投资协议条款清单(TS)termsheet-模板

投资条款清单termsheet详解一个例子

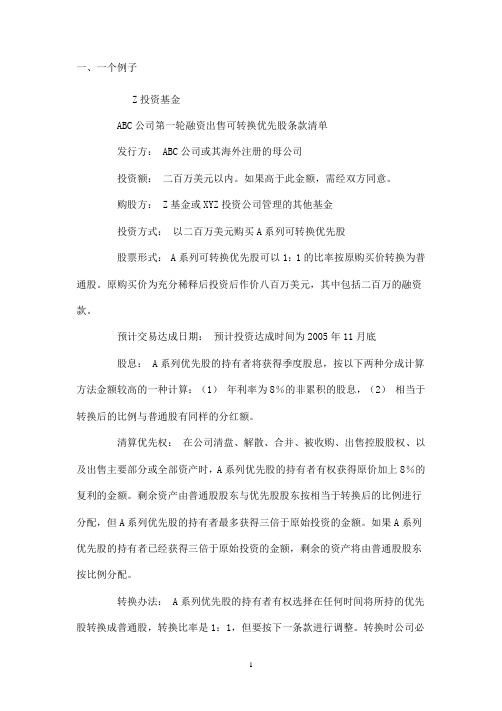

一、一个例子Z投资基金ABC公司第一轮融资出售可转换优先股条款清单发行方: ABC公司或其海外注册的母公司投资额:二百万美元以内。

如果高于此金额,需经双方同意。

购股方: Z基金或XYZ投资公司管理的其他基金投资方式:以二百万美元购买A系列可转换优先股股票形式: A系列可转换优先股可以1:1的比率按原购买价转换为普通股。

原购买价为充分稀释后投资后作价八百万美元,其中包括二百万的融资款。

预计交易达成日期:预计投资达成时间为2005年11月底股息: A系列优先股的持有者将获得季度股息,按以下两种分成计算方法金额较高的一种计算:(1)年利率为8%的非累积的股息,(2)相当于转换后的比例与普通股有同样的分红额。

清算优先权:在公司清盘、解散、合并、被收购、出售控股股权、以及出售主要部分或全部资产时,A系列优先股的持有者有权获得原价加上8%的复利的金额。

剩余资产由普通股股东与优先股股东按相当于转换后的比例进行分配,但A系列优先股的持有者最多获得三倍于原始投资的金额。

如果A系列优先股的持有者已经获得三倍于原始投资的金额,剩余的资产将由普通股股东按比例分配。

转换办法: A系列优先股的持有者有权选择在任何时间将所持的优先股转换成普通股,转换比率是1:1,但要按下一条款进行调整。

转换时公司必须付清所有应付的分红,转换时如果有不足一股的零头,公司当以等值的现金支付给投资者。

自动转换:在公司上市公开发行股票时,A系列优先股按当时适用的转换价格自动转换成普通股股票,前提是新股发行值不低于1000万美元(扣除承销费和上市费用之前)(有效的IPO)。

反稀释条款:如果新发行的股权的价格低于A系列优先股(董事会同意的用于员工期权计划的股权和其他用于特殊目的的获免股权除外),A系列优先股的股价需按平摊加权平均法做相应调整。

A系列优先股在拆股、股票分红、并股、或者以低于转换价格增发新股,以及其他资产重组的情况下也要按比例获得调整。

回购保证: A系列优先股的持有者有权选择在A系列优先股发行后五年后任何时间要求公司回购其股权。

股权投资投资条款term sheet 内附模板

投资条款致达金控投资管理(北京)有限公司致金研究院致达金控ZETA Financial Holding目录CONTENT PART ONE PART TWOPART THREE投资条款案例简析概念简介概念简介PART ONE投资条款清单是一个从海外引入的词汇,英文全称:“term sheet of equityinvestment”,简称“TS”。

通常出现在VC 【风险投资】和PE 【私募股权投资】过程中,在企业家与投资者进行初步磋商后,在尽职调查前双方签署的一份关于目标公司股权融资的框架性文件,就交易的主要条款进行一些原则性的规定,因而,没有法律约束力,可以称为“君子协议”。

投资条款简介致达金控ZETA Financial HoldingPART ONE 概念简介投资条款PART TWO保密条款序号事项意向定义1保密条款指协议当事人之间就一方告知另一方的书面或口头信息,约定不得向任何第三方披露该等信息常见条款:有关投资的条款、细则与补充约定,包括所有条款约定、本框架协议的存在以及相关的投资文件,均属保密信息,协议各方不得向任何第三方透露,协议各方另有约定或依法应予披露的除外。

协议各方同意,丙方有权将本清单项下的投资事宜披露给丙方的投资人、诚信的潜在投资人、银行、贷款人、员工、会计师、法律顾问、业务伙伴,但前提是,获知信息的个人或者机构已经承诺对相关信息予以保密。

协议各方同意,甲方有权将本清单项下的投资事宜披露给甲方的投资人、银行、员工、以及为甲方提供中介服务的会计师、律师。

但是,甲方应要求获知信息的个人或者机构承诺对相关信息予以保密。

甲方完成对丙方的正式投资后,有权向第三方或公众透露其对丙方的投资。

序号事项意向定义2丙方估值对交易标的资产价值的评定丙方估值常见条款:协议各方同意对丙方全面稀释的投资后整体估值,按2014年预测利润的8倍市盈率计算,2014年预测税后净利润为人民币1亿元,丙方全面稀释的投资后整体估值为1亿元X8=8亿元。

投资合作意向书TERMSHEET样本

投资合作意向书TERMSHEET样本尊敬的合作伙伴,感谢您对与我们进行投资合作的兴趣。

为了明确双方的合作意向和合作条件,我们编写了以下投资合作意向书TERMSHEET样本,作为进一步沟通和协商的依据。

1.投资方信息(在这一部分中,提供投资方的详细信息,包括公司名称、法定代表人姓名、联系方式等)2.被投资方信息(在这一部分中,提供被投资方的详细信息,包括公司名称、法定代表人姓名、联系方式等)3.投资金额投资方拟向被投资方投资的金额为XX万元人民币。

双方同意根据需要进行进一步讨论和确定。

4.股权结构(在这一部分中,详细描述双方在合作中所持有的股权比例,以及投资金额与股权比例之间的对应关系)5.合作方式(在这一部分中,详细描述双方的合作方式,可以是资金注入、战略合作或其他形式的合作)6.投资回报和退出方式(在这一部分中,详细描述投资方的预期投资回报和退出方式,可以是分红、股权转让或其他形式的退出方式)7.合作期限(在这一部分中,确定合作的期限,可以是固定期限、无固定期限的合作等)8.保密条款双方同意在合作期间和合作终止后继续保持对双方涉密信息的保密,并承诺不向第三方披露,除非获得双方事先书面同意。

9.争议解决双方同意如发生争议,应通过友好协商解决。

协商不成的,双方同意提交有管辖权的法院解决。

10.其他约定事项(在这一部分中,可以补充双方其他约定的事项,如双方的权利和义务、合作的具体细节等)以上为投资合作意向书TERMSHEET样本的主要内容,旨在明确双方的合作意向和合作条件。

请您阅读并确认同意以上内容,如有其他意向或建议,也欢迎您提出。

若您同意以上内容,请您签署并回复该意向书。

我们期待与您进一步展开合作。

谢谢!此致敬礼。

投资协议条款清单

投资协议条款清单第一篇:投资协议条款清单投资协议条款清单(Term Sheet)- 强卖权Term Sheet: Drag AlongThis is one of those terms that has recently increased in importance to VCs due to the all the financing and exit dynamics that occurred during the downturn of 2001 – 2003.A typical drag-along agreement is short and sweet and looks as follows: "Drag-Along Agreement: The [holders of the Common Stock] or [Founders] and Series A Preferred shall enter into a drag-along agreement whereby if a majority of the holders of Series A Preferred agree to a sale or liquidation of the Company, the holders of the remaining Series A Preferred and Common Stock shall consent to and raise no objections to such sale."As transactions started occurring that were at or below the preferred liquidation preferences, entrepreneurs and founders –not surprisingly – started to resist doing these transactions since they often weren't getting anything in the deal.While there are several mechanisms to address sharing consideration below the liquidation preferences (e.g. the "carve out" - which we'll talk more extensively about some other time), the fundamental issue is that if a transaction occurs below the liquidation preferences, it's likely that some or all of the VCs are losing money on the transaction.The VC point of view on this varies widely (and is often dependent on the situation) – some VCs can deal with this and are happy to provide some consideration to management to get a deal done; others are stubborn in their view that since they lost money, management shouldn't receive anything.However, in all of these situations, the VCs would muchrather control their ability to compel other shareholders to support the transaction being considered.As more of these situations appeared, the major holders of common stock (even when they were in the minority of ownership) began refusing to vote for the proposed transaction unless the holders of preferred waived part of their liquidation preferences in favor of the common. Needless to say, this "hold out technique" did not go over well in the venture community and, as a result, the drag-along became more prevalent.I've heard founders and early shareholders say a variety of things with regard to a drag-along, but the most inane is "it's not fair –I want to be able to vote my stock however I want to."Remember that this term is one of a basket of terms that are part of an overall negotiation associated with injecting money into your company.There aretradeoffs in any negotiation and nothing is standard –so "fair" is an irrelevant concept – if you don't like the terms, don't do the deal.If you are faced with a drag-along, your ownership position will determine whether or not this is a relevant issue for you.An M&A transaction does not require unanimous consent of shareholders (these rules vary by jurisdiction, although the two most common situations are either majority of each class (California) or majority of all shares on an as converted basis (Delaware)), although most acquirers will want 85% to 90% of shareholders to consent to a transaction.So – if you own 1% of a company, while the VCs would like you to sign up to a drag-along, it doesn't matter that much (unless there are 30 of you that own 1%.)Again – make sure you know what you are fighting for in the negotiation – don't put disproportionate energy against terms that don't matter.When a company is faced with a drag along in a VC financing proposal, the most common compromise position is to try to get the drag along to pertain to following the majority of the common stock, not the preferred.This way – if you own common – you are only dragged along when a majority of the common consents to the transaction.This is a graceful position for a very small investor to take (e.g. I'll play ball if a majority of the common plays ball) and one that I've always been willing to take when I've owned common in a company (e.g. I'm not going to stand in the way of something a majority of folks that have rights equal to me want to do.)Of course, preferred investors can always convert some of their holding to common to generate a majority, but this also results in a benefit to the common as it lowers the overall liquidation preference. 投资协议条款清单(T erm Sheet)- 购买参与权Term Sheet: Pay-to-PlayAt the turn of the century, a pay-to-play provision was rarely seen. After the bubble burst in 2001, it became ubiquitous. Interesting, this is a term that most companies and their investors can agree on if they approach it from the right perspective.In a pay-to-play provision, an investor must keep "paying" (participating pro ratably in future financings) in order to keep "playing"(not have his preferred stock converted to common stock) in the company. Sample language follows:"Pay-to-Play: In the event of a Qualified Financing (as defined below), shares of Series A Preferred held by any Investor which is offered the right to participate but does not participate fully in such financing by purchasing at least its pro rata portion as calculated above under "Right of First Refusal" below will be converted into Common Stock.[(Version 2, which is not quite as aggressive): If any holder of SeriesA Preferred Stock fails to participate in the next Qualified Financing, (as defined below), on a pro rata basis (according to its total equity ownership immediately before such financing) of their Series A Preferred investment, then such holder will have the Series A Preferred Stock it owns converted into Common Stock of the Company. If such holderparticipates in the next Qualified Financing but not to the full extent of its pro rata share, then only a percentage of its Series A Preferred Stock will be converted into Common Stock (under the same terms as in the preceding sentence), with such percentage being equal to the percent of its pro rata contribution that it failed to contribute.]A Qualified Financing is the next round of financing after the Series A financing by the Company that is approved by the Board of Directors who determine in good faith that such portion must be purchased pro rata among the stockholders of the Company subject to this provision. Suchdetermination will be made regardless of whether the price is higher or lower than any series of Preferred Stock.When determining the number of shares held by an Investor or whether this "Pay-to-Play" provision has been satisfied, all shares held by orpurchased in the Qualified Financing by affiliated investment funds shall be aggregated. An Investor shall be entitled to assign its rights to participate in this financing and future financings to its affiliated funds and to investors in the Investor and/or its affiliated funds, including funds which are not current stockholders of the Company."We believe this is good for thecompany and its investors as it causes the investors "stand up" and agree to support the company during its lifecycle at the time of the investment. If they do not, the stock they have is converted from preferred to common and they lose the rights associated with the preferred stock. When our co-investors push back on this term, we ask: "Why? Are you not going to fund the company in the future if other investors agree to?" Remember, this is not a lifetime guaranteeof investment, rather if other prior investors decide to invest in future rounds in the company, there will be a strong incentive for all of the prior investors to invest or subject themselves to total or partial conversion of their holdings to common stock. A pay-to-play term insures that all the investors agree in advance to the "rules of engagement" concerning participating in future financings.The pay-to-play provision impacts the economics of the deal by reducing liquidation preferences for the non-participating investors. It also impacts the control of the deal, as it reshuffles the future preferred shareholder base by insuring only the committed investors continue to have preferred stock (and the corresponding rights).When companies are doing well, the pay-to-play provision is often waived, as a new investor wants to take a large part of the new round. This is a good problem for a company to have, as it typically means there is an up-round financing, existing investors can help drive company-friendly terms in the new round, and the investor syndicate increases in strength by virtue of new capital (and – presumably – another helpful co-investor) in the deal.第二篇:投资协议合同起草关键条款投资协议合同起草关键条款在股权投资业务中,投资方通过对拟投资的标的公司进行初审后,会与标的公司的控股股东或实际控制人进行谈判,确定估值、投资交易结构、业绩要求和退出计划等核心商业条款,并签署投资意向书(Term Sheet)。

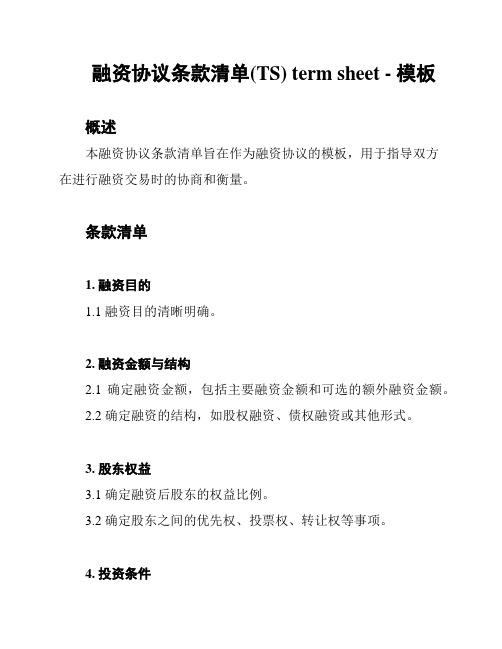

融资协议条款清单(TS) term sheet - 模板

融资协议条款清单(TS) term sheet - 模板

概述

本融资协议条款清单旨在作为融资协议的模板,用于指导双方

在进行融资交易时的协商和衡量。

条款清单

1. 融资目的

1.1 融资目的清晰明确。

2. 融资金额与结构

2.1 确定融资金额,包括主要融资金额和可选的额外融资金额。

2.2 确定融资的结构,如股权融资、债权融资或其他形式。

3. 股东权益

3.1 确定融资后股东的权益比例。

3.2 确定股东之间的优先权、投票权、转让权等事项。

4. 投资条件

4.1 确定投资方对于融资的条件,如投资金额、投资阶段、估值等。

4.2 确定融资完成后的股权结构和估值。

5. 财务条件

5.1 确定相关财务指标,如增长率、收入要求等。

5.2 确定财务报表和信息披露的要求。

6. 财务权益

6.1 确定投资方享有的财务权益,如优先分红、权益回购等。

7. 股东关系与管理

7.1 确定投资方与公司管理层之间的关系和权力分配。

7.2 确定公司的治理结构和股东会议的决策方式。

8. 赎回权与回报

8.1 确定投资方享有的赎回权和回报机制。

8.2 确定赎回方式、回报计算方式和赎回条件。

结论

本融资协议条款清单提供了一份基本的模板来指导双方在融资交易中的协商和衡量。

根据具体情况,双方可以灵活调整和补充相关条款。

请注意,在实际交易中,建议双方寻求专业法律意见,并确保相关条款得到适当的确认和合规性审核。

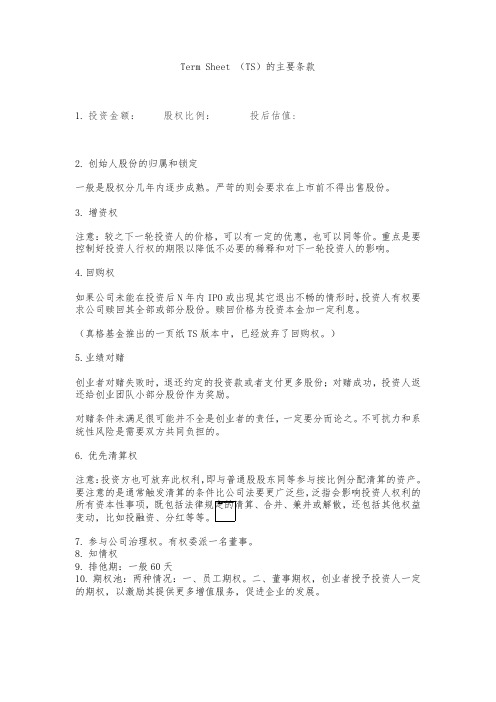

Term Sheet框架协议

Term Sheet (TS)的主要条款1.投资金额:股权比例:投后估值:2.创始人股份的归属和锁定一般是股权分几年内逐步成熟。

严苛的则会要求在上市前不得出售股份。

3.增资权注意:较之下一轮投资人的价格,可以有一定的优惠,也可以同等价。

重点是要控制好投资人行权的期限以降低不必要的稀释和对下一轮投资人的影响。

4.回购权如果公司未能在投资后N年内IPO或出现其它退出不畅的情形时,投资人有权要求公司赎回其全部或部分股份。

赎回价格为投资本金加一定利息。

(真格基金推出的一页纸TS版本中,已经放弃了回购权。

)5.业绩对赌创业者对赌失败时,退还约定的投资款或者支付更多股份;对赌成功,投资人返还给创业团队小部分股份作为奖励。

对赌条件未满足很可能并不全是创业者的责任,一定要分而论之。

不可抗力和系统性风险是需要双方共同负担的。

6.优先清算权注意:投资方也可放弃此权利,即与普通股股东同等参与按比例分配清算的资产。

要注意的是通常触发清算的条件比公司法要更广泛些,泛指会影响投资人权利的所有资本性事项,既包括法律规定的清算、合并、兼并或解散,还包括其他权益变动,比如投融资、分红等等。

7.参与公司治理权。

有权委派一名董事。

8.知情权9.排他期:一般60天10.期权池:两种情况:一、员工期权。

二、董事期权,创业者授予投资人一定的期权,以激励其提供更多增值服务,促进企业的发展。

谈谈TS及投资协议TS(Term Sheet),条款清单,在国内PE多称之为框架协议,通常在正式尽调之前与企业方签署。

TS通常约定了投资的核心条款,在尽调完成之后,投资人与企业方将签署一份更加正式的投资协议。

TS与投资协议,核心要点是一致的,本文即主要谈谈这些要点。

TS及投资协议的逻辑理解TS和投资协议有两个基础要点。

1、TS及投资协议是投资方和项目方为解决信息不对称而设置的一种解决机制。

比如TS中约定,投资的前提是尽职调查结果正常;又比如TS和投资协议中约定,项目方未来数年的盈利目标。

投资协议条款清单(TS)term sheet -模板

股东及被投资公司特此同意并承诺,若被投资公司未按照本协议约定时间完 成合格上市申报或合格上市,现有股东及被投资公司严重违反交易文件项下 的有关约定或交易文件项下的承诺、陈述及/或保证,则投资人有权(但无义 务)要求现有股东及/或被投资公司回购其届时持有的被投资公司全部或部分

投资条款清单模版Term Sheet

投资条款清单模版Term Sheet投资条款清单模版(Term Sheet)是在进行一项初步投资决策之前,投资人和公司之间达成的一份协议。

它可以被视为投资合同的“简化版”,其中包含了双方就一些主要条款达成的共识,并且为投资阶段的后续谈判奠定了基础。

以下是一份投资条款清单模版的示范,帮助你了解其主要组成部分和内容。

投资基本信息•投资人名称:•投资金额:•融资轮次(Pre-Seed, Seed, Series A/B/C, 等):•其他投资人(如果有):•投资估值:•投资人持有股份比例:•投资人优先权(如果有):•投资人退出方式(如回购、IPO、融资计划等):股本结构•公司名称:•公司成立日期:•注册资本:•实收资本:•股东的股份比例:•稀释:•优先股或普通股等股份类型的数量和比例:投资条件•投资条款:股份或债务转换、退出方案、股权回购等:•股东权利:议汇权、投票权、信息披露等:•涉及的业务和产品:•营销和销售计划:•就业和人力资源相关事项:•风险、保证和承诺:•权利与完整性保证:其他条款•谈判期限:•条款解释:•法律适用法律:•保密协议:•终止条款:执行条款•需要的文件和信息:•批准和签字:总结上述条款只是投资条款清单模版的一个示范,实际上,有些投资人可能会有其他的特定要求和条款。

因此,在确定任何投资交易之前,双方都应盡量详细地讨论和协商出各种问题,以确保交易的成功和避免未来的法律纠纷。

掌握这份模版只是一个良好的起点,在投资交易中,最重要的是通过良好的沟通和协商达成双方的共识。

投资协议条款清单(TermSheet)-优先选择权

投资协议条款清单(TermSheet)-优先选择权投资协议条款清单(Term Sheet)-优先选择权作者: 桂曙光Term Sheet: Right of First RefusalWhen we say "it doesn't matter much", we really mean "don't bother trying to negotiate it away - the VCs will insist on it.” Following is the standard language:"Right of First Refusal: Investors who purchase at least (____) shares of Series A Preferred (a "Major Investor") shall have the right in the event the Company proposes to offer equity securities to any person (other than the shares (i) reserved as employee shares described under "Employee Pool" below, (ii) shares issued for consideration other than cash pursuant to a merger, consolidation, acquisition, or similar business combination approved by the Board; (iii) shares issued pursuant to any equipment loan or leasing arrangement, real property leasing arrangement or debt financing from a bank or similar financial institution approved by the Board; and (iv) shares with respect to which the holders of a majority of the outstanding Series A Preferred waive their right of first refusal) to purchase [X times] their pro rata portion of such shares. Any securities not subscribed for by an eligible Investor may be reallocated among the other eligible Investors. Such right of first refusal will terminate upon a Qualified IPO. For purposes of this right of first refusal, an Investor’s pro rata right shall be equal to the ratio of (a) the number of shares of common stock (including all shares of common stock issuable or issued upon the conversion of convertible securities and assuming the exercise of all outstanding warrants and options) held by such Investorimmediately prior to the issuance of such equity securities to (b) the total number of share of common stock outstanding (including all shares of common stock issuable or issued upon the conversion of convertible securities and assuming the exercise of all outstanding warrants and options) immediately prior to the issuance of such equity securities." There are two things to pay attention to in this term that can be negotiated. First, the share threshold that defines a "Major Investor" can be defined. It's often convenient - especially if you have a large number of small investors - not to have to give this right to them. However, since in future rounds, you are typically interested in getting as much participation as you can, it's not worth struggling with this too much.A more important thing to look for is to see if there is a a multiple on the purchase rights (e.g. the "X times" listed above). This is an excessiveask - especially early in the financing life cycle of a company - and can almost always be negotiated to 1x.As with "other terms that don't matter much", you shouldn't let your lawyer over engineer these. If you feel the need to negotiate, focus on the share threshold and the multiple on the purchase rights.。

Term_Sheet 中文版

【基金名称】与【公司名称】A类优先股融资投资条款清单20【】年【】月【】日本投资条款清单仅供谈判之用,不构成投资机构与公司之间具有法律约束力的协议,但“保密条款”、“排他性条款”和“管理费用”具有法律约束力。

在投资人完成尽职调查并获得投资委员会的批准并以书面(包括电子邮件)通知公司后,本协议便对协议各方具有法律约束力,协议各方应尽最大努力根据本协议的规定达成、签署和报批投资合同。

排他性条款公司同意,在签订本框架协议后的肆拾伍(45)天内,公司及其股东、董事会成员、员工、亲属、关联公司和附属公司在未获得投资人书面同意的情况下,不得通过直接或间接方式向任何第三方寻求股权/债务融资或接受第三方提供的要约;不得向第三方提供任何有关股权/债务融资的信息或者参与有关股权/债务融资的谈判和讨论;且不得与第三方达成任何有关股权/债务融资的协议或安排。

如公司为满足本框架协议中股票购买协议部分所载明成交条件造成延期,本排他性条款有效期限自动延展。

尽管有上述规定,若公司或投资人均未在排他性条款有效期截止日五天之前发出希望终止谈判的书面通知,则公司应继续与投资人进行排他性谈判直至公司或投资人发出书面终止谈判通知。

保密条款有关投资的条款和细则(包括所有条款约定甚至本框架协议的存在以及任何相关的投资文件)均属保密信息而不得向任何第三方透露,除非另有规定。

若根据法律必须透露信息,则需要透露信息的一方应在透露或提交信息之前的合理时间内征求另一方有关信息披露和提交的意见。

且如另一方要求,需要透露信息一方应尽可能为所披露或提交的信息争取保密待遇。

尽管有上述说明,但在成交之后,公司有权将投资的存在、投资人对公司的投资事项披露给公司投资者、投资银行、贷款人、会计师、法律顾问、业务伙伴和诚信的潜在投资者、员工、贷款人和业务伙伴,但前提是,获知信息的个人或者机构已经同意承担保密信息的义务。

在未获投资人书面同意情况下,公司不得将投资人的投资事项在新闻发布会、行业或专业媒体、市场营销材料以及其他方式中透露给公众。

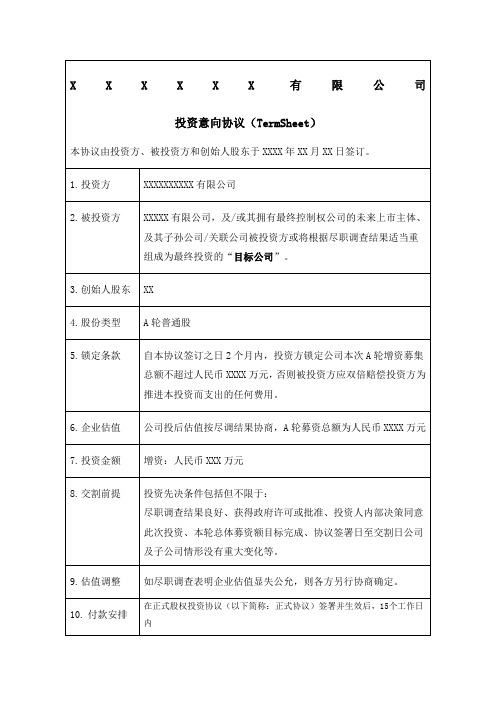

TermSheet投资意向协议模板

a.投资方有权获得目标公司月度报表和年度财务报告。

b.目标公司应保证投资人有权查阅及复制章程、股东大会会议记录、董事会会议决议、监事会决议和财务会计报告。

c.投资方有权否决目标公司损害投资方利益的行为,如不当处置核心资产(包括但不限于目标公司的注册商标)、不当输送利益等。

d.目标公司章程应根据本次投资安排做出相应修改,包括但不限于:

先认购权

当目标公司再次增资时,投资人有权以相同的价格和条件优先认购公司全部或部分增资,但股权激励方案、与资产整合、并购等相关的股权增发以及首次公开发行除外。

14.优先清算权

若目标公司发生清算、清盘或解散时,投资人有权优先于公司实际控制人股东以及其他原股东按其投资本金的150%进行资产分配。

15.限售条款

1)董事会组成;

2)董事会召开程序;

e.需要公司董事会半数以上、2/3以上以及一致同意事项范围等。

f.投资方将获得在本协议中未列出但天使轮投资人享有的所有权益。

21.尽职调查

被投资公司及核心股东应向投资方充分开放信息以便于投资方完成尽职调查及投资决策。若实现投资,或者因被投资公司及其股东的原因而未能实现投资,则尽职调查费用由被投资公司支付(上限为10万元人民币)。

11.融资用途

1)产品研发2)品牌推广及营销3)渠道建设4)团队建设

12.反稀释条款

本投资完成后,若目标公司再融资或控股股东出让股权价格低于投资方的价格,则控股股东应补偿投资方使投资方的价格不高于最新价格。

当目标公司再次增资时,投资人有权按其持股比例以相同的价格和条件优先认购公司增资部分以保证股权比例不被摊薄,再次增资的股权作价及其他设定条件等不得优于投资人本次增资,但股权激励方案、与资产整合、并购等相关的股权增发以及首次公开发行除外。

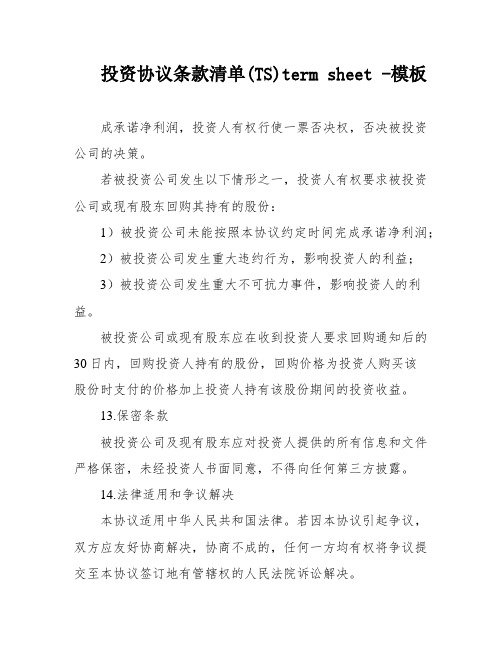

投资协议条款清单(TS)term sheet -模板

投资协议条款清单(TS)term sheet -模板成承诺净利润,投资人有权行使一票否决权,否决被投资公司的决策。

若被投资公司发生以下情形之一,投资人有权要求被投资公司或现有股东回购其持有的股份:1)被投资公司未能按照本协议约定时间完成承诺净利润;2)被投资公司发生重大违约行为,影响投资人的利益;3)被投资公司发生重大不可抗力事件,影响投资人的利益。

被投资公司或现有股东应在收到投资人要求回购通知后的30日内,回购投资人持有的股份,回购价格为投资人购买该股份时支付的价格加上投资人持有该股份期间的投资收益。

13.保密条款被投资公司及现有股东应对投资人提供的所有信息和文件严格保密,未经投资人书面同意,不得向任何第三方披露。

14.法律适用和争议解决本协议适用中华人民共和国法律。

若因本协议引起争议,双方应友好协商解决,协商不成的,任何一方均有权将争议提交至本协议签订地有管辖权的人民法院诉讼解决。

XXX】法定代表人(签字):日期:XXX】法定代表人(签字):日期:如果现有股东或被投资公司违反交易文件中的约定、承诺或声明,投资人有权要求现有股东或被投资公司回购其持有的全部或部分股份。

回购应在约定的时间内进行,现有股东或被投资公司可以自行回购或指定第三方购买,并且应支付回购价款或股份转让价款。

回购价款应为原始投资金额加上年化12%的收益率计算所得的最终金额。

交易协议中应包含有关投资和目标公司法律、财务和运营事宜的陈述和保证,包括目标公司截至交割日的财务和运营条件、知识产权、重大合同和承诺以及监管合规性等。

交割完成前,必须完成一些事项,例如签署增资协议、股东协议、修订后的目标公司章程和其他交易性文件,并获得所有相关方和监管机关的批准和同意。

本次投资发生的费用由交易各方各自承担,包括尽职调查费用和律师费用等。

双方应签署保密协议。

本条款受中国法律管辖,任何引起的纠纷都应提交至XXX进行仲裁。

本意向书不对投资者、目标公司及目标公司现有股东构成有法律约束力的协议,必须完成尽职调查并取得必要的批准和签署最终交易协议才能产生法律约束力。

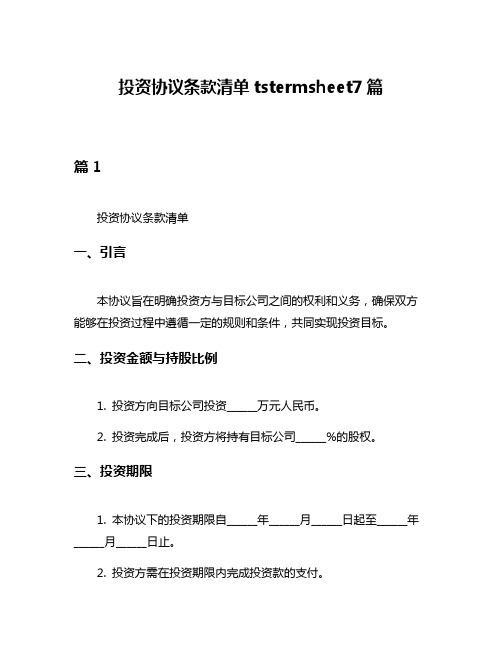

投资协议条款清单tstermsheet7篇

投资协议条款清单tstermsheet7篇篇1投资协议条款清单一、引言本协议旨在明确投资方与目标公司之间的权利和义务,确保双方能够在投资过程中遵循一定的规则和条件,共同实现投资目标。

二、投资金额与持股比例1. 投资方向目标公司投资______万元人民币。

2. 投资完成后,投资方将持有目标公司______%的股权。

三、投资期限1. 本协议下的投资期限自______年______月______日起至______年______月______日止。

2. 投资方需在投资期限内完成投资款的支付。

四、投资方式1. 投资方将以______(如:现金、股权、资产等)的方式向目标公司投资。

2. 具体投资方式需双方协商确定,并签署相关补充协议。

五、投资条件1. 目标公司需确保所投资项目具有可行性,并能够按时按质完成。

2. 投资方需确保投资款的来源合法合规,并承诺在投资期限内完成支付。

3. 双方需共同确保投资过程符合相关法律法规的规定,并遵循公平、公正、诚信的原则。

六、权利义务1. 投资方有权了解目标公司的经营状况和财务状况,并要求目标公司提供相关报表和资料。

2. 投资方有权参与目标公司的决策和管理,但不得干涉目标公司的日常运营。

3. 目标公司需确保投资款专款专用,并按时向投资方报告使用情况。

4. 目标公司需确保所投资项目符合法律法规的规定,并避免任何违法违规行为。

5. 投资方和目赌公司需共同确保投资目标的实现,并为此制定详细的计划和方案。

6. 投资方和目赌公司需共同确保投资过程的顺利进行,并为此提供必要的支持和保障。

7. 投资方和目赌公司需共同确保投资信息的保密性,并为此签订保密协议。

8. 投资方和目赌公司需共同确保投资争议的解决,并为此制定争议解决机制。

9. 投资方和目赌公司需共同确保投资合同的生效和履行,并为此签订正式的投资合同。

七、违约责任1. 如果一方违反本协议中的任何条款或承诺,违约方需承担相应的违约责任。

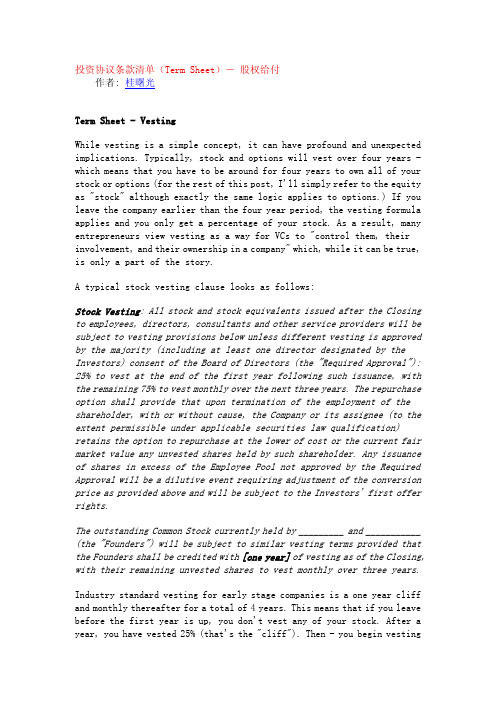

投资协议条款清单(Term Sheet)- 股权给付

投资协议条款清单(Term Sheet)- 股权给付作者: 桂曙光Term Sheet - VestingWhile vesting is a simple concept, it can have profound and unexpected implications. Typically, stock and options will vest over four years - which means that you have to be around for four years to own all of your stock or options (for the rest of this post, I'll simply refer to the equity as "stock" although exactly the same logic applies to options.) If you leave the company earlier than the four year period, the vesting formula applies and you only get a percentage of your stock. As a result, many entrepreneurs view vesting as a way for VCs to "control them, their involvement, and their ownership in a company" which, while it can be true, is only a part of the story.A typical stock vesting clause looks as follows:Stock Vesting: All stock and stock equivalents issued after the Closing to employees, directors, consultants and other service providers will be subject to vesting provisions below unless different vesting is approved by the majority (including at least one director designated by the Investors) consent of the Board of Directors (the "Required Approval"): 25% to vest at the end of the first year following such issuance, with the remaining 75% to vest monthly over the next three years. The repurchase option shall provide that upon termination of the employment of the shareholder, with or without cause, the Company or its assignee (to the extent permissible under applicable securities law qualification) retains the option to repurchase at the lower of cost or the current fair market value any unvested shares held by such shareholder. Any issuance of shares in excess of the Employee Pool not approved by the Required Approval will be a dilutive event requiring adjustment of the conversion price as provided above and will be subject to the Investors' first offer rights.The outstanding Common Stock currently held by _________ and ___________ (the "Founders") will be subject to similar vesting terms provided that the Founders shall be credited with [one year]of vesting as of the Closing, with their remaining unvested shares to vest monthly over three years. Industry standard vesting for early stage companies is a one year cliff and monthly thereafter for a total of 4 years. This means that if you leave before the first year is up, you don't vest any of your stock. After a year, you have vested 25% (that's the "cliff"). Then - you begin vestingmonthly (or quarterly, or annually) over the remaining period. So - if you have a monthly vest with a one year cliff and you leave the company after 18 months, you'll have vested 37.25% of your stock.Often, founders will get somewhat different vesting provisions than the balance of the employee base. A common term is the second paragraph above, where the founders receive one year of vesting credit at the closing and then vest the balance of their stock over the remaining 36 months. This type of vesting arrangement is typical in cases where the founders have started the company a year or more earlier then the VC investment and want to get some credit for existing time served.Unvested stock typically "disappears into the ether" when someone leaves the company. The equity doesn't get reallocated - rather it gets "reabsorbed" - and everyone (VCs, stock, and option holders) all benefit ratably from the increase in ownership (or - more literally - the reverse dilution.") In the case of founders stock, the unvested stuff just vanishes. In the case of unvested employee options, it usually goes back into the option pool to be reissued to future employees.A key component of vesting is defining what happens (if anything) to vesting schedules upon a merger. "Single trigger" acceleration refers to automatic accelerated vesting upon a merger. "Double trigger" refers to two events needing to take place before accelerated vesting (e.g., a merger plus the act of being fired by the acquiring company.) Double trigger is much more common than single trigger. Acceleration on change of control is often a contentious point of negotiation between founders and VCs, as the founders will want to "get all their stock in a transaction - hey, we earned it!" and VCs will want to minimize the impact of the outstanding equity on their share of the purchase price. Most acquires will want there to be some forward looking incentive for founders, management, and employees, so they usually either prefer some unvested equity (to help incent folks to stick around for a period of time post acquisition) or they'll include a separate management retention incentive as part of the deal value, which comes off the top, reducing the consideration that gets allocated to the equity ownership in the company. This often frustrates VCs (yeah - I hear you chuckling "haha - so what?") since it puts them at cross-purposes with management in the M&A negotiation (everyone should be negotiating to maximize the value for all shareholders, not just specifically for themselves.) Although the actual legal language is not very interesting, it is included below.In the event of a merger, consolidation, sale of assets or other change of control of the Company and should an Employee be terminated without cause within one year after such event, such person shall be entitled to[one year] of additional vesting. Other than the foregoing, there shall be no accelerated vesting in any event."Structuring acceleration on change of control terms used to be a huge deal in the 1990's when "pooling of interests" was an accepted form of accounting treatment as there were significant constraints on any modifications to vesting agreements. Pooling was abolished in early 2000 and - under purchase accounting - there is no meaningful accounting impact in a merger of changing the vesting arrangements (including accelerating vesting). As a result, we usually recommend a balanced approach to acceleration (double trigger, one year acceleration) and recognize that in an M&A transaction, this will often be negotiated by all parties. Recognize that many VCs have a distinct point of view on this (e.g. some folks will NEVER do a deal with single trigger acceleration; some folks don't care one way or the other) - make sure you are not negotiating against and "point of principle" on this one as VCs will often say "that's how it is an we won't do anything different."Recognize that vesting works for the founders as well as the VCs. I've been involved in a number of situations where one or more founders didn't work out and the other founders wanted them to leave the company. If there had been no vesting provisions, the person who didn't make it would have walked away with all their stock and the remaining founders would have had no differential ownership going forward. By vesting each founder, there is a clear incentive to work your hardest and participate constructively in the team, beyond the elusive founders "moral imperative." Obviously, the same rule applies to employees - since equity is compensation and should be earned over time, vesting is the mechanism to insure the equity is earned over time.Of course, time has a huge impact on the relevancy of vesting. In the late 1990's, when companies often reached an exit event within two years of being founded, the vesting provisions - especially acceleration clauses - mattered a huge amount to the founders. Today - as we are back in a normal market where the typical gestation period of an early stage company is five to seven years, most people (especially founders and early employees) that stay with a company will be fully (or mostly) vested at the time of an exit event.While it's easy to set vesting up as a contentious issue between founders and VCs, we recommend the founding entrepreneurs view vesting as an overall "alignment tool" - for themselves, their co-founders, early employees, and future employees. Anyone who has experienced an unfair vesting situation will have strong feelings about it - we believe fairness,a balanced approach, and consistency is the key to making vesting provisions work long term in a company.。

投资协议条款清单(TS)

右目标公司向证监会申报上市材料的,则相关条款解除。但右目标公司的上 市申报被不予受理、被否决、被劝退或者主动撤回的,且发生在业绩承诺期 内,即PP年PP月PP日前,则估值调整条款自动恢复,并视为自始有效。若 被不予受理、被否决、被劝退或主动撤回发生在业绩承诺期外,则估值调整 条款不再恢复。注:估值调整条款另行商定。

(2)由被投资公司及现有股东以连带责任对投资人作出赔偿,在此种情况 下,被投资公司及现有股东应共同及连带的赔偿投资人因该等损害所发生的

任何损失、损害、责任、成本或支出,包括但不限于合理的诉讼/仲裁费用和

律师费,使投资人的权益恢复至违约事件未发生时的状态。

11.一票否决权

12.回购条款

股东及被投资公司特此冋意并承诺,若被投资公司未按照本协议约定时间完 成合格上市申报或合格上市,现有股东及被投资公司严重违反交易文件项下 的有关约定或交易文件项下的承诺、陈述及/或保证,则投资人有权(但无义

13.陈述和保证

在交易协议中将就投资和目标公司法律、财务及运营事宜做出惯例的陈述与 保证,包括但不限于目标公司截至交割日的财务和运营条件、知识产权、重 大合同与承诺及监管合规性等。

14.交割条件和程序

交割完成前按惯例至少需要完成以下事项,包括但不限于:相关方签署增资 协议、股东协议、修订后的目标公司章程及其他交易性文件(以下简称“交 易协议”)生效,本次投资及交易协议获得所有相关的目标公司内部的、交 易协议中所要求的有关方和/或相关监管机关的批准与同意,及交易协议约定 的其他交割条件。

本投资意向书于2017年[]月[]日签署: 签署人:

姓名:职务:

8.优先认购权

目标公司新增注册资本或者发行股份时,投资者有权按照其股权比例享有优 先认购权。

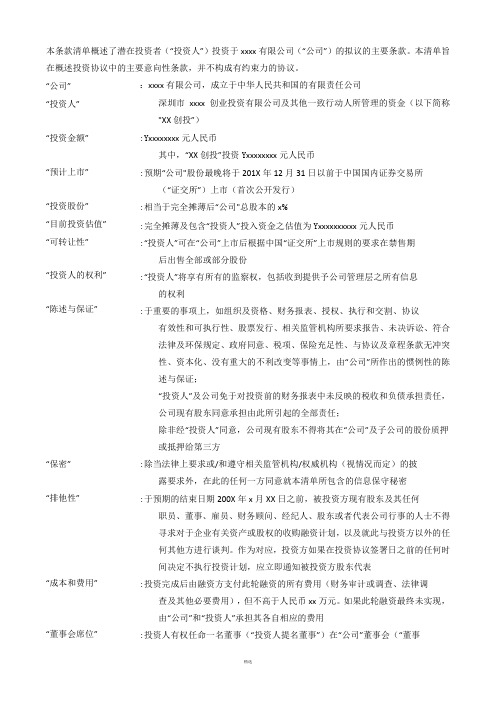

投资条款清单Term-Sheet-中文版

“公司”“投资人”“投资金额”“预计上市”“投资股份”“目前投资估值”“可转让性”“投资人的权利”“陈述与保证”“保密”“排他性”“成本和费用”“董事会席位”本条款清单概述了潜在投资者(“投资人”)投资于xxxx 有限公司(“公司”)的拟议的主要条款。

本清单旨在概述投资协议中的主要意向性条款,并不构成有约束力的协议。

:xxxx 有限公司,成立于中华人民共和国的有限责任公司 深圳市xxxx 创业投资有限公司及其他一致行动人所管理的资金(以下简称"XX 创投”) :Y xxxxxxxx 元人民币 其中,“XX 创投”投资Y xxxxxxxx 元人民币 :预期“公司"股份最晚将于201X 年12月31日以前于中国国内证券交易所 (“证交所”)上市(首次公开发行) :相当于完全摊薄后“公司"总股本的x% :完全摊薄及包含“投资人”投入资金之估值为Y xxxxxxxxxx 元人民币 :“投资人”可在“公司”上市后根据中国“证交所”上市规则的要求在禁售期 后出售全部或部分股份 :“投资人”将享有所有的监察权,包括收到提供予公司管理层之所有信息 的权利 :于重要的事项上,如组织及资格、财务报表、授权、执行和交割、协议 有效性和可执行性、股票发行、相关监管机构所要求报告、未决诉讼、符合法律及环保规定、政府同意、税项、保险充足性、与协议及章程条款无冲突性、资本化、没有重大的不利改变等事情上,由“公司”所作出的惯例性的陈述与保证; “投资人”及公司免于对投资前的财务报表中未反映的税收和负债承担责任,公司现有股东同意承担由此所引起的全部责任; 除非经“投资人”同意,公司现有股东不得将其在“公司”及子公司的股份质押或抵押给第三方 :除当法律上要求或/和遵守相关监管机构/权威机构(视情况而定)的披 露要求外,在此的任何一方同意就本清单所包含的信息保守秘密 :于预期的结束日期200X 年x 月XX 日之前,被投资方现有股东及其任何 职员、董事、雇员、财务顾问、经纪人、股东或者代表公司行事的人士不得寻求对于企业有关资产或股权的收购融资计划,以及就此与投资方以外的任何其他方进行谈判。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

右目标公司向证监会申报上市材料的,则相关条款解除。但右目标公司的上 市申报被不予受理、被否决、被劝退或者主动撤回的,且发生在业绩承诺期 内,即XX年XX月XX日前,则估值调整条款自动恢复,并视为自始有效。若 被不予受理、被否决、被劝退或主动撤回发生在业绩承诺期外,则估值调整 条款不再恢复。注:估值调整条款另行商定。

下简称“回购价款”)应为投资人届时要求回购的股份所对应的原始投资金 额加上年化12%勺收益率计算后所得的最终金额,具体计算公式如下: 回购价款=被回购的股份所对应的原始投资金额x(1 + 12%)xN

其中,N为计息期间,即自相应原始投资金额支付被投资公司的公司账户之 日(含)至投资人根据本条款约定收到全部回购价款之日/365。

8.优先认购权

目标公司新增注册资本或者发行股份时,投资者有权按照其股权比例享有优 先认购权。

9.反稀释权

如果目标公司进行再次增资,则该等增资对目标公司的投前估值不应低于本 次投资完成后的目标公司估值。

10.违约条款

被投资公司及现有股东中任何一方岀现违约,则投资人有权选择:

(1)由现有股东对被投资公司进行赔偿,在此种情况下,现有股东应赔偿被 投资公司因该等损害所发生的任何损失、损害、责任、成本或支出,包括但 不限于合理的诉讼/仲裁费用和律师费;

具体交易结构以最终投资协议为准。

4.估值

本次交易完成之日,目标公司的投前估值为人民币x亿元。

5.老股出让资金用途

本次融资用于7.业绩承诺及估值调

整

目标公司XX年、XX年、XX年三年经审计税后净利润合计不低于人民币XX亿

元(其中XX年X亿元,XX年X亿元,XX年X亿元)(以下简称“承诺净利 润”),如果目标公司未实现承诺净利润的X%则目标公司对投资人进行现

15.费用

交易各方各自承担为本次投资发生的费用,包括但不限于尽职调查费用、律 师费用等。

16.保密性条款

双方另行签订保密协议。

17.法律及司法管辖权

选择条款

本条款清单受中国法律管辖,由此引起的纠纷,协议各方同意将其提交至中 国国际经济贸易仲裁委员会进行仲裁

18.非约束条款

本意向书不对投资者、目标公司及目标公司现有股东构成针对本意向书题述 事宜的有法律约束力的协议。各方之间有法律约束力的协议尚有赖于投资者 对目标公司完成尽职调查并对尽职调查结果满意,各方取得所有必要的目标 公司批准及各方协商、批准、签署并交付最终交易协议。

(2)由被投资公司及现有股东以连带责任对投资人作出赔偿,在此种情况 下,被投资公司及现有股东应共同及连带的赔偿投资人因该等损害所发生的

任何损失、损害、责任、成本或支出,包括但不限于合理的诉讼/仲裁费用和

律师费,使投资人的权益恢复至违约事件未发生时的状态。

11.一票否决权

12.回购条款

股东及被投资公司特此冋意并承诺,若被投资公司未按照本协议约定时间完 成合格上市申报或合格上市,现有股东及被投资公司严重违反交易文件项下 的有关约定或交易文件项下的承诺、陈述及/或保证,则投资人有权(但无义

13.陈述和保证

在交易协议中将就投资和目标公司法律、财务及运营事宜做出惯例的陈述与 保证,包括但不限于目标公司截至交割日的财务和运营条件、知识产权、重 大合同与承诺及监管合规性等。

14.交割条件和程序

交割完成前按惯例至少需要完成以下事项,包括但不限于:相关方签署增资 协议、股东协议、修订后的目标公司章程及其他交易性文件(以下简称“交 易协议”)生效,本次投资及交易协议获得所有相关的目标公司内部的、交 易协议中所要求的有关方和/或相关监管机关的批准与同意,及交易协议约定 的其他交割条件。

绝密

【

项目

条款

1.被投资方

XX有限公司及其直接或间接拥有或控制的任何子公司、分公司或关联公司

(以下简称“目标公司”)

2.投资方

【XX】

3.投资方式与金额

目标公司现有股东拟对外转让其持有的部分股权,共计【】股,每股定价为

【】元,合计【】元(以下简称“老股转让安排”),其中【XX】同意认购

【】股,合计【】元人民币;

务)要求现有股东及/或被投资公司回购其届时持有的被投资公司全部或部分

项目

条款

股份。

投资人行使上述的回购权,现有股东及/或被投资公司应在约定时日内自行回

购或指定第三方购买投资人要求岀售的被投资公司股份并足额支付回购价款 /股份转让价款(各现有股东对回购价款/股份转让价款的足额支付承担连 带责任)。

各方同意,在任何情况下,前述相关回购约定的回购价款/股份转让价款(以