公司金融复习题

大学《公司金融》期末考试试题及答案解析(共三套)精选全文

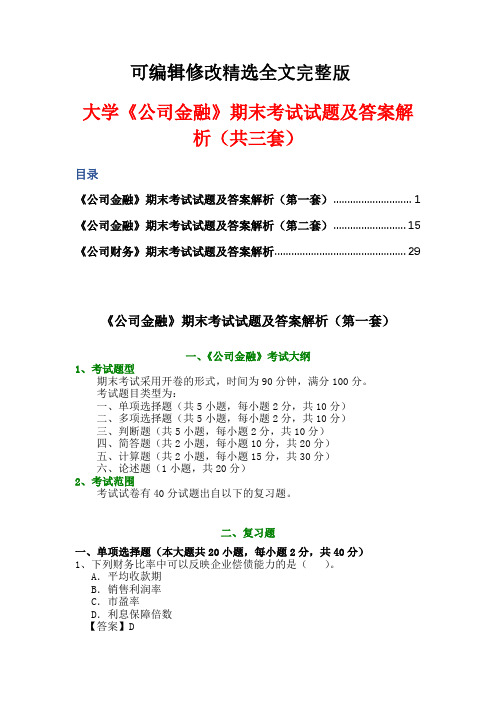

可编辑修改精选全文完整版大学《公司金融》期末考试试题及答案解析(共三套)目录《公司金融》期末考试试题及答案解析(第一套) (1)《公司金融》期末考试试题及答案解析(第二套) (15)《公司财务》期末考试试题及答案解析 (29)《公司金融》期末考试试题及答案解析(第一套)一、《公司金融》考试大纲1、考试题型期末考试采用开卷的形式,时间为90分钟,满分100分。

考试题目类型为:一、单项选择题(共5小题,每小题2分,共10分)二、多项选择题(共5小题,每小题2分,共10分)三、判断题(共5小题,每小题2分,共10分)四、简答题(共2小题,每小题10分,共20分)五、计算题(共2小题,每小题15分,共30分)六、论述题(1小题,共20分)2、考试范围考试试卷有40分试题出自以下的复习题。

二、复习题一、单项选择题(本大题共20小题,每小题2分,共40分)1、下列财务比率中可以反映企业偿债能力的是()。

A.平均收款期B.销售利润率C.市盈率D.利息保障倍数【答案】D2、在某公司的财务报表中,营业收入为20万元,应收账款年末为10万元,年初为6万元,应收账款周转次数为()。

A.1B.2C.3D.以上均不对【答案】A3、已知每年年底存款5 000元,欲计算第五年末的价值总额,应该利用()。

A.复利终值系数B.复利现值系数C.年金终值系数D.年金现值系数【答案】C4、第一次收付发生在第二期或以后各期的年金被称为()。

A.普通年金B.预付年金C.递延年金D.永续年金【答案】C5、某企业拟发行面值为100元,票面利率为10%,期限为3年的债券,当市场利率为10%时,该债券的发行价格为()。

A.80元B.90元C.100元D.110元【答案】C6、下列哪项属于普通股筹资的优点()。

A.筹资成本低B.不稀释公司的控制权C.发行新股时,会增加每股净收益,引起股价上升D.发行普通股形成自有资金可增强公司举债能力【答案】D7、某钢铁集团并购某石油公司,这种并购方式属于()。

公司金融期末复习资料(计算简答名词判断)

单选15个,多选5个,判断10个,简答3个,计算4个1财务经理必须回答的三个最基本问题是什么?答:公司理财包括以下三个基本问题:(1)投资决策(资本预算):即公司应该投资于什么样的长期资产,这个问题涉及资产负债表的左边。

比如利用回收期法,折现回收期法,内部收益率法,净现值法,平均会计收益率法等方法来进行资本预算,选择应该投资的项目或者资产。

(2)融资决策(资本结构):即公司如何筹集资本支出所需的资金。

这个问题涉及资产负债表的右边。

它表示公司短期及长期负债与所有者权益的比例。

公司一般通过发行债券、借贷或发行股票来筹资,分为负债和所有者权益。

优序融资理论,负债权益的优缺点。

(3)短期财务问题(营运资本):净营运资本指企业流动资产与流动负债之差,表示清偿所有负债后的货币量。

即公司应该如何管理它经营中的现金流量。

财务经理必须致力于管理现金流量的缺口。

企业短期偿债能力强。

2会计利润与现金流量的区别是什么?财务决策时需要考虑的是会计利润还是现金流量?答:会计利润亦称“账面利润”,是指企业出售产品的总收益减去以显性成本(会计成本,与显性成本相对)之差额,反映企业在一定时期内的经营成果。

现金流量是指企业在一定时期内的现金流入总量和现金流出总量,包括企业经营活动、投资活动、筹资活动和特殊项目所产生的现金流入和现金流出。

会计利润和现金流量的主要区别在于:非现金支出(比如折旧支出)是包括在会计利润之中的,但在现金流量中却得不到体现,因为从现金流量的概念出发,这些支出并不能够代表企业目前的实际支出水平。

3财务经理如何创造价值?(财务计划的目标是是什么?)答:财务经理的主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。

其创造价值的途径主要有两条:(1)公司必须通过购买资产创造超过其成本的现金。

(2)公司必须通过发行债券、股票和其他金融工具以筹集超过其成本的现金。

因此,公司创造的现金流量必须超过它所使用的现金流量。

《公司金融》期末复习题

例题6:某汽车公司的市值有2000万人民币,明年的自由现金流 预测有85万人民币,证券分析师预测,在之后的5年中,自由现 金流将以每年7.5%的速度增长。 (1)假设7.5%的增长率预期将一直持续下去,投资公司的股票, 投资者期望的收益率是多少? (2)该汽车公司一般情况下的账面股权收益率ROE约为12%, 50%的盈利用于再投资,其余50%的盈利作为自由现金流。假设 公司长期保持目前的ROE和再投资比率不变,股权成本又变为多 少?

例题10:已知一家纺织厂上市公司的以下信息: 请计算该公司的公司资本成本。不考虑税收。

例题11:项目预测现金流如下:(单位:元)

估计项目的贝塔为1.5,市场收益率rm为16%,无风险利率rf为 7%,请问: (1)估计资本机会成本和项目的净现值? (2)每年的确定性等值现金流是多少?

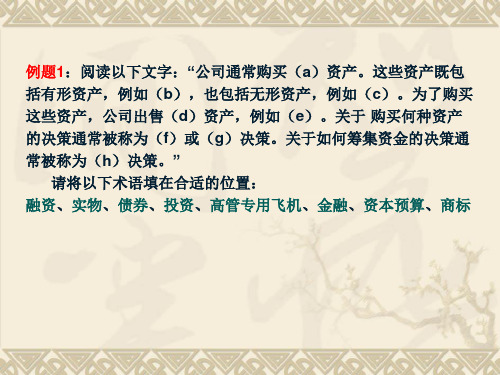

例题1:阅读以下文字:“公司通常购买(a)资产。这些资产既包 括有形资产,例如(b),也包括无形资产,例如(c)。为了购买 这些资产,公司出售(d)资产,例如(e)。关于 购买何种资产 的决策通常被称为(f)或(g)决策。关于如何筹集资金的决策通 常被称为(h)决策。”

请将以下术语填在合适的位置: 融资、实物、债券、投资、高管专用飞机、金融、资本预算、商标

例题4:假设一张面值为100元,息票利率为5%的6年期债券,年 化复利收益率为3%,假设1年后,债券的收益率仍为3%。那么 在这一年中债券投资者的收益率是多少?

假设1年后收益率降为2%,在这一年中债券投资者的收益率 又为多少?

例题5:回顾久期的计算,请计算面值为1000元,息票利率为3%, 到期收益率为4%的三年期债券的久期(列表)和修正久期。

例题9:判断正误: (1)投资者喜欢分散化公司,因为他们的风险小; (2)如果股票完全正相关,分散化将不能降低风险; (3)投资很多资产的分散化完全消除风险; (4)只有资产不相关时,分散化才有用; (5)标准差低的股票对资产组合风险的贡献比标准差高的股票小; (6)一只股票对充分分散化的资产组合的风险的贡献,取决于其 市场风险; (7)贝塔等于2.0的充分分散化的资产组合的风险是市场组合的两 倍; (8)贝塔等于2.0的没有分散化的资产组合的风险,小于市场组合 的风险的两倍。

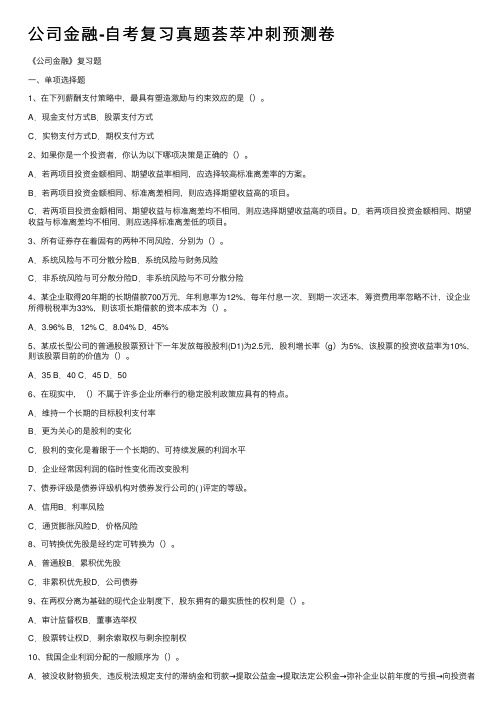

公司金融-自考复习真题荟萃冲刺预测卷

公司⾦融-⾃考复习真题荟萃冲刺预测卷《公司⾦融》复习题⼀、单项选择题1、在下列薪酬⽀付策略中,最具有塑造激励与约束效应的是()。

A.现⾦⽀付⽅式B.股票⽀付⽅式C.实物⽀付⽅式D.期权⽀付⽅式2、如果你是⼀个投资者,你认为以下哪项决策是正确的()。

A.若两项⽬投资⾦额相同、期望收益率相同,应选择较⾼标准离差率的⽅案。

B.若两项⽬投资⾦额相同、标准离差相同,则应选择期望收益⾼的项⽬。

C.若两项⽬投资⾦额相同、期望收益与标准离差均不相同,则应选择期望收益⾼的项⽬。

D.若两项⽬投资⾦额相同、期望收益与标准离差均不相同,则应选择标准离差低的项⽬。

3、所有证券存在着固有的两种不同风险,分别为()。

A.系统风险与不可分散分险B.系统风险与财务风险C.⾮系统风险与可分散分险D.⾮系统风险与不可分散分险4、某企业取得20年期的长期借款700万元,年利息率为12%,每年付息⼀次,到期⼀次还本,筹资费⽤率忽略不计,设企业所得税税率为33%,则该项长期借款的资本成本为()。

A.3.96% B.12% C.8.04% D.45%5、某成长型公司的普通股股票预计下⼀年发放每股股利(D1)为2.5元,股利增长率(g)为5%,该股票的投资收益率为10%,则该股票⽬前的价值为()。

A.35 B.40 C.45 D.506、在现实中,()不属于许多企业所奉⾏的稳定股利政策应具有的特点。

A.维持⼀个长期的⽬标股利⽀付率B.更为关⼼的是股利的变化C.股利的变化是着眼于⼀个长期的、可持续发展的利润⽔平D.企业经常因利润的临时性变化⽽改变股利7、债券评级是债券评级机构对债券发⾏公司的( )评定的等级。

A.信⽤B.利率风险C.通货膨胀风险D.价格风险8、可转换优先股是经约定可转换为()。

A.普通股B.累积优先股C.⾮累积优先股D.公司债券9、在两权分离为基础的现代企业制度下,股东拥有的最实质性的权利是()。

A.审计监督权B.董事选举权C.股票转让权D.剩余索取权与剩余控制权10、我国企业利润分配的⼀般顺序为()。

公司金融的习题及部分答案

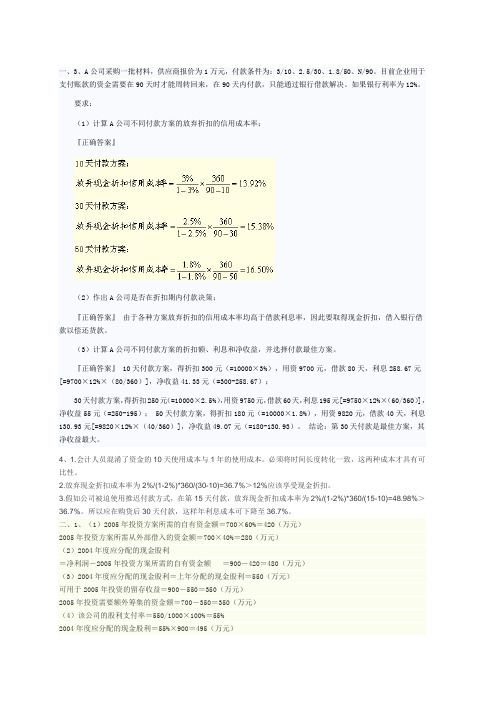

一、3、A公司采购一批材料,供应商报价为1万元,付款条件为:3/10、2.5/30、1.8/50、N/90。

目前企业用于支付账款的资金需要在90天时才能周转回来,在90天内付款,只能通过银行借款解决。

如果银行利率为12%。

要求:(1)计算A公司不同付款方案的放弃折扣的信用成本率;『正确答案』(2)作出A公司是否在折扣期内付款决策;『正确答案』由于各种方案放弃折扣的信用成本率均高于借款利息率,因此要取得现金折扣,借入银行借款以偿还货款。

(3)计算A公司不同付款方案的折扣额、利息和净收益,并选择付款最佳方案。

『正确答案』 10天付款方案,得折扣300元(=10000×3%),用资9700元,借款80天,利息258.67元[=9700×12%×(80/360)],净收益41.33元(=300-258.67);30天付款方案,得折扣250元(=10000×2.5%),用资9750元,借款60天,利息195元[=9750×12%×(60/360)],净收益55元(=250-195); 50天付款方案,得折扣180元(=10000×1.8%),用资9820元,借款40天,利息130.93元[=9820×12%×(40/360)],净收益49.O7元(=180-130.93)。

结论:第30天付款是最佳方案,其净收益最大。

4、1.会计人员混淆了资金的10天使用成本与1年的使用成本。

必须将时间长度转化一致,这两种成本才具有可比性。

2.放弃现金折扣成本率为2%/(1-2%)*360/(30-10)=36.7%>12%应该享受现金折扣。

3.假如公司被迫使用推迟付款方式,在第15天付款,放弃现金折扣成本率为2%/(1-2%)*360/(15-10)=48.98%>36.7%。

所以应在购货后30天付款,这样年利息成本可下降至36.7%。

公司金融习题及答案

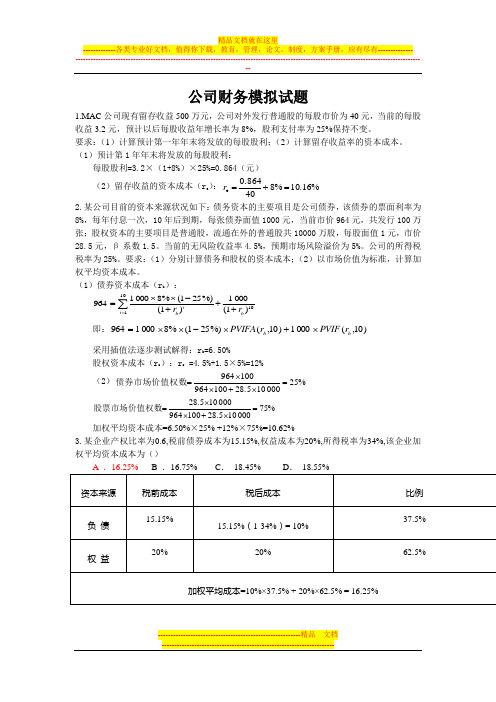

公司财务模拟试题1.MAC 公司现有留存收益500万元,公司对外发行普通股的每股市价为40元,当前的每股收益3.2元,预计以后每股收益年增长率为8%,股利支付率为25%保持不变。

要求:(1)计算预计第一年年末将发放的每股股利;(2)计算留存收益率的资本成本。

(1)预计第1年年末将发放的每股股利:每股股利=3.2×(1+8%)×25%=0.864(元)(2)留存收益的资本成本(r e ):%16.10%8400.864e =+=r 2.某公司目前的资本来源状况如下:债务资本的主要项目是公司债券,该债券的票面利率为8%,每年付息一次,10年后到期,每张债券面值1000元,当前市价964元,共发行100万张;股权资本的主要项目是普通股,流通在外的普通股共10000万股,每股面值1元,市价28.5元,β系数1.5。

当前的无风险收益率4.5%,预期市场风险溢价为5%。

公司的所得税税率为25%。

要求:(1)分别计算债务和股权的资本成本;(2)以市场价值为标准,计算加权平均资本成本。

(1)债券资本成本(r b ):10101)1(0001)1(%)251(%80001964b t t b r r +++-⨯⨯=∑=即:)10,(0001)10,(%)251(%80001964b b r PVIF r PVIFA ⨯+⨯-⨯⨯= 采用插值法逐步测试解得:r b =6.50%股权资本成本(r s ):r s =4.5%+1.5×5%=12% (2)%250001028.5100964100964=⨯+⨯⨯=债券市场价值权数%750001028.51009640001028.5=⨯+⨯⨯=股票市场价值权数加权平均资本成本=6.50%×25% +12%×75%=10.62%3.某企业产权比率为0.6,税前债券成本为15.15%,权益成本为20%,所得税率为34%,该企业加权平均资本成本为()产权比例的概念产权比率又叫债务股权比率,是负债总额与股东权益总额之比率。

公司金融期末总复习

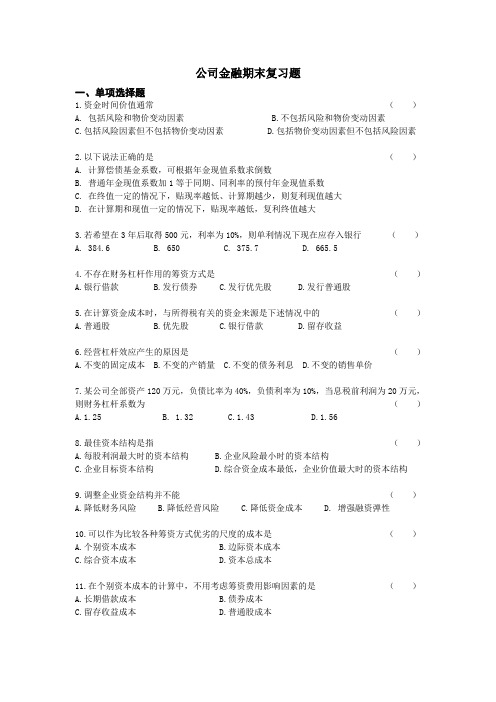

公司金融期末复习题一、单项选择题1.资金时间价值通常()A. 包括风险和物价变动因素B.不包括风险和物价变动因素C.包括风险因素但不包括物价变动因素D.包括物价变动因素但不包括风险因素2.以下说法正确的是()A. 计算偿债基金系数,可根据年金现值系数求倒数B. 普通年金现值系数加1等于同期、同利率的预付年金现值系数C. 在终值一定的情况下,贴现率越低、计算期越少,则复利现值越大D. 在计算期和现值一定的情况下,贴现率越低,复利终值越大3.若希望在3年后取得500元,利率为10%,则单利情况下现在应存入银行()A. 384.6B. 650C. 375.7D. 665.54.不存在财务杠杆作用的筹资方式是()A.银行借款B.发行债券C.发行优先股D.发行普通股5.在计算资金成本时,与所得税有关的资金来源是下述情况中的()A.普通股B.优先股C.银行借款D.留存收益6.经营杠杆效应产生的原因是()A.不变的固定成本B.不变的产销量C.不变的债务利息D.不变的销售单价7.某公司全部资产120万元,负债比率为40%,负债利率为10%,当息税前利润为20万元,则财务杠杆系数为()A.1.25 B. 1.32 C.1.43 D.1.568.最佳资本结构是指()A.每股利润最大时的资本结构B.企业风险最小时的资本结构C.企业目标资本结构D.综合资金成本最低,企业价值最大时的资本结构9.调整企业资金结构并不能()A.降低财务风险B.降低经营风险C.降低资金成本D. 增强融资弹性10.可以作为比较各种筹资方式优劣的尺度的成本是()A.个别资本成本B.边际资本成本C.综合资本成本D.资本总成本11.在个别资本成本的计算中,不用考虑筹资费用影响因素的是()A.长期借款成本B.债券成本C.留存收益成本D.普通股成本12.下列筹资方式中,资本成本最低的是()A.发行债券B.留存收益C.发行股票D.长期借款13.若债务水平被预先设定,此时计算有杠杆价值VL时,下列哪些方法的一些公式就不再适用。

公司金融习题

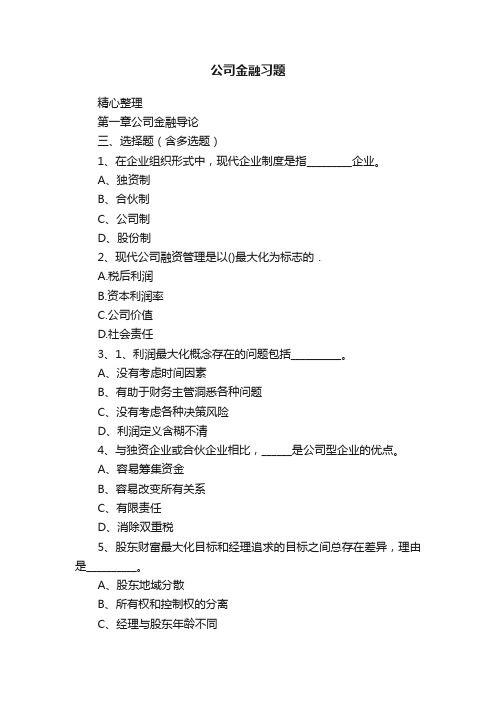

公司金融习题精心整理第一章公司金融导论三、选择题(含多选题)1、在企业组织形式中,现代企业制度是指_________企业。

A、独资制B、合伙制C、公司制D、股份制2、现代公司融资管理是以()最大化为标志的.A.税后利润B.资本利润率C.公司价值D.社会责任3、1、利润最大化概念存在的问题包括__________。

A、没有考虑时间因素B、有助于财务主管洞悉各种问题C、没有考虑各种决策风险D、利润定义含糊不清4、与独资企业或合伙企业相比,______是公司型企业的优点。

A、容易筹集资金B、容易改变所有关系C、有限责任D、消除双重税5、股东财富最大化目标和经理追求的目标之间总存在差异,理由是__________。

A、股东地域分散B、所有权和控制权的分离C、经理与股东年龄不同D、以上答案均不对6、股东财富通常由__________来计量。

A、股东所拥有的普通股帐面价值B、股东所拥有的普通股市场价值C、公司资产的帐面值D、公司资产的市场价值7、委托代理矛盾是由于_______之间目标不一致产生的。

A、股东与监事会B、股东与顾客C、股东与董事会D、股东与经理8、交易期限超过一年的长期金融资产的交易场所是指__________。

A、货币市场B、一级市场C、资本市场D、期货市场9、按交割时间划分,金融市场分为_________。

A、货币市场与资本市场B、发行市场与流通市场C、现货市场与期货市场D、股票市场与债券市场10、公司作为一种组织形式的主要缺点在于_________。

A、所有者更换困难B、公司所得税和股东收入的双重纳税C、公司负债经营的压力D、股东承担责任而经营者不承担责任11、公司金融管理的内容包括_________。

A、投资决策B、融资决策C、股利决策D、资本预算决策12、代理成本是一种“制度成本”,它由________构成。

A、委托人的监督费用B、代理人的担保费用C、沉没成本D、剩余损失13、在金融市场上,影响利率的因素主要有_________。

公司金融复习自测题参考答案

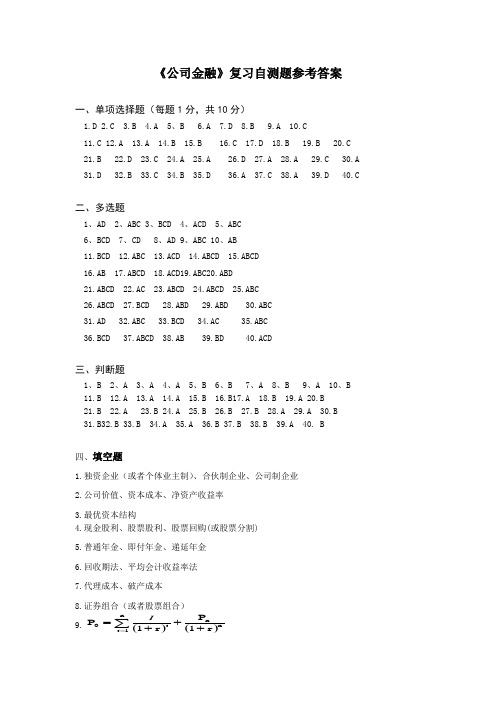

《公司金融》复习自测题参考答案一、单项选择题(每题1分,共10分)1.D2.C3.B4.A 5、B 6.A 7.D 8.B 9.A 10.C11.C 12.A 13.A 14.B 15.B 16.C 17.D 18.B 19.B 20.C 21.B 22.D 23.C 24.A 25.A 26.D 27.A 28.A 29.C 30.A 31.D 32.B 33.C 34.B 35.D 36.A 37.C 38.A 39.D 40.C二、多选题1、AD2、ABC3、BCD4、ACD5、ABC6、BCD7、CD8、AD9、ABC 10、AB11.BCD 12.ABC 13.ACD 14.ABCD 15.ABCD16.AB 17.ABCD 18.ACD19.ABC20.ABD21.ABCD 22.AC 23.ABCD 24.ABCD 25.ABC26.ABCD 27.BCD 28.ABD 29.ABD 30.ABC31.AD 32.ABC 33.BCD 34.AC 35.ABC36.BCD 37.ABCD 38.AB 39.BD 40.ACD三、判断题1、B2、A3、A4、A5、B6、B7、A8、B9、A 10、B 11.B 12.A 13.A 14.A 15.B 16.B17.A 18.B 19.A 20.B21.B 22.A 23.B 24.A 25.B 26.B 27.B 28.A 29.A 30.B31.B32.B 33.B 34.A 35.A 36.B 37.B 38.B 39.A 40. B四、填空题1.独资企业(或者个体业主制)、合伙制企业、公司制企业2.公司价值、资本成本、净资产收益率3.最优资本结构4.现金股利、股票股利、股票回购(或股票分割)5.普通年金、即付年金、递延年金6.回收期法、平均会计收益率法7.代理成本、破产成本8.证券组合(或者股票组合)10.机会成本11.公司融资、公司投资、营运资本管理12.看涨期权13.现值、终值14.∑=+=trttr DP1) 1(15.资本权重16.留存收益17.经营风险、融资风险18.普通年金19.最优资本结构20.系统、δim /δm2(ρab×δi/δm)五、名词解释1.财务杠杆:所谓财务杠杆是指由于固定利息费用的存在,而使公司普通股收益变动率大于息税前利润变动率的现象。

公司金融习题

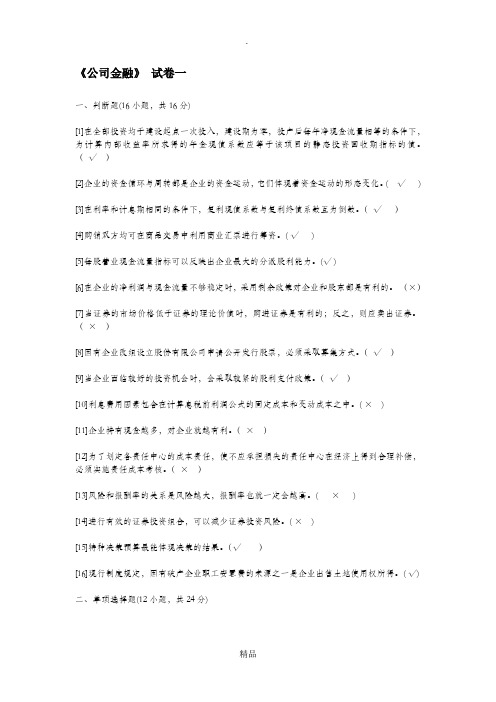

《公司金融》试卷一一、判断题(16小题,共16分)[1]在全部投资均于建设起点一次投入,建设期为零,投产后每年净现金流量相等的条件下,为计算内部收益率所求得的年金现值系数应等于该项目的静态投资回收期指标的值。

(√)[2]企业的资金循环与周转都是企业的资金运动,它们体现着资金运动的形态变化。

( √)[3]在利率和计息期相同的条件下,复利现值系数与复利终值系数互为倒数。

(√)[4]购销双方均可在商品交易中利用商业汇票进行筹资。

( √)[5]每股营业现金流量指标可以反映出企业最大的分派股利能力。

(√ )[6]在企业的净利润与现金流量不够稳定时,采用剩余政策对企业和股东都是有利的。

(×)[7]当证券的市场价格低于证券的理论价值时,购进证券是有利的;反之,则应卖出证券。

(×)[8]国有企业改组设立股份有限公司申请公开发行股票,必须采取募集方式。

(√)[9]当企业面临较好的投资机会时,会采取较紧的股利支付政策。

(√)[10]利息费用因素包含在计算息税前利润公式的固定成本和变动成本之中。

( ×)[11]企业持有现金越多,对企业就越有利。

(×)[12]为了划定各责任中心的成本责任,使不应承担损失的责任中心在经济上得到合理补偿,必须实施责任成本考核。

(×)[13]风险和报酬率的关系是风险越大,报酬率也就一定会越高。

( ×)[14]进行有效的证券投资组合,可以减少证券投资风险。

( ×)[15]特种决策预算最能体现决策的结果。

(√)[16]现行制度规定,国有破产企业职工安置费的来源之一是企业出售土地使用权所得。

( √)二、单项选择题(12小题,共24分)[1]某企业循环贷款限额为1000万,承诺费为0.5%,该企业年度内使用量700万,则应向银行支付承诺费为A、1.5万元;B、3.5万元;C、5.0万元;D、6.5万元[2]某建筑公司每年需要材料200吨,每吨年度储备成本为20元,平均每次进货费用为125元,单位订价为20元,则每年最佳采购次数为()次。

公司金融复习题

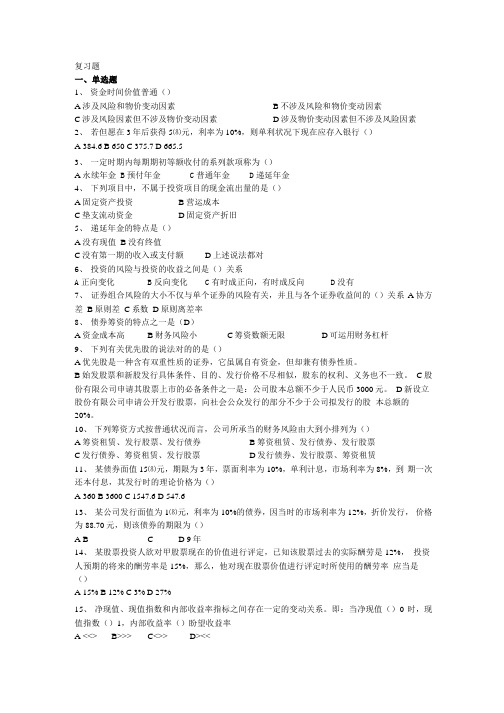

复习题一、单选题1、资金时间价值普通()A涉及风险和物价变动因素B不涉及风险和物价变动因素C涉及风险因素但不涉及物价变动因素D涉及物价变动因素但不涉及风险因素2、若但愿在3年后获得5⑻元,利率为10%,则单利状况下现在应存入银行()A 384.6B 650C 375.7D 665.53、一定时期内每期期初等额收付的系列款项称为()A永续年金 B预付年金C普通年金D递延年金4、下列项目中,不属于投资项目的现金流出量的是()A固定资产投资B营运成本C垫支流动资金D固定资产折旧5、递延年金的特点是()A没有现值B没有终值C没有第一期的收入或支付额D上述说法都对6、投资的风险与投资的收益之间是()关系A正向变化B反向变化C有时成正向,有时成反向D没有7、证券组合风险的大小不仅与单个证券的风险有关,并且与各个证券收益间的()关系A协方差B原则差C系数D原则离差率8、债券筹资的特点之一是(D)A资金成本高B财务风险小C筹资数额无限D可运用财务杠杆9、下列有关优先股的说法对的的是()A优先股是一种含有双重性质的证券,它虽属自有资金,但却兼有债券性质。

B始发股票和新股发行具体条件、目的、发行价格不尽相似,股东的权利、义务也不一致。

C股份有限公司申请其股票上市的必备条件之一是:公司股本总额不少于人民币3000元。

D新设立股份有限公司申请公开发行股票,向社会公众发行的部分不少于公司拟发行的股本总额的20%。

10、下列筹资方式按普通状况而言,公司所承当的财务风险由大到小排列为()A筹资租赁、发行股票、发行债券B筹资租赁、发行债券、发行股票C发行债券、筹资租赁、发行股票D发行债券、发行股票、筹资租赁11、某债券面值15⑻元,期限为3年,票面利率为10%,单利计息,市场利率为8%,到期一次还本付息,其发行时的理论价格为()A 360B 3600C 1547.6D 547.613、某公司发行面值为1⑻元,利率为10%的债券,因当时的市场利率为12%,折价发行,价格为88.70元,则该债券的期限为()A B C D 9年14、某股票投资人欲对甲股票现在的价值进行评定,已知该股票过去的实际酬劳是12%,投资人预期的将来的酬劳率是15%,那么,他对现在股票价值进行评定时所使用的酬劳率应当是()A 15%B 12%C 3%D 27%15、净现值、现值指数和内部收益率指标之间存在一定的变动关系。

公司金融习题

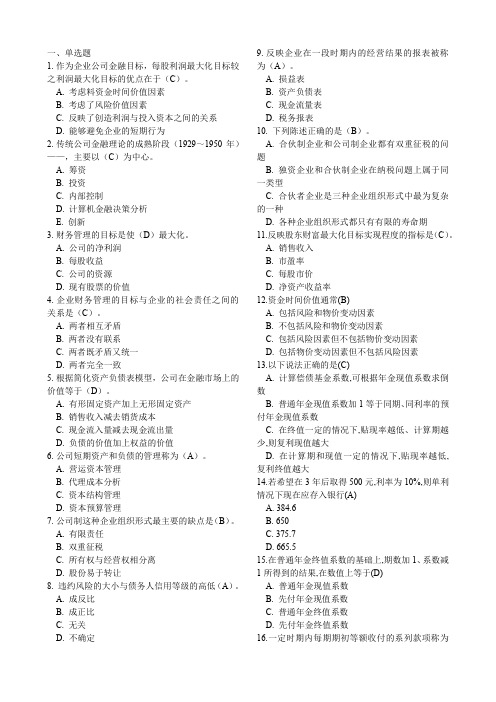

一、单选题1.作为企业公司金融目标,每股利润最大化目标较之利润最大化目标的优点在于(C)。

A. 考虑料资金时间价值因素B. 考虑了风险价值因素C. 反映了创造利润与投入资本之间的关系D. 能够避免企业的短期行为2.传统公司金融理论的成熟阶段(1929~1950年)——,主要以(C)为中心。

A. 筹资B. 投资C. 内部控制D. 计算机金融决策分析E. 创新3.财务管理的目标是使(D)最大化。

A. 公司的净利润B. 每股收益C. 公司的资源D. 现有股票的价值4.企业财务管理的目标与企业的社会责任之间的关系是(C)。

A. 两者相互矛盾B. 两者没有联系C. 两者既矛盾又统一D. 两者完全一致5.根据简化资产负债表模型,公司在金融市场上的价值等于(D)。

A. 有形固定资产加上无形固定资产B. 销售收入减去销货成本C. 现金流入量减去现金流出量D. 负债的价值加上权益的价值6.公司短期资产和负债的管理称为(A)。

A. 营运资本管理B. 代理成本分析C. 资本结构管理D. 资本预算管理7.公司制这种企业组织形式最主要的缺点是(B)。

A. 有限责任B. 双重征税C. 所有权与经营权相分离D. 股份易于转让8. 违约风险的大小与债务人信用等级的高低(A)。

A. 成反比B. 成正比C. 无关D. 不确定9.反映企业在一段时期内的经营结果的报表被称为(A)。

A. 损益表B. 资产负债表C. 现金流量表D. 税务报表10. 下列陈述正确的是(B)。

A. 合伙制企业和公司制企业都有双重征税的问题B. 独资企业和合伙制企业在纳税问题上属于同一类型C. 合伙者企业是三种企业组织形式中最为复杂的一种D. 各种企业组织形式都只有有限的寿命期11.反映股东财富最大化目标实现程度的指标是(C)。

A. 销售收入B. 市盈率C. 每股市价D. 净资产收益率12.资金时间价值通常(B)A. 包括风险和物价变动因素B. 不包括风险和物价变动因素C. 包括风险因素但不包括物价变动因素D. 包括物价变动因素但不包括风险因素13.以下说法正确的是(C)A. 计算偿债基金系数,可根据年金现值系数求倒数B. 普通年金现值系数加1等于同期、同利率的预付年金现值系数C. 在终值一定的情况下,贴现率越低、计算期越少,则复利现值越大D. 在计算期和现值一定的情况下,贴现率越低,复利终值越大14.若希望在3年后取得500元,利率为10%,则单利情况下现在应存入银行(A)A. 384.6B. 650C. 375.7D. 665.515.在普通年金终值系数的基础上,期数加1、系数减1所得到的结果,在数值上等于(D)A. 普通年金现值系数B. 先付年金现值系数C. 普通年金终值系数D. 先付年金终值系数16.一定时期内每期期初等额收付的系列款项称为(B)A. 永续年金B. 先付年金C. 普通年金D. 递延年金17.递延年金的特点是(C)A. 没有现值B. 没有终值C. 没有第一期的收入或支付额D. 上述说法都对18.给定一项资产(或投资)的期望收益率和标准差,我们可以合理的预期其实际收益在“期望值加减一个标准差”区间内的概率为(B)A. 32.66%B. 68.26%C. 95.18%D. 99.68%19.投资组合的期望收益率是投资组合中单个资产期望收益率的加权平均。

公司金融习题及答案

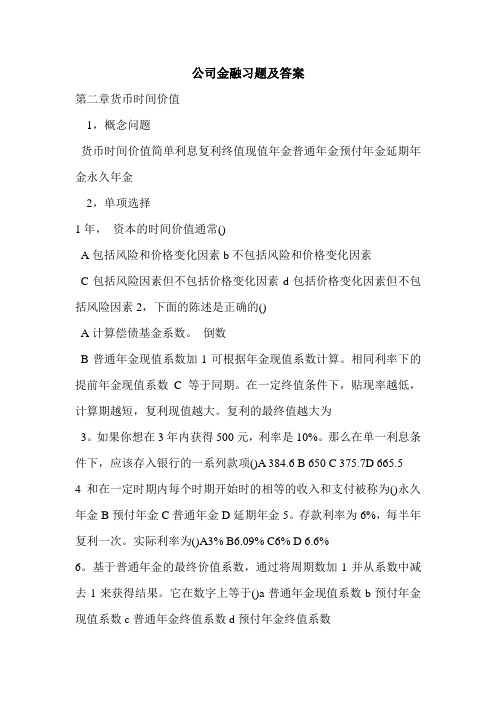

公司金融习题及答案集团标准化工作小组 [Q8QX9QT-X8QQB8Q8-NQ8QJ8-M8QMN]第二章货币的时间价值一、概念题货币的时间价值单利复利终值现值年金普通年金先付年金递延年金永续年金二、单项选择题1、资金时间价值通常()A 包括风险和物价变动因素 B不包括风险和物价变动因素C包括风险因素但不包括物价变动因素 D包括物价变动因素但不包括风险因素2、以下说法正确的是()A 计算偿债基金系数,可根据年金现值系数求倒数B 普通年金现值系数加1等于同期、同利率的预付年金现值系数C 在终值一定的情况下,贴现率越低、计算期越少,则复利现值越大D 在计算期和现值一定的情况下,贴现率越低,复利终值越大3、若希望在3年后取得500元,利率为10%,则单利情况下现在应存入银行()A B 650 C D4、一定时期内每期期初等额收付的系列款项称为()A 永续年金B预付年金C普通年金D递延年金5、某项存款利率为6%,每半年复利一次,其实际利率为()A3% B% C6% D%6、在普通年金终值系数的基础上,期数加1、系数减1所得到的结果,在数值上等于()A普通年金现值系数B先付年金现值系数C普通年金终值系数D先付年金终值系数7、表示利率为10%,期数为5年的()A复利现值系数B复利终值系数C年金现值系数D年金终值系数8、下列项目中,不属于投资项目的现金流出量的是()A固定资产投资 B营运成本C垫支流动资金 D固定资产折旧9、某投资项目的年营业收入为500万元,年经营成本为300万元,年折旧费用为10万元,所得税税率为33%,则该投资方案的年经营现金流量为()万元200 C D14410、递延年金的特点是()A没有现值 B没有终值C没有第一期的收入或支付额 D上述说法都对三、多项选择题1、资金时间价值计算的四个因素包括()A资金时间价值额B资金的未来值C资金现值D单位时间价值率E时间期限2、下面观点正确的是()A 在通常情况下,资金时间价值是在既没有风险也没有通货膨胀条件下的社会平均利润率B 没有经营风险的企业也就没有财务风险;反之,没有财务风险的企业也就没有经营风险C 永续年金与其他年金一样,既有现值又有终值D 递延年金终值的大小,与递延期无关,所以计算方法和普通年金终值相同E 在利息率和计息期相同的条件下,复利现值系数和复利终值系数互为倒数3、年金按其每期收付款发生的时点不同,可分为()A 普通年金B 先付年金C 递延年金D 永续年金E 特殊年金4、属于递延年金的特点有()A 年金的第一次支付发生在若干期之后B 没有终值C 年金的现值与递延期无关D 年金的终值与递延期无关E 现值系数是普通年金系数的倒数5、下列各项中属于年金形式的有()A 直线法计提的折旧额B 等额分期付款C 优先股股利D 按月发放的养老金E 定期支付的保险金6、下列关于资金的时间价值的表述中正确的有()A 资金的时间价值是由时间创造的B 资金的时间价值是劳动创造的C资金的时间价值是在资金周转中产生的D资金的时间价值可用社会资金利润率表示E资金的时间价值是不可以计算的7、下列表述中,正确的有()A复利终止系数和复利现值系数互为倒数B复利终值系数和资本回收系数互为倒数C普通年金终值系数和偿债基金系数互为倒数D普通年金终值系数和资本回收系数互为倒数E普通年金终值系数和普通年金现值系数互为倒数8、下列关于利率的说法正确的是()A 利率是资金的增值额同投入资金价值的比率B 利率是衡量资金增值程度的数量指标C 利率是特定时期运用资金的交易价格D 利率有名义利率和实际利率之分E 利率反映的是单位资金时间价值量四、计算题1、某项永久性奖学金,每年计划颁发50,000元,若年利率为8%,采用复利方式计息,该奖学金的本金为多少钱2、某企业2005年初向银行借入50,000元贷款,为期10年期,在每年末等额偿还。

公司金融习题及答案

公司金融习题及答案第二章货币时间价值1,概念问题货币时间价值简单利息复利终值现值年金普通年金预付年金延期年金永久年金2,单项选择1年,资本的时间价值通常()A包括风险和价格变化因素b不包括风险和价格变化因素C包括风险因素但不包括价格变化因素d包括价格变化因素但不包括风险因素2,下面的陈述是正确的()A计算偿债基金系数。

倒数B普通年金现值系数加1可根据年金现值系数计算。

相同利率下的提前年金现值系数C等于同期。

在一定终值条件下,贴现率越低,计算期越短,复利现值越大。

复利的最终值越大为3。

如果你想在3年内获得500元,利率是10%。

那么在单一利息条件下,应该存入银行的一系列款项()A 384.6 B 650 C 375.7D 665.54和在一定时期内每个时期开始时的相等的收入和支付被称为()永久年金B预付年金C普通年金D延期年金5。

存款利率为6%,每半年复利一次。

实际利率为()A3% B6.09% C6% D 6.6%6。

基于普通年金的最终价值系数,通过将周期数加1并从系数中减去1来获得结果。

它在数字上等于()a普通年金现值系数b预付年金现值系数c普通年金终值系数d预付年金终值系数7,代表10%的利率和5年期()a复利现值系数b复利终值系数c年金现值系数d年金终值系数8,其中: 不属于投资项目的现金流出有:(a)固定资产投资(b)经营成本(c)预付营运资金(d)固定资产折旧(9),投资项目年经营收入500万元,年经营成本300万元,年折旧费10万元,所得税税率33%。

那么该投资计划的年度经营现金流为()万元,A127.3 BXXXX年金,其特征是()a无现值,b无终值,C无一期收入或支付,d以上所有报表均为3,选择题1、计算资本时间价值的四个因素包括()A资本时间价值b资本未来价值c资本现值d单位时间价值率e时间周期2,以下观点是正确的()a正常情况下,资本时间价值是在不存在风险或通货膨胀的情况下社会的平均利润率b没有经营风险的企业不存在财务风险;另一方面,没有财务风险的企业也没有经营风险。

公司金融期末复习题

一1、“不要把所有鸡蛋放到同一个篮子里。

”这句话是理财原则中()的生动体现。

A. 投资分散化原则B. 货币时间价值原则C. 比较优势原则D. 风险—报酬权衡原则2、财务目标是公司价值最大化,其价值是指()。

A. 账面价值B. 账面净值C. 重置价值D. 市场价值3、反映公司价值最大化目标实现程度的指标是()。

A. 销售收入B. 市盈率C.每股市价D.净资产收益率4、公司价值的量化形式可以是()A. 未来现金流量按照资本成本率的折现B. 未来现金流量按照现金利润率的折现C. 未来股票市场的价值D. 未来利润额的合计5、发行债券,在名义利率相同的情况下,对其最不利的复利计息期是()。

A. 1年B. 半年C.1季度D.1月6、为在第5年获本利和100元,若年利率为8%,每3个月复利一次,求现在应向银行存入多少钱,下列算式正确的是()。

DA.P=100*(1+8%)5B.P=100*(1+8%)-5C. P=100*(1+8%/4)5*4D. P=100*(1+8%/4)-5*47、投资者由于冒风险进行投资而获得的超过资金价值的额外收益,称为投资的()。

CA.时间价值率B.期望报酬率C.风险报酬率D.必要报酬率8、企业某新产品开发成功的概率为80%,成功后的投资报酬率为40%,开发失败的概率为20%,失败后的投资报酬率为-100%,则该产品开发方案的预期投资报酬率为()。

CA.18%B.20%C.12%D.40%9、资金时间价值的利息率是()。

CA. 银行同期贷款利率B. 银行同期存款利率C. 没有风险和没有通货膨胀条件下社会资金平均利润率D. 加权资本成本率10、银行利率为10%时,一项6年后付款800元的购货,若按单利计息,相当于第一年初一次现金支付的购价为()元。

BA.451.6B.500C.800D.480 11、对于多方案择优,决策者的行动准则应是()。

DA.选择高收益项目B.选择高风险高收益项目C.选择低风险低收益项目D.权衡期望收益与风险,而且还要视决策者对风险的态度而定12、衡量上市公司盈利能力最重要的财务指标是()BA.净利率 B.每股收益 C.每股净资产 D.市净率13、下列评价指标中,未考虑货币时间价值的是( )CA.净现值B.内部收益率C.获利指数D.回收期14、当某独立投资方案的净现值大于0时,则内部收益率()DA.一定大于0B.一定小于0C.小于设定贴现率D.大于设定贴现率15、运用内部收益率进行独立方案财务可行性评价的标准是()CA.内部收益率大于0B.内部收益率大于1C.内部收益率大于投资者要求的最低收益率D.内部收益率大于投资利润率16、如果公司的现金超过其投资机会所需要的现金,但又没有足够的盈利性机会可以使用这笔现金,在这种情况下,公司可能( )BA.发放股票股利B.回购股票C.进行股票分割D.进行股票反分割17、要想获得减税效应,应采用低股利支付率,这种观点是( )CA.股利政策无关论B.“在手之鸟”理论C.差别税收理论D.统一税收理论18、由于股利比资本利得具有相对的稳定性,因此公司应维持较高的股利支付率,这种观点属于( )BA.股利政策无关论B.“在手之鸟”理论C.差别税收理论D.差别收入理论19、采用剩余股利政策的理由是( )AA.为了保持理想的资本结构,使加权平均资本成本最低B.有利于树立公司良好的形象,稳定股票价格C.能使股利与公司盈余亲密结合D.能使公司具有较大的灵活性二、多选1、公司理财的内容包括()。

公司金融学习题精选

1Which one of following is the rate at which a stock's price is expected to appreciate?A、current yieldB、total returnC、dividend yieldD、capital gains yieldE、coupon rate正确答案:D2Which one of the following functions should be the responsibility of the controller rather than the treasurer?A、daily cash depositB、income tax returnsC、equipment purchase analysisD、customer credit approvalE、payment to a vendor正确答案:B3Which one of the following best describes the concept of erosion?A、expenses that have already been incurred and cannot be recoveredB、change in net working capital related to implementing a new projectC、the cash flows of a new project that come at the expense of a firm's existing cash flowsD、the alternative that is forfeited when a fixed asset is utilized by a projectE、the differences in a firm's cash flows with and without a particular project正确答案:C4Which one of the following statements correctly states a relationship?A、Time and future values are inversely related, all else held constant.B、Interest rates and time are positively related, all else held constant.C、An increase in the discount rate increases the present value, given positive rates.D、An increase in time increases the future value given a zero rate of interest.E、Time and present value are inversely related, all else held constant.正确答案:E5Which one of the following best illustrates erosion as it relates to a hot dog stand located on the beach?A、providing both ketchup and mustard for its customer's useB、repairing the roof of the hot dog stand because of water damageC、selling fewer hot dogs because hamburgers were added to the menuD、offering French fries but not onion ringsE、losing sales due to bad weather正确答案:C6By definition, which one of the following must equal zero at the accounting break-even point?A、net present valueB、internal rate of returnC、contribution marginD、net incomeE、operating cash flow正确答案:D7Which of the following should be included in the analysis of a new product? I. money already spent for research and development of the new product II. reduction in sales for a current product once the new product is introduced III. increase in accounts receivable needed to finance sales of the new product IV. market value of a machine owned by the firm which will be used to produce the new product.A、I and III onlyB、II and IV onlyC、I, II, and III onlyD、II, III, and IV onlyE、I, II, III, and IV正确答案:D8Spencer Tools would like to offer a special product to its best customers. However, the firm wants to limit its maximum potential loss on this product to the firm's initial investment in the project. The fixed costs are estimated at $21,000, the depreciation expense is $11,000, and the contribution margin per unit is $12.50. What is the minimum number of units the firm should pre-sell to ensure its potential loss does not exceed the desired level?A、1,220 unitsB、1,680 unitsC、2,215 unitsD、2,560 unitsE、2,750 units正确答案:B9The specified date on which the principal amount of a bond is payable is referred to as which one of the following?A、coupon dateB、yield dateC、maturityD、dirty dateE、clean date正确答案:C10What is the effective annual rate if a bank charges you 8.25 percent compounded quarterly?A、8.32 percentB、8.38 percentC、8.42 percentD、8.51 percentE、8.61 percent正确答案:D11Miller Brothers Hardware paid an annual dividend of $0.95 per share last month. Today, the company announced that future dividends will be increasing by 2.6 percent annually. If you require a 13 percent rate of return, how much are you willing to pay to purchase one share of this stock today?A、$9.23B、$9.37C、$9.67D、$9.72E、$9.88正确答案:B12The current dividend yield on Clayton's Metals common stock is 3.2 percent. The company just paid a $1.48 annual dividend and announced plans to pay $1.54 next year. The dividend growth rate is expected to remain constant at the current level. What is the required rate of return on this stock?A、7.25 percentB、7.82 percentC、8.08 percentD、8.39 percentE、8.75 percent正确答案:A13Which one of the following is an example of a sunk cost?A、$1,500 of lost sales because an item was out of stockB、$1,200 paid to repair a machine last yearC、$20,000 project that must be forfeited if another project is acceptedD、$4,500 reduction in current shoe sales if a store commences selling sandalsE、$1,800 increase in comic book sales if a store commences selling puzzles正确答案:B14Which term relates to the cash flow which results from a firm's ongoing, normal business activities?A、operating cash flowB、capital spendingC、net working capitalD、cash flow from assetsE、cash flow to creditors正确答案:A15Textile Mills borrows money at a rate of 13.5 percent. This interest rate is referred to as the:A、compound rate.B、current yield.C、cost of debt.D、capital gains yield.E、cost of capital.正确答案:C16A firm's overall cost of equity is:A、is generally less that the firm's WACC given a leveraged firm.B、unaffected by changes in the market risk premium.C、highly dependent upon the growth rate and risk level of the firm.D、generally less than the firm's aftertax cost of debt.E、inversely related to changes in the firm's tax rate.正确答案:C17If a firm accepts Project A it will not be feasible to also accept Project B because bothprojects would require the simultaneous and exclusive use of the same piece of machinery. These projects are considered to be:A、independent.B、interdependent.C、mutually exclusive.D、economically scaled.E、operationally distinct.正确答案:C18Which one of the following accurately defines a perpetuity?A、a limited number of equal payments paid in even time incrementsB、payments of equal amounts that are paid irregularly but indefinitelyC、varying amounts that are paid at even intervals foreverD、unending equal payments paid at equal time intervalsE、unending equal payments paid at either equal or unequal time intervals正确答案:D19The cost of preferred stock:A、is equal to the dividend yield.B、is equal to the yield to maturity.C、is highly dependent on the dividend growth rate.D、is independent of the stock's price.E、decreases when tax rates increase.正确答案:A20Southern Tours is considering acquiring Holiday Vacations. Management believes Holiday Vacations can generate cash flows of $187,000, $220,000, and $245,000 over the next three years, respectively. After that time, they feel the business will be worthless. Southern Tours has determined that a 13.5 percent rate of return is applicable to this potential acquisition. What is Southern Tours willing to pay today to acquire Holiday Vacations?A、$503,098B、$538,615C、$545,920D、$601,226E、$638,407正确答案:A21The percentage of the next dollar you earn that must be paid in taxes is referred to as the _____ tax rate.A、meanB、residualC、totalD、averageE、marginal正确答案:E22All of the following are related to a proposed project. Which of these should be included in the cash flow at time zero? I. purchase of $1,400 of parts inventory needed to support the project II. loan of $125,000 used to finance the project III. depreciation tax shield of $1,100 IV.$6,500 of equipment needed to commence the project.A、I and II onlyB、I and IV onlyC、II and IV onlyD、I, II, and IV onlyE、I, II, III, and IV正确答案:B23Interest earned on both the initial principal and the interest reinvested from prior periods is called:A、free interest.B、dual interest.C、simple interest.D、interest on interest.E、compound interest.正确答案:E24The cash flow related to interest payments less any net new borrowing is called the:A、operating cash flow.B、capital spending cash flow.C、net working capital.D、cash flow from assets.E、cash flow to creditors.正确答案:E25Which one of the following is classified as an intangible fixed asset?A、accounts receivableB、production equipmentC、buildingD、trademarkE、inventory正确答案:D26The equivalent annual cost method is useful in determining:A、which one of two machines to purchase if the machines are mutually exclusive, have differing lives, and are a one-time purchase.B、the tax shield benefits of depreciation given the purchase of new assets for a project.C、the operating cash flows of a cost-cutting project.D、which one of two investments to accept when the investments have different required rates of return.E、which one of two machines should be purchased when the machines are mutually exclusive, have different machine lives, and will be replaced once they are worn out.正确答案:E27An analysis of the change in a project's NPV when a single variable is changed is called _____ analysis.A、forecastingB、scenarioC、sensitivityD、simulationE、break-even正确答案:C28The common stock of Textile Mills pays an annual dividend of $1.65 a share. The company has promised to maintain a constant dividend even though economic times are tough. How much are you willing to pay for one share of this stock if you want to earn a 12 percent annual return?A、$13.75B、$14.01C、$14.56D、$14.79E、$15.23正确答案:A29Noncash items refer to:A、accrued expensesB、inventory items purchased using creditC、the ownership of intangible assets such as patentsD、expenses which do not directly affect cash flowsE、sales which are made using store credit正确答案:D30Which one of the following is an agency cost?A、accepting an investment opportunity that will add value to the firmB、increasing the quarterly dividendC、investing in a new project that creates firm valueD、hiring outside accountants to audit the company's financial statementsE、closing a division of the firm that is operating at a loss正确答案:D31Phil can afford $200 a month for 5 years for a car loan. If the interest rate is 7.5 percent, how much can he afford to borrow to purchase a car?A、$8,750.00B、$9,348.03C、$9,981.06D、$10,266.67E、$10,400.00正确答案:C32The internal rate of return is defined as the:A、maximum rate of return a firm expects to earn on a project.B、rate of return a project will generate if the project in financed solely with internal funds.C、discount rate that equates the net cash inflows of a project to zero.D、discount rate which causes the net present value of a project to equal zero.E、discount rate that causes the profitability index for a project to equal zero.正确答案:D33Which one of the following represents the most liquid asset?A、$100 account receivable that is discounted and collected for $96 todayB、$100 of inventory which is sold today on credit for $103C、$100 of inventory which is discounted and sold for $97 cash todayD、$100 of inventory that is sold today for $100 cashE、$100 accounts receivable that will be collected in full next week正确答案:D34Which one of the following states that a firm's cost of equity capital is directly and proportionally related to the firm's capital structure?A、Capital Asset Pricing ModelB、M & M Proposition IC、M & M Proposition IID、Law of One PriceE、Efficient Markets Hypothesis正确答案:C35Which one of the following states that the value of a firm is unrelated to the firm's capital structure?A、Capital Asset Pricing ModelB、M & M Proposition IC、M & M Proposition IID、Law of One PriceE、Efficient Markets Hypothesis正确答案:B36You are the beneficiary of a life insurance policy. The insurance company informs you that you have two options for receiving the insurance proceeds. You can receive a lump sum of $200,000 today or receive payments of $1,400 a month for 20 years. You can earn 6 percent on your money. Which option should you take and why?A、You should accept the payments because they are worth $209,414 to you today.B、You should accept the payments because they are worth $247,800 to you today.C、You should accept the payments because they are worth $336,000 to you today.D、You should accept the $200,000 because the payments are only worth $189,311 to you today.E、You should accept the $200,000 because the payments are only worth $195,413 to you today.正确答案:E37Winston Co. has a dividend-paying stock with a total return for the year of -6.5 percent. Which one of the following must be true?A、The dividend must be constant.B、The stock has a negative capital gains yield.C、The dividend yield must be zero.D、The required rate of return for this stock increased over the year.E、The firm is experiencing supernormal growth.正确答案:B38The common stock of Auto Deliveries sells for $28.16 a share. The stock is expected to pay $1.35 per share next year when the annual dividend is distributed. The firm has established a pattern of increasing its dividends by 3 percent annually and expects to continue doing so.What is the market rate of return on this stock?A、7.42 percentB、7.79 percentC、19.67 percentD、20.14 percentE、20.86 percent正确答案:B39Terry is calculating the present value of a bonus he will receive next year. The process he is using is called:A、growth analysis.B、discounting.C、accumulating.D、compounding.E、reducing.正确答案:B40You are considering a project that you believe is quite risky. To reduce any potentially harmful results from accepting this project, you could:A、lower the degree of operating leverage.B、lower the contribution margin per unit.C、increase the initial cash outlay.D、increase the fixed costs per unit while lowering the contribution margin per unit.E、lower the operating cash flow of the project.正确答案:A41Steve just computed the present value of a $10,000 bonus he will receive in the future. The interest rate he used in this process is referred to as which one of the following?A、current yieldB、effective rateC、compound rateD、simple rateE、discount rate正确答案:E42The pre-tax cost of debt:A、is based on the current yield to maturity of the firm's outstanding bonds.B、is equal to the coupon rate on the latest bonds issued by a firm.C、is equivalent to the average current yield on all of a firm's outstanding bonds.D、is based on the original yield to maturity on the latest bonds issued by a firm.E、has to be estimated as it cannot be directly observed in the market.正确答案:A43Andy deposited $3,000 this morning into an account that pays 5 percent interest, compounded annually. Barb also deposited $3,000 this morning into an account that pays 5 percent interest, compounded annually. Andy will withdraw his interest earnings and spend it as soon as possible. Barb will reinvest her interest earnings into her account. Given this, which one of the following statements is true?A、Barb will earn more interest the first year than Andy will.B、Andy will earn more interest in year three than Barb will.C、Barb will earn interest on interest.D、After five years, Andy and Barb will both have earned the same amount of interest.E、Andy will earn compound interest.正确答案:C44The Buck Store is considering a project that will require additional inventory of $216,000 and will increase accounts payable by $181,000. Accounts receivable are currently $525,000 and are expected to increase by 9 percent if this project is accepted. What is the project's initial cash flow for net working capital?A、-82250B、-12250C、12250D、36250E、44250正确答案:A45The operating cash flow of a cost cutting project:A、is equal to the depreciation tax shield.B、is equal to zero because there is no incremental sales.C、can only be analyzed by projecting the sales and costs for a firm's entire operations.D、includes any changes that occur in the current accounts.E、can be positive even though there are no sales.正确答案:E46The annual annuity stream of payments that has the same present value as a project's costs is referred to as which one of the following?A、yearly incremental costsB、sunk costsC、opportunity costsD、erosion costE、equivalent annual cost正确答案:E47M & M Proposition I with no tax supports the argument that:A、business risk determines the return on assets.B、the cost of equity rises as leverage rises.C、the debt-equity ratio of a firm is completely irrelevant.D、a firm should borrow money to the point where the tax benefit from debt is equal to the cost of the increased probability of financial distress.E、homemade leverage is irrelevant.正确答案:C48At 8 percent interest, how long would it take to quadruple your money?A、16.55 yearsB、16.64 yearsC、17.09 yearsD、18.01 yearsE、18.56 year正确答案:D49The process of determining the present value of future cash flows in order to know their worth today is called which one of the following?A、compound interest valuationB、interest on interest computationC、discounted cash flow valuationD、present value interest factoringE、complex factoring正确答案:C50Green Roof Inns is preparing a bond offering with a 6 percent, semiannual coupon and a face value of $1,000. The bonds will be repaid in 10 years and will be sold at par. Given this, which one of the following statements is correct?A、The bonds will become discount bonds if the market rate of interest declines.B、The bonds will pay 10 interest payments of $60 each.C、The bonds will sell at a premium if the market rate is 5.5 percent.D、The bonds will initially sell for $1,030 each.E、The final payment will be in the amount of $1,060.正确答案:C11【单选题】Which one of the following terms is defined as the management of a firm's long-term investments?A、working capital managementB、financial allocationC、agency cost analysisD、capital budgetingE、capital structure正确答案:D2【单选题】Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A、working capital managementB、cash managementC、cost analysisD、capital budgetingE、capital structure正确答案:E3【单选题】Which one of the following is defined as a firm's short-term assets and its short-term liabilities?A、working capitalB、debtC、investment capitalD、net capitalE、capital structure正确答案:A4【单选题】Which of the following questions are addressed by financial managers?I. How should a product be marketed?II. Should customers be given 30 or 45 days to pay for their credit purchasesIII.Should the firm borrow more money?IV. Should the firm acquire new equipment?A、I, II, III, and IVB、I and IV onlyC、II and III onlyD、II, III, and IV onlyE、I, II, and III only正确答案:D5【单选题】Which one of the following functions should be the responsibility of the controller rather than the treasurer?A、daily cash depositB、income tax returnsC、equipment purchase analysisD、customer credit approvalE、payment to a vendor正确答案:B6【单选题】The controller of a corporation generally reports directly to the:A、board of directors.B、chairman of the board.C、chief executive officer.D、president.E、vice president of finance.正确答案:E7【单选题】Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A、The vice president of finance reports to the chairman of the board.B、The chief executive officer reports to president.C、The controller reports to the president.D、The treasurer reports to the vice president of finance.E、The chief operations officer reports to the vice president of production.正确答案:D8【单选题】Which one of the following is a capital budgeting decision?A、determining how many shares of stock to issueB、deciding whether or not to purchase a new machine for the production lineC、deciding how to refinance a debt issue that is maturingD、determining how much inventory to keep on handE、determining how much money should be kept in the checking account正确答案:B9【单选题】Which one of the following is a capital structure decision?A、determining which one of two projects to acceptB、determining how to allocate investment funds to multiple projectsC、determining the amount of funds needed to finance customer purchases of a new productD、determining how much debt should be assumed to fund a projectE、determining how much inventory will be needed to support a project正确答案:D10【单选题】The decision to issue additional shares of stock is an example of which one of the following?A、working capital managementB、net working capital decisionC、capital budgetingD、controller's dutiesE、capital structure decision正确答案:E1【单选题】Which one of the following business types is best suited to raising large amounts of capital?A、sole proprietorshipB、limited liability companyC、corporationD、general partnershipE、limited partnership正确答案:C2【单选题】A business created as a distinct legal entity and treated as a legal "person" is called a:A、sole proprietorship.B、general partnership.C、limited partnership.D、unlimited liability company.E、corporation.正确答案:E3【单选题】A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A、generally partner.B、sole proprietor.C、limited partner.D、corporate shareholder.E、zero partner.正确答案:C4【单选题】A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A、corporation.B、sole proprietorship.C、general partnership.D、limited partnership.E、limited liability company.正确答案:C5【单选题】A business owned by a solitary individual who has unlimited liability for its debt is called a:A、corporation.B、sole proprietorship.C、general partnership.D、limited partnership.E、limited liability company.正确答案:B1【单选题】Which one of the following best states the primary goal of financial management?A、maximize current dividends per shareB、maximize the current value per shareC、minimize operational costs while maximizing firm efficiencyD、maintain steady growth while increasing current profits正确答案:B1【单选题】Which one of the following is an agency cost?A、accepting an investment opportunity that will add value to the firmB、increasing the quarterly dividendC、investing in a new project that creates firm valueD、hiring outside accountants to audit the company's financial statementsE、closing a division of the firm that is operating at a loss正确答案:D2【单选题】Which one of the following is least likely to be an agency problem?A、increasing the size of a firmB、concentrating on maximizing current profitsC、closing a division with net lossesD、increasing the market value of the firm's sharesE、obtaining a patent for a new product正确答案:D3【单选题】Which one of the following terms is defined as a conflict of interest between the corporate shareholders and the corporate managers?A、articles of incorporationB、corporate breakdownC、agency problemD、bylawsE、legal liability正确答案:C21【单选题】Which one of the following is the financial statement that shows the accounting value of a firm's equity as of a particular date?A、income statementB、creditor's statementC、balance sheetD、statement of cash flowsE、dividend statement正确答案:C2【单选题】Net working capital is defined as:A、total liabilities minus shareholders' equityB、current liabilities minus shareholders' equityC、fixed assets minus long-term liabilitiesD、total assets minus total liabilitiesE、current assets minus current liabilities正确答案:E3【单选题】The common set of standards and procedures by which audited financial statements are prepared is known as the:A、matching principleB、cash flow identityC、Generally Accepted Accounting PrinciplesD、Financial Accounting Reporting PrinciplesE、Standard Accounting Value Guidelines正确答案:C4【单选题】Which one of the following is classified as an intangible fixed asset?A、accounts receivableB、production equipmentC、buildingD、trademarkE、inventory正确答案:D5【单选题】Which of the following are current assets?I.patentII.inventoryIII.accounts payableIV. cashA、I and III onlyB、II and IV onlyC、I, II, and IV onlyD、I, II and IV onlyE、II, III, and IV only正确答案:B6【单选题】Which one of the following is included in a firm's market value but yet is excluded from the firm's accounting value?A、real estate investmentB、good reputation of the companyC、equipment owned by the firmD、money due from a customerE、an item held by the firm for future sale正确答案:B7【单选题】Which of the following are included in current liabilities?I,note payable to a supplier in eight monthsII, amount due from a customer next monthIII,account payable to a supplier that is due next weekIV, loan payable to the bank in fourteen monthsA、I and III onlyB、II and III onlyC、I, II, and III onlyD、I, III, and IV onlyE、I, II, III, and IV正确答案:A8【单选题】Which one of the following will increase the value of a firm's net working capital?A、using cash to pay a supplierB、depreciating an assetC、collecting an accounts receivableD、purchasing inventory on creditE、selling inventory at a profit正确答案:E9【单选题】Which one of the following accounts is the most liquid?A、inventoryB、buildingC、accounts receivableD、equipmentE、land正确答案:C10【单选题】Which one of the following represents the most liquid asset?A、$100 account receivable that is discounted and collected for $96 todayB、$100 of inventory which is sold today on credit for $103C、$100 of inventory which is discounted and sold for $97 cash todayD、$100 of inventory that is sold today for $100 cashE、$100 accounts receivable that will be collected in full next week正确答案:D1【单选题】Shareholders' equity:A、increases in value anytime total assets increasesB、is equal to total assets plus total liabilitiesC、decreases whenever new shares of stock are issuedD、includes long-term debt, preferred stock, and common stockE、represents the residual value of a firm正确答案:E2【单选题】The higher the degree of financial leverage employed by a firm, the:A、higher the probability that the firm will encounter financial distressB、lower the amount of debt incurredC、less debt a firm has per dollar of total assetsD、higher the number of outstanding shares of stockE、lower the balance in accounts payable正确答案:A3【单选题】The book value of a firm is:A、equivalent to the firm's market value provided that the firm has some fixed assetsB、based on historical costC、generally greater than the market value when fixed assets are includedD、more of a financial than an accounting valuationE、adjusted to the market value whenever the market value exceeds the stated book value 正确答案:B4【单选题】Which of the following is (are) included in the market value of a firm but are excluded from the firm's book value?I.value of management skillsII .value of a copyrightIII. value of the firm's reputationIv.alue of employee's experienceA、I onlyB、II onlyC、III and IV onlyD、I, II, and III onlyE、I, III, and IV only正确答案:E5【单选题】You recently purchased a grocery store、At the time of the purchase, the store's market value equaled its book value、The purchase included the building, the fixtures, and the inventory、Which one of the following is most apt to cause the market value of this store to be lower than the book value?A、a sudden and unexpected increase in inflationB、the replacement of old inventory items with more desirable productsC、improvements to the surrounding area by other store ownersD、construction of a new restricted access highway located between the store and the surrounding residential areasE、addition of a stop light at the main entrance to the store's parking lot正确答案:D6【单选题】A firm has $520 in inventory, $1,860 in fixed assets, $190 in accounts receivables, $210 in accounts payable, and $70 in cash、What is the amount of the current assets?A、$710B、$780C、$990D、$2,430E、$2,640正确答案:B7【单选题】A firm has common stock of $6,200, paid-in surplus of $9,100, total liabilities of $8,400, current assets of $5,900, and fixed assets of $21,200,What is the amount of the shareholders' equity?A、$6,900B、$15,300C、$18,700D、$23,700。

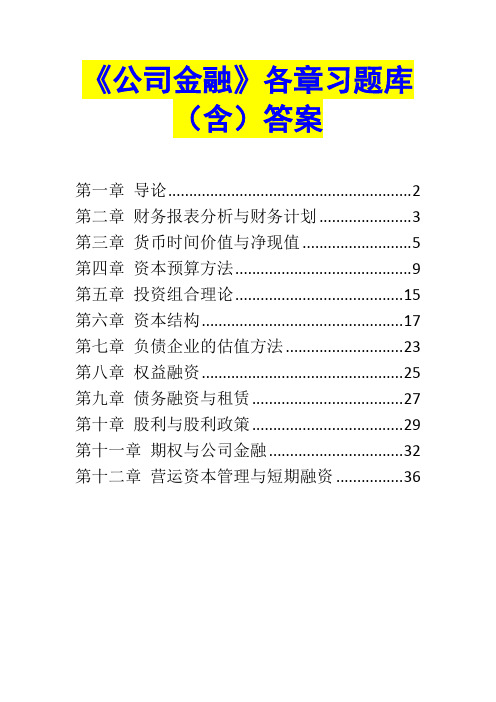

《公司金融》习题库(含)答案

《公司金融》各章习题库(含)答案第一章导论 (2)第二章财务报表分析与财务计划 (3)第三章货币时间价值与净现值 (5)第四章资本预算方法 (9)第五章投资组合理论 (15)第六章资本结构 (17)第七章负债企业的估值方法 (23)第八章权益融资 (25)第九章债务融资与租赁 (27)第十章股利与股利政策 (29)第十一章期权与公司金融 (32)第十二章营运资本管理与短期融资 (36)第一章导论1.参考教材表1-1。

2.治理即公司治理(corporate governance),它解决了企业与股东、债权人等利益相关者之间及其相互之间的利益关系。

融资(financing),是公司金融学三大研究问题的核心,它解决了公司如何选择不同的融资形式并形成一定的资本结构,实现企业股东价值最大化。

估值(valuation),即企业对投资项目的评估,也包括对企业价值的评估,它解决了企业的融资如何进行分配即投资的问题。

只有公司治理规范的公司,其投资、融资决策才是基于股东价值最大化的正确决策。

这三个问题是相互联系、紧密相关的,公司金融学的其他问题都可以归纳入这三者的范畴之中。

3.对于上市公司而言,股东价值最大化观点隐含着一个前提:即股票市场充分有效,股票价格总能迅速准确地反映公司的价值。

于是,公司的经营目标就可以直接量化为使股票的市场价格最大化。

若股票价格受到企业经营状况以外的多种因素影响,那么价值确认体系就存在偏差。

因此,以股东价值最大化为目标必须克服许多公司不可控的影响股价的因素。

第二章财务报表分析与财务计划1.资产负债表;利润表;所有者权益变动表;现金流量表。

资产= 负债+ 所有者权益2.我国的利润表采用“多步式”格式,分为营业收入、营业利润、利润总额、净利润、每股收益、其他综合收益和综合收益总额等七个盈利项目。

3.直接法是按现金收入和支出的主要类别直接反映企业经营活动产生的现金流量,一般以利润表中的营业收入为起算点,调整与经营活动有关项目的增减变化,然后计算出经营活动现金流量。

公司金融期末考试题

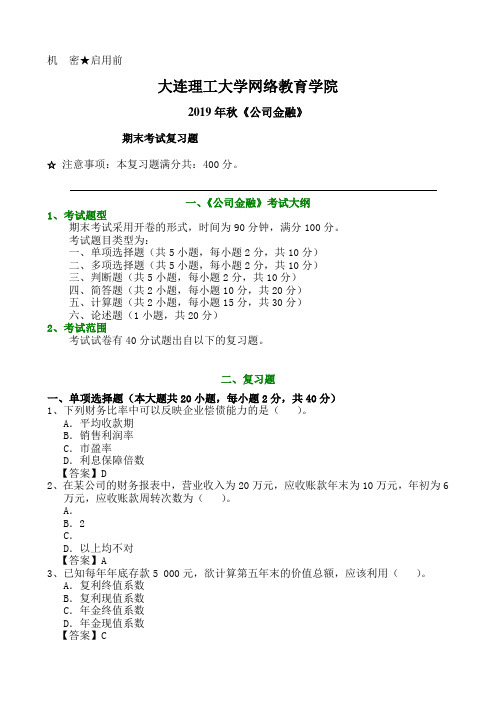

机密★启用前大连理工大学网络教育学院2019年秋《公司金融》期末考试复习题☆注意事项:本复习题满分共:400分。

一、《公司金融》考试大纲1、考试题型期末考试采用开卷的形式,时间为90分钟,满分100分。

考试题目类型为:一、单项选择题(共5小题,每小题2分,共10分)二、多项选择题(共5小题,每小题2分,共10分)三、判断题(共5小题,每小题2分,共10分)四、简答题(共2小题,每小题10分,共20分)五、计算题(共2小题,每小题15分,共30分)六、论述题(1小题,共20分)2、考试范围考试试卷有40分试题出自以下的复习题。

二、复习题一、单项选择题(本大题共20小题,每小题2分,共40分)1、下列财务比率中可以反映企业偿债能力的是()。

A.平均收款期B.销售利润率C.市盈率D.利息保障倍数【答案】D2、在某公司的财务报表中,营业收入为20万元,应收账款年末为10万元,年初为6万元,应收账款周转次数为()。

A.B.2C.D.以上均不对【答案】A3、已知每年年底存款5 000元,欲计算第五年末的价值总额,应该利用()。

A.复利终值系数B.复利现值系数C.年金终值系数D.年金现值系数【答案】C4、第一次收付发生在第二期或以后各期的年金被称为()。

A.普通年金B.预付年金C.递延年金D.永续年金【答案】C5、某企业拟发行面值为100元,票面利率为10%,期限为3年的债券,当市场利率为10%时,该债券的发行价格为()。

A.80元B.90元C.100元D.110元【答案】C6、下列哪项属于普通股筹资的优点()。

A.筹资成本低B.不稀释公司的控制权C.发行新股时,会增加每股净收益,引起股价上升D.发行普通股形成自有资金可增强公司举债能力【答案】D7、某钢铁集团并购某石油公司,这种并购方式属于()。

A.横向并购B.纵向并购C.混合并购D.向前并购【答案】C8、年度预算编制的关键和起点是()。

A.生产预算B.销售预算C.现金预算D.直接材料预算【答案】B9、某投资方案,当贴现率为16%时,其净现值为38万元;当贴现率为18%时,其净现值为-22万元。

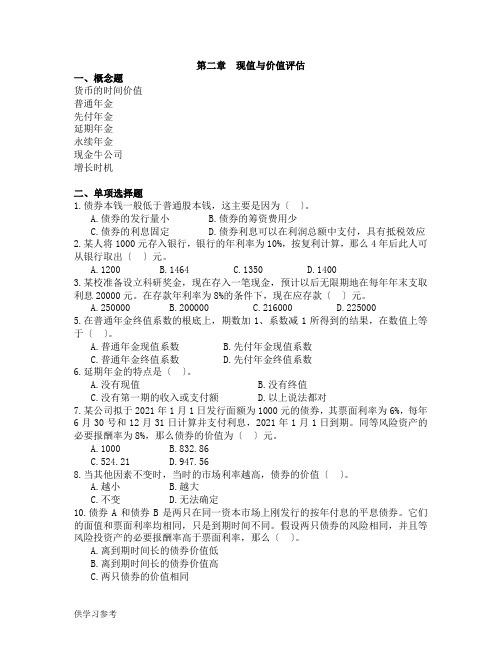

公司金融-第二章--现值与价值评估-习题

第二章现值与价值评估一、概念题货币的时间价值普通年金先付年金延期年金永续年金现金牛公司增长时机二、单项选择题1.债券本钱一般低于普通股本钱,这主要是因为〔〕。

A.债券的发行量小B.债券的筹资费用少C.债券的利息固定D.债券利息可以在利润总额中支付,具有抵税效应2.某人将1000元存入银行,银行的年利率为10%,按复利计算,那么4年后此人可从银行取出〔〕元。

A.1200B.1464C.1350D.14003.某校准备设立科研奖金,现在存入一笔现金,预计以后无限期地在每年年末支取利息20000元。

在存款年利率为8%的条件下,现在应存款〔〕元。

A.250000B.200000C.216000D.2250005.在普通年金终值系数的根底上,期数加1、系数减1所得到的结果,在数值上等于〔〕。

A.普通年金现值系数B.先付年金现值系数C.普通年金终值系数D.先付年金终值系数6.延期年金的特点是〔〕。

A.没有现值B.没有终值C.没有第一期的收入或支付额D.以上说法都对7.某公司拟于2021年1月1日发行面额为1000元的债券,其票面利率为6%,每年6月30号和12月31日计算并支付利息,2021年1月1日到期。

同等风险资产的必要报酬率为8%,那么债券的价值为〔〕元。

A.1000B.832.86C.524.21D.947.568.当其他因素不变时,当时的市场利率越高,债券的价值〔〕。

A.越小B.越大C.不变D.无法确定10.债券A和债券B是两只在同一资本市场上刚发行的按年付息的平息债券。

它们的面值和票面利率均相同,只是到期时间不同。

假设两只债券的风险相同,并且等风险投资产的必要报酬率高于票面利率,那么〔〕。

A.离到期时间长的债券价值低B.离到期时间长的债券价值高C.两只债券的价值相同D.两只债券的价值不同,但不能判断其上下11.某公司最近一年向股东分配股利15万元,假设未来股利不变,股东要求的最低报酬率为10%,那么股票的价值为〔〕万元。