《商务英语翻译》历年真题及答案[]doc

商务英语翻译试题题型及答案

商务英语翻译一:选择题(20分,共10小题)主要考课文里面的例句,给出英文的句子,从四个中文选项中选择最佳的答案(感觉不太难,只要认真看书一两遍应该无问题)二:商务词汇英译中(20分,共20小题)考一些有关商务的词汇(感觉有些课本里面有,有些课本里面没有)三:改错题(20分,共10小题)给出一个英文句子,然后给一个错误的中文翻译,要求改正错误(感觉也是从书里的例句抽出来的,不过这题考得细致一些)四:商务信件翻译(20分)给出一封完整的商务信件,要求翻译(感觉课本里面也有类似的信件,不过不知道是不是每次都从课本里抽来考)五:商务合同翻译(20分)抽出商务合同中的其中一段,要求翻译(注意课本里面那篇课文和仅有的那一题课后练习,应该有帮助)05355 商务英语翻译试卷商务英语翻译试卷第1套I. Multiple Choice (20 points, 2 points for each) 1. Rising damp, if not treated effectively, could in time cause extensive damage to the structure of your home, ruin decoration and furniture. A. 如果处理不当,墙内潮气最终可能会对房屋的结构造成大面积破坏,毁掉装修和家具。

如果处理不当,墙内潮气最终可能会对房屋的结构造成大面积破坏,毁掉装修和家具。

B. 如果处理不当,墙内潮气最终可能会对房屋的结构、装修以及家具造成大面积破坏和损害。

害。

C. 如果处理不当,墙内的潮湿气体准时可能会对房屋的结构造成大面积破坏,毁掉装修和家具。

家具。

D. 如果处理不当,墙内的潮湿气体准时可能会对房屋的结构、装修以及家具造成大面积破坏。

坏。

2. This contract is entered into as of the seventh day of March, 2002, by and between Lonk Co. Ltd., a corporation organized under the laws of the United States of America (hereinafter called the "Purchaser"), and Wingo Co. Group, a corporation organized under hereinafter called the "Seller"). the laws of the People’s Republic of China ( A. 2002年3月7日,本合同由依照美国法律成立的龙科有限公司[以下简称甲方]和依照中订立。

商务英语翻译期末试题及答案

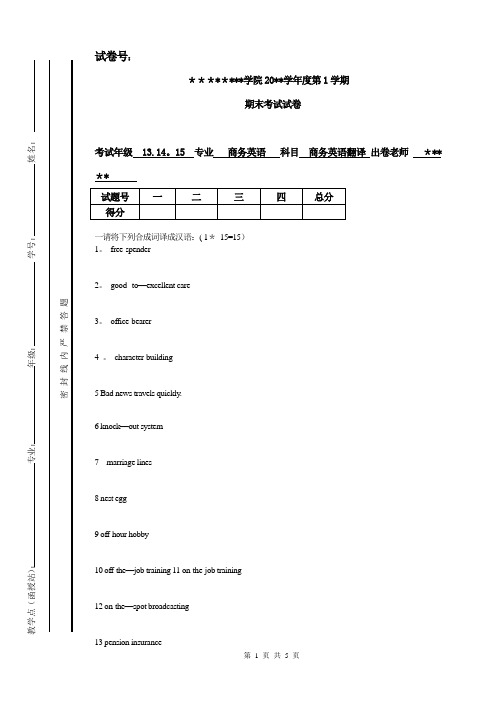

教学点(函授站):专业:年级:学号:姓名: 密封线内 严禁答题试卷号: ********学院20**学年度第1学期 期末考试试卷 考试年级 13.14。

15 专业 商务英语 科目 商务英语翻译 出卷老师 *****一请将下列合成词译成汉语:( 1* 15=15) 1。

free-spender 2。

good--to —excellent care 3。

office-bearer 4 。

character-building 5 Bad news travels quickly . 6 knock —out system 7 marriage lines 8 nest egg 9 off-hour hobby 10 off-the —job training 11 on-the-job training 12 on-the —spot broadcasting13 pension insurance14 red—hot news15 red-letter day二下面的句子可采用增减词法来翻译,请写出具体的增词法或具体的减词法:(2*5=10)1。

Rumors had already spread along the streets and lanes。

2. I could knit when I was seven.3。

The day when he was born remains unknown.4.W e live and learn.5。

Once you are in , you wouldn't be allowed to get out。

三写出下列每组分别属于何种合译:(2*5=10)1.to and from here and there off and onup and down2.often and often by and by men and men hours and hours3.thick and thin within and without off and on fair or foul4.forgive and forget now or never high and dry mend or end5.bread and butter pick and steal odds and ends house and home四。

《商务英语翻译》历年真题及答案[]doc

![《商务英语翻译》历年真题及答案[]doc](https://img.taocdn.com/s3/m/7a0eb17ab4daa58da0114a86.png)

全国商务英语翻译统一考试初级笔译练习试题练习一Part I Translate the following sentences into English or Chinese1.迄今为止,各国的移民政策侧重于为低技能工人设置障碍,同时鼓励高技能专业人才、工程师、科学家和企业家前来工作,甚至定居。

2.Kasda是瑞士的汽车、能源和食品集团公司。

本年度第一季度,尽管它的总营业额下降了6%,但是利润却增加了12.1%。

3.“海洋城”以其绵延10英里(相当于16公里)的海滩而闻名,每年接待约800万游客4.当富人想到将财富传给子孙的时候,他们通常会有两种情绪:害怕和忧虑。

他们害怕或忧虑金钱会对子孙产生消极影响;害怕金钱会让子孙失去通过努力工作获得成功的人生动力。

5.关于我方第315号订单,由于到货质量低劣,我方被迫表达强烈不满。

6.China is fielding its largest-ever Olympic team at the upcoming Beijing Games, with 639 athletes competing in all 28 sports. The Chinese team will attempt to surpass the 32 gold medals won at the Athens Olympics, four less than the United States.7.A Japanese media report says Japan and China have reached a compromise and agreed to jointly develop gas fields and share profits in disputed areas of the East China Sea.8.The number of newly laid-off U.S. workers rose last week, the latest sign that the economic downturn is affecting the job market. A report Thursday from the Labor Department said the number of people applying for unemployment benefits for the first time rose 22–thousand, to 378–thousand.9. Chinese economy suffered only a mild setback in the first quarter of 2008, and remains resilient despite inflation and worsening global credit crisis.10. Praise and encouragement also makes employees more likely to work hard and stay in their jobs, saving on the cost of finding replacements.Part II Translate the following passages into Chinese.Passage 1Most Americans believe someone isn’t grown up until age 26, probably with a completed education, a full-time job, a family to support and financial independence, a survey said.But they also believe that becoming an official grown-up is a process that takes five years from about the age of 20, concluded the report from the University of Chicago’s National Opinion Research Center. The findings were based on a representative sample of 1398 people over age 18.The poll found the following ages at which people expect the transitions to grown-up status to be completed: age 20.9 self-supporting; 21.1 no longer living with parents; 21.2 full-time job; 22.3 education complete; 24.5 being able to support a family financially; 25.7 married; and 26.2 having a child.“There is a large degree of consensus across social groups on the relative importance of the seven transitions,” said Tom Smith, director of the survey. The only notable pattern of differences is on views about supporting a family, having a child and g etting married. “Older adults and the widowed and married rate these as more important than younger adults and the never-married do,” he added. “This probably reflects in large part a shift in values across generations away from traditional family values.”The most valued step toward reaching adulthood, the survey found, was completing an education, followed by full-time employment, supporting a family, financial independence, living independently of parents, marriage and parenthood.Passage 2Spend less than you earn. This is perhaps the most worn out, overused phrase in the world of personal finance. But guess what? It’s also the single most important financial lesson you’ll ever learn. No matter how hard you work and how much money you earn, you’ll never achieve financial security if you spend more than you earn, so…… do whatever it takes to make sure that this doesn’t happen. This takes self-discipline, and might require constructing a budget, but if you ever want to get to a point where you can afford all the little niceties in life, you need to make it happen.Plan for the future. I’ve been where you are, and I know that “the future” seems like it’s a million miles away. Do yourself a favor. Sit down and define short, intermediate, and long-term goals and then put together a plan for getting there. It’s not easy, and you probably won’t get it right at first but once you do this, you’ll have something concrete to work from (and to modify in the future). Start small and work your way up.Be patient. Building a solid financial foundation takes time. Don’t look for shortcuts or try to strike it rich overnight wit h the latest hot investment tip. Likewise, don’t make major financial decisions wi thout fully considering the ramifications. This isn’t to say that you should be paralyzed fear. Rather, you need to do your homework. Turn those unknowns into knowns, andthen make an informed decision.Learn form your mistakes. Nobody’s perfect. You’re bound to make mistakes, especially when you’re just starting out. The important thing is to learn from them and move forward. If you make a bad financial decision, make a note of it and get yourself back on track. Don’t beat yourself up , and don’t throw in the towel.Part III Translate the following passages into EnglishPassage 1亲爱的布莱克先生:从您5月16日来函获知我公司销售代表敷衍草率,我深感苦恼。

商务英语考试翻译试题及答案

商务英语考试翻译试题及答案商务英语考试翻译试题及答案该题型旨在考核学生两种语言对应能力,五个汉语单句需译成英语,要求体现原语形式意义。

1. 发达成员有责任帮助发展中成员尽快走出困境。

这样也有助于发达成员实现持续发展。

2. 新的.世纪充满着机遇和挑战,让我们共同合作,迎接挑战,使多边贸易体制得到巩固和加强,为世界经济贸易的稳定和发展不断做出贡献。

3. 谢谢你方3月10日来函。

从信中我们获悉你方希望得到我方梅林牌罐头食品的报盘。

4. 在大多数情况下,目的一致(盈利)而方式各异的交易的双方最终都要经过谈判来做成生意。

5. 我们无意催促你方作出决定,但是由于该商品需求量大,为了你方的利益我们建议你方接受我们的报盘。

参考答案:1. Developed members have the obligation to help lift developing members out of the current difficulties at an early date, which will in turn facilitate their own sustainable development.2. The new century is full of opportunities and challenges. Let us work together to meet these challenges, and to consolidate and strengthen the multilateral trading system and to make continued contributions to the stability and development of world economy and trade.3. Thank you for your letter of March 10, from which we have learned that you hope to receive our offer for “Meilin” Brand canned goods.4. For the most part, negotiation comes down to theinteraction between two sides with a common goal but divergent methods.5. It is not our intention to rush you into a decision, but as this article is in great demand, we would advise you to avail yourselves of our offer in your own interest.。

商务翻译期末试题及答案

商务翻译期末试题及答案一、选择题1. 下列哪个选项最好地描述了商务翻译的主要任务?a) 在两种语言之间进行准确的语言转换b) 清晰地表达商务信息以满足客户需求c) 提供专业的口译服务d) 进行文化交流和理解答案:b) 清晰地表达商务信息以满足客户需求2. 商务翻译的重要特征之一是:a) 翻译精确无误b) 忠实于原文c) 语言流畅自然d) 掌握多种语言答案:c) 语言流畅自然3.下列哪个选项是在商务文件翻译中需要特别注意的?a) 语法错误b) 文化差异c) 原文错误d) 词汇选择答案:b) 文化差异4. 下列哪种翻译工具可以帮助商务翻译提高效率?a) 翻译记忆软件b) 在线词典c) 翻译论坛d) 语法参考书答案:a) 翻译记忆软件二、简答题1. 商务翻译为什么要注重准确性和流畅性?答案:准确性是商务翻译的基本要求,因为商务信息需要被准确地传达给客户或合作伙伴。

流畅性则是为了提高信息的可读性和可理解性,确保翻译后的文本能够顺畅表达原文的含义。

2. 商务翻译中如何处理文化差异?答案:在处理文化差异时,商务翻译需要了解不同文化背景下的商务习惯、礼仪和价值观念。

翻译时应避免使用可能引起文化冲突或误解的表达方式,并灵活运用文化转换技巧,以确保商务信息的正确传递。

3. 请列举两种商务翻译常用的互联网资源。

答案:a) 在线词典:提供多语种的词汇解释和翻译,方便翻译人员查询和验证词义。

b) 翻译记忆软件:记录翻译人员之前的翻译结果,方便在类似内容出现时进行参考,提高翻译效率。

三、翻译题英文原文:Dear Sir/Madam,We are pleased to inform you that your application for the position of Business Translator has been successful. We were impressed by your language skills and your understanding of business terminology.Your main responsibilities will include translating business documents, contracts, and reports from English to Chinese, and vice versa. You will also be required to provide interpreting services during business meetings and conferences.Please report to our office on Monday, May 3rd, at 9:00 am for an orientation session. You will receive further details about your duties and responsibilities on that day.Once again, congratulations on your appointment. We look forward to working with you.Yours sincerely,HR Manager将上述英文原文翻译成中文。

全国商务英语翻译考试讲义及真题参考答案

全国商务英语翻译考试笔译资料全国商务英语翻译考试练习题(一)Part I. Translate the following sentences into English1. 产品通过广告(例如:电视广告、收音机广告、报纸广告以及广告牌),包装(例如:设计、标签、材料),产品宣传,公关以及个人推销等途径介绍给顾客。

2. 经济界人士普遍认为:两家大公司不约而同在中国举行如此高级别和大规模的业务会议,说明了中国市场对他们的重要性。

3. 如果选择直接投资,必须解决两个问题:第一、选择合适的合作方;第二、要对合作方及其市场情况作财务、技术和法律分析,以确定投资可取性。

4. 故宫也称紫禁城,位于北京市中心,500年中曾居住过24个皇帝,是明清两代的皇宫。

它是中国最大、最完整的宫殿群,是中国文化遗产之宝库。

Part II. Translate the following sentences into Chinese1. I would appreciate it if you could quote us your best CIF price, giving a full specification of your product and shipping date. Of course our technical department would need to have some samples to test before we could place a firm order.2. The landscape of Guilin tops those elsewhere, the landscape of Yangshuo tops that of Guilin. The latter gives a perfect combination of natural scenery and cultural heritage.3. To adapt to the changes in world trade and in compliance with the requirements of both visitors and exhibitors, the Chinese Export Commodities Fair is introducing a major reform in its operation.4. You would get a full refund if there should be a delay in the shipment. However, should you fail to honor your payment in due time, we would terminate the contract and lodge a claim against you.全国商务英语翻译考试练习题(二)Part I. Translate the following sentences into English1. 德国人在商务往来时以十分拘泥于礼节而著称,对德国人来说,头衔很重要,忘记称呼某人的头衔会造成极大的冒犯。

商务英语翻译测试题及答案完整版

商务英语翻译测试题及答案HEN system office room 【HEN16H-HENS2AHENS8Q8-HENH1688】I. Translate the following sentences paying attention to the meanings of words italicized.(15%)1. The above quoted are the articles in great demand, which have won a high reputation in various markets.2. The articles in this agreement must not be modified and endedwithout the agreement by the both parties.3. However, the tariff should not be greater in amount than the margin of price caused by dumping.4. As usual, the lion’s share of the budget is for defense.5. He once again imparted to us his great knowledge, experience and wisdom.II. Translate the following sentences with extension.(15%)1. There is a mixture of the tiger and ape in the character of Hitler.2.China, which postedits highest growth rate in a decade, is Asia’s new star performer.3. John took to his studies eagerly, and proved an adept pupil.4. I have no head for mathematics.5. This would lead to a countdown in Afghanistan. III. Translate the following sentences with conversion of part of speech if necessary.(20%) 1. All international disputes must be settled through negotiations and the avoidance of any armed conflicts.2. I’ll do it nowbefore I forget it.3. One of our ways for getting heat is burning fuels.4. The oil in the tank has been up.5. Doctors have said that they are not sure they can save his life.6. The maiden voyage of the newly-built steamship was a success.7. The buildings around are mostly of modern construction.8. All peace-loving people demand the complete prohibition and thorough destruction of nuclear weapons.9. This communication system is chiefly characterized by its simplicity of operation.10. Prices have reached rock bottom.IV. Translate the following sentences with amplification or omission.(20%)1. He was weak and old.2. He was described as impressed by Deng’s flexibility.3. He dismissed the meeting without aclosing speech.4. Long-stemmed models ankled through the lobby.5. Yesterday evening I had seen her on herknees in front of the house.6. Judges are supposedto treat every person equally before the law.7. We have more waterthan earth on this globe.8. We are here to add what we can to life, not to get what we can from it.9. To learn is not an easy matter and to apply what one has learned is even harder.10. The person in the picture is wrinkled andblack, with scant gray hair.V. Translate the following letter of promotion into Chinese.(30%)Offer of a Quality Product Bamboo CarvingsDear Sirs/ Madams,We are very pleased to send you with this letter a copy of our catalogue for bamboo carvings. The high quality of our product is well-known and we are confident that a trial order would convince you our goods are excellent.We are offering you goods of the highest quality on unusually generous terms and would welcome the opportunity to serve you.Yours faithfulllyThe Brunner Trade CompanyCOLLOCATIONThe above quoted are the articles in great demand, which have won a high reputation in various markets.上述报价的商品均为畅销货物,它们已在世界各地市场上赢得很高的声誉。

商务英语翻译试题题型及答案

商务英语翻译一:选择题(20分,共10小题)主要考课文里面的例句,给出英文的句子,从四个中文选项中选择最佳的答案(感觉不太难,只要认真看书一两遍应该无问题)二:商务词汇英译中(20分,共20小题)考一些有关商务的词汇(感觉有些课本里面有,有些课本里面没有)三:改错题(20分,共10小题)给出一个英文句子,然后给一个错误的中文翻译,要求改正错误(感觉也是从书里的例句抽出来的,不过这题考得细致一些)四:商务信件翻译(20分)给出一封完整的商务信件,要求翻译(感觉课本里面也有类似的信件,不过不知道是不是每次都从课本里抽来考)五:商务合同翻译(20分)抽出商务合同中的其中一段,要求翻译(注意课本里面那篇课文和仅有的那一题课后练习,应该有帮助)05355商务英语翻译试卷第1套I. Multiple Choice (20 points, 2 points for each)1. Rising damp, if not treated effectively, could in time cause extensive damage to the structure of your home, ruin decoration and furniture.A. 如果处理不当,墙内潮气最终可能会对房屋的结构造成大面积破坏,毁掉装修和家具。

B. 如果处理不当,墙内潮气最终可能会对房屋的结构、装修以及家具造成大面积破坏和损害。

C. 如果处理不当,墙内的潮湿气体准时可能会对房屋的结构造成大面积破坏,毁掉装修和家具。

D. 如果处理不当,墙内的潮湿气体准时可能会对房屋的结构、装修以及家具造成大面积破坏。

2. This contract is entered into as of the seventh day of March, 2002, by and between Lonk Co. Ltd., a corporation organized under the laws of the United States of America (hereinafter called the "Purchaser"), and Wingo Co. Group, a corporation organized under the laws of the People’s Republic of China ( hereinafter called the "Seller").A. 2002年3月7日,本合同由依照美国法律成立的龙科有限公司[以下简称甲方]和依照中华人民共和国法律成立的文果集团公司[以下简称乙方]订立。

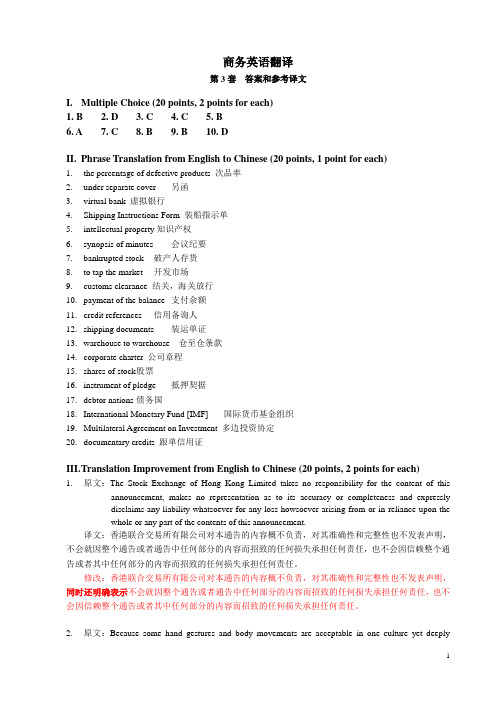

商务英语翻译试卷第3套 答案及参考译文

商务英语翻译第3套答案和参考译文I.Multiple Choice (20 points, 2 points for each)1. B2. D3. C4. C5. B6. A7. C8. B9. B 10. DII.Phrase Translation from English to Chinese (20 points, 1 point for each)1.the percentage of defective products 次品率2.under separate cover 另函3.virtual bank 虚拟银行4.Shipping Instructions Form 装船指示单5.intellectual property知识产权6.synopsis of minutes 会议纪要7.bankrupted stock 破产人存货8.to tap the market 开发市场9.customs clearance 结关,海关放行10.payment of the balance 支付余额11.credit references 信用备询人12.shipping documents 装运单证13.warehouse to warehouse 仓至仓条款14.corporate charter 公司章程15.shares of stock 股票16.instrument of pledge 抵押契据17.debtor nations 债务国18.International Monetary Fund [IMF] 国际货币基金组织19.Multilateral Agreement on Investment 多边投资协定20.documentary credits 跟单信用证III.T ranslation Improvement from English to Chinese (20 points, 2 points for each)1.原文:The Stock Exchange of Hong Kong Limited takes no responsibility for the content of thisannouncement, makes no representation as to its accuracy or completeness and expresslydisclaims any liability whatsoever for any loss howsoever arising from or in reliance upon thewhole or any part of the contents of this announcement.译文:香港联合交易所有限公司对本通告的内容概不负责,对其准确性和完整性也不发表声明,不会就因整个通告或者通告中任何部分的内容而招致的任何损失承担任何责任,也不会因信赖整个通告或者其中任何部分的内容而招致的任何损失承担任何责任。

商务英语翻译试题试卷及答案

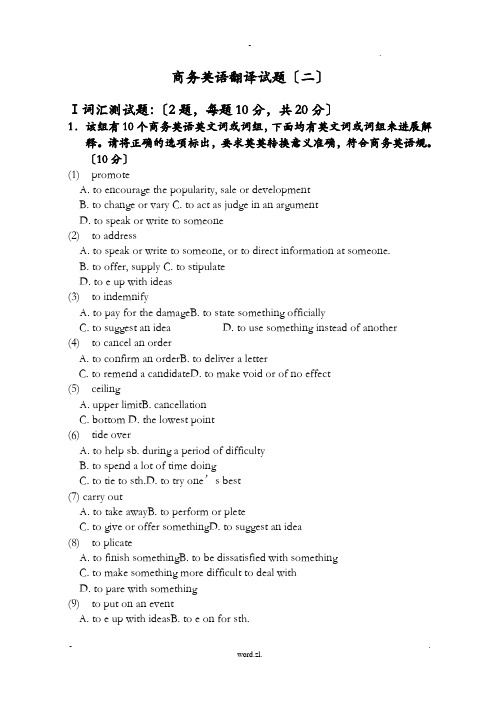

商务英语翻译试题〔二〕Ⅰ词汇测试题:〔2题,每题10分,共20分〕1.该组有10个商务英语英文词或词组,下面均有英文词或词组来进展解释。

请将正确的选项标出,要求英英转换意义准确,符合商务英语规。

〔10分〕(1) promoteA. to encourage the popularity, sale or developmentB. to change or varyC. to act as judge in an argumentD. to speak or write to someone(2) to addressA. to speak or write to someone, or to direct information at someone.B. to offer, supplyC. to stipulateD. to e up with ideas(3) to indemnifyA. to pay for the damageB. to state something officiallyC. to suggest an ideaD. to use something instead of another(4) to cancel an orderA. to confirm an orderB. to deliver a letterC. to remend a candidateD. to make void or of no effect(5) ceilingA. upper limitB. cancellationC. bottomD. the lowest point(6) tide overA. to help sb. during a period of difficultyB. to spend a lot of time doingC. to tie to sth.D. to try one’s best(7) carry outA. to take awayB. to perform or pleteC. to give or offer somethingD. to suggest an idea(8) to plicateA. to finish somethingB. to be dissatisfied with somethingC. to make something more difficult to deal withD. to pare with something(9) to put on an eventA. to e up with ideasB. to e on for sth.C. to arrange for sthD. to work on managerial skills(10) emergencyA. sth. dangerous or serious which happens suddenlyB. stipulationC. sales promotionD. an act of breaking a law, promise or agreement2. 该组有10个商务英语英文词或词组,下面均有汉语词或词组来进展解释,请将正确项选出,要求英汉转换意义准确,符合商务英语规。

商务英语翻译试题一试卷及答案1.doc

商务英语翻译试题 (一(1-5) BBCCB (6-10) ABAAB2. (1-5) CBCBD (6-10) BCABA)I词汇测试题:(2题,每题10分,共20分)1.该组有10个商务英语英文词或词组,下面均有英文词或词组来进行解释。

请将正确的选项标出,要求英英转换意义准确,符合商务英语规范。

(10分)(1)to concludeA.to give one's place to eachB.to end or ju dge after so me considera tionC. to e xplainD.to contain(2)to enfo rceA. to br eak or act a gainst a lawB. to ca use a law or rule to be obeyedC.to prevent mov ement from h appeningD.to dire ct something into a part icular place(3)to appo intA. to take back pr opertyB. to me et some one's needsC.to choose so meone offici ally for a j obD.to claim for something(4)to appro veA. to abi de byB.to comply wi thC. to hav e a positive opinionD. to come u p with(5)obviateA. to violateB. to remove a d讦ficulty, to avoidC・ to allow sb to do D. to b e apparent(6)to violat eA. to br eak or act a gainst a law , principleB・ to beat or threaten someoneC.to obey a I awD. to cause a rul e to be obey ed.(7)with respect toA. comply wi thB.in relation toC.conf orm toD. coi ncide with(8)to entert ain a die ntA. to cater forB. to t reat sb. at the tableC • to launch a product D. to sh orten a vaca tion(9)temp tationA.try ing to attra ct peopleB.to encour age the popu larity, sale s and develo pmentC・ to allow the va lue of money to varyD.to judge or decide the a mount(10)a dvaneeA. to support by giving moneyB・ to go or move sth. f orward, to d evelop or im prove C・ to i mprove or in crease D.to produce or provide2.该组有10个商务英语英文词或词组,下面均有汉语词或词组来进行解释, 请将正确项选出,要求英汉转换意义准确,符合商务英语规范。

商务英语翻译试题(五)试卷及答案_5

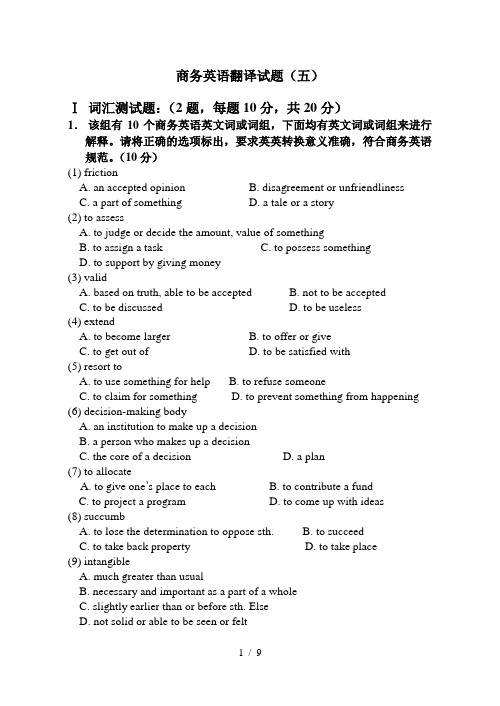

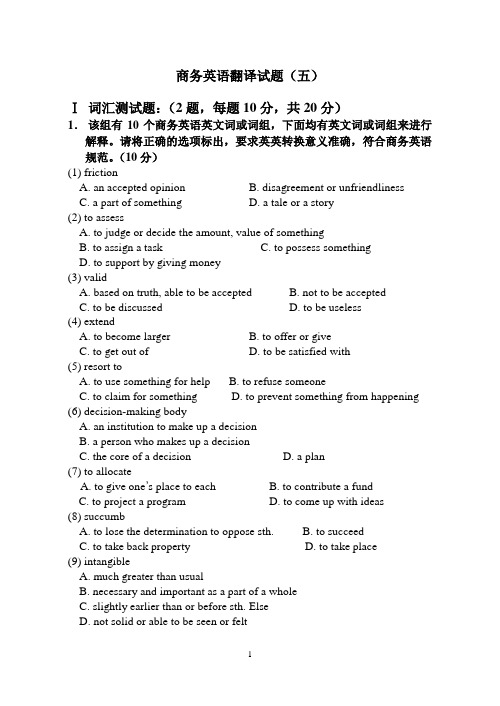

商务英语翻译试题(五)Ⅰ词汇测试题:(2题,每题10分,共20分)1.该组有10个商务英语英文词或词组,下面均有英文词或词组来进行解释。

请将正确的选项标出,要求英英转换意义准确,符合商务英语规范。

(10分)(1) frictionA. an accepted opinionB. disagreement or unfriendlinessC. a part of somethingD. a tale or a story(2) to assessA. to judge or decide the amount, value of somethingB. to assign a taskC. to possess somethingD. to support by giving money(3) validA. based on truth, able to be acceptedB. not to be acceptedC. to be discussedD. to be useless(4) extendA. to become largerB. to offer or giveC. to get out ofD. to be satisfied with(5) resort toA. to use something for helpB. to refuse someoneC. to claim for somethingD. to prevent something from happening(6) decision-making bodyA. an institution to make up a decisionB. a person who makes up a decisionC. the core of a decisionD. a plan(7) to allocateA. to give one’s place to eachB. to contribute a fundC. to project a programD. to come up with ideas(8) succumbA. to lose the determination to oppose sth.B. to succeedC. to take back propertyD. to take place(9) intangibleA. much greater than usualB. necessary and important as a part of a wholeC. slightly earlier than or before sth. ElseD. not solid or able to be seen or felt(10) entitleA. to pay for the damageB. to refuse to giveC. to have a particular right to doD. to compare with2. 该组有10个商务英语英文词或词组,下面均有汉语词或词组来进行解释,请将正确项选出,要求英汉转换意义准确,符合商务英语规范。

商务英语翻译试卷第2套-答案及参考译文

商务英语翻译第2套答案和参考译文I.Multiple Choice (20 points, 2 points for each)1.D 2.C 3.B 4.B 5.A6.C 7.B 8.D 9.D 10. BII.Phrase Translation from English to Chinese (20 points, 1 point for each)1.subsidiary companies 子公司, 附属公司2.surface appearance 表面状况3.trimming charges 平仓费4.Synopsis of Minutes 会议纪要5.to tap the market 开发市场6.tax exemption 免税7.time drafts 远期汇票8.50% discount on selected items 部分商品半价优惠9.bill for collection 托收汇票[= draft for collection]10.business circle 经济周期11.fine workmanship and durability 工艺精湛经久耐用12.cashier's desk 收银处13.China Commodity Inspection Bureau 中国商品检验局14.documents against payment 付款交单15.bill of entry 报关单16.floor price 最低限价ernment procurements 政府采购18.line of credit 信贷额度19.port of discharge 卸货港20.protective tariffs 保护性关税III.T ranslation Improvement from English to Chinese (20 points, 2 points for each)1.原文:Without prejudice to any rights which exist under the applicable laws or under the Subcontract, theContractor shall be entitled to withhold or defer payment of all or part of any sums otherwise dueby the Contractor to the Subcontractor.译文:承包商依据适当的法律或分包合同在对拥有的任何权力不带成见的条件下,应该有权扣留或暂缓支付在不同情况下应由承包商支付给分包商的任何全部或部分金额。

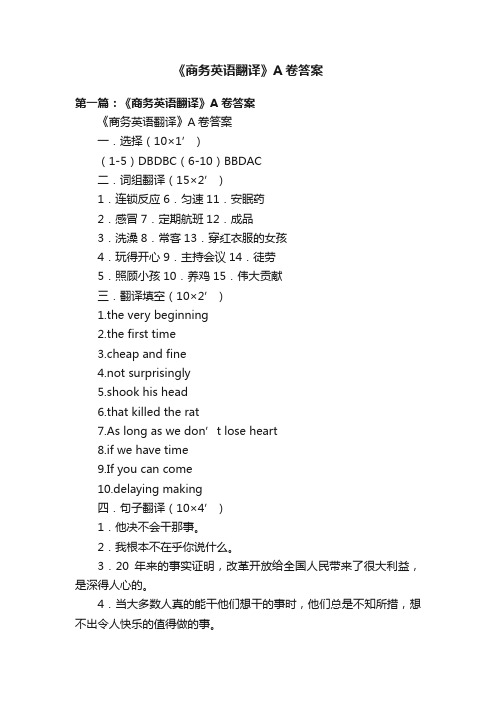

《商务英语翻译》A卷答案

《商务英语翻译》A卷答案第一篇:《商务英语翻译》A卷答案《商务英语翻译》A卷答案一.选择(10×1’)(1-5)DBDBC(6-10)BBDAC二.词组翻译(15×2’)1.连锁反应6.匀速11.安眠药2.感冒7.定期航班12.成品3.洗澡8.常客13.穿红衣服的女孩4.玩得开心9.主持会议14.徒劳5.照顾小孩10.养鸡15.伟大贡献三.翻译填空(10×2’)1.the very beginning2.the first time3.cheap and fine4.not surprisingly5.shook his head6.that killed the rat7.As long as we don’t lose heart8.if we have time9.If you can come10.delaying making四.句子翻译(10×4’)1.他决不会干那事。

2.我根本不在乎你说什么。

3.20年来的事实证明,改革开放给全国人民带来了很大利益,是深得人心的。

4.当大多数人真的能干他们想干的事时,他们总是不知所措,想不出令人快乐的值得做的事。

5.他想告诉约翰,他没有料到他的知识有这么渊博,但是觉得有些不好意思,没有说出口。

6.国家所有重点大学都建在这一地区。

7.彩虹是阳光穿过天空中的小水滴时形成的。

8.我们楼上还有两间空房,前两年没怎么用。

9.他听到女教师不住地夸他法语,他非常高兴。

10.20世纪70年代后期,中国开始实行改革开放政策以来,越来越多的外国人到这里工作。

第二篇:商务英语翻译习题答案Unit 1 Exercise 11、从合同生效之日起到合同终止的期间内,双方每年举行一次正式会晤,一边讨论合同执行中存在的问题,以及就技术改进与创新问题进行交流,为进一步的技术合作奠定基础。

双方的会晤轮流在两国举行。

讨论的内容和结论载入备忘录中。

商务英语翻译试题试卷及其规范标准答案

商务英语翻译试题(一)Ⅰ词汇测试题:(2题,每题10分,共20分)BBCCB1.该组有10个商务英语英文词或词组,下面均有英文词或词组来进行解释。

请将正确的选项标出,要求英英转换意义准确,符合商务英语规范。

(10分)(1) to concludeA. to give one’s place to eachB. to end or judge after some considerationC. to explainD. to contain(2) to enforceA. to break or act against a lawB. to cause a law or rule to be obeyedC. to prevent movement from happeningD. to direct something into a particular place(3) to appointA. to take back propertyB. to meet someone’s needsC. to choose someone officially for a jobD. to claim for something(4) to approveA. to abide byB. to comply withC. to have a positive opinionD. to come up with(5) obviateA. to violateB. to remove a difficulty, to avoidC. to allow sb to doD. to be apparent(6) to violateA. to break or act against a law, principleB. to beat or threaten someoneC. to obey a lawD. to cause a rule to be obeyed.(7) with respect toA. comply withB. in relation toC. conform toD. coincide with(8) to entertain a clientA. to cater forB. to treat sb. at the tableC. to launch a productD. to shorten a vacation(9) temptationA. trying to attract peopleB. to encourage the popularity, sales and developmentC. to allow the value of money to varyD. to judge or decide the amount(10) advanceA. to support by giving moneyB. to go or move sth. forward, to develop or improveC. to improve or increaseD. to produce or provide2. 该组有10个商务英语英文词或词组,下面均有汉语词或词组来进行解释,请将正确项选出,要求英汉转换意义准确,符合商务英语规范。

商务英语翻译试题答案

商务英语翻译试题答案一、选择题1. When it comes to business negotiations, the term "B2B" refers to:A. Business to BusinessB. Business to ConsumerC. Consumer to BusinessD. Business to Government答案: A2. The phrase "due diligence" in a business context typically means:A. Thoroughly cleaning a workplaceB. Careful assessment of a company or person's financial and legal statusC. The process of paying off debtsD. A background check on employees答案: B3. Which of the following is NOT a common method of paymentin international trade?A. Letter of CreditB. Cash in AdvanceC. BarterD. Open Account答案: C4. The "INCOTERMS" are used to define:A. International labor standardsB. Terms and conditions for the sale of goodsC. Environmental regulations for businessesD. Trade policies between countries答案: B5. In the context of business, "synergy" refers to:A. The total failure of two companies to work togetherB. The combined effect of multiple businesses or efforts being greater than the sum of their partsC. The process of laying off employees to increase efficiencyD. The reduction of a company's activities to save costs答案: B二、阅读理解Passage 1:With the rapid development of globalization, the importance of business English has become increasingly evident. Business English is not only about language proficiency; it also encompasses cultural awareness and the ability to communicate effectively in a professional context. Companies that operate internationally require employees who can navigate thecomplexities of cross-cultural communication and who are capable of understanding and using business terminology accurately.In the modern workplace, emails and reports are essential means of communication. Therefore, it is crucial for employees to be able to write clear and concise emails and reports that convey the necessary information without ambiguity. Additionally, presentations and meetings often involve discussions of complex topics, requiring a high level of language proficiency and the ability to articulate thoughts clearly.Cultural differences can also impact business communication. For example, the concept of punctuality may vary from one culture to another. What is considered polite and respectful in one culture might be seen as overly aggressive in another. Understanding these nuances is vital to avoid misunderstandings and to build strong business relationships.To improve business English skills, many companies invest in training programs that focus on communication strategies, language proficiency, and cultural awareness. These programs aim to equip employees with the tools they need to succeed in an international business environment.Questions:6. What is the main idea of the passage?A. The importance of cultural awareness in business communicationB. The necessity of clear communication in the workplaceC. The role of business English in global companiesD. The impact of cultural differences on punctuality答案: C7. What does the passage suggest about the role of emails and reports in the workplace?A. They are becoming less important due to face-to-face meetings.B. They are essential for conveying information clearly.C. They are being replaced by social media platforms.D. They are only necessary for international communication.答案: B8. What is the purpose of the training programs mentioned in the passage?A. To teach employees about different cultures.B. To improve employees' language and communication skills.C. To prepare employees for face-to-face meetings.D. To help employees understand the concept of punctuality.答案: B三、翻译题9. 将以下句子从中文翻译成英文:A. 我们的产品质量得到了国际市场的认可。

商务英语翻译试卷及解答

商务英语翻译试卷及解答《商务英语翻译》课程试卷(课程代码:5355)考生注意:1. 答案必须写在答卷上,写在问卷上无效。

2. 考试时间150分钟。

I. Multiple Choices (20 points, 2 points for each)第一套试卷1.It is not surprising, then, that the world saw a return to a floating exchange rate system. Centralbanks were no longer required to support their own currencies.A.A在这种情况下,世界各国又恢复浮动汇率就不足为奇了。

各国中央银行也就无须维持本币的汇价了。

B.不足为奇,全世界看到了汇率的回归,因此各国中央银行无需维持本币的汇价了。

C.此时此刻,世界各国又恢复了移动的交换比率,因此各国中央银行无需维持本币汇价。

D.在这种情况下,全世界又恢复了浮动交换率,这已不足为奇了,因此各国中央银行也就无需维持本币价格了。

2.Assuming the laboratory tests go well, and you can quote us a competitive price, we would certainly be able to place more substantial orders on a regular basis.A.假定实验室检验顺利,并且你的报价有竞争力,我们会大量向贵公司订货的。

B 若实验室检验合格,且你们给我们的报价具有竞争力,我们一定会定期大量订货的。

B.若实验室检验良好,且你们给出的报价具有竞争性,我们一定会定期定量订货的。

C.假定实验室发展良好,且你们的报价具有竞争力,我们一定会大量定期订货的。

3.Chinese researchers have made a breakthrough in developing new materials for nickel-hydrogen batteries used in low temperatures, Inhaul reported.A.中国研究者已经在开发新材料用于低温下使用的镍氢电池方面有了突破,据新华社报道。

商务英语翻译试题(五)试卷及答案_5

商务英语翻译试题(五)Ⅰ词汇测试题:(2题,每题10分,共20分)1.该组有10个商务英语英文词或词组,下面均有英文词或词组来进行解释。

请将正确的选项标出,要求英英转换意义准确,符合商务英语规范。

(10分)(1) frictionA. an accepted opinionB. disagreement or unfriendlinessC. a part of somethingD. a tale or a story(2) to assessA. to judge or decide the amount, value of somethingB. to assign a taskC. to possess somethingD. to support by giving money(3) validA. based on truth, able to be acceptedB. not to be acceptedC. to be discussedD. to be useless(4) extendA. to become largerB. to offer or giveC. to get out ofD. to be satisfied with(5) resort toA. to use something for helpB. to refuse someoneC. to claim for somethingD. to prevent something from happening(6) decision-making bodyA. an institution to make up a decisionB. a person who makes up a decisionC. the core of a decisionD. a plan(7) to allocateA. to give one’s place to eachB. to contribute a fundC. to project a programD. to come up with ideas(8) succumbA. to lose the determination to oppose sth.B. to succeedC. to take back propertyD. to take place(9) intangibleA. much greater than usualB. necessary and important as a part of a wholeC. slightly earlier than or before sth. ElseD. not solid or able to be seen or felt(10) entitleA. to pay for the damageB. to refuse to giveC. to have a particular right to doD. to compare with2. 该组有10个商务英语英文词或词组,下面均有汉语词或词组来进行解释,请将正确项选出,要求英汉转换意义准确,符合商务英语规范。

《商务英语翻译》期末试卷答案

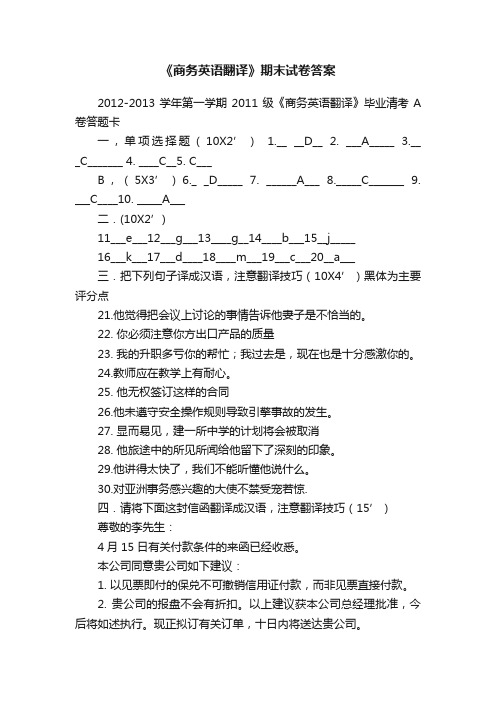

《商务英语翻译》期末试卷答案2012-2013学年第一学期2011级《商务英语翻译》毕业清考A 卷答题卡一,单项选择题(10X2’) 1.__ __D__ 2. ___A_____ 3.__ _C_______ 4. ____C__5. C___B,(5X3’)6._ _D_____ 7. ______A___ 8._____C_______ 9. ___C____10. _____A___二.(10X2’)11___e___12___g___13____g__14____b___15__j_____16___k___17___d____18____m___19___c___20__a___三.把下列句子译成汉语,注意翻译技巧(10X4’)黑体为主要评分点21.他觉得把会议上讨论的事情告诉他妻子是不恰当的。

22. 你必须注意你方出口产品的质量23. 我的升职多亏你的帮忙;我过去是,现在也是十分感激你的。

24.教师应在教学上有耐心。

25. 他无权签订这样的合同26.他未遵守安全操作规则导致引擎事故的发生。

27. 显而易见,建一所中学的计划将会被取消28. 他旅途中的所见所闻给他留下了深刻的印象。

29.他讲得太快了,我们不能听懂他说什么。

30.对亚洲事务感兴趣的大使不禁受宠若惊.四.请将下面这封信函翻译成汉语,注意翻译技巧(15’)尊敬的李先生:4月15日有关付款条件的来函已经收悉。

本公司同意贵公司如下建议:1. 以见票即付的保兑不可撤销信用证付款,而非见票直接付款。

2. 贵公司的报盘不会有折扣。

以上建议获本公司总经理批准,今后将如述执行。

现正拟订有关订单,十日内将送达贵公司。

诚望今后两公司间的会谈能促进双方的业务发展。

敬复。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

全国商务英语翻译统一考试初级笔译练习试题练习一Part I Translate the following sentences into English or Chinese1.迄今为止,各国的移民政策侧重于为低技能工人设置障碍,同时鼓励高技能专业人才、工程师、科学家和企业家前来工作,甚至定居。

2.Kasda是瑞士的汽车、能源和食品集团公司。

本年度第一季度,尽管它的总营业额下降了6%,但是利润却增加了12.1%。

3.“海洋城”以其绵延10英里(相当于16公里)的海滩而闻名,每年接待约800万游客4.当富人想到将财富传给子孙的时候,他们通常会有两种情绪:害怕和忧虑。

他们害怕或忧虑金钱会对子孙产生消极影响;害怕金钱会让子孙失去通过努力工作获得成功的人生动力。

5.关于我方第315号订单,由于到货质量低劣,我方被迫表达强烈不满。

6.China is fielding its largest-ever Olympic team at the upcoming Beijing Games, with 639 athletes competing in all 28 sports. The Chinese team will attempt to surpass the 32 gold medals won at the Athens Olympics, four less than the United States.7.A Japanese media report says Japan and China have reached a compromise and agreed to jointly develop gas fields and share profits in disputed areas of the East China Sea.8.The number of newly laid-off U.S. workers rose last week, the latest sign that the economic downturn is affecting the job market. A report Thursday from the Labor Department said the number of people applying for unemployment benefits for the first time rose 22–thousand, to 378–thousand.9. Chinese economy suffered only a mild setback in the first quarter of 2008, and remains resilient despite inflation and worsening global credit crisis.10. Praise and encouragement also makes employees more likely to work hard and stay in their jobs, saving on the cost of finding replacements.Part II Translate the following passages into Chinese.Passage 1Most Americans believe someone isn’t grown up until age 26, probably with a completed education, a full-time job, a family to support and financial independence, a survey said.But they also believe that becoming an official grown-up is a process that takes five years from about the age of 20, concluded the report from the University of Chicago’s National Opinion Research Center. The findings were based on a representative sample of 1398 people over age 18.The poll found the following ages at which people expect the transitions to grown-up status to be completed: age 20.9 self-supporting; 21.1 no longer living with parents; 21.2 full-time job; 22.3 education complete; 24.5 being able to support a family financially; 25.7 married; and 26.2 having a child.“There is a large degree of consensus across social groups on the relative importance of the seven transitions,” said Tom Smith, director of the survey. The only notable pattern of differences is on views about supporting a family, having a child and g etting married. “Older adults and the widowed and married rate these as more important than younger adults and the never-married do,” he added. “This probably reflects in large part a shift in values across generations away from traditional family values.”The most valued step toward reaching adulthood, the survey found, was completing an education, followed by full-time employment, supporting a family, financial independence, living independently of parents, marriage and parenthood.Passage 2Spend less than you earn. This is perhaps the most worn out, overused phrase in the world of personal finance. But guess what? It’s also the single most important financial lesson you’ll ever learn. No matter how hard you work and how much money you earn, you’ll never achieve financial security if you spend more than you earn, so…… do whatever it takes to make sure that this doesn’t happen. This takes self-discipline, and might require constructing a budget, but if you ever want to get to a point where you can afford all the little niceties in life, you need to make it happen.Plan for the future. I’ve been where you are, and I know that “the future” seems like it’s a million miles away. Do yourself a favor. Sit down and define short, intermediate, and long-term goals and then put together a plan for getting there. It’s not easy, and you probably won’t get it right at first but once you do this, you’ll have something concrete to work from (and to modify in the future). Start small and work your way up.Be patient. Building a solid financial foundation takes time. Don’t look for shortcuts or try to strike it rich overnight wit h the latest hot investment tip. Likewise, don’t make major financial decisions wi thout fully considering the ramifications. This isn’t to say that you should be paralyzed fear. Rather, you need to do your homework. Turn those unknowns into knowns, andthen make an informed decision.Learn form your mistakes. Nobody’s perfect. You’re bound to make mistakes, especially when you’re just starting out. The important thing is to learn from them and move forward. If you make a bad financial decision, make a note of it and get yourself back on track. Don’t beat yourself up , and don’t throw in the towel.Part III Translate the following passages into EnglishPassage 1亲爱的布莱克先生:从您5月16日来函获知我公司销售代表敷衍草率,我深感苦恼。