会计英语1-10课

会计英语PPT课件

会计报表及分析 S&A

1.Financial Statements 2.Analyzing Financial Statement

重点

the definition of Accounting; T-account; Accounting cycle

Contentsp2-5

4

教学总体目标

• 通过本课程的学习,主要目标是让财务管 理专业的学生掌握会计的基本术语,能够 用英语表述会计概念及内容,能够读懂并 分析英文会计报表。

3. 劳伦斯,赖恩. 2003 .会计基础(第九版)(英 文) .上海:立信会计出版社

4. 于久洪. 2005. 会计英语. 北京:中国人民大学出 版社

7

Part One

• General Introduction to Accounting

8

Chapter 1 General Introduction

Financial position

criterion

diverse adj.

Enterprise / firm

creditor

regulatory

sales volume

obligation

merchandise

商品,货物

会计人员

会计术语

货币计量

财务状况

评价的标准

多种多样的

企业

债权人,债主,贷方

监管的,管制的

本课程内容主要包括会计的理论概述,会计信息 的归集与披露,会计要素,资产负债表、利润表和 现金流量表等基本财务报表以及分析,内容为财务 会计中应知应会的部分。课程结合实际案例,既吸 收了西方会计理论与实务之精华,又符合我国会计 发展的具体实践。

英文会计科目名称表

英文会计科目名称表1. Assets 资产1.1. Fixed Assets 固定资产1.2. Current Assets 流动资产1.2.1. Cash 现金1.2.2. Accounts Receivable 应收账款1.2.3. Inventory 存货1.2.3.1. Raw Materials 原材料1.2.3.2. Work in Progress 在制品1.2.3.3. Finished Goods 成品1.2.4. Prepaid Expenses 预付费用1.2.5. Other Current Assets 其他流动资产2. Liabilities 负债2.1. Current Liabilities 流动负债2.1.1. Accounts Payable 应付款项2.1.2. Wages Payable 应付工资2.1.3. Interest Payable 应付利息2.1.4. Taxes Payable 应付税款2.1.5. Other Current Liabilities 其他流动负债2.2. Long-Term Liabilities 长期负债2.2.1. Long-Term Loans 长期贷款2.2.2. Bond Payable 应付债券2.2.3. Other Long-Term Liabilities 其他长期负债3. Owner's Equity 所有者权益4. Revenue 收入5. Expenses 费用6. Profit or Loss 利润或亏损7. Depreciation and Amortization 折旧和摊销8. Income Tax Expense 所得税费用9. Net Income/Loss 净收入/亏损10. Earnings per Share (EPS) 每股收益。

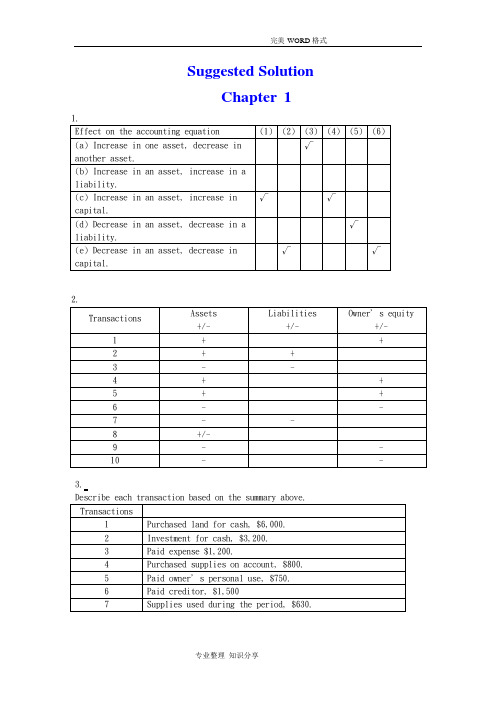

(完整版)会计英语课后习题参考答案解析

Suggested SolutionChapter 11.3.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ........................... 1,800 b.Revenue ..................................... 4,500Accounts receivable ................... 4,500 c.Owner’s withdrawals ........................ 1,500Salaries Expense ....................... 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000December 31, 2009 Cash 42,500Investment in K 42,500 Investment in K 146,000 Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100 Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400 Income tax payable 21,60020⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25). g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue ....................................... 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory ........................................... 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S) ................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S) ...................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable ................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) .......................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures in year 1 for warranty workCash ................................................... 297,600*Accounts receivable ................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable ............................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Inventory ........................................... 220,000 Deferred gross margin ............................... 90,000 To record sale of goods on accountDeferred gross margin ................................... 12,400 Accounts receivable ................................. 12,400 To record return of goods within the 30-day return period. It is assumed the goods have no value and are disposed of.Deferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash ................................................... 297,600* Accounts receivable ................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable ............................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue ....................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs ............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performancecriterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determinethe percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recordedin revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30%$ 6,0002006 $20,000 × 70%$ 14,0002007 $20,000 × 100%$ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. 5,400 7,550 5,850 2. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings ... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable . 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850 Revenue from long-termcontract .......... 6,000 8,000 6,000 5. To close construction in progress:Progress billings ....... 20,000 Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products,IAS18 defines performance as the point when the seller of the goods hastransferred the risks and rewards of ownership to the buyer. Normally, this meansthat performance is done at the time of sale. Although the seller may haveperformed much of the work prior to the sale (production, selling efforts, etc.),there is still significant risk to the seller that a buyer may not be found.Therefore, from a reliability point of view, revenue recognition is delayed untilthe point of sale. Also, there may be significant risks remaining with the sellerof the product even after the sale. Warranties given by the seller are a riskthat remains with the seller. However, if this risk can be reliably estimatedat the time of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here, performancereally is considered to be a measure of the work done. Revenue is recognizedover the production period as the work is performed. It is intended to reflectthe amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can berecognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set).However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment.As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b. Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130)20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3))3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30)4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000)36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000$ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ………………………. -48,000Payment of income tax ………………………………-13,000Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating-200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing-1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash-400,0005.。

财务会计英语版课后答案

Chapter 1Page 81.Classify following items as either an expense (E),a revenue(R),an asset(A),or a liability( L);Cash, buildings, salaries of the sales force, $5 owed to a company for work performed, Mortgage to a bank, sales.Answer:Cash—A Buildings—A Salaries of the sales force—E$5 owed—L Mortgage to a bank—L Sales—R2. Classify each of the following as n operating (O), bank (I) , or financing (F) in a statement of cash flows; Wage paid to workers, Cash received form a bank in the form of a mortgage, cash dividends paid to a supplier of inventory, Cash paid to purchase a new machine.Answer:Wage paid—O Cash of mortgage-- F Cash dividends paid -- FCash paid to supplier of inventory—O Cash paid to purchase a machine—IPage111.List several economic decisions that rely on accounting information.Answer:·Whether to grant a loan·How much to pay for a share of common stock.·Whether to grant a rate increase to an electric utility·How much in damages the loser of a lawsuit must pay ·How much of a bonus to pay a plant manager·Whether to enter a new market2. Why do financial statements have footnotes, and what kinds of information might you find in them?Answer:Financial statements have footnotes because financial disclosure is a complex business. The notes tell us some of the specifics about the company environment , what accounting methods the company has used, what the accounting numbers might be if alternative methods had been used, and some of the major contingencies that are not formally included in the statement proper.Page 201.Describe the process of setting accounting standards. What are the roles of all the parties you mention?Answer:The FASB, a private, not-for-profit organization ,sets GAAP in the U.S. It publicly declares an agenda, promulgates "ExposureDrafts" of proposed standards, holds open meetings, and invites input from interested parties. The FASB has been delegated this authority by the SEC, a government agency with legal authority to determine GAAP.2.Think of an example, like the executive compensation example in the chapter, where incentives might exist to bias accounting numbers one way or another.Answer:There are other examples, but here is one that is different. A taxpayer has incentives to bias reported income downward in order to minimize income tax payments. However, it is important to understand that tax accounting rules are different from GAAP, and this book is about GAAP. Chapter 14 covers GAAP for taxes in more detail.Other examples include:·An entrepreneur seeking a loan from a bank or funding from a venture capitalist might have incentives to bias accounting numbers to look favorable.·A firm that is subject to scrutiny for earning excess profits(e.g.,an oil company)might have incentives to bias accounting numbers to look less favorable.·A utility subject to rate regulation might have an incentive tobias accounting numbers to look less favorable in order to gain more generous increases in its rates. (At this writing, there is a rather severe controversy about whether electric utilities in California are genuinely in financial difficulty and should be allowed to continue to impose large rate increase.)Chapter 2Page 381 Define assets, liabilities, and equities.Gave an example ofeach. How are assets valued? How are liabilities valued? Answer:An asset is a probable future economic benefit obtained or controlled by an entity as a result of a past transaction. Cash marketable securities, accounts receivable, inventories, prepaid expenses, patents, copyrights, trademarks, and property, plant and equipment are all examples of assets. A liability isa probable future sacrifice of economic benefits arisingfrom present obligations of an entity to transfer assets or provide services as a result of a past transaction or event.Accounts payable, accrued liabilities, unearned revenues, warranties, and bonds payable are all examples of liabilities.Accounting valuation of assets uses severaldifferent methods, including market value, expected realizable value, lower of cost or market, present value of future cash flows, and historical cost. Accounting valuation of liabilities is the expected amount that will be paid, perhaps adjusted for the time value of money.2. Explain what is meant by the entity concept. Answer:The entity is the person or organization about which accounting's financial history is being written.3 .A company signs a ten-year employee contract with a vicepresident. The salary is $ per year, guaranteed. Is this contract an asset? Would it appear on the balance sheet?Explain.Answer:The rights conveyed by the contrat may be an asset from an economic point of view, but they are not an asset under GAAP. The contract would not appear on the balance sheet as an asset, because GAAP does not record executory contracts, which are contracts that require future performance form both parties. That is ,GAAP views the contract as determining what services will be provided, no asset is recognized under GAAP.(Neither is a liability for payment recognized until services have beenperformed.)4 .A company purchased a parcel of land 10 years ago at a cost of $.The land has recently been appraised at $. At what value is the land carried in the balance sheet? How does the appraisal affect the carrying value in the balance sheet? Answer:The land is on the balance sheet at its historical cost of $.The carrying value of the land is unaffected by the appraisal. Page 421、Define debit and credit .What kind of balance ,debit or credit ,would you expect to find in the inventory T-account?In the Common Stock T-account?Answer:A debit is an entry on the left side of a T-account. A credit is an entry on the right side of a T-account. We would except to find a debit balance in Inventory, and credit balances in Bonds Payable and Common Stock. The reason is the convention that increases in assets are debits and increases in liabilities and equities are credits.2、If the trial balances, it means that you have analyzed all the effects of transactions correctly. True or false?Explain.Answer:False. A balanced means that the trial balance is consistent, not necessarily correct. For example. If an arbitrary entry is made that debits Cash and credits Common Stock for an equal amount, the trial balance will balance but it will be wrong. An accounting can receipt of cash and the issuance of common stock, but it alone can not make cash or additional common shares.3﹑Suppose Web sell leases a portion of its space to another company. Web sell’s accounts are debited and credited to record this transaction?Answer:Web sell would debit Cash and a liability, Rent Received in Advance, for the prepayment.Chapter 3Page 571. Define revenue and expense. How does one decide to list an item as revenue in an income statement? What is matching? Answer:Revenues are increases in net assets resulting from operations over a period of time .Expense are decreases in net assets resulting from operations over a period of time .Revenue isrecognized the earnings process is substantially complete , a transaction2. Give an example not found in the text , of an expense that is paid for in cash in a prior accounting period .In a subsequent accounting period.Answer:There are many allowable responses . An example is a patent that is purchased and paid for in one year and used in next .3. Give an example, not found in the text , of a revenue that is received in cash in a prior accounting period . In a subsequent accounting period .Answer:An example is a house painting contractor that receives payment for one-third of the contract price before beginning the painting .4. Explain why it is right to think of an asset as a cost and an expense as an expired cost .Answer:An asset is a future benefit . And there is an opportunity cost associated with not selling it for cash or exchanging it to settleChapter 6Page 120:1.The following table lists the adjustments and has an X in thecolumn indicating the approach:2. We first take adjustment for prepaid insurance and insurance expense. It would be easy to think of this adjustment as focusing on how much of the insurance coverage remained, as opposed to how much was used. In fact, the same type of logic could be used---computing a monthly rate for the coverage and applying that to the months reminding, instead of the months used.Now take adjustment for depreciation expense and accumulated depreciation. Estimating the value of the equipment at year end might be easy, for example, if there is a market for used equipment, or very difficult, for example, if the equipment was specially designed for Websell. Once a value estimate for the equipment at year end is obtained, depreciation expense would be the change in value over the year.Page 1231.$5000×(1+0.06)^10=$5000×1.79085=$8954.242.$5000×(1+0.06/2)^(10×2)=$5000×(1+0.03)^20=$5000×1.80611=$9030.563. $1000×(1.05)^3+$1000×(1.05)^2+$1000×(1.05)^1=$3310.134. ($1000×0.05/5)^13+$1000×(1+0.05/5)^10+$1000×(1+0.05/5)^5=($1000×(1.01)^15)+($1000×(1.01)^10)+($1000×(1.01)^5) =$1160.97+$1104.62+$1051.01=$3316.6Page 1241.x×.(1.07)^3=$3000 x=$3000/(1.07)^3=$2448.892. Calculate the present value at 10% of $1300 received two years from now. If that is greater than $1000, you are better offwith the $1300 to be received in two years. If its present value is less that $1000, you better off with $1000 now. $1300/(1.10)^2=$1074.38Therefore, you are better off receiving $1300 two years from now.Another way to do this problem is to take the future value at 10% of $1000. At the end of two years, the $1000 would compound up to:$1000×(1.10)^2=$1210,Which is less than you would have at that point if you took the $1300.3.The most I would be willing to pay is the present value at 8% of the stream of $1000 payment:$1000/(1.08)^1+$1000/(1,08)^2+$1000/(1,08)^3=$925.926+857.339+793.832=$ 2577.1(rounded)Chapter 8Page 1681.Aging takes the balance in accounts receivable at the end of the year, and sorts it by how long ago the transaction occurred that gave rise to that receivable. Experience has shown that “older” accounts have less likelihood of ever being collected.Percentages of likely uncollectibles for each category are applied to the totals in that category , and the results added to obtain an estimate of the allowance for uncollectibles required to value properly the estimated amount that will be collected from the accounts receivable. The bad debts expense then falls out as a “plug” in the allowance for uncollectibles.The percentage-of-sales method just estimates bad debt expense as a percent of sales, and plug the balance in the allowance account.2. Cash (118)Accounts receivable (118)12/31/2003(to recognize collection of cash from companies owing service co. from 2002 sales)Allow ance for doubtful accounts (7)Accounts receivable (7)12/31/2003(to write off accounts we know will not be collected) Ac counts receivable (125)Sales reven ue (125)12/31/2003(to recognize revenue and to anticipate collection of the receivable)If we focus on recording the bad debts expense that is associated with billings for 2003, we would record.06×$=$7500 in baddebts expense.B ad debts expense………………………………………7.5 Allowan ce for doubtful accounts…………………………7.5 12/31/2003(to record bad debt expense in anticipation of not collecting 100% of receivables)Method one: focus on the percentage of sales expected not to be collected.Allowance for doubtful accounts(10.5 is the “plug”,i.e., the number that drops out)Now we move to 2004, where events now proceed as expected . Collections are $117.5 thousand. Cash………………………………………………..117.5 Accounts receivable…………………………………117.512/31/2004(to recognize collection of cash form companies owing service co. from 2003 sales)Allowance for doubtful ac counts………………………7.5 Accounts receivable………………………………….7.512/31/2004(to write off accounts we know will not be collected)Accounts receivable (125)Sales revenue (125)12/31/2004(to recognize revenue and to anticipate collection of the receivable)If we focus on recording the bad debts expense that is associated with billings for 2004, we would record.06×$=$7500 in bad debts expense.Bad debts expense……………………………………7.5 Allowance for doubtful acco unts…………………………7.5 12/31/2003(to record bad debt expense in anticipation of not collecting 100% of receivables)The allowance for doubtful accounts using the peentage-of-sales method looks like this:Method one: focus on the percentage of sales expected not to be collected.Allowance for doubtful accountsOnly the entries recording bad debt expense are different using the aging method. Instead of the above entries recording bad debt expense, we would have the following analysis: Each year, we would adjust the balance in the allowance for doubtful accounts so that the net receivable ends up at $. That is, we would solve $-X=$,and find that the ending balance in the allowance for doubtful accounts must be $7500.Analyzing the account, we would determine that at 12/31/2003 we must add $4500 to the allowance for doubtful accounts: Bad debts expense………………………………..4.5 Allowanc e for doubtful accounts…………………….4.512/31/2004(to record bad debt expense in anticipation of not collecting 100% of receivables)At 12/31/2004, we must add $7500 to the allowance for doubtful accounts:Bad debts expense………………………………..7.5 Allowan ce for doubtful accounts…………………….7.512/31/2004(to record bad debt expense in anticipation of not collecting 100% of receivables)Using aging, the allowance for doubtful accounts T-account looks like this:Method two: focus on the ending balance in the allowance for doubtful accounts.Allowance for doubtful accountsChapter 9Page 1831.LIFO is last-in first-out. It means that in computing ending inventoryand cost of goods sold, the cost of items sold is assigned in reverse chronological order of their purchase, beginning from the most regent items purchased in a period. FIFO is first-in, first-out .It means that in computing ending inventory and cost of goods sold, the cost of items sold is assigned in chronological order of their purchase, beginning from the goods on hand at the beginning of the period. Average cost means that in computing ending inventory and cost of goods sold, the average unit cost of the beginning inventory and items purchased in a period is used to determine the cost of goods sold and remaininginventory.2.Yes, it is still a positive net present value project. In fact, its netpresent value is higher than when the purchase was made at$1.05 per unit, since the cash outflow is reduced but the cash inflow remains the same. The cash outflow on 12/31/01 when purchases are at $0.95 per unit is $114.This means the net cash flow at 12/31/01 is ($4) instead of ($16),and the NPV for Widget Company is:NPV=-100-$4/1.1+$10/ (1.1^2) +$144/ (1.1^3) =$12.82First, we redo the case of FIFO. The inventory T-account is:Widget Co. Inventory Account under FIFO Flow AssumptionInventory (FIFO)Ending inventory values can be read from the above T-account. Net incomes are:Widget Incomes using FIFONow we redo the case of FIFO. First, the inventory T-account is: Widget Co. Inventory Account under FIFO Flow AssumptionInventory (FIFO)Ending inventory values can be read from the above T-account. Net incomes are:Page 186To calculate the market-to-book ratios and accounting returns on equity: Market-to-book Ratios under Average CostAccounting Rates of Return under Average CostCollecting the results for FIFO from the chapter and these results for average cost, we have:Market-to-book Ratios under Various Cost Flow AssumptionAccounting Rates of Return under Various Cost Flow AssumptionAs is apparent, the market-to-book ratios and accounting rates of return for average cost are between for LIFO and FIFO.2. Because it has more recent costs on the balance sheet in the inventory account, FIFO has market-to-book ratios closer to 1regardless of whether prices rise or fall.Chapter 10Page 1961. The total profit on the transaction is the sales price of $880.00 less the original cost of $734.03:Sales price of securities $880.00Less : original cost ($735.03)Profit on transaction $144.97The cash flows were: $735.03 out on January1, 2001, and $880.00 in on January 3, 2003.There were profit in 2001, 2002, and 2003.In 2001, therewas a profit of $81.17.In 2003,there was a profit of $5.00.2. The unadjusted book value of the security on December 31,2002 was $793.83.If the market value of the security on that date was $790.00,an adjustment reducing its carrying value by $3.83 is required to write it down to its market value: Unrealized loss on market value securities-trading ……3.83 Marketable securities –trading ………… 3.83 If the security were sold for $810.00 on January 3, 2003, the entry would be:Cash ………………………………810.00Marketable securities –trading ………………790.00Gain on marketable securities-trading …………20.001/03/2003(To record the sale of the Marketable securities—trading )Page 1981. When a securities is classified as trading security, profits or losses show up on the income statement in every period from when the security is purchased until when it is sold. when a security is classified as available-for-sale ,profits or losses only show up on the income statement in the period in which the security is sold.2. the unadjusted book value of the security on December31,2002 was $793.83.If the market value of the security on that date was $790.00,an adjustment reducing it’s carrying value by $3.83 is required to write it down to it’s market value. however unlike the trading security case ,the unrealized loss is an equity account ,not a temporary account:Unrealized loss on marketable securities-available-for-sale 3.38 Marketable securities –trading ………………3.83To record the sale of the security for $810.00 on January 3,2003: Cash ………810.00Unrealized gain on marketable securities-available-for-sale(58.80-3.83) ………54.97Marketable securities-trading …………790.00Realized gain on marketable securities-available-for-sale ……………74.9712/31/2002(To mark-to-market the Marketable securities—available-for-sale)Chapter 111.a. Under straight-line depreciation, the depreciation expense each year is$600-$100/5 years=$100 per year.b. Under double-declining balance depreciation, the depreciation expense each year is given in the following table:c. Under sum-of-year’-digits depreciation, the depreciation expense each year is given in the following table:Sum-of years’-digits depreciation2. Intangible assets are most often shown in one line that is cost net of amortization. Tangible assets are sometimes shown in three lines: cost , accumulated depreciation, and net .3. Economic depreciation is the change in the economic value of the asset. Economic depreciation can be appreciation when the asset increases in value. We seen this already with marketable debt securities, which sometimes increase in valuebecause of unpaid interest4.It is easy and fulfills the requirement of GAAP to provide depreciation using a systematic and rational method. No GAAP depreciation method likely correctly reflects economic depreciation anyway ,so a simple expedient may be good enough.1.Sraight-line depreciation is $100 per year ($300/3 years).Double-declining balance depreciation is given in the following table:2.For straight-line depreciation,the entry is the same each year:Depreciation expense (100)Accumulateddepreciation (100)For double-declining balance depreciation,the entries are: Year1Depr eciation expense (200)Accu mulated depreciation (200)Year2Depreciation expense………………………………66.67 Acc umulated depreciation………………………66.67 Year3.declining balance because depreciation expense under straight-line is only $100,while under double-declining balance depreciation expense is $200.4.If the company buys one asset every year and each asset lasts three years,then in year 4 it will have three assets.Under straight-line depreciation,each of those assets generates a depreciation expense of $100;therefore total depreciation expense would be 3*$100,or $300.Under double-declining balance depreciation,total depreciation expense depends on the age of each asset.The company would have one asset in its first year of life,one in its second year of life,and one in its third year.Therefore,totaldepreciation expense would be:$200+$66.67+$33.33=$300,the same as under straight-line.Both depreciation methods give the same total depreciation because:1.Both methods fully depreciate the assets over their lives.2.The cost of the assets has remained constant.3.The company is in a steady state in which the number ofnew assets purchased in a period equals the number ofold assets being retired in that period.。

会计英语课后习题参考答案解析(可编辑修改word版)

Suggested SolutionChapter 12.3.Describe each transaction based on the summary above.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ............................ 1,800 b.Revenue ......................................Accounts receivable ....................c. 4,5004,500Owner’s withdrawals........................ 1,500Salaries Expense ....................... 1,500d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue Service revenue 2,1002,100Consultant expense Prepaid consultant 9009004. Unearned revenueService revenue3,0003,0001. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31.Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202.April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73.(a) As a whole: the ending inventory=685(b)applied separately to each product: the ending inventory=6254.The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c)first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2.(a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000 (b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003.(1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004.Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005.a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory198,000 Cr: Accounts Payable198,000 June 11: Dr: Accounts Payable198,000Cr: Notes Payable198,000 June 12: Dr: Cash300,000Cr: Notes Payable300,000 b. Dr: Interest Expenses (for notes on June 11) 12,100 Cr: Interest Payable12,100 Dr: Interest Expenses (for notes on June 12) 8,175 Cr: Interest Payable8,175 c. Balance sheet presentation:dFor Western: Dr: Notes Payable 300,000 Interest Payable 8,175 Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability2,400Income tax payable21,600 20⨯9 Deferred income tax is an asset600 Income tax payable 26,100 (2) 20⨯8: Dr: Tax expense24,000Cr: Income tax payable 21,600 Deferred income tax2,400 20⨯9: Dr: Tax expense25,500 Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense24,000 Balance sheet: income tax payable21,600 20⨯9: Income statement: tax expense25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))Notes Payable498,000 Accrued Interest on Notes Payable20,275 . For Green:Dr: Notes Payable198,000 Interest Payable12,100 Interest Expense 7,700 Cr: Cash 217,800b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61.Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000 The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2.July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3.a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d.Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of dec laration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000 To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ............................................... 480,000 Cash/Accounts payable................................ 480,000 To record purchase of inventoryInventory ............................................... 124,000 Cash/Accounts payable................................ 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue........................................ 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory............................................ 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S).................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S)....................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable.................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ..........................Cash/Accounts payable................................ 18,60018,600To record expenditures in year 1 for warranty workCash .................................................... 297,600*Accounts receivable.................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable................................ 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, thefollowing journal entries would be used to record the transactions for the two years:Year 1Inventory ...............................................Cash/Accounts payable................................ To record purchase of inventory 480,000480,000Inventory ...............................................Cash/Accounts payable................................ To record refurbishment of inventory 124,000124,000Accounts receivable .....................................Inventory............................................ 310,000220,000Deferred gross margin................................To record sale of goods on account90,000Deferred gross margin ...................................Accounts receivable.................................. 12,40012,400To record return of goods within the 30-day return period.goods have no value and are disposed of.It is assumed theDeferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable................................ 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .................................................... 297,600* Accounts receivable.................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable................................ 8,400 To record warranty costs incurred in year 2 related to year 1 sales. Thewarranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue........................................ 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs.............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after thewarranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale.The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is notsubstantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on theassumption that we could measure the risk that remains with the seller, andmake a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated totalcosts to determine the percentage of completion) is to estimate the percentageof completion of the project at the end of each year. This is done in thefollowing table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculatedas above, the next step is to allocate the appropriate amount of revenue toeach year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction projectwould be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. . 5,400 7,550 5,8502. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings .... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable .. 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850Revenue from long-termcontract ........... 6,000 8,000 6,0005.To close construction in progress:Progress billings ....... 20,000Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a.The three criteria of revenue recognition are performance, measurability,and collectibility.Performance means that the seller or service provider has performed thework. Depending on the nature of the product or service, performance maymean quite different points of revenue recognition. For example, for thesale of products, IAS18 defines performance as the point when the seller ofthe goods has transferred the risks and rewards of ownership to the buyer.Normally, this means that performance is done at the time of sale. Althoughthe seller may have performed much of the work prior to the sale(production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability pointof view, revenue recognition is delayed until the point of sale. Also,there may be significant risks remaining with the seller of the producteven after the sale. Warranties given by the seller are a risk that remainswith the seller. However, if this risk can be reliably estimated at thetime of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue is recognized over the production period as the work is performed. It is intended to reflect the amount of effort expended by the seller(contractor). Although legal title won’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognizeduntil the extent of performance is known.Measurability means that the seller or service provider must be able toreliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it isappropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b.Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able tosell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15+ $3)) 3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000 Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000Enterprise net profit $3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a)Cash received from customers = 816,000(b)Cash payments for purchases of merchandise. =468,000(c)Cash payments for operating expenses. = 268,200(d)Income taxes paid. =36,9003.Cash sales..................................... $9,000Payment of accounts payable ………………………. -48,000Payment of income tax ……………………………… -13,000Payment of inter est ……………………………..….. -16,000 Collection of accounts receivable .................. 93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating - 200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing - 1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash - 400,0005.。

英语日常生活口语第二课工作(共10课)

baker 面包师 /’beikə/

barber 理发师 /’ba:bə/ cashier 出纳 /‘kæ ʃɪə/

delivery person 快递员

designer 设计者

/dɪ’zainə/

Sentences

•1. What’s your job? / what do you do? 你是做什么的? •2. How do you like your job? 你觉得自己的工作怎么样? •3. Do you have a part-time job? 你有兼职的工作吗? •4. I often work overtime. 我经常要加班。 •5. How long have you been a teacher? 你做老师多久了? •6. I’m thinking of quitting /kwit/my job. 我在考虑辞去现在的 工作。 •7. I’m looking for a new job. 我在找新工作。 •8. I got fired /faɪə/yesterday. 我昨天刚被炒鱿鱼。 •9. My boss gave me a raise /reiz/. 我老板给我加薪了。 •10. I want to be a boss. 我想当老板。

英语在线课堂

English online

英语生活口语

Lesson 02 工作

Learning goals

✔ 1.z掌握词汇 2. 背诵对话

Fast reading

job工 作

businessman 商人

doctor 医生

teacher 老师

worker 工人

farmer 农民

actor / actress 演员

会计英语叶建芳答案

会计英语叶建芳答案会计英语叶建芳答案>一、课程性质与目标(一)课程性质《会计英语》是会计学专业的学科基础课程之一,是为培养既具备国际相关专业知识和业务技能又具备熟练运用专业英语从事专业工作的人才而开设的一门专业限选课。

本课程的先修课程为会计学原理,大学英语等。

(二)课程目标本课程讲授内容基于国际会计准则之下的会计概念、财务报表、流动资产、长期资产、负债与或有事项、所有者权益以及会计的其他领域如成本会计,管理会计和审计的概况等。

通过本课程的学习,要求学生了解中国和XX会计处理的相同和不同,掌握基本的会计处理的英文表达方式,熟练掌握专业的英文术语。

通过考核,检查学生是否具备阅读会计英语文献,基础的专业交流能力,基础的专业做账能力。

为学生今后在外企工作,从事外贸工作打下良好的基础。

二、考试内容与考核目标chapter 1 conceptual framework underlying accounting (一)考试内容1. definition of accounting2. objectives of financial accounting3. the qualitative characteristics of accounting information4. the basic elements of financial statements and equations.5. the basic accounting assumptions(二)考核目标1. to learn objectives of financial accounting2. to learn the basic accounting assumptions3. master the basic elements of financial statements andequations4. proficiency in the qualitative characteristics o faccountinginformation.chapter 2 the accounting information system(一)考试内容1. the basic terminology in collecting accounting data.2. the double-entry system3. the procedures of accounting cycle(二)考核目标1. proficency the basic terminology in collecting accountingdata.2. understand the double-entry system3. understand the procedures of accounting cycle chapter 3 financial reporting(一)考试内容1. the elements of balance sheet and how to prepare thebalance sheet2. the elements of ine statement and how to prepare theine statement3. the elements of the statement of cash flows4. the five sections of full disclosure. (二)考核目标1. proficency the elements of balance sheet and how toprepare the balance sheet.2. prjoficency the elements of ine statement and how toprepare the ine statement.3. master the elements of the statement of cash flows4. to learn the five sections of full disclosure. chapter 4 current assets(一)考试内容1. the definition of cash and cash equivalents2. the definition of receivables and classification ofreceivables.3. the definition of account receivables, two discounts, andtwo methods used to calculate the exchange price under cashdiscount —the gross method and the method4. two methods to deal with un-collectible accountsreceivables —the direct write-off method and the allowancemethod5. two methods to determine the inventory quantity —periodicinventory system and perpetual inventory system6. master four methods available to account for the flow ofgoods from purchase to sale:(1) specific identification, (2) first in, first out, (3) last in, first out,(4) averaging7. three methods to report temporary investment-- historicalcost, market value, and the lower of cost or market (二)考核目标1. understand the definition of cash and cash equivalents2. learn the definition of receivables and classification ofreceivables.3. understand the definition of account receivables, twodiscounts, and two methods used to calculate the exchangeprice under cash discount —the gross method and the method4. figure out two methods to deal with un-collectible accountsreceivables —the direct write-off method and the allowancemethod5. identify two methods to determine the inventory quantity —periodic inventory system and perpetual inventory system6. master four methods available to account for the flow ofgoods from purchase to sale:(1) specific identification, (2) first in, first out, (3) last in, first out,(4) averaging7. understand three methods to report temporary investment--historical cost, market value, and the lower of cost or market chapter 5 long-term assets (一)考试内容1. the characteristics of property, plant, and equipment, andhow to record ppe under different situations.2. the methods of depreciation.3. capitalization expenditure and revenue expenditure of thefixed assets.4. the disposition of fixed assets5. three circumstances of investment of equity securities.6. three different debt securities.7. the characteristics of intangible assets.8. the different kinds of intangible assets (二)考核目标1. to identify the characteristics of property, plant, andequipment, and how to record ppe under different situations.2. to understand the methods of depreciation.3. to figure out capitalization expenditure and revenueexpenditure of the fixed assets.4. to learn how to deal with the disposition of fixed assets5. to understand the three circumstances of investment ofequity securities.6. to learn the three different debt securities.7. to understand the characteristics of intangible assets.8. to learn the different kinds of intangible assets chapter 6 liabilities and contingencies (一)考试内容1. the definition of current liabilities and related elements,especially notes payable2. the classification of bonds payable.3. the definition of par value, premium, discount, statedinterest rate, the effective yield, and the method to deal withamortization of premium and discount.4. the characteristics of contingency(二)考核目标1. understand the definition of currentliabilities relatedelements, especially notes payable2. identify the classification of bonds payable.3. prehend the definition of par value, premium, discount,stated interest rate, the effective yield, and the method to dealwith amortization of premium and discount.4. understand the characteristics of contingencychapter 7 stockholders ’ equity(一)考试内容1. the definition and characteristics of equity2. the sole proprietorships ’ characteristics.3. thepartnerships ’ characteristics. 4. thecorporation ’s characteristics.5. the difference between mon stock and preferred stock.6. two methods to record treasury stock(二)考核目标1. understand the definition and characteristics of equity2. identify the sole proprietorships ’ chearriasctitcs.3. learn the partnerships ’ characteristics.4. understand the corporation ’s characteristics.5. figure out the difference between mon stock andpreferred stock.6. master two methods to record treasury stock chapter8 the other fields of accounting---cost accounting,managerialaccounting, auditing(一)考试内容1. the two principles of cost accounting systems2. the characteristics of managerial accounting3. the characteristics of auditing and sevral audit reports (二)考核目标1. understand the essential of costing accounting and itsscope2. learn the characteristics of managerial accounting3. figure out the difference between auditing and accounting三、教材及参考(一)本课程使用的教材《会计英语简明教程》 [英文版 ] 李越冬编著西南财经大学出版社2022 年 5 月第 1 版(二)参考1.叶建芳,孙红星,何瑞丰 .会计英语 .上海:复旦大学出版社,2022 年2.于久洪 . 会计英语 .北京:中国人民大学出版社,2022 年3. 张国华,王晓巍著 .财会专业英语 .北京:科学出版社, 2022 年四、考试题(样题)本试题包括填空(考查对定义的理解)、调整分录(会计循环)、会计处理、完成资产负债表(考查资产负债表的要素分类)、编制利润表。

经济类各专业课程英文名称

22

必修

投资银行理论与实务

TheoryandPracticesof InvestmentBank

孙浩

23

必修

外汇业务与管理(I)

FOREXOperation& Management(I)

廖尧麟

24

必修

财务管理(I)

FinancialManagement(I)

严 俊

25

限选

市场营销(II)

Marketing(Ⅱ)

阮建军

9

必修

经济法

EconomicLaws

王新周

10

必修

国际贸易(I)

International Trade(Ⅰ)

傅江景

11

必修

管理学(II)

Management(Ⅱ)

何苏华

12

必修

国际贸易实务(I)

Practices ofInternationalTrade(Ⅰ)

李军

13

必修

市场营销(II)

Marketing(Ⅱ)

Practices ofInternationalTrade(II)

郭影帆

31

任选

金融研究专题讲座

Special Topics on Finance Studies

尹祖宁

32

任选

国际经济与贸易前沿专题

SpecialTopicsonInternationalEconomy&Trade

罗良忠

33

任选

WTO(金融)专题

陆明祥

《会计学专业》课程英文名称

课程

类别

序号

课程性质

课程名称

课程英文名称

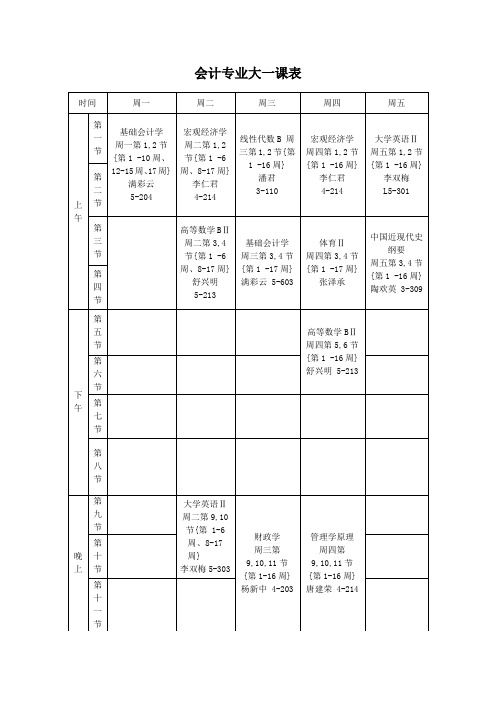

会计大一、大二课表

周一

周二

周三

周四

周五

上午

第一节

基础会计学

周一第1,2节{第1 -10周、12-15周、17周} 满彩云

5-204

宏观经济学

周二第1,2节{第1 -6周、8-17周}

李仁君 4-214

线性代数B 周三第1,2节{第1 -16周}

潘君

3-110

宏观经济学

周四第1,2节{第1 -16周} 李仁君

4-214

何金兰

5-101

大学生安全教育

周四第9,10,11节{第1-12周}

黄海宁

2-109

第十节

第十一节

第十节

第十一节

会计专业大一课表

会计专业大二课表

时间

周一

周二

周三

周四

周五

上午

第一节

大学英语4

周二第1,2节{第1-6周、8-17周}

孙健

L5-305

管理会计学

周四第1,2节{第11-16周}

朱谊辉

1-T302

毛泽东思想、邓小平理论与"三个代表"重要思想概论

周五第1,2节{第1-15周}

涂刚鹏

4-201

董建华

3-406

第六节

第七节

晚上

第九节

管理会计学

周一第9,10,11节{第1-6周、12-15周、17周}

朱谊辉

4-103

内部控制理论与实务

周二第9,10,11节{第1-5周}

张西克

3-406

管理会计学

周二第9,10,11节{第11-17周}

朱谊辉

5-203

烹饪原理

周三第9,10,11节{第1-12周}

管理会计英语培训课程

Example - Garment Manufacturer

• Chunling Company that sells five types of readymade garments to discount stores such as Kmart and Wal-Mart

• The company is operating at full capacity and is contemplating short-term adjustments to its product mix

– Such a firm is a price taker, and it chooses its product mix given the prices set in the marketplace for its products

Ability To Influence Prices

– Firms in an industry with relatively little competition, who enjoy large market shares and exercise industry leadership, must decide what prices to set for their products

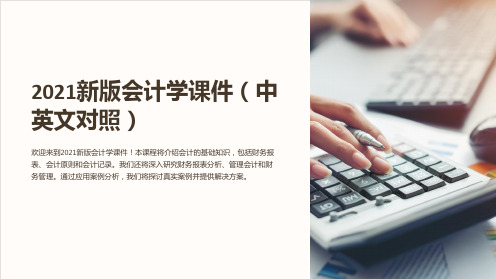

2021新版会计学课件(中英文对照)

3 财务风险管理

识别和管理财务风险,保护企业的利益。

应用案例分析

实际案例

深入研究真实的企业案例,探索 实际业务挑战。

解决方案

提供解决方案,解决实际业务问 题。

讨论与总结

与同学一起讨论案例分析结果并 总结收获。

现金流量表

跟踪企业的现金流入和流出, 评估现金流动性。

管理会计

1

预算和控制

制定预算并进行预算控制,帮助企业实

成本核算

2

现财务目标。

计算产品和服务的成本,支持经营决策。

3

经营决策

基于财务信息,做出合理的经营和投资 决策。

财务管理

1 资金管理

有效管理现金流,最大化企 业的资金利用效率。

2 投资分析

评估投资项目的可行性和回 报率。

2021新版会ห้องสมุดไป่ตู้学课件(中 英文对照)

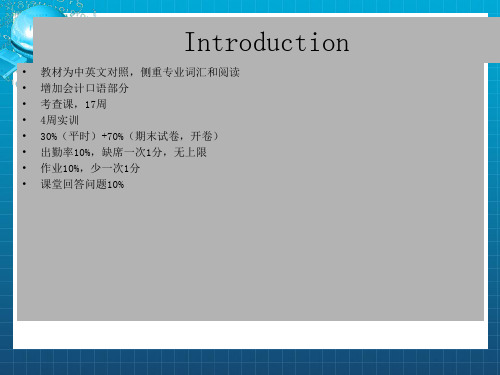

欢迎来到2021新版会计学课件!本课程将介绍会计的基础知识,包括财务报 表、会计原则和会计记录。我们还将深入研究财务报表分析、管理会计和财 务管理。通过应用案例分析,我们将探讨真实案例并提供解决方案。

课程介绍

目标和内容

学习会计基础知识,掌握财务报表分析和管理 会计技能。

学习方式

结合理论学习和实际案例分析,培养实践能力。

会计基础知识

财务报表

学习编制和解读财务报表,了解 企业的财务状况。

会计原则

掌握会计原则,确保会计记录的 准确性和可靠性。

会计记录

学习记录会计信息的方法和技巧。

财务报表分析

资产负债表

分析企业的资产、负债和所有 者权益。

利润表

了解企业的收入和费用,计算 净利润。

《会计英语》PPT课件

13. Accounts receivable应收帐款 14. Realized profits实现的利润 15. Financial accounting财务会计 16. Financial position财务状况 17. Operating results经营结果 18. Cash flow现金流量 19. Double entry复式记帐 20. Accounting entity会计主体 21. Going-concern持续经营 22. Accounting period会计期间 23. Accrual system权责发生 24. Cash basis accounting收付实现制

on 会计前提/假设 4. Accounting principles会计原则 5. Accounting elements会计要素 6. Assets资产 7. Liabilities负债 8. Owner’s equity所有者权益 9. Revenue收入 10.Profit利润 11.Expenses费用 12.Entity经营单位、实体单位

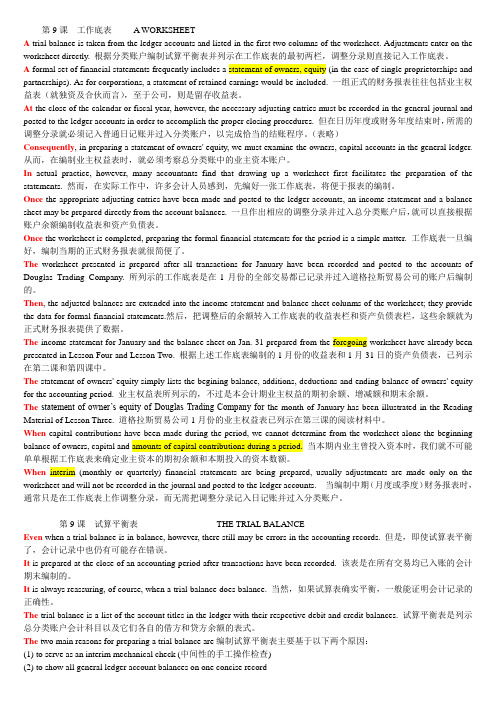

会计专业英语期末升级版

第9课工作底表 A WORKSHEETA trial balance is taken from the ledger accounts and listed in the first two columns of the worksheet. Adjustments enter on the worksheet directly. 根据分类账户编制试算平衡表并列示在工作底表的最初两栏,调整分录则直接记入工作底表。