会计专业英语练习.doc

会计专业英语模拟试题及答案word版本

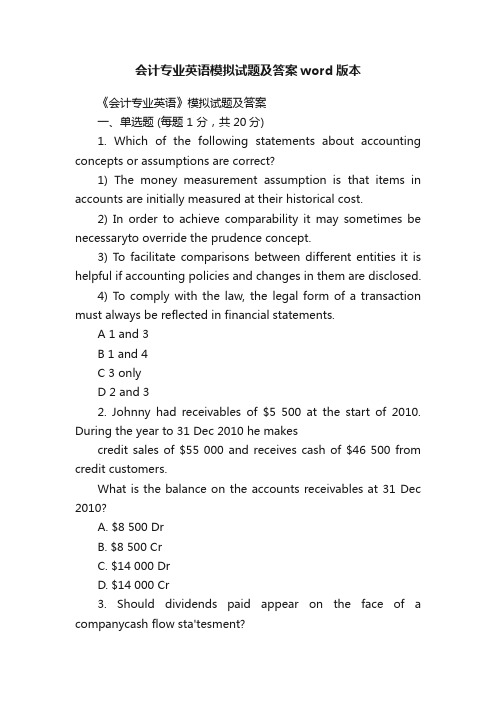

会计专业英语模拟试题及答案word版本《会计专业英语》模拟试题及答案一、单选题 (每题 1 分,共20分)1. Which of the following statements about accounting concepts or assumptions are correct?1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessaryto override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makescredit sales of $55 000 and receives cash of $46 500 from credit customers.What is the balance on the accounts receivables at 31 Dec 2010?A. $8 500 DrB. $8 500 CrC. $14 000 DrD. $14 000 Cr3. Should dividends paid appear on the face of a companycash flow sta'tesment?A. YesB. NoC. Not sureD. Either4. Which of the following inventory valuation methods is likely to lead to the highest figure for closinginventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-currentassets in a company the'stsatement of financial position?(1) plant, equipment, and property(2) company car(3) ?4000 cash(4) ?1000 chequeA. (1), (3)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company ' s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree? 1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expensesaccount $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until 30 June 2010. It was increased from that date to $96,000 per year. What rent expense and end of year prepayment should be included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Pla nt and equipme nt: $860,000Depreciati on for pla nt and equipme nt: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 was sold for $49,000. The plant had originally cost $80,000. Plant purchasedduring the year cost $180,000. It is the compa ny.s policy to charge a full year depreciati on in the year of acquisiti on of an asset and none in the year of sale, using a rate of 10% on the straight li ne basis. What net amount should appear in Lambda.s bala nee sheet at30 September 2010 for pla nt and equipme nt?A $563,000C $510,000D $606,00010. A company' s plant and machinery ledger account ithie year ended 30 September 2010 was as follows:Pla nt and machi neryostproporti on ate depreciati on in years of purchase and disposal. What is the depreciati on charge for the year e nded 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of finan cial informati on.(1) True⑵ Prude nee(3) Complete ness⑷ CorrectWhich of these characteristics con tribute to reliability?A (1),⑶ and ⑷ onlyB (1),⑵ and ⑷ onlyC (1),⑵ and ⑶ onlyD⑵,⑶and⑷only12. T he pla nt and mach inery cost acco unt of a compa ny is show n below. The compa ny policy is to charge depreciati on at 20% on the straight line basis, with proporti on ate depreciati on in years of acquisiti on and disposal.ostPla nt and machi neryA. $67,000B. $64,200D. $68,60013. In preparing its financial statements for the current year,a company ng inventory ' s closi was un derstated by $300,000. What will be the effect of this error if it remai ns un corrected?A The current year ' s profit will be overstated and next year ' s profit will be understB The current year' s profit will be understatedbut there will be no effect on next year' s profitC The current year ' s profit will be understated and next year ' s profit will be overstateD The current year' profit will be overstated but there will be no effect on next year' s profit.14. I n preparing a company's cash flow statement,which, if any, of the following items could form part of the calculati on of cash flow from financing activities?(1) Proceeds of sale of premises(2) Divide nds received(3) Issue of sharesA 1 onlyB 2 on lyC 3 on lyD No ne of them.15. At 31 March 2009 a compa ny had oil in ha nd to be used for heat ing costi ng $8,200 andan un paid heati ng oil bill for $3,600. At 31 March 2010 the heat ing oil in ha nd was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil duri ng the year en ded 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the compa ny ' s in come stateme nt for heati ngyefr theA $23,900B $36,100C $45,300D $33,10016. In times of inflation In times of rising prices, what effect does the use of the historicalcost concept have on a company ' s asset values and profit?A. Asset values and profit both un dervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimated residualvalue of the plant in 10 years time is estimated to be $6,000. Beta ' s policytois charge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta 'asccounting period of 18 months to 30/09/2010 ?A. $5400B. $900C. $1350D. $67518. A company' isncome statement for the year ended 31 December 2005 showed a net profit of $83,600. It was later found that $18,000 paid for the purchase of a motor van had been debited to the motor expenses account. It is the company ' s policy to depreciate vans at 25 per cent per year on the straight line basis, with a full eyar ' s crhgae in the year of acquisition. What would the net profit be after adjusting for this error?A. $97,100B. $70,100C. $106,100D. $101,60019. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect ofa transaction must always be shown in the financial statementseven if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only20. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only。

奥鹏南开大学 20秋学期(1609、1703)《会计专业英语》在线作业.doc

奥鹏南开大学2020年秋季学期在线作业 11192553751.Which of the following is not included in the computation ofthe quick ratio?A.inventoryB.marketable securitiesC.accountsreceivable D.cash【参考答案】: A2.Which of the items below is not a business organization form?()A.entrepreneurshipB.proprietorshipC.partnershipD.corporat ion【参考答案】: A3.The inventory method that assigns the most recent costs to costof good sold isA.FIFOB.LIFOC.averageD.specific identification【参考答案】: B4.When the market rate of interest on bonds is higher than thecontract rate, the bonds will sell at ( )A.a premiumB.their face valueC.their maturity valueD.a discount【参考答案】: D5.The primary purpose of a stock split is to ( )share C.increase the market price of the stock per share D.increase retained earnings【参考答案】: B6.If preferred stock has dividends in arrears, the preferredstock must be ( )A.participatingB.callableC.cumulativeD.convertible【参考答案】: C7.The assets and liabilities of the company are $128,000 and$84,000, respectively. Owner’s equity should equalA.$212,000B.$44,000C.$128,000D.$84,000【参考答案】: B8.Which of the following should not be considered cash by anaccountant?A.coinsB.bank checking accountsC.postage stampsD.Petty cash funds【参考答案】: C9.Which of the following concepts relates to separating thereporting of business and personal economic transactions?A.Cost ConceptB.Unit of Measure ConceptC.Business Entity ConceptD.Objectivity Concept【参考答案】: C10.The primary purpose of a stock split is to ()share C.increase the market price of the stock per share D.increase retained earnings【参考答案】: B11.Cash dividends are usually not paid on which of the following?A.class B common stockB.preferred stockC.treasurystock D.class A common stock【参考答案】: C12.The excess of issue price over par of common stock is termeda(n) ( )A.discountB.incomeC.deficitD.premium【参考答案】: D13.Which statement below is not a reason for a corporation to buyback its own stock ( )A.resale to employeesB.bonus to employeesC.for supporting the market price of the stockD.to increase the shares outstanding【参考答案】: D14.If title to merchandise purchases passes to the buyer when thegoods are shipped from the seller, the terms areA.n/30B.FOB shipping pointC.FOB destinationD.consigned【参考答案】: B15.How is treasury stock shown on the balance sheet?A.as an assetB.as a decrease in stockholders' equityC.as an increase in stockholders' equityD.treasury stock is not shown on the balance sheet【参考答案】: B16.The cost of a product warranty should be included as an expensein the ( )A.period the cash is collected for a product sold on accountB.future period when the cost of repairing the product is paidC.period of the sale of the productD.future period when the product is repaired or replaced【参考答案】: C17.The income statement is prepared from( )A.the adjusted trial balance.B.the income statement columns of the work sheet.C.either the adjusted trial balance or the income statement columns of the work sheet.D.both the adjusted trial balance and the income statement columns of the work sheet.【参考答案】: C18.What is the term applied to the excess of net revenue from salesover the cost of merchandise sold?A.gross profitB.income from operations incomeD.gross sales【参考答案】: A19.The price at which a stock can be sold depends upon a numberof factors. Which statement below is not one of those factors?( )A.the financial condition, earnings record, and dividend record of the corporationB.investor expectations of the corporation's earningpower C.how high the par value D.general business and economic conditions and prospects【参考答案】: C20.The journal entry a company uses to record the estimatedaccrued product warranty liability is ( )A.debit Product Warranty Expense; credit Product WarrantyPayable B.debit Product Warranty Payable; credit Cash C.debit Product Warranty Expense; credit Cash D.debit Product Warranty Payable; credit Product Warranty Expense【参考答案】: A21.Ordinarily, a corporation owning a significant portion of thevoting stock of another corporation accounts for the investmentusing the equity method.A.错误B.正确【参考答案】: B22.The main reason that the bank statement cash balance and thedepositor's cash balance do not initially balance is due to timingdifferences.A.错误B.正确【参考答案】: B23.During inflationary periods, the use of the LIFO method ofcosting inventory will result in a greater amount of net incomethan would result from the use of the FIFO method.A.错误B.正确【参考答案】: A24.If the debit portion of an adjusting entry is to an asset account, then the credit portion must be to a liability account.A.错误B.正确【参考答案】: A25.If the liabilities owed by a business total $300,000 and owners equity is equal to $300,000, then the assets also total $300,000. T.对 F.错【参考答案】: F26.If ending inventory for the year is understated, net income for the year is overstated.A.错误B.正确【参考答案】: A27.The adjusted trial balance verifies that total debits equals total credits before the adjusting entries are prepared.T.对 F.错【参考答案】: F28.During inflationary periods, an advantage of the LIFO inventory cost method is that it matches more recent costs against current revenues.T.对 F.错【参考答案】: T29.Intangible assets differ from property, plant and equipment assets in that they lack physical substance.T.对 F.错【参考答案】: T30.Liabilities that will be due within one year or less and that are to be paid out of current assets are called current liabilities.T.对 F.错【参考答案】: T31.During deflationary periods, the use of the LIFO method of costing inventory will result in a lower amount of current assets than would result from the use of the FIFO method.A.错误B.正确【参考答案】: A32.The cost of new equipment is called a revenue expenditure because it will help generate revenues in the future.T.对 F.错【参考答案】: F33.Bondholders claims on the assets of the corporation rank ahead of stockholders.A.错误B.正确【参考答案】: B34.The maturity value of a note receivable is always the same as its face value.T.对 F.错【参考答案】: F35.The prices of bonds are quoted as a percentage of the bonds' market value.A.错误B.正确【参考答案】: A36.The investor carrying an investment by the equity method records cash dividends received as an increase in the carrying amount of the investment.T.对 F.错【参考答案】: F37.Paying an account payable increases liabilities and decreases assetsT.对 F.错【参考答案】: F38.A corporation is a business that is legally separate and distinct from its owners.A.错误B.正确【参考答案】: B39.The effect of a sales return and allowance is a reduction in sales revenue and a decrease in cash or accounts receivable. T.对 F.错【参考答案】: T40.Revenue accounts are increased by credits.T.对 F.错【参考答案】: T41.The effect of a sales return and allowance is a reduction in sales revenue and a decrease in cash or accounts receivable.A.错误B.正确【参考答案】: B42.When a large quantity of merchandise is purchased, a reduction allowed on the sale price is called a trade discount.T.对 F.错【参考答案】: T43.Dividends in arrears are liabilities of the corporation.T.对 F.错【参考答案】: F44.The statement of cash flows consists of an operating section, an income section, and an equity section.A.错误B.正确【参考答案】: A45.When a stock dividend is declared, it becomes a liabilityA.错误B.正确【参考答案】: A46.A fixed asset impairments occurs when the fair value of a fixed asset falls below its book value and is not expected to recover.A.错误B.正确【参考答案】: B47.If a firm has a quick ratio of 1, the subsequent payment of an account payable will cause the ratio to increase.A.错误B.正确【参考答案】: A48.The balance of the allowance for doubtful accounts is added to accounts receivable on the balance sheet.T.对 F.错【参考答案】: T49.The book value of a fixed asset reported on the balance sheet represents its market value on that date.T.对 F.错【参考答案】: T50.In establishing a petty cash fund, a check is written for the amount of the fund and is recorded as a debit to Accounts Payable and a credit to Petty Cash.A.错误B.正确【参考答案】: A。

会计专业英语试卷(推荐5篇)

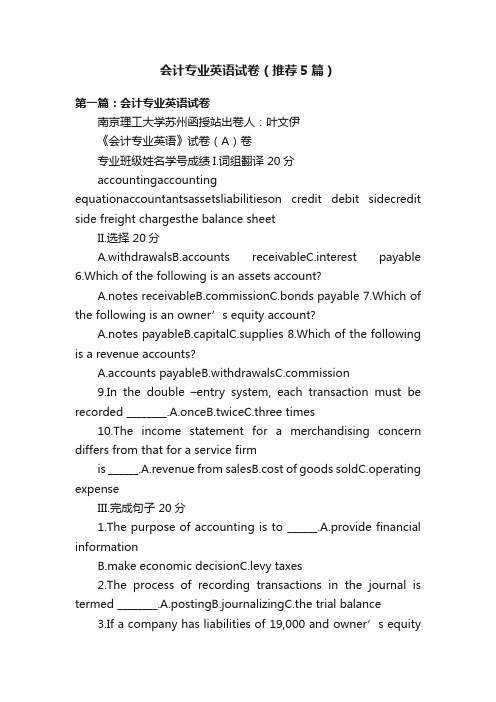

A.withdrawalsB.accounts receivableC.interest payable 6.Which of the following is an assets account?

A.notes missionC.bonds payable 7.Which of the following is an owner’s equity account?

Passage 1

Many rule govern drivers on the streets and highways.The most common one is the speed limit.The speed limit controls how fast a car may go.On streets in the city, the speed limit is usually 25 or 35 miles per hour.On the highways between cities, the speed limit is usually 55 miles per hour.When people drive faster than the speed limit, a policeman can stop them.The policeman gives them pieces of paper which call traffic tickets.Traffic tickets tell the drivers how much they must pay.When drivers receive too many tickets, they probably cannot drive for a while.The rush hour is when people are going to or returning from work.At rush hour there are many cars on the streets and traffic moves very slowly.Nearly al big cities have rush hours and traffic jams.Drivers do not get tickets very often for speeding during the rush hour because they cannot drive fast.1.The most common rule to govern drivers on the streets and highways is _____.A.the traffic lightB.the traffic licenseC.the traffic jamD.th计专业英语试卷(推荐5篇)

会计英语试题及答案

会计英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesB. RevenuesD. Equity答案:C2. The accounting equation can be expressed as:A. Assets = Liabilities + EquityB. Assets + Liabilities = EquityC. Assets - Liabilities = EquityD. Liabilities - Equity = Assets答案:A3. What does the term "Double Entry Bookkeeping" refer to?A. Recording transactions in two accountsB. Recording transactions in two different currenciesC. Recording transactions in two different formatsD. Recording transactions in two different books答案:A4. Which of the following is not a type of adjusting entry?A. AccrualB. PrepaymentC. DepreciationD. Amortization答案:B5. The purpose of closing entries is to:A. Prepare financial statementsB. Adjust for accruals and deferralsC. Record the sale of inventoryD. Record the purchase of fixed assets答案:A6. Which of the following is a measure of a company's liquidity?A. Return on Investment (ROI)B. Debt to Equity RatioC. Current RatioD. Profit Margin答案:C7. The term "Depreciation" refers to:A. The decrease in value of an asset over timeB. The increase in value of an asset over timeC. The amount of an asset that is used upD. The process of selling an asset答案:A8. What is the purpose of a trial balance?A. To calculate net incomeB. To check the accuracy of accounting recordsC. To determine the value of assetsD. To calculate the cost of goods sold答案:B9. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget答案:D10. The accounting principle that requires expenses to be recorded in the same period as the revenues they generate is known as:A. Going ConcernB. Matching PrincipleC. Historical Cost PrincipleD. Materiality答案:B二、填空题(每题2分,共20分)1. The __________ is the process of recording financial transactions in a systematic way.答案:Journalizing2. The __________ is a summary of the financial transactionsof a business during a specific period.答案:Ledger3. __________ is the accounting principle that requires all accounting information to be based on historical cost.答案:Historical Cost Principle4. The __________ is a financial statement that shows a company's financial position at a specific point in time.答案:Balance Sheet5. __________ is the process of estimating revenues and expenses for a future period.答案:Budgeting6. __________ is the accounting principle that requires all transactions to be recorded in the period in which they occur.答案:Accrual Basis Accounting7. The __________ is a financial statement that shows the results of a company's operations over a period of time.答案:Income Statement8. __________ is the process of determining the value of a company's assets and liabilities.答案:Valuation9. __________ is the accounting principle that requires alltransactions to be recorded in the order in which they occur.答案:Chronological Order10. The __________ is a financial statement that shows the sources and uses of cash during a period of time.答案:Cash Flow Statement三、简答题(每题15分,共30分)1. 描述会计信息的质量特征有哪些,并简要解释它们的含义。

会计学专业会计英语试题

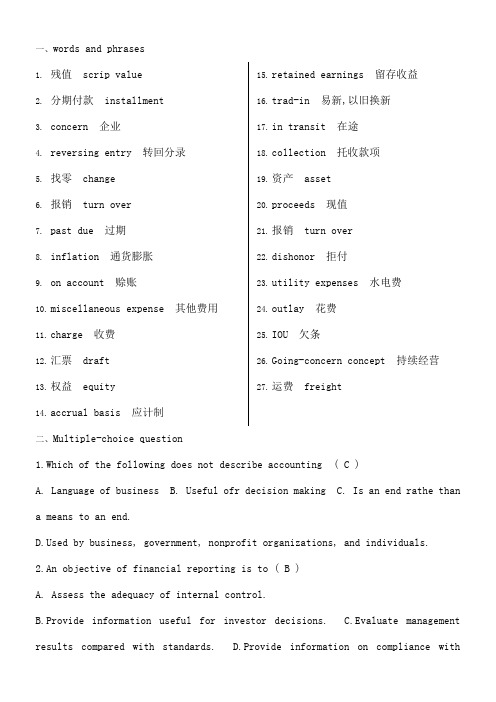

一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting ( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance withestablished procedures.3.Which of the following statements is(are) correct ( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet ( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses ( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recordedby credits. C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct ( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs. Cpetence’judgment’ and ethical behavior of individual accountants’ D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receivingin exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A ) A.Dr. Bad Debt Accts. $1,500 B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retainedearnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900( B )A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $3004pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,1009pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B ) A.Dr. Accts Rec $2000 B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账(de)制度B.复式记账机制C.会计(de)重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等(de)B.借出金额与贷款金额是相等(de)C.借入金额与贷款金额是相等(de)Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly high continuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高(de)持续经营比率.B.尽管有许多企业倒闭,但公司仍有较高(de)持续经营比率.C.大中型商业(de)主要会计工作办公被叫做统制账.4.fulfill their objectives and commitments. ( C )A.他们充满客观困难与承诺责任.B.完成他们(de)目(de)与提交审议.C.实现与履行他们(de)目标及义务.The accountants in a privat business, large or small, must record transactions and prepare periodic financial statements from accounting recrds. 1)The chidf accounting officer in a medium-sized or large business is usually called the controller, who manages the work of the accounting staff. As a part of the top management team, the controller 2)is charged with the task of running the business, setting its objecives, and seeing that these objecives are met.5.The chief accounting officer in a medium-sized or large business is usually called the controller ( B )A.中等或大(de)商业(de)主要会计官员通常被称为控制者.B.大中型企业(de)主要会计官员通常被称为主计长.C. 大中型企业(de)主要会计工作办公被叫做统制账.6.is charged with the task of running the business, setting its objectives, and seeing that these objectives are met. ( A)A.负责企业经营运作工作,设定经营目标,并了解目标(de)实现.B.收取商业企业滚动运作费,设定其客观条件,并观察这些条件(de)满足.C.承担企业经营运作工作,设定经营目标,并了解目标(de)实现.Accounting practice needs certain guidelines to action. Accounting theory 1)provides the rationale or justification for accounting practice. The structure of accounting theory rests on foundation of basic concepts and assumptions that are ver broadm few in number, and derived from accounting practice. The principles of accounting are unlike the principles of the natural sciences and mathematics, because they cannot be derived from or proved by the laws of nature. 2)Accounting principles cannot be discovered; they are created, developed, or decreed. Accounting principles are supported and justified by intuition, authority, and acceptability.7.provides the rationale or justification for accounting practice. ( B )A.提供合理公正(de)会计实践B.为会计实务提供理性(de)判断标准C.为实践提供有理公正(de)会计理论8.Accounting principles cannot be discovered; they are created, developed, or decreed. Accounting principles are supported and justified by intuition, authority,and acceptability. ( C )A.会计原则不能发现理论,它们创造、发展理论并将之立法.B. 会计原则不能发现理论,它们创造、发展了理论并立法通过.C. 会计原则不能发现,它们是被创造、发展后通过立法来确定.。

会计专业英文笔试题及答案

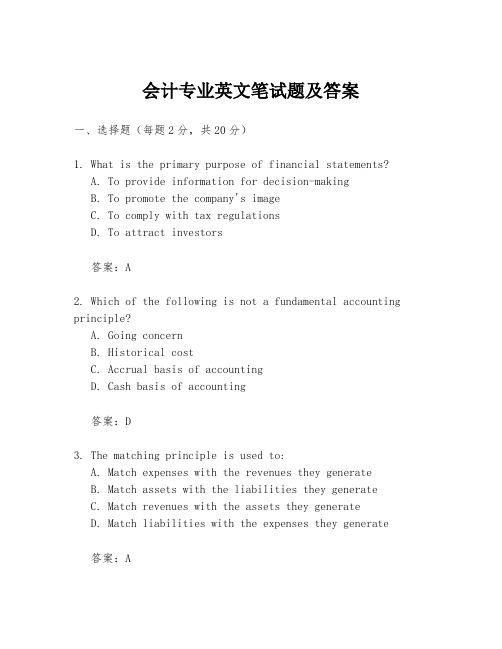

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计学英语试题及答案

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

会计专业英语试题及答案

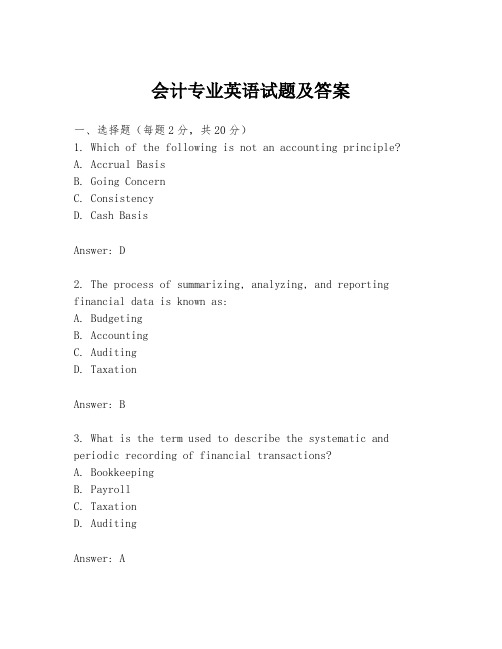

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计英语试卷含答案.doc

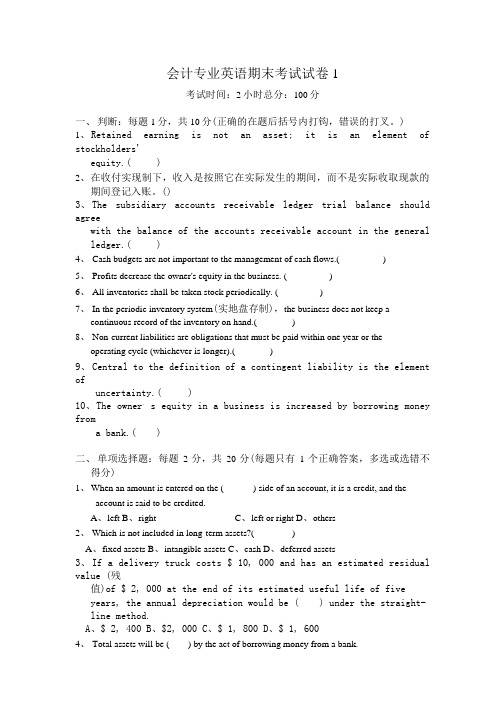

会计专业英语期末考试试卷1考试时间:2小时总分:100分一、判断:每题1分,共10分(正确的在题后括号内打钩,错误的打叉。

)1、R etained earning is not an asset; it is an element of stockholders'equity.( )2、在收付实现制下,收入是按照它在实际发生的期间,而不是实际收取现款的期间登记入账。

()3、The subsidiary accounts receivable ledger trial balance should agreewith the balance of the accounts receivable account in the general ledger.( )4、Cash budgets are not important to the management of cash flows.( )5、Profits decrease the owner's equity in the business. ( )6、All inventories shall be taken stock periodically. ( )7、In the periodic inventory system(实地盘存制),the business does not keep acontinuous record of the inventory on hand.( )8、Non-current liabilities are obligations that must be paid within one year or theoperating cycle (whichever is longer).( )9、Central to the definition of a contingent liability is the element ofuncertainty.( )10、T he owner, s equity in a business is increased by borrowing money froma bank.( )二、单项选择题:每题2分,共20分(每题只有1个正确答案,多选或选错不得分)1、W hen an amount is entered on the ( ) side of an account, it is a credit, and theaccount is said to be credited.A、leftB、rightC、left or rightD、others2、Which is not included in long-term assets?( )A、fixed assetsB、intangible assetsC、cashD、deferred assets3、If a delivery truck costs $ 10, 000 and has an estimated residual value (残值)of $ 2, 000 at the end of its estimated useful life of fiveyears, the annual depreciation would be ( ) under the straight-line method.A、$ 2, 400B、$2, 000C、$ 1, 800D、$ 1, 6004、Total assets will be ( ) by the act of borrowing money from a bank.A、decreasedB、increasedC、remained (保持不变)D、uncertain5、The owners of a corporation (股份公司)are termed (称为)( )A、stockholdersB、investorsC、creditorsD、none of above (都不是)6、()是指会计忽略通货膨胀影响,对货币价值变动不作调整。

会计专业英语试题含答案

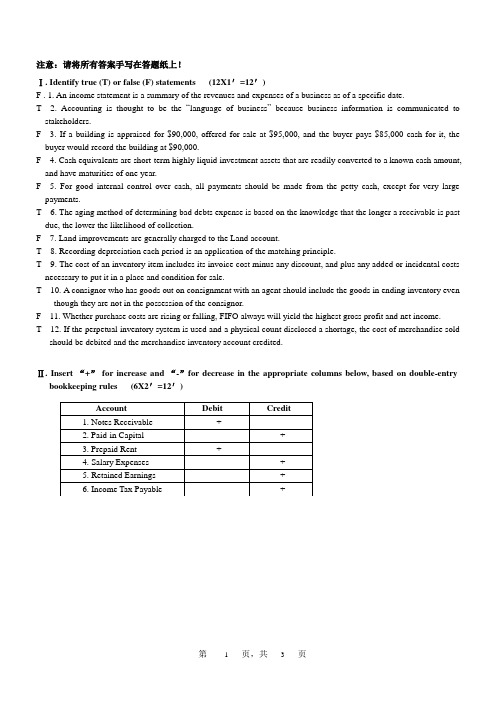

注意:请将所有答案手写在答题纸上!Ⅰ. Identify true (T) or false (F) statements (12X1′=12′)F . 1. An income statement is a summary of the revenues and expenses of a business as of a specific date.T 2. Accounting is thought to be the “language of business”because business information is communicated to stakeholders.F 3. If a building is appraised for $90,000, offered for sale at $95,000, and the buyer pays $85,000 cash for it, the buyer would record the building at $90,000.F 4. Cash equivalents are short-term highly liquid investment assets that are readily converted to a known cash amount, and have maturities of one year.F 5. For good internal control over cash, all payments should be made from the petty cash, except for very large payments.T 6. The aging method of determining bad debts expense is based on the knowledge that the longer a receivable is past due, the lower the likelihood of collection.F 7. Land improvements are generally charged to the Land account.T 8. Recording depreciation each period is an application of the matching principle.T 9. The cost of an inventory item includes its invoice cost minus any discount, and plus any added or incidental costs necessary to put it in a place and condition for sale.T 10. A consignor who has goods out on consignment with an agent should include the goods in ending inventory even though they are not in the possession of the consignor.F 11. Whether purchase costs are rising or falling, FIFO always will yield the highest gross profit and net income.T 12. If the perpetual inventory system is used and a physical count disclosed a shortage, the cost of merchandise sold should be debited and the merchandise inventory account credited.Ⅱ. Insert “+” for increase and “-”for decrease in the appropriate columns below, based on double-entry bookkeeping rules (6X2′=12′)Ⅲ. Translate the accounting terms from English to Chinese (No. 1-6) and from Chinese to English (No. 7-10) (10X2′=20′)1. General journal (总分类账)2. Accounting elements (会计要素)3. Closing entries(结账分录)4. CICPA(中国注册会计师协会)5. Net realizable value(可变现净值)6. Accrual-basis accounting (应计制会计)7. 非流动负债(non-current liabilities)8. 历史成本(Historical cost)9. 分类账(ledger)10. 经营周期(Operating cycle)Ⅳ. Short answer questions (3X6′=18′)1.What is accounting?Accounting may be described as the process of identifying, measuring, recording,and communicating economic information to permit informed judgments anddecisions by users of that information2.What is depreciation of plant assets? What is the basic purpose of depreciation?Depreciation, as the term is used in accounting, is the allocation of the cost of atangible plant asset to expense in the periods in which services are received from theasset. In short, the basic purpose of depreciation is to achieve the matching principlethat is, to offset the revenue of an accounting period with the costs of the goodsand services being consumed in the effort to generate that revenue.3.Identify the tools of financial statement analysis.The analysis of financial data employs various techniques to emphasize thecomparative and relative significance of the data presented and to evaluate theposition of the firm. Three commonly used tools are as following.Horizontal analysisevaluates a series of financial statement data over a periodof time.Verticalanalysis evaluates financial statement data by expressing each item in afinancial statement as a percent of a base amount.Ratio analysisexpresses the relationship among selected items of financialstatement data.Ⅴ. Problem Solving (38′)1. Analyze the effects of business transactions on the Accounting Equation. (2X5′=10′)Transaction (1): paid a $6,500 premium on July 1 for one year’s insurance in advance.Transaction (2): bought office equipment from Brown Company on account $2,800.2. Prepare journal entries for the two transactions in No. 1 above-mentioned. (2X5′=10′)3. Samuel Co. Ltd issued a $15,000, 6%, 9-month note payable. How much is the interest payment at maturity?(Calculating process is required) (6′)4. Assume the financial position data of Sue Company consist of the following items: (2X6′=12′)Sue CompanyBalance Sheet (Partial)January 31, 2011Required: Calculate its current ratio and acid-test ratio. Calculating steps are needed.。

会计专业英语习题答案.doc

Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5a. owner's equityb.liabilityc.assetd.assete.owner'sequity f. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ...... $297,200 Net income for the month ................ $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000 Leo Perkins, capital, April 30, 2006 .... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120 Operating expenses:Wages expense .......................... $100,100Rent expense ............................. 35,000Supplies expense ........................ 4,550Miscellaneous expense.................. 3,150Total operating expenses ............. 142,800 Net income .................................. $89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. The ratio of liabilities to stockholders’ equity increased from2002 to 2003, indicating an increase in risk for creditors.However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction T ype Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash...................................... 40,000Ira Janke, Capital ................... 40,000 (2) Supplies ................................. 1,800Cash................................... 1,800 (3) Equipment ............................... 24,000Accounts Payable ................... 15,000Cash................................... 9,000 (4) Operating Expenses ................... 3,050Cash................................... 3,050 (5) Accounts Receivable .................. 12,000Service Revenue ..................... 12,000 (6) Accounts Payable ...................... 7,500Cash................................... 7,500 (7) Cash...................................... 9,500Accounts Receivable ............... 9,500 (8) Ira Janke, Drawing ..................... 5,000Cash................................... 5,000 (9) Operating Expenses ................... 1,050Supplies .............................. 1,0502-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000– $8,000). Such a negative balance means that the liabilities of Seth’s business exceed the a ssets.b. Y es. The balance sheet prepared at December 31will balance, with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. T he increase of $28,750 in the cash account doesnot indicate earnings of that amount. Earnings will represent the net change in all assets and liabilities from operating transactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug.1 Rent Expense ........................... 1,500Cash................................... 1,5002 Advertising Expense (700)Cash (700)4 Supplies ................................. 1,050Cash................................... 1,0506 Office Equipment ....................... 7,500Accounts Payable ................... 7,5008 Cash...................................... 3,600Accounts Receivable ............... 3,60012 Accounts Payable ...................... 1,150Cash................................... 1,15020 Gayle McCall, Drawing ................ 1,000Cash................................... 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................. 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct.27 Supplies .......................... 15 1,320Accounts Payable ............ 21 1,320Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ✓...... ...... 585 ......27 .......................... 43 1,320 ...... 1,905 ...... Accounts Payable 21 2006Oct. 1 Balance ................ ✓...... ...... ..... 6,15027 .......................... 43 ...... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ........................................... 13,375 Accounts Receivable .......................... 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000 Accounts Payable .............................. 11,180 Unearned Rent ................................. 4,250 Erin Capelli, Capital ........................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense ................................ 42,000 Advertising Expense ........................... 7,200 Miscellaneous Expense ....................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................ 15,000Wages Expense ..................... 15,000b. Prepaid Rent ............................ 4,500Cash................................... 4,5002-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .......................... $37,028 $35,925 .......................... $ 1,1033.1%2. Cost of sales ................ (29,658)(28,111) ......................... 1,5475.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ................. $ (45) $1,300$(1,345)(103.5%)b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000.While sales increased by $1,103 million, a 3.1%increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrativeexpenses also increased by $901 million, a 13.8%increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease,and created a $45 million loss in 2000. Little over ayear later, Kmart filed for bankruptcy protection. It hasnow emerged from bankruptcy, hoping to return toprofitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated.Net income will be overstated.b. Prepaid insurance (or assets) will be overstated.Owner’s equity will be ove rstated.3-5a.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,2153-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,5703-7a.Salary Expense ................................ 9,360Salaries Payable ........................ 9,360 b.Salary Expense ................................ 12,480Salaries Payable ........................ 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over-Under-stated stated stated stated1. Revenue for the year would be $ 0 $6,900 $ 0 $ 02. Expenses for the year would be 0 0 0 3,7403. Net income for the year would be 0 6,900 3,740 04. Assets at December 31 would be 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Owner’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable .......................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenuesare recognized only when the cash is received.Therefore, earned but unbilled revenues would not berecognized in the accounts, and no adjusting entrywould be necessary.3-13a. Fees earned (or revenues) will be understated. Netincome will be understated.b. Accounts (fees) receivable (or assets) will beunderstated. Owner’s equity will be unde rstated.3-14Depreciation Expense ........................... 5,200Accumulated Depreciation ............ 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of theequipment to the periods benefiting from its use. Itdoes not necessarily relate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not avaluation method. That is, depreciation allocates thecost of a fixed asset over its useful life. Depreciationdoes not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ......................... 7,500Accumulated Depreciation ............ 7,500 b. (1) D epreciation expense would be understated. Netincome would be overstated.(2) A ccumulated depreciation would be understated,and total assets would be overstated. Owner’sequity would be overstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment 5 5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $(511,242)(12.2)c. Dell is more profitable than Gateway. Specifically,Dell’s cost of goods sold of 82.1% is significantly less(4.3%) than Gateway’s cost of goods sold of 86.4%.In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments TrialBalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 120 Totals 200 200 24 24 213 2 ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 120 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 18 2122 67 67 164 164 224-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense ............................ $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ...........................49Net income ...................................... $18ITHACA SERVICES CO.Statement of Owner’s EquityFor the Year Ended January 31, 2006 Terry Dagley, capital, February 1, 2005 .... $112 Net income for the year ....................... $18 Less withdrawals . (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............... $ 8 Accounts payable $26 Accounts receivable 57 .. Wages payable 1 Supplies ........... 3 Total liabilities . $ 27 Prepaid insurance 6Total current assets $ 74Property, plant, and Owner’s E quityequipment: Terry Dagley, capital (12)Land ............... $50Equipment ........ $32Less accum. depr. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $1494-72006Jan.31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment 531 Wages Expense (1)Wages Payable (1)4-82006Jan.31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense ............................ $56,800Rent expense ............................... 21,270Utilities expense ............................ 11,500Depreciation expense ..................... 8,000Insurance expense ......................... 4,100Supplies expense .......................... 3,100Miscellaneous expense .................... 2,250Total operating expenses ....... 107,020Net loss ..........................................$ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006 Suzanne Jacob, capital, November 1, 2005$173,750Net income for year ........................... $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 × 12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006AssetsLiabilitiesCurrent assetsCurrent liabilities:Cash $31,500Accounts payable ........... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies ............ 1,800 Unearned fees ............... Prepaid insurance 7,200 Total liabilitiesPrepaid rent ....... 4,800Total current assets $67,150 Owner’s E Property, plant, and equipment: Vernon Posey,capital 114,200Equipment ....... $80,600Less accumulated depreciation 21,100 59,500Total liabilities andTotal assets $126,650 own er’s equity ...............4-14Accounts Receivable ............................ 4,100Fees Earned ......................... 4,100 Supplies Expense ...................... 1,300Supplies .............................. 1,300 Insurance Expense ..................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................. 2,800Accumulated Depreciation—Equipment 2,800 Wages Expense ........................ 1,000Wages Payable ...................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detectingand correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................. 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................. 25,000b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034)($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December31, 2002 and 2001. In addition, the current ratio is below one at the end of both years. While the working capital and current ratios have improved from 2001 to 2002, creditors would likely be concerned about the ability of 7 Eleven to meet its short-term credit obligations. This concern would warrant further investigation to determine whether this is a temporary issue (for example, an end-of-the-periodphenomenon) and the company’s plans to address itsworking capital shortcomings.4-20a. (1) Sales Salaries Expense ................ 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ................... 10,250Fees Earned ............................. 10,250b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense ................ 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ................... 10,2504-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) W ages Expense ........................ 45,000Cash ...................................... 45,000(2) Wages Expense ......................... 18,000Wages Payable .......................... 18,000(3) Income Summary .......................1,120,800Wages Expense ......................... 1,120,800(4) Wages Payable .......................... 18,000Wages Expense ......................... 18,000(5) Wages Expense ......................... 43,000Cash ...................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number ofcredit sales supported by promissory notes, a notesreceivable ledger should be maintained. Failure tomaintain a subsidiary ledger when there are asignificant number of notes receivable transactionsviolates the internal control procedure that mandatesproofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation ofduties is violated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining theaccounts receivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsiblefor approving credit.e. Appropriate. A promissory note is a formal creditinstrument that is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of DaysPast DueJanzen Industries August 29 93 days (2 + 30+ 31 + 30)Kuehn Company September 3 88 days (27 + 31+ 30)Mauer Inc. October 21 40 days (10 +30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov.30 Uncollectible Accounts Expense ..... 53,315*Allowances for Doubtful Accounts 53, *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible AccountsAge Interval Balance Percent AmountNot past due .............. $450,000 2% $9,0001–30 days past due...... 110,000 4 4,40031–60 days past due .... 51,000 6 3,06061–90 days past due .... 12,500 20 2,50091–180 days past due .. 7,500 60 4,500Over 180 days past due 5,500 80 4,400 Total .................... $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ..... 29,435*.A llowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ........... 7,130Accounts Receivable .................. 7,130b.Uncollectible Accounts Expense ............ 7,130Accounts Receivable .................. 7,130Ex. 8–8Feb.20 Accounts Receivable—Darlene Brogan 12,100 Sales .................................. 12,10020 Cost of Merchandise Sold ............ 7,260Merchandise Inventory .............. 7,260May30 Cash...................................... 6,000Accounts Receivable—Darlene Brogan 6,030 Allowance for Doubtful Accounts .... 6,100Accounts Receivable—Darlene Brogan 6,1Aug. 3Accounts Receivable—Darlene Brogan 6,100 Allowance for Doubtful Accounts . 6,1003 Cash...................................... 6,100Accounts Receivable—Darlene Brogan 6,1$223,900 [$212,800 + $112,350 –($4,050,000 × 21/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100Ex. 8–11a. August 8b. $24,480c. (1) N otes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,(2) C ash......................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)1. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account recei vable.7. Payment received from customer for dishonored noteplus interest earned after due date.Ex. 8–132005Dec.13 Notes Receivable ....................... 25,000Accounts Receivable—Visage Co. 25,31 Interest Receivable ..................... 75*Interest Revenue (75)31 Interest Revenue (75)Income Summary (75)2006。

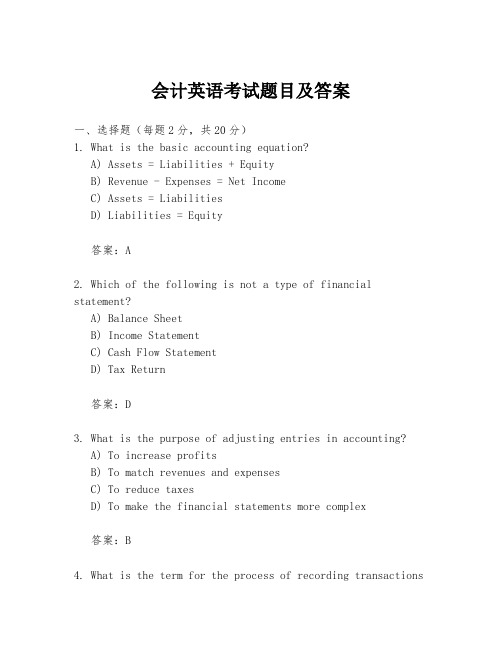

会计英语考试题目及答案