acca教材

ACCA(BPP、KPLAN、FTC)教材及习题册优点

参加ACCA考试需要用的教材主要包含ACCA课本及ACCA练习册。

ACCA推荐的课本及练习册有:BPP,Kaplan 及Becker。

各个ACCA教材供应商教材特点:

1.BPP以详细见称,BPP教材是全球ACCA使用最多的版本,通俗易懂,比较适合新老学员自学,ACCA学员以看BPP课本及精简版讲义为主。

同时但国内基本上所有的高校ACCA专业也是使用的BPP版教材,因为审计署买下了BPP教材在中国的版权,并且比之FTC版教材价格也有优势,每个点都讲解得很细。

2.FTC版是ACCA官方版本教材,在全球使用也比较多。

这套教材的优点是简洁,基本上每门课教材都比BPP版薄,但是FTC对F4阶段的ACCA备考并不是那么适用,其难度较之BPP版有所加大,所用单词也要复杂一些。

3.Kaplan Publishing(开普兰,又称:卡普兰)Kaplan以精简为主,主次分明,概括性较强。

每个版本的教材内容完全不同,但都是根据ACCA官方的大纲(syllabus)编写,都覆盖了所有内容,可以使用任一版本教材准备考试。

可以根据自己的学习习惯选择适合自己的教材。

第 1 页。

ACCA 的学习资料有哪些,该如何合理使用这些资料?

ACCA 的学习资料有哪些,该如何合理使用这些资料?Answer:一、Syllabus and Study Guide其实,所有的资料中,最重要的是 Syllabus and Study Guide。

因为其他内容可以说是以这两项为基础演变而来的。

不知道有多少学生是认认真真的阅读过Syllabus and Study Guide?据我的观察了解,认真看过的不多,很多人是一拿到书就闷头看。

弄清楚 Syllabus 的内容其实很重要。

一般,课本的前几页就会有 Syllabus,另外,在网上也可以下载。

大家应该先要把 Syllabus 看一遍,看看哪些内容是自己的弱点、难点,有哪些是大纲里的重点。

在看书的时候就可以有所侧重。

二、Textbook中国的注会考试,或其他的一些全国统考,书本就是“圣经”。

如果你真的能把全书背下来,相信你考试通过没问题。

一方面考试是以书为准,绝少超出书中的内容。

另一方面,考试有不少选择、填空、判断题,如果对书上的内容很熟,考试的时候得心应手。

但是,ACCA 不同,只有 Syllabus 才是真正的圣经。

课本都是在此基础上的写出来的。

课本有三个版本,分别是 BPP、KAPLAN 和 Becker Professional。

Textbook 的作用是帮助学员理解 Syllabus 内容,因而并不是每字每句都要熟读。

我的方法是,先把课本通读一遍,速度可以略快一些,有不是很理解的地方,先做个记号。

然后,就开始做题,如果有不太懂的地方,再回去看看书。

并且把一些难点或热点再仔细得看一边,必要时,要熟读几遍。

三、Exam Kit练习册在复习准备的过程中十分重要。

尤其大纲经常更新的科目(比如 TX、FA、AA、SBR、ATX、AAA)是一定要用最新练习册做题备考的。

有些人甚至觉得只要做练习册就可以了,我不太赞同这样的观点。

但是,如果准备的时间不够,可以用以做练习册为主,看书为辅的方法。

如果是以计算为主的科目,如 F5(PM)、F6(TX)、F7(FA)、F9(FM)、P6(ATX),我一般会将一些经典的 format,如计算个人所得税,企业预算,Discounted Cash Flow,合并报表的 format 和计算步骤记录下来。

acca教材-ACCA F1 知识课程

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

12

The impact of technology on organisations

Homeworking and supervision

IT技术还使得部分工作得以在家里迚行,员工不用去上班。但这也带来了监管上的一 些问题。 -------------------------------------------------------------------------------------------------------------Outsourcing(外包)把一些非核心业务交给别人来做。

where the employee was employed.(公司全部关闭戒部分关闭导致的人员 冗余。) 2. The requirements of the business for employees to carry out work of a particular kind have ceased or diminished or are expected to.(流程改迚, 技术迚步导致的人员冗余。)

由内到外: 组织本身 经营环境(产业层面上的环境) 宏观环境(经济政治文化技术层 面的环境) 物理环境(整个以物质形态存在 的环境 )

ACCAspace 中国ACCA特许公认会计师教育平台

Copyright ©

3

The political and legal environment

9

Social and demographic trends

• Population and the labour market(人口数量,人口结构的变化,对劳劢力市场有 深刻长进的影响)

会计考证买什么书看

会计考证买什么书看关于会计考证买什么书看会计考证是让个人在会计领域取得有权威认证的证书,是提升个人职业发展的重要方式。

在备考过程中,书籍的选择及阅读方法都至关重要。

本文将从专业会计师的角度分析会计考证买什么书看。

选择适合自己的教材在备考过程中选择合适的教材十分重要。

在选择教材时,需要根据自己的基础及考试的要求选取。

如CMA考试可以选择IMA出版的Wiley教材,ACCA考试可以选择BPP或Kaplan等出版的教材。

此外,在选择教材时,还可以参考教材的特点。

如速读的教材适合对知识基础掌握较好的考生,而深入讲解的教材适合对知识掌握度较低的考生。

阅读方法需要多维度虽然选择了合适的教材,但阅读方法仍然需要好好考虑。

在阅读时需要从多维度进行思考,不可漫不经心地阅读。

首先,可以从题目着手,明确自己需要掌握哪些知识点。

其次,在阅读中应当注重理解,一定要弄懂每一章节,这对于后期复习和应试都十分有帮助。

最后,在阅读中可进行笔记,做好重点知识点的记录。

如何阅读财经报纸在备考过程中,阅读财经报纸可以帮助考生做到及时掌握最新的财经动态,加深对于财经知识的理解及掌握。

在阅读财经报纸时,需要注意以下几点。

首先,针对自己考试的要求,选择合适的报纸。

其次,在阅读时需要注重对于节日、季节等时事的了解,这样可以更好地掌握最新的财经动态。

最后,在阅读后应当进行总结,将阅读获得的知识点进行记录及整理。

案例:1、小明本身学习能力很强,觉得自己的基础较好,选择深入讲解的教材,并注重理解,收效显著。

2、小张基础较差,选择了速读的教材,但在阅读时没有重视理解,导致效果欠佳。

3、小李在阅读财经报纸时,没有根据自己考试的要求选择合适的报纸,导致掌握的财经知识与考试没有直接关联。

4、小赵在阅读财经报纸时,只关注了新闻,忽略了对于各类涉财企业的了解,这使得其掌握的信息不够全面。

5、小伍在阅读教材时,虽然进行了笔记,但笔记内容不够清晰详细,在后期复习时反而使其困惑不解。

浅谈对acca的认识

浅谈对acca的认识ACCA在国内受到热捧,是非常适合大学生考取的国际高端财经证书。

下面就带大家认识一下ACCA比较重要的几点。

1)全面完善的课程体系。

ACCA课程使学员全面掌握财务、财务管理、审计、税务及经营战略等方面的专业知识,提升分析能力并拓宽战略思维。

2)理论与实际的密切结合。

ACCA的专业资格是理论知识与实际经验的高度紧密结合。

新考试大纲充分表达了雇主和专业人士的意见,反映了现代商务社会对财会人员的要求。

3)对专业价值和职业操守的重点强调。

ACCA创举性地开设了在线职业操守训练课程,它给予学员一系列的职业操守的理念,并设置了多个自我测试题,检验学员职业操守的价值观和行为。

取得ACCA会员资格要完成三个“E”,即通过考试、完成在线职业操守训练课程、并取得三年相关工作经验。

4)国际标准与本地实情的和谐统一。

ACCA考试大纲以国际会计准则/国际财务报告准则和国际审计准则作为依据设计考试内容,并提供了包括中国在内的40多种不同国家和地区的法律与税务方面的试卷,这使得ACCA成为最切合中国实际的国际性会计师资格。

5)公平一致的考试标准。

ACCA的专业资格考试采用全球统一标准,即统一教材、统一考试、统一评卷,最后会员取得全球统一的证书。

6)遍布全球的考点网络。

学员在一个国家向ACCA注册后,可根据需要在全球350多个考点中选择、更换适合自己的考试中心。

7)认证与学位的相互补充。

ACCA在全球范围内寻求与优秀院校的广泛合作。

满足一定的条件后,ACCA学员将有机会获得英国牛津-布鲁克斯大学应用会计理学士学位。

8)灵活的学习方式。

学员可以根据自己的实际情况,选择参加培训班或自修以及网上培训来完成ACCA考试。

急速通关计划 ACCA全球私播课大学生雇主直通车计划周末面授班寒暑假冲刺班其他课程。

acca课件

公司法基本原则及案例分析

公司法的基本原则

公司法规定了公司的设立、组织、行为和终止等方面的内容。它强调了公司的法 定性、独立性和责任性。公司必须依法设立,具有独立的法人地位,并能够独立 承担责任。

案例分析

以阿里巴巴集团为例,探讨公司法的实际应用。阿里巴巴集团作为一家大型互联 网公司,其股权结构、治理结构、业务模式等方面都涉及到公司法的相关规定。 通过对这个案例的分析,可以深入了解公司法在实际中的应用和作用。

财务报表分析

资产负债表分析

现金流量表分析

通过分析资产负债表,了解企业的资 产、负债和所有者权益的结构和质量 ,评估企业的偿债能力和资产质量。

通过分析现金流量表,了解企业的现 金流入和流出情况,评估企业的现金 产生和运用能力。

利润表分析

通过分析利润表,了解企业的收入、 成本和利润情况,评估企业的盈利能 力和经营效率。

ACCA课件

目 录

• 引言 • 财务报告与审计 • 税务与公司法 • 财务管理与决策分析 • 战略管理与领导力发展 • 职业道德与职业发展

01

引言

ACCA简介

特许公认会计师公会(ACCA )是全球领先的专业会计师组 织,提供全面的、高质量的会 计资格认证。

ACCA认证被广泛认可,作为 国际会计准则和国际财务报告 准则的重要推动者。

03

税务与公司法

税务概述

税务的基本概念

税务是指国家依据其税收法律和法规 ,对纳税人或纳税人的应税行为进行 征收和管理的活动。税务涵盖了税收 的各个方面,包括税种、税率、税收 优惠政策等。

税务的作用

税务在国家治理中具有重要的作用。 它为国家提供了稳定的财政收入,支 持了国家的发展和建设。同时,税务 还调节了经济,引导了社会资源的合 理配置。

acca的课程体系

acca的课程体系【实用版】目录1.ACCA 课程体系简介2.ACCA 课程体系的级别和课时3.ACCA 课程体系的核心课程和休息安排4.ACCA 课程体系的优势和特点正文一、ACCA 课程体系简介ACCA(Association of Chartered Certified Accountants,特许公认会计师公会)成立于 1904 年,是全球最具影响力的专业会计组织之一。

ACCA 课程体系是该组织为培养国际财务会计人才所设立的一套完善、系统的培训课程。

二、ACCA 课程体系的级别和课时ACCA 课程体系分为四个级别,分别是 S1、S2、S3 和 S4。

每个级别包含 48 个课时,每周一次课,每次课时为 2 小时,其中核心课程时间为 30 分钟,接着休息 10 分钟,然后再进行 30 分钟的核心课程学习。

三、ACCA 课程体系的核心课程和休息安排在 ACCA 课程体系中,核心课程是指那些涵盖了会计、财务管理、审计、税务和企业战略等关键领域的课程。

这些核心课程旨在帮助学员掌握国际财务会计领域的专业知识和技能。

课程安排中的休息时间,可以让学员在紧张的学习中得到适当的休息和调整,从而更好地吸收和消化所学知识。

四、ACCA 课程体系的优势和特点1.国际化:ACCA 课程体系遵循国际财务会计准则和实务,有助于学员提升国际视野,成为具有国际竞争力的财务会计人才。

2.系统性:ACCA 课程体系分为四个级别,由浅入深,逐步提升学员的专业知识和能力。

3.实用性:ACCA 课程体系注重实际操作能力和应用能力的培养,使学员能够更好地将所学知识应用于实际工作中。

4.专业性:ACCA 课程体系中的核心课程,都是由具有丰富实践经验和专业背景的专家编写,保证了课程内容的专业性和权威性。

5.灵活性:ACCA 课程体系允许学员根据自己的时间和进度进行学习,为学员提供了很大的学习自主性和灵活性。

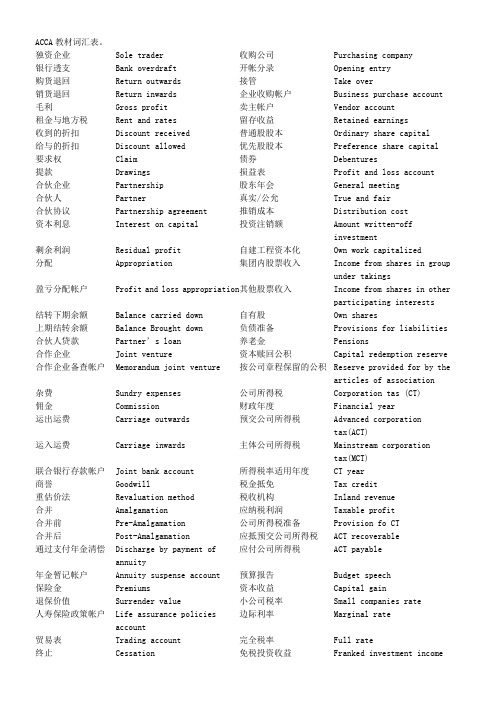

ACCA教材词汇表

ACCA教材词汇表。

独资企业Sole trader 收购公司Purchasing company银行透支Bank overdraft 开帐分录Opening entry购货退回Return outwards 接管Take over销货退回Return inwards 企业收购帐户Business purchase account 毛利Gross profit 卖主帐户Vendor account租金与地方税Rent and rates 留存收益Retained earnings收到的折扣Discount received 普通股股本Ordinary share capital给与的折扣Discount allowed 优先股股本Preference share capital要求权Claim 债券Debentures提款Drawings 损益表Profit and loss account合伙企业Partnership 股东年会General meeting合伙人Partner 真实/公允True and fair合伙协议Partnership agreement 推销成本Distribution cost资本利息Interest on capital 投资注销额Amount written-offinvestment剩余利润Residual profit 自建工程资本化Own work capitalized分配Appropriation 集团内股票收入Income from shares in groupunder takings盈亏分配帐户Profit and loss appropriation 其他股票收入Income from shares in otherparticipating interests结转下期余额Balance carried down 自有股Own shares上期结转余额Balance Brought down 负债准备Provisions for liabilities 合伙人贷款Partner’s loan养老金Pensions合作企业Joint venture 资本赎回公积Capital redemption reserve 合作企业备查帐户Memorandum joint venture 按公司章程保留的公积Reserve provided for by thearticles of association杂费Sundry expenses 公司所得税Corporation tas (CT)佣金Commission 财政年度Financial year运出运费Carriage outwards 预交公司所得税Advanced corporationtax(ACT)运入运费Carriage inwards 主体公司所得税Mainstream corporationtax(MCT)联合银行存款帐户Joint bank account 所得税率适用年度CT year商誉Goodwill 税金抵免Tax credit重估价法Revaluation method 税收机构Inland revenue合并Amalgamation 应纳税利润Taxable profit合并前Pre-Amalgamation 公司所得税准备Provision fo CT合并后Post-Amalgamation 应抵预交公司所得税ACT recoverable通过支付年金清偿Discharge by payment of应付公司所得税ACT payableannuity年金暂记帐户Annuity suspense account 预算报告Budget speech保险金Premiums 资本收益Capital gain退保价值Surrender value 小公司税率Small companies rate人寿保险政策帐户Life assurance policies边际利率Marginal rateaccount贸易表Trading account 完全税率Full rate终止Cessation 免税投资收益Franked investment income变卖资产帐户Realization account 资本减免Capital allowances合伙企业的解体Dissolution of partnership 剩余预交公司所得税Surplus ACT最后约定的资本Last agreed capital 寄售业务Consignment trading 逐步解体Piecemeal dissolution 汇票Bills of exchange变卖资产费用准备Provision for realizationexpense分支机构Branch变卖资产损失Loss on realization 代理商Agent股票帐户Shares account 交易商Trader英国境内公司UK resident company 受托人Consignee非免税收入Un-franked receipts 委托人,寄售人Consigner公司所得税费用CT charge 保障,赔偿Indemnity代扣所得税的交纳Payment under deduction of IT 销售帐单Account sales磨损Wear and tear 寄售利润Profit on consignment 拥有法定所有权的土地Freehold land 进口税Import duties过时Obsolescence 运费Delivery to customers开采或消耗Extraction of consumptionover time 途中保险费Carriage insurance on goodsdelivered to Customers直线法Straight line method 佣金Commission余额递减法Reducing balance method 汇付Remittance年数总和法Sum of the digits method 未售存货Unsold stock累计折旧Accumulated depreciations 应收票据Bills receivable 经济使用年限Useful economic lives 保险收入Insurance proceeds 每股净收益Earnings per share 面值Face value例外项目Exceptional items 贴现费用Discount charges 非常项目Extraordinary items 财务费用Financing cost前期调整Prior year adjustment 应付票据Bills payable不能抵销的预交公司税Irrevocable advancedcorporation tax支出Expenditure未抵销的损失Unrelieved losses 即期汇票Sight drafts净值基础Net basis 监管Custody零值基础Nil basis 主损益帐户Main profit and loss account 消耗品Consumable stores 部门化Departmentalization成本与可实现净值孰低The lower of cost and netrealizable value分摊Apportionment平均成本Average cost 共同性费用Common expense先进先出First in first out 包装纸Wrapping paper后进先出Last in first out 评价Assess标准成本Standard cost 独立实体Independent entity重置成本Replacement cost 投资报酬率Return on investment 资产负债表日后日期Event after balance sheet date 减除佣金后利润Post-commission profit 董事会The board of directors 赊销收入Credit sales调整事项Adjusting event 修理费用Repair charges非调整事项Non-adjusting event 一般费用General expense或有事项Contingencies 分支销售机构Selling agency branch 或有收益Contingent gain 正常存货损失Normal stock losses或有损失Contingent loss 交易帐户Trading account资本承诺Capital commitments 非常存货损失Abnormal stock losses现金流量表Cash flow statement 本地购货Local purchase信用交易Credit transaction 退货Returned goods独立分支机构Independent branch现实购买力会计Current purchasing poweraccounting (CPP)现实成本会计Current cost accounting(CCA) 往来帐户Current account零售物价指数Retail price index 复式簿记帐户Double-entry accounts持有收益Holding gains 时间差异Time lag differences业绩评估Assessment of performance 分支机构间转移Inter-branch transfer货币性项目的衡量Measurement of monetary items 结算Settlement货币性资产Monetary assets 分支机构间往来帐户Interbranch current account 货币性负债Monetary liabilities 分支机构存货调整帐户Branch stock adjustmentaccount征求意见稿Exposure draft 未实现利润准备Provision for unrealizedprofit实现原则Realization货币性营运资本调整Monetary working capitaladjustment举债比率调整Gearing adjustment 货币折算Currency translation净营业资产Net operating assets 货币兑换Currency conversion发行和赎回债券Issue and redemption当地货币Local currencydebentures债券Bonds 汇率Exchange rate契约Deed 即期汇率Spot rate无担保债券Naked-debentures(unsecured) 远期合同Forward contract拥有法定所有权的Freehold 贴水Discount偿债基金Sinking fund 升水Premium货币性项目Monetary items债券赎回偿债基金Debenture redemption sinkingfund account风险Risk偿债基金投资帐户Sinking fund investmentaccount可转换债券Convertible debentures 不确定性Uncertainty资本化发行Capitalization issue 套期保值Hedging股权发行Bonus issue 长期货币性资产Long-term monetary assets 含权价Cum-rights prices 长期货币性要求权Long-term monetary claims 除权价Ex-rights prices 汇兑收益/损失Exchange rate gain/loss可分配公积Distributable of reserves 时态法Temporal method历史汇率法Historic method以公积支付股利Paying a dividend out ofreserve已付清红利股Paid-up bonus shares 期末汇率法Closing rate method重估公积Revaluation reserve 场地费用Site expenses减资Capital reductions 管理费用Administrative expenses资本重组Capital reorganizations 装置和设备Furniture and fittings过剩资本Excess capital 房屋Premises资本重建Capital reconstruction 预付费用Payment in advance权益汇总帐户Sundry members account 建造合同Construction contract实现帐户Realization account 工程保留款Retention购买者帐户Purchaser’s account分期付款Progress payment自愿清算Voluntary liquidation 交易帐户Trading account特别决议Special resolution 合同收入Contract fee方案\计划Scheme 合同亏损Loss on contract清偿\偿还Discharge 完工百分比Percentage of completion卖方帐户Vendor account 完成合同Completed contract创立合并Amalgamation 预期利润Expected profit高估Over-valuation 承建商Contractor低估Under-valuation 矫正Rectification集团报表Group accounts 已鉴定完工价值Value of work certified纵向联合Vertical integration 总部费用Head office costs横向联合Horizontal integration 合同成本Contract costs不同行业联合Diversification 销售收入Turnover控股公司Holding company 合同损失准备Provision for loss oncontract重大影响Dominant influence 预收款Payment on account直接控制集团Direct group 可预见损失Foreseeable loss垂直控制集团Vertical group 已付款超过收入(部分) Excess progress payment混合控制集团Mixed group 股票/证券Stock ,security盈余公积Revenue reserve 债券Debenture合并公积Consolidation reserve 法定权利Legal rights少数股权Minority interests 报价Quote合并商誉Goodwill on consolidation 证券交易所Stock exchange上市投资Listed investment合并资本公积Capital reserve onconsolidation少数股东Minority share holders 偿还Repayment股本溢价Share premium 累积股息Cum div cd部分收购Partial acquisition 累积利息Cum-int ci在途支票Cheque in the post 股息除外Ex-div xd收买前后Pre( post)-acquisition 利息除外Ex-int xi调整帐户Adjustment accounts 面值Nominal value对子公司投资Investment in subsidiary 市价Market value普通公积General reserve 应计股利Accrued dividend参与股权Participating interest 应计利息Accrued interest集团内部交易Intra-group trading 证券交易所官方清单Stock exchange official list 公司间销售Inter-company sales 二级市场Secondary market溢价Premium 未上市证券市场Unlisted securities market 折价Discount 让与,出售disposal债券利息Debenture interest 加权平均Weighted分次购买Piecemeal acquisition 结帐Close off关联公司Associated company 已分派股份Allocated shares多数股权Majority holding 国库券Treasury stock累计控股Cumulative holding 认股权发行Rights issue孙公司Sub-subsidiary 赊销Credit sale子集团,附属集团Sub-group 租购Hire purchase多公司结构Multi-company structures 信用协议Credit agreement伙伴子公司Fellow subsidiaries 会计处理Accounting treatment有效股权Effective shareholdings 经营性租赁Operating lease控制股权Controlling interest 融资租赁Finance lease资本报酬率Return on capital employed 出租人/承租人Lesser /lessee产权收益率Returen on equity 一期(二期)租赁Primary(secondary)period息税前净利Net Profit before interest andtax不可撤销的付款No-cancelable payment应收帐款帐龄表Aging schedule of debtors 名义租金Peppercorn rent资金来源及运用表Source and application offunds statement报酬Reward通货膨胀Inflation 现值Present value通货紧缩Deflation 最低租赁付款额Minimum lease payment损耗Deplete 定金Deposit每股收益Earnings per share 公允价值Fair value股利保证倍数Dividend cover 财务费用Finance charge股利分配率Dividend payout ratio 实际利率Effective rate of financecharge股利收益率Dividend yield ratio 平均未付资本余额Average balance of capitaloutstanding净收益率Earnings yield 资本偿还Capital repayment市盈率Price/ earnings ratio 精确法Actuarial method公司估价The valuation of components 递延收益Deferred income联营公司Associated companies 分期支付Installment共同比财务报表Common-size financialstatements 未实现利润准备Provision for unrealizedprofit物质资源Physical resources 应收租购款帐户Hire purchase debtorsaccount会计原则Accounting principles 重新获得帐户Repossessions account 会计方法Accounting methods 金融公司Finance house权责发生制Accrual accounting 制造商Manufacturer重置成本Replacement cost 交易商Dealer一般会计原则Generally accepted accountingprinciples(GAAP)总盈余Gross earnings剩余现金Cash surplus 政府补助Government grant净值减免Writing down allowance 租赁期Lease term。

ACCAF1StudyText,PDF原版BPP教材

Accountant in Business Paper F1 Course Notes ACF1CN07 l i BPP provides revision courses question days mock days and specific material to assist you in this important phase of your studies. F1 Accountant in Business Study Programme for Standard Taught Course Page Introduction to the paper and the course...............................................................................................................iii 1 Business organisation and structure...........................................................................................................1.1 2 Information technology and systems...........................................................................................................2.1 3 Influences on organisational culture............................................................................................................3.1 4 Ethical considerations........................................................................................................................ ..........4.1 5 Corporate governance and social responsibility..........................................................................................5.1 6 Home study chapter – The macro economic environment..........................................................................6.1 End of Day 1 – refer to Course Companion for Home Study 7 The business environment..........................................................................................................................7.1 8 Home study chapter – The role of accounting.............................................................................................8.1 9 Control security and audit............................................................................................................................9.1 10 Identifying and preventing fraud................................................................................................................10.1 11 Leadership and managing people.............................................................................................................11.1 12 Individuals groups teams.........................................................................................................................12.1 End of Day 2 – refer to Course Companion for Home Study Course exam 1 13 Motivating individuals and groups.............................................................................................................13.1 14 Personal effectiveness and communication..............................................................................................14.1 15 Recruitment and selection.........................................................................................................................15.1 16 Diversity and equal opportunities..............................................................................................................16.1 17 Training and development. (1)7.1 18 Performance appraisal (1)8.1 End of Day 3 – refer to Course Companion for Home Study Course exam 2 19 Answers to Lecture Examples...................................................................................................................19.1 20 Appendix: Pilot Paper questions................................................................................................................20.1 ??Revision of syllabus ?? Testing of knowledge ?? Question practice ?? Exam technique practice INTRODUCTION ii Introduction to Paper F1 Accountant in Business Overall aim of the syllabus To introduce knowledge and understanding of the business and its environment and the influence this has on how organisations are structured on the role of the accounting and other key business functions in contributing to the efficient effective and ethical management and development of an organisation and its people and systems. The syllabus The broad syllabus headings are: A Business organisation structure governance and management B Key environmental influences and constraints on business and accounting C History and role of accounting in business D Specific functions of accounting and internal financial control E Leading and managing individuals and teams F Recruiting and developing effective employees Main capabilities On successful completion of this paper candidates should be able to: ?? Explain how the organisation is structured governed and managed ?? Identify and describe the key environmental influences and constraints ?? Describe the history purpose and position of accounting ?? Identify and explain the functions of accounting systems ?? Recognise the principles of leadership and authority ?? Recruit and develop effective employees Links with other papers This diagram shows where direct solid line arrows and indirect dashed line arrows links exist between this paper and other papers that may follow it. The Accountant in Business is the first paper that students should study as it acts as an introduction to business structure and purpose and to accountancy as a core business function. BA P3 MA F2 and FA F3PA P1 AB F1 INTRODUCTION iii Assessment methods and format of the exam Examiner: Bob Souster The examination is a two hour paper-based or computer-based examination. Questions will assess all parts of the syllabus and will test knowledge and some comprehension of application of this knowledge. The examination will consist of 40 two mark and 10 one mark multiple choice questions. The pass mark is 50 ie. 45 out of 90. INTRODUCTION iv Course Aims Achieving ACCAs Study Guide Outcomes Business organisations structure governance and management A1 The business organisation and its structure Chapter 1A2 The formal and informal business organisation Chapter 3 A3 Organisational culture in business Chapter 3 A4 Stakeholders of business organisations Chapter 3 A5 Information technology and information systems in business Chapter 2 A6 Committees in the business organisation Chapter 1 A7 Business ethics and ethical behaviour Chapter 4 A8 Governance and social responsibility Chapter 5 Key environmental influences and constraints on business and accounting B1 Political and legal factors Chapter 7 B2 Macro-economic factors Chapter 6 B3 Social and demographic factors Chapter 7 B4 Technological factors Chapter 7 B5 Competitive factors Chapter 7 History and role of accounting in business C1 The history and functions of accounting in business Chapter 8 C2 Law and regulations governing accounting Chapter 8 C3 Financial systems procedures and IT applications Chapter 8 C4 The relationship between accounting and other business functions Chapter 1 Specific functions of accounting and internal financial control D1 Accounting and financial functions within business Chapter 1 D2 Internal and external auditing and their functions Chapter 9 D3 Internal financial control and security within business organisations Chapter 9 D4 Fraud and fraudulent behaviour and their prevention in business Chapter 10 INTRODUCTION v Leading and managing individuals and teams E1 Leadership management and supervision Chapter 11 E2 Individual and group behaviour in business organisations Chapter 12 E3 Team formationdevelopment and management Chapter 12 E4 Motivating individuals and groups Chapter 13 Recruiting and developing effective employees F1 Recruitment and selection managing diversity and equal opportunities Chapter 15 16 F2 Techniques for improving personal effectiveness at work and their benefits Chapter 14 F3 Features of effective communication Chapter 14 F4 Training development and learning in the maintenance and improvement of business performance Chapter 17 F5 Review and appraisal of individual performance Chapter 18 INTRODUCTION vi Classroom tuition and Home study Your studies for BPP consist of two elements classroom tuition and home study. Classroom tuition In class we aim to cover the key areas of the syllabus. To ensure examination success you will need to spend private study time reinforcing your classroom course with question practice and reviewing areas of the Course Notes and Study Text. Home study To support you with your private study BPP provides you with a Course Companion which helps you to work at home and aims to ensure your private study time is effectively used. The Course Companion includes a Home Study section which breaks down your home study by days one to be covered at the end of each day of the course. You will find clear guidance as to the time to spend on various activities and their importance. You are also provided with sample questions and either two course exams which should be submitted for marking as they become due or an I-pass CD which is full of questions. These may include questions on topics covered in class and home study. BPP Learn Online Come and visit the BPP Learn Online free at/acca/learnonline for exam tips FAQs and syllabus health check. ACCA Forum We have thriving ACCA bulletin boards at /accaforum. Register and discuss your studies with tutors and students. Helpline If you have any queries during your private study simply contact your class tutor on the telephone number or e-mail address that they will supply. Alternatively call 44 020 8740 2222 or your local training centre if outside the London area and ask for a tutor for this paper to speak to you or to call you back within 24 hours. Feedback The success of BPP’s courses has been built on what you the students tell us. At the end of the course for each subject you will be given a feedback form to complete and return. If you have any issues or ideas before you are given the form to complete please raise them with the course tutor or relevant head of centre. If this is not possible please email . INTRODUCTION vii Key to icons Question practice from the Study Text This is a question we recommend you attempt for home study. Real world examples These can be found in the Course Companion. Section reference in the Study Text Further reading is needed on this area to consolidate your knowledge. INTRODUCTION viii 1.1 Syllabus Guide Detailed Outcomes Having studied this chapter you will be able to: ?? Ascertain the appropriate organisational structure for different types and sizes of business. ?? Understand the concepts of span of control and scalar chains. ?? Appreciate the differing levels of strategy in an organisation. Exam Context This chapter lays the foundation for an understanding of what organisations are what they do and how they do it. Section 2 Organisational structure represents a higher level of knowledge. You must be able to apply knowledge to exam questions. Qualification Context An understanding of business structures is important with regard to higher level accounting papers as well as P3 Business Analysis. Business Context Appreciating why organisations are structured in different ways will help with an understanding of how they should be managed. Business organisation and structure 1: BUSINESS ORGANISATION AND STRUCTURE 1.2Overview Departments and functions Why does the organisation exist Structural forms Business hierarchy 1: BUSINESS ORGANISATION AND STRUCTURE 1.3 1 Organisations 1.1 Definition – An organisation is a social arrangement which pursues collective goals which controls its own performance and which has a boundary separating it from its environment. Boundaries can be physical or social. 1.2 Key categories: ?? Commercial ?? Not for profit ?? Public sector ?? Charities ?? Trade unions ?? Local authorities ?? Mutual associates Class exercise Required Identify a real-world example of the above categories of organisation. 1.3 Organisations owned or run by the government local or national or government agencies are described as being in the public sector. All other organisations are classified as the private sector. Limited liability 1.4 Limited companies denoted by X Ltd or X plc are set up so as to have a separate legal entity from their owners shareholders. Liability of these owners is thus limited to the amount invested. Private v public 1.5 Private companies are usually owned by a small number of people family members and these shares are not easily transferable. Shares of public companies will be traded on the Stock Exchange. Pg 52-561: BUSINESS ORGANISATION AND STRUCTURE 1.4 2 Organisational structure 2.1 Henry Mintzberg believes that all organisations can be analysed into five components according to how they relate to the work of the organisation and how they prefer to co-ordinate. a Strategic apex Drives the direction of the business through control over decision-making. b Technostructure Drives efficiency through rules and procedures. c Operating core Performs the routine activities of the organisation in a proficient and standardised manner. d Middle line Performs the management functions of control over resources processes and business areas. e Support staff Provide expertise and service to the organisation. Strategic Apex Support Staff Technostructure Middle Line Operating Core 1: BUSINESS ORGANISATION AND STRUCTURE 1.5 Exam standard question Required Match the following staff/rules to Mintzbergs technostructure: a Manager of a retail outlet supervising 40 staff. b A salesman responsible for twenty corporate accounts. c The owner of a start-up internet company employing two staff. d The HR department which provides support to business managers. e The IT department seeking to standardise internal systems. 3 Structural forms for organisations Scalar chain and span of control 3.1 As organisations grow in size and scope different organisational structures may be suitable. 3.2 The Scalar chain and Span of control determine the basic shape. The scalar chain relates to levels in the organisation and the span of control the number of employees managed. 3.3 Tall organisations have a: a Long scalar chain via layers of management b Hierarchy c Narrow span of control. 3.4 Flat organisations have a: a Short scalar chain less layers b Wide span of control. 1: BUSINESS ORGANISATION AND STRUCTURE 1.6 3.5 MD Divisional directors Department managers Section managers MD Supervisors Department managers Charge hands Supervisors Workers Workers Tall Flat Pilot paper Required Identify factors which may contribute to the length of the chain and the span of control. Organisational structures 3.6 Entrepreneurial A fluid structure with little or no formality. Suitable for small start-up companies the activities and decisions are dominated by a key central figure the owner/entrepreneur. 3.7 Functional This structure is created via separate departments or functions. Employees are grouped by specialism and departmental targets will be set. Formal communication systems will be set up to ensure information is shared. 1: BUSINESS ORGANISATION AND STRUCTURE 1.7 3.8 Matrix A matrix organisation crosses a functional with a product/customer/projectstructure. This structure was created to bring flexibility to organisations geared towards project work or customer-specific jobs. Staff may be employed within a hierarchy or within specific functions but will be slotted into different teams or tasks where their skill is most needed. The matrix structure is built upon the principles of flexibility and dual authority. Required Identify two advantages and two disadvantages of each structure. Advantages Disadvantages Entrepreneurial Functional Matrix 3.9 Organisations are rarely composed of only one type of structure especially if the organisation has been in existence for some time and as a consequence a hybrid structure may be established. Hybrid structures involve a mixture of functional divisionalisation and at least one other form of divisionalisation. Area Manager A Area Manager B Area Manager C.。

ACCA F6 双语教材

Course NotesACCA Paper F6 (FA 2015)TaxationFor December 2016 to March 2017 examsS E P T E M B E R 2 0 1 6 R E L E A S E第一直觉教育www.fi_Intro ductio n ACCA F 6 No part of this publication may be reproduced, stored in a retrieval systemor transmitted, in any form or by any means, electronic, mechanical,photocopying, recording or otherwise, without the prior written permissionof First Intuition Ltd.Any unauthorised reproduction or distribution in any form is strictlyprohibited as breach of copyright and may be punishable by law.© First Intuition Ltd, 2016第一直觉教育www.fi_ACCA F 6Intro ductio n 1ContentsPageIntroduction i1Exam format vii2Study planner viii1: The UK tax system 11The tax regime 12The ethical professional 23The scope of income tax 34Residence 35Income tax computation pro-forma 62: Income from employment 71Income from employment 72Basis of assessment for employees 83Assessable benefits 124Marginal cost 183: Self-employment 191Basis of assessment 192The badges of trade 193Adjustment of profits: sole traders and companies 204Cash basis for small businesses 214: Capital allowances 231Overview 232The Allowances (all percentages and limits will be given in exam) 243Balancing allowances and balancing charges 294Year of cessation 295: Commencement and cessation of trade 311 Basis periods 316: Trading losses 371Introduction 372Set losses against an individual’s income then gains 373Carry forward losses 384Factors influencing which loss relief to use 385Losses in the opening years of trade 396Terminal loss relief (closing year of trade) 407Cap on loss relief 428Property business losses 439Overview of the use of trading losses 43第一直觉教育www.fi_Intro ductio n ACCA F 67: Partnerships 45 1Principles 45 2Limited liability partnerships (LLPs) 45 3Approach to exam questions 468: Property and investment income 47 1Land and buildings 47 2Savings income 49 9: Income tax computation 51 1Overview and income tax pro forma 51 2Computing tax payable 52 3Eligible interest 52 4Personal allowance 53 5Gift Aid 5710: Pensions and planning for couples 59 1Pension schemes 59 2Tax planning for married couples/civil partners 62 11: Corporation tax 63 1Scope of corporation tax 63 2Long periods of account 66 3The corporation tax liability 67 4Approach to corporation tax questions 6812: Corporation tax losses 69 1Trading losses 69 2Relief against total profits 70 3Carry forward of losses 71 4Terminal loss relief 72 5Capital losses 7213: Groups of companies 75 1Two types of group 75 2Group relief group 76 3Groups and gains 8014: Capital gains tax (CGT) 81 1Scope of CGT 81 2Exempt assets 82 3Inter-spouse transfers 82 4Connected persons 82 5Calculating gains and rates of tax 82 6Capital losses 83 7Part disposals 84 8Terminology 84第一直觉教育www.fi_ACCA F 6Intro ductio n15: Chattels and wasting assets 851Wasting chattels (life < 50 years) 852Non-wasting chattels (life > 50 years) 853Summary 864Chattel scenarios 865Wasting assets (e.g. copyright with a 20-year life) 8616: CGT reliefs 871Introduction 872Principal Private Residence 883Rollover relief 894Gift relief 925Entrepreneurs’ relief (ER) 9417: Shares and securities 971Introduction 972Gifts of quoted shares 973Bonus issues 994Rights issues, a purchase of more shares 995Re-organisations and takeovers 996Gilts and qualifying corporate bonds (QCB) 10018: Corporate gains 1011Introduction 1012Share matching for companies 10119: National insurance 1051Class 1 NIC 1052Class 2 (self-employed) 1063Class 4 (self-employed) 10620: Value added tax 1091The scope of VAT 1092Types of supply 1103VAT registration 1104Computation of VAT liabilities 1125VAT invoice 1136The valuation of supplies 1137Non-deductible input VAT 1148Bad debts 1149Penalties 11410Special schemes 11511Group registration 11612Purchases and sales from outside of the UK 117第一直觉教育www.fi_Intro ductio n ACCA F 621: Obligations for individuals 119 1Collection of income tax 119 2Self-assessment 119 3Record keeping 124 4Compliance checks and appeals 124 5HMRC powers 125 6Time limits 126 7PAYE real time reporting late filing penalty 126 22: Company tax administration 1271Self-assessment for companies 127 2Record keeping 132 3HMRC determinations 133 4Compliance Checks 133 5Discovery assessments 133 6Overpayment relief 134 23: Inheritance tax 135 1The scope of inheritance tax 135 2Persons chargeable to IHT 135 3Transfers of value 135 4Exempt transfers – lifetime transfers and transfers on death 136 5Types of lifetime transfer 136 6Calculation of lifetime tax on lifetime transfers 138 7Tax payable on death 141 8Payment of IHT 144 9Inheritance tax computation: Step by Step Guide 145 Solutions to Class lecture examples 149Chapter 1 149 Chapter 2 150 Chapter 4 151 Chapter 5 151 Chapter 6 152 Chapter 7 154 Chapter 9 155 Chapter 10 157 Chapter 11 157 Chapter 12 158 Chapter 13 158 Chapter 14 159 Chapter 16 160 Chapter 17 161 Chapter 18 162 Chapter 22 164 Chapter 23 164第一直觉教育www.fi_ACCA F 6Intro ductio n1 Exam formatFrom September 2016 this exam is a three hour and 15 minute exam with no separate time allocatedfor reading and planning.E XAM S MARTAlthough there is no specific reading and planning time, First Intuition recommends that youuse the first 15 minutes of the exam for reading and planning time and then allow 1.8minutes per mark to answer the questions.From September 2016 the exam paper is divided into three sections:Section A Fifteen multiple choice questions worth 2 marks eachSection B Three 10 mark objective test case questions. Each question consists of fiveobjective test questions based around a common scenario. Each of the objectivetest questions is worth 2 marksSection C One 10 mark question and two 15 mark questionsThe two 15 mark questions in section C will focus on income tax and corporation tax, but could includea small number of marks focussing on other taxes. All other questions can cover any area of thesyllabus.The paper will be predominantly computational and all questions are compulsory.From December 2016 this exam will be available as a computer-based exam as well as a paper basedexam. In the paper based exam all of the objective test questions in Sections A and B will be of a fouroption multiple choice style. However, in the computer based exam there will be a variety of styles ofobjective test questions. For example, some questions may be multiple response, number entry or fillin a table. In the First Intuition Question Bank we include a variety of question styles for you topractise. Practice of all question types is useful whichever style of exam you are sitting.The Examiner is a very experienced and fair Examiner. If you are well prepared, you will enjoy thisexamination.When revising, practise as many questions as possible. The key to success in this paper is questionpractice.第一直觉教育www.fi_Intro ductio n ACCA F 62 Study plannerThe chapter number in the table below refers to the chapter of the Course Notes. The time is a guideas to how long you should spend on the subject.D A Y 111The UK taxsystem The chapter starts with backgroundinformation which you can skim read. Thereare then three important areas to studycarefully:(a)Tax evasion and tax avoidance(b)The ethical professional(c)ResidenceDon’t worry, at this stage, about the incometax computation at the end of the chapter. It isincluded for you to refer back to as youcomplete each section.PO1PO15PO1725PlusquestionsOTs1-416 (CharlieBrook)2Income fromemployment (a)Employment v self-employment couldcome up, but it is not tested regularly.(b)The basis of assessment is testedregularly. The Examiner likes to tease youwith bonus payments available in one taxyear but not paid until the next. (Seequestion 10 Joe Jones)(c)PAYE comes up occasionally and it may betested in the OTs.(d)Assessable benefits are very importantand come up in most exams. They arehighly likely to be tested in the OTs. Workthrough the lecture examples and learnthe rules. There is lots of detail to learn soit is worth concentrating your time here.Refer to the income tax computation inChapter 1 and note where employmentincome goes. In your exam, calculatePO15PO17120Plusquestions66 part (a)(AndrewZoom)OTs 14, 15OTs 5 – 13OTs 16 2710 (JoeJones) (Justfind theemployment第一直觉教育www.fi_ACCA F 6Intro ductio nEnd of day 1. By the end of today you should be able to:(1)Calculate the taxable earnings of an employee(2)Adjust the profits of a sole trader(3)Compute capital allowances(4)Calculate the assessable profits for opening and closing years(5)Deal with income tax losses第一直觉教育www.fi_Intro ductio n ACCA F 6 D A Y 2第一直觉教育www.fi_ACCA F 6Intro ductio nEnd of day 2. By the end of today you should be able to(1)Calculate an individual’s income tax liability for a tax year(2)Deal with income from any source(3)Deal with Gift Aid and pension contributionsYou should also have learnt(4)The basics of how to prepare a corporation tax computation(5)How to relieve corporation tax losses第一直觉教育www.fi_Intro ductio n ACCA F 6 D A Y 3End of day 3.By the end of today you should be able to tackle any corporation tax question, including adjustment of profits, losses and groups. You will also know how to compute chargeable gains and you will have learnt about the reliefs available and how to compute gains on shares.第一直觉教育www.fi_ACCA F 6Intro ductio n D A Y 4第一直觉教育www.fi_第一直觉教育www.fi_Intro ductio nACCA F 623 Inheritance tax (IHT) An interesting chapter to finish with.IHT now features in every exam.IHT is a very different tax to othertaxes in that it focuses on what you give away rather than what you earnor gain.The 7-year cumulation is different to anything else you have seen and can be confusing at first, so take your time sorting this out.Learn everything in the chapter.PO15 PO17120 Plus questions OTs 151 – 15651 (Tom Tirith)50 (Pere Jones) 52 (Ahran)End of day 4.By the end of today you will be able to attempt any question in the Question Bank.2.1 Planning your study timeThis study plan above requires a minimum of 37 hours’ work . You also need time for final revision (see below).E XAM S MARTRemember to call your tutor if you need any help at any time.2.2 Practical Experience Requirements (PER) and Performance ObjectivesACCA requires students to have 36 months’ practical experience in order to become members. Part of the practical experience requirements is achieving performance objectives that demonstrate that you can apply what you’ve learnt when studying to real -life, work activities.ACCA has set out 20 performance objectives in 10 areas. You are required to achieve 9 performance objectives – all 5 Essentials performance objectives and any 4 from 15 technical performance objectives. ACCA has provided guidance on which objectives are strongly linked to which exam. The relevant objectives for F6 are: Essential performance objectives ❝ PO1 Professionalism and Ethics Technical objectives ❝ PO15 Tax computations and assessments ❝ PO16 Tax compliance and verification ❝PO17 Tax planning and adviceACCA F 6Intro ductio n2.3RevisionAn effective revision period is essential for passing this exam.E XAM S MARTPrepare for the real exam (THIS PARAGRAPH IS IMPORTANT)About two weeks prior to your exam, you should commence your revision. The Study Guideabove mirrors the programme we use for our classroom based teaching but whether youhave attended classroom based teaching or not, we strongly recommend that you come onone of our revision courses.If you are unable to attend on one of our revision courses, you must attempt all the otherquestions in the Question Bank. If time allows, attempt all the questions twice. You shouldalso sit our mock exam.Question practice is the key to passing this exam.第一直觉教育www.fi_Intro ductio n ACCA F 6 If you would like to come on either the revision or question day course, please call your local First Intuitionstudy centre.Make sure you get plenty of rest in the final week before the exam and avoid late nights so you remain fit and well. Make sure you know where your exam centre is and plan your journey, leaving plenty of time so you arrive calm and relaxed.Good luck!第一直觉教育www.fi_第一直觉教育www.fi_1 The tax regime1.1 Types of tax一The overall functions and purposes of taxation in a modern economy are, to raise finance, regulate demand, and guide behaviour .TAXSUFFERED BYIncome Tax Chapters 1-10Individuals – e.g. Employees Sole tradersPartners in a partnership Unemployed Retired Corporation Tax Chapters 11-13 & 18 CompaniesCapital Gains Tax Chapters 14-17 Individuals (companies pay corporation tax on capital gains) National Insurance Chapter 19 Employees Self-employed EmployersValue Added Tax Chapter 20 The consumer. Collected by businesses, both unincorporated and companies Inheritance Tax Chapter 23Individuals2 1 : T he UK tax system ACCA F 61.2The difference between direct and indirect taxationK EY TERMSK EY TERMSGeneral anti-abuse rule (GAAR)A GAAR stops tax advantages (e.g. increased deduction/decreased income) arising from abusive taxarrangements (those which cannot be regarded as a reasonable course of action).2The ethical professionalE XAM S MARTIt is vitally important that you learn the ethical rules that you, as a qualified professional, willbe governed by.As an accountant, you are a taxpayer’s agent.❝ A taxpayer may appoint an accountant to prepare and submit a tax return, but it is t he taxpayer, not the accountant, who is responsible for the return and paying tax.In dealing with clients, the ACCA requires a member to uphold its standards. These are to act❝honestly, and❝with due care and diligence, and❝showing the highest standards of integrity.It is the responsibility of an accountant who learns of a material e rror or omission in a client’s taxreturn or of a failure to file a return, to advise the client of the situation and to recommend disclosure to HMRC.第一直觉教育www.fi_第一直觉教育www.fi_ACCA F 61 : T he UK tax system 3If a client fails to correct a material error/omission or failure, the accountant must: (1) cease to act for the client,(2) inform HMRC that he is no longer acting for the client (3)make a money laundering reportNote that an accountant should not provide details to HMRC of why they are ceasing to act.The money laundering report which sets out the situation is made to the Money Laundering Reporting Officer within the accountancy firm or to the appropriate authority (National Crime Agency) if the accountant is a sole practitioner.3 The scope of income taxIndividuals are liable to income tax for a tax year.K EY TERM❝Individuals who are resident in the UK for a tax year are generally liable to UK income tax on their worldwide income.❝Non-UK resident individuals are only liable to UK income tax on income arising in the U K.4 ResidenceThere are statutory tests to determine a person’s residence status. You must consider the tests in the order set out below.If, for example, one of the automatic non residence tests is satisfied, then you do not need to consider the remaining rules.S TATUTORY TESTSTest 1: Automatic non – UK residentA person is automatically NOT resident if, in the tax year, he is in the UK for less than: ❝ 16 days, or❝ 46 days and has not been UK resident during the three previous tax y ears (i.e. is arriving in the UK or is an occasional visitor), or❝91 days, of which fewer than 31 days were working in the UK, and he works full-time o verseas.Test 2: Automatic UK residentProvided test 1 is not met, a person is automatically resident in the UK in a tax year if he ❝ Is in the UK for 183 days or more during the year, or ❝ He has his only home in the UK, or❝He works full-time in the UK and more than 75% of his working days are in the UK4 1 : T he UK tax system ACCA F 6Test 3: Sufficient ties testIf (and ONLY if) person’s residence status cannot be determined using the automatic tests above,use the sufficient ties test.Firstly, determine whether the person is a previous UK resident:For these purposes:❝ A person is a previous UK resident, if he was UK resident in one or more of the 3 p revious tax years (usually someone leaving).❝ A person who was not UK resident in any of the 3 previous tax years, is not a p revious resident (usually someone arriving).Next count how many ties the individual has with the UK:There are four UK ties for arrivers and five UK ties for leavers:(1)Having close family (a spouse/civil partner/cohabitee or minor child) resident in the U K.(2)Having UK accommodation in which the individual spends at least one night in the tax year.(3)Doing substantive work in the UK.This means work for 3 hours or more on 40 or more days in the tax year.(4)Being in the UK for more than 90 days during either or both of the two previous tax years.For leavers, there is one further tie:(5)Spending more time in the UK than in any other country during the tax year.A day in the UK is any day on which a person is present in the UK at midnight.Note: it is harder for a person leaving to become non-resident than it is for a person arriving to remain non-resident.Once you have decided a person’s previous residence status and the number of ties, determineresidence status for the tax year using the table below:Days in the UK Previously resident Not previously residentLess than 16 Automatically not resident Automatically not resident16 to 45 Resident if 4 UK ties or more Automatically not resident46 to 90 Resident if 3 UK ties or more Resident if 4 UK ties91 to 120 Resident if 2 UK ties or more Resident if 3 UK ties or more121 to 182 Resident if 1 UK ties or more Resident if 2 UK ties or more183 or more Automatically resident Automatically residentE XAM S MART❝The table above will be given to you in the exam.❝In practice, the rules are more complex than described above. However, t he F6Examiner has confirmed that the above is all that he expects you to know.第一直觉教育www.fi_ACCA F 6 1 : T he UK tax system 5Jai was born in the UK and lived here until 31 March 2015 when she retired and went to live in a houseshe had purchased overseas. Jai lived overseas throughout 2015/16 except for the 49 days when shereturned for her daughter’s wedding. Whilst in the UK Jai lived with her husband in the house theyjointly own. Her husband continued to work in the UK and lived in the house for 220 days in 2015/16.To decide whether Jai is UK resident for 2015/16, look at the automatic tests and then the ties:第一直觉教育www.fi_6 1 : T he UK tax system ACCA F 65Income tax computation pro-formaFor interest, an income tax computation looks like this: We’ll cover the detail in the followingchapters.Non-savings Savings Dividends Total££££Employment income (Ch. 2) 25,600 25,600Trading profit (Chs. 3-7) 15,000 15,000Property profit (Ch. 8) 12,000 12,000Building society interest £1,600 × 100/80 (Ch. 8) 2,0002,000Bank deposit interest £400 × 100/80 (Ch. 8) 500 500Nat. savings bank interest received gross (Ch. 8) 1,0001,000Dividends £2,700 × 100/90 (Ch. 8) 3,000 3,000Total income 52,600 3,5003,000 59,100Personal allowance (Ch. 9) (10,600) (10,600)Taxable income (Ch. 9) 42,000 3,5003,000Income tax (Ch. 9) £Non-savings (Ch. 9) 31,785 × 20% 6,357Extend basic rate band by gross personalpension & Gift Aid (Chs. 9 & 10) 4,000 × 20% 800Excess non-savings (Ch. 9) 6,215 × 40% 2,48642,000Savings (Ch. 9) 3,500 × 40% 1,400Dividends (Ch. 9) 3,000 × 32.5% 975Child benefit tax charge (Ch. 9) 980Income tax liabilityLess tax suffered on income 12,998Dividend 10% × £3,000 (300) PAYE (Ch. 2) (6,500) Building society 20% × £2,000 (400) Bank deposit interest 20% × £500 (100) Income tax due or payable第一直觉教育www.fi_。

acca英语词汇书

acca英语词汇书

以下是一些推荐的ACCA英语词汇书:

1. "ACCA F4 Corporate and Business Law (English): Passcards"

by BPP Learning Media

2. "ACCA F5 Performance Management: Passcards" by BPP Learning Media

3. "ACCA F6 Taxation (UK): Passcards" by BPP Learning Media

4. "ACCA F7 Financial Reporting: Passcards" by BPP Learning Media

5. "ACCA F8 Audit and Assurance: Passcards" by BPP Learning Media

6. "ACCA F9 Financial Management: Passcards" by BPP Learning Media

这些书籍由BPP Learning Media出版,专为ACCA考试编写,旨在帮助考生掌握ACCA的必备英语词汇。

每本书都包含了

大量的ACCA相关词汇和术语,并提供了示例和练习,以帮

助考生巩固所学内容。

无论您是想提升ACCA考试的英语能力,还是想扩展ACCA课程中的词汇知识,这些书籍都是不

错的选择。

请注意,这只是一些建议,您还可以在其他书店或在线市场上寻找其他ACCA英语词汇书的选择。

2013年ACCA教材词汇表

2013ACCA教材词汇表。

独资企业Sole trader 收购公司Purchasing company银行透支Bank overdraft 开帐分录Opening entry购货退回Return outwards 接管Take over销货退回Return inwards 企业收购帐户Business purchase account 毛利Gross profit 卖主帐户Vendor account租金与地方税Rent and rates 留存收益Retained earnings收到的折扣Discount received 普通股股本Ordinary share capital给与的折扣Discount allowed 优先股股本Preference share capital要求权Claim 债券Debentures提款Drawings 损益表Profit and loss account合伙企业Partnership 股东年会General meeting合伙人Partner 真实/公允True and fair合伙协议Partnership agreement 推销成本Distribution cost资本利息Interest on capital 投资注销额Amount written-offinvestment剩余利润Residual profit 自建工程资本化Own work capitalized分配Appropriation 集团内股票收入Income from shares in groupunder takings盈亏分配帐户Profit and loss appropriation 其他股票收入Income from shares in otherparticipating interests结转下期余额Balance carried down 自有股Own shares上期结转余额Balance Brought down 负债准备Provisions for liabilities 合伙人贷款Partner’s loan养老金Pensions合作企业Joint venture 资本赎回公积Capital redemption reserve 合作企业备查帐户Memorandum joint venture 按公司章程保留的公积Reserve provided for by thearticles of association杂费Sundry expenses 公司所得税Corporation tas (CT)佣金Commission 财政年度Financial year运出运费Carriage outwards 预交公司所得税Advanced corporationtax(ACT)运入运费Carriage inwards 主体公司所得税Mainstream corporationtax(MCT)联合银行存款帐户Joint bank account 所得税率适用年度CT year商誉Goodwill 税金抵免Tax credit重估价法Revaluation method 税收机构Inland revenue合并Amalgamation 应纳税利润Taxable profit合并前Pre-Amalgamation 公司所得税准备Provision fo CT合并后Post-Amalgamation 应抵预交公司所得税ACT recoverable应付公司所得税ACT payable通过支付年金清偿Discharge by payment ofannuity年金暂记帐户Annuity suspense account 预算报告Budget speech保险金Premiums 资本收益Capital gain退保价值Surrender value 小公司税率Small companies rate人寿保险政策帐户Life assurance policiesaccount边际利率Marginal rate贸易表Trading account 完全税率Full rate终止Cessation 免税投资收益Franked investment income 变卖资产帐户Realization account 资本减免Capital allowances合伙企业的解体Dissolution of partnership 剩余预交公司所得税Surplus ACT最后约定的资本Last agreed capital 寄售业务Consignment trading逐步解体Piecemeal dissolution 汇票Bills of exchange变卖资产费用准备Provision for realizationexpense分支机构Branch变卖资产损失Loss on realization 代理商Agent股票帐户Shares account 交易商Trader英国境内公司UK resident company 受托人Consignee非免税收入Un-franked receipts 委托人,寄售人Consigner公司所得税费用CT charge 保障,赔偿Indemnity代扣所得税的交纳Payment under deduction of IT 销售帐单Account sales磨损Wear and tear 寄售利润Profit on consignment拥有法定所有权的土地Freehold land 进口税Import duties过时Obsolescence 运费Delivery to customers开采或消耗Extraction of consumptionover time 途中保险费Carriage insurance on goodsdelivered to Customers直线法Straight line method 佣金Commission余额递减法Reducing balance method 汇付Remittance年数总和法Sum of the digits method 未售存货Unsold stock累计折旧Accumulated depreciations 应收票据Bills receivable 经济使用年限Useful economic lives 保险收入Insurance proceeds 每股净收益Earnings per share 面值Face value例外项目Exceptional items 贴现费用Discount charges 非常项目Extraordinary items 财务费用Financing cost前期调整Prior year adjustment 应付票据Bills payable不能抵销的预交公司税Irrevocable advancedcorporation tax支出Expenditure未抵销的损失Unrelieved losses 即期汇票Sight drafts净值基础Net basis 监管Custody零值基础Nil basis 主损益帐户Main profit and loss account 消耗品Consumable stores 部门化Departmentalization成本与可实现净值孰低The lower of cost and netrealizable value分摊Apportionment平均成本Average cost 共同性费用Common expense先进先出First in first out 包装纸Wrapping paper后进先出Last in first out 评价Assess标准成本Standard cost 独立实体Independent entity 重置成本Replacement cost 投资报酬率Return on investment资产负债表日后日期Event after balance sheet date 减除佣金后利润Post-commission profit董事会The board of directors 赊销收入Credit sales调整事项Adjusting event 修理费用Repair charges非调整事项Non-adjusting event 一般费用General expense或有事项Contingencies 分支销售机构Selling agency branch或有收益Contingent gain 正常存货损失Normal stock losses或有损失Contingent loss 交易帐户Trading account资本承诺Capital commitments 非常存货损失Abnormal stock losses现金流量表Cash flow statement 本地购货Local purchase信用交易Credit transaction 退货Returned goods独立分支机构Independent branch现实购买力会计Current purchasing poweraccounting (CPP)现实成本会计Current cost accounting(CCA) 往来帐户Current account零售物价指数Retail price index 复式簿记帐户Double-entry accounts持有收益Holding gains 时间差异Time lag differences业绩评估Assessment of performance 分支机构间转移Inter-branch transfer货币性项目的衡量Measurement of monetary items 结算Settlement货币性资产Monetary assets 分支机构间往来帐户Interbranch current account 货币性负债Monetary liabilities 分支机构存货调整帐户Branch stock adjustmentaccount征求意见稿Exposure draft 未实现利润准备Provision for unrealizedprofit实现原则Realization货币性营运资本调整Monetary working capitaladjustment举债比率调整Gearing adjustment 货币折算Currency translation净营业资产Net operating assets 货币兑换Currency conversion当地货币Local currency发行和赎回债券Issue and redemptiondebentures债券Bonds 汇率Exchange rate契约Deed 即期汇率Spot rate无担保债券Naked-debentures(unsecured) 远期合同Forward contract拥有法定所有权的Freehold 贴水Discount偿债基金Sinking fund 升水Premium货币性项目Monetary items债券赎回偿债基金Debenture redemption sinkingfund account偿债基金投资帐户Sinking fund investment风险Riskaccount可转换债券Convertible debentures 不确定性Uncertainty资本化发行Capitalization issue 套期保值Hedging股权发行Bonus issue 长期货币性资产Long-term monetary assets 含权价Cum-rights prices 长期货币性要求权Long-term monetary claims 除权价Ex-rights prices 汇兑收益/损失Exchange rate gain/loss可分配公积Distributable of reserves 时态法Temporal method以公积支付股利Paying a dividend out of 历史汇率法Historic methodreserve已付清红利股Paid-up bonus shares 期末汇率法Closing rate method重估公积Revaluation reserve 场地费用Site expenses减资Capital reductions 管理费用Administrative expenses资本重组Capital reorganizations 装置和设备Furniture and fittings过剩资本Excess capital 房屋Premises资本重建Capital reconstruction 预付费用Payment in advance权益汇总帐户Sundry members account 建造合同Construction contract实现帐户Realization account 工程保留款Retention购买者帐户Purchaser’s account分期付款Progress payment自愿清算Voluntary liquidation 交易帐户Trading account特别决议Special resolution 合同收入Contract fee方案\计划Scheme 合同亏损Loss on contract清偿\偿还Discharge 完工百分比Percentage of completion卖方帐户Vendor account 完成合同Completed contract创立合并Amalgamation 预期利润Expected profit高估Over-valuation 承建商Contractor低估Under-valuation 矫正Rectification集团报表Group accounts 已鉴定完工价值Value of work certified纵向联合Vertical integration 总部费用Head office costs横向联合Horizontal integration 合同成本Contract costs不同行业联合Diversification 销售收入Turnover控股公司Holding company 合同损失准备Provision for loss oncontract重大影响Dominant influence 预收款Payment on account直接控制集团Direct group 可预见损失Foreseeable loss垂直控制集团Vertical group 已付款超过收入(部分) Excess progress payment混合控制集团Mixed group 股票/证券Stock ,security盈余公积Revenue reserve 债券Debenture合并公积Consolidation reserve 法定权利Legal rights少数股权Minority interests 报价Quote合并商誉Goodwill on consolidation 证券交易所Stock exchange上市投资Listed investment合并资本公积Capital reserve onconsolidation少数股东Minority share holders 偿还Repayment股本溢价Share premium 累积股息Cum div cd部分收购Partial acquisition 累积利息Cum-int ci在途支票Cheque in the post 股息除外Ex-div xd收买前后Pre( post)-acquisition 利息除外Ex-int xi调整帐户Adjustment accounts 面值Nominal value对子公司投资Investment in subsidiary 市价Market value普通公积General reserve 应计股利Accrued dividend参与股权Participating interest 应计利息Accrued interest集团内部交易Intra-group trading 证券交易所官方清单Stock exchange official list公司间销售Inter-company sales 二级市场Secondary market溢价Premium 未上市证券市场Unlisted securities market 折价Discount 让与,出售disposal债券利息Debenture interest 加权平均Weighted分次购买Piecemeal acquisition 结帐Close off关联公司Associated company 已分派股份Allocated shares多数股权Majority holding 国库券Treasury stock累计控股Cumulative holding 认股权发行Rights issue孙公司Sub-subsidiary 赊销Credit sale子集团,附属集团Sub-group 租购Hire purchase多公司结构Multi-company structures 信用协议Credit agreement伙伴子公司Fellow subsidiaries 会计处理Accounting treatment有效股权Effective shareholdings 经营性租赁Operating lease控制股权Controlling interest 融资租赁Finance lease资本报酬率Return on capital employed 出租人/承租人Lesser /lessee产权收益率Returen on equity 一期(二期)租赁Primary(secondary)period 息税前净利Net Profit before interest andtax不可撤销的付款No-cancelable payment应收帐款帐龄表Aging schedule of debtors 名义租金Peppercorn rent资金来源及运用表Source and application offunds statement报酬Reward通货膨胀Inflation 现值Present value通货紧缩Deflation 最低租赁付款额Minimum lease payment损耗Deplete 定金Deposit每股收益Earnings per share 公允价值Fair value股利保证倍数Dividend cover 财务费用Finance charge股利分配率Dividend payout ratio 实际利率Effective rate of financecharge股利收益率Dividend yield ratio 平均未付资本余额Average balance of capitaloutstanding净收益率Earnings yield 资本偿还Capital repayment市盈率Price/ earnings ratio 精确法Actuarial method公司估价The valuation of components 递延收益Deferred income联营公司Associated companies 分期支付Installment共同比财务报表Common-size financialstatements 未实现利润准备Provision for unrealizedprofit物质资源Physical resources 应收租购款帐户Hire purchase debtorsaccount会计原则Accounting principles 重新获得帐户Repossessions account 会计方法Accounting methods 金融公司Finance house权责发生制Accrual accounting 制造商Manufacturer重置成本Replacement cost 交易商Dealer一般会计原则Generally accepted accountingprinciples(GAAP)总盈余Gross earnings剩余现金Cash surplus 政府补助Government grant 净值减免Writing down allowance 租赁期Lease term。

ACCA教材电子版|ACCA notes|ACCA资料下载

ACCA教材电子版|ACCA notes|ACCA资料下载2017年12月26日首先,要明确的一点是,ACCA官网上面下载的各类PDF文件,也就是你们所搜索的ACCA电子教材,这些都是ACCA官方发布的一手资料。

所以这些资料对于ACCA的通过来说,绝对是有重要的导向意义的,如果每天光低着头默默的刷题,感觉是做了很多,也挺辛苦的,但是成绩不见长进,这样就事倍功半了,并不是我们想要的结果!所以,在闷头做题之前,有一点很重要,那就是,要搞清楚考官出题的意图。

想要了解清楚考官出题的意图,有个东西就很重要了。

学霸们一般在开始学习某个ACCA考试科目前,一定会先去参透这个内容,这样才能够有针对性的复习。

那就是!考纲!千万不要忽视考纲,里面写的很明确的告诉你,ACCA考试科目的考试重点有哪些,涵盖了哪些知识点,这些知识点将会以什么样的形式进行考察,这些内容都必须做到心中有数!下面是每次ACCA考试都必不可少的学习资料,这些资料就像是教材一样,帮助各位自学的考生顺利通过考试。

考纲解析根据考题对于历年的考纲进行分析,解析出对学习最有利的知识点。

ACCA notes这是一些重要的学习笔记,对于没有记笔记习惯的同学来说非常重要ACCA retakes如果你曾经参加过考试但是没有通过,那你就可以跟着retakes的内容来进行深入学习。

当然,如果你是新手,retakes也同样适用。

Examiner’s Approach/Guidance考官对这门Paper知识结构、考试方式和注意事项的介绍,有时间的一定要看看,字里行间就有考官对考试的偏好。

Examiner’s Report考官对一次考试的评价,一是对考生的表现作出评判,二是反思考试出题的情况,有的考官会很明确的说某个知识点考生答得不好,以后还要加强考察,这就要注意了,加强准备为好。

有的时候考官还会说明以后考试的侧重或者考法的变化,这也值得关注。

看上一次考试的Examiner’s Report就基本够了。

ACCA电子教材(各类ACCA官网下载pdf资料)怎么用?

ACCA电子教材(各类ACCA官网下载pdf资料)怎么用?ACCA考试共有14个考试科目,ACCA官网每个考季也会更新相应的资料,还有像BPP,Kaplan 等也会出相应的tips来助考。

很多同学在每个ACCA考季复习过程中,都要搜索ACCA电子教材等相应的PDF资料,或者直接从ACCA官网相面进行下载,比如考官文章,比如考纲。

今天我们通过本篇文章来盘一盘ACCA电子教材和那些下载下来的重要资料怎么用!每个考季都下载,光下载,填充满了D盘,却没有充满你的大脑,最后考试又不能直接调取D 盘内容,所以,我们要充实大脑,从我做起!首先,要明确的一点是,ACCA官网上面下载的各类PDF文件,也就是你们所搜索的ACCA 电子教材,这些都是ACCA官方发布的一手资料!所以这些资料对于ACCA的通过来说,绝对是有重要的导向意义的,如果每天光低着头默默的刷题,感觉是做了很多,也挺辛苦的,但是成绩不见长进,这样就事倍功半了,并不是我们想要的结果!所以,在闷头做题之前,有一点很重要,那就是,要搞清楚考官出题的意图!想要了解清楚考官出题的意图,有个东西就很重要了!学霸们一般在开始学习某个ACCA 考试科目前,一定会先去参透这个内容,这样才能够有针对性的复习。

那就是!考纲!千万不要忽视考纲,里面写的很明确的告诉你,ACCA考试科目的考试重点有哪些,涵盖了哪些知识点,这些知识点将会以什么样的形式进行考察,这些内容都必须做到心中有数!还不知道考纲从哪下载?不知道自己的考纲是不是最新考纲?帮你从ACCA官网上直接下载好了,自己去拿吧!请叫我雷锋!另外,再升一级的同学会说,考纲我知道很重要,也不是没看!但是发现能够从中获取到的信息特别有限。

同一本考纲,不同的人看,收效完全不同!ACCA单科状元看考纲会如何攫取信息?ACCA会员老师看考纲又是如何捕捉信息并解析?也许你需要参考他们的思路来提升和点播你的思路,豁然开朗后,也能够有适用于自己的考纲信息攫取模式。

-BPP-F9-教材

2013-BPP-F9-教材ACCA Platinum Text IFC & IBC 2011 for DIGITAL prints_Layout 1 13/10/2011 12:28 Page 1imise Your Exam Success with BPP Learning Media’sPlatinum Approved MaterialsLEARNOur Study Texts are the only Texts that have been reviewed by the examinerThis ensures that our coverage of thesyllabus is appropriate for your examBy choosing our Platinum Approved Study Text you are one step nearer toachieving the exam success you deservePRACTISE AND APPLYOur Practice & Revision Kits are the only Kits that have been reviewed by the examinerUse our Kits and our i-PassCD-ROMs to reinforce and apply your knowledgeKits are packed with past ACCA exam questions together withfull solutions and handy tutor’s hints.i-Pass contains approximately 300 questions, covering all important syllabus areasREVISE AND RETAINRevise using our pocket-sized Passcards and then listen to our audio Success CD to give your revision a boost.Our Interactive Passcards product takes the Passcards, adds additional tutorials, comments and lots of testing and links them to the Study TextThe result is a truly interactive revision experienceRevise using the on-screen Passcards anddip into the on-screen Study Text for more detail.BPP LEARNING MEDIA CUSTOMER SERVICESTel: 0845 075 1100 UK Email: learningmedia@bppTel: +44 020 8740 2211 Overseas Website: //0>./learningmediaTo help imise your chances of passing, we’ve put togethersome exclusive additional ACCA resources To access the BPPACCA online additional resources for this material please go to: ////.n Create a user account if you don’t already have one.Make sure you reply to the confirmation email.n Log in using your registered username and password.Select the paper you wish to access.n Enter the code below when promptedYou will only haveto do this once for each paper you are studyingSTUDYTPAPER F9EXFINANCIAL MANAGEMENTTBPP Learning Media is the sole ACCA Platinum Approved Learning Partner ? contentfor the ACCA qualificationIn this, the only Paper P1 study text to be reviewed by theexaminer: We discuss the best strategies for studying for ACCA exams We highlight the most important elements in the syllabus and the key skills you will need We signpost how each chapter links to the syllabus and the study guide We provide lots of exam focus points demonstrating what the examiner will want you to do We emphasise key points in regular fast forward summaries We test your knowledge of what you've studied in quick quizzes? We examine your understanding in our exam question bank We reference all the important topics in our full indexBPP's Practice & Revision Kit, i-Pass and Interactive Passcard products alsosupport this paperFOR EXAMS UP TO JUNE 7>2014First edition 2007All our rights reserved. No part of this publication may be Sixth edition September 2012reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical,ISBN 9781 4453 9652 1photocopying, recording or otherwise, without the prior Previous ISBN 9781 4453 7766 7written permission of BPP Learning Media Ltde-ISBN 9781 4453 9212 7We are grateful to the Association of Chartered Certified Accountants for permission to reproduce pastBritish Library Cataloguing-in-Publication Data examination questions. The suggested solutions in theA catalogue record for this bookexam answer bank have been prepared by BPP Learningis available from the British LibraryMedia Ltd, unless otherwise statedPublished byBPP Learning Media LtdBPP House, Aldine PlaceLondon W12 8AA//./learningmediaPrinted in the United Kingdom byPolestar WheatonsHennock RoadMarsh BartonExeterEX2 8RPYour learning materials, published by BPP LearningMedia Ltd, are printed on paper obtained fromtraceable sustainable sourcesBPP Learning Media Ltd2012iiContentsPageIntroductionHelping you to pass ? the ONLY F9 Study Text reviewed by the examiner! vStudying F9 viiThe exam paper and exam formulae xPart A Financial management function1 Financial management and financial objectives 3Part B Financial management environment2 The economic environment for business 353 Financial markets and institutions 55Part C Working capital management4 Working capital 755 Managing working capital 896 Working capital finance 115Part D Investment appraisal7 Investment decisions 1398 Investment appraisal using DCF methods 1559 Allowing for inflation and taxation 17310 Project appraisal and risk 18711 Specific investment decisions 201Part E Business finance12 Sources of finance 22113 Dividend policy 25314 Gearing and capital structure 263Part F Cost of capital15 The cost of capital 28516 Capital structure 309Part G Business valuations17 Business valuations 32918 Market efficiency 351Part H Risk management19 Foreign currency risk 36320 Interest rate risk 387Mathematical tables 401Exam question bank 405Exam answer bank 427Index 485Review formContents iiiA note about copyrightDear CustomerWhat does the littlemean and why does it matterYour market-leading BPP books, course materials and elearning materials do not write and updatethemselves. People write them: on their own behalf or as employees of an organisation that invests in thisactivity. Copyright law protects their livelihoods. It does so by creating rights over the use of the contentBreach of copyright is a form of theft ? as well being a criminal offence in some jurisdictions, it is potentially a serious breach of professional ethicsWith current technology, things might seem a bit hazy but, basically, without the express permission ofBPP Learning Media: Photocopying our materials is a breach of copyright Scanning, ripcasting or conversion of our digital materials into different file formats, uploadingthem to facebook or emailing them to your friends is a breach of copyrightYou can, of course, sell your books, in the form in which you havebought them ? once you have finishedwith them. Is this fair to your fellow students? We update for a reason. But the e-products are sold on asingle user licence basis: we do not supply ‘unlock’ codes to people who have bought them second handAnd what about outside the UK? BPP Learning Media strives to make our materials available at pricesstudents can afford by local printing arrangements, pricing policies and partnerships which are clearlylisted on our website. A tiny minority ignore this and indulge in criminal activity by illegally photocopyingour material or supporting organisations that do. If they act illegally and unethically in one area, can youreally trust themiv Helping you to pass ? the ONLY F9 Study Text reviewedby the examiner!BPP Learning Media ? the sole PlatinumApproved Learning Partner - contentAs ACCA’s sole Platinum Approved Learning Partner ? content, BPP Learning Media gives you theunique opportunity to use examiner-reviewed study materials for the 2013 examsBy incorporating theexaminer’s comments and suggestions regarding the depth an d breadth of syllabus coverage, the BPPLearning Media Study Text provides excellent, ACCA-approved support for your studiesThe PER alertBefore you can qualify as an ACCA member, you do not only have to pass all your exams but also fulfil athree year practical experience requirement PERTo help you to recognise areas of the syllabus thatyou might be able to apply in the workplace to achieve different performance objectives, we haveintroduced the ‘PER alert’ featureYou will find this feature throughout the Study Text to remind you thatwhat you are learning to pass your ACCA exams is equally useful to the fulfilment of the PERrequirementTackling studyingStudying can be a daunting prospect, particularly when you have lots of other commitmentsThedifferent features of the text, the purposes of which are explained fully on the Chapter features page, willhelp you whilst studying and improve your chances of exam successDeveloping exam awarenessOur Texts are completely focused on helping you pass your examOur advice on Studying F9 outlines the contentof the paper, the necessary skills the examiner expects you to demonstrate and any brought forward knowledge you are expected to haveExam focus points are included within the chapters to highlight when and how specific topics wereexamined, or how they might be examined in the futureUsing the Syllabus and Study GuideYou can find the syllabus and Study Guide on page xi of this Study TextTesting what you can doTesting yourself helps you develop the skills you need to pass the exam and also confirms that you canrecall what you have learntWe include Questions ? lots of them - both within chapters and in the Exam Question Bank, as well asQuick Quizzes at the end of each chapter to test your knowledge of the chapter contentIntroduction v Chapter featuresEach chapter contains a number of helpful features to guide you through each topicTopic listTopic list Syllabus referenceWhat you will be studying in this chapter and the relevantsection numbers, together the ACCA syllabus referencesPuts the chapter content in the context of the syllabus asIntroductiona wholeLinks the chapter content with ACCA guidanceStudy GuideHighlights how examinable the chapter content is likely toExam Guidebe and the ways in which it could be examinedWhat you are assumed to know from previousKnowledge brought forward from earlier studiesstudies/examsSummarises the content of main chapter headings,FAST FORWARDallowing you to preview and review each section easilyDemonstrate how to apply key knowledge andExamplestechniquesDefinitions of important concepts that can often earn you Key termseasy marks in examsWhen and how specific topics were examined, or howExam focus pointsthey may be examined in the futureFormulae that are not given in the exam but which have toFormula to learnbe learntGives you a useful indication of syllabus areas thatclosely relate to performance objectives in your PracticalExperience Requirement PERGives you essential practice of techniques covered in theQuestionchapterReal world examples of theories and techniquesCase StudyA full list of the Fast Forwards included in the chapter,Chapter Roundupproviding an easy source of reviewA quick test of your knowledge of the main topics in theQuick QuizchapterFound at the back of the Study Text with morecomprehensive chapter questionsCross referenced forExam Question Bankeasy navigationvi Introduction Studying F9This paper examines a wide range of financial management topics, many of which will be completely newto you. You will need to be competent at a range of quite tricky calculations as well as able to explain anddiscuss financial management techniques and issuesThe F9 examiner The examiner is Tony Head. He expects you to be able to perform and comment on calculations, exercisecritical abilities, clearly demonstrate understanding of the syllabus and use question informationSyllabus updateThe F9 syllabus has been updated for the June 2013 sitting onwardsThe syllabus changes aresummarised belowSummary of changes to F9ACCA periodically reviews its qualification syllabuses so that they fully meet the needs of stakeholderssuch as employers, students, regulatory and advisory bodies and learning providersThe changes to the F9 syllabus are summarised below. The additions to the syllabus consist of two topicspreviously examined in the higher-level P4 paper which are now included at the F9 level. There are alsotwo topics which have been deleted, as they will be assumed knowledge from F2 and FMATable 1 ? Additions to F9Section and subject area Syllabus contentB3 ? The treasury function a Describe the role of money markets in:i Providing short-term liquidity toindustry and the public sectorii Providing short-term trade financeiii Allowing an organisation tomanage its exposure to foreigncurrency risk and interest rate riskb Explain the role of banks and otherfinancial institutions in the operation ofthe money marketsc Explain the characteristics and role ofthe principal money marketinstruments:i Interest-bearing instrumentsii Discount instrumentsiii Derivative productsF2 ? Estimating the cost of equity b Explain and discuss systematic andunsystematic risk, and the relationshipbetween portfolio theory and the capitalasset pricing model CAPM Introduction vii Table 2 ? Deletion from F9 Section and subject area Syllabus contentD1 ? The nature of investment decisions and a Distinguish between capital and revenuethe appraisal process expenditure, and between non-currentassets and working capital investmentb Explain the role of investment appraisalin the capital budgeting processc Discuss the stages of the capital budgeting process in relation tocorporate strategyD3 ? Discounted cash flow DCF techniques a Explain and apply concepts relating tointerest and discounting, including:i The relationship between interestrates and inflation, and betweenreal and nominal interest ratesii The calculation of future values andthe application of the annuityformulaiii The calculation of present values,including the present value of anannuity and perpetuity, and the useof discount and annuity tablesiv The time value of money and therole of cost of capital in appraisinginvestmentsviii Introduction 1 What F9 is aboutThe aim of this syllabus is to develop the knowledge and skills expected of a finance manager, in relationto investment, financing and dividend policy decisionsF9 is a middle level paper in the ACCA qualification structure. There are some links to material you havecovered in F2, particularly short-term decision making techniques. The paper with a direct link followingF9 is P4 which thinks strategically and considers wider environmentalfactors. F9 requires you to be ableto apply techniques and think about their impact on the organisation2 What skills are requiredYou are expected to have a core of financial management knowledge? You will be required to carry out calculations, with clear workings and a logical structure You will be required to explain financial management techniques and discuss whether they are appropriate for a particular organisation You must be able to apply your skills in a practical context3 How to improve your chances of passing? There is no choice in this paper, all questions have to be answered You must therefore study the entire syllabus, there are no short-cuts Practising questions under timed conditions is essential. BPP’s Practice and Revision Kit contains 25 mark questions on all areas of the syllabus Questions will be based on simple scenarios and answers must be focused and specific to theorganisation Answer all parts of the question. Even if you cannot do all of the calculation elements, you will stillbe able to gain marks in the discussion parts Make sure you write full answers to discussion sections, not one or two word lists, the examiner islooking for understanding to be demonstrated Plan your written answers and write legibly Include all your workings and label them clearlyRead Student Accountant the ACCA’s student magazine regularly ? it often contains technicalarticles written either by or on the recommendation of the examiner which can be invaluable forfuture exams4 Brought forward knowledgeYou will need to have a good working knowledge of certain management accounting techniques from F2In particular, short-term decision making techniques such as cost-volume-profit analysis and thecalculation of relevant costs. Due to the latest syllabus change, you will also need to be familiar with thecapital budgeting process, and be able to apply the concepts of interest and discounting. This includesbeing able to calculate annuities and perpetuities, and to use the discount and annuity tables to calculatenet present valuesThis Study Text revises these topics and brought forward knowledge is identified. Revision sectionsaround the capital budgeting process and interest and discounting are included in this Study Text. If youstruggle with the examples and questions used, you must go back and revisit your previous workTheexaminer will assume you know this material and it may form part of an exam questionIntroduction ix The exam paperFormat of the paperThe exam consists of four compulsory 25 mark questionsTime allowed is 3 hours with 15 minutes’ reading time x Introduction Syllabus and Study GuideThe F9 syllabus and study guide can be found belowIntroduction xixii IntroductionIntroduction xiii xiv IntroductionIntroduction xv xvi IntroductionIntroduction xvii xviii Introduction Introduction xix Analysis of past papersThe table below provides details of when each element of the syllabus has been examined and thequestion number and section in which each element appearedFurther details can be found in the ExamFocus Points in the relevant chaptersCoveredin Text June Dec June Dec June Dec June Dec Pilotchapter 2012 2011 2011 2010 2010 2009 2009 2008 PaperFINANCIAL MANAGEMENT FUNCTION1 Nature & purpose 4c1 Objectives 3a 4c,d 3a3a,b 4a1 Stakeholders 4a1e FINANCIAL MANAGEMENT ENVIRONMENT2 Economic environment3 Financial markets and institutions4aWORKING CAPITAL MANAGEMENT4, 5 Management 2a,c 2a-d 3a,b, 1a,b,c 4b,d 3c 2b,c 3a,b,cc,d6 Funding strategies 2b 4b4c 3a,b 3dINVESTMENT APPRAISAL7 Non-discounted cash flow techniques 1b1b2a,b 4b8, 9 Discounted cash flow techniques 1a 1a,b 1a,b 1a 3a,b 1a,b 2b,c 3b 4a,c10 Risk and uncertainty1c 1c11 Specific investment decisions 1c 1d3c 1c,dBUSINESS FINANCE12 Sources of short-term finance4a12 Sources of long term-finance 3。

学习ACCA用什么教材?BPP还是Kaplan

学习ACCA用什么教材?BPP还是Kaplan学ACCA应该用什么教材目前主要的教材就是BPP、Kaplan和Becker,这三种教材的区别如下:百度网盘下载,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频BPPBPP以详细见称,BPP教材是全球ACCA使用最多的版本,通俗易懂,ACCA学员以看BPP课本及精简版讲义为主。

KaplanKaplan同样被ACCA官方所认可。

不过Kaplan更加适合具备一定财务基础的人来学习,国内考试并不是特别适合。

BeckerBecker Professional Education(贝克尔)是北美教材刚进中国不久,人气并不高,所以很多ACCAer也不会选择,再就是Becker并不是非常适合国内考生。

教材购买方式BPP官网有附赠购买链接,考生可以直接前往购买,网店中文版本,选购方便,BPP在国内购买也比较方便。

Kaplan官网也可以看到购买链接,直接到亚马逊购买的,但应该是国外直接邮寄,所以价格可能也相对较高一点。

无论是BPP还是Kaplan,主页君都建议你们提前咨询好教材的适用时间、发货时间等等。

报完名后开始学习,但很多学生拿到了BPP依旧很疑惑,特别是英文的教材与练习册该怎么用呢?对于新同学来说还是很受用的。

如何有效使用教材进行学习?1.先看大纲再翻书新人在拿到ACCA教材之前,请先阅读ACCA SYLLABUS AND STUDY GUIDE也就是考试大纲与学习方法指导,去了解每门课程的教学要求和教学目的,做到有的放矢。

ACCA考试大纲的内容比较精简,教材就是根据考试大纲的要求编写的,所以追根溯源把最新的考试大纲过一遍。

2.SQ3Rs原则帮你看透一本书开始啃一本厚度惊人的BPP教材时,争取做到SQ3Rs原则,即Survey,Questions,Read,Recall,Review。

Survey:看某一章之前,浏览章节名称,阅读小结和教学目的,对整个章节的脉络有个大致了解。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

acca教材

ACCA学员想要顺利通过考试,使用正确的教材至关重要。