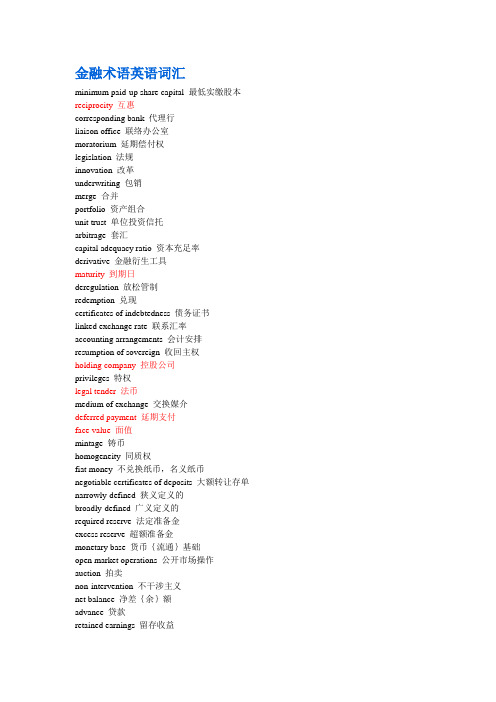

金融英语词汇(含解释)

金融词汇解释

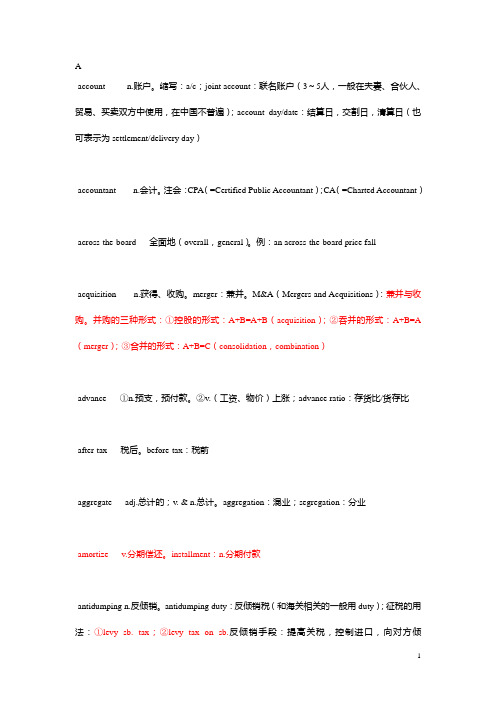

A·account n.账户。

缩写:a/c;joint account:联名账户(3~5人,一般在夫妻、合伙人、贸易、买卖双方中使用,在中国不普遍);account day/date:结算日,交割日,清算日(也可表示为settlement/delivery day)·accountant n.会计。

注会:CPA(=Certified Public Accountant);CA(=Charted Accountant)·across-the-board 全面地(overall,general)。

例:an across-the-board price fall·acquisition n.获得、收购。

merger:兼并。

M&A(Mergers and Acquisitions):兼并与收购。

并购的三种形式:①控股的形式:A+B=A+B(acquisition);②吞并的形式:A+B=A (merger);③合并的形式:A+B=C(consolidation,combination)·advance ①n.预支,预付款。

②v.(工资、物价)上涨;advance ratio:存货比/货存比·after-tax 税后。

before-tax:税前·aggregate adj.总计的;v. & n.总计。

aggregation:混业;segregation:分业·amortize v.分期偿还。

installment:n.分期付款·antidumping n.反倾销。

antidumping duty:反倾销税(和海关相关的一般用duty);征税的用法:①levy sb. tax;②levy tax on sb.反倾销手段:提高关税,控制进口,向对方倾销;·anti-laundering:反洗钱;anti-inflation:反通胀;anti-acquisition:反收购·appreciate v.增值(通常指货币)。

金融行业英语词汇

金融行业英语词汇

1.贷款(Loan):金融机构向借款人提供的资金,借款人需要在一定期限内按照合同约定还款。

2. 利率 (Interest Rate):贷款或存款所产生的利息比率,通常以年利率形式表示。

3. 存款 (Deposit):个人或企业将资金存入银行或其他金融机构的行为,可以获得一定的利息收益。

4. 投资 (Investment):将资金投入到某种资产或项目中,以获得预期的回报。

5. 股票 (Stock):企业股份的一部分,持有股票的人成为股东,可以获得股息及投票权。

6. 债券 (Bond):企业或政府向公众募集资金的一种方式,持有债券的人可以获得固定利息。

7. 保险 (Insurance):为了避免风险而投保,保险公司在保险合同规定的情况下向被保险人提供赔偿。

8. 财务报表 (Financial Statement):公司编制的反映财务状况和业绩的报告,包括资产负债表、利润表和现金流量表等。

9. 资产管理 (Asset Management):针对个人或机构资产的投资管理,旨在获得最大化的收益。

10. 风险管理 (Risk Management):识别、评估和控制风险,以最大程度地降低损失。

- 1 -。

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

金融英语词汇表

金融英语词汇表金融英语词汇表本文为金融英语词汇表,旨在帮助读者更好地理解和应用金融领域的专业术语。

以下是一些常见的金融英语词汇和它们的解释:1. Assets(资产)- 可以转化为现金或带来经济利益的资源或所有权。

2. Liabilities(负债)- 公司或个人欠债的金额或法律责任。

3. Equity(股权)- 企业或个人拥有的资产减去负债后的余额。

4. Income(收入)- 公司或个人在一定期间内实现的销售额或盈利额。

5. Expenses(费用)- 公司或个人在一定期间内发生的成本或支出。

6. Interest(利息)- 贷款或存款所产生的费用或收益。

7. Market value(市值)- 资产、证券或股权在市场上的估值。

8. Bond(债券)- 证明借款人向债权人承诺按照特定条件偿还借款本金和利息的文件。

9. Stock(股票)- 公司向股东发行的所有权证明书。

10. Mutual fund(共同基金)- 资金由多个投资者集资形成,由专业基金经理管理和投资的投资基金。

11. Dividend(股息)- 公司向股东发放的利润分红。

12. Foreign exchange(外汇)- 一国货币兑换成另一国货币的行为或货币的兑换比率。

13. Exchange rate(汇率)- 一种货币兑换为另一种货币的比率。

14. Inflation(通货膨胀)- 货币供应增加,物价上涨的现象。

15. Recession(经济衰退)- 经济活动放缓和经济增长停滞的时期。

以上仅为部分金融英语词汇表,希望对读者对金融领域的专业术语有所帮助。

了解和掌握这些词汇,对于学习和实践金融知识非常重要。

在金融职业生涯或金融决策中,正确理解和运用这些术语能够提高工作效率和决策准确性。

希望这份金融英语词汇表对您有帮助,如果您还想了解更多金融英语词汇,可以进一步扩展您的金融词汇量。

祝您在金融领域取得更好的成就!。

常用的经济学金融学专业英语-中英文词汇及解释

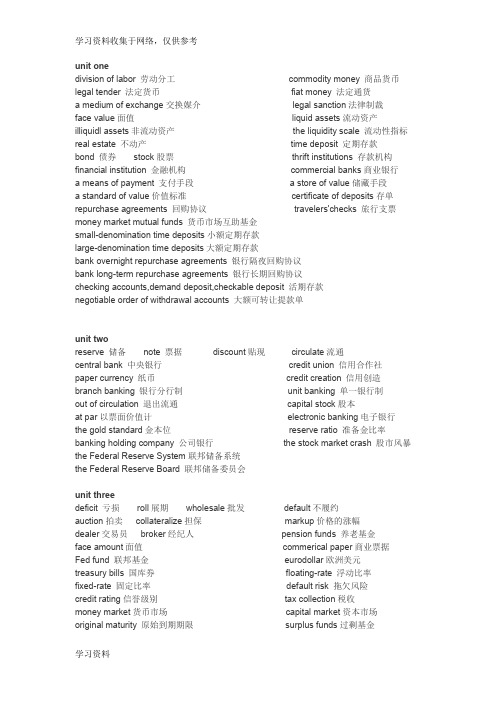

金融学和会计学英语词汇division of labor 劳动分工commodity money 商品货币legal tender 法定货币fiat money 法定通货a medium of exchange 交换媒介legal sanction 法律制裁face value 面值liquid assets 流动资产illiquidl assets 非流动资产the liquidity scale 流动性指标real estate 不动产checking accounts,demand deposit,checkable deposit 活期存款time deposit 定期存款negotiable order of withdrawal accounts 大额可转让提款单money market mutual funds 货币市场互助基金repurchase agreements 回购协议certificate of deposits 存单bond 债券stock 股票travelers'checks 旅行支票small-denomination time deposits 小额定期存款large-denomination time deposits 大额定期存款bank overnight repurchase agreements 银行隔夜回购协议bank long-term repurchase agreements 银行长期回购协议thrift institutions 存款机构financial institution 金融机构commercial banks 商业银行a means of payment 支付手段a store of value 储藏手段a standard of value 价值标准reserve 储备note 票据discount 贴现circulate 流通central bank 中央银行the Federal Reserve System 联邦储备系统credit union 信用合作社paper currency 纸币credit creation 信用创造branch banking 银行分行制unit banking 单一银行制out of circulation 退出流通capital stock 股本at par 以票面价值计electronic banking 电子银行banking holding company 公司银行the gold standard 金本位the Federal Reserve Board 联邦储备委员会the stock market crash 股市风暴reserve ratio 准备金比率deficit 亏损roll 展期wholesale 批发default 不履约auction 拍卖collateralize 担保markup 价格的涨幅dealer 交易员broker 经纪人pension funds 养老基金face amount 面值commerical paper 商业票据banker's acceptance 银行承兑汇票Fed fund 联邦基金eurodollar 欧洲美元treasury bills 国库券floating-rate 浮动比率fixed-rate 固定比率default risk 拖欠风险credit rating 信誉级别tax collection 税收money market 货币市场capital market 资本市场original maturity 原始到期期限surplus funds 过剩基金宏观经济的 macroeconomic通货膨胀 inflation破产 insolvency有偿还债务能力的 solvent合同 contract汇率 exchange rate紧缩信贷 tighten credit creation 私营部门 private sector财政管理机构 fiscal authorities宽松的财政政策 slack fiscal policy税法 tax bill财政 public finance财政部 the Ministry of Finance平衡预算 balanced budget继承税 inheritance tax货币主义者 monetariest增值税 VAT (value added tax)收入 revenue总需求 aggregate demand货币化 monetization赤字 deficit经济不景气 recession经济好转 turnabout复苏 recovery成本推进型 cost push货币供应 money supply生产率 productivity劳动力 labor force实际工资 real wages成本推进式通货膨胀 cost-push inflation 需求拉动式通货膨胀 demand-pull inflation 双位数通货膨胀 double- digit inflation极度通货膨胀 hyperinflation长期通货膨胀 chronic inflation治理通货膨胀 to fight inflation最终目标 ultimate goal坏的影响 adverse effect担保 ensure贴现 discount萧条的 sluggish认购 subscribe to支票帐户 checking account货币控制工具 instruments of monetry control 借据 IOUs(I owe you)本票 promissory notes货币总监 controller of the currency拖收系统 collection system支票清算或结算 check clearing资金划拨 transfer of funds可以相信的证明 credentials改革 fashion被缠住 entangled货币联盟 Monetary Union再购协议 repo精明的讨价还价交易 horse-trading欧元 euro公共债务 membership criteria汇率机制 REM储备货币 reserve currency劳动密集型 labor-intensive股票交易所 bourse竞争领先 frontrun牛市 bull market非凡的牛市 a raging bull规模经济 scale economcies买方出价与卖方要价之间的差价 bid-ask spreads 期货(股票) futures经济商行 brokerage firm回报率 rate of return股票 equities违约 default现金外流 cash drains经济人佣金 brokerage fee存款单 CD(certificate of deposit)营业额 turnover资本市场 capital market布雷顿森林体系 The Bretton Woods System经常帐户 current account套利者 arbitrager远期汇率 forward exchange rate即期汇率 spot rate实际利率 real interest rates货币政策工具 tools of monetary policy银行倒闭 bank failures跨国公司 MNC ( Multi-National Corporation) 商业银行 commercial bank商业票据 comercial paper利润 profit本票,期票 promissory notes监督 to monitor佣金(经济人) commission brokers套期保值 hedge有价证券平衡理论 portfolio balance theory 外汇储备 foreign exchange reserves固定汇率 fixed exchange rate浮动汇率 floating/flexible exchange rate 货币选择权(期货) currency option套利 arbitrage合约价 exercise price远期升水 forward premium多头买升 buying long空头卖跌 selling short按市价订购股票 market order股票经纪人 stockbroker国际货币基金 the IMF七国集团 the G-7监督 surveillance同业拆借市场 interbank market可兑换性 convertibility软通货 soft currency限制 restriction交易 transaction充分需求 adequate demand短期外债 short term external debt汇率机制 exchange rate regime直接标价 direct quotes资本流动性 mobility of capital赤字 deficit本国货币 domestic currency外汇交易市场 foreign exchange market国际储备 international reserve利率 interest rate资产 assets国际收支 balance of payments贸易差额 balance of trade繁荣 boom债券 bond资本 captial资本支出 captial expenditures商品 commodities商品交易所 commodity exchange期货合同 commodity futures contract普通股票 common stock联合大企业 conglomerate货币贬值 currency devaluation通货紧缩 deflation折旧 depreciation贴现率 discount rate归个人支配的收入 disposable personal income 从业人员 employed person汇率 exchange rate财政年度fiscal year自由企业 free enterprise国民生产总值 gross antional product 库存 inventory劳动力人数 labor force债务 liabilities市场经济 market economy合并 merger货币收入 money income跨国公司 Multinational Corproation 个人收入 personal income优先股票 preferred stock价格收益比率 price-earning ratio优惠贷款利率 prime rate利润 profit回报 return on investment使货币升值 revaluation薪水 salary季节性调整 seasonal adjustment关税 tariff失业人员 unemployed person效用 utility价值 value工资 wages工资价格螺旋上升 wage-price spiral收益 yield补偿贸易 compensatory trade, compensated deal 储蓄银行 saving banks欧洲联盟 the European Union单一的实体 a single entity抵押贷款 mortgage lending业主产权 owner's equity普通股 common stock无形资产 intangible assets收益表 income statement营业开支 operating expenses行政开支 administrative expenses现金收支一览表 statement of cash flow贸易中的存货 inventory收益 proceeds投资银行 investment bank机构投资者 institutional investor垄断兼并委员会 MMC招标发行 issue by tender定向发行 introduction代销 offer for sale直销 placing公开发行 public issue信贷额度 credit line国际债券 international bonds欧洲货币Eurocurrency利差 interest margin以所借的钱作抵押所获之贷款 leveraged loan 权利股发行 rights issues净收入比例结合 net income gearing常用的经济学金融学中英文词汇及解释Equilibrium,competitive 竞争均衡见竟争均衡(competitive equilibrium)。

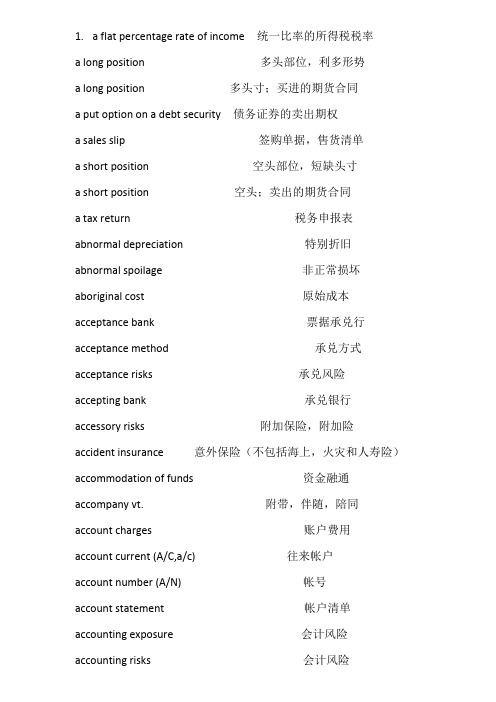

金融英语词汇(超全版)

1. a flat percentage rate of income 统一比率的所得税税率a long position 多头部位,利多形势a long position 多头寸;买进的期货合同a put option on a debt security 债务证券的卖出期权a sales slip 签购单据,售货清单a short position 空头部位,短缺头寸a short position 空头;卖出的期货合同a tax return 税务申报表abnormal depreciation 特别折旧abnormal spoilage 非正常损坏aboriginal cost 原始成本acceptance bank 票据承兑行acceptance method 承兑方式acceptance risks 承兑风险accepting bank 承兑银行accessory risks 附加保险,附加险accident insurance 意外保险(不包括海上,火灾和人寿险)accommodation of funds 资金融通accompany vt. 附带,伴随,陪同account charges 账户费用account current (A/C,a/c) 往来帐户account number (A/N) 帐号account statement 帐户清单accounting exposure 会计风险accounting risks 会计风险accounting value 帐面价值accounts of assured 保险帐户accrued bond interest 应计债券利息accrued depreciation 应计折旧accrued dividend 应计股利acknowledgement of declaration (under op预约保险申报确认书active securities 热头股票,活跃的证券actual cash value (保险用语)实际现金价值actual rate 实际汇率adaptive expectations 适应性预期additional insurance 加保,附加保险additional reserve 追加准备金adjustable policy 可调整的保险单adjustable premium 可调整的保险费adjusted debit balance 已调整的借方余额advance payment of premium 预缴保险费advance-decline theory 涨跌理论adverse exchange 逆汇、逆汇兑advice of drawing 提款通知书advising bank 通知银行affiliated bank 联行affiliated person 关联人aftermarket 次级市场agent for collection 托收代理银行Agricultural Bank of China 中国农业银行agricultural loans 农业贷款agricultural(animal husbandry)tax 农(牧)业税allowance for doubtful debt 备抵呆帐款项alternative (either/or) order 选择指令American Express card 运通卡American terms 美国标价法amount in figures 小写金额amount in words 大写金额annual membership dues 年费application form for a banking account 银行开户申请书appointed bank 外汇指定银行appreciation of exchange rate 汇率升值arbitrage 套利arbitrage 套购,套利,套汇arbitrage of exchange 套汇arbitrage of exchange or stock 套汇或套股arbitrage opportunity 套价机会arbitrage risks 套汇风险as agent 做代理as principal 做自营Asian Development Fund (ADB) 亚洲开发银行ask price = asking price = offer price 出售价,报价,开价,出价ask-bid system 竞价系统assessment of loss 估损assets insurance 资产保险assignment of policy 保单转让assumption of risk 承担风险asymmetry 不对称at owner's risk 风险由货主负担at-the-close order 收盘指令at-the-market 按市价at-the-money 平值期权at-the-opening (opening only) order 开盘指令auction marketplace 拍卖市场automated teller machines (24 hours a day) 自动取款机(24小时服务)automatic transfers between accounts 自动转帐average 平均数baby bond 小额债券back spreads 反套利back wardation 现货溢价balance n. 结余,差额,平衡bank balance 存款余额bank balance over required reserves 超出法定(必备)储备的银行存款余额bank deposit 银行存款Bank of China 中国银行Bank of Communications 交通银行bank of deposit 存款银行bank of the government 政府的银行banker's association 银行协会banker's bank 中央银行banker's guarantee 银行担保bank's buying rate 银行买入价bank's selling rate 银行卖出价banks with business dealing with the center中央银行的往来银行Barclay card 巴克莱银行信用卡base rate 基本汇价basis order 基差订单basis risk 基差风险bear market 熊市bear operation 卖空行为bear raiders 大量抛空者beneficial owner 受益所有人beneficiary of insurance 保险金受益人best-efforts offering 尽力推销(代销)发行bid and ask prices 买入和卖出价bid and ask spread 买卖差价bid price = buying price 买价bid-ask spread 递盘虚盘差价big board 大行情牌big slump 大衰退(暴跌)bill-paying services 代付帐款black market 黑市black market financing 黑市筹资black money 黑钱blanket mortgage 总括抵押block positioner 大宗头寸商blowout 畅销blue-chip stocks 蓝筹股board of arbitration 仲裁委员会board of governors 理事会bond fund 债券基金borrowing from affiliates 向联营公司借款borrowing power of securities 证券贷款能力borrowing risks 借款风险bought deal 包销bread and butter business 基本业务breadth index 宽度指数break-even 不亏不盈,收支相抵breakout 突破bridging finance 过渡性融资broker 经纪人,掮客brokerage 经纪人佣金brokerage 经纪业;付给经纪人的佣金brokerage firm 经纪商(号)broker's loan 经纪人贷款broking house 经纪人事务所building agreement 具有约束力的协定building tax (tax on construction)建筑税bullish 行情看涨business insurance 企业保险business risk 营业风险business savings 企业储蓄business tax 营业税business term loan 企业长期贷款bust-up risks 破产风险buyer's risks 买方风险call (option) 买方期权,看涨期权call and put options 买入期权和卖出期权call for funds 控股、集资call loan transaction 短期拆放往来call market 活期存款市场call money 拆放款call options on an equity 权益(证券)的买入期权call-options 认购期权cancellation 取消cancellation money 解约金cap 带利率上限的期权capital assets 资本资产capital lease 资本租赁capital market 信贷市场、资本市场capital resources 资本来源capital surplus 资本盈余capital transfer 资本转移capital turnover rate 资本周转率card issuing institution 发卡单位carefully selected applicant 经仔细选定的申请人cargo insurance 货物保险cash 现金,现款v.兑现,付现款cash a cheque 支票兑现cash account 现金帐户cash advance 差旅预支款cash against bill of lading 凭提单付现cash against documents()凭单付现,凭单据付现金=document against cashcash and carry 付现自运;现金交易和运输自理;现购自运商店cash and carry wholesale 付现自运批发cash assets 现金资产cash audit 现金审核cash audit 现金审核,现金审计cash balance 现金余额,现款结存cash basis 现金制cash basis 现金制,现金基础cash basis accounting 现金收付会计制cash before delivery()空货前付款,付款后交货,付现款交货cash bonus 现金红利cash book 现金簿;现金帐;现金出纳帐cash boy 送款员cash budget 现金预算cash card1 (银行)自动提款卡cash card2 现金卡cash claim 现金索赔cash collection basis 收现法,收现制cash credit 活期信用放款,现金付出cash credit slip 现金支出传票cash currency 现金通货cash cycle 现金循环,现金周期cash day 付款日cash debit slip 现金收入传票cash department (商业机构中的)出纳部=counting-house cash deposit 现金存款;保证金cash deposit as collateral 保证金,押金cash desk (商店、饭馆的)付款处cash disbursements 现金支出cash discount .) 现金折扣,付现折扣=settlement discount cash dispenser (美)自动提款机=cashomat cash dividend 现金股利cash down 即付,付现cash equivalent value 现金等值,现金相等价值cash flow 资金流动cash flow 现金流动cash flow stream 现金流(量)cash holdings 库存现金cash holdings 库存现金cash in advance 预付现金cash in bank 存银行现金,银行存款cash in hand (商行的)手头现金,库存现金=cash on hand cash in transit 在途现金,在运现金cash in transit policy 现金运送保险单cash in treasury 库存现金cash invoice 现购发票cash items 现金帐项,现金科目cash journal 现金日记簿cash liquidity 现金流动(情况);现金周转cash loan 现金贷款cash management services 现金管理业务cash market 现金交易市场,现货市场,付现市场cash nexus 现金交易关系cash on arrival 货到付现,货到付款cash on bank 银行存款;银行付款;现金支票付款cash on deliver (英)交货付款,现款交货=collect on delivery cash on delivery (COD) 交割付款cash order(C/O)现金订货cash paid book 现金支出簿cash payment 现金支付cash payment 现金付款,现付cash payments journal 现金支出日记帐cash position 头寸cash position 现金状况,现金头寸cash price 现金售价,现金付款价格cash purchase 现购,现金购买cash railway (商店中的)货款传送线cash ratio 现金比率cash receipts (CR) 现金收入cash receipts journal 现金收入日记帐cash records 现金记录cash register 现金登记机,现金收入记录机,收银机cash remittance 汇款单;解款单cash remittance note 现金解款单,解款单cash requirement 现金需要量cash reserve 现金储备(金)cash resources 现金资源,现金来源cash resources (reserves) 现金准备cash sale 现售,现金销售=sale by real cash cash sale invoice 现销发票,现售发票cash settlement 现金结算,现汇结算cash short and over 现金尾差,清点现金余差;现金短溢cash slip 现金传票cash statement 现金报表,(现金)库存表cash ticket 现销票,门市发票cash transaction 现金交易cash verification 现金核实,现金核查cash voucher 现金凭单;现金收据cash with order (订货时付款,订货付现,落单付现cash yield discount 现金获利率,现金收益率cash-and-carry arbitrage 现货持有套利cashier 出纳员,收支员cashier's cheque .) 银行本票=cashier's ordercentral rate 中心汇率(一国货币对美元的汇率,并据此计算对其他货币的汇率)certificate of balance 存款凭单Certificate of Deposits (CDs) 大额定期存款单certificated security 实物证券certificates of deposit (CDs) 大面额存款单certifying bank 付款保证银行change hands 交换,换手chartered bank 特许银行chattel 动产chattel mortgage 动产抵押chattel mortgage 动产抵押chattel mortgage bond (美)动产抵押(公司)债券chattel personal (私人)动产chattel real 准不动产(土地权等)check certificate 检验证明书check deposit 支票存款check list (核对用的)清单check sheet 对帐单checking account 支票帐户checking reserve 支票现金储备checkstand (超级市场的)点货收款台cheque (payable) to bearer 来人支票,不记名支票cheque book 支票簿cheque book stub 支票簿存根cheque card 支票卡cheque collection 支票兑取cheque collector 支票兑取人cheque crossed 划线支票cheque crossed generally 普通划线支票cheque crossed specially 特别划线支票cheque deposit 支票存款cheque drawer 支票出票人cheque holder 支票执票人cheque only for account 转帐支票cheque payable at sight 见票即付支票cheque protector 支票银码机cheque rate 票据汇兑汇率,票汇价格=sight rate ,short rate cheque register 支票登记簿cheque returned 退票,退回的支票cheque signer 支票签名机cheque stub 支票存根cheque to order 记名支票,指定人支票China Investment Bank 中国投资银行circulation tax (turnover tax)流转税city bank 城市银行claim a refound 索赔clean collections 光票托收clearing bank 清算银行clearing house 清算所clearinghouse 清算公司,票据交换所close out 平仓,结清(账)closed and mortgage 闭口抵押closing order 收市价订单closing rate 收盘价closing transaction 平仓交易collar 带利率上下限的期权collateral loan 抵押借款collecting bank 托收银行collecting bank 托收银行collecting bank 代收行collection instructions 委托(托收的)单据collection items 托收业务,托收项目collection of trade charges 托收货款collection on clean bill 光票托收collection on documents 跟单托收collection order 托收委托书collection risk 托收风险collection service 托收服务collective-owned enterprise bonus tax 集体企业奖金税collective-owned enterprise income tax 集体企业所得税commercial and industrial loans 工商贷款commercial deposit 商业存款commercial paper 商业票据commercial paper house 经营商业票据的商号commercial risk 商业风险commercial terms 商业条件commission 佣金commodity futures 商品期货commodity insurance 商品保险common collateral 共同担保common fund 共同基金common stock 普通股common trust fund 共同信托基金compensatory financing 补偿性融资competitive risks 竞争风险composite depreciation 综合折旧compound interest 复利compound rate 复利率compound rate deposit 复利存款comprehensive insurance 综合保险condominium 公寓私有共有方式congestion area 震荡区congestion tape 统一自动行情显示conservatism and liquidity 稳健性与流动性consortium bank 银团银行constructure risk 建设风险consumer financing 消费融资contingent risks 或有风险contract money 合同保证金contract size 合约容量contracts of difference 差异合约contractual value 合同价格controlled rates 控制的汇率converge 集聚,(为共同利益而)结合一起conversion 汇兑、兑换convertible currency 可兑换的货币cooling-off period 等待期cooperative financing 合作金融cornering the market 操纵市场corners 垄断corporate deposits 法人存款correspondent 代理行cost of maintenance 维修费counter-inflation policy 反通货膨胀对策cover 弥补,补进(卖完的商品等)保险coverage 承保险别;保险总额;范围保险coverage ratio 偿债能力比率cover-note 暂保单;投保通知单credit 信用,信贷credit account ., C/A) 赊帐=open account2 credit agreement 信贷协定credit amount 信贷金额;赊帐金额;信用证金额credit analysis 信用分析credit balance 贷方余额,结欠,贷余credit bank 信贷银行credit beneficiary 信用证受益人credit business 赊售,信用买卖credit buying 赊购credit capital 信贷资本credit cards 信用卡credit control 信用控制credit control instrument 信用调节手段credit expansion 信用扩张credit extending policy 融资方针credit facility 信用透支credit limit 信用额度credit restriction 信用限额credit risk 信用风险creditor bank 债权银行crop up (out) 出现,呈现cross hedge 交叉套做cross hedging 交叉保值cum dividend 附息cum rights 含权cumulative preferred stock 累积优先股currency futures 外币期货currency futures contract 货币期货合约current fund 流动基金current futures price 现时的期货价格current ratio 流动比率customize 按顾客的具体要求制作customs duty(tariffs)关税D/D (Banker's Demand Draft) 票汇daily interest 日息daily limit 每日涨(跌)停板date of delivery 交割期dealers 批发商death and gift tax 遗产和赠与税debt of honour 信用借款debtor bank 借方银行decision-making under risk 风险下的决策deed 契约deferred savings 定期存款deficit covering 弥补赤字deficit-covering finance 赤字财政deflation 通货紧缩delivery date 交割日demand pull inflation 需求拉动通货膨胀demand-deposit or checking-accounts 活期存款或支票帐户deposit account (D/A) 存款帐户deposit at call 通知存款deposit bank 存款银行deposit money 存款货币deposit rate 存款利率deposit turnover 存款周转率depreciation risks 贬值风险derivative deposit 派生存款derived deposit 派生存款designated currency 指定货币deutsche marks (=DM) 西德马克devaluation of dollar 美元贬值developer 发展商Development Bank 开发银行development financing 发展融资devise 遗赠die intestate 死时没有遗嘱direct exchange 直接汇兑direct financing 直接融资direct hedging 直接套做direct leases 直接租赁direct taxation 直接税discount credit 贴现融资discount market 贴现市场discount on bills 票据贴现discount paid 已付贴现额discounted cash flow 净现金量discounting bank 贴现银行dishonour risks 拒付风险disintermediation 脱媒distant futures 远期期货diversification 分散投资dividends 红利document of title 物权单据documentary collection 跟单托收Documents against Acceptance,D/A 承兑交单Documents against Payment,D/P 付款交单domestic correspondent 国内通汇银行domestic deposit 国内存款domestic exchange 国内汇兑double leasing 双重租赁double option 双向期权Dow Jones average 道·琼斯平均数down payment 首期downgrade 降级downside 下降趋势downtick 跌点交易Dragon card 龙卡draw 提款draw cheque 签发票据drawee bank 付款银行drawing account 提款帐户dual exchange market 双重外汇市场dual trading 双重交易due from other funds 应收其他基金款due to other funds 应付其他基金款dumping 抛售early warning system 预警系统easy credit 放松信贷economic exposure 经济风险efficient portfolio 有效证券组合electronic accounting machine 电子记帐机electronic cash 电子现金electronic cash register 电子收款机electronic debts 电子借贷electronic funds transfer 电子资金转帐electronic transfer 电子转帐emergency tariff 非常关税encumbrance 债权(在不动产上设定的债权)endorsement for collection 托收背书engage in arbitrage (to) 套汇entity n. 单位,整体,个体entrance fee 申请费equalization fund (外汇)平衡基金equipment leasing services 设备租赁业务equity portfolio 股票资产establishing bank 开证银行ethics risks 道德风险Euro-bank 欧洲银行Eurocard 欧洲系统卡European terms 欧洲标价法evaluation of property 房产估价evasion of foreign currency 逃汇exception clause 免责条款excess insurance 超额保险exchange adjustment 汇率调整exchange alteration 更改汇率exchange arbitrage 外汇套利exchange bank 外汇银行exchange broker 外汇经纪人exchange brokerage 外汇经纪人佣金exchange business 外汇业务exchange clearing agreement 外汇结算协定exchange clearing system 汇结算制exchange competition 外汇竞争exchange contract 外汇成交单exchange control 外汇管制exchange convertibility 外汇兑换exchange customs 交易所惯例exchange depreciation 外汇下降exchange dumping 汇率倾销exchange fluctuations 汇价变动exchange for forward delivery 远期外汇业务exchange for spot delivery 即期外汇业务exchange freedom 外汇自由兑换exchange loss 汇率损失exchange parity 外汇平价exchange position 外汇头寸exchange position 外汇头寸;外汇动态exchange premium 外汇升水exchange profit 外汇利润exchange proviso clause 外汇保值条款exchange quota system 外汇配额制exchange rate 汇价exchange rate fluctuations 外汇汇价的波动exchange rate parity 外汇兑换的固定汇率exchange rate risks 外汇汇率风险exchange reserves 外汇储备exchange restrictions 外汇限制exchange risk 外汇风险exchange risk 兑换风险exchange settlement 结汇exchange speculation 外汇投机exchange stability 汇率稳定exchange surrender certificate 外汇移转证exchange transactions 外汇交易exchange value 外汇价值exchange war 外汇战excise 货物税,消费税exercise date 执行日exercise price, striking price 履约价格,认购价格expenditure tax 支出税expenditure tax regime 支出税税制expenses incurred in the purchase 购买物业开支expiration date 到期日export and import bank 进出口银行export gold point 黄金输出点exposure 风险external account 对外帐户extraneous risks 附加险extrinsic value 外在价值face value 面值facultative insurance 临时保险fair and reasonable 公平合理far future risks 长远期风险farm subsidies 农产品补贴farmland occupancy tax 耕地占用税favourable exchange 顺汇fax base 税基feast tax 筵席税feathered assets 掺水资产fee 不动产fee interest 不动产产权fictions payee 虚构抬头人fictitious assets 虚拟资产fictitious capital 虚拟资本fiduciary a. 信托的,信用的,受信托的(人)fiduciary field 信用领域,信托领域finance broker 金融经纪人financial advising services 金融咨询服务financial arrangement 筹资安排financial crisis 金融危机financial forward contract 金融远期合约financial futures 金融期货financial futures contract 金融期货合约financial insolvency 无力支付financial institutions' deposit 同业存款financial lease 金融租赁financial risk 金融风险financial statement analysis 财务报表分析financial system 金融体系financial transaction 金融业务financial unrest 金融动荡financial world 金融界first mortgage 第一抵押权fiscal and monetary policy 财政金融政策fixed assets 固定资产fixed assets ratio 固定资产比率fixed assets turnover ratio 固定资产周转率fixed capital 固定资本fixed costs 固定成本fixed deposit (=time deposit) 定期存款fixed deposit by installment 零存整取fixed exchange rate 固定汇率fixed par of exchange 法定汇兑平价fixed savings withdrawal 定期储蓄提款fixed-rate leases 固定利率租赁flexibility and mobility 灵活性与机动性flexibility of exchange rates 汇率伸缩性flexible exchange rate 浮动汇率floating exchange rate 浮动汇率floating policy 流动保险单floating-rate leases 浮动利率租赁floor 带利率下限的期权floor broker 场内经纪人fluctuations in prices 汇率波动foregift 权利金foreign banks 外国银行foreign correspondent 国外代理银行foreign currency futures 外汇期货foreign enterprises income tax 外国企业所得税foreign exchange certificate 外汇兑换券foreign exchange crisis 外汇危机foreign exchange cushion 外汇缓冲foreign exchange dumping 外汇倾销foreign exchange earnings 外汇收入foreign exchange liabilities 外汇负债foreign exchange loans 外汇贷款foreign exchange parity 外汇平价foreign exchange quotations 外汇行情foreign exchange regulations 外汇条例foreign exchange reserves 外汇储备foreign exchange restrictions 外汇限制foreign exchange retaining system 外汇留存制foreign exchange risk 外汇风险foreign exchange services 外汇业务foreign exchange transaction centre 外汇交易中心forward exchange 期货外汇forward exchange intervention 期货外汇干预forward exchange sold 卖出期货外汇forward foreign exchange 远期外汇汇率forward operation 远期(经营)业务forward swap 远期掉期fraternal insurance 互助保险free depreciation 自由折旧free foreign exchange 自由外汇freight tax 运费税fringe bank 边缘银行full insurance 定额保险full payout leases 充分偿付租赁full progressive income tax 全额累进所得税fund 资金、基金fund account 基金帐户fund allocation 基金分配fund appropriation 基金拨款fund balance 基金结存款fund demand 资金需求fund for relief 救济基金fund for special use 专用基金fund in trust 信托基金fund liability 基金负债fund obligation 基金负担fund raising 基金筹措fundamental insurance 基本险funds statement 资金表futures commission merchants 期货经纪公司futures contract 期货合约futures delivery 期货交割futures margin 期货保证金futures market 期货市场futures price 期货价格futures transaction 期货交易FX futures contract 外汇期货合约galloping inflation 恶性通货膨胀gap 跳空general endorsement 不记名背书general fund 普通基金general mortgage 一般抵押Giro bank 汇划银行given rate 已知汇率go long 买进,多头go short 短缺;卖空,空头going away 分批买进going rate 现行汇率Gold Ear Credit Card 金穗卡government revenue 政府收入graduated reserve requirement 分级法定准备金Great Wall card 长城卡gross cash flow 现金总流量guarantee of payment 付款保证guaranteed fund 保证准备金hammering the market 打压市场handling charge 手续费harmony of fiscal and monetary policies 财政政策和金融政策的协调hedge 套头交易hedge against inflation 为防通货膨胀而套购hedge buying 买进保值期货hedge fund 套利基金hedging mechanism 规避机制hedging risk 套期保值风险hire purchase 租购hit the bid 拍板成交hoarded money 储存的货币holding the market 托盘horizontal price movement 横盘hot issue 抢手证券hot money deposits 游资存款hot stock 抢手股票house property tax 房产税hypothecation 抵押idle capital 闲置资本idle cash (money) 闲散现金,游资idle demand deposits 闲置的活期存款immobilized capital 固定化的资产immovable property 不动产import regulation tax 进口调节税imposition 征税;税;税款imprest bank account 定额银行存款专户in force (法律上)有效的in the tank 跳水inactive market 不活跃市场income in kind 实物所得income tax liabilities 所得税责任,所得税债务income taxes 所得税indemnity 赔偿,补偿indirect arbitrage 间接套汇indirect finance 间接金融indirect hedging 间接套做indirect leases 间接租赁(即:杠杆租赁)indirect rate 间接汇率indirect taxation 间接税individual income regulation tax 个人调节税individual income tax 个人所得税individual savings 私人储蓄Industrial and Commercial Bank of China 中国工商银行industrial financing 工业融资industrial-commercial consolidated tax 工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inflation 通货膨胀inflation rate 通货膨胀率inflationary spiral 螺旋式上升的通货膨胀inflationary trends 通货膨胀趋势infrastructure bank 基本建设投资银行initial margin 初始保证金initial margin 期初保证权initial margins 初始保证金initial reserve 初期准备金insider 内幕人installment savings 零存整取储蓄institution 机构投资者insurance appraiser 保险损失评价人insurance broker 保险经纪人insurance contract 保险契约,保险合同insurance saleman 保险外勤insurance services 保险业务insure against fire 保火险insured 被保险人interbank market 银行同业市场inter-business credit 同行放帐interest on deposit 存款利息interest per annum 年息interest per month 月息interest rate futures contract 利率期货合约interest rate policy 利率政策interest rate position 利率头寸interest rate risk 利率风险interest restriction 利息限制interest subsidy 利息补贴interest-rate risk 利息率风险interim finance 中间金融intermediary bank 中间银行intermediate account 中间帐户internal reserves 内部准备金international banking services 国际银行业务International Investment Bank (IIB) 国际投资银行international leasing 国际租赁in-the-money 有内在价值的期权intraday 日内intrinsic utility 内在效用intrinsic value 实际价值,内部价值inward documentary bill for collection 进口跟单汇票,进口押汇(汇票)isolation of risk 风险隔离issue bank 发行银行JCB card JCB卡joint financing 共同贷款key risk 关键风险kill a bet 终止赌博land use tax 土地使用税large deposit 大额存款large leases 大型租赁latent inflation 潜在的通货膨胀latent inflation 潜在的通货膨胀lease agreement 租约lease and release 租借和停租lease broker 租赁经纪人lease financing 租赁筹租lease immovable 租借的不动产lease in perpetuity 永租权lease insurance 租赁保险lease interest insurance 租赁权益保险lease land 租赁土地lease mortgage 租借抵押lease out 租出lease property 租赁财产lease purchase 租借购买lease rental 租赁费lease territory 租借地leaseback 回租leasebroker 租赁经纪人leased immovable 租借的不动产leasehold 租赁土地leasehold 租借期,租赁营业,租赁权leasehold property 租赁财产leaseholder 租赁人leaseholder 承租人,租借人leases agent 租赁代理leases arrangement 租赁安排leases company 租赁公司leases structure 租赁结构leasing 出租leasing agreement 租赁协议leasing amount 租赁金额leasing asset 出租财产,租赁财产leasing clauses 租赁条款leasing consultant 租赁顾问leasing contract 租赁合同leasing cost 租赁成本leasing country 承租国leasing division 租赁部leasing equipment 租赁设备leasing industry 租赁业leasing industry (trade) 租赁业leasing money 租赁资金leasing period 租赁期leasing regulations 租赁条例legal interest 法定利息legal tender 法定货币legal tender 本位货币,法定货币lessee 承租人,租户lessor 出租人letter of confirmation 确认书letter transfer 信汇leveraged leases 杠杆租赁lien 扣押权,抵押权life insurance 人寿保险life of assets 资产寿命limit order 限价指令limited floating rate 有限浮动汇率line of business 行业,营业范围,经营种类liquidation 清仓liquidity 流动性liquidity of bank 银行资产流动性listed stock 上市股票livestock transaction tax 牲畜交易税loan account 贷款帐户loan amount 贷款额loan at call 拆放loan bank 放款银行loan volume 贷款额loan-deposit ratio 存放款比率loans to financial institutions 金融机构贷款loans to government 政府贷款local bank 地方银行local income tax (local surtax) 地方所得税local surtax 地方附加税local tax 地方税long arbitrage 多头套利long position 多头头寸long position 多头寸;买进的期货合同long-term certificate of deposit 长期存款单long-term credit bank 长期信用银行long-term finance 长期资金融通loss leader 特价商品,亏损大项loss of profits insurance 收益损失保险loss on exchange 汇兑损失low-currency dumping 低汇倾销low-currency dumping 低汇倾销M/T (= Mail Transfer) 信汇main bank 主要银行maintenance margin 最低保证金,维持保证金major market index 主要市场指数management risk 管理风险managing bank of a syndicate 财团的经理银行manipulation 操纵margin 保证金margin call 保证金通知margin call 追加保证金的通知margin money 预收保证金,开设信用证保证金margin rate 保证金率markdown 跌价market discount rate 市场贴现率market expectations 市场预期market makers 造市者market order 市价订单market risk 市场风险marketability 流动性market-clearing 市场结算Master card 万事达卡matching 搭配mature liquid contracts 到期合约maximum limit of overdraft 透支额度measures for monetary ease 金融缓和措施medium rate 中间汇率medium-term finance 中期金融member bank 会员银行Million card 百万卡minimum cash requirements 最低现金持有量(需求)minimum reserve ratio 法定最低准备比率mint parity 法定平价monetary action 金融措施monetary aggregates 货币流通额monetary and credit control 货币信用管理monetary and financial crisis 货币金融危机monetary area 货币区monetary assets 货币性资产monetary base 货币基础monetary circulation 货币流通monetary device 金融调节手段monetary ease 银根松动monetary market 金融市场monetary market 金融市场monetary risk 货币风险monetary stringency 银根奇紧monetary unit 货币单位money capital 货币资本money collector 收款人money credit 货币信用money down 付现款money equivalent 货币等价money paid on account 定金money-flow analysis 货币流量分析money-over-money leases 货币加成租赁moral hazard 道德风险mortgage bank 抵押银行motor vehicle and highway user tax 机动车和公路使用税movables all risks insurance 动产综合保险movables insurance 动产保险multinational bank 跨国银行multiunit 公寓楼mutual insurance company 相互保险公司national bank 国家银行nationalized bank 国有化银行near money 准货币nearby contracts 近期合约nearby futures 近期期货nearby risks 近期风险negotiability 流通性negotiating bank 议付银行nesting 配套net settlement status 净结算状况,净结算头寸neutral money 中介货币neutrality of the central bank 中央银行的中立性nominal account 名义帐户nominal deposit 名义存款non-member bank 非会员银行non-resident account 非居民存款notional principal 名义本金notional sum 名义金额off-balance-sheet 表外业务offer rate 卖出汇率official borrowing 政府借款official devaluation 法定贬值official rate (of exchange) 官方汇价official short-term credit 官方短期信用offset reserve 坏帐准备金on a discount basis (以)折价形式open account business (= open account trade)赊帐交易open an account 开户open fair transaction tax 集市交易税open market 公开市场open market operation 公开市场业务open market policy 公开市场政策open mortgage 可资抵押open negotiation 公开议付open outcry 公开喊价,公开叫价open policy 预约保单open position (期货交易中的)头寸open positions 敞口头寸open-ended 开口的,无限制的,无限度的opening order 开市价订单operating bank 营业银行operating cash flow 营运现金流(量)operating lease 经营租赁operating leases 操作租赁operating risk 经营风险operation account 交易帐户option 期权,选择权,买卖权option buyer 期权的买方option fee (=option premium or premium o期权费option purchase price 期权的购进价格option seller 期权的卖方options on futures contract 期货合同的期权交易ordinary bank 普通银行ordinary deposit 普通存款ordinary time deposit 普通定期存款our bank 开户银行out-of-the-money 无内在价值的期权output-capital ratio 产出与资本的比率outright position 单笔头寸outward documentary bill for collection 出口跟单汇票,出口押汇outward remittance 汇出汇款over-loan position 贷款超额overnight call loan 日拆overseas bank 海外银行overseas branches 国外分行oversold 超卖over-the-counter 场外的,买卖双方直接交易的,不通过交易所交易的over-the-counter (OTC) option 场外交易市场overvalued 估价过高Pacific card 太平洋卡package policy 一揽子保险painting the tape 粉饰行情pairing 配对parking 寄售partial assignment 部分转让parties to a collection 托收各当事人pawn 典当pay up 付清,缴清payee or beneficiary 受款人,收款人,受益人paying bank 付款银行paying bank 汇入行,付款行payment facilities 支付服务设施payment of account 预付金payment of exchange 结汇payment reserve 支付准备payment risks 支付风险payroll tax 薪金税pegging 固定汇率permanent capital 永久性资本personal account 个人帐户personal deposit 私人存款personal loans 个人贷款petty current deposit 小额活期存款petty insurance 小额保险place an order 订购;下单plastic card 塑料卡Po card 牡丹卡point of delivery 交割地点policy of discount window 窗口指导政策political risk 政治风险poor for insurance 风险大的保险户popularity bank 庶民银行position 头寸;交易部位;部位post 过帐;登入总帐postal remittance 邮政汇款postal savings 邮政储蓄pre-credit risk 信贷前风险predetermined 预先约定的premium 期权费premium 期权权利金premium for lease 租赁保证金premium rate 保险费率premium rates 优惠率premium tariff 保险费率表present discount value 贴现现值presenting bank 提示银行prevailing rate 现行汇率price discovery 价格发现primary insurance 基本险principal 本金principal 本金principal (= drawer,consignor) 委托人principal and interest 本利principals (stockholders) 股东privately owned enterprise income tax 私营企业所得税product tax 产品税productivity risk 产量风险profit and loss accounts 损益帐户profit or loss on exchange 外汇买卖损益profit taking 获利回吐progressive taxation 累进税property 物业property assets 不动产property company 房地产公司property insurance 财产保险property taxes 财产税property under construction 楼花property value 房产价proposal form 投保单proposal of insurance 要保书proprietary 自有资产proprietary insurance 营业保险prospectus 募资说明书protective tariffs 保护性关税provident fund 准备基金provisional account 临时帐户proxy 代理委托证书public audit 公开审计public deposit 政府存款public money 公款pure interest 纯利息put (option) 卖方期权,看跌期权put-options 认售期权quality risks 质量风险quantity risks 数量风险ransom 赎金rate of deposit turnover 存款周转率rate of depreciation 折旧率ratio of cash reserves to deposits 存款支付准备率ratio of cash reserves to deposits 存款支付准备率ratio of cash reserves to deposits 存款支付准备率ratio of doubtful loans to total loans 坏帐比率ratio of profit to capital 收益同资本的比率rationing of exchange 外汇配售real estate 不动产real estate and personal property tax 不动产和动产税real estate brokerage services 不动产经纪业务。

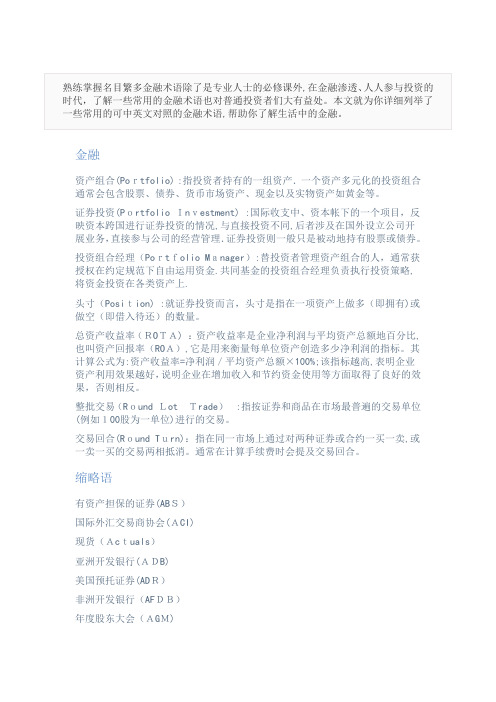

常用金融术语(中英对照)

金融资产组合(Portfolio) :指投资者持有的一组资产.一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等。

证券投资(Portfolio Investment) :国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理.证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金.共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上.头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标。

其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round LotTrade):指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(RepoRate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

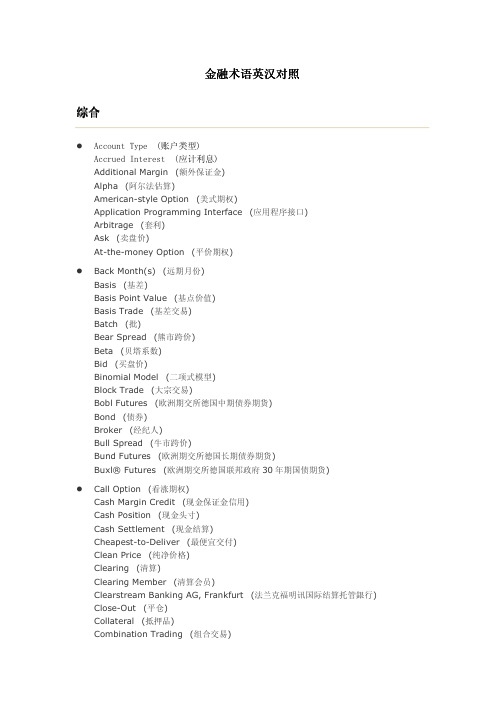

常见金融术语英汉对照与详解

综合

� Account Type (账户类型) Accrued Interest (应计利息) Additional Margin (额外保证金) Alpha (阿尔法估算) American-style Option (美式期权) Application Programming Interface (应用程序接口) Arbitrage (套利) Ask (卖盘价) At-the-money Option (平价期权)

� Raw Data (原始数据) Reference Price (参考价格) Release (版本) Release Method (释放方法) Relevant Trades (相关交易) Remaining Lifetime (距离到期时间) Repurchase Transaction ("Repo") (回购交易)

� Omega (欧米加值) Opening (开盘) Opening Interest (未平仓量) Opening of a Position (开仓) Optimization (最优化) Option (期权) Option Premium (期权金) Option Price (期权价格) Option Pricing Model (OPM) (期权定价模式) Option Seller (期权卖出者) Order (指令) Order Book (指令簿) Order Type (指令类型) OTC Trades (Over-the-Counter Trades) (场外交易) Out-of-the-money Option (价外期权) Overdue Trade-Fail (延期交易未能履约)

� Back Month(s) (远期月份) Basis (基差) Basis Point Value (基点价值) Basis Trade (基差交易) Batch (批) Bear Spread (熊市跨价) Beta (贝塔系数) Bid (买盘价) Binomial Model (二项式模型) Block Trade (大宗交易) Bobl Futures (欧洲期交所德国中期债券期货) Bond (债券) Broker (经纪人) Bull Spread (牛市跨价) Bund Futures (欧洲期交所德国长期债券期货) Buxl® Futures (欧洲期交所德国联邦政府 30 年期国债期货)

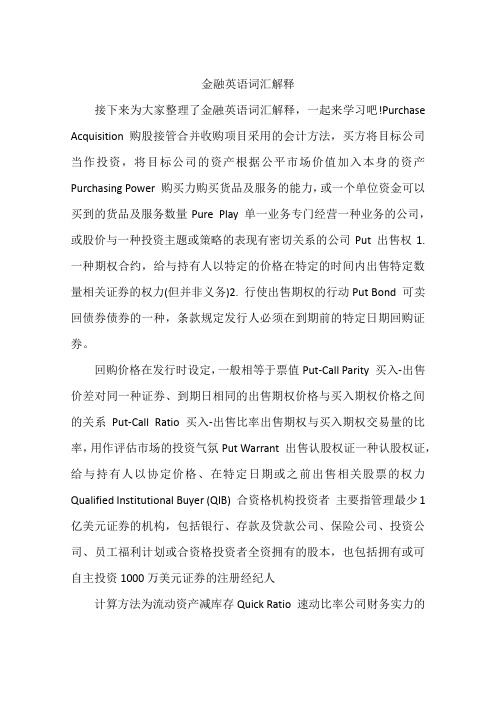

金融英语词汇解释

金融英语词汇解释接下来为大家整理了金融英语词汇解释,一起来学习吧!Purchase Acquisition 购股接管合并收购项目采用的会计方法,买方将目标公司当作投资,将目标公司的资产根据公平市场价值加入本身的资产Purchasing Power 购买力购买货品及服务的能力,或一个单位资金可以买到的货品及服务数量Pure Play 单一业务专门经营一种业务的公司,或股价与一种投资主题或策略的表现有密切关系的公司Put 出售权1. 一种期权合约,给与持有人以特定的价格在特定的时间内出售特定数量相关证券的权力(但并非义务)2. 行使出售期权的行动Put Bond 可卖回债券债券的一种,条款规定发行人必须在到期前的特定日期回购证券。

回购价格在发行时设定,一般相等于票值Put-Call Parity 买入-出售价差对同一种证券、到期日相同的出售期权价格与买入期权价格之间的关系Put-Call Ratio 买入-出售比率出售期权与买入期权交易量的比率,用作评估市场的投资气氛Put Warrant 出售认股权证一种认股权证,给与持有人以协定价格、在特定日期或之前出售相关股票的权力Qualified Institutional Buyer (QIB) 合资格机构投资者主要指管理最少1亿美元证券的机构,包括银行、存款及贷款公司、保险公司、投资公司、员工福利计划或合资格投资者全资拥有的股本,也包括拥有或可自主投资1000万美元证券的注册经纪人计算方法为流动资产减库存Quick Ratio 速动比率公司财务实力的指标。

计算方法为流动资产减库存,然后除以流动负债。

也称为酸性测试比率Quiet Filing 安静申请指促意不包括重要细节的首次公开上市申请。

发行人向美国证监会提交安静申请的目的在于展开新证券发行的申请过程,未提交资料必须在补充文件中披露。

这种申请方式所需的时间一般比传统申请方法要长Quiet Period 静止期在首次公开上市的过程中,静止期指美国证监会禁止发行人进行公开推销活动的时期。

金融名词解释大全

金融名词解释大全1. 股票(Stocks)股票是公司向公众发行的所有权份额,每股代表对公司一定比例的所有权。

股票可以在证券交易市场上交易,投资者可通过购买股票成为公司的股东,并分享公司的利润和增值。

2. 债券(Bonds)债券是借款人向投资者发行的一种债务工具,代表借款人的债务承诺。

债券投资者向发行人提供资金,债券到期时,发行人以面值偿还本金,并支付利息作为回报。

3. 利率(Interest Rate)利率是指金融交易中借款者支付给贷款人的费用,即贷款利息的百分比。

利率通常反映了借款的成本与风险。

4. 黄金(Gold)黄金是一种贵重金属,被广泛用于投资和金融交易中。

其价值通常受供求关系、经济形势和市场情绪等因素影响。

5. 外汇(Foreign Exchange)外汇是指不同国家的货币进行兑换的过程,也是进行国际贸易和金融交易的基础。

外汇市场是全球最大、最活跃的金融市场之一。

6. 期货(Futures)期货是指以标准化合约形式约定按特定价格在未来某一日期交割的金融产品。

期货合约通常包括商品、股指或货币对等。

7. 期权(Options)期权是购买或出售一种资产的权利,但并不要求买方实施该权利。

期权合约由买方获得了在未来特定日期或之前执行交易的选择权。

8. 融资(Financing)融资是指获取资金的过程,企业或个人通过向金融机构借贷或发行债券来筹集资金,以满足业务或个人需求。

9. 风险投资(Venture Capital)风险投资是指投资者将资金投入于初创公司或具有高风险和高增长潜力的企业,在期待高回报的同时,承担创业失败的风险。

10. 金融衍生品(Financial Derivatives)金融衍生品是一种基于债券、股票、商品等资产的金融合约,其价值来自于基础资产的价格波动。

常见的金融衍生品包括期货、期权和掉期等。

11. 黑天鹅事件(Black Swan)黑天鹅事件是指罕见且难以预测的突发事件,对金融市场和全球经济产生重大影响。

金融术语英语词汇

金融术语英语词汇minimum paid-up share capital 最低实缴股本reciprocity 互惠corresponding bank 代理行liaison office 联络办公室moratorium 延期偿付权legislation 法规innovation 改革underwriting 包销merge 合并portfolio 资产组合unit trust 单位投资信托arbitrage 套汇capital adequacy ratio 资本充足率derivative 金融衍生工具maturity 到期日deregulation 放松管制redemption 兑现certificates of indebtedness 债务证书linked exchange rate 联系汇率accounting arrangements 会计安排resumption of sovereign 收回主权holding company 控股公司privileges 特权legal tender 法币medium of exchange 交换媒介deferred payment 延期支付face value 面值mintage 铸币homogeneity 同质权fiat money 不兑换纸币,名义纸币negotiable certificates of deposits 大额转让存单narrowly-defined 狭义定义的broadly-defined 广义定义的required reserve 法定准备金excess reserve 超额准备金monetary base 货币{流通}基础open market operations 公开市场操作auction 拍卖non-intervention 不干涉主义net balance 净差{余}额advance 贷款retained earnings 留存收益risk-weighted assets 风险加权资产off-balance sheet items 表外业务项目collateral 抵押claims 债权denominate 面值residual maturity 剩余期限mortgage 住房抵押arrears 拖欠尾数default 违约on-balance sheet items 表内业务contingency 意外开支repurchase agreement 回购协议recourse 追索权irrevocable 不可撤消rediscounting 在贴现market risk exposure市场风险position 头寸debt-to-equity ratio 资产负债比率treasure bond 国库券leasing 租赁money laundering 洗钱treasure bill 国库券bankruptcy 破产credit securitization 信用证券化real time gross settlement 实时全额清算off-shore 离岸clearing bank清算行discount house 贴现行privileged position 最优惠头寸building society 建房协会Japanese Big Bang 日本金融改革dual banking system 双轨银行制度wire transfer 电子转帐laissez-faire 自由放任主义negotiable 可流通的installment 分期付款benchmark 基准利率turnover 成交额outstanding 未付的in favour of 以^为受益人promissory note 本票unsecured 无担保的prime rate 最优惠利率preference share 优先股ordinary share 普通股warrant 认股权current market value 当期市值option contract 期权合同hedging 套期保值Provident Fund 福利基金beneficiary 受益人collecting bank 代收行code 代号,代码,密码uncleared cheque 未清偿支票invoice 发票credit transfer 信用转帐endorsement 背书bearer 持票人defective title 有瑕疵的所有权down payment 首付款traveller's cheque 旅行支票bearer bonds 不记名债券crossed cheque划线支票countersign 联署paying bank 付款行transferable 可转让holder in due course 正当持票人holder in value 有代价持票人overdue 过期dishonoured cheque 拒付支票repo repurchase agreement 回购协议countermand 取消garnishee order 向第三债务人下达的资产扣押令winding-up 停业清理secured loan 担保贷款overdraft 透支real estate mortgage 房地产抵押chattel mortgage 动产抵押in presence of 提示reimbursement 偿还withholding interest tax 预扣税custodian 保管access 准入automatic teller machine 自动取款机personal identity number 密码.个人识别号passbook 存折insurance broker 保险经纪人hire purchase 租购working capital loan 周转资金start-up loan 创业贷款syndicated loan 辛迪加贷款project financing 项目融资foreign trade financing 对外贸易融资current assets 流动资产accounts receivable 应收帐款agent bank 代理行drawdown period 支用期grace period 宽限期principle 本金tombstone 证券发行公告factoring facilities 保理业务open credit 无担保贷款factor 保理人lessee 承租人lessor 出租人non-resourse 无追索权financial lease 金融租赁operating lease 经营租赁full payout lease 支付租赁true lease 真实租赁conditional lease 条件租赁leverage lease 杠杆租赁electronic date interchange services 电子数据交换服务retail bank 商业零售银行private bank 私人银行merchant bank 商人银行risk preference 风险偏好risk taking investor 甘冒风险的投资者risk aversion investor 逃避风险的投资者macroeconomic oriented 以宏观经济为导向的equities origination 股票发行venture capital financing 风险资本融资the spread 价差interest rate swap 利率互换leverage buyout 杠杆收购junk bond 垃圾债券red chips 红筹股"h" shares H股trustee 受托人collection 托收production combination 生产联合production cost 生产成本comparative advantage 相对优势middle agent 中间代理eliminate exchange risk 消除外汇风险shipping insurance 海险guarantee 担保performance bond 履约保证import credit 进口信贷dividends 分红money transfer 转帐bank draft 银行汇票mail transfer 信汇telegraphic transfer 电汇test key测试密钥telex 电报Society for World Inter-bank Financial Telecommunications 环球银行间金融电讯协会standardized format 标准格式clearing house 结算所computer code 电脑代码additional cost 附加成本foreign exchange rate 外汇汇率swing 浮动spot rate 现汇汇率market rate 市场汇率cross rate 交叉汇率forward exchange contract 远期外汇合同currency future contract 货币期货合同quotation 报价单rolling forex 展期外汇option on foreign exchange 外汇期权strike price 执行价格expiry date 到期日call option 多头期头put option 空头期权foreign exchange hedge 外汇套期保值foreign exchange swap 外汇掉期superannuation 养老基金pension funds 退休基金brokerage fee 经纪人佣金optimum profit 最高收益canon 标准illegal activities 非法行为speculative purpose 投机目的repayment schedule 还款安排balance sheet 资产负债表income statement 利润表long-term loan 长期贷款country-risk 国别风险quantitative yardstick 定量的评判标准credit risk 信用风险risk assessment 风险评估margin 保证金legal authority 法定权力memorandum and articles of association 公司章程cushion of assets 资产缓冲safe title 所有权credit reference agency 信用查询机构credit standing 信用状况consumer loan 消费信贷bonus 奖金gratuity 退休金track record 工作履历minor's account 未成年人帐户sole proprietors 独资企业private limited company 私人有限公司public limited company 公共有限公司inter-bank lending /borrowing 同业拆借the inter-bank money market 同业拆借市场local currency 本国货币marginal cost 边际成本inter-bank rate 同业拆借利率contingency payout 意外支出natural disaster 自然灾害legal status 法定地位documentary credit 跟单信用证documentary collection 跟单托收export credit insurance 出口信贷保险shipment policy 装运保险单issuing bank 开证行advising bank 通知行confirming bank 保兑行applicant 开证申请人irrevocable documentary letter of credit 不可撤消信用证reimbursing bank 偿付行negotiating bank 议付行verification 证实confirmed credit 保兑信用证payment in advance 预付贷款remitting bank 托收行collecting bank 代收行sight bill 即期汇票term bill 远期汇票clean collection 光票托收bill of lading 提单certificate of origin 原产地证明airway bill 航空联运certificate of inspection 检验证明insurance policy certificate 保单证明open account 赊销premium 保险费stockbroking 股票经纪going concern 持续经营net profit 净收益audited accounts 经过审计的帐户registration certificate 注册证明inheritance 遗产tangible security 有形担保intangible personal guarantee 无形个人担保deed 契约dormant partner 不参与经营的合伙人limited partner 有限责任合伙人aggressive management 扩张性管理defensive management 保守性管理gearing 举债经营prior charge 优先偿付债券charges on assets 以资产抵押fixed charge 固定抵押floating charge 浮动抵押overtrading 超资力经营life policy 人寿保险depreciation 折旧indemnity 赔偿legal mortgage 法定抵押leasehold mortgage 衡平法抵押surrender value 租赁财产抵押stocks and shares 股票和证券unquoted shares 非挂牌{上市}股票cross-guarantee 交叉担保under influence 不正当影响misrepresentation 与事实不符合的陈述debenture 债券run down 削减acknowledgement 确认tangible assets 有形资产intangible assets 无形资产copy right 版权goodwill 商誉net worth 资产净值cash flow 现金流量current ratio 流动比率quick ratio 速动比率quality of assets 资产质量investment strategy 投资策略trend analysis 趋势分析debt to equity ratio 债务产权率debt service ratio 还本付息比;偿债比率amortization 摊销receivable turnover 应收帐款inventory turnover存货周转write off 注销recession (经济)衰退social unrest 社会动荡uncleared funds 未清算资金credit limit 信贷限额bad debt 坏帐loan restructuring 贷款重新安排recovery 追陪offsetting 补偿legal proceeding 诉讼litigation solicitor诉讼律师。

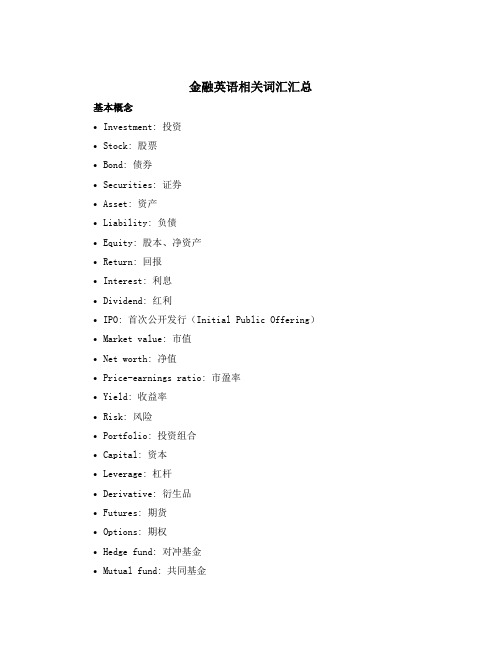

金融英语相关词汇汇总

金融英语相关词汇汇总基本概念•Investment: 投资•Stock: 股票•Bond: 债券•Securities: 证券•Asset: 资产•Liability: 负债•Equity: 股本、净资产•Return: 回报•Interest: 利息•Dividend: 红利•IPO: 首次公开发行(Initial Public Offering)•Market value: 市值•Net worth: 净值•Price-earnings ratio: 市盈率•Yield: 收益率•Risk: 风险•Portfolio: 投资组合•Capital: 资本•Leverage: 杠杆•Derivative: 衍生品•Futures: 期货•Options: 期权•Hedge fund: 对冲基金•Mutual fund: 共同基金•Asset management: 资产管理•Investment bank: 投资银行股票市场•Index: 指数•Bull market: 牛市•Bear market: 熊市•Securities exchange: 证券交易所•Shareholder: 股东•Stock market bubble: 股市泡沫•Blue chips: 蓝筹股•Broker: 经纪人•Public offering: 公开发售•Private placement: 非公开发售•Over-the-counter market: 场外交易市场•Trading day: 交易日•Stock price: 股价•High: 最高价•Low: 最低价•Close: 收盘价•Open: 开盘价•Volatility: 波动性•Margin call: 追缴保证金•Odd lot: 散股债券市场•Coupon: 票息•Yield to maturity: 到期收益率•Treasury bond: 国债•Corporate bond: 企业债•Municipal bond: 市政债•Junk bond: 垃圾债券•Call option: 赎回期权•Put option: 优先认股权证•Callable bond: 可赎回债券•Convertible bond: 可转换债券•Face value: 面值•Par value: 兑付价值银行业•Checking account: 支票账户•Savings account: 储蓄账户•Interest rate: 利率•Compound interest: 复利•Prime rate: 基准利率•Credit rating: 信用评级•Overdraft: 透支•Bankruptcy: 破产•FDIC: 次级贷款参股保险业•Premium: 保费•Deductible: 自负额•Policy: 保单•Claim: 索赔•Underwriter: 承保人•Liability insurance: 责任险•Life insurance: 寿险•Health insurance: 健康险•Property insurance: 财产险其他•Financial statement: 财务报表•Cash flow: 现金流•Accounting: 会计学•Auditing: 审计学•Taxation: 税务学•Merger: 合并•Acquisition: 收购•Bank transfer: 银行转账•Bitcoin: 比特币以上是金融英语相关词汇的基本概念和常见词汇,如果需要深入学习金融英语,建议多阅读英文金融类书籍、杂志,夯实基本词汇和理论知识。

金融专业术语英语词汇

division of labor 劳动分工commodity money 商品货币legal tender 法定货币fiat money 法定通货a medium of exchange交换媒介legal sanction法律制裁face value面值liquid assets流动资产illiquidl assets非流动资产the liquidity scale 流动性指标real estate 不动产time deposit 定期存款bond 债券stock股票thrift institutions 存款机构financial institution 金融机构commercial banks商业银行a means of payment 支付手段 a store of value储藏手段a standard of value价值标准certificate of deposits存单repurchase agreements 回购协议travelers'checks 旅行支票money market mutual funds 货币市场互助基金small-denomination time deposits小额定期存款large-denomination time deposits大额定期存款bank overnight repurchase agreements 银行隔夜回购协议bank long-term repurchase agreements 银行长期回购协议checking accounts,demand deposit,checkable deposit 活期存款negotiable order of withdrawal accounts 大额可转让提款单unit tworeserve 储备note 票据discount贴现circulate流通central bank 中央银行credit union 信用合作社paper currency 纸币credit creation 信用创造branch banking 银行分行制unit banking 单一银行制out of circulation 退出流通capital stock股本at par以票面价值计electronic banking电子银行the gold standard金本位reserve ratio 准备金比率banking holding company 公司银行the stock market crash 股市风暴the Federal Reserve System联邦储备系统the Federal Reserve Board 联邦储备委员会unit threedeficit 亏损roll展期wholesale批发default不履约auction拍卖collateralize担保markup价格的涨幅dealer交易员broker经纪人pension funds 养老基金face amount面值commerical paper商业票据Fed fund 联邦基金eurodollar欧洲美元treasury bills 国库券floating-rate 浮动比率fixed-rate 固定比率default risk 拖欠风险credit rating信誉级别tax collection税收money market货币市场capital market资本市场original maturity 原始到期期限surplus funds过剩基金premium升水discount贴水par平价deficit赤字future期货capital movements资本流动foreign exchange dealings外汇交易balance of payment国际收支eurodollar market欧洲美元市场spot rate 即期汇率forward rate远期汇率cross rate交叉汇率arbitrage transation套汇交易space arbitrage地点套汇time arbitrage时间套汇interest arbitrage 套利direct quotation直接标价法indirect quotation间接标价法decimal system十进制long position多头short position空头banker's acceptance银行承兑汇票swedish kronor瑞典克郎Sfr 瑞士法郎DM德国马克FFr法国法郎Dkr丹麦克郎Nkr挪威克郎Yen日元Can$加拿大元Lit意大利里拉Aus$澳大利亚元DG荷兰盾BF比利时法郎£英镑unit fiveover-the-counter market场外交易市场turnover总成交额invoice发票,发货单portfolio债务,投资组合not-for-profit cooperative非盈利性组织triangular arbitrage三角套汇the society for worldwide interbank financial telecommunication(SWIFT)环球银行金融电讯协会the clearing house interbank payments system(CHIPS)纽约银行同业清算系统unit sixquota 配额guaratee保函fixed exchange rate固定汇率balance of payment deficit国际收支逆差international reserve国际储备credit tranche drawing信贷份额借款credit tranche信贷份额credit tranche facilities信贷份额贷款便利international payment国际收支buffer stock缓冲存货extended facilities补偿信贷便利government borrowing国债;政府借款price fluctuation价格波动,价格涨落export earning 出口收益enlarged access policy 延期进入政策credit policy信用政策financial intermediary 金融中介concessional terms特惠条件trade credit商业信贷earning capacity收益能力debt restructuring债务重组,债务调整financial settlement财务清算Bretton Woods Agreement布雷顿森林协议International Monetary Fund 国际货币基金组织International Development Association(I.D.A.)国际开发协会International Fincance Corporation(I.F.C.)国际金融公司Bank for International Settlements(B.I.S.)国际清算银行International Bank for Resonstruction and Development(IBRD)国际复兴与开发银行unit sevensyndication辛迪加underwrite包销,认购hedge对冲买卖、套期保值innovation到期交易spread利差principal本金swap掉期交易eurobond market 欧洲债券市场Federal Reserve Bank (FRB)联邦储备银行euronote欧洲票据fixed term time deposit定期支付存款unsecured credit无担保贷款neogotiable time deposit议付定期存款lead bank牵头银行inter-bank money market银行同业货币市场medium term loan 中期贷款syndicated credit银团贷款merchant bank商业银行portfolio management 有价债券管理lease financing租赁融资note issurance facility票据发行安排floating-rate note 浮动利率票据bearer note不记名票价underwriting facility包销安排bond holder债券持持有者back-up credit line备用信贷额promissory note(P.N..p/n)本票interest rate controls 利率管制interest rate ceiling 利率上限interest rate floor 利率下限deposit insurance 存款保险London Interbank Offered Rate(LIBOR)伦敦同业优惠利率revolving cerdit 循环信用证,即revolving letter of credit non interest-bearing reserves无息储备金。

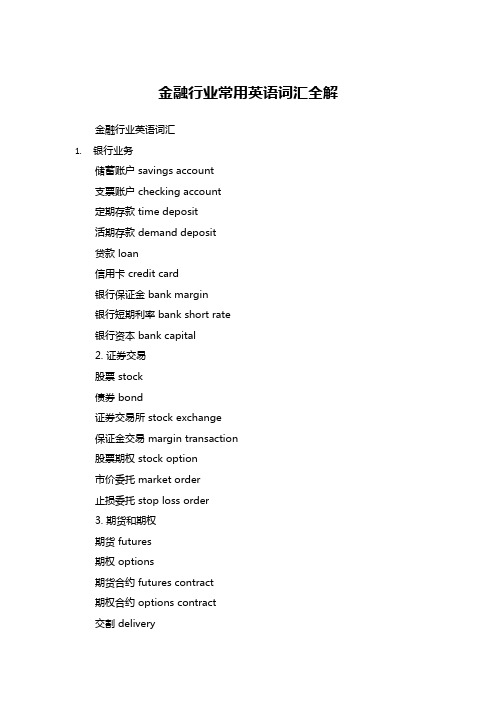

金融行业常用英语词汇全解

金融行业常用英语词汇全解金融行业英语词汇1.银行业务储蓄账户 savings account支票账户 checking account定期存款 time deposit活期存款 demand deposit贷款 loan信用卡 credit card银行保证金 bank margin银行短期利率 bank short rate银行资本 bank capital2. 证券交易股票 stock债券 bond证券交易所 stock exchange保证金交易 margin transaction股票期权 stock option市价委托 market order止损委托 stop loss order3. 期货和期权期货 futures期权 options期货合约 futures contract期权合约 options contract交割 delivery权利金 option premium保证金 margin4. 投资管理投资组合 investment portfolio 资产配置 asset allocation风险评估 risk assessment投资收益 investment return 资本增值 capital appreciation 价值投资 value investing成长投资 growth investing 5. 保险产品人寿保险 life insurance健康保险 health insurance汽车保险 auto insurance财产保险 property insurance 责任保险 liability insurance保险单 insurance policy保险费 insurance premium 6. 信贷与债务信贷 credit债务 debt信用评级 credit rating债务人 debtor债权人 creditor抵押贷款 mortgage loan商业贷款 commercial loan 7. 宏观经济指标国内生产总值 GDP消费者物价指数 CPI生产者物价指数 PPI失业率 unemployment rate利率 interest rate通货膨胀率 inflation rate法定准备金率 reserve requirement ratio 货币政策 monetary policy。

金融英语词汇(含解释)

Average Price Call平均价格买入期权权一种期权,其收益为零或相等于资产平均价格高于行使价格的金额Average Price Put平均价格出售期权一种期权,其收益为零或相等于行使价格高于资产平均价格的金额Average Up提高平均价格以比原先买入价格高的价格买入更多股票,从而提高所有股票的平均价格Back Door Listing后门上市/借壳上市未能符合股票交易所上市要求的企业采用的一种上市策略,公司通过收购一家已经上市的公司而达到上市的目的Backlog订单积压等候完成的出售指示Back Office后线金融服务公司的行政及支援人员,主要职能包括交易结算、清理、记录、合规监察、会计等Back Pricing往后定价某些期货合约采用的方法,期货商品的价格由买方在签署合约后特定日期决定Back-to-Back Loan背对背贷款两家位于不同国家的公司向对方借贷相同金额的对方国家货币贷款,目的在于对冲货币波动的风险Backstop最后担保为一项证券发行提供最终的保证或担保Bad Debt不良贷款不能回收的债务,因此对债权人没有价值Balanced Fund平衡基金将资产投资于货币市场、债券、优先股及普通股的共同基金,目的在于同时实现增长及收益Balanced InvestmentStrategy平衡投资策略旨在平衡风险及回报的投资组合分配及管理方法Balance Of Payments (BOP)国际收支差额一个国家在特定期间进行的所有交易的纪录,可用作比较一个国家与其他国家的经济活动量Balance Of Trade (BOT)国际贸易差额一个国家收支差额的最大组成项目。

指出口及进口的差额。

减项包括进口、外国援助、国民在国外的开支及国民在国外的投资。

加项包括出口、外国国民在国内的开支以及外国国民在国内的投资Balance Sheet资产负债表一家企业的财务报表,报告公司在一个特定时间的资产、负债及净值Balloon Option气球型期权名义付款额在达到若干标准后提高的期权1. 在一次债券发行中,在某一时间(一般于最终到期日)有大量债券到期的还款安排2. 贷款最后一次的偿还金额远高于之前偿还金额Bancassurance银行出售保险法文词汇,指通过银行既有的分销渠道销售保险Bank Guarantee银行担保放贷机构发出的担保,证明债务人的负债可获偿还。

金融英语词语解释全部版