Organization capital and firm performance Empirical evidence for european firms

Chapter 12 Corporations

2

Reinvested earnings

Total

$xxxxx

Sources of Paid-In Capital

Authorized

Issued Outstanding

Number of Shares

Sources of Paid-In Capital

More than half of the largest companies are incorporated in Delaware.

State grants a charter or articles of incorporation which formally create the corporation. Management and board of directors prepare bylaws which are operation rules and procedures.

Cumulative Preferred Stock

On March 7, 2010, the board of directors declares dividends of $22,000.

Cumulative Preferred Stock

Preferred Stock Dividends Dividends Paid in 2010

Nonparticipating Preferred Stock

A nonparticipating preferred stock is limited to a certain amount. Assume 1,000 shares of $4 nonparticipating preferred stock and 4,000 shares of common stock and the following:

ACCAF1重点

F1重点1. Organisation:an organization is a social arrangement which pursues collective goals,which controls its own performance and which has a boundary separating it from its environment.1.Why do organization exist?(1)organization overcome people's individual limitations.(2)organization enable people to specialist in what they do best.(3)organization save time.(4)organization accumulate and share knowledge(5)organization enable synergy.2.Limited company: Limited company is a corporation with shareholders whose liability is limited by share, personal assets are distinct from company finance.3.Types of limited company4.NGO:NGO is an independent voluntary association of people acting together for some common purpose(other than achieving government officer or making money)anisational structure:Components of the organisationStrategic apex||Technologystructure ——Middle line ——support staff||Operating core●functional departmentation●Geographic departmentation●Product/brand departmentation●Matrix and project organization●Customer departmentation7.The shamrock organisation(Charles Handy)●Professionalconsist of professional, technicians ,managerspartnership with firm●Self employedhired on contractpaid in fees for results●Contingenttemporary and part-time workerspaid by the hour or day or week●Consumersdo the work of the organisatione.g. IKEA8. Span of control:the span of control refers to the number of subordinates immediately reporting to a superior official.9.The Anthonyhierarchy:Strategic(senior management),Tactical(middle management), Operational (supervisor/operative)10.Marketing:The marketing function manages an organisation’s relationship with its customers.11.What is the relationship between marketing and strategic management?●Corporate strategic plans aim to guide the overall development of anorganisation.●Marketing planning is subordinate to corporate planning but makes asignificant contribution to it and is concerned with many of the same issues.●The marketing department is the most important source ofinformation for the development of corporate strategy.●Specific marketing strategies will be determined within the overallcorporate strategy.12. Finance function: One of the most important expert roles in the organisationRole:●Raising money from different channels●Recording and controlling what happens to money●Providing information to managers to help them make decisions●Reporting to shareholders13.Sources of finance:●The capital markets●Retained earnings●Government sources●Bank borrowings●Venture capital●The international money and capital markets14.Types of committee●Executive committeeswith the power to govern or administer●Standing committeesor a particular purpose on a permanent basis to deal with routine business ●Ad hoc committeesto complete a particular task●Sub-committeesappointed by committees to relieve the parent committee of routine work ●Joint committeesbe formed to co-ordinate the activities of two or more committees●Management committees15.The qualities of good information●Accurate●Complete●Cost-beneficial●Relevant●Authoritative●Timely●Easy to use16.Culture and structure●Power culture (Zeus):is shaped by one individual(leader focused)●characteristics:❖The organisation is capable of adapting quickly to meet change❖Personal influence decrease as the size of an organisation gets bigger. ❖Personal have to get on well with each other for this culture to work.●Role culture(Apollo):is a bureaucratic culture shaped by rationality,rules and procedures●Characteristics:❖These organisation have a formal structure, and operate by well-established rules and procedures.❖Individuals are required to perform their job to the full and tend to learn an expertise without experiencing risk.❖The bureaucratic style can be very efficient in a stable environment, when the organisation is large.●Task culture(Athena):is shaped by a focus on outputs andresults(project-focused )●Characteristics:❖The task culture is reflected in project teams and task forces❖Performance is judged by results❖Task cultures are expensive, as experts demand a market price❖Task cultures also depend on variety.●Person culture(Dionysus):is shaped by the interests of individuals●Characteristics:❖In the three other cultures, the individual is subordinate to the organisation or task.❖But in this culture, the purpose is to serve the interests of the individuals within it.17.The impact of informal organisation on the business●Employee commitment●Knowledge sharing●Speed●Responsiveness●Co-operation18.Stakeholders of business organisation●Internal stakeholders(Managers /employees)●Connected stakeholders(Shareholders/ Bankers/ Suppliers/ Customers●External stakeholders(Government/ Interest/ pressure groups/ Professional bodies)government ➢jobs/ training/tax ➢tax increases➢Regulation➢legal actionInterest/ pressure groups ➢Pollution➢Rights➢other ➢Publicity➢direct action➢Sabotage➢pressure on governmentProfessional bodies ➢members ethics ➢imposition of ethicalstandards19.Business cycle●Recession to depression(经济衰退期到经济萧条期)When the economy is entering a recession:❖Consumer demand falls❖Production and employment falls❖Price level falls❖Confidence diminishes❖Investment remains low●Recovery to boom(经济恢复期到经济增长)When the economy has reached the recovery phase of the cycle:❖Confidence returns❖Output/employment/income will begin to rise❖Production and sales rise❖Profit levels will lead to optimistic business expectations❖Price level will rise slowly❖Investment rises20.Inflation:Inflation is the name given to an increase in price levels generally. It is also manifest in the decline in the purchasing power of money.21.Causes of unemploymentSeasonal employment and fictional unemployment will be short-term. Structural unemployment technological unemployment ,and cyclical unemployment are all longer term ,and more serious.ernment policies for managing the economyTHE AIM:❖To achieve economic growth❖To control price inflation❖To achieve full employment (失业率低,而不是零失业率)❖To achieve a balance between exports and imports23.Fiscal policy:Fiscal policy relates to government policy on taxation,public borrowing and public spending.It provides a method of managing aggregate demand in the economy.24.Monetary policy:Monetary policy relates to government policy on the money supply, the monetary system, interest rates, exchange rates and the availability of credit.25.26.Functions of taxation❖To raise revenues for the government.❖To cause certain products to be priced to take into account their social costs.❖To redistribute income and wealth.❖To protect industries from foreign competition.27.Direct tax and Indirect taxDirect taxis paid direct by a person to Revenue authority.it can be levied on income and profit or on wealth.it must be paid by everyone.e.g. income tax/corporation taxIndirect tax is collected from an intermediary (supplier) who then attempt to pass on the tax to consumers in the price of goods they sell. Specific tax is charged as a fixed sum per unit sold.ad valorem tax is charged as a fixed percentage of the price of the good.28.Objectives of monetary policyMonetary policy can be used as a means towards achieving ultimate economic objectives for :❖Inflation❖The balance of trade❖Full employment❖Real economic growth29.BOP:A balance of payments (BOP) sheet is an accounting record of all monetary transactions between a country and the rest of the world. These transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. 30.宏观分析:PEST: political-legal , economic, social-cultural,technological .微观分析: include those areas which have a direct impact on the orgnisation.Five competitive forces:❖the threat of new entrants,❖the threat of substitute products or service,❖the bargaining power of customers,❖the bargaining power of suppliers,❖the current competitors❖in the industry.31.Employment protectionretirement Organisations encourage retirementresignation People resign for many reasons, personal and occupational. dismissal The termination of an employee’s contract by the employer.petitive forces33.34.Accounting:Accounting is a way of recording, analysing andsummarising transactions of business.ers of financial statements and accounting information❖Managers of the company.❖Shareholders of the company❖Employees of the company.❖Trade contacts❖Providers of finance to the company❖Her majesty's revenue and customs❖Financial analysts and advisers❖Government and their agencies❖The public36.Financial accounting VS management accountingFinancial accounting is mainly a method of reporting the results and financial position of a business.Financial accounting should be presented to the certain outsiders who need information about a company: shareholders/suppliers/customers/employees/tax authorities/the general public.Management accounting is a management information system which analyses data to provide information as a basis for managerial action.The concern of a management accountant is to present accounting information in the form most helpful to management.37.IASB:International Accounting Standards BoardIASs:International Accounting StandardsGAAP:Generally accepted accounting practice38.F1 p195 business transactions39. Manual vs computerised accounting systemsManual accounting systemsThe disadvantages of Manual accounting systems:❖productivity❖slower❖Risk of errors❖Less accessible❖Alterations❖Quality of output❖bulkcomputerised accounting systemsThe advantages of computerised accounting systems:❖It become possible to make just one entry in one of the ledgers which automatically updates the others.❖Users can specify reports, and the software will automatically extract the required data from all the relevant files.❖Both of the above simplify the workload of the user.The disadvantages of computerised accounting systems:❖Usually,it requires more computer memory than separatesystems-which means there is less space in which to store actual data. ❖Because one program is expected to do everything,the user may find that an integrated package has fewer facilities than a set of specialised modules.40.Internal audit vs external audit41.Fraud:fraud may be generally defined as ' deprivation by deceit ' .in a court case ,fraud was defined as ' a false representation of fact made withthe knowledge of its falsity, or without belief in its falsity,or without belief in its truth,or recklessly careless ,whether it be true or false.42.teeming and ladingThis is one of the best known methods of fraud in the sales ledger area.basically teeming and lading is the theft of cash or cheque receipts.setting subsequent receipts,not necessarily from the same customer against the outstanding debt conceals the theft.43.Power and influence44.Henri Fayol: five functions of management45.Taylor : scientific managementThe key elements of scientific management techniques:❖Work study techniques were used to analyse tasks and establish the most efficient ways to use.❖Planning and doing were separated.❖Jobs were micro-designed: divided into single, simple task components.❖Workers were paid incentives.46. Elton Mayo: human relationsAccording to Hawthorne studies from 1924 to 1932, he concluded: Workers have social or belonging needs .Productivity depends mainly on working attitude and relationships with those around you.Neo-human relations school:It relates to workers have more needs in the job, such as challenge, responsibility, personal development and so on.47.Mintzbery: the manager’s role48.leadership: ‘The activity of influencing people to strive willingly for group objectives.’----Terry●The key leadership skills:❖Entrepreneurship: have the ability to spot business opportunities.❖Interpersonal skills❖Decision-making and problem-solving skills❖Time-management and personal organisation❖Self-development skills.49.theories of leadership50.the Ashridge Management College Modelmaking might become a very long process.51.Blake and Mouton’s managerial Grid52.groups:A group is any collection of people who perceive themselves to be a group.❖ A sense of identity.❖Loyalty to the group.❖Purpose and leadership.53.TeamsA team is a small number of people with complementary skills who are committed to a common purpose, performance goals and approach for which they hold themselves basically accountable.---- Katzenbach and Smith 54strengths of team workin55.Belbin: Nine team roles——nine team role56.team developmentStep 1: Forming 行程阶段The team is just coming together. The individuals will be trying tofind out about each other, and about the aims and norms of the team. The objectives being pursued may as yet be unclear and a leader may not yet have emerged.Step 2: Storming调整阶段The conflicts between team members may happen. The original objectives, procedures and norms may be changed .Step 3: Norming规范化阶段A period of settling down: there will be agreements about work sharing, individual requirements and expectations of output. Norms and procedures may evolve.Step 4: Performing表现阶段The team sets to work to execute its task. The difficulties of growth and development no longer hinder the group’s objectives.Later writers added two stages Tuckman’s model:(属于休整期)●Dorming.Once a group has been performing well for some time, it may get complacent/full, and fall back into self-maintenance functions, at the expense of the task.●Mourning/adjourning.The group sees itself as having fulfilled its purpose is due to physically disband.57.theories of motivationContent theories and Process theories58.content theories of motivation——Maslow’s hierarchy of needs59.Job enrichment工作丰富化Job enrichment is planned,deliberate action to build greater responsibility,breadth and challenge of work into a job.Job enrichment is similar to empowerment.60.Job enlargement扩大就业Job enlargement is the attempt to wide jobs by increasing the number of operation in which a job holder is involved.61.pay as a motivatorpay as a motivator:Pay is the most important of the hygiene factors, but it is ambiguous in its effect on motivation.62.principles of time managementPrinciples of time management include❖Goals: specific,measureable,attainable,realistic and time-bounded❖Action plans❖Priorities(优先权)❖Focus:one thing at a time❖Urgency:urgency should always be considered together in prioritising tasks.❖Organsation:an ABCD method of in-tray management.(Act on the item immediately.Bin it .Create a define plan for coming back to the item.Delegate it to someone else to handle.)63.improving time management❖Plan each day. The daily list should include the most important tasks as well as urgent but less important task.❖Produce a longer-term plan. This can highlight the important tasks so that sufficient time is spent on them on a daily basis.❖Do not be available to everyone at all times.❖Stay in control of the telephone.64.work planningWork planning consists if a number of basic steps.❖Allocating work to people and machines.(sometime called loading) ❖Determining the order in which activities are performed(prioritising:sometimes called activity scheduling or task sequencing)❖Determining exactly when each activity will be performed❖Establishing checks and controls to ensure that deadlines are beingmet and that routine tasks still achieving their objectives.65.coaching , mentoring , counselling❖Coaching is an approach whereby a trainee is put under the guidance of an experienced employee who shows the trainee how to perform tasks.(coaching focuses on specific objectives)❖Mentoring is a long-term relationship in which a more experienced person as a teacher, counsellor, role model, supporter and encourager, to foster the individual’s personal and career development.●The differences between coaching and mentoring:❖The mentor is not usually the protégés immediate superior❖Mentoring covers a wide range of functions, not always related to current job performance.❖Counselling(意见)can be defined as ' a purpose relationship in which one person helps another to help himself. It is a way of relating and responding to another person so that that person is helped to explore his thoughts,feelings and behaviour with the aim of reaching a clearer understanding. The clearer understanding may be of himself or of a problem,or of the one in relation to the other.(counselling is non-directive.)munication patterns or networks(p341)❖The circle. Each member of the group could communicate with onlytwo other in the group, as shown.❖The chain.❖The "y"❖The wheel67.The communication process(p342)68.Job advertisingQualities if a good job advertisementContents of a job advertisement ( the organisation,the job,conditions,qualifications and experience,reward , application process) Advertising mediaChoosing(the type of organisation ,the type of job,the cost of advertising ,the readership and circulation,the frequency)69.The limitations of interviews:70.Equal opportunities is an approach to the management of people at work based on equal access and fair treatment, irrespective of gender, race, ethnicity, age, disability, sexual orientation or religious belief.71.There are three types of discrimination:❖Direct discrimination:occurs when one interested group is treated less favourably than another. (相同工作待遇不同)❖Indirect discrimination:occurs when a policy or practice is fair in form, but discriminatory in operation.(工作上歧视)❖Victimisation(欺骗):occurs when a person is penalised for giving information or taking action in pursuit of a claim of discrimination.(申诉时受到不平等的对待)The legislation does not permit positive discrimination:actions which give preference to a protected person , regardless of genuine suitability and qualification for the job.72.Diversity(差异)policy①Analyse your business environment②Define diversity and its business benefit③Introduce diversity policy into corporate strategy④Embed(嵌入)diversity into core HR processes and system⑤Ensure leaders implement policy⑥Involve staff at all levels⑦Communicate, communicate ,communicate⑧Understand your company's needs⑨Evaluate73.learning styles: Honey and Mumford●Theorists(理论型学习者)❖Programmed and structured❖Designed to allow time for analysis❖Provided by teachers who share their preference for concepts and analysis●Reflectors(思考型学习者)❖Observe phenomena, think about them and then choose how to act❖Need to work at their own pace❖Find learning difficult if forced into a hurried programme❖Produce carefully thought-out conclusions after research and reflection❖Tend to be fairly slow, non-participative and cautious●Activists(行动型学习者)❖Deal with practical, active problems and do not have patience with theory❖Require training based on hands-on experience❖Are excited by participation and pressure❖Are flexible and optimistic●Pragmatists(实用型学习者)❖Only like to study if they can see a direct link to real, practical problems❖Are good at learning new techniques through on-the- job training❖Aim to implement action plans❖May discard good ideas which only require some development74.The learning cycle: KolbConcrete experience(act)→observation and reflection(analyse)→formation of abstract concepts and generalisations(suggest)→applying/testing the implications of concept in new situations(apply) 75.Maier’s three types of approach to appraisal interviews1.The tell and sell style(告诉和销售法)The manager tells the subordinate how she has been assessed, and then ties to ‘sell’(gain acceptance of ) the evaluation and the improvement plan.Weakness is that communication is one-sided and easy to cause subordinate defensive reaction.To improve the future work is not very ideal.2.The tell and listen style(告诉与聆听法)The manager tells the subordinate how she has been assessed, and then invites the appraisee to respond. The employee is encouraged toparticipate in the assessment and the working out of improvement targets and methods. But the performance improvement is still limited.3. The problem-solving style(问题解决法,best one)Encourage manager and subordinate established initiative and open communication. The discussion is centred not on the assessment, but on the employee’s work problems. They share each other's opinions, discussed it together, and find the solutions.This method is suitable for future development of subordinate.。

2020年ACCA考试F1管理学术语英汉对照解释(1)

2020年ACCA考试F1管理学术语英汉对照解释(1) Foundations of Control:1、Control:控制The process of monitoring activities to ensure that they are being accomplished as planned and of correcting any significant deviations.是对各项活动的监视,从而保证各项行动按计划实行并纠正各种显著偏差的过程。

2、Market control:市场控制An approach to control that emphasizes the use ofexternal market mechanisms to establish the standards used in the control system.是一种强调使用外在市场机制,在系统中建立使用标准来达到控制的方法。

3、Bureaucratic control:官僚控制An approach to control that emphasizes organizational authority and relies on administrative rules, regulations,procedures, and policies.是一种强调组织的,依靠管理规章、制度、过程及政策来实现控制系统的方法。

4、Clan control:小集团控制An approach to control in which employee behavior is regulated by the shared values, norms, traditions, rituals,beliefs,and other aspects of the organization‘s culture.在小集团控制下,员工的行为靠共同的价值、规范、传统、仪式、信念及其他组织文化方面的东西来调节。

财务管理课件

财务管理基本领域 Basic Areas Of Finance

• • • •

公司理财Corporate finance 投资Investments 金融机构Financial institutions 国际财务管理International finance投资 InvFra bibliotekstments

• •

•

与金融资产打交道,如股票和债券Work with financial assets such as stocks and bonds 金融资产价值,风险与收益及资产配置 Value of financial assets, risk versus return and asset allocation 工作机会Job opportunities

财务经理目标 Goal Of Financial Management

公司目标应该是什么?What

should be the

goal of a corporation?

利润最大化?Maximize profit? 成本最小化?Minimize costs? 市场份额最大?Maximize market share? 公司当前股票价值最大化?Maximize the current value of the company’s stock?

财务长—现金管理/信用管理/资本支出和财务预测 Treasurer – oversees cash management, credit management, capital expenditures and financial planning 会计长—税/成本会计/财务会计/数据处理

财务管理决策 Financial Management Decisions

Company Law of the People's Republic of China

中华人民共和国公司法Company Law of the People's Republic of China颁布机关:全国人民代表大会常务委员会Promulgating Institution: Standing Committee of the National People's Congress文号:中华人民共和国主席令第八号Document Number: Order No. 8 of the President of the People's Republic of China颁布时间: Promulgating Date: 12/28/2013 12/28/2013实施时间: Effective Date: 03/01/2014 03/01/2014效力状态: Validity Status: 有效Valid(1993年12月29日第八届全国人民代表大会常务委员会第五次会议通过 1999年12月25日第九届全国人民代表大会常务委员会第十三次会议第一次修正 2004年8月28日第十届全国人民代表大会常务委员会第十一次会议第二次修正 2005年10月27日第十届全国人民代表大会常务委员会第十八次会议修订 2013年12月28日第十二届全国人民代表大会常务委员会第六次会议修订自2014年3月1日起施行)目录第一章总则第二章有限责任公司的设立和组织机构第一节设立第二节组织机构第三节一人有限责任公司的特别规定第四节国有独资公司的特别规定第三章有限责任公司的股权转让第四章股份有限公司的设立和组织机构第一节设立第二节股东大会第三节董事会、经理第四节监事会第五节上市公司组织机构的特别规定第五章股份有限公司的股份发行和转让第一节股份发行第二节股份转让第六章公司董事、监事、高级管理人员的资格和义务第七章公司债券第八章公司财务、会计第九章公司合并、分立、增资、减资第十章公司解散和清算第十一章外国公司的分支机构第十二章法律责任第十三章附则第一章总则(Adopted at the Fifth Session of the Standing Committee of the Eighth National People's Congress on December 29, 1993; Amended for the first time at the 13th Session of the Standing Committee of the Ninth National People's Congress on December 25, 1999; Amended for the second time at the 11th Session of the Standing Committee of the Tenth National People's Congress on August 28, 2004; Revised at the 18th Session of the Standing Committee of the Tenth National People's Congress on October 27, 2005; and Revised at the 6th Session of the Standing Committee of the Twelfth National People's Congress on December 28, 2013 and shall take effect on March 1, 2014)Table of ContentsChapter 1: General ProvisionsChapter 2: Establishment and Organizational Structure of a Limited Liability CompanySection 1: EstablishmentSection 2: Organizational StructureSection 3: Special Provisions on One-Person Limited Liability CompaniesSection 4: Special Provisions on Wholly State-Owned CompaniesChapter 3: Equity Transfer of a Limited Liability CompanyChapter 4: Establishment and Organizational Structure of a Company Limited by SharesSection 1: EstablishmentSection 2: General MeetingSection 3: Board of Directors; ManagersSection 4: Board of SupervisorsSection 5: Special Provisions on the Organizational Structure of a Listed CompanyChapter 5: Issuance and Transfer of Shares of a Company Limited by SharesSection 1: Issuance of SharesSection 2: Transfer of SharesChapter 6: Qualifications and Obligations of the Directors, Supervisors, and Senior Management Personnel of a CompanyChapter 7: Corporate BondsChapter 8: Finance and Accounting of a CompanyChapter 9: Merger, Division or Capital Increase or Reduction of a CompanyChapter 10: Dissolution and Liquidation of a CompanyChapter 11: Branches of a Foreign CompanyChapter 12: Legal LiabilitiesChapter 13: Supplementary ProvisionsChapter 1: General Provisions第一条为了规范公司的组织和行为,保护公司、股东和债权人的合法权益,维护社会经济秩序,促进社会主义市场经济的发展,制定本法。

辅助独特的人力资本

KNOWLEDGE

WORK知识性工作

T&D-investment技术培训投资

PA-strategy contribute战略性捐赠

$-performance绩效 Job-empower授权

Job-cuJsotbo-mdiyzneadm用i户c 化的S-工so作$l-vbeopnruosbJloebm-rsJo解otba决-tsioe问ncu工题ri作ty安轮全换

研究:152家超过 200雇员的多元产品

公司的CEO,资深人 Plotting HR Practices人力资源实践策略

力专员,一线经理

高

唯 一 性

UNIQUE

high

STUDY:

152 multi-product firms >200 employees

CEO, VPHR, line execs

• developmental培训

Low Value

High Value

• focus on performance关注绩效 Ancillary Compulsory

• external equity (market rate)外部公平(G市ener场ic 比例) • pay for performance为绩效付薪

design engineers (w/ Boeing)设计工程师

HHuummaann CCaappiittaallAArrcchhiitteeccttuurree

Unique

trainers (Merck/Forum)培训师 authors (McGraw-Hill)作者

Idiosyncratic Core

Legal/Reg. DDistisritbriubtuiotinon

公司理财罗斯专业词汇整理

Maturity premium: 期限溢价Risk premium: 风险溢价market portfolio: 市场组合Variance: 方差Standard deviation: 标准差Average return: 平均收益率Diversification: 分散投资Portfolio: 投资组合Unique risk or diversifiable risk: 特有风险或可分散风险Market risk or systematic risk: 市场风险或系统风险True value: 真实价值Efficient capital market: 有效资本市场Commercial paper: 短期融资券、商业票据Treasury stock: 库藏股Issued shares: 已发行股票Outstanding shares: 流通在外股票Authorized share capital: 法定股本Par value: 面值Additional paid-in capital or capital surplus: 附加实缴资本或资本公积Retained earnings: 留存收益Outside directors: 外部董事Majority voting: 多数表决投票制度Cumulative voting: 累积投票权Proxy contest: 代理权争夺Preferred stock: 优先股Net worth: 净值、资本净值Floating-rate preferred: 浮动利率优先股Counterbalance:使平衡,抵销Floating interest rate: 浮动利率Prime rate: 最优惠利率London interbank offered rate (LIBOR): 伦敦银行同业拆借利率Funded debt: 长期债务Sinking fund: 偿债基金Callable bond: 可赎回债券Subordinated debt: 次级债券或后偿债务Secured debt: 有抵押债务或有担保债务Default risk: 违约风险Eurodollars: 欧洲美元Warrant: 认股权证Convertible bond: 可转换债券Convertible preferred stock: 可转换优先股Financial deficit: 财务赤字Income statement: 利润表Common-size income statement: 共同尺度利润表、百分率利润表Balance sheet: 资产负债表Common-size balance sheet: 共同尺度资产负债表Leverage ratios: 负债比率、杠杆比率Financial leverage: 财务杠杆Long-term debt ratio: 长期负债比率Long-term debt-equity ratio: 长期债务权益比Total debt ratio: 资产负债率Times interest earned ratio: 已获利息倍数Cash coverage ratio: 现金流偿债能力比率Liquidity ratio: 变现能力比率Net working capital to total assets ratio: 净营运资本占总资产比Current ratio: 流动比率Quick (or acid-test) ratio: 速动比率或酸性测试比率Cash ratio: 现金比率Marketable securities: 有价证券Asset turnover ratio: 资产周转率Average collection period: 平均收账期Inventory turnover ratio: 存货周转率Profitability ratios: 盈利能力比率Profit margin: 销售净利率、利润边际Operating profit margin: 营业利润率Return on assets (ROA): 总资产收益率Return on equity (ROE): 净资产收益率Payout ratio: 股利支付率Plowback ratio: 留存收益率Long-term debt ratio: 长期负债比率Long-term debt-equity ratio: 长期债务权益比Total debt ratio: 资产负债率Times interest earned ratio: 已获利息倍数Interest cover ration:利息保障倍数Cash coverage ratio: 现金流偿债能力比率Du Pont system: 杜邦财务分析体系ROA: 总资产收益率ROE: 净资产收益率Creditor 债权人Deflation 通货紧缩Expenses 费用Financial statement 财务报表Financial activities 筹资活动Liabilities 负债Negative cash flow 负现金流量Operating activities 经营活动Owners equity 所有者权益Partnership 合伙企业Positive cash flow 正现金流量Retained earning 留存利润Revenue 收入Sole proprietorship 独资企业Solvency 清偿能力财会名词汉英对照表〔1〕会计与会计理论会计accounting决策人Decision Maker投资人Investor股东Shareholder债权人Creditor流动资产Current assets流动负债Current Liabilities长期负债Long-term Liabilities投入资本Contributed Capital留存收益Retained Earning----------------------------------------------------------------------------------------------------------------------应收帐款Account receivable应收票据Note receivable起运点交货价F.O.B shipping point目的地交货价F.O.B destination point商业折扣Trade discount现金折扣Cash discount销售退回及折让Sales return and allowance坏帐费用Bad debt expense备抵法Allowance method备抵坏帐Bad debt allowance出票人Maker受款人Payee本金Principal利息率Interest rate到期日Maturity date本票Promissory note贴现Discount拒付费Protest fee------------------------------------------------------------〔4〕存货存货Inventory商品存货Merchandise inventory产成品存货Finished goods inventory在产品存货Work in process inventory原材料存货Raw materials inventory市价Market value重置本钱Replacement cost可变现净值Net realizable value上限Upper limit下限Lower limit毛利法Gross margin method零售价格法Retail method本钱率Cost ratio------------------------------------------------------------〔5〕长期投资长期投资Long-term investment长期股票投资Investment on stocks长期债券投资Investment on bonds本钱法Cost method权益法Equity method合并法Consolidation method股利宣布日Declaration date股权登记日Date of record除息日Ex-dividend date付息日Payment date债券面值Face value, Par value债券折价Discount on bonds债券溢价Premium on bonds票面利率Contract interest rate, stated rate市场利率Market interest ratio, Effective rate普通股Common Stock优先股Preferred Stock现金股利Cash dividends股票股利Stock dividends清算股利Liquidating dividends到期日Maturity date到期值Maturity value---------------------------------------------------------〔6〕固定资产固定资产Plant assets or Fixed assets原值Original value预计使用年限Expected useful life预计残?nbsp;Estimated residual value折旧费用Depreciation expense累计折旧Accumulated depreciation帐面价值Carrying value应提折旧本钱Depreciation cost净值Net value在建工程Construction-in-process磨损Wear and tear过时Obsolescence直线法Straight-line method 〔SL〕工作量法Units-of-production method 〔UOP〕加速折旧法Accelerated depreciation method双倍余额递减法Double-declining balance method 〔DDB〕年数总和法Sum-of-the-years-digits method 〔SYD〕以旧换新Trade in经营租赁Operating lease融资租赁Capital lease廉价购置权Bargain purchase option 〔BPO〕资产负债表外筹资Off-balance-sheet financing最低租赁付款额Minimum lease payments--------------------------------------------------------〔7〕无形资产无形资产Intangible assets专利权Patents商标权Trademarks, Trade names著作权Copyrights特许权或专营权Franchises商誉Goodwill开办费Organization cost租赁权Leasehold摊销Amortization--------------------------------------------------------〔8〕流动负债负债Liability流动负债Current liability应付帐款Account payable应付票据Notes payable贴现票据Discount notes长期负债一年内到期局部Current maturities of long-term liabilities应付股利Dividends payable预收收益Prepayments by customers存入保证金Refundable deposits应付费用Accrual expense增值税value added tax营业税Business tax应付所得税Income tax payable应付奖金Bonuses payable产品质量担保负债Estimated liabilities under product warranties赠品和兑换券Premiums, coupons and trading stamps或有事项Contingency或有负债Contingent或有损失Loss contingencies或有利得Gain contingencies永久性差异Permanent difference时间性差异Timing difference应付税款法Taxes payable method------------------------------------------------------------〔9〕长期负债长期负债Long-term Liabilities应付公司债券Bonds payable有担保品的公司债券Secured Bonds抵押公司债券Mortgage Bonds保证公司债券Guaranteed Bonds信用公司债券Debenture Bonds一次还本公司债券Term Bonds分期还本公司债券Serial Bonds可转换公司债券Convertible Bonds可赎回公司债券Callable Bonds可要求公司债券Redeemable Bonds记名公司债券Registered Bonds无记名公司债券Coupon Bonds普通公司债券Ordinary Bonds收益公司债券Income Bonds名义利率,票面利率Nominal rate实际利率Actual rate有效利率Effective rate溢价Premium折价Discount面值Par value直线法Straight-line method实际利率法Effective interest method到期直接偿付Repayment at maturity提前偿付Repayment at advance偿债基金Sinking fund长期应付票据Long-term notes payable抵押借款Mortgage loan--------------------------------------------------〔10〕业主权益权益Equity业主权益Owners equity股东权益Stockholders equity投入资本Contributed capital缴入资本Paid-in capital股本Capital stock资本公积Capital surplus留存收益Retained earnings核定股本Authorized capital stock实收资本Issued capital stock发行在外股本Outstanding capital stock库藏股Treasury stock普通股Common stock优先股Preferred stock累积优先股Cumulative preferred stock非累积优先股Noncumulative preferred stock完全参加优先股Fully participating preferred stock局部参加优先股Partially participating preferred stock非局部参加优先股Nonpartially participating preferred stock现金发行Issuance for cash非现金发行Issuance for noncash consideration股票的合并发行Lump-sum sales of stock发行本钱Issuance cost本钱法Cost method面值法Par value method捐赠资本Donated capital盈余分配Distribution of earnings股利Dividend股利政策Dividend policy宣布日Date of declaration股权登记日Date of record除息日Ex-dividend date股利支付日Date of payment现金股利Cash dividend股票股利Stock dividend拨款appropriation-----------------------------------------------------------〔12〕财务状况变动表财务状况变动表中的现金根底SCFP.Cash Basis〔现金流量表〕财务状况变动表中的营运资金根底SCFP.Working Capital Basis〔资金来源与运用表〕营运资金Working Capital全部资源概念All-resources concept直接:)业务Direct exchanges正常营业活动Normal operating activities财务活动Financing activities投资活动Investing activities-----------------------------------------------------------〔13〕财务报表分析财务报表分析Analysis of financial statements比较财务报表Comparative financial statements趋势百分比Trend percentage比率Ratios普通股每股收益Earnings per share of common stock股利收益率Dividend yield ratio价益比Price-earnings ratio普通股每股帐面价值Book value per share of common stock资本报酬率Return on investment总资产报酬率Return on total asset债券收益率Yield rate on bonds已获利息倍数Number of times interest earned债券比率Debt ratio优先股收益率Yield rate on preferred stock营运资本Working Capital周转Turnover存货周转率Inventory turnover应收帐款周转率Accounts receivable turnover流动比率Current ratio速动比率Quick ratio酸性试验比率Acid test ratio〔14〕合并财务报表合并财务报表Consolidated financial statements吸收合并Merger创立合并Consolidation控股公司Parent company附属公司Subsidiary company少数股权Minority interest权益联营合并Pooling of interest 购置合并Combination by purchase 权益法Equity method本钱法Cost method。

大学英语精读第三册翻译

事件的官方说法是,警察受到攻击,只是试图保护自己。

11.Despite the warning that smoking kills, the umber of smokers does

not seem to drop in our coun try.

凡违反公司的安全规章应当当场解雇。

4.This is a very formal occasion」t is not appropriate to wear casual pants or休闲裤或裙子.

5.All the questi ons the police asked revolved around what she had bee n doing on the ni ght of the robbery.

of teach ing will be used in all subseque nt trai ning programs.

Dr.Smith开始第一个训练计划他自己,他的教学方法等,将在所有后 续培训课程中使用。

3.Whoever disobeys the company's safety regulations shall be dismissed on the spot.

rge-scale studies are n eeded toe on firm the en couragi ng results we have obta ined so far.

需要大规模的研究来证实我们迄今取得的令人鼓舞的结果。

2.Dr.Smith is starting the first training program himself, and his methods

英语词块翻译

Negotiating买卖谈判negotiating terms买卖谈判小组Negotiation谈判Net净的net amount of operating loss营业损失净额net assets净资产net assets value per share每股资产净值net balance净差额net book value of fixed assets固定资产帐面净值net capital gain资本净收益net capital to debt ratio净资产与债务比率net cash flow净现金流量net current assets净流动资产net earning净收益net income after tax税后净收入net income before tax税前净收入net income from operation营业净收入net liability净负债net loss净损失net margin净利net national debt国债净额Net Natinal Product(NNP)国民生产净值net present value净现值net profit after tax税后净利润net profit or loss净损益Network网络information network信息网络Ninth Five-Year Plan九五计划Nominal名义上的nominal assets名义资产nominal capital名义资本Non非...,不...non-accepted bill不认付票据non-bank financial institution非银行金融机构non-business property非营业资产non-cash assets非现金资产non-cash settlement非现金结算non-financial business非金融企业non-governmental entity非政府机构non-led ger assets帐外资产non-linear relation非线性关系non-market factor非市场因素non-nationalization非国有化non-operating profit非营业利润non-profit firm非营利公司non-registered bond不记名债券non-registered stock不记名股票non-state economic sectors非国有经济部门Noncurrent非流动的noncurrent asset(NCA)非流动资产noncurrent liability(NCL)非流动负债Normal正常的normal distribution curve正态分布曲线normal year正常年度Normed定额的normed current fund定额流动资金normed deposit account限额存款帐户Note票据,纸币note issuance货币发行note receivable应收票据Notice布告,通知bankruptcy notice破产公告notice of claim索赔通知notice of invitation for bids招标公告OObject目标,对象,物体object cost目标成本Objective目标的,客观的objective factor客观因素objective laws客观规律objective value客观价值Objectivity rule客观原则Obligation责任,义务obligation of contract契约义务Obsolete过时的,陈旧的,不使用的obsolete equipment陈旧设备Occupation占有,职业Occupied占有的,有职业的occupied rate of current capital流动资金占有率Occupy占有Offer提供,报价,发盘blind offer盲目要价offer price要价Office办公室,办事处,事务所Official官方的,正式的,官员official approval官方批准official capital官方资本official exchange rate官方汇率,法定汇率official holiday法定假日official list官方牌价official seal官方印章officials at various government levels各级政府官员On job training在职训练Open打开,开放open an account开设帐户open bid公开招标open coastal cities沿海开放城市open competition公开竟争open door policy开放政策open domestic market开放国内市场open economy开放的经济open-door to the outside world对外开放Opening up扩大开放reform and opening up policy改革开放政策Operating营业,经营operating capital经营资本,流动资本operating cost经营成本operating deficit营业亏损operating income营业收入operating license营业执照operating performance经营效绩operating profit营业利润operating strategy经营战略Operation经营,营业,操作operation and management经营和管理operation of capital资金的运用Operational经营的operational losses经营性亏损operational mechanism经营机制operational research运筹学Opinion意见,看法opinion polls民意测验Opportunity机会Optimize优化optimize capital structure优化资本结构Optimum最佳的optimum portfolio最佳投资组合Option期权,选择权Black-Scholes Option Pricing Model Black-Scholes期权定价模型call option买方期权put options卖方期权(in the money)沽盈价(out of the money)沽亏价Order定货,定单,秩序new international economic order国际经济新秩序Ordinary普通的,平常的ordinary share普通股Organization机构,组织Organizational组织的,编制中的organizational chats组织结构图organizational goals组织目标organizational structures组织结构Organized有组织的Organizer组织者Organizing组织organizing ability组织能力Original初始的,原本的,正本original capital原始资本original cost原始成本original evidences原始凭证original investment原始投资original invoice原帐单,原发票Other其它的other assets其它资产other income其它收入other liability其它负债Out在...之外out of balance不平衡out of control失去控制out of order失灵,失效out of service报废out of work失业Out-dated落后的,过时out-dated management styles落后的管理方式Output输出,产出output method of depreciation产量折旧法Outside外面outside capital外部资本outside dealing场外交易Outstanding未兑现的,未偿清的,未完成的,杰出的outstanding account未清帐目outstanding debt未清债务outstanding loan未偿还贷款outstanding obligation未偿还债务Over超过,在...之上over capitalization资本过剩over production生产过剩Over-the-counter(OTC)场外交易,柜台交易over-the-counter dealings场外交易over-the-counter market场外交易市场Overall全面的,总的,综合的overall average总平均overall balance总余额overall economic situation总的经济形势overall demand and supply总需求和总供给Overbid过高出价Overcharge要价过高Overdraft透支overdraft interest透支利息overdraft on bank向银行透支Overdue过期的overdue bill过期票据Overhead间接费用overhead account间接费用帐户overhead cost间接成本overhead expenses间接费用,经常费用Overheated economy过热的经济Overseas海外的overseas branch海外分支机构overseas assets海外资产overseas company海外公司overseas investment海外投资overseas market海外市场Overtime加班时间,额外时间overtime and night differential加班费和夜班补助Owe欠(债)taxes owed应交所得税wages owed to employees应付职工工资Own自有,拥有Owner所有人,物主owner equity业主权益owner of patent专利所有人owner’s capital自有资本Ownership所有制,所有权collective ownership集体所有制ownership by the entire people全民所有制ownership certificate所有权证书ownership of trade mark商标所有权ownership system所有制PPackage一揽子,包,包装package agreement一揽子按排,一揽子方案package deal一揽子交易package mortgage一揽子抵押贷款package program一揽子计划Packaged体揽子的,包装好的package investment一揽子投资packaged transfer成套转让Paid付清的paid cash book现金支出帐paid check已付支票paid debt已还清的债务paid off付清Paid-in已缴的,已收到的paid-in capital实收资本paid-in surplus缴入公积Paid-up已缴纳的,已付清的paid-up capital已缴清的资本paid-up loan已还清的贷款Paper纸,纸币,票据,论文paper gold特别提款权,纸黄金paper money纸币,票据paper profit帐面利润paper title所有权证书Par与票面价值相等的par issue平价发行par rate of exchange平价汇率par value票面价值,平价Parallel departmentation平行式的部门划分Parameter参数Parent母体,父母parent company母公司,总公司parent firm母公司,总公司parent-subsid iary母公司---子公司Parity等价,平价,比价parity price平价parity rate of commod ity商品比价Participating preferred stock参加分红的优先股Participative management参与管理Partner合伙人partner’s equity合伙人权益Partnership合伙关系,合伙制general partnership一般合伙limited partnership有限责任合伙partnership agreement合伙契约,合伙协议partnership assets合伙资产partnership capital合伙资本partnership enterprise合伙企业partnership property合伙财产Patent专利,专利权patent agent专利代理人patent application专利申请patent fee专利费patent licensing专利许可patent rights专利权Patentee专利权所有人Pay付钱,付款,偿还,工资pay back period还本期pay bill工资单pay check付工资的支票pay cut工资削减pay duty纳税pay freeze工资冻结pay in缴款pay in cash现金支付pay off清偿pay out支出pay up付清Payable应付的payable account应付帐目,应付帐款Payback period of investment投资回收期Payment付款,支付payment abroad境外付款payment after delivery货到付款payment in advance预付payment in cash现金支付payment in stock用股票支付Payroll工资单P/E ratio市盈率Penalty罚款administrative penalty行政罚款Penny stock低价股票Pension退休金,养老金pension fund养老基金,退休基金Per capita人均per capita annual income in cities and towns城镇人均年收入per capita annual net income in rural areas农村人均年收入per capita assets人均资产per capita gross domestic product人均国内生产总值per capita growth人均增长per capita income of rural residents农村人均收入per capita income of urban residents城镇人均收入Per share每股asset value per share每股资产值multiple of book value per share每股帐面资产比multiple of cash flow per share每股现金流比multiple of sales per share每股销售比Percentage百分比percentage depletion method百分比折耗法percentage of utilization of fixed asset固定资产利用率Perfect完全,完美perfect competition market完全竟争市场perfect monoply完全垄断Perform履行perform a contract履行会同Performance执行,履行,完成,性能,业绩performance appraisal效绩评价performance audit业绩审计performance evaluation业绩评价performance rating业绩评级performance report业绩报告performance record业绩记录Period周期period cost期间成本period of depreciation折旧期数period of production生产周期Period ical周期的,定期的period ical deposit定期存款period ical inspection定期检查Permanent永久的permanent assts永久性资产permanent income长期收入Personal个人的personal account个人帐户personal capital个人资本personal hold ing company私有股份公司personal income tax个人所得税personal investment各人投资personal liability个人责任personal property个人财产Personnel人员,全体雇员personnel administration人事管理personnel department人事部门personnel management人事管理personnel system人事制度Petty cash零用现金petty cash account零用现金帐户petty cash fund零用备用金Phase阶段Physical物理的,实际的physical assets appraisal实物资产评估physical capital有形资本physical depreciation实物折旧,有形损耗physical hold ing of stock实际库存physical inventory实物盘存Piece件,片,块piece work system计件工资制piece worker计件工人Pilot领航员,带路人,新产品试制pilot project试点项目pilot program试点计划Planned按计划的planned budget计划预算planned economy计划经济planned figures计划数字,计划指标planned purchase and supply by the state国家统购统销planned target计划目标Planning计划,规划planning committee计划委员会planning department计划管理部门planning management计划管理planning system计划管理体制Plant工厂plant idleness工厂闲置设备Pledged抵押,保证pled ged assets抵押资产Pillar支柱pillar industry支柱产业Plow back(利润转为)再投资plow back earnings再投资收益plow back profit再投资利润Plus tick股票交易价格向上浮动Point-of-sale销售点Point-of-sale system(POS)商业销售POS系统Pollution污染pollution control regulation环境保护规定Pool合伙经营,联合Pooling联营,汇集,合并pooling of interest利益共享,共同经营Poor贫穷的,粗糙的poor management管理不善Population人口population base人口基数population distribution人口分布Portfolio投资组合(投资证券时购买多种不同股票,债券以减少风险)portfolio investment证券投资portfolio management证券投资管理portfolio strategy投资组合战略portfolio theory投资搭配理论Position状况,立场,位置,职位capital position资金状况Positive正的,积极的positive capital正资本positive cash flow正向现金流positive growth正增长Possession所有,拥有,所有权actual possession实际所有权unlawful possession非法所有,不合法所有Possessory所有的possessory right所有权Potential潜力,潜在的potential competition潜在竟争potencial demand潜在需求potencial market潜在市场potencial value潜在价值Poverty贫困absolute poverty绝对贫困eliminate poverty消除贫困shake off poverty摆脱贫困Power权,能力,力量power of appointment任命权power of interpretation解释权power of sale销售权Practice实践,惯例international practices国际惯例Predatory掠夺性的predatory dumping掠夺性倾销predatory price cutting掠夺性竟争削价Prediction预测economy prediction经济预测Preference优先,优惠preference bond优先债券preference share优先股Preferential优先的,优惠的preferential interest rate优惠利率preferential loan优惠贷款preferential right优先权preferential transfer优先转让Preferred优先的preferred creditor优先债权人preferred dividend优先股息preferred ordinary stock优先普通股票preferred share优先股preferred stock premium优先股溢价preferred stockholder equity优先股股东权益Preliminary初步的,预备的preliminary expenses开办费preliminary prospectus初步募股书preliminary planning初步规划Premium溢价premium bond溢价债券premium pay加班费Prepaid已预付的,先付的prepaid assets递延资产prepaid deposit预付定金prepaid expenses预付费用prepaid interest预付利息Present现在的,目前的present capital value资本现值present value现值present value approach现值法Pretax税前的pretax earnings税前利润pretax income税前收入pretax rate of return税前回报率Prevent防止Price价格buying price买价catalog price目录价格closing price收盘价格comparable price可比价格competitive price竟争价格cost price成本价格duty-paid price完税价格futures price期货价格issue price发行价格opening price开盘价格price adjustment价格调整price analysis价格分析price elasticity价格弹性price index价格指数price indexation价格指数化price level价格水平price limit价格限制price stabilization policy稳定价格政策price support价格补贴price system价格体系price war价格战price-eanings(P/E)ratio收益率Pricing定价capital asset pricing model资本资产定价模式pricing strategy定价策略Primary初级的,最初的primary business主营业务primary data原始数据primary goods初级产品primary market初级市场primary products初级产品Prime基本的,首要的,最初的prime assets主要资产prime contractor总承包商prime cost主要成本,直接成本prime paper最佳股票prime rate优惠利率Principal本金,本金的principal and interest本金和利息principal stockholder主要股东Principle原则,原理principle of accounting会计原理,会计原则principle of equality and mutual benifit平等互利的原则principle of openness and fairness公开和公正的原则principle of profit maximization利润最大化原则Priority优先级Private私人的,私营的,私有的private capital私人资本private company私营公司private corporation私营公司private enterprise私营企业private limited partnership私人有限公司private loan私人贷款private ownership私人所有制,私有制Privatization私有化,私营化Privilege优惠,特权Privileged特许的,有特权的Probability概率,机率probability density function概率密度分布函数probability distribution概率分布probability mass function概率群分布函数probability theory概率论Procedure in bankruptcy破产程序Proceedings in bankruptcy破产诉讼Processing处理,加工processing industry加工工业processing on order来料加工processing trade加工贸易Produce生产Producer生产者,厂家producer price index生产者价格指数Product产品product cost产品成本product line生产线Production生产,产品Productive生产性的productive assets生产性资产productive capacity生产能力production power生产力Professional专业的,专门的professional accountant专业会计professional company专业公司Profit利润,盈利annual profit年利润meager profit微利,薄利profit after taxation税后利润profit and loss account损益帐profit and loss statement损益表profit distribution利润分配profit from operating营业利润profit from sale of fixed assets出售固定资产的收益profit on operation经营利润profit on sale销售利润profit or loss on exchange汇兑损益profit paid to the state上交国家利润profit rate利润率profit ratio of capital资本利润率profit ratio of paid-in capital实收资本利润率profit realized实现利润profit-making enterprises盈利企业Profit Impact of Market Strategy(PIMS) Progressive rate累进税率Project项目,方案,计划project appraisal项目评估project budget项目预算project capital system项目资本金制度project loan项目贷款project management项目管理Promotion推销,提升sales promotions促销consumer sales promotions消费者销售促销Propel推进propel reform推进改革Property财产,所有权property account财产帐户property accounting财产会计property and assets财产与资产property damage财产损失property in land土地所有权property income财产收入property rights产权property rights transfer agency产权转让机构(产权交易所)property tax财产税Proprietary所有人的,财产权proprietary interest业组权益proprietary lease产权租赁Proprietor业主Proprietorial right所有权Proprietorship业主权,独资,一人拥有全部财产的业主Prospective未来的,预期的prospective earnings预期收益prospective market未来市场Prospective yield预期收益Prospectus招股说明书protect保护,防护protect the interests of investors保持投资者的利益protect national resource保护自然资源Protection保护,防护Protective保护的protective inport duty保护性进口税protective measures保护措施protective price保护价格Protest拒绝承兑protest note拒付通知Public公开的,公共的public accountant公共会计师public corporation股份有限公司public company股份上市公司public employee公职人员public housing供低收入家庭租用的政府住房public interest公共利益public ownership公有制public property公共财产public relation公共关系public utility公用事业,公共事业public works政府公共建筑Purchase购买purchase and marketing price differentials购销价差purchase capital用于购买企业和投资的资金Purchasing购买,采购purchasing power index购买力指数purchasing power of the dollar美元购买力purchasing power of money货币购买力Purpose目的purpose of appraisals评估目的QQualification资格,资格证书qualification certificate资格证书Qualified合格的,能胜任的qualified accountant合格的会计师Qualitative定性的,质量的qualitative analysis定性分析qualitative control质量控制Quality质量,品质quality analysis质量粉析quality assurance质量保证quality circle质量圈quality control质量控制quality guarantee质量保证quality management质量管理Quantitative定量的,数量的quantitative analysis定量分析quantitative credit control贷款数量控制Quantity数量Quantum数额,数,总额Quarter季度,四分之一Quarterly季度的quarterly balance sheet季度负债表Quick快速的quick assets速动资产,可快速兑现的资产quick ratio速动比率Quit退出,辞职Quota配额,限额import quota进口配额export quota出口配额Quotation报价Quoted price牌价,报价RRaise增加,提高raise a loan借款raise a price加价raise capital集资,招募资本raise foreign funds募集外资raise money募捐,筹款Random随机,偶然random event随机事件random error随机误差random sampling随机抽样,随机采样Range范围,区域range of price价格幅度Ranking等级,顺序Rate比率,率floating exchange rate固定汇率official rate官方汇率rate of accumulation积累率rate of depreciation折旧率rate of discount贴现率rate of growth增长率rate of increment增长率rate of inflation通货膨胀率rate of margin毛利率rate of profit利润率rate of return回报率rate of return on equity股本收益率rate of saving储蓄率rate of taxation税率rate of turnover周转率rate of unemployment失业率Rating评定等级Ratio比率activity ratios经营比率capitalization ratios资本结构比率debt to equity ratio负债股本比率liq uid ratios变现比率price earnings ratio市盈率profitability ratios盈利比率ratio of current assets to fixed assets流动资产与固定资产比率ratio of current assets to current liability流动资产与流动负债比率ratio of equity(ROE)股本利润率ratio of sales(ROS)销售利润率Raw material原材料Re-employment再就业Real真实的real assets实资产real capital实际资本real cost实际成本real earnings实际收益real growth rate实际增长率real property不动产,房地产real value of money货币实际购买力Real estate不动产,房地产real estate account房地产帐户,不动产帐户real estate and property不动产和其它财产real estate investment不动产投资real estate mortgage bond不动产抵押债券real estate pool不动产投资共同基金real estate tax房地产税,不动产税Realizable可变现的realizable value可变现价值Realization变现realization and liq uidation变产清盘Reallocation再分配Reappraisal重新评估reappraisal surplus重估价盈余Reasonable合理的reasonable price合理价格Rebate回扣,退税Recapitalization(企业重组)调整资本结构Receipt收据Receivable应收的receivable account应收帐款receivables turnover应收帐款周转率Recession经济衰退Reciprocal互惠的,相互的reciprocal agreement互惠协定reciprocal contract互惠合同reciprocal duties互惠关税reciprocal hold ings互相控股reciprocal trade互惠贸易Recomputation重新计算Record记录Recourse追索权Recover索回,弥补Recoverable可收回的recoverable cost可收回成本recoverable debt可收回债务recoverable loss可收回损失Recovery收回,恢复Recruitment招聘Red balance赤字结余Redemption偿还,赎回Rediscount再贴现rediscount rate再贴现率Redistribution再分配Reduce减少Reduction减少reduction of interest降低利率Reference参考,推荐信,介绍书reference number参考数字reference price参考价格Reform改革reform measures改革措施reform of state-owned enterprises国有企业改革reform of the economic system经济体制改革reform of the property rights system产权制度改革speed up reform加快改革Refund退货,退款Region地区central and western regions中西部地区Regional地区的,局部的regional economy地区经济regional government地方政府Register登记,注册Registered注册的,登记的registered bond记名债券registered capital注册资本registered share记名股票Registration登记,注册registration form登记表registration of establishment开办登记registration of property right产权登记registration statement股票注册上市申请书Regression analysis回归分析Regessive tax递减税Regular定期的,有规则的regular expenses经常费用regular-way delivery例行交割Regulated控制的,规定的regulated company受控制公司regulated industry受(政府)管辖行业Regulation条例,规章Regulatory framework规章制度Reinsurance再保险reinvestment再投资Relation关系relation of production生产关系Relationship关系relationships among reform,developmentand stability改革,发展和稳定的关系Relative相对的,相关的relative balance相对平衡Reliability可靠性reliabilty of data数据的可靠性Relief救济relief fund救济金Renewal更新,续约renewal and reconstruction funds更新改造基金renewal expenses更新费用renewal of equipment设备更新Rent租,房租,租金Rental租金,租赁rental expenses租金费用rental property租赁财产Reorganization重组,改组Repair修理Repayment还款,偿还repayment analysis偿债分析repayment of debt偿还债务Replacement重置,更换replacement assets重置资产replacement cost approach重置成本法replacement current cost重置现行成本replacement method of depreciation重置成本折旧法replacement price method重置价格法replacement value重置价值Repled ge再抵押Report报告report of changes in assets condition资产状况变动报告Reporting申报reporting form申报报表Representative代表,代理人Reproduction再生产reproduction cost再生产成本reproduction of capital资本的再生产reproduction on an enlarged scale大规模再生产Repurchase回购repurchase price回购价格Request请求,申请书Required要求的required rate of return要求的回报率Requirement必须品,要求Resale转售,倒卖Resched uling重新安排resched uling loans重新安排贷款resched uling of payment重新安排贷款偿还期限Research研究research and development(R&D)研究与开发research and extension研究与推广research of investment feasibility投资可行性研究research on markets市场研究research on state-owned property国有资产研究Reserve准备金,储备reserve account准备金帐户reserve balance储备余额reserve bank储备银行reserve capital储备资本reserve currency储备货币reserve fund储备基金required reserve规定的准备金Reserved预备的,保留的reserved capital保留资本reserved profit保留利润reserved surplus保留盈余Resid ual余额,残值resid ual assets剩余资产resid ual equity剩余权益resid ual interest残值resid ual value残值Resource资源,财力resource allocation资源配置resource utilization资源利用Responsibility责任responsibility for one’s own profits and losses自负盈亏responsibility system责任制Restriction限定,限制restriction of credit信贷管制restriction of import进口限制Restrictive限制性的restrictive cause限制性条款restrictive measure限制性措施Restructure改组Restructuring改组,结构改造Retail零售retail price index商品零售价格指数Retained保存的,保留的retained balance from foreign exchange revenue外汇收入留成额retained earnings留存收益,留存盈余retained foreign exchange account留存外汇帐户retained funds留存资金retained income公积金retained surplus留存盈余Retirement退修,退役,报废retirement fund退休基金retirement income退休收入retirement of assets资产报废retirement pension退休金retirement system退休制度Return(投资)收益,偿还,退货return and compensate退赔return of equity资本利润率return on assets资产收益率return on capital资本收益return on investment投资收益,投资回报return on investment ratio投资回报率return on net worth净值报酬率return on shareholder’s equity股东权益收益率return on tangible asset有形资产收益率return on total assets总资产收益率Revaluation重估价值revaluation of asset资金重估revaluation of fixed assets固定资金重估Revenue收入,营业收入,收益revenue above the line预算内收入revenue account营业收入账户revenue and expend iture in balance财政收支平衡revenue assets收益资产revenue distribution收益分配revenue income收益,收入tax revenue税收收入Revolving周转的,循环的revolving credit周转信贷revolving fund周转基金Right权利,法权right of credit债权right of disposal处置权right of disposition处理权right of monopoly专利权right of ownership所有权right of patent专利权right of possession占有权right of priority优先权right of resale转售权right of trade mark商标权Risk风险risk analysis风险分析risk capital风险资本risk cost风险成本risk free rate无风险利率risk investment风险投资risk management风险管理risk sharing风险分担risk-control mechanism风险控制机制Rule条例,法规,规则rule of fair trade公平交易原则rules for registration of company公司注册章程Rural农村的,农业的rural credit cooperatives农村信用社Rush season旺季SSafeguard保护,保障safeguard measures保障措施safeguard property rightsSalary薪金,工资salary differential工资差别salary range工资幅度salary supplements附加工资Sale销售charge sale赊销sale account销售帐户sale at discount折价销售sale at premium溢价出售sale at deduced price减价出售sale commission销售佣金sales tax营业税sales revenue销售收入Salesman销售人员Sample样品sample data抽样数据Sampling采样,抽样sampling analysis抽样分析sampling check抽样检查sampling investigation抽样调查sampling rate采样率Sanction制裁trade sanction贸易制裁Saving储蓄,节约high savings高储蓄率saving account储蓄帐户saving bond储蓄公债saving fund储蓄基金saving ratio储蓄率savings bank储蓄银行Scale规模,尺度Schedule安排,日程表,计划表,明细表schedule of accounts payable应付帐款明细表schedule of accounts receivable应收帐款明细表schedule of capital资本明细表schedule of depreciation折旧明细表Scheme方案,规划Scope范围scope of business经营范围,营业范围Seal印,印章,封条seal of company公司印章Seasonal季节性的seasonal adjustment季节性调整seasonal labour季节工seasonal unemployment季节性失业Secondary第二的,从属的secondary account次级帐户secondary boycott间接抵制secondary industry第二产业secondary mortgage二次抵押secondary securities market二级证券市场Sector(经济)部门sector of economy经济部门sector of national economy国民经济部门sate-owned industrial sector国有工业部门Secure保证,担保,作保Secured有担保的secured account担保帐户secured creditors’right in bankruptcy proceedings破产中的有保证债权secured loan担保贷款Securities证券,股票securities act证券管理条例securities analysis股市分析securities and investment证券与投资securities company证券公司Securities and Exchange Commission证券交易委员会securities exchange tax证券交易税securities issue证券发行securities market证券市场Security担保,保证,保证金,安全security deposit保证金security rating股票,证券的信用风险评级security right担保权Self自我的(前缀)self-employed个体经营者self-employment income自营收入Sell卖,销售sell at a discount折价出售sell at a low price低价出售sell at half price半价出售sell by sample看样出售sell in bulk成批出售,批发sell on credit赊销Seller卖方,卖主seller’s market卖方市场seller’s price卖方价格Selling销售,出售selling and administrative expenses cost推销及管理费用成本Sell-off of enterprise’s assets廉价销售企业资产Senior老资格的,年老的senior accountant高级会计师senior citizen65岁以上的老年公民senior debt优先债务senior engineer高级工程师senior manager高级管理人员,高级经理Seniority资历,工龄seniority system年资制度Separate分开,分离separate ownership rights from management rights所有权和经营权分离Service服务,劳务service business服务性行业service company服务公司service industry服务业service life(设备的)使用年限Settlement结算,支付,解决settlement of cash现金结算settlement of obligation债务清偿settlement price结算价格Settling结算的,清算的settling bank清算银行settling fee理赔费用Share股票,股份,份额corporation share法人股share account股金帐户share capital股份资本share consolidation股票合并share hold ing economic股份制经济share of market市场份额share ownership股权share price股票价格share stock股票,股份share transfer股票过户share voting right股份投票权share warrant认股证Shareholder股东shareholders’equity股东权益shareholders’meeting股东会议shareholders’rights股东权利Sharehold ing co-operative system股份合作制Sheet表格,单子balance sheet资产负债表Shell corporation空壳公司Short短的,短期的,空头的,卖空的short account空头帐户,卖空帐户short term assets短期资产short term bond短期债券short term credit短期信贷short term debt短期债务short term investment短期投资short term liability短期负债Shortage短缺shortage of capital资金短缺Shut down关闭,停工,停产,停业Sign签署sign a contract签署合同Signature签字,签名Signing authority签字权Single单一的single budget单一预算single entry单式记帐single exchange rate单一汇率single tax system单一税制Sinking fund偿债基金Skill技能skill-intensive技术密集型Skilled有技能的熟练的skilled worker熟练工人Slowdown放慢Social社会的social benefit社会福利social insurance社会保险social security社会保障,社会保险social security act社会保障法social security number社会保险号码social security reform社会保险改革social utility社会福利事业social wealth社会财富Socialist社会主义的socialist collective ownership社会主义集体所有制socialist market economy社会主义市场经济socialist public ownership社会主义公有制socialist sector of economy社会主义经济成分Socialization社会化Soft软的soft currency软通货soft loan软贷款soft landing软着陆soft market疲软市场Software软件Sole单独的,唯一的sole agent独家代理sole legal唯一合法的sole proprietorship(个人)独资企业sole responsibilty for one’s own profits and losses自负盈亏Solely单独地solely foreign-owned enterprise外商独资企业Source来源source of funds资金来源source of revenue收入来源Special特别的,专门的special administrative region(SAR)特别行政区special demands特别要求,特别需求special deposit专用存款special drawing right特别提款权special economic z ones经济特区special fund特别基金Specialization专业化Specialized专门的,专用的specialized agency专门机构specialized company专业公司Speculation投机倒把speculation and risk投机和冒险speculation fever投机热Speculative冒险的,投机的speculative enterprise投机企业speculative market投机市场Speculator投机商Spot现货,现场spot commod ity现货spot market现货市场spot price现货价格spot trade现货贸易,现汇贸易Stabilization稳定Stabilize稳定stabilize the market稳定市场Stable稳定的,不变的stable exchange rate稳定的汇率stable price稳定的价格Staff(全体)职工staff share职工股Stagflation(经济)停滞型通货膨胀Stagnat萧条的stagnat market萧条的市场Stagnation停滞,萧条Standard标准Standard&Pool’s Corporation斯坦普耳(评级)公司Standard&Pool’s Rating斯坦普耳评级Standard&Poor’s500Stock Price Index斯坦普耳公司评出的500家公司股票价格指数standard coststandard deviation标准差Standard Industrial Code(SIC)标准行业代码standard of living生活水准standard wage rate标准工资率Start-up cost开办费用。

营运资金管理外文文献翻译

文献出处:Enqvist, Julius, Michael Graham, and Jussi Nikkinen. "The impact of working capital management on firm profitability in different business cycles: evidence from Finland." Research in International Business and Finance 32 (2014): 36-49.原文The impact of working capital management on firm profitability in different business cycles: Evidence from Finland1. IntroductionThis paper investigates the effect of the business cycle on the link between working capital, the difference between current assets and current liabilities, and corporate performance. Efficient working capital management is recognized as an important aspect of financial management practices in all organizational forms. In acknowledgement of this importance, the CFO Magazine publishes an annual study of corporate working capital management performance in many countries. The extensive literature indicates that it impacts directly on corporate liquidity ( Kim et al., 1998 and Opler et al., 1999), profitability (e.g., Shin and Soenen, 1998, Deloof, 2003, Lazaridis and Tryfonidis, 2006 and Ukaegbu, 2014), and solvency (e.g.,Berryman, 1983 and Peel and Wilson, 1994).It is reasonable to assume that economy-wide fluctuations exogenous to the operations of the firm play an important role in the demand for firms’ products and any financing decision. Korajczyk and Levy (2003), for instance, suggest that firms time debt issuance based on economic conditions. Also, given that retained earnings are a significant component of working capital, business cycles can be said to affect all enterprises financing source through its effect on economic growth and sales. For example, when company sales weaken it engenders earning declines, thereby, affecting an important source of working capital. The recent global economic downturn with crimping consumer demand is an excellent example of this. The crisis,characterized by plummeting sales, put a squeeze on corporate revenues and profit margins, and subsequently, working capital requirements. This has brought renewed focus on working capital management at companies all over the world.The literature on working capital, however, only includes a handful of studies examining the impact of the business cycle on working capital. An early study by Merville and Tavis (1973) examined the relationship between firm working capital policies and business cycle. More recent studies have investigated the degree to which firms’ reliance on bank borrowing to finance working capital is cyclical (Einarsson and Marquis, 2001), the significance of firms’ external dependence for financing needs on the link between industry growth and business the cycle in the short term (Braun and Larrain, 2005), and the influence of business indicators on the determinants of working capital management (Chiou et al., 2006). These studies have independently linked working capital to corporate profitability and the business cycle. No study, to the best of our knowledge, has examined the simultaneous working capital–profitability and business cycle effects. There is therefore a substantial gap in the literature which this paper seeks to fill. Firms may have an optimal level of working capital that maximizes their value. However, optimal levels may change to reflect business conditions. Consequently, we contribute to the literature by re-examining the relationship between working capital management and corporate profitability by investigating the role business cycle plays in this relationship.We investigate this important relationship using a sample of firms listed on the Helsinki Stock Exchange and an extended study period of 18 years, between 1990 and 2008. Finnish firms tend to react strongly to changes in the business cycle, a characteristic that can be observed from the volatility of the Nasdaq OMX Helsinki stock index. The index usually declines quickly in poor economic states, but also makes fast recoveries. Finland, therefore, presents an excellent representative example of how the working capital–profitability relationship may change in different economic states. The choice of Finland is also significant as it also offers a representative Nordic perspective of this important working capital–profitability relationship. Hitherto no academic study has examined the workingcapital–profitability relationship in the Nordic region, to the best of our knowledge. Surveys on working capital management in the Nordic region carried out by Danske Bank and Ernst & Young in 2009 show, however, that many companies rated their working capital management performance as average, with a growing focus on optimizing working capital in the future. The surveys are, however, silent on how this average performance affected profitability. This gives further impetus for our study.Our results point to a number of interesting findings. First, we find that firms can enhance their profitability by increasing working capital efficiency. This is a significant result because many Nordic firms find it hard to turn good policy intentions on working capital management into reality (Ernst and Young, 2009). Economically, firms may gain by paying increasing attention to efficient working capital practices. Our empirical finding, therefore, should motivate firms to implement new work processes as a matter of necessity. We also found that working capital management is relatively more important in low economic states than in the economic boom state, implying working capital management should be included in firms’ financial planning. This finding corroborates evidence from the survey results in the Nordic region. Specifically, the survey results by Ernst and Young (2009) indicate that the largest potential for improvement in working capital could be found within the optimization of internal processes. This suggests that this area is not prioritized in times of business growth which is typical of the general economic expansion periods and is exposed in economic downturns.The remainder of this paper is organized as follows: Section 2 presents a brief review of the literature presents the hypotheses for empirical testing. Sections 3 and 4 discuss data and models to be estimated. The empirical results are presented in Section 5 and Section 6 concludes.2. Related literature and hypotheses2.1. Literature reviewMany firms have invested significant amounts in working capital and a number of studies have examined the determinants of this investment. For example Kim et al. (1998) and Opler et al. (1999), Chiou et al. (2006) and D’Mello et al. (2008) find thatthe availability of external financing is a determinant of liquidity. Thus restricted access to capital markets requires firms to hold larger cash reserves. Other studies show that firms with weaker corporate governance structures hold smaller cash reserves (Harford et al., 2008). Furthermore firms with excess cash holding as well as weak shareholder rights undertake more acquisitions. However there is a higher likelihood of value-decreasing acquisitions (Harford, 1999). Kieschnick and Laplante (2012) provide evidence linking working capital management to shareholder wealth. They find that the incremental dollar invested in net operating capital is less valuable than the incremental dollar held in cash for the average firm. The findings reported in the paper further suggest that the valuation of the incremental dollar invested in net operating working is significantly influenced by a firm's future sales expectations, its debt load, its financial constraints, and its bankruptcy risk. Further the value of the incremental dollar extended in credit to one's customers has a greater effect on shareholder wealth than the incremental dollar invested in inventories for the average firm. Taken together the results indicate the significance of working capital management to the firm's residual claimants, and how financing impacts these effects.A thin thread of the literature links business cycles to working capital. In a theoretical model, Merville and Tavis (1973) posit that investment and financing decisions relating to working capital should be made in chorus as components of each impact on the optimal policies of the others. The optimal working capital policy of the firm is, therefore, made within a systems context, components of which are related spatially over time in a chance-constrained format. Uncertainty in the wider business environment directly affects the system. For example, short run demand fluctuations disrupt anticipated incoming cash flows, and the collection of receivables faces increased uncertainty. The model provides a structure enabling corporate managers to solve complex inventory and credit policies for short term financial planning.In an empirical study, Einarsson and Marquis (2001) find that the degree to which companies rely on bank financing to cover their working capital requirements in the U.S. is countercyclical; it increases as the state of the economy weakens. Furthermore, Braun and Larrain (2005) find that high working capital requirementsar e a key determinant of a business’ dependence on external financing. They show that firms that are highly dependent on external financing are more affected by recessions, and should take more precautions in preparing for declines in the economic environment, including ensuring a secure level of working capital reserves during times of crisis. Additionally, Chiou et al. (2006) recognize the importance of the state of the economy and includes business indicators in their study of working capital determinants. They find a positive relationship between business indicator and working capital requirements.The relationship between profitability and working capital management in various markets has also attracted intense interest. In a comprehensive study, Shin and Soenen (1998) document a strong inverse relationship between working capital efficiency and profitability across U.S. industries. This inverse relationship is supported by Deloof (2003), Lazaridis and Tryfonidis (2006), and Garcia-Teruel and Martinez-Solano (2007)for Belgian non-financial firms, Greek listed firms, and Spanish small and medium size enterprises (SME), respectively. There are, however, significant divergences in the results relating to the effect of the various components of working capital on profitability. For example, whereas Deloof (2003) find a negative and statistically significant relationship between account payable and profitability, Garcia-Teruel and Martinez-Solano (2007) find no such measurable influences in a sample of Spanish SMEs.2.2. Hypotheses developmentThe cash conversion cycle (CCC), a useful and comprehensive measure of working capital management, has been widely used in the literature (see for example Deloof, 2003 and Gill et al., 2010). The CCC, measured in days, is the length of time between a company's expenditure for the procurement of raw materials and the collection of sales of finished goods. We adopt this as our measure of working capital management in this study. Previous studies have established a link between profitability and the CCC in different countries and market segments.Efficient working capital management practices aims to shorten the CCC to optimize to levels that best suites the requirements of the specific company (Hager,1976). A short CCC indicates quick collection of receivables and delays in payments to suppliers. This is associated with profitability given that it improves corporate efficiency in its use of working capital. Deloof (2003), however, posits that low inventory levels, tight trade credit policies and utilizing obtained trade credit as a means of financing can increase risks of inventory stock-outs, decrease sales stimulants and increase accounts payable costs by forgoing given cash discounts. Managers must, therefore, always consider the tradeoff between liquidity and profitability when managing working capital. A faster rise in the cost of higher investment in working capital relative to the benefits of holding more inventories and/or granting trade credit to customers may lead to decrease in corporate profitability. Deloof (2003), Wang (2002), Lazaridis and Tryfonidis (2006), and Gill et al. (2010) all propose a negative relationship between the cash conversion cycle and corporate profitability. Following this, we propose a general hypothesis stating the expected negative relationship between the cash conversion cycle and corporate profitability:6. ConclusionsWorking capital, the difference between current assets and current liabilities, is used to fund a business’ daily operations due to t he time lag between buying raw materials for production and receiving funds from the sale of the final product. With vast amounts invested in working capital, it can be expected that the management of these assets would significantly affect the profitability of a company. Consequently, companies strive to achieve optimize levels of working capital by paying bills as late as possible, turning over inventories quickly, and collecting on account receivables quickly. The optimal level, though, may vary to reflect business conditions. This study examines the role business cycle plays in the working capital-corporate profitability relationship using a sample of Finnish listed companies from years 1990 to 2008.We utilize the cash conversion cycle (CCC), defined as the length of time between a company's expenditure for the procurement of raw materials and the collection of sales of finished goods, as our measure of working capital. We further make use of 2 measures of profitability, return on assets and gross operating income.We document a negative relationship between cash conversion cycle and corporate profitability. Our results also show that companies can achieve higher profitability levels by managing inventories efficiently and lowering accounts receivable collection times. Furthermore shorter account payable cycles enhance corporate profitability. These results, which largely mirror findings from other countries, indicate effective management of firm's total working capital as well as its individual components has a significant effect on corporate profitability levels.Our results also show that economic conditions exhibit measurable influences on the working capital-profitability relationship. The low economic state is generally found to have negative effects on corporate profitability. In particular, we find that the impact of efficient working capital (CCC) on operational profitability increases in economic downturns. We also find that the impact of efficient inventory management and accounts receivables conversion periods, subsets of CCC, on profitability increase in economic downturns.Overall the results indicate that investing in working capital processes and incorporating working capital efficiency into everyday routines is essential for corporate profitability. As a result, firms should include working capital management in their financial planning processes. Additionally, firms generate income and employment. The reduced demand in economic downturns depletes working capital of firms and threatens their stability and, implicitly, their important function as generators of employment and income. National economic policy aimed at boosting cash flows of firms may increase business ability to finance working capital internally, especially during economic down turns.译文营运资金管理对不同商业周期公司盈利能力的影响:证据来自芬兰1.引言本文研究商业周期与营运资本两者之间的联系,流动资产和流动负债之间的区别,以及公司业绩问题。

工商管理专业英语Unit4-What

• 第一,组织中的大部份工作可以毫不夸张地说是由群体完 成的,无论是短期工作队或是在组织表格中标明的正式工 作群体。

a

22

Glossary

• predict [pri‘dikt]

• v. 预言、预报、预知、预测 • e.g. We are therefore interested in predicting and explaining the

a

16

Glossary

• subset [‘sʌbset]

• n. 子集

• e.g. These organizational behaviors are important because they

represent a subset of people-related operative goals which help

due to lack of patronage, it ceases to be an organization.

• 然而,如果你最喜欢的饭店或酒馆由于缺少客人光顾而关 门,那么它就不再是一个组织了。

a

5

Glossary

• impact [‘impækt,im’pækt]

• n. 影响、冲击力 • v. 冲击、撞击、产生影响 • e.g. Particular technologies have an important impact on the

Unit 4 What is Organization behavior?

a

1

Glossary

• beast [bi:st]

• n. 兽、畜生、凶残的人

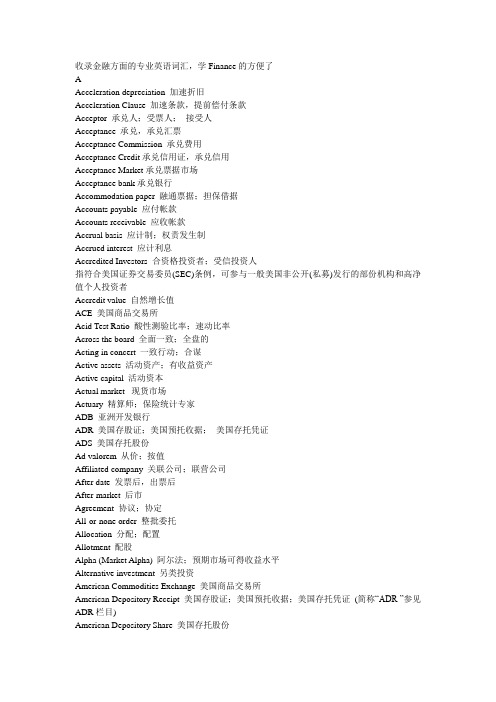

Capital Structure and Firm__ Performance