信用证翻译

信用证翻译参考译文

信用证翻译参考译文信用证翻译参考译文Issue of a Documentary Credit开具跟单信用证(说明此电文的目的)BKJPYUTYA 08E SESSION: 000 ISN: 000000(是开证行的密押,可不翻译出来)BANK OF OSAKANEWYORKNO. 216,AUMAHU,AKI_GUN,JAPAN ------- 开证行Destination Bank: 目地的银行或目地行Xxxxxxxxxxx (通知行的密押Test key)BANK OF CHINA, NANTONG BRANCH153, RENMING RD NANTONG CHINATEL: 0513-*******---- 中国银行南通分行中国南通人民路153号电话:0513-*******Type of Documentary Credit 40A IRREVOCABLE --信用证性质: 不可撤消Letter of Credit Number 20 LGU-002156 --信用证号码: LGU-002156 Date of Issue 31C 010302 -开证日期:2001年3月2日Date and Place of Expiry 31D 010330 CHINA----有效时间地点:2001年3月30日,在中国到期Applicant Bank 51A NEWYORK BANK, OSAKA---开证行:纽约银行大阪分行Applicant 50 YOUNGAN TRADING --开证申请人:永安贸易株式会社Beneficiary 59 JIAHA INTER TRADING CO.,60NONGJU RD HUAIAN JIANGSU, CHINA----受益人: 佳哈国际贸易公司中国江苏淮安农具路Currency Code, Amount 32B USD 26 520,00----币制和总金额:26 520,00美元Available with...by... 41D ANY BANK BY NEGOTIATION-----议付适用银行:任何银行议付Drafts at 42C AT SIGHT ----汇票期限:即期Drawee 42D NEW YORK BANK,OSAKA-----付款行:大阪纽约银行Partial Shipments 43P N OT ALLOWED ---分批装运:不允许Transshipment 43T NOT ALLOWED ---转运:不允许Shipping on Board/Dispatch/Packing in Charge at/ from 44A SHANGHAI----起运港:上海Transportation to 44B OSAKA, JAPAN----目的港: 日本大阪Latest Date of Shipment 44C 010320 ------最迟装运期:2001年3月20日Description of Goods or Services: 45A ------货物描述100 PCT RAYON DIASH CLOTH ---- 100% 人造丝合成纤维布30S X 30S / 56 X 54 /40 X 40CM 2 PLY ---人造丝合成纤维布幅度规格CIF OSAKA --- CIF大阪CHINA ORIGIN ---中国原产(不是“中国起源”)Documents Required: 46A ------议付单据(需要提交的跟单单据)1. SIGNED COMMERCIAL INVOICE IN 5 COPIES.------签字的商业发票一式五份2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED "FREIGHT PREPAID" NOTIFYING ACCOUNT------全套清洁已装船提单, 抬头人/收货人为TOORDER(凭指示),空白背书,且注明运费已付(FREIGHT PREPAID),通知人是客户或开证申请人。

商务英语写作-LC信用证详述

★以下是⽆忧考英⽂写作翻译频道为⼤家整理的《商务英语写作-L/C信⽤证详述》,供⼤家参考。

更多内容请看本站频道。

信⽤证(Letter of Credit,L/C) 信⽤证是⼀种由银⾏依照客户的要求和指⽰开⽴的有条件的付款的书⾯⽂件。

其当事⼈有: (1)开证申请⼈(Applicant).向银⾏申请开⽴信⽤证的⼈,在信⽤证中⼜称开证⼈(Opener)。

(2)开证⾏(Opening/Issuing Bank)。

接受开证申请⼈的委托开⽴信⽤证的银⾏,它承担保证付款的责任。

(3)通知⾏(Advising/Notifying Bank)。

指受开证⾏的委托,将信⽤证转交出⼝⼈的银⾏,它只证明信⽤证的真实性,不承担其他义务。

(4)受益⼈(Benificiary)。

指信⽤证上所指定的有权使⽤该证的⼈,即出⼝⼈或实际供货⼈。

(5)议付银⾏(Negotiating Bank)。

指愿意买⼊受益⼈交来跟单汇票的银⾏。

(6)付款银⾏(Paying/Drawee Bank)。

信⽤证上指定付款的银⾏,在多数情况下,付款⾏就是开证⾏。

信⽤证⽅式的⼀般收付程序 (1)开证申请⼈根据合同填写开证申请书并交纳押⾦或提供其他保证,请开证⾏开证。

(2)开证⾏根据申请书内容,向受益⼈开出信⽤证并寄交出⼝⼈所在地通知⾏。

(3)通知⾏核对印鉴⽆误后,将信⽤证交受益⼈。

(4)受益⼈审核信⽤证内容与合同规定相符后,按信⽤证规定装运货物、备妥单据并开出汇票,在信⽤证有效期内,送议付⾏议付。

(5)议付⾏按信⽤证条款审核单据⽆误后,把贷款垫付给受益⼈。

(6)议付⾏将汇票和货运单据寄开证⾏或其特定的付款⾏索偿。

(7)开证⾏核对单据⽆误后,付款给议付⾏。

(8)开证⾏通知开证⼈付款赎单。

信⽤证主要内容 (1)对信⽤证本⾝的说明。

如其种类、性质、有效期及到期地点。

(2)对货物的要求。

根据合同进⾏描述。

(3)对运输的要求。

(4)对单据的要求,即货物单据、运输单据、保险单据及其它有关单证。

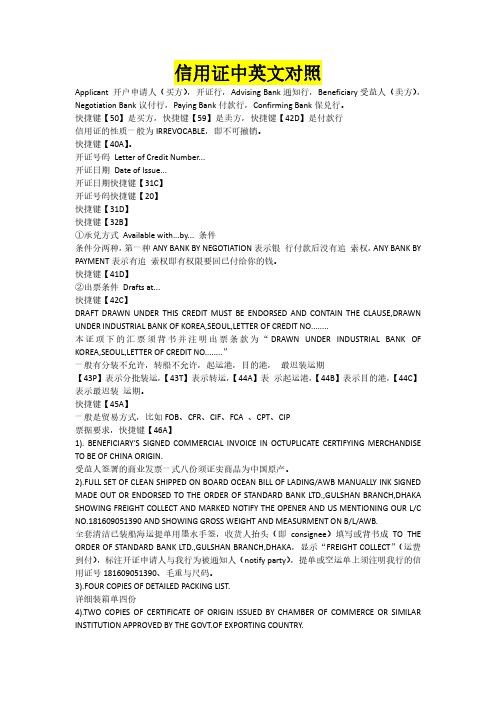

信用证中英文对照

信用证中英文对照Applicant 开户申请人(买方),开证行,Advising Bank通知行,Beneficiary受益人(卖方),Negotiation Bank议付行,Paying Bank付款行,Confirming Bank保兑行。

快捷键【50】是买方,快捷键【59】是卖方,快捷键【42D】是付款行信用证的性质一般为IRREVOCABLE,即不可撤销。

快捷键【40A】。

开证号码Letter of Credit Number...开证日期Date of Issue...开证日期快捷键【31C】开证号码快捷键【20】快捷键【31D】快捷键【32B】①承兑方式Available with...by... 条件条件分两种,第一种ANY BANK BY NEGOTIATION表示银行付款后没有追索权,ANY BANK BY PAYMENT表示有追索权即有权限要回已付给你的钱。

快捷键【41D】②出票条件Drafts at...快捷键【42C】DRAFT DRAWN UNDER THIS CREDIT MUST BE ENDORSED AND CONTAIN THE CLAUSE,DRAWN UNDER INDUSTRIAL BANK OF KOREA,SEOUL,LETTER OF CREDIT NO........本证项下的汇票须背书并注明出票条款为“DRAWN UNDER INDUSTRIAL BANK OF KOREA,SEOUL,LETTER OF CREDIT NO........”一般有分装不允许,转船不允许,起运港,目的港,最迟装运期【43P】表示分批装运,【43T】表示转运,【44A】表示起运港,【44B】表示目的港,【44C】表示最迟装运期。

快捷键【45A】一般是贸易方式,比如FOB、CFR、CIF、FCA 、CPT、CIP票据要求,快捷键【46A】1). BENEFICIARY'S SIGNED COMMERCIAL INVOICE IN OCTUPLICATE CERTIFYING MERCHANDISE TO BE OF CHINA ORIGIN.受益人签署的商业发票一式八份须证实商品为中国原产。

商务英语翻译Unit 10 信用证翻译

术语积累

• • • • • • • • • • • • 保兑信用证Confirmed L/C 不可撤销信用证Irrevocable L/C 可撤销信用证Revocable L/C 即期信用证Sight L/C 远期信用证Usance L/C 可转让信用证Transferable/Assignable/Transmissible L/C 可分割信用证Divisible L/C 有追索权信用证L/C with recourse 无追索权信用证L/C without recourse 循环信用证Revolving L/C 背对背信用证Back-to-Back L/C 对开信用证Reciprocal L/C

词汇提示

• • • • • • • • • • 寄送forward 规定stipulate 指定design 预先垫付 流程图 flowchart 受票人drawee 出票人drawer 转递transmission 偿付reimbursement 付款honour

术语积累

• • • • • • • • • • • • 汇付 remittance 信汇mail transfer 电汇telegraphic transfer 票汇demand draft 托收collection 付款交单documents against payment 承兑交单documents against acceptance 开证行issuing bank 申请人 applicant 跟单信用证Documentary L/C 光票信用证Clean L/C 不保兑信用证Unconfirmed L/C

Unit 10 信用证翻译

Letter of credit

词汇提示

• • • • • • • • Pre-advise v. 预通知 Telex n. 电传 Negociation n.议付 Accompany v. 随同 Signed adj.已签署的 Quintuplicate n. 一式五份 notify v. 通知 evidence v. 证明,显示,表明

信用证翻译[完整版]

![信用证翻译[完整版]](https://img.taocdn.com/s3/m/cbaba86969eae009581becd3.png)

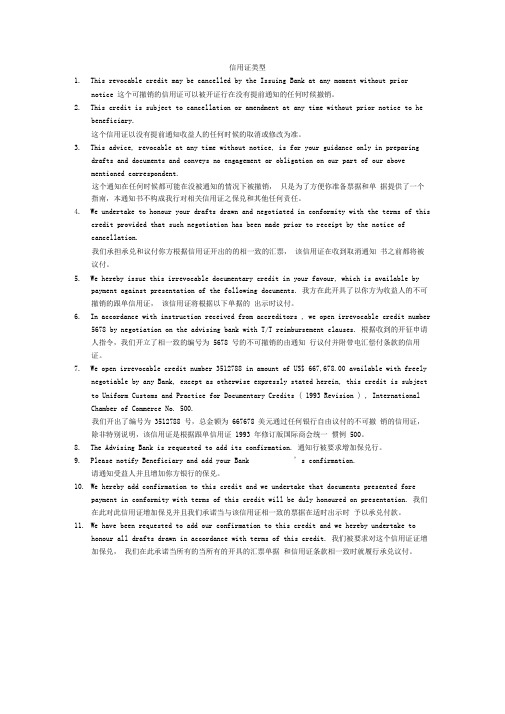

信用证类型1. This revocable credit may be cancelled by the Issuing Bank at any moment withoutprior notice这个可撤销的信用证可以被开证行在没有提前通知的任何时候撤销。

2. This credit is subject to cancellation or amendment at any time without priornotice to he beneficiary.这个信用证以没有提前通知收益人的任何时候的取消或修改为准。

3. This advice, revocable at any time without notice, is for your guidance onlyin preparing drafts and documents and conveys no engagement or obligation on our part of our above mentioned correspondent.这个通知在任何时候都可能在没被通知的情况下被撤销,只是为了方便你准备票据和单据提供了一个指南,本通知书不构成我行对相关信用证之保兑和其他任何责任。

4.We undertake to honour your drafts drawn and negotiated in conformity with theterms of this credit provided that such negotiation has been made prior to receipt by the notice of cancellation.我们承担承兑和议付你方根据信用证开出的的相一致的汇票,该信用证在收到取消通知书之前都将被议付。

5.We hereby issue this irrevocable documentary credit in your favour, which isavailable by payment against presentation of the following documents.我方在此开具了以你方为收益人的不可撤销的跟单信用证,该信用证将根据以下单据的出示时议付。

信用证翻译完整版

信用证类型1.This revocable credit may be cancelled by the Issuing Bank at any moment without priornotice 这个可撤销的信用证可以被开证行在没有提前通知的任何时候撤销。

2.This credit is subject to cancellation or amendment at any time without prior notice to hebeneficiary.这个信用证以没有提前通知收益人的任何时候的取消或修改为准。

3.This advice, revocable at any time without notice, is for your guidance only in preparingdrafts and documents and conveys no engagement or obligation on our part of our abovementioned correspondent.这个通知在任何时候都可能在没被通知的情况下被撤销,只是为了方便你准备票据和单据提供了一个指南,本通知书不构成我行对相关信用证之保兑和其他任何责任。

4.We undertake to honour your drafts drawn and negotiated in conformity with the terms of thiscredit provided that such negotiation has been made prior to receipt by the notice ofcancellation.我们承担承兑和议付你方根据信用证开出的的相一致的汇票,该信用证在收到取消通知书之前都将被议付。

5.We hereby issue this irrevocable documentary credit in your favour, which is available bypayment against presentation of the following documents. 我方在此开具了以你方为收益人的不可撤销的跟单信用证,该信用证将根据以下单据的出示时议付。

信用证翻译

英语信用证的特点与翻译

一、格式统一、规范,用语简练 (一)省略be动词 例:Partial shipment allowed 允许分批。 (被动语态省略be动词)

• (二)介词或介词词组代替句子 • 例:In the event of discrepant documents are presented to us and rejected, we may release the documents and effect settlement upon applicant’s waiver of such discrepancies. • 如果受益人提交了具有不符点的单据并被我行拒 付,在申请人放弃对上述不符点修改权力的条件 下,我行将放单结汇。 • 在例子中,分别使用介词词组in the event of 和介 词upon代替条件状语从句

• • • • • • • • • • • • • • • • •

3.drawee 付款人(或称受票人,指汇票) (1)to drawn on (or :upon) 以(某人)为付款人 (2)to value on 以(某人)为付款人 (3)to issued on 以(某人)为付款人 4.drawer 出票人 5.advising bank 通知行 (1)advising bank 通知行 (2)the notifying bank 通知行 (3)advised through…bank 通过……银行通知 6.opening bank 开证行 (1)opening bank 开证行 (2)issuing bank 开证行 (3)establishing bank 开证行 7.negotiating bank 议付行 8.paying bank 付款行 9.reimbursing bank 偿付行 10.confirming bank 保兑行

信用证翻译完整版样本

信用证翻译完整版样本顺利交单,感谢所有曾给我帮助人,做一份信用证翻译,供新手参考。

27 SEQUENCE OFTOTAL1/140A FORM OF L/C(Y/N/T)IRREVOCABLE (不可撤销信用证)20 DOCUMENT CREDITNO019080531C DATE OFISSUE070918 (开证日期)40EUCPURR LATEST VERSION 依照UCP最新版本31D DATE AND PLACE OF EXPIRE 到期日和到期地点071220CHINA51D APPLICANT BANK 开证行THE HOUSINGBANKINT'L TRADEOPERATIONP.O.BOX JORDAN.50 APPLICANT 申请人M/S:GD IMP. ANDEXP.GROUPP.O.BOX AMMAN 11118JORDANTEL:00962-6222259 BENEFICIARY 受益人COG GROUP CO.LTDADD:NO.619 HUBIN SOUTH RD XIAMENCITYCHINATEL: 0086-592-2222232B CURRENCYCODE,AMOUNTUSD35985, (信用证金额)39A PERCENTAGE CREDITAMOUNT05/05 (金额允许5% 上下浮动)41A AVAILABLEWITH..BYSCBLCNSXXXX(SCBLCNS是渣打银行的代码,意思是渣打银行议付)BY PAYMENT (by payment没有注明远期,为即期)43P PARTIALSHIPMENTALLOWED (允许分批装运)43T TRANSSHIPMENTALLOWED (允许转船)44ETIANJIN/CHINA (装运港)44F (注意B/L 的port of discharge 和port of deliver都得是AQABA PORT )AQABA PORT - JORDAN BY VESSEL INCONTAINER.44C LATEST DATE OF SHIPMENT 最后装船期07113045A DESCRIPTION OF GOODS 货物描述2300 SQM OF GRANITE PRODUCT (MONGOLLAN BLACK-DEGREEOFPOLISHED MORE 90 0/0) AT TOTAL AMOUNT USD35985ALL OTHER DETAILS AS INVOICE NO.XM2007082701, DATED 25/3/2007FOB: TIANJIN/CHINA 特别注意要完全按照这个描述做发票。

英语翻译十三章信用证

(1)advising bank 通知行 (2)the notifying bank 通知行 (3)advised through…bank 通过……银行通知 6.opening bank 开证行 (1)opening bank 开证行 (2)issuing bank 开证行 (3)establishing bank 开证行 7.negotiating bank 议付行 8.paying bank 付款行 9.reimbursing bank 偿付行 10.confirming bank 保兑行

例1. 原文:本银行(开证银行)授权贵银行(通知银行)对 本信用证加以保兑。

译文:We (The Issuing Bank) are authorized to add your (the Advising Bank’s) confirmation to this credit.

点评:信用证的开立往往会涉及几方。这几方分别是开证申 请人(applicant)、开证银行(the opening bank)、 通知银行(the Advising Bank)、受益人(Beneficiary)、 议付银行(the Negotiating Bank)和付款银行(the Paying Bank)。

十三章 国际商务信用证的汉英翻译

信用证的含义

信用证 是由银行发行的证书,授权持证者可从开证行(Opening Bank)、其支行或其他有关银行或机构提取所述款项。

信用证的两大原则:独立性原则,严格相符原则

信用证方式有三个特点: 一是信用证是一项自足文件(self-sufficient instrument)。 二是信用证方式是纯单据业务(pure documentary

信用证翻译完整版

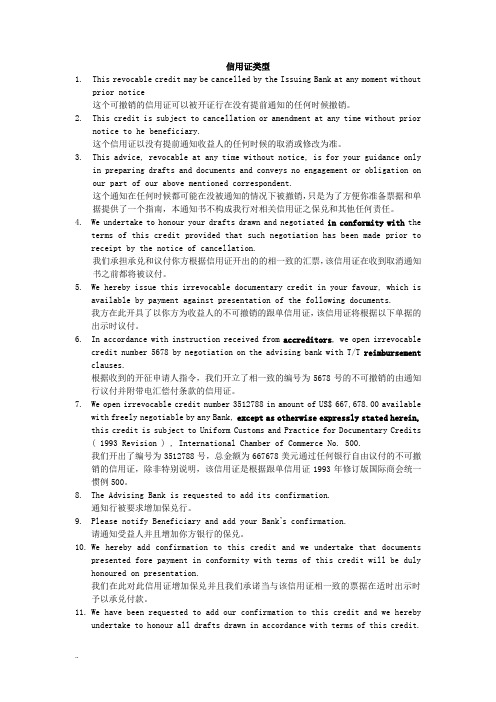

信用证类型1. This revocable credit may be cancelled by the Issuing Bank at any moment withoutprior notice这个可撤销的信用证可以被开证行在没有提前通知的任何时候撤销。

2. This credit is subject to cancellation or amendment at any time without priornotice to he beneficiary.这个信用证以没有提前通知收益人的任何时候的取消或修改为准。

3. This advice, revocable at any time without notice, is for your guidance onlyin preparing drafts and documents and conveys no engagement or obligation on our part of our above mentioned correspondent.这个通知在任何时候都可能在没被通知的情况下被撤销,只是为了方便你准备票据和单据提供了一个指南,本通知书不构成我行对相关信用证之保兑和其他任何责任。

4.We undertake to honour your drafts drawn and negotiated in conformity with theterms of this credit provided that such negotiation has been made prior to receipt by the notice of cancellation.我们承担承兑和议付你方根据信用证开出的的相一致的汇票,该信用证在收到取消通知书之前都将被议付。

5.We hereby issue this irrevocable documentary credit in your favour, which isavailable by payment against presentation of the following documents.我方在此开具了以你方为收益人的不可撤销的跟单信用证,该信用证将根据以下单据的出示时议付。

信用证英语:against

在国际贸易中,进⼝⼈和出⼝⼈都不愿意把货或钱先交给对⽅,为了解决这⼀⽭盾,避免风险,就出现了信⽤证付款的信⽤⽅式,即信⽤证(Letter of Credit,简称L/C )。

信⽤证⽀付⽅式是⽬前国际贸易中最主要的付款⽅式,我国⽬前近百分之七⼗的进出⼝货物都是靠信⽤证结汇完成的。

在对信⽤证的实际操作中,业务员由于专业及英语⽔平层次不⼀,对信⽤证特别条款理解不深或理解错误,给企业或所在单位造成不应有的损失的事情时有发⽣。

信⽤证的内容⼀般来说较为复杂,长句⼦多,涉及到⾦融、保险、商检、报运、银⾏等多项专业知识。

信⽤证的审核既需要英语⽔平,还需要多年积累的经验。

单证审核也是⼀项专门技术。

下⾯我们就对信⽤证条款中的⼀些关键英⽂词语做必要的翻译和分析,供⼤家参考。

今天我们先来看看against。

我们常见的against 是介词,通常意为“反对”( indicating opposition) ,例如:Public opinion was against the Bill. 舆论反对此法案。

The resolution was adopted by a vote of 30 in favour to 4 against it. 决议以30 票赞成、4 票反对获得通过。

另外还有“⽤…… 交换,⽤…… 兑付”之意。

如:“the rates against U. S. dollars”中的against 就是指美元兑换率。

但在信⽤证中常出现的against 这个词及词义却另有所指,⼀般词典⽆其释义及相关⽤法。

注意以下两个出现在信⽤证句中的against 之意,其意思是凭…… ”、“以…… ”(“take as the basis” or “by”),⽽不是“以…… 为背景”、“反对”、“对照”、“兑换”或其他什么意思。

1. This credit valid until September 17, 2001 in Switzerland for payment available against the presentation of following documents… 本信⽤证在2001年9⽉17⽇在瑞⼟到期前,凭提交以下单据付款……2. Documents bearing discrepancies must not be negotiated against guarantee and reserve. 含有不符之处的单据凭保函或在保留下不能议付。

常见信用证条款英汉对照翻译

常见信用证条款英汉对照翻译Business Documents国际商务单证EDI (Electronic Date Interchange)电子数据交换2000 INCOTERMS2000年国际贸易术语解释通则UCP500Uniform Customs and Practice for Documentary Credit, ICC Publication No.500 跟单信用证统一惯例CISGUnited Nations Convention on Contracts for the International Sale of Goods联合国国际货物销售合同公约Inquiry询价Offer发盘Counter Offer 还价Acceptance接受S/C Sales Confirmation 销售确认书(即合同)Physical Delivery实际交货Symbolic Delivery象征性交货FOBFree on Board装运港船上交货CFRCost and Freight成本加运费CIFCost Insurance and Freight成本加保险费和运费FCAFree Carrier货交承运人CPTCarriage Paid to运费付至CIPCarriage and Insurance Paid to 运费、保险费付至EXW工厂交货FAS装运港船边交货DAF边境交货DES目的港船上交货DEQ目的港码头交货DDU未完税交货DDP完税后交货Commission佣金Discount折扣Remittance汇付Remitter汇款人Payee收款人M/T Mail Transfer 信汇T/T Telegraphic Transfer电汇D/D Demand Draft票汇Payment in Advance预付货款Cash with Order随订单付款Collection 跟单托收Principal 委托人Drawee 付款人D/P Documents against Payment 付款交单D/A Documents against Acceptance承兑交单D/P at sight 即期付款交单D/P after sight远期付款交单T/R Trust Receipt信托收据L/C Letter of Credit 信用证Applicant 开证申请人Issuing Bank 开证行Advising Bank通知行Beneficiary受益人Negotiating Bank 议付行Paying Bank 付款行Documentary Credit跟单信用证Clean Credit光票信用证Irrevocable Letter of Credit不可撤销信用证Confirmed Letter of Credit 保兑信用证Sight Credit 即期信用证Usance Letter of Credit远期信用证Usance Credit Payable at Sight假远期信用证Stand-by L/C备用信用证L/G Banker’s Letter of Guarantee 银行保函Factoring国际保理O/A 挂帐,赊销(Open account)COD 货到付款(Cash on delivery)Payment by Installment分期付款Deferred Payment延期付款Sales by Quality凭现货销售Sales by Sample凭样品销售Seller’s Sample 卖方样品Buyer’s Sample 买方样品Counter Sample 对等样品Quality to be Considered as being to the Sample 品质与样品大致相同Specification 规格Grade 等级Standard 标准FAQFair Average Quality 良好平均品质,大路货Trade Mark 商标Brand Name品牌Name of Origin产地名称M/T Metric ton 公吨L/T Long ton 长吨S/T Short ton 短吨G.W.Gross Weight 毛重N.W. Net Weight 净重Gross for Net 以毛作净Tare Weight皮重More or Less Clause 溢短装条款Neutral Packing 中性包装Shipping Mark 运输标志,唛头Indicative Mark 指示性标志Warning Mark 警告性标志Product Code 条形码标志Commercial Invoice 商业发票,发票Customs Invoice海关发票Consular Invoice领事发票Manufacture’s Invoice 厂商发票Combined Invoice 联合发票Proforma Invoice 形式发票Packing list装箱单Weight List/Memo重量单Packing Specification包装说明Detailed Pack list详细包装单Specification List规格单Size/Color Assortment List尺码/颜色搭配单Measurement List尺码单Beneficiary’s Declaration/Certificate/Statement受益人证明Liner Transport 班轮运输Charter Transport 租船运输FCL 整箱货(Full Container Load)LCL 拼箱货(Less than Container Load)CY 集装箱堆场(Container Yard)CFS集装箱货运站(Container freight station)D/R 场站收据(Dock Receipt)CLP 集装箱装箱单(Container Load Plan)Booking Note一般货物海运出口托运单Container Booking Note集装箱货物托运单S/O Shipping Order 装货单,关单M/RMate’s Receipt 收货单,大副收据B/L Ocean Bill of Lading 海运提单On Board B/L 已装船提单Received for Shipment B/L备运提单Clean B/L清洁提单Straight B/L 记名提单Open B/L不记名提单一、跟单信用证常用条款及短语(1)special additional risk 特别附加险(2)failure to delivery 交货不到险(3)import duty 进口关税险(4)on deck 仓面险(5)rejection 拒收险(6)aflatoxin 黄曲霉素险(7)fire risk extension clause-for storage of cargo at destination Hongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(8)survey in customs risk 海关检验险(9)survey at jetty risk 码头检验险(10)institute war risk 学会战争险(11)overland transportation risks 陆运险(12)overland transportation all risks 陆运综合险(13)air transportation risk 航空运输险(14)air transportation all risk 航空运输综合险(15)air transportation war risk 航空运输战争险(16)parcel post risk 邮包险(17)parcel post all risk 邮包综合险(18)parcel post war risk 邮包战争险(19)investment insurance(political risks) 投资保险(政治风险)(20)property insurance 财产保险(21)erection all risks 安装工程一切险(22)contractors all risks 建筑工程一切二.the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks) 陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products) 陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiable form, for 110% full CIF invoice covering the risks of War & W.A. as per the People''s Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

外贸各类术语

外贸各类术语L/C (LETTER OF CREDIT) 是信用证,这个是在国际贸易中普遍运用的一种交易方式,它的风险较低,由银行来作为中介,是一种银行信用,但是交易双方向银行缴纳的费用很高,现在在交易中也出现了信用证欺诈的问题,所以使用时也应该谨慎选择。

T/T (TELEGRAFIC TRANSFER) 是电汇,在交易中它较之信用证风险要高一些,但是向银行缴纳的费用要比信用证是缴纳的费用低很多。

D/P和D/A都属于托收,D/P (DOCUMENT AGAINST PAYMENT) 是远期付款交单,就是说买方必须在向卖方付款之后才能够获得提取货物的单据,这种交易方式使卖方能够及时地收到货款,D/A (DOCUMENT AGAINST ACCEPTION) 是承兑交单,就是说只要买方在收到付款通知时向卖方做出一定付款的承诺就可以得到提取货物的有关单据,因此D/A存在一定的风险一、什么叫L/C?L/C即Letter of Credit ,信用状;信用证;信用证书为国际贸易中最常见的付款方式,指银行(开状银行)(*opening bank)询顾客(通常为买方)的请求与指示,向第三人(通常为卖方)所签发的一种文据(instruments)或函件(letter)·其内容包括申请人名称、受益人(beneficiary)、发信日期、交易货物名称、数量、价格、贸易条件、受益人应开汇票的要求(称发票条款),押汇时应付之单据、装运日期、有效期限与开状银行给押汇银行(*negotiating bank)或其他关系人之条款·在该文据或函件中,银行向卖方承诺,如果该第三人能履行该文据或函件所规定的条件,则该第三人得按所载条件签发以该行或其指定的另一银行为付款人的汇票,并由其负兑付的责任·但较特别的是︰(1)信用状中也有以买方为汇票付款人,而由开状银行负责其兑付的;(2)信用状的开发虽是基於贸易而生,但也有非基於贸易而开发的,凭这种信用状签发的汇票通常多不需附上单证,所谓无跟单信用状(*clean credit)即是·其他诸如押标保证(*bid bond)、履约保证(*performance bond)、还款保证(repayment bond)等亦以信用状达成为目的;(3)凭信用状兑款固然多要求受益人签发汇票,但也有不需签发汇票,只须提示收据(receipt)或只需提出规定单证即可兑款的,例如凭收据付款信用状(*payment on receipt credit)及凭单证付款信用状(*payment against documents credit)即是·以信用状作为付款方式,对出口商而言,只要将货物交运,并提示信用状所规定的单证,即可获得开状银行的付款担保,可不必顾虑进口商的失信,押汇银行也多乐于受理押汇,故信用状尚能给予出口商在货物装运\後即可收回货款的资金融通上的便利·就进口商而言,由于出口商必须按照信用状条件押领货款,开状银行审核单证完全符合信用状条件後才予付款,故可预防出口商以假货、劣货充数,或以假单证诈领货款·L/C的分类它的分类很多,下面作了列举,供参考.1.revocable L/C/irrevocable L/C可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight payment L/C/deferred payment L/C/acceptance L/C 即期信用证/延期信用证/承兑信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C延付信用证/预支信用证11.back to back L/C/reciprocal L/C对背信用证/对开信用证12.traveller's L/C(or:circular L/C)旅行信用证13.negotiation L/C议付信用证14.buyer's usance L/C买方远期信用证外贸信用证结汇,L/C实际业务流程(一)接到国外客户的订单(二)做形式发票传国外客户,国外客户回签,然后国外客户根据合同开立信用证给我们.(三)做生产单传国内客户,国内客户回签,(四)向国外客户要回唛头、彩图、条形码,把唛头、彩图、条形码传给工厂,并且严格按照L/C执行.(五)要求工厂进行生产(六)在离船期大约有10天左右,向国外客户的货代要订舱单标准格式,按要求填好之后反传船公司订舱(七)船公司传出正式的S/O(托单)(八)一般是自己的验货员去供应商厂里验货(如果客户在大陆有验货代表一般是要求供应商把货物拖回本公司,再让客户大陆验货代表进行验货)(九)把S/O传给拖车行(在S/O面前注明拖柜时间、地点、时间,联系电话等前往拖柜)(十)做出报关内容即“FAX MESSAGE”,向拖车行问清报关行地址,以方便外贸公司寄出全套单据(能够归类的尽量归类,目的是减少核销单)(十一)在“FAX MESSAGE”上注明报关行地址,再把“FAX MESSAGE”传给外贸公司(外贸公司会把报关资料传给报关行),同时给厂家下“装柜通知”(十二)装完柜之后,把柜号、封条号等资料填好,(需要熏蒸的货物,把熏蒸格式填好)再传给报关行,进行报关(十三)做出FORM A.(十四)做装船通知传给客户(十五)要回报关单,加上开具增值税专用发票申请表,交给财务会计(十六)做提单补料传给船公司(十七)出示正式FORMA.(十八)准备装船通知、产地证明(FORMA)、提单、发票、装箱单、(有时有消毒熏蒸证书),到银行交单.L/C的标准格式LETTER OF CREDIT编号:Reference:作者:Author:标题:Title:发往:Send to:报文类型:Message Type:优先级:Priority:传送监控:Delivery Monitoring:27 :报文页次sequence of total40A :跟单信用证类型form of documentary credit20 :跟单信用证号码documentary credit31C :开证日期date of issue31D :到期日date of expiry 到期地点place of expiry51A :开证申请人银行——银行代码applicant bank-BIC50 :开证申请人applicant59 :受益人beneficiary32B :货币与金额currency code, amount41D :指定银行与兑付方式available with …by …42C :汇票drafts at…42A :汇票付款人——银行代码drawee-BIC43P :分批装运partial shipments43T :转船transshipment44A :装船/发运/接受监管地点loading on board / dispatch/taking in charge44B :货物运往for transportation to …44C :最迟装运期latest date of shipment45A :货物/或服务名称description of goods and/or services46A :单据要求documents required47A :附加条件additional conditions71B :费用charges48 :交单期限period for presentation49 :保兑指示confirmation instructions78 :给付款行/承兑行/议付行的指示instructions to paying/accepting/negotiating bank72 :附言sender to receiver information二、什么叫T/TT/T(Telegraphic Transfer)电汇,是指汇出行应汇款人申请,拍发加押电报\电传或SWIFT给在另一国家的分行或代理行(即汇入行)指示解付一定金额给收款人的一种汇款方式.T/T付款方式是以外汇现金方式结算,由您的客户将款项汇至贵公司指定的外汇银行账号内,可以要求货到后一定期限内汇款。

【VIP专享】2.信用证的翻译参考

ISSUE OF A DOCUMENTARY CREDITZZCNCMT35P03-2806-073690* * AUTHENTICATION RESULT:CORRECT WITH CURRENCYKEY * * * -----------------INSTANCE TYPE AND TRANSMISSION-------------------------------ORIGINAL RECEIVED FROM SWIFTPRIORITY:NORMALMASSAGE OUTPUT REFERENCE:1820030813SCBLCNSXASHA1985279185CORRESPONDENT INPUTREFERENCE:1820030813SCBLHKHHAXXX 3474073794——————————————MESSAGE HEADER——————————————SWIFT OUTPUT:FIN 720 TRANSFER OF A DOC CREDIT转让信用证SENDER:SCBLHKHHXXXSTANDARD CHARTERED BANKHONG KONG HK发报行(转让行):渣打银行香港分行RECEIVER:SCBLCNSXSHASTANDARD CHARTERED BANK (SHANGHAI BRANGH)SHANGHAI CN收报行(通知行):渣打银行上海分行MUR:GAMIMX40B:FORM OF DOCUMENTARY CREDIT:IRREVOCABLE WITHOUT OUR CONFIRMATION信用证类型:不可撤销(我行不保兑)20:TRANSFERRING BANK’S REFERENCE:149010476943-BT转让行的参考号:149010476943-BT21:DOCUMENTARY CREDIT NUMBER:M125602原证号码:M12560231C:DATE OF ISSUE:030803开证日期:2003-08-0331D:DATE AND PLACE OF EXPIRY:030911 AT RBOS HK COUNTERS到期日期与地点:2003-09-11 在苏格兰皇家银行香港分行柜台52D:ISSUING BANK OF ORIG D/C –NM&ADDR:ROYAL BANK OF SCOTLAND PLC,L/C PROCESSING CENTRE,7/F STANDARDCHARTERED TOWER,388 KWUN TONG RD,KWUNTONG,KLN,H.K.原证开证行:苏格兰皇家银行信用证中心(后面是地址)50:FIRST BENEFICIARY:SHENG TAI LIMITED,UNIT C,8/F,EAST WING,SINCERE INS. BLDG 4-6 HENNESSY RDWANCHAI第一受益人:SHENG TAI LIMITED,UNIT C,8/F,EAST WING,SINCERE INS. BLDG 4-6 HENNESSY RD WANCHAI 59:SECOND BENEFICIARY:ZHEJIANG SHOUWANG GROUP COMPANY,NO.58 ZHAO HUI JIU QU,HANGZHOU 310014 P.R.CHINA 第二受益人:ZHEJIANG SHOUWANG GROUP COMPANY,NO.58 ZHAO HUI JIU QU,HANGZHOU 310014 P.R.CHINA32B:CURRENCY CODE,AMOUNT:USD25000.00信用证金额:2.5万美元39A:PERCENTAGE CREDIT AMT TOLERANCE:05/05信用证金额可上下浮动的比例:5%41D:AVAILABLE WITH…BY…-NM&ADDR:ISSUING BANK BY PAYMENT信用证可兑用的银行与方式:在开证行即期付款42C:DRAFTS AT…: SIGHT信用证需要的汇票期限:即期42D:DRAWEE-NM&ADDR:THE ROYAL BANK OF SCOTLAND PLC,HONG KONG信用证汇票的付款人:苏格兰皇家银行香港分行43P:PARTIAL SHIPMENTS:NOT ALLOWED分批装运:不允许43T:TRANSHIPMENT:ALLOWED转运:允许44A:LOADING ON BOARD/DISPATCH/TAKING IN CHARGEAT/EROM…: SHANGHAI,CHINA装运港:上海44B:FOR TRSNPORTATION TO…:FELIXTOWE OR SOUTHAMPTON目的港:费利克斯托或南安普敦44C:LATEST DATE OF SHIPMENT:030831最后装运日:2003-08-3145B:DESCRIPTN OF GOODS&/OR SERVICES:160 PCS LADIES`JACKETS STYTLE NO.70019 PO NO.D42067 AT USD31.00 EACH320 PCS LADIES`JACKETS STYTLE NO.70016 PO NO.D42069 AT USD30.00 EACH320 PCS LADIES`JACKETS STYTLE NO.70094 PO NO.D42068 AT USD32.50 EACHPRICE BASIS FOB SHANGHAI CHINA货物描述“160件女式夹克型号70019,订单号:D42067,单价每件31美元320件女式夹克型号70016,订单号:D42069,单价每件30美元320件女式夹克型号70094,订单号:D42068,单价每件32.5美元价格术语:FOB SHANGHAI CHINA46B:DOCUMENTS REQUIRED:单据要求:+1)THREE COPIES OF ORIGINAL PACKING LIST+1)三份正本装箱单+2)THREE COPIES OF ORIGINAL COMMERCIAL INVOICE+2)三份正本商业发票+3)TWO COPIES CERTIFICATE OF ORIGIN EVIDENCING GOODS OF CHINESE ORIGIN+3)两份证明货物为中国原产的原产地证明书(结合第5条,这只能提供两份副本)+4)COPY GSP FORM A CERTIFICATE OF CHINESE ORIGIN+4)证明货物为中国原产的普惠制原产地证副本+5)STATEMENT FORM SHENG TAL THAT(A) ONE ORIGIAL INVOICE,ONE ORIGIAL PACKINGLIST,ONE ORIGIAL CERTIFICATE OF ORIGINEVIDENCING GOODS OF ORIGIN AND 1/3 TRANS WAGONINTERNATIONAL COMPANY LTD SHIPPED IN BOARDONE ORIGINAL BILL OF LADING TOGETHER WITH ONESET OF NON-NEGOTIABLE DOCUMENTS WERE SENT BYCOURIER TO ROBERTSON OUTERWEAR LTD 46 HAMILTON STREET GLASGOW G42 OPL UNITED KINGDOMWITHIN 7 DAYS OF SHIPMENT DATE AND(B)SHIPPING DETAILS ALONS ALONG WITH COPY OFINVOICES,PACKING LIST WERE FAXED TO ROBERTSONOUTERWERE LTD ATTN:DBBBIE HUNTER(44 141 4232828)WITHIN 72 HOURS OF SHIPMENT(COPY OFCOURIER WAYBILL MUST ACCOMPANY THESTATEMENT).+5)SHENG TA公司的声明:A一份正本的发票、一份正本的装箱单、一份证明货物为中国原产的原产地证明书正本以及一份由TRANS WAGON INTERNATIONALCOMPANY LTD公司装运的已装船提单正本及一套非议付单据已在装船后7天内通过快递寄给了:ROBERTSON OUTERWEAR LTD 46HAMIL TON STREET GLASGOW G42 OPL UNITED KINGDOM(这是在英国的一家公司名称)以及B装运的详细情况及副本的发票、装箱单已在装船后72小时内传真给了ROBERTSON OUTERWERE LTD(注明交给:DBBBIE HUNTER),(传真)号码:44 141 423 2828.快递收据副本需随声明一并交单。

信用证翻译完整版样本

信用证类型1. This revocable credit may be cancelled by the Issuing Ba nk at any moment without priornotice这个可撤销的信用证可以被开证行在没有提前通知的任何时候撤销。

2. This credit is subject to cancellation or amendment at a ny time without prior notice to hebeneficiary.这个信用证以没有提前通知收益人的任何时候的取消或修改为准。

3. This advice, revocable at any time without notice, is fo r your guidance only in preparingdrafts and documents and conveys no engagement or obligation on our part of our abovementioned correspondent.这个通知在任何时候都可能在没被通知的情况下被撤销,只是为了方便你准备票据和单据提供了一个指南,本通知书不构成我行对相关信用证之保兑和其他任何责任。

4. We undertake to honour your drafts drawn and negotiated in conformity with the terms ofthis credit provided that such negotiation has been made pri or to receipt by the notice ofcancellation.我们承担承兑和议付你方根据信用证开出的的相一致的汇票,该信用证在收到取消通知书之前都将被议付。

5. We hereby issue this irrevocable documentary credit in yo ur favour, which is available bypayment against presentation of the following documents.我方在此开具了以你方为收益人的不可撤销的跟单信用证,该信用证将根据以下单据的出示时议付。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Sent 发送时间08.02.2010 18;15Received 接收时间08.02.2010 18;15Own BIC/TID 我行代码BKCHHKHHBXXXSWIFT Message Type SWIFT信息类别700 issue of documentary(MT700准则)Correspond BIC/TID 代理行代码EVERCNBJANJ1Sequence of total 电文页次1/1Form of documentary credit 信用证形式Irrevocable 不可撤销信用证Documentary credit number 信用证号码LC765410098aeDate of issue 开证日期08.02.2010Applicable rules 适用条文UCP latest versionDate and place of expiry 有效时间地点15.07.2010Applicant申请人Beneficiary受益人Currency code. Amount币种,金额Percentage credit amount tolerance信用证金额浮动幅度10/10Available with….by 兑付方式ANY BANK 任何银行议付BY NEGOTIATIONDrafts at 汇票付款日期4 Part A: 90 days after sight 见证90天后Part B: sight 即期付款Drawee汇票付款人Issuing bank 开证行Partial shipments 分批装运NOT ALLOWED 不允许Transshipment 转船装运NOT ALLOWED不允许Port of lading 装货港PANAJI PORT OR MORMUGAO PORT,GOA, INDIAPort of discharge卸货港QINGDAO OR RIZHAO PORT,CHINA Latest date of shipment最迟装运日25.03.2010Description of goods/or service 货物或服务描述商品名称:铁矿粉规格保证值化学成分(干基,重量比)铁:基本值54% (不小于54%)三氧化二铝:最大7%二氧化硅:最大9%磷:最大0.08%硫:最大0.05%物理规格(湿基)NAME OF COMMODITY:IRON ORE FINES SPECIFICATIONS GUARANTEED CHEMICAL COMPOSITION(ON DRY BASIS, PERCENTAGE BY WEIGHT):FE: 54.00 PCT BASIS (54.00PCT MIN)AL2O3: 7.00PCT MAXSIO2: 9.00 PCT MAXP: 0.08PCT MAXS:0.05PCT MAXPHYSICAL SPECIFICATION(ON NATURAL BASIS)LESS THAN 10MM 90PCT MIN MOISTURE(LOSS AT 105 DEGREES CENTIGRADE): 10.00PCT MAXBASIS PRICE: USD 87.00 PER DRY低于10毫米最低90%大于10毫米最大10%低于150 微米最大40%水分(105度下游离水分)最大10%基价:87美元每干吨,54%含铁量重量:50000湿吨(+/-10%)价格条款:价格调整:A,对于铁含量在54%基础上,铁含量每增长一个百分点,每干吨价格上升1.53美元在54%基础上,铁含量每下降一个百分点,每干吨价格下降3.5美元铁含量不能低于53%B,对于其他元素1.对于磷在0.08%的基础上,磷含量每增长0.015,价格下降5美分2.对于硫在0.05基础上,硫含量没增长0.01%,价格下降5美分。

3. 对于铝元素在7.00%基础上,三氧化二铝每增长一个百分点,价格下降5美分4.对于硅元素在9.00基础上,二氧化硅含量每增长一个百分点,价格下降5美分。

METRIC TON BASIS FE 54.00PCY QUANTITY: 50000WMT(+/-10PCT)PRICE TERMS: CFR QINGDAO OR RIZHAO PORT,CHINA.PRICE AJUSTMENT:A.FOR FE CONTENTTHE BASE PRICE SHALL BE INCRESED USD 1.53 PER DRY METRIC TIN FOR EACH 1PCT INCREASE, IF FE CONTENT IS ABOVE 54.00 PCT,FRACTION PRORATE THE BASE PRICR SHALL BE DECREASED BY USD 3.50 PER DRY METRIC TON FOR EACH 1PCT DECREASE,IF FE CONTENT IS BELOW BUT DOWN TO AND INCLUDING 54.00 PCT, FRATION PRORATE.FE CONTENT BELOW 53.00 IS NOT ALLOWED.B. FOR OTHER ELEMENTS1.FOR EXCESS PHOSPHRUS(p)THE BASE PRICE SHALL BE DECREASED AT RETE OF 5 US CENTS PER DRY METRIC TON FOR EACH 0.01 PCT INCRASE, IF P CONTENT IS IN EXCESS OF 0.08PCT, FRACTION PRORATE2.FOR EXCESS OF SULPHUR(s)THE BASE PRICE SHALL BE DECREASED AT THE RATE OF 5 US CENTS PER DRY METRIC TON FOR EACH 1PCT INCREASE, IF S CONTENT IS IN EXCESS OF 0.05PCT .FRACTION PRORA TE3.FOR EXCESS OF ALUMINA(AL2O3) THE BASE PRICE SHALL BE DECREASE AT THE RATE OF 5 US PER DRY METIC TON FOR EACH 1PCT INCREASE, IS AL 2O3 CONTENT IS IN EXCESS OF 7.00 PCT. FRACTION PROTA TE.4.FOR EXCESS SILICA(SIO2)THE BASE PRICE SHALL BE DECREASED AT THE RATE OF 5 US CENTS PER DRY METRIC TON FOR EACH 1.0PCT INCREASE, IF SIO2 CONTENT IS IN5.粒度大于10mm:对于超过10%的部分,每湿吨降低0.5美元低于150微米:对于超过40%的部分,每湿吨降低0.5美元。

包装:散装原产地:印度果阿卸货港:青岛或日照港EXCESS OF 9.00PCT,FRACTIONPRORATE 5.FOR SIZEABOVE 10MM: USD 0.50 PER WET METRIC YON SHALL BE APLLIED TO THE QUANTITIES OF FINES ABOVE 10MM IN EXCESS OF 10PCTBELOW 150 MICRON:USD0.50 PER WET METRIC TON SHALL BE APLIOED TO THE QUANTITIES OF FINES BELOW 150 MICRON IN EXCESS OF 40PCT PACKING; IN BULKCOUNTRY OF ORIGIN: INDIALOADING PORT:PANAJI PORT OR MORMUGAO PORT, GOA,INDIA DISCHARGING PORT;QINGDAO OR RIZHAO PORT,CHINADocuments required 议付单据A:为获取98%商品价值需要提交受益人汇票和以下单据1.已签字的预付款发票,三份原件,五份副本,并指示提单号码,合同号码,信用证号码,货船名和规格,价格调整(如果有)2.一整套已装船清洁提单,抬头为‘to order’,空白背书,注明运费已付,按指示通知3.在装运港由MITRA S.K开出的显示化学成分检测结果的质量证明一份原件和三份副本和信用证所需的其他测试4.由MITRA S.K在装运港开出的重量证一份PART A:98PCT OF CARGO V ALUE WILL BE PAID AGINST PRESENTATION OF BENEFICIARY’S DRAFTS ACCOMPANY WITH FOLLOWING DOCUMENTS:1.SIGNED PROVISIONAL INVOICE IN 3 ORIGINAL AND 5 COPIESFOR 98PCT OF CFR V ALUE INDICATING THE B/L NUMBER,CONTRACTNUMBER,10JSFT01D0176,NUMBER OF L/C AND NAME OF CARRING VESSEL,SPECIFICATIONS AND PRICE AJUSTMENT(IF ANY)2.FULL SET(3/3) OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER,BLANK ENDORSED,MARKED ‘FREIGHHT PAY ABLE AE PER CHART PARTY’ AND NOTIFING TO ORDER3.CERTIFICATE OF QUALITY IN ONE ORIGIN AND THREE COPIES ISSUED BY MITRA S.K PRIV ATE LIMITED SHOWING ACTUAL RESULTS OF TEST CHEMICAL COMPOSITION AND OTHER TEST CALLED FOR IN THIS L/C4.CERTIFICATE OF WEIGHT IN ONE ORIGIONAL AND THREE COPIES ISSUED原件,三份副本5.由任何商会或者贸易促进会开出的确认货物是印度原产的产地证,一份原件,三份副本。