econometrics notes

the economist 《经济学人》常用词汇总结.doc

The Economist 《经济学人》常用词汇总结1、绝对优势(Absolute advantage)如果一个国家用一单位资源生产的某种产品比另一个国家多,那么,这个国家在这种产品的生产上与另一国相比就具有绝对优势。

2、逆向选择(Adverse choice)在此状况下,保险公司发现它们的客户中有太大的一部分来自高风险群体。

3、选择成本(Alternative cost)如果以最好的另一种方式使用的某种资源,它所能生产的价值就是选择成本,也可以称之为机会成本。

4、需求的弧弹性(Arc elasticity of demand)如果P1和Q1分别是价格和需求量的初始值,P2 和Q2 为第二组值,那么,弧弹性就等于-(Q1-Q2)(P1+P2)/(P1-P2)(Q1+Q2)5、非对称的信息(Asymmetric information)在某些市场中,每个参与者拥有的信息并不相同。

例如,在旧车市场上,有关旧车质量的信息,卖者通常要比潜在的买者知道得多。

6、平均成本(Average cost)平均成本是总成本除以产量。

也称为平均总成本。

7、平均固定成本( Average fixed cost)平均固定成本是总固定成本除以产量。

8、平均产品(Average product)平均产品是总产量除以投入品的数量。

9、平均可变成本(Average variable cost)平均可变成本是总可变成本除以产量。

10、投资的β(Beta)β度量的是与投资相联的不可分散的风险。

对于一种股票而言,它表示所有现行股票的收益发生变化时,一种股票的收益会如何敏感地变化。

11、债券收益(Bond yield)债券收益是债券所获得的利率。

12、收支平衡图(Break-even chart)收支平衡图表示一种产品所出售的总数量改变时总收益和总成本是如何变化的。

收支平衡点是为避免损失而必须卖出的最小数量。

13、预算线(Budget line)预算线表示消费者所能购买的商品X和商品Y的数量的全部组合。

第1章 INTERMEDIATE ECONOMETRICS-原版教材

Steps in Empirical Econometric Analysis

Specify hypothesis of interest in terms of the unknown parameters . Use econometric methods to estimate the parameters and formally test the hypothesizes of interest .

14

What can econometrics do for us?

Overall, we use econometrics to explain phenomena of economic nature, make policy recommendations and make forecasts about the future.

19

Steps in Empirical Econometric Analysis

Summary Econometrics is used in all applied economic fields to test economic theories, to inform government and private policy makers, and to predict economic time series. Sometimes, an econometric model is derived from a formal economic model, but in other cases, econometric models are based on informal economic reasoning and intuition. The goal of any econometric analysis is to estimate the parameters in the model and to test hypotheses about these parameters; the values and signs of the parameters determine the validity of an economic theory and the effects of certain policies.

零基础文科生如何用Notes备考CFA一级?

1 - 1

零基础文科生如何用Notes 备考CFA 一级?

虽然CFA 考试是金融投资领域的专业证书,但是现在CFA 也不仅仅是金融生的专利了,那么对于零基础的文科生如何复习CFA 一级呢?金程CFA 小编告诉大家,可以从Economics 经济学入门,其他可以按照notes 的顺序阅读,道德Ethical and Professional Standards 放在最后阅读,因为Ethical and Professional Standards 主要是记忆。

1、从 Equity 入手,然后Fixed Income ,Alternative Investment ,最后Portfolio Management .

2、Financial Statement Analysis ,建议直接用官方教材,讲得比较系统而且不枯燥,知识点比较多,教材在一级不用掌握很深的知识点上篇幅掌握很好,用note 会疑问较多,因为会计知识相当深,很多一级考试不必要掌握。

但是这一部分是一级考试重中之重。

晚了看Corporate Finance ,问题不大,其中Corporate Governance (公司治理部分)是一个独立的知识点,建议加强中文知识背景学习。

3、Economics 没有经济学基础要补充中文知识背景,这一块教材讲得不经典,市场有很多经济学原理的教材,中级点曼昆、萨缪尔森的经济学原理

4、Ethics 只有死记,Quantitive 部分学习一级不是很深。

本文出处:/list5_1.html 转载请注明

更多CFA 资料免费下载 >>/edm/getinfo/index.html

学金融,找金程!力做您可信赖的财经培训专家!。

CFA一级:NOTES教材上的重点

CFA一级:NOTES教材上的重点在备考CFA一级时,高顿小编想说说关于CFA考试教材Notes和CFA考试重点问题1.cfa考试的notes用背下来吗?不用的话需要看到什么程度才能通过考试?观点:不用背下来。

CFA考察的是考生是否已经掌握了知识点,不是考政治经济学。

五本NOTES一般整套看下来需要多遍,因人而异,看到打开目录中的LOS,每看一个LOS都能简单说出LOS中的精华即可,对于一些模棱两可的知识点,务必回到书本上仔细再看。

通常第一遍看完还不是特别懂。

往往按顺序读完了最后的Alternatives,你就把前面的economics, quantitative通通忘掉了,有点像“转碟子”的杂技,不断的让碟子重新转动起来才是最后的成功。

这种情况不妨可以开始做题。

NOTES中的题目有点偏难,主要是“偏”,不过知识点差不多一样,可以对着书本,开卷考试做一套,没压力,还知道了知识点是如何变成考题的。

等你题目从头到尾做了120道题,彻底觉得再一打开目录中的LOS就知道每个LOS要点。

就算程度达到了。

剩下的就是不断的模考再模考。

CFA考试资料2.考试重点在哪能找到,什么时候能出考试重点?观点:其实没什么考试重点。

考试是以一个一个部分出现的,你看看下面这同学的成绩单:Multiple Choice --failQ# Topic Max Pts <=50% 51%-70% >70%- Alternative Assets 12 - - *- Derivatives 12 * - -- Economics 24 * - -- Equity Analysis 24 * - -- Ethical 36 - * -- Financial Statemen 68 - * -- Fixed Income 24 - * -- Portfolio 12 - - *- Quantitative 28 - * -*号表示通过所在的范围九块科目,每一块都很重要。

高级经济学书籍

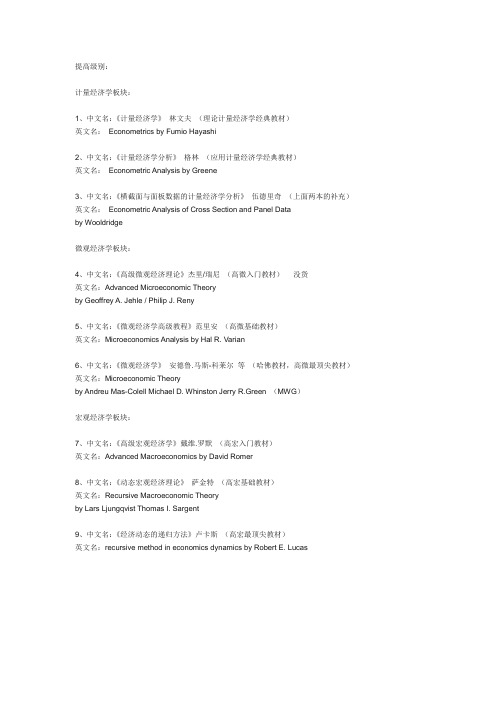

提高级别:计量经济学板块:1、中文名:《计量经济学》林文夫(理论计量经济学经典教材)英文名:Econometrics by Fumio Hayashi2、中文名:《计量经济学分析》格林(应用计量经济学经典教材)英文名:Econometric Analysis by Greene3、中文名:《横截面与面板数据的计量经济学分析》伍德里奇(上面两本的补充)英文名:Econometric Analysis of Cross Section and Panel Databy Wooldridge微观经济学板块:4、中文名:《高级微观经济理论》杰里/瑞尼(高微入门教材)没货英文名:Advanced Microeconomic Theoryby Geoffrey A. Jehle / Philip J. Reny5、中文名:《微观经济学高级教程》范里安(高微基础教材)英文名:Microeconomics Analysis by Hal R. Varian6、中文名:《微观经济学》安德鲁.马斯-科莱尔等(哈佛教材,高微最顶尖教材)英文名:Microeconomic Theoryby Andreu Mas-Colell Michael D. Whinston Jerry R.Green (MWG)宏观经济学板块:7、中文名:《高级宏观经济学》戴维.罗默(高宏入门教材)英文名:Advanced Macroeconomics by David Romer8、中文名:《动态宏观经济理论》萨金特(高宏基础教材)英文名:Recursive Macroeconomic Theoryby Lars Ljungqvist Thomas I. Sargent9、中文名:《经济动态的递归方法》卢卡斯(高宏最顶尖教材)英文名:recursive method in economics dynamics by Robert E. Lucas。

计量经济学英文重点知识点考试必备

第一章1.Econometrics(计量经济学):the social science in which the tools of economic theory, mathematics, and statistical inference are applied to the analysis of economic phenomena.the result of a certain outlook on the role of economics, consists of the application of mathematical statistics to economic data to lend empirical support to the models constructed by mathematical economics and to obtain numerical results.2.Econometric analysis proceeds along the following lines计量经济学分析步骤1)Creating a statement of theory or hypothesis.建立一个理论假说2)Collecting data.收集数据3)Specifying the mathematical model of theory.设定数学模型4)Specifying the statistical, or econometric, model of theory.设立统计或经济计量模型5)Estimating the parameters of the chosen econometric model.估计经济计量模型参数6)Checking for model adequacy : Model specification testing.核查模型的适用性:模型设定检验7)Testing the hypothesis derived from the model.检验自模型的假设8)Using the model for prediction or forecasting.利用模型进行预测●Step2:收集数据➢Three types of data三类可用于分析的数据1)Time series(时间序列数据):Collected over a period of time, are collected at regular intervals.按时间跨度收集得到2)Cross-sectional截面数据:Collected over a period of time, are collected at regular intervals.按时间跨度收集得到3)Pooled data合并数据(上两种的结合)●Step3:设定数学模型1.plot scatter diagram or scattergram2.write the mathematical model●Step4:设立统计或经济计量模型➢C LFPR is dependent variable应变量➢C UNR is independent or explanatory variable独立或解释变量(自变量)➢W e give a catchall variable U to stand for all these neglected factors➢I n linear regression analysis our primary objective is to explain the behavior of the dependent variable in relation to the behavior of one or more other variables, allowing for the data that the relationship between them is inexact.线性回归分析的主要目标就是解释一个变量(应变量)与其他一个或多个变量(自变量)只见的行为关系,当然这种关系并非完全正确●Step5:估计经济计量模型参数➢I n short, the estimated regression line gives the relationship between average CLFPR and CUNR 简言之,估计的回归直线给出了平均应变量和自变量之间的关系➢T hat is, on average, how the dependent variable responds to a unit change in the independent variable.单位因变量的变化引起的自变量平均变化量的多少。

经济计量参考书目

❖Zvi Grilichndbooks of econometrics, Amsterdam; New York: Elsevier, 1983-2023. 5v.

❖William Cecil Dampier, A history of science and its relations with philosophy and religion, fourth edition, Cambridge: Cambridge University Press,1958.

❖James Davidson, Stochastic limit theory: an introduction for econometricians, Oxford; New York: Oxford University Press, 1994.

❖Phoebus J. Dhrymes, Topics in advanced econometrics: probability foundations, New York: Springer-Verlag, 1989.

❖Arthur Goldberger, Econometric theory, Stanley, New York: J. Wiley, 1964.

❖Fumio Hayashi, Econometrics, Princeton, N. J: Princeton University Press, 2023.

❖Mas-Colell, Andreu, et al, Microeconomic theory. / New York: Oxford University Press, 1995.

❖Geoffery A. Jehle and Philip J. Reny, Advanced microeconomic theory, second edition, Shanghai: Shanghai University of Finance & Economics Press, 2023.

《经济学人》杂志原版英文(整理完整版)之欧阳学创编

Digest Of The. Economist.2006(6-7)Hard to digestA wealth of genetic information is to be found in the human gutBACTERIA, like people, can be divided into friend and foe. Inspired by evidence that the friendly sort may help with a range of ailments, many people consume bacteria in the form of yogurts and dietary supplements. Such a smattering of artificial additions, however, represents but a drop in the ocean. There are at least 800 types of bacteria living in the human gut. And research by Steven Gill of the Institute for Genomic Research in Rockville, Maryland, and his colleagues, published in this week's Science, suggests that the collective genome of these organisms is so large that it contains 100 times as many genes as the human genome itself.Dr Gill and his team were able to come to this conclusion by extracting bacterial DNA from the faeces of two volunteers. Because of the complexity of the samples, they were not able to reconstruct the entire genomes of each of the gut bacteria,just the individual genes. But that allowed them to make an estimate of numbers.What all these bacteria are doing is tricky to identify—the bacteria themselves are difficult to cultivate. So the researchers guessed at what they might be up to by comparing the genes they discovered with published databases of genes whose functions are already known.This comparison helped Dr Gill identify for the first time the probable enzymatic processes by which bacteria help humans to digest the complex carbohydrates in plants. The bacteria also contain a plentiful supply of genes involved in the synthesis of chemicals essential to human life—including two B vitamins and certain essential amino acids—although the team merely showed that these metabolic pathways exist rather than proving that they are used. Nevertheless, the pathways they found leave humans looking more like ruminants: animals such as goats and sheep that use bacteria to break down otherwise indigestible matter in the plants they eat.The broader conclusion Dr Gill draws is that people are superorganisms whose metabolism represents an amalgamation of human and microbial attributes. The notionof a superorganism has emerged before, as researchers in otherfields have come to view humans as having a diverse internal ecosystem. This, suggest some, will be crucial to the successof personalised medicine, as different people will have different responses to drugs, depending on their microbial flora. Accordingly, the next step, says Dr Gill, is to see how microbial populations vary between people of different ages, backgrounds and diets.Another area of research is the process by which these helpful bacteria first colonise the digestive tract. Babies acquire their gut flora as they pass down the birth canal and take a gene-filled gulp of their mother's vaginal and faecal flora. It might not be the most delicious of first meals, but it could well be an important one.Zapping the bluesThe rebirth of electric-shock treatmentELECTRICITY has long been used to treat medical disorders. As early as the second century AD, Galen, a Greek physician, recommended the use of electric eels for treating headaches and facial pain. In the 1930s Ugo Cerletti and Lucio Bini, two Italian psychiatrists, used electroconvulsive therapy to treat schizophrenia. These days, such rigorous techniques are practised less widely. But researchers are still investigatinghow a gentler electric therapy appears to treat depression.Vagus-nerve stimulation, to give it its proper name, was originally developed to treat severe epilepsy. It requires a pacemaker-like device to be implanted in a patient's chest and wires from it threaded up to the vagus nerve on the left side of his neck. In the normal course of events, this provides an electrical pulse to the vagus nerve for 30 seconds every five minutes.This treatment does not always work, but in some cases where it failed (the number of epileptic seizures experienced by a patient remaining the same), that patient nevertheless reported feeling much better after receiving the implant. This secondary effect led to trials for treating depression and, in 2005, America's Food and Drug Administration approved the therapy for depression that fails to respond to all conventional treatments, including drugs and psychotherapy.Not only does the treatment work, but its effects appear to be long lasting. A study led by Charles Conway of Saint Louis University in Missouri, and presented to a recent meeting of the American Psychiatric Association, has found that 70% of patients who are better after one year stay better after two years as well.The technique builds on a procedure called deep-brain stimulation, in which electrodes are implanted deep into the white matter of patients' brains and used to “reboot” faulty neural circuitry. Such an operation is a big undertaking, requiring a full day of surgery and carrying a risk of the patient suffering a stroke. Only a small number of people have been treated this way. In contrast, the device that stimulates the vagus nerve can be implanted in 45 minutes without a stay in hospital.The trouble is that vagus-nerve stimulation can take a long time to produce its full beneficial effect. According to Dr Conway, scans taken using a technique called positron-emission tomography show significant changes in brain activity starting three months after treatment begins. The changes are similar to the improvements seen in patients who undergo other forms of antidepression treatment. The brain continues to change over the following 21 months. Dr Conway says that patients should be told that the antidepressant effects could be slow in coming.However, Richard Selway of King's College Hospital, London, found that his patients' moods improved just weeks after the implant. Although brain scans are useful indetermining the longevity of the treatment, Mr Selway notes that visible changes in the brain do not necessarily correlate perfectly with changes in mood.Nobody knows why stimulating the vagus nerve improves the mood of depressed patients, but Mr Selway has a theory. He believes that the electrical stimulation causes a region in the brain stem called the locus caeruleus (Latin, ironically, for “blue place”) to flood the brain with norepinephrine, a neurotransmitter implicated in alertness, concentration and motivation—that is, the mood states missing in depressed patients. Whatever the mechanism, for the depressed a therapy that is relatively safe and long lasting is rare cause for cheer. The shape of things to comeHow tomorrow's nuclear power stations will differ from today'sTHE agency in charge of promoting nuclear power in America describes a new generation of reactors that will be “highly economical” with “enhanced safety”, that “minimise wastes” and will prove “proliferation resistant”. No doubt they will bake a mean apple pie, too.Unfortunately, in the world of nuclear energy, fine words are not enough. America got away lightly with its nuclearaccident. When the Three Mile Island plant in Pennsylvania overheated in 1979 very little radiation leaked, and there were no injuries. Europe was not so lucky. The accident at Chernobyl in Ukraine in 1986 killed dozens immediately and has affected (sometimes fatally) the health of tens of thousands at the least. Even discounting the association of nuclear power with nuclear weaponry, people have good reason to be suspicious of claims that reactors are safe.Yet political interest in nuclear power is reviving across the world, thanks in part to concerns about global warming and energy security. Already, some 441 commercial reactors operate in 31 countries and provide 17% of the planet's electricity, according to America's Department of Energy. Until recently, the talk was of how to retire these reactors gracefully. Now it is of how to extend their lives. In addition, another 32 reactors are being built, mostly in India, China and their neighbours. These new power stations belong to what has been called the third generation of reactors, designs that have been informed by experience and that are considered by their creators to be advanced. But will these new stations really be safer than their predecessors?Clearly, modern designs need to be less accident prone.The most important feature of a safe design is that it “fails safe”. Fo r a reactor, this means that if its control systems stop working it shuts down automatically, safely dissipates the heat produced by the reactions in its core, and stops both the fuel and the radioactive waste produced by nuclear reactions from escaping by keeping them within some sort of containment vessel. Reactors that follow such rules are called “passive”. Most modern designs are passive to some extent and some newer ones are truly so. However, some of the genuinely passive reactors are also likely to be more expensive to run.Nuclear energy is produced by atomic fission. A large atom (usually uranium or plutonium) breaks into two smaller ones, releasing energy and neutrons. The neutrons then trigger further break-ups. And so on. If this “chain reaction” can be controlled, the energy released can be used to boil water, produce steam and drive a turbine that generates electricity. If it runs away, the result is a meltdown and an accident (or, in extreme circumstances, a nuclear explosion—though circumstances are never that extreme in a reactor because the fuel is less fissile than the material in a bomb). In many new designs the neutrons, and thus the chain reaction, are kept under control by passing them through water to slow themdown. (Slow neutrons trigger more break ups than fast ones.) This water is exposed to a pressure of about 150 atmospheres—a pressure that means it remains liquid even at high temperatures. When nuclear reactions warm the water, its density drops, and the neutrons passing through it are no longer slowed enough to trigger further reactions. That negative feedback stabilises the reaction rate.Can business be cool?Why a growing number of firms are taking global warming seriouslyRUPERT MURDOCH is no green activist. But in Pebble Beach later this summer, the annual gathering of executivesof Mr Murdoch's News Corporation—which last year led to a dramatic shift in the media conglomerate's attitude tothe internet—will be addressed by several leading environmentalists, including a vice-president turned climatechangemovie star. Last month BSkyB, a British satellite-television company chaired by Mr Murdoch and run by hisson, James, declared itself “carbon-neutral”, having taken various steps to cut or offset its discharges of carboninto the atmosphere.The army of corporate greens is growing fast. Late lastyear HSBC became the first big bank to announce that itwas carbon-neutral, joining other financial institutions, including Swiss Re, a reinsurer, and Goldman Sachs, aninvestment bank, in waging war on climate-warming gases (of which carbon dioxide is the main culprit). Last yearGeneral Electric (GE), an industrial powerhouse, launched its “Ecomagination” strategy, aiming to cut its output ofgreenhouse gases and to invest heavily in clean (ie, carbon-free) technologies. In October Wal-Mart announced aseries of environmental schemes, including doubling the fuel-efficiency of its fleet of vehicles within a decade.Tesco and Sainsbury, two of Britain's biggest retailers, are competing fiercely to be the greenest. And on June 7thsome leading British bosses lobbied Tony Blair for a more ambitious policy on climate change, even if that involvesharsher regulation.The greening of business is by no means universal, however. Money from Exxon Mobil, Ford and General Motorshelped pay for television advertisements aired recently in America by the Competitive Enterprise Institute, with thedaft slogan “Carbon dioxide: they call it pollution; we call it life”. Besides, environmentalist critics say, some firmsa re engaged in superficial “greenwash” to boost the image ofessentially climate-hurting businesses. Take BP, themost prominent corporate advocate of action on climate change, with its “Beyond Petroleum” ad campaign, highprofileinvestments in green energy, and even a “carbon calculator” on its website that helps consumers measuretheir personal “carbon footprint”, or overall emissions of carbon. Yet, critics complain, BP's recent record profits arelargely thanks to sales of huge amounts of carbon-packed oil and gas.On the other hand, some free-market thinkers see the support of firms for regulation of carbon as the latestattempt at “regulatory capture”, by those who stand to profit from new rules. Max Schulz of the ManhattanInstitute, a conservative think tan k, notes darkly that “Enron was into pushing the idea of climate change, becauseit was good for its business”.Others argue that climate change has no more place in corporate boardrooms than do discussions of other partisanpolitical issues, such as Darfur or gay marriage. That criticism, at least, is surely wrong. Most of the corporateconverts say they are acting not out of some vague sense of social responsibility, or even personal angst, butbecause climate change creates real business risks and opportunities—from regulatory compliance to insuringclientson flood plains. And although these concerns vary hugely from one company to the next, few firms can besure of remaining unaffected.Testing timesResearchers are working on ways to reduce the need for animal experiments, but new laws mayincrease the number of experiments neededIN AN ideal world, people would not perform experiments on animals. For the people, they are expensive. For theanimals, they are stressful and often painful.That ideal world, sadly, is still some way away. People need new drugs and vaccines. They want protection fromthe toxicity of chemicals. The search for basic scientific answers goes on. Indeed, the European Commission isforging ahead with proposals that will increase the number of animal experiments carried out in the EuropeanUnion, by requiring toxicity tests on every chemical approved for use within the union's borders in the past 25years.Already, the commission has identified 140,000 chemicals that have not yet been tested. It wants 30,000 of theseto be examined right away, and plans to spend between €4 billion-8 billion ($5 billion-10 billion) doing so. Thenumberof animals used for toxicity testing in Europe will thus, experts reckon, quintuple from just over 1m a yearto about 5m, unless they are saved by some dramatic advances in non-animal testing technology. At the moment,roughly 10% of European animal tests are for general toxicity, 35% for basic research, 45% for drugs andvaccines, and the remaining 10% a varietyof uses such as diagnosing diseases.Animal experimentation will therefore be around for some time yet. But the hunt for substitutes continues, and lastweekend the Middle European Society for Alternative Methods to Animal Testing met in Linz, Austria, to reviewprogress.A good place to start finding alternatives for toxicity tests is the liver—the organ responsible for breaking toxicchemicals down into safer molecules that can then be excreted. Two firms, one large and one small, told themeeting how they were using human liver cells removed incidentally during surgery to test various substances forlong-term toxic effects.PrimeCyte, the small firm, grows its cells in cultures over a few weeks and doses them regularly with the substanceunder investigation. The characteristics of the cells are carefully monitored, to look for changes in theirmicroanatomy.Pfizer,the big firm, also doses its cultures regularly, but rather than studying individual cells in detail, it counts cellnumbers. If the number of cells in a culture changes after a sample is added, that suggests the chemical inquestion is bad for the liver.In principle, these techniques could be applied to any chemical. In practice, drugs (and, in the case of PrimeCyte,food supplements) are top of the list. But that might change if the commission has its way: those 140,000screenings look like a lucrative market, although nobody knows whether the new tests will be ready for use by2009, when the commission proposes that testing should start.Other tissues, too, can be tested independently of animals. Epithelix, a small firm in Geneva, has developed anartificial version of the lining of the lungs. According to Huang Song, one of Epithelix's researchers, the firm'scultured cells have similar microanatomy to those found in natural lung linings, and respond in the same way tovarious chemical messengers. Dr Huang says that they could be used in long-term toxicity tests of airbornechemicals and could also help identify treatments for lung diseases.The immune system can be mimicked and tested, too. ProBioGen, a company based in Berlin, is developinganartificial human lymph node which, it reckons, could have prevented the near-disastrous consequences of a drugtrial held in Britain three months ago, in which (despite the drug having passed animal tests) six men sufferedmultiple organ failure and nearly died. The drug the men were given made their immune systems hyperactive.Such a response would, the firm's scientists reckon, have been identified by their lymph node, which is made fromcells that provoke the immune system into a response. ProBioGen's lymph node could thus work better than animaltesting.Another way of cutting the number of animal experiments would be tochange the way that vaccines are tested, according to CoenraadHendriksen of the Netherlands Vaccine Institute. At the moment, allbatches of vaccine are subject to the same battery of tests. DrHendriksen argues that this is over-rigorous. When new vaccine culturesare made, belt-and-braces tests obviously need to be applied. But if abatch of vaccine is derived from an existing culture, he suggests that itneed be tested only to make sure it is identical to the batch from which itis derived. That would require fewer test animals.All this suggests that though there is still some way to go before drugs,vaccines and other substances can be tested routinely oncells ratherthan live animals, useful progress is being made. What is harder to see ishow the use of animals might be banished from fundamental research.Anger managementTo one emotion, men are more sensitive than womenMEN are notoriously insensitive to the emotional world around them. At least, that is the stereotype peddled by athousand women's magazines. And a study by two researchers at the University of Melbourne, in Australia,confirms that men are, indeed, less sensitive to emotion than women, with one important and suggestiveexception. Men are acutely sensitive to the anger of other men.Mark Williams and Jason Mattingley, whose study has just been published in Current Biology, looked at the way aperson's sex affects his or her response to emotionally charged facial expressions. People from all cultures agreeon what six basic expressions of emotion look like. Whether the face before you is expressing anger, disgust, fear,joy, sadness or surprise seems to be recognised universally—which suggests that the expressions involved areinnate, rather than learned.Dr Williams and Dr Mattingley showed the participants intheir study photographs of these emotional expressions inmixed sets of either four or eight. They asked the participants to look for a particular sort of expression, andmeasured the amount of time it took them to find it. The researchers found, in agreement with previous studies,that both men and women identified angry expressions most quickly. But they also found that anger was morequickly identified on a male face than a female one.Moreover, most participants could find an angry face just as quickly when it was mixed in a group of eightphotographs as when it was part of a group of four. That was in stark contrast to the other five sorts of expression,which took more time to find when they had to be sorted from a larger group. This suggests that something in thebrain is attuned to picking out angry expressions, and that it is especially concerned about angry men. Also, thishighly tuned ability seems more important to males than females, since the two researchers found that men pickedout the angry expressions faster than women did, even though women were usually quicker than men to recognizeevery other sort of facial expression.Dr Williams and Dr Mattingley suspect the reason for this is that being able to spot an angry individual quickly hasasurvival advantage—and, since anger is more likely to turn into lethal violence in men than in women, the abilityto spot angry males quickly is particularly valuable.As to why men are more sensitive to anger than women, it is presumably because they are far more likely to getkilled by it. Most murders involve men killing other men—even today the context of homicide is usually aspontaneous dispute over status or sex.The ability to spot quickly that an alpha male is in a foul mood would thus have great survival value. It would allowthe sharp-witted time to choose appeasement, defence or possibly even pre-emptive attack. And, if it is right, thisstudy also confirms a lesson learned by generations of bar-room tough guys and schoolyard bullies: if you wantattention, get angry. The shareholders' revoltA turning point in relations between company owners and bosses?SOMETHING strange has been happening this year at company annual meetings in America:shareholders have been voting decisively against the recommendations of managers. Until now, mostshareholders have, like so many sheep, routinely voted in accordance with the advice of the peopletheyemploy to run the company. This year managers have already been defeated at some 32 companies,including household names such as Boeing, ExxonMobil and General Motors.This shareholders' revolt has focused entirely on one issue: the method by which members of the boardof directors are elected. Shareholder resolutions on other subjects have mostly been defeated, as usual.The successful resolutions called for directors to be elected by majority voting, instead of by thetraditional method of “plurality”—which in practice meant that only votes cast in favour were counted,and that a single vote for a candidate would be enough to get him elected.Several companies, led by Pfizer, a drug giant, saw defeat looming and pre-emptively adopted a formalmajority-voting policy that was weaker than in the shareholder resolution. This required any director whofailed to secure a majority of votes to tender his resignation to the board, which would then be free todecide whether or not to accept it. Under the shareholder resolution, any candidate failing to secure amajority of the votes cast simply would not be elected. Intriguingly, the shareholder resolution wasdefeated at four-fifths of the firms that adopted a Pfizer-style majority voting rule, whereas itsucceedednearly nine times out of ten at firms retaining the plurality rule.Unfortunately for shareholders, their victories may prove illusory, as the successful resolutions were all“precatory”—meaning that they merely advised management on the course of action preferred byshareholders, but did not force managers to do anything. Several resolutions that tried to imposemajority voting on firms by changing their bylaws failed this year.Even so, wise managers should voluntarily adopt majority voting, according to Wachtell, Lipton, Rosen &Katz, a Wall Street law firm that has generally helped managers resist increases in shareholder power butnow expects majority voting eventually to “become universal”. It advises th at, at the very least,managers should adopt the Pfizer model, if only to avoid becoming the subject of even greater scrutinyfrom corporate-governance activists. Some firms might choose to go further, as Dell and Intel have donethis year, and adopt bylaws requiring majority voting.Shareholders may have been radicalised by the success last year of a lobbying effort by managersagainst a proposal from regulators to make it easier for shareholders to put up candidates in boardelections. It remains to be seen if they willbe back for more in 2007. Certainly, some of the activistshareholders behind this year's resolutions have big plans. Where new voting rules are in place, they plancampaigns to vote out the chairman of the compensation committee at any firm that they think overpaysthe boss. If the 2006 annual meeting was unpleasant for managers, next year's could be far worse.Intangible opportunitiesCompanies are borrowing against their copyrights, trademarks and patentsNOT long ago, the value of companies resided mostly in things you could see and touch. Today it liesincreasingly in intangible assets such as the McDonald's name, the patent for Viagra and the rights toSpiderman. Baruch Lev, a finance professor at New York University's Stern School of Business, puts theimplied value of intangibles on American companies' balance sheets at about $6 trillion, or two-thirds ofthe total. Much of this consists of intellectual property, the collective name for copyrights, trademarksand patents. Increasingly, companies and their clever bankers are using these assets to raise cash.The method of choice is securitisation, the issuing ofbonds based on the various revenues thrown off byintellectual property. Late last month Dunkin' Brands, owner of Dunkin' Donuts, a snack-bar chain, raised$1.7 billion by selling bonds backed by, among other things, the royalties it will receive from itsfranchisees. The three private-equity firms that acquired Dunkin' Brands a few months ago have used thecash to repay the money they borrowed to buy the chain. This is the biggest intellectual-propertysecuritisation by far, says Jordan Yarett of Paul, Weiss, Rifkind, Wharton & Garrison, a law firm that hasworked on many such deals.Securitisations of intellectual property can be based on revenues from copyrights, trademarks (such aslogos) or patents. The best-known copyright deal was the issue in 1997 of $55m-worth of “Bowie Bonds”supported by the future sales of music by David Bowie, a British rock star. Bonds based on the films ofDreamWorks, Marvel comic books and the stories of John Steinbeck have also been sold. As well asDunkin' Brands, several restaurant chains and fashion firms have issued bonds backed by logos andbrands.Intellectual-property deals belong to a class known as operating-asset securitisations. These differ fromstandard securitisations of future revenues, such as bonds backed by thepayments on a 30-yearmortgage or a car loan, in that the borrower has to make his asset work. If investors are to recoup theirmoney, the assets being securitised must be “actively exploited”, says Mr Yarett: DreamWorks mustcontinue to churn out box-office hits.The market for such securitisations is still small. Jay Eisbruck, of Moody's, a rating agency, reckons thataround $10 billion-worth of bonds ar e outstanding. But there is “big potential,” he says, pointing out thatlicensing patented technology generates $100 billion a year and involves thousands of companies.Raising money this way can make sense not only for clever private-equity firms, but also for companieswith low (or no) credit ratings that cannot easily tap the capital markets or with few tangible assets ascollateral for bank loans. Some universities have joined in, too. Yale built a new medical complex withsome of the roughly $100m it raised securitising patent royalties from Zerit, an anti-HIV drug.It may be harder for investors to decide whether such deals are worth their while. They are, after all,highly complex and riskier than standard securitisations. The most obvious risk is that the investorscannot be sure that the assets will yield。

(完整版)计量经济学Econometrics专业词汇中英文对照

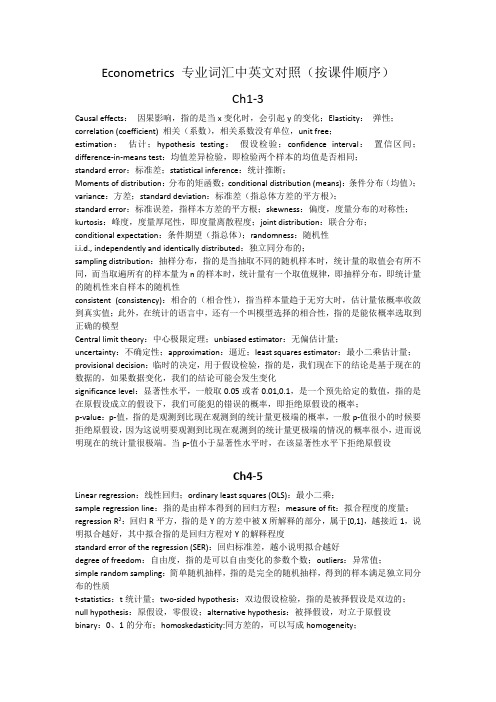

Econometrics 专业词汇中英文对照(按课件顺序)Ch1-3Causal effects:因果影响,指的是当x变化时,会引起y的变化;Elasticity:弹性;correlation (coefficient) 相关(系数),相关系数没有单位,unit free;estimation:估计;hypothesis testing:假设检验;confidence interval:置信区间;difference-in-means test:均值差异检验,即检验两个样本的均值是否相同;standard error:标准差;statistical inference:统计推断;Moments of distribution:分布的矩函数;conditional distribution (means):条件分布(均值);variance:方差;standard deviation:标准差(指总体方差的平方根);standard error:标准误差,指样本方差的平方根;skewness:偏度,度量分布的对称性;kurtosis:峰度,度量厚尾性,即度量离散程度;joint distribution:联合分布;conditional expectation:条件期望(指总体);randomness:随机性i.i.d., independently and identically distributed:独立同分布的;sampling distribution:抽样分布,指的是当抽取不同的随机样本时,统计量的取值会有所不同,而当取遍所有的样本量为n的样本时,统计量有一个取值规律,即抽样分布,即统计量的随机性来自样本的随机性consistent (consistency):相合的(相合性),指当样本量趋于无穷大时,估计量依概率收敛到真实值;此外,在统计的语言中,还有一个叫模型选择的相合性,指的是能依概率选取到正确的模型Central limit theory:中心极限定理;unbiased estimator:无偏估计量;uncertainty:不确定性;approximation:逼近;least squares estimator:最小二乘估计量;provisional decision:临时的决定,用于假设检验,指的是,我们现在下的结论是基于现在的数据的,如果数据变化,我们的结论可能会发生变化significance level:显著性水平,一般取0.05或者0.01,0.1,是一个预先给定的数值,指的是在原假设成立的假设下,我们可能犯的错误的概率,即拒绝原假设的概率;p-value:p-值,指的是观测到比现在观测到的统计量更极端的概率,一般p-值很小的时候要拒绝原假设,因为这说明要观测到比现在观测到的统计量更极端的情况的概率很小,进而说明现在的统计量很极端。

经济计量学

⒊ 课程说明

⑴ 教学目的

经济学是一门科学,实证的方法,尤其是数量 分析方法是经济学研究的基本方法论。通过该门 课程教学,使学生掌握计量经济学的基本理论与 方法,并能够建立实用的计量经济学应用模型。 ⑵ 先修课程 中级微观经济学、中级宏观经济学、经济统计 学、微积分、线性代数、概率论与数理统计等

关于学习方法的说明

(1)基础计量经济学主要是经典方法论。 (2)回归分析是核心。

第三节 计量经济分析步骤

• 对象——变量关系,计量经济模型 • 材料——经济数据

一、理论模型的设计 二、模型参数的估计 三、模型的检验 四、模型应用

一、理论模型的建立

⑴ 确定模型包含的变量

根据经济学理论和经济行为分析。 例如:同样是生产方程,电力工业和纺织工业应 该选择不同的变量,为什么? 在时间序列数据样本下可以应用Grange统计检验 等方法。 例如,消费和GDP之间的因果关系。

⑵ 统计检验 由数理统计理论决定 包括拟合优度检验 总体显著性检验 变量显著性检验

⑶ 计量经济学检验 由计量经济学理论决定 包括随机干扰项的异方差性检验、 序列相关性检验和解释变量的共线性检验

⑷ 模型预测检验 由模型的应用要求决定 包括稳定性检验:扩大样本重新估计 预测性能检验:对样本外一点进行 实际预测

obsno 1 2

wage 3.1 3.24

educ 11 12

expe 2 22

female 1 1

married 0 1

… 526

… 3.50

… 14

… 5

… 1

… 0

时间序列数据time series data

• 同一统计指标按时间顺序记录的数据列。常用的数据频率 有:年(如政府预算)、季度(如GDP)、月(如消费 价格指数)、周、日和高频数据。 • 以下是浙江省城镇居民1980~2004年收入与消费的部分 数据:

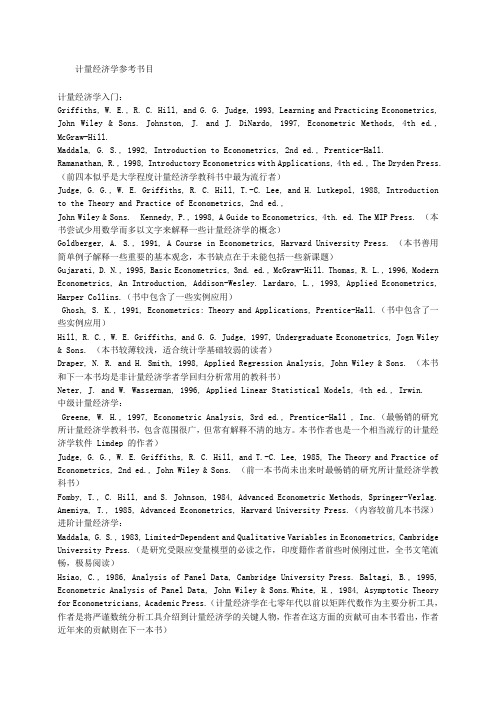

计量经济学参考书目

计量经济学参考书目计量经济学入门:Griffiths, W. E., R. C. Hill, and G. G. Judge, 1993, Learning and Practicing Econometrics, John Wiley & Sons. Johnston, J. and J. DiNardo, 1997, Econometric Methods, 4th ed., McGraw-Hill.Maddala, G. S., 1992, Introduction to Econometrics, 2nd ed., Prentice-Hall. Ramanathan, R., 1998, Introductory Econometrics with Applications, 4th ed., The Dryden Press.(前四本似乎是大学程度计量经济学教科书中最为流行者)Judge, G. G., W. E. Griffiths, R. C. Hill, T.-C. Lee, and H. Lutkepol, 1988, Introduction to the Theory and Practice of Econometrics, 2nd ed.,John Wiley & Sons. Kennedy, P., 1998, A Guide to Econometrics, 4th. ed. The MIP Press. (本书尝试少用数学而多以文字来解释一些计量经济学的概念)Goldberger, A. S., 1991, A Course in Econometrics, Harvard University Press. (本书善用简单例子解释一些重要的基本观念,本书缺点在于未能包括一些新课题)Gujarati, D. N., 1995, Basic Econometrics, 3nd. ed., McGraw-Hill. Thomas, R. L., 1996, Modern Econometrics, An Introduction, Addison-Wesley. Lardaro, L., 1993, Applied Econometrics, Harper Collins.(书中包含了一些实例应用)Ghosh, S. K., 1991, Econometrics: Theory and Applications, Prentice-Hall.(书中包含了一些实例应用)Hill, R. C., W. E. Griffiths, and G. G. Judge, 1997, Undergraduate Econometrics, Jogn Wiley & Sons. (本书较薄较浅,适合统计学基础较弱的读者)Draper, N. R. and H. Smith, 1998, Applied Regression Analysis, John Wiley & Sons. (本书和下一本书均是非计量经济学者学回归分析常用的教科书)Neter, J. and W. Wasserman, 1996, Applied Linear Statistical Models, 4th ed., Irwin.中级计量经济学:Greene, W. H., 1997, Econometric Analysis, 3rd ed., Prentice-Hall , Inc.(最畅销的研究所计量经济学教科书,包含范围很广,但常有解释不清的地方。

数量经济学书单

数量经济学书单数量经济学是经济学中的一个重要分支,研究经济活动中的数量关系和数学模型。

以下是一些学习数量经济学的经典书籍,可以帮助读者更好地理解和应用数量经济学的理论和方法。

1. 《数量经济学导论》(Introduction to Econometrics)- JamesH. Stock和Mark W. Watson这本书是学习数量经济学的入门教材,介绍了数量经济学的基本概念、方法和应用。

它以清晰的语言和实际案例,帮助读者理解如何建立和估计经济模型,并进行经济数据的分析和预测。

2. 《数量经济学》(Econometric Analysis)- William H. Greene 这是一本经典的数量经济学教材,涵盖了数量经济学的各个方面,包括线性回归模型、时间序列分析、面板数据分析等。

书中通过数学推导和实证研究,深入探讨了数量经济学的理论和应用。

3. 《经济计量学基础》(Basic Econometrics)- Damodar N. Gujarati和Dawn C. Porter这本书是经济学和商科专业学生学习数量经济学的经典教材,内容丰富而全面。

它介绍了数量经济学的基本概念和方法,包括回归分析、假设检验、模型选择等。

书中还包含了大量的案例和实证研究,帮助读者将理论应用到实际问题中。

4. 《数量经济学:现代观点》(Econometrics: Modern Methods)- Terence C. Mills这本书介绍了一些现代的数量经济学方法和技术,如非线性回归模型、计量经济学时间序列分析、计量经济学面板数据分析等。

它通过实例和案例研究,展示了这些方法在经济学研究中的应用和价值。

5. 《数量经济学:理论和实证》(Econometrics: Theory and Applications)- Bent Hansen这本书是数量经济学的高级教材,适合对数量经济学有一定基础的读者学习。

它介绍了数量经济学的一些高级理论和方法,如广义矩估计、系统估计等。

计量经济学 学习指南与练习

计量经济学学习指南与练习Econometrics: Study Guide and Practice计量经济学:学习指南与练习Econometrics is the application of statistical and mathematical methods to the analysis of economic data, aimed at revealing economic relationships and making predictions.计量经济学是应用统计和数学方法分析经济数据,旨在揭示经济关系并做出预测。

This field combines economic theory with statistical inference, allowing researchers to test hypotheses and understand complex economic systems.该领域将经济理论与统计推断相结合,使研究者能够检验假设并理解复杂的经济系统。

For students seeking to master econometrics, a solid foundation in mathematics, statistics, and economics is crucial.对于希望掌握计量经济学的学生来说,坚实的数学、统计和经济学基础至关重要。

Regular practice with real-world data sets and case studies is essential for honing skills in data analysis and interpretation. 经常使用真实世界的数据集和案例研究来磨练数据分析和解释技能是必不可少的。

With practice, students can develop a deep understanding ofeconometric models and techniques, enabling them to make informed decisions in various economic contexts.通过练习,学生可以深入理解计量经济模型和技术,使他们在各种经济环境中能够做出明智的决策。

Economics-Notes微观经济学-英文笔记-需求

Pavane’s Economics Notes[4th Feb 2021]Economics is the study of how we use our limited means to satisfy our unlimited wants.L IMITED M EANS---- All people have limited time, skills and money so they have to make choices to how to use them to the best advantage for them.C HOICE---- Since we can’t have everything we want as we have limited means we have to make decisions. (Decisions between alternatives)O PPORTUNITY C OST---- The next best alternative forgone when a decision is made. [5th Feb 2021]The economics problem is scarcity. This means that we have limited means but unlimited wants. Because of this we have to make a choice. Every choice has an opportunity cost.N EEDS---- Those things we require in order to sustain life.e.g. food, clothing and shelterW ANTS---- Things we desire to make our life more enjoyable.e.g. cell phone, stereo, SPAWants change as we get older because our tastes change and new things are introduced as technology improves.[17th Feb 2021]V ALUES ---- Core beliefs or principles that influence your decisions.>>Honesty >>Integrity >>Fair-trading >>Consideration of othersI NFLUENTS ON VALUES : Culture , Environment , Education , Upbringing (Family) Internet, FinanceD EMAND ---- Demand is the amount of a good or service that a person is willing and able to purchase at each price. falls or as the price falls the quantity demanded increases, ceteris paribus.C ETERIS PARIBUS ---- All other factors remain constant.[17th Feb 2021]Hugh’s weekly Quantity Demanded schedulePrice [$] Quantity demanded3020127>>TTitle is clear starting what the graph shows and the time period. >>AEven and appropriate scale on your axis.>>LLabel axes with item and unite.>>PPlot your points and join them using a ruler.[22nd Feb 2021]D ETERMINANTS OF D EMANDInfluents, other than price, that will influent the amount consumers’ purchase.>>Income>>Taste/ Fashion>>Price of substitutes>>Price of Complementary goods>>SeasonsS UBSTITUTEGoods that can be used to instead of other goods.e.g. butter and margarine : If the price of butter increases, more people will buy margarine as it is relating cheaper.C OMPLIMENTSGoods that are used together.e.g. DVDs and DVD players : When price of DVD players decrease there is an increase in demand for DVDs.C HANGE IND EMAND---- Change in demand is cause by a change in determinants and will result in a movement of the entire demand curve.e.g. Decrease in Demand : the demand has decrease at each price.[4th Mar 2021]D EMAND S CHEDULE----A table showing the quantity of a good or service that consumer is willing and able to purchase at various prices, in a given time period, ceteris paribus.[16th Mar 2021]I NFERIOR G OODS---- They are poorer quality goods that you will buy less as your income rises.e.g. cheap cuts of meat instead of steakN ORMAL G OODS---- Goods that you will but more as your income rises.N ECESSITIES---- Things needed to sustain life. Necessities are usually normal goods so you will buy more as your income rises.L UXURIES---- Items not needed but make your life more enjoyable. Households on low incomes spend a small proportion of their income on luxuries. As a household’s income rises they spend a greater proportion of their income on luxuries.H OUSEHOLD---- A person or group of individuals (families, flat mates) living together under one roof.A GGREGATE H OUSEHOLD E XPENDITURE---- The spending of all households taken as a single group.Average weekly Expenditure for all households 2001 Expenditure Group $ Spend % Degree Food 59Home ownership and rent 86 Clothing and footwear 12 Household operation 46Car ownership and running 57Other goods 40Other services 60Total[19th Mar 2021]S PENDING P ATTERNS---- As a person’s income increases they may spend more money but they generally will save moree.g. If a person earns $1000 and saves $100, he spends 90% and saves 10%. If his income increases to $1200, he spends $1020 (85%) and save 180 (15%).---- The amount he spend has increased but as a percentage of his income has fallen. The percentage of the savings has increased.C ONSUMPTION---- The spending on goods and services.Group1- Basic Necessities-For household with low levels of income spend most of their money on this group with a little basic services and even smaller luxuries. They have no savings.Group2- Basic Services-All levels of income mainly in low-level incomes use this. Group3- Luxury goods and services-This is for households with higher level of income as they are able to afford more and better quality products/services. Group4- Savings- Savings is what households with high income levels do as theyhave money left after buying necessities and normal goods. Graph-This graph shows what households expenditure is used on relative to levels of income[27th Mar 2021]Application questionBen Wilson’s family income has doubled since 1996. The pie Graphs below show how the family used their income in 1996 and how they use it now.。

有价值的经济计量学参考书

8

工具书 1.张晓峒著, EViews 使用指南与案例》 《 使用指南与案例 ,机械 与案例》 工业出版社,北京,2007。 2.高铁梅主编, 计量经济分析方法与建模 , 《计量经济分析方法与建模》 计量经济分析方法与建模 清华大学出版社,北京,2006。 3.攸频、张晓峒著, 《EViews 6 试验教程》 ,中 国财政经济出版社,2008。

3

1.张晓峒著, 计量经济分析 (修订版) 《计量经济分析 计量经济分析》 ,经济 科学出版社,2003。

1.Econometric Analysis of Cross Section and Panel Data, Jeffrey M. Wooldridge.2002. 2.Jeffrey M. Wooldridge 著,王忠玉译,横截面 横截面 与面板数据的计量分析,中国人民大学出版 与面板数据的计量分析 社,2007。

1.Introductory Econometrics: A Modern

Approach, Jeffrey M. Wooldridge, 4e。

2. 计量经济学导论(现代观点, 3 版, 第 英文版), 计量经济学导论 )

清华大学出版社。 3.计量经济学导论现代观点,(美国)J.M.伍德里 计量经济学导论现代观点, 计量经济学导论现代观点 奇著//费剑平译,中国人民大学出版社。

2

计量经济学著作 计量经济学著作 1.张晓峒主编, 计量经济学基础 (第 3 版, “十一五” 《计量经济学基础 计量经济学基础》 国家级规划教材) ,南开大学出版社,2007。 2. 《应用数量经济学》 ,张晓峒著,“十一五”国家级规划教 ( 材) ,机械工业出版社,2009-3。 1.Pindyck R S and D L Rubinfeld 著,钱小军等译, 计量经 《计量经 济模型与经济预测 ,机械工业出版社,1999。 济模型与经济预测》 2.Pindyck R S and D L Rubinfeld, Econometric models and economic forecasts,影印版,机械工业出版社,1999。 3.R S Pindyck and D L Rubinfeld, Econometric models and economic forecasts, McGraw-Hill Companies Inc,2000。 1. H Stock and M W Watson, Introduction to Econometrics, J Pearson Education, In, 2003。 2. Stock J H and M W Watson, Introduction to Econometrics, 影印版。上海财经大学出版社,2004。 3. 王庆石主译, H Stock and M W Watson 著, 经济计量学 , J 《经济计量学 经济计量学》 东北财经大学出版,2005。

计量经济学(Econometrics)

课程学分:3学分

课程概述:计量经济学是一门以经济理论为基础

以统计数据为依据

以数学为方法

定量研究具有随机特征的经济现象及经济变量之间数量关系的一门经济学科

是经济学研究常用的一种方法

是当前经济学研究的一个重要分支

其研究方法主要以回归分析方法为基础

主要包括单方程计量经济模型

2005

[10] 于俊年.计量经济学.对经济贸易大学出版社

2000

[11] 袁建文.经济计量学实验.科学出版社

2002

[12] 易丹辉.数据分析与eviews应用.中国统计出版社

2002

[13] 高铁梅.计量经济分析方法与建模--Eviews应用及实例.清华大学出版社

2006

其他说明:课程中所有的例子和问题我们使用EVIEWS4.1来计算

2.异方差的检验 第五章

第一~三节 11. 异方差II

自相关I 1.异方差的解决方法

2.自相关的概念及后果 第五章

第四节

第六章

第一、二节 12. 上机实验3 多元线性回归模型的参数估计与假设检验 上机实验指导书3 13. 自相关II 1.自相关的检验

2.自相关的解决方法 第六章

联立方程模型

向量自回归模型

时间序列分析等

本课程是一门为本科生开设的入门性质的计量经济学课程

主要讲述:(1)单方程计量经济模型:a)经典线性回归模型b)违背经典假设的回归c)线性回归模型的扩展d)模型设定误差(2)联立方程模型:a)基本概念;b)模型识别;c)参数估计

时间:周二上午8:00-9:50

周四上午8:00-9:50

伍德里奇计量经济学英文版各章总结(K12教育文档)

伍德里奇计量经济学英文版各章总结(word版可编辑修改)编辑整理:尊敬的读者朋友们:这里是精品文档编辑中心,本文档内容是由我和我的同事精心编辑整理后发布的,发布之前我们对文中内容进行仔细校对,但是难免会有疏漏的地方,但是任然希望(伍德里奇计量经济学英文版各章总结(word版可编辑修改))的内容能够给您的工作和学习带来便利。

同时也真诚的希望收到您的建议和反馈,这将是我们进步的源泉,前进的动力。

本文可编辑可修改,如果觉得对您有帮助请收藏以便随时查阅,最后祝您生活愉快业绩进步,以下为伍德里奇计量经济学英文版各章总结(word版可编辑修改)的全部内容。

CHAPTER 1TEACHING NOTESYou have substantial latitude about what to emphasize in Chapter 1。

I find it useful to talk about the economics of crime example (Example 1.1) and the wage example (Example 1.2) so that students see, at the outset,that econometrics is linked to economic reasoning, even if the economics is not complicated theory.I like to familiarize students with the important data structures that empirical economists use, focusing primarily on cross—sectional and time series data sets, as these are what I cover in a first—semester course. It is probably a good idea to mention the growing importance of data sets that have both a cross—sectional and time dimension。

第六讲 计量经济学

Functional form 函数形式

Logarithmic form 对数函数形式 Models with Quadratics 含二次式的模型 Models with interaction terms 含交叉项的模型

Intermediate Econometrics, Yan Shen 3

Redefining Variables 重新定义变量

Intermediate Econometrics, Yan Shen

9

Impact of changing the scale of the independent variable 改变解释变量测度单位的影响 The t statistics are identical. t 统计量相同 The R squared are identical. R平方相同 The SSR are identical. SSR相同 The SER are identical. SER相同

Multiple Regression Analysis 多元回归分析

y = β0 + β1x1 + β2x2 + . . . βkxk + u 4. Further Issues 进一步的问题

Intermediate Econometrics, Yan Shen

1

Chapter Outline 本章大纲

ˆ ˆ ˆ bwght = β 0 + ( β1 * 20)( cigs / 20) + β 2 fa min c

Now compare columns (1) and (3). 现在比较 第(1)列和第(3)列。 Coefficients estimates and standard errors on faminc and intercept are the same. 变量faminc系数和截距项的估计值和其标准差分析同上。 Coefficients estimates and standard errors on packs are 20 times larger. packs的系数估计值和标准差变为20倍。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter1Introduction§1.1Econometrics?1.What is econometrics?•Literally interpreted,econometrics means economic measurement •Econometrics may be defined as the quantitative analysis of actual economic phenomena based on economic theory,mathematics,and statistical inference.2.Relationships with Mathematics,Statistics and Economics •There are several aspects of the quantitative approach to economics,and no single one of these aspects taken by itself,should be confounded with econometrics.•Thus,econometrics is–by no means the same as economic statistics.–Nor is it identical with what we call general economic theory,al-though a considerable portion of this theory has a definitely quanti-tative character.–Nor should econometrics be taken as synonomous with the applica-tion of mathematics to economics.•Experience has shown that each of these three viewpoints,that of statis-tics,economic theory,and mathematics,is a necessary,but not by itself a sufficient,condition for a real understanding of the quantitative relations in modern economic life.It is the unification of all three that is powerful.And it is this unification that constitutes econometrics.3.Econometrics’History1Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008•–1933,thefirst issue of Econometrica,Ragnar Frisch;–Nobel1969,Jan Tinbergen,Ragnar Frisch;–Nobel1980,Lawrence Robert Klein;–Nobel1989,Trygve Haavelmo;–Nobel1993,Douglass North,Robert Fogel;–Nobel2000,James Heckman,Daniel McFaddan;–Nobel2003,Robert Engle,Clive Granger.4.Types of Econometricstheoretical econometrics and applied econometrics.5.Methodology of Econometrics1.(a)Statement of theory or hypothesis;(b)Specification of the mathematical model of the theory;(c)Specification of the statistical,or econometric,model;(d)Obtaining the data;(e)Estimation of the parameters of the econometric model;(f)Hypothesis testing;(g)Forecasting or prediction;(h)Using the model for control or policy purposes.6.Software for Econometrics•–EViews:QMS Software–GAUSS:Aptech System,Inc.–LIMDEP:Econometric Software–MATLAB:The Math Works,Inc.–RATS:Estima–SHAZAM:Department of Economics,University of British ColumbiaEconometric Analysis Fall2008–SPSS:SPSS,Inc.–SAS:SAS,Inc.7.References•–Damodar N.Gujarati,Basic Econometrics(4th edition),Mc Graw Hill.–Jeffrey M.Wooldridge,Introductory Econometrics:a Modern Ap-proach(2nd edition,South-western College Publishing.–Robert S.Pindyck,Daniel L.Rubinfeld,Econometric Modelsand Economic Forecasts(4th edition),Mc Graw Hill.–Greene,W.,Econometric Analysis(5th edition),2003.–Hamilton,J.,Time Series Analysis,1994,Princeton UniversityPress.–Brockwell,P.J.and R.A.Davis,Time Series:Theory andMethods,2nd Edition,1991,Springer-Verlag.–Campbell,J.Y.,A.W.Lo,and A.C.MacKinlay,The Econo-metrics of Financial Markets,1997,Princeton University Press.–Tsay,R.,Analysis of Financial Time Series,2nd Edition,2005,Wiley-Interscience.Econometric Analysis Fall2008§1.2Example:Keynes’s Consumption Function1.Statement of Theory or HypothesisFrom Keynes’s(1936)General Theory of Employment,Interest and Money: The amount that the community spends on consumption depends(i) partly on the amount of its income,(ii)partly on other objective attendant circumstances,and(iii)partly on the subjective needs and the psychological propensities and habits of the individuals composing it.Men are disposed, as a rule and on the average,to increase their consumption as their income increases,but not by as much as the increase in their income.In short,Keynes postulated that the marginal propensity to con-sume(MPC),is greater than zero but less than1.2.Specification of the Mathematical Model of ConsumptionFor simplicity,a mathematical economist might suggest the following form of the Keynesian consumption function:Y=β1+β2X,0<β2<1where Y=consumption expenditure and X=income,and whereβ1and β2,known as the parameters of the model,are,respectively,the intercept and slope coefficients.3.Specification of the Econometric Model of ConsumptionIn addition to income,other variables affect consumption expenditure.For example,size of family,ages of the members in the family,family religion,etc., are likely to exert some influence on consumption.Modify the deterministic consumption function as follows:Y=β1+β2X+εwhereε,known as the disturbance,or error term,is a random(stochastic) variable that has well-defined probabilistic properties.4.Obtaining Data5.Estimation of the Econometric ModelRegression analysis is the main tool used to obtain the estimates.6.Hypothesis TestingAs noted earlier,Keynes expected the MPC to be positive but less than1. In our example we found the MPC to be about0.72.But we want to know that,is0.72statistically less than1?7.Forecasting or PredictionIf the chosen model does not refute the hypothesis or theory under consid-eration,we may use it to predict the future value(s)of the dependent,or forecast,variable Y on the basis of known or expected future value(s)ofthe explanatory,or predictor,variable X.e of the Model for Control or Policy PurposesAn estimated model may be used for control,or policy,purposes.By appro-priatefiscal and monetary policy mix,the government can manipulate the control variable X to produce the desired level of the target variable Y.§1.3Some applications of econometricsEconometrics can play the following roles economics:•Examine how well an economic theory can explain historical economic data(particularly the important stylized facts);•Test validity of economic theories and economic hypotheses;•Predict the future evolution of the economy.To appreciate the roles of modern econometrics in economic analysis,we now discuss a number of illustrative econometric examples in variousfields of economics andfinance.1.The Keynes Model,the Multiplier and Policy Recommendation The simplest Keynes model can be described by the system of equationsY t=C t+I t+G tC t=α+βY t+εtwhere Y t is aggregate income,C t is private consumption,I t is private invest-ment,G t is government spending,andεt is consumption shock.The param-etersαandβcan have appealing economic interpretations:αis survival level consumption,andβis the marginal propensity to consume.The multiplier of the income with respect to government spending is∂Y t1−βwhich depends on the marginal propensity to consumeβ.To assess the effect offiscal policies on the economy,it is important to know the magnitude ofβ.Economic theory can only suggest a positive qual-itative relationship between income and consumption.It never tells exactly whatβshould be for a given economy.Problems:—βdiffers from country to country;—βdepends on the stage of economic development in an economy.Methods:Econometrics offers a feasible way to estimateβfrom observed data.In fact,economic theory even does not suggest a specific functional form for the consumption function.Econometrics can provide a consistent estima-tion procedure for the unknown consumption function.This is called the nonparametric method.•Hardle,W.(1990),Applied Nonparametric Regression,Cambridge Uni-versity Press,Cambridge.•Pagan,A.and A.Ullah(1999),Nonparametric Econometrics,Cam-bridge University Press,Cambridge.2.The Production Function and the Hypothesis on Constant Re-turn to ScaleSuppose that for some industry,there are two inputs,labor L i and capital stock K i,and one output Y i,where i is the index forfirm i.The production function offirm i is a mapping from inputs(L i,K i)to output Y i:Y i=exp(εi)F(L i,K i)whereεi is a stochastic factor.An important economic hypothesis is that the production technology displays a constant return to scale(CRS),which is defined as follows:λF(L i,K i)=F(λL i,λK i)for allλ>0.CRS is a necessary condition for the existence of a long-run equilibrium of a competitive market economy,and testing CRS versus IRS has important policy implication,namely whether regulation is necessary.A conventional approach to testing CRS is to assume that the production function is a Cob-Douglas function:F(L i,K i)=A exp(εi)Lαi Kβi.Then CRS becomes a mathematical restriction on parameters(α,β):H0:α+β=1Ifα+β>1,the technology display IRS.Problems:T test procedure is not suitable for many cross-sectional economic data,which usually displays conditional heteroskedasticity.Methods:One need to use a robust,heteroskedasticity-consistent test procedure,origi-nally proposed in White(1980).•White,H.(1980),A Heteroskedasticity-Consistent Covariance matrix Es-timator and a Direct Test for Heterokedasticity,Econometrica48,817-838.3.Effect of Economic Reforms on a Transitional EconomyWe now consider an extended Cob-Dauglas production function(after taking a logarithmic operation)ln Y it=ln A it+αln L it+βln K it+γBonus it+δContract it+εitwhere i is the index forfirm i∈{1,2,···,N},and t is the index for year t∈{1,2,···,T};Bonus it is the proportion of bonus out of total wage bill, and Contract it is the proportion of workers who have signed afixed-term contract.This is an example of the so-called panel data model.To examine the effects of these incentive reforms,we consider the null statistical hypothesisH0:γ=δ=0.Problems:Conventional t-tests or F-tests cannot be used because there may well exist the other way of causation from Y it to Bonus it.This will cause correlation between the bonuses and the error termεit,rendering the OLS estimator inconsistent and invalidating the conventional t-tests or F-tests.Methods:Econometricians have developed an important estimation procedure called Instrumental Variables estimation,which can effectivelyfilter out the impact of the causation from output to bonus and obtain a consistent estimator for the bonus parameter.•Hsiao,C.(2003),Panel Data Analysis,2nd Edition,Cambridge University Press,Cambridge.4.The Efficient Market Hypothesis and Predictability of Finan-cial ReturnsLet Y t be the stock return in period t,and let I t−1={Y t−1,Y t−2,···}be the information set containing the history of past stock returns.The weak form of efficient market hypothesis(EMH)states that it is impossible to predictfuture stock returns using the history of past stock returns:E(Y t|I t−1)=E(Y t)An important implication of EMH is that mutual fund managers will have no informational advantage over layman investors.One simple way to test EMH is to consider the following autoregression AR(p)modelY t=α0+pi=1αi Y t−i+εt,t=1,2,···,Twhere p is a pre-selected number of lags,andεt is a random disturbance. EMH impliesH0:α1=α2=···=αp=0.Any nonzero coefficientαi,i=1,2,···,p,is evidence against EMH.Thus,to test EMH,one can test whether theαi are jointly zero.Problems:EMH may coexist with volatility clustering,which is one of the most im-portant empirical stylized facts offinancial markets.This implies that the standard F-test statistic cannot be used here.Similarly,the popular Box and Pierce’s(1970)portmanteau Q test also cannot be used.Methods:One has to use procedures that are robust to conditional heteroskedasticity.5.Volatility Clustering and ARCH ModelsIn economics,volatility is a key instrument for measuring uncertainty and risk infinance.This concept is important to investigate informationflows andvolatility spillover,financial contagions betweenfinancial markets,options pricing,and calculation of Value at Risk.Volatility can be measured by the conditional variance of asset return Y t given the information available at time t−1.An example of the condi-tional variance is the AutoRegressive Conditional Heteroskdeasticity(ARCH) model,originally proposed by Engle(1982).An ARCH(q)model assumes thatY t=µt+εt,εt=σ2t z t,{z t}∼i.i.d.N(0,1)µt=E(Y t|I t−1),σ2t=α+ q j=1βjε2t−j,α>0,β>0.This model can explain a well-known stylized fact infinancial markets-volatility clustering:a high volatility tends to be followed by another high volatility, and a small volatility tends to be followed by another small volatility.It can also explain the non-Gaussian heavy tail of asset returns.More sophisticated volatility models,such as Bollerslev’s(1986)Generalized ARCH or GARCH model,have been developed in time series econometrics.Problems:In practice,an important issue is how to estimate a volatility model.Methods:Although{z t}is not necessarily i.i.d.N(0,1)and we know this,the estimator obtained this way is still consistent for the true model parameters.However, the asymptotic variance of this estimator is larger than that of the MLE(i.e., when the true distribution of{z t}is known),due to the effect of not knowing the true distribution of{z t}.This method is called the quasi-MLE,or QMLE.•Bollerslev,T.(1986),Generalized Autoregressive Conditional Heteroskedastc-ity,Journal of Econometrics,31,307-327.•Engle,R.(1982),Autoregressive Conditional Hetersokedasticity with Es-timates of the Variance of United Kingdom Inflation,,Econometrica50, 987-2008.•White,H.(1994),Estimation,Inference and Specification Analysis,Cam-bridge University Press:Cambridge.Chapter2The Classical Multiple LinearRegression Model§2.1Regression•Historical origin of the term regression.The term regression was introduced by Francis Galton.•Example of father-son-height.•Example of60families’weekly income(x)and weekly expenditure(y).It is clear that each conditional mean E(y|x i)is a function of x i,that isE(y|x i)=f(x i),i=1,2,···,60We assume that PRF E(y|x i)is a linear function of x i,E(y|x i)=β1+β2x iεi=y i−E(y|x i)y i=E(y|x i)+εi=β1+β2x i+εi.§2.2The Linear Regression ModelThe generic form of the linear regression model isy=f(x1,x2,···,x K)+ε=x1β1+x2β2+···+x KβK+ε—y:dependent variables();—x1,x2,···,x K:independent variables();—In the literature the terms dependent variable and independent variable are described variously.A representative list is:∗Explained variable,Explanatory variable∗Dependent variable,Independent variable21Econometric Analysis Fall2008∗Predictand,Predictor∗Regressand,Regressor∗Response,Stimulus∗Endogenous,Exogenous∗Outcome,Covariate∗Controlled variable,Control variable—ε:random disturbance().—β1,β2,···,βK are unknown butfixed parameters()knownas the regression coefficients(intercept coefficient(),slope coeffi-cient()).—Population Regression Function(PRF)()of y on x1,x2,···,x K.Each observation in a sample(y i,x i1,x i2,···,x iK)i=1,2,···,n is gener-ated by an underlying process described byy i=x i1β1+x i2β2+···+x iKβK+εi(i=1,2,···,n)(1)—Sample Regression Function(SRF)()ˆy i=x i1ˆβ1+x i2ˆβ2+···+x iKˆβK(i=1,2,···,n)where(ˆβ1,ˆβ2,···,ˆβK)are some estimations()ofβ1,β2,···,βK.Our objective is—estimate the unknown parameters of the model;—use the data to study the validity of theoretical propositions();—use the model to predict()the variable y.Example1:Keynes’s Consumption FunctionExample2:Earning and EducationEconometric Analysis Fall2008§2.3Assumptions of the Classical Linear Regression Model •Linearity()•Full Rank()•Exogeneity of the independent variables()•Homoscedasticity and nonautocorrelation()•Exogenously generated data()•Normal distribution()Firstly,we give the following notations:—x k is a column vector(n×1),x k=(x1k,x2k,···,x nk) k=1,2,···,K.—X is a data matrix(n×K)X=x11x12···x1Kx21x22···x2K.........x n1x n2···x nK=(x1,x2,···,x K)—y is a column observation vector(n×1),y=(y1,y2,···,y n) —εis a column random vector(n×1)ε=(ε1,ε2,···,εn) —βis a column coefficient vector(K×1)β=(β1,β2,···,βK) Using above notations,the model(1)can be written asEconometric Analysis Fall2008y=x1β1+x2β2+···+x KβK+εor in form ofy=Xβ+ε.When referring to a single observation,we would writey i=x iβ+εiAssumption1:LinearityWe can write the multiple regression model asy=Xβ+εFor the regression to be a linear,it must be of the form of model(1) either in the original variables or after some suitable transformation.—loglinear model()—semilog model()—translog model()Assumption2:Full RankX has full column rank(),rank(X)=K.—columns of X are linearly independent();—size of observation()n is at least as large as K.—identification condition()—short rank()cause nearly multicollinearity().Assumption3:Conditional Mean()is ZeroThis conditional mean assumption stats that no observations on X conveyEconometric AnalysisFall 2008information about the expected value of the disturbance.(X)E (εi |X )=0E (ε|X )=E (ε1|X )=0E (ε2|X )=0...E (εn |X )=0=0—assume that the disturbances convey no information about each other.E [εi |ε1,···,εi −1,εi +1,···,εn ]=0—E (εi )=0,Cov (εi ,X )=0,i =1,2,···,nAssumption4:Homoscedasticity and NonautocorrelationHomoscedasticity :V ar [εi |X ]=σ2,for all i =1,···,n.—heteroscedasticity:(1)Profits of firms (size);(2)Household expendi-ture patterns (income).Nonautocorrelation :the assumption is that deviations of observations from their expected value are uncorrelated().Cov [εi ,εj |X ]=0,for alli =j.Econometric AnalysisFall 2008V ar [ε|X ]=E [εε |X ]=E (ε1ε1|X )E (ε1ε2|X )···E (ε1εn |X )E (ε2ε1|X )E (ε2ε2|X )···E (ε2εn |X )...E (εn ε1|X )E (εn ε2|X )···E (εn εn |X )=σ20···00σ2...0 (00)···σ2=σ2I—V ar [ε]=σ2I—Disturbances that meet the twin assumptions of homoscedasticity and nonautocorrelation are sometimes called spherical disturbances ().Assumption5:Exogenously Generated DataX may be fixed or random,but it is generated by a mechanism that is unrelated to ε.Assumption6:Normalityε|X ∼N [0,σ2I ]Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Econometric Analysis Fall2008Appendix for Chapter2Conditional DistributionSuppose X and Y are continuous random variable,and the joint probability density function is f(x,y).The conditional densities over y for each value of x isf(x,y)f Y|X(y|x)=31Econometric Analysis Fall2008•Decomposition of VarianceV ar[y]=V ar X[E[y|x]]+E X[V ar[y|x]].Econometric Analysis Fall2008§3.4Goodness of Fit and the Analysis of Variance()Consider a multiple regression modely=Xb+e=ˆy+e,For an individual observation,we havey i=ˆy i+e i=x i b+e i,y i−¯y=ˆy i−¯y+e i=(x i−¯x) b+e i.(2) where¯x=133Econometric Analysis Fall2008Econometric Analysis Fall2008 deviations from sample means,M0=I n−1n−1n−1n···−1n−1n,M0y=y1−¯yy2−¯y...y n−¯ywhere i=(1,1,···,1) ,then equation(2)could use the following formM0y=M0Xb+M0e.The total sum of squares isy M0y=b X M0Xb+e e.(4) Definition:Coefficient of determination()R2=SSRy M0y=1−e e35Econometric Analysis Fall2008Theorem3.6Change in R2When Adding Variable to a Regression Let R2Xz be the coefficient of determination in the regression of y on X and an additional variable z,let R2X be the same for the regression of y on X alone,and let r∗2yz be the partial correlation between y and z,controlling for X.ThenR2Xz=R2X+(1−R2X)r∗2yz.Two problems:•Thefirst concerns the number of the explanatory variable.•The second concerns the constant term in the model.The adjusted R2()which incorporates a penalty for these results is computed as follows:¯R2=1−e e/(n−K)(1−R2).n−KWhether¯R2rises or falls depends on actually computed as the contribution of the new variable to thefit of the regression more than offsets the correction for the loss of an additional degree of freedom.(¯R2)Econometric Analysis Fall2008Appendix-B for Chapter31SPSSSPSS Analyze→Correlatio()→Par-tial()→”Partial Correlation”→”Controlling for”→”Variables”→OK.2EViews(1)New File Work File()(2)Quick Empty Group,(3)ls c12...K.Chapter4Finite-Sample Properties of the LeastSquares Estimator§4.1Gauss Markov Theorem1.Assumptions of the Classical Linear Regression Model:A1.Linearity().A2.Full Rank().A3.Exogeneity of the Independent Variables().A4.Homoscedasticity and nonautocorrelation().A5.Exogenously generated data().A6.Normal Distribution().2.Unbiased Estimation():Writeb=(X X)−1X y=β+(X X)−1X ε.Take expectations,iterating over X,E(b|X)=β+E{(X X)−1X ε|X}=β+(X X)−1X E(ε|X)=β.Therefore,E(b)=E X{E(b|X)}=E X(β)=β.38Econometric Analysis Fall2008V ar(b|X)=E{(b−E(b|X))(b−E(b|X)) |X}=E{(b−β)(b−β) |X}=E{(X X)−1X ε·ε X(X X)−1|X}=(X X)−1X ·E{εε |X}·X(X X)−1=σ2(X X)−1.Use the decomposition of varianceV ar(b)=E X{Var(b|X)}+Var X{E(b|X)}=σ2E X{(X X)−1}.3.Minimum Variance():Since b has been proved that it is unbiased estimation,in the following we are going to show that b has minimum variance in the class of unbiased estimations(b).Let b∗be a another linear unbiased estimator ofβ,b∗=[(X X)−1X +C]ywhere C is a constant matrix.b∗=[(X X)−1X +C](Xβ+ε)=β+(X X)−1X ε+CXβ+Cε.Since b∗is a unbiased estimation ofβ,the following equation must be hold (b∗)CX=0.Therefore,b∗−β=(X X)−1X ε+Cε.Econometric Analysis Fall2008 V ar(b∗|X)=E{[(X X)−1X ε+Cε]·[(X X)−1X ε+Cε] |X}=σ2(X X)−1+σ2(X X)−1(CX) +σ2(CX)(X X)−1+σ2(CC )=σ2(X X)−1+σ2(CC ).Note that,in the above equation CC is a nonnegative definite matrix( ).Therefore,every quadratic form in V ar(b∗|X)is larger than the corresponding quadratic form in V ar(b|X),which implies a very important conclusion of the least squares.Theorem4.2Gauss-Markov TheoremIn the classical linear regression model with regressor matrix X,the least squares estimator b is the minimum variance linear unbiased estimator of β.For any vector of constants w,the minimum variance linear unbiased estimator of w βin the classical regression model is w b,where b is the least squares estimator.(X bβw,w βw b,b)Theorem4.3Gauss-Markov Theorem(Concluded)In the classical linear regression model,the least squares estimator b is the minimum variance linear unbiased estimator ofβwhether X is stochastic or nonstochastic,so long as the other assumptions of the model continue to hold.§4.2Sampling Distributions of the Least Squares1.Unbiased estimator ofσ2:We can use the following to estimate the variance of stochastic error term()ˆσ2=1n.Note thatE(e e|X)=E{tr(ε Mε)|X}=E{tr(Mεε )|X}=tr{M·E(εε |X)}=σ2·tr(M)=σ2·tr{I n−X(X X)−1X }=(n−K)σ2andE(e e)=E X{E(e e|X)}=(n−K)σ2.An unbiased estimator ofσ2iss2=e e41Theorem B.8Distribution of an Idempotent Quadratic Form in a Standard Normal VectorIf x∼N(0,I)and A is idempotent,then x Ax has a chi-squared distribution with degrees of freedom equal to the number of unit roots of A,which is equal to the rank of A.(x∼N(0,I)A x AxA A)Applying the above theorem,s2follows theχ2distribution in the following form(n−K)s2σ2=(εσ)∼χ2(n−K).3.A very important theorem about the independence of estimations:()Theorem4.4Independence of b and s2Ifεis normally distributed,then the least squares coefficient estimator b is statistically independent of the vector e and therefore,all functions of e, including s2.§4.3Testing Hypothesis of Regression Model1.Testing a hypothesis about a coefficient():Considering the significance of the k th explanatory variable,that is testing the following hypothesis:H0:βk=0←→H1:βk=0.With the normality assumption forε,the LS estimator b are themselves normally distributed with means and variance.(1)Whenσ2is given,the z-statisticz k=b k−βk V ar(b k)follows a standard normal distribution,where V ar(b k)=σ2(X X)−1kkis the variance of the b k.(2)Whenσ2is unknown,by using s2instead ofσ2,we can derive a statistic(n−K)s2V ar(b k)[(n−K)s243Notes:•Under the null hypothesis;If the value of trueβk is specified under the null hypothesis,the t ratio can readily be computed from the available sample,and therefore it can serve as a test statistic.•Given significance levelα=5%;The confidence-interval statements such as the following can be made:Prob −tα/2≤b k−β∗k V ar(b k)≤tα/2 =1−αwhereβ∗k is the ture value ofβk under H0and where−tα/2and tα/2are the values of t(the critical t values)obtained from the t table for(α/2)level of significance.•Acceptance region of t−test(t)Rearranging confidence-interval,we obtainProb β∗k−tα/2 V ar(b k) =1−α. which gives the interval in which b k will fall with(1−α)probability,given βk=β∗k.acceptance region(of the null hypothesis);rejection region(of H0)or the critical region;critical values.•Two sides test and one side test;•Simple test and composite test;•p−value.2.Confidence interval for parameters():Under the confidence level1−α,a confidence interval forβk isProb b k−tα/2 V ar(b k) =1−α.3.Testing the significance of the regression(): Considering the significance of the regression equation as a whole,that is testing the following hypothesisH0:β=0←→H1:β=0orH0:β1=β2=···=βK=0←→H1:Not all ofβ1,β2,···,βK equals zero.We have the following results:(1)SST=1σ2ni=1(y i−ˆy i)2∼χ2(n−K)(3)SSR=1SSE/(n−K)=R2/(K−1)45Appendix-A for Chapter4Finite Sample Properties of Statistics()1.Unbiasedness.An estimatorˆθis said to be an unbiased estimator ofθif the expected value ofˆθis equal to the trueθ,that isE(ˆθ)=θ.2.Minimum Variance.ˆθis said to be a minimum-variance estimator ofθif the variance ofˆθ1is 1smaller than or at most equal to the variance ofˆθ2,which is any other estimator ofθ.3.Best Unbiased,or Efficient,Estimator.Ifˆθ1andˆθ2are two unbiased estimators ofθ,and the variance ofˆθ1is smaller than or at most equal to the variance ofˆθ2,thenˆθ1is a minimum-variance unbiased,or best unbiased,or efficient,estimator.Appendix-B for Chapter4Large Sample Properties of Statistics()It often happens that an estimator does not satisfy one or more of the desir-able statistical properties in small samples.But as the sample size increases indefinitely,the estimator possesses several desirable statistical properties. These properties are known as the large-sample,or asymptotic,proper-ties.1.Asymptotic Unbiasedness.An estimatorˆθis said to be an asymptotically unbiased estimator ofθifE(ˆθ)=θ.limn→∞2.Consistency.ˆθis said to be a consistent estimator if it approaches the true valueθas the sample size gets larger and larger.3.Asymptotic EfficiencyLetˆθbe an estimator ofθ.The variance of the asymptotic distribution ofˆθis called the asymptotic variance ofˆθ.Ifˆθis consistent and its asymptotic variance is smaller than the asymptotic variance of all other consistent esti-mators ofθ.ˆθis called asymptotically efficient.4.Asymptotic Normality.An estimatorˆθis said to be asymptotically normally distributed if its sam-pling distribution tends to approach the normal distribution as the sample size n increases indefinitely.。