会计专业英语翻译题知识分享

会计专业英语

会计专业英语-CAL-FENGHAI.-(YICAI)-Company One1一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance with established procedures.3.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits.C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’ equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs.petence’ judgment’ and ethical behavior of individual accountants’D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receiving in exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A.Dr. Bad Debt Accts. $1,500B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retained earnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900(B)A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $300pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )A.Dr. Office Equipment $2,000B.Dr.Office Equipment $2,000Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,100pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B )A.Dr. Accts Rec $2000B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )A.Dr.Office equipment $2500B.Dr. Office equipment $2500Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly highcontinuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

会计专业英语翻译题

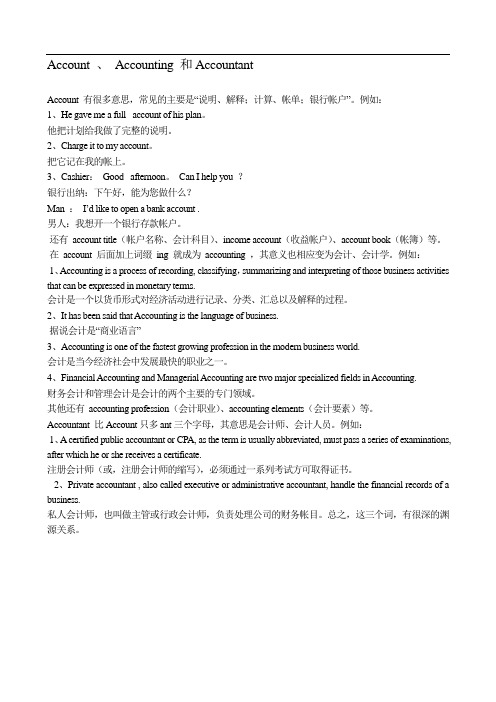

Account 、Accounting 和AccountantAccount 有很多意思,常见的主要是“说明、解释;计算、帐单;银行帐户”。

例如:1、He gave me a full account of his plan。

他把计划给我做了完整的说明。

2、Charge it to my account。

把它记在我的帐上。

3、Cashier:Good afternoon。

Can I help you ?银行出纳:下午好,能为您做什么?Man :I’d like to open a bank account .男人:我想开一个银行存款帐户。

还有account title(帐户名称、会计科目)、income account(收益帐户)、account book(帐簿)等。

在account 后面加上词缀ing 就成为accounting ,其意义也相应变为会计、会计学。

例如:1、Accounting is a process of recording, classifying,summarizing and interpreting of those business activities that can be expressed in monetary terms.会计是一个以货币形式对经济活动进行记录、分类、汇总以及解释的过程。

2、It has been said that Accounting is the language of business.据说会计是“商业语言”3、Accounting is one of the fastest growing profession in the modern business world.会计是当今经济社会中发展最快的职业之一。

4、Financial Accounting and Managerial Accounting are two major specialized fields in Accounting.财务会计和管理会计是会计的两个主要的专门领域。

会计专业英语翻译

.1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing.2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language."3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.。

常用会计词汇汉译英

常用会计词汇汉译英一贯原则consistency人名帐户personal account工作底稿working paper已承兑汇票accepted draft/bill已发行股本issued capital己催缴股本called-up capital己缴股本paid-up capital已赎回票据retired bill欠付催缴股款calls in arrear毛存现金cash in hand毛利gross profit毛利率gross profit ratio/margin毛损gross loss日记簿journal月结单monthly statement少量余额minority balance分配allocation分类帐ledger公证文件noting分摊apportionment加成mark-up永久业权freehold主要成本prime cost未催缴股本uncalled capital申请及分配application and allotment 目标条款object clause平价发行issued at par出让人帐vendor account自平self-balancing自平分类帐self-balancing ledger自动转帐autopay成本会计cost accounting共同joint存货记录簿stock records存货周转率stock turnover rate存货帐stock account年终盘点存货year-end stock taking 企业个体business entity合伙企业partnership在运品goods in transit在制品work-in-progress呆帐bad debts呆帐准备provision for bad debts没收forfeiture利息帐法interest account method重置replacement决算表final accounts折扣栏discount column折旧depreciation折旧帐法depreciation account method折旧准备帐法depreciation provision account method 折价discount非人名帐户impersonal account抽取extract固定资产fixed assets长期负债long-term liabilities法人legal person股本share capital拒付票据dishonoured bill股份share或有负债contingent liability所有权ownership承兑acceptance承兑人acceptor法定股本authorised capital股东主权shareholders'equity股东资金shareholders'fund受票人drawee直线折旧法straight-line depreciation method 直接工资direct wages直接原料direct material直接费用direct expenses股票share certificate承销人consignee承销清单account sales抵销set-offs抵销性错误compensating error定额制度imprest system科目account负债liabilities信讬人trustee按比例分配pro rata背书endorsement持票人holder盈余surplus盈余分拨帐appropriation account重点钜数materiality重估折旧法revaluation depreciation method 借方debit借项通知单debit note借项通知单(银行用) debit advice库存现金cash in hand配比match个别several纯利net profit纯利率net profit ratio记帐时借贷方互调complete reversal of entries 特别原始簿special book of original entry原始分录错误error of original entry原始分录簿book of original entry原则性错误error of principle流动资产current assets流动负债current liabilities流动比率current ratio流动抵押品floating charge租购hire purchase租购公司hirer个体entity差额承上balance brought down差额承前balance brought forward差额转下balance carried down帐户account透支overdraft透支额度facility extent名调乱错误error of commission现金日记簿cash book现金收支帐receipts and payments account 现金折扣cash discount虚帐户nominal account净损失net loss累积基金accumulated fund停止经营quit concern动用资金capital employed专利税royalty专利权patent货物寄销帐goods sent on consignment account 票面值par value接纳accept净流动资产net current assets速动比率liquidity ratio寄销consignment寄销人consignor寄销帐consignment account票据拒付手续费noting charges票据贴现discounting bill of exchange 组织大纲memorandum of association 组织章程articles of association商誉goodwill贷方credit贷项通知单credit note贷项通知单(银行用) credit advice提用drawings提款帐drawings account费用expenses期未存货closing stock期初存货opening stock单式簿记single-entry bookkeeping备忘memorandum补助分类帐subsidiary account报表statement贴现discount发票invoice发票人drawer间接工资indirect wages贴现手续费discounting charge普通股ordinary shares普通日记簿general journal普通原始簿general book of original entry 间接原料indirect material间接费用indirect expenses, overhead间接制造成本factory overhead开帐分录opening entries结帐分录closing entries短期合营joint venture短期合营帐joint venture account短期合营备忘帐memorandum joint venture account 结算票据honour the bill of exchange超额利润super profit资本capital资本主proprietor资本支出capital expenditure资本报酬率return on capital employed零用现金凭单petty cash voucher零用现金簿petty cash book债权人creditor债券debenture预计利息帐法interest suspense account method预付费用prepaid expenses预取收益receipt in advance会计等式accounting equation损益帐profit and loss account损益计算income determination过帐posting资产assets资产负债表balance sheet资产收回价值goods repossessed value试算表trial balance经常性项目recurrent item溢价premium溢价发行issued at premium催缴股款call银行往来调节表bank reconciliation statement 复式簿记double-entry bookkeeping说明account for实帐户real account对销contra制成品finished goods汇票bill of exchange, draft实际成本actual cost截线enter short认讲意图offer暂记帐户suspense account销货成本cost of goods sold销货折扣discounts allowed销货退回簿returns inwards book 销货净额net sales销货发票sales invoice销货簿sales journal调整adjustment制造成本会计manufacturing account数量表达及稳定货币量度quantifiability and stable monetary measure随要随付payable on demand余绌surplus and deficit遗漏错误error of omission余额承上balance brought down余额承前balance brought forward余额递减折旧法reducing balance depreciation method余额转下balance carried down历史成本historical cost担保还款佣金del credere commission总分类帐general ledger应付帐款分类帐creditors ledger, purchases ledger应付帐款分类帐统制帐户creditors ledger control account, purchases ledger control account应收帐款分类帐debtors ledger, sales ledger应收帐款分类帐统制帐户debtors ledger control account, sales ledger control account应计收益accrued income亏绌deficit购货折扣discounts received购货退出簿returns outwards book购货帐purchases account购货净额net purchases购货簿purchases journal营业折扣trade discount购销帐trading account购销损益帐trading and profit and loss account优先股preference shares应付帐款赊帐期限credit period received form trade creditors 应付票据bill payable应收帐款赊帐期限credit period allowed to trade debtors 应收票据bill receivable应计基础accrued basis购买权option偿债基金sinking fund营运资金比率working capital ratio转让transfer旧换新trade-in稳健保守conservatism, prudence簿记bookkeeping继续经营going concern变产帐realisation account赎回资本准备金capital redemption reserve fund税收报表词汇英汉对照Withholding Tax Form (代扣所得税表)English Language Word or Term Chinese Language Word or Term INDIVIDUAL INCOME TAX WITHHOLDING RETURN 扣缴个人所得税报告表Withholding agent's file number 扣缴义务人编码Date of filing 填表日期Day 日Month 月Year 年Monetary Unit 金额单位RMB Yuan 人民币元This return is designed in accordance with the provisions of Article 9 of INDIVIDUAL INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA. The withholding agents should turn the tax withheld over to the State Treasury and file the return with the local tax authorities within seven days after the end of the taxable month.根据《中华人民共和国个人所得税法》第九条的规定,制定本表,扣缴义务人应将本月扣缴的税款在次月七日内缴入国库,并向当地税务机关报送本表。

会计专业英语 帮忙翻译一下

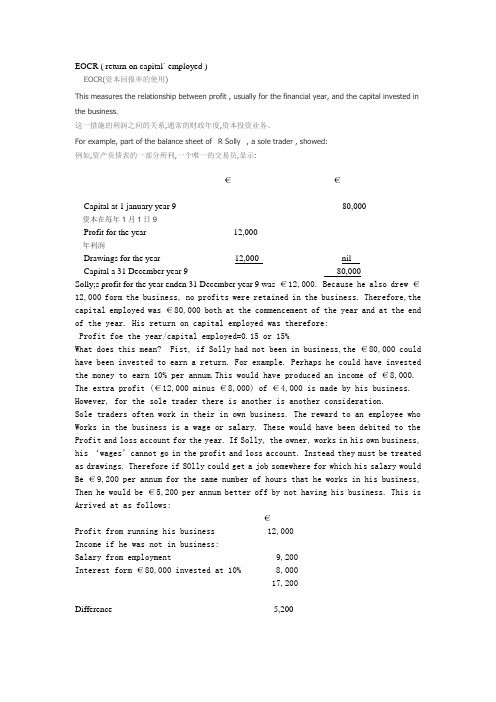

EOCR ( return on capital` employed )EOCR(资本回报率的使用)This measures the relationship between profit , usually for the financial year, and the capital invested in the business.这一措施的利润之间的关系,通常的财政年度,资本投资业务。

For example, part of the balance sheet of R Solly , a sole trader , showed:例如,资产负债表的一部分所利,一个唯一的交易员,显示:€€Capital at 1 january year 9 80,000资本在每年1月1日9Profit for the year 12,000年利润Drawings for the year 12,000 nilCapital a 31 December year 9 80,000Solly;s profit for the year enden 31 December year 9 was €12,000. Because he also drew €12,000 form the business, no profits were retained in the business. Therefore,the capital employed was €80,000 both at the commencement of the year and at the end of the year. His return on capital employed was therefore:Profit foe the year/capital employed=0.15 or 15%What does this mean? Fist, if Solly had not been in business,the €80,000 could have been invested to earn a return. For example. Perhaps he could have invested the money to earn 10% per annum.This would have produced an income of €8,000.The extra profit (€12,000 minus €8,000) of €4,000 is made by his business. However, for the sole trader there is another is another consideration.Sole traders often work in their in own business. The reward to an employee who Works in the business is a wage or salary. These would have been debited to the Profit and loss account for the year. If Solly, the owner, works in his own business, his ‘wages’cannot go in the profit and loss account. Instead they must be treated as drawings. Therefore if SOlly could get a job somewhere for which his salary would Be €9,200 per annum for the same number of hours that he works in his business, Then he would be €5,200 per annum better off by not having his business. This is Arrived at as follows:€Profit from running his business 12,000Income if he was not in business:Salary from employment 9,200Interest form €80,000 invested at 10% 8,00017,200Difference 5,200But what if the figures on Solly’s balance sheet had been:€€Capital 1 January Year 9 80,000Profit the year 12,000Drawings for the year 10,000 2,000Capital 31 December year 9 82,000You will see that Solly has not withdrawn all of the profit that he has made in the year ended 31 December Yare 9. So how do we calculate the return on capital employed? There is no doubt about the profit. It is €12,000. But what is the capital employed? There are three possibilities:€Capital employed at 1 January Year 9 80,000Capital employed at 31 December Year 9 82,000Average capital empioyed for the year 81,000The return on capital employed would 15%, 14.63% and 14.81%respectively.This debate will become more important to you when you approach your Third LEVEL Accounting studies. For Second Level, it is enough to say that it is usual to calculate the profit made during a year as a percentage of the capital employed at the end that year. In this example, then, the usual answer would be 14.63%.Measuring the return on capital employed is more difficult where the businessman Not only user his own money but borrows money as well. To illustrate the effect of this, suppose that as well as his own capital, Solly has a loan form his bank amounting to €18,000.He borrowed this at the beginning of Year 7,and will repay it at the end of Year 11. It carries a fixed interest rate of 9%.How does this affect the calculation of the return on capital employed?The fist thing to note is that Solly would have paid €1,620 interest on the loan for the year, and this charge would have been debited to his profit and loss account. The profit and loss account would shoe:€Profit before interest charge 13,620Less interest on €18,000 loan at 9% 1,620Net profit 12,000The capital employed is:€Owner’s capital at 31 December Year 9 82,000Borrowed capital 18,000Total capital employed 100,000With these figures we can now calculate the returns on capital employed. These Are:Return on total capital employed€13,620/ €100,000=13.62%。

财务会计英语题型

财务会计英语考试范围只考一到五单元。

第一题,会计术语英汉互译,10题*2分=20分,中译英,英泽中各五个,(流动负债current liabilities,流动资产current assets,折旧depreciation Direct write-off method直接冲销法Double entry system 复式会计制度 Cash flow statement现金流量表会计等式accounting equation 直线摊销straight-line amortization可转换债券 convertible bonds 资产负债表balance sheet坏账bad debt balance sheet 资产负债表Accounts receivable应收账款 LIFO后进先出法Fixed assets 固定资产分录entry借方余额debit balance 到期日 maturity date应付利息interest payable6会计等式 accounting equation 7 直线摊销 straight-line amortization8 可转换债券convertible bonds9 资产负债表balance sheet10坏账 bad debt第二题,填空15题*1分=15分,(蓝色的以前考过,其它在课本上的)1.1.The accounting elements include asset,liability,owner’s equity,revenue,expense,and profit.1.2.Such things as cash,accounts receivables,inventory,supplies,equipment,buildings,land,etc.are included in assets.1.3 Liabilities are debts of a business.1.4 The net assets of a business are called owner’s equity.1.5 Cash borrowed from a bank is not revenue but a liability.1.6 Expenses are the decrease in owner’s equity caused by the company’s revenue-producing operations.1.11 The debit is on the left side of the vertical line.The credit is on the right side of the account.1.12 ”Dr.”stands for debit,while “Cr.”is the abbreviation for credit.1.13 If an amount is recorded on the debit side,account is said to be debited.1.14 Asset and expense increases are recorded as debits.1.15 Liability,owner’s equity,revenue and profit decreases are recorded as debits.1.16 In double-entry system,the debit and credit entries for every transaction must be equal.1.22 Journalizing is the process to record transactions in a journal.1.23 Copying journal entries from the journals to the ledger for purpose of summarizing is called postin g.2.1 Cash includes coins,paper currency,money orders,checks and money deposits.2.5 Receivables are created through transactions of the sale of merchandise or service on credit and through lending of money.2.6 In business,credit sales give rise to the two most common types of receivables:accounts receivable and note receivable.2.7 When an account receivable becomes uncollectible,a firm incurs a bad debt loss.2.8 Ways to account for uncollectible accounts include the direct write-off method and the allowance method.2.9 With the allowance method,a firm uses its experience or industry averages to estimate the amount uncollectible.2.10 With aging method,each receivable is categorized according to age.2.14 Inventory is the name given to goods that are either manufactured for sale or purchased for resale in normal operations.2.15 A service business does not have products or inventory to account.2.16 Inventory is classified as a current asset and reported on the balance sheet.2.17 The perpetual inventory method requires that the company keep records of the quantity and cost of all goods purchased and sold at the time of each transaction.2.18When a business has identical items of inventory purchased at different time and costs,there remains a problem of determining which costs are matched to inventory on hand and to cost of goods sold during the period.2.20 When property,plants,and equipment are acquired by purchase,they are initially recorded as costs.2.21 A basket purchase involves two or more assets acquired together at a single price.2.22Depreciation is simply a systematic write-off of the original cost of an asset.2.23 In order to calculate depreciation expense for an asset, one must be clear of the original cost,estimated useful life and estimated salvage value.3.1Accounts payable represents a short-term interest-free loan from the supplier because in accounting for accounts payable interest is not considered.3.2Normally notes payable require payment of interest that is stated separately or it may be deducted in advance by discounting it from the face value.3.3Accrud liabilities are accrued expenses.3.4Examples of utilities expenses are water,electricity,telephone services,etc.3.5Because unearned revenue presents obligations to deliver goods or services in the future it is actually a liability.3.10Non-current liabilities are obligations of a business that due to be paid after one year.3.11A bond represents money borrowed from the lender by the borrower.In a bond the borrower promises to pay a specific amount of interest periodically and repay the principal at the maturity date.3.12 Bonds can be categorized according to the protection to the bondholders,the way howinterest is paid,and maturity of the bonds.3.13A mortgage payable is similar to a note payable in that it is a written promise to paya stated sum of money in equal monthly instalments.3.14If a lease is a simple,short-term one,it is called an operating lease; if the lease is accounted for as an asset and a non-current-liability,it is capital lease.4.1 When partners voluntarily agree to form a partnership,a partnership agreement is needed.4.2Unlimited liability means that each partner is required by law to pay for all the debts of the partnership with his or her own personal wealth if all the assets of the business are not enough to pay all the debts.4.3 If no agreement for sharing income and losses exists,the law states that income and losses must be shared equally.4.4In partnership accounting,the partnership uses a capital account and a drawing account for each of the partners.4.9 The limited liability of stockholders means that,in case of bankruptcy,the maximum loss is the stockholders’original investment in the corporation.4.10 Stockholders can buy or sell shares without affecting the legal status or economic operation of the corporation.4.11 The disadvantage of a corporation is that a corporation’s income tax is taxed twice.4.12Outstandign stock is issued and in the hands of the stockholders.4.13 If only one type of stock is authorized for the corporation,it is known as commons stock which is the most important type of stock.4.14Accounting for the corporation is different from accounting for the proprietorship and the partnership by the treatment of owner’s equity.4.15When a corporation is organized,often more stocks are authorized than are intended to be issued.This will enable future business expansion without applying for more shares.5.1 According to accrual basis of accounting,revenues are recognized when earned,regardless of when cash is actually received.Expenses are matched to the revenues,regardless of when cash is actually paid out.5.2 The revenues of an accounting period generally are not the same as the period’s cash receipts.5.3In general,revenue is recognized when goods are delivered to customers or services is performed.5.4It happens that cash is received earlier or later than the time revenue is to be recognized.5.5 Revenue that has been earned by the business but has not as yet been paid to the business is called accrued revenue.5.6 The prudence principle is intended as a preference for understatement rather than overstatement of assets or revenues when dealing with measurement of uncertainties.5.7The realization principle states that the amount recognized as revenue is the amount that is certain to be realized.5.8 The matching principle is applied by determining the items and amounts of revenue and then matching the items of cost to the revenue.第五题,会计分录40分类似于课本P38,练习2.12、2.13;P44练习2.19;P53练习2.25、2.262.21 On March 10 Whitman sold lawn mower AX-1 of $1200 with terms 2/10,1/20,n/30(If paymentis made within 10days,cash discount rate is 2%; if made within 20days,the rate is 1%; if made within 30days ,the net amount should be paid.)to Adam Smith.Smith returned,on the next day,$200 of the merchandise.The remaining was paid on March 18.Journalize these transactions.答案:Mar.10 Accounts Receivable 1200Sales Income 1200Mar.11 Sales Returns 200Accounts Receivable 200Mar,18 Cash 980Sales Discounts 20Accounts Receivable 10002.13 Assume that on March 14,Farm Land Products received a 12%,30-day note from the customer,J,Halsted,in settlement of the existing account receivable of $1500.Journalize the entry for this transaction and the collection on the maturity date.答案:Mar.14 Notes Receivable 1500Accounts Receivable 1500Apr.13 Cash1 1515Notes Receivable 1500Interest Income 152.19 Suppose Zimer Company had the following data for the first half of the year 2006:March1,beginning inventory 10 units at $200 each; April 14,purchased 50 units at $210 each; April24,sold 40 units; May 4,purchased 70 units at $220 each; June 25, sold 60 e FIFO method to determine the total cost of goods sold and the ending inventory at the of firsthalf year.答案:Beginning Inventory 10units*$200 $2000Purchased,April 14 50units*$210 $10500Sold,April 24 10units*$200 $200030units*$210 $6300Purchased,May 4 70units*$220 $15400Sold,June 25 20units*$210 $420040units*$220 $8800Total Cost of Goods Sold $21300 Ending Inventory $66002.25 Crown Taxi Company purchased a used car on July 1,2005,for $15000.The estimated lifeof the car was 4 years or 104000 miles,and its salvage value was estimated to be $2000.Thecar was driven 9000 miles in 2005 and 27000 miles in 2006.Calculate the amount of depreciation expense for 2005 and 2006,using(a)the straight-line method,and (b)units -of-production method.答案:(a)Straight-line Method:Annual Depreciation Expense=($15000-$2000)/4=$3250Depreciation Expense for year 2005=c2(half a year)=$1625Depreciation Expense for year 2006=$3250(b)Units-of-production Method:Depreciation Expense for year 2005=($15000-$2000)/104000miles*9000miles=$1125Depreciation Expense for year 2006=($15000-$2000)/104000miles*27000miles=$33752.26 Zimer Company purchased a lathe for $100000.The machine had an estimated useful life of 8 years and a salvage value of $6000.Journalize the disposal of the machine under each of the following conditions (with straight-line depreciation).(a)Sold the machine for $88000 after 2 years.(b)Sold the machine for $28000 after 5 years.答案:(a)Sold the machine for $88000 after 2 years.Annual Depreciation Expense=($100000-$6000)/8=$11750Annual Depreciation=$11750*2=$23500Book Value=$76500($100000-$23500)Cash 88000Accumulated Depreciation 23500Lathe 100000Gain on Sale of Lathe 11500Gain on Salvage Value=$5500($11500-$6000).This means that the company sold the lathe for $5500 more than is its salvage value.(b)Sold the machine for $28000 after 5 years.Depreciation Expense=$11750*5=$58750Book Value=$41250($100000-$58750)Cash 28000Accumulated Depreciation 58750Loss on Sale of Lathe 13250Lathe 100000Loss on Salvage Value=$7250($13250-$6000).This means that the company suffered not only the loss of the salvage value but an extra $7250 in selling the lathe.。

会计英语试题及答案

会计英语试题及答案会计专业英语是会计专业人员职业发展的必要工具。

学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。

以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。

一、单选题1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2)In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 2. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from creditcustomers. What is the balance on the accounts receivables at 31 Dec 2010? A. $8 500 Dr B. $8 500 Cr C. $14 000 Dr D. $14 000 Cr3. Should dividends paid appear on the face of a company’s cash flow statement?A. YesB. NoC. Not sureD. Either4. Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position?(1) plant, equipment, and property (2) company car(3) 4000 cash (4) 1000 cheque A. (1), (3)B. (1), (2)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company’s balance sheet?(1) investment in subsidiary(2) Loan matured within one year. (3) income tax accrued untill year end. (4) Preference dividend accrued A (1), (2) and (3) B (1), (2) and (4) C (1), (3) and (4) D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640 Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree?1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expenses account $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance. A 1 and 2 B 2 and 3 C 2 and 4 D 3 and 48. Listed below are some characteristics of financial information. (1) True (2) Prudence (3)Completeness (4) CorrectWhich of these characteristics contribute to reliability? A (1), (3) and (4) only B (1), (2) and (4) only C (1), (2) and (3) only D (2), (3) and (4) only (window.cproArray = window.cproArray || []).push({ id: "u3054369" });9. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect of a transaction must always be shown in the financial statements even if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on year A. 2 and 3 only B. All of them C. 1 and 2 only D. 3 only10. which of the following about accruals concept are correct? (1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it’s paid or notA. 2 and 3 onlyB. All of themC. 1 and2 only D.3 only二、翻译题1、将下列分录翻译成英文1. 借:固定资产清理 30 000累计折旧10 000 贷:固定资产 40 000 2.借:应付票据40 000 贷:银行存款 40 000 2、将下列词组按要求翻译(中翻英,英翻中) (1) 零用资金 (2) 本票 (3) 试算平衡(4) 不动产、厂房和设备 (5) Notes and coins (6) money order (7) general ledger (8) direct debt (9) 报销(10) revenue and gains三、业务题Johnny set up a business and in the first a few days of trading the following transactions occurred (ignoreall the tax):1) He invests $80 000 of his money in his business bank account.2) He then buys goods from Isabel, a supplier for $4 000 and pays by cheque, the goods is delivered right after the payment3) A sale is made for $3 000 –the customer pays by cheque4) Johnny makes another sale for $2 000 and the customer promises to pay in the future 5) He then buys goods from another supplier, Kamen, for $2 000 on credit, goods is delivered on time6) He pays a telephone bill of $800 by cheque7) The credit customer pays the balance on his account8) He returened some faulty goods to his supplier Kamen, which worth $400. 9) Bank interest of $70 is received10) A cheque customer returned $400 goods to him for a refund(window.cproArray = window.cproArray || []).push({ id: "u3054371" });参考答案1、单选题1-5 CCACB 6-10 DCABA2、翻译题1)中翻英1.Dr disposal of fixed assetDepreciation Cr fixed asset2.Dr notes payableCr bank3、业务题1) Dr Cash Cr capital2) Dr finished goods Cr Cash3)Dr CashCr sales revenue4) Dr accounts receivable Cr sales revenue5) Dr finished goods Cr accounts re ceivable6) Dr administrative expense Cr Cash7)Dr CashCr accounts receivable8)Dr CashCr finished goods9)Dr CashCr financial expense10) Dr sales revenue Cr Cash。

会计面试题英文翻译及答案

会计面试题英文翻译及答案Accounting Interview Questions and Answers1. What is the primary role of an accountant in a business setting?Answer: The primary role of an accountant is to manage and interpret financial transactions, ensuring that all financial records are accurate and in compliance with relevant laws and regulations. They also play a crucial part in financial planning, forecasting, and advising on financial matters to support business decisions.2. How do you handle discrepancies in financial records?Answer: When discrepancies are found in financial records, I first verify the accuracy of the data by checking the source documents and the entries. If the error is identified, I correct it in the system and document the correction process.I also analyze the cause of the discrepancy to preventsimilar issues in the future.3. What are the key financial statements, and what do they represent?Answer: The key financial statements include the Balance Sheet, Income Statement, Cash Flow Statement, and Statementof Changes in Equity. The Balance Sheet represents the company's financial position at a specific point in time, showing assets, liabilities, and equity. The Income Statement, also known as the Profit and Loss Statement, shows the company's revenues and expenses over a period, resulting inthe net profit or loss. The Cash Flow Statement illustratesthe inflows and outflows of cash, while the Statement of Changes in Equity details the changes in the equity accounts during the period.4. How do you ensure compliance with GAAP (Generally Accepted Accounting Principles)?Answer: To ensure compliance with GAAP, I stay updated withthe latest accounting standards and regulations. I applythese principles consistently in preparing financial statements and maintain proper documentation for all transactions. Additionally, I collaborate with auditors and other financial professionals to review and validate the accuracy and compliance of financial reporting.5. Can you explain the difference between accrual and cashbasis accounting?Answer: Accrual basis accounting records revenues and expenses when they are earned or incurred, regardless of when cash is received or paid. This method provides a more comprehensive picture of a company's financial performance over a period. On the other hand, cash basis accounting records transactions only when cash is exchanged, which can result in a less accurate reflection of the business's financial health, especially for businesses with significant credit sales or purchases.6. What is your experience with budgeting and financial forecasting?Answer: I have extensive experience in creating and managing budgets, as well as conducting financial forecasting. I use historical data, market trends, and business plans to project future financial performance. This process helps in strategic planning and decision-making, ensuring that the company is on track to meet its financial goals.7. How do you approach the task of auditing a company's financial records?Answer: When auditing a company's financial records, I start by understanding the company's operations and financialsystems. I then review the financial statements and underlying transactions to ensure they are accurate and comply with GAAP. I also look for any signs of fraud or errors and recommend corrective actions if necessary.8. What software and tools are you familiar with for accounting purposes?Answer: I am proficient in various accounting software and tools such as QuickBooks, Xero, SAP, and Microsoft Excel. These tools help in streamlining the accounting process, from recording transactions to generating financial reports.9. Can you describe a challenging situation you faced in your accounting career and how you resolved it?Answer: One challenging situation I encountered was identifying and correcting a complex error in a large set of financial records. I resolved it by working closely with the team, meticulously reviewing the data, and implementing a systematic approach to trace and correct the error. This experience reinforced the importance of attention to detail and effective communication in resolving accounting issues.10. How do you stay current with the latest accounting trendsand regulations?Answer: I stay current by participating in professional development courses, attending industry conferences, and being an active member of accounting associations. I also regularly read industry publications and follow updates from regulatory bodies to ensure my knowledge and practices are up to date.Conclusion:In conclusion, accounting is a dynamic field that requires continuous learning and adaptation to new regulations and technologies. As an accounting professional, I am committed to maintaining the highest standards of accuracy, compliance, and ethical practice to support the financial health of the organizations I work with.。

会计专业英语

✓Long-term Borrowings ✓Bonds Payable

Difference Between Liability and Debt

• Liability

♠ Liabilities 是liability 的复数形式。它的意思是法律 上的责任、义务。如 liability for an accident (肇事 的责任);liability to pay taxes (纳税的义务)。 只有其为复数形式 liabilities 时才表示负债、债务 的意思。例如:负债是指将来需用货币或服务偿 还的债务或履行的义务还有就是欠外部的数额, 如应付票据、应付帐款、应付债券。

Unit 2 Recording Business Transaction

企业交易记录

2.0 Accounting Theory 2.1 Types of Business Entities 2.2 The Accounting Equation 2.3 Double Entry Bookkeeping

Accounting Assumption

• The monetary assumption

Accounting measurement shall be based on unit of currency.

The Elements of Financial Statement

• The basic elements include:

✓Prepayments ✓Accounts Receivable ✓Interests Receivable ✓Notes Receivable ✓Other Receivables ✓Raw Materials ✓Finished Goods ✓Low Value Consumables

会计英语翻译题目

会计英语一、英译汉1、This paper examines the role of corporate governance in bank loan financing using allA - share publicly trade d companies in China. Specifically, we investigate the effect of corporate governance on firm’ pability to raise bank loans and the c ost of their bank loans. The results show that corporate governance has no significant effect on firms’ ability to raise either short - term bank loans or long - term bank loans. Firms’ ability to raise bank loans depends more on their financial performanc e. The cost of firms’bank loans decreases with, among all corporate governance factors, the number of supervisors on the board and increases with ownership concentration. The evidence imp lies that corporate governance p lays a limited role in the decision of granting a loan by Chinese banks.1.本文探讨使用ALLA银行贷款融资的公司治理中的作用- 以股份公开上市公司在中国。

会计专业基础英语

Accounting- 1 -Unit 4 AccountingPART I Fundamentals to Accounting第一部分 会计基本原理1.accounting [ə'ka ʊnt ɪŋ]n. 会计会计2.double-entry system 复式记账法复式记账法 2-1 Dr.(Debit) 借记借记借记 2-2 Cr.(Credit) 贷记贷记贷记3.accounting basic assumption 会计基本假设会计基本假设4.accounting entity 会计主体会计主体5.going concern 持续经营持续经营6.accounting periods 会计分期会计分期7.monetary measurement 货币计量货币计量8.accounting basis 会计基础会计基础9.accrual [ə'kr ʊəl] b asis basis 权责发生制权责发生制 【讲解】【讲解】accrual n. 自然增长,权责发生制原则,应计项目自然增长,权责发生制原则,应计项目自然增长,权责发生制原则,应计项目 accrual concept 应计概念应计概念应计概念 accrue [ə'kruː] v. 积累,自然增长或利益增加,产生积累,自然增长或利益增加,产生积累,自然增长或利益增加,产生 10.accounting policies 会计政策会计政策 11.substance over form 实质重于形式实质重于形式12.accounting elements 会计要素会计要素 13.recognition [rek əg'n ɪʃ(ə)n] n.确认确认 13-1 initial recognition [rek əg'n ɪʃ(ə)n] 初始确认初始确认 【讲解】【讲解】recognize ['r ɛk əg'na ɪz] v.确认确认确认14.measurement ['me ʒəm(ə)nt] n.计量计量计量 14-1 subsequent ['s ['s ʌbs ɪkw(ə)nt] measurement 后续计量后续计量后续计量 15.asset ['æset] n. 资产资产资产 16.liability [la ɪə'b ɪl ɪt ɪ] n. 负债负债负债 17.owners’ equity 所有者权益所有者权益 18.shareholder’s equity 股东权益股东权益股东权益 19.expense [ɪk'spens; ek-] n. 费用费用费用 20.profit ['pr ɒf ɪt] n.利润利润利润 21.residual [r ɪ'z ɪdj ʊəl] equity 剩余权益剩余权益 22.residual claim 剩余索取权剩余索取权 23.capital ['kæpɪt(ə)l] n.资本资本资本 24.gains [ɡeinz] n. 利得利得利得 25.loss [l ɒs] n.损失损失损失 26.Retained earnings 留存收益留存收益 27.Share premium 股本溢价股本溢价股本溢价28.historical cost 历史成本历史成本 【讲解】【讲解】historical [h ɪ'st ɒr ɪk(ə)l] adj. 历史的历史的历史的,,历史上的历史上的 historic [h ɪ'st ɒr ɪk] adj.有历史意义的有历史意义的有历史意义的,,历史上著名的历史上著名的28-1 replacement [r [r ɪ'ple ɪsm(ə)nt] cost重置成本重置成本 29.Balance Sheet/Statement of Financial Position 资产负债表资产负债表 29-1 Income Statement 利润表利润表 29-2 Cash Flow Statement 现金流量表现金流量表29-3 Statement of changes in owners’equity (or shareholders’shareholders’equity) equity) 所有者权益(股东权益)变动表东权益)变动表29-4 notes [n [n əʊts] n.附注附注附注PART II Financial Assets*第二部分 金融资产*30.financial assets 金融资产金融资产e.g. A financial instrument is any contract that gives rise to a financial asset ofone enterprise and a financial liability or equity instrument of another enter 【讲解】【讲解】give rise to 引起,导致引起,导致31.cash on hand 库存现金库存现金 32.bank deposits [d ɪ'p ɒz ɪt] 银行存款银行存款 33.A/R, account receivable 应收账款应收账款 34.notes receivable 应收票据应收票据 35.others receivable 其他应收款项其他应收款项 36.equity investment 股权投资股权投资 37.bond investment 债券投资债券投资38.derivative financial instrument 衍生金融工具衍生金融工具 39.active market 活跃市场活跃市场40.quotation [kw ə(ʊ)'te ɪʃ(ə)n]n.报价报价 41.financial assets at fair value through profit or loss 以公允价值计量且其变动计入当期损益的金融资产入当期损益的金融资产41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产且其变动计入当期损益的金融资产41-2 financial assets held for trading 交易性金融资产交易性金融资产 42.financial liability 金融负债金融负债 43.transaction costs 交易费用交易费用43-1 incremental external cost 新增的外部费用新增的外部费用 【讲解】【讲解】incremental [ɪnkr ə'm əntl] adj.增量的增量的增量的,,增值的增值的44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利已宣告但尚未发放的现金股利 投资收益投资收益45.profit and loss arising from fair value changes 公允价值变动损益公允价值变动损益 46.Held-to-maturity investments 持有至到期投资持有至到期投资 47.amortized cost 摊余成本摊余成本 【讲解】【讲解】amortized [ə'm ɔ:taizd]adj. 分期偿还的分期偿还的,,已摊销的已摊销的48.effective interest rate 实际利率实际利率 49.loan [l əʊn] n.贷款贷款贷款 50.receivables [ri'si:v əblz] n.应收账款应收账款应收账款 51.available-for-sale financial assets 可供出售金融资产可供出售金融资产 52.impairment of financial assets 金融资产减值金融资产减值52-1 impairment loss of financial assets 金融资产减值损失金融资产减值损失 53.transfer of financial assets 金融资产转移金融资产转移53-1 transfer of the financial asset in its entirety 金融资产整体转移金融资产整体转移 53-2 transfer of a part of the financial asset 金融资产部分转移金融资产部分转移 54.derecognition [diː'rekəg'n ɪʃən] n.终止确认,撤销承认终止确认,撤销承认54-1 derecognize [diː'rekə[diː'rekəgna ɪz] v.撤销承认撤销承认撤销承认 e.g. An enterprise shall derecognize a financial liability (or part of it) only w the underlying present obligation (or part of it) is discharged /cancelled . 【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

会计专业英语复习单词和句子翻译

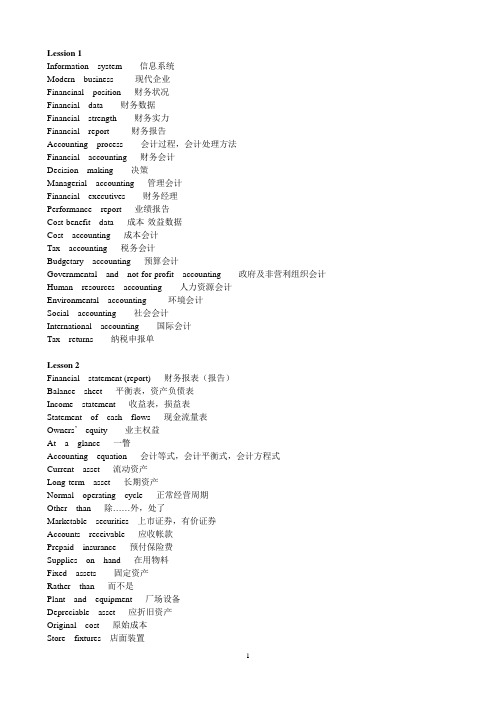

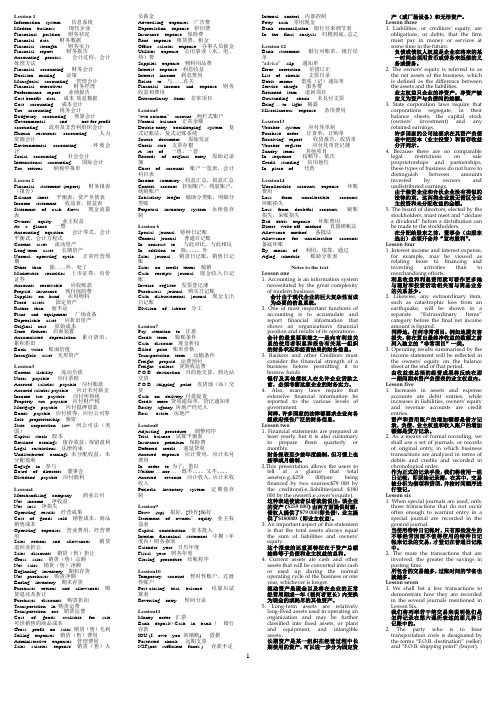

Lession 1Information system 信息系统Modern business 现代企业Financinal position 财务状况Financial data 财务数据Financial strength 财务实力Financial report 财务报告Accounting process 会计过程,会计处理方法Financial accounting 财务会计Decision making 决策Managerial accounting 管理会计Financial executives 财务经理Performance report 业绩报告Cost-benefit data 成本-效益数据Cost accounting 成本会计Tax accounting 税务会计Budgetary accounting 预算会计Governmental and not-for-profit accounting 政府及非营利组织会计Human resources accounting 人力资源会计Environmental accounting 环境会计Social accounting 社会会计International accounting 国际会计Tax returns 纳税申报单Lesson 2Financial statement (report) 财务报表(报告)Balance sheet 平衡表,资产负债表Income statement 收益表,损益表Statement of cash flows 现金流量表Owners’equity 业主权益At a glance 一瞥Accounting equation 会计等式,会计平衡式,会计方程式Current asset 流动资产Long-term asset 长期资产Normal operating cycle 正常经营周期Other than 除……外,处了Marketable securities 上市证券,有价证券Accounts receivable 应收帐款Prepaid insurance 预付保险费Supplies on hand 在用物料Fixed assets 固定资产Rather than 而不是Plant and equipment 厂场设备Depreciable asset 应折旧资产Original cost 原始成本Store fixtures 店面装置Accumulated depreciation 累计折旧,累积折旧Book value 账面价值Intangible asset 无形资产Lession3Current liability 流动负债Notes payable 应付票据Accrued salaries payable 应付账款Accured salaries payable 应计未付薪金Income tax payable 应付所得税Property tax payable 应付财产税Mortgage payable 应付抵押借款Bonds payable 应付债券,应付公司券Sole proprietorship 独资State corporation law 州公司法(美国)Capital stock 股本Retained earnings 留存收益,保留盈利Legal restrictions 法律约束Undistributed earnings 未分配收益,未分配盈利Engage in 参与Board of directors 董事会Divedend payable 应付股利Lesson4Merchandising company 商业公司Net income 净收益Net loss 净损失Operating results 经营成果Cost of goods sold 销售成本,商品销售成本Operating expenses 营业费用,经营费用Sales returns and allowances 销货退回及折让Sales discounts 销货(售)折让Gross sales 销货(售)总额Net sales 销货(售)净额Beginning inventory 期初存货Net purchases 购货净额Ending inventory 期末存货Purchases returns and allowances 购货退还及折让Purchases discounts 购货折扣Transportation in 购货运费Transportation out 销货运费Cost of goods available for sale 可供销售的商品成本Gross profit on sales 销货(售)毛利Selling expenses 销货(售)费用Administrative expenses 管理费用Sales salaries expense 销货(售)人员薪金Advertising expenses 广告费Depreciation expense 折旧费Insurance expense 保险费Rent expense 租赁费,租金Office salaries expense 办事人员薪金Utilities expense 公用事业(水、电、热)费Supplies expense 物料用品费Interest expense 利息收益Interest income 利息费用Relate to 与……有关Financial income and expense 财务收益和费用Extraordinary items 非常项目Lession5“two-column”account 两栏式账户Normal balance 正常余额Double-entry bookkeeping system 复式记账法,复式记账系统Source document 原始凭证Check stub 支票存根A set of 一组,一套Records of original entry 原始记录簿Chart of accounts 账户一览表,会计科目表Income summary 收益汇总,损益汇总Control account 控制账户,统驭账户,统制账户Subsidiary ledger 辅助分类账,明细分类账Perpetual inventory system 永续盘存制Lession 6Special journal 特种日记账General journal 普通日记账In consrast to 与此对比,与此相反In addition to 除。

会计专业英语复习单词和句子翻译

Lession 1Information system 信息系统Modern business 现代企业Financinal position 财务状况Financial data 财务数据Financial strength 财务实力Financial report 财务报告Accounting process 会计过程,会计处理方法Financial accounting 财务会计Decision making 决策Managerial accounting 管理会计Financial executives 财务经理Performance report 业绩报告Cost-benefit data 成本-效益数据Cost accounting 成本会计T ax accounting 税务会计Budgetary accounting 预算会计Governmental and not-for-profit accounting 政府及非营利组织会计Human resources accounting 人力资源会计Environmental accounting 环境会计Social accounting 社会会计International accounting 国际会计T ax returns 纳税申报单Lesson 2Financial statement (report) 财务报表(报告)Balance sheet 平衡表,资产负债表Income statement 收益表,损益表Statement of cash flows 现金流量表Owners’equity 业主权益At a glance 一瞥Accounting equation 会计等式,会计平衡式,会计方程式Current asset 流动资产Long-term asset 长期资产Normal operating cycle 正常经营周期Other than 除……外,处了Marketable securities 上市证券,有价证券Accounts receivable 应收帐款Prepaid insurance 预付保险费Supplies on hand 在用物料Fixed assets 固定资产Rather than 而不是Plant and equipment 厂场设备Depreciable asset 应折旧资产Original cost 原始成本Store fixtures 店面装置Accumulated depreciation 累计折旧,累积折旧Book value 账面价值Intangible asset 无形资产Lession3Current liability 流动负债Notes payable 应付票据Accrued salaries payable 应付账款Accured salaries payable 应计未付薪金Income tax payable 应付所得税Property tax payable 应付财产税Mortgage payable 应付抵押借款Bonds payable 应付债券,应付公司券Sole proprietorship 独资State corporation law 州公司法(美国)Capital stock 股本Retained earnings 留存收益,保留盈利Legal restrictions 法律约束Undistributed earnings 未分配收益,未分配盈利Engage in 参与Board of directors 董事会Divedend payable 应付股利Lesson4Merchandising company 商业公司Net income 净收益Net loss 净损失Operating results 经营成果Cost of goods sold 销售成本,商品销售成本Operating expenses 营业费用,经营费用Sales returns and allowances 销货退回及折让Sales discounts 销货(售)折让Gross sales 销货(售)总额Net sales 销货(售)净额Beginning inventory 期初存货Net purchases 购货净额Ending inventory 期末存货Purchases returns and allowances 购货退还及折让Purchases discounts 购货折扣Transportation in 购货运费Transportation out 销货运费Cost of goods available for sale 可供销售的商品成本Gross profit on sales 销货(售)毛利Selling expenses 销货(售)费用Administrative expenses 管理费用Sales salaries expense 销货(售)人员薪金Advertising expenses 广告费Depreciation expense 折旧费Insurance expense 保险费Rent expense 租赁费,租金Office salaries expense 办事人员薪金Utilities expense 公用事业(水、电、热)费Supplies expense 物料用品费Interest expense 利息收益Interest income 利息费用Relate to 与……有关Financial income and ex pense 财务收益和费用Extraordinary items 非常项目Lession5“two-column”account 两栏式账户Normal balance 正常余额Double-entry bookkeeping system 复式记账法,复式记账系统Source document 原始凭证Check stub 支票存根A set of 一组,一套Records of original entry 原始记录簿Chart of accounts 账户一览表,会计科目表Income summary 收益汇总,损益汇总Control account 控制账户,统驭账户,统制账户Subsidiary ledger 辅助分类账,明细分类账Perpetual inventory system 永续盘存制Lession 6Special journal 特种日记账General journal 普通日记账In consrast to 与此对比,与此相反In addition to 除。

会计专业英语翻译题

Account 、Accounting 和AccountantAccount 有很多意思,常见的主要是“说明、解释;计算、帐单;银行帐户”。

例如:1、He gave me a full account of his plan。

他把计划给我做了完整的说明。

2、Charge it to my account。

把它记在我的帐上。

3、Cashier:Good afternoon。

Can I help you ?银行出纳:下午好,能为您做什么?Man :I’d like to open a bank account .男人:我想开一个银行存款帐户。

还有account title(帐户名称、会计科目)、income account(收益帐户)、account book(帐簿)等。

在account 后面加上词缀ing 就成为accounting ,其意义也相应变为会计、会计学。

例如:1、Accounting is a process of recording, classifying,summarizing and interpreting of those business activities that can be expressed in monetary terms.会计是一个以货币形式对经济活动进行记录、分类、汇总以及解释的过程。

2、It has been said that Accounting is the language of business.据说会计是“商业语言”3、Accounting is one of the fastest growing profession in the modern business world.会计是当今经济社会中发展最快的职业之一。

4、Financial Accounting and Managerial Accounting are two major specialized fields in Accounting.财务会计和管理会计是会计的两个主要的专门领域。

会计专业英语翻译

结转股息红利账户

留存收益 5,000

红利 5,000

注意:一旦结转过程完成 附带留存收益账户才是资产负债表利润表和股息红利账户及结转为零,为了公司的下一期的报表。

电子计算机与会计

电子计算机在快速提升公司的能力避免算数错误上给予了公司极大的便利。由于电脑的应用所花费的在日记账和总结成试算平衡帐户已经大大减少了。早期的商业计算机都是二战时期发明的那些科技电脑的后裔,最初把电脑应用于会计中是因为担心成本消耗过高,过去为了了解过高的成本是如何消耗的,字1950年期每三年陈本便被削减至认定估计的一半,这意味着购买相同的计算能力,2001年耗费成本1000美元而在1950年则要耗费131百万美元。另一些注意这些今天早期电脑发展的是为了会计的是可靠的。任何一个人经历了依靠及其的便利的冲击都会感激在1950年的真空管。

有个问题会被问起:倘若电子计算机现在覆盖会计功能的每一个角落,那么为什么商人还要了解接待日记账分类账丁字帐失算平衡呢?问得好!首先,即使电子计算机做最脏最累的工作,从使用鹅毛笔时代到如今会计的实质也没有改变。因此,理解这章的过程仍旧以电子计算机为基础的会计系统有关。总之,有没有电子计算机借贷方的用房丁字帐仍然提供一个有效且广为流传的分析业务的记账方法。短时间内商人们会越来越熟悉账簿语言,例如,为什么现金余额在贷方中或留存收益余额在解放就意味着丈母有问题,需要检查。最后,一个关于账目循环的理解----解析记录更改和准备。给了一个组织如何运用信息运作的并且有利于增加对流动信息的理解。

许多西方的会计人员被雇佣去解释俄罗斯的收入确认,活力伤愈和红利的收入。然而,并不是所有提供的帮助都是受欢迎的,偶然的,来自西方的顾问们是这出售复杂的系统给那些努力想要实行基本权责发生制的国家。正如一位东欧的官员所说:你想教我们如何把橘子榨成橘子汁,可我们需要学习的是怎么把土豆做成汤。是这一位俄罗斯会计更直接的说:会计反映了我们的社会现实。俄罗斯的社会现实就是很复杂的。

会计专业外文翻译--公允价值测量1

外文原文:Fair Value Measurements1 In February 2006 the International Accounting Standards Board (IASB) and the US Financial Accounting Standards Board (FASB) published a Memorandum of Understanding reaffirming their commitment to the convergence of US generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRSs) and to their shared objective of developing high quality, common accounting standards for use in the world’s capital markets. The convergence work programme set out in the Memorandum reflects the standard-setting context of the ‘roadmap’ developed by the US Securities and Exchange Commission in consultation with the IASB, FASB and European Commission for the removal of the reconciliation requirement for non-US companies that use IFRSs and are registered in the US. The work programme includes a project on measuring fair value.2 The FASB has recently issued Statement of Financial Accounting Standards No. 157 Fair Value Measurements (SFAS 157), on which work was well advanced before the Memorandum of Understanding was published. SFAS 157 establishes a single definition of fair value together with a framework for measuring fair value for US GAAP. The IASB recognised the need for guidance on measuring fair value in IFRSs and for increased convergence with US GAAP. Consequently, the IASB decided to use the FASB’s standard as the starting point for its deliberations. As the first stage of its project, the IASB is publishing in this discussion paper its preliminary views on the principal issues contained in SFAS 157.3 The IASB plans to hold round-table meetings on this discussion paper in conjunction with the development of an exposure draft. Please indicate in your response to this Invitation to Comment if you are interested in taking part in a round-table meeting. Please note that, because of timing and space constraints, not all of those indicating an interest may be able to take part.4 The IASB will consider responses to this Invitation to Comment and the related round-table discussions in developing an exposure draft of an IFRS on fair value measurement. The exposure draft will be prepared specifically for application to IFRSs. Although provisions of SFAS 157 may be used in the preparation of an exposure draft, they may be reworded or altered to be consistent with other IFRSs and to reflect the decisions of the IASB. The IASB plans to publish an exposure draft by early 2008.5 In November 2005 the IASB published for comment a discussion paper, Measurement Bases for Financial Accounting – Measurement on Initial Recognition, written by the staff of the Canadian Accounting Standards Board. Although that paper contained a discussion of fair value, its primary purpose was to discuss which measurement attributes were appropriate for initial recognition. That paper is part of the ongoing Conceptual Framework project that seeks to establish, among other things, a framework for measurement in financial reporting. Because of the different scope and intent of that paper, it is not discussed in this discussion paper. However, comments on that discussion paper relatingto the measurement of fair value will be considered in the development of the exposure draft of an IFRS on fair value measurement as well as in the Conceptual Framework project. Issue 1. SFAS 157 and fair value measurement guidance in current IFRSs6 IFRSs require some assets, liabilities and equity instruments to be measured at fair value in some circumstances. However, guidance on measuring fair value is dispersed throughout IFRSs and is not always consistent. The IASB believes that establishing a single source of guidance for all fair value measurements required by IFRSs will both simplify IFRSs and improve the quality of fair value information included in financial reports. A concise definition of fair value combined with consistent guidance that applies to all fair value measurements would more clearly communicate the objective of fair value measurement and eliminate the need for constituents to consider guidance dispersed throughout IFRSs.7 The IASB emphasises that the Fair Value Measurements project is not a means of expanding the use of fair value in financial reporting. Rather, the objective of the project is to codify, clarify and simplify existing guidance that is dispersed widely in IFRSs. However, in order to establish a single standard that provides uniform guidance for all fair value measurements required by IFRSs, amendments will need to be made to the existing guidance. As discussed further in Issue 2, the amendments might change how fair value is measured in some standards and how the requirements are interpreted and applied.8 In some IFRSs the IASB (or its predecessor body) consciously included measurement guidance that results in a measurement that is treated as if it were fair value even though the guidance is not consistent with the fair value measurement objective. For example, paragraph B16 of IFRS 3 Business Combinations provides guidance that is inconsistent with the fair value measurement objective for items acquired in a business combination such as tax assets, tax liabilities and net employee benefit assets or liabilities for defined benefit plans. Furthermore, some IFRSs contain measurement reliability criteria. For example, IAS 16 Property, Plant and Equipment permits the revaluation model to be used only if fair value can be measured reliably This project will not change any of that guidance. Rather, that guidance will be considered project by project. However, the IASB plans to use the Fair Value Measurements project to establish guidance where there currently is none, such as in IAS 17 Leases, as well as to eliminate inconsistent guidance that does not clearly articulate a single measurement objective.9 Because SFAS 157 establishes a single source of guidance and a single objective that can be applied to all fair value measurements, the IASB has reached the preliminary view that SFAS 157 is an improvement on the disparate guidance in IFRSs. However, as discussed in more detail below, the IASB has not reached preliminary views on all provisions of SFAS 157.Issue 2. Differences between the definitions of fair value in SFAS 157 and in IFRSs10 Paragraph 5 of SFAS 157 defines fair value as ‘the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.’Bycomparison, fair value is generally defined in IFRSs as ‘the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction’ (withsome slight variations in wording in different standards). Thedefinition in SFAS 157 differs from the definitionin IFRSs in three important ways:(a)The definition in SFAS 157 is explicitly an exit (selling) price. Thedefinition in IFRSs is neither explicitly an exit price nor an entry (buying) price.(b)The definition in SFAS 157 explicitly refers to market participants. The definition in IFRSs refers to knowledgeable, willing parties in an arm’s length transaction.(c)For liabilities, the definition of fair value in SFAS 157 rests on the notion that the liability is transferred (the liability to the counterparty continues; it is not settled with the counterparty). The definition in IFRSs refers to the amount at which a liabilitycould be settled between knowledgeable, willing parties in an arm’s length transaction.11 These differences are discussed in more detail below.Issue 2A. Exit price measurement objective12 The Basis for Conclusions of SFAS 157 includes the following discussion:C26The transaction to sell the asset or transfer the liability is a hypothetical transaction at the measurement date, considered from the perspective of a market participant that holds the asset or owes the liability. Therefore, the objective of a fair value measurement is to determine the price that would be received for the asset or paid to transfer the liability at the measurement date, that is, an exit price. The Board [FASB] concluded that an exit price objective is appropriate because it embodies current expectations about the future inflows associated with the asset and the future outflows associated with the liability from the perspective of market participants. The emphasis on inflows and outflows is consistent with the definitions of assets and liabilities in FASB Concepts Statement No. 6, Elements of Financial INVITATION TO COMMENT Statements. Paragraph25 of Concepts Statement 6 defines assets in terms of future economic benefits (future inflows). Paragraph 35 of Concepts Statement 6 defines liabilities in terms of future sacrifices of economic benefits (future outflows).13 Paragraph 49 of the IASB’s Framework for the Preparation and Presentation of Financial Statements similarly defines assets and liabilities in terms of inflows and outflows of economic benefits. The majority of IASB members believe that a fair value measurement with an exit price objective is consistent with these definitions and is appropriate because it reflects current market-based expectations of flows of economic benefit into or out of the entity.14 Other IASB members agree with this view, but in their view an entry price also reflects current market-based expectations of flows of economic benefit into or out of the entity. Therefore, they suggest replacing the term ‘fair value’ with terms that are more descriptive of the measurement attribute, such as ‘current entry price’ or ‘current exit price’.15 An entry price measurement objective would differ from the exit price objective in SFAS 157 in that it would be defined as the price that would be paid to acquire an asset or received to assume a liability in an orderly transaction between market participants at the measurement date. Some members of the IASB are of the view that an entry price and an exit price would be the same amount in the same market, assuming that transaction costs are excluded. However, an entity might buy an asset or assume a liability in one market and sell that same asset or transfer that same liability (ie without modification or repackaging) in another market. In such circumstances, the exit price in SFAS 157 would be likely to differ from the entry price.16Some fair value measurements required by IFRSs might not be consistent with an exit price measurement objective. In particular, the IASB observes that this might be the case when fair value is required on initial recognition, such as in:(a)IFRS 3,(b)IAS 17 for the initial recognition of assets and liabilities by a lessee under a finance lease, and(c)IAS 39 Financial Instruments: Recognition and Measurement for the initial recognition of some financial assets and financial liabilities.17In developing an exposure draft, the IASB may propose a revised definition of fair value. If so, it will complete a standard-by-standard review of fair value measurements required in IFRSs to assess whether each standard’s intended measurement objective is consistent with the proposed definition. If the IASB concludes that the intended measurement objective in a particular standard is inconsistent with the proposed definition of fair value, either that standard will be excluded from the scope of the exposure draft or the intended measurement objective will be restated using a term other than fair value (such as ‘current entry value’). To assist in its review, the IASB would like to understand how the fair value measurement guidance in IFRSs is currently applied in practice. It therefore requests respondents to identify those fair value measurements in IFRSs for which practice differs from the fair value measurement objective in SFAS 157.Issue 2B. Market participant view18SFAS 157 emphasises that a fair value measurement is a market-basedmeasurement, not an entity-specific measurement. Therefore, a fairvalue measurement should be based on the assumptions that marketparticipants would use in pricing the asset or liability. Furthermore, evenwhen there is limited or no observable market activity, the objective ofthe fair value measurement remains the same: to determine the pricethat would be received to sell an asset or be paid to transfer a liability inan orderly transaction between market participants at the measurementdate, regardless of the entity’s intention or ability to sell the asset ortransfer the liability at that date.19Paragraph 10 of SFAS 157 defines market participants as buyers andsellers in the principal (or most advantageous) market for the asset orliability who are:(a)Independent of the reporting entity; that is, they are not related parties(b)Knowledgeable, having a reasonable understanding about the asset or liability and the transaction based on all available information, including information that might be obtained through due diligence efforts that are usual and customary(c)Able to transact for the asset or liability(d)Willing to transact for the asset or liability; that is, they are motivated but not forced or otherwise compelled to do so.20In comparison, the definition of fair value in IFRSs refers to‘knowledgeable, willing parties in an arm’s length transaction’.Paragraphs 42-44 of IAS 40 Investment Property provide a description of this concept:42The definition of fair value refers to ‘knowledgeable, willing parties’.In this context, ‘knowledgeable’ means that both the willing buyer and the willing seller are reasonably informed about the nature and characteristics of the investment property, its actual and potential uses, and market conditions at the balance sheet date. A willing buyer ismotivated, but not compelled, to buy. This buyer is neither over-eager nor determined to buy at any price. The assumed buyer would not pay a higher price than a market comprising knowledgeable, willing buyers and sellers would require.43A willing seller is neither an over-eager nor a forced seller, prepared to sell at any price, nor one prepared to hold out for a price not considered reasonable in current market conditions. The willing seller is motivated to sell the investment property at market terms for the best price obtainable. The factual circumstances of the actual investment property owner are not a part of this consideration because the willing seller is a hypothetical owner (ega willing seller would not take into account the particular tax circumstances of the actual investment property owner).44The definition of fair value refers to an arm’s length transaction.Anarm’s length transaction is one between parties that do not have a particular or special relationship that makes prices of transactions uncharacteristic of market conditions. The transaction is presumed to be between unrelated parties, each acting independently.21The IASB’s preliminary view is that the market participant view is generally consistent with the concepts of a knowledgeable, willing party in an arm’s length transaction that are currently contained in IFRSs. However, in the IASB’s view, the proposed definition more clearly articulates the market-based fair value measurement objective in IFRSs.中文译文:公允价值测量1 在 2006 年二月,国际会计准则委员会 (IASB) 和美国财务会计标准委员会 (FASB) 公布了再断言他们对美国公认会计原则 (GAAP) 和国际的金融报告标准 (IFRSs) 的集中承诺的一个备忘录和对他们的发展中高级质量的被分享的目的, 公共的为全球的使用资本市场的会计准则。

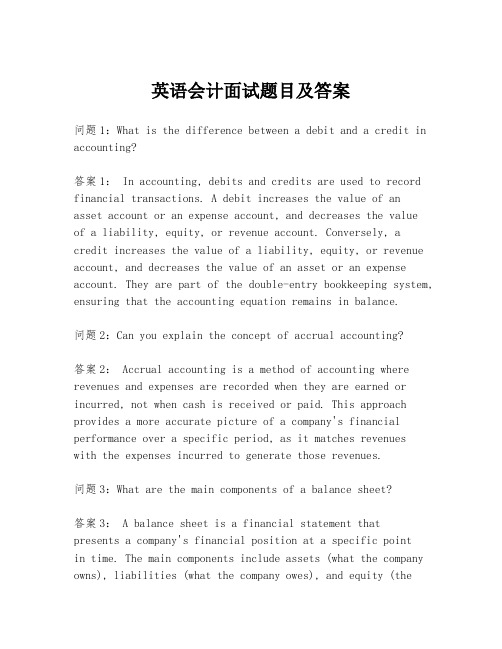

英语会计面试题目及答案

英语会计面试题目及答案问题1:What is the difference between a debit and a credit in accounting?答案1: In accounting, debits and credits are used to record financial transactions. A debit increases the value of anasset account or an expense account, and decreases the valueof a liability, equity, or revenue account. Conversely, acredit increases the value of a liability, equity, or revenue account, and decreases the value of an asset or an expense account. They are part of the double-entry bookkeeping system, ensuring that the accounting equation remains in balance.问题2:Can you explain the concept of accrual accounting?答案2: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid. This approach provides a more accurate picture of a company's financial performance over a specific period, as it matches revenueswith the expenses incurred to generate those revenues.问题3:What are the main components of a balance sheet?答案3: A balance sheet is a financial statement thatpresents a company's financial position at a specific pointin time. The main components include assets (what the company owns), liabilities (what the company owes), and equity (thenet worth of the company, which is the difference between assets and liabilities).问题4:How do you calculate the gross profit margin?答案4: The gross profit margin is calculated by dividing the gross profit by the net sales. Gross profit is the difference between the net sales and the cost of goods sold (COGS). The formula is: Gross Profit Margin = (Net Sales - COGS) / Net Sales.问题5:What is the purpose of a cash flow statement?答案5: A cash flow statement is a financial statement that provides information about a company's cash inflows and outflows during a specific period. It helps investors and creditors assess the liquidity of the company and its ability to generate cash to fund operations, pay debts, and invest in future growth.问题6:How do you handle errors in financial records?答案6: Errors in financial records should be corrected promptly to maintain accurate financial statements. The process involves identifying the error, determining the correct amount, and adjusting the accounts accordingly. This may involve journal entries to reverse the incorrect entry and record the correct one, ensuring the integrity of the financial data.问题7:What are the ethical considerations for an accountant?答案7: Ethical considerations for an accountant include maintaining integrity, confidentiality, and objectivity. Accountants must adhere to professional standards and regulations, avoid conflicts of interest, and ensure that their work is accurate and truthful.问题8:Can you describe a situation where you had to resolve a complex accounting issue?答案8: [应聘者应根据个人经验提供一个具体的例子,说明如何识别问题、分析情况、采取行动并成功解决问题的过程。

会计专业英语知识点汇总

会计专业英语知识点汇总会计专业是现代商业领域中非常重要的一门专业。

在学习会计专业时,除了掌握会计理论和实践技巧外,掌握一定的英语知识也是非常重要的。

本文将为大家汇总一些会计专业的英语知识点,希望能够帮助到学习会计专业的同学们。

1.会计基础知识 (Accounting Basics)–Assets:资产–Liabilities:负债–Equity:所有者权益–Revenue:收入–Expenses:费用–Balance Sheet:资产负债表–Income Statement:损益表–Cash Flow Statement:现金流量表2.会计准则和规范 (Accounting Standards and Regulations)–Generally Accepted Accounting Principles (GAAP):通用会计准则–International Financial Reporting Standards (IFRS):国际财务报告准则–Financial Accounting Standards Board (FASB):美国财务会计准则委员会–International Accounting Standards Board (IASB):国际会计准则委员会3.资产负债表相关术语 (Balance Sheet Terminology)–Current Assets:流动资产–Non-current Assets:非流动资产–Current Liabilities:流动负债–Non-current Liabilities:非流动负债–Shareholders’ Equity:股东权益–Goodwill:商誉–Depreciation:折旧–Amortization:摊销4.损益表相关术语 (Income Statement Terminology)–Gross Profit:毛利润–Operating Income:营业收入–Operating Expenses:营业费用–Net Income:净收入–Earnings per Share (EPS):每股收益5.现金流量表相关术语 (Cash Flow Statement Terminology)–Cash Inflows:现金流入–Cash Outflows:现金流出–Operating Activities:经营活动–Investing Activities:投资活动–Financing Activities:筹资活动–Net Cash Flow:净现金流量6.会计报表分析 (Financial Statement Analysis)–Ratio Analysis:比率分析–Liquidity Ratios:流动性比率–Solvency Ratios:偿债能力比率–Profitability Ratios:盈利能力比率–Efficiency Ratios:效率比率7.审计和内部控制 (Auditing and Internal Control)–Audit:审计–Internal Control:内部控制–Segregation of Duties:职责分离–Internal Audit:内部审计–External Audit:外部审计8.税务会计 (Tax Accounting)–Taxable Income:应税收入–Tax Deductions:税收减免–Tax Credits:税收抵免–Tax Liability:税务负债–Tax Planning:税务规划这些是会计专业中一些重要的英语知识点,希望能够帮助到学习会计专业的同学们。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Account 、Accounting 和AccountantAccount 有很多意思,常见的主要是“说明、解释;计算、帐单;银行帐户”。

例如:1、He gave me a full account of his plan。

他把计划给我做了完整的说明。

2、Charge it to my account。

把它记在我的帐上。

3、Cashier:Good afternoon。

Can I help you ?银行出纳:下午好,能为您做什么?Man :I’d like to open a bank account .男人:我想开一个银行存款帐户。

还有account title(帐户名称、会计科目)、income account(收益帐户)、account book(帐簿)等。

在account 后面加上词缀ing 就成为accounting ,其意义也相应变为会计、会计学。

例如:1、Accounting is a process of recording, classifying,summarizing and interpreting of those business activities that can be expressed in monetary terms.会计是一个以货币形式对经济活动进行记录、分类、汇总以及解释的过程。

2、It has been said that Accounting is the language of business.据说会计是“商业语言”3、Accounting is one of the fastest growing profession in the modern business world.会计是当今经济社会中发展最快的职业之一。

4、Financial Accounting and Managerial Accounting are two major specialized fields in Accounting.财务会计和管理会计是会计的两个主要的专门领域。

其他还有accounting profession(会计职业)、accounting elements(会计要素)等。

Accountant 比Account只多ant三个字母,其意思是会计师、会计人员。