金融市场与金融机构 第二章

第二章同业拆借市场《金融市场》PPT课件

C (3)有利于及时反映货币市场资金供 求变化。

D

(4)有利于中央银行货币政策 的实现。

2.2 同业拆借市场的运行机制 2.2.1 同业拆借市场的参与者

A (1)资金需求者

B

(2)资金供给者

C (3)市场中介人

D (4)中央银行与金融监管机构

2.2 同业拆借市场的运行机制 2.2.2 同业拆借市场的支付工具

CHAPTER

TWO

第二章同业拆 借市场

2.1 同业拆借市场概述

2.1.1 同业拆借市场的概念

同业拆借是在具有法人资格的金融机构及经法人授权的非法人金融机构、 分支机构之间的短期资金融通,目的在于调剂头寸和临时性资金余缺。 按照资金流动的方向,将从资金多余的金融机构临时借入款项,称为拆 入;而资金多余的金融机构向资金不足的金融机构贷出款项,则称为拆 出。这种金融机构之间进行短期资金融通、临时性头寸调剂等资金拆借 活动所形成的市场就被称为同业拆借市场,亦称“同业拆放市场”。

1

一

1984—1995 年年底:初 始阶段

2

二

1996—1998 年:规范阶 段

3

三

1998年至今: 规范发展阶 段

2.3 我国的同业拆借市场及运作实务 2.3.2 当前我国同业拆借市场的基本情况

1)同业拆借市场运作体系基本确立

2)同业拆借市场成员不断增加

3)拆借利率市场化,利率形成机制不断完善 4)同业拆借已成为商业银行短期资金管理的 首选方式

01

本票

02

支票

06

03

资金拆借 支付工具 承兑汇票

05

转贴现

04

同业债券

2.2 同业拆借市场的运行机制

MBA金融市场学(第二章)

四、消费信用 – 消费信用: 是企业、银行和其他金融机构对消费者个人所提供的, 用于生活消费目的的信用。 – 消费信用主要有两种方式:

企业赊销

金融机构的消费贷款

五、国际信用 – 国际信用: 是国际间一个国家官方(政府)和非官方(如商业银行、进出 口银行、其他经济主体)向另一个国家的政府、银行、企业或 其他经济主体提供的信用,属国际间的借贷行为。 – 包括:

以赊销商品形式提供的国际商业信用 以银行贷款形式提供的国际银行信用 政府间相互提供的信用

1.国际商业信用 – 国际商业信用:是由出口商以商品形式提供的信用。 – 有来料加工和补偿贸易等形式: ⑴ 来料加工:来料加工是指由出口国企业提供原材料、设 备零部件或部分设备,利用进口国的厂房、劳动力等在进口 国企业加工,成品归出口国企业所有,进口国企业获得加工 费收入。 ⑵ 补偿贸易:补偿贸易是指由出口国企业向进口国企业提 供机器设备、技术力量、专利、各种人员培训等,联合发展 生产和科研项目,待项目完成或竣工投产后,进口国企业可 将该项目的产品或以双方商定的其他办法偿还出口国企业的 投资。

银行信用的特点 1) 银行信用的主体与商业信用不同。 2) 银行信用的客体是单一形态的货币资本。这一特点使银行 信用能较好地克服商业信用的局限性。

3)

银行信用是一种中介信用。

银行信用扩大了信用的界限 – 银行信用是现代信用的主要形式。 – 银行信用有了巨大的发展与变化,主要表现在: 越来越多的借贷资本集中在少数大银行手中; 银行规模越来越大; 贷款数额增大,贷款期限延长; 银行资本与产业资本的结合日益紧密;

3.政府间信用为,其特点是金额不大, 利率较低,期限较长,通常用于非生产性支出。

《金融市场与金融机构》课后习题答案

《金融市场与金融机构》米什金第七版课后习题答案

(请集中复习1-6、10-13、15章)

第一章为什么研究金融市场与金融机构

第二章金融体系概览

第三章利率的含义及其在定价中的作用

第四章为什么利率会变化

第五章利率的风险结构和期限结构如何影响利率

第六章金融市场是否有效

第十章货币政策传导:工具、目标战略和战术

第七版中的12题在第五六版中没有,此处的12-19题即为第七版的13-20题

第十一章货币市场

第十二章债券市场

第十三章股票市场

第十四章抵押贷款市场

第十五章外汇市场。

金融市场与金融工具2(2013)

3、按投资的性质划分,可分为:债务凭证类金融工具

(债务工具)和所有权凭证类金融工具(权益工具)。 ☆所有权凭证类金融工具只有股票一种;其他都属于债 务凭证类金融工具。 ☆二者差别 债务凭证表明投入的资金取得了债权,所以有权据 以到期讨还本金; 而所有权凭证表明资金的投入并非取得债权而是所 有权,因而可从发行者处获得分红,但无权据以索要 本金,只可以在必要时通过转让所有权,即出售证券 的方式收回本金。

3.风险性:指金融工具的所有者收回本金的可能性, 亦称为风险性。主要的风险有:信用风险和市场 风险。 ☆例1:某投资者用每股20元的价格买进某股票 1000股,花费2万元。后来该股票价格一直走低, 该投资者不得不在15元的价格上卖出该股票,股 票收入1.5万元,因此该投资者损失了5000元的 本金。 ☆例2:一家水泥厂需要资金5000万元以购买一 套外国设备,拟采用发行债券的方式筹集资金。 经有关部门批准发行了一笔面额为1000元,期限 为5年的债券,发行对象为社会自然人和法人。 后来由于该厂家决策失误,经营出现了重大困难, 不到5年的时间就破产倒闭了,该债券到期也无 法偿付,给购买者带来了巨大的损失。

☆货币市场互助基金:货币市场互助基金简称 MMMF。这种基金吸收小额投资,然后再用来在 货币市场上投资。利润可不受存款利率的限制。 ☆货币市场存款账户(MMDA):MMDA是美国银行 1972年推出的一种储蓄与投资相结合的“利率 自由化”支票存款账户。MMDA类似于储蓄账户, 但它不属于转账账户。其开办成本低于NOW账 户。 ☆协定账户(NA):协定账户是一种可在活期存款 账户、可转让支付命令账户、货币市场互助基 金账户三种账户之间自动转账的账户。

货币市场—期限在1年以内的短期金融工具的 交易市场。 资本市场—期限在1年以上的长期金融工具交 易的市场。 思考:以下的金融工具属于哪个市场? 银行票据,国库券,商业票据,股票,公债

金融市场与金融机构(chapter)

of the demand curve ,and the supply

curve ,at point 1,with an equilibrium federal rate of iff. *

Market equilibrium

市场均衡发生在准备金的需求数量 d 和供给数量相等时,即Rs =R。因 此均衡产生于需求曲线和供给曲线 位于点1的交点处,均衡联邦基金 利率为iff*

Demand curve

因此,对银行准备金的需求数量等于法定 准备金加上超额准备金,超额准备金是应对存 款流出的保险金额,而持有这些超额准备金的 成本就是其机会成本,即这些银行准备金借出 所能赚取的利率,它等于联邦基金利率。因此随 着联邦基金利率降低,持有超额准备金的机会 成本也将降低,当其他条件保持不变时,对银 行准备金的需求数量将会增加。银行准备金的 需求曲线向下移动。

Discount lending

A lower discount rate, with the federal funds rate held constant,leads to a greater quantity of reserves supplied and shifts the s s supply curve to the right from R1 to R2.The result is that the equilibrium moves from point 1 to point 2,lowering the federal funds 1 2 rate from iff to iff.

Demand curve

federal funds rate

Rs

1 i

Rd

Quantity of ResAs we saw in the preceding section,when discount lending increases, the quantity of reserves supplied to the banking system also increases. when banks borrow from the Fed,their principal benefit is the earnings from lending these funds out at the federal funds rate . Thus holding everything else constant, when the federal funds rate increases, banks will borrow more from the Fed,and the resulting rise in discount lending means t hat the quantity of reserves supplied rise. For this reason ,the supply curve for reserves,slopes upward.

2第二章-金融机构体系概览(蒋先玲编著货币金融学第3版ppt课件可编辑)精选全文

一、降低交易成本

(三)银行类金融机构可以降低交易成本

二、缓解信息不对称

(一)信息不对称影响金融结构

逆向选择:在交易之前,信息不对称所导致 道德风险:在交易之后,信息不对称所导致

二、缓解信息不对称

(一)信息不对称影响金融结构

1.逆向选择及其对金融结构的影响 ➢ 金融市场上的逆向选择,是指由于信息不对称,贷款者将资金贷给了

二、存款性金融机构

(四)乡村银行

➢ 指为本地区的居民或企业提供小额信贷服务的银行机构 ➢ 村镇银行特点:一是地域和准入门槛:在地(市)、县(市)、乡(

镇)设立的, 注册资本分别不低于5000万元、300万元、100万元; 二是市场定位:满足农户的小额贷款需求和服务于当地中小型企业

三、契约性金融机构

(1)存款功能:也称“信用中介”功能,筹资,改变并构建金融资产。 (2)经纪和交易功能:代表客户交易,提供结算服务。 (3)承销功能:创造金融资产并出售。 (4)咨询和信托功能:提供投资建议,保管金融资产,管理投资组合。

例题

1.直接融资的缺点有( )。 A.公司商业秘密有可能暴露再竞争对手下 B.进入门槛较高 C.资金借贷双方对金融机构的依赖增加 D.投资风险较大

是资产。 ➢ 凭证大多具有较高的流动性。

一、资金融通的意义及渠道

(一)直接融资

1. 优点 ①筹集长期资金。②合理配置资源。③加速资本积累。

2.不足 ①进入门槛较高。②公开性的要求。可能将公司商业秘密暴露,与企业 保守商业秘密的需求相冲突。③投资风险较大。

一、资金融通的意义及渠道

(二)间接融资

也称间接金融,是指资金供求双方通过金融机构来完成资金融通活 动的一种融资方式。 ➢ 资金盈余单位和短缺单位不发生直接的关系,而是分别与金融机构发

金融学课件2 第2章 金融中介体系

一、资金融通模式

直接融资

是指资金需求者直接发行融资凭证给资金供给者来筹集资金的 方式。

在直接融资过程中,短缺单位通过出售股票、债券等凭证而获 得资金,盈余单位持有这些凭证而获得本息收入或股息收入。

直接融资避开银行等中介环节,由资金供求双方直接进行交易。

判直接断融题资:需直借接助融证券资公不司需、要证金券融交易机所构等参金与融,机而构的是服资务金,供主 求要为双筹方资直者接缓进和。行投资交者易牵。线搭桥,提供策划、咨询、承销、经

银行可以通过与资金最终供求双方分别签订合同,同时满足双 方对流动性的偏好,亦即: 一方面,通过存款合约向资金最终供给者承诺,满足其随时可 能提出的对流动性的需要; 另一方面,通过贷款合约向资金最终需求者承诺,满足其在一 定时间之内对“无需担心流动性”的需要。 这就是银行的“金融中介化”过程:

资金最终需求者

因此,银行可以帮助投资者承担风险,更好地保证资金运用的 安全性。

4、协调流动性偏好 流动性偏好——经济中的当事人往往喜欢较高的流动性,

亦即喜欢那种根据需要可以随时将其他资产转换为现金资产 的境界。 但是,不同的当事人对流动性偏好的程度不一致。 一般地,资金最终供给者对流动性偏好较强,期望在未来自 己需要用款时能够随时收回资金;资金最终需求者则反之。

于交易双方对信息的掌握处在不对称的地位,使优胜劣汰 的市场机制失灵,出现类似于劣币驱逐良币现象。 • 要么贷方调高利率,赶走信用较高的借款人;要么干脆

谁都不借。 • 最后恶性循环,融资市场逐渐萎缩。

交易之后的问题:道德风险(Moral Hazard) • 金融市场上的道德风险,是指贷款者把资金贷放给借 款者以后,借款者可能会从事那些为贷款者所不希望 的风险活动,这些活动很可能导致贷款不能如期归还。 即金融市场上,资金短缺者获得资金盈余者提供的资 金后,违反合约而从事高风险投资活动。 案例:P35 朋友李文案例

金融市场学整理

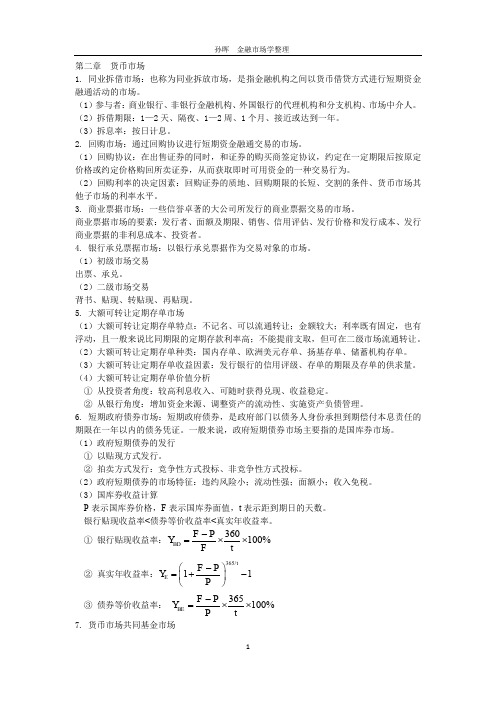

F P 360 100% F t

365/ t

F P ② 真实年收益率: YE 1 P

③ 债券等价收益率: YBE 7. 货币市场共同基金市场

1

F P 365 100% P t

1

孙晖

ห้องสมุดไป่ตู้

金融市场学整理

(1)货币市场共同基金:共同基金是将众多的小额投资者的资金集合起来,由专门的经理 人进行市场运作, 赚取收益后按一定的期限及持有的份额进行分配的一种金融组织形式。 而 对于主要在货币市场上进行运作的共同基金,则称为货币市场共同基金。 (2)货币市场共同基金的发行:采取发行人直接向社会公众招募、由投资银行或证券公司 承销或通过银行及保险公司等金融机构进行分销等办法。 (3)货币市场共同基金的交易:基金的初次认购按面额进行,一般不收或收取很少的手续 费。其购买或赎回价格所依据的净资产值是不变的,一般是每个基金单位 1 元。衡量该类基 金表现好坏的标准就是其投资收益率。 (4)货币市场共同基金的特征:投资于货币市场中高质量的证券组合;提供一种有限制的 存款账户;所受到的法规限制相对较少。 第三章 资本市场 1. 股票的认购与销售 (1)包销: 承销商以低于发行定价的价格把公司发行的股票全部买进,再转给投资者。这 样承销商就承担了在销售过程中股票价格下跌的全部风险。 承销商所得到的买卖差价是对承 销商所提供的咨询服务以及承担包销风险的报偿,也称为承销折扣。 (2)代销: 即“尽力销售” ,指承销商许诺尽可能多的销售股票,但不保证能够完成预定销 售额,任何没有出售的股票可退给发行公司。这样,承销商不承担风险。 (3)备用包销: 是指通过认股权来发行股票并不需要投资银行的承销服务,但发行公司可 与投资银行协商签订备用包销合同, 该合同要求投资银行作备用认购者买下未能售出的剩余 股票,而发行公司为此支付备用费。 2. 保证金交易 (1)信用交易:又称垫头交易或保证金交易,是指证券买者或卖者通过交付一定数额的保 证金,得到证券经纪人的信用而进行的证券买卖。 (2)保证金购买:指对市场行情看涨的投资者交付一定比例的初始保证金,由经纪人垫付 其余价款,为他买进指定证券。 【保证金买空例】 某投资者有本金 5 万元,判断 X 股票价格将上涨。X 股票当前市价为 50 元/股,法定保证金比率为 50%,维持保证金比率为 30%,保证金的贷款利率为 10%。借 5 万 元购买 X 股票 2000 股。 假设一年后股价上涨到 60 元,如果没有进行保证金,则投资收益率为 20%,而保证金 购买的投资收益率为[60×2000-50000(1+10%)-50000]/50000=30%。 假设一年后股价下跌到 40 元,则投资者保证金比率变为 [40 × 2000-50000]/[40 × 2000]=37.5%,投资者的收益率为[40×2000-50000(1+10%)-50000]/50000=-50%。 股价下跌到什么价位,投资者会收到追缴保证金的通知呢? [2000X-50000]/2000X=30%,解得 X=35.71。 (3)卖空交易:指对市场行情看跌的投资者本身没有证券,就向经纪人交纳一定比率的初 始保证金(现金或证券)借入证券,在市场上卖出,并在未来买回该证券还给经纪人。 【保证金卖空例】 某投资者有本金 5 万元,卖空 X 股票 2000 股,卖空股价 50 元/股,法定 保证金比率为 50%,维持保证金比率为 20%。 当股价下跌至 40 元/股时买回,投资者收益率为 40%。 当股票上涨到 60 元/股时,投资者的收益率为-40%。此时的保证金比率为[100000+ 50000-60×2000]/(60×2000)=25%。 股价上升到什么价位,投资者会收到追缴保证金通知呢? [100000+50000-2000X]/2000X=20%,解得 X=62.5 元。

金融机构与金融市场第二章

18

2.4.2 Function of Financial Intermediaries

•

A financial intermediary’s low transaction costs mean that it can provide its customers with liquidity services, services that make it easier for customers to conduct transactions

16

2.4 Function of Financial Intermediaries (FIs)

Financial Intermediaries

1. 2.

Engage in process of indirect finance More important source of finance than securities markets Needed because of transactions costs and asymmetric information

13

2.2.6 Classifications of Financial Markets

1.

Primary Market

New security issues sold to initial buyers

2.

Secondary Market

Securities previously issued are bought and sold

11

2.2.4 Characteristics of Financial Markets

1.

Debt Markets

《金融市场机构与工具》教学大纲

金融市场机构与工具》教学大纲一、课程基本信息二、课程的对象和性质本课程的授课对象为章乃器学院金融学专业学生,性质是专业必修课。

本课程侧重于培养学生面对金融市场的实践感知能力,灵活应用所学金融理论知识理解现代金融市场运作特点的能力。

通过本课程的学习,着眼于提供一个对金融市场的职能、定价和制度性结构的透析,略去宏观经济学工具的同时,给出了不同金融工具的定价方法,以与市场中运做的工具与机构间的差别,本课程要求学生具备一定的西方经济学、会计学、统计学、数学、计算机软件应用的前期知识,具备基础概念认知、计算评估、报表分析、文字描述等能力。

学习过程前后,学生应该对金融与相关市场有一定的了解与关注。

三、课程的教学目的和要求通过本课程学习,具有一定的分析美国金融市场与金融机构现象的能力。

了解中国金融市场与金融机构发展的现状与主要问题。

理解存款性金融机构的业务特点,风险来源,以与金融监管的方法。

理解投资基金的种类、结构以与主要热点问题的解释:如基金表现,封闭性基金折价等。

理解投资银行的主要业务以与主要市场现象,如IPO抑价、股价支持,声誉资本等。

解释金融市场的组织与微观结构,如股票发行过程,交易市场的结构,做市商制度与竞价制度等从市场结构角度分析基本的市场操纵现象,如专营商非法获利,做市商报价问题等。

提高伦理意识。

解释中央银行是如何介入金融市场的。

明显提高口头与书面分析金融市场与金融机构问题的能力。

四、授课方法在课堂教学中注意使用启发式,讲授和讨论相结合,加强习题课和课堂讨论,因材施教。

在课堂外面引导学生查阅资料并进行文献综述,每章要求学生写小论文,教学实习等进行教学。

改变过去单一的闭卷考试方式,代之实施一套“闭卷+课程论文+实验动手能力”等多种有利于学生创新能力培养的考试方法,考试重点从获取知识量向知识、能力、综合素质的评价转移,注重对学生知识运用能力的考察。

使用Powerpoint软件完成教学幻灯片的制作,将课程介绍、教学大纲、教材、教案、教学安排和教学进度、参考阅读资料、习题等在网上公开,以利于学生对本课程的了解、利于学生对所学知识的复习、自学和交流。

金融市场与金融机构

第一章 导论一、金融市场的概念:是资金融通市场,是指资金供应者和资金需求者双方通过信用工具进行交易而融通资金的市场,广而言之,是实现货币借贷和资金融通、办理各种票据和有价证券交易活动的市场。

比较完善的金融市场定义是:金融市场是交易金融资产并确定金融资产价格的一种机制 。

二、金融市场的功能——有三个功能:(l)流动性;(2)信息;(3)风险分担三、金融市场的先天缺陷——5个因素:(1)负的外部性;(2)公共品;(3)信息不对称;(4)垄断;(5)经济周期。

这些缺陷意味着金融市场存在着系统性风险,有可能造成金融体系崩溃;而且知情少的一方往往会受到严重的侵害。

因此,健全和完善金融市场,维护金融安全尤为重要。

四、金融市场的分类按金融资产进入市场的时间来划分,金融市场可分为一级市场和二级市场;按期限分,金融市场可分为货币市场(1年以内)和资本市场(1年以上);注意:货币市场与资本市场的区别。

(货币市场证券一般期限为0到一年不等,最长不能超过一年。

而资本市场证券期限长于一年,一般1年到30年的为中场期债券,股票也属于资本市场债券,其无固定到期日。

)按即时交割或远期交割划分,金融市场可分为现货市场、远期市场以及衍生工具市场;按组织结构划分,金融市场可分为拍卖市场、场外市场和中介市场;等等。

从全球视角看,金融市场又可以分为国内金融市场,国际金融市场和离岸金融市场。

五、金融机构的分类:分为存款性机构和非存款性机构六、做市商:做市商是重要的金融中介机构,它是金融工具买卖双方的联系人,安排和执行买卖双方的交易,在证券买卖中扮演关键角色。

做市商有助于帮助维持一个运行平稳并井然有序的金融市场。

第二章 货币市场一、货币市场的概念和货币市场的功能货币市场:是一个经营短期资金的市场。

货币市场可以调剂短期资金的盈缺,还可帮助流动性管理和负债管理。

货币市场的功能:1、是将个人、公司和政府部门(资金供给者)的短期闲置资金转移给那些需要利用短期资金的经济主体(资金需求者)。

金融机构与金融市场

金融机构与金融市场金融机构和金融市场是现代金融业的两大核心组成部分。

金融机构是指从事接受存款、发放贷款、提供信用等金融服务的机构,包括商业银行、证券公司、保险公司、基金公司等;而金融市场则是指用于交易和定价金融资产的市场,如股票市场、债券市场、外汇市场、期货市场等。

本文将重点探讨金融机构和金融市场之间的关系以及它们对整个经济系统的影响。

一、金融机构与金融市场的关系金融机构与金融市场是相互联系的,二者之间的协调与互动关系至关重要。

从一定意义上来说,金融市场是金融机构的客户,金融机构则是金融市场的参与者。

金融机构为金融市场提供了多种功能服务,如提供流动性、风险管理、债券承销等;而金融市场则提供了多种金融产品和工具,为金融机构提供了大量的资金来源和投资渠道。

首先,金融机构作为资金的流通和分配中介,将资金从投资者手中吸纳并运用于市场中。

比如,商业银行通过吸收存款来解决企业和个人的资金需求,同时通过贷款和信用等方式把资金流向金融市场,为市场提供了大量的资金来源。

此外,金融机构还能够为投资者提供多种形式的风险管理工具,帮助其降低风险。

例如,保险公司可以为投资者提供保险产品,降低其在市场波动下的损失;证券公司则可以为投资者提供股票期权等衍生品来对冲风险。

这些服务在市场中的发挥的作用需要金融市场的支持,金融市场能够提供定价机制,让各种金融产品的价格在市场上得到公正、合理的定价。

其次,金融机构还通过金融市场为自身提供了大量的资金来源和投资渠道。

商业银行、保险公司、证券公司等金融机构都需要大量的资金支持其运营和投资,而这些资金来源主要来自金融市场。

商业银行可以通过发行债券、股票等金融产品来获得资金,同时通过市场投资来获取收益;保险公司同样也可以通过市场投资来获取收益,这些收益来自于股票、债券等金融资产的价值变化;证券公司则是以提供证券发行和交易服务为主,同时也需要大量资金来支持其业务。

总的来说,金融市场和金融机构是相互促进、相互依存的。

金融市场学(张亦春)第 2 章货币市场课后习题答案

第二章货币市场1.假如某金融机构的资产组合中有如下一些金融资产,请指出其中哪些属于货币市场中的金融资产。

a.民生银行的股票。

b.07 央行票据06(期限为一年)。

c.封闭型基金(股票型)——基金开元。

d.债券:00 国开 1O(由国家开发银行发行的期限为1O 年的政策性金融债券)。

e.在同业拆借市场上拆入期限为7 天的资金。

f.还有3 个月就要到期的银行承兑汇票。

答:货币市场工具,是指期限小于或等于 1 年的债务工具,它们具有很高的流动性,属固定收入证券的一部分。

那么符合该性质的是b、e、f。

2.根据表2-1 绘出当天的Shibor 曲线。

答:略。

3.根据你的理解,比较银行可转让大额存单与普通定期存款的区别。

答:同传统的定期存款相比,大额可转让定期存单具有以下几点不同:(1)定期存款记名、不可转让;大额可转让定期存单是不记名的、可以流通转让的。

(2)定期存款金额不固定,可大可小;大额可转让定期存单金额较大。

(3)定期存款;利率固定;大额可转让定期存单利率有固定的也有浮动的,且一般高于定期存款利率。

(4)定期存款可以提前支取,但要损失一部分利息;大额可转让定期存单不能提前支取,但可在二级市场流通转让。

4.假设某回购协议本金为 1OOOOOO 元人民币,回购天数为7 天。

如果该回购协议的回购价格为1001556 元人民币,请计算该回购协议的利率。

按照你的理解,阐述影响回购协议利率的因素。

解:回购利息= 1001556 -1000000 = 1556元,设回购利率为x ,则:1000000 ⨯x ⨯7360= 1556 ,解得:x = 8% 。

回购协议利率的确定取决于多种因素,这些因素主要有:(1)用于回购的证券的质地。

证券的信用度越高,流动性越强,回购利率就越低,否则,利率相对来说就会高一些。

(2)回购期限的长短。

一般来说,期限越长,由于不确定因素越多,因而利率也应高一些。

但这并不是一定的,实际上利率是可以随时调整的。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Slide #2-33

假设某人寿保险公司拥有100 000个保单持有人,他们每个 个保单持有人, 假设某人寿保险公司拥有 个保单持有人 人都是40岁 每个客户申请100万美元的保单。保险公司 万美元的保单。 人都是 岁,每个客户申请 万美元的保单 应向每个保单持有人收取多少保险费呢? 应向每个保单持有人收取多少保险费呢? 确定预期死亡人数。 确定预期死亡人数。100 000*4/000=400 预期索赔金额=100*400=4亿 预期索赔金额 亿 假设该保险公司的分析家估计本年其投资组合平均收益率为 8%。 。 预期索赔现值=4亿 ( 预期索赔现值 亿/(1+8%)=370.4百万 ) 百万 估计每个保单持有人的净保险费= 估计每个保单持有人的净保险费 370.4百万 百万/100 000=3 704 百万

Slide #2-3

Function of Financial Markets

一、聚敛 二、配置功能 三、调节功能 四、反映功能 国民经济的“晴雨表”和“气

象台”

Slide #2-4

Slide #2-5

Slide #2-6

Slide #2-7

Slide #2-8

Slide #2-9

Slide #2-10

Slide #2-11

Slide #2-12

Slide #2-13

Slide #2-14

Slide #2-15

Slide #2-16

Slide #2-17

Asymmetric Information: Adverse Selection and Moral Hazard

Adverse Selection

Reputational risk Operational risk

GOAL

stockholders

Slide #2-31

Fundamental risks

Credit risk Liquidity risk Market risk Operational risk Reputational risk Legal risk Capital or solvency偿付能力risk

Slide #2-28

Liabilities(%) CN 81.4 14.9 US 65.8 27.2

Banks' Income Statement

Slide #2-29

Banking Risks and Returns

Profitability, liquidity, and solvency trade-off

Slide #2-20

Asymmetric Information: Adverse Selection and Moral Hazard

Moral Hazard

Example: int. rate = 8% - Loan approved for Project I: 10% return with 100% probability of success - New opportunity Project II: 100% return with 80% probability of success (20% prob. of failure)

The fundamental objective of bank management is to maximize shareholders’ wealth, i.e., to maximize the market value of the bank’s common stock. Wealth maximization requires the manager to evaluate and balance the trade-offs between the opportunity for higher returns, the probability of not realizing those returns, and the possibility that the bank might fail. Risk management is the process by which managers identify, assess, monitor, and control risks associated with a financial institution’s activities.

受委托的监管者(deligated monitor) 受委托的监管者

Williamson( 1986) , Krasa 和Villamil( 1992) 等文献都抓住了银 行的这一重要特征: 银行是大量投资人和融资人的联合, 行的这一重要特征: 银行是大量投资人和融资人的联合, 能集中处 理监管企业的任务, 并且能更好的解决信息不对称问题。 理监管企业的任务, 并且能更好的解决信息不对称问题。银行的 这一优势核心在于其多元化发放贷款, 因此对存款人来说, 这一优势核心在于其多元化发放贷款, 因此对存款人来说, 只要银 行足够大, 就不需要监管银行能否按时还款。 行足够大, 就不需要监管银行能否按时还款。

Part 1 Introduction

Chapter 2 AN OVERVIEW OF THE FINANCIAL SYSTEM

Slide #2-1

Chapter Objectives

Function of Financial Markets Classifications of Financial Markets Function of Financial Intermediaries Types of Financial Intermediaries Regulation of Financial Markets

Slide #2-30

Governmental regulator Hurry!

Compisk

Liquidity risk Market risk

Well Done! Legal risk Capital risk Customers

Just an Inch Remained!

Slide #2-23

Financial Intermediaries

Slide #2-24

Types of Financial Intermediaries

Depository Institutions (Banks)

Commercial banks Savings & Loan Associations (S&Ls) Mutual Savings Banks Credit Unions

Slide #2-19

Asymmetric Information: Adverse Selection and Moral Hazard

Moral Hazard

1. After transaction occurs 2. Hazard that borrower has incentives to engage in undesirable (immoral) activities making it more likely that won't pay loan back

Slide #2-25

Commercial banks

Defined by the Functions It Serves and the Roles It Play A financial intermediary accepting deposits and granting loans Offer the widest range of financial services. --Financial department stores

Slide #2-32

Types of Financial Intermediaries

Contractual Savings Institutions(契约性储蓄机构包 括各种保险公司和养老基金。它们的共同特征是 以合约方式定期定量地从持约人手中收取资金( 保险费或养老金预付款),然后按合约规定向持 约人提供保险服务或养老金。)

Slide #2-2

Function of Financial Markets

1. Allows transfers of funds from person or business without investment opportunities to one who has them 2. Improves economic efficiency

1. Before transaction occurs 2. Potential borrowers most likely to produce adverse outcome are ones most likely to seek loan and be selected

Slide #2-18

Slide #2-21

信息发掘( 信息发掘 information provision)

Diamond ( 1984) 对Leland 和Pyle ( 1977) 做了一个重要推广: 假设企业家的投资项目的回报是独立分布 做了一个重要推广: 那么他们可以联合起来向投资者借款。这样, 的, 那么他们可以联合起来向投资者借款。这样, 每个项目的期望回报 不变, 但由于多元化, 其风险大大降低了, 不变, 但由于多元化, 其风险大大降低了, 从而减少了信息不对称带来的 资本成本, 这样的联合便是银行。 资本成本, 这样的联合便是银行。银行可以克服企业家和投资者之间的 信息不对称, 吸收存款并投资于银行有内部信息的投资项目。 信息不对称, 吸收存款并投资于银行有内部信息的投资项目。