L14 - After-tax Cash Flows

consolidated statements of cash flows -回复

consolidated statements of cash flows -回复中括号内的主题是“consolidated statements of cash flows”。

在这篇文章中,我将一步一步回答与该主题相关的问题,并解释与该主题相关的基本概念和重要性。

什么是综合现金流量表?综合现金流量表是一份财务报表,用于揭示公司在特定时间段内经营、投资和筹资活动所产生的现金流量。

它提供了关于公司现金流入和现金流出的信息,可以帮助投资者和其他相关方了解公司的现金状况以及公司如何运用和获取现金。

综合现金流量表包括哪些部分?综合现金流量表分为三个主要部分:经营活动现金流量、投资活动现金流量和筹资活动现金流量。

经营活动现金流量部分反映了与公司日常经营活动相关的现金流量。

这包括销售产品和服务所收到的现金、支付供应商和员工的现金、支付利息和税收的现金,以及其他与公司经营有关的现金流入和流出。

投资活动现金流量部分显示了公司在购买和出售长期资产以及其他投资时所产生的现金流量。

这包括购买和出售固定资产、合并和收购其他公司的现金流动,以及与其他投资相关的现金流入和现金流出。

筹资活动现金流量部分揭示了公司在筹资方面的现金流动。

这包括发行和回购股票所产生的现金流动、发行和偿还债券所产生的现金流动,以及与其他筹资活动相关的现金流入和现金流出。

为什么综合现金流量表重要?综合现金流量表对于投资者、财务分析师和其他相关方非常重要。

它提供了关于公司现金流量的详细信息,使他们能够判断公司的现金状况和现金流出和流入的原因。

综合现金流量表可以帮助投资者评估公司的盈利能力和偿付能力。

通过分析现金流量表,投资者可以判断公司是否有足够的现金流入来支付债务,并评估公司是否能够持续盈利。

此外,综合现金流量表还可以帮助投资者识别公司经营能力的强弱。

如果公司的主要现金流入来源是经营活动,而非投资或筹资活动,那么这表明公司在日常经营中取得了良好的成果。

财务管理英文第十三版

Corporate Capital Gains / Losses

Currently, capital gains are taxed at ordinary income tax rates for corporations, or a maximum 35%.

The Capital Budgeting Process

Generate investment proposals consistent with the firm’s strategic objectives.

Estimate after-tax incremental operating cash flows for the investment projects.

c) - (+) Taxes (tax savings) due to asset sale or disposal of “new” assets

d) + (-) Decreased (increased) level of “net” working capital

e) = Terminal year incremental net cash flow

Depreciation and the MACRS Method

Everything else equal, the greater the depreciation charges, the lower the taxes paid by the firm.

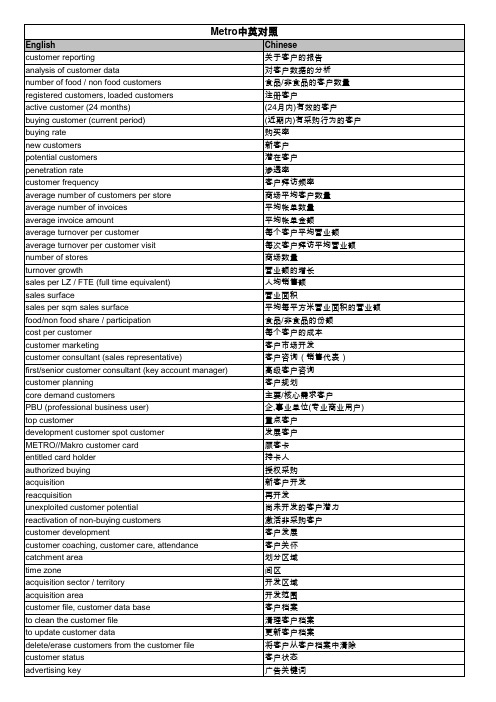

metro中英对照

Chinese 广告底限(与最低营业额有关) 销售封锁标志 目标群体标志 客户满意 客户忠诚度 客户益处 以客户为导向 客户生命周期 客户净价值 客户问卷 客户分类 营销计划 针对客户类别的特殊活动 行动计划 促销 特殊商业行动 电话行销 回执率 电话销售 客户俱乐部 拜访客户 邮寄邮件 广告小册子 形象手册 插页 传真 周年庆 直销 客户关系管理 目标客户群 地址 地址供应商 商会 一客户在现购自运方面的采购潜力 采购行为 专业需求 满足客户需求 客户分类 客户行业 行业领域 摊贩 非独立食品零售商 跨地区连锁店 地区性连锁店 独立食品零售商 国内的/本国的 外国的 精制食品零售商 鱼类水产零售商 饮料零售商 蔬菜水果零售商

englishchinesecustomerreportinganalysiscustomerdatanumbernonfoodcustomersregisteredcustomersloadedcustomersactivecustomer24monthsbuyingcustomercurrentperiodbuyingratenewcustomerspotentialcustomerspenetrationratecustomerfrequencyaveragenumbercustomersperstoreaveragenumberinvoicesaverageinvoiceamountaverageturnoverpercustomeraverageturnoverpercustomervisitnumberstoresturnovergrowthsalesperlzftefulltimeequivalentsalessurfacesalespersqmsalessurfacefoodnonfoodshareparticipationcostpercustomercustomermarketingcustomerconsultantsalesrepresentativefirstseniorcustomerconsultantkeyaccountmanagercustomerplanningcoredemandcustomerspbuprofessionalbusinessusertopcustomerdevelopmentcustomerspotcustomermetromakrocustomercardentitledcardholderauthorizedbuyingacquisitionreacquisitionunexploitedcustomerpotentialreactivationnonbuyingcustomerscustomerdevelopmentcustomercoachingcustomercareattendancecatchmentareatimezoneacquisitionsectorterritoryacquisitionareacustomerfilecustomerdatabasecustomerfileupdatecustomerdatadeleteerasecu

MIT15_401F08_summary

Course Summary

© 2007–2008 by Andrew W. Lo

Slide 12

Key Points: Portfolio Theory

15.401

'LYHUVLILFDWLRQUHGXFHVULVN The standard deviation of a portfolio is always less than the average standard deviation of the individual

Financial Intermediaries

Capital Markets

Course Summary

Nonfinancial Corporations

The Financial System

© 2007–2008 by Andrew W. Lo

Slide 3

Six Fundamental Principles of Finance

Course Summary

© 2007–2008 by Andrew W. Lo

15.401 Slide 5

Course Overview

15.401

Four Sections D. Corporate Finance

Capital budgeting and project finance

15.401

15.401 Finance Theory

MIT Sloan MBA Program

Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School

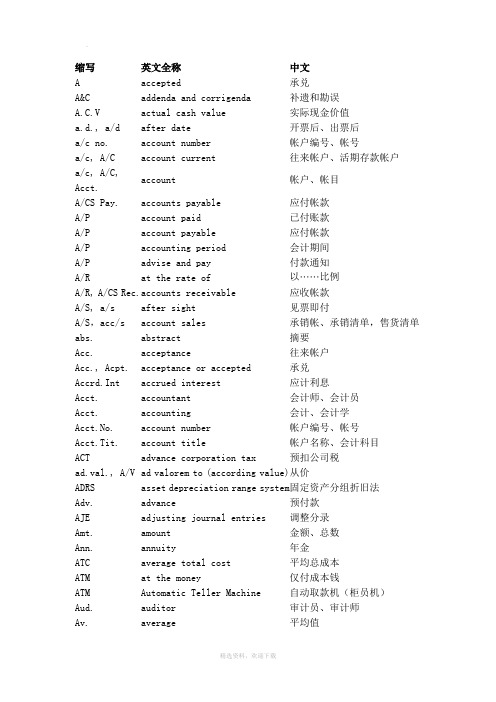

财务管理专业英语词汇表

a profit and loss statement accelerated methodsaccounts payableaccounts payable turnover ratio accounts receivableaccounts receivableaccounts receivable turnover ratios accrrual accountingaccrued expenseaccumulated depreciation accumulated retained earnings acquireaffiliateagency costagency problemagency relationshipaging scheduleallocateallocationally efficient markets amortizationannuityannuity dueanomalyappreciatearbitrage pricing theory(APT)Asian currency optionasset management ratiosasset turnover ratioauthorized sharesautonomyaverage age of accounts receivable avreage rate currency optionbad debt loss ratiobalance sheetbalance sheetbank debtbankers'acceptancebankruptcybasic earnings per shareBaumol cash management model behavioral financebeta coefficientbond indenturebonding costbook valuebottom-up approachbreak-even analysiabrokerage feebusinessbusiness riskcapital asset pricing model(CAPM) capital asset pricing model(CAPM) capital budgetcapital budgetingcapital expenditurecapital leasecapital marketcapital rationingcapital structurecapital surpluscash conversion cyclecash dividendcash dividendscash Flow Coverage Ratiocash flow from financingcash flow from investingcash flow from operationscash offercash ratiocentralize payableschairpersoncheckchief executive officer(CEO)chief financial officer(CFO) chronologicalclaimclearing time floatclosely held corporation coefficientcollateralcommercial papercommon stockcommon stockcommon stockholder or shareholder company-specific factor compensating balancecomplex capital structure compound interestcompoundingconcentration bankingconstant dividend payout ratioconstant growth model consumer creditcontingent value rights controllerconversion premiumconversion ratioconvertible bondconvertible debtconvertible debtconvertible preferred stock convertible securities corporate annual reports correlation coefficientcost of capitalcost of capitalcovariancecreative accountingcredit and collectiong policy credit cardcredit periodcredit salecredit termcreditorcross-currency pooling system cross-currency quote cumulative votingcurrency forward contract currency futures contract currency optioncurrency riskcurrency swapcurrent assetcurrent liabilitycurrent liabilitycurrent market valuecurrent ratiocurrent yielddebt holderdebt instrumentdebt management ratiosdebt ratiodebt-to-equity ratiodebt-to-total-capital decision-makingdeclaration datedefault riskdeferred annuitydeferred taxdepreciatedepreciationdesired or target capital structure diluted earnings per sharedilution of controldilution of ownershipdilutivedirect methoddirect quotationdisbursementdiscount perioddiscount ratediscount ratediscounted cash flow(DCF)discounted payback perioddiscountingdiversifiable riskdiversifydividend discount modeldividend irrelevane theorydividend payoutdividend payout ratiodividend policydividend yielddividend-payout ratiodo-it-yourself dividenddufault riskDuPont Analysis of ROEearnings before interest and taxes (EBI earnings before interest and taxes(EBIT earnings per shareearnings per shareeconomic order quantity(EOQ)efficient market hypothesis(EMH) employee stock option program(ESOP) equity multiplierEuropean Economic AreaEuropean Economic CommunityEuropean unionexchange rateexchange-rate riskex-dividend dateexecutive directorexotic optionexpansion projectexpected returnexpected utility theoryexternal financingface valueFinancial Accounting Standards Board(FA financial analystfinancial distressfinancial distressfinancial economistfinancial flexibilityfinancial leveragefinancial managementfinancial marketfinancial ratiofinancial riskfinancial riskfinancial standardsfinancial statementfinancing cash flowsfinancing mixfinancing mixfinancing mixfirst-in ,first out (FIFO)Fitch Investor Servicesfixed exchange rate systemfloatfloatationfloatation costfloating exchange rate systemFortune 500forward discountforward marketforward premiumforward rateforward tradefree cash flow hypothesisfree tradefree-riding problemfuture contractfuture value(FV)general partnerGenerally Accepted Accounting Principle general-purpose assetsgo publicgoing concernGoldman Sachsgross profit margingrowth perpetuityhedginghistorical costhoard of directorshomemade dividendshurdle ratehurdle ratehybird securityhybridincentive stock optionincome statementincremental cash flows independent auditorindependent projectindirect methodindirect quotationinformation asymmetry informationally efficient markets initial public offering(IPO)initial public offering(IPO)initial public offerings institutional investorinstitutional investorintangible fixed assetsinterest coverage ratiointerest deductioninterest rate parityinterest rate riskinternal financinginternal rate of return(IRR) Internal Revenue Service(IRS) international corporation international financial management international Monetary Fund intrinsic valueinventoryinventoryinventory processing period inventory turnover ratioinvesting cash flowsinvestment bankinvestment bankerinvestor rationlityJanuary effectjeopardizejoint venturejust-in-time(JIT)systemlast-in ,first-out (LIFO)law of one pricelearning curveleaseleaselesseelessorleverage ratioslevered firmliabilitylimited partnerlimited partnershipline of creditliquidating dividendliquidationliquidity ratiolock box systemlong-term debt to total capital ratios long-term liabilitylong-term ratiolookback currency optionlow regular plus specially designated d mail floatmanagenment buyoutmanipulatemarket conversion valuemarket imperfectionmarket riskmarket shareMarketabilitymarketable securitiesmarketable securitiesmarketable securitymarketable securitymarket-to-book value ratioMaster of AccountingMaster of Business Administration(MBA) Master of Financial Managementmaterial requirement planning (MRP)syst maturitymean-variance frontiermean-variance worldMerrill LynchMiller-orr cash management modelmix of debt and equitymoderate approachModigliani and Miller(M&M)theorem Monday effectmoney marketmoney ordermonitoring costsMoody’s and Standard & Poor’sMoody's Investors Service,Inc.(Moody's) Morgan Stanley Dean Wittermortgagemultinational corporationmutual fundmutually exclusive projectnegotiable certificates of deposit(CDs) negotiate offernet incomenet present value(NPV)net present value(NPV)net profit marginnet working capticalNew York Stock Exchange(NYSE)New York Stork Exchangenewly listed companynon-executive directornormal distributionnormality assumptionnote payableoffering priceopen marketoperating cash flowsoperating incomeoperating income(loss)operating leaseoperating leverageoperating profit marginoperating profit marginoperationally efficient markets opportunity costopportunity costoptimal capital structureoption contractoption exchangeoption-like securityordinary annuityoutstandingoutstanding sharesoverheadover-the-counter marketowner’s equityP/E ratiopartnerpartnershippatentpayback period(PP)payment datepecking order theoryperfect capital marketperpetual inventory systemperpetuitypivotalportfolio theorypost-auditpost-earnings announcement drift precautionary motivepreemptive rightpreemptive rightpreferred stockpreferred stockpreferred stockholder or shareholder present value(PV)price takerprimary marketprincipalprincipal-agent or agency relationship private corporationprivate placementprivately held corporationprivileged subscriptionpro rataprobabilityprobability distributionprobability distribution function processing floatprocrastinationprofitprofitabilityprofitability index(PI)profitability ratioproperty dividendproperty,plant,and equipment(PPE)pros and consprospect theoryprotfoliopublic offerpublicly held companypublicly traded corporations publicly traded firmpurchasing power parityput optionput pricequick ratiorandom variablerate of returnrational behaviorreal assetsreal estaterecord dateregular dividendrelaxed or conservative approach replacement projectrepurchaserepurchaserepurchase agreementrequired rate of returnreserve borrowing capacityresidual claimresidual dividend policyresidual valuerestricted or aggressive approach restrictive covenanatsretail incestorretail investorreturnreturn on asset (ROA)return on common equity (ROCE) return on total equity (ROTE) return on total equity ratio (ROE) revenueright to proxyright to transfer ownershipright to voterights offerrisk aversionSalomon Smith Barneysaturation pointscenario analysisseasoned issuesecondary marketSecurities and Exchange Commission(SEC) semi-strong formsensitivity analysissensitivity analysisseparation of ownership and control share repurchaseshareholderside effectsimple capital structuresimple interstsimulationslowing disbursementsocial goodsole proprietorshipsolvencysource of cashspecial-purpose assetsspeculative motivespin-offsspot ratespot tradestable dollar dividend policy stakeholder theorystand-alone riskStandard & Poor's Corporation(S&P) standard deviationstatement of cash flowstatement of change in shareholders' eq statement of retained earningsstock buybackstock dividendsstock offeringstock offeringstock optionstock price appreciationstock repurchasestock splitstockholderstockholders'equitystraight or majority votingstraight-line depreciationstrong formsunk costswapsyndicate of underwritertakeovertangible fixed assetstarget capital structuretax exempt instrumenttax shieldteminal valuetender offertender offer(=takeover bid)term loantime value of moneytotal asset turnover ratiotrade credittrademarktradeofftradeoff theorytransaction costtransaction motivetreasurertreasury notestreasury sharetreasury stockunbiased forward rateunderlying common stockunderpricingunderpricingunderwriterunderwritingunlevered firmunseasoned issueUS Treasury Billuse of cashvalue effectvalue(wealth)maximizationvariable-rate debtvarianceventure capitalventure capitalistviabilityvice president of financevolatilityvolatilityvoting rightwarrantwarrantweak formweighted average cost of capital(WACC) well-beingwindow dressingwithdrawalworking capital management working captical management world Trade Organization yield to maturity (YTM) zero balance account(ZBA)加速折旧法应付账款应付账款周转率应收账款应收账款应收账款周转率应计制会计应计费用累计折旧累计留存收益获得,取得(在财务中有时指购买;名词形式是acquisition,意为收购)分支机构代理成本代理问题代理关系账龄表(资源,权利等)配置(名词形式是allocation,如capital allocation,意为资本配置)配置有效市场摊销年金先付年金异常(人或事物)升值套利定价理论亚式期权资产管理比率资产周转比率授权股自主权,自治应收账款平均账龄均价期权坏账损失率资产负债表资产负债表银行借款银行承兑汇票破产基本每股收益鲍莫尔现金管理模型行为财务贝塔系数债券契约契约成本账面价值盈亏平衡点分析经纪费企业,商务,业务经营风险资本资产定价模型资本资产定价模型资本预算资本预算资本支出融资性租赁资本市场资本限额资本结构资本盈余现金周转期现金股利现金股利现金流量保障比率筹资活动现金流投资活动现金流经营活动现金流现金收购现金比率集中支付主席(chairmanor chairwoman)支票首席执行官首席财务官按时间顺序排列的(根据权力提出)要求,要求权,主张,要求而得到的东西清算浮游量控股公司系数抵押商业票据普通股普通股普通股股东(也可以是ordinary stockholder or shareholder公司特有风险补偿性余额复杂资本结构复利复利计算集中银行法固定股利支付率政策固定增长率模型消费者信用或有价值权会计长转换溢价转换比率可转换债券可转债可转债可转换优先股可转换证券公司年报相关系数资本成本资本成本协方差创造性会计,寻机性会计信用与收款政策信用卡信用期限赊销信用条件债权人外汇交叉组合系统交叉标价累积投票制远期外汇合约货币期货合约货币期权外汇风险货币互换流动资产流动负债流动负债现行市场价值流动比率现行收益债权人(也可以是debtor,creditor)债务工具债务管理比率债务比率债务与权益比率债务与全部资本比率决策,决策的股利宣布日违约风险递延年金递延税款贬值折旧目标资本结构稀释的每股收益控制权稀释所有权稀释(公司股票)冲减每股收益的直接法直接标价支出、支付折扣期限折扣率折现率折现现金流折现回收期折现计算可分散风险多样化股利折现模型股利无关论股利支付率股利支付比率股利政策股利收益率股利支付比率自制股利违约风险权益报酬率的杜邦分析体系息税前盈余息税前盈余每股收益(盈余)每股盈余经济订货量有效市场假设员工股票期权计划权益乘数欧洲经济区协定欧洲经济共同体欧盟汇率汇率风险除息日执行董事特种期权扩充项目期望收益期望效用理论外部融资面值(美国)会计准则委员会财务分析师财务困境财务困境财务经济学家财务灵活性财务杠杆财务管理金融市场财务比率财务风险财务风险(有时也指金融风险)财务准则财务报表筹资现金流融资比率融资结构融资组合(指负债与所有者权益的比例关系)先进先出惠誉国际公司固定汇率制度浮游量、浮差发行证券;挂牌上市上市成本浮动汇率制度财富500指数远期贴水远期市场远期升水远期汇率远期交易自由现金流假说自由贸易搭便车问题期货合约未来值,终值一般合伙人公认会计原则一般目的资产公开上市持续的高盛公司毛利增长年金避险 套期保值历史成本董事会自制股利门坎利率,最低报酬率门槛利率,最低报酬率混合证券混合金融工具激励性股票期权利润表增量现金流量独立审计师独立项目间接法间接标价信息不对称信息有效市场首次公开发行股票首发股票首发股票机构投资者机构投资者无形固定资产利率保障比率利息抵减利率平价利息率风险内部融资内部收益率,内含报酬率美国国内税务署跨国公司国际财务管理国际货币基金组织内在价值存货存货存活周转期存货周转率投资现金流投资银行投资银行家投资者的理性一月效应危害合资企业即时制后进先出单一价格法则学习曲线租赁租赁承租人出租人杠杠比率杠杆企业负债有限责任合伙人有限合伙制企业贷款额度股利清算清算流动性比率锁箱系统长期债务与全部资本比率长期负债长期比率回顾试货币期权低正常股利加额外股利政策邮寄浮游量管理层收购操纵市场转换价值市场不完备性市场风险市场份额可销售性短期证券有价证券短期有价证券流动性证券,有价证券市场价值与账面价值的比率会计学硕士工商管理硕士财务管理专业硕士物料需求计划系统(债券、票据等)到期均值-方差有效边界均值-方差世界美林公司米勒-欧尔现金管理模型负债与股票的组合适中策略MM定理星期一效应拨款单,汇款单,汇票监督成本穆迪和标准普尔穆迪公司摩根士丹利-添惠公司抵押跨国公司共同基金互不相容项目大额可转让存单议价收购净利润净现值净现值净利润净营运资本纽约证券交易市场纽约股票交易所新上市公司非执行董事正态分布正态假设应付票据发行价格公开市场经营现金流经营收益经营收益(损失)经营性租赁经营杠杆经营利润市场价值比率运营有效市场机会成本机会成本最优资本结构期权合约期权交易类期权证券普通年金(证券等)发行在外的发行股制造费用场外交易市场所有者权益市盈率合伙制企业专利回收期股利支付日排序理论完美资本市场(存货)永续盘存制永续年金关键的,枢纽的组合理论期后审计期后盈余披露预防动机优先权优先认购权优先股优先股优先股股东(英国人用preference stockholder or shareholder)现值价格接受者一级市场本金委托-代理关系(代理关系)私募公司,未上市公司私募私人控股公司有特权的认购按比例,成比例概率概率分布概率分布函数内部处理浮游量延迟利润盈利能力现值指数盈利比率财产股利土地、厂房与设备正反两方面期望理论组合公开发行公众控股公司公开上市公司,公众公司,上市公司(其他的表达法如,listed corporation,public corporation,etc)公开上市公司购买力平价卖出期权卖出价格速动比率随机变量收益率理性行为实务资产房地产(有时也用real property,或者就用property表示)股权登记日正常股利稳健策略更新项目回购回购回购协议要求的报酬率保留借款能力剩余索取权剩余股利政策残余价值激进策略限制性条款散户投资者(为自己买卖证券而不是为任何公司或机构进行投资的个人投资者)个人投资者.散户投资者回报资产收益率普通权益报酬率全部权益报酬率权益报酬率收入代理权所有权转移权投票权认股权发行风险规避所罗门美邦投资公司饱和点情况分析适时发行、增发(seasoned是指新股稳定发行。

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文课件

7 Net Present VCaolrupeoraantedFinance

Capital Budgeting Ross • Westerfield • Jaffe

Seventh Edition

Seventh Edition

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

Cash Flows—Not Accounting Earnings.

• Consider depreciation expense. • You never write a check made out to “depreciation”. • Much of the work in evaluating a project lies in taking accounting

《公司理财》斯蒂芬A.罗斯..-机械工业出版社-英文

Incremental Cash Flows

• Side effects matter. • Erosion and cannibalism are both bad things. If our new product causes existing customers to demand less of current products, we need to recognize that.

Cost of bowling ball machine: $100,000 (depreciated according to ACRS 5-year life).

• Later chapters will deal with the impact that the amount of debt that a firm has in its capital structure has on firm value.

L14_IPA_项目会计合集

6

Overview(总体介绍) 如何实现?——灵活的自动会计

根据企业的核算需要,设置自动会计规则,大大降低手工劳动

事物处理

10 小时 劳动 周一, 五月 12, 1997 发生在项目 XYZ, 任务1

公司-成本中心--帐户 金额

01-100-5153

$220

10 Preliminary Design

24 Detailed Design

37 Programming and Testing

47 Integration Testing

54 System Test

59 Installation

70 Operations and Maintenance

76

14

Overview(总体介绍)

software!

21

定义你的项目

详尽的在线查询和报告

定义 条款 & 规则

收集成本

把资产投入 使用

定义项目

确认收入

生成发票

其他的 Oracle或 非Oracle 应用产品

灵活的调整能力

22

项目模板

Templates ensure consistent Best Practices 使用模板可以确保项目管理的连贯性和采用最好 的管理模式。

接受

拒绝

接受

Oracle 应付帐模块:

$100 外协 05-1月-1997

Oracle PTE:

8 小时工时 18-8月-1996

外部的成本

采集系统:

$1200 机票 04-8月-1996

Oracle 采购模块:

$100 外协 29-12月-1996

Cash flow statement模板

Cash flows from operating activitiesNet income after distributions1,394.01,366.0 Depreciation and amortization838.0896.0 Acquired identifiable amortizable intangible assets, net of accum. amort.0.00.0 Amortization of definite-lived intangible assets88.082.0 Restructuring52.0222.0 Goodwill impairment0.00.0 Stock-based compensation118.0121.0 Gain on sale0.00.0 Deferred tax(30.0)(134.0) Excess tax benefits(7.0)(11.0) Other, net0.011.0 Income taxes103.0(33.0) Changes in operating operating working capitalChanges in trade accounts receivable(63.0)(371.0) Changes in inventories(609.0)(400.0) Changes in other current assets(98.0)40.0 Changes in accounts payable141.0(443.0) Changes in gift card liabilities0.00.0 Changes in accrued compensation0.00.0 Changes in accrued liabilities279.0(156.0) Net changes in working capital(350.0)(1,330.0) Total cash provided by (used for) operating activities2,206.01,190.0Cash flows from investing activitiesCAPEX [Purchase of property, leasehold improvements & equipment](615.0)(744.0) Proceeds from sale of property, leasehold improvements & equipment(16.0)(267.0) Business acquisitions net of cash acquired [& net of intangibles/other](7.0)0.0 Proceeds from sale of businesses [spin-offs]0.021.0 Proceeds from sale of investments56.0415.0 Change in restricted assets18.0(2.0) Settlement of investment hedges40.012.0 Other(16.0)(4.0) Total cash provided by (used for) investing activities(540.0)(569.0)Cash flows from financing activitiesShort-term borrowings (repayments)0.00.0 Long-term borrowings (repayments)(210.0)(99.0) Proceeds from issuance of common stock and additional paid-in capital138.0179.0 Repurchase of common stock [treasury stock]0.0(1,193.0) Preferred Dividends Payable0.00.0 Distributions(234.0)(237.0) Payments to non-controlling interests0.00.0 Other(42.0)(7.0) Total cash provided by (used for) financing activities(348.0)(1,357.0) Effect of exchange rate on cash10.013.0Total change in cash and cash equivalents1,328.0(723.0)SUPPLEMENTAL DATA:Cash flow before debt paydownActuals Estimates2012A2013E2014E2015E2016E2017E2018E22.0943.1868.2823.1774.5769.2764.9897.0905.2943.7981.71,016.41,050.61,084.70.00.00.00.00.00.00.048.046.545.544.643.744.244.6288.00.00.00.00.00.00.01,207.00.00.00.00.00.00.0120.0120.0120.0120.0120.0120.0120.0(55.0)0.00.00.00.00.00.028.0(30.0)(134.0)28.0(30.0)(134.0)28.00.0(11.0)(11.0)(11.0)(11.0)(11.0)(11.0)25.00.00.00.00.00.00.025.0103.0(33.0)25.0103.0(33.0)25.041.044.244.944.043.1(21.1)(21.3)120.082.1105.4110.9108.7(53.2)(53.8)(24.0)34.520.920.520.1(9.8)(9.9)574.0(380.7)(93.0)(97.8)(95.9)47.047.40.0(5.9)(9.0)(8.8)(8.6) 4.2 4.30.020.9(8.6)(11.0)(10.8) 5.3 5.3(23.0)(91.6)(24.6)(31.4)(30.7)15.115.2688.0(296.5)35.926.325.8(12.6)(12.8)3,293.01,780.41,835.42,037.72,042.41,793.32,043.5(766.0)(749.5)(770.5)(760.0)(693.0)(683.3)(683.3)(112.0)(112.0)(112.0)(112.0)(112.0)(112.0)(112.0)(174.0)0.00.00.00.00.00.00.00.00.00.00.00.00.0290.00.00.00.00.00.00.040.00.00.00.00.00.00.00.00.00.00.00.00.00.0(2.0)0.00.00.00.00.00.0(724.0)(861.5)(882.5)(872.0)(805.0)(795.3)(795.3)0.0(523.0)0.00.00.00.00.0509.0(1,403.4)(281.6)0.00.00.00.067.00.00.00.00.00.00.0(1,500.0)0.00.00.00.00.00.00.00.00.00.00.00.00.0(228.0)(141.5)(130.2)(123.5)(116.2)(115.4)(114.7)(1,303.0)0.00.00.00.00.00.0(23.0)0.00.00.00.00.00.0(2,478.0)(2,067.9)(411.8)(123.5)(116.2)(115.4)(114.7)5.00.00.00.00.00.00.0。

财务管理专业英语-PDF图书下载-刘媛媛-编-在线阅读-PDF免费电子书下载-第一图书网

财务管理专业英语_PDF图书下载_刘媛媛编_在线阅读_PDF免费电子书下载_第一图书网前言 A journey of a thousand miles begins with a single step. ——Chinese proverb The future is not what it used to be. ——Paul Valery 21世纪是一个竞争激烈、国际化的高科技时代,21世纪的高级专门人才要具备扎实的专业知识、较高的信息素养和能在专业领域用外语进行交流沟通的能力。

作为一名财务管理专业教师,近几年来,我一直采用国外原版教材从事财务管理专业和非财务管理专业的财务管理课程的双语教学。

我深切体会到,虽然学生已经系统学习了大学基础英语,但由于缺乏专业英语基础,财务管理双语课程的教学效果并不尽如人意。

因此,很有必要在财务管理专业教学中设置财务管理专业英语课程。

财务管理专业英语教学,作为从基础英语教学向专业课双语教学过渡的桥梁,是财务管理专业学生从基础英语学习向专业领域英语应用过渡的不可或缺的中间环节。

要对学生进行财务管理专业英语素养的培养,一本合适的财务管理专业英语教材就成为至关重要的因素。

本书从财务管理专业培养目标出发,力求成为一本实用的财务管理专业英语教材,并采用有助于提高学生专业知识和实际运用能力的编写形式,以期能使学生成为满足日益激烈的国际竞争和频繁的国际交流需求的高素质财务管理人才。

本书按财务管理专业主干课程的架构分为12个专题,分别介绍财务管理各个方面的专业英语基础知识。

每一专题均先以“名人名言”和“微型案例”开始,以激发学生的兴趣去主动获取知识、开阔视野。

正文尽量体现财务管理专业的基本理念与核心内容,每一专题还设有“知识扩展”、“相关网址”等,进一步丰富了教学内容。

本书为财务管理专业的学生编写,采用的是导读式的教材风格,而非包罗万象的财务辞典。

根据多年教学经验,我建议财务管理专业英语教师在使用本教材时,除了教会学生如何阅读专业英语文献、掌握专业英语术语和翻译的技巧之外,最主要的任务是培养学生把所学到的专业知识转化为财务管理专业英语的实际运用能力。

CFA特许金融分析师-CFA一级-强化练习题(参考)-04-CorporateFinance

CFA特许金融分析师-CFA一级-强化练习题(参考)-04-CorporateFinance [单选题]1.Which of the following statements regarding corpora(江南博哥)te shareholders is most accurate?A.Cross-shareholdings help promote corporate mergers.B.Dual-class structures are used to align economic ownership with control.C.Affiliated shareholders can protect a company against hostile takeover bids.正确答案:C参考解析:C is correct. The presence of a sizable affiliated stockholder (such as an indi- vidual, family trust, endowment, or private equity fund) can shield a company from the effects of voting by outside shareholders.[单选题]3.Which of the following statements regarding stakeholder management is most accurate?pany management ensures compliance with all applicable laws and regulations.B.Directors are excluded from voting on transactions in which they hold material interest.C.The use of variable incentive plans in executive remuneration is decreasing.正确答案:B参考解析:B is correct. Often, policies on related-party transactions require that such transactions or matters be voted on by the board (or shareholders), excluding the director holding the interest.[单选题]4.Which of the following represents a responsibility of a company’s board of directors?A.Implementation of strategyB.Enterprise risk managementC.Considering the interests of shareholders only正确答案:B参考解析:B is correct. The board typically ensures that the company has an appropriate enterprise risk management system in place.[单选题]5.Which of the following represents a principal–agent conflict between shareholders and management?A.Risk toleranceB.Multiple share classesC.Accounting and reporting practices参考解析:A is correct. Shareholder and manager interests can diverge with respect to risk tolerance. In some cases, shareholders with diversified investment portfolios can have a fairly high risk tolerance because specific company risk can be diver- sified away. Managers are typically more risk averse in their corporate decision making to better protect their employment status.[单选题]6.Which of the following statements about non-market factors in corporate governance is most accurate?A.Stakeholders can spread information quickly and shape public opinion.B.A civil law system offers better protection of shareholderinterests than does a common law system.C.Vendors providing corporate governance services have limited influence on corporate governance practices.正确答案:A参考解析:A is correct. Social media has become a powerful tool for stakeholders to instantly broadcast information with little cost or effort and to compete with company management in influencing public sentiment.[单选题]7.Hermann Corporation is considering an investment of €375 million with expected after-tax cash inflows of €115 million per year for seven years and an additional after-tax salvage value of €50 million in Year 7. The required rate of return is 10 percent. What is the investment’s PI?A.1.19.B.1.33.C.1.56.正确答案:C参考解析:Answer: C[单选题]8.An investment has an outlay of 100 and after-tax cash flows of 40 annually for four years. A project enhancement increases the outlay by 15 and the annual after-tax cash flows by 5. As a result, the vertical intercept of the NPV profile of the enhanced project shifts:A.Up and the horizontal intercept shifts left.B.Up and the horizontal intercept shifts right.C.Down and the horizontal intercept shifts left.参考解析:Answer: AThe vertical intercept changes from 60 to 65 (NPV when cost of capital is 0%), and the horizontal intercept (IRR, when NPV equals zero) changes from 21.86 percent to 20.68 percent.[单选题]9.With regard to net present value (NPV) profiles, the pointat which a profile crosses the vertical axis is best described as:A.the point at which two projects have the same NPV.B.the sum of the undiscounted cash flows from a project.C.a project's internal rate of return when the project's NPV is equal to zero.正确答案:B参考解析:Answer: BThe vertical axis represents a discount rate of zero. The point where the profile crosses the vertical axis is simply the sum of the cash flows.[单选题]10.Shirley Shea has evaluated an investment proposal andfound that its payback period is one year, it has a negative NPV, and it has a positive IRR. Is this combination of results possible?A.Yes.B.No, because a project with a positive IRR has a positive NPV.C.No, because a project with such a rapid payback period has apositive NPV.正确答案:A参考解析:这道题目问的是Shirley Shea评估了一项投资计划,发现投资回收期为一年,净现值为负,内部收益率为正。

出口税务会计cixl

立核算,需汇总到总机构所在地办理;分支机构 独立核算且有进出口经营权,可以在分支机构所 在地办理退税 5.其他特准予以退税的出口货物,由企业所在地 主管退税税务机构退税

第二节 我国现行的出口退税政策规定

五、增值税免税与退税的办法 出口增值税的突出特点:零税率、部分或全部免

2.出口货物退税的作用

新的出口退税机制运行:全部还清历年累 计拖欠的出口退税款,缓解了企业资金周 转的困难,降低了企业财务成本,优化了 出口商品结构,促进了对外贸易和吸引外 资的健康持续发展。

出口退税由中央(92.5%)、地方(7.5%)共同 分担,调动了地方政府参与的积极性和主动 性,为规范出口退税秩序起到了积极的作 用。

=免税购进原材料价格×(征税率-退税率)

2.免抵退税额计算 免抵退税额= FOB×汇率×退税率-免抵退税额抵减

额

3.当期应退税额和免抵额的计算

若为可退税,应退税计算公式按孰低原则 如下:

FOB×汇率×退税率≧未抵扣完的当期进项 税额时:

应退税额=未抵扣完的当期进项税额

反之:应退税额= FOB×汇率×退税率

第二节 我国现行的出口退税政策规定

五、退税的做法: 1. 外贸企业——实行“先征后退”的办法 即出口环节增值税免税,按出口货物的收购价(进

项税额)与退税率计算后退还企业。 2.生产型企业(包括外商投资企业)——采用“免、

抵、退”办法 即出口环节增值税免税,进项税额准予抵扣的部 分,在内销货物的应纳税额中抵扣,不足抵扣的 部分退税 3.国家列明的钢铁企业“以产顶进”钢材——免抵

税与退税。 根据中国现行政策,制造出口商品的企业材料来

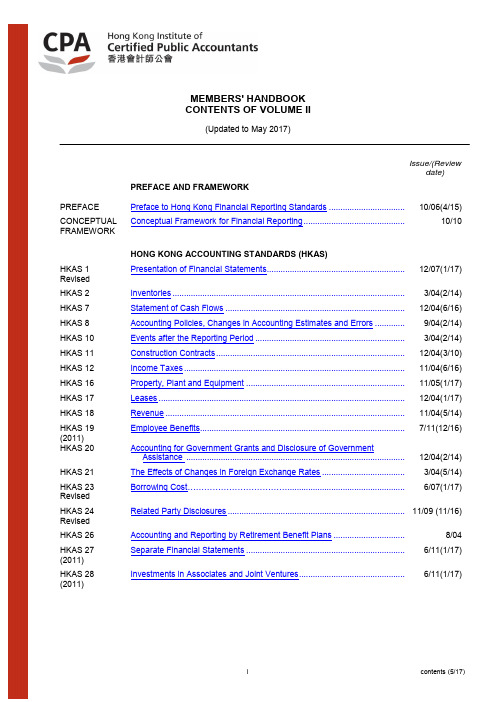

香港会计准则

MEMBERS' HANDBOOKCONTENTS OF VOLUME II(Updated to May 2017)Issue/(Reviewdate) PREFACE AND FRAMEWORKPREFACE Preface to Hong Kong Financial Reporting Standards .....................................10/06(4/15)CONCEPTUALFRAMEWORKConceptual Framework for Financial Reporting ................................................10/10HONG KONG ACCOUNTING STANDARDS (HKAS)HKAS 1RevisedPresentation of Financial Statements................................................................12/07(1/17) HKAS 2 Inventories .........................................................................................................3/04(2/14) HKAS 7 Statement of Cash Flows ..................................................................................12/04(6/16) HKAS 8 Accounting Policies, Changes in Accounting Estimates and Errors .................9/04(2/14) HKAS 10 Events after the Reporting Period .....................................................................3/04(2/14) HKAS 11 Construction Contracts ......................................................................................12/04(3/10) HKAS 12 Income Taxes ....................................................................................................11/04(6/16) HKAS 16 Property, Plant and Equipment .........................................................................11/05(1/17) HKAS 17 Leases ...............................................................................................................12/04(1/17) HKAS 18 Revenue ............................................................................................................11/04(5/14) HKAS 19(2011)Employee Benefits.............................................................................................7/11(12/16)HKAS 20 Accounting for Government Grants and Disclosure of GovernmentAssistance ...................................................................................................12/04(2/14) HKAS 21 The Effects of Changes in Foreign Exchange Rates ........................................3/04(5/14) HKAS 23RevisedBorrowing Cost……………………………….......................................................6/07(1/17)HKAS 24RevisedRelated Party Disclosures .................................................................................11/09 (11/16) HKAS 26 Accounting and Reporting by Retirement Benefit Plans ...................................8/04HKAS 27(2011)Separate Financial Statements .........................................................................6/11(1/17)HKAS 28 (2011) Investments in Associates and Joint Ventures ..................................................6/11(1/17)HKAS 29 Financial Reporting in Hyperinflationary Economies .....................................3/04(4/10) HKAS 32 Financial Instruments: Presentation ...............................................................11/04(11/14) HKAS 33 Earnings per Share ........................................................................................3/04(5/14) HKAS 34 Interim Financial Reporting ............................................................................10/04(12/16) HKAS 36 Impairment of Assets .....................................................................................8/04(1/17) HKAS 37 Provisions, Contingent Liabilities and Contingent Assets ..............................11/04(11/16) HKAS 38 Intangible Assets ............................................................................................8/04(1/17) HKAS 39 Financial Instruments: Recognition and Measurement ..................................1/06(11/16) HKAS 40 Investment Property .......................................................................................11/05(4/17) HKAS 41 Agriculture ......................................................................................................12/04(1/17)HONG KONG FINANCIAL REPORTING STANDARDS (HKFRS)First-time Adoption of Hong Kong Financial Reporting Standards ...............12/08(1/17) HKFRS 1RevisedHKFRS 2 Share-based Payment ...................................................................................4/04(11/16) HKFRS 3Business Combinations ..................................................................................3/08(11/16) RevisedHKFRS 4 Insurance Contracts .......................................................................................3/06(01/17) HKFRS 5 Non-current Assets Held for Sale and Discontinued Operations ...................8/04(12/16) HKFRS 6 Exploration for and Evaluation of Mineral Resources ....................................2/05(2/10) HKFRS 7 Financial Instruments: Disclosures ................................................................9/05(12/16) HKFRS 8 Operating Segments .....................................................................................3/07(12/16) HKFRS 9 Financial Instruments .....................................................................................11/09 (09/14) HKFRS 9 Financial Instruments (Hedge Accounting) ...................................................12/13 Financial Instruments .....................................................................................09/14 HKFRS 9(2014)HKFRS 10 Consolidated Financial Statements ...............................................................6/11(1/17) HKFRS 11 Joint Arrangements ........................................................................................6/11(12/16) HKFRS 12 Disclosure of Interests in Other Entities .........................................................6/11(1/17) HKFRS 13 Fair Value Measurement ................................................................................6/11(11/16) HKFRS 14 Regulatory Deferral Accounts ........................................................................2/14(1/17) HKFRS 15 Revenue from Contracts with Customers ......................................................7/14(6/16) HKFRS 16 Leases ............................................................................................................5/16 Annual Improvements to HKFRSs 2014-2016 Cycle.....................................3/17 ANNUALIMPROVEMENTSHONG KONG (IFRIC) INTERPRETATIONS (HK(IFRIC)-Int)HK(IFRIC)-Int 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities ......8/04(7/10) HK(IFRIC)-Int 2 Members’ Shares in Co-operative Entities and Similar Instruments .................2/05(2/14) HK(IFRIC)-Int 4 Determining whether an Arrangement contains a Lease ..................................2/05(2/14) HK(IFRIC)-Int 5 Rights to Interests arising from Decommissioning, Restoration andEnvironmental Rehabilitation Funds ............................................................2/05(2/14) HK(IFRIC)-Int 6 Liabilities arising from Participating in a Specific Market – WasteElectrical and Electronic Equipment .............................................................9/05 HK(IFRIC)-Int 7 Applying the Restatement Approach under HKAS 29 Financial Reportingin Hyperinflationary Economies...................................................................1/06(7/10) HK(IFRIC)-Int 9 Reassessment of Embedded Derivatives .........................................................5/06(2/14) HK(IFRIC)-Int 10 Interim Financial Reporting and Impairment ....................................................9/06(7/12) HK(IFRIC)-Int 12 Service Concession Arrangements ...................................................................3/07(1/17) HK(IFRIC)-Int 13 Customer Loyalty Programmes .........................................................................9/07(2/14) HK(IFRIC)-Int 14 HKAS 19 —The Limit on a Defined Benefit Asset, Minimum Funding9/07(11/16) Requirements and their Interaction ..............................................................HK(IFRIC)-Int 15 Agreements for the Construction of Real Estate ...............................................8/08(8/10) HK(IFRIC)-Int 16 Hedges of a Net Investment in a Foreign Operation .........................................8/08(5/14) HK(IFRIC)-Int 17 Distributions of Non-cash Assets to Owners .....................................................12/08(5/14) HK(IFRIC)-Int 18 Transfers of Assets from Customers .................................................................2/09(8/10) HK(IFRIC)-Int 19 Extinguishing Financial Liabilities with Equity Instruments ...............................12/09(5/14) HK(IFRIC)-Int 20 Stripping Costs in the Production Phase of a Surface Mine 11/11 HK(IFRIC)-Int 21 Levies 6/13 HONG KONG INTERPRETATIONS (HK-Int)*HK-Int 4 Leases – Determination of the Length of Lease Term in respect of HongKong Land Leases .......................................................................................6/06 (12/09) HK-Int 5 Presentation of Financial Statements – Classification by the Borrower ofa Term Loan that Contains a Repayment on Demand Clause ....................11/10Note: * With effect from 24 May 2005, all Interpretations that are developed locally by the Institute are named Hong Kong Interpretations.HONG KONG (SIC) INTERPRETATIONS (HK(SIC)-Int)HK(SIC)-Int 10 Government Assistance – No Specific Relation to Operating Activities ..........12/04(8/10) HK(SIC)-Int 15 Operating Leases – Incentives .........................................................................12/04(9/10) HK(SIC)-Int 25 Income Taxes – Changes in the Tax Status of an Enterprise or itsShareholders ................................................................................................12/04(8/10) HK(SIC)-Int 27 Evaluating the Substance of Transactions Involving the Legal Form of aLease ............................................................................................................12/04(9/10)HK(SIC)-Int 29 Service Concession Arrangements: Disclosures ..............................................12/04(8/10) HK(SIC)-Int 31 Revenue – Barter Transactions Involving Advertising Services .......................12/04(5/14) HK(SIC)-Int 32 Intangible Assets – Web Site Costs ..................................................................12/04(5/14)GLOSSARY Glossary of Terms Relating to Hong Kong Financial Reporting Standards ......... 3/08(11/14) HONG KONG FINANCIAL REPORTING STANDARD FOR PRIVATEENTITIES (HKFRS-PE)HKFRS-PE HONG KONG FINANCIAL REPORTING STANDARD FORPRIVATE ENTITIES ................................................................................. 4/10 (9/15)HKFRS-PE (Revised) HONG KONG FINANCIAL REPORTING STANDARD FORPRIVATE ENTITIES (REVISED) ........................................................... 5/17 SMALL AND MEDIUM-SIZED ENTITY FINANCIAL REPORTING FRAMEWORKAND FINANCIAL REPORTING STANDARD (SME-FRF & SME-FRS)SME-FRF &SME-FRSSME-FRF & SME-FRF .................................................................................... 8/05 (2/11)SME-FRF &SME-FRS(Revised)SME-FRF & SME-FRF (Revised)..................................................................... 3/14(12/15)ACCOUNTING GUIDELINES (AG)AG 1 Preparation and Presentation of Accounts from Incomplete Records ..............3/84AG 5 Merger Accounting for Common Control Combinations ...................................05/11 (11/13) AG 7 Preparation of Pro Forma Financial Information for Inclusion inInvestment Circulars.....................................................................................3/06ACCOUNTING BULLETINS (AB)AB 3 Guidance on Disclosure of Directors’ Remuneration ........................................1/00AB 4 Guidance on the Determination of Realised Profits and Losses in theContext of Distributions under the Hong Kong Companies Ordinance........5/10AB 5 Guidance for the Preparation of a Business Review under the Hong KongCompanies Ordinance Cap. 622..................................................................7/14AB 6 Guidance on the Requirements of Section 436 of the Hong KongCompanies Ordinance Cap. 622..................................................................6/15。

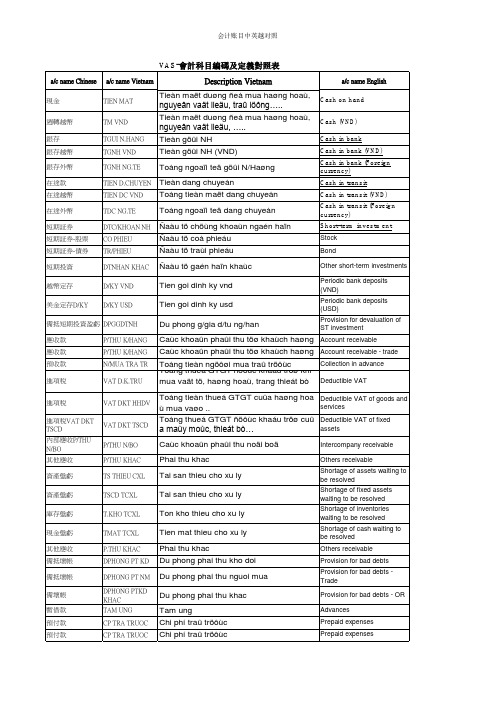

中英越财务账目对照

Description Vietnam Tieàn maët duøng ñeå mua haøng hoaù, nguyeân vaät lieäu, traû löông….. Tieàn maët duøng ñeå mua haøng hoaù, nguyeân vaät lieäu, ….. Tieàn göûi NH Tieàn göûi NH (VND) Toång ngoaïi teä göûi N/Haøng Tieàn dang chuyeån Toång tieàn maët dang chuyeån Toång ngoaïi teä dang chuyeån Ñaàu tö chöùng khoaùn ngaén haïn Ñaàu tö coå phieáu Ñaàu tö traùi phieáu Ñaàu tö gaén haïn khaùc Tien goi dinh ky vnd Tien goi dinh ky usd Du phong g/gia d/tu ng/han Caùc khoaûn phaûi thu töø khaùch haøng Caùc khoaûn phaûi thu töø khaùch haøng Toång tieàn ngöôøi mua traû tröôùc Toång thueá GTGT ñöôùc khaáu tröø khi mua vaät tö, haøng hoaù, trang thieát bò …. Toång tieàn thueá GTGT cuûa haøng hoa ù mua vaøo .. Toång thueá GTGT ñöôùc khaáu tröø cuû a maùy moùc, thieát bò… Caùc khoaûn phaûi thu noäi boä Phai thu khac Tai san thieu cho xu ly Tai san thieu cho xu ly Ton kho thieu cho xu ly Tien mat thieu cho xu ly Phai thu khac Du phong phai thu kho doi Du phong phai thu nguoi mua Du phong phai thu khac Tam ung Chi phí traû tröôùc Chi phí traû tröôùc

IntermediateAccountingChapter4中级会计学第四章课后习题答案

Chapter 4The Income Statement and Statement of Cash FlowsQUESTIONS FOR REVIEW OF KEY TOPICSQuestion 4-5The term earnings quality refers to the ability of reported earnings (income) to predict a company’s future earnings. After all, an income statement simply reports on events that already have occurred. The relevance of any historical-based financial statement hinges on its predictive value.Question 4-7The process of intraperiod tax allocation matches tax expense or tax benefit with each major component of income, specifically continuing operations and any item reported below continuing operations. The process is necessary to achieve the desired result of separating the total income effects of continuing operations from the two separately reported items - discontinued operations and extraordinary items, and also to show the after-tax effect of each of those two components.Question 4-9Extraordinary items are material gains and losses that are both unusual in nature and infrequent in occurrence, taking into account the environment in which the entity operates.Question 4-11GAAP permit alternative treatments for similar transactions. Common examples are the choice among FIFO, LIFO, and average cost for the measurement of inventory and the choice among alternative revenue recognition methods. A change in accounting principle occurs when a company changes from one generally accepted treatment to another.In general, we report voluntary changes in accounting principles retrospectively. This means revising all previous periods’ financial statements as if the new method were used in those periods. In other words, for each year in the comparative statements reported, we revise the balance of each account affected. Specifically, we make those statements appear as if the newly adopted accounting method had been applied all along. Also, if retained earnings is one of the accounts whose balance requires adjustment (and it usually is), we revise the beginning balance of retained earnings for the earliest period reported in the comparative statements of shareholders’ equity (or statements of retained earnings if they’re presented instead).Then we create a journal entry to adjust all account balances affected as of the date of the change. In the first set of financial statements after the change, a disclosure note would describe the change and justify the new method as preferable. It also would describe the effects of the change on all items affected, including the fact that the retained earnings balance was revised in the statement of shareholders’ equity along with the cumulative effect of the change in retained earnings.An exception is a change in depreciation, amortization, or depletion method. These changes are accounted for as a change in estimate, rather than as a change in accounting principle. Changes in estimates are accounted for prospectively. The remaining book value is depreciated, amortized, or depleted, using the new method, over the remaining useful life.Question 4-15Comprehensive income is the total change in equity for a reporting period other than from transactions with owners. Reporting comprehensive income can be accomplished with a separate statement or by including the information in either the income statement or the statement of changes in shareholders’ equity.Question 4-22U.S. GAAP designates cash outflows for interest payments and cash inflows from interest and dividends received as operating cash flows. Dividends paid to shareholders are classified as financing cash flows. IFRS allows more flexibility. Companies can report interest and dividends paid as either operating or financing cash flows and interest and dividends received as either operating or investing cash flows. Interest and dividend payments usually are reported as financing activities. Interest and dividends received normally are classified as investing activitiesBRIEF EXERCISESBrief Exercise 4-6*$850,000 x 40%Note: Restructuring costs, interest revenue, and loss on sale of investments are included in income before income taxes and extraordinary item.Brief Exercise 4-9*$5,800,000 x 30%** Loss from operations of discontinued component:Impairment loss ($8 million book value less$7 million net fair value) $(1,000,000) Operating loss (3,600,000) Total before-tax loss $(4,600,000)EXERCISES Exercise 4-3* 30% x $440,000Pretax income from continuing operations $14,000,000Income tax expense (5,600,000) Income from continuing operations 8,400,000 Less: Net income 7,200,000 Loss from discontinued operations $1,200,000 $1,200,000 60%* = $2,000,000 = before tax loss from discontinued operations.*1-tax rate of 40% = 60%Pretax income of division $4,000,000 Add: Loss from discontinued operations 2,000,000 Impairment loss $6,000,000 Fair value of division’s assets$11,000,000 Add: Impairment loss 6,000,000 Book value of division’s assets$17,000,000Requirement 1This is a change in accounting estimate.Requirement 2$2,400,000 Cost$240,000 Previous annual amortization ($2,400,000 ÷ 10 years) x 21/2 yrs. 600,000 Amortization to date (2009-2011)1,800,000 Book value÷ 5 yrs. Estimated remaining life(given)$ 360,000 New annual amortizationTiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Net income $ 900Adjustments for noncash effects:Depreciation expense 240Changes in operating assets and liabilities:Decrease in accounts receivable 80Increase in inventory (40)Increase in prepaid insurance (30)Decrease in accounts payable (60)Decrease in administrative and other payables (100)Increase in income taxes payable 50Net cash flows from operating activities $1,040 Cash flows from investing activities:Purchase of plant and equipment (300) Cash flows from financing activities:Proceeds from issuance of common stock 100Proceeds from note payable 200Payment of dividends (1) (940)Net cash flows from financing activities(640)Net increase in cash 100 Cash, January 1 200 Cash, December 31 $ 300(1)Retained earnings, beginning $540+ Net income 900- Dividends x x = $940Retained earnings, ending $500The T-account analysis of the transactions related to operating cash flows is shown below. To derive the cash flows, the beginning and ending balances in the related assets and liabilities are inserted, together with the revenue and expense amounts from the income statements. In each balance sheet account, the remaining (plug) figure is the other half of the cash increases or decreases.Based on the information in the T-accounts above, the operating activities section of the SCF for Tiger Enterprises would be as shown next.Exercise 4-23 (concluded)Tiger EnterprisesStatement of Cash FlowsFor the Year Ended December 31, 2011($ in thousands)Cash flows from operating activities:Collections from customers $ 7,080Prepayment of insurance (130)Payment to inventory suppliers (3,460)Payment for administrative & other exp. (1,900)Payment of income taxes (550)Net cash flows from operating activities $ 1,040CPA / CMA REVIEW QUESTIONSCPA Exam Questions1. c. U.S. GAAP requires that discontinued operations be disclosed separatelybelow income from continuing operations.2. d.Other than sales, COGS, and administrative expenses, only the gain or lossfrom disposal of equipment is considered part of income from continuingoperations. Income from continuing operations was ($5,000,000 - 3,000,000- 1,000,000 + 200,000) = $1,200,000.3. a. In a single-step income statement, revenues include sales as well as otherrevenues and gains.Sales revenue $187,000Interest revenue 10,200Gain on sale of equipment 4,700Total $201,900The discontinued operations and the extraordinary gain are reported belowincome from continuing operations.4.a.The $400,000 impairment loss and the $1,000,000 loss from operationsshould be combined for a total loss of $1,400,000.5.d. The change in the estimate for warranty costs is based on new informationobtained from experience and qualifies as a change in accounting estimate. Achange in accounting estimate affects current and future periods and is notaccounted for by restating prior periods. The accounting change is a part ofcontinuing operations.6. a. Dividends paid to shareholders is considered a financing cash flow, not anoperating cash flow.7. c. Issuing common stock for cash is considered a financing cash flow, not aninvesting cash flow.CMA Exam Questions1.d. Discontinued operations and extraordinary gains and losses are shownseparately in the income statement, below income from continuing operations.The cumulative effect of most voluntary changes in accounting principle isaccounted for by retrospectively revising prior years’ financial statements.2.c.The operating section of a retailer’s income statement includes all revenuesand costs necessary for the operation of the retail establishment, e.g., sales,cost of goods sold, administrative expenses, and selling expenses.3 a. Extraordinary items should be presented net of tax after income fromoperations.PROBLEMSProblem 4-9Requirement 1Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Collections from customers (1)$880,000Payment of operating expenses (2)(660,000)Payment of income taxes (3)(85,000)Net cash flows from operating activities $135,000Cash flows from investing activities:Sale of investments 50,000Net cash flows from investing activities 50,000Cash flows from financing activities:Proceeds from issue of common stock 100,000Payment of dividends (80,000)Net cash flows from financing activities 20,000Increase in cash 205,000Cash and cash equivalents, January 1 70,000Cash and cash equivalents, December 31 $275,000(1)$900,000 in service revenue less $20,000 increase in accounts receivable.(2) $700,000 in operating expenses less $30,000 in depreciation less $10,000 increase in accounts payable.(3)$80,000 in income tax expense plus $5,000 decrease in income taxes payable.Problem 4-9 (concluded)Requirement 2Diversified Portfolio CorporationStatement of Cash FlowsFor the Year Ended December 31, 2011Cash flows from operating activities:Net income $120,000Adjustments for noncash effects:Depreciation expense 30,000Changes in operating assets and liabilities:Increase in accounts receivable (20,000)Increase in accounts payable 10,000Decrease in income taxes payable (5,000)Net cash flows from operating activities $135,000。

香港会计准则第40号