FRM一级模考

VB模拟题2013

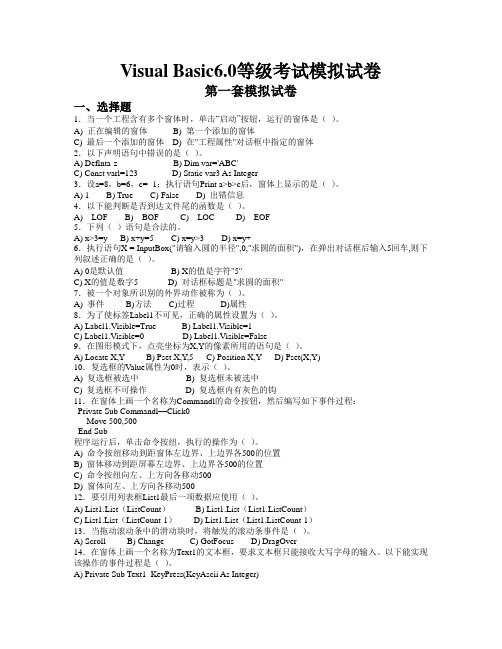

Visual Basic6.0等级考试模拟试卷第一套模拟试卷一、选择题1.当一个工程含有多个窗体时,单击“启动”按钮,运行的窗体是()。

A) 正在编辑的窗体B) 第一个添加的窗体C) 最后一个添加的窗体D) 在"工程属性"对话框中指定的窗体2.以下声明语句中错误的是()。

A) Deflnta-z B) Dim var='ABC'C) Const varl=123 D) Static var3 As Integer3.设a=8,b=6,c= -1;执行语句Print a>b>c后,窗体上显示的是()。

A) 1 B) True C) False D) 出错信息4.以下能判断是否到达文件尾的函数是()。

A) LOF B) BOF C) LOC D) EOF5.下列()语句是合法的。

A) x>3=y B) x+y=5 C) x=y>3 D) x=y+6.执行语句X = InputBox("请输入圆的半径",0,"求圆的面积"),在弹出对话框后输入5回车,则下列叙述正确的是()。

A) 0是默认值B) X的值是字符"5"C) X的值是数字5 D) 对话框标题是"求圆的面积"7.被一个对象所识别的外界动作被称为()。

A) 事件B)方法C)过程D)属性8.为了使标签Label1不可见,正确的属性设置为()。

A) Label1.Visible=True B) Label1.Visible=1C) Label1.Visible=0 D) Label1.Visible=False9.在图形模式下,点亮坐标为X,Y的像素所用的语句是()。

A) Locate X,Y B) Pset X,Y,5 C) Position X,Y D) Pset(X,Y)10.复选框的Value属性为0时,表示()。

关于CreditMetrics模型的计算举例

资产组合的VAR 计算步骤(一)对于单个资产VAR 的计算Credit Metrics 组合模型中,按以下步骤计算单个资产VAR:第一步:确定信用等级评价系统,可以在给定某一公司的信用质量及给定的某一时间水平下,确定公司信用质量从某一信用等级向另一信用等级转移的概率。

第二步:确定度量信用风险的期限,通常情况下为一年;第三步:确定每一信用等级的公司在给定的时间水平下的远期折现曲线,进而确定违约情况下贷款的价值,及确定相应的“回收率”;第四步:计算由信用等级迁移所引起的组合价值的远期分布。

举例:一笔5年期的固定贷款利率,利率为6%,贷款总额为100,目前信用等级为BBB 级。

则该笔贷款的市值为:44433322211)1(106)1(6)1(6166s r s r s r s r P ++++++++++++= 其中:i r 表示零息债券的无风险利率;i s 表示信用价差。

同时一年期的信用等级的迁移概率矩阵为:年末的等级迁移概率年初信用级别 AAA AA A BBB BB B CCC D AAA 98.01 8.330.68 0.06 0.12 0 0 0 AA 0.7 96.56 7.79 0.64 0.06 0.14 0.02 0 A 0.09 2.27 91.05 5.52 0.74 0.26 0.01 0.06 BBB 0.02 0.33 5.95 86.93 5.36 1.17 0.12 0.18 BB 0.03 0.14 0.67 7.73 80.53 8.84 1.00 1.06 B 0 0.11 0.24 0.43 6.48 83.46 4.07 5.2 CCC0.220.221.32.3811.2464.8619.79资料来源:Credit Metrics 技术文档,JP. .Morgan ,1997(穆迪公司的一年期的信用等级的迁移概率矩阵)假设债务人在于发放贷款的金融机构来说,这笔贷款在第一年结束时的市值是:66.108)0532.1(106)0493.1(6)0432.1(6)0372.1(66432=++++=P迁移到其它信用等级的情形,可以以此类推。

国家二级VB机试(选择题)模拟试卷423(题后含答案及解析)

国家二级VB机试(选择题)模拟试卷423(题后含答案及解析) 题型有:1. 选择题选择题1.在线性表的顺序存储结构中,其存储空间连续,各个元素所占的字节数( )。

A.不同,但元素的存储顺序与逻辑顺序一致B.不同,且其元素的存储顺序可以与逻辑顺序不一致C.相同,元素的存储顺序与逻辑顺序一致D.相同,但其元素的存储顺序可以与逻辑顺序不一致正确答案:C解析:在线性表的顺序存储结构中,其存储空间连续,各个元素所占的字节数相同,在存储空间中是按逻辑顺序依次存放的。

知识模块:公共基础知识2.下列叙述中正确的是( )。

A.结点中具有两个指针域的链表一定是二叉链表B.结点中具有两个指针域的链表可以是线性结构,也可以是非线性结构C.循环链表是循环队列的链式存储结构D.循环链表是非线性结构正确答案:B解析:结点中具有两个指针域的链表既可以是双向链表也可以是二叉链表,双向链表是线性结构,二叉链表属于非线性结构。

循环链表是线性链表的一种形式,属于线性结构,采用链式存储结构,而循环队列是队列的一种顺序存储结构。

知识模块:公共基础知识3.在具有2n个结点的完全二叉树中,叶子结点个数为( )。

A.nB.n+1C.n-1D.n/2正确答案:A解析:由二叉树的定义可知,树中必定存在度为0的结点和度为2的结点,设度为0结点有a个,根据度为0的结点(即叶子结点)总比度为2的结点多一个,得度为2的结点有a-1个。

再根据完全二叉树的定义,度为1的结点有0个或1个,假设度1结点为0个,a+0+a-1=2n,得2a=2n-1,由于结点个数必须为整数,假设不成立;当度为1的结点为1个时,a+1+a-1=2n,得a=n,即叶子结点个数为n。

知识模块:公共基础知识4.下列算法中均以比较作为基本运算,则平均情况与最坏情况下的时间复杂度相同的是( )。

A.在顺序存储的线性表中寻找最大项B.在顺序存储的线性表中进行顺序查找C.在顺序存储的有序表中进行对分查找D.在链式存储的有序表中进行查找正确答案:A解析:寻找最大项,无论如何都要查看所有的数据,与数据原始排列顺序没有多大关系,无所谓最坏情况和最好情况,或者说平均情况与最坏情况下的时间复杂度是相同的。

MySQL DBA面试题

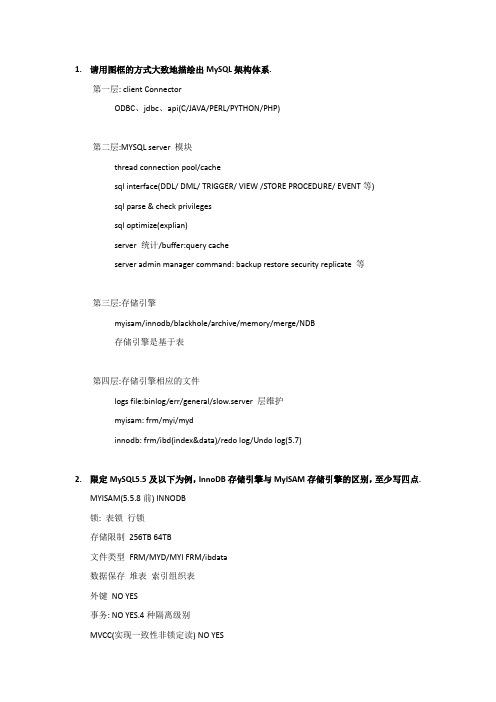

1.请用图框的方式大致地描绘出MySQL架构体系.第一层: client ConnectorODBC、jdbc、api(C/JAVA/PERL/PYTHON/PHP)第二层:MYSQL server 模块thread connection pool/cachesql interface(DDL/ DML/ TRIGGER/ VIEW /STORE PROCEDURE/ EVENT等)sql parse & check privilegessql optimize(explian)server 统计/buffer:query cacheserver admin manager command: backup restore security replicate 等第三层:存储引擎myisam/innodb/blackhole/archive/memory/merge/NDB存储引擎是基于表第四层:存储引擎相应的文件logs file:binlog/err/general/slow.server 层维护myisam: frm/myi/mydinnodb: frm/ibd(index&data)/redo log/Undo log(5.7)2.限定MySQL5.5及以下为例,InnoDB存储引擎与MyISAM存储引擎的区别,至少写四点.MYISAM(5.5.8前) INNODB锁: 表锁行锁存储限制256TB 64TB文件类型FRM/MYD/MYI FRM/ibdata数据保存堆表索引组织表外键NO YES事务: NO YES.4种隔离级别MVCC(实现一致性非锁定读) NO YESmvcc通过读取undo段内容生成的最新快照数据# tablespace包含的内容索引缓存YES YES数据缓存NO YES查询缓存YES YES# index二级索引叶节点行地址行主键B-tree index YES YEST-tree index NO NOHash index NO NO,adaptivefulltext index YES 5.6后支持空间数据YES YES空间索引YES NO索引max长度(byte) 1000 768(1-2byte head)memcache NO 5.6后支持[在server层实现,并不是存储引擎实现的功能[/color]压缩数据支持(只读) 支持,但必须是Barracuda file format加密数据支持同步支持备份点恢复[备份]# 单表备份myisam 可以直接拷贝frm/myd/myi文件即可innodb 不能直接拷贝文件[other]表行数:innodb需要全部遍历/ MYISAM实时维护,不需要全表遍历。

金融风险管理师(FRM)国际认证考试培训介绍

金融风险管理师(FRM)国际认证考试培训:培训简介盖普风险管理培训中心在师资、教材、课程设置和培训方案等方面得到了全球风险协会和金融风险管理师考试委员会的大力支持和帮助,培训中心的师资主要是欧美、XX、XX和国内专门从事金融风险管理师认证考试培训的资深教师,教材选用全球风险协会推荐的国际教材。

通过三个学习阶段、五大教学模块66个模块单元、180个学时的教学,对学员进展全方位、针对性、实用性的金融风险管理专业培训,帮助学员成为系统地掌握国际最先进风险管理知识和分析技能,具备独立开展风险管理和决策能力的高级风险管理专业人员。

这些通过了金融风险管理师考试的人员将成为我国金融机构风险管理行业的中坚力量和金融机构开展全球化竞争的基石。

培训目标对学员进展全方位、针对性、实用性的金融风险管理知识培训,帮助学员到达以下目标:1. 全面掌握金融风险管理的根底理论、模型,培养科学、量化的风险管理意识和理念;2. 洞悉理论界和实务界在金融风险管理上的最新开展动态,了解最新金融风险管理技术;3. 全面掌握各类定量化的风险测量工具和风险管理方法;4. 提高从事金融风险管理实务工作的综合知识、技能、素质;5. 成为各类金融机构高素质的金融风险管理专业人员;6. 获得全球风险协会金融风险管理师〔FRM〕的资格认证。

培训对象1. 金融机构从事信用风险、市场风险、投资风险、操作风险管理和内部控制工作〔包括但不限于信贷风险管理、信贷政策研究与分析、贷款审批、贷后管理、不良资产处置、贷款组合管理、贷款交易、市场风险管理、资金交易、资金管理、证券投资、后台清算、法律文本管理、信用评估与评级、内部控制与稽核等〕的人员;2. 金融机构的中高级管理人员;3. 各金融监管部门的中高级管理人员和业务骨干;4. 企业中高级管理人员、财务人员和业务骨干;5. 从事法律、会计、管理咨询的中高级管理人员和业务骨干;6. 从事风险管理研究与教学人员;7. 大专院校学生;8. 对于风险管理有浓厚兴趣,或希望从事金融风险管理工作的有关人员。

frm一级英语

frm一级英语frm一级英语是指英语语言能力的一级考试,该考试主要面向初学者,要求考生具备基本的英语听、说、读、写的能力。

下面将对frm一级英语的考试内容进行详细介绍。

一、听力部分frm一级英语的听力部分主要考察考生对英语语音、语调、对话和短文的理解能力。

考试形式多样,包括听对话选择正确答案、听短文选择正确答案、听问题选择正确答案等。

考生需要通过听力材料来获取信息,并正确回答问题。

在备考过程中,考生可以通过听英语广播、听英语歌曲、观看英语电影等方式提高自己的听力水平。

同时,要掌握一些听力技巧,如注意听力材料中的关键词、上下文的逻辑关系、语调的变化等。

二、口语部分frm一级英语的口语部分主要考察考生的口语表达能力和交际能力。

考试形式包括自我介绍、问答、对话等。

考生需要准备一些常用的口语表达,如问候语、道歉、邀请、询问、感谢等,并能够灵活运用。

此外,考生还需注意发音、语法和语速的正确性。

在备考过程中,考生可以通过模拟考试、和其他考生进行口语练习、参加英语角等方式提高口语水平。

同时,要注意积累一些日常生活和工作中常用的口语表达,扩大自己的词汇量。

三、阅读部分frm一级英语的阅读部分主要考察考生对英语文章的理解能力。

考试形式包括阅读短文选择正确答案、阅读短文判断正误、阅读短文填空等。

考生需要通过阅读理解材料,获取信息并回答相关问题。

在备考过程中,考生可以通过大量阅读英语文章、英语新闻、英语故事等提高阅读理解能力。

同时,要注意提高阅读速度和词汇量,掌握一些阅读技巧,如略读、寻读、推理等。

四、写作部分frm一级英语的写作部分主要考察考生的写作能力。

考试形式包括写作短文、写作对话、写作邮件等。

考生需要根据所给的题目或情景,进行写作,表达自己的观点和意见。

在备考过程中,考生可以通过练习写作、背诵范文、模仿写作等方式提高写作水平。

同时,要注意提高写作的准确性和流畅性,注意语法和拼写的正确性。

总之,frm一级英语考试是一个综合考察英语语言能力的考试,需要考生具备一定的听、说、读、写的能力。

最新2020年最新公需科目《大数据》模拟考核题库(含标准答案)

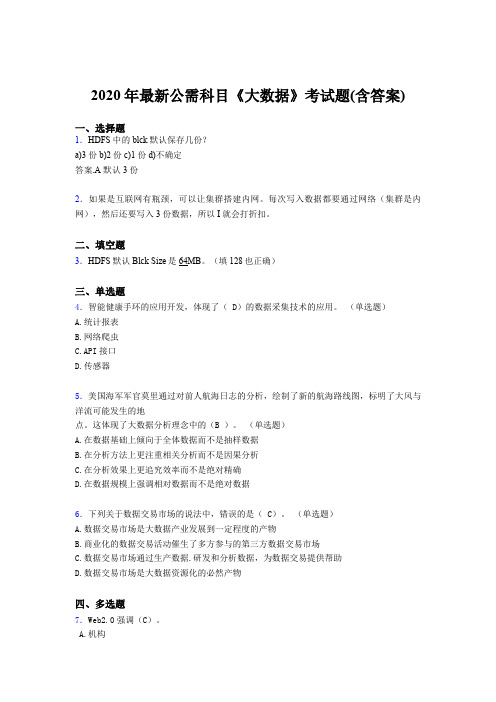

2020年最新公需科目《大数据》考试题(含答案)一、选择题1.HDFS 中的 blck 默认保存几份?a)3 份 b)2 份 c)1 份 d)不确定答案.A 默认 3 份2.如果是互联网有瓶颈,可以让集群搭建内网。

每次写入数据都要通过网络(集群是内网),然后还要写入 3 份数据,所以 I 就会打折扣。

二、填空题3.HDFS 默认 Blck Size是64MB。

(填128也正确)三、单选题4.智能健康手环的应用开发,体现了( D)的数据采集技术的应用。

(单选题)A.统计报表B.网络爬虫C.API接口D.传感器5.美国海军军官莫里通过对前人航海日志的分析,绘制了新的航海路线图,标明了大风与洋流可能发生的地点。

这体现了大数据分析理念中的(B )。

(单选题)A.在数据基础上倾向于全体数据而不是抽样数据B.在分析方法上更注重相关分析而不是因果分析C.在分析效果上更追究效率而不是绝对精确D.在数据规模上强调相对数据而不是绝对数据6.下列关于数据交易市场的说法中,错误的是( C)。

(单选题)A.数据交易市场是大数据产业发展到一定程度的产物B.商业化的数据交易活动催生了多方参与的第三方数据交易市场C.数据交易市场通过生产数据.研发和分析数据,为数据交易提供帮助D.数据交易市场是大数据资源化的必然产物四、多选题7.Web2.0强调(C)。

A.机构B.单位C.个人D.网站8.下列哪些国家已经将大数据上升为国家战略?ABCDA.英国B.日本C.美国D.法国9.根据周琦老师所讲,大数据加速道路网络快速更新,高德()完成全国10万公里15万处更新。

A.2010年B.2006年C.2014年D.2008年10.建立大数据需要设计一个什么样的大型系统?■A.能够把应用放到合适的平台上■B.能够开发出相应应用■C.能够处理数据■D.能够存储数据11.2015 年,阿里平台完成农产品销售达到 6000 多亿元。

(判断题 1 分)正确■错误12.()年,部分计算机专家首次提出大数据概念。

《VB程序设计基础》模拟试题

《VB程序设计》模拟试题●填空题1.窗体模块的文件扩展名为 ___FRM_________ 、标准模块的文件扩展名为____BAS______ 、类模块文件的扩展名为______CLS_______ 。

Basic中数据类型可分为 _____标准数据类型________和用户自定义数据类型两大类,前者根据其取值的不同,可分为_____整型_________、 ______长整型_____、布尔型和 ____字符型_________。

3. Abs= ;Int= ____-10_______。

4. "程序"& "设计"运算结果为 ___程序设计____ 。

5. Dim a, b as Boolean语句显式声明变量a是___变体___变量,b是___布尔__变量。

6. MsgBox函数的返回值中, VBRetry表示单击了____重试_____按钮,VBYes 表示单击了___是_____按钮,VBNo表示单击了_____否____按钮。

7. 要加载窗体,可以在代码中使用___________语句,要显示窗体,可以在代码中使用___________方法,要隐藏窗体,可以在代码中使用Hide方法,要卸载窗体,可以在代码中使用___________方法。

8.对话框分为_________对话框和________对话框两种类型,其中_____________ 对话框最常用。

9. 对象是Visual Basic应用程序的基本单元,它是由 ___类___创建的。

在Visual Basic中可以用属性、 __方法___、___事件___ 来说明和衡量一个对象的特性。

10. 条件判断语句可以使用___If…then____________语句、____If…Then…Else______语句和 ______If…Then…ElseIf______语句。

Select case 语句11. 声明一个值为的常量Pi的语句为___Const pi = 。

宝马CAN总线故障诊断与分析

西南交通大学工程硕士论文

摘

要

第l页

由于信息技术的发展,汽车中的电子控制系统越来越复杂。许多汽车生产厂商将 计算机技术与车载控制系统相结合,运用CAN数据总线系统来进行信息的传输与交换。 在信息的共享的同时也造成了故障原因的交叉和混合,从而使汽车故障现象更为复杂, 故障原因更加不易确定。如何准确找出故障原因,迅速判断出具体故障部件,并总结 出CAN数据总线系统故障诊断的规律和方法,成为了摆在汽车维修企业面前急需解决 的一个问题。所以CAN数据总线系统故障诊断是一个具有重要实用价值的研究课题。

with other module.Next it measures,analyzes and comprises the waveform of the normal

work,short circuit and open circuit of PT—CAN,K-CAN and F-CAN using excluding tools of BMW.The auto repair personnel in the actual work compares the waveforms、7l,itll the

system.It is very significant to research the CAN BUS system. First it introduces the CAN BUS system of BMW E90 models.This paper mainly

introduces the operation principles of CAN BUS system.Then it introduces the relating control units and the control logic on the FRM of BMW E90 models that is most associated

投资学讲义目录

投资学(现代投资理论)前言我们先考虑如下三个问题1Finance是什么?2Finance金融体系内容是什么?3投资学(现代投资理论)是什么?Finance,在中文中有这么几个意思:理财(对个人、家庭、企业、公司)、财务(企业或公司)、金融(投融资机构:基金公司,银行等)、财政(国家)等意思所以把Finance仅仅翻译成金融是不恰当的。

有三本著名的金融财务杂志(1)JFE(Journal of Financial Economics)(2)JF(Journal of Finance这是美国金融学会的)(3)RFS(Reviews of Financial Studies)有三个国际性的证书考试:(1) CFA(Chartered Financial Analyst特许金融分析师:是证券投资与管理界的一种职业资格称号,由美国“特许金融分析师学院”(ICFA)发起成立,每年在全球范围内举行资格考试。

CFA 协会主办的CFA 课程和考试被认为全球投资专业里最为严格的考试,在投资知识、专业标准及道德操守方面制定了全球准则。

CFA特许状持有人可以向其客户、雇主和同事表明他已经修读了一套严谨的专业课程,知识涵盖了广泛的投资领域,并且承诺遵守最高的职业道德准则。

因此,CFA特许状被投资业看成一个“黄金标准”,投资者也希望找到那些持有CFA特许状的专业人士,因为这一资格被认为是投资业界中具有专业技能和职业操守的承诺。

)要上万美元的考试费。

特许金融分析师 (CFA)报考条件:大四学生及以上。

取得资格所需时间(平均):3-4 年。

取得资格所需费用(不含培训):RMB18,000。

国际认可程度:高,全球投资领域通行证。

国内认可程度:高,是高端金融领域“王牌”认证,目前12000 名考生,800-1000 名持证人,2007 年考生增长57%。

薪酬水平:对投资行业薪酬状况的调查表明,雇主愿意提供高额奖金给拥有CFA特许资格认证的投资专业人士。

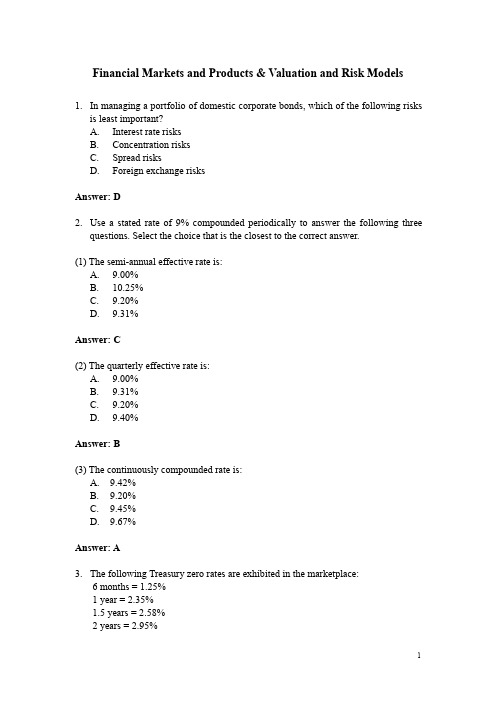

FRM一级_金融市场与产品&估值和风险模型习题及答案(★★)

Financial Markets and Products & Valuation and Risk Models1.In managing a portfolio of domestic corporate bonds, which of the following risksis least important?A.Interest rate risksB.Concentration risksC.Spread risksD.Foreign exchange risksAnswer: De a stated rate of 9% compounded periodically to answer the following threequestions. Select the choice that is the closest to the correct answer.(1) The semi-annual effective rate is:A.9.00%B.10.25%C.9.20%D.9.31%Answer: C(2) The quarterly effective rate is:A.9.00%B.9.31%C.9.20%D.9.40%Answer: B(3) The continuously compounded rate is:A.9.42%B.9.20%C.9.45%D.9.67%Answer: A3.The following Treasury zero rates are exhibited in the marketplace: 6 months = 1.25% 1 year = 2.35%1.5 years =2.58% 2 years = 2.95%Assuming continuous compounding, the price of a 2-year Treasury bond that paysa 6 percent semiannual coupon is closest to:A.105.20B.103.42C.108.66D.105.90Answer: D4. A two-year zero-coupon bond issued by corporate XYZ is currently rated A. Oneyear from now XYZ is expected to remain at A with 85% probability, upgraded to AA with 5% probability, and downgraded to BBB with 10% probability. The risk free rate is flat at 4%. The credit spreads are flat at 40, 80, and 150 basis points for AA, A, and BBB rated issuers, respectively. All rates are compounded annually.Estimate the expected value of the zero-coupon bond one year from now (for USD 100 face amount). Fixed Income Securities:D 92.59D 95.33D 95.37D 95.42Answer: C5.Assuming the long-term yield on a perpetual note is 5%, compute the dollar valueof a 1 bp. Increase in the yield (DV01) for a perpetual note paying a USD 1,000,000 annual coupon.A.-20,000B.-30,000C.-40,000D.-50,000Answer: C6.Given the following portfolio of bonds:What is the value of the portfolio’s DV01 (Dollar value of 1 basis point)?A.8,019B.8,294C.8,584D.8,813Answer: C7.Assuming other things constant, bonds of equal maturity will still have differentDV01 per USD 100 face value. Their DV01 per USD 100 face value will be in the following sequence of highest value to lowest value:A.Premium bonds, par bonds, zero coupon bondsB.Zero coupon bonds, Premium bonds, par bondsC.Premium bonds, zero coupon bonds, par bondsD.Zero coupon bonds, par bonds, Premium bondsAnswer: A8.Which of the following statements about standard fixed rate government bondswith no optionality is TRUE?I.Higher coupon implies shorter duration.II.Higher yield implies shorter duration.III.Longer maturity implies larger convexity.A.I and II onlyB.II and III onlyC.I and III onlyD.I, II, and IIIAnswer: D9.Which of the following is not a property of bond duration?A.For zero-coupon bonds, Macaulay duration of the bond equals its years tomaturity.B.Duration is usually inversely related to the coupon of a bond.C.Duration is usually higher for higher yields to maturity.D.Duration is higher as the number of years to maturity for a bond selling atpar or above increases.Answer: C10.Estimated price changes using only duration tend to:A.Overestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.B.Underestimate the decrease in price that occurs with a increase in yield forlarge changes in yield.C.Overestimate the increase in price that occurs with a decrease in yield forsmall changes in yield.D.Underestimate the increase in price that occurs with a decrease in yield forlarge changes in yield.Answer: D11.A portfolio consists of two positions: One position is long $100M of a two yearbond priced at 101 with a duration of 1.7; the other position is short $50M of a five year bond priced at 99 with a duration of 4.1. What is the duration of the portfolio?A.0.68B.0.61C.-0.68D.-0.61Answer: D12.A zero-coupon bond with a maturity of 10 years has an annual effective yield of10%. What is the closest value for its modified duration?A.9B.10C.100D.Insufficient InformationAnswer: A13.A portfolio manager uses her valuation model to estimate the value of a bondportfolio at USD 125.482 million.The term structure is ing the same model,she estimates that the value of the portfolio would increase to USD 127.723 million if all the interest rates fell by 30bp and would decrease to USD 122.164 million if all the interest rates rose by ing these estimates,the effective duration of the bond is closest to :A. 8.38B. 16.76C. 7.38D. 14.77Answer: C14.A portfolio manager has a bond position worth USD 100 million. The position hasa modified duration of eight years and a convexity of 150 years. Assume that theterm structure is flat. By how much does the value of the position change if interest rates increase by 25 basis points?D -2,046,875D -2,187,500D -1,953,125D -1,906,250Answer: C15.An investment in a callable bond can be analytically decomposed into a:A.Long position in a non-callable bond and a short position in a put optionB.Short position in a non-callable bond and a long position in a call optionC.Long position in a non-callable bond and a long position in a call optionD.Long position in a non-callable and a short position in a call optionAnswer: D16.A European bank exchanges euros for USD, lends them at the U.S. risk-free rate,and simultaneously enters into a forward contract to sell the loan proceeds for euros at loan maturity. If the net effect of these transactions is to earn the risk-free euro rate, it is an example of:A.ArbitrageB.Spot-forward equalityC.Interest rate parityD.The law of one priceAnswer: C17.At the inception of a six-month forward contract on a stock index, the value of theindex was $1,150, the interest rate was 4.4%, and the continuous dividend was1.8%. Three months later, the value of the index is $1,075. Which of the followingstatement is True? The value of the:A.long position is $82.41.B.long position is $47.56.C.short position is $47.56.D.long position is -$82.41.Answer: D18.Assuming the 92-day and 274 day interest rate is 8% (act/360, money market yield)compute the 182-day forward rate starting in 92 days (act/360, money market yield).A.7.8%B.8.0%C.8.2%D.8.4%Answer: B19.The 1-year US dollar interest rate is 3% and the 1-year Canadian dollar interestrate is 4.5%. The current USD/CAD spot exchange rate is 1.5000. Calculate the 1-year forward rate.A. 1.5225B. 1.5218C. 1.5207D. 1.5199Answer: B20.The price of a three-year zero coupon government bond is 85.16. The price of asimilar four-year bond is 79.81. What is the one-year implied forward rate form year 3 to year 4?A. 5.4%B. 5.5%C. 5.8%D. 6.7%Answer: D21.The clearinghouse in a futures contract performs all but which of the followingroles? The clearing house:A.guarantees traders against default from another party.B.splits each trade and acts as a buyer to futures sellers and as a seller tofutures buyers.C.allows traders to reverse their position without having to contract the otherside of the position.D.guarantees the physical delivery of the underlying asset to the buyer offuture contracts.Answer: D22.A weakening of the basis is a consequence of the:A.Spot price increasing faster than the futures price over time.B.Spot price moving according to hyper-arithmetic Brownian motion.C.Futures price increasing faster than the spot price over time.D.Futures price moving according to hyper-arithmetic Brownian motion. Answer: C23.Which of the following statements best describes marking-to-market of a futurescontract? At the:A.End of the day, the maintenance margin is increased for traders who lost anddecreased for traders who gained.B.Conclusion of each trade, the gains or losses from all previous trades in thefutures contract are tallied.C.Maturity of the futures contract, the gains or losses are tallied to the trader’saccount.D.End of the day, the gains or losses are tallied to the trader’s account. Answer: D24.A trader buys one wheat contract (underlying = 5,000 bushels) at a price of $3.05per bushel. The initial margin on the contract is $4,500 and the maintenance margin is $3,750. At what price will the trader receive a maintenance margin call?A.$2.30B.$2.90C.$3.20D.$3.80Answer: B25.The S&P 500 index is trading at 1,025. The S&P 500 pays an expected dividendyield of 1.2% and the current risk-free rate is 2.75%. The value of a 3-month futures contract on the S&P 500 index is closest to:A.$1,028.98B.$1,108.59C.$984.86D.$1,025.00Answer: A26.The current spot price of gold is $325/oz and the price of 90-day gold futurescontract (nominal amount of 100 oz) is $315. If 90-day Treasury bills are trading at yields of 3.55% - 3.58% and storage and delivery costs are ignored, what is the potential arbitrage profit per contract?A.$1,266B.$1,286C.$1,334D.$1,344Answer: C27.Which of the following statements describing the role of a convenience yield inpricing commodity futures is true? The convenience yield:I.will cause contango in the futures pricing relationship.II.Effectively reduces the cost of carry in the futures pricing relationship.III.Eliminates the potential for arbitrage between the futures and spot price.IV.Accounts for additional costs for storing an asset in the futures pricing relationship.A.I onlyB.II onlyC.II, III, and IV onlyD.I and II onlyAnswer: B28.A firm is going to buy 10,000 barrels of West Texas Intermediate Crude Oil. Itplans to hedge the purchase using the Brent Crude Oil futures contract. The correlation between the spot and futures prices is 0.72. The volatility of the spot price is 0.35 per year. The volatility of the Brent Crude Oil futures price is 0.27 per year. What is the hedge ratio for the firm?A. 0.9333B. 0.5554C. 0.8198D. 1.2099Answer: A29.The hedge ratio is the ratio of derivatives to a spot position (or vice versa thatachieves an objective such as minimizing or eliminating risk. Suppose that the standard deviation of quarterly changes in the price of a commodity is 0.57, the standard deviation of quarterly changes in the price of a futures contract on the commodity is 0.85, and the covariance between the two changes is 0.3876. What is the optimal hedge ratio for a 3.-month contract?A.0.1893B.0.2135C.0.2381D.0.2599Answer: D30.Consider an equity portfolio with market value of USD 100M and a beta of 1.5with respect to the S&P 500 Index. The current S&P 500 index level is 1000 and each futures contract is for delivery of USD 250 times the index level. Which of the following strategy will reduce the beta of the equity portfolio to 0.8?A.Long 600 S&P 500 futures contractsB.Short 600 S&P 500 futures contractsC.Long 280 S&P 500 futures contractsD.Short 280 S&P 500 futures contractsAnswer: D31.Corporates normally use FRAs to:A.Lock-in the cost of borrowing in the futureB.Lock-in the cost of lending in the futureC.Hedge future currency exposuresD.Create future currency exposuresAnswer: A32.An investor has entered into a forward rate agreement(FRA) where she hascontracted to pay a fixed rate of 5 percent on $5,000,000 based on the quarterly rate in three months. If interest rates are compounded quarterly, and the floating rate is 2 percent in three months, what is the payoff at the end of the sixth month?The investor will:A.make a payment of $37,500.B.receive a payment of $37,500.C.make a payment of $75,000.D.receive a payment of $75,000.Answer: A33.Consider the following 6x9 FRA ,Assume the buyer of the FRA agrees to acontract rate of 6.35% on a notional amount of 10 million USD ,Calculate the settlement amount of the seller if the settlement rate is 6.85%. Assume a 30/360 day count basis.A.–12,500B.–12,290C.+12,500D.+12,290Answer: B34.XYZ Corporation plans to issue a 10-year bond 6 months from now. XYZ wouldlike to hedge the risk that interest rates might rise significantly over the next 6 months. In order to effect this, the treasurer is contemplating entering into a swap transaction. Under the swap, she should:A.Pay fixed and receive LIBORB.Pay LIBOR and receive fixedC.Either swap (a or b above) will workD.Neither swap (a or b above) will workAnswer: A35.Consider the following plain vanilla swap. Party A pays a fixed rate 8.29% perannum on a semiannual basis (180/360), and receives from Party B LIBOR+30 basis point. The current six-month LIBOR rate is 7.35% per annum. The notional principal is $25M. What is the net swap payment of Party AA.$20,000B.$40,000C.$80,000D.$110,000Answer: C36.A trader executes a $420 million 5-year pay fixed swap(duration 4.433) with oneclient and a $385 million 10year receive fixed swap(duration 7.581) with another client shortly afterwards. Assuming that the 5-year rate is 4.15 % and 10-year rate is 5.38 % and that all contracts are transacted at par, how can the trader hedge his net delta position?A.Buy 4,227 Eurodollar contractsB.Sell 4,227 Eurodollar contractsC.Buy 7,185 Eurodollar contractsD.Sell 7,185 Eurodollar contractsAnswer: B37.Assume an investor with a short position is about to deliver a bond and has fourbonds to choose from which are listed in the following table. The last settlement price is $95.75 (this is the quoted futures price). Determine which bond is the cheapest-to-deliver.Bond Quoted Bond Price Conversion Factor1 99 1.012 125 1.243 103 1.064 115 1.14A. Bond 1B. Bond 2C. Bond 3D. Bond 4Answer: C38.What is the lower pricing bound for a European call option with a strike price of80 and one year until expiration? The price of the underlying asset is 90, and the1-year interest rate is 5% per annum. Assume continuous compounding of interest.A.14.61B.13.90C.10.00D. 5.90Answer: B39.According to Put-Call parity, buying a call option on a stock is equivalent to:A.Writing a put, buying the stock, and selling short bonds (borrowing).B.Writing a put, selling the stock, and buying bonds (lending).C.Buying a put, selling the stock, and buying bonds (lending).D.Buying a put, buying the stock, and selling short bonds (borrowing). Answer: D40.Jeff is an arbitrage trader, and he wants to calculate the implied dividend yield ona stock while looking at the over-the-counter price of a 5-year put and call (bothEuropean-style) on that same stock. He has the following data:• Initial stock price = USD 85• Strike price = USD 90• Continuous risk-free rate = 5%• Underlying stock volatility = unknown• Call price = USD 10• Put price = USD 15What is the continuous implied dividend yield of that stock?A. 2.48%B. 4.69%C. 5.34%D.7.71%Answer: C41.The current price of a stock is $55. A put option with $50 strike price thatexpires in 3 months is available. If N(d1)=0.8133, N(d2)=0.7779, the underlying stock exhibits an annual standard deviation of 25 percent, and current risk free rates are 3.25 percent, the Black-Scholes value of the put is closet to:A.$0.75B.$1.25C.$1.50D.$5.00Answer: A42.Which of the following is the riskiest form of speculation using options contracts?A.Setting up a spread using call optionsB.Buying put optionsC.Writing naked call optionsD.Writing naked put optionsAnswer: C43.A long position in a put option can be synthetically produced by:A.Long position in the underlying and a short position in a call.B.Short position in the underlying and a long position in a call.C.Long position in the underlying and a long position in a put.D.Short position in the underlying and a short position in a put.Answer: B44.ABEX Corporation common stock is selling for $50.00 per share. Both anAmerican call option and a European call option are available on ABEX common, and each have identical strike prices and expiration dates. Which of the following statements concerning these two options is TRUE?A.Because the American and European options have identical terms and arewritten against the same common stock, they will have identical optionpremiums.B.The greater flexibility allowed in exercising the American option willnormally result in a higher market value relative to an otherwise identicalEuropean option.C.The American option will have a higher option premium, because theAmerican security markets are larger than the European markets.D.The European option will normally have a higher option premium because oftheir relative scarcity compared to American options.Answer: B45.Put option values increase as a result of increases in which of the followingfactors?I.V olatilityII.DividendsIII.Stock PriceIV.Time to expirationA.I, II, and IV onlyB.I, III, and IV onlyC.II and IV onlyD.I and III onlyAnswer: A46.Your firm has no prior derivatives trades with its counterparty Super Bank. Yourboss wants you to evaluate some trades she is considering. in particular, she wants to know which of the following trades will increase your firm’s credit risk exposure to Super Bank:I.Buying a put optionII.Selling a put optionIII.Buying a forward contractIV.Selling a forward contractA.I and II onlyB.II and IV onlyC.III and IV onlyD.I, III, and IV onlyAnswer: D47.Which of the following statements about a floor is true?A.floor is a put option and protects against a fall in interest ratesB.floor is a call option and protects against a fall in interest ratesC.floor is a put option and protects against a rise in interest ratesD.floor is a call option and protects against a rise in interest ratesAnswer: A48.You are given the following information about a call option:• Time to maturity = 2 years• Continuous risk-free rate = 4%• Continuous dividend yield = 1%• N(d1) = 0.64Calculate the delta of this option.A.-0.64B.0.36C.0.63D.0.64Answer: C49.Call and put option values are most sensitive to changes in the volatility of theunderlying when:A.both calls and puts are deep in-the-money.B.both puts and calls are deep out-of-the-money.C.calls are deep out-of-the-money and puts are deep in-the-money.D.both calls and puts are at-the-money.Answer: D50.What is the reason for undertaking a Vega hedging? To minimize the:A.Possibility of counterparty default risk.B.Potential loss as a result of a change in the volatility of the underlying sourceof risk.C.Adverse effect due to the government regulation.D.Potential loss as a result of a large movement in the underlying source ofrisk.Answer: B51.Suppose an existing short option position is delta-neutral, but has a gamma of−600. Also assume that there exists a traded option with a delta of 0.75 and a gamma of 1.50. In order to maintain the position gamma-neutral and delta-neutral, which of the following is the appropriate strategy to implement?A. Buy 400 options and sell 300 shares of the underlying asset.B. Buy 300 options and sell 400 shares of the underlying asset.C. Sell 400 options and buy 300 shares of the underlying asset.D. Sell 300 options and buy 400 shares of the underlying asset.Answer: A52.W hich of the following is not an assumption of the BS options pricing model?A. The price of the underlying moves in a continuous fashionB. The interest rate changes randomly over timeC. The instantaneous variance of the return of the underlying is constantD. Markets are perfect,i.e.short sales are allowed,there are on transaction costs or taxes,andmarkets operate continuously.Answer: B53.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a short call option position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: C54.If risk is defined as a potential for unexpected loss, which factors contribute to therisk of a long straddle position?A.Delta, vega, rhoB.Vega, rhoC.Delta, vega, gamma, rhoD.Delta, vega, gamma, theta, rhoAnswer: B55.Long a call on a stock and short a call on the same stock with a higher strike priceand same maturity is called:A. A bull spreadB. A bear spreadC. A calendar spreadD. A butterfly spreadAnswer: A56.Consider a bullish spread option strategy of buying one call option with a $30exercise price at a premium of $3 and writing a call option with a $40 exercise price at a premium of $1.50. If the price of the stock increases to $42 at expiration and the option is exercised on the expiration date, the net profit per share at expiration (ignoring transaction costs) will be:A.$8.50B.$9.00C.$9.50D.$12.50Answer: A57.An investor sells a June 2008 call of ABC Limited with a strike price of USD 45for USD 3 and buys a June 2008 call of ABC Limited with a strike price of USD40 for USD 5. What is the name of this strategy and the maximum profit and lossthe investor could incur?A.Bear Spread, Maximum Loss USD 2, Maximum Profit USD 3B.Bull Spread, Maximum Loss Unlimited, Maximum Profit USD 3C.Bear Spread, Maximum Loss USD 2, Maximum Profit UnlimitedD.Bull Spread, Maximum Loss USD 2, Maximum Profit USD 3Answer: D58.Which of the following actions would be most profitable when a trader expects asharp rise in interest rates?A.Sell a payer swaption.B.Buy a payer swaption.C.Sell a receiver swaption.D.Buy a receiver swaption.Answer: B59.Initially, the call option on Big Kahuna Inc. with 90 days to maturity trades atUSD 1.40. The option has a delta of 0.5739. A dealer sells 200 call option contracts, and to delta-hedge the position, the dealer purchases 11,478 shares of the stock at the current market price of USD 100 per share. The following day, the prices of both the stock and the call option increase. Consequently, delta increases to 0.7040. To maintain the delta hedge, the dealer shouldA.sell 2,602 sharesB.sell 1,493 sharesC.purchase 1,493 sharesD.purchase 2,602 sharesAnswer: D60.A risk manager for bank XYZ, Mark is considering writing a 6 month American put optionon a non-dividend paying stock ABC. The current stock price is USD 50 and the strike price of the option is USD 52. In order to find the no-atbitrage price of the option, Mark uses a two-step binomial tree model. The stock price can go up or down by 20% each period. Mark’s view is that the stock price has an 80% probability of going up each period and a 20% probability of going down. The risk-free rate is 12% per annum with continuous compounding.What is the risk-neutral probability of the stock price going up in a single step?A. 34.5%B. 57.6%C. 65.5%D. 80.0%Answer: B61.Given the following 30 ordered simulated percentage returns of an asset, calculatethe VaR and expected shortfall (both expressed in terms of returns) at a 90% confidence level.-16, -14, -10, -7, -7, -5, -4, -4, -4, -3, -1, -1, 0, 0, 0, 1, 2, 2, 4, 6, 7, 8, 9, 11, 12, 12, 14, 18, 21, 23A.VaR (90%) = 10, Expected shortfall = 14B.VaR (90%) = 10, Expected shortfall = 15C.VaR (90%) = 14, Expected shortfall = 15D.VaR (90%) = 18, Expected shortfall = 22Answer: B62.What is the correct interpretation of a $3 million overnight VaR figure with 99%confidence level?A.The institution can be expected to lose at most $3 million in 1 out of next100 days.B.The institution can be expected to lose at least $3 million in 95 out of next100 days.C.The institution can be expected to lose at least $3million in 1 out of next 100days.D.The institution can be expected to lose at most $6 million in 2 out of next100 days.Answer: C63.In the presence of fat tails in the distribution of returns, VaR based on thedelta-normal method would (for a linear portfolio):A.underestimate the true VaRB.be the same as the true VaRC.overestimate the true VaRD.cannot be determined from the information providedAnswer: A64.Value at risk (VaR) measures should be supplemented by portfolio stress testingbecause:A.VaR does not indicate how large the losses will be beyond the specifiedconfidence level.B.stress testing provides a precise maximum loss level.C.VaR measures are correct only 95% of the time.D.stress testing scenarios incorporate reasonably probable events.Answer: A65.Assume we calculate a one-week VaR for a natural gas position by rescaling thedaily VaR using the square-root rule. Let us now assume that we determine the “true” gas price process to be mean reverting and recalculate the VaR. Which of the following statements is true?A.The recalculated VaR will be less than the original VaRB.The recalculated VaR will be equal to the original VaRC.The recalculated VaR will be greater than the original VaRD.There is no necessary relation between the recalculated VaR and the originalVaRAnswer: A66.If a portfolio with a VaR of 200 is combined with a portfolio with a VaR of 500,the VaR of the combination could be:I.Less than 200.II.Less than 500.III.More than 200.IV.More than 500.A.I and IIB.III and IVC.I, II and IVD.II, III and IVAnswer: D67.Consider the following portfolio consisting only of stock Alpha. Stock Alpha has amarket value of $635,000 and an annualized volatility of 28%. Calculate the VaR assuming normally distributed returns with a 99% confidence interval for a 10-day holding period and 252 business days in a year. The daily expected return is assumed to be zero.A.$56,225B.$69,420C.$82,525D.$96,375Answer: C68.Babson Bank is interested in knowing the risk exposure of their assets for variousprobabilities and time horizons. Babson has estimated that the annual variance (based on a 250 day year) of their $638 million asset portfolio is 151.29. If Z1%, Z5%, Z10%, are 2.32, 1.65, and 1.28, respectively, which of the following statements is false? The maximum dollar loss that can be expected to be exceeded:A.5% of the time in any six month period is $64.74 millionB.1% of the time on any given day is $11.51 millionC.10% of the time in any given quarter is $50.22 millionD.1% of the time in any given week is $25.25 millionAnswer: A69.The VaR on a portfolio using a 1-day horizon is USD 100 million. The VaR usinga 10-day horizon is:D 316 million if returns are not independently and identically distributedD 316 million if returns are independently and identically distributedD 100 million since VaR does not depend on any day horizonD 31.6 million irrespective of any other factorsAnswer: B70.If stock returns are independently, identically, normally distribution and the annualvolatility is 30%, then the daily VaR at the 99% confidence level of a stock market portfolio is approximately。

frm一级考试大纲2023

frm一级考试大纲2023

frm一级考试大纲2023包括两个科目,分别是Foundations of Risk Management和Quantitative Analysis。

Foundations of Risk Management科目中的风险管理最佳实践与金融风

险失败案例两大板块内容变化显著,组合管理部分总体变化较少、核心考点稳定。

该科目覆盖风险管理最佳实践、组合管理、金融失败案例与金融危机、GARP从业准则。

学习方法上,总体上该科目仍然以考察定性内容为主,对英文阅读理解水平要求较高,计算部分较少。

建议重点理解核心概念及框架逻辑,不能死记硬背。

Quantitative Analysis科目时间序列分析部分新增一个章节,对非平稳时

间序列展开讨论。

另外原二级市场风险中的相关性度量指标章节也加入其中。

原有重点考察章节即波动率模型移至估值与风险模型科目中进行考察。

虽然总体授课逻辑有些调整,但除上述具体内容外的其他考点变动较少。

总的来说,frm一级考试大纲2023相较于2022年,部分内容有所调整,

建议考生及时关注frm官方网站发布的大纲更新信息,以便更好地备考。

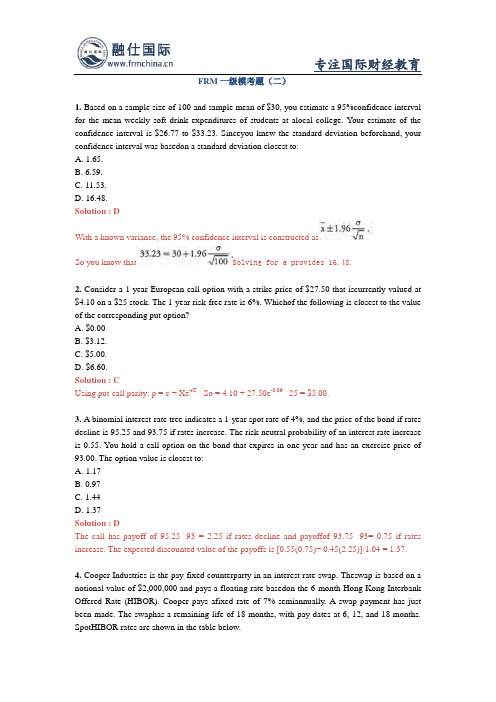

FRM一级模考题(二)

FRM一级模考题(二)1. Based on a sample size of 100 and sample mean of $30, you estimate a 95%confidence interval for the mean weekly soft drink expenditures of students at alocal college. Your estimate of the confidence interval is $26.77 to $33.23. Sinceyou knew the standard deviation beforehand, your confidence interval was basedon a standard deviation closest to:A. 1.65.B. 6.59.C. 11.53.D. 16.48.Solution : DWith a known variance, the 95% confidence interval is constructed asSo you know that Solving for a provides 16.48.2. Consider a 1-year European call option with a strike price of $27.50 that iscurrently valued at $4.10 on a $25 stock. The 1-year risk-free rate is 6%. Whichof the following is closest to the value of the corresponding put option?A. $0.00B. $3.12.C. $5.00.D. $6.60.Solution : CUsing put-call parity: p = c + Xe-rT - So = 4.10 + 27.50e-0.06 - 25 = $5.00.3. A binomial interest-rate tree indicates a 1-year spot rate of 4%, and the price of the bond if rates decline is 95.25 and 93.75 if rates increase. The risk-neutral probability of an interest rate increase is 0.55. You hold a call option on the bond that expires in one year and has an exercise price of93.00. The option value is closest to:A. 1.17B. 0.97C. 1.44D. 1.37Solution : DThe call has payoff of 95.25 -93 = 2.25 if rates decline and payoffof 93.75- 93= 0.75 if rates increase. The expected discounted value of the payoffs is [0.55(0.75)+ 0.45(2.25)]/1.04 = 1.37.4. Cooper Industries is the pay-fixed counterparty in an interest rate swap. Theswap is based on a notional value of $2,000,000 and pays a floating rate basedon the 6-month Hong Kong Interbank Offered Rate (HIBOR). Cooper pays afixed rate of 7% semiannually. A swap payment has just been made. The swaphas a remaining life of 18 months, with pay dates at 6, 12, and 18 months. SpotHIBOR rates are shown in the table below.The value of the swap to Cooper Industries is closest to:A. $0.B. $6,346.C. $17,093.D. $72,486.Solution : CThe fixed payments made by Cooper are (0.07 / 2) x $2,000,000 = $70,000. Thepresent value of the fixed payments == $67,762 + $65,398 + $1,849,747 = $1,982,907The value of the floating rate payments received by Cooper at the payment date is thevalue of the notional principal, or $2,000,000.The value of the swap to Cooper Industries is ($2,000,000 - $1,982,907) =$17,093.5. A stack-and-roll hedge as described in the Metallgesellschaft case is bestdescribed as:A. buying futures contracts of different expirations and allowing them to expirein sequence.B. buying futures contracts of different expirations and closing out the positionshortly before expiration.C. using short-term futures to hedge a long-term risk exposure by replacingthem with longer-term contracts shortly before they expire.D. using short-term futures contracts with a larger notional value than thelong-term risk they are meant to hedge.Solution : CA stack is a bundle of futures contracts with the same expiration. Over time, a firmmay acquire stacks with various expiry dates. To hedge a long-term risk exposure, a firmwould close out each stack as it approaches expiry and enter into a contract with a moredistant delivery, known as a roll. This strategy is called a stack-and-roll hedge and isdesigned to hedge long-term risk exposures with short-term contracts. Using short-termfutures contracts with a larger notional value than the long-term risk they are meant tohedge could result in "over hedging" depending on the hedge ratio.。

谈谈FRM中的信用衍生品种类

谈谈FRM中的信用衍生品种类作者:高顿财经讲师JackDPCDerivative product company(DPC)是银行或其他低等级衍生品交易商的高质量的附属机构,可以使母机构与更高等级的衍射品交易商交易。

用 mirror trade 与母公司的账面相匹配,但是当破产时,资产会和母公司相分离。

CDS信用衍生品是与信用事件相关的。

可以说其标的就是信用事件(注意如何区分信用衍生品)。

一般的信用衍生品有:1、违约互换(CDS)。

CDS 的买方会向卖方定期的支付现金流,直到发生了信用事件(模拟题)违约互换更加像一个期权的性质。

所以:Payment in a credit swap is contingent upon a future credit event. Payment i n a total rate of return swap is not contingent upon a future credit event(就是说信用互换的支付总是视未来信用事件而定,而总收益互换却不是视未来信用事件而定,因为总收益互换的支付取决于参考利率和资产的贬值情况,是取决于市场变量的)。

银行利用与准备金等值的违约互换就可以完全解放资本。

2、first-to-default put为组合中第一个违约的资产保险,不管哪一个,payoff 就是 par 或者 book value。

3、总收益互换是将资产的收益换取固定的现金流,只要求出两个利率的差值再乘以面值即可。

4、以资产作抵押的 credit-link-note 是与贷款组合的表现相联系,当贷款贬值时,CLN 的购买者也需要承担一部分风险。

5、价差期权的支付:max(0,到期日的价差-执行价差)*面值*duration。

6、信用中介互换是在两个不愿直接交易的参与者之间加入一个高质量的第三方,当没有违约或者有利的一方违约的时候,中介机构就会获利。

CLN信用联系票据(CLN)是一种附息票据,是将信用风险证券化的结果。

错题

C.文件系统管理的数据量较少,而数据库系统可以管理庞大的数据量

D.文件系统不能解决数据冗余和数据独立性问题,而数据库系统可以解决

3)在数据库三级模式中,对用户所用到的那部分数据的逻辑描述是()。A

A.外模式B.概念模式C.内模式D.逻辑模式

A.索引是一个指向表中数据的指针

B.索引是在元组上建立的一种数据库对象

C.索引的建立和删除对表中的数据毫无影响

D.表被删除时将同时删除在其上建立的索引

8)下面(C)文件不能与SQLServer数据库进行导入和导出操作。

A.文本文件B.Excel文件C.Word文件D.Access数据库

4)在数据库的安全性控制中,授权的数据对象的(B),授权子系统就越灵活。

6.4.(分值:6.7)将名为Sales数据库改为NewSales。ALTERDATABASESalesMODIFYNAME=NewSales

7.6.(分值:6.7)在工程1中有两个窗体,窗体Form1上有一个命令按钮Command1,单击

该按钮,Form1窗体消失,显示窗体Form2,补充以下程序:Private Sub Command1_Click()UnloadForm1MsgBox"显示form2"Form2.ShowEnd Sub

A: Image数据类型可以用来存储图像

B:使用字符数据类型时,可以改变长度信息

C:使用数字数据类型时,可以改变长度信息

D: Bit数据类型为1位长度,可以存储表示是/否的数据

23.(分值:1.0分)VB 6.0中RecordSet对象的UPDATE方法的作用是

A:在内存中开辟一个存放新记录的缓冲区

计算机语言与程序设计 试题库(含答案)

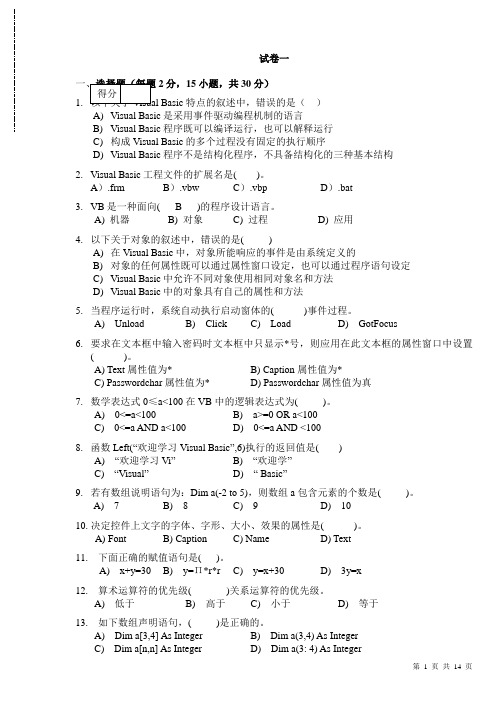

试卷一2分,15小题,共30分)1.特点的叙述中,错误的是()A)Visual Basic是采用事件驱动编程机制的语言B)Visual Basic程序既可以编译运行,也可以解释运行C)构成Visual Basic的多个过程没有固定的执行顺序D)Visual Basic程序不是结构化程序,不具备结构化的三种基本结构2.Visual Basic工程文件的扩展名是( )。

A).frm B).vbw C).vbp D).bat3.VB是一种面向( B )的程序设计语言。

A) 机器B) 对象C) 过程D) 应用4.以下关于对象的叙述中,错误的是( )A)在Visual Basic中,对象所能响应的事件是由系统定义的B)对象的任何属性既可以通过属性窗口设定,也可以通过程序语句设定C)Visual Basic中允许不同对象使用相同对象名和方法D)Visual Basic中的对象具有自己的属性和方法5.当程序运行时,系统自动执行启动窗体的( )事件过程。

A) Unload B) Click C) Load D) GotFocus6.要求在文本框中输入密码时文本框中只显示*号,则应用在此文本框的属性窗口中设置( )。

A) Text属性值为* B) Caption属性值为*C) Passwordchar属性值为* D) Passwordchar属性值为真7.数学表达式0≤a<100在VB中的逻辑表达式为( )。

A) 0<=a<100 B) a>=0 OR a<100C) 0<=a AND a<100 D) 0<=a AND <1008.函数Left(“欢迎学习Visual Basic”,6)执行的返回值是( )A)“欢迎学习Vi”B)“欢迎学”C)“Visual”D)“ Basic”9.若有数组说明语句为:Dim a(-2 to 5),则数组a包含元素的个数是( )。

FRM一级模考

FRM⼀级模考FRM⼀级模拟题1 . Which of the following is the riskiest form of speculation using options contracts?A. Setting up a spread using call options'B. Buying put optionsC. Writing naked call optionsD. Writing naked put optionsAnswer: CSelling an option is riskier than a spread or buying a put. In the case of selling a naked put option, the maximum loss equals the strike price. In the case of selling a naked call, the loss potential is unlimited, so it is the riskiest of the choices provided2 . A long position in a put option can be synthetically produced by:A. Long position in the underlying and a short position in a call.B. Short position in the underlying and a long position in a call.C. Long position in the underlying and a long position in a put.D. Short position in the underlying and a short position in a put.Answer: BA long put option has intrinsic value when the price of the underlying asset goes down. The payoff of a long put option is the same as the payoff of a short position in the underlying and a long position in the call. This synthetic alternative has value when the price of the under lying asset goes down . When the price of the underlying asset goes up, the call buyer will exercise and the call seller will need to liquidate the long position in the asset.3 . Consider a non-dividend paying stock currently priced at $37. It is known with certainty that over the next tw0 3-month periods, the price will either rise by 5% or fall by 5%. The continuously com pounded risk free rate is 7%. Calculate the value of a 6-month European call option with a strike price at $38.A. $1.065B. $1.234C. $1.856D. $2.710Answer: BThe binomial tree approach is shown as follows:4 . Consider a European call option on a non-dividend paying stock. T he current market price is $100, the strike price is $102, the time to maturity is 9 months and the risk free rate is 7.25%. Calculate the lower bound of the option price.A. $3.40B. $3.22C. $2.75D. $2.00Answer: A5 . Which of the following is most true about American options?A. Early exercise is never optimal.B. Early exercise of an American call. on a non-dividend paying stock is never optimal.C. Early exercise of an American put on a non-dividend paying stock is never optimal. 'D. Prior to exercise the value of the American call is always equal to the European call. Answer: BA stock's price drops following the payment of a dividend This reduces the value of a call. That'swhy it may make sense to exercise early if a stock pays a dividend。

构件库概述

内容提要

✓构件的描述与分类 ✓构件的验证 ✓构件的存储

构件的检索 ✓构件的评估与反馈 ✓互操作

构件的检索

✓ 基于外部索引的检索 ✓ 基于内部静态索引的检索 ✓ 基于内部动态索引的检索

基于外部索引的检索

✓ 采用控制词典、属性等外部索引对构件进行 检索

• 如:关键词检索、刻面检索和基于属性的检索 • 自动化支持

• ……

内容提要

✓构件的描述与分类 ✓构件的验证 ✓构件的存储 ✓构件的检索

构件的评估与反馈 ✓互操作

构件的评估与反馈

✓ 为什么要评估和反馈?

• 构件评估与反馈机制有助于用户从检索到的构件中选取 最符合自己需求的构件,提高选取的正确性和高效性。

• 对构件的度量结果也需要一套辅助分析决策支持的机制。

常见分类法(1)

✓ 关键词分类法

• 用一组与之相关的关键词编目。即每一个关键词 构成分类中子集合中元素的满足条件。

• 关键词(keyword)描述了构件所拥有的特征。 • 发布时,每个构件被赋予一组与之相关的关键词。 • 检索时,复用者给出描述所需构件的关键词,通

过关键词匹配查找满足需求的构件。

常见分类法(2)

✓ 分类信息: • 分类模式+分类取值

• 关键词分类法的某个分类模式中,分类取值为关键词 • 枚举分类法的某个分类模式中,分类取值为子领域名 • 属性值分类法的某个分类模式中,分类取值为(属性,值)对 • 刻面分类法的某个分类模式中,分类取值为(刻面,术语)对

✓ 检索分类条件表达式: • 原子检索分类条件表达式的逻辑组合(或,与,否) • 原子检索分类条件表达式:

• 领域专用构件库

• Ada软件库、电子商务软件库

• 软件资产库

FRM模型丨效用函数和风险偏好的辨析

FRM模型丨效用函数和风险偏好的辨析1.效用历史沿革效用的概念是丹尼尔·伯努利(不是数学家伯努利,但是他们都是伯努利家族的。

)在解释圣彼得堡悖论时提出的,目的是挑战以金额期望值作为决策的标准,证明期望收益并不是人们在做决策时的唯一衡量标准。

经济学家对于效用的理解是有一个过程的。

●19世纪的威廉姆·斯坦利·杰文斯、里昂·瓦尔拉斯和阿尔弗雷德·马歇尔等早期经济学家认为效用如同人们的身高和体重一样是可以测量的。

●而约翰·希克斯则尝试了只在序数性效用的假定下,也取得了很多的研究成果。

希克斯认为,效用的数值表现只是为了表达偏好的顺序,并非效用的数值。

因此,从分析消费者行为的方法来看,基数效用论者采用边际效用分析方法,序数效用论者采用无差异曲线分析方法。

从教科书等内容判断,现在比较通用的应该是后者的序数性效用。

1.1.效用概念的提出——圣彼得堡悖论圣彼得堡悖论是尼古拉·伯努利在1738年提出的一个概率期望值悖论。

它来自于一种掷币游戏,圣彼得堡游戏。

游戏规则为:掷出正面或者反面为成功,游戏者如果投掷成功,得奖金2元,游戏结束;若不成功,继续投掷,二次成功得奖金4元,游戏结束;这样,游戏者如果投掷不成功就反复继续投掷,直到成功,游戏结束。

如果n 次投掷成功,得奖金2n元,游戏结束。

首先,我们用公式1()k kk E X x p ∞==∑来计算这个游戏收益的数学期望值:23423411111()2222222222n n E X n n ==⨯+⨯+⨯+⨯++⨯= 从理论上来说,该游戏的期望值是无穷大的。

按照概率的理论,多次试验的结果将会接近于其数学期望。

这就出现了计算的期望值与实际情况的“矛盾”。

如果仅仅以期望值标准,我们将无法给这个游戏进行定价。

圣彼得堡悖论反映了决策理论和实际之间的差别。

人们总是不自觉地把模型与实际问题进行比较,但决策理论模型与实际问题并不是一个东西;圣彼得堡问题的理论模型是一个概率模型,它不仅是一种理论模型,而且本身就是一种统计的 “近似的”模型。

VB试题库

一.选择题1.窗体上有多个控件,在Form_Activate()事件过程中添加_____B_____语句,就可确保每次运行程序时,都将光标定位在文本框Text1上。

A.Text1.Text="" B.Text1.SetFocusC.Form1.SetFocus D.Text1.Visible=True2.语句Print "5*20"输出的结果是_____C____。

A."5*20" B.出现错误信息C.5*20 D.1003.不能打开代码窗口的操作是__B______。

A.双击窗体设计器的任何地方B.按下F4键C.单击工程窗口中的“查看代码”按钮D.选择“视图”下拉菜单中的“代码窗口”4.在VB中可以作为容器的是____B____。

A.Form、TextBox、PictureBoxB.Form、PictureBox、FrameC.Form、TextBox、LabelD.PictureBox、TextBox、ListBox5.能被对象所识别的动作与对象可执行的活动分别称为对象的___D_____。

A.方法、事件B.过程、方法C.事件、属性D.事件、方法6.计算下面的表达式,其值是___B_____。

CInt(4.5) * Fix(-3.81) + Int(4.1) * (5 Mod 3)4 -3 4 2A.-7 B.-4 C.-8 D.67.以下有关对象属性的说法中正确的是___D_____。

A.对象所有的属性都罗列在属性窗口列表中B.不同对象不可能有同名属性C.不同对象的同名属性取值一定相同D.对象的某些属性既可在属性窗口中设置,也可通过程序代码设置或改变8.要使定时器控件可以使用,需设置的属性是____B_____。

A.IntervalB. EnabledC. ValueD. Text9.在某过程中已说明变量a为Integer类型、变量s为String类型,过程中的以下四组语句中,不能正常执行的是 ____D____。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

FRM一级模拟题

1 . Which of the following statements regarding the lease rate in commodity futures contracts is incorrect?

I The lease rate is the return required by the lender in exchange for lending a commodity.

II Assuming it is positive, as the lease rate increases, the futures price for a commodity increases.

III In a cash-and-carry arbitrage, the lease rate is earned whether or not the underlying commodity is actually loaned.

IV Lease rates are similar to dividends paid lo the lender of a share of common stock.

V If the lease rate is less than the risk-free rate, the forward market is said to be in contango.

A . II and III

B . III and V

C . I, III, and V

D . II and IV

Answer: A

The lease rate is the amount that a lender requires as compensation for Jending a commodity. In determining the price of a commodity futures contract, the lease rate, 81, is subtracted from the risk-free rate, r, as follows:

Assuming a positive lease rate, the lease rate effectively reduces the futures price, all else constant.

This also assumes that there is an active market for lending the commodity underlying the futures contract. The lease rate can only be earned by actually lending the underlying commodity.

2 . .Consider the factors that affect the price of futures contracts on various commodities. Which of the following statements does not accurately describe the relationship between a commodity's futures price and its underlying factors?

A. Gold futures have an implicit lease rate which, because it is not actually paid by commodity borrowers, creates incentive to' hold physical rather than synthetic gold as ideal strategy to gain gold exposure.

B. Natural gas is produced relatively consistently but has seasonal demand, causing the futures price to rise steadily in the fall months, since natural gas is too expensive to store.

C. The cost of storing corn, which has relatively constant demand, causes the futures price to rise until the next harvest at which point the price falls.

D. Relatively constant worldwide demand for oil and its ability to be cheaply transported keep oil prices relatively stable in the absence of short-run supply and demand.

Answer: A

Gold futures have an implicit lease rate, because it is not actually paid by commodity borrowers, which creates incentive to hold physical rather than synthetic gold as ideal strategy to gain gold exposure.

Gold can be loaned out to financial intermediaries and other investors willing to pay the lease rate (the price for borrowing the gold) to the lender. Thus, holding physical gold requires the investor to forgo earning the lease rate while also incurring storage costs. Therefore, the ideal gold exposure strategy is generally to hold synthetic gold.

3 . The S&P 500 index is trading at l,025. The S&P 500 pays an expected dividend yield of l .2% and the current risk-free rate is 2.75%. The value of a 3-month futures contract on the S&P 500 index is closest to:

A. $1,028.98

B. $1,108.59

C. $984.86

D. $1,025.00

Answer: A

4 . Which of the following statements describing the role of a convenience yield in pricing commodity futures is true? The convenience yield:

I will cause contango in the futures pricing relationship.

II Effectively reduces the cost of carry in the futures pricing relationship.

III Eliminates the potential for arbitrage between the futures and spot price.

IV Accounts for additional costs for storing an asset in the futures pricing Relationship.

A. I only

B. II only

C. II, III, an d IV only

D. I and II only

Answer: B

The convenience yield suggests there is a benefit, or convenience, to owning the spot asset. This generally means the spot price of the underlying asset will be above the futures price (normal backwardation). The convenience yield serves to reduce the cost of carry in the futures pricing relationship. .

5 . Consider a 6-month futures contract on the S&P 500, and suppose the current value of the index is1330. Suppose the dividend yield is l.5% annually for the stocks underlying the index, and that the continuously compounded risk-free interest rate is 5.5% annually. What is the cost of carry for this futures contract?

A. 4.0%

B. -4.0%

C. 2.0%

D. -2.0%。