的是要结合企业的具体情况,考虑行业特点、市场环境和企业战略等因素,以确保分析结果的准确性和实用性。

同时,财务分析是一个动态的过程,需要不断地根据新的财务数据和市场信息进行更新和调整。

企业财务分析课后答案

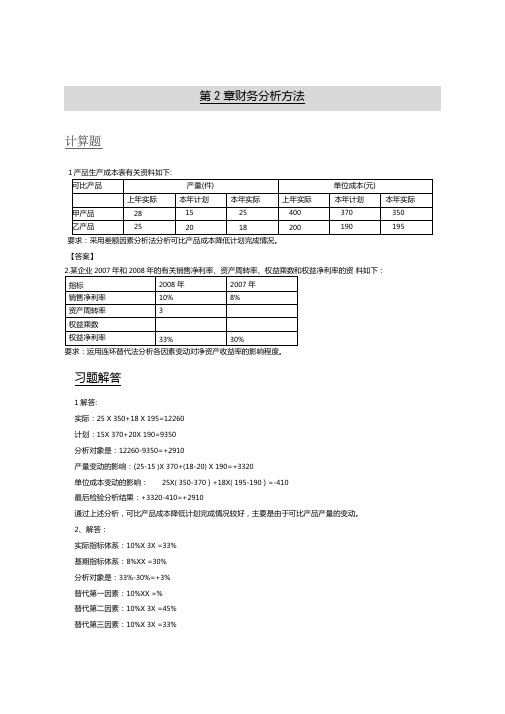

1产品生产成本表有关资料如下:要求:采用差额因素分析法分析可比产品成本降低计划完成情况。

【答案】料如下:要求:运用连环替代法分析各因素变动对净资产收益率的影响程度。

习题解答1解答:实际:25 X 350+18 X 195=12260计划:15X 370+20X 190=9350分析对象是:12260-9350=+2910产量变动的影响:(25-15 )X 370+(18-20) X 190=+3320单位成本变动的影响:25X( 350-370 ) +18X( 195-190 ) =-410最后检验分析结果:+3320-410=+2910通过上述分析,可比产品成本降低计划完成情况较好,主要是由于可比产品产量的变动。

2、解答:实际指标体系:10%X 3X =33%基期指标体系:8%XX =30%分析对象是:33%-30%=+3%替代第一因素:10%XX =%替代第二因素:10%X 3X =45%替代第三因素:10%X 3X =33%销售净利率的影响:%-30%=+%资产周转率的影响:45%%=+%权益乘数的影响:33%-45%=-12%最后检验分析结果:+%+%-12%=+3%练习题1.我国某家电企业主要以生产彩电和空调为主,同时也将业务拓展到通讯产品的生产领域。

该公司2008年和2009年的成本资料如表4—27所示:表4 —27要求:根据2008年和2009年的成本资料,对该公司2009年全部营业成本的变动情况进行分析。

2.康佳集团股份有限公司(000016)和四川长虹电器股份有限公司(600839)2008年度现金流量表的有关资料如表 4 - 28所示:表4 —28要求:根据以上资料(1)计算康佳和四川长虹现金流量充足率、经营现金流量对资本支出比率、经营现金流量对借款偿还比率、现金流量股利保障倍数;(2)通过比较两家公司上述指标的差异,说明两家公司的现金流量状况和财务弹性。

3.中国移动和中国联通2004与2005年度现金流量表的有关资料如表4—29所示:表4 —29要求:通过计算中国移动和中国联通的现金流量充足率、经营性现金流量对资本支出比率、经营性现金流量对借款偿还的比率,并评价这两家公司的财务弹性。

《财务分析》课后答案

财务分析习题答案第一章财务分析概述【练习题】1.财务分析是指财务分析主体利用财务报表及与之有关的其他数据资料,采用一定的方法对企业财务活动中的各种经济关系及财务活动结果进行综合分析、评价并对企业未来经营状况进行预测,为财务战略选择、财务诊断、咨询、评估、监督、控制提供所需财务信息。

其实质是财务分析主体对企业财务活动进行全面分析和评价的过程。

开展财务报表分析,了解企业的投资活动、经营活动和筹资活动的问题,寻找相应的对策,指导企业未来的发展。

2.企业投资者、经营者和债权人等都需要进行财务分析。

(1)投资者进行投资决策,关注企业的盈利能力、风险情况以及前景。

对于上市公司的股东而言,他们还会关心自己持有的公司的股票的市场价值和股利分配政策,以期取得适当的收益。

(2)企业债权人进行财务分析的目的。

债权人需要做出信贷决策,包括决定是否将资金贷给企业、以何种利率贷给企业、是否提供信用以及是否提前收回债权等。

他们关心的是能否按期收到利息以及到期收回本金,因此他们进行财务分析主要是了解企业的信用状况、流动性情况以及偿债的保证等,以便对提供信贷资金的风险进行评价,从而做出正确的授信决策。

(3)企业管理层进行财务分析的目的。

管理人员主要关心企业经营业绩如何、管理质量和效率如何、偿债能力如何、财务结构及其风险的稳定性如何、资源配置的效率如何、企业发展趋势以及前景如何等。

管理人员的财务分析是一种全面的财务分析,管理层通过分析可以把握企业现状、发现管理缺陷、预测未来变动趋势、及时修正和完善经营方案,保证企业按照合理的发展战略可持续地经营下去。

3.(1)不愿意提供贷款给该公司。

因为高科技公司属于经营风险较高的企业,而该企业股东和债权人出资分别为2亿元,单纯从出资来看,债权人的资金是安全的,但是偿债的前提是盈利。

该企业的年净利润为3 000万元,实现了15%的净资产收益率(3 000万元除以股东出资额2亿元),为偿还债务提供了可能性,但是结合现金流量表来看,经营活动的现金流出量大于现金流入量,净利润并没有足够的现金流量作为支撑,使得偿债能力受到影响。

财务分析课后练习答案1.doc000000

第一章财务分析理论1、财务分析:财务分析是以会计核算和报告资料及其他相关资料为依据,采用一系列专门的分析技术和方法,对企业等经济组织过去和现在有关筹资活动、投资活动、经营活动及分配活动中的盈利能力、营运能力、偿债能力和增长能力状况等进行分析与评价,为企业的投资者、债权者、经营者及其他关心企业的组织和个人了解企业过去、评价企业现状、预测企业未来,做出正确决策提供准确的信息或依据的经济应用学科。

2、财务分析产生的原因与会计发展、实践需要和财务分析技术及形式发展紧密相关。

(1)会计技术发展。

会计技术的发展阶段是:第一,利用会计凭证记录交易;第二用会计分类账记录交易;第三是编制会计报表;第四是财务报表解释。

会计报表解释要求分析。

同时,会计汇总(或报表)的出现也使对会计报表的分析成为必要与可能。

(2)财务分析应用领域的发展。

对财务分析的需求最初开始于银行家;然后在投资领域也开展财务分析;现代财务分析的领域不断扩展,早已不限于初期的银行信贷分析和一般投资分析。

财务分析在资本市场、企业重组、绩效评价、企业评估等领域的应用也越来越广泛。

(3)财务分析技术发展,如比率分析的发展,趋势百分比的出现和标准比率的产生都使财务分析不断完善。

(4)财务分析形式发展。

从静态分析为主,变为静态分析与动态分析结合;从外部分析为主,变为内部分析与外部分析相结合。

第二章财务分析方法1、会计分析:会计分析是财务分析的基础,通过会计分析,对发现的由于会计准则、会计政策等原因引起的会计信息差异,应通过一定的方式加以说明或调整,消除会计信息的失真问题。

2、比率分析:比率分析实质上是将影响财务状况的两个相关因素联系起来,通过计算比率,反映它们之间的关系,借以评价企业财务状况和经营状况的一种财务分析方法。

3、因素分析:因素分析是依据分析指标与其影响因素之间的关系,按照一定的程序和方法,确定各因素对分析指标差异影响程度的一种技术方法。

4.水平分析法与垂直分析法的区别:第一,分析目的不同。

《财务管理》第11章财务分析

(一)按比较内容分类 1.会计报表项目比较 2.会计报表项目构成比较

构成比率 效率比率 相关比率

3.财务比率比较

2019/12/20

14

第十一章 财务分析

(二)按比较对象分类 1.与本企业历史比——趋势分析法 2.与同类企业比——横向比较 3.与计划预算比——差异分析 •应注意的问题 计算口径一致性 剔除偶发因素 运用例外原则

2019/12/20

11

第十一章 财务分析

三、财务分析的内容 •一般内容

偿债能力、营运能力、盈利能力、发展能力和获取 现金能力 •不同利益相关人财务分析的重点内容

投资人、债权人、经营者、供应商、客户、政府、 雇员、中介机构

2019/12/20

12

第十一章 财务分析

四、财务报告本身的局限性 •1.以历史成本报告资产 •2.假设币值不变 •3.要求预计损失而不预计收益 •4.按年度分期报告,不能提供反映长期潜力的信息 •5.会计政策选择的影响 •6.财务报告的真实性问题

注意是否规范、是否有遗漏、是否有反常现象 •7.审计报告及注册会计师的信誉 •8.比较基础问题——参照标准

同业标准、历史数据、计划或预算本身问题

2019/12/20

13

第十一章 财务分析

第二节 财务分析方法

一、比较分析法 比较分析法是指将两个或两个以上可比数据进行对

比,从而揭示差异和矛盾的财务分析方法。

①

项目

第一20次05替年代:6%2×006.年8×2=9.6% ②

权益净利率 第二8次% 替代:6%×9%0.5×2=6% ③ 销售净利率 第三5次% 替代:6%×6%0.5×3=9% ④

资产周转率 0.8

0.5

财务管理 第十一章 财务分析答案

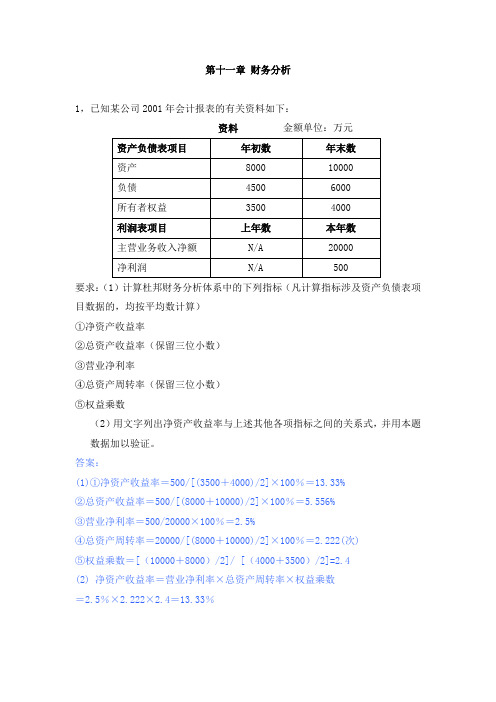

第十一章财务分析1,已知某公司2001年会计报表的有关资料如下:资料金额单位:万元要求:(1)计算杜邦财务分析体系中的下列指标(凡计算指标涉及资产负债表项目数据的,均按平均数计算)①净资产收益率②总资产收益率(保留三位小数)③营业净利率④总资产周转率(保留三位小数)⑤权益乘数(2)用文字列出净资产收益率与上述其他各项指标之间的关系式,并用本题数据加以验证。

答案:(1)①净资产收益率=500/[(3500+4000)/2]×100%=13.33%②总资产收益率=500/[(8000+10000)/2]×100%=5.556%③营业净利率=500/20000×100%=2.5%④总资产周转率=20000/[(8000+10000)/2]×100%=2.222(次)⑤权益乘数=[(10000+8000)/2]/ [(4000+3500)/2]=2.4(2) 净资产收益率=营业净利率×总资产周转率×权益乘数=2.5%×2.222×2.4=13.33%2,某公司××年度简化的资产负债表如下:资产负债表××公司××年12月31日单位:万元其他有关财务指标如下:(1)长期负债与所有者权益之比:0.5(2)销售毛利率:10%(3)存货周转率(存货按年末数计算):9次(4)平均收现期(应收账款按年末数,一年按360天计算):18天(5)总资产周转率(总资产按年末数计算):2.5次要求:利用上述资料,在答题卷填充该公司资产负债表的空白部分,并列示所填数据的计算过程。

答案:所有者权益=100+100=200长期负债=200×0.5=100负债及所有者权益合计=200+100+100=400资产合计=负债及所有者权益合计=400销售收入=2.5×400=1000应收账款=18×1000/360=50(销售收入-销售成本)/销售收入=10%,销售成本=900存货=900/9=100固定资产=400-50-50-100=2003,某商业企业2006年度营业收入为2000万元,营业成本为1600万元,年初、年末应收账款余额分别为200万元和400万元,年初、年末存货余额分别为200万元和600万元,年末速动比率为1.2,年末现金与流动负债的比为0.7。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第十一章财务分析

思考练习

一、单项选择题

1.A 2.C 3.B 4.C 5.D 6.A 7.A 8.D

9.A 10.B 11.C 12.D 13.B 14.C 15.D

二、多项选择题

1.CD 2.AD 3.ABC 4.BC 5.ABCD 6.ABC 7.BCD 8.ABD

9.ABCD 10.BD 11.BCD 12.ABC 13.BC 14.ABCD 15.BC

三、判断题

1-5.××××× 6-10.√×√×× 11-15.×√×√×

四、计算题

1.(1)年末流动负债余额=270/3=90万元

(2)年末速动资产余额=90×1.5=135万元

年末存货余额=270-135=135万元

平均存货余额=(145+135)/2=140万元

(3)本年销售成本=140×4=560万元

(4)平均应收账款=平均速动资产=(125+135)/2=130万元

应收账款周转率=960/130=7.3846(次)

360/7.3846=48.75(天)

2.(1)应收账款周转率:

应收账款平均余额=(期初应收账款+期末应收账款) ÷2

=(12+10)÷2=11(万元)

应收账款周转率=主营业务收入净额÷应收账款平均余额=77÷11=7 (次)

(2)总资产周转率:`1

因为:存货周转率=主营业务收入净额÷存货平均余额

=主营业务收入净额÷[(期初存货+期末存货) ÷2]

所以:期末存货=2×主营业务收入净额÷存货周转率-期初存货

=2×77÷7-8=14(万元)

因为:期末速动比率=(期末流动资产-期末存货)÷期末流动负债×100%

期末流动比率=期末流动资产÷期末流动负债×100%

所以,可得以下两个方程:

150%=(期末流动资产-14)÷期末流动负债

200%=期末流动资产÷期末流动负债

解方程可得期末流动资产为56(万元)

因此,期末资产总额=56+50=106(万元)

最后,计算总资产周转率:

总资产周转率=主营业务收入净额÷资产平均占用额

=主营业务收入÷[(期初资产+期末资产)÷2]

=77÷[(80+106)÷2]=0.83(次)

(3)总资产净利率:

净利润=主营业务收入×主营业务净利率=77×10%=7.7(万元) 总资产净利率=净利润÷平均资产总额

=净利润÷[(期初资产+期末资产) ÷2]

=7.7÷[(80+106)÷2]×100%=8.28%

3.

(1)2004年年初的股东权益总额=400×3=1200(万元)

2004年年初的资产总额=1200+400=1600(万元)

2004年年初的资产负债率=400/(400+1200)×100%=25%

(2)2004年年末的股东权益总额=1200+1200×50%=1800(万元)

2004年年末的负债总额=1800/(1-40%)×40%=1200(万元)

2004年年末的资产总额=1800+1200=3000(万元)

2004年年末的产权比率=1200/1800×100%=66.67%

(3)总资产净利率=300/[(1600+3000)/2] ×100%=13.04%

使用平均数计算的权益乘数=[(1600+3000)/2]/[(1200+1800)/2]=1.53 平均每股净资产=[(1200+1800)/2]/普通股总数=1500/600=2.5(元/股) 每股收益=净利润/普通股股数=300/600=0.5(元/股)

2004年末的市盈率=普通股每股市价/普通股每股收益=5/0.5 =10 (4)2005年的每股收益=净利润/普通股总数=400/600=0.67(元/股)

因为05年末企业保持04年末的资金结构和04年的资本积累率,

所以2005年年末的股东权益=1800×(1+50%)=2700(万元)

因为资产负债率=40%,

所以2005年年末的资产总额=2700/(1-40%)=4500(万元)

2005年的总资产平均额=(3000+4500)/2=3750(万元)

2005年的总资产净利率=净利润/平均总资产=400/3750×100%=10.67%

2005年使用平均数计算的权益乘数=[(3000+4500)/2]/[(1800+2700)/2]=1.67 2005年的平均每股净资产=[(1800+2700)/2]/600=3.75(元/股)

每股收益变动额=0.67-0.5=0.17

2004年的每股收益=13.04%×1.53×2.5=0.5

替代总资产净利率:10.67%×1.53×2.5=0.41

替代权益乘数:10.67%×1.67×2.5=0.45

替代平均每股净资产:10.67%×1.67×3.75=0.67

所以:总资产净利率变动的影响额=0.41-0.5=-0.09

权益乘数变动的影响额=0.45-0.41=0.04

平均每股净资产变动的影响额=0.67-0.45=0.22

案例实战

案例1

(1)05年资产周转率=4300/[(1560+1430)÷2]=2.88次

05年销售利润率=4.7%

05年权益乘数=2.39

06年总资产周转率=3800/[(1659+1596)÷2]=2.33次

06年销售利润率=2.6%

06年权益乘数=2.50

05年权益净利率=4.7%×2.88×2.39=32.35%

06年权益净利率=2.6%×2.33×2.50=15.15% 下降了17.2%

销售利润率变动的影响:

(2.6%-4.7%)×2.88×2.39=-14.45%

资产周转率变动的影响:

2.6%×(2.33-2.88)×2.39=-

3.42%

权益乘数变动的影响:

2.6%×2.33×(2.5-2.39)=0.67%

合计=-14.45%+(-3.42%)+0.67%=-17.2%

评价:

①该公司权益净利率比上年下降,主要原因是运用资产的获利能力下降,其中资产周转率和销售利润率均下降。

②总资产周转率下降的原因是平均收现期延长和存货周转率下降。

③销售利润率下降的原因是销售毛利率在下降。

(2)该公司资产、负债和所有者权益的变化及其原因:

①该公司的总资产在增加,主要原因是存货和应收账款占用增加。

②该公司的负债增加,主要来源是流动负债。

③该公司的所有者权益都没有变化,其所有盈余都用于发放股利。

(3)该公司应采取的措施:

①扩大销售

②降低消息成本

③降低存货、降低应收账款

④减少流动负债、增加收益留存

案例2

答:(1)

主要年报会计数据

单位:(人民币)元

主要财务指标

单位:(人民币)元

注:如果报告期末至报告披露日,公司股本发生变化的,按新股本计算。