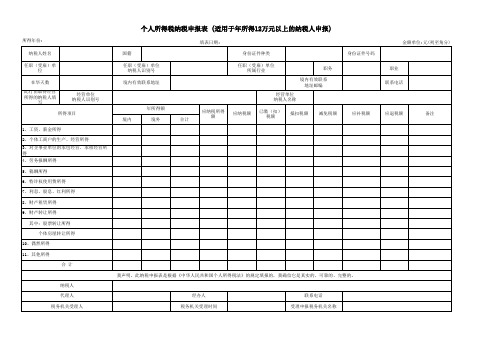

个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)

《个人所得税纳税申报表》格式及填写示例(表头部分仅需修改带“X”项目)

附件个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)所得年份: 20xx年填表日期:20xx年x月xx日金额单位:人民币元(列至角分)- 1 -填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1、所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

3、身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4、任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5、任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6、任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

其中,行业应按国民经济行业分类标准填写,一般填至大类。

7、职务:填写纳税人在受理申报的任职、受雇单位所担任的职务。

8、职业:填写纳税人的主要职业。

9、在华天数:由中国境内无住所的纳税人填写在税款所属期内在华实际停留的总天数。

10、中国境内有效联系地址:填写纳税人的住址或者有效联系地址。

其中,中国有住所的纳税人应填写其经常居住地址。

中国境内无住所居民住在公寓、宾馆、饭店的,应当填写公寓、宾馆、饭店名称和房间号码。

经常居住地,是指纳税人离开户籍所在地最后连续居住一年以上的地方。

11、经营单位纳税人识别码、纳税人名称:纳税人取得的年所得中含个体工商户的生产、经营所得和对企事业单位的承包经营、承租经营所得时填写本栏。

Removed_IIT filing return 个人所得税纳税申报表(中英文版)

个人房屋转让所得 Income from transfer of personal estate

10、偶然所得 Incidental income

:50 45. 44. 43. by 42.41.— 4—0.— 3—9.—3—8.by 37@.—— 36.35. —34—. ——33.3312..1.2.3.43.05..6—.—29.by28.by@ 27.26.—— 25. 24. 23. 22. by 21.20. — 1—9.by:18.by:17.— 1—6.— 1—5.—1—4.—— 13. 12. 111.0.“ ”by:M9.“OOOKN”b8y. :——7.——6.——5.——4.——3.——2.——1.——

税务机关受理人(签字): (盖章):

应纳税额 Tax

payable

身份证照 号码

ID number

职务 Title

职业 Profession

境内有效联 系地址邮编

Post code

联系电话 Tel number

经营单位 纳税人名称 Name of the

business

已缴(扣) 税额

Tax pre-paid and withheld

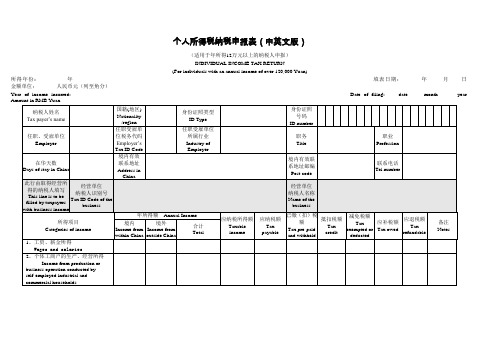

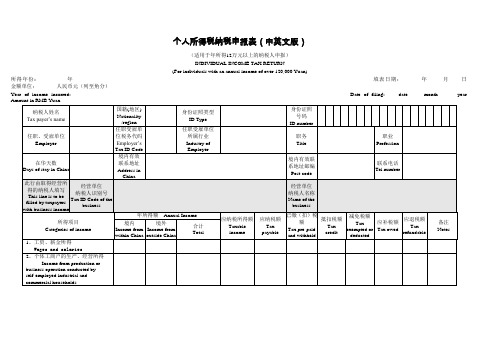

个人所得税纳税申报表(中英文版)

所得年份: 金额单位:

年 人民币元(列至角分)

(适用于年所得12万元以上的纳税人申报) INDIVIDUAL INCOME TAX RETURN

(For individuals with an annual income of over 120,000 Yuan)

填表日期:

抵扣税额 Tax credit

年所得12万元以上纳税申报个人所得税自行申报有关问题的解答

年所得12万元以上纳税申报个人所得税自行申报有关问题的解答一、“年所得12万元以上的”应如何样把握?都包括哪些内容?答:《个人所得税自行纳税申报方法(试行)》(以下简称《方法》)规定,年所得12万元以上的,是指一个纳税年度内以下11项所得合计达到12万元:“工资、薪金所得”、“个体工商户的生产、经营所得”、“对企事业单位的承包经营、承租经营所得”、“劳务酬劳所得”、“稿酬所得”、“特许权使用费所得”、“利息、股息、红利所得”、“财产租赁所得”、“财产转让所得”、“偶然所得”、以及“其他所得”。

二、哪些所得能够不运算在年所得中?答:在运算12万元年所得时,对个人所得税法及事实上施条例中规定的免税所得以及承诺在税前扣除的有关所得,能够不运算在年所得中。

要紧包括以下三项:(一)个人所得税法第四条第一项至第九项规定的免税所得,即:1.省级人民政府、国务院部委、中国人民解放军军以上单位,以及外国组织、国际组织颁发的科学、教育、技术、文化、卫生、体育、环境爱护等方面的奖金;2.国债和国家发行的金融债券利息;3.按照国家统一规定发给的补贴、津贴,即个人所得税法实施条例第十三条规定的按照国务院规定发放的政府专门津贴、院士津贴、资深院士津贴以及国务院规定免纳个人所得税的其他补贴、津贴;4.福利费、抚恤金、救济金;5.保险赔款;6.军人的转业费、复员费;7.按照国家统一规定发给干部、职工的安家费、退职费、退休工资、离休工资、离休生活补助费;8.依照我国有关法律规定应予免税的各国驻华使馆、领事馆的外交代表、领事官员和其他人员的所得;9.中国政府参加的国际公约、签订的协议中规定免税的所得。

(二)个人所得税法实施条例第六条规定能够免税的来源于中国境外的所得。

(三)个人所得税法实施条例第二十五条规定的按照国家规定单位为个人缴付和个人缴付的差不多养老保险费、差不多医疗保险费、失业保险费、住房公积金(简称“三费一金”)。

三、各个所得项目的年所得如何样运算呢?答:《方法》依照2005年个人所得税法修订的精神,将“年所得”界定为纳税人在一个纳税年度内取得须在中国境内缴纳个人所得税的11项应税所得的合计数额;同时,从方便纳税人和简化运算的角度动身,在不违抗上位法的前提下,明确了各个所得项目所得的具体运算方法:(一)工资,薪金所得,是指未减除费用及附加减除费用的收入额。

个人所得税纳税申报表填报模板

附件2个人所得税纳税申报表(填报模板-标红为必填项目)(适用于年所得12万元以上的纳税人申报)计算机代码:本人身份证号码申报所得年份:2015年填表日期:年月日金额单位:元(列至角分)税务机关受理人(签字):税务机关受理时间:年月日受理申报税务机关名称(盖章):填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上的纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字。

四、本表各栏的填写说明如下:1、申报所得年份:填写纳税人实际取得所得的年度;填表日期:填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证件(身份证、护照、回乡证、军人身份证件等)名称。

3、身份证照号码:填写纳税人有效身份证件上的号码。

4、任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5、任职、受雇单位税务代码:填写任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6、在华天数:由在中国境内无住所的纳税人填写在税款所属期内在华实际停留的总天数。

7、中国境内有效联系地址:填写纳税人的住址或者有效联系地址。

中国境内无住所居民住在公寓、宾馆、饭店的,应当填写公寓、宾馆、饭店名称和房间号码。

8、经营单位纳税人识别号及名称:纳税人取得的年所得中含个体工商户的生产、经营所得和对企事业单位的承包经营、承租经营所得时填写本栏。

经营单位纳税人识别码:填写税务登记证号码。

经营单位纳税人名称:填写个体工商户、个人独资企业、合伙企业名称,或者承包承租经营的企事业单位名称。

IIT-filing-return-个人所得税纳税申报表(中英文版)教学文稿

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

《个人所得税纳税申报表(中英文对照).》

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

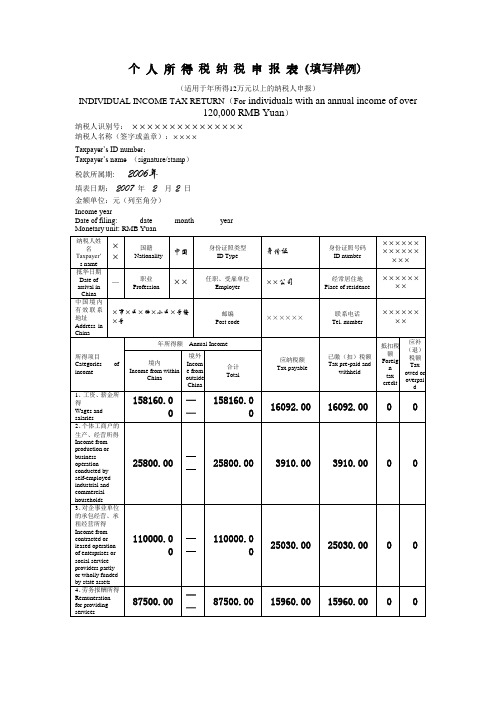

个人所得税纳税申报表式样

附件:个人所得税纳税申报表式样 ANNEX: INDIVIDUAL INCOME TAX RETURN FORMAT 附表1个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 RMB Yuan)纳税人识别号:纳税人名称(签字或盖章):Taxpayer’s ID number Taxpayer’s name (signature/stamp)税款所属期: 填表日期:年月日金额单位:元(列至角分)Income year Date of filing: date month year Monetary unit: RMB Yuan页脚(Responsible tax officer) (Time: Date/Month/Year) (Responsible tax office) 页脚填表须知一、本表根据《人民国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上的纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字。

四、本表各栏的填写说明如下:1、纳税人识别码、纳税人名称:纳税人取得的年所得中含个体工商户的生产、经营所得和对企事业单位的承包经营、承租经营所得时填写本栏。

纳税人识别码:填写税务登记证。

纳税人名称:填写个体工商户、个人独资企业、合伙企业名称,或者承包承租经营的企事业单位名称。

2、税款所属期和填表日期税款所属期,填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

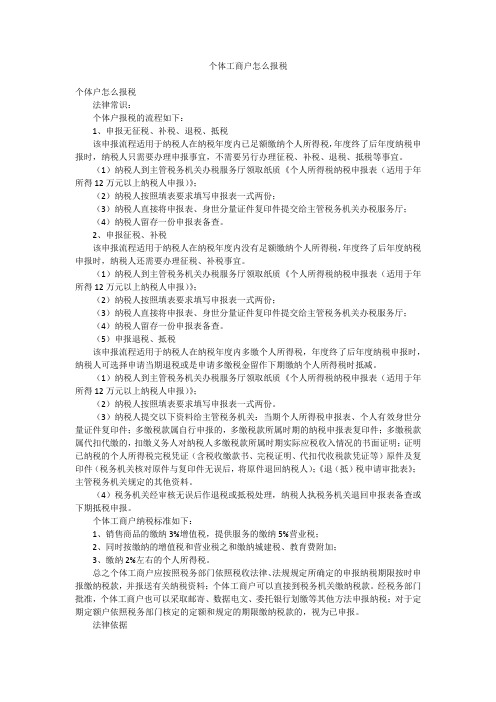

个体工商户怎么报税

个体工商户怎么报税个体户怎么报税法律常识:个体户报税的流程如下:1、申报无征税、补税、退税、抵税该申报流程适用于纳税人在纳税年度内已足额缴纳个人所得税,年度终了后年度纳税申报时,纳税人只需要办理申报事宜,不需要另行办理征税、补税、退税、抵税等事宜。

(1)纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》;(2)纳税人按照填表要求填写申报表一式两份;(3)纳税人直接将申报表、身世分量证件复印件提交给主管税务机关办税服务厅;(4)纳税人留存一份申报表备查。

2、申报征税、补税该申报流程适用于纳税人在纳税年度内没有足额缴纳个人所得税,年度终了后年度纳税申报时,纳税人还需要办理征税、补税事宜。

(1)纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》;(2)纳税人按照填表要求填写申报表一式两份;(3)纳税人直接将申报表、身世分量证件复印件提交给主管税务机关办税服务厅;(4)纳税人留存一份申报表备查。

(5)申报退税、抵税该申报流程适用于纳税人在纳税年度内多缴个人所得税,年度终了后年度纳税申报时,纳税人可选择申请当期退税或是申请多缴税金留作下期缴纳个人所得税时抵减。

(1)纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》;(2)纳税人按照填表要求填写申报表一式两份。

(3)纳税人提交以下资料给主管税务机关:当期个人所得税申报表、个人有效身世分量证件复印件;多缴税款属自行申报的,多缴税款所属时期的纳税申报表复印件;多缴税款属代扣代缴的,扣缴义务人对纳税人多缴税款所属时期实际应税收入情况的书面证明;证明已纳税的个人所得税完税凭证(含税收缴款书、完税证明、代扣代收税款凭证等)原件及复印件(税务机关核对原件与复印件无误后,将原件退回纳税人);《退(抵)税申请审批表》;主管税务机关规定的其他资料。

所得12万元以上个人所得税自行申报指南

所得12万元以上个⼈所得税⾃⾏申报指南2017年所得12万元以上个⼈所得税⾃⾏申报指南 根据我国税法规定,每年1⽉1⽇⾄3⽉31⽇,上年年所得超过12万元的个⼈要向主管税务机关办理个⼈所得税⾃⾏申报。

地税机关提醒相关纳税⼈及时办理个⼈所得税⾃⾏申报。

下⾯是yjbys⼩编为⼤家带来的关于年所得12万元以上个⼈所得税⾃⾏申报指南的知识,欢迎阅读。

尊敬的纳税⼈: 按《个⼈所得税⾃⾏纳税申报办法》第⼆条的规定,凡在中国境内负有个⼈所得税纳税义务的纳税⼈,具有以下五种情形之⼀的,应当按照规定⾃⾏向税务机关办理纳税申报: (⼀)年所得12万元以上的; (⼆)从中国境内两处或两处以上取得⼯资、薪⾦所得的; (三)从中国境外取得所得的; (四)取得应税所得,没有扣缴义务⼈的; (五)国务院规定的其他情形。

以上五种情形中,第⼀种和第五种情形是修订后的个⼈所得税法新增加的规定。

第⼀种情形的纳税⼈,不包括在中国境内⽆住所,且在⼀个纳税年度中在中国境内居住不满1年的个⼈。

在此,⼩税恭喜您的收⼊超过⼤多数,并整理编辑《年所得12万元以上个⼈所得税⾃⾏申报指南》奉上,提醒您在2017年3⽉31⽇前⾃⾏申报哦~ 年所得12万元以上个⼈所得税⾃⾏申报指南 ⼀、 “年所得12万元以上”是指什么? 年所得12万元以上,是指纳税⼈在⼀个纳税年度取得以下各项所得的合计数额达到12万元,具体为: (⼀)⼯资、薪⾦所得:是指未减除费⽤(每⽉3500元)及附加减除费⽤(每⽉1300元)的收⼊额。

上述减除费⽤,是指在⼯资薪⾦所得个⼈所得税计算过程中的扣除标准,⼈们常说的“⽉收⼊3500元以上才要缴个⼈所得税”,实际上指的就是这个。

附加减除费⽤主要适⽤于外籍个⼈、华侨和⾹港、澳门、台湾同胞以及在中国境内有住所⽽在中国境外任职或者受雇取得⼯资、薪⾦所得的个⼈。

实践中最常见的情况是,中⽅员⼯计算个⼈所得税时扣除的是3500元,⽽外籍员⼯则是扣除4800元(3500+1300=4800)。

税务-个人所得税纳税申报表填写样例 精品

0

10、偶然所得Incidental ine

20000.00

——

20000.00

4000.00

4000.00

0

0

11、其他所得other ine

10000.00

——

10000.00

2000.00

2000.00

0

0

合计Total

699160.00

——

699160.00

104738.00

104738.00

Place of residence

××××××××

中国境内有效联系地址

Address in China

×市×区×路×小区×号楼×号

邮编

Post code

××××××

联系电话

Tel. number

××××××××

所得项目

Categories of ine

年所得额Annual Ine

应纳税额

Tax payable

0

0

8、财产租赁所得

Ine from lease of property

42000.00

——

42000.00

3000.00

3000.00

0

0

9、财产转让所得

Ine from transfer of property

177000.00

(股票:60000.00)

——

177000.00

23400.00

23400.00

110000.00Biblioteka ——110000.00

25030.00

25030.00

0

0

4、劳务报酬所得

Remuneration for providing services

个 人 所 得 税 纳 税 申 报 表(填写样例)

0

0

10、偶然所得Incidental income

20000.00

——

20000.00

4000.00

4000.00

0

0

11、其他所得other income

10000.00

——

10000.00

2000.00

2000.00

0

0

合计Total

699160.00

——

699160.00

104738.00

个人所得税纳税申报表(填写样例)

(适用于年所得12万元以上的纳税人申报)

INDIVIDUAL INCOME TAX RETURN(Forindividuals with an annual income of over 120,000 RMB Yuan)

纳税人识别号:×××××××××××××××纳税人名称(签字或盖章):××××

××××××××

中国境内有效联系地址

Address inChina

×市×区×路×小区×号楼×号

邮编

Post code

××××××

联系电话

Tel. number

××××××××

所得项目

Categories of income

年所得额Annual Income

应纳税额

Tax payable

已缴(扣)税额

——

4500.00

406.00

406.00

0

0

6、特许权使用费所得Royalties

40000.00

——

40000.00

6400.00

6400.00

0

0

7、利息、股息、红利所得

所得12万以上个人自行申报系统操作指南

深圳市地方税务局

错误!未找到引用源。

错误!未找到引用源。

Version错误!未指定书签。

1.前言

我国现行个人所得税法规定,年所得12万元以上的纳税义务人,应在年度终了后3个月内到主管税务机关办理纳税申报。

为了给纳税人提供灵活多样的纳税申报方式,深圳市地方税务局开发了年所得12万以上个人自行申报系统。

为帮助纳税人、扣缴义务人学习和掌握这个系统,特编写本操作指南。

因现阶段自行申报系统仍需不断完善,对本操作指南的界面截图,使用时请以系统的实际界面为准。

2.系统登录

2.1登录系统

1)年所得12万元以上的纳税人输入地址/12w,登录年所得12万以上个人自行申报系统,登录界面如下图。

登录须输入证件类别、证件号码、密码和校验码并通过系统验证。

2)纳税人此前未开通个人自行申报系统的,可以点击按钮,并在以下的开户界面录入

个人基本信息(如下图,红色“*”号表示为必填项)。

录入校验码并点击按钮,就完成了开户操作。

纳税人随后可回到登录页面进行登录操作。

3)已开通个人自行申报系统的纳税人忘记了登录密码,可以点击登录页面上的链接,系统

将显示找回密码界面(如下图,红色“*”号为必填项),输入证件类别、证件号码与校验码后点击

按钮。

如果纳税人此前在登记基本信息时,已录入“找回密码的问题、答案”,这时找回密码界面会扩展如下图:

纳税人输入正确的“找回密码答案”并点击按钮后,系统将会提示重设新密码。

纳税人输

入新密码并点击按钮后,登录密码即修改为新密码。

2017年个税申报表

职务

职业

在华天数

境内有效联系地 址邮编

联系电话

此行由取得经营所得的纳税 人填写

经营单位纳税人 识别号(社会信 用代码) 年所得额

经营单位纳税人 名称

所得项目

境内

境外

合计 0.00

应纳税所得额

应纳税额

已缴(扣)税额

抵扣税额

减免税额

应补税额

应退税额

备注

1.工资薪金所得 2.个体工商户生产经营所得

0.00

0.00

0.00

0.00

0.00

3.企事业单位的承包、承租经营所得

0.00

0.00

0.00

4.劳务报酬所得 5.稿酬所得 6.特许权使用费所得 7.利息、股息、红利所得 8.财产租赁所得 9.财产转让所得 其中:股票转让所得 个体房屋转让所得 10.偶然所得 11.其他所得 合 计 0.00 0.00

个人所得税纳税申报表

(适用于年所得12万元以上的纳税人申报) 450103197607070540 所得年份 年 填表日期 金额单位:人民币元(列至角分)

纳税人姓名

国籍(地区) 任职(受雇)单 位纳税人识别号 (社会信用代 码) 境内有效联系地 址

身份证件种类

身份证件号码

任职(受雇)单位名称

任职(受雇)单位 所属行业

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

ቤተ መጻሕፍቲ ባይዱ

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

个人所得税纳税申报表(适用于境外所得的纳税人年度申报)填表说明正文

个人所得税纳税申报表(适用于境外所得的纳税人年度申报)填表说明正文第一篇:个人所得税纳税申报表(适用于境外所得的纳税人年度申报)填表说明个人所得税纳税申报表(适用于境外所得的纳税人年度申报)填表说明一、在中国境内有住所,或者无住所而在境内居住满1年的个人,从中国境外取得的,应于年度终了后30日内将税款缴入国库,并向税务机关报送本表。

二、纳税人基础信息1、“国籍或地区”:据实填列如:中国、中国台湾、香港、美国、日本、德国、韩国、澳大利亚、瑞典、挪威等。

2、“身份证照类型”:身份证、军官证、士兵证、外籍人编码、其他。

3、“职业”:按劳动和保障部门国标。

A、国家机关、党群组织、企业、事业单位负责人。

1、国家机关及其工作机构负责人、2、事业单位负责人、3、企业负责人B、专业技术人员。

1、科学研究人员、2、工程技术人员、3、卫生专业技术人员、4、经济业务人员、5、金融业务人员、6、法律专业人员、7、教学人员、8、文学艺术工作人员、9、体育工作人员、10、新闻出版、文化工作人员 C、办事人员和有关人员D、商业服务人员。

1、购销人员、2、饭店、旅游及健身娱乐场所服务人员 E、农、林、牧、渔、水利生产人员 F、生产、运输设备操作人员及有关人员 G、军人 H、其他4、“所得来源国”:填列中国、中国台湾、香港、美国、日本、德国、韩国、澳大利亚、瑞典、挪威、其他。

5、“所得项目”:填列“工资、薪金所得”、“劳务报酬所得”、“稿酬所得”、“特许权使用费所得”、“利息、股息、红利所得”、“财产租赁所得”、“财产转让所得”、“偶然所得”、“其他所得”。

6、“抵华日期”:在中国境内无住所的纳税人填写此栏。

7、“任职、受雇单位”:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的任职、受雇单位。

8、“经常居住地”:是指纳税人离开户籍所在地最后连续居住一年以上的地方。

9、“中国境内有效联系地址”:填写纳税人的住址或者有效联系地址。

个人所得税申报表

所得年份: 纳税人姓名 任职(受雇)单位 在华天数 此行由取得经营 所得的纳税人填 写 经营单位 纳税人识别号 年所得额 所得项目 境内 1、工资、薪金所得 2、个体工商户的生产、经营所得 3、对企事业单位的承包经营、承租经营所 得 4、劳务报酬所得 5、稿酬所得 6、特许权使用费所得 7、利息、股息、红利所得 8、财产租赁所得 9、财产转让所得 其中:股票转让所得 个体房屋转让所得 10、偶然所得 11、其他所得 合 计 我声明,此纳税申报表是根据《中华人民共和国个人所得税法》的规定填报的,我确信它是真实的、可靠的、完整的时间 联系电话 受理申报税务机关名称 境外 合计 应纳税所得额 应纳税额 国籍 任职(受雇)单位 纳税人识别号 境内有效联系地址 经营单位 纳税人名称 已缴(扣) 税额 抵扣税额 减免税额 应补税额 应退税额 备注 填表日期: 身份证件种类 任职(受雇)单位 所属行业 职务 境内有效联系 地址邮编 身份证件号码 职业 联系电话 金额单位:元(列至角分)

个人所得税纳税申报表(中英文对照)Word模板

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份:年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuanof perjury , I declare that this return has been filed according to THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE ' S REPUBLIC OF CHINA and other rele to the best of my knowledge and belief. I guarantee the information provided is true, correct and complete.axpayer ' s signaturPreparer (Other than taxpayer)' s firme number税务机关受理人(签字):税务机关受理时间: 年月日受理申报税务机关名称(盖章):Signature of responsible tax officer : Filing date: Time:Year/Month/Date填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

个人所得税自行纳税申报例题及填报范例

个人所得税自行纳税申报例题及填报范例例解一:年所得中是否包含单位为个人缴付的“三费一金”?答:根据《个人所得税自行纳税申报办法(试行)》(以下简称《办法》)第七条规定,“个人所得税法实施条例第二十五条规定的按照国家规定单位为个人缴付和个人缴付的基本养老保险费、基本医疗保险费、失业保险费、住房公积金”(以下简称“三费一金”)可以不计入年所得12万元之内,具体标准应符合《财政部国家税务总局关于基本养老保险费、基本医疗保险费、失业保险费、住房公积金有关个人所得税政策的通知》(财税[20XX]10号)的规定,单位和个人超过规定的标准缴付的“三费一金”应计入年所得范围内。

因此,在计算年所得时,如果工资、薪金收入中含单位按照国家规定缴付的“三费一金”,则在计算年所得时应将其减除;如果工资、薪金收入中不含这部分收入,则不用再减除(以下的举例均假设个人取得的工资薪金收入不含单位为个人缴付的“三费一金”,且单位为个人缴付的“三费一金”均按国家规定标准缴纳)。

例解二:小赵是我市思明区A公司(非上市公司)的技术骨干并拥有公司的股份。

20XX年,小赵的全部收入及税款缴纳情况如下:(1)全年取得工薪收入188400元,每月收入及扣缴税款情况见下表:(2)取得公司股权分红20XX0元,扣缴个人所得税4000元;(3)20XX年6月份取得银行储蓄存款账户孳生利息收入1200元;(4)购买国债,取得利息收入20XX元;(5)购买企业债券,取得利息收入1500元,没有扣缴个人所得税;(6)出售家庭非唯一住房(原值700000元),取得转让收入860000元,按规定缴纳个人所得税12900元及营业税、契税等其他税费43000元;(7)出租自有商铺给某公司,每月租金3500元,缴纳个人所得税250元,及按国家规定缴纳的营业税等其他税费200元;(8)在上交所转让A股流通股票盈利60000元;(9)持有某上市公司A股股票,取得股息3000元,扣缴个人所得税300元;(10)发明一项专利,让渡给某公司使用,取得收入40000元,扣缴个人所得税6400元(不考虑营业税及附加税费);(11)一次购买体育彩票,中奖9000元。

个人所得税b报税流程

个人所得税b报税流程(一)个人直接到税务机关申报纳税人直接到主管税务机关申报,又分为三种情况,下面将分别讲解:1、申报无征税、补税、退税、抵税该申报流程适用于纳税人在纳税年度内已足额缴纳个人所得税,年度终了后年度纳税申报时,纳税人只需要办理申报事宜,不需要另行办理征税、补税、退税、抵税等事宜。

第一步,纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》第二步,纳税人按照填表要求填写申报表一式两份。

第三步,纳税人直接将申报表、身份证件复印件提交给主管税务机关办税服务厅。

第四步,纳税人留存一份申报表备查。

2、申报征税、补税该申报流程适用于纳税人在纳税年度内没有足额缴纳个人所得税,年度终了后年度纳税申报时,纳税人还需要办理征税、补税事宜。

第一步,纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》第二步,纳税人按照填表要求填写申报表一式两份。

第三步,纳税人直接将申报表、身份证件复印件提交给主管税务机关办税服务厅。

第四步,纳税人执税务机关开具的税收缴款书缴纳税款。

第五步,纳税人留存一份申报表备查。

3、申报退税、抵税该申报流程适用于纳税人在纳税年度内多缴个人所得税,年度终了后年度纳税申报时,纳税人可选择申请当期退税或是申请多缴税金留作下期缴纳个人所得税时抵减。

第一步,纳税人到主管税务机关办税服务厅领取纸质《个人所得税纳税申报表(适用于年所得12万元以上纳税人申报)》第二步,纳税人按照填表要求填写申报表一式两份。

第三步,纳税人提交以下资料给主管税务机关。

(1)当期个人所得税申报表;(2)个人有效身份证件复印件;(3)多缴税款属自行申报的,多缴税款所属时期的纳税申报表复印件;多缴税款属代扣代缴的,扣缴义务人对纳税人多缴税款所属时期实际应税收入情况的书面证明;(4)证明已纳税的个人所得税完税凭证(含税收缴款书、完税证明、代扣代收税款凭证等)原件及复印件(税务机关核对原件与复印件无误后,将原件退回纳税人);(5)《退(抵)税申请审批表》;(6)主管税务机关规定的其他资料。

个人所得税纳税申报表.doc

个人所得税纳税申报表(适用于所得12万元以上的纳税人申报)纳税人任职单位纳税编码纳税人姓名宁波市地方税务局印制个人所得税自行纳税申报办法(试行)规定一、“年所得”是指纳税人在一个纳税年度内取得须在中国境内缴纳个人所得税的11项应纳税所得的合计数额,具体包括:(一)工资、薪金所得;(二)个体工商户的生产、经营所得;(三)对企事业单位的承包经营、承租经营所得;(四)劳务报酬所得;(五)稿酬所得;(六)特许权使用费所得;(七)利息、股息、红利所得;(八)财产租赁所得;(九)财产转让所得;(十)偶然所得;(十一)经国务院财政部门确定征税的其他所得。

二、年所得12万元以上的个人,如果没有在纳税申报期内办理纳税申报,要负相应的法律责任:(一)根据《税收征管法》第六十二条规定,如果纳税人未在规定期限内(即纳税年度终了后3个月内)办理纳税申报和报送纳税资料的,由税务机关责令限期改正,可以处2000元以下的罚款;情节严重的,可以处2000元以上1万元以下的罚款。

(二)按照《税收征管法》第六十四条第二款的规定,如果纳税人不进行纳税申报,因此造成不缴或者少缴税款的,由税务机关追缴其不缴或者少缴的税款、滞纳金,并处不缴或者少缴的税款50%以上5倍以下的罚款。

三、年得12万元的纳税人,应办理纳税的地点:《办法》规定,年所得12万元以上的纳税人,年度终了后的纳税申报地点应区别不同情况按以下顺序来确定,具体为:(一)在中国境内在任职、受雇单位的,向任职、受雇单位所在地主管地税机关申报。

(二)在中国境内有两处或者两处以上任职、受雇单位的,选择并固定向其中一处单位所在地主管地税机关申报。

(三)在中国境内无任职、受雇单位,年所得项目中有个体工商户的生产、经营所得或者对企业事业单位的承包经营、承租经营所得(以下统称生产、经营所得)的,向其中一处实际经营所在地主管地税机关申报。

(四)在中国境内无任职、受雇单位,年所得项目中无生产、经营所得的,向户籍所在地主管地税机关申报。

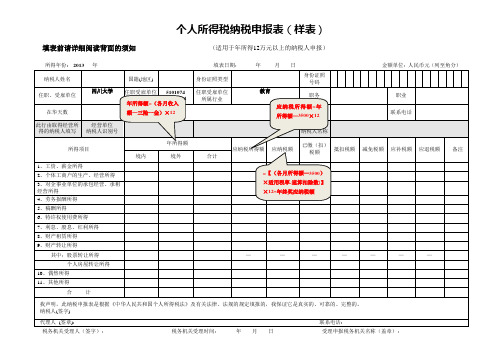

个人所得税纳税申报表(样表)

个人所得税纳税申报表(样表)填表前请详细阅读背面的须知(适用于年所得12万元以上的纳税人申报)所得年份: 2013 年填表日期:年月日金额单位:人民币元(列至角分)税务机关受理人(签字):税务机关受理时间:年月日受理申报税务机关名称(盖章):填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1.所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2.身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

3.身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4.任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5.任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6.任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

其中,行业应按国民经济行业分类标准填写,一般填至大类。

7.职务:填写纳税人在受理申报的任职、受雇单位所担任的职务。

8.职业:填写纳税人的主要职业。

9.在华天数:由中国境内无住所的纳税人填写在税款所属期内在华实际停留的总天数。

10.中国境内有效联系地址:填写纳税人的住址或者有效联系地址。

其中,中国有住所的纳税人应填写其经常居住地址。

中国境内无住所居民住在公寓、宾馆、饭店的,应当填写公寓、宾馆、饭店名称和房间号码。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 RMB Yuan)所得年份:年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB YuanPreparer (Other than taxpayer)’s firm Filing date: Time: Year/Month/Date Responsible tax office:填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1.所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2.身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、港澳台通行证等)名称。

3.身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4.任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5.任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6.任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

其中,行业应按国民经济行业分类标准填写,一般填至大类。

7.职务:填写纳税人在受理申报的任职、受雇单位所担任的职务。

8.职业:填写纳税人的主要职业。

9.在华天数:由中国境内无住所的纳税人填写在税款所属期内在华实际停留的总天数。

10.中国境内有效联系地址:填写纳税人的住址或者有效联系地址。

其中,中国有住所的纳税人应填写其经常居住地址。

中国境内无住所居民住在公寓、宾馆、饭店的,应当填写公寓、宾馆、饭店名称和房间号码。

经常居住地,是指纳税人离开户籍所在地最后连续居住一年以上的地方。

11.经营单位纳税人识别码、纳税人名称:纳税人取得的年所得中含个体工商户的生产、经营所得和对企事业单位的承包经营、承租经营所得时填写本栏。

纳税人识别码:填写税务登记证号码。

纳税人名称:填写个体工商户、个人独资企业、合伙企业名称,或者承包承租经营的企事业单位名称。

12.年所得额:填写在纳税年度内取得相应所得项目的收入总额。

年所得额按《个人所得税自行纳税申报办法》的规定计算。

各项所得的计算,以人民币为单位。

所得以非人民币计算的,按照税法实施条例第四十三条的规定折合成人民币。

13.应纳税所得额:填写按照个人所得税有关规定计算的应当缴纳个人所得税的所得额。

14.已缴(扣)税额:填写取得该项目所得在中国境内已经缴纳或者扣缴义务人已经扣缴的税款。

15.抵扣税额:填写个人所得税法允许抵扣的在中国境外已经缴纳的个人所得税税额。

16.减免税额:填写个人所得税法允许减征或免征的个人所得税税额。

17.本表为A4横式,一式两联,第一联报税务机关,第二联纳税人留存。

Instructions一、This return is designed in accordance with THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE’S REPUBLIC OF CHINA, THE IMPLEMENTING RULES OF THE INDIVIDUAL INCOME TAX LAW OF THE PEOPLE’S REPUBLIC OF CHINA and THE RULES CONCERNING INDIVIDUAL INCOME TAX SELF DECLARATION(provisional), and is applicable for individuals with an annual income of reach 120,000 Yuan.二、Taxable individuals are obliged to fill out and submit the return to the local tax authority within 3 months after the end of the tax year, either by themselves or other entrusted prepares. In case of inability to file the return within the prescribed time limit, an application should be submitted to the local tax authority within prescribed time limit and upon the tax authority’s approval, the filing deadline may be extended.三、The return should be filled out in Chinese or in both Chinese and a foreign language.四、Instructions for filling out various items:1、Year of income incurred and Date or filling:Year of income incurred: The year in which the taxpayer receives the income.Date or filling: the actual date when the return is filed.2、ID Type:The name of the valid identification certificate of the taxpayer(ID Card, passport, solider certificate, military officer certificate, permit for residents Hong Kong / Macau / Taiwan to Chinese mainland, etc.)3、ID number:The number of the valid identification certificate of the taxpayer.4、Employer:The taxpayer’s employer. The name of the employer for the reporting shall be filled if there are more than one employer.5、Employer’s Tax ID Code:The ID code of the taxpayer’s employer registered at tax authority either as a taxpayer or as a withholder.6、Industry of Employer:The industry a taxpayer’s employer belongs to. It should fall into the general categories of the Categorization of National Economy Industries.7、Title:The taxpayer’s official rank at his/her employer.8、Profession:The main profession of the taxpayer.9、Days of stay in China:The actual days stayed in China by a taxpayer without a permanent residence during the tax due period.10、Address in China:The address or the effective contacting address of the taxpayer. For a person without a residence who lives in a hotel, it means the room number and hotel name.11、Taxpayer’s Tax ID code and Taxpayer’s Name:Tax ID Code of the business: The number on the tax registration certificate.Name of the business: The name of the taxable self-employed industrial and commercial households, individually-invested enterprises, partnerships, individually-invested or partner-invested private non-enterprises, or enterprises or social service providers partly or wholly funded by state assets under contracted or leased operation.12、Annual Income:The total amount of the corresponding items of income in the tax year. The annual receipts income is calculated in accordance with THE INPLEMENTING RULES OF THE INDIVIDUAL INCOME TAX LAW OR THE PEOPLE’S REPUBLIC OF CHINA and THE LAW OF PEOPLE’S REPUBLIC OF CHINA CONCERNING ADMINISTRATION OF COLLECTION.The calculation shall be in RMB Yuan. Those in foreign currencies shall be converted to the RMB Yuan on the basis of the foreign exchange rate quoted by the competent state foreign exchange authority.13、Taxable income:The part of an income which is subject to the individual income tax.14、Tax pre-paid and withheld:The amount of the tax paid or withheld for the current items of income within China.15、Tax credit:The amount of individual income tax paid outside China that it to be credited against in accordance with the Individual Income Tax Law.16、Tax exempted or deducted:The amount of individual income tax which is to be exempted or deducted in accordance with the Individual Income Tax Law.17、There shall be two original copies of this table in A4 format. One is for the taxpayer and the other is for the tax office for record.。