.《现代金融市场概论》教学课件Portfolio Thoery

合集下载

《现代金融市场理论》课件

意义。

现代投资组合理论

总结词

现代投资组合理论为投资者提供了构建 多样化投资组合的方法,以最小化风险 并最大化回报。

VS

详细描述

现代投资组合理论认为,投资者应该根据 自身的风险承受能力和投资目标,构建多 样化的投资组合。该理论提出了均值-方 差优化方法,通过调整不同资产的配置比 例,以最小化投资组合的风险并最大化回 报。此外,该理论还强调了投资组合的长 期表现和资产配置的重要性。

有效市场假说

总结词

有效市场假说认为市场能够充分反映所有相关信息,价格波动反映了市场对信息的反应 。

详细描述

有效市场假说认为,市场参与者都是理性的,他们能够根据所有可获得的信息做出最佳 决策。因此,市场的价格能够充分反映所有相关信息,并且价格波动是随机的,反映了 市场对信息的反应。这一理论对于投资者制定投资策略和评估投资机会具有重要的指导

期权

期权是赋予持有者在未来某一时间以 特定价格买入或卖出标的资产的权利 。

外汇与货币市场工具

外汇

外汇是不同货币之间的兑换,涉及汇率风险和套利机会。

货币市场工具

货币市场工具包括短期债券、商业票据等,主要用于短期融资和流动性管理。

其他金融衍生品

远期合约

远期合约是买卖双方约定在未来某一时间以特定价格交割标的资产的合约。

风险管理理论

总结词

风险管理理论提供了识别、测量和降低风险的方法,帮助投资者在不确定的市场环境中做出明智的决 策。

详细描述

风险管理理论认为,投资者应该对投资组合面临的风险进行充分了解和管理。该理论提供了识别、测 量和降低风险的方法,包括使用衍生品、进行套期保值等。此外,风险管理理论还强调了风险管理在 长期投资策略中的重要性,帮助投资者在不确定的市场环境中做出明智的决策。

现代投资组合理论

总结词

现代投资组合理论为投资者提供了构建 多样化投资组合的方法,以最小化风险 并最大化回报。

VS

详细描述

现代投资组合理论认为,投资者应该根据 自身的风险承受能力和投资目标,构建多 样化的投资组合。该理论提出了均值-方 差优化方法,通过调整不同资产的配置比 例,以最小化投资组合的风险并最大化回 报。此外,该理论还强调了投资组合的长 期表现和资产配置的重要性。

有效市场假说

总结词

有效市场假说认为市场能够充分反映所有相关信息,价格波动反映了市场对信息的反应 。

详细描述

有效市场假说认为,市场参与者都是理性的,他们能够根据所有可获得的信息做出最佳 决策。因此,市场的价格能够充分反映所有相关信息,并且价格波动是随机的,反映了 市场对信息的反应。这一理论对于投资者制定投资策略和评估投资机会具有重要的指导

期权

期权是赋予持有者在未来某一时间以 特定价格买入或卖出标的资产的权利 。

外汇与货币市场工具

外汇

外汇是不同货币之间的兑换,涉及汇率风险和套利机会。

货币市场工具

货币市场工具包括短期债券、商业票据等,主要用于短期融资和流动性管理。

其他金融衍生品

远期合约

远期合约是买卖双方约定在未来某一时间以特定价格交割标的资产的合约。

风险管理理论

总结词

风险管理理论提供了识别、测量和降低风险的方法,帮助投资者在不确定的市场环境中做出明智的决 策。

详细描述

风险管理理论认为,投资者应该对投资组合面临的风险进行充分了解和管理。该理论提供了识别、测 量和降低风险的方法,包括使用衍生品、进行套期保值等。此外,风险管理理论还强调了风险管理在 长期投资策略中的重要性,帮助投资者在不确定的市场环境中做出明智的决策。

《金融市场概论》课件

Part Five

市场风险: 价格波动、 流动性风 险等

信用风险: 违约风险、 信用评级 等

利率风险: 利率变动、 利率期限 结构等

汇率风险: 汇率波动、 外汇风险 等

操作风险: 操作失误、 系统故障 等

法律风险: 法律法规 变动、合 规风险等

风险识别:识别金融市场中存在的各种风险 风险评估:评估风险的可能性和影响程度 风险控制:采取措施控制风险,如设置止损点、分散投资等 风险转移:通过保险、合约等方式将风险转移给其他主体 风险监测:持续监测金融市场的风险状况,及时调整风险管理策略

市场参与者:包括投资者、金融机构、监 管机构等

交易机制:包括竞价交易、做市商交易等

价格形成机制:包括市场供求、投资者预 期等

风险管理:包括风险控制、风险对冲等

监管制度:包括法律法规、监管机构等

信息披露:包括上市公司信息披露、市场 信息披露等

监管机构:包括中央银行、证 券监管机构、保险监管机构等

监管法规:包括《证券法》、 《保险法》、《银行法》等

投资者:个人投资 者、机构投资者

融资者:企业、政 府、个人

中介机构:银行、 证券公司、保险公 司等

监管机构:政府、 央行、证监会等

资源配置:将资金从储蓄者手中转移到投资者手中 风险管理:分散风险,降低投资风险 价格发现:通过市场交易发现资产价格 信息传递:传递市场信息,影响投资者决策

按照交易对象分类:货币市场、资本市场、外汇市场、衍生品市场等 按照交易场所分类:场内市场、场外市场 按照交易方式分类:现货市场、期货市场、期权市场等 按照交易目的分类:投资市场、投机市场、套利市场等

交易方式:电子交易、电话 交易、柜台交易等

交易时间:全球24小时不间 断交易

第一章 金融市场概论《金融市场学》PPT课件

金融市场的媒体

(2)证券经纪人;它是指在证券市场上充当交易 双方中介和代理买卖证券而收取佣金的中间商 人。

(3)证券承销人;它又称证券承销商,是指以包销 或代销方式帮助发行人发行证券的商人或机构。

(4)外汇经纪人;它又称外汇市场经纪人,是指在 外汇市场上促成外汇买卖双方外汇交易的中介 人。外汇经纪人既可以是个人,也可以是中介组织, 如外汇中介行或外汇经纪人公司等。

此外,金融公司、财务公司、票据公司、信托公 司、信用合作社以及国外金融机构,也在金融市场上 起着重要的中介作用。

1.2 金融市场的结构

1、按交易对象划分,金融市场可分为货币市场、资 本市场、外汇市场、黄金市场、保险市场和金融衍生 工具市场等。

2、按交割方式划分,金融市场可分为现货市场、期 货市场和期权市场。

1.3 金融市场的功能

5)财富功能:一个资本市场如果没有财富管理功 能,而只具有融资功能,那么这个资本市场就还只是一 个很低级的市场,它完全可以被传统的商业银行所代 替。资本市场之所以能在过去近百年的发展过程中生 生不息,就是因为这个市场所创造的产品具有财富管理 的功能,并且这种功能有很好的成长性,也有优良的风 险抵御机制。

金融市场的主体

金融市场的主体,即金 融市场的交易者,也就是 资金的供给者或资金的需 求者。

金融市场的交易者既 可以是法人,也可以是自 然人,一般包括政府、企 业、金融机构、机构投资 者、家庭或个人五类。

金融市

场的主 体

政府

企业

金融 机构

机构 投资 者

家庭 或个 人

金融市场的客体

金融市场的客体是指金融市场的交易对象或交易的 标的物,即通常所说的金融工具。

1.2 金融市场的结构

金融市场概述ppt课件

印花税 买时为0;卖时为成交金额的0 5‰

过户费 只有上证的收;深证不收

8

2 5分类 1普通股:指在公司的经营管理和盈利及财产的分配上享有普通权利

的股份 2优先股:优先股相对于普通股 3垃圾股:经营亏损或违规的公司的股票 4绩优股:公司经营很好;业绩很好;每股收益0 8元以上 市盈率1015

倍以内 5蓝筹股:股票市场上;那些在其所属行业内占有重要支配性地位 业

6 增加授信 企业成功挂牌新三板;是一种非常积极的信号 银行对于这样的企业;是非常愿 意增加授信并提供贷款的;因为他们也面临激烈的竞争;并且以后这种竞争还会加 剧 7 股权质押

有些企业挂牌新三板后;就会有银行找来;说可以提供贷款;因为股权可以质 押了

8 品牌效应 挂牌新三板后;就成为了非上市公众公司;企业会获得一个6位的以4开头的挂 牌代码;还有一个企业简称 以后企业的很多信息都要公开 但与此同时;企业的影 响和知名度也在不断扩大

包括存款 贷款 信托 租赁 保险 票据 抵押与贴现 股票债券买卖等全部金 融活动

2

1 金融市场体系

货币市场

金

融

市

资本市场

场

外汇市场

储蓄 承兑贴现市场

拆借市场

国库券市场 证券市场

股票市场 债券市场 基金市场

衍生工具市场

信贷市场 保险市场

期货市场 期权市场

黄金市场 3

1 2金融市场的功能和作用

1便利投资和筹资 2合理引导资金流向和流量;促进资本集中并 向高效益单位转移 3方便资金的灵活转换 4实现风险分散;降低交易成本 5有利于增强宏观调控的灵活性 6有利于加强部门之间;地区之间和国家之间的经济 联系

4

二 证券市场

现代金融市场理论PPT课件

11

市场是提供信息的作用。即信息是无代价的,被所有 个人同时接受。

所有个人都是理性预期效用最大化者。

➢ 法玛的有效率市场假说是一种广义上的有效率, 不管市场是否有配置效率或者运作效率,只要所 有应得的信息都反映在资产价格中,市场(从信 息上说)就是有效率的。基于这点,有的人就把 市场有效率,称为信息的有效率,》上发表题为《股票 市场价格的行为》(The behavior of Stock Market Prices,1965)论文,提出了有效市场假 说,指明了市场是鞅模型,或者“公平博弈”, 就是说,信息不能被用来在市场上获取利润。

➢ 有效市场假说与奥斯本的假设5相似,从纯形式上 说,有效市场假说并不要求时际的不相关性或者 只接受不相关的同等分布的观察。而随机游走模 型则要求这些假设。如果收益是随机的,市场就 是有效率的,即“随机游走”一定是市场有效率, 但是逆定理不一定正确,即市场有效率不一定是 “随机游走”。

18

(三)对有效率市场假说的检验

1.检验方法 ➢ 用于评估市场效率的检验方法可以分为两类:

➢ 一类是将实际收益率与市场是有效率的假设条件下的 应有收益率进行比较;

➢ 一类是进行模拟交易战略的测试,观察这些战略能否 提供超额收益。

19

2.对弱式效率市场的检验 ➢ 有效率市场假说的弱式效率表明,一个投资者不

10

(一)完善的市场与有效率的市场

➢ 完善的市场必须具备以下条件:

市场是无摩擦的。即没有任何交易成本,所有的资产 都具有完全可分性和可交易性,并且没有任何约束性 规定。

在产品市场和证券市场中有完全的竞争。在产品市场 中的完全竞争,是指所有的生产者都以最小的平均成 本供给商品和劳务;而证券市场中的完全竞争是指所 有的参与者都是价格接受者。

市场是提供信息的作用。即信息是无代价的,被所有 个人同时接受。

所有个人都是理性预期效用最大化者。

➢ 法玛的有效率市场假说是一种广义上的有效率, 不管市场是否有配置效率或者运作效率,只要所 有应得的信息都反映在资产价格中,市场(从信 息上说)就是有效率的。基于这点,有的人就把 市场有效率,称为信息的有效率,》上发表题为《股票 市场价格的行为》(The behavior of Stock Market Prices,1965)论文,提出了有效市场假 说,指明了市场是鞅模型,或者“公平博弈”, 就是说,信息不能被用来在市场上获取利润。

➢ 有效市场假说与奥斯本的假设5相似,从纯形式上 说,有效市场假说并不要求时际的不相关性或者 只接受不相关的同等分布的观察。而随机游走模 型则要求这些假设。如果收益是随机的,市场就 是有效率的,即“随机游走”一定是市场有效率, 但是逆定理不一定正确,即市场有效率不一定是 “随机游走”。

18

(三)对有效率市场假说的检验

1.检验方法 ➢ 用于评估市场效率的检验方法可以分为两类:

➢ 一类是将实际收益率与市场是有效率的假设条件下的 应有收益率进行比较;

➢ 一类是进行模拟交易战略的测试,观察这些战略能否 提供超额收益。

19

2.对弱式效率市场的检验 ➢ 有效率市场假说的弱式效率表明,一个投资者不

10

(一)完善的市场与有效率的市场

➢ 完善的市场必须具备以下条件:

市场是无摩擦的。即没有任何交易成本,所有的资产 都具有完全可分性和可交易性,并且没有任何约束性 规定。

在产品市场和证券市场中有完全的竞争。在产品市场 中的完全竞争,是指所有的生产者都以最小的平均成 本供给商品和劳务;而证券市场中的完全竞争是指所 有的参与者都是价格接受者。

.《现代金融市场概论》教学课件SWAPCurrencya.

swap

Currency & Interest Rate

Currency & Interest Rate Swaps

This chapter discusses currency and interest rate swaps, which are relatively new instruments for hedging long-term interest rate risk and foreign exchange risk.

An Example of an Interest Rate Swap

Firm B is a BBB-rated U.S. company. It needs $10,000,000 to finance an investment with a five-year economic life.

Outline

Types of Swaps Size of the Swap Market The Swap Bank Interest Rate Swaps Currency Swaps

Outline (continued)

Swap Market Quotations Variations of Basic Currency and Interest Rate Swaps Risks of Interest Rate aቤተ መጻሕፍቲ ባይዱd Currency Swaps Swap Market Efficiency Concluding Points About Swaps

The Swap Bank

A swap bank is a generic term to describe a financial institution that facilitates swaps between counterparties. The swap bank can serve as either a broker or a dealer.

Currency & Interest Rate

Currency & Interest Rate Swaps

This chapter discusses currency and interest rate swaps, which are relatively new instruments for hedging long-term interest rate risk and foreign exchange risk.

An Example of an Interest Rate Swap

Firm B is a BBB-rated U.S. company. It needs $10,000,000 to finance an investment with a five-year economic life.

Outline

Types of Swaps Size of the Swap Market The Swap Bank Interest Rate Swaps Currency Swaps

Outline (continued)

Swap Market Quotations Variations of Basic Currency and Interest Rate Swaps Risks of Interest Rate aቤተ መጻሕፍቲ ባይዱd Currency Swaps Swap Market Efficiency Concluding Points About Swaps

The Swap Bank

A swap bank is a generic term to describe a financial institution that facilitates swaps between counterparties. The swap bank can serve as either a broker or a dealer.

.《现代金融市场概论》教学课件PortfolioThoery.

Major asset classes: cash

“Cash” may mean currency, but in an investment context cash is just a really short term highly liquid fixed interest investment. Longer term fixed interest investments are usually called “bonds”, shorter term fixed interest investments may be called “notes” and really short term ones are often called “bills”.

Chapter One

Introduction of Portfolio Theory

Part One

The asset classes

Basic principles

There are many asset classes and many of them are useful to investors. Some asset classes are noted for their long term stability (low risk), others for their high returns. Generally speaking, the higher the reward you are after, the more risk you’ll need to take. Portfolios can be constructed that exhibit superior risk and return relationships to any single asset, because one can significantly reduce risk by diversification.

《金融市场理论》课件

交易方式:竞价交易、做市商交易等

交易成本:佣金、印花税等

交易对象:股票、债券、期货、期权等

交易监管:证券监管机构、自律组织 等

金融市场的信息披露机制

信息披露的定义:上市公司向投资者披露其财务状况、经营情况等信息的行为 信息披露的目的:提高市场透明度,保护投资者利益 信息披露的内容:包括财务报表、公司治理、重大事项等 信息披露的方式:通过定期报告、临时公告、投资者关系活动等方式进行披露

商业票据:企业 发行的短期无担 保债务工具,用 于短期资金周转

资本市场产品

股票:上市公司发行的所 有权凭证

债券:政府、金融机构或 企业发行的债务凭证

基金:集合投资者资金, 由专业经理人管理投资的 产品

期货:标准化的远期合约, 用于对冲风险或投机获利

期权:赋予持有者在特定 时间以特定价格买卖某种 资产的权利

风险管理理论: 包括风险度量、 风险控制等

金融科技:利用 大数据、人工智 能等技术进行金 融创新

PART 4

金融市场的产品

货币市场产品

货币市场基金: 投资于短期货币 市场工具,如国 库券、商业票据 等

短期债券:期限 在一年内的债券, 如短期国债、企 业债券等

回购协议:金融 机构之间以债券 为抵押的短期资 金借贷

监管机构:政府、央行、证监 会等

金融市场的功能

资源配置:将资 金从储蓄者转移 到投资者,实现 资源的有效配置

风险管理:通过 分散投资,降低 风险,提高资金 安全性

价格发现:通过 市场交易,发现 资产的真实价值

信息传递:传递 市场信息,帮助 投资者做出决策

金融市场的分类

按照交易对象: 货币市场、资 本市场、外汇 市场、衍生品

现代投资学讲义(英文版)PPT课件( 72页)

Wealth Accumulation after Expenses

$10,000.00

$1,000.00 $100.00 $10.00 $1.00

Stocks

$825.45 $27.26

Bonds

$0.10

1926 1930 1934 1938 1942 1946 1950 1954 1958 1962 1966 1970 1974 1978 1982 1986 1990 1994 1998 2002

How are securities traded

Primary Market

Market for new issues of securities

Initial Public Offerings (IPO) Seasoned Public Offerings Private Placements

Rates of returns versus time for major security types

Investments Over the Long-Term

What is the current value of $1 invested between 1926-2002 in

Portfolio of large U.S. stocks (Standard and Poor’s Composite Index)

-0.13%

0.20%

9.87%

Risk

Founding Dates for World Equity Market

2000 1950 1900 1850 1800 1750 1700 1650 1600

Netherlands France Belgium Austria UK USA Ireland Italy

《现代金融市场理论》PPT课件

法玛的这个结论不免使许多在做股 价分析的人有点沮丧,他们全力研 究各家公司的会计报表与未来前景 以决定其价值,并试图在此基础上 做出正确的金融决策。难道股价真 的是如此随机,金融市场就没有经 济学的规律可循吗?

萨缪尔森的看法是,金融市场并非不按经济规律运 作,恰恰相反,这正是符合经济规律的作用而形成的一 个有效率的市场。 因此,“有效市场假说”包含以下几个要点: 第一, 在市场上的每个人都是理性的经济人 ; 第二, 股票的价格反映了这些理性人的供求的平衡; 第三, 股票的价格也能充分反映该资产的所有可获得的 信息。

现代金融理论和效率市场假 说是建立在有效的市场竞争 基础上的。行为金融理论的 支持者却认为现实中市场并 不一定能够满足有效市场竞 争的条件。

26

二、行为金融理论的发展历史

行为金融理论的发展历史可以概括为以下几个阶段:

1.早期阶段。凯 恩斯是最早强调心 理预期在投资决策 中作用的经济学家, 他基于心理预期最 早提出股市“选美 竞赛”理论和基于 投资者“动物精神” 而产生的股市“乐 车队效应” 。

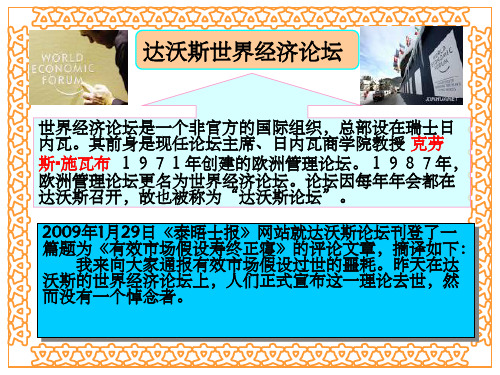

我来向大家通报有效市场假设过世的噩耗。昨天在达 沃斯的世界经济论坛上,人们正式宣布这一理论去世,然 而没有一个悼念者。

1

宣告仪式发生在一场头脑风暴会议上, 与会者包括众多世界一流经济学家、 政治家、商界领袖……以及少数戴着 墨镜和假须的银行家。 对于“主要是什么样的政策理念导致 了这场全球金融危机”这个问题,到 目前为止最普遍的回答是对于“市场 具有自我调节机制”的信念。

达沃斯世界经济论坛

世界经济论坛是一个非官方的国际组织,总部设在瑞士日 内瓦。其前身是现任论坛主席、日内瓦商学院教授 克劳 斯·施瓦布 1971年创建的欧洲管理论坛。1987年, 欧洲管理论坛更名为世界经济论坛。论坛因每年年会都在 达沃斯召开,故也被称为“达沃斯论坛”。 2009年1月29日《泰晤士报》网站就达沃斯论坛刊登了一 篇题为《有效市场假设寿终正寝》的评论文章,摘译如下:

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Why risk and return are linked

Investment A is the obvious choice…

A

… but add

A

risk, is the

choice still

obvious? B

B

B would die out through lack of takers!

▪ Inflation risk is a major problem with the more “conservative” asset classes such as fixed interest and cash. Many pensioners find to their horror that they can no longer live off their savings, despite the conservatism of their strategy, simply because inflation devalued their money and the portfolio did grow enough to keep up.

▪ Averaged out over many companies, shares as an asset class tend to respond to interest rates and the economy.

▪ Although in the last few years many markets have fallen substantially, shares are still the highest performing asset class over the long term.

When two investments appear to offer identical risk, investors will prefer to buy the higher returning one. If the market is peopled by reasonably well informed investors, there simply won’t be any high returning low risk investments left and nobody will buy high risk assets with a low expected return.

▪ In a portfolio construction context “risk” is usually measured with some sort of measure of price volatility.

▪ There are other risks of course that need to be taken into account.

▪ Portfolios can be constructed that exhibit superior risk and return relationships to any single asset, because one can significantly reduce risk by diversification.

▪ It is necessary for all but the most short term oriented investors to consider at least some exposure to growth assets like shares and property, just to fight inflation.

▪ Shares generally go up in price over the long term because businesses don’t pay out 100% of their profits as dividends, they keep some to grow the value of the business itself.

Major asset classes: shares

▪ Shares are part interests in businesses. How good a return you get on your share depends to a large extent on the fundamental business developments of the company itself and on the price you paid for the share.

▪ Over the long term, shares have beaten inflation.

Major asset classes: property

▪ There are many types of property to invest in, each are different.

▪ The highest income yield comes generally from commercial and industrial property.

Chapter Oy

Part One

The asset classes

Basic principles

▪ There are many asset classes and many of them are useful to investors.

▪ Some asset classes are noted for their long term stability (low risk), others for their high returns.

▪ Generally speaking, the higher the reward you are after, the more risk you’ll need to take.