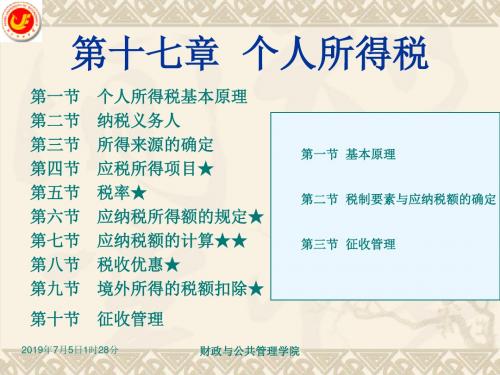

Chapter_17个人所得税PPT课件

合集下载

2019年17个人所得税.ppt

Annual tax expenditure budget Technical problems with measuring tax expenditures

Incentive effects

Defining income

Philosophical objections

17-13

The Simplicity Issue

Taxpayer and spouse Children under 19 (or 24 if in school) Children and other relatives who pass certain tests (depend on taxpayer for support) Phase out Adjust ability to pay for presence of children Provide tax relief for low-income families

Reduces excess burden Reduces incentive to cheat Greater simplicity Equity

Shifts burden from rich to middle class Simplicity an illusion

Arguments against

CHAPTER 17

THE PERSONAL INCOME TAX

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

Computation of Federal Personal Income Tax Liability

Incentive effects

Defining income

Philosophical objections

17-13

The Simplicity Issue

Taxpayer and spouse Children under 19 (or 24 if in school) Children and other relatives who pass certain tests (depend on taxpayer for support) Phase out Adjust ability to pay for presence of children Provide tax relief for low-income families

Reduces excess burden Reduces incentive to cheat Greater simplicity Equity

Shifts burden from rich to middle class Simplicity an illusion

Arguments against

CHAPTER 17

THE PERSONAL INCOME TAX

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

Computation of Federal Personal Income Tax Liability

《个人所得税》PPT课件

必国然。要 因回 此到 ,中他国虽居因住公,离习境惯,性但·居仍·住 是··地 中·仍 国·在 的中居

民纳税义务人,在4年任期里取得的境内、

外所得应当在中国缴纳个人所得税。

17

非居民

• 例如:侨居新加坡的某女士, 应我国某集邮展 览会的提议,将其邮品在中国展出,该女士没有

来中国,但由于她的邮品在中国展示,其所得来 源于中国,故该所得(境内)应在中国纳税。

——《民法通则》实Leabharlann 习惯性住所 经常性居住地。

施 条

例

“有住所”:因户籍、家庭、经济利益关系而 第

在中国境内·习·惯·性居住。

二 条

16

• 王先生为我驻外大使馆秘书,任期4年。赴 任前,他在中国办理了户口吊销手续,属于 在中国没有户籍的人,且居住在外国,但由 于其家庭或经济利益仍在中国,任期届满后,

• 在中国境内任职、受雇而取得的工资、薪金所得 • 在中国境内生产经营所得 • 在中国境内提供劳务所得 • 财产出租使用于中国境内所得 • 转让中国境内财产、在中国境内转让财产 • 许可特许权在中国境内使用所得 • 从中国境内取得利息、股息、红利

23

个人独资企业 的投资者

合伙企业的 每个合伙人

2000 年 起 成 为 纳 税 人

项应税收入进行综合,再减除规 定的扣除费用,就其余额按照超 额累进税率计算征税的税制模式,

它具有税负公平、合理的优点,

为世界上发达国家广泛采用,如

英、美、法、德等。但操作复

杂,管理水平要求较高,工作量 较大。

8

混合所得税制

• 是指根据纳税人取得应税收入的不同情况,有的项 目分类计税,有的项目综合计税,即分类征收与综

1

• • • • •

民纳税义务人,在4年任期里取得的境内、

外所得应当在中国缴纳个人所得税。

17

非居民

• 例如:侨居新加坡的某女士, 应我国某集邮展 览会的提议,将其邮品在中国展出,该女士没有

来中国,但由于她的邮品在中国展示,其所得来 源于中国,故该所得(境内)应在中国纳税。

——《民法通则》实Leabharlann 习惯性住所 经常性居住地。

施 条

例

“有住所”:因户籍、家庭、经济利益关系而 第

在中国境内·习·惯·性居住。

二 条

16

• 王先生为我驻外大使馆秘书,任期4年。赴 任前,他在中国办理了户口吊销手续,属于 在中国没有户籍的人,且居住在外国,但由 于其家庭或经济利益仍在中国,任期届满后,

• 在中国境内任职、受雇而取得的工资、薪金所得 • 在中国境内生产经营所得 • 在中国境内提供劳务所得 • 财产出租使用于中国境内所得 • 转让中国境内财产、在中国境内转让财产 • 许可特许权在中国境内使用所得 • 从中国境内取得利息、股息、红利

23

个人独资企业 的投资者

合伙企业的 每个合伙人

2000 年 起 成 为 纳 税 人

项应税收入进行综合,再减除规 定的扣除费用,就其余额按照超 额累进税率计算征税的税制模式,

它具有税负公平、合理的优点,

为世界上发达国家广泛采用,如

英、美、法、德等。但操作复

杂,管理水平要求较高,工作量 较大。

8

混合所得税制

• 是指根据纳税人取得应税收入的不同情况,有的项 目分类计税,有的项目综合计税,即分类征收与综

1

• • • • •

《所得税个人所得税》课件

● 07

第7章 结语

个人所得税的重 要性

个人所得税作为国家的主要税种之一,直接关系到每个纳税 人的利益。遵守税法规定,合理纳税是每个公民的义务。在 社会发展的过程中,个人所得税的征收是国家财政收入的重 要来源之一。

纳税人的责任

遵守税法规定

严格遵守税法规定, 按时足额缴纳个人

所得税。

配合税务检查

经济发展

合规纳税能够增加财政收入 支持国家基础设施建设

个人权益

遵守税法能够保障个人财产安 全 确保个人合法权益受到保护

法律责任

违法纳税可能面临罚款、拘留 等法律责任 合规纳税免除不必要的风险

总结

个税合规管理是每个纳税人应尽的责任,遵守税法不仅有利 于个人财产保障,也是维护社会稳定和促进经济发展的重要 手段。加强税收意识,了解税法规定,做好财务记录,都是 做好个税合规管理的关键步骤。

● 05

第五章 税务审查

什么是税务审查?

税务审查是指税务机关对纳税人申报的税务情况进行核实和 检查的过程。在税务审查中,税务机关会检查纳税人的税务 资料、报税行为等,以确保符合税法规定。

个税审查的方式

现场检查

税务机关到纳税人 的现场进行检查

调查取证

通过调查取证方式 获取相关证据

资料复核

对纳税人提交的资 料进行核实

汇算清缴

纳税人在每年年终 对全年收入进行综 合清算,计算税款

填报税表

纳税人需按照要求填写个人所 得税纳税申报表 正确填报个人所得税申报表, 确保所得项目和金额准确无误

缴纳税款

根据个人所得税计算结果,纳 税人需要按时足额缴纳税款 逾期不缴纳将会产生滞纳金和 罚款

提交申报

纳税人需要在规定的时间内将 填好的税表提交给税务机关 确保申报流程规范,避免漏报 或错报

《个人所得税 》课件

02

非居民纳税人仅就其来源于中国 境内的所得缴纳个人所得税,其 纳税义务相对较轻。

个人所得税的征收范围

工资、薪金所得

生产、经营所得

财产租赁所得

财产转让所得

利息、股息、红利 所得

包括个人因任职或者受 雇而取得的工资、薪金 、奖金、年终加薪、劳 动分红、津贴、补贴以 及与任职或者受雇有关 的其他所得。

包括个人独资企业、合 伙企业、个体工商户的 生产经营所得,以及个 人依法从事办学、医疗 、咨询以及其他有偿服 务活动取得的所得。

包括个人出租房屋、土 地使用权、机器设备、 车船以及其他财产取得 的所得。

包括个人转让有价证券 、股权、建筑物、土地 使用权、机器设备、车 船以及其他财产取得的 所得。

包括个人储蓄存款利息 ,公债利息,企业债券 利息,金融债券利息, 股票及其他股息红利所 得。

综合所得

将纳税人一定期间内取得 的所有所得加总,按照累 进税率计算应纳税额。

分项所得

将纳税人一定期间内取得 的不同类别的所得分别计 算应纳税额,然后加总。

计算公式

应纳税所得额 = 总收入 扣除项目金额。

个人所得税的减免与扣除

减免项目

减免与扣除的计算公式

包括基本生活费用、教育费用、医疗 费用等。

应纳税所得额 = 总收入 - 减免项目 扣除项目金额。

个人所得税改革的影响与展望

影响

个人所得税改革对个人收入分配、财政收入、经济发展等方面产生影响。

展望

未来个人所得税改革将继续深化,逐步完善税收制度,提高税收公平性和效率 ,促进社会公平正义和经济发展。

个人所得税的征收方式

代扣代缴

个人所得税由支付所得的单位或 个人代扣代缴,税务机关定期对

非居民纳税人仅就其来源于中国 境内的所得缴纳个人所得税,其 纳税义务相对较轻。

个人所得税的征收范围

工资、薪金所得

生产、经营所得

财产租赁所得

财产转让所得

利息、股息、红利 所得

包括个人因任职或者受 雇而取得的工资、薪金 、奖金、年终加薪、劳 动分红、津贴、补贴以 及与任职或者受雇有关 的其他所得。

包括个人独资企业、合 伙企业、个体工商户的 生产经营所得,以及个 人依法从事办学、医疗 、咨询以及其他有偿服 务活动取得的所得。

包括个人出租房屋、土 地使用权、机器设备、 车船以及其他财产取得 的所得。

包括个人转让有价证券 、股权、建筑物、土地 使用权、机器设备、车 船以及其他财产取得的 所得。

包括个人储蓄存款利息 ,公债利息,企业债券 利息,金融债券利息, 股票及其他股息红利所 得。

综合所得

将纳税人一定期间内取得 的所有所得加总,按照累 进税率计算应纳税额。

分项所得

将纳税人一定期间内取得 的不同类别的所得分别计 算应纳税额,然后加总。

计算公式

应纳税所得额 = 总收入 扣除项目金额。

个人所得税的减免与扣除

减免项目

减免与扣除的计算公式

包括基本生活费用、教育费用、医疗 费用等。

应纳税所得额 = 总收入 - 减免项目 扣除项目金额。

个人所得税改革的影响与展望

影响

个人所得税改革对个人收入分配、财政收入、经济发展等方面产生影响。

展望

未来个人所得税改革将继续深化,逐步完善税收制度,提高税收公平性和效率 ,促进社会公平正义和经济发展。

个人所得税的征收方式

代扣代缴

个人所得税由支付所得的单位或 个人代扣代缴,税务机关定期对

个人所得税-精品PPT课件

5 个税法定减免及扣缴 义务人法律责任

法定减免

1、免征

福利费(指按国家有关规定从企 业、事业单位、国家机关提留的福利 费或工会经费中支付给个人的生活补 助。

抚恤金、救济金;省级政府组织 以上颁发的科技、文教卫体、环保等 奖金;国债和国家发行的金融债券利 息;按照国务院规定发给的特殊津贴 、院士津贴等;保险赔款等。

取得的收入。

➢ 薪金是指从事社会公职或管理活动的劳动者(公职人员)

取得收入。 ➢ 工资、薪金所得属于非独立个人劳动所得。非独立个人劳

动是指个人从事的是由他人指定、安排并接受管理的劳动。

➢ 劳动分红是劳动者(雇员)对企业年度净利润的分配。

劳动分红不计入成本费用,而工资、薪金要计入成本费用。

注意:对不属于工资、薪金性质的补贴、津贴 不予征税。如独生子女补贴、差旅费津贴。

月1000元的标准定额扣除,扣除期限最长不超过240个月。

纳税人只能享受一次首套住房贷款的利息扣除。

0

赡养老人:纳税人赡养一位及以上被赡养人的赡养支出,统一按照

6

以下标准定额扣除:

A、纳税人为独生子女的,按照每月2000元的标准定额扣除;

B、纳税人为非独生子女的,由其与兄弟姐妹分摊每月2000元的扣

个税计算

4、专项附加扣除0 1 Nhomakorabea子女教育:纳税人的子女接受全日制学历教育的相关支出

,按照每个子女每月1000元的标准定额扣除。

大病医疗:在一个纳税年度内,纳税人发生的与基本医保

0

相关的医药费用支出,扣除医保报销后个人负担(指医保目录

3

范围内的自付部分)累计超过15000元的部分,由纳税人在

办理年度汇算清缴时,在80000元限额内据实扣除。

17 个人所得税

个人独资企业和合伙企业投资者也为个人所得税的 纳税义务人。

居民纳税人

非居民纳税人

3

居民和非居民纳税人的判断标准: 住所标准+居住时间标准

(一)住所标准

以习惯性居住地是否在中国境内判断是否是 居民纳税人。

(二)居住时间标准(适用于无住所的个人)

以一个纳税年度内在中国境内居住的天数判 断是否是居民纳税人。

12

(九)财产转让所得 (十)偶然所得 个人得奖、中奖、中彩以及其他偶然性质所 得。 (十一)其他所得

13

四、税率

(一)七级超额累进税率 工资、薪金所得 (二)五级超额累进税率 1.个体工商户生产、经营所得 2.对企事业单位承包经营、承租经营所得 (1)对经营成果拥有所有权 ——五级超额累进税率 (2)对经营成果不拥有所有权 ——七级超额累进税率

得的所得。

(三)其他 个人换购住房的规定

出售自有住房并在1年内重新购房,出售现住房缴纳 的个人所得税,视其重新购房的价值全部或部分予 以退还。

20

第二节 个人所得税的计算

重点: 工资、薪金,劳务报酬,稿酬应纳税额的计算 难点:

全年一次性奖金应纳税额的计算 同时取得雇佣单位和派遣单位工资应纳税额的计算

分析: 雇佣企业=3000<3500,不纳税 派遣单位=1000×3%=30(元) 实际应纳税额=(3000+1000-3500)×3%

=15(元) 应退税=30-15=15(元)

35

劳务报酬所得应纳税额的计算

(一)每次收入≤4000元的 应纳税额=应纳税所得额×20%=(每次收入额-800) ×20% (二)每次收入>4000元的 应纳税额=应纳税所得额×20%=每次收入额×(1- 20%)×20% (三)每次收入的应纳税所得额>20000元的 ——加成征收 应纳税额=每次收入额×(1-20%)×税率-速算扣 除数

居民纳税人

非居民纳税人

3

居民和非居民纳税人的判断标准: 住所标准+居住时间标准

(一)住所标准

以习惯性居住地是否在中国境内判断是否是 居民纳税人。

(二)居住时间标准(适用于无住所的个人)

以一个纳税年度内在中国境内居住的天数判 断是否是居民纳税人。

12

(九)财产转让所得 (十)偶然所得 个人得奖、中奖、中彩以及其他偶然性质所 得。 (十一)其他所得

13

四、税率

(一)七级超额累进税率 工资、薪金所得 (二)五级超额累进税率 1.个体工商户生产、经营所得 2.对企事业单位承包经营、承租经营所得 (1)对经营成果拥有所有权 ——五级超额累进税率 (2)对经营成果不拥有所有权 ——七级超额累进税率

得的所得。

(三)其他 个人换购住房的规定

出售自有住房并在1年内重新购房,出售现住房缴纳 的个人所得税,视其重新购房的价值全部或部分予 以退还。

20

第二节 个人所得税的计算

重点: 工资、薪金,劳务报酬,稿酬应纳税额的计算 难点:

全年一次性奖金应纳税额的计算 同时取得雇佣单位和派遣单位工资应纳税额的计算

分析: 雇佣企业=3000<3500,不纳税 派遣单位=1000×3%=30(元) 实际应纳税额=(3000+1000-3500)×3%

=15(元) 应退税=30-15=15(元)

35

劳务报酬所得应纳税额的计算

(一)每次收入≤4000元的 应纳税额=应纳税所得额×20%=(每次收入额-800) ×20% (二)每次收入>4000元的 应纳税额=应纳税所得额×20%=每次收入额×(1- 20%)×20% (三)每次收入的应纳税所得额>20000元的 ——加成征收 应纳税额=每次收入额×(1-20%)×税率-速算扣 除数

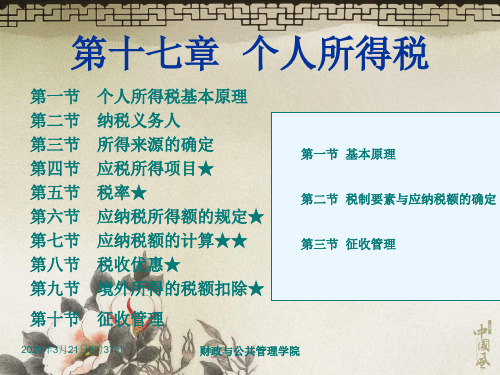

17第十七章个人所得税

❖ 【答案】B

2020年3月21日8时37分

财政与公共管理学院

(四)所得来源地的确定②

❖ 1、工资、薪金所得,以纳税人任职、受聘单位的所在地为所 得来源地。

❖ 2、个体工商户的生产、经营所得,以生产、经营活动实现地 为所得来源地。

❖ 3、劳务报酬所得,以纳税人实际提供劳务的地点为所得来源 地。

❖ 4、在中国境内以图书、报刊方式出版、发表作品取得的稿酬 所得,为来源于我国境内所得。

优点:可以对纳税人的全部所得征税,从收入的角 度体现税收公平的原则;

缺点:不利于针对不同收入进行调节,不利于 体现国家的有关社会、经济政策;

优点:既可实现税收的政策性调节功能,也可体现 税收的公平原则。

财政与公共管理学院

第二节 税制要素

一、纳税人②

(一)纳税人的概念

个人所得税的纳税人指在中国境内有住所, 或者无住所而在境内居住满一年的个人,以及在 中国境内无住所又不居住或者在境内居住不满一 年但有来源于中国境内所得的个人。

❖ 【答案】AC

2020年3月21日8时37分

财政与公共管理学院

2.个体工商户的生产、经营所得

个人独资企业和合伙企业生产经营所得比照个体工 商户的生产、经营所得计征个税

个人独资企业、合伙企业的个人投资者以企业资金 为本人、家庭成员及其相关人员支付与企业生产经营无 关的消费性支出及购买汽车、住房等财产性支出,视为 企业对个人投资者利润分配,并入投资者个人的生产经 营所得,依照“个体工商户的生产经营所得”项目计征 个人所得税。

❖ 有关费用的扣除分三类: ❖ 1.扣除与应税收入相配比的经营成本和费用; ❖ 2.扣除与个人总体能力相匹配的免税扣除和

家庭生计扣除; ❖ 3.扣除体现特定社会目标而鼓励的支出,称

2020年3月21日8时37分

财政与公共管理学院

(四)所得来源地的确定②

❖ 1、工资、薪金所得,以纳税人任职、受聘单位的所在地为所 得来源地。

❖ 2、个体工商户的生产、经营所得,以生产、经营活动实现地 为所得来源地。

❖ 3、劳务报酬所得,以纳税人实际提供劳务的地点为所得来源 地。

❖ 4、在中国境内以图书、报刊方式出版、发表作品取得的稿酬 所得,为来源于我国境内所得。

优点:可以对纳税人的全部所得征税,从收入的角 度体现税收公平的原则;

缺点:不利于针对不同收入进行调节,不利于 体现国家的有关社会、经济政策;

优点:既可实现税收的政策性调节功能,也可体现 税收的公平原则。

财政与公共管理学院

第二节 税制要素

一、纳税人②

(一)纳税人的概念

个人所得税的纳税人指在中国境内有住所, 或者无住所而在境内居住满一年的个人,以及在 中国境内无住所又不居住或者在境内居住不满一 年但有来源于中国境内所得的个人。

❖ 【答案】AC

2020年3月21日8时37分

财政与公共管理学院

2.个体工商户的生产、经营所得

个人独资企业和合伙企业生产经营所得比照个体工 商户的生产、经营所得计征个税

个人独资企业、合伙企业的个人投资者以企业资金 为本人、家庭成员及其相关人员支付与企业生产经营无 关的消费性支出及购买汽车、住房等财产性支出,视为 企业对个人投资者利润分配,并入投资者个人的生产经 营所得,依照“个体工商户的生产经营所得”项目计征 个人所得税。

❖ 有关费用的扣除分三类: ❖ 1.扣除与应税收入相配比的经营成本和费用; ❖ 2.扣除与个人总体能力相匹配的免税扣除和

家庭生计扣除; ❖ 3.扣除体现特定社会目标而鼓励的支出,称

17第十七章 个人所得税

财政与公共管理学院

( 三)非居民纳税人及其纳税义务

非居民纳税人,是指在中国境内无 住所又不居住或者在境内居住不满一 年的个人。

仅就来源于中国境内的所得缴纳个 人所得税。

2019年7月5日1时28分

财政与公共管理学院

纳税义务人

判定标准

(1)在中国境内有住所的个人 (2)在中国境内无住所,而在 中国境内居住满一年的个人。

【答案】B

2019年7月5日1时28分

财政与公共管理学院

(四)所得来源地的确定②

1、工资、薪金所得,以纳税人任职、受聘单位的所在地为所 得来源地。

2、个体工商户的生产、经营所得,以生产、经营活动实现地 为所得来源地。

3、劳务报酬所得,以纳税人实际提供劳务的地点为所得来源 地。

4、在中国境内以图书、报刊方式出版、发表作品取得的稿酬 所得,为来源于我国境内所得。

我国个人所得税实行分类所得税制。

2019年7月5日1时28分

财政与公共管理学院

项目 1.分类征收制

(我国)

2.综合征收制

3.混合征收制

2019年7月5日1时28分

内容

优点:对纳税人全部所得区分性质进行区别征税, 能够体现国家的政治、经济与社会政策;缺点:对 纳税人整体所得把握得不一定全面,容易导致实际 税负的不公平;

个人独资企业和个人合伙企业投资者也为个 人所得税的纳税义务人。

2019年7月5日1时28分

财政与公共管理学院

案例

某外国人2006年2月12日来华工作,2007年2月15日 回国, 2007年3月2日返回中国,2007年11月15日 至2007年11月30日期间,因工作需要去了日本, 2007年12月1日返回中国,后于2008年11月20日离 华回国,则该纳税人( )。 A.2006年度为我国居民纳税人,2007年度为我 国非居民纳税人 B.2007年度为我国居民纳税人,2008年度为我 国非居民纳税人 C.2007年度和2008年度均为我国非居民纳税人 D.2006年度和2007年度均为我国居民纳税人

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Tax Liability interest, dividends, capital gain moving expenses, educator (or loss), business income (or expenses, self-employed

loss), pensions, farm income (or health insurance premium

Charitable contributions, home

loss), rents, royalties, Social payments, student loan

mortgage interest, state and

Security benefits, etc.

payments, tuition and fees,

17-5

Evaluating the H-S Criterion

Equity – treats likes alike Efficiency – treats all forms of income the

same; decisions made on the basis of economic value not tax consequences

CHAPTER 17

THE PERSONAL INCOME TAX

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

Computation of Federal Personal Income Wages and compensation, Trade or business expenses,

Tax liability before credexictesss of regular tax liability

- Tax credits

Regular tax liability

Pay tax or claim refund

17-2

Haig-Simons Income (Comprehensive Income)

Income = Consumption + DNet Worth Maximum consumption taxpayers can enjoy

without spending down their wealth Anything received that can be used, either

• Ttaaxxarabtlee Income rcaaDrtn.eCdds.eictfFtaocfiopr.r;sridtPtati-vhThliegdaimaeseineelndd-StPshoeastaourxalymtyrlwittaoeeoibrbtnvhiutltehiaytirenyteitcvruod’oessismdiAcnaeergMbteeldeATrmidMtl,,iiaTnbebilAiatysMeinT.

17-6

Excludable Forms of Money Income

Interest on State & Local Bonds Some dividends Capital gains Employer contributions to benefit plans Some types of saving

Transfer payments, including Social Security benefits, unemployment compensation, and welfare

Capital gains

Realized versus unrealized

Income in kind

Imputed rent

17-4

Some Practical and Conceptual Problems

Computing income net of business expenses Computing capital gains and losses Computing imputed income from durables Valuing in-kind servicld twaixth, aindcdoitmioenal child tax, EITC, Six HorOdPinEaraynrdatLeisfetime Learning,

reimbursed employee expenses; Phase out with income; Differs by filing status

now or later, to purchase goods and services Subtract costs of earning income

17-3

Items Included in H-S Income

Employer pension contributions and insurance purchase

- Exemptions (1e0l%ec,tr1ic5%ve,h2ic5l%es,, health coverage 28ta%x, 3a3d%op,t3io5n%, )m; ortgage interest,

- Larger of standscrdtiehfaftietaliudrressra;mdbnseydpndefditlcieesniapagdlevinnudgecsntctioconatrnreibcuorteirodniit,,temized deductions

local taxes, medical expenses

Tax Base

alimony paid, etc.

in excess of 7.5% of AGI, casualty and theft losses, non-

- “Above-the-line” Pdheasde-uoucttions