DrGodden on Enterprise Risk Management for Auto Supply Industry

Enterprise Risk Management 企业风险管理

NBIMC440 rue King Street, Tour York TowerFredericton, NB E3B 5H8Enterprise Risk Management FrameworkAugust 2007Updated: February 2008ContentsI.OverviewII.Risk Management PhilosophyIII.General Risk Management Activities IV.Types of Riska.Strategic Riskb.Investment Riskc.Operational RiskV.ConclusionsAppendix A: Risk Governance Structure Appendix B: Risk Management OutlineI.OverviewRisk is an inherent part of investing and therefore risk management is a very important component of our business and in reaching our primary goal to“…assist the plan sponsor in meeting the pension promise to itsmembers.”In order to meet this pension promise NBIMC has based its investment policies on the following two objectives:i.Maximize investment returns, andii.Protect accumulated assetsThe NBIMC Board of Directors, as outlined in section 2.6 of their Terms of Reference, is responsible for understanding the principal risk facing the corporation and the systems that management has put in place to mitigate and manage those risks as outlined in this document.While each Board Committee supports the Board’s risk management oversight in areas related to their specific mandate, the Audit Committee is specifically assigned the task of assisting the Board in its oversight of risk management.Our enterprise risk management framework has been put in place to integrate strong corporate oversight with a series of well-defined independent risk management systems and processes within the various NBIMC business teams. The process involves the participation of the NBIMC Board, management, and external service providers. An outline of the risk governance structure is provided in Appendix A.The following document presents NBIMC’s philosophy and management of risk by identifying:•the types of risks faced by the corporation in its normal business operations and, •what parties are accountable for monitoring each risk type, while also outlining the means and timing through which we seek to measure and manage these risks.An overall risk review is provided through the President’s Report at each quarterly Board Meeting, and a more detailed review of this Risk Framework and related issues is conducted annually by the Audit Committee and subsequently the Board.The corporation believes that this system will significantly contribute to providing the highest long-term risk adjusted returns possible to meet the actuarial requirements of our funds under management.II. Risk Management PhilosophyNBIMC bases the core of its investment decision making processes on the following Investment Beliefs:i.NBIMC is a relatively low risk investment manager when compared to itspeers.ii.Real Return Bonds, because of their long-term inflation-linked characteristics, are considered to be an excellent match for our pension liabilities.iii.New asset classes are introduced incrementally in order to progressively gain experience and to minimize transition costs.iv.The establishment of the appropriate asset mix for each of the funds under management is heavily influenced by both the actuarial profile and fundingstatus of each plan.v.NBIMC believes that market inefficiencies present opportunities to add value through active management.Given the importance that NBIMC places on comprehensively managing risks, each of the first four core beliefs of the corporation concern (either directly or indirectly) the management or reduction of risk.In general, NBIMC faces three major categories of risk related to its business activities; Strategic Risk, Investment Risk, and Operational Risk. Risk management is a primary responsibility of the Board of Directors and is guided by a specific Board approved Risk Management Policy. Oversight of specific risks may be delegated to one of the Board Committees as outlined in their Committee Terms of Reference.Board of Directors Risk Management ProcessNBIMC’s risk management process provides a general framework through which the corporation carries out its risk management activities, and is intended to:i.Ensure that NBIMC takes a proactive and systematic approach to identifyingand managing the risks inherent in its operations and environment ii.Ensure that there is agreement among NBIMC stakeholders (Board, senior management, and staff) as to its risk management priorities at any point intimeiii.Ensure appropriate involvement by the Board and senior management in setting the above prioritiesIII. General Risk Management ActivitiesIn general, risk management is a circular process, where potential risks are identified, methods to measure and manage these risks are designed and implemented, and systems are put in place to monitor the effectiveness of the original risk management systems, thus allowing for the identification of new potential risks.Risk management at NBIMC is based on several principles and assumptions designed to ensure that the Corporation takes a “proactive and systematic” approach to managing risk. Specifically, the Corporation believes through its Risk Management Policy that:i.Risk management is an input into, rather than a substitute for, the businessplanning process.ii.Establishing a risk framework is a necessary prerequisite to meaningful discussions on risk by NBIMC fiduciaries.iii.Due to its detailed understanding of the operations of the Corporation, management should play a leading role in identifying the primary risks of thecorporation. The role of the Board is to provide input into, and ultimatelyapprove, the risk management priorities identified by management, and toensure that management then develops a business plan and budget foraddressing the risk priorities.iv.Risk should be defined broadly enough to encompass all major aspects of the Corporation, including such areas as Investments, Administration, HumanResources, and Technology.v.No risk framework can be expected to identify or address every conceivable risk. It is important, therefore, that once adopted, the risk managementframework be continually refined and updated to reflect new risks once theyare identified.vi.At any point in time, the risks that can be identified will exceed the Corporation’s capacity to address them. Resources must therefore be focusedon those risks that are deemed to be the most critical.NBIMC manages risk through a number of processes: investment risk is measured and managed within various systems from both a policy perspective as well as an active management/relative return perspective, while operational risks are managed through the activities of various committees and policies. The following section provides details on the specific functioning of the risk systems, controls and responsibilities, with an emphasis on explaining the rationale for their existence, the techniques by which they operate, and the information they provide to senior management and the Board to aid in risk management decision making.IV. Types of RiskNBIMC has identified three main categories of risk related to its business activities. Within these sections we have also subdivided a number of specific risk areas in which we have assigned specific monitoring and control responsibilities and set out the specific measures used to achieve them.The following chart summarizes each of the three main risk categories and the respective specific risk elements.Strategic Risk Investment Risk Operational Risk Governance Investment Legal, Regulatory, and PolicyComplianceStrategyBusinessOperationsFiduciaryTechnologyBusinessEnvironmentHuman ResourcesReputationalExternal CommunicationThe following section outlines a more detailed description of each risk category and specific risk element that is reviewed by the corporation. A summary of this information is provided in a table contained in Appendix B.Category A: Strategic RiskStrategic risk is the risk of not achieving the Objects and Purposes of the Corporation (or mission) as outlined in the New Brunswick Investment Management Corporation Act, within the parameters provided in the legislation. It is significantly related to many of the other shorter term risks faced by the organization but manifests itself in the long-term time frame under which pension investment management activities are managed. NBIMC subdivides Strategic Risk as follows:Governance riskThis risk comes about through potential improper governance structures (including delegation of authority) between directors, senior management, and staff, leading to improper decision making in the Corporation. Good governance processes thatoutline key responsibility and accountability areas is a key part of overall riskmanagement.ResponsibilityThe NBIMC Act and By-Laws outline the governance responsibilities of theCorporation as well as related reporting obligations.The Board of Directors have set out a series of Board Policies that must befollowed, of which first and foremost are the Investment Policies for each fundunder management. The Board and each Board Committee also have Terms ofReference that outline their respective responsibilities.NBIMC management has developed an extensive Administration Manual andInvestment Procedures Manual that outline specific operational responsibilitiesand authorities. All staff members also have position descriptions that outlinetheir specific responsibilities.MeasuresThe Governance Committee of the Board of Directors oversees and coordinatesthe governance responsibilities of the organization.The Board of Directors, and Board Committees, meets at least quarterly. TheCorporation is also scheduled to appear annually before the Crown Corporation’s Committee of the Legislature.Business strategy riskThe risk of not developing, executing, or monitoring the business activities of the corporation in order to achieve the mission of the Corporation.ResponsibilityThe Board of Directors and management participate in creating a five-yearstrategic plan for the organization and review it on an annual basis.Management develops an annual business plan that is reviewed with the Board of Directors near the inception of each fiscal year. Progress against the plan isreviewed by the Board periodically throughout the year, and in measuring overall performance at year-end.MeasuresQuarterly Board Meetings and annual Strategic Plan review sessions (Board &Management)Fiduciary riskThe risk that fiduciary responsibilities are not fully respected or executed by NBIMC on behalf of its investment management and trustee responsibilities.ResponsibilityThe Board of Directors acts in a fiduciary capacity and do not represent anyspecific constituency. Their focus is therefore solely on the best interest of thefunds under management The Board is responsible for approving governingPolicies and also a Code of Ethics and Business Conduct that governs the ethical affairs of the corporation. Management is responsible for setting outadministrative and procedural guidelines.MeasuresDirectors and employees annually acknowledge understanding and compliancewith the Code of Ethics and Business Conduct. Management assembles acorporate Administration Manual and an Investment Risk ManagementCommittee meet on an ad-hoc basis to consider changes to an InvestmentProcedure Manual.NBIMC also has set-out a clear segregation of duties between the investmentoperations activity and the accounting and performance measurement activities of the corporation.Business environment riskThe risk that NBIMC is not continuously anticipating, monitoring, understanding, or reacting to external changes to the business environment in which NBIMC operates.ResponsibilityManagement and staff are primarily responsible for keeping abreast of industrydevelopments through media reports, legislative pronouncements, and bothongoing peer and supplier communication.MeasuresThe Corporation is an active participant in a number of industry relatedassociations such as the Pension Investment Management Association of Canada(PIAC), and the Canadian Coalition for Good Governance (CCGG). Management also actively participates in a number of global industry conferences which notonly provide up-to-date information on emerging industry issues, but providegood networking opportunities with personnel from peer institutional investmentorganizations.A number of employees are also members of professional associations such as theCFA Institute, CA, CGA organizations etc.Reputational riskThe risk of damage to our reputation, image, or credibility as a prudent and effective investment manager due to internal or external factors.ResponsibilityThe Board and Government of New Brunswick (as key stakeholder) haveinstituted a number of oversight and audit relationships that provide third partyassurance to the corporation’s reputation.MeasuresThe Government, as plan sponsor, appoints an Actuary to review the fundingposition and investment assumptions for the Fund’s under management. TheAuditor General for the Province also has reviewed the corporation’s activitiesfrom time-to-time.The Board, through its Audit Committee, annually appoints both an External and Internal audit firm to review and advise on various corporate activities.External communication riskThe risk of not effectively communicating the governance structure, strategic plan, operational activities, and performance of the corporation to stakeholders.ResponsibilityThe Chairperson of the Board and the President are responsible for all officialCommunication activities.MeasuresThe NBIMC Act outlines specific communication requirements for theCorporation that include the provision of an annual budget, and submission of an annual report including an auditor’s report.The corporation has undertaken to provide a number of other communicationactivities that have been outlined in further detail in Appendix B.Category B: Investment RiskThe risk that investments are not made in accordance with NBIMC’s mission and do not achieve the long-term return on investments as required by the Plan Sponsor for the Funds under management.ResponsibilityThe Board of Directors is responsible for the Investment Policy of the Fundsunder management. This policy sets out the benchmark portfolio asset weights,permitted asset weight deviations from the benchmark, performance benchmarks, permissible investments, and performance evaluation metrics.Management is responsible for developing and managing the underlyinginvestment strategy and program that operates within the Board approvedguidelines. This program is outlined in an Investment Procedures Manual. AnInvestment Risk Management Committee, made up of representatives from both the investment and administration teams, review any changes to investmentstrategies before they are included in the Procedures Manual.There are a number of significant areas of investment related risk which are outlined in more detail in the section below:Asset-Liability Mismatch (ALM)Investments are made to support the pension obligations of each Fund. ALMrisk refers to the risk that the investment portfolio held for a particular fundwill be insufficient to meet the obligations set out by the specific pensionobligation.MeasuresEach fund undergoes an actuarial valuation, as determined by the PlanSponsor, at a minimum of every three years. The Board determines anappropriate asset mix that is believed to best meet the future pensionobligations of each fund. Funding status estimates are monitored by the Boardon a quarterly basis between valuation dates.Management assists the Board’s decision by undertaking an asset liabilitystudy which attempts to identify the most efficient mix of financial assets thatwill meet or exceed the Sponsor’s required funding rate with the least amountof risk. Management has also developed a Policy Asset Mix Capital-at-Risk(PAM CaR) process that estimates and monitors the risk between the actualasset mix and the pension liability estimate. This calculation estimates themaximum change in value of the funding position of the Fund that would beexpected at a 95 percent confidence level over a one year time period. Thereport is distributed weekly to the Board Chair and to members of theInvestment Risk Management Committee.Active ManagementActive risk, also known as relative return risk, is the risk that actualinvestment returns do not meet the pre-specified benchmark portfolio andresult in under-performance versus those that would have resulted frompassive management.MeasuresThe Board approved Investment Policies outline the expected return and valueadded objectives in excess of those achieved by a passive managementapproach.Management utilizes a risk budgeting approach to active management whichlinks the amount of active risk taken with the overall active return target.Management has also developed a Capital-at-Risk (CaR) process thatestimates and monitors the risk of the active value added investment activities conducted by the investment staff. This calculation estimates the maximumchange in value of the relative value added to the benchmark that would beexpected at a 95 percent confidence level over a one year time period. Thiscalculation is distributed weekly to the Board Chair and to members of theInvestment Risk Management Committee.Market RiskMarket risk is broadly defined as the risk of a change in the value at which an investment portfolio could be sold due to exposure of the portfolio to certainunderlying variables. This risk is commonly considered to be the risk of anadverse change, or, the risk that the value of a portfolio will decline. NBIMCfaces market risk in virtually all of its investment portfolios, although thefundamental drivers of this risk tend to be unique, depending on thecomposition of the portfolio.MeasuresThe Board approved Investment Policies are developed in the context ofproviding a diversified portfolio of assets that will provide protection against a significant adverse change to any specific asset class.Management monitors market risk through the weekly PAM CaR processmentioned earlier.Benchmark RiskThe risk that the benchmarks used to evaluate investment performance do not appropriately reflect the underlying portfolio.MeasuresThe Investment Policies set out by the Board approve the appropriatebenchmarks for each investment asset class. These benchmarks are typicallystandards set out by the institutional investment industry and correspondclosely to those used by peer organizations.Credit RiskCredit risk is defined as the risk that a specific counterparty will not meet itsfinancial obligations as set out in a previously agreed upon contract. Creditrisk arises from numerous activities including the holding of investments in aspecific entity that require a scheduled repayment as well as through enteringinto derivatives transactions with various counterparties (banks/investmentdealers). Credit risk can manifest itself through changes in the market value ofa security or obligation, and is generally measured through procedures thatattempt to model the probability of default and / or loss.MeasuresThe Investment Policies set out by the Board provide limits in terms ofpermissible investments and credit quality requirements for a number ofinvestment alternatives.Management monitors this exposure through a monthly Counterparty CreditExposure reporting process.Liquidity RiskLiquidity Risk is the risk that an investment position can not be unwound oroffset in the financial markets in a timely fashion without enduring significant losses. An occurrence of this type could lead to NBIMC not being able tomeet payment obligations as they become due because of an inability toliquidate assets.MeasuresThe Board approved Investment Policies are developed with a considerationto the near term periodic cash flow requirements of each pension fund. Credit risk mitigation also ensures that investments are made in higher quality assets that tend to be more liquid in terms of transaction availability. Liquidity risk is also mitigated through the actions of a Trade Management OversightCommittee which is composed of senior NBIMC investment staff.Category C: Operational RiskOperational risk is generally considered to include all risks not arising out of investment or business strategy decisions of the firm. It concerns the risks arising from the loss of effectiveness or efficiency in the corporation from reliance on specialized internal processes.NBIMC has subdivided operational risk as follows:Legal, regulatory, and policy compliance riskThe risk of loss from illegal or inappropriate business practices or activities by the Corporation or its employees.ResponsibilityThe Board of Directors, or a Board Committee, is responsible for monitoring the Corporation’s compliance with legal, regulatory, and policy compliance.The Governance Committee of the Board is responsible for the oversight of theNBIMC Code of Ethics and Business Conduct. The Audit Committee isresponsible for the oversight of the Corporation’s financial reporting process.Senior management is responsible for the accurate preparation and completeness of the financial reporting prepared by the Corporation.MeasuresThe Board of Directors engage two independent accounting firms to act asexternal and internal auditors of NBIMC’s financial reporting and activities.Senior management reports to the Board quarterly with respect to InvestmentPolicy Compliance. They also present quarterly financial statements to the Audit Committee and Board for review.Management in conjunction with the Investment Finance and Corporate Services team also monitor and report on NBIMC’s compliance with both InvestmentPolicy and Investment Procedures Manual guidelines on a weekly basis.Operational riskThe risk of either direct or indirect loss resulting from inadequate or failed internal operational processes.ResponsibilityManagement is responsible to ensure operational efficiency.MeasuresThe corporation has developed both a comprehensive Administration Manual anda Business Continuity Plan in order to standardize operational processes and toenable an efficient continuity plan in the case of adverse events.Management has delineated a clear segregation of duties with respect totransaction initiation, authorization, and recording activities. Banking authorities and limits are also clearly set out.Each employee position has a specific job description, and cross training is usedextensively to provide back-up support. The corporation also has a mandatoryvacation policy.The Internal Auditor for the corporation also performs ad-hoc audit work in thisarea.Technology RiskNBIMC relies significantly on management information systems and communication technology. It is therefore exposed to the potential for material risk of direct or indirect loss resulting from inadequate or failed information technology.ResponsibilityManagement is responsible to ensure technological operational efficiency.MeasuresAs noted above, the corporation has developed both a comprehensiveAdministration Manual and a Business Continuity Plan. Management utilizes an Information Technology Risk Management Committee to help oversee anddevelop related initiatives throughout the corporation.Human Resources RiskThe risk of loss resulting from inadequate or failed internal human resource performance and from business practices that are inconsistent with generally accepted HR laws and practices.ResponsibilityThe Human Resources and Compensation Committee of the Board is responsible for oversight of the Corporation’s Human Resource policies.Senior Management is responsible for effective human resource activities with the help of a Human Resources Coordinator position. This includes the development of job descriptions for each employee, training and development activities, andannual performance reviews.MeasuresThe Human Resources and Compensation Committee has developed aCompensation Philosophy for the corporation. They annually review thecompetitive compensation landscape versus a group of peer institutional pensionfund managers, and periodically retain the services of an external consultant toprovide advice in this regard. The Committee also annually reviews and adviseson Management’s annual succession plan for key staff positions.Management maintains all human resource policies and procedures in thecorporation’s Administration Manual.V. ConclusionThis document presented a summary of NBIMC’s philosophy on the management of risk, discussed the risks that the Corporation is exposed to in the normal course of operations, and provided a brief overview of the investment risk management procedures that are currently employed by the corporation to aid in managerial decision making.NBIMC attempts to take an integrative point of view on the management of risk, and uses tools and processes available to it in various situations, such as quantitative tools for objective investment risks, and qualitative assessments for other risks such as operational risks.Risk management is, as mentioned, a circular process. The undertaking of risk management procedures often leads to the identification of previously unidentified sources of risk. For this reason, this document is expected to be a living document, and will be continually updated as NBIMC updates its risk management beliefs, objectives, and processes.Appendix A:Risk Governance StructureBoard of Directors and its CommitteesManagement and its CommitteesPlan Sponsor RelationshipsExternal Service ProvidersEnterprise Risk Management Framework Appendix B: Risk Management OutlineCore Risk Detailed Risk NBIMC Process and ReponsibilitySTRATEGICGovernance *NBIMC Act, By-Laws, Board Policy, Management Procedures, Annual Crown CorporationCommittee Appearance, Quarterly Board Governance CommitteeBusiness Strategy *Strategic Plan - 5 year cycle, Annual Business Planning Process, Regular Board MeetingsFiduciary Administration Manual, Procedures Manual, Code of Ethics (Annual Acknowledgement)Business Environment Senior Management Monitor, Industry Association InvolvementReputational *PNB Actuary Interaction, PNB Auditor General Interaction, External and Internal Audit RelationshipsExternal Communications *Centralized with President, Audit Committee Approves Ad-Hoc Press ReleasesAnnual Report, PSSA Consultation Committee Involvement, NBTA Pension Committee Involvement,Annual Crown Corporations Committee Appearance, Annual PNB Board of Management BudgetDiscussion, Quarterly PNB Board of Management Performance DiscussionINVESTMENTInvestment *Asset-Liability Studies (as per receipt of Actuarial analysis), Investment Policies (Board Approved),Investment Risk Management Committee, Weekly Relative & Nominal Risk Reports (CaR, PAM CaR),Monthly Counterparty Credit Exposure Report , Key Vendor Selection Policy (Board Approved),Trade Management Oversight Committee (TMOC)OPERATIONALLegal, Regulatory, and Policy Regular Board Meetings - President Report, Quarterly Board Audit Committee, Weekly InternalCompliance *Compliance Reports (Independent Team), Annual External Audit, Internal Audit Projects (external co.)Operational Administration Manual, Business Resumption Plan (external consultant)Technology *IT Risk Management Committee, Business Continuity Plan (external consultant)Human Resources *Board Human Resources & Compensation Committee, Annual Succession Plan, Administration Manual, CompensationPhilosophy, Peer Institutional Manager Compensation Survey participation and external consultant reviews.- Page 21 of 21 -。

奥尔马全球风险管理英文

奥尔马全球风险管理英文Orma Global Risk ManagementIntroductionOrma Global Risk Management is a leading risk management firm that provides comprehensive services to organizations around the world. With a strong focus on identifying and managing potential risks, we help businesses protect their assets and achieve their goals in a secure and controlled environment. In this article, we will explore the services offered by Orma Global Risk Management and discuss the importance of risk management in today's unpredictable business landscape.Services OfferedOrma Global Risk Management offers a wide range of services that can be tailored to meet the specific needs of different organizations. Some of our key services include:1. Risk Assessment and Analysis: Our team of experts conducts thorough assessments to identify potential risks and vulnerabilities in various aspects of a business. This helps in developing strategies to mitigate risks and minimize their impact on the organization.2. Crisis Management: We assist organizations in developing robust crisis management plans to effectively respond to emergencies and mitigate potential damages. Our experts guide businesses through crisis scenarios, providing support and guidance to ensure a quick and efficient recovery.3. Business Continuity Planning: We help organizations develop and implement business continuity plans to minimize disruptions during critical events. Our experts work closely with stakeholders to identify key processes, prioritize resources, and create backup plans to ensure the smooth functioning of the business.4. Compliance and Regulatory Support: Staying compliant with ever-changing regulations is crucial for the success of any organization. Orma Global Risk Management offers support in understanding and implementing regulatory requirements, ensuring businesses operate within legal frameworks and minimize potential penalties.5. Cybersecurity: As cyber threats continue to evolve, securing sensitive information has become a top priority for organizations. Orma Global Risk Management provides comprehensive cybersecurity solutions, including vulnerability assessments, threat intelligence, and incident response services, to protect businesses from cyberattacks and data breaches.Importance of Risk ManagementIn today's volatile business environment, effective risk management is essential for organizations to survive and thrive. Here are some reasons why risk management should be a priority: 1. Protecting Assets: Risk management helps protect a company's assets, including physical properties, intellectual property, and financial resources. By identifying vulnerabilities andimplementing appropriate safeguards, organizations can reduce the likelihood and impact of potential risks.2. Minimizing Financial Losses: Unexpected events can lead to significant financial losses for businesses. By managing risks, companies can minimize the financial impact of disruptions and ensure sustainable growth.3. Enhancing Reputation: Effective risk management demonstratesa company's commitment to corporate governance and responsible business practices. This can enhance the organization's reputation and build trust with stakeholders, including customers, investors, and regulators.4. Anticipating Future Challenges: Risk management enables organizations to proactively identify potential threats and opportunities, allowing them to plan and strategize for the future. By staying ahead of emerging risks, companies can adapt to changing environments and maintain a competitive edge.5. Regulatory Compliance: Compliance with regulations is critical for businesses to avoid legal and financial penalties. Effective risk management ensures organizations stay updated with legal requirements and implement necessary measures to meet compliance standards.ConclusionOrma Global Risk Management provides comprehensive services to help organizations identify, assess, and manage risks effectively.In today's dynamic business environment, risk management is crucial for protecting assets, minimizing financial losses, enhancing reputation, anticipating challenges, and ensuring regulatory compliance. With a team of experienced professionals, Orma Global Risk Management is committed to providing tailored solutions to organizations worldwide, enabling them to navigate uncertainties and achieve their objectives.Risk Management StrategiesIn addition to the services offered, Orma Global Risk Management also assists organizations in developing and implementing effective risk management strategies. These strategies help businesses build resilience, adapt to changing environments, and ensure long-term success. Here are some key risk management strategies that organizations should consider:1. Risk Identification: The first step in effective risk management is identifying and understanding the various risks that may affect the organization. This involves conducting a thorough assessment of potential internal and external risks, such as operational, financial, strategic, legal, reputational, and compliance risks. Orma Global Risk Management employs various techniques, such as risk workshops, interviews, and data analysis, to identify and prioritize risks based on their likelihood and potential impact.2. Risk Assessment and Analysis: Once risks are identified, they need to be assessed and analyzed to understand their potential impact on the organization. Orma Global Risk Management uses quantitative and qualitative analysis techniques, such as risk matrices, scenario analysis, and cost-benefit analysis, to evaluaterisks and determine their severity. This enables organizations to prioritize risks and allocate appropriate resources to mitigate them effectively.3. Risk Mitigation: After identifying and analyzing risks, organizations need to develop strategies to mitigate or reduce their impact. Orma Global Risk Management works closely with organizations to develop customized risk mitigation plans, which may include implementing control measures, updating policies and procedures, enhancing cybersecurity defenses, diversifying suppliers, and implementing redundancy measures. These mitigation strategies aim to reduce the likelihood and impact of risks, ensuring business continuity and protecting assets.4. Risk Monitoring and Control: Risk management is an ongoing process that requires continuous monitoring and control. Orma Global Risk Management helps organizations establish risk monitoring mechanisms, including regular risk assessments, key performance indicators, and early warning indicators. These mechanisms enable organizations to proactively identify emerging risks, monitor the effectiveness of mitigation measures, and make timely adjustments to the risk management strategy as needed.5. Stakeholder Engagement: Effective risk management requires active engagement and collaboration with stakeholders, including employees, customers, suppliers, regulators, and investors. Orma Global Risk Management assists organizations in establishing robust communication channels with stakeholders, ensuring transparency and trust. This enables organizations to gather valuable insights and perspectives, align risk managementstrategies with stakeholder expectations, and build strong relationships that support risk mitigation efforts.6. Training and Education: Risk management is a multidisciplinary field that requires expertise and knowledge in various areas. Orma Global Risk Management offers training and educational programs to help organizations build internal capabilities and enhance risk management skills among employees. These programs cover various aspects of risk management, including risk assessment techniques, crisis management, cybersecurity best practices, and regulatory compliance. By equipping employees with the necessary knowledge and skills, organizations can foster a risk-aware culture and empower individuals at all levels to contribute to the risk management process.7. Business Continuity Planning: In today's interconnected and rapidly changing world, unexpected events, such as natural disasters, cyberattacks, and health crises, can disrupt business operations. Orma Global Risk Management assists organizations in developing comprehensive business continuity plans that outline procedures and protocols to ensure the continued delivery of critical products and services during emergencies. These plans include identifying essential processes, establishing alternative communication channels, securing backup systems and data, and training employees on their roles and responsibilities during a crisis.8. Constant Review and Improvement: Risk management is a dynamic process that requires regular review and continuous improvement. Orma Global Risk Management helps organizationsestablish mechanisms for reviewing the effectiveness of risk management strategies and making necessary adjustments. Regular risk assessments, performance monitoring, and feedback systems enable organizations to learn from their experiences, identify areas for improvement, and enhance their risk management capabilities over time.ConclusionEffective risk management is vital for organizations to navigate uncertainties, protect assets, and achieve their objectives. Orma Global Risk Management offers a comprehensive range of services and strategies to help organizations identify, analyze, and mitigate risks in today's volatile business landscape. By partnering with Orma Global Risk Management, organizations can benefit from the expertise and experience of dedicated risk management professionals, enabling them to build resilience, enhance compliance, and ensure sustainable growth in today's challenging environment. Risk management is not a one-time activity but a continuous process that requires ongoing commitment and attention. With Orma Global Risk Management as a trusted partner, organizations can effectively manage risks and seize opportunities for success.。

《上市公司社会责任信息披露研究国内外文献综述2900字》

上市公司社会责任信息披露研究国内外文献综述1国外研究现状Moskowite(1972)是最早对公司社会责任信息披露进行经验研究的学者,经过多年的发展,形成了一个比较成熟的研究领域。

现代西方公司社会责任信息披露所谓研究成果主要沿着两条线索进行:意识相关理论研究;二是影响因素和经济后果研究,包括外在的压力和内在驱动力。

最早提出“企业社会责任”一词的是西方学者谢尔顿,他把企业社会责任与企业满足产业内外人们需要的责任相联系,认为企业社会责任包含有道德因素。

弗里德曼提出,“企业社会责任就是在遵守法律和相应的道德标准的前提下赚尽可能多的钱”,这种定义被认为是股东价值最大化倡导者最极端的一个定义,即把企业社会责任限定在经济责任范围之内。

卢代富对企业社会责任的定义进行了修正,他认为,“企业社会责任是指企业在谋求股东利润最大化之外所负有的维护和增进社会公益的义务”。

斯蒂芬·P·罗宾斯认为“企业的社会责任是追求有利于社会的长远目标的义务,而不是法律和经济所要求的义务”。

哈罗德·孔茨、海因茨·韦里克认为“企业的社会责任就是认真地考虑公司的一举一动对社会的影响”。

Roberts(1992)、Mitchell等(1995)研究证实,负债比权益的比率越高,公司社会责任信息披露水平就越高。

但是Becchetti等(2008)、Mc Guire等(1988)、Orlistky等(2003)的实证研究却发现财务风险与社会责任信息披露是负相关关系。

Nazli & Ghazal(2007)等研究发现,社会责任信息披露水平与国家持股数正相关,与公司内部董事的持股数负相关。

Delphine & Evans(2009)发现,政府和机构投资者控股的石油公司相比家庭控股石油公司,能够更好的履行社会责任。

Cowen等(1987)发现社会责任信息披露水平最高的是化工行业,而其他类别的社会责任信息与行业之间的关系不明显。

德豪国际德国会计师事务所

12

审计师的工作–对财务尽职调查的报告

• 向公司及投资银行提供的非公开报告 (公司总体状况和对特定问题的评论) • 调查范围由德豪,公司管理层及投资银行决定

公司总体状况

• 历史及商业活动 • 战略 • 市场及竞争 • 组织结构和员工 • 税务

内部控制

• 控制环境 • 风险评估 • 控制力度 • 信息和交流 • 监测

4杰出的团队 – 肩并来自与我们的中国成员所一起公司财务专家

注册会计师 德国客户 服务伙伴

中国员工

税务专家 IT-专业人员

我们确信您将会从我们的中德 专家团队中获得最大的利益.

德豪国际中国成员所

律师

5

生成价值

为每一庄交易 设计的量体裁 身的方案

全力以赴

现金价值

我们投入时间确保您获得充分适合您的 服务. 我们的目标是找出真正的问题并 寻求解决之道

BDO (德豪国际) 全球网络和中国 成员所

世界第五大国际会计与咨询组织 强大的中国成员所 (北京, 上海, 深圳, 武汉), 马来西亚

及 新加坡

我们的使命

国家 成员所 2005年营业额 员工

105 620 家 33亿美元 28.000名

建立于专业及地域知识和敏锐商业触觉上的服务 通过这个网络建立广泛的客户资源 不断建立全球网络以提供对跨国交易的服务 在个人层面上了解我们的客户得以时刻满足他们的需要,提供及时优质服务, 实现他们的梦想

报告

审计师意见 审计报告 告慰函 特殊报告

独立的上市后审计

8

审计师的工作 – 帮助企业进行上市整合

设计您独特的上市概念

确认大股东的目标 是否融资?融多少资? 上市流通是正确的吗/或者是否有另外的选择? 什么股份需要流通 – 公司是否需要重整? 财务科目设置是否符合国际财务报告准则? 预期销售,成本,现金流的状况? 是否管理层结构符合上市公司标准? 是否会计及控制系统完善? 是否上市时间表能够实现?

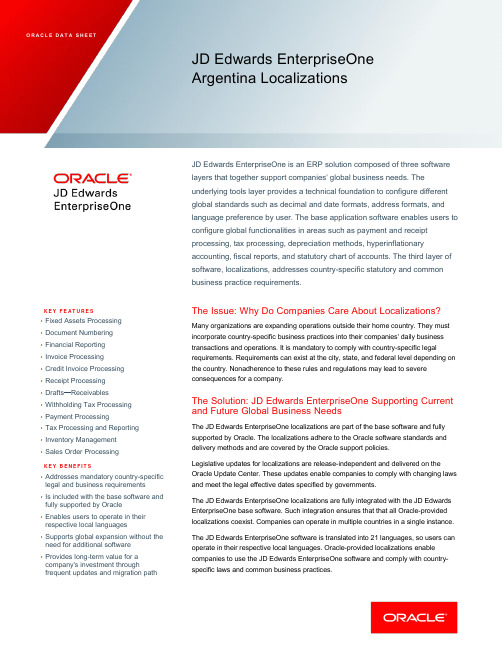

JD Edwards EnterpriseOne 阿根廷地区本地化说明书

JD Edwards EnterpriseOneArgentina LocalizationsJD Edwards EnterpriseOne is an ERP solution composed of three software layers that together support companies' global business needs. The underlying tools layer provides a technical foundation to configure different global standards such as decimal and date formats, address formats, and language preference by user. The base application software enables users to configure global functionalities in areas such as payment and receipt processing, tax processing, depreciation methods, hyperinflationary accounting, fiscal reports, and statutory chart of accounts. The third layer of software, localizations, addresses country-specific statutory and common business practice requirements.K E Y F E A T U R E S•Fixed Assets Processing •Document Numbering•Financial Reporting•Invoice Processing•Credit Invoice Processing•Receipt Processing •Drafts—Receivables•Withholding Tax Processing •Payment Processing•Tax Processing and Reporting •Inventory Management•Sales Order ProcessingK E Y B E N E F I T S•Addresses mandatory country-specific legal and business requirements•Is included with the base software and fully supported by Oracle•Enables users to operate in their respective local languages •Supports global expansion without the need for additional software •Provides long-term value for a company's investment through frequent updates and migration path The Issue: Why Do Companies Care About Localizations?Many organizations are expanding operations outside their home country. They must incorporate country-specific business practices into their companies' daily business transactions and operations. It is mandatory to comply with country-specific legal requirements. Requirements can exist at the city, state, and federal level depending on the country. Nonadherence to these rules and regulations may lead to severe consequences for a company.The Solution: JD Edwards EnterpriseOne Supporting Current and Future Global Business NeedsThe JD Edwards EnterpriseOne localizations are part of the base software and fully supported by Oracle. The localizations adhere to the Oracle software standards and delivery methods and are covered by the Oracle support policies.Legislative updates for localizations are release-independent and delivered on the Oracle Update Center. These updates enable companies to comply with changing laws and meet the legal effective dates specified by governments.The JD Edwards EnterpriseOne localizations are fully integrated with the JD Edwards EnterpriseOne base software. Such integration ensures that that all Oracle-provided localizations coexist. Companies can operate in multiple countries in a single instance.The JD Edwards EnterpriseOne software is translated into 21 languages, so users can operate in their respective local languages. Oracle-provided localizations enable companies to use the JD Edwards EnterpriseOne software and comply with country-specific laws and common business practices.•Reduces end user training and total cost of ownership with the same standards, look and feel •Supports single instance of the JD Edwards EnterpriseOne solution, resulting in a more easily managed software environmen t JD Edwards EnterpriseOne is a long-term investment. For companies expanding their business operations around the globe, no additional software is required for operating in most countries. Timely legislative updates are continuously provided. When companies are ready to migrate to the most current release, upgrade paths are provided.Feature Highlights for ArgentinaThe JD Edwards EnterpriseOne localizations for Argentina are included with the software and supported for customers who have license version 9.0 or later.The following table provides a sample of the functionalities included with the JD Edwards EnterpriseOne localizations for Argentina.Feature Highlights FunctionalitiesFixed Assets Processing ∙Fixed Asset Reporting—Annex ADocument Numbering ∙Legal Document NumberingFinancial Reporting ∙General Ledger ReportsInvoice Processing ∙Invoice Print Format∙Legal Resolution 738—Perception Report∙Invoice Reprint∙Interest Invoices∙Legal Invoices∙RG1702 Barcode∙Invoice Numbering RG 4290∙SIRE VAT Perception RG4523Credit Invoice Processing ∙Credit Invoice Law—Payables, Receivables, SalesOrder∙Credit Notes Generation for DiscountsReceipt Processing ∙Receipt Entry∙Batch Receipt Entry∙Receipt PrinterDrafts—Receivables ∙Draft Register∙Collection Process∙Generation of Delinquency Fees∙Massive Draft Entry∙Draft Entry∙Payment in Kind∙Summarized Customer Ledger∙Draft Inquiry∙Generation of Credit or Debit NoteWithholding Tax Processing ∙Profit Withholding Integrity Report∙Withholding Tax Calculations for Automatic andManual Payment∙Legal Resolution 726—Update WithholdingPercentage∙Print and Reprint Withholding Tax Certificates∙Legal Resolution 738—Numbering WithholdingCertificates∙Perceptions Reporting RG 715∙VAT Withholding RG 3732∙Profit Withholding RG 4245∙SIRE VAT Withholding RG4523Payment Processing ∙Voucher Authorization∙Legal Number Validation∙Import Voucher Processing∙Postdated Checks∙Check Format∙Payment Order∙Payments in KindTax Processing ∙Additional Tax Information∙Additional Tax Information for EDI∙Calculate Country-Specific Taxes∙Tax Reclassification∙UTES Profit Management∙Tax Controls for RG100 (A/P, A/R, SOP)Tax Reporting ∙Country-Specific Tax ReportsInventory Management ∙Inflation Inventory Adjustment∙Inflation Adjustment∙Lot Processing for Imported ItemsSales Order Processing ∙Credit Order or Invoice Relationship∙ Legal Resolution 738—Perception Report∙ Print and Reprint Legal Shipment Notes or Invoices∙Invoice or Shipment Note—Provisional andPrenumbered∙Void Invoices or Shipment Notes∙RG1702 BarcodeTag File Maintenance ∙Purge Closed A/P, A/R, and SOP RecordsC O N T A C T U SFor more information about JD Edwards EnterpriseOne, visit or call +1.800.ORACLE1 tospeak to an Oracle representative.C O N N E C T W I T H U S/oracle/oracle/oracleCopyright © 2020, Oracle and/or its affiliates. All rights reserved. This document is provided for information purposes only, and thecontents hereof are subject to change without notice. This document is not warranted to be error-free, nor subject to any otherwarranties or conditions, whether expressed orally or implied in law, including implied warranties and conditions of merchantability orfitness for a particular purpose. We specifically disclaim any liability with respect to this document, and no contractual obligations areformed either directly or indirectly by this document. This document may not be reproduced or transmitted in any form or by any means,electronic or mechanical, for any purpose, without our prior written permission.Oracle and Java are registered trademarks of Oracle and/or its affiliates. Other names may be trademarks of their respective owners.Intel and Intel Xeon are trademarks or registered trademarks of Intel Corporation. All SPARC trademarks are used under license andare trademarks or registered trademarks of SPARC International, Inc. AMD, Opteron, the AMD logo, and the AMD Opteron logo aretrademarks or registered trademarks of Advanced Micro Devices. UNIX is a registered trademark of The Open Group. 0117。

德勤内控资料第四期

通过本次调查, 在上市公司对公司治理的认 识、 治理现状、 存在的问题及发展方向等方 面,我们有如下发现:

研究室

30 合同风险合规(Contract Risk and Compliance) 32 Hedging 企业的市场风险

连载

36 企业内部控制实务(4)——采购(1)内部控制的原点

企业风险用语

38 操作风险 (Operational Risk)

推荐书籍

41 Enterprise Architecture as Strategy (以企业架构为策略)

多数上市公司能够按照监管要求建立治理机 制, 但运行中需要进一步完善, 如关联交易 的管理和信息披露方面的工作。 本次调查显 示,65%的上市公司认为本公司已经建立起完 整的公司治理体系并且在有效运行, 但仍有 35%的上市公司认为需要进一步推动公司治理 体系的建设,以保证其有效运转;14%的上市 公司对关联交易的管理未达到《上市公司治理 准则》中需签订书面协议的要求;61%的被调 查公司认为信息披露尚有提升空间。

德勤企业风险 第一辑

公司治理——发展趋势与洞察

德勤企业风险管理服务部 编

德勤企业风险(第一辑)

公司治理——发展趋势与洞察

德勤企业风险管理服务部 编

内容提要 本书是德勤企业风险丛书的第一辑,主要涉及公司治理方面的最前沿话题。内容有 2010 年上市公司治理调查; 浅谈 CSA 在公司治理中的应用;对民营企业治理结构的思考;董事会运作的天龙八“不”;搭建授权体系,优 化公司治理;股改与公司治理;中美日公司治理比较;合同风险合规;HEDGING 企业的市场风险;企业内部 控制实务;企业风险用语。 本书适合企业管理人员以及相关研究人员阅读和参考。

企业风险管理erm衡量指标

企业风险管理erm衡量指标英文回答:Enterprise Risk Management (ERM) is a comprehensive approach to identifying, assessing, and mitigating risks that can impact an organization's objectives. To effectively measure and manage these risks, various indicators and metrics can be used. Here are some commonly used ERM measurement indicators:1. Key Risk Indicators (KRIs): KRIs are specific metrics that provide early warning signals of potential risks. They are typically quantitative in nature and help organizations monitor and track the likelihood and impact of risks. For example, in the financial industry, a KRI could be the number of fraudulent transactions detected in a month.2. Risk Appetite: Risk appetite refers to the level of risk an organization is willing to accept to achieve itsobjectives. It is often expressed in terms of financial metrics, such as the maximum acceptable loss or the desired return on investment. For instance, a technology company may have a high risk appetite and be willing to invest in innovative but risky projects that have the potential for high returns.3. Risk Exposure: Risk exposure measures the potential impact of a risk on an organization's financial or operational performance. It can be calculated bymultiplying the probability of a risk event occurring by the potential loss associated with that event. For example, a manufacturing company may assess the risk exposure of a supply chain disruption by considering the likelihood of a disruption and the potential financial loss from delayed production.4. Risk Mitigation Effectiveness: This indicator measures the effectiveness of risk mitigation measures implemented by an organization. It can be assessed by evaluating the reduction in the likelihood or impact of a risk after implementing controls or preventive measures.For instance, a healthcare provider may measure the effectiveness of a patient safety program by tracking the number of adverse events or medical errors before and after implementing new protocols.5. Risk Culture: Risk culture refers to the attitudes, beliefs, and behaviors of individuals and groups within an organization regarding risk. It is an important indicator of how well risks are understood and managed throughout the organization. For example, a company with a strong risk culture encourages employees to report potential risks and actively participates in risk management activities.中文回答:企业风险管理(ERM)是一种全面的方法,用于识别、评估和减轻可能影响组织目标的风险。

企业信用报告_英属开曼群岛高谛安资本有限公司上海代表处

5.1 被执行人 ......................................................................................................................................................7 5.2 失信信息 ......................................................................................................................................................7 5.3 裁判文书 ......................................................................................................................................................8 5.4 法院公告 ......................................................................................................................................................8 5.5 行政处罚 ......................................................................................................................................................8 5.6 严重违法 ......................................................................................................................................................8 5.7 股权出质 ......................................................................................................................................................8 5.8 动产抵押 ......................................................................................................................................................8 5.9 开庭公告 ......................................................................................................................................................8

risk management 外文教材

risk management 外文教材对于风险管理(Risk Management)的外文教材,以下是一些可供参考的教材:"Risk Management: Principles and Practice" by Donald芬格、John穆尔和David威肯斯:这本书是风险管理领域的经典教材之一,涵盖了风险管理的基本原则、方法和实践,适合初学者和有经验的风险管理专业人士。

"Modern Risk Management: A Practical Guide to Financial and Operational Risk" by David布朗和David威肯斯:这本书重点介绍了财务和运营风险的管理,提供了实用的指南和案例分析,适合金融机构和企业管理者。

"Enterprise Risk Management: A Practical Guide to Applying the Framework" by the Committee of Sponsoring Organizations of the Treadway Commission (COSO):这本书是风险管理框架的权威指南,详细介绍了COSO风险管理框架的原理、方法和应用,适合企业高管和风险管理专业人士。

"The Practice of Enterprise Risk Management" by the Institute of Internal Auditors:这本书详细介绍了企业风险管理的实践方法和案例,提供了实用的工具和框架,适合内部审计师和管理者。

这些教材都是权威的、实用的风险管理指南,有助于深入了解风险管理的理论和实践,掌握风险管理的方法和技术,提升企业的风险意识和应对风险的能力。

ERM企业风险管理框架英文

ERM企业风险管理框架英文Enterprise Risk Management (ERM) is a comprehensive framework that enables organizations to effectively identify, assess, and respond to risks that may impact their operations. This proactive approach to risk management allows businesses to better protect themselves and maximize their opportunities for growth. In this article, we will explore the key components of an ERM framework and its benefits in managing risks.The first component of an ERM framework is risk identification. This involves systematically identifying and categorizing potential risks that an organization may face. Risks can come from various sources, including operational, financial, regulatory, and reputational risks. By identifying these risks, organizations can better understand and prioritize their risk exposures.Once risks have been identified, the next step is risk assessment. This involves analyzing and evaluating the potential impact and likelihood of each risk materializing. Risk assessment helps organizations determine the level of risk they are willing to undertake and provides valuable insights for decision-making. It also allows for the allocation of resources to manage high-priority risks more effectively.After assessing the risks, the next component of the ERM framework is risk response. This involves developing strategies and plans to mitigate, avoid, transfer, or accept risks. Risk response strategies may include implementing control measures, developing contingency plans, purchasing insurance, or divesting from high-risk areas. The key is to have a proactive approach towards riskmanagement, rather than a reactive one.The next component of the ERM framework is risk monitoring. This involves continuous monitoring and tracking of identified risks. Organizational changes, evolving market conditions, and emerging risks require ongoing monitoring to ensure that risk profiles are up to date. Regular risk assessments and monitoring allow organizations to adapt their risk management strategies promptly.The final component of the ERM framework is risk communication. Effective risk communication ensures that relevant stakeholders are aware of the organization's risk exposure and mitigation strategies. It includes both internal communication with employees and external communication with investors, regulators, and other external stakeholders. Transparent and timely communication helps build trust and confidence in the organization's risk management practices.Implementing an ERM framework has several benefits for organizations. Firstly, it enables organizations to take a holistic view of their risk landscape. By identifying, assessing, and addressing risks comprehensively, organizations can reduce the likelihood of unexpected events disrupting their operations. This increases their ability to achieve their strategic objectives and enhances their resilience.Secondly, an ERM framework promotes a risk-aware culture within organizations. It encourages employees at all levels to be proactive in identifying risks and taking appropriate actions tomitigate them. This proactive risk management approach fosters accountability and empowers employees to contribute to the overall success of the organization.Furthermore, an ERM framework helps organizations make informed decisions. By assessing risks and their potential impact, organizations can make more informed choices about new initiatives, investments, and business strategies. This reduces the likelihood of making poor decisions that could lead to significant financial losses or reputational damage.In conclusion, an ERM framework provides a structured and systematic approach to managing risks. By identifying risks, assessing their impact, developing appropriate response strategies, monitoring risks, and communicating effectively, organizations can navigate uncertainties more effectively. This proactive approach enables organizations to protect themselves, make informed decisions, and maximize opportunities for growth. Implementing an ERM framework is essential for organizations that want to build a strong risk management culture and enhance their long-term sustainability.继续写相关内容,1500字。

德勤-信用风险管理(英文版)

Monitoring/ Control

Risk Management

Exposure

Management

– Aggregation

– Control

Periodic Account Reviews – Payments/Aging – Credit Condition

Compliance with Covenants, Terms

stability with higher P/E multiples – Marketplace penalizes credit induced volatility and “surprises”

Raises questions about quality of management

Corporate Credit Risk

Companies are exposed to significant levels of credit risk emanating from different sources

Accounts Receivables Other Notes Receivables Buyer and Franchise Financing With Recourse Financing

Improve Profitability

Credit Strategy/ Plan

Common Performance

Metrics

Credit Objectives and Risk

Tolerances

Credit Policies

Credit Risk Management

Processes

Reporting

国外风险管理理论研究综述

国外风险管理理论研究综述2011年11月22日17:04 来源:《金融发展研究》2011年第2期作者:字号打印纠错分享推荐浏览量 118王东(对外经济贸易大学保险学院)摘要:风险管理在五十年的发展中实现了从多领域分散研究向企业风险管理整合框架的演进,本文对传统风险管理理论、金融风险管理理论、内部控制理论和企业风险管理理论的主要观点进行了综述,并对后危机时代的风险管理发展趋势进行了展望。

关键词:风险管理;内部控制;企业风险管理Abstract:Risk management transited from disperse study of multiple fields to integrated framework of enterprise risk management in last fifty years. This paper summarizes the major views about traditional risk management theory,financial risk management theory,internal control theory and enterprise risk management theory,and reviews the future development tendency of risk management after the subprime crisis.Key Words:risk management,internal control,enterprise risk management2007年次贷危机的爆发,各大金融机构的破产,使得风险管理再度成为理论界研究的热点,雷曼兄弟、美林等公司都曾经是风险管理的先行者,但还是在危机面前走向了破产,那么究竟该如何进行风险管理呢?在回答这个问题之前,我们有必要回顾一下风险管理理论的演进与发展,从历史的脉络中来寻找企业风险管理的精要所在。

公司治理实践新动向_:从_ESG_到反_ESG

发布ESG信息披露指引,鼓励相关企业按照指引进行专项信息披露。

由摩根士丹利资本国际公司围绕ESG评级发布的明晟指数(MSCI)则是机构投资者的风向标。

近年来,国内的投资机构和学术研究机构也陆续推出了标准不完全相同的ESG评级和排序。

越来越多的评级和排名,以及不统一甚至混乱的评价标准,使得ESG实践难以形成公认的权威影响力,是否属于ESG行为变成各说各话,甚至是自说自话的一家之言。

一个典型的例子来自特斯拉。

从事新能源汽车生产的特斯拉在中国自然是符合ESG标准的。

然而,在标准普尔的一家评级机构将特斯拉从一个主要的ESG指数中移除之后,马斯克称“ESG是一个骗局”,它已成为“虚假的社会正义战士的武器”。

另外一个例子则来自刚刚退休的巴菲特领导的伯克希尔。

著名的公司治理咨询机构ISS 对伯克希尔的评价是,“在ESG治理方面不足,审计委员会没有充分发挥职责,该公司没有适应一个ESG对业绩变得更加重要的世界”。

这项批评源于伯克希尔长期以来只聚焦投资主业,从不关注ESG方面的投资。

在2007年伯克希尔股东大会上,巴菲特解释了为什么他决定通过捐赠给家人和他的朋友比尔·盖茨管理的基金会来“养活”他的慈善事业。

巴菲特说:“当我有钱可以捐的时候,我就会把钱交给那些精力充沛、努力工作、聪明、用自己的钱去做事情的人。

而我自己则继续做我喜欢做的事。

”伯克希尔显然是把能显著提高ESG评级和排序的慈善等企业社会责任,交给专业的机构来完成,没有兴趣在并非主业的这些问题上不计成本、费时费力地亲力亲为。

第二,ESG行为演变为符合政治正确的形式主义,对企业的实际经营和管理改善未能带来实质性益处,甚至逐步异化为一项公司治理成本。

2023年3月倒闭被接管的美国硅谷银行,成为ESG行为演变为符合政治正确的形式主义的典型。

硅谷银行严格奉行ESG 投资理念,在公司治理实践中,成立了许多ESG工作组。

在摩根士丹利资本国际公司明晟指数的ESG评级中,硅谷银行的等级从2017年到2022年连续5年都是A级。

企业风险管理的英文作文

企业风险管理的英文作文英文:Enterprise risk management (ERM) is a crucial aspect of any business, as it allows companies to identify and mitigate potential risks that could negatively impact their operations. As someone who has worked in risk managementfor several years, I can attest to the importance of having a comprehensive ERM strategy in place.One of the key benefits of ERM is that it enables companies to take a proactive approach to risk management. By identifying potential risks before they occur, businesses can take steps to prevent or mitigate them, rather than simply reacting to them after the fact. This can help to minimize the impact of risks on the company's operations, reputation, and bottom line.Another benefit of ERM is that it can help companies to make more informed decisions. By having a clearunderstanding of the risks associated with differentcourses of action, businesses can make more strategic decisions that are based on a thorough analysis ofpotential risks and rewards.Of course, implementing an effective ERM strategy requires a significant amount of time and resources. However, the benefits of doing so far outweigh the costs.By investing in ERM, companies can protect themselves against potential risks, make more informed decisions, and ultimately improve their overall performance and profitability.中文:企业风险管理(ERM)是任何企业的重要组成部分,因为它可以帮助企业识别和减轻可能对其运营造成负面影响的潜在风险。

d开头的金融职位单词

d开头的金融职位单词摘要:1.金融领域的职位概述2.以“D”开头的金融职位a.风险管理总监(Director of Risk Management)b.数据分析师(Data Analyst)c.投资银行家(Investment Banker)d.财务总监(Director of Finance)e.股票交易员(Stock Trader)f.产品经理(Product Manager)g.金融工程师(Financial Engineer)h.风险投资家(Venture Capitalist)正文:在金融领域,有许多不同类型的职位和角色。

这些职位涉及各种金融工具、市场和业务领域。

在此篇文章中,我们将重点关注以“D”开头的金融职位。

1.风险管理总监(Director of Risk Management)风险管理总监负责制定、实施和维护金融机构的风险管理策略。

他们需要对市场风险、信用风险和操作风险有深刻的理解,并具备良好的分析、沟通和领导能力。

2.数据分析师(Data Analyst)数据分析师负责收集、处理和分析金融数据,以支持业务决策。

他们需要具备扎实的统计和数据分析技能,能够熟练使用各种分析工具和软件。

3.投资银行家(Investment Banker)投资银行家为企业和政府提供各种金融服务,如并购、股权发行和债务融资。

他们需要具备强大的沟通能力、分析能力和对金融市场的深刻理解。

4.财务总监(Director of Finance)财务总监负责公司的财务管理,包括财务规划、预算编制和财务报告。

他们需要具备全面的财务知识和经验,以及出色的领导和管理能力。

5.股票交易员(Stock Trader)股票交易员负责在证券市场上买卖股票,以实现投资回报。

他们需要具备良好的市场分析能力、快速的决策能力和较强的风险承受能力。

6.产品经理(Product Manager)产品经理负责金融产品的开发、推广和维护,以满足客户需求。

人力资源治理师HR知识声誉治理让企业价值保值

人力资源治理师HR知识:声誉治理让企业价值保值从来没有一个时期能像今天一样,企业的声誉会在一晚上之间变成垃圾。

十年前,公司提供的产品不能知足消费者需求,消费者因此采取的一些行动,可能很少会被普遍传播,可不能有人明白这件丑闻。

可是,在Twitter、 Facebook、微博等社交网络如此壮大的今天,企业的一丝过失似乎都无处可逃,企业声誉也处于前所未有的风险中。

“企业应该在内部成立一套量化企业声誉的体系,而且要将企业的声誉治理融入到企业战略和运营打算的方方面面,切实履行企业所作的许诺。

”全世界最大的治理会计师组织——CIMA皇家特许治理会计师公会全世界执行董事Andrew Harding在其题为《企业声誉:什么缘故如此重要和如何治理》的报告中建议说。

品牌不是声誉的全数很多人以为只要做好公关建设、做好企业品牌就能够够操纵治理企业声誉,这种熟悉是错误的。

Andrew Harding在同意《第一财经日报》专访时说:“企业声誉更多的是表现企业的价值,并非局限于品牌本身。

”Andrew Harding以为企业声誉是外人对公司的主动认知,它取决于包括企业如何与供给商打交道,如何对待它的员工等治理运营的各个环节。

其建设,也需要一个漫长的进程。

不同的是,企业的品牌建设只是一个时期性的情形,例如企业能够投资成立一个品牌或聘请一些专业咨询机构推行这些品牌。

企业的品牌反映的是企业希望在他人心目中成立的形象,是企业能够操纵的。

比如,丰田那个壮大的品牌大伙儿都耳熟能详,而且公司的市场推行力度也超级大,可是那个壮大的品牌是成立在公司的声誉之上的。

之前丰田以优质靠得住的产品闻名,是因为丰田在生产进程中超级注重整个流程的质量操纵而且实行持续改善的打算。

后来丰田的治理层制定了新的目标,公司要赶超美国通用,致力成为全世界最大的汽车制造商。

于是公司执行委员会把重点放在提高销量和销售额上,因此忽略了持续改善和质量操纵的项目。

2006年公司高质量的声誉开始显现下滑迹象,以后丰田汽车又不断显现一些故障,可是治理层并无采取应付的方法,最后问题积存演变成公众丑闻。

澳大利亚大企业税收风险管理介绍

澳大利亚大企业税收风险管理介绍一、关于风险管理的基本看法关于风险。

人们常说风险是指后果和可能性,也有人说,风险是指威胁到“战略目标”的因素,这就需要了解什么是“战略目标”并确定有哪些威胁。

风险管理可分几个层次:管理、方案;战略、业务、战术(即个案)层次。

风险管理的必要性。

因为税务局的工作不可能面面俱到,需要分清主次,作出选择。

以什么根据作出选择对全局的战略目标至关重要;例如,就个案而言,应修改哪些法律等等。

税务局从税收管理视角管理风险,要努力尽早确定那些重大威胁状况,并确定其后果和发生的可能性,一旦确定了“风险”便需采取措施,以降低其严重程度。

风险识别框架的应用。

通过识别和确定风险,达到这样的目标:一是,了解税务系统各种风险的性质和程度,根据风险识别框架对纳税人进行定位,评定纳税人相对于其他纳税人的风险等级,按风险程度不同确定有针对性的管理方式。

二是,制定风险应对战略,例如执行项目、修改法律、发布公共裁定。

三是选择个案,进一步开展遵从风险分析和审计活动,确定某纳税人有具体的税务风险,评定该具体税务风险的风险等级,根据该风险等级确定是否将个案升级到审计。

评定纳税人遵从风险的主要因素:一是以往遵从表现;二是税务风险管理和治理情况;三是企业绩效与税务结果和本行业其他企业绩效的比较情况;四是税务机关专业部门和情报收集过程中发现的问题,特别是重大业务方面的问题;税务机关行业部门有关行业绩效及其与税务风险的关系的情报,包括税务表现的规律和趋势,国外税务机构的情报,其他政府部门的情报和公开信息,落实新税法所产生的风险,国际业务活动的程度以及此类活动带来的税务结果,特别研究方案。

哪些因素可能构成遵从风险:一是相关方跨境和避税港业务往来,在本国享受某项减税,但并无对应的应征税收入;二是复杂的企业结构和集团内业务往来,与获得税收减免有关,但与企业商业活动的经济实质无关;三是财务和其他方面的安排,所获税收减免过多,与其有限的金融风险不成比例,或者企业商业活动的实际经济实质与所报告的不同;四是用某些安排或产品(例如,税收裁定)转移或获得法律没有考虑到的税收减免;五是在税收上对某些业务往来的描述不符合其经济实质;六是歪曲市场估价,与公允价值相矛盾;七是提倡以筹划钻税法空子;八是办理业务往来的方式与有关该业务往来产品税收裁决相去甚远。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

4

Expected Benefits of ERM

• Gain clear knowledge of operations and business strategy • Quantify and prioritize risk reduction efforts • Improve insurance buying and capital allocation • Guard against earnings related surprises • Generate strategies for business continuity planning • Improve credit ratings and cost of capital

8

Getting Started Identifying and Prioritizing Enterprise Risks

1. Form a core team to own the ERM process 2. Define enterprise view of business and associated organizational structure 3. Form a larger cross-functional team of experts 4. Identify enterprise portfolio of risks 5. Filter, assess, and prioritize risks 6. Work on “top actionable risks” 7. Monitor & update risk dashboard regularly

12

Financial Risks

New or Public Boycott Foreign & Condemnation Credit Default Competitors Adverse Offensive Timing of Business Changes in Advertising Decisions & Moves Interest Rate Industry Corporate Fluctuations Counterparty Regulations Market Share Battles Culture Risk Pricing & Incentive Wars Foreign Loss of Intel. Currency & Foreign Market Attacks on Brand Loyalty Equip., Facilities, Business Property Exchange Rate Product-Market Protectionism Acquisitions & Divestitures Fluctuations Customer Relations Alignment Mergers & Asset Valuation Financial Supplier Relations “Gotta Have Products” Transaction Industry Liquidity / Cash Markets Processing Errors Uncompetitive Dealer Relations Program Launch Consolidation Ineffective Instability Inadequate Customer Demand Cost Structure Inadequate / Planning Accounting / Mgmt. Oversight Seasonality & Variability Inaccurate Financial Tax Law Revenue Budget Overruns / Technology Decisions Ethics Controls & Changes Management Economic Unplanned Expenses Joint Venture / Alliance Relations Violations Reporting Adverse Recession Health Care & Union Relations, Labor Perceived Quality Changes in Pension Debt & Credit Product Development Process Disagreements & Currency Environmental Costs Rating Contract Frustrations Product Design & Engineering Inconvertibility Regulations Shareholder Activism

Enterprise Risk Management

Risk in the context of business strategy Risk "portfolio" development Focus on critical risks Risk optimization Risk strategy Defined risk responsibilities Monitoring & measurement Risk is everyone's responsibility

• Treasury / Insurance Risk • Supply Chain/Logistics Operations • Procurement / Purchasing • Manufacturing / Engineering • Facilities • Audit • Security • Information Technology • R&D / Technical Staff • Others?

10

Organizational Structure – How Much Interdependency Is Inherent?

Independent Departments / Business Units or Matrixed Organization?

Board of Directors? Board of Directors?

Kurt Godden, Ph.D., GM Technical Fellow kurt.godden@ General Motors R&D Manufacturing Systems Research Lab

Agenda

Introduction to Enterprise Risk Mgmt (ERM) at GM

Global Mfg Operations

Facilities Management Asset maintenance, risk mgmt. inside the plants

Insurance Risk Mgmt Audit Security IT Sess risk mgmt External risks financing IT risks, disaster & threats recovery monitoring

Working Definition “The process of systematically identifying, quantifying, and managing all risks & opportunities that can affect achievement of a corporation’s strategic and financial goals.”

9

Enterprise View of Business

Note: Risk mgmt. expertise already exists internally, but can be enhanced by improving information sharing & collaboration

Process / Function

World Region

North tin & South Asia Amer. Amer., Procurement Supply Chain IT Facilities Mfg …

11

Financing

Insurance

Mortgage

Cross-Functional Team to Identify and Regularly Monitor Risks

Disruptions in operations can be very costly, and can be of the same magnitude of impact as other crises.

• Cost of supply chain “glitches” – average of 10.28% decrease in shareholder value at time of announcement, with share price recovery (if firm does recover…) in roughly 60 trading days.1 • Cost of crises – sharp initial decrease of almost 8%, with full share price recovery (if firm does recover…) in roughly 50 trading days. 2

5

Why Apply ERM to Supply Chain Operations?

6

Real-Time Global Awareness of Operating Environment