2020年国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知(精选干货)

[(精华版)国家开放大学电大本科《社会政策》网络课形考任务1-4试题及答案]

![[(精华版)国家开放大学电大本科《社会政策》网络课形考任务1-4试题及答案]](https://img.taocdn.com/s3/m/b1b536dd9b6648d7c0c7461b.png)

[(精华版)国家开放大学电大本科《社会政策》网络课形考任务1-4试题及答案](精华版)国家开放大学电大本科《社会政策》网络课形考任务1-4试题及答案100%通过考试说明:2020年秋期电大把该网络课纳入到“国开平台”进行考核,该课程共有4个形考任务,针对该门课程,本人汇总了该科所有的题,形成一个完整的标准题库,并且以后会不断更新,对考生的复习、作业和考试起着非常重要的作用,会给您节省大量的时间。

做考题时,利用本文档中的查找工具,把考题中的关键字输到查找工具的查找内容框内,就可迅速查找到该题答案。

本文库还有其他网核及教学考一体化答案,敬请查看。

课程总成绩= 形成性考核×50% + 终结性考试×50% 形考任务1 一、填空题(每小题5分,共25分)题目1 政策是政府或其他社会组织为实现其目标而制定的、指导人们行动的各种()。

答:规则体系题目2 ()年,德国学者成立了“德国社会政策学会”。

答:1873 题目3 ()是社会政策早期形态,起源于1601年英国政府颁布的《济贫法》。

答:社会救助政策题目4 ()原则是整个封建传统社会、专制王国、乃至转型期社会的社会管理的核心原则。

答:父权主义题目5 1884年,在英国伦敦,卫伯夫妇发起成立了()。

答:费边社二、单项选择题(每题5分,共30分)题目6 作为一个概念,社会政策最早是由()学者提出的。

选择一项:B. 德国题目7 1601年,英国伊丽莎白女王颁布了(),规定地方教区可以通过征收税收、接受捐赠、罚款等方式,对穷人实行救济。

选择一项:C. 《济贫法》题目8 1834年,英国政府通过了(),体现了自由主义思潮。

选择一项:B. 新《济贫法》题目9 在经历了大萧条后,1935年,美国实施了()。

选择一项:D. 《社会保障法案》题目10 第二次世界大战后,()奠定了英国20世纪40年代主要的社会福利模式。

选择一项:D. 《贝弗里奇报告》题目11 1948年,福利国家首先在()宣布建立。

天津股权投资企业和股权投资管理机构管理办法范文

天津股权投资企业和股权投资管理机构管理办法天津市发展和改革委员会天津市人民政府金融服务办公室文件天津市工商行政管理局天津市商务委员会天津市财政局津发改财金〔〕675号关于印发《天津股权投资企业和股权投资管理机构管理办法》的通知各区、县人民政府,各委、办、局,各有关单位:为贯彻落实《国家发展改革委办公厅关于规范试点地区股权投资企业发展和备案管理工作的通知》《发改办财金[ ]253号》要求,进一步促进我市股权投资企业和股权投资管理机构规范健康发展,根据《天津市促进股权投资基金业发展办法》《津政发[ ]45号》有关规定,经市领导同意,市发展改革委、金融办、工商局、商务委、财政局联合制定了《天津股权投资企业和股权投资管理机构管理办法》,现予发布,请贯彻执行。

附:天津股权投资企业和股权投资管理机构管理办法市发改委市金融办市工商局市商务委市财政局二О一一年七月十一日主题词:经济管理投资办法通知抄送:市政府办公厅、各功能区管委会、各区县发改委天津市发展和改革委员会办公室 7月11日印打字:王金玲校对:胡齐艺(共印400份)天津股权投资企业和股权投资管理机构管理办法第一章总则为促进股权投资企业及其管理机构规范健康发展,严格防范金融风险和非法集资等非法金融活动,规范股权投资企业、股权投资管理机构的登记、托管、备案、运作等,保护投资者等当事人的合法权益,根据《中华人民共和国公司法》、《中华人民共和国合伙企业法》和《公司登记管理条例》、《合伙企业登记管理办法》、《外国企业或者个人在中国境内设立合伙企业管理办法》,结合《国家发展改革委办公厅关于规范试点地区股权投资企业发展和备案管理工作的通知》(发改办财金〔〕253号)(简称《通知》)和《天津市促进股权投资基金业发展办法》(津政发〔〕45号)的有关规定,特制定本办法。

第一条本办法所称股权投资企业(包括内资、外商投资)是指以非公开方式募集的、用于投资非公开交易的企业股权的企业。

私募股权基金法律法规汇总

私募股权投资涉及的法律法规第一部分:合伙《合伙企业法》《外国企业或者个人在中国境内设立合伙企业管理办法》第二部分:公司《公司法》第三部分:证券《证券投资基金法》《证券投资基金管理暂行办法》《证券投资基金运作管理办法》《证券投资基金年销售管理办法》《产业投资基金管理暂行办法》《设立境外中国产业投资基金管理办法》第四部分:股权投资《股权投资基金管理办法》《关于促进股权投资基金业发展的意见》《关于进一步规范试点地区股权投资企业发展和备案管理工作的通知》《北京市关于促进股权投资基金业发展的意见》《重庆市关于鼓励股权投资类企业发展的意见》重庆市人民政府关于鼓励股权投资类企业发展的意见(渝府发〔2008〕110号)《宁波市鼓励股权投资企业发展的若干意见》《上海关于本市股权投资企业工商登记事项的通知》《浦东新区促进股权投资企业和股权投资管理企业发展的实施办法》《上海市浦东新区设立外商投资股权投资管理企业试行办法》天津《关于私募股权投资基金、私募股权投资基金管理公司(企业)进行工商登记的意见》《天津股权投资基金和股权投资基金管理公司(企业)登记备案管理试行办法》《天津市促进股权投资基金业发展办法》第五部分:创业投资《创业投资管理暂行办法》《创业投资企业管理暂行办法》《国家税务总局关于实施创业投资企业所得税优惠问题的通知》(国税发〔2009〕87号)《关于创业投资引导基金规范设立与运作的指导意见》《深圳经济特区创业投资条例》第六部分:税收《企业所得税法》《中华人民共和国企业所得税法实施条例》《中华人民共和国个人所得税法》《关于合伙企业合伙人所得税问题的通知》《关于实施创业投资企业的所得税优惠问题通知》《关于促进创业投资企业发展有关税收政策的通知》第七部分:信托《信托法》《信托公司管理办法》《信托公司集合资金信托管理办法》《信托公司集合资金信托计划管理办法》第八部分:保险《保险法》第106条《保险资金运用管理暂行办法》第12条,16条《保险资金投资股权暂行办法》《保险资金投资不动产暂行办法》,第九部分:其他《关于建立我国风险投资机制的若干意见》《境内证券市场转持部分国有股充实全国社会保障基金实施办法》第五条《关于当前金融促进经济发展的若干意见》《国务院办公厅就金融促进经济发展三十条意见》《国务院批转发展改革委关于2009年深化经济体制改革工作意见的通知》,《关于鼓励和引导民间投资健康发展的若干意见》,《关于加强地方政府融资平台公司管理有关问题的通知》《最高人民法院关于审理非法集资刑事案件具体应用法律若干问题的解释》法释〔2010〕18号按部门划分法律部分:1、《中华人民共和国公司法》(2005年修订)2、《中华人民共和国外资企业法》(2000年修正)3、《中华人民共和国中外合资企业经营法》(2001年修正)4、《中华人民共和国中外合作经营法企业法》(2000年修正)5、《中华人民共和国证券法》(2004年修改)6、《中华人民共和国企业破产法》7、《中华人民共和国信托法》8、《中华人民共和国企业所得税法》9、《中华人民共和国个人所得税法》(2007年修改)10、《中华人民共和国合伙企业法》(2006年修订)11、《中华人民共和国证券投资基金法》行政法规及国务院的文件:1、《国务院关于股份有限公司境外募集股份及上市的特别规定》2、《中华人民共和国外汇管理条例》3、《外国企业或个人在中国境内设立合伙企业管理办法》4、《国务院关于经营者集中申报标准的规》5、《国务院源于进一步加强在境外发行股票和上市管理的通知》6、《国务院关于促进企业兼并重组的意见》中国证券监督管理委员会文件:1、《关于落实<</FONT>国务院关于进一步加强在境外发行股票和上市管理的通知>若干问题的通知》2、《中国证券监督管理委员会关于企业申请境外上市有关问题的通知》3、《关于规范境内公司所属企业到境外上市有关问题的通知》4、《首次公开发行股票上市管理办法》5、《上市公司重大资产重组管理办法》6、《上市公司收购管理办法》7、《外国投资者对上市公司战略投资管理办法》8、《首次公开发行股票并在创业板上市管理暂行办法》9、《上市公司证券发行管理办法》10、《证券登记结算管理办法》国务院国有资产监督管理委员会文件:1、《国有企业清产核资办法》2、《企业国有产权转让管理暂行办法》商务部文件:1、《外商投资企业投资者股权变更的若干规定》2、《关于外商投资企业境内投资的暂行规定》3、《外商投资创业投资企业管理规定》4、《关于外国投资者并购境内企业的规定》5、《关于外商投资举办投资性公司的规定》6、《关于外商投资举办投资性公司的补充规定》7、《商务部关于外商投资创业投资企业、创业投资管理企业审批事项的通知》发展和改革委员会文件:1、《关于创业投资引导基金规范设立与运作的指导意见》2、《创业投资企业管理暂行办法》3、《关于促进股权投资企业规范发展的通知》(2864号)财政部、国家税务总局文件:1、财政部、国家税务总局关于印发《关于个人独资企业和合伙企业投资者征收个人所得税的规定》的通知2、《关于个人独资企业和合伙企业投资者征收个人所得税的规定》3、《国家税务总局关于企业投资企业业务若干所得税的通知》4、国家税务总局关于《关于个人独资企业和合伙企业投资者征收个人所得税的规定》执行口径的通知5、国家税务总局《关于外商投资创业投资公司缴纳企业所得税有关税收问题的通知》6、国家税务总局《关于外国投资者并购境内企业股权有关税收问题的通知》7、财政部、国家税务总局《关于促进创业投资企业发展有关税收政策的通知》8、国家税务总局《关于下发协定股息税率情况一览表的通知》9、《关于调整个体工商户个人独资企业和合伙企业》10、《个人所得税税前扣除标准有关问题的通知》11、《关于合伙企业合伙人所得税问题的通知》财税[2008]159号科学技术部文件:1、财政部、科技部关于印发《科技型中小企业创业投资引导基金管理暂行办法》的通知2、《关于外商投资创业投资企业、创业投资管理企业审批有关事项的通知》3、《商务部关于外商投资创业、创业投资管理企业审批事项的通知》中国银监会文件:1、《信托公司私人股权投资信托业务操作指引》2、《信托公司集合资金信托计划管理办法》国家外汇管理局文件:1、国家外汇管理局《关于完善外资并购外汇管理有关问题的通知》2、国家外汇管理局《关于境内居民通过境外特殊目的公司融资及返程投资外汇管理有关问题的通知》3、国家外汇管理局综合司《关于印发<</FONT>国家外汇管理局关于境内居民通过境外特殊目的公司融资及返程投资外汇管理有关问题的通知>操作规程的通知》国家工商总局文件:1、《外商投资合伙企业登记管理规定》最高人民法院司法解释:1、《最高人民法院关于适用<</FONT>中华人民共和国公司法>若干问题的规定》(二)。

国家发展改革委关于印发《2020年新型城镇化建设和城乡融合发展重点任务》的通知

国家发展改革委关于印发《2020年新型城镇化建设和城乡融合发展重点任务》的通知文章属性•【制定机关】国家发展和改革委员会•【公布日期】2020.04.03•【文号】发改规划〔2020〕532号•【施行日期】2020.04.03•【效力等级】部门规范性文件•【时效性】现行有效•【主题分类】发展规划正文国家发展改革委关于印发《2020年新型城镇化建设和城乡融合发展重点任务》的通知发改规划〔2020〕532号中央和国家机关有关部门、直属机构,各省、自治区、直辖市及计划单列市、新疆生产建设兵团发展改革委,全国工商联,中国国家铁路集团有限公司、国家开发银行、中国农业发展银行:经城镇化工作暨城乡融合发展工作部际联席会议成员单位共同确定并报告国务院,现将《2020年新型城镇化建设和城乡融合发展重点任务》印发你们,请认真贯彻执行。

国家发展改革委2020年4月3日2020年新型城镇化建设和城乡融合发展重点任务2020年是全面建成小康社会和“十三五”规划收官之年,也是为“十四五”发展打好基础的关键之年。

为深入贯彻落实习近平总书记关于统筹推进新冠肺炎疫情防控和经济社会发展工作的重要指示精神,贯彻落实中央经济工作会议精神和党中央、国务院印发的《国家新型城镇化规划(2014—2020年)》《关于建立健全城乡融合发展体制机制和政策体系的意见》,现提出以下任务。

一、总体要求以习近平新时代中国特色社会主义思想为指导,全面贯彻党的十九大和十九届二中、三中、四中全会精神,坚持稳中求进工作总基调,坚持新发展理念,加快实施以促进人的城镇化为核心、提高质量为导向的新型城镇化战略,提高农业转移人口市民化质量,增强中心城市和城市群综合承载、资源优化配置能力,推进以县城为重要载体的新型城镇化建设,促进大中小城市和小城镇协调发展,提升城市治理水平,推进城乡融合发展,实现1亿非户籍人口在城市落户目标和国家新型城镇化规划圆满收官,为全面建成小康社会提供有力支撑。

资产评估业务类型简述

资产评估业务类型简述附二:资产评估业务类型简述一、单项资产评估业务(一)业务范围单项资产评估业务,按照经济行为分为:1.资产转让;2.资产拍卖;3.资产偿债;4.资产租赁;5.资产抵押/质押;6.资产重组;7.资产捐赠;8.资产补偿;9.资产涉讼;10.认定报关价格;11.对外投资;12.接受投资;13.接受抵债资产;14.债务重组及其他。

(二)业务依据1.《企业国有资产评估管理暂行办法》(国务院国资委令第12号);2.《金融企业国有资产评估监督管理暂行办法》(财政部令第47号);3.《行政单位国有资产管理暂行办法》(财政部令第35号);4.《事业单位国有资产管理暂行办法》(财政部令第36号);5.《中央级事业单位国有资产管理暂行办法》(财教[2008]13号);6.《中央级事业单位国有资产使用管理暂行办法》(财教[2009]192号);7.《中央文化企业国有资产评估管理暂行办法》(财文资[2012]15号);8.其他有关文件。

(三)专业胜任能力要求熟悉资产转让、置换、拍卖、偿债、租赁的业务流程和控制要点;熟悉与资产转让、置换、拍卖、偿债、租赁相关的法律、法规和政策规定;熟练操作资产评估业务。

二、公司制改建整体资产评估业务(一)业务范围公司制改建。

(二)业务依据1.《企业国有资产评估管理暂行办法》(国务院国资委令第12号);2.《金融企业国有资产评估监督管理暂行办法》(财政部令第47号);3.《行政单位国有资产管理暂行办法》(财政部令第35号);4.《事业单位国有资产管理暂行办法》(财政部令第36号);5.《中央级事业单位国有资产管理暂行办法》(财教[2008]13号);6.《中央级事业单位国有资产使用管理暂行办法》(财教[2009]192号);7.《中央文化企业国有资产评估管理暂行办法》(财文资[2012]15号);8.《公司注册资本登记管理规定》(国家工商总局令第22号);(国家工商总局令第39号);9.《股权出资登记管理办法》10.《公司债权转股权登记管理办法》(国家工商总局令第57号);11.《涉及外商投资企业股权出资的暂行规定》(商务部令第8号);12.《国务院办公厅转发国务院国有资产监督管理委员会关于规范国有企业改制工作意见的通知》(国办发[2003]96号);13.《国务院办公厅转发国资委关于进一步规范国有企业改制工作实施意见的通知》(国办发[2005]60号);14.其他有关文件。

资产评估业务类型简述

附二:资产评估业务类型简述一、单项资产评估业务(一)业务范围单项资产评估业务,按照经济行为分为:1.资产转让;2.资产拍卖;3.资产偿债;4.资产租赁;5.资产抵押/质押;6.资产重组;7.资产捐赠;8.资产补偿;9.资产涉讼;10.认定报关价格;11.对外投资;12.接受投资;13.接受抵债资产;14.债务重组及其他。

(二)业务依据1.《企业国有资产评估管理暂行办法》(国务院国资委令第12号);2.《金融企业国有资产评估监督管理暂行办法》(财政部令第47号);3.《行政单位国有资产管理暂行办法》(财政部令第35号);4.《事业单位国有资产管理暂行办法》(财政部令第36号);5.《中央级事业单位国有资产管理暂行办法》(财教[2008]13号);6.《中央级事业单位国有资产使用管理暂行办法》(财教[2009]192号);7.《中央文化企业国有资产评估管理暂行办法》(财文资[2012]15号);8.其他有关文件。

(三)专业胜任能力要求熟悉资产转让、置换、拍卖、偿债、租赁的业务流程和控制要点;熟悉与资产转让、置换、拍卖、偿债、租赁相关的法律、法规和政策规定;熟练操作资产评估业务。

二、公司制改建整体资产评估业务(一)业务范围公司制改建。

(二)业务依据1.《企业国有资产评估管理暂行办法》(国务院国资委令第12号);2.《金融企业国有资产评估监督管理暂行办法》(财政部令第47号);3.《行政单位国有资产管理暂行办法》(财政部令第35号);4.《事业单位国有资产管理暂行办法》(财政部令第36号);5.《中央级事业单位国有资产管理暂行办法》(财教3[2008]13号);6.《中央级事业单位国有资产使用管理暂行办法》(财教[2009]192号);7.《中央文化企业国有资产评估管理暂行办法》(财文资[2012]15号);8.《公司注册资本登记管理规定》(国家工商总局令第22号);9.《股权出资登记管理办法》(国家工商总局令第39号);10.《公司债权转股权登记管理办法》(国家工商总局令第57号);11.《涉及外商投资企业股权出资的暂行规定》(商务部令第8号);12.《国务院办公厅转发国务院国有资产监督管理委员会关于规范国有企业改制工作意见的通知》(国办发[2003]96号);13.《国务院办公厅转发国资委关于进一步规范国有企业改制工作实施意见的通知》(国办发[2005]60号);14.其他有关文件。

EOD项目最新申报要点及投融资模式简析

EOD项目最新申报要点及投融资模式简析目录一、定义 (2)二、实施EOD模式必要性和意义 (3)三、EOD模式的优势 (3)四、EOD模式相关政策文件 (4)五、EOD模式试点申报要求 (6)六、EOD项目申报前期准备和申报流程 (8)七、EOD适宜的项目应用领域 (9)八、EOD项目的三大落地方式 (11)1、PPP (11)2、ABO (11)3、“流域治理+片区开发” (11)九、EOD融资筹措方式 (11)十、EOD项目回报资金来源及路径 (13)十一、相关注意事项及建议 (14)十二、EOD项目案例分享 (15)(一)蓟运河(蓟州段)全域水系治理、生态修复、环境提升及产业综合开发EOD项目 (15)(二)云南滇中新区小哨国际新城 (16)一、定义EOD模式是以生态保护和环境治理为基础,以特色产业运营为支持,以区域综合开发为载体,采取产业链延伸、联合经营、组合开发等方式,推动公益性较强、收益性差的生态环境治理项目与收益较好的关联产业有效融合,统筹推进,一体化实施,将生态环境治理带来的经济价值内部化,是一种创新性的项目组织实施方式。

具体来看,包含三个核心要点,一是“融合”:肥瘦搭配,推进公益性生态环境治理与关联产业开发项目有效融合。

二是“一体”:一个市场主体统筹实施,将生态环境治理作为整体项目一体化推进,建设运维一体化实施。

三是“反哺”:在项目边界范围内力争实现项目整体收益与成本平衡,减少政府资金投入。

EOD模式运行机制图二、实施EOD模式必要性和意义实施EOD模式是践行“两山”理念,加强生态环保投融资,推进生态产品价值实现,支撑深入打好污染防治攻坚战和生态文明建设的重要探索。

(一)EOD模式是实现发展和保护融合共生的重要方式。

通过项目组织实施方式创新,以生态环境治理提升产业开发价值,以产业收益反哺生态环境治理,实现发展和生态保护融合共生。

(二)EOD模式是生态产品价值实现的有效路径。

通过改善生态环境质量,提升产品品质,推动生态优势转化为产业优势,实现产业增值溢价,拓展生态产品价值实现方式。

国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知2011253号

国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知发改办财金[2011]253号北京市、天津市、上海市、江苏省、浙江省、湖北省人民政府办公厅:遵照国务院有关文件精神,我委自2008年6月以来,先后在天津滨海新区、北京中关村科技园区、武汉东湖新技术产业开发区和长江三角洲地区,开展了股权投资企业备案管理先行先试工作。

为进一步规范试点地区股权投资企业备案管理工作,更好地促进股权投资企业健康规范发展,现就有关事项通知如下:一、规范股权投资企业的设立、资本募集与投资领域股权投资企业应当遵照《中华人民共和国公司法》和《中华人民共和国合伙企业法》有关规定设立。

其中,以有限责任公司、股份有限公司形式设立的股权投资企业,可以通过组建内部管理团队实行自我管理,也可采取委托管理方式将资产委托其他股权投资企业或股权投资管理企业管理。

股权投资企业的资本只能以私募方式向具有风险识别和承受能力的特定对象募集,不得通过在媒体(包括企业网站)发布公告、在社区张贴布告、向社会散发传单、向不特定公众发送手机短信或通过举办研讨会、讲座及其他公开或变相公开方式(包括在商业银行、证券公司、信托投资公司等机构的柜台投放招募说明书等)直接或间接向不特定对象进行推介。

股权投资企业的资本募集人须向投资者充分揭示投资风险及可能的投资损失,不得向投资者承诺确保收回投资本金或获得固定回报。

所有投资者只能以合法的自有货币资金认缴出资。

资本缴付可以采取承诺制,即投资者在股权投资企业资本募集阶段签署认缴承诺书,在股权投资企业投资运作实施阶段,根据股权投资企业的公司章程或者合伙协议的约定分期缴付出资。

股权投资企业的投资领域限于非公开交易的企业股权,投资过程中的闲置资金只能存放银行或用于购买国债等固定收益类投资产品;投资方向应当符合国家产业政策、投资政策和宏观调控政策。

股权投资企业所投资项目必须履行固定资产投资项目审批、核准和备案的有关规定。

私募股权管理暂行办法

私募股权管理暂行办法第一章总则第一条为促进股权投资企业和股权投资管理企业健康、稳步和规范发展,根据《公司法》、《合伙企业法》等有关法律法规以及国家发展改革委《关于做好非试点地区股权投资企业规范发展和备案管理工作的通知》(发改办财金〔2022〕1481号)精神,按照先行先试的要求,制定本暂行办法。

第二条股权投资企业是指以非公开发行方式向特定对象募集设立的对非上市企业进行股权投资并提供增值服务的非证券类投资企业。

股权投资管理企业(以下简称“管理企业”)是指受托管理运作股权投资企业资产的企业。

第三条股权投资企业可以通过组建内部管理团队实行自我管理;也可采取委托管理方式将资产委托给管理企业进行管理。

实行委托管理的,股权投资企业与受托管理企业须签订委托管理协议。

第四条股权投资企业和管理企业可以依法采取公司制、合伙制两种企业组织形式。

第五条本办法适用于除创业投资企业、外商投资创业投资企业及其管理企业之外,在本省行政区域内登记注册的其它股权投资企业及其管理企业。

创业投资企业与外商投资创业投资企业及其管理企业的设立、管理、备案和各项优惠政策,均按国家和我省现有规定执行。

第二章股东与合伙人资格第六条除法律、行政法规和国务院决定规定禁止外,境内外自然人、法人和其他合法经济组织,均可以作为股权投资企业与管理企业的股东或合伙人,所有股东或合伙人均应当以货币形式出资。

第七条股权投资企业及其管理企业的股东或合伙人,应当具有风险识别能力和风险承担能力,且资信良好;应当以自有货币资金出资,不得接受其他投资者的委托持股。

第三章设立与注册登记第八条设立股权投资企业与管理企业应当依法在工商部门登记注册。

外商投资的股权投资企业和管理企业,应按有关规定经外经贸部门审批同意后,向工商部门申请设立登记注册;外商投资的合伙制股权投资企业及其合伙制管理企业,由工商部门向同级发展改革部门征求意见后予以登记注册。

第九条以股份有限公司形式设立的股权投资企业与管理企业,发起人数不得少于2人、最高不得超过200人;以有限责任公司形式设立的股权投资企业与管理企业,股东人数不得超过50人;以合伙制企业形式设立的股权投资企业与管理企业,合伙人数不少于2人、最高不得超过50人。

2020年最新版:企业所得税适用税率表

2020年最新版:企业所得税适⽤税率表⼀、企业所得税税率基本税率:25%⼆、符合条件的⼩型微利企业税率:20%其中:2019年1⽉1⽇⾄2021年12⽉31⽇,应纳税所得额不超过100万元的部分,减按25%计⼊应纳税所得额,对年应纳税所得额超过100万元但不超过300万元的部分,减按50%计⼊应纳税所得额。

三、⾼新技术企业:15%1.《企业所得税法》(主席令第⼆⼗三号)第⼆⼗⼋条规定,国家需要重点扶持的⾼新技术企业,减按15%的税率征收企业所得税。

2.《企业所得税法实施条例》(国务院令第512号)第九⼗三条规定,企业所得税法第⼆⼗⼋条第⼆款所称国家需要重点扶持的⾼新技术企业,是指拥有核⼼⾃主知识产权,并同时符合下列条件的企业:(⼀)产品(服务)属于《国家重点⽀持的⾼新技术领域》规定的范围;(⼆)研究开发费⽤占销售收⼊的⽐例不低于规定⽐例;(三)⾼新技术产品(服务)收⼊占企业总收⼊的⽐例不低于规定⽐例;(四)科技⼈员占企业职⼯总数的⽐例不低于规定⽐例;(五)⾼新技术企业认定管理办法规定的其他条件。

四、西部地区⿎励类产业企业:15%1.《财政部海关总署国家税务总局关于深⼊实施西部⼤开发战略有关税收政策问题的通知》(财税〔2011〕58号)第⼆条规定,⾃2011年1⽉1⽇⾄2020年12⽉31⽇,对设在西部地区的⿎励类产业企业减按15%的税率征收企业所得税。

上述⿎励类产业企业是指以《西部地区⿎励类产业⽬录》中规定的产业项⽬为主营业务,且其主营业务收⼊占企业收⼊总额70%以上的企业。

2.《财政部税务总局国家发展改⾰委关于延续西部⼤开发企业所得税政策的公告》(财政部税务总局国家发展改⾰委公告2020年第23号)第⼀条规定,⾃2021年1⽉1⽇⾄2030年12⽉31⽇,对设在西部地区的⿎励类产业企业减按15%的税率征收企业所得税。

本条所称⿎励类产业企业是指以《西部地区⿎励类产业⽬录》中规定的产业项⽬为主营业务,且其主营业务收⼊占企业收⼊总额60%以上的企业。

天津市《关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法》

天津市《关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法》天津市发展和改革委员会天津市人民政府金融服务办公室文件天津市商务委员会天津市工商行政管理局津发改财金〔2011〕1206号关于印发《关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法》的通知各区、县人民政府,各委、办、局,各有关单位:为进一步贯彻落实《天津滨海新区综合配套改革试验总体方案》(津政发〔2008〕30号)的要求,做好符合条件的境外投资者参与设立境内股权投资企业工作,根据《天津股权投资企业和股权投资管理机构管理办法》(津发改财金〔2 011〕675号)要求,经市领导同意,市发展改革委、金融办、商务委、工商局联合制定了《关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法》,现予发布,请贯彻执行。

附:关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法市发改委市金融办市商务委市工商局二О一一年十月十四日主题词:金融试点办法通知天津市发展和改革委员会办公室 2011年10月14日印打字:王金玲校对:胡齐艺(共印60份)关于本市开展外商投资股权投资企业及其管理机构试点工作的暂行办法第一章总则第一条为促进本市外商投资股权投资企业的规范健康发展,根据《国家发展改革委办公厅关于规范试点地区股权投资企业发展和备案管理工作的通知》(发改办财金〔20 11〕253号)、《天津股权投资企业和股权投资管理机构管理办法》(津发改财金〔2011〕675号)等有关法律、法规的规定,制定本暂行办法。

第二条本办法所称外商投资股权投资企业,是指在本市依法由外国企业或个人参与投资设立的,以非公开方式向境内外投资者募集资金,投资于非公开交易的企业股权的企业。

本办法所称试点外商投资股权投资企业,是指根据本办法经市产业(股权)投资基金发展与备案管理办公室(以下简称市备案办)认定为开展此次试点的外商投资股权投资企业(以下简称试点股权投资企业)。

国务院办公厅关于对2020年落实有关重大政策措施真抓实干成效明显地方予以督查激励的通报

国务院办公厅关于对2020年落实有关重大政策措施真抓实干成效明显地方予以督查激励的通报文章属性•【制定机关】国务院办公厅•【公布日期】2021.04.30•【文号】国办发〔2021〕17号•【施行日期】2021.04.30•【效力等级】国务院规范性文件•【时效性】现行有效•【主题分类】机关工作正文国务院办公厅关于对2020年落实有关重大政策措施真抓实干成效明显地方予以督查激励的通报国办发〔2021〕17号各省、自治区、直辖市人民政府,国务院各部委、各直属机构:为进一步推动党中央、国务院重大决策部署贯彻落实,充分激发和调动各地担当作为、干事创业的积极性、主动性和创造性,根据《国务院办公厅关于对真抓实干成效明显地方进一步加大激励支持力度的通知》(国办发〔2018〕117号),结合国务院大督查、专项督查、“互联网+督查”和部门日常督查情况,经国务院同意,对2020年落实稳就业保民生、打好三大攻坚战、深化“放管服”改革优化营商环境、推动创新驱动发展、实施乡村振兴战略等有关重大政策措施真抓实干、取得明显成效的216个地方予以督查激励,相应采取30项奖励支持措施。

希望受到督查激励的地方充分发挥模范表率作用,再接再厉,取得新的更大成绩。

2021年是实施“十四五”规划、开启全面建设社会主义现代化国家新征程的第一年。

各地区、各部门要在以习近平同志为核心的党中央坚强领导下,以习近平新时代中国特色社会主义思想为指导,全面贯彻党的十九大和十九届二中、三中、四中、五中全会精神,坚持稳中求进工作总基调,立足新发展阶段、贯彻新发展理念、构建新发展格局,推动高质量发展,巩固拓展疫情防控和经济社会发展成果,扎实做好“六稳”工作、全面落实“六保”任务,结合自身实际,积极开拓创新,勇于攻坚克难,增强抓落实的主动性和自觉性,力戒形式主义、官僚主义,确保“十四五”开好局起好步,以优异成绩庆祝中国共产党成立100周年。

附件:2020年落实有关重大政策措施真抓实干成效明显的地方名单及激励措施国务院办公厅2021年4月30日附件2020年落实有关重大政策措施真抓实干成效明显的地方名单及激励措施一、在2020年脱贫攻坚成效考核中认定为完成年度计划、减贫成效显著、综合评价好的地方河北省,山西省,内蒙古自治区,吉林省,黑龙江省,安徽省,江西省,河南省,湖北省,湖南省,广西壮族自治区,海南省,重庆市,四川省,贵州省,云南省,西藏自治区,陕西省,甘肃省,青海省,宁夏回族自治区,新疆维吾尔自治区。

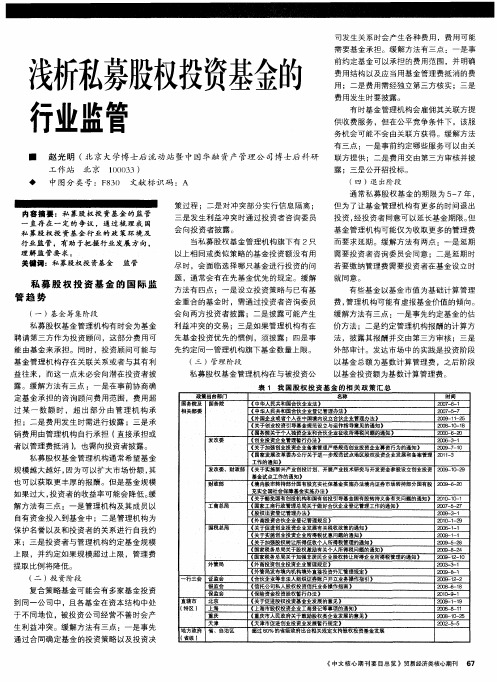

浅析私募股权投资基金的行业监管

如果过大 , 投资者的收益率可能会降低 。 缓

解方法有三点 :一是管理机 构及其成员 以

自有资金投入到基 金中 ;二是管理机构为

保护名誉 以及 和投 资者 的关系进行 自我约 束 ;三是投资者与 管理机构 约定 基金规模 上限 ,并约定如果规模 超过 上限 ,管理费 提取 比例将降低。 ( )投 资阶段 二 复合策略基金可能会 有多家基金投资 到同一公 司中 ,且各基金在 资本 结构 中处

题 ,通 常 会 有 在 先 基 金 优 先 的规 定 。缓 解 方 法 有 四 点 :一 是 设 立 投 资 策 略 与 已有 基

通 常 私 募 股 权 基 金 的期 限 为 5 7年 , — 内容 摘 要 :私 募 股 权 投 资 基 金 的 监 管 直存在 一 定的争议 ,通过梳 理我 国 私 募 股 权 投 资基 金 行 业 的 政 策 环 境 及 行 业 监 管 , 有助 于把 握 行 业发 展 方 向 , 理 解 监 管要 求 。 关键 词 :私 募股 权 投 资基 金 监 管

( )管 理 阶 段 三

价方法 ;二是 约定 管理机 构报酬的计 算方 法 ,披露其报酬并交由第三方审核 ;三是 外部 审计 。发达市场中的实践是投资阶段 以基 金总额为基数计 算管理 费 ,之后阶段 以基 金投 资额 为基数计算管理费 。

名称 时间 - - 61

基金 管理机 构存在关联关系或者 与其有利

(四 )退 出阶段

◆ 中 图分 类 号 :F 3 文献 标 识 码 :A 80

策过程 ;二是对冲突部分 实行信息隔 离 ; 三是发生利益冲 突时通过投资者 咨询委 员 会 向投资者披 露。 当私募股权基金管理机构旗下 有 2只 以上相 同或类似策略的基金投资额没有用 尽 时 ,会面临选择哪只基金进行投资的 问

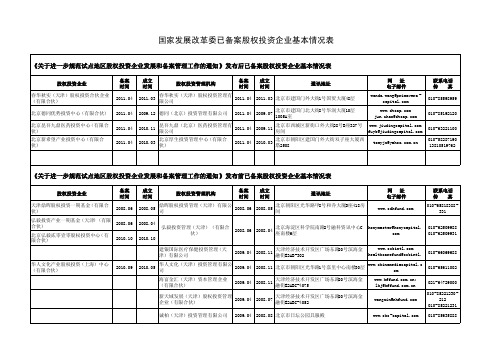

国家发展改革委已备案股权投资企业基本情况表

010-85598959

2009.12 德同(北京)投资管理有限公司

2011.04

2009.07

北京市建国门北大街8号华润大厦10层 1005A室

jun.zhao@

010-85192120

2010.11

昆吾九鼎(北京)医药投资管理有 限公司

2011.04

中信资本(天津)投资管理合伙企 业(有限合伙)

2009.11

2009.07 北京市朝阳区新源南路6号京城大厦1701室

中盛邮信投资管理(天津)有限公 司

2009.11

2008.09

北京市朝阳区建国路89号华贸中心15号楼 1201室

martin@chinaprosper

010-59761199

泰达荷宝(天津)股权管理有限公 司

2009.11

2009.05 天津市河西区解放南路256号泰达大厦8层

chenshaofeng@.c n

022-23202287

兴边富民投资管理有限公司

2009.11

2009.02

北京市朝阳区东四环中路嘉泰国际大厦14 层

联系电话 传真 010-65266655 010-65260700

010-65630202

ekk777888@ 010-66069688

信达资本管理有限公司

2009.11 2008.12 北京市西城区大拐棒胡同27号

zhangkai@ 010-64183183

天津经济技术开发区广场东路20号滨海金 融街E2ABC-4052

; lhj@

wangxin@

021-64729000

010-85221230212

010-85221231

股权投资与创业投资的区别

股权投资与创业投资的区别

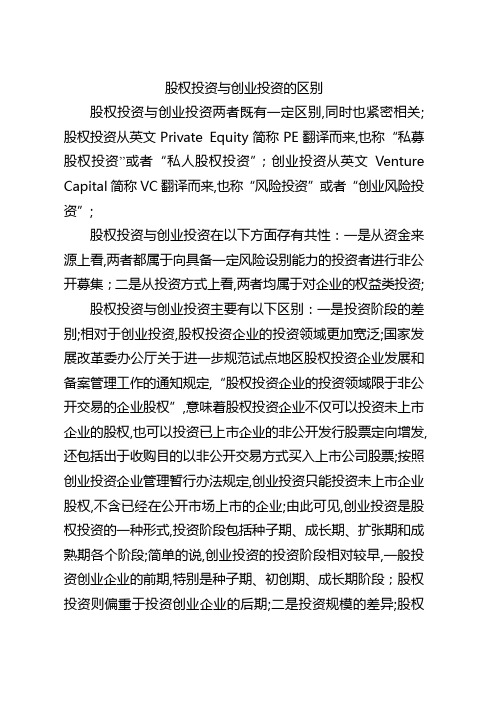

股权投资与创业投资两者既有一定区别,同时也紧密相关;股权投资从英文Private Equity简称PE翻译而来,也称“私募股权投资”或者“私人股权投资”;创业投资从英文Venture Capital简称VC翻译而来,也称“风险投资”或者“创业风险投资”;

股权投资与创业投资在以下方面存有共性:一是从资金来源上看,两者都属于向具备一定风险设别能力的投资者进行非公开募集;二是从投资方式上看,两者均属于对企业的权益类投资;

股权投资与创业投资主要有以下区别:一是投资阶段的差别;相对于创业投资,股权投资企业的投资领域更加宽泛;国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知规定,“股权投资企业的投资领域限于非公开交易的企业股权”,意味着股权投资企业不仅可以投资未上市企业的股权,也可以投资已上市企业的非公开发行股票定向增发,还包括出于收购目的以非公开交易方式买入上市公司股票;按照创业投资企业管理暂行办法规定,创业投资只能投资未上市企业股权,不含已经在公开市场上市的企业;由此可见,创业投资是股权投资的一种形式,投资阶段包括种子期、成长期、扩张期和成熟期各个阶段;简单的说,创业投资的投资阶段相对较早,一般投资创业企业的前期,特别是种子期、初创期、成长期阶段;股权投资则偏重于投资创业企业的后期;二是投资规模的差异;股权

投资的投资规模一般较大,尤其是对上市公司的投资更是如此;而创业投资所投资的创业企业多为成长性的中小企业,而且为了分散风险,创业投资对单个创业企业的投资额度不会太大;三是投资理念的差异;相对于创业投资企业,有些股权投资企业并不是单纯为了通过资本市场运作来获得收益,而是为了整合产业链以获得高额利润;。

国家发展改革委办公厅、国家能源局综合司关于做好电力现货市场试点连续试结算相关工作的通知

国家发展改革委办公厅、国家能源局综合司关于做好电力现货市场试点连续试结算相关工作的通知文章属性•【制定机关】国家发展改革委办公厅,国家能源局•【公布日期】2020.03.26•【文号】发改办能源规〔2020〕245号•【施行日期】2020.03.26•【效力等级】部门规范性文件•【时效性】失效•【主题分类】电力及电力工业正文国家发展改革委办公厅国家能源局综合司关于做好电力现货市场试点连续试结算相关工作的通知发改办能源规〔2020〕245号山西省、浙江省、山东省、广东省能源局,内蒙古自治区、福建省、四川省、甘肃省工信厅(经信厅),华北、南方能监局,山西省、浙江省、福建省、山东省、四川省、甘肃省能监办,国家电网有限公司、中国南方电网有限责任公司、内蒙古电力(集团)有限责任公司,各电力交易中心,各相关市场主体:为落实《中共中央国务院关于进一步深化电力体制改革的若干意见》(中发〔2015〕9号)及其配套文件精神,适应电力现货市场试点地区连续试结算工作的需要,现就做好相关工作通知如下。

一、高度重视电力现货市场试点连续试结算相关工作(一)电力现货市场试点是电力市场化的关键改革,是有序发电和稳定用电的组合改革,是优化布局和优化结构的重大改革。

电力现货市场连续运行后,对电力系统的经济机制产生了质的影响。

起步阶段,适当加强宏观引导,加强电力市场风险防控工作,保障电力市场平稳运行和电力系统安全稳定运行,有利于构建公平竞争的市场环境,有利于打造健康可持续的行业体系。

二、结合实际制定电力现货市场稳定运行的保障措施(二)做好电力中长期交易合同衔接工作。

售电企业及直接参加电力现货交易的电力用户应与发电企业在合同中约定分时结算规则,包括但不限于固定价格、分时电价或详细分时结算曲线(组)等。

售电企业及直接参加电力现货交易的电力用户(或发电企业)在日前市场开市前需提交结算曲线,未提交结算曲线的,由市场运营机构按照试点地区电力现货市场规则进行处理。

十二大改革及措施

一、行政体制改革中共十八届二中全会对行政体制改革作出部署。

全会强调,行政体制改革是推动上层建筑适应经济基础的必然要求,要深入推进政企分开、政资分开、政事分开、政社分开,健全部门职责体系,建设职能科学、结构优化、廉洁高效、人民满意的服务型政府。

全会通过的《国务院机构改革和职能转变方案》,贯彻党的十八大关于建立中国特色社会主义行政体制目标的要求,以职能转变为核心,继续简政放权、推进机构改革、完善制度机制、提高行政效能,稳步推进大部门制改革,对减少和下放投资审批事项、减少和下放生产经营活动审批事项、减少资质资格许可和认定、减少专项转移支付和收费、减少部门职责交叉和分散、改革工商登记制度、改革社会组织管理制度、改善和加强宏观管理、加强基础性制度建设、加强依法行政等作出重大部署。

要深刻认识深化行政体制和政府机构改革的重要性和紧迫性,处理好政府和市场、政府和社会、中央和地方的关系,深化行政审批制度改革,减少微观事务管理,以充分发挥市场在资源配置中的基础性作用、更好发挥社会力量在管理社会事务中的作用、充分发挥中央和地方两个积极性,加快形成权界清晰、分工合理、权责一致、运转高效、法治保障的国务院机构职能体系,切实提高政府管理科学化水平。

要坚持以人为本、执政为民,在服务中实施管理,在管理中实现服务。

要加强公务员队伍建设和政风建设,改进工作方式,转变工作作风,提高工作效率和服务水平,提高政府公信力和执行力。

国务院机构改革和职能转变任务艰巨,事关改革发展稳定大局,事关社会主义市场经济体制完善,要精心组织实施,确保改革顺利进行。

全会强调,要进一步深化改革开放,尊重人民首创精神,深入研究全面深化体制改革的顶层设计和总体规划,把经济、政治、文化、社会、生态等方面的体制改革有机结合起来,把理论创新、制度创新、科技创新、文化创新以及其他各方面创新有机衔接起来,构建系统完备、科学规范、运行有效的制度体系。

二、住房管理制度改革2月20日召开的国务院常务会议,研究部署继续做好房地产市场调控工作。

上海市发展和改革委员会、上海市金融服务办公室关于对本市股权投资企业实施备案管理的通知

上海市发展和改革委员会、上海市金融服务办公室关于对本市股权投资企业实施备案管理的通知

文章属性

•【制定机关】上海市发展和改革委员会,上海市金融服务办公室

•【公布日期】2011.07.18

•【字号】沪发改财金[2011]045号

•【施行日期】2011.07.18

•【效力等级】地方规范性文件

•【时效性】现行有效

•【主题分类】企业

正文

上海市发展和改革委员会、上海市金融服务办公室关于对本市股权投资企业实施备案管理的通知

(沪发改财金[2011]045号)

各区县人民政府、各有关企业:

根据《国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知》(发改办财金[2011]253号,以下简称《通知》)有关规定,经市政府批准,由市发展改革委和市金融办共同负责本市股权投资企业备案管理工作。

市金融办具体负责股权投资企业备案材料的受理并提出初审意见,股权投资企业注册地所在区县政府配合市金融办做好股权投资企业的初审工作;市发展改革委具体负责向国家发展改革委转报本市初审意见。

请本市股权投资企业按照《通知》及《股权投资企业备案文件指引》(以下简称《文件指引》)的要求,到注册地所在区县的职能部门提交申请备案材料。

《通知》及《文件指引》内容可登陆国家发展和改革委财金司网站(http:

//)查询。

本市股权投资企业备案管理部门联系方式见附件。

特此通知。

上海市发展和改革委员会

上海市金融服务办公室

二○一一年七月十八日附件:。

小度写范文【PE监管暗战】暗战危城模板

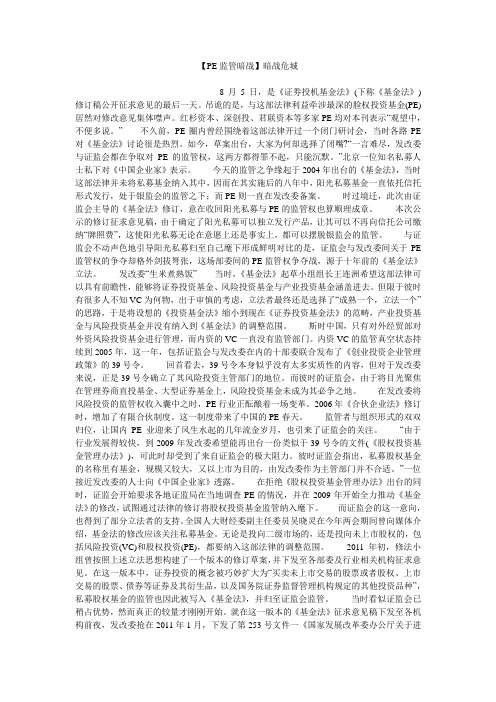

【PE监管暗战】暗战危城8月5日,是《证劵投机基金法》(下称《基金法》)修订稿公开征求意见的最后一天。

吊诡的是,与这部法律利益牵涉最深的脸权投资基金(PE)居然对修改意见集体噤声。

红杉资本、深创投、君联资本等多家PE均对本刊表示“观望中,不便多说。

”不久前,PE圈内曾经围绕着这部法律开过一个闭门研讨会,当时各路PE 对《基金法》讨论很是热烈。

如今,草案出台,大家为何却选择了闭嘴?“一言难尽,发改委与证监会都在争取对PE的监管权,这两方都得罪不起,只能沉默。

”北京一位知名私募人士私下对《中国企业家》表示。

今天的监管之争缘起于2004年出台的《基金法》,当时这部法律并未将私募基金纳入其中,因而在其实施后的八年中,阳光私募基金一直依托信托形式发行,处于银监会的监管之下;而PE则一直在发改委备案。

时过境迁,此次由证监会主导的《基金法》修订,意在收回阳光私募与PE的监管权也算顺理成章。

本次公示的修订征求意见稿,由于确定了阳光私募可以独立发行产品,让其可以不再向信托公司缴纳“牌照费”,这使阳光私募无论在意愿上还是事实上,都可以摆脱银监会的监管。

与证监会不动声色地引导阳光私募归至自己麾下形成鲜明对比的是,证监会与发改委间关于PE 监管权的争夺却格外剑拔弩张,这场部委间的PE监管权争夺战,源于十年前的《基金法》立法。

发改委“生米煮熟饭”当时,《基金法》起草小组组长王连洲希望这部法律可以具有前瞻性,能够将证券投资基金、风险投资基金与产业投资基金涵盖进去。

但限于彼时有很多人不知VC为何物,出于审慎的考虑,立法者最终还是选择了“成熟一个,立法一个”的思路,于是将设想的《投资基金法》缩小到现在《证券投资基金法》的范畴,产业投资基金与风险投资基金并没有纳入到《基金法》的调整范围。

斯时中国,只有对外经贸部对外资风险投资基金进行管理,而内资的VC一直没有监管部门。

内资VC的监管真空状态持续到2005年,这一年,包括证监会与发改委在内的十部委联合发布了《创业投资企业管理政策》的39号令。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

【Statute Title】 Notice of the General Officeof the National Development and ReformCommissionon Further Regulating the Developmentand Filing Management of Equity Investment Enterprises in Pilot Areas[Effective]【法规标题】国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知[现行有效]Promulgationdate:01-31-2011Effective date:01-31-2011Department:State Development and Reform Commission (incl. Former State Development Planning Commission, formerSubject:Reform and Opening-up 发布日期:2011-01-31生效日期:2011-01-31发布部门:国家发展和改革委员会(含原国家发展计划委员会、原国家计划委员会)类别:改革开放Notice of the General Office of the National Development and Reform Commission on Further Regulating the Development and Filing Management of Equity Investment Enterprises in Pilot Areas (No.253 [2011] of the General Office of the National Development and Reform Commission, January 31, 2011)The general offices of the people’s governments of Beijing Municipality, Tianjin Municipality, Shanghai Municipality, Jiangsu Province, Zhejiang Province and Hubei Province:According to the spirit of the relevant documents of the State Council, the National Development and Reform Commission (NDRC) has successively conducted a pilot program on the filing management of equity enterprises in Tianjin Binhai New Area, Beijing Zhongguancun Science and Technology Park, Wuhan Donghu New-tech Industrial Development Zone and Yangtze River Delta Area since June 2008. To further regulate the filing management of equity investment enterprises in pilot areas and promote国家发展改革委办公厅关于进一步规范试点地区股权投资企业发展和备案管理工作的通知(发改办财金[2011]253号2011年1月31日)北京市、天津市、上海市、江苏省、浙江省、湖北省人民政府办公厅:遵照国务院有关文件精神,我委自2008年6月以来,先后在天津滨海新区、北京中关村科技园区、武汉东湖新技术产业开发区和长江三角洲地区,开展了股权投资企业备案管理先行先试工作。

为进一步规范试点地1 / 5 感谢聆听the sound development of equity investment enterprises, we hereby notify you of the relevant issues as follows: 区股权投资企业备案管理工作,更好地促进股权投资企业健康规范发展,现就有关事项通知如下:I. Standardizing the formation, fund-raising and investment field of equity investment enterprisesEquity investment enterprises shall be formed pursuant to the Company Law of the People’s Republic of China and the Partnership Law of the People’s Republic of China. In particular, those in the form of a limited liability company or a joint-stock limited company may realize self-management by forming their internal management teams, or entrust their assets to other equity investment enterprises or equity investment management enterprises for management.Equity investment enterprises may only raise funds in the form of private placement from specific objects with a risk identification ability and certain risk tolerance, and shall not make direct or indirect recommendations to unspecific objects by publishing announcements on media (including their own websites), posting bulletins in communities, giving out flysheets to the general public, sending text messages to unspecific public through mobile phones, holding forums or lectures or any other public or disguised public means (including placing prospectus on the counters of commercial banks, securities companies, trust investment companies and other relevant institutions). The fundraiser of an equity investment enterprise must fully disclose the investment risks and potential losses to investors, and shall not promise any recovery of principal or fixed return to investors. Investors may only contribute legitimate self-owned monetary funds. Contribution of capital may be made on commitment, i.e. an investor only needs to sign a letter of commitment in the fund-raising stage and pays off his contribution in installments in the investment operation period according to the bylaws or partnership agreement of the equity investment company.The investment field of equity investment enterprises shall be limited to corporate shares not openly traded, and their idle funds in the process of investment may only be deposited in banks or used to purchase treasury bonds or other fixed-income investment products. Their investment direction shall conform to the industrial policies, investment policies and macro-control policies of the state. Their investment projects must meet the relevant provisions on examination and approval, verification and一、规范股权投资企业的设立、资本募集与投资领域股权投资企业应当遵照《中华人民共和国公司法》和《中华人民共和国合伙企业法》有关规定设立。

其中,以有限责任公司、股份有限公司形式设立的股权投资企业,可以通过组建内部管理团队实行自我管理,也可采取委托管理方式将资产委托其他股权投资企业或股权投资管理企业管理。

股权投资企业的资本只能以私募方式向具有风险识别和承受能力的特定对象募集,不得通过在媒体(包括企业网站)发布公告、在社区张贴布告、向社会散发传单、向不特定公众发送手机短信或通过举办研讨会、讲座及其他公开或变相公开方式(包括在商业银行、证券公司、信托投资公司等机构的柜台投放招募说明书等)直接或间接向不特定对象进行推介。