2015年ACCA考试《F1财务会计》辅导资料1

F1 ACCA 讲义

5. The syllabus of F1 (You can see the contents and relationships between parts of F1)

The business organisation, its stakeholders and the external environment (A)

END

F1

Stakeholders in business organisations

3. The common features of organisations

a b

c d e

Formal documented systems and procedures People specialization

Variety of objectives Inputs-processing-outputs Synergy

5. The types of organisations

• Non-governmental organisations

An independent voluntary association of people acting together for common purposes The primary objective of a NGO is not a commercial one but related to social, political or environmental issues.

5. The types of organisations

• Example question In which of the following organisation can one member dominate the organisation? A. Cooperatives B. Limited companies

accaf1考试真题及答案解析

accaf1考试真题及答案解析ACCA F1考试真题及答案解析ACCA(Association of Chartered Certified Accountants)是全球最大的会计师协会之一,其资格认证考试被全球广泛认可。

F1是ACCA专业资格中的第一门课程,也是全球近百万学员的入门课程。

那么,让我们来看一下一道ACCA F1考试真题及其答案解析。

真题:(以下是一道ACCA F1真题)Question 1:XYZ公司是一个制造业企业,正在考虑引进新的制造设备来提高生产效率。

分析师通过研究发现,按照目前的市场需求,这项投资预计将为该公司每年带来额外利润100,000美元,而新设备的购买价格为300,000美元。

分析师还预计,这台新设备的使用寿命为5年,并且整体投资的资本回收期为3年。

XYZ公司的资本成本为10%。

请回答以下问题:1. 计算并解释投资回报率(ROI)。

2. XYZ公司应该做出什么决策?为什么?答案解析:1. 投资回报率(ROI)的计算公式为:ROI = (项目收益 - 项目成本)/ 项目成本× 100%在该问题中,项目收益为100,000美元,项目成本为300,000美元。

代入公式计算得到:ROI = (100,000 - 300,000)/ 300,000 × 100%= -66.67%解析:投资回报率(ROI)为负数,表示该投资预计无法实现回报。

这意味着该投资计划对XYZ公司来说可能是一项高风险的决策。

2. XYZ公司应该认真考虑这个投资计划并权衡风险和回报。

尽管该投资计划的投资回报率为负数,但考虑到每年额外利润100,000美元,XYZ公司可能仍然希望提高生产效率和市场竞争力。

此外,新设备的使用寿命为5年,并且整体投资的资本回收期为3年,这也是XYZ公司考虑投资的因素。

最终决策取决于公司的战略目标、可用的资金和风险承受能力。

以上是对这道ACCA F1考试真题的解答和分析。

ACCA F1 Ch10 Identifying and prevending fraud

6. Money laundering

External fraud: 反洗钱

1 What is fraud?

‘deprivation by deceit’ (使用欺骗手段获取不当或非法利益)

‘a false representation of fact made with the knowledge of its falsity, or without belief in its truth, or recklessly careless, whether it be true or false’ (故意、无意或大意的错报)

Intentional misrepresentation

Understating expenses Manipulation of depreciation figures

Applying incorrect rates or inconsistent policies

Example: WorldCom

A fictitious member of staff added to the payroll list

Removal of funds or assets

Teeming theft of

and lading (截留挪用) cash or cheque receipts receipts conceals the theft the sales ledger

A.

Over-valuation of inventory

a) b) c)

Inventory records may be manipulated Deliveries to customers may be omitted Returns to suppliers may not be recorded

acca教材-ACCA F1 知识课程

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

12

The impact of technology on organisations

Homeworking and supervision

IT技术还使得部分工作得以在家里迚行,员工不用去上班。但这也带来了监管上的一 些问题。 -------------------------------------------------------------------------------------------------------------Outsourcing(外包)把一些非核心业务交给别人来做。

where the employee was employed.(公司全部关闭戒部分关闭导致的人员 冗余。) 2. The requirements of the business for employees to carry out work of a particular kind have ceased or diminished or are expected to.(流程改迚, 技术迚步导致的人员冗余。)

由内到外: 组织本身 经营环境(产业层面上的环境) 宏观环境(经济政治文化技术层 面的环境) 物理环境(整个以物质形态存在 的环境 )

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

3

The political and legal environment

9

Social and demographic trends

• Population and the labour market(人口数量,人口结构的变化,对劳劢力市场有 深刻长进的影响)

F1.Financial Reporting and TaxationCIMA F1教学大纲

《F1:Financial Reporting and Taxation》课程教学大纲课程编号: 02824制定单位:会计学院制定人:宋京津审核人:李宁制定时间: 2015年9月1日江西财经大学会计学院《F1:Financial Reporting and Taxation》课程教学大纲一、课程总述本课程大纲是以2014年会计本科专业人才培养方案为依据编制的。

二、教学时数分配三、单元教学目的、教学重难点和内容设置CHAPTER 1Regulation and conceptual frameworksLEARNING OBJECTIVES:1. Appreciate the IASB’s objectives and structure.2. Demonstrate the standard setting process.3. Identify the relationship between GAAP and conceptual framework.4. Understand the underlying assumptions: Accruals basis Going concern.FOCUSES AND DIFFICULTIES:The standard setting processThe elements of financial statementsCHAPTER OUTLINE:I.IASB’s objectivesII.IASB’s structure•The International Financial Reporting Interpretations Committee (IFRIC) •The Standards Advisory Council (SAC)•IASB and IOSCOIII.The standard setting processIV.The objective of financial statementsV.Underlying assumptions: Accruals basis Going concernVI.The elements of financial statementsVII.Qualitative characteristics of financial informationPresentation of published financial statementsLEARNING OBJECTIVES:1. Describe the different types of financial statements.2.Present the notes to the financial statements.FOCUSES AND DIFFICULTIES:Statement of financial positionStatement of profit or loss and other comprehensive incomeStatement of changes in equityCHAPTER OUTLINE:I.IAS 1: Presentation of financial statementsII.Proforma financial statementsIII.Notes to the financial statement required by IFRSIV.IAS 8: Accounting policies, changes in accounting estimates and errors V.IFRS8: Operating segmentsNon-current assetsLEARNING OBJECTIVES:1. Understand the definition, measurement and depreciation of PPE.2. Discuss the definition, measurement and amortisation of intangible assets.3. Understand the definition, recognition and measurement of investment properties.4. Discuss the transfers of investment properties.5. Discuss the approaches of determination of government grants.FOCUSES AND DIFFICULTIES:1. IAS 16: Property, plant and equipment2. Measurement after recognition: cost model vs. revaluation/fair value model3. Transfers of investment propertiesCHAPTER OUTLINE:I.IAS 16: Property, plant and equipment•Definition•Measurement at recognition•Measurement after recognitionCost modelRevaluation model•DepreciationII.IAS 38: Intangible assets•Definition•Measurement at recognition•Measurement after recognitionCost modelRevaluation model•AmortisationIII. IAS 40: Investment properties•Definition•Measurement at recognition•Measurement after recognitionCost modelFair value model•TransfersIV.IAS 20: Government grants•Definition•Capital vs. revenue grantsImpairment of assetsLEARNING OBJECTIVES:1. Recognize the recoverable amount.2. Recognize the cash-generating units (CGUs).3. Identify impairment indicators4. Recognize the losses in financial statements.5. Reverse the past impairmentsFOCUSES AND DIFFICULTIES:•Allocation of impairment losses for a CGU•Reverse the past impairmentsCHAPTER OUTLINE:I.Definitions•Impairment•Recoverable amount•Cash-generating unitsII.Recognition of impairment losses•Allocation of impairment losses for a CGU•Recognition of impairment losses in financial statements •Reversal of past impairmentsEmployee benefitsLEARNING OBJECTIVES:1. Understand the definitions of DC plan & DB plan.2. Discuss the recognition and measurement of DC plan.FOCUSES AND DIFFICULTIES:Appreciate the recognition and measurement of DB plan. CHAPTER OUTLINE:I.Defined contribution plan•Definition•Measurement•PresentationII.Defined benefit plan•Definition•Measurement•PresentationIAS 7: Statements of cash flowLEARNING OBJECTIVES:Understand the approach to prepare cash flow statements.FOCUSES AND DIFFICULTIES:Present the operating cash flows.CHAPTER OUTLINE:I.Investing activities•Investment of PPEII.Financing activities•Issuance of sharesIII.Operating activities•Indirect method: adjustments•Income taxes paid•Interest and dividends paidGroup accounts: An introductionLEARNING OBJECTIVES:1. Discuss the types of acquisition.2.Discuss the concept of group financial statements3. Appreciate the relevant definitions.FOCUSES AND DIFFICULTIES:Definition of subsidiaryCHAPTER OUTLINE:I. Types of acquisitionIII. Concept of group financial statementsIV. Definition of subsidiarySUBSIDIARY = CONTROLV. Exemption from preparing consolidated financial statements•it is itself a wholly-owned subsidiary, or is partially-owned with the consent of the minority interest; and•its debt or equity instruments are not publicly traded; and•it did not or is not in the process of filing its financial statements with a regulatory organisation for the purpose of publicly issuing financial instruments; and•the ultimate or any intermediate parent produces consolidated financial statements available for public use that comply with IFRS.Group accounts: Preparation of the consolidated statement of financial positionLEARNING OBJECTIVES:1. Understand how to prepare the consolidated balance sheet2. Understand the trading transactions.3. Discuss the other intra-group transactions.FOCUSES AND DIFFICULTIES:•Calculation of fair value•Calculation of goodwill•Calculation of post-acquisition reserves•Inventories sold at profit within the groupCHAPTER OUTLINE:I.Investment elimination and goodwill•Date of acquisition•Calculation of goodwill•Impairment testingII.Fair value of net assets of subsidiaryIII.Trading transactions•Intra-group balances•Reconciliation of intra-group balances•Inventories sold at profit within the groupIV.Approach to the consolidated statement of financial positionGroup accounts: Preparation of the consolidated comprehensive income statementLEARNING OBJECTIVES:Understand the approach to prepare the consolidated income statement.FOCUSES AND DIFFICULTIES:Discuss the steps to prepare the consolidated income statement.CHAPTER OUTLINE:V.PurposeVI.Intra-group tradingVII.Approach to the consolidated income statement。

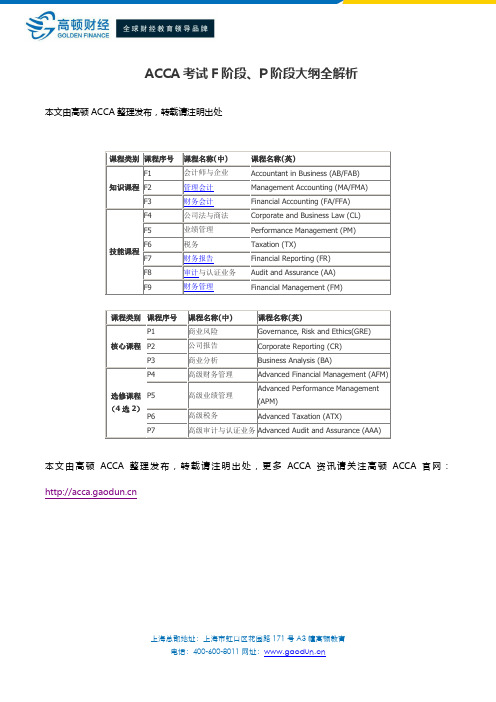

ACCA考试F阶段、P阶段大纲全解析

本文由高顿ACCA整理发布,转载请注明出处

课程类别

课程序号

课程名称(中)

课程名称(英)

知识课程

F1

会计师与企业

Accountant in Business (AB/FAB)

F2

管理会计

Management Accounting (MA/FMA)

F3

财务会计

Financial Accounting (FA/FFA)

本文由高顿ACCA整理发布,转载请注明出处,更多ACCA资讯请关注高顿ACCA官网:

选修课程

(4选2)

P4

高级财务管理

Advanced Financial Management (AFM)

P5

高级业绩管理

Advanced Performance Management (APM)

P6

高级税务

Advanced Taxation (ATX)

P7

高级审计与认证业务

Advanced Audit and Assurance (AAA)

技能课程

F4

公司法与商法

Corporate and Business Law (CL)

F5

业绩管理

Performance Management (PM)

F6

税务

Taxation (TX)

F7

财务报告

Financial Reporting (FR)

F8

审计与认证业务

Audit and Assurance (AA)

F9

财务管理

Financial Management (FM)

课程类别

课程序号

课程名称(中)

acca考试复习题

acca考试复习题在准备ACCA(特许公认会计师公会)考试的过程中,理解和掌握关键概念、原则和应用是至关重要的。

以下是一组复习题,旨在帮助学生巩固知识点并提高解题能力。

1. 财务会计与报告(FAR)- 简述财务报表的四个基本要素,并解释它们在财务报告中的作用。

- 描述会计准则在编制财务报表中的重要性,并举例说明其对企业决策的影响。

- 解释什么是权责发生制,以及它如何影响收入和费用的确认。

2. 管理会计(MA)- 阐述成本分类的不同方法,并解释它们在决策过程中的应用。

- 描述预算编制的过程,并讨论预算在企业资源分配中的作用。

- 简述标准成本计算的目的,并解释如何使用标准成本进行成本控制。

3. 财务报告(FR)- 描述国际财务报告准则(IFRS)的主要特点,并讨论其对全球会计实践的影响。

- 解释资产减值测试的步骤,并讨论其在财务报告中的重要性。

- 讨论合并财务报表的编制过程,包括合并范围的确定和合并调整。

4. 审计与保证(AA)- 简述审计的基本概念,包括审计目标、审计证据和审计风险。

- 描述内部控制的作用,并讨论如何评估一个组织的内部控制体系。

- 解释审计师在发现和报告财务报表中的欺诈行为中的角色和责任。

5. 税务(TX)- 阐述个人所得税和公司税的基本区别,并讨论它们对企业财务规划的影响。

- 描述增值税(VAT)的工作原理,并解释其对消费者和企业的影响。

- 讨论税务筹划的基本原则,并举例说明如何合法地减少税负。

6. 企业法与公司法(LW)- 描述公司法对公司治理结构的要求,并讨论其对企业决策过程的影响。

- 阐述合同法的基本原则,并讨论它们在商业交易中的应用。

- 解释知识产权法的重要性,并讨论它如何保护企业的创新成果。

7. 企业战略与创新(CS)- 描述企业战略规划的过程,并讨论其对企业长期发展的影响。

- 阐述创新在企业战略中的作用,并讨论如何通过创新提高企业的竞争力。

- 讨论企业社会责任(CSR)的概念,并解释企业如何通过履行社会责任来增强其品牌形象。

ACCAF1考试-会计师与企业(基础阶段)历年真题精选及详细解析1109-9

ACCAF1考试-会计师与企业(基础阶段)历年真题精选及详细解析1109-91.The IASB\'s Conceptual Framework for Financial Reporting gives six qualitative characteristics offinancial information. What are these six characteristics?A Relevance, Faithful representation, Comparability, Verifiabilit, Timeliness and UnderstandabilityB Accuracy, Faithful representation, Comparability, Verifiability, Timeliness and UnderstandabilityC Relevance, Faithful representation, Consistency, Verifiability, Timeliness and UnderstandabilityD Relevance, Comparability, Consistency, Verifiability, Timeliness and Understandability答案:A2. Listed below are some comments on accounting concepts.1 Financial statements always treat the business as a separate entity.2 Materiality means that only items having a physical existence may be recognised as assets.3 Provisions are estimates and therefore can be altered to make the financial results of a business more attractive to investors.Which, if any, of these comments is correct, according to the IASB\'s Conceptual Framework for Financial Reporting?A 1 onlyB 2 onlyC 3 onlyD None of them答案:A3. Listed below are some characteristics of financial information.1 Relevance2 Consistency3 Faithful representation4 AccuracyWhich of these are qualitative characteristics of financial information according to the IASB\'s Conceptual Framework for Financial Reporting?A 1and2onlyB 2 and 4 onlyC 3 and 4 onlyD 1 and 3 only答案:D4. Which ONE of the following statements describes faithful representation, a qualitative characteristic of faithful representation?A Revenue earned must be matched against the expenditure incurred in earning it.B Having information available to decision-makers in time to be capable of influencing their decisions.C The presentation and classification of items in the financial statements should stay the same from one period to the next.D Financial information should be complete, neutral and free from error5. According to the IASB\'s Conceptual Framework for Financial Reporting, which TWO of the following are part of faithful representation?1 It is neutral2 It is relevant3 It is presented fairly4 It is free from material errorA 1and2B 2and3C 1and4D 3and4。

2015年12月ACCA考试F4讲义(二)

2015年12月ACCA考试F4讲义(二) 12月ACCA考试就要到了,为了方便大家更好地复习12月ACCA F4考试,小编在百度文库定期传一些考试资料,如有需要请关注财萃财经的百度文库。

Session 3 Types of cost and cost behaviorMain contents:1. Classifying costs2. Cost objects, cost and cost centers3. Analysis of costs into fixed and variable elements3.1 Classifying costsCosts can be classified in a number of different ways:·Element –costs are classified as materials, labor or expenses (overheads)·Nature –costs are classified as being direct or indirect.a. Direct cost is expenditure that can be directly identified with a specific cost unit or cost center.(1). Direct material is all material becoming part of the product unless used in negligible amount and/or having negligible cost. (component parts, part finished work and primary packing material)(2). Direct wages –are wages paid for labor either as basic hours or as overtime expensed on the product line.(3). Direct expense are any expense which are incurred on a specified product other than direct material and direct labor.b. Indirect costs/ overheads; are expenditure that can not be directly identified with a specific unit or cost center and must be ‘shared out’on an equitable basis.·Behavior –costs are classified as being fixed, variable, semi-variable or stepped fixed.a. Fixed costs: are costs that are not affected in total by the level of activity, but remain the same.b. Variable costs: are the costs that change in total in direct proportion to the level of activity.c. Semi-variable/semi-fixed/mixed costs: are costs which contain both fixed and variable components and so it partly affected by changes in the level of activity.d. Step costs: are fixed in nature but only within certain level of activity.·Function: costs are classified as being production or non-production costs.e. Production costs: are costs included in a stock valuation. The product cost is the cost of making or buying.f. Period costs (general cost): are costs that are not attributed to product costs, but instead are treated as a cost of the time period when they arise.·Other cost classification:Avoidable cost: cost which can be eliminated by changing operationsUnavoidable cost: cost which will not be changed by decision making.Controllable cost: those cost controllable by a particular manager in a given period.Uncontrollable cost: any cost that can not be affected by management within a given period.COST MODEL: $Direct material: 2Direct labor 3Direct expense 1Direct cost 6Production overhead (Note) 1Total production cost 7Administration Overhead 1Selling and distribution Overhead 1Total cost 9Note: Production overhead includes indirect material, indirect labor and indirect expense.3.2 Analyzing costs:Cost objects: a cost object is any activity for which a separate measurement of cost is undertaken.Cost units: a cost unit is a unit of product or service in relation to which costs are ascertainedResponsibility centers: a department whose performance is the direct responsibility of a specific manager.The main responsibility centers are:·Cost center –the performance of a cost center manager is judged on the extent to which cost targets have been achieved.·Revenue center –Within an organization, this is a centre or activity that earns sales revenue. And whose manager is responsible for the revenue earned but not for the costs incurred.·Profit center – a part of the business whose manager is responsible and accountable for both costs and revenue. The performance of a profit center manager is measured in terms of the profit made by the centre.·Investment centre– a profit centre with additional responsibility for investment and possibly also for financing, and whose performance is measured by its return on capital employed.(ROCE).Cost equations:Equation of a straight lineThe equation of a straight line is a linear function and is represented by the following equation:Y = a + bxTotal cost = Total FC + Total VCY= a + bx·Y = total cost· a = the fixed cost for the given period · b = the variable cost per unit·x = the number of units of activity Cost graphsCost and revenue $。

FM 辅导课件文稿基础会计学

FM365辅导课件文稿基础会计学前言第一章总论第一节会计的基本概念第二节会计的对象第三节会计的任务第四节会计核算的基本前提第五节会计核算的一般原则第六节会计核算的方法第二章会计科目和账户第一节会计要素第二节会计等式第三节会计科目第四节账户及其基本结构第三章复式记账第一节复式记账原理第二节借贷记账法第四章账户和借贷记账法的应用第一节工业企业的主要经济业务第二节资金筹集业务的核算第三节生产准备业务的核算第四节产品生产业务的核算第五节产品销售业务的核算第六节财务成果业务的核算第五章账户的分类第一节账户按经济内容的分类第二节账户按用途和结构的分类第六章会计凭证第一节会计凭证的意义和种类第二节原始凭证的填制和审核第三节记账凭证的填制和审核第四节会计凭证的传递和保管第七章账簿第一节账簿的意义和种类第二节账簿的设置与登记第三节账簿登记和使用的规则第四节结账和对账第八章会计核算形式第一节会计核算形式的意义第二节记账凭证核算形式第三节科目汇总表核算形式第四节多栏式日记账核算形式第五节汇总记账凭证核算形式第六节日记总账核算形式第七节通用日记账核算形式第九章财产清查第一节财产清查的意义和种类第二节财产清查的方法第三节财产清查结果的处理会计报表会计报表的作用、种类和编制要求财务状况报表财务成果报表财务评价指标几其计算第十一章会计工作的组织第一节组织会计工作的意义和要求第二节会计机构第三节会计人员第四节会计法规制度第五节会计电算化三套模拟题辅导基础会计学前言下面我们开始学习基础会计课程,在讲课之前我先说一下学习这门课程应该注意的问题,基础会计学是全国高等教育自学考试会计专业方向的专业基础课,也是学习工业企业管理、商业企业管理、财政、税收、金融、统计等专业共同学习的一门基础课,本课程自学考试指定的教材是由全国高等教育考试指导委员会组编,由王俊生主编的基础会计学,中国财政经济出版社出版。

为了讲课方便,我们选用了一九九九年十二月第一次印刷的三十二开本的教材,学习本课程必须明确课程的性质和学习的目的、课程体系结构、学习要求和学习方法。

ACCAF1知识点总结

ACCAF1知识点总结ACCA F1是《管理会计基础》(Fundamentals of Business Mathematics and Financial Accounting)的考试科目,也是ACCA资格认证的第一门科目。

以下是ACCA F1考试的知识点总结:1.经济和商业环境:-经济体系及其类型-供需关系-国际贸易-经济增长和就业-货币和货币政策-通货膨胀和利率2.成本与管理会计基础:-成本和费用的概念与分类-成本-收益分析-边际成本与边际收益-战略与战术成本-成本预测与变动成本-学习曲线3.管理会计制度和方法:-不同类型的管理会计信息-管理会计的目的和特点-管理会计条例与道德-成本-利润-利润关系-预算与预算控制-绩效评估和激励4.财务会计和财务报表:-财务会计的目的和特点-财务记录和凭证-会计方程式和会计周期-货币和计量概念-资产负债表和利润表的解读-现金流量表5.财务分析和财务比率:-财务分析的目的和方法-比率分析和比率计算-经营和财务风险-财务健康和稳定性分析-盈利能力和效率分析6.提供财务信息:-需要财务信息的利益相关者-可比性和一贯性原则-隐含与显性假设-外部财务报告-内部财务报告7.管理信息系统:-信息系统的组成和功能-数据的收集和处理-数据库和数据仓库-信息系统的设计和实施-信息系统的风险和控制8.管理与决策科学:-决策的类型和过程-优化和约束问题-边际分析和边际效益-敏感性分析和决策树-风险分析和决策9.商业伦理和社会责任:-伦理的定义和原理-伦理决策模型-商业伦理的重要性-伦理决策和社会责任-可持续发展和企业道德ACCAF1考试主要考察考生对管理会计和财务会计的基本概念和方法的理解与应用能力。

考生需要熟悉各种会计和管理会计方法,并能够解读和分析财务信息和财务报表。

此外,考生还需要了解企业的商业环境和相关的伦理和社会责任问题。

参加ACCAF1考试前,考生需要充分准备,并掌握上述知识点。

ACCA F阶段知识整理

ACCA F阶段知识整理ACCA考试科目一共有13门,其中F阶段考试科目一共占了9门课程,其中的重要性不言而喻,那么F阶段和P阶段有什么关联呢?P阶段应该如何选择呢?带着这些疑问一起和高顿ACCA来看看吧。

给大家整理了一套电子版ACCA备考资料,里面有很多ACCA考试资料可供大家选择。

而且在对于上班族来说,电子版的也很适合在地铁上查阅:电子版ACCA 备考资料F1 Accountant in Business这一门倾向于管理方面,课程难度不大,很多常识性的知识点,但是毕竟是ACCA第一门考试,所以刚开始大多数同学都会对很多专业词汇的英文表述不熟悉,加上F1中的知识点比较细碎,因此加大了学习的难度。

建议大家把每章的知识点自己做一个梳理总结,每一章节整理出大框架,可以很好地帮助本科的学习。

F2 Mangement Accounting这一门课是管理会计,课体总体难度不大,差异分析的部分可能有些难度,另外一些财务比率的计算需要掌握,为以后的学习打好基础。

F3 Financial Accounting这一门课是财务会计,属于基础会计学,其中会涉及到会计科目、会计分录、丁字账、试算平衡表等等一系列会计基础知识,对于没有会计基础的同学一开始会觉得一头雾水,但是入了门之后这门课程难度并不算大。

这一门课程是之后F7和P2的学习基础,一定要掌握知识点,同时积累英语专业词汇。

F4 Corporate and Business Law英美法系和大陆体系的不同在于他们使用的是判例法,因此F4中涉及到不同年代各种法律案例,并且有很多专业词汇。

以判例法为主考试难度感觉是在上升,但是通过率在上升F5 Performance Management这门课是管理会计的进阶,对于F2基础打得好的同学拿下这门课应该不在话下。

这门课程总体难度不大,重点在于掌握不同成本法及业绩评价方法的应用。

F6 Taxation这门课90%以上都是计算,是中国考生最拿手的地方。

ACCA(F1-F3)学习方法总结

ACCA(F1-F3)学习方法总结ACCA共有16门课程,其中基础阶段主要分为知识课程和技能课程两个部分。

知识课程主要涉及财务会计和管理会计方面的核心知识,也为接下去进行技能阶段的详细学习搭建了一个平台。

F1-F3由于是ACCA全部课程体系内容中最为基础的三门课程,又作为财务会计体系中的入门课程,知识难度并不高,同时通过考试的压力也并不大。

F1:Accountant inBusiness(AB)F1这门课的内容很杂,主要涉及到以下三门主要学科:组织行为学,人力资源管理,会计和审计。

F1要求学生学习时一定要通看课本和老师讲义,而且应该做大量阅读,注意广度,以理解为主,不要对某方面知识死钻牛角尖。

F1的学习绝对不可猜题,复习时也绝对不可有遗漏或空白。

学习方法:1.完整学习网课内容,理解和记忆主要知识点,勤做笔记,完成练习,加深对知识点的认识和印象。

章节结束及时总结,清晰每章内容和关键知识点,完成讲义的自我梳理和配套的练习,熟悉每章的知识结构。

实战练习,熟悉考点,把握基本的答题规律2.对基础知识进行梳理,对知识点有整体把握。

根据冲刺串讲课程,复习精要知识点,复述相关概念。

整理第一阶段的错题,查漏补缺,加强薄弱环节。

3.罗列复习纲要,对知识点进行复述式记忆,发现薄弱知识点,进行答疑和重新梳理。

对所有错题所考查的知识点再次梳理,对不熟悉和遗漏的知识点多次记忆。

对样卷和ACCA官网模拟题进行仿真训练,严格控制考试时间,并自我认真审阅。

F2:Management Accounting(MA)F2主要向学员介绍成本会计和管理会计的体系,以及管理会计如何发挥支持企业计划、决策、控制的作用。

主要包括:管理会计起源、成本的分类、成本核算的方法、预算控制、差异分析、绩效评估相关知识点。

学习方法:1.报了网课或者面授的话,那么聆听老师的讲解是非常重要的。

对于老师发下来的讲义一定要认真研读,讲义往往是老师对于这门课的精炼总结,涵盖了所有的考点,仔细研究讲义可以专注于对高频考点的学习、提高学习效率,同时也能节省自己的时间和精力。

ACCA考试题型+分值构成分析(F1

ACCA考试题型+分值构成分析(F1ACCA F1 (机考)考试科目 : 企业会计时间 : 2 hours ;通过分数 : 50 ,F1 考试包含2个sections:Section A :46 道题目,其中30道题,每题2分;16道题,每题1分。

总分值是76分。

Section B :6道题目,每道题目4分。

总分值24分。

所有的题目都是必做题。

ACCA F2 (机考)考试科目 : 管理会计时间 : 2 hours 通过分数 : 50 ; F2 考试包含2个sections:Section A :25道题目,每道题目2分。

总分值是70分。

Section B :3道题目,每道题目10分。

总分值是30分。

ACCA F3 (机考)考试科目 : 财务会计时间 : 2 hours 通过分数 : 50,F3 考试包含2个sectionsSection A : 25道题目,每道题目2分。

总分值是70分。

Section B : 3道题目,每道题目10分。

总分值是30分。

ACCA F4 (机考 & 纸考)考试科目 : 企业法和商法时间 : 2 hours 通过分数 : 50 ,F4包含2个sectionsSection A : 45道题目,其中25道题,每题2分;20道题,每题1分,总分值是70分。

Section B : 5道题目,每道题目6分。

总分值30分。

ACCA F5 (机考 & 纸考)考试科目:绩效管理时间: 3 hours 通过分数: 50,F5包含了3个sectionsSection A : 15道客观题,每题2分,总分30分。

Section B : 3道案例题,每道案例题由5道客观题构成,每题2分,总分30分Section C : 2道案例分析题,每题20分,总分40分。

ACCA F6 (机考 & 纸考)考试科目:税法(UK版本)时间: 3 hours 通过分数:50,F6包含了3个sections:Section A : 15道客观题,每题2分。

accafa复习资料

accafa复习资料ACCA(特许公认会计师)是全球范围内最具影响力和最受尊敬的会计资格之一。

作为一个综合性的会计考试,ACCA考试涵盖了会计、财务管理、税务、审计等多个领域,对考生的知识、技能和职业素养都有较高的要求。

为了帮助考生顺利通过ACCA考试,复习资料是必不可少的工具。

ACCA复习资料的重要性不言而喻。

首先,ACCA考试的内容庞杂繁多,涉及的知识点广泛而深入。

复习资料可以帮助考生系统地整理和梳理知识点,帮助他们建立起完整的知识框架。

同时,复习资料还可以提供大量的例题和习题,帮助考生巩固所学知识,并培养解题的能力和技巧。

其次,ACCA考试的难度较高,要求考生具备较强的学习能力和应试能力。

复习资料可以帮助考生找到合适的学习方法和策略,提高学习效率。

通过对历年真题的分析和总结,复习资料可以帮助考生把握考试的重点和难点,从而有针对性地进行复习。

同时,复习资料还可以提供一些解题技巧和策略,帮助考生在有限的时间内完成考试,并取得好成绩。

此外,ACCA考试的通过率相对较低,竞争也较为激烈。

复习资料可以帮助考生了解考试的评分标准和要求,从而提高答题的准确性和针对性。

通过对模拟考试和模拟题的训练,复习资料可以帮助考生熟悉考试的形式和要求,增加应试经验,提高应试能力。

然而,ACCA复习资料的选择也是一门学问。

首先,考生应该选择权威可靠的复习资料。

ACCA官方提供的复习资料是首选,因为它们与考试内容和要求最为契合。

其次,考生还可以选择一些知名的培训机构提供的复习资料。

这些资料经过专业的整理和编辑,质量和可靠性相对较高。

此外,考生还可以通过参加培训课程来获取复习资料。

培训课程通常会提供讲义和课件,帮助考生理解和掌握考试的知识点。

除了选择合适的复习资料,考生还应该制定合理的复习计划。

复习计划应该根据考试的时间安排和自身的学习进度来制定,合理安排每天的学习时间和内容。

在复习过程中,考生应该注重理论与实践的结合,既要掌握理论知识,又要进行大量的习题训练和模拟考试。

ACCA F1 重点词汇大全

ACCA F1 重点词汇大全1. Accountablity 责任2. Accounting 会计3. Activist 积极分子4. Ad hoc 临时5. Advocacy 辩护6. Agency theory 代理理论7. Aggregate demand 总需求8. Aggregate supply 总供给9. Apprisal 评估10. Artefact 人工11. Asset 资产12. Audit 审计13. Audit committee 审计委员会14. Audit trail 审计追踪15. Authority 权威16. Back-up 备份17. Balance of payment 国际收支平衡18. Bargaining power 讨价还价能力19. Belief 信仰20. Bonus scheme 奖金制度21. Boundaryless 无边界组织22. Budget 预算23. Business cycle 商业周期24. Business strategy 商业战略25. Capital 资本26. Capital expenditure 资本性支出27. Capital market 资本市场28. Centralization 集权29. Coach 教练30. Coercive 强迫31. Committee 委员会32. Competence 称职33. Compliance 遵守34. Confidentiality 保密性35. Conflict of interest 利益冲突36. Consensus 一致37. Consumer price index (CPI) 居民消费价格指数38. Consumer surplus 消费者剩余39. Contingency 权变40. Corporate 合作41. Corporate social responsibility (CSR) 企业社会责任42. Code of ethics 行为规范43. Cyclical unemployment 周期性失业44. Data 数据45. Decentralization 分权46. Delayering 简化管理结构47. Delegation 授权48. Demand 需求49. Demand curve 需求曲线50. Deontology 义务论51. Depression 萧条52. Direct discrimination 直接歧视53. Dismissal 辞退54. Diversity 多样性55. Dorming 调整期56. Double-entry bookkeeping 复式记账法57. Egoism 利己主义58. Elasticity 弹性59. Empowerment 授权60. Entrepreneurial 企业家61. Environmental footprint 环境脚印62. Equilibrium price 平衡价格63. Ethics 道德64. Exchange rate 汇率65. Executive director 执行董事66. External 外部67. Feedback 反馈68. Fiduciary responsibility 诚信义务69. Finance function 财务部70. Financial accounting 财务会计71. Financial statement 财务报表72. Firm 企业73. Fiscal policy 财政政策74. Flat organization 扁平结构75. Fraud 舞弊76. Frictional unemployment 摩擦性失业77. Generally Accepted Accounting Practice (GAAP) 美国通用会计准则78. Governance principle 治理原则79. Grievance 委屈80. Gross Domestic product 国内生产总值81. Gross National product 国民生产总值82. Group thinking 团队思维83. Hawthorne Study 霍桑实验84. Hollow organization 中空组织85. Honesty 诚实86. Hospitablity 热情87. Human Resourse Management (HRM) 人力资源管理88. Hygiene 保健89. Imperfect competition 不完全竞争90. Inbound logistic 向内运输91. Incentive 刺激92. Income 收入93. Induction 入职培训94. Inferior good 劣质产品95. Inflation 通货膨胀96. Inseparability 不可分割97. Intangibility 无形98. Integrity 诚实99. Intellectual 智商100. Interest rate 利率101. Internal audit 内审102. Internal control 内控103. International Accounting Standard Board (IASB) 国际会计准则理事会104. International Federation of Accountant (IFAC) 国际会计师联合会105. Interpersonal 人际106. Interview 面试107. Intimidation 恐吓108. Intrinsic 内部109. Job enlargement 工作扩大化110. Job enrichment 工作丰富化111. Job rotation 工作轮岗制112. Joint committee 联合委员会113. Judgement 判决114. Leadership 领导力115. Learning process 学习过程116. Liablity 负债117. Limited liability 有限责任118. Litigation 诉讼119. Lowballing 虚报低价120. Macroeconomic 宏观经济121. Management 管理122. Marginal utility 边际效益123. Market 市场124. Matrix 矩阵125. Mentor 导师126. Middle line 企业中层127. Microeconomic 微观经济128. Minimum wage 最低工资标准129. Module 模块130. Monetary policy 货币政策131. Money laundering 洗钱132. Monopolistic competition 垄断竞争133. Monopoly 垄断134. Morale 士气135. Motivation 激励136. Mourning 悲哀137. Multiplier effect 乘数效应138. Nomination committee 提名委员会139. Non-current asset 固定资产140. Non-governmental organization 非政府组织141. Norm 原则142. Objectivity 客观143. Offshore 离岸144. Oligopoly 寡头垄断145. Operational 运营146. Organization 组织147. Outbound logistic 向外运输148. Output 输出149. Oursource 外包150. Overhead 间接成本151. Ownership 所有权152. Partnership 合伙制153. Password 密码154. Payable 应付账款155. Payroll 工资156. Perception 感知157. Performance management 业绩管理158. Personality 性格159. Political 政治160. Price mechanism 定价机制161. Priortization 优先162. Privacy 隐私163. Probity 诚实164. Process 流程165. Procurement 采购166. Product life cycle 产品生命周期167. Professional 专业168. Profit 利润169. Project 项目170. Public sector 公共部门171. Purchasing 采购172. Quality control 质量控制173. Rate of unemployment 失业率174. Rational 理性175. Raw material 原材料176. Receivable 应收账款177. Recession 衰退178. Recovery 恢复179. Recruit 招聘180. Redundancy 裁员181. Relativism 相对主义182. Reputation 声誉183. Remuneration 薪酬184. Resignation 辞职185. Reward 奖励186. Retail Price Index (RPI) 居民消费价格指数187. Sarbanes-Oxley Act 萨班斯法案188. Scalar chain 层级链189. Selection 选拔190. Share capital 实收资本191. Shareholder 股东192. Social class 社会层级193. Sole trader 个体户194. Span of control 控制维度195. Spreadsheet 电子表格196. Stagflation 停滞性通货膨胀197. Stakeholder 企业利益相关者198. Strategy 战略199. Substitute 替代品200. Supervision 监督201. Supply 供给202. Synergy 协作203. Taxation 税务204. Team building 团队建设205. Teeming and lading 拆东墙补西墙206. Theorist 理论家207. Transparancy 透明208. Treasury 财政209. Uncertainty 不确定性210. Unemployment 失业211. Utilitarianism 功利主义212. Valence 效价213. Value chain 价值链214. Variable 变量215. Victimisation 受害216. Whistleblow 告密者217. Working capital 营运资本218. World Trade Organization (WTO) 世界贸易组织由东亚国际ACCA金牌讲师——孔令裔精心整理。

ACCA考试复习资料推荐

ACCA考试复习资料推荐ACCA(Association of Chartered Certified Accountants)考试是国际上享有盛誉的会计资质认证考试。

通过ACCA考试,可以获得全球范围内认可的专业会计资格。

为了帮助考生高效备考ACCA考试,本文将推荐一些值得使用的复习资料。

一、教材类资料1. Kaplan学习资料:Kaplan是ACCA考试备考领域的知名机构,其提供的教材以内容全面、讲解详细而著称。

Kaplan的教材包含了每一门考试科目的重点知识点和考点,还有大量练习题和模拟考试题,非常适合考生进行系统性的学习和巩固。

2. BPP教材:BPP也是ACCA备考教材领域的翘楚,其教材内容准确、深入浅出,被广大考生所推崇。

BPP的教材结构清晰,理论和实践相结合,适用于各个考试科目的学习。

二、题库类资料1. ACCA 官方题库:ACCA官方题库包含了大量的过往考试真题和模拟考试题,具有很高的可信度和代表性。

通过做官方题库,考生可以对考试的难度和考点有更加准确的把握,同时也可以熟悉考试的时间要求。

2. ACCA 培训机构提供的题库:许多ACCA培训机构会提供自制的题库,这些题库经过精心整理和筛选,具有一定的难度和质量保证。

通过做这些题库,考生可以更好地了解各个知识点的考察形式和难度,进行针对性的复习。

三、讲义类资料1. ACCA 培训机构提供的讲义:ACCA培训机构一般会提供自编的讲义,这些讲义通常会根据各个考试科目的内容进行整理和编写,内容简明扼要,并配有重点知识点和案例分析。

这些讲义可以作为复习和备考的参考资料,帮助考生更好地理解和掌握考试内容。

2. ACCA 官方教材补充讲义:ACCA官方教材中有时会包含一些附加的讲义,用于解释和扩展主教材的知识点。

这些讲义内容丰富,且与教材内容相互补充,有助于加深对知识点的理解和记忆。

四、在线学习资源1. ACCA官方网站:ACCA官方网站上提供了大量的考试信息和学习资源,包括考试介绍、报考指南、考试教材等。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2015年ACCA考试《F1财务会计》辅导资料1

本文由高顿ACCA整理发布,转载请注明出处

Chapter 1

The business organisation

Chapter learning objectives

Upon completion of this chapter you will be able to:

§ define the term organisation

§ explain the need for a formal organisation

§ distinguish between different types of organisation

§ summarise the main areas of responsibility for different functions within an organisation

§ explain how different departments co-ordinate their activities

§ explain the nature and process of strategic planning

§ explain the purpose of each level of organizational management.

1 The nature of organisations

1.1 What is an organisation?

‘Organisations are social arrangements for the controlled performance of collectiv e goals.’ (Buchanan and Huczynski)

The key aspects of this definition are as follows:

§ collective goals

§ social arrangements

§ controlled performance.

Expandable text

As yet there is no widely accepted definition of an organisation. This is because the term can be used broadly in two ways:

§ It can refer to a group or institution arranged for efficient work. To organise implies that there is an arrangement of parts or elements that produces more than a random collection.

§ Organisation can also refer to a process, i.e. structuring and arranging the activities of the enterprise or institution to achieve the stated objectives. The very work organisation implies that there is order or structure.

更多ACCA资讯请关注高顿ACCA官网:。