国际结算复习资料

国际结算期末复习材料.doc

期末复习专栏一填空1.国际结算的方式,根本有三大类:汇款方式、〔托收〕方式、〔信用证〕方式。

2.狭义的票据主要包括〔汇票〕、〔本票〕、〔支票〕。

3.汇票的付款时间有〔见票即付〕、〔定日付款〕、〔出票后定期付款〕、〔见票后定日付款〕四种。

4.汇票的收款人〔即抬头〕有三种表示方法,分别是〔来人抬头〕、〔指示性抬头〕、〔限制性抬头〕。

5.汇票债务人承担汇票付款的责任次序在承兑前是〔1〕〔出票人〕、〔2〕〔第一背书人〕、〔3〕〔第二背书人〕;承兑后是〔1〕〔承兑人〕、〔2〕〔出票人〕、〔3〕〔第一背书人〕。

6.远期汇票需要两次提示:〔提示承兑〕和〔提示付款〕。

7.本票是出票人无条件付款的〔承诺++〕,而汇票和支票是无条件付款的〔命令/委托〕。

8.汇票按是否跟随单据,分为〔跟单汇票〕和〔光票〕。

二、判断正误:1.过户转让的受让人获得权利不受转让人权利缺陷的影响。

〔×〕2.交付转让可以通过单纯交付或背书交付而转让票据,不必通知原债务人。

〔√ 〕3.流通转让是转让人通过单纯交付或背书交付票据给受让人,受让人善意支付对价,不必通知原债务人。

〔√ 〕4.采取限制性抬头的汇票,不经过背书可以直接转让。

〔×〕限制性抬头的汇票不得转让他人5.见票后定期付款的汇票,从出票日起算,确定付款到期日。

〔×〕6.要式性指票据的作成必须符合法定的要件,才能发生票据效力。

〔√ 〕7.票据关系的产生总是有一定原因的,但是票据是否成立,不受票据原因的影响。

〔√ 〕票据的产生是有原因的,总是有一定的根底关系,所谓的票据产生的根底关系指的是:出票人与付款人之间的权利义务关系;出票人与收款人、背书人与被背书人之间的资金对价关系。

8.一张汇票出票后付款人总是主债务人。

〔F 〕9.支票有即期和远期之分。

〔 F 〕10.汇付方式是一种对买卖双方均有较大风险的支付方式。

〔F〕11.托收指示书与托收申请书是一回事。

〔F 〕12.偿付行不负责审单,只凭开证行指示或授权,偿付款项给议付行。

国际结算复习资料

支票:是出票人签发的,委托办理支票存款业务的银行或者其他金融机构在见票时无条件支付确定金额给收款人或者持票人的票据。

支票的特征:支票是由银行付款的票据,支票是见票即付的票据。

本票:是出票人签发的,承诺自已在见票时无条件支付确定的金额给收款人或持票人的票据。

本票的特征(1)本票是由出票人自己付款的票据(2)本票是无条件支付的承诺本票必须记载的事项是:表明“本票”的字样;无条件支付的承诺;确定的金额;收款人或其指定人;出票日期;出票人签名本票的种类:银行本票和商业本票2. 记名本票和指示性本票3. 即期本票和远期本票汇票:是由出票人签发的,委托付款人在见票时或在指定日期无条件支付确定的金额给收款人或持票人的票据汇票的必要记载事项:1票据名称2 无条件支付的委托3 确定的金额4 付款人和收款人名称5 出票日期和出票人签章汇票的种类:1 按付款期限不同:即期汇票和远期汇票2 按出票人不同:银行汇票和商业汇票3.按承兑人不同:银行承兑汇票和商业承兑汇票形式发票:是一种非正式发票,是卖方对潜在的买方报价的一种形式。

买方常常需要形式发票,以作为申请进口和批准外汇之用。

背书:是指汇票背面的签字。

背书作为票据行为,它包括两个动作:一是在汇票背面签名或再加上受让人,二是交付给受让人。

写成背书只是表明背书人有转让票据权利的意图,交付之后才算完成票据权利的转让。

背书的三种效力:转移效力、担保效力、权利证明效力背书的种类:1特别背书。

又称为记名背书或完全背书。

事项包括:被背书人名称;日期;签名。

2空白背书。

又称为无记名背书或略式背书,不记载被背书人,仅背书人签名。

3其他非转让背书:①限制性背书②委托收款背书③质押背书。

转让方法:依交付转让;依空白背书转让;依特殊背书转让;变更为记名背书转让。

审单:原则是“单证一致”和“单单一致”银行审单的时间不得超过从其收到单据的翌日起算7个银行工作日。

保兑信用证:如果开证行授权或要求另一家银行(保兑行)对信用证加具保兑,亦即开证行和保兑行均同时对这张信用证承担保证付款责任的,则属于保兑信用证。

最新国际结算复习资料

国际结算复习资料国际结算复习资料1.名词解释:国际结算(international settlement),是对国际债券债务进行了结和结算的经济行为。

2.汇票:由出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或持票人的票据。

3.收款人的名称:(1)限制性抬头(restrictive order),不能流通转让,只有汇票上指定的收款人才能接受票款。

如:Pay to Brown only.(2)指示性抬头(demonstrative order),这种汇票可以背书转让,可流通且安全。

如:Pay to the A or order(3)来人抬头(pay to holder),不指定收款人名称,只写明付给持票人或来人。

如:Pay to bearer(支付给来人)4. 即期汇票(sight draft):见票即行付款的汇票。

远期汇票(time/usance/term draft):必须在双方约定的日期方可请求付款的汇票,又叫定期付款汇票。

5. 汇票的票据行为:出票(有两个动作构成:一是出票人写成汇票并在汇票上签字,二是将汇票交给收款人)、背书、承兑、保证、付款、追索。

6. 汇付的有关当事人:汇款人(remitter)、汇出行(remitting bank)、汇入行(paying bank/receiving)、收款人(payee/beneficiary)7. 汇付方式的应用。

(1)预付货款(payment in advance),进口商先将部分或全部货款给出口商,出口商收到货款后再发货。

(2)货到付款(payment after arrival of goods):出口商先发货,待进口商收到货后再付款。

8. 托收(collection)方式的四个当事人:委托人(principal)、托收行(remitting bank)、代收行(collecting bank)、付款人(payer)。

国际结算复习资料

国际结算复习资料一、重点词汇英汉互译:第一章国际结算的介绍Correspondent Bank 代理行Test key 密押Specimen of authorized signature 印鉴Debit (for bank) 借记Nostro account 往户账IMF 国际货币基金组织 ICC 国际商会CHIPS 英国同业银行自动支付系统URC522 《跟单托收统一规则》国际结算 International Settlement预付货款 Payment in advance汇款(汇付) Remittance跟单信用证 Documentary L/C Control Documents 控制文件Terms and conditions 费率表SWIFT 环球银行金融电讯协会Credit (for bank) 贷记Vostro account 来户账WBG 世界银行组织CHAPS 纽约银行同业电子清算系统UCP 600 《跟单信用证统一惯例》赊账 Open Account(O/A)托收Collection银行保函 Bank Guarantee第二章票据Recourse 追索 Non-causation 无因性流通工具 Negotiable Instrument汇票 Bill of Exchange/Draft 本票 Promissory Note 支票 Check/Cheque drawer 出票人 payer/drawee 付款人 payee 收款人 endorser 背书人acceptor 承兑人 Holder 持票人 Holder for value 对价持票人Holder in due course/Bona fide holder 正当持票人/善意的持票人汇票出票 Issue 背书 Endorsement) 提示(Presentation 承兑(Acceptance 保证 Guarantee 付款 Payment 拒付 Dishonor 追索 Recourse拒绝证书 Protest Tenor 付款期限 Usance bill 远期汇票Blank endorsement 空白背书 Acceptance/payment for honor 参加承兑和参加付款支票Crossed check 划线支票 Uncrossed check 非划线支票 Open check 现金支票Rubber check/bad check 空头支票 Collecting bank 托收行 out of date 过期第三章Remittance 汇付,顺汇 Reverse remittance 逆汇Remitter 汇款人 Remitting bank 汇出行 Paying bank 汇入行,解付行Beneficiary or payee 收款人,受益人Reimbursement of remittance cover 拨头寸T/T 电汇 M/T 信汇 D/D 票汇 Payment in advance 预付货款Open account / payment after goods arrival 赊销 Consignment 寄售第四章Documentary collection 跟单托收Clean collection 光票托收Direct collection 直接托收D/P at sight 即期付款交单D/P after sight 远期付款交单D/A 承兑交单D/P.T/R/ 付款交单凭信托收据借单Outward bills/ 出口押汇Inward bills /进口押汇Principal/ 委托人Remitting Bank/托收行Collecting Bank/ 代收行Drawee/付款人 Principal’s representative in case of need/需要时的代理第五章Applicant 申请人Advising Bank 通知行承兑行 Accepting Bank 索偿行 Claiming BankBeneficiary 受益人 Issuing Bank 开证行Confirming Bank 保兑行 Paying Bank 付款行议付行 Negotiating Bank 偿付行 Reimbursing Bank 寄单行 Remitting Bankin duplicate 一式两份 in triplicate 一式三份in quadruplicate 一式四份 in quintuplicate 一式五份Confirm 保兑 Negotiate 议付 undertaking 承诺Primary liability forpayment of the Issuing Bank 开证行承担第一性付款责任Documentary Credit Nominated Bank 指定银行soft clause 软条款跟单与光票信用证 Documentary and clean L/C不可撤销与可撤销信用证 Irrevocable and revocable L/C保兑与不保兑信用证 Confirmed and unconfirmed L/C即期付款、延期付款、承兑和议付信用证,假远期信用证Sight 、 Usance 、 Acceptance and Negotiation L/C可转让与不可转让信用证 Transferable and Untransferable L/C循环信用证 Revolving L/C 对开信用证 Reciprocale L/C背对背信用证 Back to back L/C 预支(红条款)信用证) Anticipantory L/C 备用信用证 Standby L/C二、知识重点:第一章国际结算的介绍一、国际结算定义:(Definition)1、是指处于两个处于不同国家的当事人通过银行办理的两国间货币收付业务。

国际结算复习资料

国际结算复习资料第⼀章国际结算概述⼀、国际结算—是指国际间由于政治、经济、⽂化、外交、军事等⽅⾯的交往或联系⽽发⽣的以货币表⽰的债权债务清偿⾏为或资⾦转移⾏为。

(是指两国不同国家的当事⼈,不论是个⼈、单位、企业还是政府,因为商品买卖、服务、供应、资⾦调拨、国际借贷⽽需要通过银⾏办理的两国间的外汇收付业务,都属于国际结算)⼆、国际结算的基本类别1、按是否直接使⽤现⾦分为:○1现⾦结算—通过收付货币或现⾦来结算国际间的债权债务关系。

特点:不安全、风险⼤、运费⼤、时间长、不⽅便。

○2⾮现⾦结算—使⽤各种⽀付⼯具,通过银⾏间的划账冲抵来结算国际间的债权债务关系。

特点:迅速、简便、节约现⾦和流通费,加快资⾦的循环周转。

2、按发⽣国际间债权债务关系的原因分为:○1国际贸易结算:国际商品贸易结算,国际服务贸易结算。

○2⾮贸易国际结算:是指由其他国际经济活动和政治,⽂化交流所引起的(包括服务贸易结算中的⾮贸易从属费⽤结算及其他)货币收付的结算称为⾮贸易国际结算。

主要包括:对外投资,筹资,外汇买卖,捐款,侨汇,信⽤卡,旅⾏⽀票业务,经济军事援助等。

3、按付款⽅式分为:现汇结算和记帐结算○1现汇结算—通过两国银⾏对贸易和⾮贸易往来,⽤可兑换货币进⾏的逐笔结算。

○2记帐结算—是指两国银⾏使⽤记帐外汇进⾏的定期(⼀年⼀清)结算。

4、国际结算的基本内容:(1)、国际结算的信⽤⼯具;信⽤⼯具是规定债权⼈与债务⼈存在权利与义务的书⾯契约凭证,⼴义的信⽤⼯具包括国库券,债券,存单等,⽽国际结算中的信⽤⼯具主要是票据(汇票、本票和⽀票);(2)、国际结算⽅式:是指货币收付的⼿段和渠道,是国际结算的中⼼内容,内容从传统的三⼤结算⽅式—汇款、托收、信⽤证、到与担保、融资结合的银⾏保函和备⽤信⽤证,国际保理和福费延(包买票据)等。

(3)、国际结算单据;基本单据:发票、保险单据、运输单据。

附属单据:其他,如产地证、质检证。

(4)、国际结算融资:是指进出⼝商利⽤票据及(或)单据,结合结算⽅式进⾏特定⽅式的融资(或融物)的⽅式。

国际结算复习资料

国际结算第一章关贸总协定:GATT国际商会:ICC服务贸易总协定:GATS(由WTO制定)经合组织:OECD第二章一、银行境外分支机构设置一般有以下几种形式:1.代表处(Represent Office)。

代表处是银行设在境外的非营业性办事机构。

实质上,其没有自己名下的资产和负债、没有法人资格,不能经营真正的银行业务,代表处的主要职能是探询新的业务前景、寻找新的盈利机会、开辟当地信息新来源,并代表母行从事信息传递、公共关系、业务招揽等活动。

代表处是分支机构最低级和最简单的形式,通常是设立更高层次机构的一种过渡形式。

2.办事处(Agency Office)。

办事处是银行设在境外的,能够从事资金汇兑和贷款业务,但不能在东道国吸收当地存款的分支机构。

办事处是母行的一个组成部分,不具备法人资格,介于代表处和分行之间。

3.分支行(Branch and Sub-branch)。

分行是银行根据业务发展需要而设在境内外的一种最主要的营业性机构。

分行不是独立的法律实体,没有独立的法人地位,要受到本国或本国与东道国双方的法律及规章制约;其业务范围及经营政策须与母行保持一致,业务规模须以母行的资本、资产及负责为基础,母行对分行的活动负完整责任。

一般来说,分行可以经营完全的银行业务,但不能经营非银行业务。

4.附属银行(Subsidiary Bank)。

附属银行是银行在东道国登记注册成立的公司性质的银行机构,其在法律上是一个完全独立的经营实体,对其自身债务仅以其注册资本为限承担有限责任。

其股权的全部或大部分为母行所控制。

附属银行的经营范围较广,通常可以从事东道国国内银行所能经营的全部商业银行业务活动,此外,附属银行还可以经营证券、投资、信托、保险等非银行业务。

5.联营银行(Affiliated Bank)。

联营银行在法律地位、性质和经营特点上与附属银行类似,而不同之处是,任何一家外国投资者拥有的股权只能在50%以下,即拥有少数股权,其余股权可以为东道国所有,或由几家外国投资者共有。

国际结算期末复习资料

国际结算期末复习资料一、名词解释:1.空白背书:29又称不记名背书,即不记载被背书人名称,只有背书人签字。

2.贴现;39是指远期汇票承兑后尚未到期,由银行或贴现公司从票面金额中扣减按照一定贴切现率计算的贴现息后,将净款付给持票人,从而贴切进票据的行为。

3.福费廷;77包买商/福费廷商通常是商业银行或银行的附属机构,从出口商那里无追索权贴现已被进口商所在地银行担保的远期汇票或本票,这种业务叫包买票据也叫福费廷。

4.逆汇:98又称出票法,是由债权人以开出汇票的方式,委托银行向国外债务人索取一定金额的结算方式。

其特点是结算工具传递方向和资金运动方向相反。

5.SWIFT:103环球同业银行金融电讯协会简称SWIFT,是一个国际银行同业间非盈利性的合作组织,总部设在比利时的布鲁塞尔,该组织成立于1973年5月,董事会为最高权利机构。

6.中心汇票:112银行开出汇票,其付款行是在货币清算中心城市的汇票叫做中心汇票。

也可以说地点和币别配套对口的汇票就是中心汇票。

7.售定:117是指买卖双方已经成交,货物售妥发运,并经进口商收到后一定时期将货款汇交出口商。

8.国际保理;140是银行伯为保理商为国际贸易记帐赊销方式提供出口贸易速效\销售帐务处理\收取应收账款及买方信用担保合为一体的综合性金融服务.9.可转让信用证212是指信用证的受益人(第一受益人)可以请求授权付款、承担延期付款责任、承兑或议付的银行,或如果是自由议付信用证时可以要求信用证特别授权的转让行,将信用证全部或部分转让给一个或数个受益人使用的信用证。

10.背对背信用证:221中间商将国外开来的以他为受益人的原始信用证或主要信用证作为支付资金的援助,请求银行依据原始信用证条款,开出以供货人为受益人的信用证。

这种信用证称为背对背信用证又称对应信用证。

11.清洁运输单据296系指未载有明确宣称货物及包装状况有缺陷的条文或批注的运输单据。

12.唛头:362贸易上的唛头是为了识别货物而印刷在包装上面的装运标志,便于承运人和收货人识别货物。

国际结算复习资料

1、国际结算:国际结算是指国际间由于政治,经济,文化,外交,军事等方面的交往或联系而发生地以货币表示债权债务的清偿行为或资金转移行为。

分为国际贸易结算和非贸易国际结算。

2、银行保函,或银行保证书,是指商业银行根据申请人的请求,向受益人开出的担保申请人正常履行合同义务的书面证明。

它是银行有条件承担一定经济责任的契约文件。

3、信用证,是银行做出的有条件的付款承诺。

它是开证银行根据申请人(进口商)的要求和指示做出的在满足信用证要求和提交信用证规定的单据的条件下,向第三者(受益人、出口商)开立的承诺在一定期限内支付一定金额的书面文件。

4、本票:我国票据法规定,本票是出票人签发的,承诺自己在见票时无条件支付确定的金额给收款人或持票人的票据。

另外,该法所称本票是指银行本票,不包括商业本票,更不包括个人本票。

英国票据法规定:本票是一个人向另一个人签发的,保证于见票时或定期或在可以确定的将来的时间,对某人或其指定人或持票人无条件支付一定金额的书面承诺。

5、汇票,我国票据法规定,汇票是由出票人签发的,委托付款人在见票时或在指定日期无条件支付确定的金额给收款人或持票人的票据。

英国票据法规定,汇票是由出票人向另一人签发的要求即期、定期或在可以确定的将来时间向指定人或根据其指令向来人无条件支付一定金额的书面命令。

6、顺汇,所谓顺汇,指结算工具的流向与货款的流向是同一个方向,是作为债务方的买方主动将进口货款通过汇款方式汇付给作为债权人的卖方的一种方法。

顺汇也称汇付法,是由债务人主动将款项交给本国银行,委托该银行通过某种结算工具的使用将汇款汇付给国外债权人或收款人,因其结算工具的流向与资金流向相同,故称之为顺汇。

7、包买票据:福费廷业务是一种无追索权形式为出口商贴现远期票据的金融服务,也称为包买票据或票据买断,指包买商(一般为商业银行或其他金融企业)从出口商那里无追索权地购买已经承兑的并通常由进口商所在地银行担保的远期汇票或本票。

国际结算》总复习

第一篇 国际结算中的票据

• 1、国际结算的含义(概念、基本要 素) • 2、票据的含义 • 3、票据的特性 • 4、票据的作用 • 5、票据行为 • 6、票据的基本当事人

• • • • • • •

7、汇票的含义 8、汇票的内容(绝对必要记载项目) 9、汇票的种类 10、本票的含义 11、本票与汇票的区别 12、支票的概念 13、支票的特征

Байду номын сангаас

第四篇 国际结算中的融资担保

• • • • • • • 1、担保的含义 2、担保的方式 3、外汇担保的含义、特点 4、外汇担保的基本当事人 5、外汇担保按合同方式的分类 6、银行保函的含义、作用 7、保函的基本当事人

• • • • • • • •

8、保函的基本内容 9、备用证的性质 10、福费廷的含义、特点、应用 11、福费廷业务对出口商的益处 12、国际保理的含义 13、国际保理的服务项目 14、国际双保理的业务程序 15、福费廷与国际保理的比较

第二篇 国际结算的方式

• • • • 1、汇付的含义 2、汇付的特点、种类 3、汇付的业务程序 4、汇款在国际经济与贸易中的主要应用方 式 • 5、托收的概念 • 6、托收的业务程序(当事人的权利和义务) • 7、托收方式下的融资

• • • •

8、信用证的含义 9、跟单信用证的特点 10、信用证的种类(应用) 11、信用证的业务程序(当事人的权利和 义务) • 12、信用证下的融资(进口贸易、出口贸 易) • 13、信用证的风险与防范(出口商、进口 商、银行)

第三篇 国际结算中的单据

• • • • • • • • 1、单据的作用 2、单据的种类 3、出口商制单的原则 4、银行审单的原则 5、海运提单的含义、作用 6、国际多式联运单据含义 7、海运单含义、应用 8、空运单的含义、作用

国际结算考试复习资料

1.票据是指以支付金钱为目的的债权有价证券,是指由出票人签发的,无条件约定由自己或委托他人在一定日期支付确定金额的流通证券。

2.作用:支付工具;流通工具;信用工具;融资工具3.汇票是由出票人签发的,委托付款人在见票时或在指定日期无条件支付确定的金额给收款人或持票人的票据。

4.种类:以票据的付款期限长短为标准,可分为即期汇票和远期汇票。

远期汇票即定期付款汇票。

它包括:(1)以票据的商业性质为标准,可分为银行汇票和商业汇票。

出票日后定期汇票。

(2)见票后定期汇票。

(3)定日付款汇票。

以票据的商业性质为标准,可分为银行汇票和商业汇票。

5.票汇的一般流程:(1)汇款人填写并呈交汇款申请书;(2)汇出行开立汇票,并将汇票正本交汇款人;(3)汇款人既可自带汇票到国外亲自取款,也可以将汇票寄给国外收款人;(4)持票人将汇票背书转让,委托他的银行(票据托收行)收款;(5)票据托收行通过交换或其他途径收取票款;(6)付款行对汇票付款;(7)票据托收行将票款收入收款人账户;(8)如果持票人不经过自己往来银行收款,则直接向付款行提示汇票;(9)付款行对汇票付款;(10)付款行与出票行之间头寸偿付6、汇付专指银行接受客户的委托,通过自身所建立的通汇网络,使用合适的支付凭证,将款项交付给收款人的一种结算方式。

7.汇付方式的应用:预付货款:预付货款对出口商是最有利的,他可以收款后再发货从而掌握主动权,甚至收款后再购货发运从而做一笔无本钱生意。

而进口商则有钱货两空的风险,或资金长期被他人占用而损失利息。

货到付款:货到付款又称先出后结,是指出口商先发货,待进口商收到货后再付款。

货到付款对进口商是最有利的,他不但掌握了依货付款的主动权,货物不符合合同要求就可拒绝付款,而且不用承担资金风险,如果他收货后并不及时付款,实际上就是占用了出口商的资金。

而出口商则有货款不能收回或不能全部收回或不能及时收回的风险。

8.汇付的风险与防范:以银行为中间媒介;以商业信用为基础;买卖双方的资金和风险负担悬殊;手续简单费用低廉。

国际结算复习资料

复习题一、名词解释1.国际结算(International Settlement)是指为清偿国际间债权债务关系或跨国转移资金而发生在不同国家之间的货币收付活动。

P12.代理行(Correspondent Bank or Correspondent,CORRES)是指与其他国家建立往来账户,代理对方的一些业务,为对方提供服务的银行。

对一家银行来说,代理行实际上不附属于本银行,代理行关系就是不同国家银行之间建立的结算关系。

P223.控制文件(Control Documents)包括密押,印鉴和费率表。

P224.密押(Test Key)是银行之间事先约定的,在发送电报时,由发电行在电文中加注密码。

5.签字样本是银行有权签字人的签字式样。

6.费率表(Terms and Conditions)是银行在办理代理业务时收费的依据。

7.汇票(Bill,Bill of Exchange,B/E)是由一人向另一人签发的要求即期、定期或在可以确定的将来时间向指定人或根据其指令向来人无条件支付一定金额的书面命令。

P498.本票(Promissory Note)是一人向另一人签发的,约定即期或定期或在可以确定的将来时间向指定人或根据其指示向来人无条件支付一定金额的书面付款承诺。

P569.支票(Cheque or Check)是银行存款户根据协议向银行签发的无条件支付命令。

P5810.拒绝证书(Protest)是由付款人当地的公证机构等在汇票被拒付时制作的书面证明。

P5311.追索权(Recourse)是持票人在票据被拒付时,对背书人、出票人及其他义务人行驶请求偿还的行为。

P8312.背书(Endorsement / Indorsement)是指持票人在票据背面签名,并交付给受让人的行为。

P7213.提示(Presentation)是指持票人向付款人出示票据,要求其履行票据义务的行为,是持票人要求票据权利的行为。

P7914.承兑(Acceptance)是指远期汇票的付款人在汇票上注明“承兑”并签章,同意按出票人指示到期付款的行为。

国际结算复习资料

国际结算复习资料国际结算复习题型:单选(20*1’)、多选(10*2’)、判断(10*1’)、实践(2*10’)、案例(制单2*10’)、计算题(贴现10’)第一章导论(一)国际结算工具——票据:汇票(即期/远期商业汇票、银行汇票)、本票、支票(二)结算方式1.国际贸易结算方式:基本方式——汇款,跟单托书,跟单信用证;附属方式——银行保函、国际保理,包买票据2.非贸易结算方式:旅游支票与信用卡,外币汇兑,买汇与光票托收(三)单据1.基本单据:商业单据(商业发票、包装单据、其他发票),运输单据(海运提单、租船合约提单、海运单、其他),保险单2.附属单据:检验证书、产地证明、船公司证明、装船通知、受益人申明(四)国际结算1.含义国际结算是不同国家当事人之间通过银行进行的国际货币收付业务。

即应用一定的金融工具(汇票、本票、支票等),采取一定的方式(汇付、托收、信用证等)利用一定的渠道(通讯网、Internet 等),通过一定的媒介机构(银行或其他金融机构),进行国与国之间的货币收付行为,从而使国际债权债务得以清偿。

2.性质:银行中间业务,设计国际金融实务,以国际贸易为基础3.研究对象:国际结算工具、方式、单据,以银行为中心的支付体系4.有关法律及国际惯例1法律:《中华人民共和国票据法》,《英国票据法》,《日内瓦统一票据法》等2国际惯例:《国际保理业务惯例规则》(IFC),《见索即付保函统一规则》(URDG458),《跟单信用证统一规则》(UCP600),《托收统一规则》(URC522),《国际贸易术语解释通则》(INCOTERMS2010)5.制度:双边结算制度,多变结算制度(五)现代国际结算的特点及发展1.特点现代国际结算是以票据为基础、单据为条件、银行为中介、结算和融资相结合的非现金结算体系1票据是国际结算的基础2以银行为中枢,形成了结算和融资日益结合的国际结算体系3象征性交货、单据的多样化4电子数据交换(EDI)将最终替代纸质单据成为国际结算的主要形式2.新的发展趋势:多样化(内容,结算单据、凭证,结算方式);国际结算风险日益加大;采用新技术,新方法进行业务操作(六)国际结算中的往来银行1.地位:中枢2.作用:国际汇兑,保证(用银行信用代替商业信用),融资(从事国际贸易的重要条件,如进出口押汇、贴现、打包放款、预支L/C等融资手段),其他服务3.商业银行分支机构1代表处:本身不是银行,营运资金都来自总行,不能经营存、贷款等常规银行业务,所以不产生收入或利润,即是一个只出不进的机构。

国际结算复习资料

国际结算复习资料国际结算复习资料〔黑体局部为课本解释〕知识点:汇票〔Bill of Exchange,Draft〕是出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或者持票人的票据。

〔一人向另一人签发的,要求他在即期或定期或可以确定的将来时间向某人或某指定人或持票人,无条件支付一定金额的货币的书面命令〕P33受票人付款人(Drawee)又称受票人。

即指接受票据命令支付票款的人。

他是票据的当事人。

付款人对票据承当付款责任。

〔是按汇票上记载接受别人的汇票且要对汇票付款的人,在他实际支付了汇票规定的款项后也称为付款人〔payer〕P42背书人背书是一种票据行为,是票据转让的一种重要方式。

背书是由持票人在汇票反面签上自己的名字,并将汇票交付给受让人的行为。

这里的持票人称为背书人,受让人称为被背书人。

〔背书人是收款人或持票人在汇票反面签字,并将汇票交付给另一个人,说明将汇票上的权利转让的人〕P42承兑人承兑人是指在商业汇票上承诺并记载汇票上在汇票到期日支付汇票金额的付款人,也是汇票的主债务人。

〔受票人同意接受出票人的命令在汇票上签字,就成为承兑人〕P43持票人票据权利人又称持票人,是指持有票据,可依法向票据义务人主张票据权利即要求对方付款的人,包括拥有票据的收款人和从转让人手中取得票据的受让人。

〔指收款人或被背书人或来人,是现在正在持有汇票的人〕P43空白背书空白背书〔blank endorsement),又称无记名背书、略式背书、不完全背书,是指不记载被背书人名称而仅由背书人签章的背书。

〔又称不记名背书。

即背书人仅在反面签名,而不注明被背书人〕P46追索是指票据遭到拒付,持票人对前有请求归还票据金额及费用的权利。

〔汇票遭到拒付时,持票人要求其前手背书人或出票人或其他票据债务人归还汇票金额及费用的行为。

〕P51顺汇顺汇是指资金从付款一方转移到收款一方,由付款方主动汇付的方式,是国际间通过银行进行资金转移的一种方式。

国际结算复习资料..

1.国际结算(International Settlement) :指国际间由于政治、经济、文化、外交、军事等方面的交往或联系而发生的以货币表示的债权债务的清偿行为或资金转移行为。

2.国际结算特征和功能:属于银行的中介业务;比国内结算复杂;以国际贸易为基础;与国际金融密不可分3.FOB+装运港(装运港船舷):买方-办理租船订舱、保险;支付运费、保险费CIF+目的港(装运港船舷):卖方-办理租船订舱、保险;支付运费、保险费4.票据的概念:是出票人签发的,承诺自己或委托他人在见票时或指定日期向收款人或持票人无条件支付一定金额,可以流通转让的一种有价证券4. 票据的特性设权性;无因性;要式性;流通性;文义性;货币性;债权性;提示性;返还性;可追索性无因性:票据一旦作成,票据权利和义务的执行就与票据原因相分离。

如:票据的转让过程中,不需要调查票据原因是否合理、合法。

1.票据的有效性应以(A)地国家的法律解释。

A.出票地B.行为地C.付款地D.交单地2.票据的作成,形式上需要记载的必要项目必须齐全,各个必要项目又必须符合票据法律规定,方可使票据产生法律效力。

这是票据的(C)性质。

A.要式性B.设权性C.提示性D.流通转让性3.票据上的债权人在请求票据债务人履行票据义务时,必须向付款人提示票据,方能请求付给票款。

这是票据的( C )性质。

A.要式性B.设权性C.提示性D.流通转让性4.出票人在票据上立下书面的支付信用保证,付款人或承兑人允诺按照票面规定履行付款义务。

这是票据的(B)作用。

A.结算作用B.信用作用C.流通作用D.抵消债务作用5. 汇票(Bill,Bill of exchange,B/E):出票人签发的,委托付款人在见票时或在指定的日期无条件支付确定金额给收款人或持票人的票据。

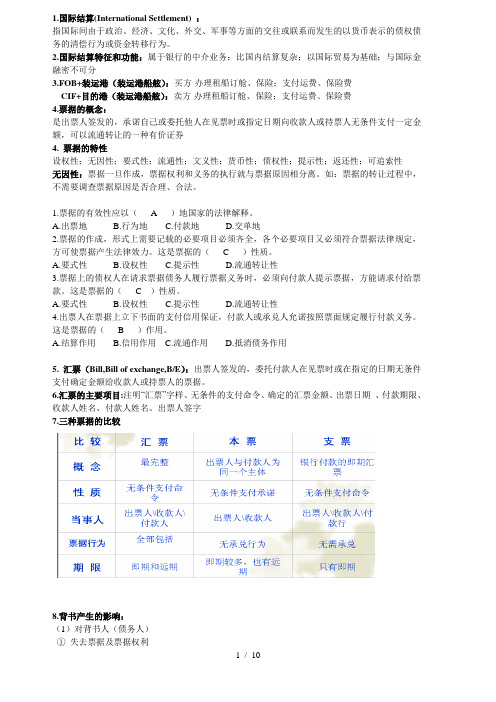

6.汇票的主要项目:注明“汇票”字样、无条件的支付命令、确定的汇票金额、出票日期、付款期限、收款人姓名、付款人姓名、出票人签字7.三种票据的比较8.背书产生的影响:(1)对背书人(债务人)①失去票据及票据权利②向后手证明签收签名的真实性和票据的有效性③担保承兑和付款(2)对被背书人(债权人)享有票据的全部权利:付款请求权和追索权。

国际结算期末复习资料

国际结算期末复习资料一.名词解释1.即期外汇买卖:交割日或称起息日为交易日以后第二个工作日(即银行营业日)的外汇买卖。

2.远期外汇买卖:外汇买卖交易中,凡交割日预定在即期外汇买卖起息日以后一定时期的外汇买卖。

3.掉期外汇买卖:买入某日交割的甲货币(卖出乙货币)的同时,卖出在另外一个交割日的甲货币(买回乙货币),这两笔外汇买卖货币数额相同,买卖方向相反,交割日不同。

4.期货:期货市场是以远期合同作为交易内容的集中形式市场,期货是依托期货合同进行交割的商品或金融资源。

期货合同承诺在将来某一指定时间购买或出售固定数量的某一商品或金融资产。

5.期权:期权合同的买方具有在期满日或期满日以前,可按合同约定的价格买经或卖出约定数量的某种金融工具,但也可以不履行这个合同的权利。

6.利率互换:两比债务的利率方式互相掉换,一般期初或到期日都没有实际本金的交换,交换的只是双方不同特征的利息。

7.货币互换:两方按固定汇率在期初交换两种不同货币的本金,然后按预先固定的日期进行利息和本金的分歧互换。

8.远期汇率协议:是一种远期合约,买卖双方商定将来一定时间的协议利率并规定以何种利率为参照利率,在将来清算日,按照约定的期限和本金额,由一方或另一方支付协议利率和参照利率的差额的贴现金额。

9.利率上限:是指买卖双方就未来某一时间内,商定一个固定利率作为利率的上限。

如果协议规定的市场利率超过上限利率,则由卖方将市场利率与上限利率的差额支付给买方,但买方在协议签约时必须支付卖方一定的费用。

10.利率下限:是指买卖双方就未来某一时间内,商定一个固定利率作为利率的下限。

如果协议规定的市场利率低于利率下限,则由卖方将市场利率与下限利率的差额支付给买方,但买方在协议签约时必须支付卖方一定的费用。

11.利率上下限:买入一个利率上限的同时,出售一个利率下限。

是利率上限和利率下限两种交易的组合。

目的在于锁定利率,规避利率波动的风险。

二.简答部分1. 同业拆放:指银行同业之间的短期资金借贷。

(完整版)国际结算复习资料

国际结算:是指为清偿国际间的债权债务关系而发生在不同国家之间的货币收付活动。

票据:出票人签发的、承诺自己或委托他人在见票时或指定日期向收款人或持票人无条件支付一定金额、可以流通转让的一种有价证券。

汇票:由出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定金额给收款人或持票人的票据。

本票:出票人做成的一项无条件的书面自我支付承诺。

支票:无条件的书面支付命令,是一种以银行为付款人的即期汇票。

正当持票人:取得或受让票据时是善意的,并给付对价。

对价:可以支持一项简单交易之物。

出票:即票据的签发。

包括两个环节:一是做成汇票,并由出票人本人或授权人签名;二是将汇票交付给收款人。

背书:汇票的持有者在汇票背面加注签章并将汇票交给被背书人的行为。

承兑:远期汇票的付款人签章于汇票的正面,明确表示于到期日支付票据金额的一种票据行为。

顺汇:又称汇付,是指债务人主动将款项交给本国银行,委托该银行通过某种结算工具的使用将款项汇付给国外债权人或者收款人。

逆汇;是指债权人通过出具票据委托本国银行向国外债务人收取汇票金额的结算方式。

汇款:银行根据汇款人或客户的委托,以一定的方式,通过其国外联行或代理行,将一定金额的货币支付给国外收款人或债权人的结算方式。

托收:出口商开立金融票据或商业票据或两者兼有,委托托收行通过其联行或代理行向进口商收取货款或劳务费用的结算方式。

付款交单D/P:代收行必须在进口商付清票款后,才将商业票据包括提单交给进口商的一种提单方式。

承兑交单(D/A):代收行在付款人承兑远期汇票后,把商业单据交给付款人,于汇票到期日时由付款人付款的一种交单方式。

跟单托收:DOCUMENTAY BILL FOR COLLECTION按金融单据是否随附商业单据分为两种,一种是金融票据随商业单据的托收,另一种是商业单据不付金融单据的托收。

光票托收:CLEAN BILL FOR COLLECTION出口商仅开立汇票而不附有任何的商业单据,委托银行收取货款的一种托收方式。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

I. True or false1. Without bank’s participation, modern int’l trade payment system would notexist any more T2. The essence of both buyers and sellers concern is whether the counterpartfulfills the contract T3. Int’l settlement and trade payment is a theory rather than a practice F4. Int’l settlement can only be used in visible trade FII. What do the following abbreviations stand for?1. ICC 国际商会The International Chamber of Commerce2. FDI Foreign Direct Investment外商直接投资3. FX Foreign Exchange外汇4. FAS Free Alongside Ship 船边交货条件5. FOB FREE ON BOARD 装运港船上交货条件6. CIF COST, INSURANCE AND FREIGHT 成本加运保费交货条件7. SWIFT The Society For Worldwide Inter-bank FinancialTelecommunications(环球银行间金融电讯协会)8. CNY China Yuan 人民币9. GBP Great Britain Sterling Pound 英镑10. JPY Japanese yen 日元11. HKD Hong Kong dollar 港币12. AUD Australian Dollar,澳元13. SGD 新加坡元Singapore dollar14. NZD 新西兰元New Zealand dollar15. CAD 加拿大元Canada DollarA. Term explanation1. drafta bill of exchange, esp. any bill before it has been accepted, or a bank bill, or asight bill, or an inland bill. Any written order to pay money2. acceptanceact of accepting responsibility for paying the value of a bill)3. guaranteea 3rd party to a draft, the guarantor, who promises to pay the draft whenpresented if it’s a sight draft or to accept when presented and to pay when it is due if it’s a time draft When it is dishonored by non-payment or non-acceptance, the guarantor becomes reliable for the draft4. protesta formal declaration in writing made by a notary public, witnessing & recordingthe dishonor of a draft or promissory note5. right of recoursethe right of the payee or holder of a draft that is dishonored at its maturity to demand payment from the other parties, such as the drawer or an endorser, unless these parties have written the words without recourse or sans recours against their signatures.6. presentmenta sight draft has to be presented duly for payment;a time draft, has to do so duly for acceptance 1st and to be presented again for payment at maturity7. paymentperformed when a draft is paid8. notice of dishonora written information given to the drawer & each endorser on the next businessday after the dishonor of the draft.9. issue1) to draw and sign a draft;2) to deliver it to the payee, based on the Bills of ExchangeAct After the 2 steps, the draft is irrevocable under the drawer’s fir m promise for the drawee is to accept and pay for it.10. endorsementan act of negotiation. A payee or the holder of a draft should endorse it 1st if he transfers or passes its title to others; Still, the holder must do so on the back of it before he sells it to the buyer if he sells or discounts it.11. guarantorperson who guarantees the acceptance and the payment of an instrument12. dishonora failure or refusal to accept a time draft or pay a sight draft when it’spresented.B. Based on the draft given below, please fill in the blanks with relative numbers in brackets and some other terms: Exchange for GBP 1,250.00 (1) Beijing, 1 April, 200xAt 90 d/s after sight (2) pay to the order of DEF C0. (3)the sum of Pounds one thousand two hundred and fifty onlyTo XYZ BankLondon (4) For ABC Co., Beijing (5)(Signature) The draft is an unconditional order in writing addressed by (5__) to (_4_) signed by (_5_) giving it requiring (_4_) to whom it is addressed to pay (_2_) the sum of (_1_) to (_3_). The holder of the draft is (_3_) who must firstly present it to (_4_) for _acceptance__. At maturity, the holder must present it for _payment__ .D. Fill in the following blank form to draw a draft with the information given below:Date: 31 Aug., 2005; Amount: USD8,690.64;Tenor: at 30 d/s after sight Drawer: Peter Hardley, London; Payee: John Smith or bearerDrawee: Northern Bank Ltd, London;Exchange for USD_ 8,690.64_ London, 31 Aug, 2005At 30 d/s after sight, pay this 1st draft (2nd of same tenor& date unpaid) to the order of __ John Smith _______or bearer, theSum of US Dollars ____ Eight thousand six hundred ninety ___________ and64/100 only.Drawn to Northern Bank Ltd, London Peter Hardley, London(Signature)E. Multiple choices1. If a draft is termed like __, its exact time for payment is to be fixed by the payer after hisacceptance. BA. at sightB. at x x d/s after sightC. at x x d/s after dateD. at x x d/s after shipment2. In the following drafts, it is not negotiable if marked with A__.A. Pay to Johnson Co. Ltd onlyB. Pay to bearerC. Pay to ABC Co. & its orderD. Pay to the order of Johnson Co. Ltd3. On the face of a draft, _D_ is to be added to the end of the sum in words to preventfrom being alteredA. OKB. endC. enoughD. onlyIf a contract for the amount of GBP720,000 was approved for buyer’s credit up to 85% of the said amount by Bank of Oslo, Norway to BOC, Beijing. After thepayment, BOC would issue a Promissory note on 1st July, 2005 specifying that it is payable at 3 yrs after the above stated date to the order of BOO the sum of 85% of GBP720,000. Please write a promissory note by filling in the blanks of thefollowing form:Promissory NoteIssued in _ Beijing ___ the _1st July __ , 2005. On _1st July__, 2008 fixed,we promise to pay against this promissory note tothe order of _ BOO____, Norway the sum of GBP_612,000____(say Pounds six hundred and twelve thousand only),payable only in___ Oslo, Norway____.For and on behalf_BOC, , Beijing ___(Signature)Fill in the following blanks with the numbers in brackets:Check for USD3,00.00 (1) Shanghai, May 5, 200xPay to the order of John Smith (2) the sum of threethousand US dollars. (3)To: Bank of China, Shanghai, China (4)For China ABC Co., Shanghai (5)(signature) The above check is addressed by _5_, the customer to _4__, the bank, authorizing that bank to pay on demand the sum of 1 or 3 _ to _2__.II. True or false?1. Check can be considered as the demand draft drawn on a bank T2. The writer of a check is not allowed to write a check w ith his signature which doesn’tcomply with his signature left to a bank in advance. T3. After the acceptance of a time draft, the acceptor becomes the payer as the primary debtorT4. Traveler’s check is one of the checks.FFill in blanks with proper wordsT/T M/T D/ D A form of sending a form of payment a form of demand draft cable or telex or order or mail adviceSWIFT2. Examined by test key examined by signature examined by signature3. A safe method not so safe as T/T not so safe as T/T4. With _highest__ cost with lower_ cost with lower_ cost5. The fastest and not so often used a useful method of most popular due to its slower_s peed remittance & pay able method of remittance by a bank rather than thepaying bankFill in blanks with proper terms:1. 4 parties to a remittance are remitter,remitting bank,paying bank & payee2. Remittance through a bank from one country to another may usu. be made by one of thefollowing methods:M/T, T/T and D/D.True or false1. D/D stands for demand draft T2. Among T/T, M/T & D/D, T/T is the cheapest method of payment F3. SWIFT is the speediest form of payment T4. SWIFT stands for Society for Worldwide Inter-bank Financial Telecommunications T Multiple choice1. SWIFT is _______B____________________.A. in the U.S.A.B. a kind of communications belonging to T/T system for inter-bank’s fund transferC. an institution of the UN;D. a government organization2. Mail transfers are sent to the correspondent bank C_,unless otherwise instructed byclients.A. by courier serviceB. by ordinary mailC. by airmailD. by sea-mail3. The various methods of settlement all involve the same book keeping, only different at theA .A. method by which the overseas bank is advised about the transferB. method by which the beneficiary is advised about the transferC. the speedD. the beneficiary4. A D payment doesn’t take as long as an M/T paymentA. SWIFTB. T/TC. D/DD. A or BTerm explanation1. M/Tfunds are transferred against a payment order or a mail advice, or sometimes a debt advice issued by a remitting bank, at the request of the remitter.2. T/Ta quick way of sending money by cabled bank transfer to a person in another country. Thepayee can be paid either in cash or by credit to his bank a/c. Test key is used to verify its authenticity (whether the cable is true or not).3. D/Da negotiable instrument drawn by a bank on its overseas branch or its correspondentabroad, instructing the latter to pay on demand the stated amount to the holder.4. reverse remittancedifferent directions for the way of funds & settlement instruments to be transferred.The movement of draft & proceeds in different direction, with payment asked for by the payee as the exporter initiativelyFill in blanks with proper words or letters:a. The abbreviation for Delivery of documents against payment is D/P.b. The abbreviation for Delivery of documents against acceptance is D/A.c. Collection means the handling by banks of documents in accordance with instructionsreceived in order to 1) obtain payment &/or acceptance or 2) deliver documents against payment &/or against acceptance.d. Financial documents means bills of exchange,promissory notes, checks. Commercialdocuments mean invoices,transport documents, documents of title or other similar documents.e. Parties in a collection incl. drawer (or seller), remitting bank, collecting bank (or presentingbank), and drawee (or buyer).True or false?1. If the instructions are D/P, the importer’s bank will release the documents to the importeronly against payment. T2. The principal is usu. the importer. F3. Promissory notes are commercial documents. F4. Banks have no liability for any delay or loss caused by postal or telex failure. T5. In the case of documents payable at sight the presenting bank must make presentation forpayment without delay. T6. Goods should not be dispatched direct to the address of a bank or consigned to a bank wi-thout prior agreement on the part of that bank. TTerm explanation1) collectionobtaining payment of a debt, e.g. a bill of exchange (draft), check, etc. through banks from the debtor2) clean collectiona means of collection settlement in which the seller asks his bank to collect his proceeds from the buyer by prese nting the bank a clean draft without shipping documents attached. It’s contrary to documentary collection, it’s not accompanied by commercial invoices, such as invoice B/L, etc.3) documentary collectioncollection on financial instruments with commercial documents or collection on commercial documents without financial instruments, i.e. the collection of a sum due from a buyer by a bank against delivery of certain documents, say, a draft.4) D/Pa means of getting payment for export shipments, by which the exporter or his agent sends the shipping documents to a bank at the port of destination with an order to hand the documents to the buyer or his agent only when the draft has been paid5) D/Aa means of settlement for the importer to get the documents he needs in order to get possession of the goods after he accepts the draft presented by bankMultiple choice1. parties to a collection involve AA. drawer, remitting bank, collecting bank, draweeB. drawer, drawee, holder, endorser,C. drawer, endorser, endorsee, payerD. holder in due course, drawer, guarantor, payer2. Ownership of the goods belongs to D before the importer pays or accepts thedocumentary collectionA. payerB. collecting bank,C. shipping companyD. drawer3. Under collection, the payer for the draft should be BA. exporterB. importerC. remitting bankD. collecting bank4. Settlement for collection is based on trade credit because C .A. no banks participateB. commercial draft is drawnC. banks have no obligation to ensure payment5. If drawee refuses to pay when collecting bank presents him the documents, the bank is toCA. ask the payer to explain whyB. write “dishonored” on the draftC. Inform the drawer of the dishonor at onceD. try to protest the draft6. The major difference between D/P & D/A lies at that B C .A. D/P belongs to documentary collection, while D/A belongs to clean collectionB.under D/P,documents are delivered after pay-ment, while under D/A, after acceptanceC.under D/P, payment is made at sight, while under D/A, after sightD. under D/P, payment is made after sight, while under D/A, made at sightBriefly answer the following question:a. What is the difference between D/P & D/A?Delivery at different time:D/P: exporter’s documents are delivered after importer’s paymentD/A: exporter’s documents are delivered after importer’s acceptancePayment at different time:D/P: importer has to pay at sight (sight draft);D/A: importer may pay after sight ( time one)Seller with different riskD/P: the exporter suffers low riskD/A: the seller possible to loss both goods and proceedsb. What’s collection based on as a form of settlement?Commercial credit and trade creditc. What int’l rules should be observed for the business of collection at present?The uniform rules for collections(URC522)、The uniform rules for collections is the internationally recognized codification of rules unifying banking practice regarding collection operations for drafts and for documentary collectionsd. What is the nature of D/A, and that of D/P?D/P:not only importer can get goods,but also exporter can get payment in timeD/A: importer may pay after sight,favorable for importer to get the B/L in time,unfavorable for exporter.Both belong to documentory collection.e.How many basic parties concerned are there in collection and who are they?Four、drawer、remitting bank、collecting bank、draweef. How many ways are there in collection & what are they?Three、D/P 、D/A、acceptance documents against paymentFill in blanks with proper wordsa. Under an irrevocable L/C, the issuing bank must bear the 1st reliability for payment.b. An irrevocable credit can neither be cancelled nor modified without the agreement of theissuing bank, the confirming bank (if any) & the beneficiaryc. If a credit is issued by BOC, Guangzhou & confirmed by BOC, New York, the payment isensured by both banks.d. A confirmed credit is favorable to exporter, but not favorable to importer.e. if an L/C is attached with no transport documents & allows payment to be made only against a draft, it’s a clean credit.f. Because it’s too risky on the side of exporter, revocable credit is hardly used ininternational trade.Who areA. paying bankB. issuing bankC. reimbursement bank,D. confirming bankE. beneficiaryF. advising bankG. negotiating bank H. applicant respectively? (Match work)1. whose obligation is to arrange for an L/C to be opened or issued in favor of the exporter H2. referred to sb. who can benefit from the L/C by its assurance of payment to him & this payment term is usu. incorporated in the S/C at the request of the exporter. E3. the bank that issued the documentary credit on behalf of the applicant B4. the bank that has the task of informing the beneficiary that credit has been issued in his favor so that the beneficiary may make necessary preparation for shipping the goods & drafting the documents stipulated in the credit.F5. The bank that is authorized to pay the beneficiary or accept or negotiate his drafts, against his presentation of proper documents. A6. The bank that buys an exporter’s draft submitted to it under a documentary credit G7. The bank that is requested to add its own commitment ( make payment to the beneficiary) to the documentary credit. D8. The bank that, at the request of the issuing bank, is to authorized to pay, or accept and pay time drafts under the L/C CWhat do the following abbreviations stand for?1. UCPUniform Customs and Practice2. L/CLetter of credit3. B/Lbill of lading4.N/Nnon-negotiable5. A/Caccount6. H/OHEAD OFFICEMultiple choice1. A is the 1stly reliable payer under an L/C.A. issuing bankB. negotiating bankC. applicantD. advising bank2. The most important thing for a beneficiary of an L/C to examine the L/C is to make sureC .A. the L/C’s authenticityB. the issuing bank’s authenticity;C. if the terms & conditions of the L/C comply with those in the S/C;D. the political background of the issuing bank3. “strict consistency” in L/C business refers to the consistency between C_.A. L/C & S/CB. L/C & goods concernedC. documents & L/CD. documents & goods concerned4. According to UCP500, an L/C is B L/C if it’s not marked “irrevocable” or “revocable.A. revocableB. irrevocableC. either revocable or irrevocableD. none of A, B & CQuestions1. ABC Co., an exporter, who ships the goods & delivers the documents concerned to itsnegotiating bank under an L/C, but the importer, EFG Co. is bankrupt suddenly & unable to make the payment. If so, can the exporter gets the proceeds? Why or why not?Yes, because issuing bank is the 1stly reliable payer under an L/C, if the documents presented by the seller are in compliance with the terms & conditions of the L/C, the issuing bank is to pay the seller, even the applicant is bankrupt or in default.2. If L/C specifies the date for shipment as “on/or about 15th May” & the beneficiarypresents the B/L dated “ May 20”, can the negotiating bank negotiate the document? Why or why not?Yes,According to the UCP 600, if the expression “ on or about ” or similar expressions are used, banks will interpret them as a stipulation that shipment is to be made during the period from five days before to five days after the specified date, both end days included.Fill in blanks with proper words:A. A credit can be transferable once onlyB. Bank charges when a credit is transferable are payable by the first beneficiaryC. The benefit of an irrevocable documentary L/C may be available to a 3rd party if the 1stbeneficiary uses it as security to obtain another documentary L/C in favor of the actual supplierD. The 1st beneficiary is th e Middleman of the back-to-back L/C & the 2nd beneficiary is theactual supplierE. Red clause credits belong to partial sum to be paid in advance creditsF. There are 2 kinds of revolving credits, one may revolve in relation to time, another may revolve in relation to amountG. 3 modes of restoration to the original credit amount:a. if automatically restored to the original amount when it is exhausted.It’s automatic restoration to revolve;b. if restored to the original amount only on receipt of issuing bank’s notice, it’snon-automatic restoration to revolve;c. if the negotiating bank is mot informed of stopping restoration to the original amount atthe beginning of the next period, it’s Semi-automatic restoration to revolve.H. Difference between assignment & transfer in a transferable L/C:The beneficiary has the right to assign any proceeds within his share to a 3rd party;The beneficiary transfers his right to perform under the credit to a third partyA. Pls issue an assignment of proceeds instruction based on the following details:Issuing bank: Mellon Bank NA, New York (1)Negotiating bank: ICBC, Guangzhou Branch (2)Beneficiary: Dafeng Trading Co., Guangzhou (3)Assignee: Bailee Development Co., Shenzhen (4)Credit No.34967 (5) for USD24000.00 to expire on or before 31, May, 200x (6)Assignment of Proceeds InstructionTo: _(2 )_We hereby issue an irrevocable assignment of proceeds instruction to you to accept our instru-ction of assignment to assign 90% of the credit proceeds being USD _(21600 )__towhich we might be or become entitled under credit No_(5 )__ of _( 1 )__, New York to assignee _( 4 )_. The credit is available by negotiation with ICBC, Guangzhou and does not allow partial shipments. This instruction will expire _( 6 )_.For ___( 3 )__(Signature)B. Issue a standby L/C with following data:beneficiary: (1) Bank of Asia, GuangzhouIssuing bank: (2) Sanwa Bank Ltd, ShenzhenCredit No.: (3) 6251470Applicant: (4) ABC Co.Total amount of : (5) USD3.2 mil.(6) Signed statement in duplicate issued by you certifying that the amount drawn hereunderrepresents & covers the unpaid balance of debt due to yourselves by “ABC Co.” under “agreement”(7) We engage with drawers that such drafts drawn under & in incompliance with the termsof this credit shall be duly honored on due presentation to us for payment on or before 30 Dec., 200xA Standby L/C by Sanwa Bank Ltd, GuangzhouIssuing date: 18 Jan., 200xTo: Beneficiary: _( 1 )_From: Issuing bank: _( 2)_Standby L/C No. ( 3 )with reference to the Loan Agreement dated & signed on 18 Jan., 200x by ABC Co. & Bank of Asia, Shen-zhen, we hereby open our irrevocable standby L/C No. _(3 )__ in your favor for a/c of _(4 )_, a sum or sums not over a total amount of _( 5)_, available by your draft drawn on ourselves at sight for 100% of statement value to be accompanied by the following documents: _(6)_. All drafts drawn hereunder must be marked the words “Drawn under the Sanwa Bank Ltd., Shenzhen, Standby L/C No.6251470 date d on 18 Jan., 200x”.in this credit is available as from 18 Jan., 200x. This credit _( 7)_ and this standby L/C is subject to ISP 98.The Sanwa Bank Ltd, Shenzhen(signature)2C. Issue a reciprocal credit with following dataIssuing bank: (1) the Fuji Bank Ltd, TokyoBeneficiary: (2) ABC Co., GuangzhouAdvising bank: (3) Bank of Asia, GuangzhouCredit amount for JPY25 mil. To be converted at USD/JPY 100 into (4) USD 0.25 mil.Applicant: (5) Nashi Trading Co. Ltd., TokyoDraft drawn on (6) us at sight.This is a (7) reciprocal L/C against Bank of Asia, Gua- ngzhou, Credit No. 12009 favoring Nashi Trading Co., Ltd., Tokyo, covering shipment of 10000 sets of MP5.Signing Bank: (8) the Fuji Bank Ltd., TokyoReciprocal Credit Form( 1 )______Tokyo, 20 May, 200xCredit No. 118-10063Advised through ( 3 ) To: (2 )Dear SirsWe hereby issue an irrevocable documentary credit No.118-10063 for USD ( 4 ) in your favor for a/c of ( 4 ), Tokyo, available with advising bank by negotiation of your draft drawn on (5 ) at sight for 100% of invoice value accompanied by the following documents: xxxThis is a (7)For ( 8 ) (signature)Choose the best answerA. “This credit s hall be renewable automatically twice for a period of 1 month each for anamount of USD 50000 for each period making a total of USD 150000”If a credit has such a statement, it must be(a). automatic(b). non-automatic(c). Semi-automaticrestriction to revolveB. “Should the n egotiating bank not be advised of stopping renewal within a week, theunused balance of this credit shall be increased to the original amount at beginning of the next week after each negotiation”.If a credit has such a statement, it must be(a). automatic(b). non-automatic( c). semi-automaticrestoration to revolveChoose the better answera. Whether B/L is provided with the following functions or characteristics:1) It’s a receipt of goods A. yes B. no2) It’s a contract of carriage A. yes B. no3) It’s a document of title A. yes B. no4) It’s a negotiable document A. yes B. no5) It may control the delivery of the goods A. yes B. nob. A B/L has 2 basic parties, viz. carrier andA. consignor B consigeec. Consignor is also called shipper. Generally, the shipper is the seller or theA. consigneeB. beneficiaryunder commercial L/C. In special case, the shipper may be the buyer sometimesd. Whether non-negotiable sea waybill is provided with the following function orcharacteristics1). It’s a receipt of goods A. yes B. no2). It’s a contract of carriag e A. yes B. no3) It’s a document of title A. yes B. no4) It’s a negotiable document A. yes B. no5) It may control the delivery of the goods A. yes B. noe. Whether charter party B/L is provided with the following functions or characteristics1) It’s a receipt of goods A. yes B. no2) It’s a contract of carriageA. yesB. it’s subject to charter party agreement3) It’s a negotiable documentA. yesB. it’s subject to charter party agreement4) It’s a document of titleA. yesB. it’s subject to charter party agreement5) It may control the delivery of the goodsA. YesB. it’s subject tot charter party agreement6) Even if the credit requires presentation of a charter party contract, bankA. willB. won’t examine such contract, but will pass it along without responsibility1) A commercial invoice is the accounting document by which the seller claims paymentfrom the A. shipper B. buyer for the value of the goods &/or services being supplied2) Unless otherwise specified in the L/C, commercial invoice A. need B. needn’t be signed3) If an L/C calls for shipment of FOB Shanghai, then when a commercial invoice under thisdoesn’t specifically state “FOB Shanghai”A. it’s a discrepancyB. it’s not a discrepancyg. As for marine B/L and mail B/L, ___.A. both are title to goodsB. both are negotiable title to goodsC. the former is the negotiable title to goods, but the latter isn’tterms explanation:a . insurance policya legal evidence of the agreement to insure, also a written contract between the insurance co. & the party insured.b. packing listan important document for the customs & the importers to check goods. It details the packing of goods item by item such as assortment, weight, etc. The contents must be consistent with those on the commercial invoice.c. marine B/Lth e most important transport document as the document of title as well as its wide usage in int’l settlement. Of the seaway B/L, banks only a ccept On Board B/L, Clean B/L. If L/C doesn’t forbid, banks also accept partial shipment & transhippment B/L, Charter Party B/L, etc.d. certificate of origina document evidencing the goods originated from a particular country, issued by the Inspection Bureau, or by the Council for Promotion of Int’l Trade, or by the exporter himself sometimes.Choose a better answera. Whether CTD or Multimodal Transport Document provided part of the journey by seahas the following functions or characteristics?1) it’s a receipt of goods a. yes b. no2) it’s a contract of carriage a. yes b. no3) it’s a document of title a. yes b. no4) It’s a negotiable document a. yes b. no5) It may control the delivery of the goods a. yes b. noB. Whether a parcel post receipt is provided with the following functions or characteristics?1). It’s a receipt of goods a. yes b. no2) it’s a contract of carriage a. yes b. no3) it’s a document of title a. yes b. no4) it’s a negotiable document a. yes b. no5). It may control the delivery of the goodsa. yesb. noC. Whether a courier receipt provided with the following functions or characteristics?1). It’s a receipt of goods a. yes b. no2) it’s a contract of carriage a. yes b. no3) it’s a document of title a. yes b. no4) it’s a negotiable document a. yes b. no5). It may control the delivery of the goodsa. yesb. noD. 1) If the L/C ask for insurance policy, the presentation of an insurance certificate of it A.is B. isn’t permissible.2) Date of insurance document must be no later than the date ofA. shipmentB. issuance of L/CBriefly answer the following questions:1. Is there anything in common for airway bill, railway bill, road transport document & postal receipt?They are a receipt of goods and a contract of carriage.The functions of a them are similar to those of a bill of lading, except that they are not negotiable and they are not a document of title.2. Where do the applicant for an L/C, issuing bank & beneficiary appear on a marine B/L respectively?P120。