OptionsonForeignExchange(国际财务管理,英文版)

CashManagement(国际财务管理,英文版)

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10

$20 $25

$25

$10

$10

$10

18-17

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

18-8

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

$20 $30

18-9

18-6

Multilateral Netting

Consider a U.S. MNC with three subsidiaries and the following foreign exchange transactions:

$10 $

$20 $30

$40 $10

$25 $60

$20 $30

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

MarketforForeignExchange(国际财务管理,英文版)

Market participants include international banks, their customers, nonbank dealers, FOREX brokers, and central banks.

McGraw-Hill/Irwin

FOREX Market Participants

The FOREX market is a two-tiered market:

Interbank Market (Wholesale)

About 700 banks worldwide stand ready to make a market in Foreign exchange.

Spot Rate Quotations The Bid-Ask Spread Spot FX trading Cross Rates

McGraw-Hill/Irwin

4-8

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

McGraw-Hill/Irwin

4-2

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

Chapter Outline

Function and Structure of the FOREX Market

The Spot Market

4-6

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

Correspondent Banking Relationships

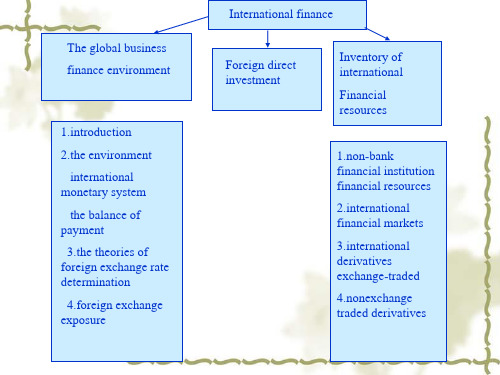

国际金融英文版(全)

Short-and Medium-term Debt Markets

Euro-commercial paper (ECP)and Euro-medium-term

notes(EMTN) Floating rate Euro-notes(Floating rate notes(FRN)represent an early innovation in the eurobond market.Interest is usually paid semiannually and they trade at a spread of the reference rate,e.g.,LIBOR.Margin above LIBOR may amount to 25-100 basis points or more.After 6 months ,the rate is reset with the same margin. International REPO market(repurchase agreement ,or REPOS)

Non-bank

Public international financial institutions public global financial institutions regional public national public Private international financial institutions global private regional private national private

the balance of payment

3.the theories of foreign exchange rate determination 4.foreign exchange exposure

OptionsonForeignExchange(国际财务管理,英文版)

Daily Resettlement: An Example

Currently $1 = ¥140 and it appears that the dollar is strengthening.

If you enter into a 3-month futures contract to sell ¥at the rate of $1 = ¥150 you will make money if the yen depreciates. The contract size is ¥12,500,000

Futures are standardized contracts trading on organized exchanges with daily resettlement through a clearinghouse.

Irwin/McGraw-Hill

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

Irwin/McGraw-Hill

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

Futures Contracts: Preliminaries

A futures contract is like a forward contract:

Second Edition

EUN / RESNICK

Irwin/McGraw-Hill

Copyright © 2001 by The McGraw-Hill Companies, Inc. All rights

Chapter Outline

商务英语国际金融词汇

商务英语国际金融词汇为了让大家更好的准备商务英语BEC考试,我给大家整理了商务英语高频词汇,下面我就和大家分享,来欣赏一下吧。

商务英语国际金融词汇:国际收支国际收支Balance of Payments国际货币基金组织International Monetary Fund国际收支平衡Balance of Payments Statement经常项目Current Account贸易收支Goods劳务收支Service单方面转移收支Unilateral Transfer资本项目Capital Account长期资本Direct Investment热钱/游资Hot Money平衡项目(储备项目/结算项目) Balancing or Settlement Account官方储备Official Reserves自主性交易Autonomous Transaction调节性交易Accommodating Transaction事前交易Ex-ante Transaction事后交易Ex-post Transaction国际收支顺差Balance of Payments Surplus国际收支逆差Balance of Payments Deficit贸易差额Trade Balance经常项目差额The Current Account Balance商务英语国际金融词汇:外汇与汇率通汇合约Agency Agreement通汇银行Correspondent Bank商业汇票Commercial Bill of Exchange银行支票Banker’s Check国外汇票Foreign Bill of Exchange关键货币Key Currency汇率Exchange Rate直接标价法DirectQuotation间接标价法IndirectQuotation汇价点Point买入汇率Buying Rate卖出汇率Selling Rate中间汇率Medial Rate现钞汇率Bank Note Rate即期汇率Spot Rate远期汇率Forward Rate基本汇率Basic Rate套算汇率Cross Rate固定汇率Fixed Rate浮动汇率Floating Rate可调整的钉住Adjustable Peg单一汇率Single Rate复汇率Multiple Rate贸易汇率Commercial Rate金融汇率Financial Rate交叉汇率Cross Rate远期差额Forward Margin升水Premium贴水Discount平价At Par固定汇率制度Fixed Exchange Rate System 金本位Gold Standard纸币Paper Money贴现率Discount Rate浮动汇率制度Floating Exchange Rate System 自由浮动汇率Freely Floating Exchange Rate管理浮动汇率Managed Floating Exchange Rate单独浮动汇率Single Floating Exchange Rate联合浮动汇率Joint Floating Exchange Rate钉住汇率制Pegged Exchange Rate区域性货币一体化Regional Monetary Integration欧洲货币体系European Monetary System (EMS)欧洲货币单位European Currency Unit (ECU)欧洲货币联盟European Monetary Union含金量Gold Content铸币平价Mint Par黄金输送点Gold Point官方储备Official Reserve外汇管制Foreign Exchange Control商务英语国际金融词汇:外汇交易即期外汇交易Spot Exchange Transaction远期外汇交易Forward Exchange Transaction交割日固定的远期外汇交易Fixed Maturity Forward Transaction选择交割日的远期交易(择期交易) Optional Forward Transaction掉期交易Swap即期对远期掉期Spot-Forward Swap即期对即期掉期Spot-Spot Swap远期对远期掉期Forward-Forward Swap地点套汇Space Arbitrage直接套汇(两角套汇) Direct Arbitrage (Two Points Arbitrage)间接套汇(三角套汇) Indirect Arbitrage (Three Points Arbitrage)时间套汇Time Arbitrage现代套汇交易Cash Against Currency Future套利Interest Arbitrage非抵补套利Uncovered Arbitrage非抵补利差Uncovered Interest Differential抵补套利Covered Arbitrage期货Futures期货交易Futures Transaction国际货币市场International Monetary Market (IMM)伦敦国际金融期货交易所London International Financial Futures Exchange (LIFFE)“逐日盯市”制度Market-to-Market期权Options外汇期权Foreign Currency Options协议价格Strike Price敲定价格Exercise Price期权费/权力金Premium期权到期日Expiration Date美式期权American Options欧式期权European Options看涨期权(买权,买入期权) Call Options 期权买方Call Buyer期权卖方Call Seller/Writer看跌期权(卖权,卖出期权) Put Options 期权协议价格Strike Price敲定价格(履约价格) Exercise Price期权费(期权权利金,保险费) Premium 期权保证金Margins期权内在价值Intrinsic value价内期权In the Money价外期权Out of the Money平价期权At the Money期权时间价值Time value易变性Volatility商务英语高频词汇:财务与会计损益表:beginning inventory :期初存货cost of goods sold :销货成本depreciation :n.折旧distribution :n.配销freight :n.运费gross margin :毛利income statement :损益表net income :净损益,净收入net sales :销货净额operating expense :营业费用sales revenue :销货收入资产负债表:accumulated depreciation :备抵折旧asset :n.资产balance sheet :资产负债表contributed capital :实缴股本fixed asset :固定资产liability :n.负债notes payable :应付票据prepaid expense :预付款项retained earnings :保留盈余stockholders equity :股东权益商务英语高频词汇:贸易Commerce 贸易1.bid 出价;投标;喊价mercial 商业化;商用的;营利的petitor 竞争者;对手4.consolidate 结合;合并;强化;巩固5.contract 契约;合同6.corporate 全体的;团体的;公司的;法人的7.credible 可信的;可靠的8.debit 借方;借项9.earnings 薪水;工资;收益10.export 输出;出口11.haggle 讨价还价12.import 输入;进口13.invoice 发票;发货清单;完成工作的清单(明列数量和价钱)14.long-range 长期的;远程的15.stock 现货;存货16.payment 支付;付款17.quote 报价18.supply 供应品;供应物;库存19.tariff 关税20.voucher 保证人;凭证;凭单;折价券21.bill of lading 提货单modity 商品;农产品23.consignee 收件人;受托人24.consumer 消费者;顾客25.contractor 立契约人;承包商26.cost-effective 符合成本效益的27.dealer 商人;业者28.due 应付的;到期的;该发生的29.endorse 背书;支持;赞同30.forward 送到,转号31.headquarters 总公司;总部;司令部32.inventory 详细目录;清单;存货33.letter of credit 信用状34.order 汇单;订货;订单;汇票35.patent 专利;取得…的专利36.quota 定量;定额;配额37.shipment 一批货38.surplus (1)过剩的量;盈余(2)过剩的;剩余的39.trademark 注册商标40.warehouse 仓库;货价;大商店。

国际财务管理(英文版)课后习题答案6

CHAPTER 5 THE MARKET FOR FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Give a full definition of the market for foreign exchange.Answer: Broadly defined, the foreign exchange (FX) market encompasses the conversion of purchasing power from one currency into another, bank deposits of foreign currency, the extension of credit denominated in a foreign currency, foreign trade financing, and trading in foreign currency options and futures contracts.2. What is the difference between the retail or client market and the wholesale or interbank market for foreign exchange?Answer: The market for foreign exchange can be viewed as a two-tier market. One tier is the wholesale or interbank market and the other tier is the retail or client market. International banks provide the core of the FX market. They stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, corporations or individuals, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Retail transactions account for only about 14 percent of FX trades. The other 86 percent is interbank trades between international banks, or non-bank dealers large enough to transact in the interbank market.3. Who are the market participants in the foreign exchange market?Answer: The market participants that comprise the FX market can be categorized into five groups: international banks, bank customers, non-bank dealers, FX brokers, and central banks. International banks provide the core of the FX market. Approximately 100 to 200 banks worldwide make a market in foreign exchange, i.e., they stand willing to buy or sell foreign currency for their own account. These international banks serve their retail clients, the bank customers, in conducting foreign commerce or making international investment in financial assets that requires foreign exchange. Non-bank dealers are large non-bank financial institutions, such as investment banks, mutual funds, pension funds, and hedge funds, whose size and frequency of trades make it cost- effective to establish their own dealing rooms to trade directly in the interbank market for their foreign exchange needs.Most interbank trades are speculative or arbitrage transactions where market participants attempt to correctly judge the future direction of price movements in one currency versus another or attempt to profit from temporary price discrepancies in currencies between competing dealers.FX brokers match dealer orders to buy and sell currencies for a fee, but do not take a position themselves. Interbank traders use a broker primarily to disseminate as quickly as possible a currency quote to many other dealers.Central banks sometimes intervene in the foreign exchange market in an attempt to influence the price of its currency against that of a major trading partner, or a country that it “fixes” or “pegs” its currency against. Intervention is the process of using foreign currency reser ves to buy one’s own currency in order to decrease its supply and thus increase its value in the foreign exchange market, or alternatively, selling one’s own currency for foreign currency in order to increase its supply and lower its price.4. How are foreign exchange transactions between international banks settled?Answer: The interbank market is a network of correspondent banking relationships, with large commercial banks maintaining demand deposit accounts with one another, called correspondent bank accounts. The correspondent bank account network allows for the efficient functioning of the foreign exchange market. As an example of how the network of correspondent bank accounts facilities international foreign exchange transactions, consider a U.S. importer desiring to purchase merchandise invoiced in guilders from a Dutch exporter. The U.S. importer will contact his bank and inquire about the exchange rate. If the U.S. importer accepts the offered exchange rate, the bank will debit the U.S. importer’s account for the purchase of the Dutch guilders. The bank will instruct its correspondent bank in the Netherlands to debit its correspondent bank account the appropriate amount of guilders and to credit the Dutch exporter’s bank account. The importer’s bank will then debit its books to offset the debit of U.S. importer’s account, reflecting the decrease in its correspondent bank account balan ce.5. What is meant by a currency trading at a discount or at a premium in the forward market?Answer: The forward market involves contracting today for the future purchase or sale of foreign exchange. The forward price may be the same as the spot price, but usually it is higher (at a premium) or lower (at a discount) than the spot price.6. Why does most interbank currency trading worldwide involve the U.S. dollar?Answer: Trading in currencies worldwide is against a common currency that has international appeal. That currency has been the U.S. dollar since the end of World War II. However, the euro and Japanese yen have started to be used much more as international currencies in recent years. More importantly, trading would be exceedingly cumbersome and difficult to manage if each trader made a market against all other currencies.7. Banks find it necessary to accommodate their clients’ needs to buy or sell FX forward, in many instances for hedging purposes. How can the bank eliminate the currency exposure it has created for itself by accommodating a client’s forward transaction?Answer: Swap transactions provide a means for the bank to mitigate the currency exposure in a forward trade. A swap transaction is the simultaneous sale (or purchase) of spot foreign exchange against a forward purchase (or sale) of an approximately equal amount of the foreign currency. To illustrate, suppose a bank customer wants to buy dollars three months forward against British pound sterling. The bank can handle this trade for its customer and simultaneously neutralize the exchange rate risk in the trade by selling (borrowed) British pound sterling spot against dollars. The bank will lend the dollars for three months until they are needed to deliver against the dollars it has sold forward. The British pounds received will be used to liquidate the sterling loan.8. A CD/$ bank trader is currently quoting a small figure bid-ask of 35-40, when the rest of the market is trading at CD1.3436-CD1.3441. What is implied about the trader’s beliefs by his prices?Answer: The trader must think the Canadian dollar is going to appreciate against the U.S. dollar and therefore he is trying to increase his inventory of Canadian dollars by discouraging purchases of U.S. dollars by standing willing to buy $ at only CD1.3435/$1.00 and offering to sell from inventory at the slightly lower than market price of CD1.3440/$1.00.9. What is triangular arbitrage? What is a condition that will give rise to a triangular arbitrage opportunity?Answer: Triangular arbitrage is the process of trading out of the U.S. dollar into a second currency, then trading it for a third currency, which is in turn traded for U.S. dollars. The purpose is to earn anarbitrage profit via trading from the second to the third currency when the direct exchange between the two is not in alignment with the cross exchange rate.Most, but not all, currency transactions go through the dollar. Certain banks specialize in making a direct market between non-dollar currencies, pricing at a narrower bid-ask spread than the cross-rate spread. Nevertheless, the implied cross-rate bid-ask quotations impose a discipline on the non-dollar market makers. If their direct quotes are not consistent with the cross exchange rates, a triangular arbitrage profit is possible.PROBLEMS1. Using Exhibit 5.4, calculate a cross-rate matrix for the euro, Swiss franc, Japanese yen, and the British pound. Use the most current American term quotes to calculate the cross-rates so that the triangular matrix resulting is similar to the portion above the diagonal in Exhibit 5.6.Solution: The cross-rate formula we want to use is:S(j/k) = S($/k)/S($/j).The triangular matrix will contain 4 x (4 + 1)/2 = 10 elements.¥SF £$Euro 138.05 1.5481 .6873 1.3112 Japan (100) 1.1214 .4979 .9498 Switzerland .4440 .8470U.K 1.90772. Using Exhibit 5.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Canadian dollar and the Swiss franc using the most current quotations. State the forward cross-rates in “Canadian” terms.Solution: The formulas we want to use are:F N(CD/SF) = F N($/SF)/F N($/CD)orF N(CD/SF) = F N(CD/$)/F N(SF/$).We will use the top formula that uses American term forward exchange rates.F1(CD/SF) = .8485/.8037 = 1.0557F3(CD/SF)= .8517/.8043 = 1.0589F6(CD/SF)= .8573/.8057 = 1.06403. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points.Spot 1.3431-1.3436One-Month 1.3432-1.3442Three-Month 1.3448-1.3463Six-Month 1.3488-1.3508Solution:One-Month 01-06Three-Month 17-27Six-Month 57-724. Using the spot and outright forward quotes in problem 3, determine the corresponding bid-ask spreads in points.Solution:Spot 5One-Month 10Three-Month 15Six-Month 205. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,CD= [(F N($/CD) - S($/CD/$)/S($/CD)] x 360/Nf1,CD= [(.8037 - .8037)/.8037] x 360/30 = .0000f3,CD= [(.8043 - .8037)/.8037] x 360/90 = .0030f6,CD= [(.8057 - .8037)/.8037] x 360/180 = .0050The pattern of forward premiums indicates that the Canadian dollar is trading at an increasing premium versus the U.S. dollar. That is, it becomes more expensive (in both absolute and percentage terms) to buy a Canadian dollar forward for U.S. dollars the further into the future one contracts.6. Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results?Solution: The formula we want to use is:f N,$= [(F N (£/$) - S(£/$))/S(£/$)] x 360/Nf1,$= [(.5251 - .5242)/.5242] x 360/30 = -.0023f3,$= [(.5268 - .5242)/.5242] x 360/90 = -.0198f6,$= [(.5290 - .5242)/.5242] x 360/180 = -.0183The pattern of forward premiums indicates that the British pound is trading at a discount versus the U.S. dollar. That is, it becomes more expensive to buy a U.S. dollar forward for British pounds (in absolute but not percentage terms) the further into the future one contracts.7. Given the following information, what are the NZD/SGD currency against currency bid-ask quotations?American Terms European TermsBank Quotations Bid Ask Bid AskNew Zealand dollar .7265 .7272 1.3751 1.3765Singapore dollar .6135 .6140 1.6287 1.6300Solution: Equation 5.12 from the text implies S b(NZD/SGD) = S b($/SGD) x S b(NZD/$) = .6135 x 1.3765 = .8445. The reciprocal, 1/S b(NZD/SGD)= S a(SGD/NZD)= 1.1841. Analogously, it is implied that S a(NZD/SGD) = S a($/SGD) x S a(NZD/$) = .6140 x 1.3765 = .8452. The reciprocal, 1/S a(NZD/SGD) = S b(SGD/NZD)= 1.1832. Thus, the NZD/SGD bid-ask spread is NZD0.8445-NZD0.8452 and the SGD/NZD spread is SGD1.1832-SGD1.1841.8. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting €0.7627/$1.00 and Credit Suisse is offering SF1.1806/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current €/SF quote of .6395. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What €/SF price will eliminate triangular arbitrage?Solution: To make a triangular arbitrage profit the Deutsche Bank trader would sell $5,000,000 to Dresdner Bank at €0.7627/$1.00. This trade would yield €3,813,500= $5,000,000 x .7627. The Deutsche Bank trader would then sell the euros for Swiss francs to Union Bank of Switzerland at a price of €0.6395/SF1.00, yielding SF5,963,253 = €3,813,500/.6395. The Deutsche Bank trader will resell the Swiss francs to Credit Suisse for $5,051,036 = SF5,963,253/1.1806, yielding a triangular arbitrage profit of $51,036.If the Deutsche Bank trader initially sold $5,000,000 for Swiss francs, instead of euros, the trade would yield SF5,903,000 = $5,000,000 x 1.1806. The Swiss francs would in turn be traded for euros to UBS for €3,774,969= SF5,903,000 x .6395. The euros would be resold to Dresdner Bank for $4,949,481 = €3,774,969/.7627, or a loss of $50,519. Thus, it is necessary to conduct the triangular arbitrage in the correct order.The S(€/SF)cross exchange rate should be .7627/1.1806 = .6460. This is an equilibrium rate at which a triangular arbitrage profit will not exist. (The student can determine this for himself.) A profit results from the triangular arbitrage when dollars are first sold for euros because Swiss francs are purchased for euros at too low a rate in comparison to the equilibrium cross-rate, i.e., Swiss francs are purchased for only €0.6395/SF1.00 instead of the no-arbitrage rate of €0.6460/SF1.00. Similarly, when dollars are first sold for Swiss francs, an arbitrage loss results because Swiss francs are sold for euros at too low a rate, resulting in too few euros. That is, each Swiss franc is sold for €0.6395/SF1.00 instead of the higher no-arbitrage rate of €0.6460/SF1.00.9. The current spot exchange rate is $1.95/£ and the three-month forward rate is $1.90/£. Based on your analysis of the exchange rate, you are pretty confident that the spot exchange rate will be $1.92/£ in three months. Assume that you would like to buy or sell £1,000,000.a. What actions do you need to take to speculate in the forward market? What is the expected dollar profit from speculation?b. What would be your speculative profit in dollar terms if the spot exchange rate actually turns out to be $1.86/£.Solution:a. If you believe the spot exchange rate will be $1.92/£ in three months, you should buy £1,000,000 forward for $1.90/£. Your expected profit will be:$20,000 = £1,000,000 x ($1.92 -$1.90).b. If the spot exchange rate actually turns out to be $1.86/£ in three months, your loss from the long position will be:-$40,000 = £1,000,000 x ($1.86 -$1.90).10. Omni Advisors, an international pension fund manager, plans to sell equities denominated in Swiss Francs (CHF) and purchase an equivalent amount of equities denominated in South African Rands (ZAR).Omni will realize net proceeds of 3 million CHF at the end of 30 days and wants to eliminate the risk that the ZAR will appreciate relative to the CHF during this 30-day period. The following exhibit shows current exchange rates between the ZAR, CHF, and the U.S. dollar (USD).Currency Exchange Ratesa.Describe the currency transaction that Omni should undertake to eliminate currency riskover the 30-day period.b.Calculate the following:• The CHF/ZAR cross-currency rate Omni would use in valuing the Swiss equityportfolio.•The current value of Omni’s Swiss equity portfolio in ZAR.• The annualized forward premium or discount at which the ZAR is trading versus theCHF.CFA Guideline Answer:a.To eliminate the currency risk arising from the possibility that ZAR will appreciateagainst the CHF over the next 30-day period, Omni should sell 30-day forward CHFagainst 30-day forward ZAR delivery (sell 30-day forward CHF against USD and buy30-day forward ZAR against USD).b.The calculations are as follows:•Using the currency cross rates of two forward foreign currencies and three currencies (CHF, ZAR, USD), the exchange would be as follows:--30 day forward CHF are sold for USD. Dollars are bought at the forward sellingprice of CHF1.5285 = $1 (done at ask side because going from currency into dollars)--30 day forward ZAR are purchased for USD. Dollars are simultaneously sold to purchase ZAR at the rate of 6.2538 = $1 (done at the bid side because going fromdollars into currency)--For every 1.5285 CHF held, 6.2538 ZAR are received; thus the cross currency rate is1.5285 CHF/6.2538 ZAR = 0.244411398.• At the time of execution of the forward contracts, the v alue of the 3 million CHF equity portfolio would be 3,000,000 CHF/0.244411398 = 12,274,386.65 ZAR.• To calculate the annualized premium or discount of the ZAR against the CHF requires comparison of the spot selling exchange rate to the forward selling price of CHF for ZAR.Spot rate = 1.5343 CHF/6.2681 ZAR = 0.24477912030 day forward ask rate 1.5285 CHF/6.2538 ZAR = 0.244411398The premium/discount formula is:[(forward rate – spot rate) / spot rate] x (360 / # day contract) =[(0.244411398 – 0.24477912) / 0.24477912] x (360 / 30) =-1.8027126 % = -1.80% discount ZAR to CHFMINI CASE: SHREWSBURY HERBAL PRODUCTS, LTD.Shrewsbury Herbal Products, located in central England close to the Welsh border, is an old-line producer of herbal teas, seasonings, and medicines. Its products are marketed all over the United Kingdom and in many parts of continental Europe as well.Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for £320,000 of its products, conditional upon delivery being made in three months’ time and the order invoiced in euros.Shrewsbury’s controller, Elton Peters, is concerned with whether the pound will appreciate versus the euro over the next three months, thus eliminating all or most of the profit when the euro receivable is paid. He thinks this is an unlikely possibility, but he decides to contact the firm’s banker for suggestions about hedging the exchange rate exposure.Mr. Peters learns from the banker that the current spot e xchange rate is €/£ is €1.4537, thus the invoice amount should be €465,184. Mr. Peters also learns that the three-month forward rates for the pound and the euro versus the U.S. dollar are $1.8990/£1.00 and $1.3154/€1.00, respectively. The banker offers to set up a forward hedge for selling the euro receivable for pound sterling based on the €/£ forward cross-exchange rate implicit in the forward rates against the dollar.What would you do if you were Mr. Peters?Suggested Solution to Shrewsbury Herbal Products, Ltd.Note to Instructor: This elementary case provides an intuitive look at hedging exchange rate exposure. Students should not have difficulty with it even though hedging will not be formally discussed until Chapter 8. The case is consistent with the discussion that accompanies Exhibit 5.9 of the text. Professor of Finance, Banikanta Mishra, of Xavier Institute of Management – Bhubaneswar, India contributed to this solution.Suppose Shrewsbury sells at a twenty percent markup. Thus the cost to the firm of the £320,000 order is £256,000. Thus, the pound could appreciate to €465,184/£256,000 = €1.8171/1.00 before all profit was eliminated. This seems rather unlikely. Nevertheless, a ten percent appreciation of the pound (€1.4537 x 1.10) to €1.5991/£1.00 would only yield a profit of £34,904 (= €465,184/1.5991 - £256,000). Shrewsbury can hedge the exposure by selling the euros forward for British pounds at F3(€/£) = F3($/£) ÷ F3($/€) = 1.8990 ÷ 1.3154 = 1.4437. At this forward exchange rate, Shrewsbury can “lock-in” a price of £322,217 (= €465,184/1.4437) for the sale. The forward exchange rate indicates that the euro is trading at a premium to the British pound in the forward market. Thus, the forward hedge allows Shrewsbury to lock-in a greater amount (£2,217) than if the euro receivable was converted into pounds at the current spotIf the euro was trading at a forward discount, Shrewsbury would end up locking-in an amount less than £320,000. Whether that would lead to a loss for the company would depend upon the extent of the discount and the amount of profit built into the price of £320,000. Only if the forward exchange rate is even with the spot rate will Shrewsbury receive exactly £320,000.Obviously, Shrewsbury could ensure that it receives exactly £320,000 at the end of three-month accounts receivable period if it could invoice in £. That, however, is not acceptable to the French wholesaler. When invoicing in euros, Shrewsbury could establish the euro invoice amount by use of the forward exchange rate instead of the current spot rate. The invoice amount in that case would be €461,984 = £320,000 x 1.4437. Shrewsbury can now lock-in a receipt of £320,000 if it simultaneously hedges its euro exposure by selling €461,984 at the forward rate of 1.4437. That is, £320,000 = €461,984/1.4437.。

国际财务管理英文版第版马杜拉答案Chapter

Chapter 3International Financial Markets Lecture OutlineMotives for Using International Financial Markets Motives for Investing in Foreign MarketsMotives for Providing Credit in Foreign MarketsMotives for Borrowing in Foreign MarketsForeign Exchange MarketHistory of Foreign ExchangeForeign Exchange TransactionsExchange QuotationsForeignInterpretingCurrency Futures and Options MarketsInternational Money MarketOrigins and DevelopmentStandardizing Global Bank RegulationsInternational Credit MarketSyndicated LoansInternational Bond MarketEurobond MarketDevelopment of Other Bond MarketsComparing Interest Rates Among CurrenciesInternational Stock MarketsIssuance of Foreign Stock in the U.S.Issuance of Stock in Foreign MarketsComparison of International Financial MarketsHow Financial Markets Affect an MNC’s ValueChapter ThemeThis chapter identifies and discusses the various international financial markets used by MNCs. These markets facilitate day-to-day operations of MNCs, including foreign exchange transactions, investing in foreign markets, and borrowing in foreign markets.Topics to Stimulate Class Discussion1. Why do international financial markets exist?2. How do banks serve international financial markets?3. Which international financial markets are most important to a firm that consistently needsshort-term funds? What about a firm that needs long-term funds?Critical debateShould firms that go public engage in international offerings?Proposition Yes. When a firm issues shares to the public for the first time in an initial public offering (IPO), it is naturally concerned about whether it can place all of its shares at a reasonable price. It will be able to issue its shares at a higher price by attracting more investors. It will increase its demand by spreading the shares across countries. The higher the price at which it can issue shares, the lower is its cost of using equity capital. It can also establish a global name by spreading shares across countries.Opposing view No. If a firm spreads its shares across different countries at the time of the IPO, there will be less publicly traded shares in the home country. Thus, it will not have as much liquidity in the secondary market. Investors desire shares that they can easily sell in the secondary market, which means that they require that the shares have liquidity. To the extent that a firm reduces its liquidity in the home country by spreading its share across countries, it may not attract sufficient home demand for the shares. Thus, its efforts to create global name recognition may reduce its name recognition in the home country.With whom do you agree? State your reasons. Use InfoTrac or some other search engine to learn more about this issue. Which argument do you support? Offer your own opinion on this issue.ANSWER: The key is that students recognize the tradeoff involved. A firm that engages in a relatively small IPO will have limited liquidity even when all of the stock is issued in the home country. Thus, it should not consider issuing stock internationally. However, firms with larger stock offerings may be in a position to issue a portion of their shares outside the home country. They should not spread the stocks across several countries, but perhaps should target one or two countries where they conduct substantial business. They want to ensure sufficient liquidity in each of the foreign countries where they sell shares.Stock Markets are inefficientPropositionI cannot believe that if the value of the euro in terms of, say, the British pound increases three days in a row, on the fourth day there is still a 50:50 chance that it will go up or down in value. I think that most investors will see a trend and will buy, therefore the price is morelikely to go up. Also, if the forward market predicts a rise in value, on average, surely it is going to rise in value. In other words, currency prices are predictable. And finally, if it were so unpredictable and therefore unprofitable to the speculator, how is it that there is such a vast sum of money being traded every day for speculative purposes – there is no smoke without fire.The simple answer is that if that is what you believe, buy currencies that have viewOpposingincreased three days in a row and on average you should make a profit, buy currencies where the forward market shows an increase in value. The fact is that there are a lot of investors with just your sort of views. The market traders know all about such beliefs and will price the currency so that such easy profit (their loss) cannot be made. Look at past currency rates for yourself, check all fourth day changes after three days of rises, any difference is going to be not enough to cover transaction costs or trading expenses and the slight inaccuracy in your figures which are likely to be closing day mid point of the bid/ask spread. No, all currency movements are related to information and no-one knows if tomorrows news will be better or worse than expected.With whom do you agree? Could there be undiscovered patterns? Could some movements not be related to information? Could some private news be leaking out?ANSWER: Clearly there are no obvious patterns. Discussion on the impossibility of obvious patterns is worth emphasizing. However, does market inefficiency necessarily involve patterns, could market manipulation be occasional. There is worrying evidence from share price movements that there is unusual movement before announcements on many occasions, so the ideathat traders do not occasionally collude and move the price without supporting economic evidence is not an unreasonable view. Proof is however difficult as we have to separate anticipation from prior knowledge, the lucky speculator from the speculator who was in the know.Answers to End of Chapter Questions1. Motives for Investing in Foreign Money Markets. Explain why an MNC may invest fundsin a financial market outside its own country.ANSWER: The MNC may be able to earn a higher interest rate on funds invested in a financial market outside of its own country. In addition, the exchange rate of the currency involved may be expected to appreciate.2. Motives for Providing Credit in Foreign Markets. Explain why some financial institutionsprefer to provide credit in financial markets outside their own country.ANSWER: Financial institutions may believe that they can earn a higher return by providing credit in foreign financial markets if interest rate levels are higher and if the economic conditions are strong so that the risk of default on credit provided is low. The institutions may also want to diversity their credit so that they are not too exposed to the economic conditions in any single country.3. Exchange Rate Effects on Investing. Explain how the appreciation of the Australian dollaragainst the euro would affect the return to a French firm that invested in an Australian money market security.ANSWER: If the Australian dollar appreciates over the investment period, this implies that the French firm purchased the Australian dollars to make its investment at a lower exchange rate than the rate at which it will convert A$ to euros when the investment period is over.Thus, it benefits from the appreciation. Its return will be higher as a result of this appreciation.4. Exchange Rate Effects on Borrowing. Explain how the appreciation of the Japanese yenagainst the UK pound would affect the return to a UK firm that borrowed Japanese yen and used the proceeds for a UK project.ANSWER: If the Japanese yen appreciates over the borrowing period, this implies that the UK firm converted yen to pounds at a lower exchange rate than the rate at which it paid for yen at the time it would repay the loan. Thus, it is adversely affected by the appreciation. Its cost of borrowing will be higher as a result of this appreciation.5. Bank Services. List some of the important characteristics of bank foreign exchange servicesthat MNCs should consider.ANSWER: The important characteristics are (1) competitiveness of the quote, (2) the firm’s relationship with the bank, (3) speed of execution, (4) advice about current market conditions, and (5) forecasting advice.6. Bid/ask Spread. Delay Bank’s bid price for US dollars is £0.53 and its ask price is £0.55.What is the bid/ask percentage spread?ANSWER: (£0.55– £0.53)/£0.55 = .036 or 3.6%7. Bid/ask Spread. Compute the bid/ask percentage spread for Mexican peso in which the askrate is 20.6 New peso to the dollar and the bid rate is 21.5 New peso to the dollar.ANSWER: direct rates are 1/20.6 = $0.485:1 peso as the ask rate and 1/21.5 = $0.465:1 peso as the bid rate so the spread is[($0.485 – $0.465)/$0.485] = .041, or 4.1%. Note that the spread is fro the Mexiccan peso not the dollar.8. Forward Contract. The Wolfpack ltd is a UK exporter that invoices its exports to the UnitedStates in dollars. If it expects that the dollar will appreciate against the pound in the future, should it hedge its exports with a forward contract? Explain..ANSWER: The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. Yet, in this case, the Wolfpack Corporation should not hedge because it would benefit from appreciation of the dollar when it converts the dollars to pounds.9. Euro. Explain the foreign exchange situation for countries that use the euro when theyengage in international trade among themselves.ANSWER: There is no foreign exchange. Euros are used as the medium of exchange.10. Indirect Exchange Rate. If the direct exchange rate of the euro is worth £0.685, what is theindirect rate of the euro? That is, what is the value of a pound in euros?ANSWER: 1/0.685 = 1.46 euros.11. Cross Exchange Rate. Assume Poland’s currency (the zloty) is worth £0.17 and theJapanese yen is worth £0.005. What is the cross (implied) rate of the zloty with respect to yen?ANSWER: £0.17/£0.005 = 34 zloty:1 yen12. Syndicated Loans. Explain how syndicated loans are used in international markets.ANSWER: A large MNC may want to obtain a large loan that no single bank wants to accommodate by itself. Thus, a bank may create a syndicate whereby several other banks also participate in the loan.13. Loan Rates. Explain the process used by banks in the Eurocredit market to determine the rateto charge on loans.ANSWER: Banks set the loan rate based on the prevailing LIBOR, and allow the loan rate to float (change every 6 months) in accordance with changes in LIBOR.14. International Markets. What is the function of the international money market? Brieflydescribe the reasons for the development and growth of the European money market. Explain how the international money, credit, and bond markets differ from one another.ANSWER: The function of the international money market is to efficiently facilitate the flow of international funds from firms or governments with excess funds to those in need of funds.Growth of the European money market was largely due to (1) regulations in the U.S. that limited foreign lending by U.S. banks; and (2) regulated ceilings placed on interest rates of dollar deposits in the U.S. that encouraged deposits to be placed in the Eurocurrency market where ceilings were nonexistent.The international money market focuses on short-term deposits and loans, while the international credit market is used to tap medium-term loans, and the international bond market is used to obtain long-term funds (by issuing long-term bonds).15. Evolution of Floating Rates. Briefly describe the historical developments that led to floatingexchange rates as of 1973.ANSWER: Country governments had difficulty in maintaining fixed exchange rates. In 1971, the bands were widened. Yet, the difficulty of controlling exchange rates even within these wider bands continued. As of 1973, the bands were eliminated so that rates could respond to market forces without limits (although governments still did intervene periodically).16. International Diversification. Explain how the Asian crisis would have affected the returnsto a UK. firm investing in the Asian stock markets as a means of international diversification.[See the chapter appendix.]ANSWER: The returns to the UK firm would have been reduced substantially as a result of the Asian crisis because of both declines in the Asian stock markets and because of currency depreciation. For example, the Indonesian stock market declined by about 27% from June 1997 to June 1998. Furthermore, the Indonesian rupiah declined against the U.S. dollar by 84%.17.Eurocredit Loans.a.With regard to Eurocredit loans, who are the borrowers?b. Why would a bank desire to participate in syndicated Eurocredit loans?c. What is LIBOR and how is it used in the Eurocredit market?ANSWER:a. Large corporations and some government agencies commonly request Eurocredit loans.b. With a Eurocredit loan, no single bank would be totally exposed to the risk that theborrower may fail to repay the loan. The risk is spread among all lending banks within the syndicate.c. LIBOR (London interbank offer rate) is the rate of interest at which banks in Europe lendto each other. It is used as a base from which loan rates on other loans are determined in the Eurocredit market.18. Foreign Exchange. You just came back from Canada, where the Canadian dollar was worth£0.43. You still have C$200 from your trip and could exchange them for pounds at the airport, but the airport foreign exchange desk will only buy them for £0.40. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for £0.055 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1500 New Pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain.ANSWER: Exchange with the tourist. If you exchange the C$ for pesos at the foreign exchange desk, the C$200 is multiplied by £0.40 and then divided by £0.055 ie a ratio of £0.40/0.055 = 7.27 pesos to the C$. The total pesos would be 200 x 7.27 = 1454 pesos, a little less than is being offered by the tourist.19. Foreign Stock Markets. Explain why firms may issue stock in foreign markets. Why mightMNCs issue more stock in Europe since the conversion to a single currency in 1999?ANSWER: Firms may issue stock in foreign markets when they are concerned that their home market may be unable to absorb the entire issue. In addition, these firms may have foreign currency inflows in the foreign country that can be used to pay dividends on foreign-issued stock. They may also desire to enhance their global image. Since the euro can be used in several countries, firms may need a large amount of euros if they are expanding across Europe.20. Stock Market Integration. Bullet plc a UK firm, is planning to issue new shares on theLondon Stock Exchange this month. The only decision still to be made is the specific day on which the shares will be issued. Why do you think Bullet monitors results of the Tokyo stock market every morning?ANSWER: The UK stock market prices sometimes follow Japanese market prices. Thus, the firm would possibly be able to issue its stock at a higher price in the UK if it can use the Japanese market as an indicator of what will happen in the UK market. However, this indicator will not always be accurate.Advanced Questions21. Effects of September 11. Why do you think the terrorist attack on the U.S. was expected tocause a decline in U.S. interest rates? Given the expectations for a potential decline in U.S.interest rates and stock prices, how were capital flows between the U.S. and other countries likely affected?ANSWER: The attack was expected to cause a weaker economy, which would result in lower U.S. interest rates. Given the lower interest rates, and the weak stock prices, the amount of funds invested by foreign investors in U.S. securities would be reduced.22. International Financial Markets. Carrefour the French Supermarket chain has established retail outlets worldwide. These outlets are massive and contain products purchased locally as well as imports. As Carrefour generates earnings beyond what it needs abroad, it may remit those earnings back to France. Carrefour is likely to build additional outlets especially in China.a. Explain how the Carrefour outlets in China would use the spot market in foreign exchange.ANSWER:The Carrefour stores in China need other currencies to buy products from other countries, and must convert the Chinese currency (yuan) into the other currencies in the spot market to purchase these products. They also could use the spot market to convert excess earnings denominated in yuan into euros, which would be remitted to the French parent.b. Explain how Carrefour might utilize the international money markets when it isestablishing other Carrefour stores in Asia.ANSWER: Carrefour may need to maintain some deposits in the Eurocurrency market that can be used (when needed) to support the growth of Carrefour stores in various foreign markets. When some Carrefour stores in foreign markets need funds, they borrow from banks in the Eurocurrency market. Thus, the Eurocurrency market serves as a deposit or lending source for Carrefour and other MNCs on a short-term basis. (Eurocurrency refers to international currencies, most likely the dollar, not just the euro!)c. Explain how Carrefour could use the international bond market to finance theestablishment of new outlets in foreign markets.ANSWER: Carrefour could issue bonds in the Eurobond market to generate funds needed to establish new outlets. The bonds may be denominated in the currency that is needed; then, once the stores are established, some of the cash flows generated by those stores could be used to pay interest on the bonds.23.Interest Rates. Why do interest rates vary among countries? Why are interest rates normallysimilar for those European countries that use the euro as their currency? Offer a reason why the government interest rate of one country could be slightly higher than that of the government interest rate of another country, even though the euro is the currency used in both countries.ANSWER: Interest rates in each country are based on the supply of funds and demand for funds for a given currency. However, the supply and demand conditions for the euro are dictated by all participating countries in aggregate, and do not vary among participating countries. Yet, the government interest rate in one country that uses the euro could be slightly higher than others that use the euro if it is subject to default risk. The higher interest rate would reflect a risk premium.Blades plc Case Study。

国际财务管理(英文版)课后习题答案8

CHAPTER 7 FUTURES AND OPTIONS ON FOREIGN EXCHANGESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Explain the basic differences between the operation of a currency forward market and a futures market.Answer: The forward market is an OTC market where the forward contract for purchase or sale of foreign currency is tailor-made between the client and its international bank. No money changes hands until the maturity date of the contract when delivery and receipt are typically made. A futures contract is an exchange-traded instrument with standardized features specifying contract size and delivery date. Futures contracts are marked-to-market daily to reflect changes in the settlement price. Delivery is seldom made in a futures market. Rather a reversing trade is made to close out a long or short position.2. In order for a derivatives market to function most efficiently, two types of economic agents are needed: hedgers and speculators. Explain.Answer: Two types of market participants are necessary for the efficient operation of a derivatives market: speculators and hedgers. A speculator attempts to profit from a change in the futures price. To do this, the speculator will take a long or short position in a futures contract depending upon his expectations of future price movement. A hedger, on-the-other-hand, desires to avoid price variation by locking in a purchase price of the underlying asset through a long position in a futures contract or a sales price through a short position. In effect, the hedger passes off the risk of price variation to the speculator who is better able, or at least more willing, to bear this risk.3. Why are most futures positions closed out through a reversing trade rather than held to delivery?Answer: In forward markets, approximately 90 percent of all contracts that are initially established result i n the short making delivery to the long of the asset underlying the contract. This is natural because the terms of forward contracts are tailor-made between the long and short. By contrast, only about one percent of currency futures contracts result in delivery. While futures contracts are useful for speculation and hedgi ng, their standardized delivery dates make them unlikely to correspond to the actual future dates when foreignexchange transactions will occur. Thus, they are generally closed out in a reversing trade. In fact, the commission that buyers and sellers pay to transact in the futures market is a single amount that covers the round-trip transactions of initiating and closing out the position.4. How can the FX futures market be used for price discovery?Answer: To the extent that FX forward prices are an unbiased predictor of future spot exchange rates, the market anticipates whether one currency will appreciate or depreciate versus another. Because FX futures contracts trade in an expiration cycle, different contracts expire at different periodic dates into the future. The pattern of the prices of these cont racts provides information as to the market’s current belief about the relative future value of one currency versus another at the scheduled expiration dates of the contracts. One will generally see a steadily appreciating or depreciating pattern; however, it may be mixed at times. Thus, the futures market is useful for price discovery, i.e., obtaining the market’s forecast of the spot exchange rate at different future dates.5. What is the major difference in the obligation of one with a long position in a futures (or forward) contract in comparison to an options contract?Answer: A futures (or forward) contract is a vehicle for buying or selling a stated amount of foreign exchange at a stated price per unit at a specified time in the future. If the long holds the contract to the delivery date, he pays the effective contractual futures (or forward) price, regardless of whether it is an advantageous price in comparison to the spot price at the delivery date. By contrast, an option is a contract giving the long the right to buy or sell a given quantity of an asset at a specified price at some time in the future, but not enforcing any obligation on him if the spot price is more favorable than the exercise price. Because the option owner does not have to exercise the option if it is to his disadvantage, the option has a price, or premium, whereas no price is paid at inception to enter into a futures (or forward) contract.6. What is meant by the terminology that an option is in-, at-, or out-of-the-money?Answer: A call (put) option with S t > E (E > S t) is referred to as trading in-the-money. If S t E the option is trading at-the-money. If S t< E (E < S t) the call (put) option is trading out-of-the-money.7. List the arguments (variables) of which an FX call or put option model price is a function. How does the call and put premium change with respect to a change in the arguments?Answer: Both call and put options are functions of only six variables: S t, E, r i, r$, T andσ.When all else remains the same, the price of a European FX call (put) option will increase:1. the larger (smaller) is S,2. the smaller (larger) is E,3. the smaller (larger) is r i,4. the larger (smaller) is r$,5. the larger (smaller) r$ is relative to r i, and6. the greater is σ.When r$ and r i are not too much different in size, a European FX call and put will increase in price when the option term-to-maturity increases. However, when r$ is very much larger than r i, a European FX call will increase in price, but the put premium will decrease, when the option term-to-maturity increases. The opposite is true when r i is very much greater than r$. For American FX options the analysis is less complicated. Since a longer term American option can be exercised on any date that a shorter term option can be exercised, or a some later date, it follows that the all else remaining the same, the longer term American option will sell at a price at least as large as the shorter term option.PROBLEMS1. Assume today’s settlement price on a CME EUR futures contract is $1.3140/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $1,700. The next three days’ settlement prices are $1.3126, $1.3133, and $1.3049. Calculate the chan ges in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day.Solution: $1,700 + [($1.3140 - $1.3126) + ($1.3126 - $1.3133)+ ($1.3133 - $1.3049)] x EUR125,000 = $2,837.50,where EUR125,000 is the contractual size of one EUR contract.2. Do problem 1 again assuming you have a long position in the futures contract.Solution: $1,700 + [($1.3126 - $1.3140) + ($1.3133 - $1.3126) + ($1.3049 - $1.3133)] x EUR125,000 = $562.50,where EUR125,000 is the contractual size of one EUR contract.With only $562.50 in your performance bond account, you would experience a margin call requesting that additional funds be added to your performance bond account to bring the balance back up to the initial performance bond level.3. Using the quotations in Exhibit 7.3, calculate the face value of the open interest in the June 2005 Swiss franc futures contract.Solution: 2,101 contracts x SF125,000 = SF262,625,000.where SF125,000 is the contractual size of one SF contract.4. Using the quotations in Exhibit 7.3, note that the June 2005 Mexican peso futures contract has a price of $0.08845. You believe the spot price in June will be $0.09500. What speculative position would you enter into to attempt to profit from your beliefs? Calculate your anticipated profits, assuming you take a position in three contracts. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes?Solution: If you expect the Mexican peso to rise from $0.08845 to $0.09500, you would take a long position in futures since the futures price of $0.08845 is less than your expected spot price.Your anticipated profit from a long position in three contracts is: 3 x ($0.09500 - $0.08845) x MP500,000 = $9,825.00, where MP500,000 is the contractual size of one MP contract.If the futures price is an unbiased predictor of the expected spot price, the expected spot price is the futures price of $0.08845/MP. If this spot price materializes, you will not have any profits or losses from your short position in three futures contracts: 3 x ($0.08845 - $0.08845) x MP500,000 = 0.5. Do problem 4 again assuming you believe the June 2005 spot price will be $0.08500.Solution: If you expect the Mexican peso to depreciate from $0.08845 to $0.07500, you would take a short position in futures since the futures price of $0.08845 is greater than your expected spot price.Your anticipated profit from a short position in three contracts is: 3 x ($0.08845 - $0.07500) x MP500,000 = $20,175.00.If the futures price is an unbiased predictor of the future spot price and this price materializes, you will not profit or lose from your long futures position.6. George Johnson is considering a possible six-month $100 million LIBOR-based, floating-rate bank loan to fund a project at terms shown in the table below. Johnson fears a possible rise in the LIBOR rate by December and wants to use the December Eurodollar futures contract to hedge this risk. The contract expires December 20, 1999, has a US$ 1 million contract size, and a discount yield of7.3 percent.Johnson will ignore the cash flow implications of marking to market, initial margin requirements, and any timing mismatch between exchange-traded futures contract cash flows and the interest payments due in March.Loan TermsSeptember 20, 1999 December 20, 1999 March 20, 2000 ∙Borrow $100 million at ∙Pay interest for first three ∙Pay back principal September 20 LIBOR + 200 months plus interestbasis points (bps) ∙Roll loan over at∙September 20 LIBOR = 7% December 20 LIBOR +200 bpsLoan First loan payment (9%) Second paymentinitiated and futures contract expires and principal↓↓↓∙∙9/20/99 12/20/99 3/20/00a. Formulate Johnson’s September 20 floating-to-fixed-rate strategy using the Eurodollar future contracts discussed in the text above. Show that this strategy would result in a fixed-rate loan, assuming an increase in the LIBOR rate to 7.8 percent by December 20, which remains at 7.8 percent through March 20. Show all calculations.Johnson is considering a 12-month loan as an alternative. This approach will result in two additional uncertain cash flows, as follows:Loan First Second Third Fourth payment initiated payment (9%) payment payment and principal↓↓↓↓↓∙∙∙∙9/20/99 12/20/99 3/20/00 6/20/00 9/20/00b. Describe the strip hedge that Johnson could use and explain how it hedges the 12-month loan (specify number of contracts). No calculations are needed.CFA Guideline Answera. The basis point value (BPV) of a Eurodollar futures contract can be found by substituting the contract specifications into the following money market relationship:BPV FUT = Change in Value = (face value) x (days to maturity / 360) x (change in yield)= ($1 million) x (90 / 360) x (.0001)= $25The number of contract, N, can be found by:N = (BPV spot) / (BPV futures)= ($2,500) / ($25)= 100ORN = (value of spot position) / (face value of each futures contract)= ($100 million) / ($1 million)= 100ORN = (value of spot position) / (value of futures position)= ($100,000,000) / ($981,750)where value of futures position = $1,000,000 x [1 – (0.073 / 4)]102 contractsTherefore on September 20, Johnson would sell 100 (or 102) December Eurodollar futures contracts at the 7.3 percent yield. The implied LIBOR rate in December is 7.3 percent as indicated by the December Eurofutures discount yield of 7.3 percent. Thus a borrowing rate of 9.3 percent (7.3 percent + 200 basis points) can be locked in if the hedge is correctly implemented.A rise in the rate to 7.8 percent represents a 50 basis point (bp) increase over the implied LIBOR rate. For a 50 basis point increase in LIBOR, the cash flow on the short futures position is:= ($25 per basis point per contract) x 50 bp x 100 contracts= $125,000.However, the cash flow on the floating rate liability is:= -0.098 x ($100,000,000 / 4)= - $2,450,000.Combining the cash flow from the hedge with the cash flow from the loan results in a net outflow of $2,325,000, which translates into an annual rate of 9.3 percent:= ($2,325,000 x 4) / $100,000,000 = 0.093This is precisely the implied borrowing rate that Johnson locked in on September 20. Regardless of the LIBOR rate on December 20, the net cash outflow will be $2,325,000, which translates into an annualized rate of 9.3 percent. Consequently, the floating rate liability has been converted to a fixed rate liability in the sense that the interest rate uncertainty associated with the March 20 payment (using the December 20 contract) has been removed as of September 20.b. In a strip hedge, Johnson would sell 100 December futures (for the March payment), 100 March futures (for the June payment), and 100 June futures (for the September payment). The objective is to hedge each interest rate payment separately using the appropriate number of contracts. The problem is the same as in Part A except here three cash flows are subject to rising rates and a strip of futures is used tohedge this interest rate risk. This problem is simplified somewhat because the cash flow mismatch between the futures and the loan payment is ignored. Therefore, in order to hedge each cash flow, Johnson simply sells 100 contracts for each payment. The strip hedge transforms the floating rate loan into a strip of fixed rate payments. As was done in Part A, the fixed rates are found by adding 200 basis points to the implied forward LIBOR rate indicated by the discount yield of the three different Eurodollar futures contracts. The fixed payments will be equal when the LIBOR term structure is flat for the first year.7. Jacob Bower has a liability that:∙has a principal balance of $100 million on June 30, 1998,∙accrues interest quarterly starting on June 30, 1998,∙pays interest quarterly,∙has a one-year term to maturity, and∙calculates interest due based on 90-day LIBOR (the London Interbank OfferedRate).Bower wishes to hedge his remaining interest payments against changes in interest rates.Bower has correctly calculated that he needs to sell (short) 300 Eurodollar futures contracts to accomplish the hedge. He is considering the alternative hedging strategies outlined in the following table.Initial Position (6/30/98) in90-Day LIBOR Eurodollar ContractsStrategy A Strategy BContract Month (contracts) (contracts)September 1998 300 100December 1998 0 100March 1999 0 100a. Explain why strategy B is a more effective hedge than strategy A when the yield curveundergoes an instantaneous nonparallel shift.b. Discuss an interest rate scenario in which strategy A would be superior to strategy B.CFA Guideline Answera. Strategy B’s SuperiorityStrategy B is a strip hedge that is constructed by selling (shorting) 100 futures contracts maturing in each of the next three quarters. With the strip hedge in place, each quarter of the coming year is hedged against shifts in interest rates for that quarter. The reason Strategy B will be a more effective hedge than Strategy A for Jacob Bower is that Strategy B is likely to work well whether a parallel shift or a nonparallel shift occurs over the one-year term of Bower’s liability. That is, regardless of what happens to the term structure, Strategy B structures the futures hedge so that the rates reflected by the Eurodollar futures cash price match the applicable rates for the underlying liability-the 90day LIBOR-based rate on Bower’s liability. The same is not true for Strategy A. Because Jacob Bower’s liability carries a floating interest rate that resets quarterly, he needs a strategy that provides a series of three-month hedges. Strategy A will need to be restructured when the three-month September contract expires. In particular, if the yield curve twists upward (futures yields rise more for distant expirations than for near expirations), Strategy A will produce inferior hedge results.b. Scenario in Which Strategy A is SuperiorStrategy A is a stack hedge strategy that initially involves selling (shorting) 300 September contracts. Strategy A is rarely better than Strategy B as a hedging or risk-reduction strategy. Only from the perspective of favorable cash flows is Strategy A better than Strategy B. Such cash flows occur only in certain interest rate scenarios. For example Strategy A will work as well as Strategy B for Bower’s liability if interest rates (instantaneously) change in parallel fashion. Another interest rate scenario where Strategy A outperforms Strategy B is one in which the yield curve rises but with a twist so that futures yields rise more for near expirations than for distant expirations. Upon expiration of the September contract, Bower will have to roll out his hedge by selling 200 December contracts to hedge the remaining interest payments. This action will have the effect that the cash flow from Strategy A will be larger than the cash flow from Strategy B because the appreciation on the 300 short September futures contracts will be larger than the cumulative appreciation in the 300 contracts shorted in Strategy B (i.e., 100 September, 100 December, and 100 March). Consequently, the cash flow from Strategy A will more than offset the increase in the interest payment on the liability, whereas the cash flow from Strategy B will exactly offset the increase in the interest payment on the liability.8. Use the quotations in Exhibit 7.7 to calculate the intrinsic value and the time value of the 97 September Japanese yen American call and put options.Solution: Premium - Intrinsic Value = Time Value97 Sep Call 2.08 - Max[95.80 – 97.00 = - 1.20, 0] = 2.08 cents per 100 yen97 Sep Put 2.47 - Max[97.00 – 95.80 = 1.20, 0] = 1.27 cents per 100 yen9. Assume spot Swiss franc is $0.7000 and the six-month forward rate is $0.6950. What is the minimum price that a six-month American call option with a striking price of $0.6800 should sell for in a rational market? Assume the annualized six-month Eurodollar rate is 3 ½ percent.Solution:Note to Instructor: A complete solution to this problem relies on the boundary expressions presented in footnote 3 of the text of Chapter 7.C a≥Max[(70 - 68), (69.50 - 68)/(1.0175), 0]≥Max[ 2, 1.47, 0] = 2 cents10. Do problem 9 again assuming an American put option instead of a call option.Solution: P a≥Max[(68 - 70), (68 - 69.50)/(1.0175), 0]≥Max[ -2, -1.47, 0] = 0 cents11. Use the European option-pricing models developed in the chapter to value the call of problem 9 and the put of problem 10. Assume the annualized volatility of the Swiss franc is 14.2 percent. This problem can be solved using the FXOPM.xls spreadsheet.Solution:d1 = [ln(69.50/68) + .5(.142)2(.50)]/(.142)√.50 = .2675d2 = d1 - .142√.50 = .2765 - .1004 = .1671N(d1) = .6055N(d2) = .5664N(-d1) = .3945N(-d2) = .4336C e = [69.50(.6055) - 68(.5664)]e-(.035)(.50) = 3.51 centsP e = [68(.4336) - 69.50(.3945)]e-(.035)(.50) = 2.03 cents12. Use the binomial option-pricing model developed in the chapter to value the call of problem 9.The volatility of the Swiss franc is 14.2 percent.Solution: The spot rate at T will be either 77.39¢ = 70.00¢(1.1056) or 63.32¢ = 70.00¢(.9045), where u = e.142 .50= 1.1056 and d = 1/u= .9045. At the exercise price of E= 68, the option will only be exercised at time T if the Swiss franc appreciates; its exercise value would be C uT= 9.39¢ = 77.39¢ - 68. If the Swiss franc depreciates it would not be rational to exercise the option; its value would be C dT = 0.The hedge ratio is h = (9.39 – 0)/(77.39 – 63.32) = .6674.Thus, the call premium is:C0= Max{[69.50(.6674) – 68((70/68)(.6674 – 1) +1)]/(1.0175), 70 – 68}= Max[1.64, 2] = 2 cents per SF.MINI CASE: THE OPTIONS SPECULATORA speculator is considering the purchase of five three-month Japanese yen call options with a striking price of 96 cents per 100 yen. The premium is 1.35 cents per 100 yen. The spot price is 95.28 cents per 100 yen and the 90-day forward rate is 95.71 cents. The speculator believes the yen will appreciate to $1.00 per 100 yen over the next three months. As the speculator’s assistant, you have been asked to prepare the following:1. Graph the call option cash flow schedule.2. Determine the speculator’s profit if the yen appreciates to $1.00/100 yen.3. Determine the speculator’s profit if the yen only appreciates to the forward rate.4. Determine the future spot price at which the speculator will only break even.Suggested Solution to the Options Speculator:1.-2. (5 x ¥6,250,000) x [(100 - 96) - 1.35]/10000 = $8,281.25.3. Since the option expires out-of-the-money, the speculator will let the option expire worthless. He will only lose the option premium.4. S T = E + C = 96 + 1.35 = 97.35 cents per 100 yen.。

国际财务管理课后习题答案chapter 7doc资料