金融英语考试模拟练习题一

(金融保险类)金融英语模拟题集

Test2Part One ListeningSection One (10%)Directions: In this section you will hear 10 short statements. Each statement will be spoken only once. After each statement there will be a pause. During the pause, you must read the four suggested answers marked a, b, c and d, and decide which is the best answer.Now you will hear the example: She went to the bank with Mr. Smith.You will read:A. She went home. C.She went to the bank.B. She liked Mr. smith. D.She went to Mr. Smith's house. Statement C, "She went to the bank" is the closest in meaning to the statement "She went to the bank with Mr. Smith." Therefore, you should choose answerC. Now listen to the statements.1. A. Financial markets must support sound financial institutions.B. Sound financial institutions are made by financial markets.C. Financial markets should be backed by strong financial institutions.D. Financial markets are sound because of financial institutions.2. A. US dollar is going higher vs. Japanese Yen.B. US dollar is going higher vs. Pound Sterling.C. US dollar is going lower vs. Japanese Yen.D. US dollar is going lower vs. Deutsche Mark.3. A. Please remit us the bill amount through Barclay's bank on due date.B. Please claim the bill amount on Barclay's Bank on due date.C. Please pay the bill amount to Barclay's Bank.D. Please inform Barclay's Bank to reimburse us on due date.4. A. The People's Bank of China may not provide loans for organizations or individuals.B. The People's Bank of China may not give financial support to enterprises.C. The People's Bank of China may act as a financial guarantor for organizations or individuals.D. The People's Bank of China may not effect a financial guarantee for individuals or organizations..5. A. Policy is the only factor that affects stock prices.B. Policy is one factor that affects stock prices.C. Monetary policy is one of the factors that affect stock prices.D. Monetary policy is the only factor that affects stock prices..6. A. I wish to cash some cheques.B. I wish to cash some traveler's cheques.C. I wish to pay cash for my expenses here.D. I wish to pay for my traveller's cheques here7.A. The L/C will be confirmed by our bank.B. Our bank's agent will confirm the L/C.C. The credit will be opened by our bank's agent.D. Our branch in San Francisco will confirm the L/C.8.A. U.S. dollar is dearer.B. U.S. dollar is higher.C. Japanese yen is weaker.D. Japanese yen is stronger.9. A. The draft is a sight one.B. The draft is payable by Citibank.C. The bill is drawn on Citi Branch.D. The bill is not negotiable.10. A. We paid you early as required.B. Your documents came to us as required.C. Your documents have been correctly presented as required.D. You did not present the documents as required.S ection Two (10%)Directions: In this section, you will hear 10 short conversations. At the end of each conversation a question will be asked about what was said. Theconversations and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answerNow you will hear :M: Does our bank have a direct correspondent relationship with the Bradalys' Bank?W:No, we don't. So we have to advise this L/C via another bank.Q: Which of the following is right?Now you will read:A. We can advise this L/C to the Bradlays' Bank.B. The Bradlays' Bank is our correspondent.C. The L/C has to be advised by a third bank.D. We should advise this L/C by ourselves.From the conversation we know that we have to advise this L/C via another bank. The best answer is C. Therefore you should choose answer C.11. A. To apply for rolling over the loan for another period.B. To default on repayment.C. To repay it immediately.D. To apply for a new loan.2. A. 827.28 B. 829.19 C. 826.71 D. Not mentioned.13. A. He sold a house.B. He borrows some money from the man.C. He borrowed some money from the bank.D. He visited a new house.4. A. She pays a visit to the bank.B. She deals with a transaction with her customer.C. She wants to check Parks' cash and transactions of the day.D. She pays a visit to the Auditing Department.5.A. About remitting money. B. About getting a bill of exchange.C. About discounting a bill of exchange.D. About quotation of buying rate.16. A. she definitely accepted the request.B. She will not do what the man requested.C. She will use her car.D. She definitely refused the request.17. A. How to get a ticket to Paris. B. How to go to Paris.C. How to transfer money to Paris.D. How to fill the form.18. A. To open a current account. B. To open a savings account.C. To cash her cheques.D. To draw money from her savings account.19.A. 5% B. 3% C. 8% D. 6% 20. A. The interest rate will belowered B. The interest rate will be stable.C. The interest rate will increase.D. The interest rate will befloating.Section Three (10%)Directions: In this section, you will hear 3 short passages. At the end of each passage you will hear some questions about what was said. The passages and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answer Questions 21--23 are based on passage 121. A. 4:00 p.m. B. 5:30 p.m. C. 6:00 p.m. D. 6:30 p.m.22. A. He goes to concerts. B. He visits his friends.C. He meets his customers.D. He works at home.3. A. The bank's staff. B. The bank's location.C. The bank's long hours of services.D. The bank's balance sheet. Questions 24-26 are based on passage 224. A. Short term loans without guarantees by banks.B. Long term loans without guarantees by their respective governments.C. Long term loans under guarantees by their respective governments.D. Medium term loans under guarantees by their respective banks.25. A. International banks. B. industrial nations.C. Syndicates of international banks.D. Developed countries.26. A. Yes, they are. B. No, they are not.C. Yes, they are. They represent unusual risk to banks.D. No, they are not. They represent usual risk to banks.Questions 27-30 are based on Passage 327.A. 146 B. 159 C. 194 D. 16828. A. US$ 32.1 billion B. US$ 37.4billion.C. US$ 27.3 billion.D. US$ 4.8 billion.29. A. Allowing more foreign banks to do RMB business in Pudong.B. Extending the experimentation to Shenzhen.C. Increasing the limit on the RMB position of the foreign banks on acase-by-case basis.D. All of the above.30.A. To introduce new products and expertise.B. To improve efficiency in financial intermediation.C. To introduce more foreign capital into China.D. Both A and BPart two Reading Section One (10%)Directions: There are ten statements in this section. For each statement there are four choices marked A,B,C,D.You should choose the best answer.31. Which activities are not the investment banking activities?A. underwriting new issuesB. financial advisingC. dealing and brokingD. savings'taking32. ___________is the purchase of one company by another using mainly borrowed funds.A. A horizontal mergerB. A leveraged buyoutC. A vertical mergerD. A MBO33. The bill of lading is evidence of ownership. It thus functions as a ________.A. receipt for goodsB. contract for deliveryC. title documentD. negotiable instrument34. Liquidity ______________.A. is a measure of how quickly an item may be converted to foreign currenciesB. is a measure of how quickly an item may be converted to cashC. is a measure of how quickly an item may be converted to liabilitiesD. is a measure of how quickly an item may be converted to fixed capital 35.35.Among various worries concerning the internet banking, the first and foremost is the problem of __________.A. profitB. interestC. clientD. security36. According to the rules of debit and credit for balance sheet accounts ______________.A. decreases in asset, liabilities, and owner's equity accounts are recorded by debitsB. increases in liabilities and owner's equity accounts are recorded by creditsC. decreases in liabilities and asset are recorded by creditsD. increases in asset and owner's equity are recorded by debits37. _________ consist of a simultaneous sale or purchase of currency.A. Spot transactionsB. Forward transactionsC. Option forward transactionsD. Swap transaction38. Cash inflows from financing activities for a bank exclude: ________.A. receiving depositsB. issuance of equity securities (capital stock)C. issuance of debt securities ( bond, notes, mortgages)D. redemption of debt39. When a bank holds some valuables on behalf of its customer, the relationship between the bank and customer is ___________.A. debtor-----creditorB. bailor--------baileeC. principal-----agentD. trustor-------trustee40. The red clause documentary credit is often used as a method of ______.A. providing the seller with funds prior to shipmentB. providing the buyer with funds prior to shipmentC. providing the seller with funds after shipmentD. providing the buyer with funds after shipmentSection Two (10%)Directions: There are 10 blanks in the following passages. For each blanks there are four choices marked A, B, C, D. You should choose the best answer.Passage OneCommercial banks ___41______many functions, some central to their main role in the economy and others more peripheral. Although lending and deposit _____42______have been the epicenter of commercial banking, the last few years have witnessed a _______43_______in both the types and the volume of banking services. This surge has ____44____in part by government_____45_____,but most importantly by competitive pressures.41. A. do B. entailC. perform D. work42.A. allocating B. taking C. saving D. mobilizing43.A. increase B. improvement C. decrease D. surge44.A. been induced B. caused C. attributed D. been45.A. relaxation B. Control C. Regulation D. deregulationpassage TwoThere are generally several types of credits. A(n) "___46____" guarantees payment to the beneficiary, provided that the credit terms and conditions are met and the standing of the advising bank in the beneficiary's country is sound. A(n) " ____47______" may be cancelled at any time up to the moment the advising bank pays. This type of credit is ___48_____ favorable to the exporter. There is a risk that goods may be shipped and the credit revoked before documents are presented to the advising bank. A(n) "____49______" may not be cancelled or even amended without the consent of all the parties involved. This type of credit guarantees that no single party will revoke the contract already signed. A(n) "____50_____", like a commercial credit, is a promise by the issuer to honor the beneficiary's presentation of the credit.46.A. stand-by credit B. revocable credit C. irrevocable creditD. confirmed credit47.A. confirmed credit B. revocable credit C. irrevocable creditD. stand-by credit48.A. the most B. the least C. far D. much49. A. confirmed credit B. revocable credit C. irrevocable creditD. stand-by credit50.A. stand-by credit B. revocable credit C. irrevocable creditD. confirmed credits ection Three (10%)Directions: Read the following passages, and determine whether the sentences are "Right" or "wrong". If there is not enough information to answer " right" or "wrong''. choose "Doesn't say".Passage OneInternet banking has many advantages for banks. It is much cheaper to service a customer who makes contact only by phone, interactive TV, computer or other terminals, doing without the expensive branch network. Nevertheless, with Internet banking, customers do much of the basic data inputting themselves, further saving staff time of banks. Banks can invest the saved resources of human power and capital on utilizing the information of its customers when they are transacting, i. e. to route, analyze, and integrate data into meaningful patterns. Processed customer information is and will remain to be an invaluable asset of banks. And there is an element of self selection by higher earning customers - the Internet banking customers tend to be those who are relatively wealthy and generate the banks' profits. These advantages therefore suggest that the Internet is regarded as an increasingly important commercial tool by a growing number of banks.51. Internet banking services customers by phone, interactive TV, computer or other terminals.A. RightB.WrongC.Doesn't say52. Internet banking can save human power and capital.A.RightB.WrongC.Doesn't say53. Internet banking has many disadvantages for banks such as the risks and uncertainty of outcome.A.Righ tB.Wrong C .Doesn't sayPassage TwoRevocable credit is the one which can be amended or cancelled at any time, but the issuing bank is bound to pay drawing under the credit negotiated by the advising bank or the transmitting bank prior to the receipt by it of the notice of revocation or of amendment. An irrevocable credit, however, carries the irrevocable undertaking of the issuing bank to pay all drawings made in terms of the credit. Such a credit can only be amended or cancelled with the consent of all parties to it, that is the applicant, the issuing bank, the intermediary bank, if any, and the beneficiary.Where the confirmation of an intermediary bank is added to an irrevocable letter of credit, the credit is a confirmed credit, or more exactly, a confirmed irrevocable credit, and such a confirmation constitutes a definite undertaking ofthe confirming bank in addition to the undertaking of the issuing bank.54. A revocable credit can be amended in any circumstances.A. RightB. WrongC. Doesn't say55. An irrevocable confirmed credit gives the beneficiary a double assurance of payment.A. RightB. WrongC. Doesn't say56. An irrevocable credit cannot be cancelled.A. RightB. WrongC. Doesn't say57. Where the confirmation of intermediary bank is added to a revocable letter of credit, the credit is a confirmed revocable credit.A. RightB. WrongC. Doesn't sayPassage ThreeThe source of foreign exchange for overseas investment by domestic entities are subject to review by the SAFE before the application for such investment is filed with the relevant government agencies.Profits or other foreign exchange income of Chinese investors from their overseas investment must be remitted home within eight months after the close of each local accounting year and surrendered or kept in foreign exchange accounts in accordance with the regulations. Unless otherwise approved by the SAFE, Chinese investors may not divert foreign exchange receipts to any other purposes or keep them abroad. Whenever an enterprise winds up its overseas business, the investor shall repatriate all of the assets.58. SAFE is the abbreviation of the Stated Administration of Foreign Exchange.A. RightB. WrongC. Doesn't say59. When a corporation ends its overseas business, the investor shall repatriate all of the assets.A. RightB. WrongC. Doesn't say60. Chinese investors cannot divert foreign exchange receipts to any other purposes or keep them abroad.A.RightB.WrongC.Doesn't says ection Four (20%)Directions: There are 4 passages in this sections. Each passage is followed by some questions or unfinished statements. For each of them there are four choices marked A, B, C, D. You should choose the best answer.Passage OneA revolving documentary credit is one by which, under the terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the documentary credit being required. The revolving documentary credit may be revocable or irrevocable, and may revolve in relation to time or value.In the case of a documentary credit that revolves in relation to time, e. g. which is initially available for up to USD15, 000. 00 per month during a fixedperiod of time, say, six months, the documentary credit is automatically available for USD15, 000. 00 each month irrespective of whether any sum was drawn during the previous month. A documentary credit of this nature can be cumulative or non-cumulative. If it is stated to be 'cumulative,'any sum not utilised during the first period carries over and may be utilised during a subsequent period. If it is 'non- cumulative,' any sum not utilised in a period ceases to be available, that is, it is not carried over to a subsequent period. It must be remembered that under this kind of documentary credit and following this example, the obligations of the issuing bank would be for USD90,000.00, i.e. six revolving periods each for USD15, 000. 00. Thus while the face value of the documentary credit is given as USD15, 000. 00 the total undertaking of the issuing bank is for the full value that might be drawn.In the case of a documentary credit that revolves in relation to value, the amount is reinstated utilisation within a given overall period of validity. The documentary credit may provide for automatic reinstatement immediately upon presentation of the specified documents, or it may provide for reinstatement only after receipt by the issuing bank of those documents or another stated condition.This kind of documentary credit involves the buyer and the banks in an incalculable liability. For that reason, it is not in common use. To maintain a degree of control, it would be necessary to specify the overall amount that may be drawn under the documentary credit. Such amount would have to be decided by the buyer and the seller to meet their requirements, and would have to be agreed to by the issuing bank.61. What's the correct definition of revolving documentary credit?A. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is reinstated without specific amendments to whichever kinds of credit the customer required.B. A revolving documentary credit is one by which, under the terms and conditions thereof, the tenor is extended without specific amendmentsto the documentary credit being required.C. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is renewed with specific amendments tothe documentary credit being required.D. A revolving documentary credit is one by which, under the terms and conditions thereof, the amount is reinstated without specific amendments to the documentary credit being required.62. "Ceases to" in Line 11 probably means __________________.A. "continue"B. "suspend to"C. "stop"D. "carry over"63. Which of the following statements is true?A. The revolving documentary credit may revolve according to the amount and time.B. A revolving documentary credit must be irrevocable.C. A revolving documentary credit must be revocable.D. The amount of a revolving documentary credit cannot be cumulated.64. When is the amount reinstated in the case of a documentary credit thatrevolves in relation to value?A. Just on presentation of specified documents.B. Only after the issuing bank receives those documents.C. Under the stated condition.D. All of above.65. The documentary credit that revolves in relation to value isn't commonlyused because ________.A. the overall amount that may be drawn under the documentary credit has been specifiedB. such credit involves the buyer and the bank in an incalculable liabilitiesC. it makes the issuing bank entail an incalculable liabilities.D. the documentary credit may provide for reinstatement immediately and automatically.Passage TwoPacking loan is a pre-shipment financing facility. The exporter can obtain packing loan from a bank when it receives the letter of credit issued in its favour. The money required is to finance the business between the commencement of the manufacturing process and the despatch of goods. This period is identical for the exporter. Usually, the finance available will not exceed 90% of the L/C amount. After shipment, the exporter can present the documents to a bank for negotiation, and repay the packing loan.For the security, the lending bank must keep in touch with the exporter, and urge them to dispatch the goods and present document in time. If the exporter fails to present documents after the expiry of the L/C, the bank will ask them to repay according to the terms of the loan agreement.66. The exporter can get packing loan from a bank when____________.A. the importer issues a L/C.B. the exporter presents the documents to the bankC. it receives the letter of credit issued in the exporter's favourD. it receives the letter of credit issued in the bank's favour67. "Commencement" in Line 3 probably means _______________.A. endingB. beginningC. implementationD. finish68. When does the exporter repay the packing loan?A. After shipment.B. Just after finishing the manufacturing process.C. Upon presentation of the documents to a bank for negotiation.D. Both A and C69. Which of the following statements is not true?A. Packing loan is a pre-shipment financing facility.B. The amount of packing loan will not exceed 90% of the L/C amount.C. Packing loan is just granted to the exporter.D. If the exporter fails to present documents after the expiry of the L/C, the bank will ask them to repay according to the terms of the L/C agreement. assage Three An option contract is a risk management or control tool designed to mitigate the effects of possible adverse movements in the price of a security or commodity. Depending upon the right acquired by the taker, options are divided into "calls" and "puts". A call option gives the taker (just the buyer of the option) the right (but not the obligation) to buy at a fixed price, while a put option confers upon him the right (but not the obligation) to sell at a fixed price. The fixed price at which the taker may buy or sell the underlying commodity or security, a procedure known as exercising the option, is called the striking price. If the striking price is identical to the current market price of the commodity or security (i.e. the prevailing price for delivery and payment on expiration date), the option is said to be at the money. When the striking price of a call option is lower than the current market price it is in the money. When it is higher than current market price it is out of the money. In contrast, the put option is in the money when the striking price is higher than the current market price or out of the money when the striking prices lower than the current market price.It will by now clear that there are two basic prices in an options contract, the price paid for the purchase of the actual option, which is the premium, and the fixed price at which the option may be exercised, which is the striking price. In turn, the price of the premium is itself made up of two component parts, the intrinsic value and extrinsic value (often known as the time value). Intrinsic value may be defined as the amount by which an option is in the money. The calculation of a proper time value for an option is far more complex. It is influenced by four different factors ----the duration of the option, the historical price volatility of the underlying commodity or security, current interest rates and the supply of and demand for the option.70. Depending on _________, options are divided into "calls" and "puts".A. the right acquired by the sellerB. the right acquired by the buyerC. the obligation acquired by the sellerD. the obligation acquired by the seller71. A put option_____________.A. gives the buyer the right to sell the underlying commodity at a fixed priceB. gives the seller the right to buy the underlying commodity at a fixed priceC. confers upon the seller the right to buy the underlying commodity at fixed price.D. confers upon the seller the right to sell the underlying commodity at fixed price.72. When the striking price of the put option is higher than the current market price, it is calledA. at the moneyB. in the moneyC. out of the moneyD. none of the money73. The premium in option_____________.A. is the striking price of the underlying commodityB. means the option is sold at par valueC. is just the margin that all option deals demandD. is the price of an option contract 74. Which of the following statement is not true?A. The premium consists of the intrinsic value and the extrinsic valueB. The extrinsic value is just the time value.C. The time value for an option is only influenced by the duration of the option and current interest rates.D. The intrinsic value is just the amount by which an option is in the money. assage FourOn the balance sheet, assets and liabilities are classified as either current or long-term to indicate their relative liquidity. Liquidity is a measure of how quickly an item may be converted to cash. Therefore cash is the most liquid asset. Account receivable is a relatively liquid asset because the business expects to collect the amount in cash in the near future. Supplies are less liquid than accounts receivable, and furniture and buildings are even less so. Users of financial statements are interested in liquidity because business difficulties often arise owing to a shortage of cash. Balance sheets list assets and liabilities in the order of their relative liquidity.Current Assets. Current assets are assets that are expected to be converted to cash, sold, or consumed during the next 12 months or within the business's normal operating cycle if longer than a year. The operating cycle is the time span during which (1) cash is used to acquire goods and services, and (2) these goods and services are sold to customers, who in turn pay for their purchases with cash. For most businesses, the operating cycle is a few months. A few types of business have operating cycles longer than a year. Cash Accounts Receivable, Notes receivable due within a year or less are current assets. Merchandising entities such as Sears, Penney's and K Mart have an additional current asset. Inventory. This account shows the cost of goods that are held for sale to customers.Long-term Assets. Long-term assets are all assets other than current assets. They are not held for sale, but rather they are used to operate the business. One category of long-term assets is plant assets, or fixed assets. Land, buildings, furniture and fixtures, and equipment are examples of plant assets.Financial statement users such as creditors are most interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more current it is. Liabilities that must be paid on the earliest future date create the greatest stain on cash. Therefore, the balance sheet lists liabilities in the order in which they are due. Knowing how many of a business's liabilities are current and how many are long-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications,。

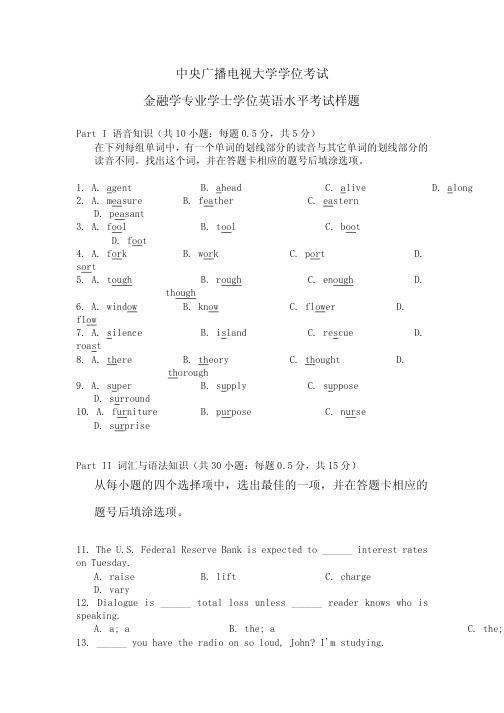

电大金融学学位英语考试模拟题

22. No matter what you say, I don‘t think he would be ______ refuse to help us.

A. as selfish as to B. selfish enough

C. so selfish as to

D. enough selfish 23. She died of heart failure ______ her life‘s work remaining unfinished.

A. while

B. with

C.

but

D. before

24. At no time and under no circumstances ______ the experiment.

A. will I stop

B. will stop I

C. may I stop

D. I will ___ again.

How do you like your job

16. It was only when I reread these poems recently ______ I began to appreciate their beauty.

A. that

B. then

C. until

D. after

17. There is no ______ in going to school if you're not willing to learn.

A. while

B. unless

C. if

D.

though

21. The reporter said that the UFO ______ east to west when he saw it.

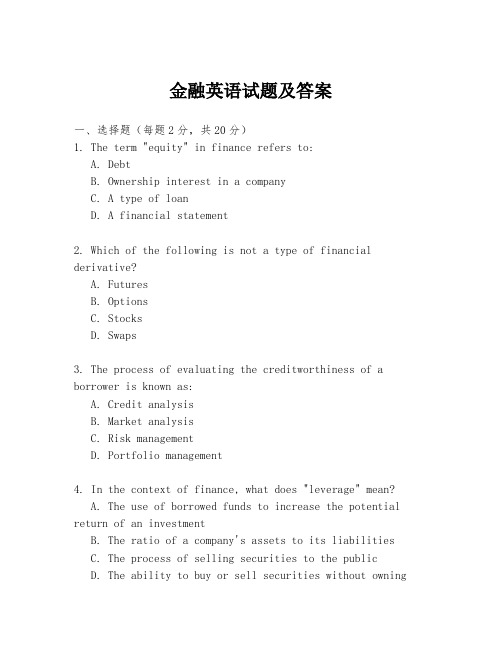

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. The term "equity" in finance refers to:A. DebtB. Ownership interest in a companyC. A type of loanD. A financial statement2. Which of the following is not a type of financial derivative?A. FuturesB. OptionsC. StocksD. Swaps3. The process of evaluating the creditworthiness of a borrower is known as:A. Credit analysisB. Market analysisC. Risk managementD. Portfolio management4. In the context of finance, what does "leverage" mean?A. The use of borrowed funds to increase the potential return of an investmentB. The ratio of a company's assets to its liabilitiesC. The process of selling securities to the publicD. The ability to buy or sell securities without owningthem5. A bond that pays no periodic interest but is issued at a discount to its face value is called:A. A zero-coupon bondB. A coupon bondC. A convertible bondD. A junk bond6. Which of the following is a measure of a company's ability to meet its short-term obligations?A. Current ratioB. Debt-to-equity ratioC. Return on equity (ROE)D. Earnings per share (EPS)7. The term structure of interest rates refers to the relationship between:A. The risk of an investment and its expected returnB. The maturity of a debt instrument and its yieldC. The size of a company and its market shareD. The economic cycle and the stock market performance8. A financial instrument that allows the holder to buy or sell an asset at a specified price within a specific time period is known as:A. A futureB. A forwardC. An optionD. A swap9. In finance, the term "carry trade" refers to:A. Borrowing money at a low interest rate to invest in a higher-yielding assetB. The practice of selling securities shortC. The strategy of buying and holding stocks for long periodsD. The process of hedging against currency fluctuations10. The primary market is where:A. Securities are first offered to the publicB. Securities are traded after they have been issuedC. Companies buy back their own sharesD. Investors can purchase commodities二、填空题(每空1分,共10分)11. The ________ is the difference between the bid price and the ask price of a security.12. A ________ is a financial institution that accepts deposits and provides loans.13. The ________ is the process of buying and selling securities on the same day.14. The ________ is the risk that the value of an asset will decrease due to market conditions.15. A ________ is a financial statement that shows a company's financial performance over a specific period.16. The ________ is the risk that a borrower will not repay a loan.17. A ________ is a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets.18. The ________ is the potential for an asset's value toincrease or decrease.19. The ________ is the process of determining the value of a business or business assets.20. A ________ is a financial instrument that represents ownership in a company.三、简答题(每题5分,共30分)21. Explain the concept of "leverage" in finance.22. What is the difference between a "mutual fund" and a "hedge fund"?23. Describe the role of a "stock exchange" in the financial markets.24. What is "risk management" and why is it important in finance?四、论述题(每题20分,共40分)25. Discuss the impact of "inflation" on different types of investments.26. Analyze the importance of "corporate governance" in ensuring the long-term success of a company.答案:一、1. B2. C3. A4. A5. A6. A7. B8. C9. A10. A二、11. Spread12. Bank13. Day trading14. Market risk15. Income statement16. Credit risk17. Mutual fund18. Volatility19. Valuation20. Stock三、21. Leverage in finance refers to the use of borrowed money to finance investments, with the goal of increasing potential returns. However, it。

《金融英语》试卷(I卷)

常熟理工学院2012〜2013学年第二学期20XX 级后续课《金融英语》考查试卷(I 卷)试题总分:Part I Listening Comprehension©' 25=50')Section A Short ConversationsListe n carefully and choose the best an swer to the questi on after each conv ersatio n.1. Which of the following is NOT among the four major commercial banks of China?A. Ba nk of China.B. China Co nstruction Ba nk.C. I ndustrial and Commercial Ba nk of Chi na.D. The People's Bank of Chi na.2. Which of the following is NOT mentioned in the dialog?A. China Mercha nts Ban k.B. I ndustrial Ba nk Co., Ltd.C. China Citic Bank.D. Chi na Min she ng Banking Corp. Ltd. 3. What is the man accord ing to the dialog?A. A bank man ager.B. A clerk of a foreig n bank.C. A uni versity stude nt.D. A teacher from a college.4. Which of the followi ng has the right to decide the preside nt of BOC?A. The shareholders.B. The shareholders' meet ing.C. The Board of Directors.D. The Preside nt Office.5. A. The man lost his checkbooks.B. The man lost his passport.C. The man lost his password.D. The man lost his passbook. 6. A. Hous ing loa n.B. Foreig n curre ncy loa n.C. Dollar loa n.D. Credit loa n. 7. A. Jan uary 24. B. February 31. C. Jan uary 25. D. February 26.8. A. Payme nt by dema nd drafts. B. Payme nt by collectio n.C. Payme nt by letters of credit.D. Payme nt by remitta nee. 9. A. To avoid problems aris ing from in flatio n.B. To preve nt possible fraud.C. To avoid problems aris ing from fluctuati ons of excha nge rate.D. To preve nt overdraw ing. 10. A. In spect ion certificate. B. Certificate of origi n. C. In sura nee policy. D. Bill of ladi ng.Section B Long ConversationListe n to the conv ersati on carefully and choose the best an swer to each of the questio ns below.11. Which of the following statements was mentioned in the magazine The Banker?A. BOC ranked the 9th amo ng the world's top 1,000 banks in 2007.B. BOC is one of the four big commercial banks of China.C. The developme nt of BOC is un believable.D. The top man ageme nt of BOC is young and effective. 12. What are the main sect ions un der the top man ageme nt of BOC?A. Corporate banking sect ion and retail banking sect ion.B. Security sect ion and supervisory sect ion.C. Operati onal sect ion and supervisory sect ion.D. Audit ing sect ion and in spect ion secti on. 13. Which do you think is NOT the duty of the supervisory section?A. Audit ing the ban k's acco un ts.B. Han dli ng gen eral affairs.C. Being resp on sible for the security of the ban k..D. Oversee ing the banking operati on. 14. What is the bus in ess scope of the operati onal secti on?A. Banking bus in ess.B. Gen eral bus in ess.C. Support ing bus in ess.D. All items men ti oned above.15. Which of the followi ng is NOT men ti oned among the bus in esses offered by BOC?A. Retail banking.B. Docume ntary letter of credit.C. On li ne banking or e-ba nking.D. Finan cial advisory service. Section C PassagesDirecti ons: In this sect ion, you will hear three short passages. At the end of each passage, you will hear some questi ons. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C and D. The n mark the corresp onding letter on the ANSWER SHEET with a si ngle line through the cen ter.Passage One16. A. 1992 B. 1993 C. 1994 D. 199517. A. The People's Bank of China. B. China Foreig n Excha nge Tradi ng Cen ter.C. I nter-ba nk Foreig n Excha nge Market.D. The State Admi nistratio n of Foreig n Excha nge.18. A. 1%0.3% C. 0.5% Passage Two19. A. High risk. B. A type of credit product. 20. A. Collateral loan. B. Educati on loa n.21. A.1952 B.1958 D. 0.4% C. High in terest. D . A ki nd of revolvi ng loa n C. Mortgage loa n. D . Commercial loa n. C.1962 D . 1968C. Public con fide nce in the in surers rema ined low.D. A rise in Tokyo stock helped improve the bala nce sheets of life in surers.Part II. Reading Comprehension (30 ')Section A (1 '*10=10 ')Directions: Each of the following sentences is provided with four choices. Choose the one that best completes the sentence.26. Although the compa ny showed a profit, the bala nce sheet looks in creas in gly .A. brightB. dimC. shallowD. fragile 27. _ money refers to curre ncy issued on the basis of ban k's credit in stead of gold reserve. A. Fair B. Fiduciary C. FixedD. Deposit 28. In creased flows of world capital inten sify finan cial competiti on among n ati ons. This trend places pressures on n ati onal gover nment to their domestic markets and liberalize intern ati onal capital moveme nts.A. removeB. settleC. deregulateD. con trol 29. Many finan cial tran sacti ons are _ sheet items such as in terest rate swaps and are not clearly ide ntified through the usual report ingcha nn els.A. zeroB. capitalC. off-bala nceD. major30. The ban kers _ the steel compa ny's new shares, which means the share issue will be sold to the ban kers in stead of the public directly. A. un derwrite B. un dercharge C. un dertakeD. un derestimate 31. With no in terest rate _ on deposits or restrict ions on maturities, banks can offer any deposit product customers dema nd. A. cutB. ceili ngsC. dema ndD. con tract 32. From ban k's perspective, liabilities have become more in terest elastic, so that small rate cha nges can produce large fluctuati ons in bala nces.A. outsta ndingB. outreach ingC. rema iningD. dema nding33. Checks are attractive because they are readily accepted and provide formal _______________ of payment. A. credit B. verificati onC. clarityD. collectio n 34. Normally, ____ capital loans are secured by accounts receivable or by pledges of inventory and carry a floating interest rate on theamounts actually borrowed aga inst the approved credit line.A. curre ntB. stockC. work ingD. Ion g-term35. Dealers in gover nment and private securities n eed short-term financing to purchase new securities and carry their exist ing portfolios ofsecurities un til those securities are sold to customers or reach ________ .A. bus in essB. marketsC. maturityD. objectiveSection B (2*10=20 * Directi ons: Read the passages and choose the right an swer for each questio n.Passage 1Text ?36. How many types of banks or banking in stitutio ns are men ti oned in the lecture?A. 5.B. 4.C. 52.D. 183.37. Which of the follow ing is NOT a join t-equity commercial bank? A. China Min she ng Ba nki ng Corp. Ltd. B. Bank of East Asia.C. China Citic Bank.D. Bank of Commun icati ons.38. How many bran ches and sub-bra nches have foreig n banks set up in China accord ing to the speaker?A. 264.B. 177.C. 183.D. 235. 39. Which of the follow ing was once ran ked amon gst the top three stron gest banks in Chin a's mainland?A. Chi na In dustrial Ba nk.B. Ba nk of East Asia.C. China Mercha nts Ba nk.D. Sha nghai Pudo ng Developme nt Ban k.40. Which of the following is a wholly foreign-owned bank?A. Chi na Min she ng Ba nki ng Corp., Ltd.B. Chi na Citic Bank.C. Hong Kong & Shan ghai Banking Corporati on Limited.D. China Export & Import Bank.Passage 2Liabilities are "outsider claims ” , whiche economic obligations, debts payable to outsiders. These outside parties are called creditors.Financial statement users such as creditors are interested in the due dates of an entity's liabilities. The sooner a liability must be paid, the more curre nt it is. Liabilities that must be paid on the earliest future date create the greatest stra in on cash. Therefore, the bala nce sheet lists liabilities in the order in which they are due. Knowing how many of a bus in ess's liabilities are curre nt and how many are Ion g-term helps creditors assess the likelihood of collecting from the entity. Balance sheets usually have at least two liability classifications: current liabilities and Iong-term liabilities.Current liabilities are debts that are due to be paid with in one year or with the en tity's operati ng cycle. Notes payable due with in one year, salary 22. A. It is a ki nd of short-term loa n.C. It is supposed to pay back at one time.Passage Three23. A. A rise in Tokyo stock.B. It is also called bridge loa n. D. Its maturity exceeds five years.C. Negative spread.24. A. Rise. B. Fall. 25. A. The value of outsta nding policies went dow n. B. Japa n's life in sura nee firms. D. Japa nese life in surers' difficult situati on.C. Rema in un cha nged.D. Not sure. B. Life in surers' n egative spreads ten ded to grow small.payable, unearned reve nue, and in terest payable owed on no tes payable are curre nt liabilities.Long-term liabilities are those liabilities other than current ones.41. The liabilities are classified as current or Iong-term liabilities according to _ .A. the liquidity of the liabilityB. the future date when the liability must be paidC. the operati ng cycleD. one year42. Liabilities are __ .A. money borrowed from banksB. money received from creditorsC. "outsider claims ” which are economic obligations, debts payable to outsidersD. notes receivable43. Which of the followi ng is current liability?A. cashB. inventoryC. salary payableD. money from the bank44. Which of the following is Iong-term liability?A. debt payable due with 10 yearsB. inven toryC. unearned revenueD. note payable due withi n 6 mon ths45. For a note payable to be paid in in stallme nts with in 5 years, which of the follow ing stateme nts is correct?A. The first installment due within one year is a current liability.B. The first installment due within one year is a Iong-term liability.C. All the in stallme nts due are Ion g-term liabilities.D. All the in stallme nts due are curre nt liabilities.Part ill. Translation (2‘ *=10')Part IV. Writing (10 ')Directions: You are asked to write a report on Bank of China with 120 words to make the brief introduction of BOC s orga ni zati ons and developme nt.。

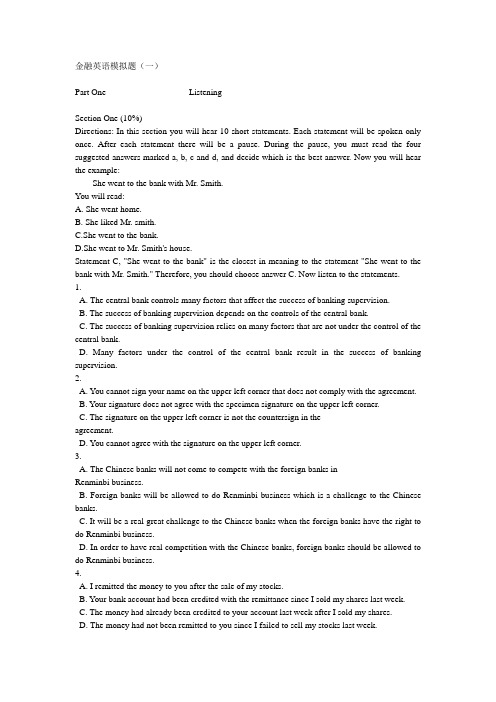

金融英语模拟题(一)T1P1-Listening

金融英语模拟题(一)Part One ListeningSection One (10%)Directions: In this section you will hear 10 short statements. Each statement will be spoken only once. After each statement there will be a pause. During the pause, you must read the four suggested answers marked a, b, c and d, and decide which is the best answer. Now you will hear the example:She went to the bank with Mr. Smith.You will read:A. She went home.B. She liked Mr. smith.C.She went to the bank.D.She went to Mr. Smith's house.Statement C, "She went to the bank" is the closest in meaning to the statement "She went to the bank with Mr. Smith." Therefore, you should choose answer C. Now listen to the statements.1.A. The central bank controls many factors that affect the success of banking supervision.B. The success of banking supervision depends on the controls of the central bank.C. The success of banking supervision relies on many factors that are not under the control of the central bank.D. Many factors under the control of the central bank result in the success of banking supervision.2.A. You cannot sign your name on the upper left corner that does not comply with the agreement.B. Your signature does not agree with the specimen signature on the upper left corner.C. The signature on the upper left corner is not the countersign in theagreement.D. You cannot agree with the signature on the upper left corner.3.A. The Chinese banks will not come to compete with the foreign banks inRenminbi business.B. Foreign banks will be allowed to do Renminbi business which is a challenge to the Chinese banks.C. It will be a real great challenge to the Chinese banks when the foreign banks have the right to do Renminbi business.D. In order to have real competition with the Chinese banks, foreign banks should be allowed to do Renminbi business.4.A. I remitted the money to you after the sale of my stocks.B. Your bank account had been credited with the remittance since I sold my shares last week.C. The money had already been credited to your account last week after I sold my shares.D. The money had not been remitted to you since I failed to sell my stocks last week.5.A. The bank makes profits only from its own money.B. The bank makes profits not only from the deposits but also from its own money.C. The bank makes profits with special obligations to depositors.D. The bank has special obligation to make profits.6.A. We thank you for your doing kindness to us.B. We hope you send us your check as soon as possible.C. We thank you because you provide us convenience in checking.D. You will have to pay us $50,000.7.A. The Chinese economists made a proposal that banks' savings interest rates should further be lowered.B. The Chinese economists thought banks' savings interest rates should be improved.C. The Chinese economists believed that banks' savings interest rates should be maintained.D. The Chinese economists suggested that banks' savings interest rates should be kept.8.A. We are the credit holders.B. We are the bank who can encash the card.C. We are the bank who can stop your lost card.D. We are the bank who can find your lost card.9.A. In the foreign exchange market, exchange rates are quoted by the sellers and buyers.B. In the foreign exchange market, exchange rates are quoted by commercial banks.C. In the foreign exchange market, selling and buying of foreign exchange decide exchange rates.D. In the foreign exchange market, exchange rates are fixed by governments.10.A. The bank has the right to charge you fees if your check has bounced.B. The bank will not charge you any service commission even if your check returned.C. No one reserves the right to impose a service charge for returned cheques.D. The bank has the right to impose a charge for encashed cheques.Section Two (10%)Directions: In this section, you will hear 10 short conversations. At the end of each conversation a question will be asked about what was said. The conversations and questions will be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answerNow you will hear :M: Does our bank have a direct correspondent relationship with the Bradalys' Bank?W:No, we don't. So we have to advise this L/C via another bank.Q: Which of the following is right?Now you will read:A. We can advise this L/C to the Bradlays' Bank.B. The Bradlays' Bank is our correspondent.C. The L/C has to be advised by a third bank.D. We should advise this L/C by ourselves.From the conversation we know that we have to advise this L/C via another bank. The best answer is C. Therefore you should choose answer C.11.A. Her account number is 60789410B. Her account number is 60798410C. Her account number is 60798401D. Her account number is 6078914012.A. in the safeB. in the drawerC. on the deskD. in the box13.A. 1.89%B. 1.98%C. 8.19%D. none14.A. to open an account with the bankB. to exchange moneyC. to check if the remittance has arrivedD. to remit some money to her brother Tony Waller15.A. employee and bossB. broker and bank clerkC. two bank clerksD. bank clerk and customer16.A. 8 hoursB. 10 hoursC. 12 hoursD. 24hours17.A. one monthB. twelve monthsC. six monthsD. half a month18.A. draw money from her account through ATM.B. write her secret code on the card.C. forget her password.D. ask somebody to pick up her card.19.A. US$ 24,580B. US$ 28,450C. US$ 45,280D. US$ 25,48020.A. Special risks will be excluded.B. You have to pay more money for the inclusion of all risks.C. Exclusion of the special risks means more money you have to pay.D. You have to pay more premium to include a special risk.Section Three (10%)Directions: In this section, you will hear 3 short passages. At the end of each passage you will hear some questions about what was said. The passages and questions wi1l be spoken only once. During the pause, you must read the four suggested answers marked a, b, c, and d, and decide which is the best answerQuestions 21--23 are based on passage 121.A. threeB. fourC. fiveD. six22.A. one-dollar billB. five-dollar billC. ten-dollar billD. twenty-dollar bill23.A. by checks and fund transfersB. by CHAPS and fund transfersC. by CHIPS and fund transfersD. by SWIFT and fund transfersQuestions 24-26 are based on passage 224.A. They will buy houses.B. They will buy cars.C. They will postpone building a new plant.D. They will hire more workers.25.A. because they affect consumers' willingness to spend or save.B. because they affect businesses' investment decisions.C. because interest rates are the cost of borrowings.D. both a and b.26.A. mortgage interest ratesB. car loan ratesC. interest rates on many different types of bondsD. current interest ratesQuestions 27-30 are based on Passage 327.A. corporateB. interbankC. mortgageD. syndicate28.A. pay all attentions to a specific area of lendingB. consider someone more important than the otherC. handle loan applications based on hard and fast ruleD. try to build up a well-balanced loan portfolio29.A. prudenceB. profitabilityC. liquidityD. safety30.A. to ensure healthy growth for the bankB. to outperform the competition in financial industryC. to make the profitsD. to achieve specific business targets。

金融英语练习题(附答案)

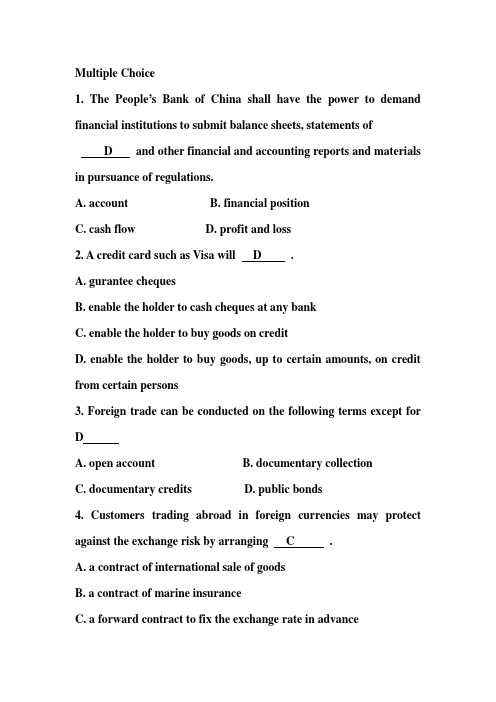

Multiple Choice1. The People’s Bank of China shall have the power to demand financial institutions to submit balance sheets, statements ofD and other financial and accounting reports and materials in pursuance of regulations.A. accountB. financial positionC. cash flowD. profit and loss2. A credit card such as Visa will D .A. gurantee chequesB. enable the holder to cash cheques at any bankC. enable the holder to buy goods on creditD. enable the holder to buy goods, up to certain amounts, on credit from certain persons3. Foreign trade can be conducted on the following terms except for DA. open accountB. documentary collectionC. documentary creditsD. public bonds4. Customers trading abroad in foreign currencies may protect against the exchange risk by arranging C .A. a contract of international sale of goodsB. a contract of marine insuranceC. a forward contract to fix the exchange rate in advance5. The danger to the exporter in open account trading is that by surrendering the shipping documents to the importer, heB before he has obtained payment for them.A. is in control of the goodsB. losses control of the goodsB. retain control of the goods D. gives up control of the goods6. Leasing is an arrangement whereby one party obtains on a long-term basis A which belongs to another party.A. the use of a capital assetB. the use of a current assetC. the use of working capitalD. the use of current liabilities7. From a Chinese bank’s point of view, the currency account which it maintains abroad is known as , while a RMB account operated in China for a foreign bank is termed B .A. a vostro account, a nostro accountB. a nostro account, a vostro accountC. a mirror account, a nostro accountD. a vostro account, a mirror account8. Find the interest on US $65,000 for 14 days at 3 percent per annum.B .A. US $37.91B. US $75.83C. US $113.74D. US $227.499. Which of the following can not be included in the functions ofmoney?D 。

【精编范文】金融英语模拟习题-推荐word版 (6页)

本文部分内容来自网络整理,本司不为其真实性负责,如有异议或侵权请及时联系,本司将立即删除!== 本文为word格式,下载后可方便编辑和修改! ==金融英语模拟习题1. In general, the more liquid an asset the ______.A. less it is likely to yieldB. greater its risk of defaultC. lower its market price will beD. more it will add to bank profits2. The interest rate printed on the face of a bond is called the ______.A. coupon rateB. prime rateC. printed rateD. nominal rate3. A rise in interest rates leads to ______.A. capital gains for bondholdersB. capital losses for bondholdersC. income gains for bondholdersD. income losses for bondholders4. If the reserve requirement ratio were equal to zero, then______.A. the deposit multiplier would be infinitely largeB. required reserves would be equal to zeroC. the banking system would theoretically be able to create an infinitely large amount of demand depositsD. all of the above5. Financial intermediaries’ primary function in financial markets is to serve as ______.A. ultimate borrowersB. ultimate lendersC. ultimate saversD. middlemen6. Suppose the Fed buys $10 million in government securities froma commercial bank. If the required reserve ratio is 0.25, what is the maximum amount by which checkable deposits in the banking system can change? ______.A. +$10000000B. +$25000000C. +$40000000D. -$400000007. Suppose the annualized yield on a 91-day Treasury bill is1.25%. If you invested $10 000 in this bill, how much would you have to pay for this security? ______.A. $11.250B. $10012.50C. $9998.75D. $9968.938. Who are the first to bear financial losses incurred by the bank? ______.A. The depositorsB. The debtorsC. The bank capital shareholdersD. The bank employees9. A government is faced with a balance of payments deficit. It may take action to deal with this by doing all of the following except ______.A. devalue the currencyB. reduce interest ratesC. restrict consumer spendingD. restrict imports10. According to the principle of comparative advantage, countries ______.A. should specialize in producing goods they have lower opportunity cost forB. should export goods they can produce at lower input costsC. will specialize in producing goods which they can produce at lower input costsD. should specialize in producing goods they have lower absolute costs for11. A currency depreciation on the foreign exchange market will ______.A. encourage imports to the country whose currency has depreciatedB. discourage imports to the country whose currency has depreciatedC. discourage exports to the country whose currency has depreciated。

金融英语模拟习题一

金融英语证书考试(FECT)Exercises-1(1)来源:考试大 2010/11/26 【考试大:中国教育考试第一门户】模拟考场视频课程字号:T T金融英语证书考试(FECT)Exercises-1(1)。

密切关注考试大金融英语试题辅导中心,你将可以挖掘到更多实用更实惠的金融辅导资料。

1.Which of the following is not a function of money?______。

A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To provide a double coincidence of wantsE.To act as a means of payment2.The price in the foreign exchange market is called ______。

A.the trade surplusB.the exchange rateC.the money priceD.the currency rate3.Market risk refers to the risk of______。

A.financial prices fluctuationsB.defaultC.fraudD.deferred payments4.Which of the following is not among the generally accepted accounting principles?______。

A.Cash basisB.PrudenceC.ConsistencyD.Going concernE.Money measurement。

5.What is a documentary letter of credit?______。

金融英语模拟题(一)T1P2-Reading

金融英语模拟题(一)Part two ReadingSection One (10%)Directions: There are ten statements in this section. For each statement there are four choices marked A,B,C,D. You should choose the best answer.31. If the lessor makes an equity investment equal to 20% of the equipment's original cost, and borrows the remaining 80% from a long-term creditor, and writes a noncancelable lease for the equipment, such lease is called a ___________.A. operating leaseB. leveraged leaseC. direct-financing leaseD. sales-type lease32. The interest rate for borrowing funds from inter-bank market is close to, but always slightly ____________ the rate that is available from the central bank.A. lower thanB. higher thanC. as high asD. not as high as33. ___________ is a financial market in which securities that have been previously issued can be resold.A. A primary marketB. A secondary marketC. A issuing marketD. The capital market34. Of the challenging issues in Internet banking, which people care most,is _________.A. the provision of a secure platform for banking transactionsB. whether management has the creativity and vision to harness the technologyC. how to deliver high-quality products for the customers' convenienceD. whether management has the ability to satisfy customers' continually changing financial needs35. From a Chinese Bank's point of view, the currency account which it maintains abroad is known as _______, while a RMB account operated in China for a foreign bank is termed ________.A. a vostro account; a nostro accountB. a mirror account; a nostro accountC. a nostro account; a vostro accountD. a vostro account; a mirror account36. If __________, such a situation is called break-even.A. contribution margin= fixed costsB. contribution margin=total costsC. profit=expenseD. sales revenue=variable cost37. Foreign-funded enterprises may retain their export earnings if those earnings _______.A. get after SAFE approvesB. will be remitted abroadC. will be invested in local areaD. do not exceed the limit set by the SAFE38. BOT is an abbreviated form of _________.A. build-or-technologyB. build-operate-transferC. build-operate-technologyD. benefit-operate-transfer39. _________ is the foundation of private accounting, which analyzes a business's costs to help managers control expenses.A. BudgetingB. Management information systemC. Internet auditingD. Cost accounting40. Underwriting simply means that the investment banker promises to ________ the securities.A. buyB. sellC. designD. issueSection Two (10%)Directions: There are 10 blanks in the following passages. For each blanks there are four choices marked A, B, C, D. You should choose the best answer.Passage OneAnother way of distinguishing markets is on the basis of the _____41_______of the securities in each market. The __42______ is a financial market in which only short-term debt instruments are traded. The ___43_____ isthe market in which longer-term debt and equity instruments are traded. The securities in the former are usually more widely traded than those in the latter and so tend to be ____44______. In addition, short-term securities have _____45______fluctuations in prices than long-term securities, making them safer investments.41.A. volumeB. maturityC. issuing procedureD. kind42.A. money marketB. capital marketC. primary marketD. secondary market43.A. money marketB. capital marketC. primary marketD. secondary market44.A. more solventB. more riskC. more liquidD. safer45.A. volatileB. violentC. widerD. smallerPassage TwoIn documentary credit operations, all parties concerned deal in ___46____ and not in ____47____. The banks check exclusively on the basis of documents ___48____to them to see whether the terms of the credit have been fulfilled. They are ____49_____to verify whether the goods supplied actually agree with those specified in the credit, ____50____differences, say, between the goods invoiced and those actually delivered, nor answerable to the buyers' complaints about these differences. It is up to the buyers and sellers to settle questionables of this nature between themselves.46.A. goodsB. creditsC. documentsD. contracts47.A. goodsB. creditsC. documentsD. contracts48.A. deliveredB. presentedC. deliverD. release49.A. responsibleB. not responsibleC. boundD. willing50.A. nor liable forB. or liable forC. nor liable toD. or liable toSection Three (10%)Directions: Read the following passages, and determine whether the sentences are "Right" or "wrong". If there is not enough information to answer " right" or "wrong''. choose "Doesn't say".Passage OneNew issues of common stock come into two varieties, primary distributions and secondary distributions. Primaries are sales of stock that have never been issued before. There are two types of primary distributions--initial public offering (IPOs) and additional floats of companies' stock that will dilute eachshareholder's existing holding. Of the two, the latter are more common in the new issues market for equities since they involve offerings of shares of larger, more mature companies seeking additional equity capital. Secondary distributions are sales of stock that previously existed in some form or other but are too large to be accommodated on the stock exchanges. Procedures for secondaries often follow those for primaries although the offering period is much shorter and may involve a matter of hours rather than days.The actual marketing for these issues is done by investment bankers directly to the public. On rare occasions, companies have attempted to sell their shares or bonds directly to the public, avoiding investment banking fees. Unless the company is very well known, such attempts are less than successful. The behavior of investment bankers is key to the reception of new issues and directly affects the cost of capital for a company. As a result, the choice of an investment banker is crucial for a company, and the wrong choice could affect its costs over the near term.51. Initial public offerings (IPOs) are one of the type of primary distributions,while additional floats of companies' stock belong to secondary distributions.A.RightB.WrongC.Doesn't say52. Compared with additional floats of companies' stock, initial public offering(IPOs) are more common because they involve offerings of shares larger, more mature companies seeking additional equity capital.A.RightB.WrongC.Doesn't say53.Both primary distributions and secondary distributions are issued in primary markets.A.RightB.WrongC.Doesn't say54. Few companies have attempted to see their shares or bonds directly to the public.A.RightB.WrongC.Doesn't sayPassage TwoThe simplest means of transferring funds abroad is by means of the airmail remittance order. For example, a local customer of the bank wishes to send money to a relative in Japan. The local customer goes to the United States bank and specifies where and to whom the money is to be delivered. He also indicates the amount he wishes to send, for example, USD$100. The bank prepares a letter to its correspondent bank in the town nearest towhere the relative lives. In this letter, the United States bank says, "Advise and pay US dollars 100 to ( name and address ) of recipient." The letter says that this is by order of its local customer, giving his name. Then it adds, " In reimbursement, we credit your account with us." This informs the Japanese bank that its account in the United States bank has been credited USD100 (The United states bank credits the Japanese banks due to account).55. MT is the simplest means of transferring funds abroad.A.RightB.WrongC.Doesn't say56. According to the passage, the local customer of U.S. is a remitter.A.RightB.WrongC.Doesn't say57.The Japanese bank debits the U.S. bank's due from account.A.RightB.WrongC.Doesn't sayPassage ThreeTo finance the national debt, the government issues a variety of debt securities. The most widely held liquid security is the Treasury bill, which is commonly issued by the ministry of finance. However. some Treasury bills, like the Treasury bill of the U. S. government, do not actually pay interest. Instead they are issued at a discount from par (their value at maturity). The investor’s yield comes from the increase in the value of the security between the time it was purchased and the time it matures.Treasury bills are attractive to investors because they are backed by the government and therefore are virtually free of default risk. Because even if the government ran out of money it could simply print more to pay them off when they mature. The risk of unexpected changes in inflation is also low because of the short term to maturity. The markets for Treasury bills in most developed countries are deep and liquid, A deep market is one with many different buyers and sellers. A liquid market is one in which securities can be bought and sold quickly and with low transaction costs. Investors in markets that are deep and liquid have little risk that they will not be able to sell their securities when they want to.58. Treasury bills are short-term and virtually free of default risk.A.RightB.WrongC.Doesn't say59. As some treasury bills do not actually pay interest, they are not attractive to investorsA.RightB.WrongC.Doesn't say60.Investors in deep and liquid markets face immense risk that they will not be able to selltheir securities when they want to.A.RightB.WrongC.Doesn't saySection Four (20%)Directions: There are 4 passages in this sections. Each passage is followed by some questions or unfinished statements. For each of them there are four choices marked A, B, C, D. You should choose the best answer.Passage OneSince equal dollar amounts of debits and credits are entered in the accounts for every transaction recorded, the sum of the debits in the ledger must be equal to the sum of all the credits. If the computation of account balances has been accurate, it follows that the total of the accounts with debit balances must be equal to the total of the accounts with credit balances.Before using the account balances to prepare financial statements, it is desirable to prove that the total of accounts with debit balances is in fact equal to the total of accounts with credit balances. This proof of the equality of debit and credit balances is called a trial balances. A trial balance is a two-column schedule listing the names and balances of all the accounts in the order in which they appear in the ledger. The debit balances are listed in the left-hand column and the credit balances in the right-column. The totals of the two columns should agree.The trial balance provides proof that the ledger is in balance. The agreement of the debit and credit totals of the trial balance gives assurance that:1.Equal debits and credits have been recorded for all transactions.2.The debit or credit balance of each account has been correctly computed.3. The addition of the account balances in the trial balance has been correctly performed.Suppose that the debit and credit totals of the trial balance do not agree. This situation indicates that one or more errors have been made. Typical of such errors are (1) the entering of a debit as a credit or vice verse; (2) arithmetical mistakes in balancing accounts; (3) clerical errors in copying account balances into the trial balance;(4) listing a debit balance in the credit column of the trial balance, or vice verse; and (5) errors in addition of the trial balance.The preparation of a trial balance does not prove that transactions have been correctly analyzed and recorded in the proper accounts. If, for example, a receipt of cash were not be disclosed by the trial balance. In brief, the trial balance proves only one respect of the ledger, and that is the equality of debit and credits.61. A trial balance is a two-column schedule listing the names and balances of all the accounts to prove _______________.A. the agreement of the debit and credit totalsB. the order in which they appear in the ledgerC. the equality of account balances of financial statementsD. the order in which they appear in the recording62. Unless __________, the totals of the debit and credit of trial balance should agree.A. the debit or credit balance of each amount has been correctly computedB. debits and credits have been recorded correctly for all transactionsC. unequal debits and credits have been recorded for all transactionsD. the addition of the account balance in the trial balances has been correctly performed63.If ____________, the debit and credit totals of the trial balance do not agree.A. mistakes appear in computing balancing accountsB. a credit is entered as a debitC. a credit balance is listed in the debit columnD. All of the above64. If a payment of cash is recorded by ________, the trial balance would still balance.A. crediting the Account Payable accountB. debiting the cash accountC. debiting the Account Receivable accountD. debiting the land account65. A trial balance is a working paper which is intended ___________.A. for distribution to various outsidersB. to prepare financial statementsC. for distribution to various accountantsD. to prepare ledger accountsPassage TwoInsurance is almost as important to business as banking. It works quite simply by spreading over a large number of people, the costs or the losses which otherwise would fall on the few who actually suffer them.Fire, for instance, normally damages only a few businesses each year but almost all companies buy insurance to protect themselves against it. What happens is that most companies pay regular small amounts of money, called the premium to insurance groups and so a large fund of money builds up. Then the few who have suffered fires claim the cost of the damages. After investigation, the claims are paid out by the insurance companies.For the operation to work, insurance companies have to calculate what is the chance or probability of certain events happening, and what the cost of making accidents good will be, and how many people will pay, what rates,to have protection. Premiums are fixed in proportion to the risk involved.There are four principles backing up every insurance contract. The first, known as indemnity, is that the insured should get back the same value as was lost. If you insure your watch against the risk of its being stolen, then the insurance company will only pay out the cost of a similar, second. hired watch unless you make a special agreement with them.The second principle is that of agreeing that the insurer has to own, or have the insurable interest in, the property covered, both at the time of affecting the insurance and at the time of loss. This is usual for policies covering fire;but the insurance on ships and their cargoes can be transferred to new owners if required.Thirdly it is necessary for the agreement to be concluded in good faith. Generally the company providing insurance cover charges a premium based on what it is told. If a company fails to mention that a warehouse sometimes contains explosives the underwriter may declare the contract not valid and refuse to pay a claim if the warehouse blows up.Finally, insurers distinguish between remote and immediate causes of an event. If there is an earthquake and a house is damaged, catches fire and is flooded by firemen when putting out the flames, the compensation due will depend on the exact words used in the detailed insurance contract. Usually companies do not provide cover against earthquake damage, so the house owner may not get any compensation for the effects of the fire or water, as these were a direct result ofthe earthquake.66. What are the four principles backing up every insurance contract?A. Indenmity, the insurable interest, premium and good faith.B. Indemnity, the cost of the damage, the exact words in the contract and the insurableinterest.C.Indemnity, the insurable interest, good faith and remote and immediate causes of anevent.D. Indemnity, the insurable interest, the cost of the damages and good faith.67. I n Para. 2, the term "premium" means ___________A. the cost of the damageB. a sum of money paid regularly to an insurance companyC. proportion of the risk involvedD. a large fund of money68. Which of the following is NOT true according to the passage?A. Premiums are usually decided in proportion to the risk involved.B. Insurance companies often do not provide cover against earthquake damages.C. Insurance on ships and their cargoes can be transferred to new owners if required.D. Those who buy insurance can claim the cost of damages if they suffer from firescaused by an earthquake.69. Which of the following is implied, but not directly stated in the passage?A. A regular small sum of money will cover your losses.B. Insurance companies usually do not provide cover against earthquake losses.C. An insurance company can build up a large sum of money from those who pay insurance charge.D. You cannot cover the losses you suffer if the results of the investigation by insurance company turn outnot to be in your favor.70. The purpose of this passage is ___________ .A. to get you familiar with insurance businessB. to advise you to insure your propertiesC. to tell you how to get compensation from an insurance companyD. to teach you how to sign an insurance contractPassage ThreeOnce the exporter has been advised that a letter of credit has been issued in its favor, many exporters make the mistake of starting to prepare or fulfill the requirements of the foreign customer's purchase order before actually receiving the actual letter of credit from the opening or issuing bank. Unless the exporter has had good or excellent prior experience with the foreign customer and its issuing bank, the exporter runs the risk of having the goods ready for shipment, without receiving the original letter of credit. The exporter runs a risk because it may or may not be able to comply with certain terms and conditions contained in the actual original letter of credit. It is always conceivable new conditions might be added to the credit instrument. Or the goods might be shipped and arrived at the overseas port of destination without any original documents because the original L/C arrives late. Thus, the foreign customer will be unable to clear goods through customs, and the goods will be stored in a customs warehouse to accrue expensive demurrage charges.The answer to the above mentioned problem is to have the opening bank issue the letter of credit via tested telex or SWIFT to the advising or negotiating bank as the "original operative instrument" which can be presented for payment by the beneficiary. The exporter must make sure the negotiating or confirming bank, usually the advising bank, is willing to accept the aforementioned as the original operative instrument. Sometimes advising, negotiating, and even confirming banks who pay on behalf of issuing banks still want to wait for the original written letter of credit to be received by them via mail. This might indicate a financial problem with the issuing bank or some sort of technical problems between the banks which the exporter should investigate immediately. The solution helps reduce or eliminate any delays in credit timely for payment after shipment of the goods. Remember in many cases banks want the original on-board ocean bill of lading presented to them with the original letter of credit.71. The exporter should start to prepare or fulfill the requirements of the foreign customer's purchase order _______________.A. before the exporter has been advised that a letter of credit has been issued in its favorB. after the exporter has been advised that a letter of credit has been issued in its favorC. before the exporter actually receives the letter of credit from the opening or issuing bankD. after the exporter actually receives the letter of credit from the opening or issuing bank72. If the exporter starts to prepare or fulfill the requirements of the foreign customer's purchase order when he has been advised that a letter of credit has been issued, he may run the risk of ________.A. having the goods ready to board a steamship which may not comply with certain terms and conditionsstipulated in the letter of creditB. having the goods shipped to the destination and cleared through customsC. having the goods stored in the custom's warehouse without any chargesD. None of the above73. According to the passage, the importer can clear goods through customs on presentation of ____________.A. the original letter of creditB. the original documentsC. the credit instrumentD. expensive demurrage charges74. The bank that issues a letter of credit is called ____________.A. an issuing bankB. a confirming bankC. a negotiating bankD. an advising bank75. Which of the following is NOT true?A. The negotiating bank always agrees to accept the tested telex letter of credit as the original operative instrument.B. The advising bank sometimes agrees to pay on behalf of the issuing bank.C. The confirming bank sometimes still wants to wait for the original letter of credit.D.The exporter sometimes pays no attention to the financial problem with the issuing bank.Passage FourCost- V olume-Profit (C-V-P) analysis is the technique for determining how changes in cost and volume affect the profitability of an organization. Here we will discuss how the analysis of cost behavior patterns allows management to understand the effects that changes in cost, volume, and revenue will have on profit. The techniques for studying these relationships are collectively referred to as cost-volume-profit (C-V-P) analysis. They can be used in making decisions about selling prices, production volume, levels of discretionary fixed costs, and so on.There are three common and related ways to perform C-V-P analysis: (1) The contribution margin approach;(2) The equation approach; and (3) the graphical approach. Although all the three common methods of C-V-P analysis are variations of the same calculations, each approach has its advantages. The graphical approach allows the simultaneous analysis of several different activity levels.Among others things, C-V-P analysis is used to compute break-even points and target net income levels. The equation approach is especially useful in assessing how profit change when costs or revenues change.Three limiting assumptions are (1) that the sales mix is constant, (2) that cost and revenue behavior patterns are linear and remain constant over the relevant range, and (3)that all costs can be categorized as either fixed or variable. When sales volumes are relatively stable management should always emphasize the products with the highest contribution-margin ratios.76. According to the passage, which of the following statements is not mentioned?A. There are three common and related ways to perform C-V-P analysis.B. There are three limiting assumption in C-V-P analysis.C. There are three advantages of C-V-P analysis.D. There are three main factors in C-V-P analysis.77. C-V-P analysis can be used for determining the following item except __________.A. the discretionary fixed costsB. the production volumeC. the capital amountD. the selling price78. ______ is (are) especially useful in simultaneous analysis of several different activity levels.A. The graphical approachB. The contribution margin approachC. The equation approachD. All of above79. Which of the following statements is false?A. C-V-P analysis can be used to computer break-even points and target net income levels.B. One of the three limiting assumptions is that cost and revenue behavior patterns are linear and remain constant over the relevant range.C. The other limiting assumptions are that the sales mix is constant and all costs can be categorized as either fixed or variable.D. The contribution margin approach is especially useful in assessing how profits change when costs or revenue change.80. Which is not the three limiting assumptions in C-V-P analysis?A. The sales mix is constant cost.B. Revenue behavior patterns are linear and remain constant over the relevant range.C. All costs can be categorized as either fixed or variable.D. The sales volumes are relatively stable.。

金融英语模拟题一至五答案

TEST 4: C , A , D , D , C , C , A , B , B , C ,

A , B , D , A , B , B , A , A , C , C ,

A , B , B , A , A , B , B , A , C , B ,

C , A , B , D , C , C , D , A , B , A ,

A , C , D , B , C , A , D , A , B , C ,

C , A , C , B , B , C , A , B , A , A ,

A , D , D , A , A , C , B , D , A , C ,

D , A , C , C , C , B , A , D , A , C

C , C , A , B , D , D , C , C , A , B

TEST 5: B , A , A , D , A , C , B , C , C , A ,

D , A , B , D , C , C , A , C , D , C ,

B , A , A , C , A , B , C , C , A , C ,

Section Three

May 17, 2002

ABC Bank

Dear sirs,

Re: the new interest rate

We are pleased to notify you that effective Aug. 1,2002 until further notice interest is to be calculated on the credit balance at 5.5% and charge at 6% p.a. on overdrafts in your Renminbi account with us. We would add that generally your account is not allowed to be overdrawn and it is hoped that you will see to it that your account always keeps a credit balance and is replenished in time when overdrawn.

金融英语(FECT)考试模拟练习题大汇总