public finance5

公司理财(罗斯 第五版)

Corporate Finance

财务分析三

Fifth Edition

三、财务杠杆(长期偿债能力) 债务增大具有双重性:风险和收益 负债比率 = 总 负 债 总资产 负债权益比 = 总 债 务 总权益 权益乘数 = 总 资 产 总权益 利息保障倍数 = 息前税前利润 利息费用

Fifth Edition

公司理财

第五版

斯蒂芬 A.罗斯 (Stephen A.Ross)

Corporate Finance

Ross Westerfield Jaffe

罗德尔福 W.菲斯特费尔德

(Randolph W.Westerfield) 杰弗利 F.杰富 (Jeffrey F.Jaffe) 吴世农 沈艺峰 等译

Irwin/McGraw-Hill © The McGraw-Hill Companies, Inc., 1999

. .

公司理财研究的问题

1-7 Fifth Edition

投资:资本预算、资本性支出、流动资产投资 筹资:资本成本、资本结构(V=B+S) 经营中现金流量管理:短期资本(流动资本)、 短

Corporate Finance

Ross Westerfield Jaffe

期负债(流动负债)、净营运资本(短期资本-短期 负债)

股利分配:股利政策 净营

运资本 流动资产

流动负债 长期负债

. .

固定资产 1、有形固定资产 2、无形固定资产

Irwin/McGraw-Hill

所有者权益

© The McGraw-Hill Companies, Inc., 1999

《Public Finance》双语课程教学大纲

《Public Finance》(双语)课程教学大纲(2003年制订,2006年修订)课程编号:110110中文名:公共财政课程类别:专业主干课前置课:西方经济学、财政学、大学英语后置课:学分:3学分课时:51课时主讲教师:任巧玲、郭晔、毛翠英等选定教材:Harvey S. Rosen: Public Finance, New York: McGraw-Hill, 2002(节选).课程概述:本课程为财政学专业的专业主干课,本大纲适用于财政学本科专业。

当前,我国的公共财政体制正在进一步地发展和完善,在这个过程中,充分了解和有效借鉴西方市场经济国家财政领域的基础理论和实践状况十分必要。

而在财政学专业课程体系中设置相应课程,正体现出与这一现实要求的协调一致。

本课程主要内容包括:财政学的定义及其主要思想;公共品的定义及其提供等问题;外部性的本质及其影响和对策;公共选择的各种机制的讨论与评估;赤字融资及其相关问题等。

教学目的:本课程的教学目的在于使学生在已有知识基础上,重点掌握西方财政学体系中的基本理论观点,也可以了解到西方国家(主要是美国)财政运行的一般情况;使学生能够在不同的具体现实条件中思考运用所学到的相应观点和知识;同时,使学生掌握财政学方面术语的英语表达方式。

教学方法:本课程作为一门双语教学课程,使用的是英文教材,课堂教学过程中的内容讲解采用中英文结合方式,英语使用程度需要参考学生的整体接受程度。

为强化相关理论知识及其实践运用,本课程根据教学内容进程及其侧重点设置了讨论课时段。

同时,本课程大量借助多媒体手段使讲解更加清楚。

各章教学要求及教学要点Chapter 1 Introduction课时分配:3课时教学要求:通过本章的学习使学生掌握财政学的内涵及其主要功能,并以此为基础把握两种主要的财政思想。

本章重点为财政学的基本涵义。

教学内容:1.1Introduction of Public FinancePublic finance, also known as public sector economics or public economics, focuses on the taxing and spending activities of government and their influence on the allocation of resources and distribution of income.1.2 Public Finance and Ideology1. Organic view of governmentSociety is conceived of as a natural organism.Each individual is a part of this organism,and the government can be thought of as its heart. The individual has significance only as part of the community,and the good of the individual is defined with respect to the good of the whole. Thus,the community is stressed above the individual.2. Mechanistic view of governmentGovernment is not an organic part of society. Rather, it is a contrivance created by individuals to better achieve their individual goals.The individual rather than the group is at center stage.思考题:1. How is public finance defined?2. What are the ideological views concerning the relationship between the individual and the state?Chapter 2 Public Goods课时分配:12课时教学要求:通过本章学习使学生掌握公共品的界定和内涵,并以此为基础把握公共品的有效提供及其生产方面的基本观点。

公共财政学PublicFinance

CER

• (一)非排他性

• 所谓非排他性,指的是一旦产品被提供出 来,不可能排除任何人对它的同等消费。 • (二)非竞争性

• 所谓非竞争性指的是,一旦产品被提供, 增加一个人的消费不会减少其他任何消费 者的收益;也不会增加社会成本,其新增 消费者使用该产品的边际成本为零。

Public Finance

CER Public Finance

• 二、公共品的分类 • (一)纯公共品和混合公共品

排他性 特征 有 有 竞争性 无 俱乐部产品

高速公路,有线电视

无 公共资源

空气、渔业

私人产品

纯 公共品

国防、警察

CER

• 纯公共品指的是严格满足非竞争性和非排他性 两个条件的产品。

CER Public Finance

以下哪些是纯公共物品?

国防 公共安全 教育 科学技术 文化体育与传媒 社会保障和就业 外交 城乡社区事务 农林水事务 交通运输 资源勘探电力信息等事务 医疗卫生与计划生育 金融监管等事务 节能环保 国土资源气象等事务 住房保障 商业服务业等事务

CER

• 公共物品与混合物品以及私人物品之间的 转化。中国改革开放前后,教育、医疗, 住房等物品的供给模式。

• 非竞争:

非竞争-排他:边际收益为正,边际成本为零。消费不足,电 影的例子。

Public Finance

第二节 纯公共品供给的均衡分析

CER Public Finance

• 一、庇古模型 • 庇古模型假定:每个人都从公共品的消费中受 益(获得效用),但效用是递减的;同时,个 人为了享受公共品,必须缴纳税收;纳税会给 纳税人(即公共产品的消费者)带来负效用。 庇古把税收产生的负效用,定义为放弃私人产 品消费的机会成本。 • 他认为,公共品应该持续提供到最后一元钱所 得到的正边际社会效用(公共品的边际收益) 等于为最后一元公共品而纳税的负边际效用 (纳税的边际成本)相等时。

public finance

Public FinancePeking University HSBC Business SchoolFall 2014 / 1st ModuleEE&FEInstructor: Daeyong LeeRm. 751 HSBC Buildingdaeyong@Class meeting: Lectures are given on M/Th at 13:30~15:20Classroom: 403Office hours: M/Th 10:30~11:30 am, or by appointmentTeaching assistant: Jessica Shen, 1301213902@TA office hours: TBA1.Course OverviewPublic finance (also known as public economics) studies the economics of government taxation and redistribution in market economies, in theory and practice. We will analyze the reason for government interventions in a market economy, as well as the impact of alternative government interventions on economic outcomes. Public economics include two primary topics of analysis: government expenditures and taxation. This course covers both topics, with a focus on the impact of government intervention on the relevant agents: households (consumers, workers) and firms. The class will also briefly present different tax systems in different parts of the world, especially focusing on the U.S. tax system. In this course, you will learn how to interpret economic analyses and how to use the tools of microeconomics and empirical analyses to investigate and predict the effects of public expenditures, regulations and government revenue-raising activities. Although not mandatory, this class will provide you with the necessary background for its companion class taught in the second semester: “Economics for Public Issues,”(Spring 2015). This course will more focus on U.S. government expenditure policy, and its companion course, “Economics for Public Issues”, will focus on U.S. government tax policy.• Prerequisites:To follow up the class well, you are required to have passed “microeconomics” with at least a “B+”, and “mathematics for economists” with at least a “A” (or, pass the math exam). Students with background in statistics and/or econometrics will find this class more accessible. Basic knowledge of econometric software such as STATA and SAS is strongly recommended.2.Coursework and Grading∙Homework: 30%∙Midterm: 25%∙Final exam: 30%∙Final team project: 15%∙Class attendance: weight (no absence: 1.0, one absence: 0.99, two absences: 0.98, more than two absences: 0.7) used for the final GPA adjustment.∙FYI, GPAs below 70 are considered as failure of the course by the PKU academic rule. • Homework:Students are required to submit 4 reports (hardcopy version) to a TA. Students can write either a summary of published papers or a referee report of working papers. This is an individual task, not a group work. These homeworks will help students keep track of key and recent public economics papers and find their dissertation topics. Published and working papers on the lists are below with due dates and marked with (S) representing the summary and (R) representing the referee report.►Format guideline:All text should be double-spaced with Times New Roman 12 point font, one inch margins. Footnotes should be single-spaced. Indent the first word of a new paragraph by one-half inch. Use only one space after the period at the end of a sentence, do not right-adjust the text, and do not add a line of space between paragraphs. Do not cut sentences or paragraphs from original papers and paste them into your summary/referee reports. DO summarize / referee papers in your own word. Do not copy the contents from other students.1)Summary:Summary papers should include a technical and non-technical summary of 1000–1500 words. No more than 5 pages in MS word.The summary should identify the main results of the paper, explain their importance, and relate the work to the previous literature.2)Referee:Referee reports should include a technical and non-technical review of 500–1000 words. No more than 3 pages in MS word.The referee reports should explain limitation or problems of the papers and suggest how to improve it.Homework ListsHW 1: Due Thursday, September 4 HW 2: Due Thursday, September 25 HW 3: Due Monday, October 13 HW 4: Due Monday, November 3• Exams:There will be a midterm (25%) and a final exam (30%). Both exams will include problem solving type questions and short essays. The midterm will be on Monday, September 29. The Final will be held on Monday, November 10 from 3:30 to 5:30pm.Since there will be no make-up exam, please carefully plan your 2014 Fall schedule ahead.• Team Project:Students need to make a presentation of their projects at the end of the semester. Each group (max 3 students) chooses one of the topics covered in class and applies it to current Chinese systems, especially focusing on Shenzhen and the Guangdong province. Students should analyze one of the current Chinese government policies and empirically investigate its effect on the Chinese economy, and suggest a new policy to improve the current system. This final team project helps students deepen the understanding of Chinese government policies and economy.The presentation will be evaluated based on the presentation skill, the level of understanding the topic, how to handle questions during the presentation, and the feasibility of the suggested policy under the current Chinese system. Each group will have 20 minutes for the presentation and 10 minute Q&A time. Each group must submit the final report, original dataset, and programming codes by 5:00pm, November 7 on SZT.• Class Participation:Students’ final GPAs will be adjusted by their “participation” weight in class, including presence and participation.• Rescheduling the Class:September 8 (Mid-Autumn Festival holiday) → September 10, same venue and time.• Class Policy:Students are not allowed to use their laptops or cellphones in the classroom.3.Course Materials•Required Textbook:1.Jonathan Gruber, Public Finance and Public Policy, 4th ed. Worth Publishers. [JG]: Thisbook is currently available for consultation in the administration office.2.Required (*) and optional readings: A list of journal articles is provided below.• Recommended References:1.Rosen, Harvey and Ted Gayer, Public Finance, 9th ed., McGraw-Hill, 2010. [HR&TG]:An older version (ed. 2008) of this book is available at the library. Classno:F817.12/1.v82.Handbook of Public Economics, vol.1~5.4.Class Schedule (tentative)Part 1: Introduction to Public Finance –JG Ch. 1&2; HR&TG Part I (Ch. 1-3)• Presentation; Course Overview;• Introduction to Public Finance and BackgroundParts 2: Externalities, Public Goods and Public Choice; Layers of Governments; Social Insurance• Welfare economics; Market failures: definition, formalization, government role; Externalities: Theory; Private and Public Solutions; Applications: Environmental Damages;–JG Ch. 5&6; HR&TG Ch. 5• Market F ailures: Public goods; Club Goods; Common Property–JG Ch. 7; HR&TG Ch. 4• Cost Benefit Analysis –JG Ch. 8• Optimal Fiscal Federalism: State and Loca l Governments; Decentralization–JG Ch. 10ReferencesJames Adreoni and Theodore Bergstrom, “Do government subsidies increase the private supply of public goods? ,” Public Choice, 1996, 295-308* James Buchanan, “An economic theory of clubs,” Economica, 1965, 1-14.* H. Scott Gordon, “The economic theory of a common property resource,” Journal of Political Economy, April 1954, 124-142.* Theodore Bergstrom, Lawrence Blume and Hal Varian, “On the private provision of public goods”, Journal of Public Economics, 1986, 25-49.* Tiebout, Charles, “A pure theory of local expenditures,” Journal of Political Economy, 1956, 416-24.* Ronald Coase, “The problem of social cost,” Journal of Law and Economics, 1960, 1-44.* William Vickery, “Pricing in urban and suburban transport,” American Economic Review, 1963, 452-65.Part 3: Social Insurance and Redistribution• Social Insurance and Social Securi ty –JG Ch. 12&13• Health Insurance–JG Ch. 15&16• Income Distribution and Welfare Programs –JG Ch. 17ReferencesAbel, A. B. "Precautionary savings and accidental bequests." American Economic Review 75, no.4 (September 1985): 777-791.Abel, Andrew B. ''The Effects of Investing Social Security Funds, in the Stock market When Fixed Costs Prevent Some Households from Holding Stocks.'' American Economic Review 91, no. 1 (March 2001): 128-48.Bernheim, D., J. Skinner, and S. Weinberg. "What Accounts for the Variation in Retirement Wealth Among U.S. Households?" American Economic Review 91, no. 4 (2001): 832-857.Brian Knight, “Endogenous Federal grants and crowd-out of State government spending: Theory and evidence from the Federal Highway Aid Program,” American Economic Review, March 2002, 71-92.Diamond, P., and J. Geanakoplos."Social Security Investment in Equities." American Economic Review(2003).Gruber, J., and M. Lettau. "How Elastic is the Firm's Demand for Health Insurance." July 2004, Journal of Public Economics.James R. Hines, Jr. and Richard Thaler, “Anomalies: The flypaper effect,” Journal of Economic Perspectives, Fall 1995, 217-226Hurd, M., and S. Rohwedder. "The Retirement-Consumption Puzzle: Anticipated and Actual Declines in Spending at Retirement." NBER Working Paper 9586 (March 2003).Leora Friedberg, “The labor supply effects of the Social Security earnings test,” The Review of Economics and Statistics, Volume 82 (1), February 2000, 48-63* Martin Feldstein, “Social Security, induced retirement, and aggregate capital accumulation,” Journal of Political Economy, Sep. 1974, 905-26.* Michael Rothschild and Joseph E. Stiglitz, “Equilibrium in competitive insurance markets,” Quarterly Journal of Economics, 1976, 629-49.Part 4: Taxation in Theory and Practice• Introduction to Taxation: Taxation around the World (Types, Structure); Criteria for Evaluating Tax Systems: Fairness, Efficiency, Administrative Burden –JG Ch. 18• Tax Incidence: Which side of the market bears the burden of taxes?–JG Ch. 19• Optimal Taxation: Taxation and Efficiency; Taxation of Consumption an d Income in Theory and Practice–JG Ch. 20• Issues with income taxation: Taxing Labor; How Labor Reacts to Taxes in Theory; Empirical Evidence; Labor Incentive Mechanisms–JG Ch. 21• Issue with Income Taxation: Taxing Savings; Theory, Evidence; Incentive mechanisms; Application to retirement savings, entrepreneurial activities, innovation–JG Ch. 22• Impact of Wealt h Taxes on Risk-Taking Behavior–JG Ch. 23• Corporate Taxation–JG Ch. 24. This course or “Economics of Public Issues” course will not cover this topic because “Taxation and Business Strategy” course will cover this in very detail.• Fundamental Tax Reform–JG Ch. 25• Final Project PresentationReferencesAuerbach, Alan J. “Taxation and corporate financial policy,” Chapter 19 in the Handbook, Vol. 3. Auerbach, A., and K. Hassett. "On the Marginal Source of Investment Funds." Journal of Public Economics 87, no. 1 (2003): 205–32.Bernheim, Douglas B. “Taxation and saving,” Chapter 18 in the Handbook, Vol. 3.Bricker, J., A. Kennickell, et al. "Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances." (PDF) Federal Reserve Bulletin 98, no. 2 (2012): 1–80. * Chetty, R., A. Looney, et al. "Salience and Taxation: Theory and Evidence." American Economic Review 99, no. 4 (2009): 1145–77.Chetty, R. "Bounds on Elasticities with Optimization Frictions: A Synthesis of Micro and Macro Evidence on Labor Supply." Econometrica 80, no. 3 (2012): 969–1018.Chetty, R., J. Friedman, et al. "Adjustment Costs, Firm Responses, and Micro vs. Macro Labor Supply Elasticities: Evidence from Danish Tax Records." Quarterly Journal of Economics 126 (2011): 749–804.* Diamon, Peter, “A many-person Ramsey tax rule,” Journal of Public Economics, 1975* Peter Diamond and James A. Mirrlees, “Optimal taxation and public production, I and II”, American Economic Review, LXI8-27 and 261-278Eissa, Nada e t al. “Evaluation of four tax reforms in the United States: Labor supply and welfare effects for single mothers,” Journal of Public Economics, 2008, 795-816.Fama, E., and K. French. "Financing Decisions: Who Issues Stock?" Journal of Financial Economics 76 (2005): 549–82.Givoly, D., et al. "Taxes & Capital Structure: Evidence from Firms' Responses to the Tax Reform Act of 1986." Review of Financial Studies 5 (1992): 331–55.Graham, J. "A Review of Taxes and Corporate Finance." Foundations and Trends in Finance 1, no. 7 (2006): 573–691.* Gruber, J., and B. Koszegi. "Tax Incidence When Individuals Are Time-Inconsistent: The Case Of Cigarette Excise Taxes." Journal of Public Economics 88, no. 9–10 (2004): 1959–87. Hassett, Kevin and R. Glenn Hubbard, “Tax policy and business investment,” Chapter 20 in the Handbook, Vol. 3.Huang J.T., “The personal tax exemptions and married women’s birth spacing in the U.S.”, Public Finance Review, November 2008, 728-47.Imbens, G., D. Rubin, et al. "Estimating the Effect of Unearned Income on Labor Earnings, Savings, and Consumption: Evidence from a Survey of Lottery Winners." American Economic Review 91, no. 4 (2001): 778–94.Keane, M. "Labor Supply and Taxes: A Survey." Journal of Economic Literature 49, no. 4 (2011): 961–1075.Knittel, M. "Corporate Response to Accelerated Tax Depreciation: Bonus Depreciation for Tax Years 2002-2004." (PDF) U.S. Treasury Office of Tax Analysis Working Paper 98, May 2007.Korinek, A., and J. Stiglitz. "Dividend Taxation and Intertemporal Arbitrage." Journal of Public Economics 93, no. 1–2 (2009): 142–59.Kumar, A. "Labor Supply, Deadweight Loss, and the Tax Reform Act of 1986: A Nonparametric Evaluation Using Panel Data." Journal of Public Economics 92, no. 1–2 (2008): 236–53.* Mirrlees, James A. “An exploration in the theory of optimum income taxation,” Review of Economic Studies, 1971, 175-208.Poterba, J. "Taxation and Corporate Payout Policy." American Economic Review 94, no. 2 (2004): 171–5.* Sandmo, Agnar, “Optimal taxation in the presence of externalities,” The Swedish Journal of Economics, 1975* Stiglitz, Joseph E. “Effects of wealth, income and capital gains taxation on risk taking,” Quarterly Journal of Economics, 1969, 263-83.。

Public_Finance

公共财政与中国实践Public Finance and China’s Practices中国社会科学院研究生院刘迎秋课程编号:课程名称: 公共财政与中国实践课程英文名称: Public Finance and The Practice in China学时:48学时学分:2学分授课对象:博士研究生开课单位:政府政策与公共管理系任课教师职称要求:副教授或者教授教学方式:采用讨论与启发式教学。

教师先从总体上对本门课程的主要内容进行介绍,然后由学生自愿报名承担教学大纲和主选教材中的一至二章,在先行深入研读和比较分析、写出包括中外实践比较等内容的教案并制作PPT基础上,在课堂上做20~30分钟(每章)的讲解与中外比较评述,然后再由同学提问与评议、主讲教师做出点评与小结。

课程内容摘要:《Public Finance and China’s Practices》是一门以介绍当代公共财政理论为主、同时注意进行中外比较与评述、使用英文原版教材的双语授课课程。

本课程以经济学基本理论为基础和线索来安排和组织教学内容,包括公共财政理论分析和应用研究两大板块。

在理论分析板块中,主要介绍研究方法、公共品、外部性、直接民主制、代议制民主、税收的公平与效率等内容。

在应用研究板块主要介绍收入分配、社会保险、公共支出评价、扶贫计划、个人所得税、公司税、消费税、财富税、财政体制、赤字融资等内容。

教学目的:通过公共财政理论与实践的讲解与研讨,使国民经济学专业博士研究生掌握公共财政学基本理论框架和研究与分析方法,了解公共财政政策的制定及政府公共管理职能的实现,引导学生关注和深入研究中国宏观经济运行过程中的公共财政问题,通过中外实践的分析与比较,提高学生分析与解决中国公共财政理论和实践中发生的各种重大问题的能力。

预备知识或者先修课程要求:西方经济学(中级以上);了解福利经济学、公共选择理论、税收政策、政府行政体制等基本知识。

考核方式:采取课堂教学与课程论文相结合的方式进行考核。

公共财政学PublicFinance

Security Investment

财 经• 学 院

二、证券市场的产生

•

股份公司的产生与发展也对证券市场提出了两方面的要 求:一是建立股票的发行市场,推销各公司发行的股票,筹集 创办企业的资本;二是需要建立股票的转让市场,增强股票的 流动性。 • 三、证券市场的发展 • 世界上最早的证券交易所是1613年(一说是:1680年)设立 的荷兰阿姆斯特丹证券交易所。在中国大陆,最早的证券交易 所是1905年外商组织的上海众业公所,以及1918年设立的北京 证券交易所。 • 当今证券市场的发展呈现以下特征:第一,证券品种多 样化,筹资技术日新月异。第二,证券交易的现代化与信息化 。第三,证券市场的国际化。

2019/1/30 8

•

•

Security Investment

财 经 学 院

• (2)增发的条件 • (1)前一次公开发行的股份已募足,且募集资金的使用与 其招股说明书所述用途相符,资金使用效益良好;

• (2)距前一次公开发行股票的时间在1年以上

• (3)公司在最近3年内连续盈利,并可向股东支付股利; • (4)公司在最近3年内财务会计文件无虚假记载; • (5)公司预期利润率可达同期银行存款利率。

5

• 第二节 股票发行市场

财 经 学 院 •

证券发行市场又称“初级市场”或“一级市场”,是指各发行 主体及中介机构发售各种证券所形成的市场,一般是无形的。股票发 行市场是指发生股票从规划到销售的全过程,是资金需求者直接获得 资金的市场。

新公司的成立,老公司的增资或举债,都要通过发行市场,都要 借助于发生、销售股票来筹集资金,从而创造新的实际资产和金融资 产,增加社会总资本和生产能力,以促进社会经济的发展,这就是初 级市场的作用。 股票发行市场的特点:一是无固定场所,可以在投资银行、信托 投资公司和证券公司等处发生,也可以在市场上公开出售新股票;二 是没有统一的发生时间,由股票发行者自行决定何时发行。

财政 外部性

Positive

Public Finance Public Finance

–污染 –噪音 Negative

外部性的图形分析 Graphical Analysis

CUFE CUFE Public Finance Public Finance

4

以厂商产生的负外部性为代表 假定一家钢铁厂向河水中排污,对下游的渔业产 生影响 假定——竞争市场,钢铁厂和养鱼厂的目标分别 是最大化各自利润

CUFE CUFE Public Finance Public Finance

6

社会最优条件 MB=MSC

Price of steel

MSC = MPC+MD

MPC MD

MB

0

社会最优产出

真实产出

Q*

Q1

Quantity of steel

从

CUFE CUFE Public Finance Public Finance

(

)

1 GOS = (140 60 )( 480 160 ) = $12800 2

操作中的问题 Practical Questions

CUFE CUFE Public Finance Public Finance

13

谁导致的污染

–例如酸雨,很难断定是由哪一家工厂还是自然 界的活动所导致.

什么污染物是有害的?

Q 到 Q *:

7

钢铁厂商的损失是MB和MPC 之间的部分(dcg) Price of 渔场主的收益等于减少的污染 即MD夹在Q 和Q*之间的部分 (cdhg=abef) 社会收益为dhg d g c f b a

0 steel

MSC = MPC+MD

财政学习题及答案(详细)

财政学复习思考题及答案模拟试题一一、填空题(每题2分共20分)请将答案写在下面答题项上,每题都写在___________。

1.___________ ___________ 2.___________ 3.___________ 4.___________ 5.___________ 6.________ __________ 7._________ _________ _________ 8.___________ 9.___________ 10.__________1.在当今世界上,绝大多数国家的经济是由_______________和_______________共同组成的,这就是所谓的混合经济。

2.财政职能解决的是市场经济下政府应当__________的问题。

3.在所有选民中偏好居中的那位投票人,即一半投票人对某公共产品的偏好比他强,另一半则比他弱,这样的投票人称作____________。

4.由于经济活动所产生的成本或收益未能通过____________反映出来,因此施加这种成本或收益的个体并没有为此而付出代价或得到收益,这一情形就称为外部性。

5.政府在安排财政支出时,可以通过对不同项目的____________的分析和评价,从中选出最优的支出项目。

6.财政补贴,按补贴的透明度划分,可分为________和________。

7.税率是税法规定的应征税额与________之间的比例。

它的三种基本形式是________税率、________税率和________税率。

8.以关税的征收目的为标准,关税可以分为__________和保护关税。

9.现代政府预算最初产生于________国,是市场和资本的产物。

10.中国于1994年起开始实行________财政体制。

二、单项选择(每题1分共10分)请将答案写在下面答题项上,每题都在正确的选项上画“√”1、A B C D2、A B C D3、A B C D4、A B C D5、A B C D6、A B C D7、A B C D8、A B C D9、A B C D 10、A B C D1.在混合经济中,政府是如何参与市场的?A. 作为产品和服务的购买者B. 作为产品和服务的提供者C. 作为要素的提供者D. 作为要素的购买者2.在市场经济条件下,不是市场失灵表现的有______。

public finance

1、Unified budget: The document which itemizes(逐项列出) all the federal government’s expenditures(支出) and revenues(收入). 统一预算:联邦政府在一种文件中将其支出逐项列出。

2、regulatory budget: An annual statement of the costs imposed on(施加影响于) the economy by government regulations.(Currently, there is no such budget.) 管制预算:政府管制给经济造成的成本的年度报告。

(目前尚无)3、entitlement programs: Programs whose expenditures are deter mined by the number of people who qualify, rather than preset budget allocations(分配). 公民权力性计划其支出由符合条件的人数而非预先的预算安排来决定的计划。

Summary : 1、public finance ,also known as public sector economics or public economics, focuses on the taxing and spending activities of gov ernment and their influence on the allocation of resources and distribution(分配) of income. 财政学,也称公共部门经济学或公共经济学,以政府的收支活动及其资源配置与收入分配的影响为研究对象2、In an organic view of society ,individuals are valued only by their contribution to the realization of social goals. These goals are determined by the government. 按照社会有机论,个人只有在有助于社会目标实现时才有价值。

finance是什么意思_finance的中文解释

finance是什么意思_finance的中文解释finance是什么意思_finance的中文解释finance英[faɪ'næns; fɪ-; 'faɪnæns] 美 ['faɪnæns]n. 财政,财政学;金融vt. 负担经费,供给…经费vi. 筹措资金n. (Finance)人名;(法)菲南斯[ 过去式 financed 过去分词 financed 现在分词 financing ] 【网络释义】财务什么是证据,唯一的铁证只有隆尧公安局自身的财务(Finance)帐本或华龙(Hualong)方便面的财务帐本可以有纪录,再有(Again)就是本家儿自己,我们平民百姓不可能查到这个账。

金融电子金融(E-Finance)是以网络等信息技术手段为基础的金融创新形式,金融信息化的高级阶段,指服务供应商在互联网等新技术的基础上对原有财政学学了十年(Ten years),最少还有两科没读――《财政学(Finance)》和《金融学》。

知识创造家当这句话确切地说应该是,结构化(Structured)的知识创造财富,灵活运用的知识创造财富。

【词组短语】public finance 公共财政 ; 公共财政 ; 财政学 ; 财政Finance ministry 财政部 ; 财政部 ; 财务部 ; 财政部Mathematical finance 金融数学 ; 金融数学 ; 数理金融学 ; 数学金融Project finance 项目融资 ; 专案融资 ; 项目贷款 ; 项目金融学Google Finance Google财经 ; 谷歌财经 ; Google财经 ; 谷歌金融Finance islamique 伊斯兰银行Company finance 公司融资公司财务 ; 公司财务 ; 公司融资 ; 考试大MSc Finance 金融学 ; 金融学硕士 ; 金融 ; 金融硕士Finance Committee 财务委员会 ; 财政委员会 ; 委员会 ; 财政专门委员会ministry of finance 财政部public finance 财政学international finance 国际金融finance and economics 经济,财经;金融与经济corporate finance 公司金融;公司理财;公司融资finance department 财务部;财政部;财会部finance minister 财政部长national finance 国家财政local finance 地方财政real estate finance 房地产金融;不动产财务housing finance 住宅信贷,住宅金融;住房集资company finance 公司财务;公司融资finance manager 财务经理;财政经理finance ministry 财政部finance company 金融公司;信贷公司finance and accounting 财务会计;财务部;会计学;金融和会计 trade finance 贸易金融project finance 项目融资;项目贷款finance and trade 财贸;金融与贸易accounting and finance 会计和金融;会计与财务【同近义词】n. [财政]财政,财政学;[金融]金融policy of tightening control over expenditure and credit , cameralisticsvi. 筹措资金fund raising【双语例句】He does not understand finance at all.他对财务一窍不通。

财政学(第五版)英文版课件gruber_5e_lecture_slides_ch23

• In keeping with this position, Buffett, along with other wealthy Americans such as William Gates, Sr., and George Soros, has long been an outspoken critic of moves to repeal the estate tax, a tax levied on large estates upon the death of their owners.

Taxes on Risk Taking and Wealth

• Buffett has argued that allowing children to inherit all of their parents’ riches causes them to be spoiled and sapped of all motivation, and keeping the tax in force helps to preserve America’s meritocracy.

5 of 32

23

CHAPTER 23 ■ TAXES ON RISK TAKING AND WEALTH

Taxes on Risk Taking and Wealth

• Second, individuals can also be taxed not only on the return from their savings in each period but on the amount of wealth they have accumulated through past savings.

Public Finance and Public Policy JoCnoaptyhraignhGt ©rub2e0r10FWifthorEthdiPtiuobnlisCheorpsyright © 2016 Worth Publishers

《Public Finance》双语课程教学大纲

《Public Finance》(双语)课程教学大纲(2003年制订,2006年修订)课程编号:110110中文名:公共财政课程类别:专业主干课前置课:西方经济学、财政学、大学英语后置课:学分:3学分课时:51课时主讲教师:任巧玲、郭晔、毛翠英等选定教材:Harvey S. Rosen: Public Finance, New York: McGraw-Hill, 2002(节选).课程概述:本课程为财政学专业的专业主干课,本大纲适用于财政学本科专业。

当前,我国的公共财政体制正在进一步地发展和完善,在这个过程中,充分了解和有效借鉴西方市场经济国家财政领域的基础理论和实践状况十分必要。

而在财政学专业课程体系中设置相应课程,正体现出与这一现实要求的协调一致。

本课程主要内容包括:财政学的定义及其主要思想;公共品的定义及其提供等问题;外部性的本质及其影响和对策;公共选择的各种机制的讨论与评估;赤字融资及其相关问题等。

教学目的:本课程的教学目的在于使学生在已有知识基础上,重点掌握西方财政学体系中的基本理论观点,也可以了解到西方国家(主要是美国)财政运行的一般情况;使学生能够在不同的具体现实条件中思考运用所学到的相应观点和知识;同时,使学生掌握财政学方面术语的英语表达方式。

教学方法:本课程作为一门双语教学课程,使用的是英文教材,课堂教学过程中的内容讲解采用中英文结合方式,英语使用程度需要参考学生的整体接受程度。

为强化相关理论知识及其实践运用,本课程根据教学内容进程及其侧重点设置了讨论课时段。

同时,本课程大量借助多媒体手段使讲解更加清楚。

各章教学要求及教学要点Chapter 1 Introduction课时分配:3课时教学要求:通过本章的学习使学生掌握财政学的内涵及其主要功能,并以此为基础把握两种主要的财政思想。

本章重点为财政学的基本涵义。

教学内容:1.1Introduction of Public FinancePublic finance, also known as public sector economics or public economics, focuses on the taxing and spending activities of government and their influence on the allocation of resources and distribution of income.1.2 Public Finance and Ideology1. Organic view of governmentSociety is conceived of as a natural organism.Each individual is a part of this organism,and the government can be thought of as its heart. The individual has significance only as part of the community,and the good of the individual is defined with respect to the good of the whole. Thus,the community is stressed above the individual.2. Mechanistic view of governmentGovernment is not an organic part of society. Rather, it is a contrivance created by individuals to better achieve their individual goals.The individual rather than the group is at center stage.思考题:1. How is public finance defined?2. What are the ideological views concerning the relationship between the individual and the state?Chapter 2 Public Goods课时分配:12课时教学要求:通过本章学习使学生掌握公共品的界定和内涵,并以此为基础把握公共品的有效提供及其生产方面的基本观点。

财政学(第五版)英文版课件gruber_5e_lecture_slides_ch14

• The Extended Unemployment Compensation program was passed and extended these benefits temporarily.

• As the recession persisted, the EUC program was extended as the Worker, Homeownership, and Business Assistance Act of 2009 was signed into law. This law extended unemployment benefits through 79 weeks, depending on the state of the worker’s residency.

In the state of Michigan, no unemployment benefits are paid to those earning less than $243 per week in the highest quarter of the past year. Once the $243 level has been reached, unemployment benefits rise with the weekly wage in the highest quarter of the past year, with a maximum benefit of $362.

财政学(第五版)英文版课件gruber_5e_lecture_slides_ch11

12 of 34

11.2

Problems with Educational Vouchers

CHAPTER 11 ■ EDUCATION

Critics make several arguments against vouchers.

• Vouchers may lead to excessive school specialization.

2. Competition

o Vouchers allow the education market to benefit from the competitive pressures that make private markets function efficiently.

Public Finance and Public Policy Jonathan Gruber Fifth Edition Copyright © 2016 Worth Publishers

Education?

• Educational credit market faidit market to make loans that would raise total social surplus by financing productive education.

Public Finance and Public Policy JoCnoaptyhraignhGt ©rub2e0r10FWifthorEthdiPtiuobnlisCheorpsyright © 2016 Worth Publishers

1 of 34

11 Education

11.1 Why Should the Government Be Involved in Education?

财政学(第五版)英文版课件gruber_5e_lecture_slides_ch03

• Whenever we see a correlation between A and B, there are three possible explanations:

1. A is causing B.

2. B is causing A.

3. Some third factor is causing both.

Public Finance and Public Policy JoCnoaptyhraignhGt ©rub2e0r10FWifthorEthdiPtiuobnlisCheorpsyright © 2016 Worth Publishers

1 of 33

3 Empirical Tools of Public Finance

• Causal: Two economic variables are causally related if the movement of one causes movement of the other.

Public Finance and Public Policy Jonathan Gruber Fifth Edition Copyright © 2016 Worth Publishers

The identification problem is a problem of bias.

• Bias: Any source of difference between treatment and control groups that is correlated with the treatment but is not due to the treatment.

3.4 Conclusion

PREPARED BY

财政学(第五版)英文版课件gruber_5e_lecture_slides_ch01

3. What is the effect of those interventions on economic outcomes?

4. Why do governments choose to intervene in the way that they do?

• Impressive results:

• Immunization rates never higher than 70% prior to outbreak.

• Rose to 90% by 1995.

• Government intervention clearly reduced this negative externality, discussed in Chapters 5 and 6.

• Economics generally presumes that markets deliver efficient outcomes, so why should government do anything?

• Primary motive for government intervention is therefore market failure.

Public Finance and Public Policy Jonathan Gruber Fifth Edition Copyright © 2016 Worth Publishers

o The “anti-vaccine” movement has taken root, resulting in large pockets of nonimmunized children in some areas.

公司金融5

Copyright © 2003 by The McGraw-Hill Companies, Inc. All rights reserved

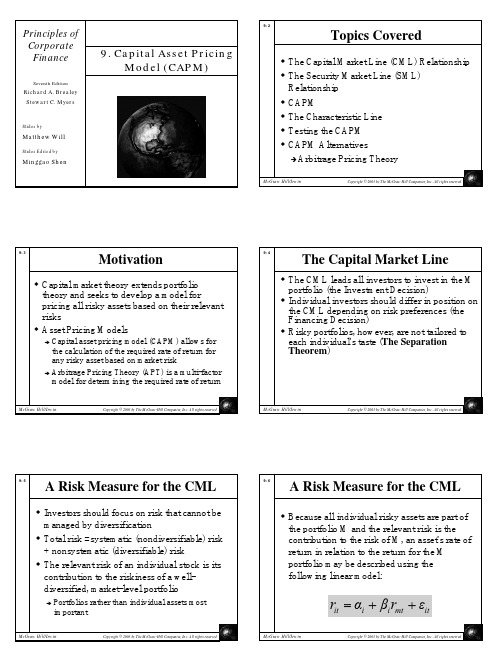

9-14 The Capital Asset Pricing Model

E(ri ) = rf + βi × E(rm ) − rf

Expected rate of return of a risky asset is determined by the rf plus a risk premium for the individual asset

E(rm) rf

M x

y σM

x = risk premium =E(rm) - rf

y =risk =σm Slope =x/y

=[E(rm) - rf]/σm y-intercept = rf

9- 11

Capital Market Line

Slope of the CML is the market price of risk for efficient portfolios, or the equilibrium price of risk in the market

Asset Pricing Models

Î Capital asset pricing model (CAPM) allows for the calculation of the required rate of return for any risky asset based on market risk

Helps to value an asset by providing an appropriate discount rate to use in valuation models

Public Finance

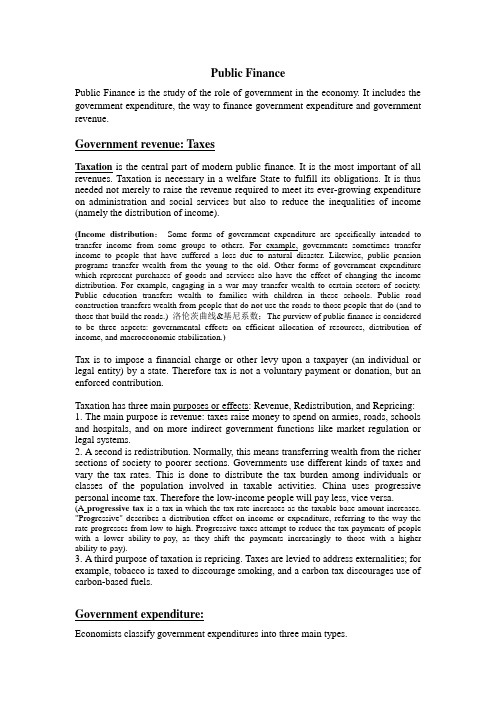

Public FinancePublic Finance is the study of the role of government in the economy. It includes the government expenditure, the way to finance government expenditure and government revenue.Government revenue: TaxesTaxation is the central part of modern public finance. It is the most important of all revenues. Taxation is necessary in a welfare State to fulfill its obligations. It is thus needed not merely to raise the revenue required to meet its ever-growing expenditure on administration and social services but also to reduce the inequalities of income (namely the distribution of income).(Income distribution:Some forms of government expenditure are specifically intended to transfer income from some groups to others. For example, governments sometimes transfer income to people that have suffered a loss due to natural disaster. Likewise, public pension programs transfer wealth from the young to the old. Other forms of government expenditure which represent purchases of goods and services also have the effect of changing the income distribution. For example, engaging in a war may transfer wealth to certain sectors of society. Public education transfers wealth to families with children in these schools. Public road construction transfers wealth from people that do not use the roads to those people that do (and to those that build the roads.) 洛伦茨曲线&基尼系数;The purview of public finance is considered to be three aspects: governmental effects on efficient allocation of resources, distribution of income, and macroeconomic stabilization.)Tax is to impose a financial charge or other levy upon a taxpayer (an individual or legal entity) by a state. Therefore tax is not a voluntary payment or donation, but an enforced contribution.Taxation has three main purposes or effects: Revenue, Redistribution, and Repricing: 1. The main purpose is revenue: taxes raise money to spend on armies, roads, schools and hospitals, and on more indirect government functions like market regulation or legal systems.2. A second is redistribution. Normally, this means transferring wealth from the richer sections of society to poorer sections. Governments use different kinds of taxes and vary the tax rates. This is done to distribute the tax burden among individuals or classes of the population involved in taxable activities. China uses progressive personal income tax. Therefore the low-income people will pay less, vice versa.(A progressive tax is a tax in which the tax rate increases as the taxable base amount increases. "Progressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from low to high.Progressive taxes attempt to reduce the tax payments of people with a lower ability-to-pay, as they shift the payments increasingly to those with a higher ability-to-pay).3. A third purpose of taxation is repricing. Taxes are levied to address externalities; for example, tobacco is taxed to discourage smoking, and a carbon tax discourages use of carbon-based fuels.Government expenditure:Economists classify government expenditures into three main types.ernment consumption:are government purchases of goods and services forcurrent use. Such as the official supplies.ernment investment : are government purchases of goods and servicesintended to create future benefits -- such as infrastructure investment or research spending.3.transfer payments: are government expenditures that are not purchases of goodsand services, and instead just the transfers of money--- such as social security payments.(Social security may also refer to the action programs of government intended to promote the welfare of the population through assistance measures guaranteeing access to sufficient resources for food and shelter and to promote health and wellbeing for the population at large and potentially vulnerable segments such as children, the elderly, the sick and the unemployed.)Financing of government expendituresGovernments can take out loans, issue bonds and make financial investments. As the government represents the people, government debt can be seen as an indirect debt of the taxpayers. (Government debt can be categorized as internal debt, owed to lenders within the country, and external debt, owed to foreign lenders.) Governments usually borrow by issuing securities such as government bonds.(A government bond is a bond issued by a national government, generally promising to pay a certain amount (the face value) on a certain date, as well as periodic interest payments. Government bonds are usually denominated in the country's own currency. Bonds issued by national governments in foreign currencies are normally referred to as sovereign bonds. Consols(见投资)(A government budget is a document plan of public revenue and expenditure that is often passed by the legislature(law). The two basic elements of any budget are the revenues and expenses. In the case of the government, revenues are derived primarily from taxes. Government expenses include spending on current goods and services, which economists call government consumption; government investment expenditures such as infrastructure investment or research expenditure; and transfer payments like unemployment or retirement benefits.)(There are two indexes to judge if the public finance is dangerous.Deficit rate: deficit/GDP <=3%Liabilities rate:national debt balance/GDP <=60%Deficit: revenue is less than expenditure.National debt balance: the margin of budget balance, budget deficit and budget surplus.)。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Externalities

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Externalities

• Externality – An activity on one entity that affects the welfare of another entity in a way that is outside the market mechanism • Not an Externality – suburban-urban migration example

• Empirical Evidence: What is the Effect of Pollution on Health? • What Activities Produce Pollutants? • What is the Value of the Damage Done? • Empirical Evidence: The Effect of Air Pollution on Housing Values

– The costs to the parties of bargaining are low – The owners of resources can identify the source of damages to their property and legally prevent damages

Public Responses to Externalities- Emissions Fee

$ MC

f*

MSB 0 e* Pollution reduction

Emissions Fees ContinuedUniform Pollution Reductions

MCH

Bart’s Tax Payment MCB f= $50 f= $50

MC’ $ MC*

f*

MSB 0 ef e’ e* Pollution reduction Too much pollution reduction

Too little pollution reduction

Emissions Fee v Cap-andTrade

• • • • Responsiveness to Inflation Responsiveness to Cost Changes Responsiveness to Uncertainty Distributional Effects

Homer’s Taxrt’s pollution reduction

25

50

75

90 Homer’s pollution reduction

Public Responses to Externalities- Cap-and-Trade

MCH b

MCB f= $50 a 10 50 75 90 Bart’s pollution reduction 25 50 75 90 Homer’s pollution reduction f= $50

– Emissions fee – Cap-and-Trade

• Policy Perspective: Addressing Climate Change

Command-and-Control Regulation

• Incentive-based regulations • Command-and-control regulations

Progress with Incentive-Based Approaches

• Policy Perspective: Cap-and-Trade for Sulfur Dioxide

Implications for Income Distribution

• Who Benefits? • Who Bears the Cost?

Cap-and-Trade vs. Emissions Fee

MC’ $ MC*

f*

MSB 0 ef e’ e* Too little pollution reduction Pollution reduction Too much pollution reduction

Cap-and-Trade v Emissions Fee

i j

d c

MD

MB 0 Q* Q1 Q per year

Public Responses to Externalities - Subsidies

MSC = MPC + MD $ Pigouvian subsidy d c k f g h (MPC + cd) MPC

i j

MD

MB 0 e Q* Q1 Q per year

Positive Externalities

$ MC

MSB = MPB + MEB MPB MEB R1 R* Research per year

A Cautionary Note

• Requests for subsidies

– Resource extracted from taxpayers – Market does not always fail

Bargaining and the Coase Theorem

MSC = MPC + MD $ MPC

h d c g MD

MB 0 Q* Q1 Q per year

The Coase Theorem

• Coase Theorem – Provided that transaction costs are negligible, an efficient solution to an externality problem is achieved as long as someone is assigned property rights, independent of who is assigned those rights • Assumptions necessary for Coase Theorem to work

• Policy Perspective: Owner-Occupied Housing

The Nature of Externalities-Graphical Analysis

MSC = MPC + MD $ MPC

h d c g MD

0 Socially efficient output

b a Q*

f e Q1 Actual output

MB Q per year

What Pollutants Do Harm?

– Technology standard – Performance standard

• Is command-and-control ever better?

– Hot spots

The U.S. Response

• Clean Air Act

– 1970 amendments – Command-and-control in the 70s – How well did it work?

The Nature of Externalities

• Privately-owned versus commonly-owned resources • Externalities can be produced by consumers as well as firms • Externalities are reciprocal in nature • Externalities can be positive • Public goods can be viewed as a special kind of externality

Other Private Solutions

• Mergers • Social conventions

Public Responses to Externalities - Taxes

MSC = MPC + MD $ Pigouvian tax revenues (MPC + cd) MPC