会计英语复习汇总

会计的基本英语知识点汇总

会计的基本英语知识点汇总1. Introduction to Accounting会计简介Accounting is the systematic process of identifying, recording, measuring, classifying, summarizing, interpreting, and communicating financial information. It plays a crucial role in the management and decision-making processes of businesses and organizations.会计是一种系统性的流程,用于识别、记录、度量、分类、总结、解释和传达财务信息。

它在企业和组织的管理和决策过程中发挥着至关重要的作用。

2. Basic Accounting Principles基本会计原则There are several fundamental principles that underpin the field of accounting:有几个基本原则支撑着会计领域:a) Accrual Principle: This principle states that financial transactions should be recorded when they occur and not when the cash is received or paid out.应计原则:该原则规定财务交易应在其发生时记录,而不是在现金收到或支付时记录。

b) Matching Principle: This principle states that expenses should be recognized in the same accounting period as the revenues they help generate.配比原则:该原则规定支出应在与其相关的收入产生的同一会计期间内确认。

会计英语期末复习

会计英语期末复习一、判断题20题20分二、多项选择题10题20分三、名词解释5题15分四、汉译英20题20分五、会计实践操作25分名词解释1、A ccounting (会计)P3Accounting is an information system that identifies, records, and com muni cates releva nt, reliable, and comparable in formati on about an orga ni zati on 'bus in ess activities that can be expressed in mon etary terms.2、A ccrual Basis Accounting (权责发生制)P183、L iability (负债)P148Liabilities are defi ned as probable future sacrifices of econo mic ben efits arising from present obligations of a particular entity to transfer assets or provide services to other en tities in the future as a result of past tran sact ions or eve nts4、C apital Expenditure (资本性支出)P29Capital expe nditure are expe nditures expected to yield ben efits bey ond the curre nt acco unting period, that is, have future cash flows , and thus should be added to the pla nt and equipme nt or capital asset acco unt.5、M atchi ng prin ciple (配比原则)P26Matchi ng refers to the tim ing of recog niti on of reve nues and expe nses in the in come stateme nt. Un der this con cept, all expe nses in curred in earning reve nue should be recog ni zed in the same period the reve nue is recog ni zed.6、Substanee Over Form (实质重于形式)P3oSubsta nee over form requires that tran sacti ons and other eve nts are accounted for and presented in accordance with their substance and economic reality and not merely their legal form.汉译英真实性和公允性truth and fairness收付实现制cash basis of acco unting持续经营假设going concern assumpti on谨慎性原贝V con servatism资本性支出capital expe nditures配比原贝V matchi ng prin ciple临时性账户temporary acco unt经营成果operat ing results盈余公积surplus reserve 未分配利润un distributed profit银行对账单bank stateme nt应付票据no tes payable实质重于形式substa nee over form 货币计量假设mon etary un it assumpti on重要性原则materiality可变现净值net realizable value完工百分比法perce ntage-of-completi on method 会计主体假设separate en tity assumpti on交易与事项transactions and eve nts会计分期假设acco unting period assumpti on 会计循环acco un ti ng cycle多选题1.会计信息外部使用者有哪些?Suppliers, regulators, lawyers, brokers, the in vestors , le nders, non-executive directors2.资产负债表的构成项目(资产,负债,所有者权益)Assets, liabilities, owners 'equity3.现金流量表的构成项目(经营,投资,筹资)Operating, investing , financing activities4 •所有者权益变动表In vestors, capital reserve, surplus reserve,reta ined5.应收款项的分类Acco unts receivable, no tes receivable, other receivable6.存货的计价方法Specific ide ntificati on, average cost, first-i n first-out7.制造业企业存货的构成Raw materials, good in process of manufacture, fini shed goods8.固定资产折旧的方法press shareholders /un distributed profit first-out, last-i n6。

会计英语复习笔记

会计英语复习笔记单选10 题,书后⾯的,可能有的换⼀个数字三张报表第⼀章financial statementbalance sheet 填9个空会计等式第⼆章分录题,journal entries第三章closing entries 结账分录p79 4笔分录利润表的数字的结转利润、收⼊、费⽤-虚账户期末要结转A sole proprietorship独资企业Service revenue 劳动收⼊举例1、结转收⼊Sales revenue 1000Income summary 10002、结转费⽤Income summary 800Salary summary 200Supplies expense 300Interest expense 60Insurance expense 40Rent expense 70Depreciation 80Utilities expense 503、结转利润Income summery 200Capital 200以上是收⼊1000,为盈利;如收⼊600,为亏损,则1、2、相同,3、反做4、提取的分录Capital 150 Withdrawals 150Corporation (4笔分录)公司前2笔与上⾯的相同3、盈利Income summery 200Retained earnings 200如是亏了,做相反的分录4、宣布发放股利Retained earnings 150Cash dividend declare 150第三章试算平衡表、⼯作底稿不考第四章jurnal entries赊购赊销15笔左右三个discount1、trade discount 商业折扣2、purchase discount 购买折扣3、sales discount 现⾦折扣2/10 1/20 n/30举例分录如下Jan.1赊购purchase on account merchandise $2000 2/10 n/30 FOB. factory Merchandise inventory 2000Accounts payable 2000Jan.2 paid transportation charge $300 运费Merchandise inventory 300Cash 300Jan.3 return unacceptable goods $400 to suppliesAccounts payable 400Merchandise inventory 400Jan.11 paid the accounts payableAccounts payable 1600Cash 1568Merchandise inventory 32这⾥与中国的冲财务费⽤不⼀样总成本1568+300Jan.12 credit sale goods $1500 to a customer 3/10 n/30,Cost of the goods is $1000 Accounts receivable 1500Sales 1500Cost of goods sold 1000Merchandise inventory 1000Jan.15 customer return goods $600 (货是好的)Sales returns and allowances 600Accounts receivable 600Merchandise inventory 400(1000/1500*600)Cost of goods sold 400Jan.22 received a check form the customer to pay to A/PCash 873Sales discount 27(现⾦折扣3%)Accounts receivable 900Jan.31 Ending inventory on the account is $1200 .physical count the amount is $1150 (存货盘亏(英⽂) inventory shrinkage p117页)Cost of goods sold 50Merchandise inventory 50Jan.31 针对15⽇的退货(中国没有该分录)Sales 600Sales returns and allowances 600第五章bank reconciliation exercises 5-1 problem5-3难点在调整分录Bad debt p149 P5-5 备抵法Noting discounting 应收票据贴现第六章inventory estimation第七章depreciation E7-2 P7-1 直线法、双倍余额法,年数总法等Bank reconciliation p145Problem5-3 Cash 5440 Notes receivable 5000 Interest revenue 350 Accounts payable 90 Service charge 265 Accounts receivable 2700 Cash 2965第五章备抵法Income statement method Balance sheet method 应收账款余额法P5-5 4笔分录应收票据Apr.1 receive a note $3000 60天6% May.1贴现discounting the note 9%1\maturity value =3000*(1+6%*(60/360) )+3030 2\proceeds=maturity value –discounting interest =3030-3030*9%*(30/360) =3007.275Units Price AmountsJan.1balance 10 @ $10 $100Jan.5purchase 30 @ $11 $330Jan.10sold 20Jan.15purchase 40 @ $12 $480Jan.20sold 30Jan.30 purchase 20 @ $13 $260Total 100 $1170Jan.30 50 $1、FIFO:30×12+20×13=$6202、LIFO(periodic):10×10+30×11+10×12=$5503、LIFO(perpetual):10×10+10×11+10×12+20×13=$5904、Weighed Average:(1170/100)×50=$5856、Specific Identification:10×11+20×12+20×13 =$610。

会计英语复习资料

会计英语复习资料一.汉译英练习1.会计原则是每个会计人员在进行工作时必须遵守的规则。

2.编制会计分录是在会计期间经常要做的工作。

3.编制工作底稿是每个会计期末要做的工作。

4.实账户是负债表账户。

在月末,它们的余额应不被结平,而转入下一期。

5.虚账户是利润表账户。

在月末,它们的余额应结平,以便用来记录下一期的经营成果。

6.这个月费用很大,我们要查一下原因,分析一下有关经济业务。

7.如果销售商品时,若客户没有付现金,则这种销售被称为赊销。

8.赊销时,卖方会对卖方提出付款条件,这个条件被称为信用条件。

9.固定资产每月都必须计提折旧。

10.无形资产每月计提摊销。

11.企业外部的许多人关心企业的财务信息,而及时提供财务信息给他们是会计的工作。

12.财务报表是人们进行经营决策的依据之一。

13.我们必须准备足够的资金,这笔贷款下个月到期。

14.调整分录与结账分录必须计入日记账和分类账,否则账上的余额会与报表上数额不符。

15.在西方会计中,股份公司的权益科目与独资企业的权益科目是不同的。

16.销售商品的收入常被称为是销售收入。

17.本年利润是用于计算利润的账户,他与其他损益类科目一样,年末,都要被结平。

18.请给我看一下有关这个月应缴的税费的数据二.会计专业词汇练习会计词汇辨析()Dividends ()Cash()Inventory ()Accumulated depreciation()Accounts receivable ()Interest payable()Income taxes payable ()Owner’s capital()Retained earnings ()Closing entry()Journalizing ()Administrative expenses()Cost of goods sold ()Net income()Business transaction ()Unearned revenues()Ending balance ()Financial expenses()Prepaid expenses ()operating results()Withdrawals ()Sales( )Allowance for bad accounts ()Common stock()Office supplies inventory ()long-term bonds investments ()Accounts payable ()Cash basis accounting ()Office equipments ()Posting()Beginning balance ()Business transaction()Trial balance ()Financial statements()Selling expenses. ()Financial position()Marketable securities ( ) paid in capital( ) operating equipments ()Notes payable( ) Short term investment ( ) Gain()Extraordinary items ()Finished products()Salary expenses ()Interest receivable()Accrual basis accounting ()Income statements()Adjusting entry ()Intangible assets( ) Source documents ( ) Gross sales( ) Purchase ( ) Fixed assets1.期末余额28. 坏账准备2.应付所得税29. 应收账款3.销售费用30. 主营业务收入4.业主资本31. 经营成果5.主营业务成本32 管理费用6.应付利息33 存货7.留存收益34 调整分录8.预收账款35 结账分录9.累计折旧36 权责发生制10.经济业务37 应付票据11.财务报表38 编制分录12.试算平衡39. 期初余额13.现金收付制40. 应付账款14.财务费用41. 净利润15.普通股42. 财务状况16.营业外收支项目43. 过账17.应收利息44 办公用品库存18.实收资本45. 办公设备19.库存46. 股利20.经营设备47. 业主提取21.利得48. 产成品22.待摊费用49. 交易性金融资产23.长期债券投资50. 短期投资24.无形资产51. 工资费用25.生产设备52销售总额26.原始凭证53 固定资产27.采购54. 工资费用三.英译汉1.Revenue is the price of goods sold and services rendered during a given accounting period. Earning revenue causes owner’s equity to increase. When a business renders services of sells merchandise to its customers, it usually receives cash or acquires an account receivable from the customer.2.To clearly identify the effects of the business operations on each of the accounting elements, it is necessary to transfer those records from journal to each corresponding books used for recording different accounting element. This transfer process is called “posting”.3.The journal is a day-by-day record of business transactions. The information recorded about each transaction includes the date of the transaction, the debit and credit changes in specific ledger accounts, and a brief explanation of the transaction.4.The things a business owns can be classified into five categories, which also called accounting elements, they are: assets, liabilities, owners' equity, revenues, and expenses. Every business transaction of the business may affect more than one of the above elements。

英文会计知识点总结归纳

英文会计知识点总结归纳IntroductionAccounting is a fundamental aspect of any business, as it involves the recording, analyzing, and reporting of financial transactions. It provides businesses with essential information to make informed decisions, assess their financial health, and comply with regulatory requirements. In this article, we will summarize and consolidate key accounting knowledge points that are crucial for understanding the principles and practices of accounting.1. Basics of Accounting1.1. Definition of AccountingAccounting is the process of recording, analyzing, and interpreting financial transactions of an organization. It provides a systematic and comprehensive record of all financial activities and enables the preparation of financial statements.1.2. Accounting EquationThe accounting equation, also known as the balance sheet equation, is a fundamental principle of accounting that states:Assets = Liabilities + EquityThis equation represents the relationship between a company's assets, liabilities, and equity, and must always remain in balance.1.3. Types of AccountingThere are several types of accounting, including financial accounting, management accounting, cost accounting, and tax accounting. Each type serves a specific purpose and audience, such as external stakeholders, internal management, and regulatory authorities.2. Financial Statements2.1. Balance SheetThe balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess its solvency and liquidity.2.2. Income StatementThe income statement, also known as the profit and loss statement, summarizes a company's revenues and expenses over a specific period. It provides insights into the company's profitability and performance.2.3. Cash Flow StatementThe cash flow statement tracks the inflow and outflow of cash within an organization. It categorizes cash flows into operating, investing, and financing activities, and helps assess the company's ability to generate cash and meet its obligations.3. Principles of Accounting3.1. Accrual Basis vs. Cash Basis AccountingAccrual basis accounting recognizes revenues and expenses when they are incurred, regardless of when cash is exchanged. Cash basis accounting, on the other hand, records transactions only when cash is received or paid. Accrual basis accounting provides a more accurate representation of a company's financial performance.3.2. Matching PrincipleThe matching principle requires that expenses be recognized in the same period as the revenues to which they relate. This principle ensures that a company's financial statements accurately reflect its profitability.3.3. Revenue RecognitionRevenue recognition dictates when and how revenue should be recorded in a company's financial statements. It is crucial for determining a company's financial performance and must adhere to generally accepted accounting principles (GAAP).4. Assets and Liabilities4.1. Types of AssetsAssets are resources owned by a company and can be categorized into current assets (e.g., cash, inventory) and non-current assets (e.g., property, plant, and equipment). Understanding the nature and value of an organization's assets is vital for assessing its financial health.4.2. Types of LiabilitiesLiabilities represent an organization's obligations to outside parties and can include accounts payable, long-term debt, and accrued expenses. Managing and tracking liabilities is crucial for maintaining financial stability.5. Internal Controls5.1. Importance of Internal ControlsInternal controls are processes and procedures that a company implements to safeguard its assets, ensure accuracy in financial reporting, and comply with regulations. They help prevent fraud, errors, and mismanagement of funds.5.2. Segregation of DutiesSegregation of duties involves dividing responsibilities among different individuals to prevent the occurrence of fraud and errors. It ensures that no single individual has control over critical financial processes.6. Auditing6.1. Purpose of AuditingAuditing is the process of examining a company's financial statements and accounting records to ensure accuracy, integrity, and compliance with laws and regulations. It provides independent assurance to stakeholders regarding the company's financial performance.6.2. Types of AuditsThere are different types of audits, such as external audits conducted by independent accounting firms, internal audits performed by a company's internal audit department, and government audits carried out by regulatory agencies.7. Taxation7.1. Tax PlanningTax planning involves the structuring of financial activities to minimize tax liabilities within the boundaries of the law. It requires an in-depth understanding of tax laws, regulations, and incentives.7.2. Tax Deductions and CreditsUnderstanding tax deductions and credits is essential for businesses to optimize their tax positions and reduce their tax burden. Deductions lower taxable income, while credits directly reduce the amount of tax owed.8. Financial Analysis8.1. Ratio AnalysisRatio analysis involves the use of financial ratios to evaluate a company's performance, liquidity, solvency, and efficiency. Common ratios include profitability ratios, liquidity ratios, and leverage ratios.8.2. Trend AnalysisTrend analysis involves comparing financial data over different periods to identify patterns, changes, and potential areas for improvement. It helps in assessing a company's financial health and predicting future performance.ConclusionAccounting is a critical aspect of business that provides insights into an organization's financial performance, health, and compliance. Understanding the basics of accounting, financial statements, principles, assets and liabilities, internal controls, auditing, taxation, and financial analysis is essential for business owners, managers, and financial professionals to make informed decisions and ensure the financial success of their organizations. By consolidating and summarizing these key accounting knowledge points, individuals can gain a comprehensive understanding of the principles and practices of accounting.。

会计英语知识点汇总

会计英语知识点汇总会计英语是指与会计相关的英语词汇、表达方式以及专业术语。

随着国际间经济交流的日益频繁和全球化进程的加快,掌握会计英语成为了很多专业人士的必备技能。

本文将梳理一些常见的会计英语知识点,以帮助读者更好地理解和运用这些术语。

一、财务报表1. Balance Sheet(资产负债表):用于反映企业在特定日期的资产、负债和所有者权益的情况。

2. Income Statement(利润表):反映企业在一定期间内的收入、费用和净利润。

3. Cash Flow Statement(现金流量表):按照企业的经营、投资和筹资活动分类,反映现金的流入和流出。

4. Statement of Retained Earnings(留存收益表):展示企业在一定期间内的净利润留存情况。

二、会计核算1. Accounting Equation(会计等式):Assets(资产)= Liabilities(负债)+ Owner's Equity(所有者权益),反映了企业财务状况的基本平衡关系。

2. Depreciation(折旧费用):用于反映资产价值随时间的减少。

3. Accrual Accounting(权责发生制):将收入和费用与实际发生的时间匹配,而非支付和收入的时间。

4. Double-entry Bookkeeping(复式记账法):每笔交易必须同时记录借方和贷方的金额。

5. Financial Ratios(财务比率):用于分析企业财务状况和经营绩效的指标,包括盈利能力、杠杆比率、偿债能力等。

三、财务分析1. Liquidity(流动性):反映企业偿付短期债务的能力。

2. Solvency(偿债能力):反映企业偿付长期债务的能力。

3. Profitability(盈利能力):反映企业获取利润的能力。

4. Efficiency(效率):反映企业运营资源利用的程度。

5. DuPont Analysis(杜邦分析):将利润率、资产周转率和资本结构相互关联,分析企业绩效因素。

会计专业英语复习资料

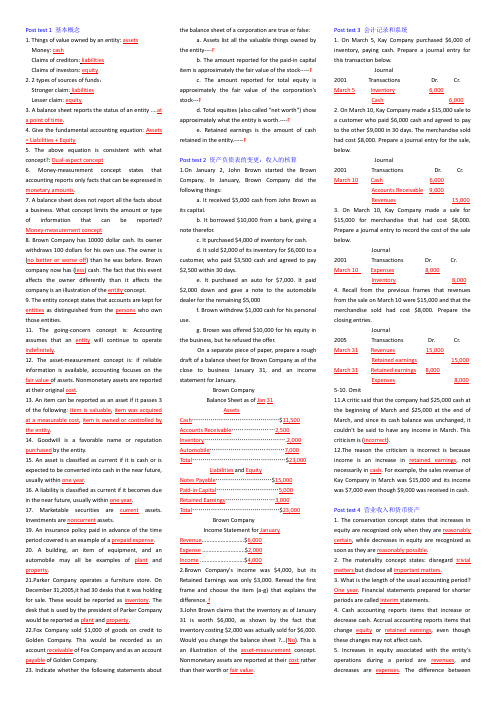

Post test 1 基本概念1. Things of value owned by an entity: assets Money: cashClaims of creditors: liabilitiesClaims of investors: equity2. 2 types of sources of funds:Stronger claim: liabilitiesLesser claim: equity3. A balance sheet reports the status of an entity ....ata point of time.4. Give the fundamental accounting equation: Assets = Liabilities + Equity5. The above equation is consistent with what concept?: Dual-aspect concept6. Money-measurement concept states that accounting reports only facts that can be expressed in monetary amounts.7. A balance sheet does not report all the facts abouta business. What concept limits the amount or type of information that can be reported? Money-measurement concept8. Brown Company has 10000 dollar cash. Its owner withdraws 100 dollars for his own use. The owner is (no better or worse off) than he was before. Brown company now has (less) cash. The fact that this event affects the owner differently than it affects the company is an illustration of the entity concept.9. The entity concept states that accounts are kept for entities as distinguished from the persons who own those entities.11. The going-concern concept is: Accounting assumes that an entity will continue to operate indefinitely.12. The asset-measurement concept is: if reliable information is available, accounting focuses on the fair value of assets. Nonmonetary assets are reported at their original cost.13. An item can be reported as an asset if it passes 3 of the following: item is valuable, item was acquired at a measurable cost, item is owned or controlled by the entity.14. Goodwill is a favorable name or reputation purchased by the entity.15. An asset is classified as current if it is cash or is expected to be converted into cash in the near future, usually within one year.16. A liability is classified as current if it becomes due in the near future, usually within one year.17. Marketable securities are current assets. Investments are noncurrent assets.19. An insurance policy paid in advance of the time period covered is an example of a prepaid expense.20. A building, an item of equipment, and an automobile may all be examples of plant and property.21.Parker Company operates a furniture store. On December 31,2005,it had 30 desks that it was holding for sale. These would be reported as inventory. The desk that is used by the president of Parker Company would be reported as plant and property.22.Fox Company sold $1,000 of goods on credit to Golden Company. This would be recorded as an account receivable of Fox Company and as an account payable of Golden Company.23. Indicate whether the following statements about the balance sheet of a corporation are true or false:a. Assets list all the valuable things owned bythe entity----Fb. The amount reported for the paid-in capitalitem is approximately the fair value of the stock-----Fc. The amount reported for total equity isapproximately the fair value of the corporation’sstock---Fd. Total equities (also called “net worth”) showapproximately what the entity is worth.----Fe. Retained earnings is the amount of cashretained in the entity.-----FPost test 2 资产负债表的变更:收入的核算1.On January 2, John Brown started the BrownCompany. In January, Brown Company did thefollowing things:a. It received $5,000 cash from John Brown asits capital.b. It borrowed $10,000 from a bank, giving anote therefor.c. It purchased $4,000 of inventory for cash.d. It sold $2,000 of its inventory for $6,000 to acustomer, who paid $3,500 cash and agreed to pay$2,500 within 30 days.e. It purchased an auto for $7,000. It paid$2,000 down and gave a note to the automobiledealer for the remaining $5,000f. Brown withdrew $1,000 cash for his personaluse.g. Brown was offered $10,000 for his equity inthe business, but he refused the offer.On a separate piece of paper, prepare a roughdraft of a balance sheet for Brown Company as of theclose to business January 31, and an incomestatement for January.Brown CompanyBalance Sheet as of Jan31AssetsCash……………………………………$11,500Accounts Receivable…………………2,500Inventory………………………………….2,000Automobile………………………………7,000Total………………………………………$23,000Liabilities and EquityNotes Payable………………………$15,000Paid-in Capital…………………………5,000Retained Earnings……………………3,000Total……………………………………$23,000Brown CompanyIncome Statement for January Revenue...........................$6,000Expense ...........................$2,000Income ............................$4,0002.Brown Company's income was $4,000, but itsRetained Earnings was only $3,000. Reread the firstframe and choose the item (a-g) that explains thedifference. f3.John Brown claims that the inventory as of January31 is worth $6,000, as shown by the fact thatinventory costing $2,000 was actually sold for $6,000.Would you change the balance sheet ?...(No). This isan illustration of the asset-measurement concept.Nonmonetary assets are reported at their cost ratherthan their worth or fair value.Post test 3 会计记录和系统1. On March 5, Kay Company purchased $6,000 ofinventory, paying cash. Prepare a journal entry forthis transaction below.Journal2001 Transactions Dr. Cr.March 5Inventory6,000Cash6,0002. On March 10, Kay Company made a $15,000 sale toa customer who paid $6,000 cash and agreed to payto the other $9,000 in 30 days. The merchandise soldhad cost $8,000. Prepare a journal entry for the sale,below.Journal2001 Transactions Dr. Cr.March 10Cash6,000Accounts Receivable9,000Revenues15,0003. On March 10, Kay Company made a sale for$15,000 for merchandise that had cost $8,000.Prepare a journal entry to record the cost of the salebelow.Journal2001 Transactions Dr. Cr.March 10 Expenses8,000Inventory8,0004. Recall from the previous frames that revenuesfrom the sale on March 10 were $15,000 and that themerchandise sold had cost $8,000. Prepare theclosing entries.Journal2005 Transactions Dr. Cr.March 31Revenues15,000Retained earnings15,000March 31Retained earnings8,000Expenses8,0005-10. Omit11.A critic said that the company had $25,000 cash atthe beginning of March and $25,000 at the end ofMarch, and since its cash balance was unchanged, itcouldn't be said to have any income in March. Thiscriticism is (incorrect).12.The reason the criticism is incorrect is becauseincome is an increase in retained earnings, notnecessarily in cash. For example, the sales revenue ofKay Company in March was $15,000 and its incomewas $7,000 even though $9,000 was received in cash.Post test 4 营业收入和货币资产1. The conservation concept states that increases inequity are recognized only when they are reasonablycertain, while decreases in equity are recognized assoon as they are reasonably possible.2. The materiality concept states: disregard trivialmatters but disclose all important matters.3. What is the length of the usual accounting period?One year. Financial statements prepared for shorterperiods are called interim statements.4. Cash accounting reports items that increase ordecrease cash. Accrual accounting reports items thatchange equity or retained earnings, even thoughthese changes may not affect cash.5. Increases in equity associated with the entity’soperations during a period are revenues, anddecreases are expenses. The difference betweenthem is labeled income.6. The realization concept states that revenues are recognized when goods or services are delivered.7. H Company manufactures a table in August and places it in its retail store in September. R Smith, a customer, agrees to buy the table in October, it is delivered to him in November, and he pays the bill in December. In what month is the revenue is recognized? (November)8. The receipt of cash is a debit to Cash. What is the offsetting credit and (type of account) for the following types of sales transactions?Account Crediteda. Cash received prior to delivery. Advances from customers (a liability)b. Cash received in same period as delivery. Revenuec. Cash received after the period of delivery. Accounts receivable (an asset)9.Similarly, revenue is a credit entry. What is the offsetting debit when revenue is recognized in each of these periods?Account Debiteda. Revenue recognized prior to receipt of cash. Accounts receivableb. Revenue recognized in same period as receipt of cash. Cashc. Revenue recognized in the period following receipt of cash. Advances from customers10.In February, H Company agrees to sell a table to a customer for $600, and the customer makes a down payment of $100 at that time. The cost of the table is $400. The table is delivered to the customer in March, and the customer pays the remaining $500 in April. Give the journal entries (if any) that would be made in February, March, and April for both the revenue and expense aspects of this transaction. February:Cash100Advances from customers100March:Accounts receivable500Advances from customers100Revenue600March:Expenses400Inventory400April:Cash500Accounts receivable50011.At the end of 2005, M Company had accounts receivable of $200,000, and it estimated that $2,000 of this amount was a bad debt. Its revenue in 2005, with no allowance for the bad debts, was $600,000. A. What account should be debited for the $2,000 bad debt? RevenueB. What account should be credited? Allowance for doubtful accountsC. What amount would be reported as net accounts receivable on the balance sheet? $198,000D. What amount would be reported as revenue on the 2005 income statement? $598,00012.In 2006, the $2,000 of bad debt was written off.A. What account should be debited for this written off? Allowance for doubtful accountsB. What account should be credited? AccountsreceivablePost test 5 费用的核算;损益表1. An expenditure occurs in the period in which goodsor services are acquired. An expense occurs in theperiod in which goods or services are consumed.2. A certain asset was acquired in May. There wastherefore an expenditure in May. At the end of May,the item was either on hand, or it was not. If it wason hand, it was an asset; If it was not on hand, it wasan expense in May.3. Productive assets are unexpired costs. Expensesare expired costs.4. The matching concept states that costs associatedwith the revenues of a period are expenses of thatperiod.5. Expenses of a period consist of:a. costs of the goods and services delivered duringthat period.b. other expenditures that benefit operations ofthe period.c. losses6. If Brown company pays rent prior to the periodthat the rent covers, the amount is initially reportedas credit to cash and a debit to Prepaid Rent, which isan asset account. If Brown Company pays the rentafter the period covered, the amount is initiallyrecorded as a debit to Rent Expense and a credit toAccrued Rent, which is a liability account.7. A brand new machine owned by Fay Company wasdestroyed by fire in 2005. It was uninsured. It hasbeen purchased for $10,000 with the expectationthat it would be useful for 5 years. The expenserecorded in 2005 should be $10,000.8. Gross margin is the difference between salesrevenue and cost of sales.9. gross margin percentage: (gross margin)/(salesrevenue)10. The difference between revenues and expenses inan accounting period (or the amount by which equity[i.e., retained earnings] increased from operatingactivities during the period) is called net income.11. A distribution of earnings to shareholders is calleddividends(股利).12. retained earnings at the end of the period=retained earnings at the beginning of the period + netincome–dividends.Post test 6 存货和销售成本1. A dealer sells a television set for $800 cash. It hadcost $600. Write journal entries for the four accountsaffected by this transaction.Dr. Cash800Cr. Revenue800Dr. Cost of Sales600Cr. Inventory6002. When using the perpetual inventory method (永续盘存), a record is kept for each item, showingreceipts, issues, and the amount on hand.3. Write an equation that shows how the cost of salesis determined by deduction:Cost of sales = beginning inventory+purchases –ending inventory4.Omit5.In periods of inflation, many companies use theLIFO method in calculating their taxable incomebecause LIFO gives a higher cost of sales and hence alower taxable income.6. A company discovers that the fair value of itsinventory is $1000 lower than its cost. What journalentry should it take?Dr. Cost of Sales1,000Cr. Inventory1,0007. In a manufacturing business, what three elementsenter into the cost of a manufactured item?Direct material, direct labor, and overhead.8. Period costs become an expense during the periodin which they were incurred.9. Product costs become an expense during theperiod in which the products were sold.10. One type of overhead rate involves use of thetotal direct labor costs and total production overheadcosts for a period. Write a ratio that shows how theoverhead rate is calculated.(Total production overhead costs)/(Total directlabor costs)11. A given finished item requires $50 of directmaterials and 5 hours of direct labor at $8 per hour.The overhead rate is $4 per direct labor hour. At whatamount would the finished item be shown ininventory? $110 = 50 + 40 + 2012. An inventory turnover of 5 is generally better thanan inventory turnover of 4 because it indicates thatless capital is tied up in inventory, and there is lessrisk that the inventory will become obsolete.Post test 7 非流动资产和折旧1. The amount at which a new plant asset is recordedin the accounts includes its purchase price plus allcosts incurred to make the asset ready for itsintended use (such as transportation andinstallation).2. A plant asset is acquired in 2005. It is expected tobe worn out at the end of 10 years and to becomeobsolete in five years. What is its service life? ---Fiveyears.3. Ordinarily, land is not depreciated because itsservice life is indefinitely long.4.A plant asset is acquired in 2005 at a cost of $20000.Its estimated service life is 10 years, and its estimatedresidual value is $2000 :a. The estimated depreciable cost of the asset is$18,000b. If the straight-line depreciation method is used,the depreciation rate for this asset is 10 percent.c. What amount will be recorded as depreciationexpense in each year of the asset’s life?---$1,800d. What amount will be debited and what accountwill be credited to record this depreciation expense?Dr. Depreciation expenseCr. Accumulated depreciatione. After five years have elapsed, how would thisasset be reported on the balance sheet?1) Plant------$20,0002) Less accumulated depreciation-------$9,0003) Book value-------$11,0005. A machine is purchase on January 2, 2005, for$20,000 and its has an expected life of five years andno estimated residual value.a. If the a machine is still in use six years later, what amount of depreciation expense will be reported in for the sixth year?----zerob. What amount, if any, will be reported on the balance sheet at the end of the sixth year?1) It will not be reported.-----X2) It will be reported as follows:Machine$20,000Accumulated depreciation$20,000Book value$06. A machine is purchase on January 2, 2005, for $50,000. It has an expected service life for 10 years and no residual value. Eleven years later it is sold for $3,000 cash.a. There will be a gain of $3,000b. What account will be debited and what account credited to record this amount?Dr. CashCr. Gain on disposition of assets.7. Given an example of each of the following types of assets, and give the name of the process used in writing off the cost of the second and third type. Asset type\Example\Write-off processPlant Asset\m achine, b uilding\Depreciation Wasting asset\c oal, o il ,m inerals\Depletion Intangible asset\g oodwill, t rademark \Amortization 8. Conoil Company purchased a producing oil property for $10,000,000 on January 2, 2005. It estimated that the property contained one million barrels of oil and that the property had a service life of 20 years. In 2005, 40,000 barrels of oil were recovered from the property. What amount should be charged as an expense in 2005?------$400,0009. Wasting assets and intangible assets are reported on the balance sheet in a different way than building, equipment, and similar plant assets. The difference is that wasting assets are reported at the net amount and plant assets are reported at cost, accumulated depreciation, and net amount.10. In calculating its taxable income, a company tries to report its income as low as it can. In calculating its financial accounting income, a company tries to report its income as fairly as it can.11. As compared with straight-line depreciation, accelerated depreciation writes off more depreciation in the early years of an asset’s life and less in the later years. Over the whole life of asset, accelerated depreciation writes off the same total cost as straight-line depreciation.12. Companies usually use accelerated depreciation in tax accounting because it reduces taxable income and hence income tax in the early years.13. Assume an income tax rate of 40%. If a company calculated its financial accounting income (before income taxes) in 2005 as $6 million and its taxable income as$4 million, what amount would it report as income tax expense on its 2005 income statement?----$2,400,00014. Fill in the missing name on the following table:Income tax expense $100,000Income tax paid -60,000Deferred income tax$ 40,000 The $40,000 would be reported on the balance sheet as a liability.。

《会计专业英语》期末复习资料

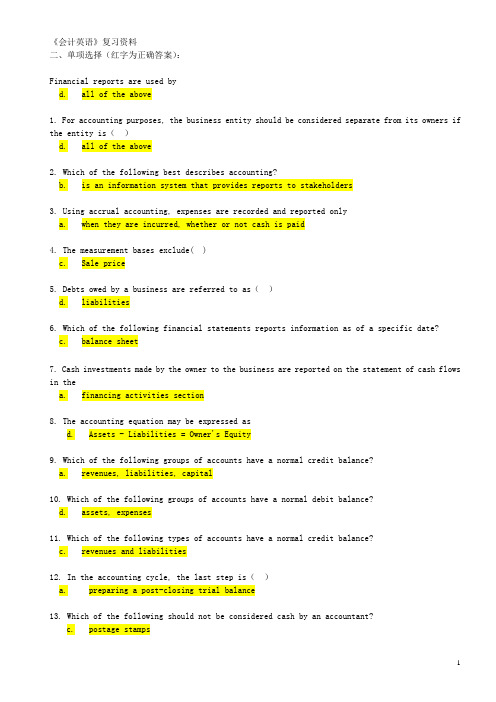

《会计英语》复习资料二、单项选择(红字为正确答案):Financial reports are used byd. all of the above1. For accounting purposes, the business entity should be considered separate from its owners if the entity is()d. all of the above2. Which of the following best describes accounting?b. is an information system that provides reports to stakeholders3. Using accrual accounting, expenses are recorded and reported onlya. when they are incurred, whether or not cash is paid4. The measurement bases exclude( )c. Sale price5. Debts owed by a business are referred to as()d. liabilities6. Which of the following financial statements reports information as of a specific date?c. balance sheet7. Cash investments made by the owner to the business are reported on the statement of cash flows in thea. financing activities section8. The accounting equation may be expressed asd. Assets - Liabilities = Owner's Equity9. Which of the following groups of accounts have a normal credit balance?a. revenues, liabilities, capital10. Which of the following groups of accounts have a normal debit balance?d. assets, expenses11. Which of the following types of accounts have a normal credit balance?c. revenues and liabilities12. In the accounting cycle, the last step is()a. preparing a post-closing trial balance13. Which of the following should not be considered cash by an accountant?c. postage stamps14. A bank reconciliation should be prepared periodically because ()c. any differences between the depositor's records and the bank's recordsshould be determined, and any errors made by either party should bediscovered and corrected15. The amount of the outstanding checks is included on the bank reconciliation as a(n) ()c. deduction from the balance per bank statement16. The asset created by a business when it makes a sale on account is termedc. accounts receivable17. What is the type of account and normal balance of Allowance for Doubtful Accounts?a. Contra asset, credit18. The term "inventory" indicates ()d. both A and B19. Merchandise inventory at the end of the year was understated. Which of the following statements correctly states the effect of the error?a. net income is understated20.Merchandise inventory at the end of the year is overstated. Which of the following statements correctly states the effect of the error?b. owner's equity is overstated21.The inventory method that assigns the most recent costs to cost of good sold isb. LIFO22.Under which method of cost flows is the inventory assumed to be composed of the most recent costs?b. first-in, first-out23. When the perpetual inventory system is used, the inventory sold is debited to ( )b. cost of merchandise sold24.All of the following below are needed for the calculation of depreciation exceptd. book value25. A characteristic of a fixed asset is that it isb. used in the operations of a business26. Accumulated Depreciation ( )c. is a contra asset account27. The two methods of accounting for investments in stock are the cost method and the ()b. equity method28. A capital expenditure results in a debit to ()d. an asset account29. Current liabilities are()d. due and payable within one year30. The debt created by a business when it makes a purchase on account is referred to as anb. account payable31. Notes may be issued ()d. all of the above32.The cost of a product warranty should be included as an expense in thec. period of the sale of the product33. If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually witha face value of $100,000 will bec. Less than $100,00034. The interest rate specified in the bond indenture is called the ()b. contract rate35. When the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds ared. callable bonds36. When the market rate of interest on bonds is higher than the contract rate, the bonds will sell atd. a discount37. One potential advantage of financing corporations through the use of bonds rather than common stock isc. the interest expense is deductible for tax purposes by the corporation38. Characteristics of a corporation include ()d. shareholders who have limited liability39. Stockholders' equity ()c. includes retained earnings and paid-in capital40. The excess of issue price over par of common stock is termed a(n) ()d. premium41. Cash dividends are usually not paid on which of the following?c. treasury stock42. Which of the following accounts below is reported in the paid-in capital/stockholders' equity section of the corporate balance sheet?d. Preferred Stock43. If preferred stock has dividends in arrears, the preferred stock must bed. convertible44. The primary purpose of a stock split is tob. reduce the market price of the stock per share45. Which statement below is not a reason for a corporation to buy back its own stock.d. to increase the shares outstanding46. The liability for a dividend is recorded on which of the following dates?d. the date of declaration47. In credit terms of 2/10, n/30, the "2" represents thed. percent of the cash discount48. Revenue should be recognized when()b. the service is performed49. The ability of a business to pay its debts as they come due and to earn a reasonable amount of income is referred to as ()b. solvency and profitability50. Which of the following is not included in the computation of the quick ratio?a. inventory四、问答题:3.Differentiate between financial accounting and managerial accounting.财务会计与管理会计的区别。

英文会计知识点总结

英文会计知识点总结1. Accrual basis accounting vs. cash basis accountingAccrual basis accounting records revenues and expenses when they are incurred, regardless of when the cash is received or paid. This method provides a more accurate representation of a company's financial performance as it reflects all economic transactions, not just cash transactions. On the other hand, cash basis accounting records revenues and expenses only when cash is exchanged, which may not provide an accurate reflection of the company's financial position.2. Revenue recognitionRevenue recognition refers to the process of recording revenue when it is earned, regardless of when the cash is received. This principle is important as it ensures that revenue is recognized in the period in which it is earned, providing a more accurate picture of a company's financial performance. There are specific criteria that must be met for revenue to be recognized, including evidence of an arrangement, delivery of goods and services, and collectability of payment.3. Matching principleThe matching principle states that expenses should be recorded in the same period as the revenues they helped generate. This principle ensures that expenses are properly matched with the revenues they helped produce, leading to a more accurate representation of a company's profitability.4. Materiality conceptThe materiality concept states that financial information should be disclosed if omitting it could influence the decision-making process of users. This concept allows for a certain degree of judgment in financial reporting, as not all information needs to be disclosed if it is not material to users' decision making.5. Going concern conceptThe going concern concept assumes that a company will continue to operate in the foreseeable future. This concept is important as it allows for the preparation of financial statements under the assumption that the company will continue its operations, which is crucial for making informed investment and business decisions.6. Consistency principleThe consistency principle states that accounting methods and practices should be consistent from one period to the next. This principle ensures comparability of financial information across different periods, facilitating the analysis of a company's financial performance over time.7. Conservatism principleThe conservatism principle requires accountants to be conservative in their approach to recording and reporting financial information. This means that when faced with uncertainty, accountants should be cautious and avoid overstating assets or revenue, while also recognizing all potential liabilities and expenses. This principle ensures that financial statements are not overly optimistic and reflect a more realistic view of a company's financial position.8. Relevance and reliability of financial informationFinancial information should be both relevant and reliable. Relevant information is important for decision making and helps users understand a company's financial position and performance. Reliable information is information that is accurate and can be trusted by users to make informed decisions.9. Objectivity in financial reportingObjectivity in financial reporting is crucial in ensuring that financial information is free from bias and is based on verifiable evidence. This principle ensures that financial statements accurately represent a company's financial performance and position, leading to greater trust and confidence from users.These key accounting concepts and principles provide the foundation for understanding the discipline of accounting and are essential for producing accurate and reliable financial information. By following these principles, businesses can ensure that their financial reporting is not only compliant with accounting standards but also serves the needs of users in making informed decisions.。

会计英语复习资料

会计英语复习资料会计英语期末复习资料⼀、单词1.accounting 会计学2.accounting elements 会计要素3.accounting equation 会计等式4.assets 资产5.liabilities 负债6.owner`s equity 所有者权益7.revenue 收⼊8.expenses 费⽤9.profits 利润10.accounting period 会计期间11.transaction 经济业务/会计事项12.double-entry system 复式记账法13.debit 借⽅14.credit 贷⽅15.ledger 分类账16.chart of accounts 会计科⽬表17.journal ⽇记账18.current assets 流动资产19.cash 现⾦20.cash equivalents 现⾦等价物21.check ⽀票22.bank deposits 银⾏存款23.cash in bank 银⾏存款24.money orders 汇票25.cash on band 库存现⾦26.accounts receivable 应收账款27.allowance for bad debts 坏账准备/doc/be38e1fd80eb6294dd886c5c.html realizable value 可变现净值29.inventory 存货30.finished goods 产成品31.semi-finished goods 半成品32.goods in process 在产品33.historical cost 历史成本34.specific identification 个别计价法35.first-in, first-out 先进先出法/doc/be38e1fd80eb6294dd886c5c.html st-in, first-out 后进先出法37.weighted average 加权平均法38.raw materials 原材料39.short-term investment 短期投资40.marketable securities 有价证券41.shareholder 股东42.bonds 债券43.debentures 债券44.long-term assets 长期资产45.fixed assets 固定资产46.intangible assets ⽆形资产47.deferred assets 递延资产/doc/be38e1fd80eb6294dd886c5c.html eful life 使⽤寿命49.depreciation 折旧50.depreciable amount 应计折旧额51.depreciation method 折旧⽅法52.estimated net residual value 预计净残值53.straight-line method 直线法54.units of production method ⼯作量法55.double declining balance method 双倍余额递减法56.sum-of-the-years-digits method 年数总和法57.amortization 摊销58.impairment 减值59.current liabilities 流动负债60.accounts payable 应付账款61.notes payable 应付票据62.unearned revenue 预收账款63.income taxes payable 应交所得税64.contingent liabilities 或有负债65.long-term liabilities 长期负债66.bonds payable 应付债券67.ownership 所有权68.sole proprietorship 独资企业69.partnership 合伙企业70.corporation 公司/doc/be38e1fd80eb6294dd886c5c.html mon shareholders 普通股股东72.preferred shareholders 优先股股东/doc/be38e1fd80eb6294dd886c5c.html mon stock 普通股74.preferred stock 优先股75.dividends 股利76.retained earnings 留存收益77.paid-in capital 实收资本78.capital stock 股本79.addtional paid-in capital 附加投⼊资本80.capital surplus 资本公积81.undistributed profit 未分配利润82.par value ⾯值83.fair value 公允价值84.reserve fund 盈余公积85.legal reserve 法定盈余86.stock split 股利分割87.cash dividends 现⾦股利88.stock dividends 股票股利89.sales revenue 销售收⼊90.service revenue 劳务收⼊91.product costs 产品成本92.direct material costs 直接材料成本93.direct labor costs 直接⼈⼯成本94.indirect costs 间接成本95.manufacturing overhead 制造费⽤96.period expenses 期间费⽤97.operating expense 营业费⽤98.administrative expense 管理费⽤99.finance expense 财务费⽤100.balance sheet 资产负债表101.income statement 利润表/损益表102.cash flow statement 现⾦流量表⼆、填空1. The accounting elements include , , , , , and .2. Liabilities are of a business.3. Borrowing cash from a bank does not belong to ; it simply belongs to liability.4. Profit is the of revenue over expenses for the accounting period.5. The accounting equation is : = + .6.“Dr.” stands for debits ,while “Cr.” is the abbreviation for .7. Liability, owner`s equity, revenue and profit decreases are recorded as .8. Short-term investments refer to various of .9. Marketable securities include and to be realized within one year from the balance sheet date and shall be accounted for at cost.10. Depreciation refers to the systematic allocation of the of a fixed asset over its useful life.11. The four common depreciation methods are .12. shall be employed when it is assumed that an asset`s economic revenue is the same each year, and the repair and maintenance cost is also the same for each period.13. When depreciation is mainly due to wear and tear, are usually used.14. The two types of intangible assets are finite and intangibles.15. Please name five most commonly seen intangibles , i.e., , , , , and .16. Intangible assets do not include internally generated , and .17. Intangible assets should be measured initially at .18. For intangible assets with finite useful lives enterprises shall consider their while intangible assets with indefinite useful lives shall not be amortized.19. The account of should be decreased when the service paid for in advancehas been provided.20. The account of should be recorded when the business purchased supplies on credit.21. The account of used to show what the business owes the bank.22. A corporation`s balance sheet contains assets, liabilities, and .23. and are the two common capital stocks issued by a corporation.24. and are the usual forms of distribution to share holders.25. A is a proportional distribution to shareholders of additional shares of the corporation`s common or preferred stocks.26. represents the corporation`s accumulated net income, less accumulated dividends and other amounts transferred to paid-in capital accounts.三、单选1. Matching each of the following statements with its poper term.(1) accounts receivable ( )(2) dishonored notes receivable ( )(3) allowance method ( )(4) direct write-off method ( )A. The method of accounting for un-collectible accounts that provides an expense for un-collectible receivables in advance of their write-off.B. A receivable created by selling merchandise or service on credit.C. A note that maker fails to pay on the due date.D. The method of accounting for un-collectible accounts that recognizes the expense only when accounts are judged to be worthless.2. At the end of the fiscal year, accounts receivable has a balance of $100000 and allowance for doubtful accounts has a balance of $7000, The expected net realizable value of the accounts receivable is ( )A. $7000B. $93000C. $100000D. $1070003. If merchandise inventory is being valued at cost and the price level is steadily rising, the method of costing that will yield the higher net income is ( )A.LIFOB.FIFOC.AverageD.Periodic4. Given the following information, which of the following accounting transactions is true?( )Gross payroll $20000Federal income tax withheld $4000Social security tax withheld $1600A. $1600 is recorded as salary expense.B. $14400 is recorded as salary payableC. The $1600 deducted for employee social security tax belongs to the companyD. Payroll is an example of an estimated liability5.If a corporation has outstanding 1000 shares of $9 cumulative preferred stock of $100 par and dividends have been passed for the preceding three years, what is the amount of preferred dividends that must be declared in the current year before a dividend can be declared on common stock?( )A. $9000B. $27000C. $36000D. $450006. All of the following are reasons for purchasing treasury stock except to ( )A. make a market for the stockB. increase the number of shareholdersC. increase the earnings per share and return on equityD. give employee as compensation7. Paid-in capital for a corporation may arise from which of the following sources?( )A. Issuing cumulative preferred stockB. Receiving donations of real estateC. Selling the corporation`s treasury stockD. All of the above8. Under the equity method, the investment account is decreased by all of the following except the investor`s proportionate share of ( )A. dividends paid by the investeeB. declines in the fair value of the investmentC. the losses of the investeeD. all of the options9. Cash dividends are paid on the basis of the number of shares ( )A. authorizedB. issuedC. OutstandingD. outstanding less the number of treasury shares10. The stockholders` equity section of the balance sheet may include ( )A. common stockB. preferred stockC. donated capitalD. all of the above11. Declaration and issuance of a dividend in stock ( )A. increases the current ratioB. decreases the amount of working capitalC. decreases total stockholders` equityD. has no effect on total assets, liabilities, or stockholders` equity12. If a corporation reacquires its own stock, the stock is listed on the balance sheet in the ( )A. current assets sectionB. long term liability sectionC. stockholders` equity sectionD. investments section13. A corporation has issued 25000 shares of $100 par common stock and holds 3000 of these shares as treasury stock. If the corporation declares a $2 per share cash dividend, what amount will be recorded as cash dividend?( )A. $22000B. $2500014. A company declared a cash dividend on its common stock on December 15, 2004, payable on January 12, 2005. How would this dividend affect shareholders` equity on the following dates? ( ) December 15, January 122004 2005A. Decrease. Decrease.B. No effect. No effect.C. No effect. No effect.D. Decrease. Decrease.15. An example of a cash flow from an operating activity is ( )A. the receipt of cash from issuing stockB. the receipt of cash from issuing bondsC. the payment of cash for dividendsD. the receipt of cash from customers on account16. An example of a cash flow from an investing activity is ( )A. the receipt of cash from the sale of equipmentB. the receipt of cash from issuing bondsC. the payment of cash for dividendsD. the payment of cash to acquire treasury stock17. An example of a cash flow from a financing activity is ( )A. the receipt of cash from customers on accountB. the receipt of cash from the sale of equipmentC. the payment of cash for dividendsD. the payment of cash to acquire marketable securities18. A receivable created by selling merchandise or services on credit. ( )A. accounts receivableB. dishonored notes payableC. allowance methodD. direct write-off method19. At the end of the fiscal year, accounts receivable has a balance of $100000 and allowance for doubtful accounts has a balance of $7000. The expected net realizable value of the accounts receivable is ( )A. $7000B. $93000C. $100000D. $10700020.( ) are valuable resources owned by the entity.C. EquityD. None of them21. Which is intangible asset ( )A. internally generated goodwillB. internally generated publishing titlesC. franchises and licenseD. internally generated brands22.( ) shall be employed when it is assumed that an asset`s economic revenue is the same each year, and the repair and maintenance cost is also the same for each period.A. straight-line methodB. units of production methodC. double declining balance methodD. sum-of-the-years-digits(SYD) method四、判断1. Fixed assets are intangible assets. ( )2. Internally generated goodwill can be viewed as intangible assets. ( )3. Land doesn`t need depreciation and is considered to have an infinite life. ()4. Fixed assets are usually subjected to depreciation. ( )5. Bonds and stocks are classified as intangible assets.( )6. Once the expected useful life and estimated net residual value are determined, they shall not be changed under any circumstances.( )7. When a corporation issues one type of capital stocks, common stocks are always issued. ( )8. Par value is strictly a legal matter, and it establishes the legal capital of a corporation. ( )9. The balance of the additional paid-in capital account represents a gain on the sale of stocks and increases net income. ( )10. A corporation must, by law, pay a dividend once a year. ( )11. Dividends are an expense of a corporation and should be charged to the periodic income. ( )12. Revenue increase owner`s equity. ( )13. Revenue is recognized when we receive cash from the buyers. ( )14. Advertising expense is usually collected as period expense. ( )15. Interest revenue should be measured based on the length of time. ( )16. If revenue exceed expenses for the same accounting period, the entity is deemed to suffera loss. ( )17. Asset = liabilities + Expense. ( )18. Liabilities are debts of a business. ( )19. Borrowing cash from a bank belongs to revenue. ( )20. Increase in asset is recorded in credit side. ( )21. When depreciation is mainly due to wear and tear, straight-line method shall be employed. ( )22. Bonds payable belong to current liabilities.( )23. All fixed assets are depreciable over their limited useful life.( )24. Fixed assets are intangible assets. ( )25. Internally generated goodwill can be viewed as intangible assets. ( )26. Land doesn`t need depreciation and is considered to have an infinite life. ( )五、翻译1. Accounting contains elements both of science and art. The important thing is that it is not merely a collection of arithmetical techniques but a set of complex processes depending on and prepared for people.2. Inventories refer to merchandise, finished goods, semi-finished goods, goods in process, and all kinds of materials, fuels, containers, low-value and perishable articles and so on that stocked for the purpose of sale, production or consumption during the production operational process, Inventories are normally accounted for at historical cost, as the cost principle requires. Normally, a company may account inventories under the following methods:(1)Specific identification (2)first-in, first-out(FIFO) (3)last-in, first-out(LIFO) (4)weighted average3. In contrast to current assets, long-term assets refer to those assets that will be realized or consumed within a period longer than one year of their acquisition, which are normally divided into fixed assets, intangible assets and deferred assets.Fixed assets refer to the assets whose useful life is over one year, unit value is above the prescribed criteria and where original physical form remains during the process of utilization.4. Depreciation is defined as the accounting process of systematically allocating the depreciable amount of a fixed asset over its useful life by a selected depreciation method. When calculating the depreciation expense of a fixed asset, an enterprise should consider its depreciable amount,estimated net residual value, estimated useful life, and the depreciation methods.5. The amount of retained earnings represents the cumulative net income of the firm since its beginning, less the total dividends that have been distributed to shareholders. It is important to note that retained earnings are not the assets, but the existence of retained earnings means that net assets generated by profitable operations have been kept in the company to help it grow or to meet other business needs. However, a credit balance in Retained Earnings does not mean that cash or any designated set of assets is directly associated with retained earnings. The fact that earnings have been retained means that net assets as a whole have been increased.6. In China, companies must provide “legal reserve.”Today in USA, appropriations of retained earnings are seldom seen on balance sheets.7. Revenue is the gross inflow of economic benefits arising in the course of the ordinary activities of an enterprise from such events as the sale of goods, the rendering of service and the use of enterprise by others. Revenue growth is an important indicator of the market reception of a company`s products and services.8. Sales revenue arises from the sale of goods.Service revenue arises from the rendering of services.9. Expenses refer to the outlays incurred by an enterprise in the course of production and operation. It means the outflows or other using up of assets or incurrence of liabilities during a period. According to the relationship with products, we can divide expenses into two categories: product costs and period expense.Product costs are directly related to the products, which are composed of direct material costs, direct labor costs and the indirect costs.10. Period expenses are not directly associated with products, but they are indispensable for generating the current revenue.11. A balance sheet is a summary of a company`s balances. Assets, liabilities and owner`s equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a snapshot of a company`s financial condition.12. The income statement is a financial statement that summarizes the results of a company`s operation by matching revenue and related expenses for a particular accounting period. It shows the net income or net loss. It is also called earnings statement, statement of operations, and profit and loss statement.13. The cash flow statement is a financial statement that reports the cash receipts and cash payments of an entity during a particular period. The term cash refers not only to the bills and coins we normally think of as cash, but also to cash equivalents. Cash equivalents are highly liquid short-term investment that can easily and quickly be converted into cash, usually with maturity of three months or less at the date of purchase.The cash flows of an entity usually come from cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.14. Assets are economic resources that are possessed or controlled by an enterprise to generate revenue to the enterprise. Assets of an enterprise are usually divided into the following categories: current assets, long-term investment, fixed assets, intangible assets and other assets. Current assets are assets that will be realized or consumed within one year or within an operating cycle. Typical current assets include cash, bank deposit, accounts receivables and so on. Cash is listed first of all current assets because it is the most liquid of all assets.15. Long-term liabilities are obligations of business that are due to be paid after one year or beyond the operating cycle, whichever is longer. Decisions related to long-term debt are critical because how a company finances its operations is the most important factor in the company`s long-term liability. The amount and type of debt a company incurs depends on many factors, including the nature of the business, its competitive environment, the state of the financial markets, and the predictability of its earnings.六、业务题1.(1)According to the above information, use weighted-average method and the ending inventory should be(2)According to the above information, use LIFO method, the most assigned to the sold should be(3)According to the above information, use FIFO method, the cost assigned to the sold should be(4)According to the above information, use LIFO method, the cost assigned to the ending inventory is2.(1)On June 5, K. Company purchased $6000 of inventory, paying cash.(2)On June 10, K. Company received $10000 of good sales.(3)On June 12, K. Company paid $5000 in salaries by bank deposit.(4)Bought office furniture from Simple Company on account, $30000(5)On June 30, K. Company paid $10000 to Simple Company on account.3. Record each transaction in the accompanying account of L & T Co.(1) Bought supplies on account for $600.(2) Bought equipment for $2700, paying one third down and owing the balance.(3) Gave a note in settlement of transaction (2).(4) Received $500 as an income.4. Record the following entries in the general journal for Stephens Cleaning Company.(1) Invested $10000 cash in the business.(2) Paid $2000 for office furniture.(3) Bought equipment costing $6000 on account.(4) Received $2200 in cleaning income.(5) Paid a quarter of the amount owed on the equipment.5.(1)Accounting to the following information, use weighted-average method and the ending inventory should be(2)Using the information from question(1), the LIFO method, the cost assigned to the ending inventory is6.Assuming that net purchase cost $250000 during the year and that the ending stock was $4000 less than the beginning stock of $30000, the cost of goods would be7. Emily started her business-Emily`s Bakery. The transaction in the year of 2008 are as follow.(1) Emily contributed $10000 in cash.(2) The company borrowed $3000 from a bank.(3) The company purchased equipment for $5000 cash.(4) The company performed service for $12000. The customer paid $8000 in cash and promised to pay the rest amount at a later date.(5) The company paid $9000 for expenses (wages, interest and maintenance)(6) The company paid dividend of $1000.The balance sheet of Emily`s bakeryDecember31, 2008Current Assets Current LiabilitiesLong-term Assets Long-term LiabilitiesOwner`s equityTotal Assets Total Liabilities and Owner`s Equity七、例题1.1 During the month of January, Ted Lott, a lawyer(1) Invested $8000 to open his practice.(2)Bought office supplies (stationery, forms, pencils, and so on)for cash, $700.(3) Bought several pieces of office furniture from Ferraro Furniture Company on account, $2000.(4) Receive $3500 in service fees earned during the month.(5) Paid office rent for January, $600.(6) Paid salary for part-time help, $800.(7) Paid $1600 to Ferraro Furniture Company on account.(8) After taking inventory at the end of the month, Lott found that he had used $200 worth of supplies.(9) Withdrew $470 for personal use.2.1 ABC Company had the following transaction in 2007.(1) Recognized $5000 of sales revenue earned on account.(2) Collected $3000 cash from accounts receivable.(3) Recognized $500 of bad debt expense for accounts receivable that are expected to be un-collectible in the future.2.3 Assume that ABC Company is a listed company. Simple buys 10000 shares of ABC Company`s common stock in New York Securities Exchange on November 1, 2007, at the price of $20 per share.2.4 (1) Assume that, on March 15, 2008, ABC company declared that they decided to give dividends at S3 per common stock. Thus, Simple Company would receive $30000 of dividend. At this time the cash was not given but an accounting record was requested.(2) On April, Simple Company received $30000 of cash dividend. So they need a new accounting record.4.1 Simple Company buys goods for $50000 on credit. The journal entry in Simple Company`s accounting records for this transaction.4.2 (1) On March 1, Simple Company borrows $40000 from its bank for a period of six months at an annual interest rate of 10%. Six months later on September 1, Simple Company will have to pay the bank the principal amount of $40000 plus $2000 interest. As an evidence of this loan, the bank requires Simple Company to issue a note payable. The journal entry in Simple Company`s accounting records for this March 1 borrowing is as follow.(2) Borrowed $40000 for six months at 10% interest per year.(3) The entry on September 1 to record payment of the note will be as follow.4.3 (1) Simple Company signed up a contract with another company to perform services. Simple Company received an advanced cash payment in the amount of $20000 and the term of the contract was one month. The transaction acts to increase assets (cash) and liabilities (unearned revenue). The journal entry in Simple Company`s accounting records for this transaction is as follow.(2) At this time, Simple Company received cash but didn`t perform the services. So the cash of $20000 was not the real revenue. Only when Simple Company performed the services, a new journal entry would be made in the follow.4.4 Bonds issued at a discountAssume that ABC Company plans to issue $1000000 face value of 10%, 10-year bonds. At the issuance date of May 1, the going market rate of interest is slightly above 10% and the bonds sell at a market price of only $950. The issuance of the bonds will be recorded by the following entry.4.5 In this example, the discount on bonds payable has a beginning debit balance of $50000. Each year $5000 will be amortized into Bond Interest Expense.Assuming that the interest payment dates are October 31 and April 30, the entries to be made each six months to record bond interest expense are as follow.(1) Paid semi-annual interest on $1000000 of 10%, 10-year bonds.(2) Amortized discount for six months on 10-year bond issue ($50000/20=$2500)5.1On January 1, Joan Adams and Richard Brown decide to form a partnership by consolidating their two retail stores. A capital account will be opened for each partner and credited, with the agreed valuation of the net assets that the partner contributes. The journal entries to open the accounts of the partnership of Adams and Brown are as follow.(1) To record the investment by Joan Adams in the partnership of Adams and Brown.(2) To record the investment by Richard Brown in the partnership of Adams and Brown.(3) After six months of operation the firm is in need of more cash, and the partners make additional investments of $10000 each on July 1. These additional investments are credited to the capital accounts as shown below.5.3 Adams and Brown have agreed to share profits equally. Assuming that the partnership earns net income of $60000 in the first year of operations, the entry to close the income summary account is as follow.(1) To divide net income for the year in accordance with partnership agreement to share profits equally.The next step in closing the accounts is to transfer the balance of each partner`s drawing account to his capital account. Assuming that withdrawals during the year amounted to $24000 for Adams and $16000 for Brown, the entry at December 31 to close the drawing accounts is as follow.(2) To transfer debit balances in partner`s drawing accounts to their respective capital accounts.5.4 The issuance of 100000 shares of common stock, par $1, for cash of $1.2 per share would be recorded as follow.5.5 Assume that a corporation issues 10000 shares of no-par common stock at $40 a share and ata later date issues 1000 additional shares at $36. The entries to record the no-par stock are as follow.(1) Issued 10000 shares of no-par common stock at $40.(2) Issued 1000 shares of no-par common stock at $36.5.6 Assume that a corporation has a balance of $300000 in retained earnings and 50000 shares of $10 par value common stock. The current fair market value of its stock is $15 per share.(1) If the corporation declares a 10% stock dividend, the entry to record this transaction at the declaration and payment date is as follow.(2) If the corporation declares a 40% stock dividend, the entry to record this transaction at the declaration and payment date is as follow.5.7 Assume that on December 1,2005, the directors of A corporation declare a 40 cents per share cash dividend on 100000 shares of $10 par value common stock. The dividend is $40000 (100000*0.4).(1) the entry to record the declaration is as follow.(2) At the end of the year, the dividends account is closed to retained earnings by the following entry.⼋、附加题1.Whether an account is to be debited or credited depends on the accounting elements. By convention, increases in assets and expenses are recorded as debits, whereas increases in liability, owner`s equity, revenue and profit are recorded as credits. Assets and expense decreases are recorded as credits, whereas liability, owner`s equity, revenue and profit decreases are recorded as debits.2.In an accounting system, a separate account is designated for each asset, each liability, and each component of owner`s equity, including revenues and expenses. That`s to say, accounts are grouped according to accounting elements. These groups of accounts are called the ledger.3. The chart of accounts is a listing of the accounts by title and number. Assets and liability accounts are arranged according to their liquidity. While income, expense and owner`s equity accounts are listed according to their importance.4.A business`s accounts receivable are the amounts that its customers owe it and these accounts receivable are sometimes called trade creditors.Allowance for bad debts is the estimated amount of accounts receivable that will not be collected.The net realizable value is the amount that a company is actually expecting to get in the future. Net realizable = accounts receivable — allowance for bad debts4. Short-term investments refer to various marketable securities, which can be realized at any time and will be held less thana year, as well as other investment with a life of no longer thana year.。

会计英语全书总体复习

Users of Accounting Information

Internal users

External users Investors Creditors Suppliers Government Labor unions Banks The general public

Rules of debits &credits

The type of account determines the side in which increases and decreases are recorded.

Chapter 5 The FIFO & LIFO Chapter 6 The cost of an asset P58 The SYD & DDB Intangible assets p62 Long-term investment‟s measuring p65

相等物financialposition财务状况operatingresults经营成果balancesheet资产负债表incomestatement利润表cashflows现金流量表costgoodssold销货成本grossprofit毛利润operatingexpenses经营费用incometaxexpense所得税费用salaryexpenserentexpenseresidualvaluestraightlinemethod直线法unitsofproductionmethod工作量法decliningbalancemethod余额递减法sumoftheyears?digitsmethod年数总和法doubledecliningbalanceddbmethod双倍余额递减法depreciationexpense折旧费用accumulateddepreciation累计折旧trendanalysis趋势分析法commonsizeanalysis结构分析currentratio流动比率ratesales销售利润率grossprofitpercentage毛利率debtratio负债比率exercisesexercisesp178refrigerator冰箱usedmeatprocessor加工者hasestimatedresidualvalueestimatedusefullifeyearsdepreciationexpense13500depreciationexpense13500accumulateddepreciation13500straightlinemethodstraightlinemethoddepreciationexpense9000year1

会计专业英语复习资料10页word文档

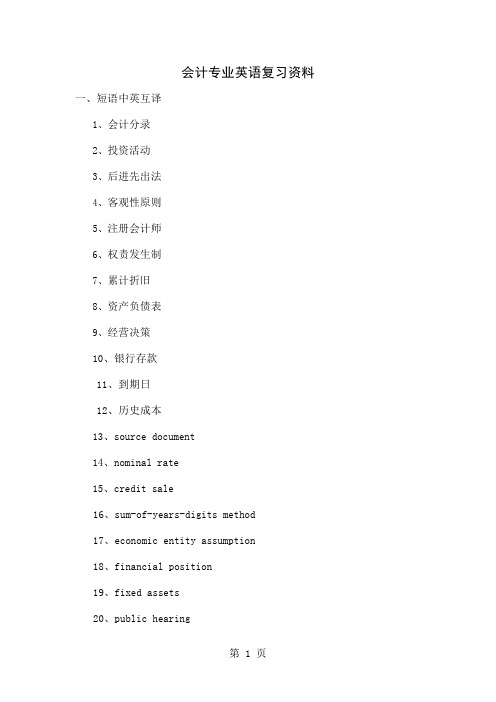

会计专业英语复习资料一、短语中英互译1、会计分录2、投资活动3、后进先出法4、客观性原则5、注册会计师6、权责发生制7、累计折旧8、资产负债表9、经营决策10、银行存款11、到期日12、历史成本13、source document14、nominal rate15、credit sale16、sum-of-years-digits method17、economic entity assumption18、financial position19、fixed assets20、public hearing21、income statement22、sales discount23、value added tax24、trade mark25、bank overdraft二、从下列选项中选出最佳答案1、Generally,revenue is recorded by a business enterprise at a pointwhen :( )A、Management decides it is appropriate to do soB、The product is available for sale to consumersC、An exchange has taken place and the earning process isvirtually completeD、An order for merchandise has been received2、Why are certain costs capitalized when incurred and then depreciated or amortized over subsequent accounting periods?( )A、To reduce the income tax liabilityB、To aid management in making business decisionsC、To match the costs of production with revenue as earnedD、To adhere to the accounting concept of conservatism3、What accounting principle or concept justifies the use of accruals and deferrals?( )A、Going concernB、MaterialityC、ConsistencyD、Stable monetary unit4、An accrued expense can best be described as an amount ( )A、Paid and currently matched with revenueB、Paid and not currently matched with revenueC、Not paid and not currently matched with revenueD、Not paid and currently matched with revenue5、Continuation of a business enterprise in the absence of contrary evidence is an example of the principle or concept of ( )A、Business entityB、ConsistencyC、Going concernD、Substance over form6、In preparing a bank reconciliation,the amount of checks outstanding would be:( )A、added to the bank balance according to the bank statement.B、deducted from the bank balance according to the bank statement.C、added to the cash balance according to the depositor’s records.D、deducted from the cash balance according to the depositor’srecords.7、Journal entries based on the bank reconciliation are requiredfor:( )A、additions to the cash balance according to the depositor’srecords.B、deductions from the cash balance according to the depositor’srecords.C、Both A and BD、Neither A nor B8、A petty cash fund is :( )A、used to pay relatively small amounts。

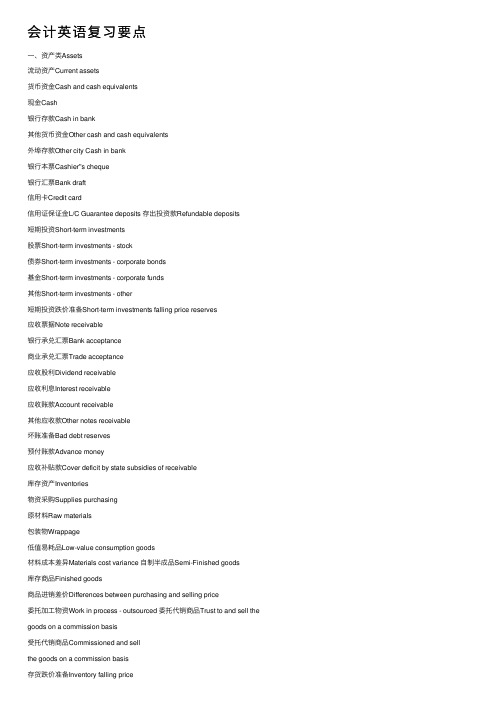

会计英语复习要点