财务管理【英文】

CashManagement(国际财务管理,英文版)

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10

$20 $25

$25

$10

$10

$10

18-17

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

18-8

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

$20 $30

18-9

18-6

Multilateral Netting

Consider a U.S. MNC with three subsidiaries and the following foreign exchange transactions:

$10 $

$20 $30

$40 $10

$25 $60

$20 $30

$30 $40

Multilateral Netting

Bilateral Netting would reduce the number of foreign exchange transactions by half:

$10 $35

$10

$40 $10

$25 $60

财务管理(英文第十三版)ch 3_sheena

= $246,900

Your firm has been told that it needs $74,300 today to fund a $120,000 expense 6 years from now. What rate of interest was used in the computation?

FVn=PV0 (FVIFi,n) (FVIFi,8) = FV8/PV0

= 3,000/1,000

=3

i= 14.68%

How long would it take for an investment of $1,000 to grow to $1,900 if we invested it at a compound annual interest rate of 10 percent?

SI = P0(i)(n)

SI: Simple Interest P0: Deposit today (t=0) i: Interest Rate per Period n:Number of Time Periods

Assume that you deposit $1,000 in an account earning 7% simple interest for 2 years. What is the accumulated interest at the end of the 2nd year?

What is the Present Value (PV) of the previous problem?

The Present Value is simply the $1,000 you originally deposited. That is the value today!

财务管理英语知识

第一章财务管理总论Overview of Financial Man agement一、主要专业术语或概念中英文对照财务管理financial management财务管理的目标the goal of financial management关于企业财务目标的三种综合表述:利润最大化profit maximization (maximize profit)每股盈余最大化earnings per share maximization股东财富最大化stockholder (shareholder) wealth maximization利益相关者stakeholder股东stockholder/shareholder债权人creditor/bondholder顾客customer职工employee政府government股东价值的影响因素the factors that affect the stockholder value (2008注会财管教材P4图1-1)经营现金流量operating cash flows资本成本cost of capital销售及其增长/成本费用revenues and its growth/cost and expense资本投资/营运资本capital investment/working capital资本结构/破产风险/税率/股利政策capital structure/bankruptcy risk/tax rate/dividend policy经营活动operating activity投资活动investing activity筹资活动financing activity股东、经营者和债权人利益的冲突与协调Conflicts of interest between shareholders,managers and creditors and their reconciliationAn agency relationship(代理关系) exists whenever a principal (委托人) hires an agent(代理人)to act on their behalf。

英文财务管理的概念

财务管理的概念:Concerns the acquisition, financing, and management of assets with some overall goal in mind. Investment decisions,Financing decisions,Asset management decisions。

The Goal of the Firm:Maximization of Shareholder Wealth:Value creation occurs when we maximize the share price for current shareholders.公司组织形式:Sole Proprietorships:Advantages:Simplicity,Low setup cost,Quick set up,Single tax filing on individual form。

Disadvantages:Unlimited liability,Hard to raise additional capital,Transfer of ownership difficulties,Partnerships (general and limited) Advantages:Can be simple,Low setup cost, higher than sole proprietorship,Relatively quick setup,Limited liability for limited partners。

Disadvantages:Unlimited liability for the general partner,Difficult to raise additional capital, but easier than sole proprietorship,Transfer of ownership difficultiesCorporations :Advantages:Limited liability,Easy transfer of ownership,Unlimited life,Easier to raise large quantities of capital。

财务管理(英文第十三版)ch 1_sheena

10

Fundamentals of Financial Management 2020/10/10

11

树立质量法制观念、提高全员质量意 识。20. 10.1020.10.10S aturda y, October 10, 2020

人生得意须尽欢,莫使金樽空对月。03:39:3003:39:3003:3910/10/ 2020 3:39:30 AM

2

It is concerned with the acquisition, financing, and management of assets with some overall goal in mind.

The decision function of financial management

牢记安全之责,善谋安全之策,力务 安全之 实。2020年10月10日 星期六3时39分 30秒Sa turday, October 10, 2020

创新突破稳定品质,落实管理提高效 率。20. 10.102020年10月10日 星期六 3时39分30秒20.10.10

谢谢大家!

The Role of Financial Management

What is Financial Management? The Goal of the Firm Corporate Governance Organization of the Financial

Management

Fundamentals of Financial Management 2020/10/10

作业标准记得牢,驾轻就熟除烦恼。2020年10月10日星期 六3时39分30秒 03:39:3010 October 2020

财务管理(英文第十三版)Ch 4_sheena

Cash Flow: only the face value received

at maturity.

Fundamentals of Financial

22

Management /12th Edition

Zero-Coupon Bond

and face value at maturity

V=

I

(1 + kd)1

I

I + MV

+ (1 + kd)2 + ... + (1 + kd)n

nI

=S t=1

(1 + kd)t

+

MV

(1 + kd)n

V = I (PVIFA kd, n) + MV (PVIF kd, n)

Fundamentals of Financial

Types of Bonds

A non-zero coupon-paying bond is a bond has a finite maturity and the bondholder receive interest payment and face value at maturity

Cash Flow: not only the fixed annual interest payment, but also the face value at maturity.

V = $120 (PVIFA10%, 30) + $1,000 (PVIF10%, 30) = $120 (9.427) + $1,000 (.057)

[Table IV]

[Table II]

= $1131.24 + $57

财务管理(Financial

财务管理(Financial管理学院张剑英一、课程称号:财务管理〔Financial Management〕二、授课对象:会计学财务管理管理信息系统专业本科生三、学时:1.总学时 54学时2.授课学时 46学时3.习题课 6学时4.案例剖析 2学时四、教学目的与要求本门课的教学注重理念性教学,除使先生掌握财务管理的基础知识和基本实际,了解和掌握财务管理的发生、开展进程和作用外,要灵敏掌握实务中财务效果的处置,并掌握资金的时间价值、企业筹资方式、投资方式、最优资本结构确定、营运资金管理以及财务剖析的基本内容及方法,最后经过案例剖析到达实际知识与实践的结合。

用两个专题性的案例使先生对债转股和管理层融资收买有一个片面的了解。

要求:记笔记,撰写案例剖析说明,往常作业两份。

五、内容体系«财务管理»这门课共包括九个局部的内容,主要为:第一章总论 (general view)第二章财务管理的基础概念〔basic concept of financial management〕第三章筹资方式〔financing methods〕第四章资金本钱与资本结构〔capital cost & capital structure〕第五章项目投资 (project investment)第六章证券投资 (securities investment)第七章营运资金的管理(management of working capital)第八章收益分配 (income distributing )第九章财务剖析 (financial analysis)六、教学布置七、参考教材及教材剖析1. 参考教材:〔1〕全国会计专业技术资历考试指导小组办公室编«财务管理»中国财政经济出版社1998年10月出版〔2〕财政部注册会计师考试委员会办公室编«财务本钱管理»西南财经大学出版社出版1999年3月出版〔3〕Eugene F. Brighman & Louis C. Gapenski <Intermediate Financial Management > 1998 .12. 教材剖析:〔1〕«财务管理»一书是全国会计专业技术资历考试指定用书,由全国会计专业技术资历考试指导小组办公室编写,该书的体系和内容契合我国国情,实务性较强,目前在国际财务管理教材中威望性较强。

英文财务管理(1)

英文财务管理(1)

Course content

The final section of book consist of five chapters that deal with financial forecasting, derivatives and risk management, multinational financial management, hybrid financing vehicles, and mergers(财务预测, 衍生工具和风险管理,跨国财务管理,混合融资 工具以及合并)。

企业、公司:(firm business enterprise company corporation venture)

英文财务管理(1)

Organization of the Financial Management Function: Figure 1-1

Board of Directors

President(CEO)

英文财务管理(1)

Chapter 1 Goals and Governance of the Firm Topics Covered: w Investment and Financing Decisions w What is a Corporation? w Who Is The Financial Manager? w Goals of the Corporation w Careers in Finance

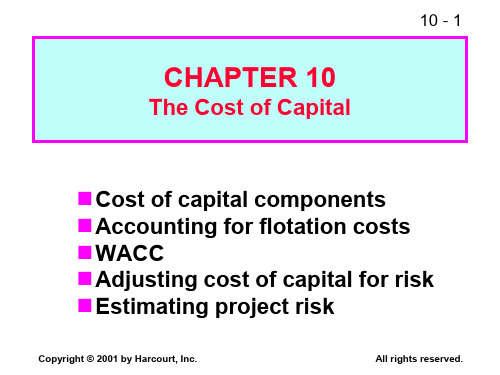

CH10TheCostofCapital(财务管理,英文版)

10 - 22

What’s a reasonable final estimate of ks?

Method CAPM DCF kd + RP

Average

Estimate 14.2% 13.8% 14.0% 14.0%

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

Example:

10 - 12

kp = 9% kd = 10% T = 40%

kp, AT = kp – kp (1 – 0.7)(T) = 9% – 9%(0.3)(0.4) =

7.92%.

What’s the expected future g?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

Retention growth rate:

10 - 19

g = (1 – Payout)(ROE) = 0.35(15%) = 5.25%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 3

Should we focus on before-tax or after-tax capital costs?

Stockholders focus on A-T CFs. Therefore, we should focus on A-T capital costs, i.e., use A-T costs in WACC. Only kd needs adjustment.

Copyright © 2001 by Harcourt, Inc.

财务管理专业用于英文表达

? 销售利润率( Return on sales ROS)

? 总资产回报率( Return on total asset ROTA)

? 总资产报酬率( Return on assets)

? 每股盈余( Earnings per share EPS)

? 资产负债率( debit-to-asset ratio)

? 负债与权益比率( debit-to-equity ratio)

? 已获利息倍数( Times-interest-earned ratio)

? 资产周转率 (Assets turnover ratio)

? 固定资产周转率( Fixed asset turnover ratio)

? 到期风险附加率( Maturity Risk Premium Rate)

? 财务估价( Financial value)

? 必要报酬率( Required return)

? 期望报酬率( Expected return)

? 实际报酬率( Effective return)

? 经营风险( Business Risk)

? 财务风险( Fincncial Risk)

? 财务杠杆系数( Degree of financial Levevage)

? 经营杠杆系数( Degree of Operating Leverrage)

? 股利无关论( dividend irrelevance)

? 终值( Future value)

? 现值( Present value)

? 现金流量( Cash flow)

财务管理(英文版)Financial Management

b) UNCERTAINTY of Returns

(Risk - Ch. 6)

Goal of the Firm

2) Shareholder Wealth Maximization?

this is the same as: a) Maximizing Firm Value b) Maximizing Stock Price

Government

The Corporation and Financial Markets

• Primary Market

The Corporation and Financial Markets

• Primary Market

– Market in which new issues of a security are sold to initial buyers.

Corporation Investors

Government

The Corporation and Financial Markets

Corporation

cash

Investors

Government

The Corporation and Financial Markets

Corporation

Cash flow

tax

Secondary markets

Government

The Corporation and Financial Markets

Corporation

reinvest

cash

securities

Investors

Cash flow

tax

财务管理英文课件Operating-and-Financial-Leverage.ppt

Impact of Operating Leverage on Profits

(in thousands) Firm F Firm V Firm 2F

Sales

$15

Operating Costs

$16.5 $29.25

Fixed

7

Variable

3

Operating Profit $ 5

Break-Even (Quantity) Point

Break-Even Point -- The sales volume required so that total revenues and total costs are equal; may be in units or in sales dollars.

volume.

When studying operating leverage, profits refers to operating profits before taxes (i.e., EBIT) and excludes

debt interest and dividend payments.

16-1

Operating Leverage

Operating Leverage -- The use of fixed operating costs by the firm.

One potential effect caused by the presence of operating leverage is that a change in the volume of sales results in a more than proportional change in operating profit (or loss).

FinancialManagement(财务管理,英文版)

Japanese yen

111.11

Australian dollar

1.5385

Yen:

1/0.009 = 111.11.

A. Dollar: 1/0.650 = 1.5385.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

What is a cross rate?

domestic financial management?

1. Different currency denominations.

2. Economic and legal ramifications.

3. Language differences.

4. Cultural differences.

1 Unit

Japanese yen

0.009

Australian dollar

0.650

Are these currency prices direct or indirect quotations?

Since they are prices of foreign currencies expressed in dollars, they are direct quotations.

the dollar profit on the sale?

250 yen = 250(0.0138) = 3.45 A. dollars. 6 – 3.45 = 2.55 Australian dollar profit. 1.5385 A. dollars = 1 U. S. dollar. Dollar profit = 2.55/1.5385 = $1.66.

财务管理的英文怎么说

财务管理的英文怎么说简单的说,财务管理是组织企业财务活动,处理财务关系的一项经济管理工作。

那么你知道财务管理用英文怎么说吗?下面店铺为大家带来财务管理的英文说法和相关英语例句,供大家阅读学习。

财务管理的英文说法1:financial management英 [faɪˈnænʃ(ə)l ˈmænidʒmənt]美 [faɪˈnænʃ(ə)l ˈmænɪdʒmənt]财务管理的英文说法2:management through finance英 [ˈmænidʒmənt θru: faiˈnæns]美 [ˈmænɪdʒmənt θru fəˈnæns]财务管理相关英文表达:国际财务管理师 International Finance Manager财务管理系统 financial management system财务管理组织 financial management organization财务管理与分析 Financial Management and Analysis家庭财务管理系统 Family Financial Management财务管理英文说法例句:1. In running a company, strict financial management means everything.经营一家公司, 严格的财务管理是至关重要的.2. The company was skillfully financed.这个公司的财务管理得很得法.3. Financial controls were given to priority.他们把财务管理当成头等大事.4. It also provides the ERP solution for the financemanagement system.提出了ERP在财务管理系统的解决方案.5. Financial management is key in any company or enterprise.在任何公司和企业单位中财务管理是关键.6. The perfect foreign trade enterprise supplies the chain the financial control.完善外贸企业供应链的财务管理.7. My assignment of strategy Financial Management is due today.我的转让的战略财务管理,是今天上交.8. Corporate enterprise, there are three levels of financial management.公司制企业财务管理存在着三个层次.9. Bachelor degree or above, majored in accounting, finance management or other related.大学本科学历,会计专业、财务管理专业.10. Investment decision - making is a substantial portion of enterprise finance management.投资决策是企业财务管理中的一个重要部分.11. B 2 C e - commerce system, client relationship management system, financial system, Internet marketing system.B2C电子商务系统、客户关系管理系统、财务管理系统、网络营销系统.12. Financing is an eternal topic in business development and financial management.融资是企业经营发展和财务管理的永恒话题.13. At least 3 years experiences at department managerial level . 4.具有三年以上国际物流行业财务管理经验.14. Financial management is guided by a framework ofguidelines, limits and benchmarks.财务管理是遵循一个框架,指导方针, 限制和基准.15. Real estate finance and investment, Financial Management, Project finance, etc.房地产融资与投资(双语) 、财务管理(双语) 、项目融资等.。

财务管理的英语介绍

财务管理的英语介绍英文回答:Financial management is the process of planning, organizing, directing, and controlling the financial activities of an organization. It involves the efficient and effective use of financial resources to achieve the organization's goals. Financial management is a critical function in any organization, regardless of its size or industry. It helps organizations to maximize theirfinancial performance and achieve their long-term objectives.The primary goals of financial management are to:Ensure the availability of financial resources to meet the organization's needs.Allocate financial resources efficiently and effectively.Manage financial risks.Maximize the organization's financial performance.Financial management is a complex and multifaceted field. It involves a wide range of activities, including:Financial planning and analysis.Budgeting.Capital budgeting.Cash flow management.Investment management.Credit management.Risk management.Financial managers play a vital role in the success of any organization. They are responsible for making sound financial decisions that help the organization achieve its goals. Financial managers must have a strong understanding of financial principles and practices, as well as a deep understanding of the organization's business.中文回答:财务管理是指规划、组织、指导和控制组织财务活动的过程。

财务管理英文

财务管理英文Introduction:Financial management is an essential aspect of any organization. It involves the management of money coming into the business and going out of the business. Financial managers are responsible for ensuring that an organization's financial resources are allocated appropriately, so as to achieve the organization's goals. In this paper, we will explore the key principles of financial management, discuss the major financial statements, and analyze the importance of financial planning and budgeting.Principles of Financial Management:The principles of financial management can be grouped into three broad categories: capital budgeting, capital structure, and working capital management. Capital budgeting refers to the process of allocating financial resources to long-term projects or investments. Capital structure, on the other hand, is concerned with the mix of long-term financing options used by the organization. Working capital management, finally, deals with the management of short-term assets and liabilities.Capital budgeting:Capital budgeting involves making investment decisions that will generate future cash flows. Essentially, it involves evaluating the potential returns of various investment options and selecting the most profitable investments. Key methods of capital budgeting include net present value (NPV), internal rate of return (IRR), and payback period. With NPV, the focus is on the present valueof future cash flows generated by an investment in relation to the initial investment. IRR, on the other hand, measures the rate of return of an investment, while payback period focuses on the time it takes to recoup the initial investment.Capital structure:The second principle of financial management is capital structure. This refers to the mix of long-term funding or financing options an organization uses to finance its operations. Most organizations use a combination of debt and equity financing. Debt financing involves borrowing money from lenders at a fixed interest rate, while equity financing involves offering investors ownership in the company in exchange for financial contributions. A crucial aspect of capital structure is determining the optimal mix of debt and equity financing that will minimize the company's overall cost of capital.Working capital management:The third principle of financial management is working capital management. This involves managing the day-to-day financial operations of the company, including maintaining an appropriate level of cash and other liquid assets to meet short-term obligations. Effective working capital management allows a company to maintain operations and meet financial obligations in the short term without resorting to high-interest borrowing.Financial Statements:One of the critical functions of financial management is to provide accurate and timely financial information to stakeholders. There are fourmajor financial statements companies use to communicate financial information: the balance sheet, income statement, cash flow statement, and statement of changes in equity.Balance sheet:The balance sheet presents a snapshot of the company's financial position by showing its assets and liabilities at a particular point in time. Assets include cash, buildings, equipment, and inventory, while liabilities include debts and other financial obligations.Income statement:The income statement shows how much revenue the company generated during a specific period and the expenses incurred to generate that revenue. After subtracting the expenses from revenues, the resulting figure represents net income or loss.Cash flow statement:The cash flow statement shows the inflow and outflow of cash during a particular period. It is divided into three categories: operating activities, investing activities, and financing activities.Statement of changes in equity:Finally, the statement of changes in equity shows any activity that affects shareholders' equity during the accounting period.Financial Planning and Budgeting:Financial planning and budgeting are critical components of financial management. Financial planning involves anticipating financial needs and developing a plan to meet them. Budgeting, on the other hand, involves allocating resources to specific activities, taking into account projected revenues and expenses.Benefits of financial planning and budgeting:Effective financial planning and budgeting provide several benefits to organizations. For instance, it helps organizations to prioritize investments, manage cash flow, identify potential risks and opportunities, and measure the success of their operations.Conclusion:In conclusion, financial management plays a critical role in the success of any organization. The principles of financial management include capital budgeting, capital structure, and working capital management. The major financial statements used to communicate financial information include the balance sheet, income statement, cash flow statement, and statement of changes in equity. Finally, financial planning and budgeting are essential components of financial management and enable organizations to prioritize investments, manage cash flow, identify potential risks and opportunities, and measure the success of their operations.。

关于财务管理的英文单词

关于财务管理的英文单词IntroductionFinancial management is a crucial aspect of running a business or managing personal finances. Understanding the vocabulary related to financial management is essential for effective communication and decision-making in this field. In this document, we will explore a comprehensive list of English words that are frequently used in the context of financial management.Basic Financial Terminology1.Assets: Resources owned by an individual or business, such as cash, investments, or property.2.Liabilities: Debts or financial obligations owed by an individual or business, including loans, credit card debt, or mortgages.3.Equity: The value of an individual’s or business’ assets minus its liabilities. It represents the ownership interest in a company.4.Income: The money earned from various sources, such as salaries, investments, or business revenue.5.Expenses: The costs incurred by an individual or business, including rent, utilities, salaries, and other operational expenses.6.Budget: A financial plan that outlines expected income and expenses over a specific period. It helps individuals and businesses manage their finances and achieve their financial goals.Financial Statements7.Balance Sheet: A financial statement that provides a snapshot of an indi vidual’s or business’ financial condition, showing assets, liabilities, and equity at a specific point in time.8.Income Statement: Also known as a profit and loss statement, it shows an individual’s or business’ revenue, expenses, and net profit or loss over a specific period. It helps evaluate performance and profitability.9.Cash Flow Statement: A statement that tracks the movement of cash into and out of an individual’s or business’ accounts over a specific period. It helps analyze liquidity and cash management.Financial Analysis10.Ratio Analysis: The process of evaluating financial statements using various ratios to assess an individual’s or business’ performance, liquidity, profitability, and solvency.11.Return on Investment (ROI): A metric used to evaluate the profitability of an investment. It measures the return or gn on an investment relative to the cost of the investment.12.Gross Margin: The difference between revenue and the cost of goods sold, expressed as a percentage. It indicates how efficiently a company produces its goods or services. Present Value (NPV): The present value of cash inflows minus the present value of cash outflows over a specific period. It helps individuals and businesses determine the profitability of an investment.14.Break-Even Point: The level of sales at which total revenue equals total expenses. It indicates the minimum level at which a business must operate to avoid losses.15.Risk Management: The process of identifying, assessing, and prioritizing risks in order to minimize their impact on financial goals. It involves developing strategies to mitigate risks and protect assets. Investment and Financial Instruments16.Stocks: Represent ownership in a company and are traded on stock exchanges.17.Bonds: Debt instruments issued by governments or corporations. Investors lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.18.Mutual Funds: Investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.19.Diversification: Spreading investments across different assets or asset classes to reduce risk.20.Derivatives: Financial contracts whose value is derived from an underlying asset, such as options, futures contracts, or swaps. They are used to manage risk or speculate on price movements.ConclusionThis document has presented a comprehensive list of English words related to financial management. Understanding these terms is essential for effectively managing personal finances or running a business. Constant learning and staying updated with financial terminology can help individuals and businesses make informed decisions and improve their financial well-being.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2

Covers you and your possessions in an apartment, a condo, a rented house, government quarters, the barracks and even on a ship.

Three out of four people do NOT have this coverage, but if you move, keep items in storage or in your car, you NEED it.

Financial Security

1. Protecting Yourself

2. Managing YOUR Money

3. Planning for the Future

Insurance

37

Parts Of An Auto Policy

• • • • • Liability Medical expense Uninsured/underinsured motorists Comprehensive Collision

Renters Property Insurance

• Covers property

– Stolen – Damaged by fire, vandalism, lighting, hail, wind, smoke, explosion, power surge etc.

• Average annual premium: $150–$200 • Named Perils vs. All Risk • Actual Cash Value vs. Replacement Cost

Version A

46A

Renters Property Insurance

A type of homeowners insurance that covers your personal property and your personal liability (including your pets) WORLDWIDE.

38

Price vs. Liability Limits

$860(s) / $688(m) 15/30/10 $1027(s) / $819(m) 100/200/50 Location: San Diego, CA $1099(s)/$875(m) 300/500/100

2010 Honda Accord 6-month premium 23-year-old male with 7 years driving experience Minimum coverage, clean driving record $500/$1000 deductible VA requires: 25/50/20

Version A

43A

Price vs. Type Of Vehicle

Both 23 years old

2010 Chevrolet Corvette 2010 Honda Accord

Male $750 $596

Female $596 $477

6-month premium Jacksonville, Florida

• Dependency and Indemnity Compensation (DIC)

• Survivor Benefit Plan (SBP)

• • • • •

• Spouse receives for life (unless remarries prior to age 57) • Child receives until age 18 (23 if in school) • Tax-Exempt No cost while on active duty 0 Benefit is 55% of Base Amount (75% of High 3 Average) Spouse receives for life (unless remarries prior to age 55) Reduced by Amount of DIC for Spouse Taxable Based on service member’s earned income Spouse receives until youngest child is age 16 Child receives until age 18 (19 if in school) May be taxed or reduced depending on other sources of income

Financial Management

Larry Diddlemeyer Captain, US Navy (Ret)

The USAA Educational Foundation

A Nonprofit Organization

• Does not endorse or promote any commercial supplier, product or service, nor does DOD or the U.S. Coast Guard.

Version A

45A

Price vs. Driving Record

$631

Clean

$861

2 tickets

$1178

2 accidents

$1749

Drunk Driving

Location: Ft. Benning, Georgia 2010 Honda Accord 6-month premium 23-year-old male Minimum coverage $500/$1000 deductible

• Provides income source for your survivoபைடு நூலகம்s • SGLI may be enough: • Spouse coverage: • Children Coverage: $400,000 $100,000 SGLI $10,000 per child

50

Active Duty Survivor Benefits

48

Renters Liability Insurance • Pays others for:

– Damages you cause – Injuries you cause

49

Life Insurance

• Covers your debts

– Funeral expenses – Outstanding bills