英文会计分录

中级财务会计英 会计分录汇总

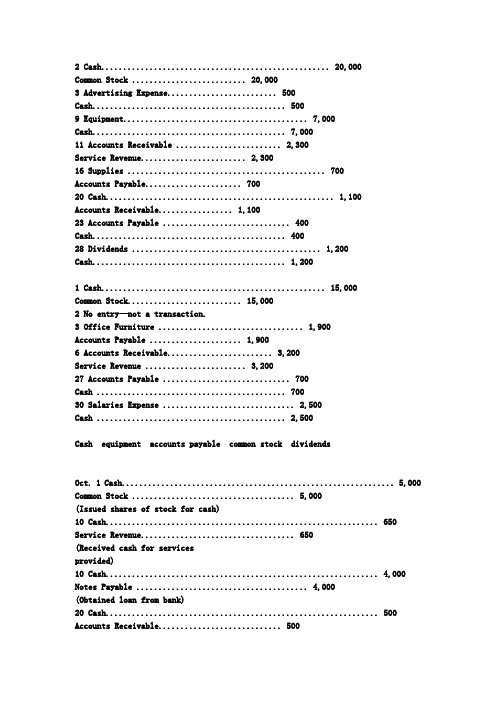

中级财务会计英会计分录汇总考点1调整分录和结账分录Ex. 3-125—Adjusting entries.Present, in journal form, the adjustments that would be made on July 31, 2011, the end ofthe fiscal year, for each of the following.1. The supplies inventory on August 1, 2010 was $7,350. Supplies costing $20,150 wereacquired during the year and charged to the supplies inventory. A count on July 31,2011 indicated supplies on hand of $8,810.2. On April 30, a ten-month, 9% note for $20,000 was received from a customer.*3. On March 1, $12,000 was collected as rent for one year and a nominal account was credited.Solution 3-1251. Supplies Expense ........................................................................ 18,690Supplies ............................................................................. 18,6902. Interest Receivable (450)Interest Revenue (450)*3. Rent Revenue .............................................................................. 7,000Unearned Revenue ........................................................... 7,000 Ex. 3-126—Adjusting entries.Reed Co. wishes to enter receipts and payments in such a manner that adjustments at theend of the period will not require reversing entries at the beginning of the next period.Record the following transactions in the desired manner and give the adjusting entry on December 31, 2010. (Two entries for each part.)1. An insurance policy for two years was acquired on April 1, 2010 for $8,000.2. Rent of $12,000 for six months for a portion of the building was received onNovember 1, 2010.Solution 3-1261. Prepaid Insurance .......................................................................... 8,000Cash .................................................................................. 8,000 Insurance Expense ........................................................................ 3,000Prepaid Insurance ............................................................. 3,000 2. Cash ............................................................................................. 12,000Unearned Rent .................................................................. 12,000 Unearned Rent .............................................................................. 4,000Rent Revenue ................................................................... 4,000 Pr. 3-133—Adjusting entries and account classification.Selected amounts from Trent Company's trial balance of 12/31/10 appear below:1. Accounts Payable $ 160,0002. Accounts Receivable 150,0003. Accumulated Depreciation—Equipment 200,0004. Allowance for Doubtful Accounts 20,0005. Bonds Payable 500,0006. Cash 150,0007. Common Stock 60,0008. Equipment 840,0009. Insurance Expense 30,00010. Interest Expense 10,00011. Merchandise Inventory 300,00012. Notes Payable (due 6/1/11) 200,00013. Prepaid Rent 150,00014. Retained Earnings 818,00015. Salaries and Wages Expense 328,000(All of the above accounts have their standard or normal debit or credit balance.)Part A. Prepare adjusting journal entries at year end, December 31, 2010, based on the following supplemental information.a. The equipment has a useful life of 15 years with no salvage value. (Straight-linemethod being used.)b. Interest accrued on the bonds payable is $15,000 as of 12/31/10.c. Expired insurance at 12/31/10 is $20,000.d. The rent payment of $150,000 covered the six months from November 30, 2010through May 31, 2011.e. Salaries and wages earned but unpaid at 12/31/10, $22,000.Part B. Indicate the proper balance sheet classification of each of the 15 numbered accounts in the 12/31/10 trial balance before adjustments by placingappropriate numbers after each of the following classifications. If the accounttitle would appear on the income statement, do not put the number in any ofthe classifications.a. Current assetsb. Property, plant, and equipmentc. Current liabilitiesd. Long-term liabilitiese. Stockholders' equitySolution 3-133Part A.a. Depreciation Expense—Equipment ($840,000 – 0) ÷ 15 ..................... 56,000Accumulated Depreciation—Equipment .................................. 56,000b. Interest Expense ................................................................................... 15,000Interest Payable ....................................................................... 15,000c. Prepaid Insurance ................................................................................. 10,000Insurance Expense ($30,000 - $20,000) ................................. 10,000d. Rent Expense ($150,000 ÷ 6) ................................................................ 25,000Prepaid Rent ............................................................................ 25,000e. Salaries and Wages Expense .............................................................. 22,000Salaries and Wages Payable ................................................... 22,000 Pr. 3-134—Adjusting entries.Data relating to the balances of various accounts affected by adjusting or closing entriesappear below. (The entries which caused the changes in the balances are not given.) Youare asked to supply the missing journal entries which would logically account for thechanges in the account balances.1. Interest receivable at 1/1/10 was $1,000. During 2010 cash received from debtors forinterest on outstanding notes receivable amounted to $5,000. The 2010 incomestatement showed interest revenue in the amount of $5,400. You are to provide themissing adjusting entry that must have been made, assuming reversing entries arenot made.2. Unearned rent at 1/1/10 was $5,300 and at 12/31/10 was $8,000. The records indicatecash receipts from rental sources during 2010 amounted to $40,000, all of which wascredited to the Unearned Rent Account. You are to prepare the missing adjustingentry.3. Accumulated depreciation—equipment at 1/1/10 was $230,000. At 12/31/10 thebalance of the account was $270,000. During 2010, one piece of equipment was sold.The equipment had an original cost of $40,000 and was 3/4 depreciated when sold.You are to prepare the missing adjusting entry.4. Allowance for doubtful accounts on 1/1/10 was $50,000. The balance in the allowanceaccount on 12/31/10 after making the annual adjusting entry was $65,000 and during2010 bad debts written off amounted to $30,000. You are to provide the missingadjusting entry.5. Prepaid rent at 1/1/10 was $9,000. During 2010 rent payments of $120,000 weremade and charged to "rent expense." The 2010 income statement shows as a generalexpense the item "rent expense" in the amount of $125,000. You are to prepare themissing adjusting entry that must have been made, assuming reversing entries arenot made.6. Retained earnings at 1/1/10 was $150,000 and at 12/31/10 it was $210,000. During2010, cash dividends of $50,000 were paid and a stock dividend of $40,000 wasissued. Both dividends were properly charged to retained earnings. You are to providethe missing closing entry.Solution 3-1341. Interest Receivable ........................................................................ 1,400Interest Revenue ............................................................... 1,400 Interest revenue per books $5,400Interest revenue received related to 2010($5,000 – $1,000) 4,000Interest accrued $1,4002. Unearned Rent Revenue ............................................................... 37,300Rent Revenue ................................................................... 37,300 Cash receipts $40,000Beginning balance 5,300Ending balance (8,000)Rent revenue $37,300Solution 3-134(cont.)3. Depreciation Expense .................................................................. 70,000Accumulated Depreciation—Equipment ........................... 70,000 Ending balance $270,000Beginning balance 230,000Difference 40,000Write-off at time of sale 3/4 × $40,000 30,000$ 70,0004. Bad Debt Expense ......................................................................... 45,000Allowance for Doubtful Accounts ....................................... 45,000 Ending balance $65,000Beginning balance 50,000Difference 15,000Written off 30,000$45,0005. Rent Expense ................................................................................ 5,000Prepaid Rent ..................................................................... 5,000 Rent expense $125,000Less cash paid 120,000Reduction in prepaid rent account $ 5,0006. Income Summary ........................................................................... 150,000Retained Earnings ............................................................. 150,000 Ending balance $210,000Beginning balance 150,000Difference 60,000Cash dividends $50,000Stock dividends 40,000 90,000$150,000Pr. 3-135—Adjusting and closing entries.The following trial balance was taken from the books of Fisk Corporation on December 31,2010.Account DebitCreditCash $ 12,000Accounts Receivable 40,000Note Receivable 7,000Allowance for Doubtful Accounts $ 1,800 Merchandise Inventory 44,000Prepaid Insurance 4,800Furniture and Equipment 125,000Accumulated Depreciation--F. & E. 15,000 Accounts Payable 10,800 Common Stock 44,000 Retained Earnings 55,000 Sales 280,000Cost of Goods Sold 111,000Salaries Expense 50,000Rent Expense 12,800Totals $406,600 $406,600 Pr. 3-135 (cont.)At year end, the following items have not yet been recorded.a. Insurance expired during the year, $2,000.b. Estimated bad debts, 1% of gross sales.c. Depreciation on furniture and equipment, 10% per year.d. Interest at 6% is receivable on the note for one full year.*e. Rent paid in advance at December 31, $5,400 (originally charged to expense).f. Accrued salaries at December 31, $5,800.Instructions(a) Prepare the necessary adjusting entries.(b) Prepare the necessary closing entries.Solution 3-135(a) Adjusting Entriesa. Insurance Expense .............................................................. 2,000Prepaid Insurance .............................................................. 2,000b. Bad Debt Expense ...................................................................... 2,800Allowance for Doubtful Accounts ....................................... 2,800c. Depreciation Expense ................................................................. 12,500Accumulated Depreciation--F. & E. .................................... 12,500d. Interest Receivable (420)Interest Revenue (420)*e. Prepaid Rent ................................................................................ 5,400Rent Expense ..................................................................... 5,400f. Salaries Expense ........................................................................ 5,800Salaries Payable ................................................................ 5,800(b) Closing EntriesSales ................................................................................................... 280,000Interest Revenue (420)Income Summary ..................................................................... 280,420Income Summary ................................................................................ 191,500Salaries Expense ..................................................................... 55,800Rent Expense ........................................................................... 7,400Depreciation Expense .............................................................. 12,500Bad Debt Expense ................................................................... 2,800Insurance Expense .................................................................. 2,000Cost of Goods Sold .................................................................. 111,000Income Summary ................................................................................ 88,920Retained Earnings .................................................................... 88,920 考点2应收帐款总价净价法,坏账处理,应收票据折价Ex. 7-136—Entries for bad debt expense.A trial balance before adjustment included the following:Debit Credit Accounts receivable $80,000Allowance for doubtful accounts 730Sales $340,000Sales returns and allowances 8,000Give journal entries assuming that the estimate of uncollectibles is determined by taking(1) 5% of gross accounts receivable and (2) 1% of net sales.Solution 7-136(1) Bad Debt Expense ................................................................... 3,270Allowance for Doubtful Accounts ................................ 3,270 Gross receivables $80,000Rate 5%Total allowance needed 4,000Present allowance (730)Adjustment needed $ 3,270Solution 7-136(cont.)(2) Bad Debt Expense ................................................................... 3,320Allowance for Doubtful Accounts ................................ 3,320 Sales $340,000Sales returns and allowances 8,000Net sales 332,000Rate 1%Bad debt expense $ 3,320Ex. 7-137—Accounts receivable assigned.Accounts receivable in the amount of $250,000 were assigned to the Fast FinanceCompany by Marsh, Inc., as security for a loan of $200,000. The finance companycharged a 4% commission on the face amount of the loan, and the note bears interest at9% per year.During the first month, Marsh collected $130,000 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.InstructionsMake all the entries for Marsh Inc. associated with the transfer of the accounts receivable,the loan, and the remittance to the finance company.Solution 7-137Cash ...................................................................................................... 192,000Finance Charge ..................................................................................... 8,000 Notes Payable ........................................................................... 200,000Cash ...................................................................................................... 130,000 Accounts Receivable ................................................................. 130,000Notes Payable ...................................................................................... 130,000Interest Expense .................................................................................... 1,500 Cash ......................................................................................... 131,500PROBLEMSPr. 7-138—Entries for bad debt expense.The trial balance before adjustment of Risen Company reports the following balances:Dr. Cr.Accounts receivable $100,000Allowance for doubtful accounts $ 2,500Sales (all on credit) 750,000Sales returns and allowances 40,000Instructions(a) Prepare the entries for estimated bad debts assuming that doubtful accounts areestimated to be (1) 6% of gross accounts receivable and (2) 1% of net sales.(b) Assume that all the information above is the same, except that the Allowance forDoubtful Accounts has a debit balance of $2,500 instead of a credit balance. Howwill this difference affect the journal entries in part (a)?Solution 7-138(a) (1) Bad Debt Expense .............................................................. 3,500Allowance for Doubtful Accounts ............................ 3,500 Gross receivables $100,000Rate 6%Total allowance needed 6,000Present allowance (2,500)Bad debt expense $ 3,500(2) Bad Debt Expense .............................................................. 7,100Allowance for Doubtful Accounts ............................ 7,100 Sales $750,000Sales returns and allowances (40,000)Net sales 710,000Rate 1%Bad debt expense $ 7,100(b) The percentage of receivables approach would be affected as follows:Gross receivables $100,000Rate 6%Total allowance needed 6,000Present allowance 2,500Additional amount required $ 8,500The journal entry is therefore as follows:Bad Debt Expense .............................................................. 8,500Allowance for Doubtful Accounts ............................ 8,500 The entry would not change under the percentage of sales method.Pr. 7-140—Accounts receivable assigned.Prepare journal entries for Mars Co. for:(a) Accounts receivable in the amount of $500,000 were assigned to Utley Finance Co.by Mars as security for a loan of $425,000. Utley charged a 3% commission on theaccounts; the interest rate on the note is 12%.(b) During the first month, Mars collected $200,000 on assigned accounts after deducting$450 of discounts. Mars wrote off a $530 assigned account.(c) Mars paid to Utley the amount collected plus one month's interest on the note.Solution 7-140(a) Cash .............................................................................................. 410,000Finance Charge ............................................................................... 15,000Notes Payable ..................................................................... 425,000(b) Cash .............................................................................................. 200,000Sales Discounts (450)Allowance for Doubtful Accounts (530)Accounts Receivable........................................................... 200,980(c) Notes Payable ................................................................................. 200,000Interest Expense .............................................................................. 4,250Cash .................................................................................... 204,250考点三存货盘存方法,折扣Ex. 8-148—Recording purchases at net amounts.Flint Co. records purchase discounts lost and uses perpetual inventories. Preparejournal entries in general journal form for the following:(a) Purchased merchandise costing $900 with terms 2/10, n/30.(b) Payment was made thirty days after the purchase.Solution 8-148(a) Inventory (.98 × $900) (882)Accounts Payable (882)(b) Accounts Payable (882)Purchase Discounts Lost (18)Cash (900)Ex. 8-149—Recording purchases at net amounts.Dill Co. records purchases at net amounts and uses periodic inventories. Prepareentries for the following:June 11 Purchased merchandise on account, $5,000, terms 2/10, n/30.15 Returned part of June 11 purchase, $800, and received credit on account.30 Prepared the adjusting entry required for financial statements.Solution 8-149June 11 Purchases (.98 × $5,000) ................................................... 4,900Accounts Payable ................................................... 4,90015 Accounts Payable (.98 × $800) (784)Purchase Returns and Allowances (784)30 Purchase Discounts Lost (.02 × $4,200) (84)Accounts Payable (84)Pr. 8-159—Accounting for purchase discounts.Otto Corp. purchased merchandise during 2010 on credit for $300,000; terms 2/10, n/30.All of the gross liability except $60,000 was paid within the discount period. The remainderwas paid within the 30-day term. At the end of the annual accounting period, December 31,2010, 90% of the merchandise had been sold and 10% remained in inventory. Thecompany uses a periodic system.Instructions(a) Assuming that the net method is used for recording purchases, prepare the entriesfor the purchase and two subsequent payments.(b) What dollar amounts should be reported for the final inventory and cost of goods soldunder the (1) net method; (2) gross method? Assume that there was no beginninginventory.Solution 8-159(a) Purchases ..................................................................................................... 294,000Accounts Payable ............................................................................ 294,000(To record the purchase at net amount:.98 × $300,000 = $294,000.)Accounts Payable ......................................................................................... 235,200 Cash ................................................................................................. 235,200(To record payment within the discount period:$300,000 – $60,000 = $240,000; .. .98 × $240,000 = $235,200.)Accounts Payable ......................................................................................... 58,800Purchase Discounts Lost .............................................................................. 1,200 Cash ................................................................................................. 60,000(To record the final payment.)考点四,存货减值跌价准备LCMEx. 9-143—Lower-of-cost-or-market.At 12/31/10, the end of Jenner Company's first year of business, inventory was $4,100and $2,800 at cost and at market, respectively.Following is data relative to the 12/31/11 inventory of Jenner:Original Net Net RealizableAppropriateCost Replacement Realizable Value Less InventoryItem Per Unit Cost Value Normal Profit ValueA $ .65 $ .45B .45 .40C .70 .75D .75 .65E .90 .85Selling price is $1.00/unit for all items. Disposal costs amount to 10% of selling price and a "normal" profit is 30% of selling price. There are 1,000 units of each item in the 12/31/11 inventory.Instructions(a) Prepare the entry at 12/31/10 necessary to implement the lower-of-cost-or-marketprocedure assuming Jenner uses a contra account for its balance sheet.(b) Complete the last three columns in the 12/31/11 schedule above based upon thelower-of-cost-or-market rules.(c) Prepare the entry(ies) necessary at 12/31/11 based on the data above.(d) How are inventory losses disclosed on the income statement?Solution 9-143(a) Loss Due to Market Decline of Inventory ........................................ 1,300Allowance to Reduce Inventory to Market .......................... 1,300 Solution 9-143(Cont.)(b) Original Net Net Realizable AppropriateCost Replacement Realizable Value Less InventoryItem Per Unit Cost Value Normal Profit ValueA $ .65 $ .45 $ .90 $ .60 $ .60B .45 .40 .90 .60 .45C .70 .75 .90 .60 .70D .75 .65 .90 .60 .65E .90 .85 .90 .60 .85$3.45 $3.25**$3.25 × 1,000 = $3,250(c) Allowance to Reduce Inventory to Market....................................... 1,300Cost of Goods Sold ............................................................. 1,300Loss Due to Market Decline of Inventory (200)Allowance to Reduce Inventory to Market (200)(Cost of inventory at 12/31/07 = $7,250)ORA student can record a recovery of $1,100.(d) Inventory losses can be disclosed separately (below gross profit in operatingexpenses) or they can be shown as part of cost of goods sold.Pr. 9-149—Gross profit method.On December 31, 2010 Felt Company's inventory burned. Sales and purchases for theyear had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1,2010) was $170,000; in the past Felt's gross profit has averaged 40% of selling price.InstructionsCompute the estimated cost of inventory burned, and give entries as of December 31,2010 to close merchandise accounts.Solution 9-149Beginning inventory $ 170,000Add: Purchases 980,000Cost of goods available 1,150,000Sales $1,400,000Less 40% (560,000) 840,000Estimated inventory lost $ 310,000Sales ...................................................................................... 1,400,000Income Summary ...................................................................... 1,400,000Cost of Goods Sold ................................................................................ 840,000Fire Loss ................................................................................................ 310,000 Inventory .................................................................................... 170,000 Purchases .................................................................................. 980,000处置出售捐赠Ex. 10-136—Donated assets.Cheng Company has recently decided to accept a proposal from the City of Bel Aire that publicly owned property with a large warehouse located on it will be donated to Cheng ifCheng will build a branch plant in Bel Aire. The appraised value of the property is$490,000 and of the warehouse is $980,000.InstructionsPrepare the entry by Cheng for the receipt of the properties.Solution 10-136Building (Warehouse) ............................................................................ 980,000Land ....................................................................................................... 490,000 Contribution Revenue................................................................ 1,470,000Ex. 11-132—Composite depreciation.Kemp Co. uses the composite method to depreciate its equipment. The following totalsare for all of the equipment in the group:Initial Residual Depreciable DepreciationCost Value Cost Per Year $700,000 $100,000 $600,000 $60,000Instructions(a) What is the composite rate of depreciation? (To nearest tenth of a percent.)(b) A machine with a cost of $18,000 was sold for $11,000 at the end of the third year.What entry should be made?Solution 11-132(a) $60,000———— = 8.6%$700,000(b) Cash ............................................................................................... 11,000Accumulated Depreciation ............................................................. 7,000Equipment ........................................................................... 18,000 Pr. 11-135—Adjustment of Depreciable Base.A truck was acquired on July 1, 2008, at a cost of $216,000. The truck had a six-yearuseful life and an estimated salvage value of $24,000. The straight-line method ofdepreciation was used. On January 1, 2011, the truck was overhauled at a cost of $20,000, which extended the useful life of the truck for an additional two years beyond thatoriginally estimated (salvage value is still estimated at $24,000). In computingdepreciation for annual adjustment purposes, expense is calculated for each month theasset is owned.InstructionsPrepare the appropriate entries for January 1, 2011 and December 31, 2011.Solution 11-135Cost $216,000Less salvage value 24,000Depreciable base, July 1, 2008 192,000Less depreciation to date [($192,000 ÷ 6) × 2 1/2] 80,000Depreciable base, Jan. 1, 2011 (unadjusted) 112,000Overhaul 20,000Depreciable base, Jan. 1, 2011 (adjusted) $132,000January 1, 2011Accumulated Depreciation ..................................................................... 20,000 Cash .......................................................................................... 20,000December 31, 2011Depreciation Expense ............................................................................ 24,000 Accumulated Depreciation ($132,000 ÷ 5.5 yrs) ....................... 24,000Ex. 12-130Barkley Corp. obtained a trade name in January 2009, incurring legal costs of $15,000.The company amortizes the trade name over 8 years. Barkley successfully defendedits trade name in January 2010, incurring $4,900 in legal fees. At the beginning of2011, based on new marketing research, Barkley determines that the fair value of thetrade name is $12,000. Estimated total future cash flows from the trade name are$13,000 on January 4, 2011.InstructionsPrepare the necessary journal entries for the years ending December 31, 2009, 2010,and 2011. Show all computations.Solution 12-1302009Dec. 31 Amortization Expense - Trade Name 1,875Trade Name 1,875($15,000 ÷ 8 years)。

(财务会计)英文会计分录最全版

(财务会计)英文会计分录accompanyingdocument附件account账户、科目accountpayable应付账款accounttitle/accountingitem会计科目accountingdocument/accountingvoucument 会计凭证accountingelement会计要素accountingentity会计主体accountingentries会计分录accountingequation/accountingidentity 会计恒等式accountingfunction会计职能accountingpostulate会计假设accountingprinciple会计原则accountingreport/accountingstatement 会计报表accountingstandard会计准则accountingtimeperiodconcept会计分期accountsreceivable/receivables应收账款accrual-basisaccounting权责发生制原则accumulateddepreciation累计折旧amortizationexpense/expensenotallocated 待摊费用annualstatement年报ArthurAndersenWorldwide安达信全球assets资产balance余额balancesheet资产负债表begainningbalance/openingbalance 期初余额capital资本capitalexpenditure资本性支出capitalshare股本capitalsurplus资本公积cash现金cashinbank银行存款cashjournal现金日记账cashonhand现金cashsystem(basis)ofaccounting/cash-basisprinci 收付实现制certifiedpracticingaccountant注册会计师comparabilityprinciple可比性原则compoundjournalentry复合分录conservatism(保守)principle/theprudence(稳健)prin谨慎性原则consistencyprinciple 壹贯性原则contingentassets或有资产contingentliabilities 或有负债costaccounting成本会计creditbalance贷方余额creditside贷方currentinvestment 短期投资debitbalance借方余额debitside借方deferredassets递延资产deferredliabilities递延负债DeloitteToucheTohmatsu 德勤depreciablelife折旧年限depreciationexpense折旧费用depreciationrate折旧率descriptions摘要doubleentry复式记账double-entrybook-keeping 复式簿记employeebenefitspayable 应付福利费endingbalance期末余额Ernst&YoungInternational 安永国际estimateldscrapvalue估计残值exchangegain汇兑收益exchangeloss汇兑损失expenses/charges费用factoryoverhead/manufacturingexpense 制造费用financialaccounting财务会计financialexpense财务费用fiscalyear/accountingperiods会计年度fixedassets固定资产floatingassets/currentassets流动资产floatingliabilities/currentliability 流动负债generalledger总分类账going-concernbasis持续运营goodwill商誉historicalcost历史成本historicalcostprinciple历史成本原则:incomestatement/profitandlossstatement 利润表损益表incometax所得税intangibleassets无形资产internationalaccounting国际会计KPMGInternational毕马威国际liabilities负债liabilitydividend/dividendpayable应付股利long-terminvestmentlong-termliabilities长期负债managementaccounting 管理会计managementexpense 管理费用matchingprinciple配比原则materialityprinciple重要性原则monthlystatement月报negativegoodwill负商誉净资产netcost净成本netincome净收益netincomeapportionment 利润分配netproceeds净收入netprofit净利润non-operatinggain营业外收入non-operatinglossnotespayable应付票据notesreceivable/receivables 应收票据objectivity(reliability)principle 客观性原则obligee/creditor债权人Obligor/invester债务人operatingexpense营业费用operatingrevenue营业收入owner'sequity所有者权益periodexpense期间费用perpetualinventorysystem永续盘存制personalproperty动产physicalinventorysystem实地盘存制postingdocument记账凭证prepayments/paymentinadvance 预付款项PriceWaterHouseCoopers普华永道productcost/outputcost生产成本product/finishedgoods产成品profit利润profitaftertax税后利润profitbeforetax税前利润purchase购货purchasereturnandallowances 购货退回和折让quarterlystatement季报rawmaterials原材料realestate不动产relevanceprinciple相关性原则reserveforbaddebts/baddebtsexpense/provisi 坏帐准备residual(salvage)value折余价值(残值)retainsearning留存收益revenueexpenditure收益性支出revenues收入salesallowances 销货折让salesdiscount 销货折扣salesinvoice销货发票salesonaccount 赊销salesreturn销售退回salesrevenue 销售收入sellingcost销售成本sellingexpense销售费用simpleournalentry简单分录sourcedocument原始凭证stable-monetaryconcept货币计量starting-loadcost/organizationcosts开办费statementofcashflow/cashflowstatement 现金流量表stockonhand/inventory存货stub存根subsidiaryaccounts 明细账户subsidiaryledger 明细分类账surplusreserve盈余公积T-account/transfer T字形账户tangibleassets有形资产taxespayable应交税金theunderstandabilityprinciple明晰性原则timeliness及时性原则transaction交易travelingexpense差旅费trialbalance试算平衡undistributedprofits/undividedprofits 未分配利润unearnedrevenue预收款项unrelatedbusinessincome营业外收益usefullife使用年限valueaddedtax增值税voucher付款凭证wagespayable/salariespayable 应付工资workinprocess/goodsinprocess在产品。

会计分录英文版

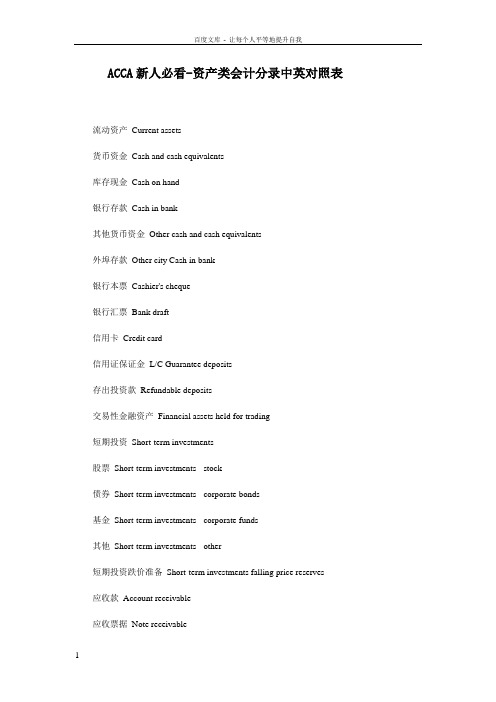

资产类 Assets流动资产 Current assets货币资金 Cash and cash equivalents库存现金 Cash on hand银行存款 Cash in bank其他货币资金 Other cash and cash equivalents外埠存款 Other city Cash in bank银行本票 Cashier's cheque银行汇票 Bank draft信用卡 Credit card信用证保证金 L/C Guarantee deposits存出投资款 Refundable deposits交易性金融资产 Financial assets held for trading短期投资 Short-term investments股票 Short-term investments - stock债券 Short-term investments - corporate bonds基金 Short-term investments - corporate funds其他 Short-term investments - other短期投资跌价准备 Short-term investments falling price reserves应收款 Account receivable应收票据 Note receivable银行承兑汇票 Bank acceptance商业承兑汇票 Trade acceptance 、应收股利 Dividend receivable应收利息 Interest receivable应收账款 Account receivable其他应收款 Other notes receivable坏账准备 Bad debt reserves资产减值损失 Asset impairment loss预付账款 Advance payment应收补贴款 Cover deficit by state subsidies of receivable库存资产 Inventories物资采购 Supplies purchasing原材料 Raw materials包装物 Wrappage低值易耗品 Low-value consumption goods材料成本差异 Materials cost variance自制半成品 Semi-Finished goods在途物资Materials in transport库存商品 Finished goods 商品进销差价 Differences between purchasing and selling price委托加工物资 Work in process - outsourced委托代销商品 Trust to and sell the goods on a commission basis受托代销商品 Commissioned and sell the goods on a commission basis存货跌价准备 Inventory falling price reserves分期收款发出商品 Collect money and send out the goods by stages待摊费用 Deferred and prepaid expenses长期投资 Long-term investment长期股权投资 Long-term investment on stocks股票投资 Investment on stocks其他股权投资 Other investment on stocks长期债权投资 Long-term investment on bonds债券投资 Investment on bonds其他债权投资 Other investment on bonds长期投资减值准备 Long-term investments depreciation reserves股权投资减值准备 Stock rights investment depreciation reserves债权投资减值准备 Bcreditor's rights investment depreciation reserves委托贷款 Entrust loans本金 Principal利息 Interest减值准备 Depreciation reserves固定资产 Fixed assets房屋 Building建筑物 Structure机器设备 Machinery equipment运输设备 Transportation facilities工具器具 Instruments and implement累计折旧 Accumulated depreciation固定资产减值准备 Fixed assets depreciation reserves 房屋、建筑物减值准备 Building/structure depreciation reserves机器设备减值准备 Machinery equipment depreciation reserves工程物资 Project goods and material专用材料 Special-purpose material专用设备 Special-purpose equipment预付大型设备款 Prepayments for equipment为生产准备的工具及器具 Preparative instruments and implement for fabricate在建工程 Construction-in-process安装工程 Erection works在安装设备 Erecting equipment-in-process技术改造工程 Technical innovation project大修理工程 General overhaul project在建工程减值准备 Construction-in-process depreciation reserves固定资产清理 Liquidation of fixed assets无形资产 Intangible assets专利权 Patents非专利技术 Non-Patents商标权 Trademarks, Trade names著作权 Copyrights土地使用权 Tenure商誉 Goodwill无形资产减值准备 Intangible Assets depreciation reserves专利权减值准备 Patent rights depreciation reserves商标权减值准备 trademark rights depreciation reserves 未确认融资费用 Unacknowledged financial charges待处理财产损溢 Wait deal assets loss or income长期待摊费用 Long-term deferred and prepaid expenses待处理财产损溢 Wait deal assets loss or income待处理流动资产损溢 Wait deal intangible assets loss or income待处理固定资产损溢 Wait deal fixed assets loss or income二、负债类 Liability短期负债 Current liability短期借款 Short-term borrowing应付票据 Notes payable银行承兑汇票 Bank acceptance商业承兑汇票 Trade acceptance应付账款 Account payable预收账款 Deposit received代销商品款 Proxy sale goods revenue应付工资 Accrued wages 应付福利费 Accrued welfarism应付股利 Dividends payable应交税金 Tax payable应交增值税 value added tax payable进项税额 Withholdings on VAT已交税金 Paying tax转出未交增值税 Unpaid VAT changeover减免税款 Tax deduction销项税额 Substituted money on VAT出口退税 Tax reimbursement for export进项税额转出 Changeover withnoldings on VAT出口抵减内销产品应纳税额 Export deduct domestic sales goods tax转出多交增值税 Overpaid VAT changeover未交增值税 Unpaid VAT应交营业税 Business tax payable应交消费税 Consumption tax payable应交资源税 Resources tax payable应交所得税 Income tax payable应交土地增值税 Increment tax on land value payable 应交城市维护建设税 Tax for maintaining and building cities payable应交房产税 Housing property tax payable应交土地使用税 Tenure tax payable应交车船使用税 Vehicle and vessel usage license plate tax(VVULPT) payable应交个人所得税 Personal income tax payable其他应交款 Other fund in conformity with paying其他应付款 Other payables预提费用 Drawing expense in advance其他负债 Other liabilities待转资产价值 Pending changerover assets value预计负债 Anticipation liabilities长期负债 Long-term Liabilities长期借款 Long-term loans一年内到期的长期借款 Long-term loans due within one year一年后到期的长期借款 Long-term loans due over one year应付债券 Bonds payable债券面值 Face value, Par value债券溢价 Premium on bonds债券折价 Discount on bonds应收利息 Interest receivable应计利息 Accrued interest长期应付款 Long-term account payable应付融资租赁款 Accrued financial lease outlay一年内到期的长期应付 Long-term account payable due within one year一年后到期的长期应付 Long-term account payable over one year专项应付款 Special payable一年内到期的专项应付 Long-term special payable due within one year一年后到期的专项应付 Long-term special payable over one year递延税款 Deferral taxes三、所有者权益类 OWNERS'' EQUITY资本 Capita实收资本(或股本) Paid-up capital(or stock)实收资本 Paicl-up capital实收股本 Paid-up stock已归还投资 Investment Returned公积资本公积 Capital reserve资本(或股本)溢价 Cpital(or Stock) premium接受捐赠非现金资产准备 Receive non-cash donate reserve股权投资准备 Stock right investment reserves拨款转入 Allocate sums changeover in外币资本折算差额 Foreign currency capital其他资本公积 Other capital reserve盈余公积 Surplus reserves法定盈余公积 Legal surplus任意盈余公积 Free surplus reserves法定公益金 Legal public welfare fund储备基金 Reserve fund企业发展基金 Enterprise expension fund利润归还投资 Profits capitalizad on return of investment 润 Profits本年利润 Current year profits利润分配 Profit distribution其他转入 Other chengeover in提取法定盈余公积 Withdrawal legal surplus 提取法定公益金 Withdrawal legal public welfare funds 提取储备基金 Withdrawal reserve fund提取企业发展基金 Withdrawal reserve for business expansion提取职工奖励及福利基金 Withdrawal staff and workers'' bonus and welfare fund利润归还投资 Profits capitalizad on return of investment 应付优先股股利 Preferred Stock dividends payable提取任意盈余公积 Withdrawal other common accumulation fund应付普通股股利 Common Stock dividends payable转作资本(或股本)的普通股股利 Common Stock dividends change to assets(or stock)未分配利润 Undistributed profit四、成本类 Cost生产成本 Cost of manufacture基本生产成本 Base cost of manufacture辅助生产成本 Auxiliary cost of manufacture制造费用 Manufacturing overhead材料费 Materials管理人员工资 Executive Salaries奖金 Wages退职金 Retirement allowance补贴 Bonus外保劳务费 Outsourcing fee福利费 Employee benefits/welfare会议费 Coferemce加班餐费 Special duties市内交通费 Business traveling通讯费 Correspondence电话费 Correspondence水电取暖费 Water and Steam税费 Taxes and dues租赁费 Rent管理费 Maintenance车辆维护费 Vehicles maintenance油料费 Vehicles maintenance培训费 Education and training接待费 Entertainment图书、印刷费 Books and printing运费 Transpotation保险费 Insurance premium支付手续费 Commission杂费 Sundry charges折旧费 Depreciation expense机物料消耗 Article of consumption劳动保护费 Labor protection fees季节性停工损失 Loss on seasonality cessation劳务成本 Service costs五、损益类 Profit and loss收入 Income业务收入 OPERATING INCOME主营业务收入 Prime operating revenue产品销售收入 Sales revenue服务收入 Service revenue其他业务收入 Other operating revenue材料销售 Sales materials代购代售包装物出租 Wrappage lease出让资产使用权收入 Remise right of assets revenue返还所得税 Reimbursement of income tax其他收入 Other revenue公允价值变动损益 Profit and loss arising from fair value changes持有至到期投资 Held-to-maturity investment投资收益 Investment income摊余成本 Amortized cost短期投资收益 Current investment income长期投资收益 Long-term investment income计提的委托贷款减值准备 Withdrawal of entrust loans reserves补贴收入 Subsidize revenue国家扶持补贴收入 Subsidize revenue from country其他补贴收入 Other subsidize revenue营业外收入 NON-OPERATING INCOME非货币性交易收益 Non-cash deal income现金溢余 Cash overage处置固定资产净收益 Net income on disposal of fixed assets出售无形资产收益 Income on sales of intangible assets 固定资产盘盈 Fixed assets inventory profit 罚款净收入 Net amercement income支出 Outlay业务支出 Revenue charges主营业务成本 Operating costs产品销售成本 Cost of goods sold服务成本 Cost of service主营业务税金及附加 Tax and associate charge营业税 Sales tax消费税 Consumption tax城市维护建设税 Tax for maintaining and building cities 资源税 Resources tax土地增值税 Increment tax on land value其他业务支出 Other business expense销售其他材料成本 Other cost of material sale其他劳务成本 Other cost of service其他业务税金及附加费 Other tax and associate charge 费用 Expenses营业费用 Operating expenses代销手续费 Consignment commission charge运杂费 Transpotation保险费 Insurance premium展览费 Exhibition fees广告费 Advertising fees管理费用 Administrative expenses职工工资 Staff Salaries修理费 Repair charge低值易耗摊销 Article of consumption办公费 Office allowance差旅费 Travelling expense工会经费 Labour union expenditure研究与开发费 Research and development expense福利费 Employee benefits/welfare职工教育经费 Personnel education待业保险费 Unemployment insurance劳动保险费 Labour insurance医疗保险费 Medical insurance会议费 Coferemce聘请中介机构费 Intermediary organs咨询费 Consult fees诉讼费 Legal cost业务招待费 Business entertainment技术转让费 Technology transfer fees矿产资源补偿费 Mineral resources compensation fees排污费 Pollution discharge fees房产税 Housing property tax车船使用税 Vehicle and vessel usage license plate tax(VVULPT)土地使用税 Tenure tax印花税 Stamp tax财务费用 Finance charge利息支出 Interest exchange汇兑损失 Foreign exchange loss各项手续费 Charge for trouble各项专门借款费用 Special-borrowing cost营业外支出 Nonbusiness expenditure捐赠支出 Donation outlay减值准备金 Depreciation reserves非常损失 Extraordinary loss处理固定资产净损失 Net loss on disposal of fixed assets出售无形资产损失 Loss on sales of intangible assets固定资产盘亏 Fixed assets inventory loss债务重组损失 Loss on arrangement罚款支出 Amercement outlay所得税 Income tax以前年度损益调整 Prior year income adjust ment应交税费-应交所得税 Tax payable - income tax payable应交税费-应交增值税(进项税额) Tax payable - VAT(input VAT)应交税费-应交增值税(销项税额)Tax payable - VAT(output VAT)应交税费-应交增值税(出口退税)Tax payable - VAT(refund of export duty)应交税费-应交增值税(进项税额转出)Tax payable - VAT(transfer-out of input VAT)应交税费-应交增值税(已交税金)Tax payable - VAT(taxes paid)应交税费-应交增值税(转出未交增值税)Tax payable - VAT(transfer-out of unpaid VAT)应交税费-应交增值税(转出多交增值税)Tax payable - VAT(transfer-out of overpaid VAT)应交税费-应交增值税(减免税款)Tax payable - VAT(VAT deductions and exemptions)应交税费-应交增值税(出口抵减内销产品应纳税额) Tax payable -VAT(export duty deductible from taxes payable on domestic sales)应交税费-应交营业税 Tax payable - business tax payable 应交税费-应交消费税 Tax payable - excise tax payable。

会计分录英文版

会计分录英文版资产类 Assets流动资产 Current assets货币资金 Cash and cash equivalents1001 现金 Cash1002 银行存款Cash in bank 1009 其他货币资金Other cash and cash equivalents100901 外埠存款 Other city Cash in bank100902 银行本票 Cashier''s cheque100903 银行汇票Bank draft 100904 信用卡Credit card 100905 信用证保证金 L/C Guarantee deposits100906 存出投资款 Refundable deposits1101 短期投资 Short-term investments110101 股票 Short-term investments - stock110102 债券Short-term investments - corporate bonds 110103 基金 Short-term investments - corporate funds 110110 其他 Short-term investments - other1102 短期投资跌价准备 Short-term investments falling price reserves应收款 Account receivable 1111 应收票据 Note receivable 银行承兑汇票 Bank acceptance 商业承兑汇票 Trade acceptance 1121 应收股利 Dividend receivable 1122 应收利息 Interestreceivable1131 应收账款 Accountreceivable1133 其他应收款 Other notesreceivable1141 坏账准备 Bad debtreserves1151 预付账款 Advance money 1161 应收补贴款 Cover deficit by state subsidies of receivable 库存资产 Inventories1201 物资采购 Supplies purchasing1211 原材料 Raw materials 1221 包装物 Wrappage1231 低值易耗品 Low-value consumption goods1232 材料成本差异 Materials cost variance1241 自制半成品 Semi-Finished goods1243 库存商品 Finished goods 1244 商品进销差价 Differences between purchasing and selling price1251 委托加工物资 Work in process - outsourced1261 委托代销商品 Trust to and sell the goods on a commission basis1271 受托代销商品Commissioned and sell the goods on a commission basis 1281 存货跌价准备 Inventory falling price reserves1291 分期收款发出商品 Collect money and send out the goodsby stages1301 待摊费用 Deferred and prepaid expenses长期投资 Long-term investment 1401 长期股权投资 Long-term investment on stocks 140101 股票投资 Investment on stocks140102 其他股权投资 Other investment on stocks1402 长期债权投资 Long-term investment on bonds 140201 债券投资 Investment on bonds140202 其他债权投资 Other investment on bonds1421 长期投资减值准备 Long- term investments depreciation reserves股权投资减值准备 Stock rights investment depreciation reserves债权投资减值准备 Bcreditor''s rights investment depreciation reserves1431 委托贷款 Entrust loans 143101 本金 Principal 143102 利息 Interest143103 减值准备 Depreciation reserves1501 固定资产 Fixed assets房屋 Building建筑物 Structure机器设备 Machinery equipment运输设备 Transportationfacilities工具器具 Instruments andimplement1502 累计折旧 Accumulateddepreciation1505 固定资产减值准备 Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciation reserves1601 工程物资 Project goods and material160101 专用材料 Special-purpose material160102 专用设备 Special-purpose equipment160103 预付大型设备款Prepayments for equipment 160104 为生产准备的工具及器具 Preparative instruments and implement for fabricate1603 在建工程 Construction-in-process安装工程 Erection works在安装设备 Erecting equipment-in-process技术改造工程 Technical innovation project大修理工程 General overhaul project1605 在建工程减值准备Construction-in-process depreciation reserves1701 固定资产清理 Liquidation of fixed assets1801 无形资产 Intangible assets 专利权 Patents非专利技术 Non-Patents商标权 Trademarks, Trade names著作权 Copyrights 土地使用权 Tenure 商誉 Goodwill1805 无形资产减值准备Intangible Assets depreciation reserves专利权减值准备 Patent rights depreciation reserves商标权减值准备 trademarkrights depreciation reserves1815 未确认融资费用Unacknowledged financial charges待处理财产损溢 Wait dealassets loss or income1901 长期待摊费用 Long-term deferred and prepaid expenses 1911 待处理财产损溢 Wait deal assets loss or income191101待处理流动资产损溢Wait deal intangible assets lossor income191102待处理固定资产损溢Wait deal fixed assets loss or income二、负债类 Liability短期负债 Current liability2101 短期借款 Short-term borrowing2111 应付票据 Notes payable 银行承兑汇票 Bank acceptance 商业承兑汇票 Trade acceptance 2121 应付账款 Account payable 2131 预收账款 Deposit received 2141 代销商品款 Proxy sale goods revenue2151 应付工资 Accrued wages 2153 应付福利费 Accrued welfarism2161 应付股利 Dividends payable2171 应交税金 Tax payable 217101 应交增值税 value added tax payable21710101 进项税额Withholdings on VAT 21710102 已交税金 Paying tax 21710103 转出未交增值税Unpaid VAT changeover 21710104 减免税款 Tax deduction21710105 销项税额 Substituted money on VAT21710106 出口退税 Tax reimbursement for export 21710107 进项税额转出Changeover withnoldings on VAT21710108 出口抵减内销产品应纳税额 Export deduct domesticsales goods tax21710109 转出多交增值税Overpaid VAT changeover21710110 未交增值税 UnpaidVAT217102 应交营业税 Businesstax payable217103 应交消费税Consumption tax payable217104 应交资源税 Resourcestax payable217105 应交所得税 Income taxpayable217106 应交土地增值税Increment tax on land valuepayable217107 应交城市维护建设税Tax for maintaining and building cities payable217108 应交房产税 Housing property tax payable217109 应交土地使用税 Tenure tax payable217110 应交车船使用税 Vehicle and vessel usage license plate tax(VVULPT) payable217111 应交个人所得税Personal income tax payable 2176 其他应交款 Other fund in conformity with paying2181 其他应付款 Other payables2191 预提费用 Drawing expense in advance其他负债 Other liabilities2201 待转资产价值 Pending changerover assets value 2211 预计负债 Anticipation liabilities长期负债Long-term Liabilities 2301 长期借款Long-term loans 一年内到期的长期借款 Long-term loans due within one year 一年后到期的长期借款 Long-term loans due over one year 2311 应付债券 Bonds payable 231101 债券面值 Face value, Par value 231102 债券溢价 Premium on bonds231103 债券折价 Discount on bonds231104 应计利息Accrued interest 2321 长期应付款Long-termaccount payable应付融资租赁款 Accruedfinancial lease outlay一年内到期的长期应付 Long-term account payable due withinone year一年后到期的长期应付 Long-term account payable over oneyear2331 专项应付款 Specialpayable一年内到期的专项应付 Long-term special payable due withinone year一年后到期的专项应付 Long-term special payable over oneyear2341 递延税款 Deferral taxes三、所有者权益类 OWNERS''EQUITY资本 Capita3101 实收资本(或股本) Paid-upcapital(or stock)实收资本 Paicl-up capital实收股本 Paid-up stock3103 已归还投资 Investment Returned公积3111 资本公积 Capital reserve 311101 资本(或股本)溢价Cpital(or Stock) premium 311102 接受捐赠非现金资产准备 Receive non-cash donate reserve311103 股权投资准备 Stock right investment reserves 311105 拨款转入 Allocate sums changeover in311106 外币资本折算差额Foreign currency capital 311107 其他资本公积 Other capital reserve3121 盈余公积 Surplus reserves 312101 法定盈余公积 Legal surplus312102 任意盈余公积 Free surplus reserves312103 法定公益金 Legal public welfare fund312104 储备基金 Reserve fund 312105 企业发展基金Enterprise expension fund312106 利润归还投资 Profitscapitalizad on return ofinvestment利润 Profits3131 本年利润 Current yearprofits3141 利润分配 Profit distribution314101 其他转入 Otherchengeover in314102 提取法定盈余公积Withdrawal legal surplus314103 提取法定公益金Withdrawal legal public welfarefunds314104 提取储备基金Withdrawal reserve fund314105 提取企业发展基金Withdrawal reserve for businessexpansion314106 提取职工奖励及福利基金 Withdrawal staff andworkers'' bonus and welfarefund314107 利润归还投资Profits capitalizad on return of investment314108 应付优先股股利Preferred Stock dividends payable314109 提取任意盈余公积Withdrawal other common accumulation fund314110 应付普通股股利Common Stock dividends payable314111 转作资本(或股本)的普通股股利Common Stockdividends change to assets(or stock)314115 未分配利润Undistributed profit四、成本类 Cost4101 生产成本 Cost of manufacture410101 基本生产成本 Base cost of manufacture410102 辅助生产成本 Auxiliary cost of manufacture 4105 制造费用 Manufacturing overhead材料费 Materials管理人员工资 Executive Salaries奖金 Wages退职金 Retirement allowance 补贴 Bonus外保劳务费 Outsourcing fee福利费 Employeebenefits/welfare会议费 Coferemce 加班餐费 Special duties市内交通费 Business traveling通讯费 Correspondence电话费 Correspondence水电取暖费 Water and Steam税费 Taxes and dues租赁费 Rent管理费 Maintenance车辆维护费 Vehiclesmaintenance油料费 Vehicles maintenance培训费 Education and training接待费 Entertainment图书、印刷费 Books andprinting运费 Transpotation保险费 Insurance premium支付手续费 Commission杂费 Sundry charges折旧费 Depreciation expense 机物料消耗 Article of consumption劳动保护费 Labor protection fees季节性停工损失 Loss on seasonality cessation4107 劳务成本 Service costs 五、损益类 Profit and loss收入 Income业务收入 OPERATING INCOME5101 主营业务收入 Prime operating revenue产品销售收入 Sales revenue 服务收入 Service revenue 5102 其他业务收入 Other operating revenue材料销售 Sales materials代购代售包装物出租 Wrappage lease 出让资产使用权收入 Remise right of assets revenue返还所得税 Reimbursement of income tax其他收入 Other revenue 5201 投资收益 Investmentincome短期投资收益 Current investment income长期投资收益 Long-term investment income计提的委托贷款减值准备Withdrawal of entrust loans reserves5203 补贴收入 Subsidize revenue国家扶持补贴收入 Subsidize revenue from country其他补贴收入 Other subsidize revenue5301 营业外收入 NON- OPERATING INCOME非货币性交易收益 Non-cashdeal income现金溢余 Cash overage处置固定资产净收益 Net income on disposal of fixed assets出售无形资产收益 Income on sales of intangible assets固定资产盘盈 Fixed assets inventory profit罚款净收入 Net amercement income支出 Outlay业务支出 Revenue charges5401 主营业务成本 Operating costs产品销售成本 Cost of goods sold服务成本 Cost of service5402 主营业务税金及附加 Tax and associate charge营业税 Sales tax消费税 Consumption tax城市维护建设税 Tax for maintaining and building cities 资源税Resources tax土地增值税 Increment tax on land value5405 其他业务支出 Other business expense销售其他材料成本 Other cost of material sale其他劳务成本 Other cost of service其他业务税金及附加费 Other tax and associate charge费用 Expenses5501 营业费用 Operating expenses代销手续费 Consignment commission charge运杂费 Transpotation保险费 Insurance premium展览费 Exhibition fees广告费 Advertising fees5502 管理费用 Administrative expenses职工工资 Staff Salaries修理费 Repair charge低值易耗摊销 Article of consumption办公费 Office allowance差旅费 Travelling expense 工会经费 Labour unionexpenditure研究与开发费 Research anddevelopment expense福利费 Employeebenefits/welfare职工教育经费 Personnel education待业保险费 Unemployment insurance劳动保险费 Labour insurance医疗保险费 Medical insurance 会议费 Coferemce聘请中介机构费 Intermediary organs咨询费 Consult fees诉讼费 Legal cost业务招待费 Business entertainment技术转让费 Technology transfer fees矿产资源补偿费 Mineral resources compensation fees 排污费 Pollution discharge fees 房产税 Housing property tax车船使用税 Vehicle and vessel usage license plate tax(VVULPT) 土地使用税 Tenure tax印花税 Stamp tax5503 财务费用 Finance charge 利息支出 Interest exchange汇兑损失 Foreign exchange loss 各项手续费 Charge for trouble 各项专门借款费用 Special- borrowing cost5601 营业外支出 Nonbusinessexpenditure捐赠支出 Donation outlay减值准备金 Depreciation reserves非常损失 Extraordinary loss处理固定资产净损失 Net loss on disposal of fixed assets出售无形资产损失 Loss on sales of intangible assets固定资产盘亏 Fixed assets inventory loss债务重组损失 Loss on arrangement罚款支出 Amercement outlay 5701 所得税 Income tax以前年度损益调整 Prior year income adjustment。

英文会计分录

中文科目是老的叫法)现金Cash in hand银行存款Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票Other monetary assets - bank draft其他货币资金-信用卡Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment 短期投资-股票投资Investments - Short term - stocks短期投资-债券投资Investments - Short term - bonds短期投资-基金投资Investments - Short term - funds短期投资-其他投资Investments - Short term - others短期投资跌价准备Provision for short-term investment长期股权投资-股票投资Long term equity investment - stocks长期股权投资-其他股权投资Long term equity investment - others 长期债券投资-债券投资Long term securities investemnt - bonds长期债券投资-其他债权投资Long term securities investment - others 长期投资减值准备Provision for long-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interest receivable应收帐款Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款Prepayment应收补贴款Allowance receivable其他应收款Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产Other current assets物资采购Purchase原材料Raw materials包装物Packing materials低值易耗品Low value consumbles材料成本差异Material cost difference自制半成品Self-manufactured goods库存商品Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资Consigned processiong material委托代销商品Consignment-out受托代销商品Consignment-in分期收款发出商品Goods on instalment sales存货跌价准备Provision for obsolete stocks待摊费用Prepaid expenses待处理流动资产损益Unsettled G/L on current assets待处理固定资产损益Unsettled G/L on fixed assets委托贷款-本金Consignment loan - principle委托贷款-利息Consignment loan - interest委托贷款-减值准备Consignment loan - provision固定资产-房屋建筑物Fixed assets - Buildings固定资产-机器设备Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures固定资产-运输设备Fixed assets - Automobiles累计折旧Accumulated depreciation固定资产减值准备Impairment of fixed assets工程物资-专用材料Project material - specific materials工程物资-专用设备Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具Project material - tools and facilities for production在建工程Construction in progress在建工程减值准备Impairment of construction in progress固定资产清理Disposal of fixed assets无形资产-专利权Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权Intangible assets - trademark rights无形资产-土地使用权Intangible assets - land use rights无形资产-商誉Intangible assets - goodwill无形资产减值准备Impairment of intangible assets长期待摊费用Deferred assets未确认融资费用Unrecognized finance fees其他长期资产Other long term assets递延税款借项Deferred assets debits应付票据Notes payable应付帐款Trade creditors预收帐款Adanvances from customers代销商品款Consignment-in payables其他应交款Other payable to government其他应付款Other creditors应付股利Proposed dividends待转资产价值Donated assets预计负债Accrued liabilities应付短期债券Short-term debentures payable其他流动负债Other current liabilities预提费用Accrued expenses应付工资Payroll payable应付福利费Welfare payable短期借款-抵押借款Bank loans - Short term - pledged短期借款-信用借款Bank loans - Short term - credit短期借款-担保借款Bank loans - Short term - guaranteed一年内到期长期借款Long term loans due within one year一年内到期长期应付款Long term payable due within one year长期借款Bank loans - Long term应付债券-债券面值Bond payable - Par value应付债券-债券溢价Bond payable - Excess应付债券-债券折价Bond payable - Discount应付债券-应计利息Bond payable - Accrued interest长期应付款Long term payable专项应付款Specific payable其他长期负债Other long term liabilities应交税金-所得税Tax payable - income tax应交税金-增值税Tax payable - V AT应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings, beginning of the year资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - reture investment by investment主营业务收入Sales主营业务成本Cost of sales主营业务税金及附加Sales tax营业费用Operating expenses管理费用General and administrative expenses财务费用Financial expenses投资收益Investment income其他业务收入Other operating income营业外收入Non-operating income补贴收入Subsidy income其他业务支出Other operating expenses营业外支出Non-operating expenses所得税Income tax一、资产类assets现金cash on hand银行存款cash in bank其他货币资金other cash and cash equivalent短期投资short-term investment短期投资跌价准备short-term investments falling price reserve应收票据notes receivable应收股利dividend receivable应收利息interest receivable应收帐款accounts receivable坏帐准备bad debt reserve预付帐款advance money应收补贴款cover deficit receivable from state subsidize其他应收款other notes receivable在途物资materials in transit原材料raw materials包装物wrappage低值易耗品low-value consumption goods库存商品finished goods委托加工物资work in process-outsourced委托代销商品trust to and sell the goods on a commission basis受托代销商品commissioned and sell the goods on a commission basis 存货跌价准备inventory falling price reserve分期收款发出商品collect money and send out the goods by stages待摊费用deferred and prepaid expenses长期股权投资long-term investment on stocks长期债权投资long-term investment on bonds长期投资减值准备long-term investment depreciation reserve固定资产fixed assets累计折旧accumulated depreciation工程物资project goods and material在建工程project under construction固定资产清理fixed assets disposal无形资产intangible assets开办费organization/preliminary expenses长期待摊费用long-term deferred and prepaid expenses待处理财产损溢wait deal assets loss or income二、负债类debts短期借款short-term loan应付票据notes payable应付帐款accounts payable预收帐款advance payment代销商品款consignor payable应付工资accrued payroll应付福利费accrued welfarism应付股利dividends payable应交税金tax payable其他应交款accrued other payments其他应付款other payable预提费用drawing expenses in advance长期借款long-term loan应付债券debenture payable长期应付款long-term payable递延税款deferred tax住房周转金revolving fund of house三、所有者权益owners equity股本paid-up stock资本公积capital reserve盈余公积surplus reserve本年利润current year profit利润分配profit distribution四、成本类cost生产成本cost of manufacture制造费用manufacturing overhead五、损益类profit and loss (p/l)主营业务收入prime operating revenue其他业务收入other operating revenue折扣与折让discount and allowance投资收益investment income补贴收入subsidize revenue营业外收入non-operating income主营业务成本operating cost主营业务税金及附加tax and associate charge 其他业务支出other operating expenses存货跌价损失inventory falling price loss营业费用operating expenses管理费用general and administrative expenses 财务费用financial expenses营业外支出non-operating expenditure所得税income tax以前年度损益调整adjusted p/l for prior year。

英文分录写法

英文分录写法是指在会计记录中,将每一笔经济业务按照借贷方向和金额进行详细描述的方法。

以下是一些常见的英文分录写法:1. 资产类账户的借方分录:-收到现金或银行存款:Dr. Cash/Bank A/C + Cr. Sales/Receivables A/C-购买固定资产:Dr. Fixed Assets A/C + Cr. Cash/Bank A/C-收到应收账款:Dr. Receivables A/C + Cr. Sales A/C2. 负债类账户的贷方分录:-支付现金或银行存款:Dr. Cash/Bank A/C + Cr. Payables A/C-偿还借款:Dr. Loans Payable A/C + Cr. Cash/Bank A/C-支付应付账款:Dr. Payables A/C + Cr. Cash/Bank A/C3. 所有者权益类账户的贷方分录:-收到投资款项:Dr. Capital A/C + Cr. Cash/Bank A/C-发放股息:Dr. Dividends A/C + Cr. Cash A/C-支付工资:Dr. Salaries and Wages A/C + Cr. Cash A/C4. 收入类账户的贷方分录:-销售商品:Dr. Sales A/C + Cr. Receivables A/C-提供服务收入:Dr. Service Revenue A/C + Cr. Receivables A/C-收到利息收入:Dr. Interest Income A/C + Cr. Cash A/C5. 费用类账户的借方分录:-购买原材料:Dr. Materials A/C + Cr. Cash A/C-支付租金:Dr. Rent A/C + Cr. Cash A/C-支付工资:Dr. Salaries and Wages A/C + Cr. Cash A/C。

会计英语分录

•1)purchases of inventory in cash for $3 000•Dr. Inventory 3000Cr. Cash 3000•2)sales on account of $10 000•Dr. Accounts receivable 10 000Cr. Sales revenue 10 0003)paid $50 000 in salaries & wagesDr. Salaries & wages expense 50 000Cr. Bank deposit 50 0004)cash sale of US$1 180Dr. Cash 1 180Cr. Sales revenue 1 1805)pre-paid insurance for $12 000Dr. Prepaid insurance 12 000Cr. Bank deposit 12 0006) Issued a one-month-term note $20 000 for the payment of accounts payable .Dr. Accounts payable 20 000Cr. Notes payable 20 0007) purchased a piece of land as long-term investment for cash $10 000.Dr. Land 10 000Cr. Cash 10 0008) purchased office equipment for cash $5 000.Dr. Office equipment 5000Cr. Cash 50009) purchased on account a lot of merchandise amounting $60 000.Dr. Inventory 60 000Cr. Accounts payable 60 00010) made a sale of merchandise on account for $81 000Dr. Accounts receivable 81 000Cr. Sales revenue 81 00011) paid cash in advance for two months’ rent $800.Dr. Prepaid rent 800Cr. Cash 80012) collection from customers $70 000: $60 000 cash, $10 000 note–a one-month term note bearing 10.8% interest.Dr. Cash 60 000Notes receivable 10 000Cr. Accounts receivable 70 00013) paid $40 000 cash for accounts payable–liability item.Dr. Accounts payable 40 000Cr. Cash 40 00014) paid other expenses $5 200 in cash.Dr. Other expenses 5 200Cr. Cash 5 20015) paid cash for employees’ salaries $16 000 for the first four weeks of the month.Dr. Salary expenses 16 000Cr. Cash 16 00016) payment of cash dividend $2 000.Dr. Dividend 2 000Cr. Cash 2 00017) paid a $1 200 premium(费用)in cash for one year’s insurance in advance.Dr. Prepaid Insurance 1 200Cr. Cash 1 20018) At the end of this month, $100 of prepaid insurance had expired(期满) or been used up.Dr. Insurance Expense 100Cr. Prepaid Insurance 10019) The owner Andy invest $20 000 cash into businessDr. Bank Deposit 20 000Cr. Capital 20 00020) Purchased a dental equipment(牙科设备) for $16,000 cash in bank(银行存款)Dr. Dental equipment 16 000Cr. Cash in bank 16 00021) Purchase an air conditioner(空调)on credit for $16,000Dr. Air conditioner 16 000Cr. Account payable 16 00022) Received Accounting service revenue $1500Dr. Bank deposit 1 500Cr. Service revenue 1 50023) Sold goods on credit for $1000 that originally cost $600Dr. Account receivable 1000Cr. Sales revenues 1000Dr. Cost of good sold(主营业务成本) 600Cr. Inventory 60024) Paid money owed to the transportation company $100Dr. Account payable 100Cr. Bank deposit 10025) Received $150 cash from customer.Dr. cash 150Cr. Account receivable 15026) Owner withdrew $100 cash for personal useDr. Drawings(资本退出)100Cr. Cash 10027) Customer- Janson owing $100 has gone bankrupt (破产)Dr. Bad debts (坏账)100Cr. Account receivable 100。

会计英语分录

1/1 Ba l.

6,000 5,500

Re nta l Re ve nue 1/31 500

Learning Objective

To prepare adjusting entries to accrue unpaid expenses.

LO5

Accruing Unpaid Expenses

End of Current Period

Transaction Paid cash in advance of incurring expense (creates an asset).

Adjusting Entry Recognizes portion of asset consumed as expense, and Reduces balance of asset account.

Converting Liabilities to Revenue

Examples Include: Airline Ticket Sales Sports Teams’ Sales of Season Tickets

Converting Liabilities to Revenue

$6,000 Rental Contract Coverage for 12 Months $500 Monthly Rental Revenue Jan. 1 Dec. 31

GENERAL JOURNAL

Da te Ja n. Account Title s a nd Ex pla na tion 1 Ca sh Une a rne d Re nta l Re ve nue Colle cte d $6,000 in a dva nce for re nt. De bit 6,000 6,000 Cre dit

英文会计分录

中文科目是老的叫法)现金Cash in hand银行存款Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票Other monetary assets - bank draft其他货币资金-信用卡Other monetary assets - credit cards其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment 短期投资-股票投资Investments - Short term - stocks短期投资-债券投资Investments - Short term - bonds短期投资-基金投资Investments - Short term - funds短期投资-其他投资Investments - Short term - others短期投资跌价准备Provision for short-term investment长期股权投资-股票投资Long term equity investment - stocks长期股权投资-其他股权投资Long term equity investment - others 长期债券投资-债券投资Long term securities investemnt - bonds长期债券投资-其他债权投资Long term securities investment - others 长期投资减值准备Provision for long-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interest receivable应收帐款Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款Prepayment应收补贴款Allowance receivable其他应收款Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产Other current assets物资采购Purchase原材料Raw materials包装物Packing materials低值易耗品Low value consumbles材料成本差异Material cost difference自制半成品Self-manufactured goods库存商品Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资Consigned processiong material委托代销商品Consignment-out受托代销商品Consignment-in分期收款发出商品Goods on instalment sales存货跌价准备Provision for obsolete stocks待摊费用Prepaid expenses待处理流动资产损益Unsettled G/L on current assets待处理固定资产损益Unsettled G/L on fixed assets委托贷款-本金Consignment loan - principle委托贷款-利息Consignment loan - interest委托贷款-减值准备Consignment loan - provision固定资产-房屋建筑物Fixed assets - Buildings固定资产-机器设备Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment, furniture and fixtures固定资产-运输设备Fixed assets - Automobiles累计折旧Accumulated depreciation固定资产减值准备Impairment of fixed assets工程物资-专用材料Project material - specific materials工程物资-专用设备Project material - specific equipment工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具Project material - tools and facilities for production在建工程Construction in progress在建工程减值准备Impairment of construction in progress固定资产清理Disposal of fixed assets无形资产-专利权Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权Intangible assets - trademark rights无形资产-土地使用权Intangible assets - land use rights无形资产-商誉Intangible assets - goodwill无形资产减值准备Impairment of intangible assets长期待摊费用Deferred assets未确认融资费用Unrecognized finance fees其他长期资产Other long term assets递延税款借项Deferred assets debits应付票据Notes payable应付帐款Trade creditors预收帐款Adanvances from customers代销商品款Consignment-in payables其他应交款Other payable to government其他应付款Other creditors应付股利Proposed dividends待转资产价值Donated assets预计负债Accrued liabilities应付短期债券Short-term debentures payable其他流动负债Other current liabilities预提费用Accrued expenses应付工资Payroll payable应付福利费Welfare payable短期借款-抵押借款Bank loans - Short term - pledged短期借款-信用借款Bank loans - Short term - credit短期借款-担保借款Bank loans - Short term - guaranteed一年内到期长期借款Long term loans due within one year一年内到期长期应付款Long term payable due within one year长期借款Bank loans - Long term应付债券-债券面值Bond payable - Par value应付债券-债券溢价Bond payable - Excess应付债券-债券折价Bond payable - Discount应付债券-应计利息Bond payable - Accrued interest长期应付款Long term payable专项应付款Specific payable其他长期负债Other long term liabilities应交税金-所得税Tax payable - income tax应交税金-增值税Tax payable - V AT应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings, beginning of the year资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - reture investment by investment主营业务收入Sales主营业务成本Cost of sales主营业务税金及附加Sales tax营业费用Operating expenses管理费用General and administrative expenses财务费用Financial expenses投资收益Investment income其他业务收入Other operating income营业外收入Non-operating income补贴收入Subsidy income其他业务支出Other operating expenses营业外支出Non-operating expenses所得税Income tax一、资产类assets现金cash on hand银行存款cash in bank其他货币资金other cash and cash equivalent短期投资short-term investment短期投资跌价准备short-term investments falling price reserve应收票据notes receivable应收股利dividend receivable应收利息interest receivable应收帐款accounts receivable坏帐准备bad debt reserve预付帐款advance money应收补贴款cover deficit receivable from state subsidize其他应收款other notes receivable在途物资materials in transit原材料raw materials包装物wrappage低值易耗品low-value consumption goods库存商品finished goods委托加工物资work in process-outsourced委托代销商品trust to and sell the goods on a commission basis受托代销商品commissioned and sell the goods on a commission basis 存货跌价准备inventory falling price reserve分期收款发出商品collect money and send out the goods by stages待摊费用deferred and prepaid expenses长期股权投资long-term investment on stocks长期债权投资long-term investment on bonds长期投资减值准备long-term investment depreciation reserve固定资产fixed assets累计折旧accumulated depreciation工程物资project goods and material在建工程project under construction固定资产清理fixed assets disposal无形资产intangible assets开办费organization/preliminary expenses长期待摊费用long-term deferred and prepaid expenses待处理财产损溢wait deal assets loss or income二、负债类debts短期借款short-term loan应付票据notes payable应付帐款accounts payable预收帐款advance payment代销商品款consignor payable应付工资accrued payroll应付福利费accrued welfarism应付股利dividends payable应交税金tax payable其他应交款accrued other payments其他应付款other payable预提费用drawing expenses in advance长期借款long-term loan应付债券debenture payable长期应付款long-term payable递延税款deferred tax住房周转金revolving fund of house三、所有者权益owners equity股本paid-up stock资本公积capital reserve盈余公积surplus reserve本年利润current year profit利润分配profit distribution四、成本类cost生产成本cost of manufacture制造费用manufacturing overhead五、损益类profit and loss (p/l)主营业务收入prime operating revenue其他业务收入other operating revenue折扣与折让discount and allowance投资收益investment income补贴收入subsidize revenue营业外收入non-operating income主营业务成本operating cost主营业务税金及附加tax and associate charge 其他业务支出other operating expenses存货跌价损失inventory falling price loss营业费用operating expenses管理费用general and administrative expenses 财务费用financial expenses营业外支出non-operating expenditure所得税income tax以前年度损益调整adjusted p/l for prior year。

常见的会计分录英文表达

常见的会计分录英文表达(清楚整理)一、资产类assets现金cash on hand银行存款cash in bank其他货币资金other cash and cash equivalent短期投资short-term investment短期投资跌价准备short-term investments falling price reserve 应收票据notes receivable应收股利dividend receivable应收利息interest receivable应收帐款accounts receivable坏帐准备bad debts reserve预付帐款prepayments / payment in advance应收补贴款cover deficit receivable from state subsidize其他应收款other notes receivable在途物资materials in transit原材料raw materials包装物wrappage低值易耗品low-value consumption goods库存商品finished goods委托加工物资work in process-outsourced委托代销商品trust to and sell the goods on a commission basis受托代销商品commissioned and sell the goods on a commission basis存货跌价准备inventory falling price reserve分期收款发出商品collect money and send out the goods by stages 待摊费用deferred and prepaid expenses长期股权投资long-term investment on stocks长期债权投资long-term investment on bonds长期投资减值准备long-term investment depreciation reserve固定资产fixed assets累计折旧accumulated depreciation工程物资project goods and material在建工程project under construction固定资产清理fixed assets disposal无形资产intangible assets开办费organization/preliminary expenses长期待摊费用long-term deferred and prepaid expenses待处理财产损溢wait deal assets loss or income二、负债类debts短期借款short-term loan应付票据notes payable应付帐款accounts payable预收帐款advance payment代销商品款consignor payable应付工资accrued payroll应付福利费accrued welfarism应付股利dividends payable应交税金tax payable其他应交款accrued other payments其他应付款other payable预提费用drawing expenses in advance 长期借款long-term loan应付债券debenture payable长期应付款long-term payable递延税款deferred tax住房周转金revolving fund of house三、所有者权益owners equity股本paid-up stock资本公积capital reserve盈余公积surplus reserve本年利润current year profit利润分配profit distribution四、成本类cost生产成本cost of manufacture制造费用manufacturing overhead,五、损益类profit and loss (p/l)主营业务收入prime operating revenue其他业务收入other operating revenue折扣与折让discount and allowance投资收益investment income补贴收入subsidize revenue营业外收入non-operating income主营业务成本operating cost主营业务税金及附加tax and associate charge其他业务支出other operating expenses存货跌价损失inventory falling price loss营业费用operating expenses管理费用general and administrative expenses 财务费用financial expenses营业外支出non-operating expenditure所得税income tax以前年度损益调整adjusted p/l for prior year资产+费用=负责+所有者权益+收入财务三大主表:资产负债表、利润表(权益表)、现金流量表Account 帐chart of account 会计科目表credit 借方debit 贷方journal 日记帐ledger 分类帐posting 过帐trial balance 试算平衡表Accounting system 会计系统Audit 审计accrual-basis accounting 权责发生制会计accrued expense 应计费用accrued revenue 应计收入accumulated depreciation 累计折旧Balance sheet 资产负债表Income statement 损益表Statement of cash flow 现金流量表感谢下载!欢迎您的下载,资料仅供参考。

英语会计分录

3 Office Furniture ................................. 1,900

Accounts Payable ..................... 1,900

6 Accounts Receivable........................ 3,200

3 Advertising Expense......................... 500

Cash............................................ 500

9 Equipment.......................................... 7,000

会计分录印花税会计分录工会经费会计分录差旅费会计分录利息收入会计分录计提工资会计分录会计分录大全会计分录习题及答案累计折旧会计分录增值税会计分录

2 Cash.................................................... 20,000

Common Stock .......................... 20,000

Accounts Payable ............................................... 500

Common Stock.................................................... 7,000

Dividends............................................................. 300

常见的会计分录英文表达

常见的会计分录英文表达(清楚整理)一、资产类 assets现金 cash on hand银行存款 cash in bank其他货币资金 other cash and cash equivalent短期投资 short-term investment短期投资跌价准备 short-term investments falling price reserve 应收票据 notes receivable应收股利 dividend receivable应收利息 interest receivable应收帐款 accounts receivable坏帐准备 bad debts reserve预付帐款prepayments / payment in advance应收补贴款 cover deficit receivable from state subsidize其他应收款 other notes receivable在途物资 materials in transit原材料 raw materials包装物 wrappage低值易耗品 low-value consumption goods库存商品 finished goods委托加工物资 work in process-outsourced委托代销商品 trust to and sell the goods on a commission basis 受托代销商品 commissioned and sell the goods on a commission basis 存货跌价准备 inventory falling price reserve分期收款发出商品 collect money and send out the goods by stages 待摊费用 deferred and prepaid expenses长期股权投资 long-term investment on stocks长期债权投资 long-term investment on bonds长期投资减值准备 long-term investment depreciation reserve固定资产 fixed assets累计折旧 accumulated depreciation工程物资 project goods and material在建工程 project under construction固定资产清理 fixed assets disposal无形资产 intangible assets开办费 organization/preliminary expenses长期待摊费用 long-term deferred and prepaid expenses待处理财产损溢 wait deal assets loss or income二、负债类 debts短期借款 short-term loan应付票据 notes payable应付帐款 accounts payable预收帐款 advance payment代销商品款 consignor payable应付工资 accrued payroll应付福利费 accrued welfarism应付股利 dividends payable应交税金 tax payable其他应交款 accrued other payments其他应付款 other payable预提费用 drawing expenses in advance长期借款 long-term loan应付债券 debenture payable长期应付款 long-term payable递延税款 deferred tax住房周转金 revolving fund of house三、所有者权益 owners equity股本 paid-up stock资本公积 capital reserve盈余公积 surplus reserve本年利润 current year profit利润分配 profit distribution四、成本类 cost生产成本 cost of manufacture制造费用manufacturing overhead,五、损益类 profit and loss (p/l)主营业务收入 prime operating revenue其他业务收入 other operating revenue折扣与折让 discount and allowance投资收益 investment income补贴收入 subsidize revenue营业外收入 non-operating income主营业务成本 operating cost主营业务税金及附加 tax and associate charge 其他业务支出 other operating expenses存货跌价损失 inventory falling price loss 营业费用 operating expenses管理费用 general and administrative expenses财务费用 financial expenses营业外支出 non-operating expenditure所得税 income tax以前年度损益调整 adjusted p/l for prior year资产+费用=负责+所有者权益+收入财务三大主表:资产负债表、利润表(权益表)、现金流量表Account 帐chart of account 会计科目表credit 借方 debit 贷方journal 日记帐 ledger 分类帐posting 过帐trial balance 试算平衡表Accounting system 会计系统Audit 审计accrual-basis accounting 权责发生制会计accrued expense 应计费用accrued revenue 应计收入accumulated depreciation 累计折旧Balance sheet 资产负债表Income statement 损益表Statement of cash flow 现金流量表(注:表格素材和资料部分来自网络,供参考。

常见的会计分录英文表达

一、资产类现金银行存款其他货币资金短期投资短期投资跌价准备应收票据应收股利应收利息应收帐款坏帐准备预付帐款应收补贴款其他应收款在途物资原材料包装物低值易耗品库存商品委托加工物资委托代销商品受托代销商品存货跌价准备分期收款发出商品待摊费用长期股权投资长期债权投资长期投资减值准备固定资产累计折旧工程物资在建工程固定资产清理无形资产开办费长期待摊费用待处理财产损溢参考医学常见的会计分录英文表达(清楚整理)assets cashon hand cashin bankother cash and cash equivalent short-term investment short-term investments falling price reservenotes receivable dividend receivable interest receivable accounts receivable bad debts reserve prepayments / payment in advance cover deficit receivable from state subsidize other notes receivable materials in transitraw materials wrappage low-value consumption goods finished goodswork in process-outsourcedtrust to and sell the goods on a commission basis commissioned and sell the goods on a commission basis inventory falling price reserve collect money and send out the goods by stages deferred and prepaid expenseslong-term investment on stocks long-term investment on bonds long-term investment depreciation reserve fixed assets accumulated depreciation project goods and material project under constructionfixed assets disposal intangible assetsorganization/preliminary expenses long-term deferred and prepaid expenses wait deal assets loss or income参考医学二、负债类短期借款应付票据应付帐款预收帐款代销商品款应付工资应付福利费应付股利应交税金其他应交款其他应付款预提费用长期借款应付债券长期应付款递延税款住房周转金debts short-term loan notes payable accounts payable advance paymentconsignor payable accrued payrollaccrued welfarism dividends payable tax payableaccrued other payments otherpayabledrawing expenses in advancelong-term loan debenture payable long-term payable deferred tax revolving fund of house三、所有者权益 owners equity 股本paid-up stock资本公积盈余公积本年利润利润分配capital reserve surplus reserve current year profit profit distribution四、成本类生产成本制造费用costcost of manufacture manufacturing overhead ,五、损益类主营业务收入其他业务收入折扣与折让投资收益补贴收入营业外收入主营业务成本profit and loss ( p/l )prime operating revenue other operating revenue discount and allowance investment income subsidize revenue non-operating income operating cost主营业务税金及附加 tax and associate charge其他业务支出存货跌价损失营业费用other operating expenses inventory falling price loss operating expenses管理费用 财务费用 f 营业外支出 所得税 inc 以前年度损益调整 income tax参考医学general and administrative expenses financial expenses non-operating expenditureadjusted p/l for prior year资产 +费用=负责 +所有者权益 +收入财务三大主表:资产负债表、利润表(权益表)、现金流量表 Account 帐chart of account 会计科目表 credit 借方 debit 贷方 journal 日记帐 ledger 分类帐 posting 过帐 trial balance 试算平衡表 Accounting system 会计系统 Audit 审计 accrual-basis accounting 权责发生制会计 accrued expense 应计费用 accrued revenue 应计收入 accumulated depreciation 累计折旧 Balance sheet 资产负债表 Income statement 损益表Statement of cash flow 现金流量表(注:表格素材和资料部分来自网络,供参考。

中英对照会计分录

中英对照会计分录

会计分录是会计核算过程中的重要环节,它记录了所有会计业务的发生和处理情况。

以下是一些常见的中英对照会计分录:

1. 购进材料

中文:借:原材料进货

贷:银行存款

英文:Debit: Purchases of Raw Materials

Credit: Bank Account

2. 销售商品

中文:借:银行存款

贷:销售收入

英文:Debit: Bank Account

Credit: Sales Revenue

3. 支付租金

中文:借:租金支出

贷:银行存款

英文:Debit: Rent Expense

Credit: Bank Account

4. 支付工资

中文:借:工资支出

贷:银行存款

英文:Debit: Wage Expense

Credit: Bank Account

5. 借款

中文:借:银行贷款

贷:银行存款

英文:Debit: Bank Loan

Credit: Bank Account

以上是常见的中英对照会计分录,需要注意的是,每个企业的具体情况可能不同,会计人员需要根据实际业务情况进行正确的会计分录。

ACCA新人必看资产类会计分录中英对照表