The Economist - manufacturing in China(1)

中国的进步与发展英语新闻摘抄

中国的进步与发展英语新闻摘抄An English News Digest":China's rapid economic growth and technological advancements have been the subject of extensive global attention in recent years. As the world's second-largest economy, China's progress has had a significant impact on the global landscape, transforming not only its own society but also the international community. This essay aims to provide an overview of some of the key developments in China's progress and development, drawing from recent English news reports.One of the most notable aspects of China's progress has been its sustained economic growth. According to a report by the World Bank, China's GDP grew by 8.1% in 2021, outpacing the global average and demonstrating the resilience of the Chinese economy despite the challenges posed by the COVID-19 pandemic. This growth has been driven by a range of factors, including the country's continued investment in infrastructure, the expansion of its manufacturing and service sectors, and the rise of its burgeoning tech industry.The growth of China's tech sector has been particularly impressive, with the country emerging as a global leader in areas such as artificial intelligence, e-commerce, and renewable energy technology.A recent article in The Economist highlighted the rapid development of China's electric vehicle (EV) industry, noting that the country now accounts for over 50% of global EV sales. This progress has been driven by government policies that incentivize the adoption of EVs, as well as significant investments in research and development by Chinese tech companies.Another area of progress in China has been its efforts to address environmental challenges. The country has made significant stridesin transitioning to renewable energy sources, with a report by the International Energy Agency indicating that China is the world's largest producer and consumer of renewable energy. This shift has been driven by ambitious government targets for renewable energy production, as well as the rapid expansion of the country's solar and wind power industries.China's progress has also been evident in its efforts to improve the quality of life for its citizens. A recent article in The New York Times highlighted the country's investments in public transportation, noting that China has built the world's largest high-speed rail network, connecting major cities and reducing travel times for millions of people. Additionally, the government has madesignificant investments in healthcare and education, with the goal of improving access to these essential services for all Chinese citizens.However, it is important to note that China's progress has not been without its challenges. The country has faced criticism from the international community on issues such as human rights, trade practices, and geopolitical tensions. Additionally, the rapid pace of economic and social change has led to widening income inequality and environmental degradation in some regions.Despite these challenges, China's progress and development over the past several decades have been truly remarkable. The country's transformation from a largely agrarian economy to a global powerhouse has been a testament to the resilience and ingenuity of the Chinese people, as well as the effectiveness of the country's economic and social policies. As China continues to evolve and adapt to the changing global landscape, it will undoubtedly play an increasingly important role in shaping the future of the world.。

外刊每日精读 Making trouble

外刊每日精读 | Making trouble文章脉络【1】看重制造业的国家都有工业战略,但是英国没有。

【2】英国对自己的可再生能源产业非常自满。

【3】安迪·霍尔丹称英国很可能在这场再工业化军备竞赛中落后。

【4】与中国相比,西方在绿色技术方面觉醒地太晚了。

【5】英国想要成为一个制造业“超级大国”还有一段路要走。

【6】英国不再是一流的制造业经济体,而且几十年以来都不是。

【7】戴森最近宣布将把电池工厂建在新加坡,这也完美诠释了英国现在正面临的挑战。

【8】戴森没有选择在英国建厂有多重原因。

【9】英国进行高价值的脑力劳动,其他国家负责生产的想法已经不再符合实际。

【10】国家相关战略的缺失让制造商处于竞争劣势。

【11】缺少合适的、有规划的工业战略是英国的致命弱点。

【12】从行动来看,英国似乎并没有参与竞争。

经济学人原文Making trouble:UK needs an industrial strategy to compete in manufacturing【1】Countries that are serious about manufacturing have industrial strategies.The US and China have one. So do Germany and France. Britain does not . Rishi Sunak talks about turning the UK into a “science and technology superpower” but that’s all it is: talk. It is a PR strategy masquerading as an industrial strategy.【2】Faced with the challenge presented by Joe Biden’s inflation reduction act (IRA), the government says it has no need to respond to the package of green subsidies being provided by Washington because Britain has already established a thriving renewables sector and the Americans are playing catch up. The complacency is staggering.【3】Andy Haldane , once the Bank of England’s chief economist and now the chief executive of the Royal Society of Arts, last week said: “The world is facing right now an arms race in re-industrialisation. And I think we’re at risk of falling behind in that arms race unless we give itthe giddy-up.”【4】China, Haldane added, had been focusing on green technology for many, many years and had forged ahead in tech such as solar and batteries. “The west has belatedly woken up,” he said. “The IRA is throwing cash to the wall on that. The cost of that [is] almost certainly north of half a trillion dollars. Possibly north of $1tn. The EU is now playing catch up, [and] the UK currently is not really in the race at any kind of scale.”【5】A quick glance at the latest trade figures shows Britain has some way to go to be a manufacturing“superpower”.manufacturing’s share of the economy shrank from more than 30% to less than 10% of national output in Elizabeth II’s reign. The goods deficit, last in surplus in the early 1980s, stood at £55bn in the first three months of this year, with imports more than 50% higher than exports. A £40bn quarterly surplus in services was not enough to close the trade gap.【6】Those who supported Brexit say the UK now has the freedom to export more to faster growing parts of the world economy . Those who opposed it say exporting to the EU has become more burdensome. Both are right, but both are missing the point. Before Britain can take advantage of export opportunities it has to have stuff to export. The fact is the UK is no longer a firstrank manufacturing economy and hasn’t been for decades.【7】Dyson’s recent announcement that it will build a battery factory in Singapore is a perfect illustration of the challenge facing the UK. There was never the remotest possibility that the plant would be in the UK due to what its founder James Dyson, a prominent Brexit supporter, called in a letter to the Times, t he “scandalous neglect” of science and technology businesses.【8】Only part of the company’s reluctance to manufacture in the UK is due to the recent jump in corporation tax, though that wipes out any benefit from tax breaks for research and development. It is also the planning system, the lack of trained engineers, the disdain shown for science and technology, and government interference in the way businesses are run.【9】The company says the UK will remain a centre for R&D, and it will invest £100m in a new tech centre in Bristol for software and AI research. But the idea that Britain can do all the high-value brain power stuff while other countries do the production is an illusion. Increasingly, Dyson’s R&D happens in Singapore, the site of its global HQ, and in the Philippines.【10】Dyson is by no means alone. A report by the lobby group Make UK found that six in 10manufacturers thought government had never had a longterm vision for manufacturing, while eight in 10 considered the absence of a strategy put their company at a competitive disadvantage compared with other manufacturing nations. It is no surprise that AstraZeneca recently announced it was building its new factory in Ireland .【11】Stephen Phipson, Make UK ’s chief executive , said last week the US was spending 1.5% of national output on its IRA. The equivalent sum in the UK would be £33bn. It was not just the money, though. “A lack of a proper, planned industrial strategy is the UK’s achilles heel ,” Phipson said. “Every other major economy, from Germany, to China, to the US, has a long-term national manufacturing plan, underlying the importance of an industrial base to the success of its wider economy. The UK is the only country to not have one.“If we are to not only tackle our regional inequality, but also compete on a global stage, we need a national industrial strategy as a matter of urgency.”【12】One option is to concentrate instead on sectors where the UK does have global clout: financial and business services, for example. In that case, the pretence has to stop that levelling up will be delivered by new factories turning out world-beating products.The government can either make Britain an attractive place for manufacturing companies to invest or it can decide not to compete. Judged by its actions rather than by its rhetoric, it seems to have chosen the latter option.。

中国制造的现状英语作文

中国制造的现状英语作文英文回答:Current State of Manufacturing in China。

China's manufacturing sector has undergone asignificant transformation over the past several decades, evolving from a primarily labor-intensive industry to a highly competitive, technology-driven engine of growth.Labor Costs and Competitiveness。

Historically, China's manufacturing competitiveness has been driven by its abundant and relatively low-cost labor force. However, as the country's economy has developed and wages have increased, labor costs have become a less significant factor. Chinese manufacturers have responded by investing in automation and technology to enhance productivity and remain competitive globally.Technology and Innovation。

In recent years, China has made substantial investments in research and development, leading to the emergence of a growing number of innovative manufacturing companies. These companies are leveraging cutting-edge technologies such as artificial intelligence, robotics, and additive manufacturing to optimize production processes and create value-added products.Industrial Upgrading。

高考英语时事新闻语法填空---货币多极化日趋明晰,如何辨认AI作画破绽

The rising use of the RMB helps boost world financial stability货币多极化趋势日益明晰Recently, there 1___________(be) a rise in the global use of the Chinese renminbi in trade, financing and reserve management.China and Brazil reached a deal to trade in their own currencies (货币) on March 29. This means that people can exchange the Chinese renminbi for reais (雷亚尔) and vice versa (反之亦然), instead of going through the US dollar.The Brazilian central bank said on March 31 that the renminbi 2___________(surpass) (超过) the euro and is now the second-biggest share of Brazil’s international exchange reserves.China serves 3_________ a manufacturing powerhouse (制造业大国) and the renminbi’s value is stable. These two factors have contributed to the growing role of the renminbi, experts said.The 4_________(rise) use of the renminbi will contribute to global financial 5 ______________(stable) . A more diversified international monetary (货币的) system – as opposed to a dollar-centered one –_6__________(help) reduce the risks brought by fluctuations (波动) in the dollar’s value caused by ongoing US financial turmoil (混乱) and increasing US government debt, according to Shao Yu, chief economist at Orient Securities.What’s more, the use of the renminbi creates a win-win situation for China as well as its trade and investment partners. It can reduce the losses 7___________(cause) by exchange rate fluctuations.According to Huang Yiping, an expert at Peking University, if a country uses its own currency to trade, it can also solve the problem of currency mismatch (货币错配). Huang said that many developing countries usually have debts in foreign currencies, mainly the US dollar.8_________, their assets (资产) are generally in their own currencies. “Normally it’s balanced, but 9_______ something happens and a country’s currency depreciates (贬值), its assets will be not enough 10 ___________(pay) for the debts, which might lead to panic and financial crisis,” Huang said.参考答案:1 has been 2 had surpassed 3 as 4 rising 5 stability 6 caused 7 helps 8 However 9 if 10 to pay重点词汇积累1 reach a deal达成协议2 trade贸易3 exchange交流,交换4 share 份额5 reserve储备6 manufacturing7 stable---stablility稳定8 contribute to导致9 global全球10 financial金融的11 diversified多元化122 ongoing持续的13 Securities14 investment投资15 loss损失16 debt债务17 generally一般18 asset资产19 panic恐慌20 crisis危机PS:However, experts noted that there remains a big gap between the renminbi’s global profile anddeveloped economies’ currencies. The renminbi’s share of global foreign exchange reserves (外汇储备) stood at 2.69 percent in the fourth quarter of 2022. It ranked fifth among all reserve currencies but was much less than the dollar’s 58.36 percent, data from the International Monetary Fund (国际货币基金组织) showed on March 31.Ways to tell if an image is made by AI 如何一眼识破人工智能画作的“破绽”?Artificial intelligence (AI) has been increasingly good at fooling people. A series of photos 1_____________(show) former US president Donald Trump being aggressively arrested by police have caught people’s attention. They were fake 2__________ very convincing.Created by the AI program Midjourney, the photos were highly realistic, from the characters’ movements 3 ________ the surroundings.4 ___________, many details can give away the fact that they 5 ____________(make) by AI. The Washington Post’s technology writer Shira Ovide shared her tips. The main idea is to spot the glitches – anything 6___________ would look strange in a photo.AI software has a history of generating human hands incorrectly. It sometimes can create hands with more than five fingers. This is7 __________AI isn’t sure what a “hand” exactly is, according to Popular Science. The data AI uses to learn often show hands and fingers in various gestures, which can be very 8_____________(confuse) for AI.AI-generated images also usually contain details that defy (违背) reality. 9_________(spot) this, focus on items like accessories. For example, people in an image may be missing earrings or one part of their sunglasses.Another thing AI is terrible at handling is the background. If there’s a crowd in the image, people’s faces in the background are 10____________(usual) blurry – or they don’t have faces at all!参考答案:1 showing 2 but 3 to 4 However 5 are made 6 that 7 because 8 confusing 9 To spot 10 usuallyPS:The development of AI-generated art also raises alarm bells about how these fake images could be used to spread misinformation (不实信息). “I think misinformation is going to hit an all-time high,”Jamie Cohen, a digital culture and AI expert in the US, told New York Post. Generating an AI artwork is to “create reality”, Cohen argued, adding that being able to tell whether the work is real or not requires high media literacy (素养) skills. “The world may not be ready for how realistic the images have become,” Shane Kittelson, a US researcher, told The Washington Post.英国百年剧院于3月末关闭The Oldham Coliseum in the UK brought down the curtain for the final time 1________March 31 after Arts Council England (ACE) axed (削减) its £1.8 million (about 15.14 million yuan) grant, reported The Guardian.This news made many people feel heartbroken.2_____________( establish) in 1885, the Oldham Coliseum established itself as an important place for _3_______________(entertain) before World War I. According to the website About Manchester, the famous comedian Charlie Chaplin once performed pantomime (默剧) in front of audiences numbering around 2,000 there. It was also a stage for opera and melodrama (情节剧) 4__________brought much delight for residents in the city.The Oldham Coliseum was “not just theater,5__________ a community center and a safe haven,” BBC News noted. “[It gave] the population an identity, hope, pride and an outlet to express and to witness.”Though the cotton town of Oldham declined 6________the early 20th century and many local people couldn’t afford tickets 7_____________(attend) shows, the theater “rose from the ashes (废墟)” once again as a receiving house for touring productions, visiting companies and special one-night events later on. That helped “launch the careers of local actors”, reported The Guardian.At that same time, the theater produced some of 8_________best work and was hard at work representing the local community with various shows, events and gigs (现场演出).“The Oldham [was] a new kind of people’s theater. It’s 9___________(true) ‘owned’ by its audience, its artists and its participants,” stated Ian Tabbron, former senior relationship manager of ACE, on the theater’s website.Though its closure 10_____________(upset) many, there’s still good news to give them comfort. As The Guardian noted, a new venue will be opened to carry on Oldham Coliseum’s cultural legacy (遗产).参考答案:1 on 2 Established 3 entertainment 4 which 5 but 6 in 7 to attend 8 its 9truly 10 upsets。

经济学人信息部3月30日发布:纵观中国的海外并购

© Economist Intelligence Unit 2010

3

勇闖新天地 縱觀中國的海外併購

編者按

諸

多迹象顯示中國經濟實力呈持續增長態勢,其中一個現象就是尋求在海外收購資產的 中國公司數量急劇增長。2009年,當發達經濟體仍然在全球金融危機的泥沼中舉步維

艱時,中國公司進行跨國收購的數量卻創下了新的歷史記錄,總數約298宗。許多中國投資都 深受資金短缺的西方企業歡迎,因為如果沒有中國的投資,它們將面臨嚴峻的生存危機。然 而,中國的大肆收購卻引發了諸多憂慮,尤其當有中國國有企業參與海外競購時,這種擔憂 便愈發強烈。與此前的西方同行一樣,中國企業逐漸意識到要順利完成併購絕非易事,進行 跨國併購尤為如此。 在《勇闖新天地:縱觀中國的海外併購》(A brave new world: The climate for Chinese M&A abroad)報告中,我們試圖瞭解這些計劃進行海外資產收購的中國企業的擔憂與期望,並試圖 為這些企業提供一個視角,讓它們能夠瞭解潛在併購對象和國外監管機構所存在的關切。 以下是我們調查研究得出的一些重要結論:

• 調整思路,下調收購股權。過去中國競購企業總是尋求對其收購對象的完全控股,或至少

在管理上對其實施掌控。我們對2004年至2009年的5,000萬美元以上的交易進行分析,其中 半數交易涉及收購對象50%-100%的股權,另外13%的交易涉及收購對象25%-50%的股權(中 方企業雖為少數股東,但仍占相當股份)。但是諸多迹象表明,中國競購企業已經意識到由 於種種原因,這種收購思路也許並非最佳,特別是因為它可能引起外國公眾和監管機構的警 惕。在表示確定進行或很有可能進行海外投資的受訪者中,47%的受訪者表示他們傾向於成立 合資企業(占29%)或企業聯盟(占18%),只有27%的人表示他們會採取收購的方式。

Unit 1 The three sectors of the economy

• The economist J.K. Galbraith • He don't think it is possible to stop this progressive change in the patterns of human consumption. It is inevitable.

2. The secondary sector manufacturing industry, in which raw materials are turned into finished products. All of manufacturing, processing and construction. (smelting iron, cutting mental,milling mental, pressing metal, wilding mental,assembling,building)

3. The tertiary sector the commercial services that help industry produce and distribute goods to the final consumer, as well as activities such as education, health care, leisure, tourism, and so on.

1 . Small investment, method to expend employment ,to ensure social stability,improve people's living standards and the quality of life.

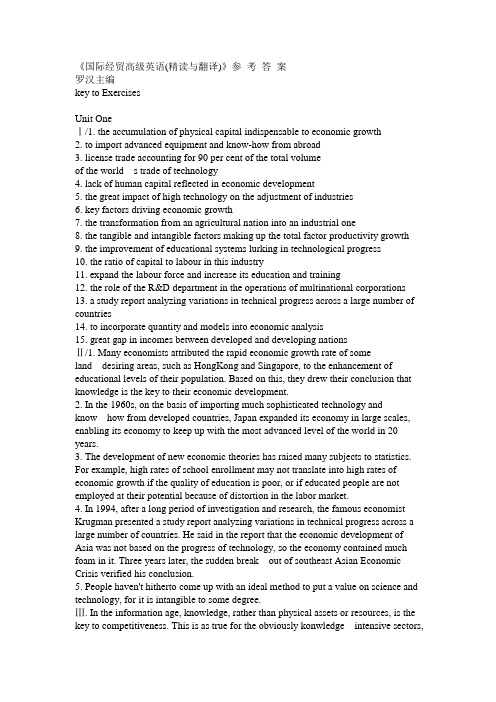

国际经贸高级英语

《国际经贸高级英语(精读与翻译)》参考答案罗汉主编key to ExercisesUnit OneⅠ/1. the accumulation of physical capital indispensable to economic growth2. to import advanced equipment and know-how from abroad3. license trade accounting for 90 per cent of the total volumeof the world s trade of technology4. lack of human capital reflected in economic development5. the great impact of high technology on the adjustment of industries6. key factors driving economic growth7. the transformation from an agricultural nation into an industrial one8. the tangible and intangible factors making up the total factor productivity growth9. the improvement of educational systems lurking in technological progress10. the ratio of capital to labour in this industry11. expand the labour force and increase its education and training12. the role of the R&D department in the operations of multinational corporations13. a study report analyzing variations in technical progress across a large number of countries14. to incorporate quantity and models into economic analysis15. great gap in incomes between developed and developing nationsⅡ/1. Many economists attributed the rapid economic growth rate of someland desiring areas, such as HongKong and Singapore, to the enhancement of educational levels of their population. Based on this, they drew their conclusion that knowledge is the key to their economic development.2. In the 1960s, on the basis of importing much sophisticated technology andknow how from developed countries, Japan expanded its e conomy in large scales, enabling its economy to keep up with the most advanced level of the world in 20 years.3. The development of new economic theories has raised many subjects to statistics. For example, high rates of school enrollment may not translate into high rates of economic growth if the quality of education is poor, or if educated people are not employed at their potential because of distortion in the labor market.4. In 1994, after a long period of investigation and research, the famous economist Krugman presented a study report analyzing variations in technical progress across a large number of countries. He said in the report that the economic development of Asia was not based on the progress of technology, so the economy contained much foam in it. Three years later, the sudden break out of southeast Asian Economic Crisis verified his conclusion.5. People haven't hitherto come up with an ideal method to put a value on science and technology, for it is intangible to some degree.Ⅲ. In the information age, knowledge, rather than physical assets or resources, is the key to competitiveness. This is as true for the obviously konwledge intensive sectors,such as software or biotechnology, as it is for industrial age manufacturing companies or utilities.For the knowledge intensive sectors,knowledge which feeds through from research and development to innovative products and processes is the critical element. Butwith industrial age manufacturing companies or utilities, using knowledge aboutcustomers to improve service is what counts.What is new about attitudes to knowledge today is the recognition of the need to harness, manage and use it like any other asset. This raises issues not only of appropriate processes and systems, but also of how to account for knowledge in the balance sheet.In future, the value of intellectual capital will be more widely measured and reported. The measurement and reporting of key performance indicators related to intellectual capital will become a more widespread practice among major organizations, completing the financial accounts.Unit TwoⅠ/1. to crack the FORTUNE Global 5002. a collective enterprise supervised by workers3. be pessimistic about the factory s ability to absorb technology4. the incorporation (mix)of foreign management practices and Chinese nationalism5. a leading guru of Japanese quality control6. to transfer the management concepts to new acquisitions7. the dominant position in China s refrigerator market8. a case study of the management art9. to let shoddy products released to the market in large quantities10. to set the stage for the renovation of the enterprise11. the wholly-owned companies and holding companies under the control of the parent company12. to soak up the laid-offs released from state owned companies13. to sell modern refrigerator making technolog y to the factory14. the state-owned enterprises accounting for the majority of industrial enterprises15. the development of domestic pillar industriesⅡ/1. Although this joint venture has been growing very fast, it still has a long way to go to realize its goal of cracking the Fortune Global 500.2. Haier once tried to place the sample products in sight of the assembly line workers to improve the quality of the products, but now it has outgrown thispractice.3. In the early 1980s, out of every 1000 urban Chinese households, there were only two or three that owned refrigerators. With the enhancement of people's livingstandard, refrigerators have become the first big item in the households buy of many families.4. The company has 70 subsidiaries around the world, one third of which arewholly-owned, with their products sold to 108 countries and areas. In recent years, it has averaged an increase of 50% a year in revenues.5. The rapid development of collective and private enterprises will help to soak up the labour force released from poorly operated state-owned enterprises and to relieve the nation's employment burden.Ⅲ. Many managers feel uncomfortable if not actively involved in accomplishing a given job. This is said to result from a“low tolerance for ambiguity”. The manager desires to know what is happening on a moment by moment basis. A wise manager should know clearly what work must be delegated, and train employees to do it. If after training, an employee is truly unable to perform the work, then replacement should be considered. A manager should avoid reverse delegation.This happens when an employee brings a decision to the manager that the employee should make. An acceptance of reverse delegation can increase the manager'swork load and the employee is encouraged to become more dependent on the boss. Unit ThreeⅠ/1. to issue a vast amount of short term government bonds2. plenty of capital inflow to the security market in the recent period3. the preference of investors to the inflation protected treasury bonds4. to decrease the risk by hedging5. diversified portfolio6. to reach more than 50% of the initial public offering7. dilution of securities caused by the distribution of shares8. the trigger event that causes the imploding on market index9. short maturity U.S. government and corporate fixed income secu r ities10. real assets like commodities and real estate11. to avoid insider-trading charges through legal windows12. some trigger events that will charge the interest rate in the capital market13. reflect investors' wary view of the market14. shepherd the funds every step of the way15. the agriculture bonds that come back in the stock marketⅡ/1. During the past several months, the interest rate and the exchange rate have fluctuated greatly, which has brought enormous loss to many investors. But this institution overrode the adverse factors in the market and still obtained a big profit by wise hedging investments.2. The diversification of portfolio can decrease the non-systematic riskof individual securities in the portfolio efficiently, but it is unable to remove the systematic risk of the market.3. During the period of high inflation in capitalist countries between the late 1960s and late 1970s, many people tended to convert their money incomes into goods or real estate.4. One of the Bundesbank council members said that the central bank is under no immediate pressure to cut interest rates and that it needs more time to study the economic data before making a decision.5. Many experts consider that the interest rates would trend higher, because, although it is true that there is not much inflation now, wage inflation is evidentand the entire economy is in such high gear right now.Ⅲ. For all the similarities between the 1929 and 1987 stock market crashes, there are one or two vital differences. The most important of these was the reaction of the financial authorities. In 1929, the US Federal Reserve reacted to the crash by raising interest rates, effectively clamping down on credit. This caused manyotherwise healthy companies to fail simply due to cash flow problems. If onecompany failed leaving debts, many others down the line would meet the same fate. In 1987, the authorities were quick to lower interest rates and to ensure that ample credit was made available to help institutions overcome their difficulties. There were no widespread business failures and, more importantly, the economy did not enter another depression. There was a period of recession(milder than a 1930s-style depression), but this was largely due to a resurgence of inflation. The sharp interest rate cuts, and excessively hasty financial deregulation, pushed inflation higher, which in turn forced governments to reverse earlier interest rate cuts, prompting an economic slow-down.Unit FourⅠ/1. to rely heavily on monetary flexibility to reign in inflation2. to execute tight monetary policy3. to implement fiscal policy in the form of social insurance and national taxes4. to pour into economically expanding regions5. to replace their individual currencies with a single currency6. to bode well for the future of the EMU7. to control government deficits to meet Maastricht conditions8. the overvalued currency as a main barrier to export9. to refrain from dumping surplus goods abroad10. the influence of integrated economy on capital flow11. the balance-of-payments deficit warranting the devaluation policy adopted by the monetary authority12. to eliminate the economic costs associated with holding multiple currencies13. costs that must be taken into account when estimating profits14. to take advantage of the small difference between the central bank's pegged rates and market rates15. to hedge against risks coming from volatile exchange ratesⅡ/1. Ironically, Europe will see an increase in economic specialization along with the European unification process.2. The European Central Bank will face a dilemma when two member countries both badly need certain monetary policies to regulate their economies but the policies they need are of opposite directions.3. A person will be called an“arbitrageur"if, to gain profits, he takes advantage of the different exchange rates on different markets, or at different times on a same market.4. The national economies of many European countries have recently been forced to fit Maastricht conditions and arbitrary deadlines, and such actions have created unnecessary economic turmoils.5. As a central bank, the Federal Reserve System currently uses its control over the money supply to keep the national inflation rates low and to expand national economies in recession.Ⅲ. Even before construction of the euro is complete, governments can point to one notable success. The past year has seen extraordinary turmoil in global financial markets. Rich country stock markets and currencies have not been spared. Yet Europe has been, comparatively speaking, a safe haven, Intra-European movements in exchange rates have been tiny. This is something that the euro-11 governments had committed themselves to, but their success could not have been taken for granted a year ago. The fact is, at a time of unprecedented financial turbulence, theforeign exchange markets regarded the promise to stabilize intra-European exchange rates as credible. Currencies have held steady and interest rates have converged: it augurs well for the transition to the new system.Unit FiveⅠ/1. a major engine of growth in Asian economy2. the structural weakness in South Korea's financial system3. to execute economic policies which adhere to IMF-aid programs4. a sharp decline in the price competitiveness of that country's exports5. the slump in the Japanese stock market6. a more advantageous position than its rivals in terms of price competitiveness7. trade disputes sparked by price distortion8. the financial panic triggered by the devaluation of Japanese yen9. to stabilize the recently turbulent capital flows10. the advantageous position of industrial countries in the world trade system11. the serious welfare losses for all nations resulted from a full scale trade war12. a USD 58 billion bailout which South Korea was forced to seek from the IMF13. the great expenditure caused by huge government institutions14. technology intensive and knowledge intensive products with high competitiveness15. the country's economy which remains mired in recessionⅡ/1. While the Asian economy regained stability, the possibility of devaluation of the HongKong dollar will be an important variable affecting the recurrence of similar economic crises in Asia.2. In order to connect the improvement of price competitiveness brought about bythe currency depreciation to a better balance of payment, internationalcooperation is as essential as are internal reforms.3. The Asian financial crisis owing to the heavily indebted banking systems,excessive government spending and over reliance on foreign loans has damaged the world economy seriously.4. Some Japanese companies began to fall out of their over reliance on loansfrom the banking system, focusing on profits and cutting out wasteful spending.5. Erupted in July 1997, the Asian financial crisis reflected the defectsin the fragile financial systems of Asian countries.Ⅲ. Like death and taxes, international economic crises cannot be avoided. Theywill continue to occur as they have for centuries past. But the alarmingly rapid spread of the 1997 Asian crisis showed these economies' vulnerability to investor skittishness. Unfortunately, there is no international“911" that emerging markets can dial when facing economic collapse. Neither the IMF nor a new global financial architecture will make the world less dangerous. Instead, countries that want toavoid a rerun of the devastating 1997—98 crisis must learn to protect themselves. And liquidity is the key to financial self help. A country that has substantial international liquidity—large foreign currency reserves and a ready source offoreign currency loans—is less likely to be the object of a currency attack. Substantial liquidity also enables a country already under a speculative siege to defend itself better and make more orderly financial adjustments. The challenge is to find ways to increase liquidity at reasonable cost.Unit SixⅠ/1. capital flight depleting a country s foreign exchange reserves2. domestic hyperinflation caused by devaluation3. to adopt expansionary fiscal policy to increase national income4. be faced with the danger of increasingly shrinking aggregate demand5. capital market harassed by liquidity trap6. to rule out the possibility of massive speculative activities7. to drive down domestic prices at the expense of economic stagnation8. the international gold standard system characterized by fixed exchange rates9. the pressure of hot money flow on currencies10. the neoclassical theory centering on the spontaneous adjustments of market11. intelligent policy makers who will use variable means to achieve economic goals12. flexible fiscal and financial policies that can help the economy out of depression13. the different dilemmas that the developing countries and the mature economies are faced with14. to sacrifice full employment to achieve high output rate15. the increased demand for this currency that will lead to the devaluation of another currencyⅡ/1. The economic turmoil in that country made the central bank and the treasury department take each other to task, which reflected the importance of the collaboration of a country s monetary and fiscal policies.2. The government has now slipped into such a dilemma that if it wants toimprove its balance of payment, it will need to lower the exchange rate, but to lower the exchange rate will lead to inflation.3. Although devaluation will magnify exports, it can also lead to the increasing foreign curren cy denominated debt;it can even cause the collapse of people's confidence in the government. Therefore, the government did not dare to adopt the devaluation policy without careful consideration.4. The increase of foreign currency denominated debt is not necessarilythe indispensable cost of economic development. Because, although it may promote economic growth in the short run, it will increase the burden of domestic enterprises and lead to imbalanced balance of payment in the long run.5. Major capitalist countries had been seeing gold standard as a symbol of strong economic power, but they were forced to give it up for good during the Great Depression.Ⅲ. Troubled Asian Economies have turned out to have many policy and institutional weaknesses. But if America or Europe should get into trouble next year or the year after, we can be sure that in retrospect analysts will find equally damning things to say about Western values and institutions. And it is very hard to make the case that Asian policies were any worse in the 1990s than they had been in previous decades, so why did so much go so wrong so recently?The answer is that the world became vulnerable to its current travails not because economic policies had not been reformed, but because they had. Around the worldcountries responded to the very real flaws in post Depression policy regimes bymoving back toward a regime with many of the virtues of pre-Depressionfree-market capitalism. However, in bringing back the virtues of old fashioned capitalism, we also brought back some of its vices, most notably a vulnerability both toinstability and sustained economic slumps.Unit SevenⅠ/1. government reforms compatible with a country's development program2. lay emphasis on the resolution of government involvement3. the state induced transfer of wealth from the rich to the less fortunate4. to finance the development of public sectors5. a sharp decrease in the subsidy expenditure of a welfare state6. to minimize the public expenditure of this country7. the growth rate of gross fixed asset formation8. heavy interest obligations resulting from huge interest payments9. a certain share of shadow economy in the government performance10. to avoid increasing government spending and lowering the economic growth rates11. the benchmark to assess the scope for reducing the size of government12. be of growing importance in government reforms13. to facilitate adjustment to the new economic environment14. the detrimental short-run effects of reforms on some groups15. the protectionist and competitive devaluation policies administered by some industrial countriesⅡ/1. Over the years, opinions about the role of state have been changing, andpolitical institutions have been changing as well, to accommodate the demand for more state involvement in the economy.2. It's generally believed that even if welfare states cut down the hugewelfare expenditures, they can't necessarily solve their serious economic problems such as large budget deficits and hyperinflation.3. The government carried out the expansionary fiscal policy, which resulted inthe increase of budget deficits. To compensate the deficits, it should take certain measures, such as issuing bonds or increasing the money supply.4. Many industrial countries face the dilemma during their reforms between high inflation rates and low unemployment rates, so they must consider all around to minimize the losses.5. Radical reforms must aim at maintaining public sector objectives while reducing spending. In this process, the role of the government will change from the provider to the overseer or the regulator of activities.Ⅲ. Modern societies have accepted the view that governments must play a larger role in the economy and must pursue objectives such as income redistribution andincome maintenance. The clock cannot be set back and, in fact, it should not be. For the majority of citizens, the world is certainly a more welcoming place now than it was a century ago. However, we argue that most of the important social and economic gains can be achieved with a drastically lower level of public spendingthan that which prevails today. Perhaps the level of public spending does not needto be much higher than, say, 30 percent of GDP to achieve most of the importantsocial and economic objectives that justify government intervention. Achievingthis expenditure level would require radical reforms, a well-functioning private market, and an efficient regulatory role for the government.Unit EightⅠ/1. winds of reform in Japan s banking sector2. the amended Bank of Japan Law in line with the global standards for autonomy and transparency3. touch on the paramount goal in the sphere of monetary policies4. charge the central bank with maintaining price stability and nurturing a secure credit system5. generate unnecessary panics in the financial markets6. the execution of monetary policies independent of the bureaucracy7. the institutions in charge of formulating the interest rate policies8. a discount rate at a historical low of 0.5%9. to keep maintaining and nurturing the credit system in accordance with the state policy10. in the spheres of fiscal and monetary policies11. the new economic law entering force this year12. in the context of propelling economic reforms13. to strengthen the government s functions through fiscal policies14. key measures which have won confidence from the market15. the implementation of a merit based promotion systemⅡ/1. It is no overstatement to say that the bad accounts in Japan's banks have accumulated to a very high level.2. The central bank's quasi-bureaucratic status has stymied its normal operations, so many economists call for the enhancement of its autonomy in accordance with the global standards.3. It has been normal for bank shares to march in line with movements in net interest margins, which means bank shares tend to rise as net margins widen and fall as the latter narrow.4. Japan's bank shares are in a different position from their American counterparts: America s bank shares have already risen sharply thanks to the country's full-fledged economic recovery, while Japan's bank shares are still weak as the banks struggle to get to grips with their bad debts.5. Runs on the banks proliferated and a sharp fall in bank loans followed, before the non-performing loans, amounting to 30% of bank assets, were taken over by the state in 1997.Ⅲ. How fast Japan's financial system seems to be reforming. Barely a week goes by without news of another merger between Japan s huge but troubled financial firms. Deregulation is the spur. Three years ago the government announced a “Big Bang"for the country's financial-services industry. This would tear down firewallsthat had largely stopped insurance companies, banks and stockbrokers from competing in each other's patches. It was also meant to put an end to arbitrary, stiflingand often corrupt supervision.The biggest reason for deregulation in this way was that Japan's incestuous,Soviet'style financial system was hopelessly bad at allocating credit around the economy. The massive bad-loan problems that have plagued the country's banks for most of the 1990s are merely one symptom of an even bigger ill. Even so, there was wide spread scepticism that the government would go through with the cure. It deserves some credit, therefore, for largely sticking to its plans.Unit NineⅠ/1. the most commonly used measures of income distribution2. the shift from labour to capital markets3. specialization in production and the dispersion of specialized production processes4. the widening gap between the wages of skilled workers and those of unskilled workers5. new production techniques biased toward skilled labor6. economic inefficiency and distortions retarding growth7. sustainable growth and a viable balance of payments policy8. a broadly based, efficient and easily administered tax system9. reduce disparities in human capital across income groups10. targeted programs consistent with the macroeconomic framework11. constitutional rules on revenue sharing12. to promote equality of opportunities through deregulating economy13. cash compensation in lieu of subsidies14. stimulate the use of public resources and the overall economic growth15. take effective measures to promote employment and equityⅡ/1. Much of the debate about income distribution has centered on wage earnings, which have been identified as an important factor in the overall distribution of incomes. But in Africa and Latin America, unequal ownership of land is a factor that cannot be ignored.2. Globalization has linked the labor, product and capital markets of theeconomies around the world and has indirectly led to specialization in production and the dispersion of specialized production processes to geographically distant locations.3. Although fiscal policies are usually viewed as the principal vehicle for assisting low-income groups and those affected by reform programs, quite a number of countries have adopted specific labor market policies in an effort to influence income distribution.4. Measures governments can take to promote equality of opportunities include deregulating the economy;setting up strong and responsible institutions, including a well functioning judicial system;reducing opportunities for corrupt practices;and providing adequate access to health and education services.5. Another important issue is whether governments should focus on outcomes—such as decreasing the number of people living in poverty, or ensuring that all members of society have equal opportunities.Ⅲ. One theory on wealth distribution indicates that irrational distribution andcorruption are the major reasons for the uneven income level. According to this theory, wealth goes through four stages of distribution—the market, the government, non governmental organizations and unlawful activities, mainly corruption. Usually the first stage of distribution—the market—will result in an uneven spread of resources, which should be redressed by the second distribution stage, the government. In the third stage, the distribution of wealth is realized through contributions and donations made by non governmental organizations. The contributions are given to the poor in the form of charity activities. Thenfollows illegal grabbing of wealth, such as robbery, embezzlement, tax evasion andbribery. Their harm to social equality and stability is enormous and cannot really be measured.Unit TenⅠ/1. to facilitate the establishment of a new form of leadership in today's corporations2. to link a corporation's developing prospective to its present business performance3. companies which forge ahead in the rather changeable world economy4. to encourage domestic enterprises to seek out opportunities to enter foreign markets5. to instill development strategies of new products into employees at all levels6. to consider the promotion in the company the criteria to judge whether one is successful or not。

中国制造业上市企业 英语

中国制造业上市企业英语The Chinese manufacturing industry has seen a meteoric rise in recent decades, propelling many companies to become publicly listed enterprises with significant global influence. These manufacturing firms, with their deep roots in innovation, technology, and scalability, are not only driving China's economic growth but also shaping the global manufacturing landscape.The rise of Chinese manufacturing companies can be traced back to several key factors. Firstly, the country's commitment to industrialization and technology development has created a fertile ground for innovation. Secondly, the vast pool of skilled labor and affordable production costs has made China a preferred destination for manufacturing activities. Lastly, the government's policies promoting domestic and foreign investments have furthered the growth of these enterprises.One of the most remarkable aspects of Chinese manufacturing companies is their ability to adapt to changing market conditions. Whether it's embracing digital transformation, developing smart manufacturing capabilities, or entering into strategic partnerships, these companies have demonstrated remarkable agility and resilience. This adaptability has enabled them to capitalize on new opportunities and overcome challenges, thereby maintaining their competitive edge.The impact of Chinese manufacturing companies on the global economy cannot be overstated. Their products,ranging from consumer electronics to automotive components, are exported to markets across the globe, fueling growthand creating employment opportunities. Furthermore, the technological advancements made by these companies areoften shared with their global partners, driving innovation and progress in the manufacturing sector.The rise of Chinese manufacturing companies has also been accompanied by a growing interest in international collaboration and investment. Many of these companies have expanded their operations beyond China, setting upproduction facilities and research centers in other countries. This trend not only helps them tap into new markets but also enables them to leverage global resources and expertise.However, the rise of Chinese manufacturing companies has not been without its challenges. Trade tensions and protectionist measures implemented by some countries have created obstacles for these enterprises. Additionally, the increasing costs of production and rising competition from other regions have made it necessary for these companies to 不断创新 and improve their operational efficiencies.Despite these challenges, the future of Chinese manufacturing companies looks bright. The country's commitment to technology development and innovation, coupled with its vast pool of skilled labor and expanding global footprint, positions these companies well for continued growth and success. Moreover, their increasing involvement in international collaborations and investments is likely to further enhance their global influence and competitiveness.In conclusion, the Chinese manufacturing industry has emerged as a key player in the global manufacturing landscape. The rise of publicly listed manufacturing companies, their adaptability to changing market conditions, and their growing global influence, all point to apromising future for this sector. As these companies continue to innovate and expand, they will play a crucial role in driving global economic growth and progress.**中国制造业上市企业的全球影响力**中国制造业在近几十年来实现了迅猛的发展,推动了许多企业成为具有全球影响力的上市企业。

国际经济与贸易英语论文

国际经济与贸易论文The contribution of foreign trade to China's economic growth analysis Summary:Although in recent years, China's exports continued strong growth, rapid expansion of trade surplus, rising position in international trade, import and export commodity structure further optimize. But our economy still shows four uncoordinated: uncoordinated, uncoordinated merchandise trade and trade in services, foreign trade of the eastern and western uncoordinated, uncoordinated trade and industrial speed and efficiency. These uncoordinated has seriously affected China's foreign trade growth in the quality and efficiency of foreign trade $ 2 trillion by 2020, by the number of goals, the traditional mode of growth is difficult to achieve. This paper analyzes the status of China's trade from the start, to clarify the new situation adhere to quality realistic options strategies to improve the quality awareness of products and services, changes in competitive strategy of low prices, and strive to build the core competitiveness of Chinese enterprises, China's manufacturing to China from the realization of create change.Keywords: international trade, our manufacturing, our creationFirst, the current development of China's foreign tradeChina's foreign trade has made remarkable achievements. China's current trade growth mode presents the following characteristics:(一)To expand the number of typeSince the reform and opening up, China's foreign trade developed rapidly, with an average annual growth over the same period the average annual growth rate in the world of international trade. Scale to promote the export of China's ranking inworld exports(二)the processing tradeAfter China's reform and opening up, the development of processing trade very quickly, once reached more than 50 percent of China's total imports and exports, up 56.9 percent. In the 21st century, the processing trade has been gradually replaced by general trade, became the dominant position in China's foreign trade. And the concern is the rapid rise of China's processing trade and foreign direct investment behavior is closely related.(三)"three capital" enterprises have become the main exportSince the reform and opening up, China's foreign trade by guiding policy and industrial policy, foreign direct investment continues to grow. Foreign investment in China is mainly to fancy our huge market and low labor costs.Foreign-invested enterprises to adopt the great quantities of production, procurement of raw materials in foreign countries, domestic processing, production and export of products. Foreign exports accounted for more than 50% of the country's exports.(四)the export market structure is relatively simpleWith the development of economic globalization and regional economic integration, China and neighboring countries and regions and regional economic cooperation with other trade partners booming market diversification to achieve greater development. However, the proportion of the top ten trading partners of China's total imports and exports, total exports andtotal imports are still relatively large, top ten trading partners trade has accounted for more than 80% of China's total imports and exports, have declined until 2011 . The United States remained China's largest export market, Japan is still the largest source of imports.Second, the contribution of foreign trade to economic growth and the main problem of the existence of(一)Contribution of the Foreign Trade and Economic Growth1 imported factors of production can directly increase the supply of factors ofa country, for most countries, due to differences in resource endowments, the production can not completely have all the elements required for production, then the imports of production factors become a prerequisite for economic growth; for most developed countries, in the course of its economic take-off, without exception, have obtained through imports from less developed countries stable and cheap industrial raw materials, importing large quantities of these factors of production, on the one hand make up the lack of domestic supply of relevant elements, it also greatly increased the production of corporate profit margins, which is to maintain the level of domestic investment and thus promote economic growth played a significant role in promoting; for most developing countries, not only with the Like developed countries, the need to import some domestic scarce natural resources, and more importantly, developing countries generally lack the ability to produce modern machinery and equipment, advanced equipment imported by obtained from thedeveloped countries, its economic development played a crucial role.China's foreign trade in the process of rapid development, some enterprises lack of scientific management, the overall strength is weak; single means to participate in international competition; product non-price competitiveness is not strong, the lack of its own brand and marketing network;low export levels, many products are still in the low end of the international division of the value chain links, the added value is not high. Extensive trade growth mode has not changed fundamentally, economic and social benefits to be further improved.2 export development can be "driven" to increase domestic and foreign investmentFactor income of a country's export sector factor income is much higher than import-competing sectors. That is, the average profit margin of the export sector level higher than the average profit margin of import-competing sectors.Thus, it will have a substantial increase in domestic investment, "cause" part of the domestic export sector inflows factor in domestic factor mobility mechanism is relatively smooth conditions, a large number of elements of the inflow means export sector. In addition to the increase driven by domestic investment outside the rapid development of the export sector will attract some foreign investors to enter. As an important component of the foreign demand for capital formation, which directly affects the formation of capital, which is directly related to the speed of economic growth. Coupled with the operation of foreign capital into the domestic counterpart funds, so active inthe entire national chain and become an incentive for economic growth.3 can be driven by the expansion of exports to increase domestic employmentForeign trade impact on a country's domestic employment levels, especially as our country such a large developing country with rich labor resources, the significance is undoubtedly a far-reaching and significant. American economist Anne. Kruger has made ??a study of this system. Professor Kruger that the choice of open trade strategy will also help job growth in developing countries. 30 years of reform and opening up, China's foreign trade to GDP growth rate higher than the rate of rapid development, while the export commodity structure has also undergone major changes, from the export of primary products to manufactured goods into the main productive labor time intensive products industry has developed rapidly. Exports increased requirements to increase production, increase production and thus increasing employment needs. Professor Kruger believes compatible with different trading strategies trade policies will directly affect technology choice for all industries, thus affecting the industrial capital / labor ratio.4 Foreign trade can promote the formation of economies of scaleTraditional international trade theory usually assumes constant returns to scale, that foreign trade does not exist economies of scale. In practice, however, the reality is assumed that the development of international trade is not consistent. U.S. economist Paul Krugman ·R ·believes that countries are increasingly similar, more imperfect market competition today, instead of the economies of scale factorendowments differences have become the main reason for the promotion of trade development. We know that many industry only reach a certain size in order to reduce costs, relying solely on the size of a small domestic market often can not be achieved. And one country to vigorously promote exports, expand the international market, the domestic industry can be formed that economies of scale to create the conditions.(二)At present the problems of China's foreign trade1. A low price competition caused by the gradual increase in anti-dumpinginvestigationAccording to China's Ministry of Commerce statistics, in June 2011, China's state-sponsored by other anti-dumping investigations has reached more than 600 since. In 2010 alone, China's anti-dumping investigation of 51 cases, involving 1.79 billion U.S. dollars, has for 13 consecutive years as the world's anti-dumping investigations than any other country. Anti-dumping is for dumping purposes, the so-called dumping refers to the export price of a product at a price lower than the normal value of the market into another country. Dumping appeared, some countries are considered to be unfair trade practices and to be resisted by the legislative anti-dumping measures to protect the domestic industry. According to "Anti-Dumping Agreement," the implementation of anti-dumping measures must have three basic elements: dumping, the causal link between the damage, dumping and injury.Because our products generally have a clear price advantage, making international competitors and trading partners to take defensive or offensive trademeasures against Chinese products, and anti-dumping measures is most likely to be used. Also according to "Anti-Dumping Agreement" provides for products from non-market economy countries, the normal price in determining the dumping, the importing countries generally use the price "alternative country" as the base price. Many trading partner of our products, as a non-market economy country, in determining the margin of dumping of the product is often deviated from WTO rules, select the price of other "alternative country" as determined in accordance with the normal price of the product. As the "alternative country" system flexibility and irrationality, so as to abuse of the importing country, "cut right amount of freedom" in determining the dumping country when looking for an alternative to open the door.2.Economies of scale and social imbalanceCurrently, there are 172 kinds of commodity production in the world, "China's manufacturing" has been in many countries around the world, penetrated into every corner of life, many countries consumers irresistible products. The scale of China's manufacturing expanded rapidly in the rapid increase in the share of world manufacturing the same time, there is a lot of regret: product exports nearly 30% share in total exports, the common feature of these products is the low value-added, the price is very low , net of costs, the profit is very low, some products even price gains of only a few cents. U.S. exports equivalent to a Boeing airliner of 200 000 -30 million color TV sets exports.China's economic development is still stuck on to consume natural resources atthe expense of environmental quality development model. Rely on putting in a lot of natural resources and social resources in many areas has made the world's market share, but also caused a rather severe environmental problems. Environmental pollution and ecological destruction is increasingly becoming the impact of global economic and social development issues, and to become the focus of people's attention.Third, adhere to the "quality win" strategyImprove the quality of trade growth quality and efficiency of export goods is a sign of the national spirit, not only related to the efficiency of enterprises, but also related to the international image of our products. To better implement the "quality win" strategy, companies must the consumer's point of view, the product selectivity in durability, aesthetics, functionality, reliability, service, compliance, reputation and other aspects of comprehensive improve product and service quality, and increase the added value of export products, and further optimize the export structure, to create its own brand of high-value and enhance the international competitiveness of export enterprises.(一)increase the export of non-price competitivenessProvided to meet the needs or desires of the target consumer products is the key to successful operation. Products are anything to offer to the market to meet the needs and desires in the market include physical goods, services, experiences, events, people, places, property, organization, information and ideas. Non-marketing guru Philip. Kotler believes Products include coreinterests, basic product, expected product, additional products and potential products five levels, each level adds more customer value, customer value hierarchy constituted. From the essence of today's product competitiveness is not what companies in factory production, but other than that they increase the plant in the form of other values?, such as packaging, services, advertising, customer advice, financing, delivery arrangements and people seriously. Consumers generally from the factor characteristics and quality of products, product mix and quality of service, product prices and other judges he contacted products.1.Grasp customer price psychology, clever set commodity pricesAs the product information asymmetry, as well as non-professional consumers to buy, consumers in the purchase of goods, especially in the less familiar items to buy their own, always consciously or unconsciously, with the price and quality of goods intrinsic value linked to the price of goods as an important yardstick to measure the quality of the merits and value of size. They tend to believe that commodity prices are high, it means that the product is good quality, great value; low commodity prices, then the difference in the quality of goods, small value. Enterprises in the correct pricing strategy, the price must be in-depth study of the psychological impact on consumers, their prices grasp the psychological characteristics and can not take the low-price strategy.2 manufacturing customer perceived valueConventional wisdom is that as long as the price of the product is lower than competitors can seize more market . Reflect changes in the market price is the most sensitive factor for competitive products on the market position and market share has a direct impact . However, this effect is only limited in the industrial economy era , when corporate mission is to manufacture products and sell products , but in the knowledge economy era , the task has become a manufacturing enterprise value and transfer value to the enterprise market competition into energy consumer competitive price competition rather than the value created by the product . The key goal of marketing is to correctly determine the customer's needs and desires , and more effective than competitors better target customers transferred the desired product or service , these products or services to meet consumer needs or solve the problems they face tool. If the competition between enterprises blindly stuck in price competition stage , it will not only damage the interests of enterprises , and consumers are not necessarily derive a higher value because of price competition is necessarily accompanied by low-quality products and services and may also undermine the corporate image. With differentiated products , high value-added services , such as core technical capabilities to compete , the benefits accruing to compete more generous than the low bleed . Companies can earn huge profits , but also to compete for market share is more than the low significance. With the success of the enterprise should be a strength , corporate profits should be derived from the value of the market, but neveragainst opponents should be the purpose of business .Combined with the status quo of China's specific national conditions and development of enterprises, the paper argues that treat green, technical barriers and trade friction from abroad, to calmly. On the one hand should change their concepts, trade friction is clearly in the process of rapid economic development, a normal phenomenon, it is difficult to avoid, and objectively rational measure friction, the impact of barriers to trade and the economy. On the other hand should take this as an opportunity to improve the capability of independent innovation, enhance scientific and technological content of products. In addition, from the perspective of consumer psychology, low price competition for corporate branding strategy with hazards, Chinese enterprises should make full sense of urgency and mission, and strive to improve the value of the products, attention to technology investment, enhance product development and management, led export products.References:1.LiYushi.Changes in China's foreign trade2.LiJiaqin:On the Realization of Foreign Trade both a fundamental shift several issues3.YiShuoxiang:Changes in the competitive and comparative advantage of the growth mode4.JianXinghua:On China's foreign trade growth mode transformation5.LongGuoqiang:Foreign trade growth mode where to start6.ZhaoShuiqin:Reflections transformation of foreign trade growth mode 7.LiJunsheng:China's foreign trade and economic growth8.LiYuju:Accelerate the transformation of China's foreign trade growth 9.GuoKesha:The contribution of foreign trade to China's economic growth analysis10.XuJianbin: the current development of China's foreign trade。

中国制造的现状英语作文

中国制造的现状英语作文The Current Status of Made in China: A Comprehensive Analysis。

In recent decades, the phrase "Made in China" has become ubiquitous, symbolizing both the prowess and the challenges of the global manufacturing industry. As the world's largest exporter, China's manufacturing sector plays a crucial role in the global economy. However, the label "Made in China" also carries connotations of cheap labor, environmental concerns, and quality issues. In this essay, we will delve into the current status of "Made in China," examining its strengths, weaknesses, and the ongoing efforts to address its challenges.Strengths of Made in China:One of the primary strengths of "Made in China" lies in its vast manufacturing capabilities. China's abundant labor force, coupled with its infrastructure development andtechnological advancements, has enabled the country to produce a wide range of goods at competitive prices. From electronics to textiles, China's manufacturing sector has established itself as a global leader, supplying products to markets around the world.Additionally, China's strategic focus on industrialization and export-led growth has propelled its manufacturing sector to new heights. Government policies promoting foreign investment, trade liberalization, and industrial upgrading have created a conducive environment for manufacturing expansion. This has led to the emergence of manufacturing clusters and special economic zones, fostering innovation, efficiency, and economies of scale.Moreover, China's integration into global supply chains has further strengthened its position in the manufacturing landscape. By participating in international trade agreements and establishing partnerships with multinational corporations, Chinese manufacturers have gained access to foreign markets and technologies, enhancing their competitiveness on a global scale.Challenges Facing Made in China:Despite its strengths, the "Made in China" label faces several challenges that undermine its reputation and competitiveness. Chief among these challenges are concerns related to product quality, intellectual property rights, and environmental sustainability.Quality control has been a persistent issue for Chinese manufacturers, with reports of counterfeit goods, substandard products, and safety hazards tarnishing the reputation of "Made in China." Instances of product recalls and scandals have eroded consumer trust, leading to calls for stricter regulations and enforcement measures to ensure product safety and quality standards.Furthermore, China's reputation as a hub forintellectual property infringement has been a source of contention in international trade relations. Allegations of copyright infringement, patent violations, and forced technology transfer have strained diplomatic ties and ledto trade disputes with major trading partners. Addressing these concerns requires comprehensive legal reforms, enforcement mechanisms, and greater protection of intellectual property rights.Environmental sustainability is another critical challenge facing "Made in China." The rapidindustrialization and urbanization of the country have resulted in widespread pollution, resource depletion, and ecological degradation. From air and water pollution to deforestation and habitat destruction, China's manufacturing activities have exacted a heavy toll on the environment. Recognizing the urgency of the situation, the Chinese government has implemented various environmental regulations, initiatives, and green technologies to promote sustainable development and reduce the environmental impact of manufacturing operations.Efforts to Address Challenges:In response to the challenges facing "Made in China," the Chinese government has undertaken proactive measures toenhance the quality, innovation, and sustainability of its manufacturing sector. This includes initiatives such as the "Made in China 2025" plan, which aims to upgrade the country's manufacturing capabilities through innovation, automation, and advanced technologies. By prioritizing key industries such as robotics, biotechnology, and clean energy, China seeks to transition from being the world's factory to a global leader in high-tech manufacturing.Moreover, the Chinese government has stepped up efforts to enforce stricter regulations and standards to improve product quality and safety. This includes strengthening oversight mechanisms, conducting inspections, and imposing penalties on non-compliant manufacturers. By holding companies accountable for their products and practices, China aims to rebuild consumer trust and confidence in "Made in China" products.Additionally, China has pledged to address intellectual property concerns and enhance intellectual property rights protection through legal reforms, enforcement actions, and international cooperation. By strengthening intellectualproperty laws, cracking down on infringement activities, and promoting innovation and creativity, China aims to foster a more conducive environment for investment, research, and development.Furthermore, China has made significant investments in environmental protection and sustainability initiatives to mitigate the environmental impact of its manufacturing activities. This includes promoting renewable energy sources, improving energy efficiency, and implementing pollution control measures. By embracing green technologies and sustainable practices, China seeks to reduce its carbon footprint, conserve natural resources, and preserve the environment for future generations.Conclusion:In conclusion, the "Made in China" label represents both the strengths and challenges of China's manufacturing sector. While China has achieved remarkable success in becoming the world's factory, it faces ongoing challenges related to product quality, intellectual property rights,and environmental sustainability. However, through concerted efforts to enhance quality control, protect intellectual property, and promote sustainable development, China is poised to overcome these challenges and emerge as a global leader in manufacturing innovation and excellence. By embracing technological advancements, fostering innovation, and adopting sustainable practices, China can redefine the narrative of "Made in China" and shape the future of global manufacturing.。

MISALLOCATION AND MANUFACTURING TFP IN CHINA AND INDIA