国际金融英文版Chapter3课后答案

米什金 货币金融学 英文版习题答案chapter 3英文习题

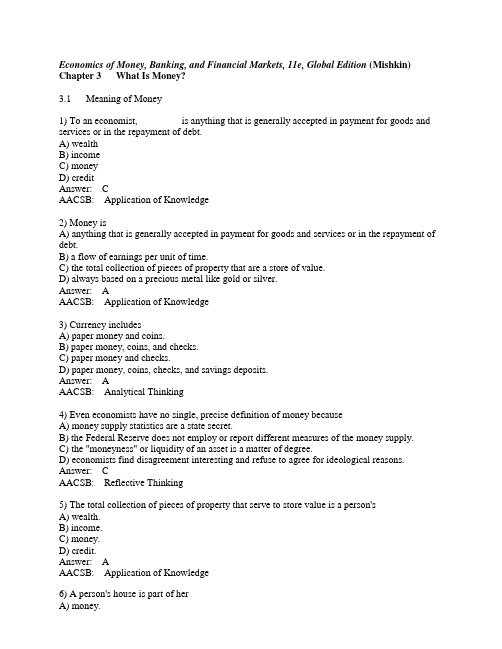

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 3 What Is Money?3.1 Meaning of Money1) To an economist, ________ is anything that is generally accepted in payment for goods and services or in the repayment of debt.A) wealthB) incomeC) moneyD) creditAnswer: CAACSB: Application of Knowledge2) Money isA) anything that is generally accepted in payment for goods and services or in the repayment of debt.B) a flow of earnings per unit of time.C) the total collection of pieces of property that are a store of value.D) always based on a precious metal like gold or silver.Answer: AAACSB: Application of Knowledge3) Currency includesA) paper money and coins.B) paper money, coins, and checks.C) paper money and checks.D) paper money, coins, checks, and savings deposits.Answer: AAACSB: Analytical Thinking4) Even economists have no single, precise definition of money becauseA) money supply statistics are a state secret.B) the Federal Reserve does not employ or report different measures of the money supply.C) the "moneyness" or liquidity of an asset is a matter of degree.D) economists find disagreement interesting and refuse to agree for ideological reasons. Answer: CAACSB: Reflective Thinking5) The total collection of pieces of property that serve to store value is a person'sA) wealth.B) income.C) money.D) credit.Answer: AAACSB: Application of Knowledge6) A person's house is part of herA) money.B) income.C) liabilities.D) wealth.Answer: DAACSB: Analytical Thinking7) ________ is used to make purchases while ________ is the total collection of pieces of property that serve to store value.A) Money; incomeB) Wealth; incomeC) Income; moneyD) Money; wealthAnswer: DAACSB: Reflective Thinking8) ________ is a flow of earnings per unit of time.A) IncomeB) MoneyC) WealthD) CurrencyAnswer: AAACSB: Application of Knowledge9) An individual's annual salary is herA) money.B) income.C) wealth.D) liabilities.Answer: BAACSB: Analytical Thinking10) When we say that money is a stock variable, we mean thatA) the quantity of money is measured at a given point in time.B) we must attach a time period to the measure.C) it is sold in the equity market.D) money never loses purchasing power.Answer: AAACSB: Reflective Thinking11) The difference between money and income is thatA) money is a flow and income is a stock.B) money is a stock and income is a flow.C) there is no difference—money and income are both stocks.D) there is no difference—money and income are both flows.Answer: BAACSB: Reflective Thinking12) Which of the following is a TRUE statement?A) Money and income are flow variables.B) Money is a flow variable.C) Income is a flow variable.D) Money and income are stock variables.Answer: CAACSB: Reflective Thinking13) Which of the following statements uses the economists' definition of money?A) I plan to earn a lot of money over the summer.B) Betsy is rich—she has a lot of money.C) I hope that I have enough money to buy my lunch today.D) The job with New Company gave me the opportunity to earn more money.Answer: CAACSB: Analytical Thinking3.2 Functions of Money1) Of money's three functions, the one that distinguishes money from other assets is its function as aA) store of value.B) unit of account.C) standard of deferred payment.D) medium of exchange.Answer: DAACSB: Reflective Thinking2) If peanuts serve as a medium of exchange, a unit of account, and a store of value, then peanuts areA) bank deposits.B) reserves.C) money.D) loanable funds.Answer: CAACSB: Reflective Thinking3) ________ are the time and resources spent trying to exchange goods and services.A) Bargaining costsB) Transaction costsC) Contracting costsD) Barter costsAnswer: BAACSB: Application of Knowledge4) Compared to an economy that uses a medium of exchange, in a barter economyA) transaction costs are higher.B) transaction costs are lower.C) liquidity costs are higher.D) liquidity costs are lower.Answer: AAACSB: Reflective Thinking5) When compared to exchange systems that rely on money, disadvantages of the barter system includeA) the requirement of a double coincidence of wants.B) lowering the cost of exchanging goods over time.C) lowering the cost of exchange to those who would specialize.D) encouraging specialization and the division of labor.Answer: AAACSB: Reflective Thinking6) The conversion of a barter economy to one that uses moneyA) increases efficiency by reducing the need to exchange goods and services.B) increases efficiency by reducing the need to specialize.C) increases efficiency by reducing transactions costs.D) does not increase economic efficiency.Answer: CAACSB: Reflective Thinking7) Which of the following statements best explains how the use of money in an economy increases economic efficiency?A) Money increases economic efficiency because it is costless to produce.B) Money increases economic efficiency because it discourages specialization.C) Money increases economic efficiency because it decreases transactions costs.D) Money cannot have an effect on economic efficiency.Answer: CAACSB: Reflective Thinking8) When economists say that money promotes ________, they mean that money encourages specialization and the division of labor.A) bargainingB) contractingC) efficiencyD) greedAnswer: CAACSB: Reflective Thinking9) Money ________ transaction costs, allowing people to specialize in what they do best.A) reducesB) increasesC) enhancesD) eliminatesAnswer: AAACSB: Application of Knowledge10) For a commodity to function effectively as money it must beA) easily standardized, making it easy to ascertain its value.B) difficult to make change.C) deteriorate quickly so that its supply does not become too large.D) hard to carry around.Answer: AAACSB: Reflective Thinking11) All of the following are necessary criteria for a commodity to function as money EXCEPTA) it must deteriorate quickly.B) it must be divisible.C) it must be easy to carry.D) it must be widely accepted.Answer: AAACSB: Analytical Thinking12) Whatever a society uses as money, the distinguishing characteristic is that it mustA) be completely inflation proof.B) be generally acceptable as payment for goods and services or in the repayment of debt.C) contain gold.D) be produced by the government.Answer: BAACSB: Reflective Thinking13) All but the most primitive societies use money as a medium of exchange, implying thatA) the use of money is economically efficient.B) barter exchange is economically efficient.C) barter exchange cannot work outside the family.D) inflation is not a concern.Answer: AAACSB: Reflective Thinking14) Kevin purchasing concert tickets with his debit card is an example of the ________ function of money.A) medium of exchangeB) unit of accountC) store of valueD) specializationAnswer: AAACSB: Analytical Thinking15) When money prices are used to facilitate comparisons of value, money is said to function as aA) unit of account.B) medium of exchange.C) store of value.D) payments-system ruler.Answer: AAACSB: Analytical Thinking16) When there are many goods is that in a barter systemA) transactions costs are minimized.B) there exists a multiple number of prices for each good.C) there is only one store of value.D) exchange of services is impossible.Answer: BAACSB: Reflective Thinking17) In a barter economy the number of prices in an economy with N goods isA) [N(N - 1)]/2.B) N(N/2).C) 2N.D) N(N/2) - 1.Answer: AAACSB: Analytical Thinking18) If there are five goods in a barter economy, one needs to know ten prices in order to exchange one good for another. If, however, there are ten goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 20B) 25C) 30D) 45Answer: DAACSB: Analytical Thinking19) If there are four goods in a barter economy, then one needs to know ________ prices in order to exchange one good for another.A) 8B) 6C) 5D) 4Answer: BAACSB: Analytical Thinking20) Because it is a unit of account, moneyA) increases transaction costs.B) reduces the number of prices that need to be calculated.C) does not earn interest.D) discourages specialization.Answer: BAACSB: Reflective Thinking21) Dennis notices that jackets are on sale for $99. In this case money is functioning as aA) medium of exchange.B) unit of account.C) store of value.D) payments-system ruler.Answer: BAACSB: Analytical Thinking22) As a store of value, moneyA) does not earn interest.B) cannot be a durable asset.C) must be currency.D) is a way of saving for future purchases.Answer: DAACSB: Analytical Thinking23) Patrick places his pocket change into his savings bank on his desk each evening. By his actions, Patrick indicates that he believes that money is aA) medium of exchange.B) unit of account.C) store of value.D) unit of specialization.Answer: CAACSB: Analytical Thinking24) ________ is the relative ease and speed with which an asset can be converted into a medium of exchange.A) EfficiencyB) LiquidityC) DeflationD) SpecializationAnswer: BAACSB: Application of Knowledge25) Increasing transactions costs of selling an asset make the assetA) more valuable.B) more liquid.C) less liquid.D) more moneylike.Answer: CAACSB: Reflective Thinking26) Since it does not have to be converted into anything else to make purchases, ________ is the most liquid asset.A) moneyB) stockC) artworkD) goldAnswer: AAACSB: Reflective Thinking27) Of the following assets, the least liquid isA) stocks.B) traveler's checks.C) checking deposits.D) a house.Answer: DAACSB: Analytical Thinking28) Ranking assets from most liquid to least liquid, the correct order isA) savings bonds; house; currency.B) currency; savings bonds; house.C) currency; house; savings bonds.D) house; savings bonds; currency.Answer: BAACSB: Analytical Thinking29) People hold money even during inflationary episodes when other assets prove to be better stores of value. This can be explained by the fact that money isA) extremely liquid.B) a unique good for which there are no substitutes.C) the only thing accepted in economic exchange.D) backed by gold.Answer: AAACSB: Reflective Thinking30) If the price level doubles, the value of moneyA) doubles.B) more than doubles, due to scale economies.C) rises but does not double, due to diminishing returns.D) falls by 50 percent.Answer: DAACSB: Analytical Thinking31) A fall in the level of pricesA) does not affect the value of money.B) has an uncertain effect on the value of money.C) increases the value of money.D) reduces the value of money.Answer: CAACSB: Analytical Thinking32) A hyperinflation isA) a period of extreme inflation generally greater than 50% per month.B) a period of anxiety caused by rising prices.C) an increase in output caused by higher prices.D) impossible today because of tighter regulations.Answer: AAACSB: Analytical Thinking。

托马斯国际金融课后习题答案解析

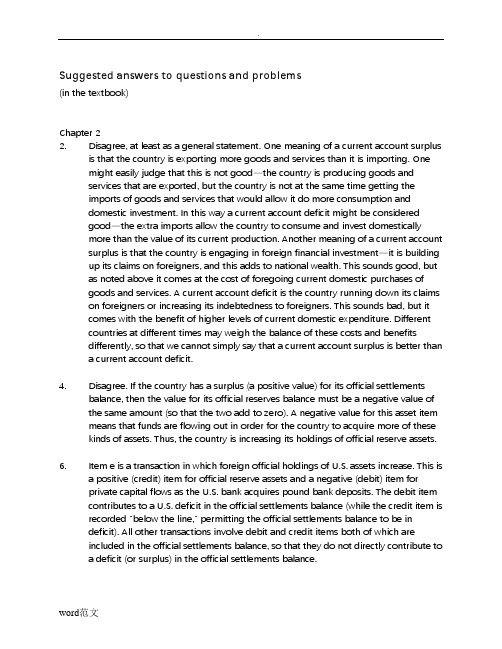

Suggested answers to questions and problems(in the textbook)Chapter 22. Disagree, at least as a general statement. One meaning of a current account surplusis that the country is exporting more goods and services than it is importing. Onemight easily judge that this is not good—the country is producing goods andservices that are exported, but the country is not at the same time getting theimports of goods and services that would allow it do more consumption anddomestic investment. In this way a current account deficit might be consideredgood—the extra imports allow the country to consume and invest domesticallymore than the value of its current production. Another meaning of a current account surplus is that the country is engaging in foreign financial investment—it is building up its claims on foreigners, and this adds to national wealth. This sounds good, but as noted above it comes at the cost of foregoing current domestic purchases ofgoods and services. A current account deficit is the country running down its claims on foreigners or increasing its indebtedness to foreigners. This sounds bad, but itcomes with the benefit of higher levels of current domestic expenditure. Differentcountries at different times may weigh the balance of these costs and benefitsdifferently, so that we cannot simply say that a current account surplus is better thana current account deficit.4. Disagree. If the country has a surplus (a positive value) for its official settlementsbalance, then the value for its official reserves balance must be a negative value of the same amount (so that the two add to zero). A negative value for this asset item means that funds are flowing out in order for the country to acquire more of these kinds of assets. Thus, the country is increasing its holdings of official reserve assets.6. Item e is a transaction in which foreign official holdings of U.S. assets increase. This isa positive (credit) item for official reserve assets and a negative (debit) item forprivate capital flows as the U.S. bank acquires pound bank deposits. The debit item contributes to a U.S. deficit in the official settlements balance (while the credit item is recorded "below the line," permitting the official settlements balance to be indeficit). All other transactions involve debit and credit items both of which areincluded in the official settlements balance, so that they do not directly contribute toa deficit (or surplus) in the official settlements balance.8. a. Merchandise trade balance: $330 - 198 = $132Goods and services balance: $330 - 198 + 196 - 204 = $124Current account balance: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settlements balance: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b. Change in official reserve assets (net) = - official settlements balance = -$23.The country is increasing its net holdings of official reserve assets.10. a. International investment position (billions): $30 + 20 + 15 - 40 - 25 = $0.The country is neither an international creditor nor a debtor. Its holding ofinternational assets equals its liabilities to foreigners.b. A current account surplus permits the country to add to its net claims onforeigners. For this reason the country's international investment position willbecome a positive value. The flow increase in net foreign assets results in the stock of net foreign assets becoming positive.Chapter 32. Exports of merchandise and services result in supply of foreign currency in theforeign exchange market. Domestic sellers often want to be paid using domesticcurrency, while the foreign buyers want to pay in their currency. In the process ofpaying for these exports, foreign currency is exchanged for domestic currency,creating supply of foreign currency. International capital inflows result in a supply of foreign currency in the foreign exchange market. In making investments in domestic financial assets, foreign investors often start with foreign currency and mustexchange it for domestic currency before they can buy the domestic assets. Theexchange creates a supply of foreign currency. Sales of foreign financial assets that the country's residents had previously acquired, and borrowing from foreigners by this country's residents are other forms of capital inflow that can create supply offoreign currency.4. The U.S. firm obtains a quotation from its bank on the spot exchange rate for buyingyen with dollars. If the rate is acceptable, the firm instructs its bank that it wants to use dollars from its dollar checking account to buy 1 million yen at this spotexchange rate. It also instructs its bank to send the yen to the bank account of the Japanese firm. To carry out this instruction, the U.S. bank instructs its correspondent bank in Japan to take 1 million yen from its account at the correspondent bank and transfer the yen to the bank account of the Japanese firm. (The U.S. bank could also use yen at its own branch if it has a branch in Japan.)6. The trader would seek out the best quoted spot rate for buying euros with dollars,either through direct contact with traders at other banks or by using the services of a foreign exchange broker. The trader would use the best rate to buy euro spot.Sometime in the next hour or so (or, typically at least by the end of the day), thetrader will enter the interbank market again, to obtain the best quoted spot rate for selling euros for dollars. The trader will use the best spot rate to sell her previously acquired euros. If the spot value of the euro has risen during this short time, thetrader makes a profit.8. a. The cross rate between the yen and the krone is too high (the yen value of the kroneis too high) relative to the dollar-foreign currency exchange rates. Thus, in aprofitable triangular arbitrage, you want to sell kroner at the high cross rate. Thearbitrage will be: Use dollars to buy kroner at $0.20/krone, use these kroner to buy yen at 25 yen/krone, and use the yen to buy dollars at $0.01/yen. For each dollarthat you sell initially, you can obtain 5 kroner, these 5 kroner can obtain 125 yen,and the 125 yen can obtain $1.25. The arbitrage profit for each dollar is therefore 25 cents.b. Selling kroner to buy yen puts downward pressure on the cross rate (the yenprice of krone). The value of the cross rate must fall to 20 (=0.20/0.01) yen/krone to eliminate the opportunity for triangular arbitrage, assuming that the dollar exchange rates are unchanged.10. a. The increase in supply of Swiss francs puts downward pressure on theexchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.b. The increase in supply of francs puts downward pressure on the exchange-ratevalue ($/SFr) of the franc. The monetary authorities must intervene to defend thefixed exchange rate by buying SFr and selling dollars.c. The increase in supply of francs puts downward pressure on the exchange-ratevalue ($/SFr) of the franc. The monetary authorities must intervene to defend thefixed exchange rate by buying SFr and selling dollars.d. The decrease in demand for francs puts downward pressure on theexchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.Chapter 42. You will need data on four market rates: The current interest rate (or yield) on bondsissued by the U.S. government that mature in one year, the current interest rate (or yield) on bonds issued by the British government that mature in one year, thecurrent spot exchange rate between the dollar and pound, and the current one-year forward exchange rate between the dollar and pound. Do these rates result in acovered interest differential that is very close to zero?4. a. The U.S. firm has an asset position in yen—it has a long position in yen. To hedge itsexposure to exchange rate risk, the firm should enter into a forward exchangecontract now in which the firm commits to sell yen and receive dollars at the current forward rate. The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.b. The student has an asset position in yen—a long position in yen. To hedge theexposure to exchange rate risk, the student should enter into a forward exchangecontract now in which the student commits to sell yen and receive dollars at thecurrent forward rate. The contract amounts are to sell 10 million yen and receive$90,000, both in 60 days.c. The U.S. firm has an liability position in yen—a short position in yen. To hedge itsexposure to exchange rate risk, the firm should enter into a forward exchangecontract now in which the firm commits to sell dollars and receive yen at the current forward rate. The contract amounts are to sell $900,000 and receive 100 million yen, both in 60 days.6. Relative to your expected spot value of the euro in 90 days ($1.22/euro), the currentforward rate of the euro ($1.18/euro) is low—the forward value of the euro isrelatively low. Using the principle of "buy low, sell high," you can speculate byentering into a forward contract now to buy euros at $1.18/euro. If you are correct in your expectation, then in 90 days you will be able to immediately resell those euros for $1.22/euro, pocketing a profit of $0.04 for each euro that you bought forward. If many people speculate in this way, then massive purchases now of euros forward(increasing the demand for euros forward) will tend to drive up the forward value of the euro, toward a current forward rate of $1.22/euro.8. a. The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) isgreater than its current spot value ($0.500/SFr).b. The covered interest differential "in favor of Switzerland" is ((1 + 0.005) (0.505) /0.500) - (1 + 0.01) = 0.005. (Note that the interest rate used must match the timeperiod of the investment.) There is a covered interest differential of 0.5% for 30 days(6 percent at an annual rate). The U.S. investor can make a higher return, coveredagainst exchange rate risk, by investing in SFr-denominated bonds, so presumably the investor should make this covered investment. Although the interest rate onSFr-denominated bonds is lower than the interest rate on dollar-denominatedbonds, the forward premium on the franc is larger than this difference, so that thecovered investment is a good idea.c. The lack of demand for dollar-denominated bonds (or the supply of these bondsas investors sell them in order to shift into SFr-denominated bonds) puts downward pressure on the prices of U.S. bonds—upward pressure on U.S. interest rates. Theextra demand for the franc in the spot exchange market (as investors buy SFr inorder to buy SFr-denominated bonds) puts upward pressure on the spot exchange rate. The extra demand for SFr-denominated bonds puts upward pressure on theprices of Swiss bonds—downward pressure on Swiss interest rates. The extra supply of francs in the forward market (as U.S. investors cover their SFr investments backinto dollars) puts downward pressure on the forward exchange rate. If the only rate that changes is the forward exchange rate, this rate must fall to about $0.5025/SFr.With this forward rate and the other initial rates, the covered interest differential is close to zero.10. In testing covered interest parity, all of the interest rates and exchange rates that areneeded to calculate the covered interest differential are rates that can observed inthe bond and foreign exchange markets. Determining whether the covered interest differential is about zero (covered interest parity) is then straightforward (although some more subtle issues regarding timing of transactions may also need to beaddressed). In order to test uncovered interest parity, we need to know not onlythree rates—two interest rates and the current spot exchange rate—that can beobserved in the market, but also one rate—the expected future spot exchangerate—that is not observed in any market. The tester then needs a way to find outabout investors' expectations. One way is to ask them, using a survey, but they may not say exactly what they really think. Another way is to examine the actualuncovered interest differential after we know what the future spot exchange rateactually turns out to be, and see whether the statistical characteristics of the actualuncovered differential are consistent with an expected uncovered differential ofabout zero (uncovered interest parity).Chapter 52. a. The euro is expected to appreciate at an annual rate of approximately ((1.005 -1.000)/1.000)⋅(360/180)⋅100 = 1%. The expected uncovered interest differential isapproximately 3% + 1% - 4% = 0, so uncovered interest parity holds (approximately).b. If the interest rate on 180-day dollar-denominated bonds declines to 3%, then thespot exchange rate is likely to increase—the euro will appreciate, the dollardepreciate. At the initial current spot exchange rate, the initial expected future spot exchange rate, and the initial euro interest rate, the expected uncovered interestdifferential shifts in favor of investing in euro-denominated bonds (the expecteduncovered differential is now positive, 3% + 1% - 3% = 1%, favoring uncoveredinvestment in euro-denominated bonds. The increased demand for euros in thespot exchange market tends to appreciate the euro. If the euro interest rate and the expected future spot exchange rate remain unchanged, then the current spot ratemust change immediately to be $1.005/euro, to reestablish uncovered interestparity. When the current spot rate jumps to this value, the euro's exchange ratevalue is not expected to change in value subsequently during the next 180 days. The dollar has depreciated immediately, and the uncovered differential then again iszero (3% + 0% - 3% = 0).4. a. For uncovered interest parity to hold, investors must expect that the rate of changein the spot exchange-rate value of the yen equals the interest rate differential, which is zero. Investors must expect that the future spot value is the same as the currentspot value, $0.01/yen.b. If investors expect that the exchange rate will be $0.0095/yen, then they expect theyen to depreciate from its initial spot value during the next 90 days. Given the other rates, investors tend to shift their investments toward dollar-denominatedinvestments. The extra supply of yen (and demand for dollars) in the spot exchange market results in a decrease in the current spot value of the yen (the dollarappreciates). The shift to expecting that the yen will depreciate (the dollarappreciate) sometime during the next 90 days tends to cause the yen to depreciate (the dollar to appreciate) immediately in the current spot market.6. The law of one price will hold better for gold. Gold can be traded easily so that anyprice differences would lead to arbitrage that would tend to push gold prices (stated in a common currency by converting prices using market exchange rates) back close to equality. Big Macs cannot be arbitraged. If price differences exist, there is noarbitrage pressure, so the price differences can persist. The prices of Big Macs(stated in a common currency) vary widely around the world.8. According to PPP, the exchange rate value of the DM (relative to the dollar) has risensince the early 1970s because Germany has experienced less inflation than has the United States—the product price level has risen less in Germany since the early1970s than it has risen in the United States. According to the monetary approach,the German price level has not risen as much because the German money supplyhas increased less than the money supply has increased in the United States, relative to the growth rates of real domestic production in the two countries. The Britishpound is the opposite case—more inflation in Britain than in the United States, and higher money growth in Britain.10. a. Because the growth rate of the domestic money supply (M s) is two percentagepoints higher than it was previously, the monetary approach indicates that theexchange rate value (e) of the foreign currency will be higher than it otherwisewould be—that is, the exchange rate value of the country's currency will be lower.Specifically, the foreign currency will appreciate by two percentage points more per year, or depreciate by two percentage points less. That is, the domestic currency will depreciate by two percentage points more per year, or appreciate by twopercentage points less.b. The faster growth of the country's money supply eventually leads to a faster rate ofinflation of the domestic price level (P). Specifically, the inflation rate will be twopercentage points higher than it otherwise would be. According to relative PPP, afaster rate of increase in the domestic price level (P) leads to a higher rate ofappreciation of the foreign currency.12. a. For the United States in 1975, 20,000 = k⋅100⋅800, or k = 0.25.For Pugelovia in 1975, 10,000 = k⋅100⋅200, or k = 0.5.b. For the United States, the quantity theory of money with a constant k meansthat the quantity equation with k = 0.25 should hold in 2002: 65,000 =0.25⋅260⋅1,000. It does. Because the quantity equation holds for both years with thesame k, the change in the price level from 1975 to 2002 is consistent with thequantity theory of money with a constant k. Similarly, for Pugelovia, the quantityequation with k = 0.5 should hold for 2002, and it does (58,500 = 0.5⋅390⋅300).14.a. The tightening typically leads to an immediate increase in the country's interestrates. In addition, the tightening probably also results in investors' expecting that the exchange-rate value of the country's currency is likely to be higher in the future. The higher expected exchange-rate value for the currency is based on the expectation that the country's price level will be lower in the future, and PPP indicates that thecurrency will then be stronger. For both of these reasons, international investors will shift toward investing in this country's bonds. The increase in demand for thecountry's currency in the spot exchange market causes the current exchange-ratevalue of the currency to increase. The currency may appreciate a lot because thecurrent exchange rate must "overshoot" its expected future spot value. Uncovered interest parity is reestablished with a higher interest rate and a subsequent expected depreciation of the currency.b. If everything else is rather steady, the exchange rate (the domestic currency priceof foreign currency) is likely to decrease quickly by a large amount. After this jump, the exchange rate may then increase gradually toward its long-run value—the value consistent with PPP in the long run.Chapter 62. We often use the term pegged exchange rate to refer to a fixed exchange rate,because fixed rates generally are not fixed forever. An adjustable peg is an exchange rate policy in which the "fixed" exchange rate value of a currency can be changedfrom time to time, but usually it is changed rather seldom (for instance, not morethan once every several years). A crawling peg is an exchange rate policy in whichthe "fixed" exchange rate value of a currency is changed often (for instance, weekly or monthly), sometimes according to indicators such as the difference in inflationrates.4. Disagree. If a country is expected to impose exchange controls, which usually makeit more difficult to move funds out of the country in the future, investors are likely to try to shift funds out of the country now before the controls are imposed. Theincrease in supply of domestic currency into the foreign exchange market (orincrease in demand for foreign currency) puts downward pressure on the exchange rate value of the country's currency—the currency tends to depreciate.6. a. The market is attempting to depreciate the pnut (appreciate the dollar) toward avalue of 3.5 pnuts per dollar, which is outside of the top of the allowable band (3.06 pnuts per dollar). In order to defend the pegged exchange rate, the Pugelovianmonetary authorities could use official intervention to buy pnuts (in exchange fordollars). Buying pnuts prevents the pnut’s value from declining (selling dollarsprevents the dollar’s value from rising). The intervention satisfies the excess private demand for dollars at the current pegged exchange rate.b. In order to defend the pegged exchange rate, the Pugelovian government couldimpose exchange controls in which some private individuals who want to sell pnuts and buy dollars are told that they cannot legally do this (or cannot do this without government permission, and not all requests are approved by the government). By artificially restricting the supply of pnuts (and the demand for dollars), thePugelovian government can force the remaining private supply and demand to"clear" within the allowable band. The exchange controls attempt to stifle the excess private demand for dollars at the current pegged exchange rate.c. In order to defend the pegged exchange rate, the Pugelovian government couldincrease domestic interest rates (perhaps by a lot). The higher domestic interestrates shift the incentives for international capital flows toward investments inPugelovian bonds. The increased flow of international financial capital into Pugelovia increases the demand for pnuts on the foreign exchange market. (Also, thedecreased flow of international financial capital out of Pugelovia reduces the supply of pnuts on the foreign exchange market.) By increasing the demand for pnuts (and decreasing the supply), the Pugelovian government can induce the private market to clear within the allowable band. The increased domestic interest rates attempt toshift the private supply and demand curves so that there is no excess privatedemand for dollars at the current pegged exchange rate value.8. a. The gold standard was a fixed rate system. The government of each countryparticipating in the system agreed to buy or sell gold in exchange for its owncurrency at a fixed price of gold (in terms of its own currency). Because eachcurrency was fixed to gold, the exchange rates between currencies also tended to be fixed, because individuals could arbitrage between gold and currencies if thecurrency exchange rates deviated from those implied by the fixed gold prices.b. Britain was central to the system, because the British economy was the leader inindustrialization and world trade, and because Britain was considered financiallysecure and prudent. Britain was able and willing to run payments deficits thatpermitted many other countries to run payments surpluses. The other countriesused their surpluses to build up their holdings of gold reserves (and of international reserves in the form of sterling-denominated assets). These other countries weresatisfied with the rate of growth of their holdings of liquid reserve assets, and most countries were able to avoid the crisis of running low on international reserves.c. During the height of the gold standard, from about 1870 to 1914, the economicshocks to the system were mild. A major shock—World War I—caused manycountries to suspend the gold standard.d. Speculation was generally stabilizing, both for the exchange rates between thecurrencies of countries that were adhering to the gold standard, and for theexchange rates of countries that temporarily allowed their currencies to float.10. a. The Bretton Woods system was an adjustable pegged exchange rate system.Countries committed to set and defend fixed exchange rates, financing temporarypayments imbalances out of their official reserve holdings. If a "fundamentaldisequilibrium" in a country's international payments developed, the country could change the value of its fixed exchange rate to a new value.b. The United States was central to the system. As the Bretton Woods system evolved,it became essentially a gold-exchange standard. The monetary authorities of other countries committed to peg the exchange rate values of their currencies to the U.S.dollar. The U.S. monetary authority committed to buy and sell gold in exchange for dollars with other countries' monetary authorities at a fixed dollar price of gold.c. To a large extent speculation was stabilizing, both for the fixed rates followed bymost countries, and for the exchange rate value of the Canadian dollar, whichfloated during 1950-62. However, the pegged exchange rate values of currenciessometimes did come under speculative pressure. International investors andspeculators sometimes believed that they had a one-way speculative bet againstcurrencies that were considered to be "in trouble.” If the country did manage todefend the pegged exchange rate value of its currency, the investors betting against the currency would lose little. They stood to gain a lot of profit if the currency wasdevalued. Furthermore, the large speculative flows against the currency requiredlarge interventions to defend the currency's pegged value, so that the government was more likely to run so low on official reserves that it was forced to devalue.12. a. The dollar bloc and the euro bloc. A number of countries peg their currencies to theU.S. dollar. A number of European countries use the euro, and, in addition, a number of other countries peg their currencies to the euro.b. The other major currencies that float independently include (as of the beginning of2002) the Japanese yen, the British pound, the Canadian dollar, and the Swiss franc.c. The exchange rates between the U.S. dollar and the other major currencies havebeen floating since the early 1970s. The movements in these rates exhibit trends in the long run—over the entire period since the early 1970s. The rates also showsubstantial variability or volatility in the short and medium runs—periods of less than one year to periods of several years. The long run trends appear to be reasonablyconsistent with the economic fundamentals emphasized by purchasing powerparity—differences in national inflation rates. The variability or volatility in the short or medium run is controversial. It may simply represent rational responses to thecontinuing flow of economic and political news that has implications for exchange rate values. The effects on rates can be large and rapid, because overshootingoccurs as rates respond to important news. However, some part of the largevolatility may also reflect speculative bandwagons that lead to bubbles thatsubsequently burst.Chapter 72. Disagree. In a sense a national government cannot go bankrupt, because it can printits own currency. But a national government can refuse to honor its obligations,even if it might be able to pay. If the benefit from not paying exceeds the cost of not paying, the government may rationally refuse to pay. And, a national governmentcan run short of foreign currency to pay obligations denominated in foreigncurrency, because it cannot print foreign money.4. The debt crisis in 1982 was precipitated by (a) increased cost of servicing debt,because of a rise in interest rates in the United States and other developed countries as tighter monetary policies were used to fight inflation, (b) decreased exportearnings in the debtor countries, because of decreased demand and lowercommodity prices as the tighter monetary policies resulted in a world recession, and(c) an investor shift to curtailing new lending and trying to get old loans repaidquickly, once it became clear that (a) and (b) would lead to some defaults.6. With free international lending Japan lends 1,800 (= 6,000 - 4,200) to America, at。

金融市场与金融机构基础(第3章)英文版答案

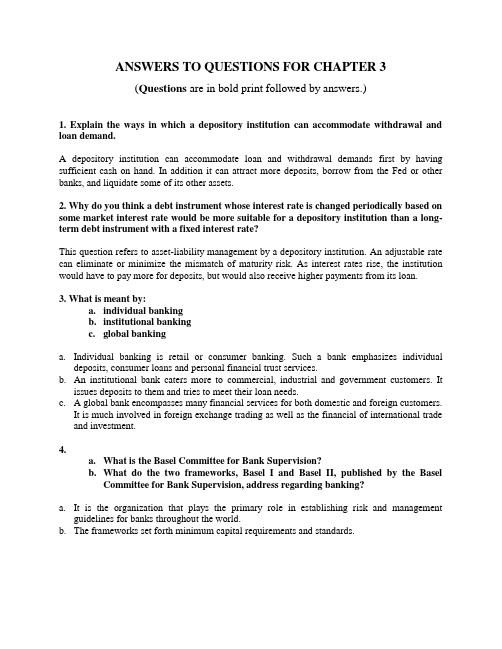

ANSWERS TO QUESTIONS FOR CHAPTER 3(Questions are in bold print followed by answers.)1. Explain the ways in which a depository institution can accommodate withdrawal and loan demand.A depository institution can accommodate loan and withdrawal demands first by having sufficient cash on hand. In addition it can attract more deposits, borrow from the Fed or other banks, and liquidate some of its other assets.2. Why do you think a debt instrument whose interest rate is changed periodically based on some market interest rate would be more suitable for a depository institution than a long-term debt instrument with a fixed interest rate?This question refers to asset-liability management by a depository institution. An adjustable rate can eliminate or minimize the mismatch of maturity risk. As interest rates rise, the institution would have to pay more for deposits, but would also receive higher payments from its loan.3. What is meant by:a.individual bankingb.institutional bankingc.global bankinga.Individual banking is retail or consumer banking. Such a bank emphasizes individualdeposits, consumer loans and personal financial trust services.b.An institutional bank caters more to commercial, industrial and government customers. Itissues deposits to them and tries to meet their loan needs.c. A global bank encompasses many financial services for both domestic and foreign customers.It is much involved in foreign exchange trading as well as the financial of international trade and investment.4.a.What is the Basel Committee for Bank Supervision?b.What do the two frameworks, Basel I and Basel II, published by the BaselCommittee for Bank Supervision, address regarding banking?a.It is the organization that plays the primary role in establishing risk and managementguidelines for banks throughout the world.b.The frameworks set forth minimum capital requirements and standards.5. Explain each of the following:a.reserve ratiob.required reservesa.The reserve ratio is the percentage of deposits a bank must keep in a non-interest-bearingaccount at the Fed.b.Required reserves are the actual dollar amounts based on a given reserve ratio.6. Explain each of the following types of deposit accounts:a.demand depositb.certificate of depositc.money market demand accounta.Demand deposits (checking accounts) do not pay interest and can be withdrawn at any time(upon demand).b.Certificates of Deposit (CDs) are time deposits which pay a fixed or variable rate of interestover a specified term to maturity. They cannot be withdrawn prior to maturity without a substantial penalty. negotiable CDs (large business deposits) can be traded so that the original owner still obtains liquidity when needed.c.Money Market Demand Accounts (MMDAs) are basically demand or checking accounts thatpay interest. Minimum amounts must be maintained in these accounts so that at least a 7-day interest can be paid. Since many persons find it not possible to maintain this minimum (usually around $2500) there are still plenty of takers for the non-interest-bearing demand deposits.7. How did the Glass-Steagall Act impact the operations of a bank?The Glass-Steagall Act prohibited banks from carrying out certain activities in the securities markets, which are principal investment banking activities. It also prohibited banks from engaging in insurance activities.28. The following is the book value of the assets of a bank:Asset Book Value (in millions)U.S. Treasury securities $ 50Municipal general obligationbonds50Residential mortgages 400Commercial loans 200Total book value $700a.Calculate the credit risk-weighted assets using the following information:Asset Risk WeightU.S. Treasury securities 0%Municipal general obligationbonds20Residential mortgages 50Commercial loans 100b.What is the minimum core capital requirement?c.What is the minimum total capital requirement?a.The risk weighted assets would be $410b.The minimum core capital is $28 million (.04X700) i.e., 4% of book value.c.Minimum total capital (core plus supplementary capital) is 32.8 million, .08X410, which is8% of the risk-weighted assets.9. In later chapters, we will discuss a measure called duration. Duration is a measure of the sensitivity of an asset or a liability to a change in interest rates. Why would bank management want to know the duration of its assets and liabilities?a.Duration is a measure of the approximate change in the value of an asset for a 1% change ininterest rates.b.If an asset has a duration of 5, then the portfolio’s value will change by approximately 5% ifinterest rate changes by 100 basis points.3-310.a.Explain how bank regulators have incorporated interest risk into capitalrequirements.b.Explain how S&L regulators have incorporated interest rate risk into capitalrequirements.a.The FDIC Improvement Act of 1991, required regulators of DI to incorporate interest raterisk into capital requirements. It is based on measuring interest rate sensitivity of the assets and liabilities of the bank.b.The OST adopted a regulation that incorporates interest rate risk for S&L. It specifies that ifthrift has greater interest rate risk exposure, there would be a deduction of its risk-based capital. The risk is specified as a decline in net profit value as a result of 2% change in market interest rate.11. When the manager of a bank’s portfolio of securities considers alternative investments, she is also concerned about the risk weight assigned to the security. Why?The Basel guidelines give weight to the credit risk of various instruments. These weights are 0%, 20%, 50% and 100%. The book value of the asset is multiplied by the credit risk weights to determine the amount of core and supplementary capital that the bank will need to support that asset.12. You and a friend are discussing the savings and loan crisis. She states that “the whole mess started in the early 1980s.When short-term rates skyrocketed, S&Ls got killed—their spread income went from positive to negative. They were borrowing short and lending long.”a.What does she mean by “borrowing short and lending long”?b.Are higher or lower interest rates beneficial to an institution that borrows shortand lends long?a.In this context, borrowing short and lending long refers to the balance sheet structure ofS&Ls. Their sources of funds (liabilities) are short-term (mainly deposits) and their uses (assets) are long-term in nature (e.g. residential mortgages).b.Since long-term rates tend to be higher than short-term ones, stable interest rates would bethe best situation. However, rising interest rates would increase the cost of funds for S&Ls without fully compensating higher returns on assets. Hence a decline in interest rate spread or margin. Thus lower rates, having an opposite effect, would be more beneficial.13. Consider this headline from the New York Times of March 26, 1933: “Bankers will fight Deposit Guarantees.” In this article, it is stated that bankers argue that deposit guarantees will encourage bad banking. Explain why.The barrier imposed by Glass-Steagall act was finally destroyed by the Gramm-Leach Bliley Act of 1999. This act modified parts of the BHC Act so as to permit affiliations between banks and insurance underwriters. It created a new financial holding company, which is authorized to4engage in underwriting and selling securities. The act preserved the right of state to regulate insurance activities, but prohibits state actions that have would adversely affected bank-affiliated firms from selling insurance on an equal basis with other insurance agents.14. How did the Gramm-Leach-Bliley Act of 1999 expand the activities permitted by banks?a.Deposit insurance provides a safety net and can thus make depositors indifferent to thesoundness of the depository recipients of their funds. With depositors exercising little discipline through the cost of deposits, the incentive of some banks owners to control risk-taking accrue to the owners. It becomes a “heads I win, tails you lose” situation.b.One the positive side, deposit insurance provides a comfort to depositors and thus attractsdepositors to financial institutions. But such insurance carries a moral hazard, it can be costly and, unless premiums are risk-based, it forces the very sound banks to subsidize the very risky ones.15. The following quotation is from the October 29, 1990 issue of Corporate Financing Week:Chase Manhattan Bank is preparing its first asset-backed debt issue, becomingthe last major consumer bank to plan to access the growing market, Street asset-backed officialsSaid…Asset-backed offerings enable banks to remove credit card or other loanreceivables from their balance sheets, which helps them comply with capitalrequirements.a.What capital requirements is this article referring to?b.Explain why asset securitization reduces capital requirements.a.The capital requirements mentioned are risk based capital as specified under the BaselAgreement, which forces banks to hold minimum amounts of equity against risk-based assets.b.Securitization effectively eliminates high risk based loans from the balance sheet. The capitalrequirements in the case of asset securitization are lower than for a straight loan.16. Comment on this statement: The risk-based guidelines for commercial banks attempt to gauge the interest rate risk associated with a bank’s balance sheet.This statement is incorrect. The risk-based capital guidelines deal with credit risk, not interest-rate risk, which is the risk of adverse changes of interest rates on the portfolio position.17.a.What is the primary asset in which savings and loan associations invest?b.Why were banks in a better position than savings and loan associations toweather rising interest rates?a.Savings and Loans invest primarily in residential mortgages.b.During 1980's, although banks also suffered from the effects of deregulation and rising3-5interest rates, relatively they were in a better position than S&L association because of their superior asset-liability management.618. What federal agency regulates the activities of credit unions?The principal federal regulatory agency is the National Credit Union Administration.3-7。

陈雨露国际金融第三章课后答案

5、假定芝加哥IMM交易的3月到期的英镑期货价格为$1.5020£,某银行报同一交割日期的英镑远期合约价格为$1.5000£。

(1)如果不考虑交易成本,是否存在无风险套利机会?

存在

(2)应当如何操作才能去谋取收益?使计算最大可能收益。

买入远期合约,卖出期货合约。

最大可能收益为1.3%

(3)套利活动对两个尺长的英镑价格将产生怎样影响?

远期市场英镑价格上升,期货市场英镑价格下降。

(4)结合以上分析,试论证外汇期货市场与外汇远期市场之间存在联动性。

期货市场与远期市场上的价格应该趋于一致,苟泽存在套利机会,套利行为会使得价格差异消失,比如远期市场的外汇价格低于期货市场的外汇价格,则可以在远期市场买入外汇,同时在期货市场卖出外汇,这样既可以获得无缝小收益。

但如果考虑到远期市场的流动性相对较差,远期市场的外汇价格可能相对略低,而期货市场的流动性较好,外汇价格可以略高。

6、家丁一美国企业的德国分公司将在9月份收到125万欧元的货款。

为规避欧元贬值风险,购买了20张执行汇率为$0.900/€的欧式看跌期权,期权费为每欧元0.0216美元。

(

(2)若合约到期日的现汇汇率为$0.850/€,计算该公司的损益结果。

公司在期权市场盈利$35500。

国际金融中英文版答案)

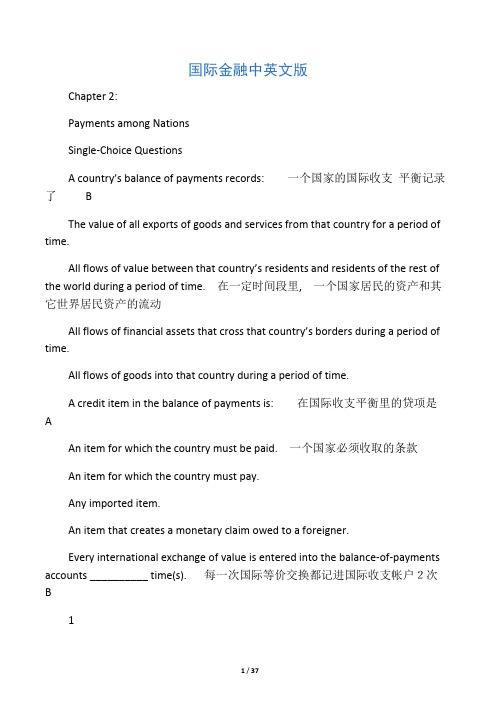

国际金融中英文版答案)国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country?s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from that countryfor a period of time.b.All flows of value between that c ountry?s residents andresidents of the rest of the world during a period of time.在一定时间段里,一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country?s bordersduring a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid.一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay.一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following items isalways recorded as a positive entry? D在国际收支中,下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services./doc/864363004.html,itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals …compensating? transactions.d.Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits inthe U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account at Credit Suissein Basel (Switzerland) to his account at a San Francisco branchof Wells Fargo Bank.b.A French resident transfers $100 from his account at WellsFargo Bank in San Francisco to his Credit Suisse account in Basel.一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a French resident.d.A U.S. resident sells his Credit Suisse stock to a Frenchresident.8.An increase in a nation's financial liabilities to foreign residents is a:一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held by governmentsand that are recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.W hich of the following is considered a capital inflow? 下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen?s repayment of a loan from a foreign bank.11.I n a country?s balance of payments, which of the followingtransactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners are decreased.外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold to nonresidents.d.Securities are sold by domestic residents to nonresidents.12.T he role of ___D_______ is to direct one nation?s savings intoanother nation?s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows资金流13.T he net value of flows of goods, services, income, and unilateraltransfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.T he net value of flows of financial assets and similar claims(excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.T he financial account in the U.S. balance of payments includes:美国国家收支表中的金融帐包括:Ba.Everything in the current account.b.U.S. government payments to other countries for the use ofmilitary bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.AU.S. resident increasing her holdings of a foreign financial assetcauses a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account.美国资本帐的借帐17.A foreign resident increasing her holdings of a U.S. financial assetcauses a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18.A deficit in the current account: 经常帐户中的赤字Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasing imports.19.I n September, 2005, exports of goods from the U.S. decreased $3.3billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account.经常帐户d.Unilateral transfers.20.W hich of the following would contribute to a U.S. current accountsurplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reduction onimported goods.b.The United States cuts back on American military personnelstationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in the UnitedStates.21.W hich of the following transactions is recorded in the financialaccount?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chinese toplay an exhibition game in Beijing, China.22.I f a British business buys U.S. government securities, how will thisbe entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是?Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase in U.S.assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decrease in U.S.assets held by foreigners.23.I n the balance of payments, the statistical discrepancy or error term isused to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum of all credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-payments deficit.d.Obtain an accurate account of a balance-of-payments surplus.24.O fficial reserve assets are: 官方储备资产是 Ba.The gold holdings in the nation?s central bank.b.Money like assets that are held by governments and that arerecognized by governments as fully acceptable for payments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可/doc/864363004.html,ernment T-bills and T-bonds./doc/864363004.html,ernment holdings of SDR?s25.W hich of the following constitutes the largest component of theworld?s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies.外汇(币)26.T he net accumulation of foreign assets minus foreign liabilities is:海外净资产的积累减去外债等于C/doc/864363004.html, official reserves./doc/864363004.html, domestic investment./doc/864363004.html, foreign investment.国外投资净值/doc/864363004.html, foreign deficit.27.A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and service trade,international income payments and receipts and internationaltransfers.28.T he ___C_______ measures the sum of the current accountbalanceplus the private capital account balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.I f the overall balance is in __A________, there is an accumulation ofofficial reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.W hich of the following is the current account balance NOT equal to?以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment./doc/864363004.html, foreign investment.d.The difference between government saving and governmentinvestment. 政府储蓄与政府投资的差值True/False Questions31.C apital inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32.T he net value of the flow of goods, services, income, and gifts is thecurrent account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.T he net flow of financial assets and similar claims is the privatecurrent account balance. 金融资产和类似的资产的净值叫经常帐目余额34.T he majority of countries' official reserves assets are now foreignexchange assets, financial assets denominated in a foreign currencythat is readily acceptable in international transactions. (T)大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35.A country's financial account balance equals the country's net foreigninvestment.一个国家的金融帐差额相当于一个国家的净国外投资36.A country has a current account deficit if it is saving more than it isinvesting domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.T he official settlements balance measures the sum of the capitalaccount balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38.A nation's international investment position shows itsstock ofinternational assets and liabilities at a moment in time. (T)一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39.A nation is a borrower if its current account is in deficit during a timeperiod. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40.A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41.A transaction leading to a foreign resident increasing her holdings ofa U.S. financial asset will be recorded as a debit on the U.S. financialaccount.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42.A credit item is an item for which a country must pay. 贷项是指一个国家必须还款的条项43.G old is a major reserve asset that is currently often used in officialreserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.T he current account balance is equal to the difference betweendomestic product and national expenditure.(T)经常项目余额等于国民生产与国民支出的差额45.I n 2007 U.S. households, businesses and government were buyingmore goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

实用国际金融英语参考答案

《实用国际金融英语》参考答案Chapter 1Lead-in Activities1. Balance of payment data serve as record of the flows of goods, services and finance between an economy and the rest of the world. As one of the primary functions of the IMF is to prevent financial crises and assist countries in balance of payment difficulties, the collection of standardized, comparable balance of payment data is seen as a core task.BOP is a statistical statement that summarizes, for a specific period (typically a year or quarter), the economic transactions of an economy with the rest of the world. It covers:·All the goods, services, factor income and current transfers an economy receives from or provides to the rest of the world;·Capital transfers and changes in an economy’s external financial claims and liabilities.2. When a country has a surplus in its current account, i.e. when its exports exceed its imports, there will probably be a surplus in the balance of payment because the current account forms a very large proportion in the balance of payment. The surplus means the supply of foreign exchange exceeds demand. The monetary authority has to increase the purchase of the foreign currency and the stock of its international reserve. Meanwhile, the supply of domestic currency adds at an accelerated speed, which may lead to further issue of the local currency and cause inflation.3. When there is a long-lasting surplus in the balance of payment, particularly in the current account, there will also be excessive demand for its currency. The country’s exchange rate will rise, unless the central bank is willing to provide its currency to the market in exchange for foreign currencies. For example, when the export of the United States exceeds much more than import, a large quantity of US dollars are wanted by those importers to pay for the US goods. Thus, the exchange rate of US dollars rises.When the balance of payment has a long-lasting deficit, the payable debts denominated in foreign currencies are more than receivable claims; there will be a considerable demand for foreign currencies over the supply. As a result, the foreign currencies wanted appreciate, and the domestic one devalues.4.Temporary drop of surplus or moderate short-term deficit does not seriously affect a country’s economy or foreign trade. On one hand, deficit means larger amount of import than export in current account; on the other hand, it more likely shows an increasing demand of foreign currencies to pay for the imported goods. In other words, deficit may cause the raise of exchange rate of foreign hard currencies, which is conducive to the investors from the issuing countries of these appreciating currencies. This is surely good news to those that are in need of foreign investment. Temporary drop of surplus helps cool off the national economy and serves as a brake stopping ongoing inflation.5.The stock of international reserve should be neither more or less than necessary. The International Exchange Reserves are kept in the debit entry in BOP statements in that the monetary authority has to pay in exchange for the foreign hard currencies. Therefore, the amount and composition of exchange reserves are to be decided by taking the following factors into consideration.(1) The duration of the government’s external debt should be related to the duration of thereserves, with emphasis on the interest rate exposure risk.(2) High-risk-return assets should be limited within a safe range.(3) One of the most important issues raised in the context of investing the reserves of a centralbank is the choice of a reference basket.It is well recognized that the lowest level of the stock of international reserve should be no less than the amount payable for a 3-month import. And, the stronger an economy is, the less international reserve is to be kept.6. C7. CExercisesI. True or False1. F2. F3. F4. F5. F6. F7. F8. F9. F 10. F11. F 12. T 13. F 14. F 15. TII.Translation Task1.在与国际货币基金组织的技术援助使团于2000年上半年进行了磋商之后,国家外汇管理局吸取了国际通行的经验,以提高其国际收支报告的及时性。

国际金融英文版习题Chapter-3(1)

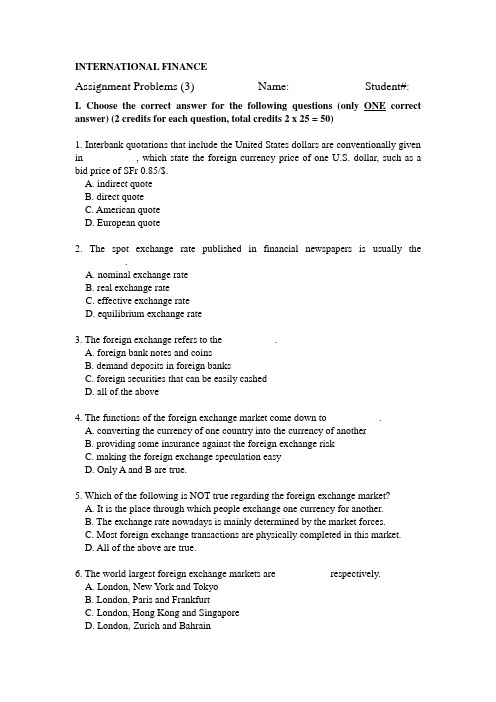

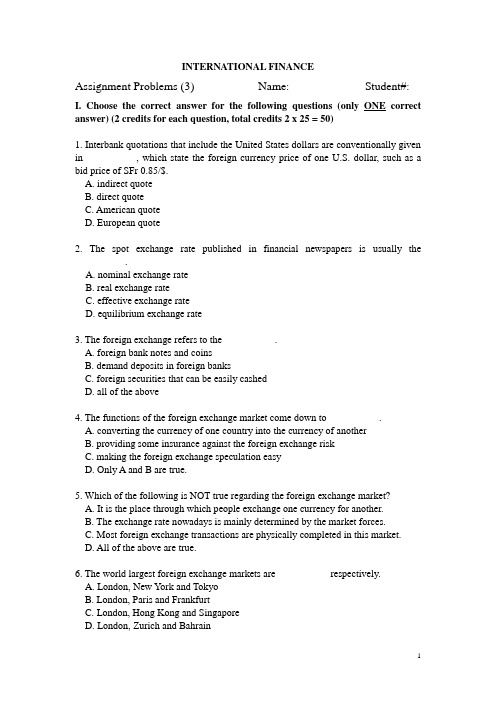

INTERNATIONAL FINANCEAssignment Problems (3) Name: Student#: I. Choose the correct answer for the following questions (only ONE correct answer) (2 credits for each question, total credits 2 x 25 = 50)1. Interbank quotations that include the United States dollars are conventionally given in __________, which state the foreign currency price of one U.S. dollar, such as a bid price of SFr 0.85/$.A. indirect quoteB. direct quoteC. American quoteD. European quote2. The spot exchange rate published in financial newspapers is usually the __________.A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate3. The foreign exchange refers to the __________.A. foreign bank notes and coinsB. demand deposits in foreign banksC. foreign securities that can be easily cashedD. all of the above4. The functions of the foreign exchange market come down to __________.A. converting the currency of one country into the currency of anotherB. providing some insurance against the foreign exchange riskC. making the foreign exchange speculation easyD. Only A and B are true.5. Which of the following is NOT true regarding the foreign exchange market?A. It is the place through which people exchange one currency for another.B. The exchange rate nowadays is mainly determined by the market forces.C. Most foreign exchange transactions are physically completed in this market.D. All of the above are true.6. The world largest foreign exchange markets are __________ respectively.A. London, New York and TokyoB. London, Paris and FrankfurtC. London, Hong Kong and SingaporeD. London, Zurich and Bahrain7. The foreign exchange market is NOT efficient because __________.A. monetary authorities dominate the foreign exchange market and everybody knows that by definition, central banks are inefficientB. commercial banks and other participants of the market do not compete with one another due to the fact that transaction takes place around the world and not in a single centralized locationC. foreign exchange dealers have different prices such as bid and ask pricesD. None of the reasons listed are correct because the foreign exchange market is an efficient market8. __________ earn a profit by a bid-ask spread on currencies they buy and sell. __________ on the other hand, earn a profit by bringing together buyers and sellers of foreign exchanges and earning a commission on each sale and purchase.A. Foreign exchange brokers; foreign exchange dealersB. Foreign exchange dealers; foreign exchange brokersC. arbitragers; speculatorsD. commercial banks; central banks9. Most foreign exchange transactions are through the U.S. dollars. If the transaction is expressed as the currencies per dollar, this is known as __________ whereas __________ are expressed as dollars per currency.A. direct quote; indirect quoteB. indirect quote; direct quoteC. European quote; American quoteD. American quote, European quote10. From the viewpoint of a Japanese investor, which of the following would be a direct quote?A. SFr 1.25/€B. $1.55/₤C. ¥ 110/€D. €0.0091/ ¥11. Which of the following is true about the foreign exchange market?A. It is a global network of banks, brokers, and foreign exchange dealers connected by electronic communications system.B. The foreign exchange market is usually located in a particular place.C. The foreign exchange rates are usually determined by the related monetary authorities.D. The main participants in this market are currency speculators from different countries.12. The extent to which the income from individual transactions is affected by fluctuations in foreign exchange values is considered to be _________.A. Translation exposureB. economic exposureC. transaction exposureD. accounting exposure13. Which of the following exchange rates is adjusted for price changes?A. nominal exchange rateB. real exchange rateC. effective exchange rateD. equilibrium exchange rate14. Suppose the exchange rate of the RMB versus U.S. dollar is ¥6.8523/$ now. If the RMB were to undergo a 10% depreciation, the new exchange rate in terms of ¥/$ would be:A. 6.1671B. 7.5375C. 6.9238D. 7.613515. At least in a U.S. MNC’s financial accounting statement, if the value of the euro depreciates rapidly against that of the dollar over a year, this would reduce the dollar value of the euro profit made by the European subsidiary. This is a typical __________.A. transaction exposureB. translation exposureC. economic exposureD. operating exposure16. A Japanese-based firm expects to receive pound-payment in 6 months. The company has a (an) __________.A. economic exposureB. accounting exposureC. long position in sterlingD. short position in sterling17 The exposure to foreign exchange risk known as Translation Exposure may be defined as __________.A. change in reported owner’s equity in consolidated financial statements caused by a change in exchange ratesB. the impact of settling outstanding obligations entered into before change in exchange rates but to be settled after change in exchange ratesC. the change in expected future cash flows arising from an unexpected change in exchange ratesD. All of the above18 When a firm deals with foreign trade or investment, it usually has foreign exchange risk exposure. So if an American firm expects to receive a dollar-paymentfrom a Chinese company in the next 30 days, the U.S. firm has the possible __________.A. economic exposureB. transaction exposureC. translation exposureD. none of the above19. In order to avoid the possible loss because of the exchange rate fluctuations, a firm that has a __________ position in foreign exchanges can __________ that position in the forward market.A. short; sellB. long; sellC. long; buyD. none of the above20. A forward contract to deliver Japanese yens for Swiss francs could be described either as __________ or __________,A. selling yens forward; buying francs forwardB. buying francs forward; buying yens forwardC. selling yens forward; selling francs forwardD. selling francs forward; buying yens forward21. Dollars are trading at S0SFr/$=SFr0.7465/$ in the spot market. The 90-day forward rate is F1SFr/$=SFr0.7432/$. So the forward __________ on the dollar in basis points is __________:A. discount, 0.0033B. discount, 33C. premium, 0.0033D. premium, 3322. If the spot rate is $1.35/€, 3-month forward rate is $1.36/€, which of the following is NOT true?A. euro is at forward premium by 100 points.B. dollar is at forward discount by 100 points.C. dollar is at forward discount by 55 points.D. euro is at forward premium by 2.96% p.a.23. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the outright forward quote in American term should be __________.A. 1.0330 – 1.0345B. 1.0280 – 1.0285C. 0.9681 – 0.9667D. 0.9728 – 0.972324. If the spot C$/$ rate is 1.0305/15, forward dollar is 25/30 premium, the $/C$ forward quote in terms of points should be __________.A. 30/25B. 25/30C. – (23/28)D. – (28/23)25. The current U.S. dollar exchange rate is ¥85/$. If the 90-day forward dollar rate is ¥90/$, then the yen is selling at a per annum __________ of __________.A. premium; 5.88%B. discount; 5.56%C. premium; 23.52%D. discount; 22.23%II. ProblemsQuestions 1 through 10 are based on the information presented in Table 3.1. (2 credits for each question, total credits 2 x 10 = 20)Table 3.1Country Exchange rate Exchange rate CPI V olume of Volume of (2008) (2009) (2008) exports to U.S imports from U.S. Germany €0.75/$ €0.70/$ 102.5 $200m $350m Mexico Mex$11.8/$ Mex$12.20/$ 110.5 $120m $240mU.S. 105.31. The real exchange rate of the dollar against the euro in 2009 was __________.2. The real exchange rate of the dollar against the peso in 2009 was __________.3. The dollar was __________ against the euro in nominal term by __________.A. appreciated; 6.67%B. depreciated; 6.67%C. appreciated; 7.14%D depreciated; 7.14%4. The Mexican peso was __________ against the dollar in nominal term by __________.A. appreciated; 3.39%B. depreciated; 3.39%C. appreciated; 3.28%D. depreciated; 3.28%5. The volume of the German foreign trade with the U.S. was __________.6. The volume of the Mexican foreign trade with the U.S. was __________.7. Assume the U.S. trades only with the Germany and Mexico. Now if we want to calculate the dollar effective exchange rate in 2009 against a basket of currencies of euro and Mexican peso, the weight assigned to the euro should be __________.8. The weight assigned to the peso should be __________.9. Assume the 2008 is the base year. The dollar effective exchange rate in 2009 was __________.10. Was the dollar generally stronger or weaker in 2009 according to your calculation?11. The following exchange rates are available to you.Fuji Bank ¥80.00/$United Bank of Switzerland SFr0.8900/$Deutsche Bank ¥95.00/SFrAssume you have an initial SFr10 million. Can you make a profit via triangular arbitrage? If so, show steps and calculate the amount of profit in Swiss francs. (8 credits)12. If the dollar appreciates 1000% against the ruble, by what percentage does the ruble depreciate against the dollar? (5 credits)13. As a percentage of an arbitrary starting amount, about how large would transactions costs have to be to make arbitrage between the exchange rates S SFr/$= SFr1.7223/$, S$/¥= $0.009711/¥, and S¥/SFr = ¥61.740/SFr unprofitable? Explain. (7 credits14. You are given the following exchange rates:S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670Calculate the bid and ask rate of S¥/£: (5 credits)15. Suppose the spot quotation on the Swiss franc (CHF) in New York is USD0.9442 –52 and the spot quotation on the Euro (EUR) is USD1.3460 –68. Compute the percentage bid-ask spreads on the CHF/EUR quote. ( 5 credits)Answers to Assignment Problems (3)Part II1. 0.70 x (105.3/102.5) = 0.7 x 1.0273 = 0.71912. 12.2 x (105.3/110.5) = 12.2 x .9529 = 11.62593. B (0.7 /.75) – 1 = -6.67%4. D (1/12.2)/(1/11.8) – 1 = -3.28%5. 5506. 3607. 550/910 = 60.44%8. 360/910 = 39.569. (0.70/0.75)(60.44%) + (12.2/11.8)(39.56%) = .5641 + 0.4090 = .9731 = 97.31%10. weaker, because dollar depreciated by 2.69%.11. Since S¥/$S$/SFr S SFr/¥= 80 x 1/0.8900 x 1/95.00 = 0.946186 < 1, there is an arbitrage opportunity.Steps:①Buy ¥ from Deutsche Bank, SFr10 million x 95.00 = ¥950 million②Buy $from Fuji Bank, $950 m / 80.00 = $11.875 m③Buy SFr from UBS, $11.875 x 0.8900 = SFr10.56875 mProfit (ignoring transaction fees):SFr10.56875 – SFr10 = 0.56875 million = 568,75012. (x – 1) = 1000%; 1/11 – 1 = 90.9%13. S SFr/$ S$/¥S¥/SFr = SFr1.7223/$ x $0.009711/¥ x ¥61.740/SFr = 1.0326If transaction costs exceed $0.0326 (3.26%), the arbitrage is unprofitable.14. Given: S¥/A$ = 67.05 – 68.75S£/A$ = 0.3590 – 0.3670So, S¥/₤ = 67.05/0.3670 = 182.70 (bid)S£/₤ = 68.75/0.3590 = 191.50 (ask)15. Given: USD0.9442 – 52/SFrUSD1.3460 – 68/SFrSo, S SRr/€ = 1.3460/0.9452 =1.424 (bid)S SFr/€ = 1.3468/0.9442 = 1.4264 (ask)。

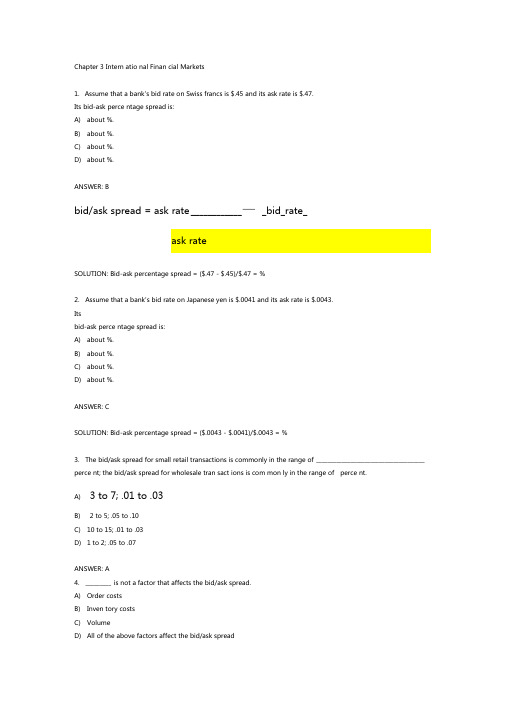

Chapter3InternationalFinancialMarkets练习答案+详解