大学教育-金融企业会计-期末考试-财税英语 -

大学会计英语考试题及答案

大学会计英语考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting principle?A. Going ConcernB. ConsistencyB. MaterialityD. Cash Basis AccountingAnswer: D2. What is the purpose of the balance sheet?A. To show the profitability of a company.B. To show the financial position of a company at a given point in time.C. To show the cash flow of a company.D. To show the company's budget.Answer: B3. The term "Accrual Basis Accounting" refers to accounting where:A. Revenues and expenses are recognized when cash is received or paid.B. Revenues and expenses are recognized when they are earned or incurred, regardless of the cash flow.C. Only expenses are recognized when they are incurred.D. Only revenues are recognized when they are earned.Answer: B4. What does the term "Double Entry Bookkeeping" mean?A. Every transaction is recorded in two accounts.B. Every transaction is recorded in only one account.C. Transactions are recorded on both sides of the balance sheet.D. Transactions are not recorded in the general ledger.Answer: A5. Which of the following is a non-current asset?A. InventoryB. Accounts PayableC. LandD. Wages ExpenseAnswer: C二、填空题(每空2分,共20分)6. The accounting equation is _______ = _______ + _______. Answer: Assets; Liabilities; Owner's Equity7. The term "Depreciation" refers to the systematic allocation of the cost of a(n) _______ asset over its useful life.Answer: Tangible8. In accounting, the matching principle requires thatrevenues and expenses must be recognized in the same periodin which they are _______.Answer: Earned or Incurred9. The financial statement that shows the results ofoperations over a period of time is known as the _______.Answer: Income Statement10. The process of adjusting the accounts at the end of the accounting period to match revenues and expenses is called_______.Answer: Adjusting Entries三、简答题(每题10分,共20分)11. Explain the difference between "Historical Cost" and"Fair Value" in accounting.Answer: Historical Cost refers to the original amountpaid to acquire an asset or the amount received to issue a liability. It is the amount recorded on the company's booksat the time of the transaction. Fair Value, on the other hand, is the estimated amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm's length transaction. It is the current marketvalue of the asset or liability.12. What are the main components of a Cash Flow Statement and how do they reflect the liquidity of a company?Answer: The main components of a Cash Flow Statement arethe Cash Flows from Operating Activities, Cash Flows from Investing Activities, and Cash Flows from Financing Activities. These components reflect the liquidity of a company by showing how much cash is being generated or used by the company's operations, investments, and financing activities. A positive cash flow from operations indicates that the company is generating enough cash to sustain itself, while negative cash flows may indicate financial stress.四、计算题(每题15分,共40分)13. A company has the following transactions for the year:- Sales on credit: $50,000- Cash sales: $30,000- Purchases on credit: $40,000- Cash purchases: $10,000- Wages paid in cash: $15,000- Depreciation expense: $5,000- Interest paid in cash: $2,000Calculate the net cash provided by operating activities using the indirect method.Answer:Net Income = Sales - (Cost of Goods Sold + Operating Expenses)= ($50,000 + $30,000) - ($40,000 + $10,000 + $15,000 + $5,000)= $80,000 - $70,000= $10,000Adjustments for Non-Cash Items:- Depreciation Expense: +$5,000 (since it's a non-cash expense)Increase/Decrease in Operating Assets and Liabilities: - Accounts Receivable: -$50,000 (decrease in asset, so。

财务英语试题及答案

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

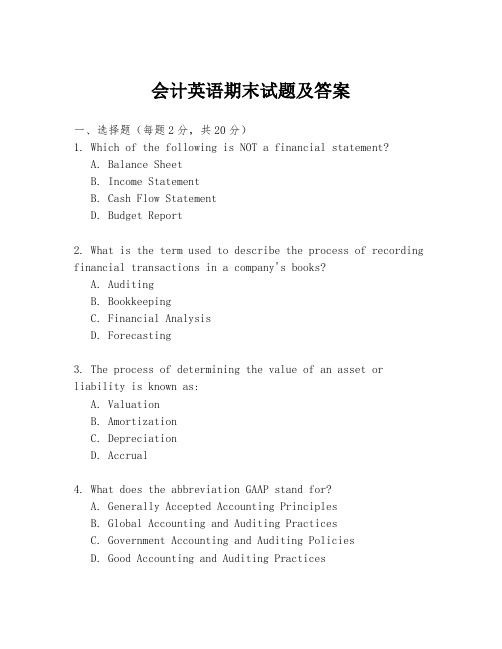

会计英语期末试题及答案

会计英语期末试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Budget Report2. What is the term used to describe the process of recording financial transactions in a company's books?A. AuditingB. BookkeepingC. Financial AnalysisD. Forecasting3. The process of determining the value of an asset orliability is known as:A. ValuationB. AmortizationC. DepreciationD. Accrual4. What does the abbreviation GAAP stand for?A. Generally Accepted Accounting PrinciplesB. Global Accounting and Auditing PracticesC. Government Accounting and Auditing PoliciesD. Good Accounting and Auditing Practices5. The term "revenue recognition" refers to the process of:A. Recording expenses when they are incurredB. Recording revenues when they are earnedC. Allocating costs to products or servicesD. Matching revenues with their related expenses6. Which of the following is a non-current asset?A. InventoryB. Accounts ReceivableC. LandD. Prepaid Expenses7. The matching principle in accounting requires that:A. All expenses must be recorded in the same period as the revenues they generateB. All assets must be listed on the balance sheetC. All liabilities must be paid off within one yearD. All revenues must be recognized in the period they are received8. What is the purpose of adjusting entries?A. To increase the company's reported profitsB. To ensure that financial statements reflect the current financial position of the companyC. To prepare the company for an auditD. To reduce the company's tax liability9. The accounting equation is:A. Assets = Liabilities + EquityB. Liabilities = Assets - EquityC. Equity = Assets - LiabilitiesD. All of the above10. Which of the following is a type of depreciation method?A. FIFOB. LIFOC. Straight-lineD. FIFO and LIFO are both inventory valuation methods答案:1. D2. B3. A4. A5. B6. C7. A8. B9. D10. C二、填空题(每空1分,共10分)11. The primary financial statements include the ______,______, and ______.12. The accounting cycle consists of several steps, including journalizing, ______, posting, and preparing financial statements.13. In accounting, the term "double-entry" refers to the practice of recording each transaction in ______ accounts. 14. The accounting equation shows the relationship between assets, liabilities, and ______.15. The accrual basis of accounting records revenues andexpenses when they are ______, not necessarily when cash is received or paid.答案:11. Balance Sheet, Income Statement, Cash Flow Statement12. footing13. two14. equity15. earned or incurred三、简答题(每题5分,共20分)16. 简述会计信息的四个主要特征。

财政学英语测试题及答案

财政学英语测试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of government revenue?A. TaxationB. FeesC. DonationsD. Fines2. The process of allocating government funds is known as:A. BudgetingB. SpendingC. AllocatingD. Distributing3. The term "fiscal policy" refers to:A. The management of government finances.B. The setting of interest rates by a central bank.C. The regulation of money supply.D. The control of inflation.4. What is the primary purpose of a government budget?A. To increase the national debt.B. To plan for government spending and revenue.C. To reduce taxes.D. To increase government spending.5. Which of the following is an example of an expenditure ina government budget?A. Tax revenueB. Public debtC. Defense spendingD. Foreign aid6. The term "deficit" in fiscal terms means:A. The amount by which government spending exceeds revenue.B. The amount by which government revenue exceeds spending.C. The total amount of government debt.D. The amount of money a government has in reserve.7. What does "fiscal discipline" imply?A. The government's ability to borrow money.B. The government's adherence to a balanced budget.C. The government's ability to spend without limit.D. The government's ability to collect taxes efficiently.8. A "balanced budget" is one where:A. Government spending is equal to revenue.B. Government spending is less than revenue.C. Government spending is more than revenue.D. There is no public debt.9. What is the role of "public finance" in a country's economy?A. To provide financial support for private businesses.B. To manage the government's income and expenditure.C. To regulate the stock market.D. To control the money supply.10. The "fiscal year" is:A. The same as the calendar year for all countries.B. The period during which the government operates its budget.C. The year in which the government's financial statementsare audited.D. The year in which the government's taxes are collected.二、填空题(每空1分,共10分)11. The main sources of government revenue include taxes, fees, and _______.12. When the government spends more than it earns, it results in a _______.13. A government that practices fiscal discipline is likelyto have a _______ budget.14. The fiscal policy can be used to influence economicactivity by adjusting _______.15. Public finance is crucial for the provision of _______ services.三、简答题(每题5分,共20分)16. Explain the difference between a "surplus" and a "deficit" in fiscal terms.17. What are the potential consequences of a governmentrunning a persistent deficit?18. Describe the role of fiscal policy in economic stabilization.19. Discuss the importance of fiscal discipline for acountry's long-term economic health.四、论述题(每题15分,共30分)20. Discuss the challenges a government faces in creating a balanced budget and the strategies it might employ.21. Analyze the impact of fiscal policy on the overall economic growth and development of a country.五、案例分析题(共20分)22. A country is facing a recession. The government decidesto increase public spending on infrastructure to stimulatethe economy. Discuss the potential benefits and drawbacks of this fiscal policy action.答案:一、选择题1. C2. A3. A4. B5. C6. A7. B8. A9. B 10. B二、填空题11. fines/penalties12. deficit13. balanced14. taxation/tax rates/government spending15. public/social三、简答题16. A surplus occurs when government revenue exceeds spending, while a deficit occurs when spending exceeds revenue.17. Persistent deficits can lead to increased national debt, higher interest rates, and potential economic instability. 18. Fiscal policy can stabilize the economy by increasing spending during recessions and reducing it during booms to prevent overheating.19. Fiscal discipline ensures that a country can meet its financial obligations, maintain investor confidence, and support sustainable economic growth.四、论述题20. [自由发挥,根据财政学原理论述]21. [自由发挥,根据财政学原理论述]五、案例分析题22. [自由发挥,根据财政学原理分析]。

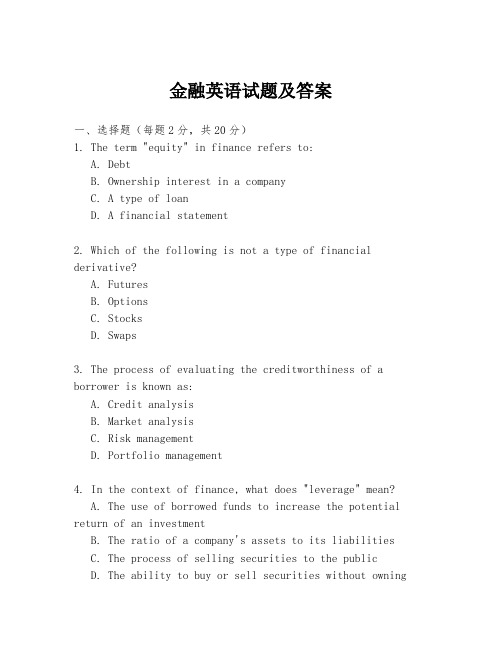

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. The term "equity" in finance refers to:A. DebtB. Ownership interest in a companyC. A type of loanD. A financial statement2. Which of the following is not a type of financial derivative?A. FuturesB. OptionsC. StocksD. Swaps3. The process of evaluating the creditworthiness of a borrower is known as:A. Credit analysisB. Market analysisC. Risk managementD. Portfolio management4. In the context of finance, what does "leverage" mean?A. The use of borrowed funds to increase the potential return of an investmentB. The ratio of a company's assets to its liabilitiesC. The process of selling securities to the publicD. The ability to buy or sell securities without owningthem5. A bond that pays no periodic interest but is issued at a discount to its face value is called:A. A zero-coupon bondB. A coupon bondC. A convertible bondD. A junk bond6. Which of the following is a measure of a company's ability to meet its short-term obligations?A. Current ratioB. Debt-to-equity ratioC. Return on equity (ROE)D. Earnings per share (EPS)7. The term structure of interest rates refers to the relationship between:A. The risk of an investment and its expected returnB. The maturity of a debt instrument and its yieldC. The size of a company and its market shareD. The economic cycle and the stock market performance8. A financial instrument that allows the holder to buy or sell an asset at a specified price within a specific time period is known as:A. A futureB. A forwardC. An optionD. A swap9. In finance, the term "carry trade" refers to:A. Borrowing money at a low interest rate to invest in a higher-yielding assetB. The practice of selling securities shortC. The strategy of buying and holding stocks for long periodsD. The process of hedging against currency fluctuations10. The primary market is where:A. Securities are first offered to the publicB. Securities are traded after they have been issuedC. Companies buy back their own sharesD. Investors can purchase commodities二、填空题(每空1分,共10分)11. The ________ is the difference between the bid price and the ask price of a security.12. A ________ is a financial institution that accepts deposits and provides loans.13. The ________ is the process of buying and selling securities on the same day.14. The ________ is the risk that the value of an asset will decrease due to market conditions.15. A ________ is a financial statement that shows a company's financial performance over a specific period.16. The ________ is the risk that a borrower will not repay a loan.17. A ________ is a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets.18. The ________ is the potential for an asset's value toincrease or decrease.19. The ________ is the process of determining the value of a business or business assets.20. A ________ is a financial instrument that represents ownership in a company.三、简答题(每题5分,共30分)21. Explain the concept of "leverage" in finance.22. What is the difference between a "mutual fund" and a "hedge fund"?23. Describe the role of a "stock exchange" in the financial markets.24. What is "risk management" and why is it important in finance?四、论述题(每题20分,共40分)25. Discuss the impact of "inflation" on different types of investments.26. Analyze the importance of "corporate governance" in ensuring the long-term success of a company.答案:一、1. B2. C3. A4. A5. A6. A7. B8. C9. A10. A二、11. Spread12. Bank13. Day trading14. Market risk15. Income statement16. Credit risk17. Mutual fund18. Volatility19. Valuation20. Stock三、21. Leverage in finance refers to the use of borrowed money to finance investments, with the goal of increasing potential returns. However, it。

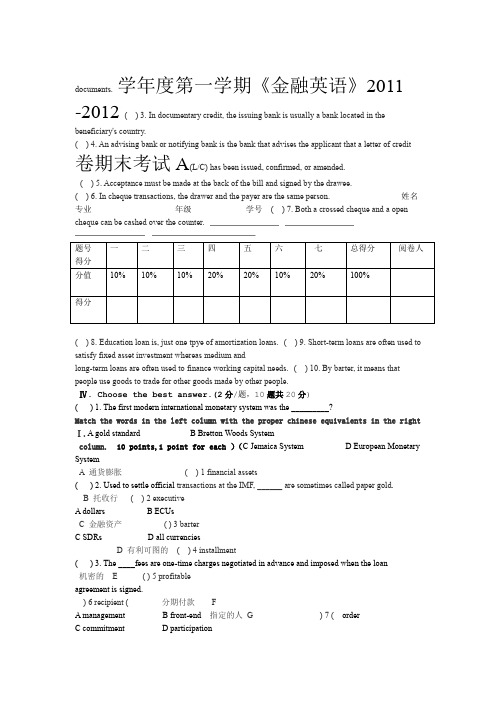

金融英语期末试卷

documents.学年度第一学期《金融英语》2011 -2012 ( ) 3. In documentary credit, the issuing bank is usually a bank located in the beneficiary's country.( ) 4. An advising bank or notifying bank is the bank that advises the applicant that a letter of credit 卷期末考试A(L/C) has been issued, confirmed, or amended.( ) 5. Acceptance must be made at the back of the bill and signed by the drawee.( ) 6. In cheque transactions, the drawer and the payer are the same person. 姓名专业年级学号( ) 7. Both a crossed cheque and a open cheque can be cashed over the counter.( ) 8. Education loan is, just one tpye of amortization loans.( ) 9. Short-term loans are often used to satisfy fixed asset investment whereas medium andlong-term loans are often used to finance working capital needs.( ) 10. By barter, it means that people use goods to trade for other goods made by other people.Ⅳ. Choose the best answer.(2分/题,10题共20分)( ) 1. The first modern international monetary system was the _________?Match the words in the left column with the proper chinese equivalents in the right Ⅰ.A gold standard B Bretton Woods Systemcolumn.10 points,1 point for each )(C Jemaica System D European Monetary SystemA 通货膨胀( ) 1 financial assets( ) 2. Used to settle official transactions at the IMF, ______ are sometimes called paper gold.B 托收行( ) 2 executiveA dollarsB ECUsC 金融资产( ) 3 barterC SDRsD all currenciesD 有利可图的( ) 4 installment( ) 3. The ____fees are one-time charges negotiated in advance and imposed when the loan机密的 E ( ) 5 profitableagreement is signed.) 6 recipient ( 分期付款 FA managementB front-end 指定的人G ) 7 ( orderC commitmentD participation( 行政人员H ) 8 inflation( ) 4. The person paying the money is _______ of a cheque.I 物物交换) 9 confidental (A the draweeB the endorser ( 收信人J ) 10 remitting bankC the payeeD the endorsee( ) 5. The documents will not be delivered to the buyer until ________.分)105题,(II.Give the full name to the following words.2分/ 题共A the buyer has cleared goods B the goods have arrived ______________________________ ECU .1C the bill is paid or accepted D both A and B______________________________ IMF .2( ) 6. If it is not stated as D/P or D/A, the documents can be released_________.______________________________ SDRs 3.A against acceptance pour avalB against acceptance 4. D/A_______________________________C against paymentD in either way.5CPA ________________________________ ( ) 7. Under_____, no draft is drawn. It is also used as a means of avoiding the stamp duty(10分). Decide whether each of the following statements is true(T) or false(F). Ⅲpayable on drafts.the ( personal with be not should transactions Business 1. ) confused Similarly, transactions.A the acceptance creditB the derferred payment credit transactions of different entities should not be accounted for together.D the negotiated creditC the payment credit ) 2. A usance credit means a credit which stipulates the immediate payment on presentation of(( ) 8. ________is the bank to which the pricipal has entrusting the collection.“We needed furniture(家具) for our living room.”Says John Ross, “and we just didn't have enough money to buy it. So we decided to try making a few tables and chairs.”B The collecting bank John got married six A The remitting bankmonths ago, and like many young people these days, they are struggling to make a home at a time when D Both A and BC The presenting bankthe cost of living is very high. The Rosses took a 2-week course for $ 280 at a night school. Nowthey ) 9. Which principle has the assumption that the business will continue in operation?(build all their furniture and make repairs around the house.B The going-concern concept A The cost principleJim Hatfield has three boys and his wife died. He has a full-time job at home as well as in a shoe C The matching principle D Both A and Bmaking factory. Last month, he received a car repair bill for $ 420. “I was deeply upset about it. Now I ( ) 10. _______ is the most important part of a bank letter.have finished a car repair course, I should be able to fix the car by myself.” B Body ASubjectJohn and Jim are not unusual people. Most families in the country are doing everything they can to D SignatureC Complimentary closesave money so they can fight the high cost of living. If you want to become a “)do-it-yourself”, you can Ⅴ. Translate the following sentences. (20分go to DIY classes. And for those who do not have time to take a course, there are books that tell you 1. The usual way wordor by writing stamping the the drawee accepts a draft iss authorized signature and the ACCEPTED” on the face of the draft, plus the drawee'“how you can do things yourself.1. We can learn from the text that many newly married people _______. date accepted.that theA. find it hard to pay for what they need verify reasonable good 2. Banks wiil act in faith and exercise care and mustdocuments received appear to ba as listed in the collection order. B. have to learn to make their own furniture.C. take DIY courses run by the government. hospitals, as churches, most government agencies, andsuch 3. Nonprofit organizationscolleges use accounting information in much the same way that profit oriented businesses D. seldom go to a department store to buy things2. John and his wife went to evening classes to learn how to _____ do.4. 用货币作为交换媒介是货币的主要职能之一。

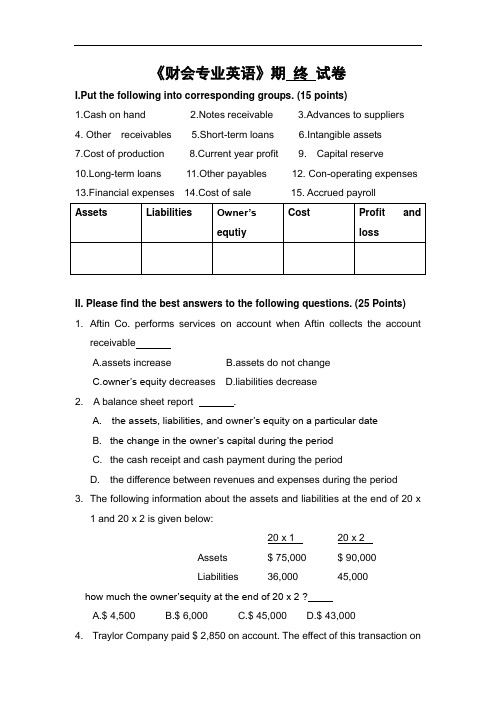

《财会专业英语》期末考试卷及问题详解

《财会专业英语》期终试卷I.Put the following into corresponding groups. (15 points)1.Cash on hand2.Notes receivable3.Advances to suppliers4. Other receivables5.Short-term loans6.Intangible assets7.Cost of production 8.Current year profit 9. Capital reserve10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payrollII.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the accountreceivableA.assets increaseB.assets do not changeC.owner’s equity d ecreasesD.liabilities decrease2. A balance sheet report .A. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period3. The following information about the assets and liabilities at the end of 20 x1 and 20 x2 is given below:20 x 1 20 x 2Assets $ 75,000 $ 90,000Liabilities 36,000 45,000how much the owner’sequity at the end of 20 x 2 ?A.$ 4,500B.$ 6,000C.$ 45,000D.$ 43,0004. Traylor Company paid $ 2,850 on account. The effect of this transaction onthe accounting equation is to .A. Decreas e assets and decrease owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities5. The entry to record the collection of $ 890 from a customer on account is .A. Dr.Accounts Payable 890Cr. Cash 890B. Dr.Cash 890Cr. Accounts Receivable 890C. Dr.Cash 890Cr. Account Payable 890D. Dr.Cash 890Cr. Service Revenue 8906. The ending Cash account balance is $ 57,600. During the period, cash receipts equal $ 124,300. If the cash payments during the period total $ 135,100, then the beginning Cash amount must haveA. $ 68,400B.$ 46,800C. $ 181,900D.annot be determined from theinformation given7. Use the following selected information for the Alecia Company to calculate the correct credit column total for a trial balance .Accounts receivable $ 7,200Accounts payable $ 6,900Building $ 179,400Cash $ 15,800Capital $ 64,000Insurance expense $ 6,500Salary expense $ 56,100Salary payable $ 3,600Service revenue $ 190,500A. $ 201,000B. $ 137,100C. $ 265,000D. $ 74,5008. ABC paid $500 for inventories in cash ,and purchased additional inventories on account for $700 in the month. At the end of the month,ABC paid $300 of the account payable.what is the balance in the inventoryies account?A $ 500B. $ 900C. $ 1,200D. $ 1,5009.The debit side of an account is used to recordA.increasesB.decreasesC. increases or decreases,depending on the type of accountD.decline10.ABC ,began the year with total assets of $120,000,liabilities of $70,000,and owner’s equit y of $50,000.during the year ABC earned revenue of $110,000 and paid espenses of $30,000.and also invensted an additional $20,000 in the business .how much is the owner’s equity at the end of the year?A. $150,000B.$180,000C.$190,000D.$220,00011.Which of the following is true? __________.A. Owners’ Equity - Assets = LiabilitiesB. Assets –Owners’ Equity = LiabilitiesC. Assets + Liabilities = Owners’ EquityD. Liabilities = Owners’ Equity + Assets12.Which of these is an example of an liability account? _____ ________.A. Service RevenueB. CashC. Accounts ReceivableD. Short-term loans13.Which of the following is a correct statement of the rules of debit and credit? ______.A. Debits increase assets and decrease liabilitiesB. Debits increase assets and increase owners’ equityC. Credits decrease assets and decrease liabilitiesD. Credits increase assets and increase owners’ equity14.If earnings haven’t been distributed as dividends, it should have been retained in the company. The name of this portion of number listed in the balance sheet is ____________.A. paid-in capitalB. retained earningsC. dividendD. cash15.Please select the components which should be deducted from the original value of plant assets when we compute their net value _______.A. Merchandise inventoryB. Income tax payableC. Accumulated depreciationD. Retained earnings16.Which of the following would not be included on a balance sheet?A. Accounts receivable.B. Accounts payable.C. Sales.D. Cash.17. Remington provided the following information about its balance sheet:Cash $ 100Accounts receivable 500Stockholders' equity 700Accounts payable 200Short-term loans 1,000Based on the information provided, how much are Remington's liabilities?A. $200.B. $900.C. $1,200.D. $1,700.18. Gerald had beginning total stockholders' equity of $160,000. During theyear, total assets increased by $240,000 and total liabilities increased by $120,000. Gerald's net income was $180,000. No additional investments were made; however, dividends did occur during the year. How much were the dividends?A. $20,000.B. $60,000.C. $140,000.D. $220,000.19.If the assets of a business are $162,600 and the liabilities are $86,000,howmuch is the owner’s equity?A..$76,600B. $248,600.C. $147,000.D. $250,000.20.Aftin Co. purchases on account when Aftin pay the account payableA.assets increaseB.assets do not changeC.owner’s equity decreasesD.liabilities decrease21.A income statement reports .A. the assets, liabilities, and owner’s equity on a particular dateB. the change in the owner’s capital during the periodC. the cash receipt and cash payment during the periodD. the difference between revenues and expenses during the period22.The following information about the assets and liabilities at the end of 20 x 1and 20 x 2 is given below: 20 x 1 20 x 2Assets $ 75,000 $ 90,000Liabilities 36,000 45,000 If net income in 20 x 2 was $ 1,500 and there were no withdrawals, how much did the owner invest?A.$ 4,500B.$ 6,000C.$ 45,000D.$ 43,00023.Traylor Company receive $ 2 850 on account. The effect of this transactionon the accounting equation is to .A. Decrease assets and decreas e owner’s equityB. Increase liabilities and decrease owner’s equityC. Have no effect on total assetsD. Decrease assets and decrease liabilities24.The entry to record the collection of $ 8000 from a customer on accountis .A. Dr.Accounts Payable 8000Cr.Cash 8000B. Dr.Cash 8000Cr.Accounts Receivable 8000C. Dr.Cash 8000Cr.Account Payable 8000D. Dr.Cash 8000Cr.Service Revenue 800025.A list of a business entitys assests,liabilities,and owner’s equity on a givendate isA.a balance sheetB.an income statementC.a statement of cash flow C. A retained earnings statementIII. Translate the following sentences into Chinese.(10 points)1. The accounting profession today is changing rapidly.2. Assets are what you own.Liabilities are what you owe.Owner’s Equty iswhat’s left over .3. The original voucher is obtained or filled in what business transactions tookplace.4. Normally an asset account will have a debit balance.5. The term “debit” is often abbreviated to “Dr.”IV. Prepare a convenient bank reconciliation form according to the following bank statement and depositor’s book.(10 points)Bank StatementDepositor’s RecordBank ReconciliationDate MonthV. Put the correct answer into the blanks.(6points)1.The basic Accouting equation is: .2.The rule of debits and credits is: ,.3. Using straight-line depreciation,Annual Dpreciation=( - )/VI. Translate The Following Terms Into Chinese . (10 points).1. surplus reserve2.manufacturing machine3. Construction in progress worth5. promissory note6. in other words7.profit distribution 8. storage room9.principal plus interest 10. accounting statementVII. The following is transactions of ABC company.please make entries.(24 poins)1. .ABC company was established on Jan.1,2010,when the owners,MrsSmiths and his friends,invested $30,000 in cash,patent X,valuing $24,000 and equipment A,valuing $40,000 into the company.2. ABC sells merchandise to another customer and send the customer a$2,500 bill for the products they provide. They allows the customer to pay these goods within 30 days.3. A customer buys $3,000 worth of goods from ABC ,and draws a promissorynote from a lacal bank.4. ABC buys a machine for $20,000,and pays the bill in cash.5. ABC paid the telephone bill for $700 in cash.6. ABC paid $3,800 on the accounts payable.7. ABC determine the month depreciation of the manufactory bulding for$5,000.8. ABC purchasese materials of $5,000 on account.9. ABC sells some goods to a client and receives a check from the customerfor $ 2,000 for the goods provided.10.ABC issues a 9%-5,$100,000 bond at its face amount. The bond is dated January 1, 2010 and requires interest payments until the bond principal at the end of 5 years.(1) Entry to bonds issued;(2) Entry to record the accrual interest for each year;(3) 2014 the company repays the principal plus interest.《财会专业英语》期末试卷答卷I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions. (25 Points)III. Translate the following sentences into Chinese.(10 points)1.2.3.4.5.IV. (10points)Bank ReconciliationDate MonthV. Put the correct answer into the blanks.(6points)1.The basic Accouting equation is: .2.The rule of debits and credits is: ,.3. Using straight-line depreciation,Annual Dpreciation=( - )/VI. Translate The Following Terms Into Chinese . (10 points).1. 2.3. 4.5. 6.7. 8.9. 10.VII. The following is transactions of ABC company.please make entries.(24 poins)《财会专业英语》答案I.Put the following into corresponding groups. (15 points)II. Please find the best answers to the following questions. (25 Points)III. Translate the following sentences into Chinese.(10 points) (略)IV. (10points)Bank ReconciliationDate 31 Month MayV. Put the correct answer into the blanks.(6points)1.Assets=Liabilities+Owner’s equity .2. Every debit must have a credit,all debits must equal all credits. ,3. Using straight-line depreciation,Annual Dpreciation=( Original Cost- Salvage Value) /Years of Service LifeVI. Translate The Following Terms Into Chinese . (10 points).(略)VII. The following is transactions of ABC company.please make entries.(24 poins)(略)。

财税专业英语考试大题参考资料

1(一)市场不完善: 指市场不能有效率运转的情况(即不完全有效率市场)。

价格无法反映公开的所有信息,并可能受垄断行为或政府控制的影响。

Market failure: When a market fails to operate efficiently (inefficient market). Prices do not reflect all publicly available information, and may be influenced by monopolistic practices or government regulations.(二)Market failureLast chapter concluded that markets function well, markets bring about an efficient allocation of resources without any need for coordination through government intervention. For this conclusion, we made several assumptions about how markets work. When these assumptions do not hold, our conclusion that the market equilibrium is efficient may no longer be true. In this chapter, let consider briefly three of the most important of these assumptions.First, our analysis assumed that markets are perfectly competitive. In the world, however, competition is sometimes far from perfect. In some markets, a single buyer or seller (or a small group of them) may be able to control market prices. This ability to influence prices is called market power. Market power can cause markets to be inefficient because it keeps the price and quantity away from the equilibrium of supply and demand.Second, our analysis assumed that the outcome in a market matters only to the buyers and sellers in that market. Y et, in the world, the decisions of buyers and sellers sometimes affect people who are not participants in the market at all. Pollution is the classic example of a market outcome that affects people not in the market. Such side effects, called externalities, cause welfare in a market to depend on more than just the value to the buyers and the cost to the sellers. Because buyers and sellers don not take these side effects into account when deciding how much to consume and produce, the equilibrium in a market can be inefficient from the standpoint of society as a whole.Third, all market participants have the same information about the nature of the good and the circumstances under which it is traded. Y et, in the world, there is asymmetric information between buyers and sellers.If one or more of these assumptions does not hold, the market system does not give rise to an efficient outcome (i.e. the first theorem does not hold). These inefficient outcomes are called market failure. The principal types of market failure are discussed below2财政联邦主义;是指各级政府财政收入和支出的划分,以及由此产生的相关制度。

会计英语期末考试试题

会计英语期末考试试题一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets + Liabilities = EquityD. Equity = Assets - Liabilities2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget Report3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The decrease in the value of a tangible asset due to wear and tear.C. The process of allocating the cost of an asset over its useful life.D. The sale of an asset at a reduced price.4. What is the purpose of an audit?A. To verify the accuracy of financial statements.B. To provide tax advice to a company.C. To prepare financial statements.D. To manage a company's cash flow.5. Which of the following is an example of a current asset?A. InventoryB. LandC. MachineryD. Building6. What is the accounting term for the cost of goods sold?A. COGSB. CGSC. COSD. COTS7. In accounting, what is the term for the net income of a business after all expenses have been deducted?A. Gross ProfitB. Net ProfitC. Operating ProfitD. Earnings Before Tax8. What is the process of adjusting the accounts at the end of an accounting period to show the correct financial position of a company?A. Closing the accountsB. Posting the accountsC. Adjusting entriesD. Balancing the accounts9. Which of the following is a non-current liability?A. Accounts PayableB. Notes PayableC. Long-term DebtD. Sales Tax Payable10. What does the acronym GAAP stand for?A. Globally Accepted Accounting PrinciplesB. Generally Accepted Accounting PracticesC. Government Accounting and Auditing PrinciplesD. Global Accounting and Auditing Principles二、简答题(每题5分,共20分)1. Explain the difference between a debit and a credit in accounting.2. Describe the purpose of a trial balance in the accounting process.3. What are the main components of a balance sheet?4. How does the matching principle affect the calculation of net income?三、计算题(每题10分,共30分)1. Calculate the net income for a company with the following figures:- Revenue: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $50,000- Depreciation: $20,000- Interest Expense: $10,0002. A company has the following assets at the end of the year: - Cash: $10,000- Accounts Receivable: $15,000- Inventory: $20,000- Equipment: $50,000 (with accumulated depreciation of $10,000)Calculate the total current assets and total assets.3. If a company has a balance of $75,000 in its retained earnings account at the beginning of the year and a net income of $30,000, calculate the ending balance of retained earnings.四、案例分析题(共30分)A company has just completed its fiscal year and is preparing its financial statements. The following information is available:- Sales Revenue: $1,500,000- Cost of Goods Sold: $900,000- Selling and Administrative Expenses: $200,000- Depreciation Expense: $50,000- Interest Expense: $30,000- Taxes Payable: $100,000- Dividends Paid: $50,000Based on the information provided, prepare an income statement for the company. Explain any assumptions made during the preparation of the income statement.五、论述题(共30分)Discuss the importance of ethical behavior in the field of accounting. Provide examples of ethical dilemmas that an accountant might face and how they can be resolved.请注意,本试题仅为示例,实际考试内容和格式可能会有所不同。

大学教育-金融企业会计-期末考试-高级英语2 - -087

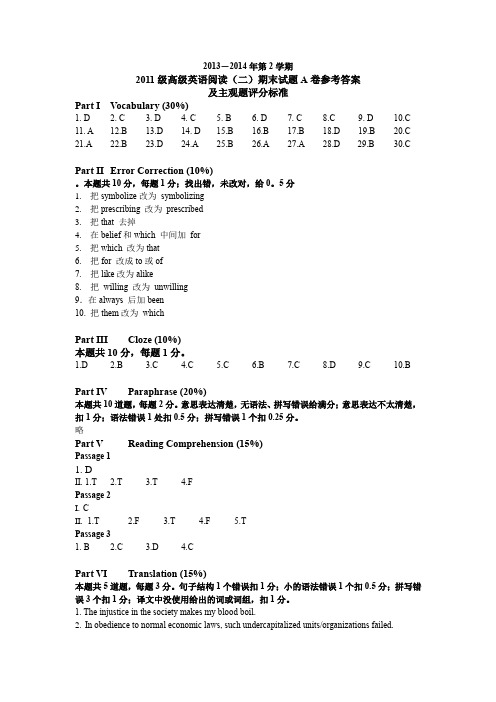

2013-2014年第2学期2011级高级英语阅读(二)期末试题A卷参考答案及主观题评分标准Part I Vocabulary (30%)1. D2. C3. D4. C5. B6. D7. C8.C9. D 10.C 11. A12.B13.D14. D15.B16.B17.B18.D19.B20.C 21.A22.B23.D24.A25.B26.A27.A28.D 29.B30.CPart II Error Correction (10%)。

本题共10分,每题1分;找出错,未改对,给0。

5分1.把symbolize改为symbolizing2.把prescribing 改为prescribed3.把that 去掉4.在belief和which 中间加for5.把which 改为that6. 把for 改成to或of7. 把like改为alike8. 把willing 改为unwilling9.在always 后加been10. 把them改为whichPart III Cloze (10%)本题共10分,每题1分。

1.D2.B3.C4.C5.C6.B7.C8.D9.C10.BPart IV Paraphrase (20%)本题共10道题,每题2分。

意思表达清楚,无语法、拼写错误给满分;意思表达不太清楚,扣1分;语法错误1处扣0.5分;拼写错误1个扣0.25分。

略Part V Reading Comprehension (15%)Passage 11.DII. 1.T 2.T 3.T 4.FPassage 2I.CII.1.T 2.F 3.T 4.F 5.TPassage 31. B2.C3.D4.CPart VI Translation (15%)本题共5道题,每题3分。

句子结构1个错误扣1分;小的语法错误1个扣0.5分;拼写错误3个扣1分;译文中没使用给出的词或词组,扣1分。

1. The injustice in the society makes my blood boil.2.In obedience to normal economic laws, such undercapitalized units/organizations failed.。

会计英语 期末试题及答案

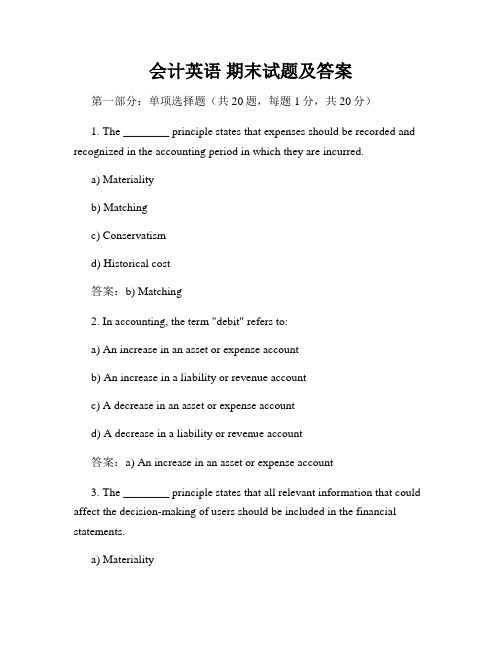

会计英语期末试题及答案第一部分:单项选择题(共20题,每题1分,共20分)1. The ________ principle states that expenses should be recorded and recognized in the accounting period in which they are incurred.a) Materialityb) Matchingc) Conservatismd) Historical cost答案:b) Matching2. In accounting, the term "debit" refers to:a) An increase in an asset or expense accountb) An increase in a liability or revenue accountc) A decrease in an asset or expense accountd) A decrease in a liability or revenue account答案:a) An increase in an asset or expense account3. The ________ principle states that all relevant information that could affect the decision-making of users should be included in the financial statements.a) Materialityb) Faithful representationc) Comparabilityd) Relevance答案:d) Relevance4. The balance sheet reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:b) Assets, liabilities, and equity5. Which of the following statements about the accrual basis of accounting is true?a) Revenues and expenses are recognized when cash is received or paidb) Transactions are recorded when they occur, regardless of when cash is received or paidc) Only cash transactions are recorded in the financial statementsd) Liabilities and expenses are recognized when they are incurred, and revenues are recognized when cash is received答案:b) Transactions are recorded when they occur, regardless of when cash is received or paid6. The financial statement that shows a company's revenues, expenses, and net income or loss for a specific period of time is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:a) Income statement7. A decrease in an asset account is recorded as a ________.a) Debitb) Creditc) Liabilityd) Equity答案:b) Credit8. The accounting equation can be expressed as:a) Assets = Liabilities + Equityb) Assets + Liabilities = Equityc) Equity = Assets + Liabilitiesd) Liabilities + Equity = Assets答案:a) Assets = Liabilities + Equity9. The financial statement that shows the changes in equity during the accounting period is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:d) Statement of retained earnings10. Which of the following is an example of an intangible asset?a) Landb) Buildingsc) Inventoryd) Goodwill答案:d) Goodwill11. The ________ principle states that assets should be recorded at their original cost.a) Objectivityb) Consistencyc) Historical costd) Materiality答案:c) Historical cost12. The statement of cash flows reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:c) Cash flows from operating, investing, and financing activities13. Which of the following is a current liability?a) Accounts payableb) Bond payable due in 10 yearsc) Mortgage payable due in 5 yearsd) Long-term note payable答案:a) Accounts payable14. The ________ principle states that the financial statements should be prepared assuming that the entity will continue to operate indefinitely.a) Going concernb) Revenue recognitionc) Materialityd) Consistency答案:a) Going concern15. Which financial statement reports the financial position of a company at a specific point in time?a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:c) Balance sheet16. The ________ states that an entity should use the same accounting methods and procedures from period to period.a) Materialityb) Going concernc) Consistencyd) Historical cost答案:c) Consistency17. What type of account is "Accounts Receivable"?a) Assetb) Liabilityc) Revenued) Expense答案:a) Asset18. The financial statement that shows the cash inflows and outflows from operating, investing, and financing activities is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:b) Statement of cash flows19. If a company has a current ratio greater than 1, it means that:a) The company has more assets than liabilitiesb) The company has more liabilities than assetsc) The company is profitabled) The company can pay its current liabilities with its current assets答案:d) The company can pay its current liabilities with its current assets20. Which of the following is considered an external user of financial statements?a) Company managementb) Employeesc) Suppliersd) Creditors答案:d) Creditors第二部分:填空题(共10题,每题2分,共20分)1. The periodicity assumption assumes that a company's activities can be divided into ________ periods of equal length.答案:accounting2. The ________ principle states that an entity should recognize revenues when they are earned, regardless of when cash is received.答案:revenue recognition3. The adjusting entry to record the use of supplies during an accounting period would include a ________ to the Supplies Expense account.答案:debit4. The adjusting entry to recognize revenue that has been earned but not yet collected would include a ________ to the Accounts Receivable account.答案:credit5. The ________ principle requires that expenses be reported in the same period as the revenue that is earned as a result of those expenses.答案:matching6. The financial statement that reports the financial position of a company at a specific point in time is the ________.答案:balance sheet7. The accounting equa tion can be expressed as: ________ = Assets − Liabilities.答案:Equity8. The financial statement that shows the changes in equity during the accounting period is the ________.答案:statement of retained earnings9. The adjusting entry to record the portion of prepaid rent that has been used during an accounting period would include a ________ to the Rent Expense account.答案:debit10. The unearned revenue account is a ________ account.答案:liability第三部分:简答题(共4题,每题10分,共40分)1. What is the matching principle in accounting? Why is it important?答案:The matching principle in accounting states that expenses should be recorded and recognized in the accounting period in which they are incurred, regardless of when the cash is paid. This principle is important to ensure that the expenses are properly matched with the revenues that theyhelp generate. By matching expenses with revenues, the financial statements provide a more accurate representation of the company's financial performance during a specific period. This helps users of the financial statements make informed decisions based on reliable financial information.2. Explain the difference between an asset and a liability. Provide an example of each.答案:An asset is a resource owned by a company that has economic value and is expected to provide future benefits. Examples of assets include cash, accounts receivable, inventory, and property, plant, and equipment.A liability, on the other hand, is an obligation or debt owed by a company to external parties. It represents an economic sacrifice that the company is required to make in the future. Examples of liabilities include accounts payable, loans payable, and accrued expenses.3. What is the purpose of the statement of cash flows? How is it prepared?答案:The purpose of the statement of cash flows is to provide information about the cash inflows and outflows from operating, investing, and financing activities during a specific period. It helps users understand how a company generates and uses its cash resources.The statement of cash flows is prepared using the indirect method or the direct method. In the indirect method, the net income from the income statement is adjusted for non-cash items and changes in working capital to arrive at the net cash provided by operating activities. Cash flows from investing and financing activities are directly reported. In the direct method,the actual cash receipts and payments are directly reported in each category of cash flows.4. What is the purpose of the adjusting entries? Provide two examples of adjusting entries and explain their impact on the financial statements.答案:The purpose of adjusting entries is to ensure that the revenues and expenses are properly recognized in the accounting period in which they are incurred, and that the balance sheet accounts reflect the true financial position of the company at the end of the period.Two examples of adjusting entries are:- Accrued expenses: An adjusting entry is made to recognize expenses that have been incurred but not yet paid or recorded. For example, at the end of the accounting period, salaries for the last few days of the period may not have been paid. An adjusting entry is made to recognize the expense for the unpaid salaries, which increases the expenses on the income statement and decreases the retained earnings on the balance sheet.- Prepaid expenses: An adjusting entry is made to recognize expenses that have been paid in advance but have not yet been used. For example, if a company pays rent for the next three months in advance, an adjusting entry is made to allocate a portion of the prepaid rent to the current accounting period. This decreases the prepaid rent on the balance sheet and increases the rent expense on the income statement.。

财经英语期末答案

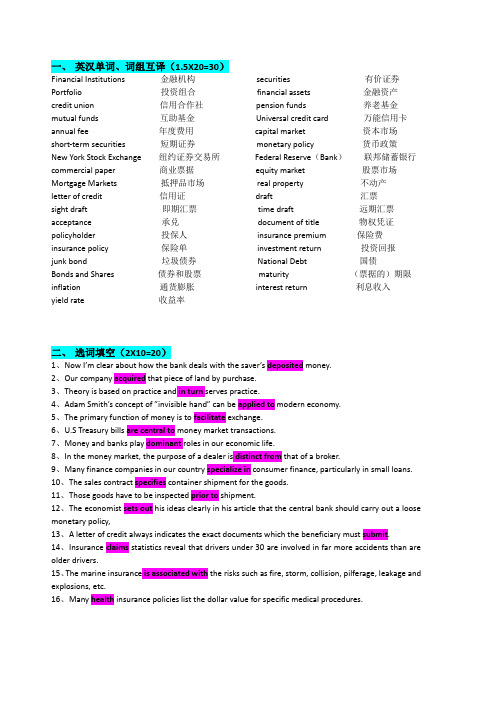

一、英汉单词、词组互译(1.5X20=30)Financial Institutions 金融机构securities 有价证券Portfolio 投资组合financial assets 金融资产credit union 信用合作社pension funds 养老基金mutual funds 互助基金Universal credit card 万能信用卡annual fee 年度费用capital market 资本市场short-term securities 短期证券monetary policy 货币政策New York Stock Exchange 纽约证券交易所Federal Reserve(Bank)联邦储蓄银行commercial paper 商业票据equity market 股票市场Mortgage Markets 抵押品市场real property 不动产letter of credit 信用证draft 汇票sight draft 即期汇票time draft 远期汇票acceptance 承兑document of title 物权凭证policyholder 投保人insurance premium 保险费insurance policy 保险单investment return 投资回报junk bond 垃圾债券National Debt 国债Bonds and Shares 债券和股票maturity (票据的)期限inflation 通货膨胀interest return 利息收入yield rate 收益率二、选词填空(2X10=20)1、Now I’m clear about how the bank deals with the saver’s deposited money.2、Our company acquired that piece of land by purchase.3、Theory is based on practice and in turn serves practice.4、Adam Smith’s concept of ”invisible hand” can be applied to modern economy.5、The primary function of money is to facilitate exchange.6、U.S Treasury bills are central to money market transactions.7、Money and banks play dominant roles in our economic life.8、In the money market, the purpose of a dealer is distinct from that of a broker.9、Many finance companies in our country specialize in consumer finance, particularly in small loans.10、The sales contract specifies container shipment for the goods.11、Those goods have to be inspected prior to shipment.12、The economist sets out his ideas clearly in his article that the central bank should carry out a loose monetary policy,13、A letter of credit always indicates the exact documents which the beneficiary must submit.14、Insurance claims statistics reveal that drivers under 30 are involved in far more accidents than are older drivers.15、The marine insurance is associated with the risks such as fire, storm, collision, pilferage, leakage and explosions, etc.16、Many health insurance policies list the dollar value for specific medical procedures.三、英汉句子互译(4X10=40)1、Lower-then-expected returns on one issue may be offset by higher-then-expected returns on another,一项低于预期的证券收益可以通过另一项高于预期收益的证券发行来抵消。

财务类英语试题及答案

财务类英语试题及答案一、选择题(每题1分,共10分)1. Which of the following is a common financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. All of the above2. The term "equity" in finance refers to:A. Money owed to a company.B. Money invested in a company.C. Money earned by a company.D. Money spent by a company.3. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) * 100B. ROI = (Total Assets / Net Income) * 100C. ROI = (Net Profit / Cost of Investment) * 100D. ROI = (Cost of Investment / Net Profit) * 1004. The process of forecasting a company's future financial position is known as:A. BudgetingB. ForecastingC. PlanningD. Analysis5. Which of the following is not a type of financial risk?A. Credit riskB. Market riskC. Liquidity riskD. Fixed risk6. The term "leverage" in finance is used to describe:A. The use of borrowed money to increase potential returns.B. The process of selling a financial asset.C. The amount of money a company has in the bank.D. The ratio of a company's equity to its debt.7. What does "EBIT" stand for in financial analysis?A. Earnings Before Interest and TaxesB. Earnings Before Income and TaxesC. Earnings Before Interest and TotalD. Earnings Before Interest, Taxes, and Depreciation8. The "time value of money" concept implies that:A. Money received in the future is worth less than money received today.B. Money received in the past is worth more than money received today.C. Money has no value over time.D. The value of money is constant over time.9. Which of the following is a method of financial analysis?A. SWOT analysisB. PEST analysisC. Ratio analysisD. Porter's Five Forces analysis10. The "break-even point" in finance is the point at which:A. A company's revenue equals its expenses.B. A company's net income is zero.C. A company's assets equal its liabilities.D. A company's cash flow is positive.答案:1. D2. B3. C4. B5. D6. A7. A8. A9. C10. A二、填空题(每题1分,共5分)11. The __________ is a financial statement that shows a company's assets, liabilities, and equity at a particular point in time.Answer: Balance Sheet12. The __________ is the difference between revenue and expenses during a specific period.Answer: Net Income13. In finance, the term "capital" often refers to the__________ of the business.Answer: Owners' Equity14. If a company's current assets are greater than itscurrent liabilities, it is said to have a positive __________. Answer: Working Capital15. The __________ is a measure of how well a company can pay its current debts.Answer: Quick Ratio三、简答题(每题5分,共10分)16. What is the purpose of a financial statement analysis?Answer: The purpose of financial statement analysis is to assess the performance and financial health of a company. It helps investors, creditors, and other stakeholders to make informed decisions about the company's financial stability, profitability, and risk.17. Explain the difference between "operating activities" and "financing activities" in the context of a cash flow statement.Answer: Operating activities in a cash flow statement referto the cash transactions that are directly related to thecore business operations of the company, such as cashreceived from sales and cash paid for expenses. Financing activities, on the other hand, involve cash transactions related to the company's financing arrangements, such as issuing or repaying debt, issuing or buying back shares, and paying dividends.四、计算题(每题5分,共5分)18. If a company has a net profit of $100,000 and a cost of investment of $500,000, what is the ROI?Answer: ROI = (Net Profit / Cost of Investment) * 100ROI = (100,000 / 500,000) * 100ROI = 20%五、论述题(每题10分,共10分)19. Discuss the importance of financial planning in business management.Answer: Financial planning is a critical component of business management as it helps in setting financial goals, allocating resources efficiently, and forecasting。

会计英语期末试题及答案

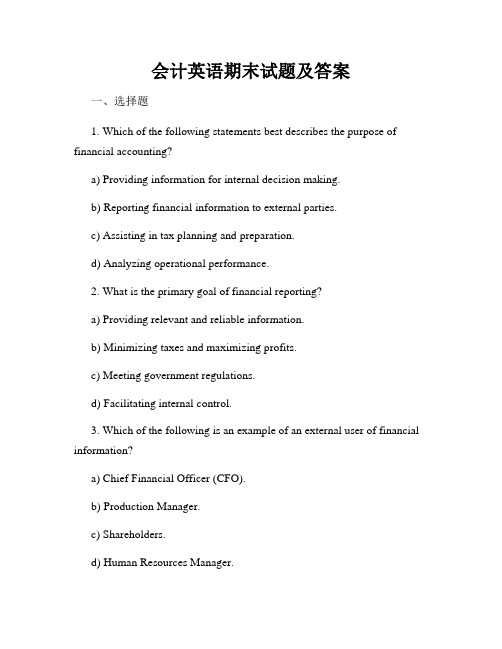

会计英语期末试题及答案一、选择题1. Which of the following statements best describes the purpose of financial accounting?a) Providing information for internal decision making.b) Reporting financial information to external parties.c) Assisting in tax planning and preparation.d) Analyzing operational performance.2. What is the primary goal of financial reporting?a) Providing relevant and reliable information.b) Minimizing taxes and maximizing profits.c) Meeting government regulations.d) Facilitating internal control.3. Which of the following is an example of an external user of financial information?a) Chief Financial Officer (CFO).b) Production Manager.c) Shareholders.d) Human Resources Manager.4. The accounting equation can be stated as:a) Assets = Liabilities + Equity.b) Equity = Assets - Liabilities.c) Liabilities = Assets - Equity.d) Assets = Equity - Liabilities.5. What is the purpose of the income statement?a) To report the company's financial position at a specific point in time.b) To disclose changes in the company's equity during a period of time.c) To report the company's revenues, expenses, and net income for a period of time.d) To provide information about the company's cash flows.二、填空题1. A company's assets are equal to its _______________ minus its liabilities.2. The _______________ principle states that expenses should be recorded in the same accounting period as the revenues they help to generate.3. The financial statements include the _______________, the balance sheet, the statement of cash flows, and the statement of stockholders' equity.4. _______________ involves analyzing and interpreting financial information to make informed business decisions.5. The _______________ is a financial ratio that measures a company's ability to pay its short-term debts.三、解答题1. Explain the difference between accrual accounting and cash accounting.2. Discuss the importance of the balance sheet in financial reporting.3. Describe the purpose and content of the statement of cash flows.4. What is the role of the Generally Accepted Accounting Principles (GAAP) in financial reporting?5. Explain the concept of depreciation and how it is recorded in the financial statements.答案:一、选择题1. b) Reporting financial information to external parties.2. a) Providing relevant and reliable information.3. c) Shareholders.4. a) Assets = Liabilities + Equity.5. c) To report the company's revenues, expenses, and net income for a period of time.二、填空题1. Equity2. Matching3. Income statement4. Financial analysis5. Current ratio三、解答题1. Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when the associated cash flows occur. Cash accounting, on the other hand, records revenue and expenses only when cash is received or paid out. Accrual accounting provides a more accurate picture of a company's financial health and performance.2. The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. The balance sheet is important for investors, creditors, and other stakeholders to assess the company's liquidity, solvency, and overall financial stability.3. The statement of cash flows reports the cash inflows and outflows from a company's operating activities, investing activities, and financing activities. Its purpose is to provide information about the cash generated and used by the company during a specific period of time. It helps users understand the company's cash flow patterns and assess its ability to generate cash for future operations and investments.4. Generally Accepted Accounting Principles (GAAP) are a set of accounting standards and guidelines that companies must follow when preparing their financial statements. GAAP ensures consistency, comparability, and transparency in financial reporting, allowing users of financial statements to make meaningful and informed decisions. It helps maintain public trust in the financial reporting process.5. Depreciation is the systematic allocation of the cost of a long-term asset over its useful life. It reflects the wearing out, consumption, or expiration of the asset's value over time. Depreciation is recorded as an expense on the income statement and as an accumulated depreciation contra-asset on the balance sheet. It helps match the cost of the asset with the revenue it helps to generate, providing a more accurate reflection of the company's profitability.。

金融英语期末试题及答案

金融英语期末试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of financial instrument?A. StockB. BondC. DerivativeD. Real estate2. The term "Bull Market" refers to a market condition where:A. Prices are fallingB. Prices are stableC. Prices are risingD. There is no trading activity3. In finance, what does the acronym "IPO" stand for?A. Initial Public OfferingB. International Private OfferingC. Inflation Protection OptionD. Interest Payment Option4. What is the primary role of a central bank?A. To manage the national economyB. To provide banking services to individualsC. To regulate the money supply and interest ratesD. To sell financial products to the public5. The risk associated with the potential changes in exchangerates is known as:A. Market riskB. Credit riskC. Liquidity riskD. Currency risk6. What does "leverage" mean in the context of finance?A. The use of borrowed money to increase the potential return of an investmentB. The process of buying and selling securitiesC. The ability to influence the marketD. The amount of capital a company has7. A "futures contract" is an agreement to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future. What is the main purpose of futures trading?A. To speculate on price movementsB. To provide a means of transferring riskC. To invest in commoditiesD. To earn interest on investments8. In finance, "beta" is a measure of:A. The volatility of a security or a portfolio in comparison to the market as a wholeB. The amount of risk a security or a portfolio carriesC. The market capitalization of a companyD. The rate of return on an investment9. Which of the following is a type of investment strategy?A. DiversificationB. ArbitrageC. HedgingD. All of the above10. The term "blue chip" is used to describe:A. A company with a high market capitalizationB. A company that is financially stable and has a history of reliable performanceC. A company that is new to the stock marketD. A company that is involved in high-risk ventures二、填空题(每题1分,共10分)11. The process of converting interest rates from an annual rate into a rate for a shorter period is known as ______. 12. A ______ is a type of investment fund that pools money from many investors to invest in a diversified portfolio of assets.13. The ______ is the difference between the bid price and the ask price of a security.14. An investor who believes that the price of a securitywill rise is said to have a ______ position.15. The ______ is a measure of the performance of a company's investments.16. A ______ is a financial contract that obligates the buyer to purchase an asset or a service, including a financial instrument, from the seller at a predetermined future date and price.17. The ______ is the process of evaluating an investment based on its risk and potential return.18. A ______ is a type of financial derivative that gives the holder the right, but not the obligation, to buy or sell anunderlying asset at a specified price within a specified period.19. The ______ is the risk of default by a borrower or issuer of debt.20. An ______ is a financial statement that shows a company's financial performance over a period of time.三、简答题(每题5分,共20分)21. Define the term "leverage" in the context of finance and explain its potential benefits and drawbacks.22. What is the difference between a "bear market" and a "bull market"?23. Explain the concept of "diversification" and why it is important in portfolio management.24. Describe the role of a futures contract in risk management.四、论述题(每题15分,共30分)25. Discuss the importance of understanding financial ratios for investors and provide examples of commonly used financial ratios.26. Analyze the impact of inflation on the economy and on individual investments.五、案例分析题(共20分)27. (a) Assume you are an investor considering the purchase of a company's stock. Describe the factors you would consider before making an investment decision.(b) Based on the information provided in the case study (not included in this template), evaluate the company's financial health and make。

财务会计英语试题3

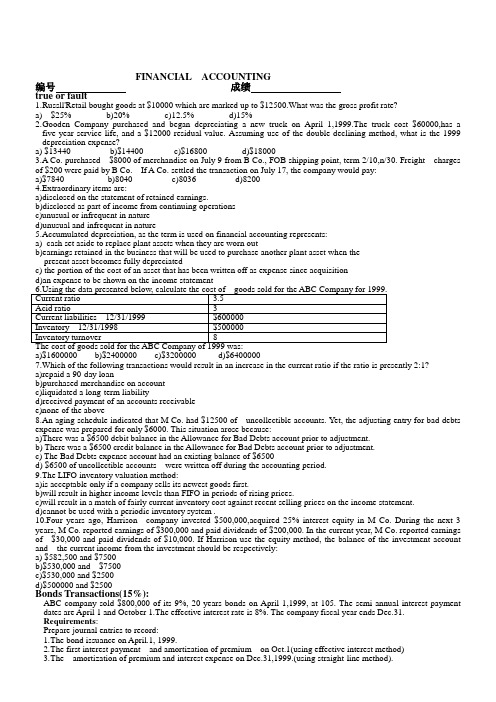

FINANCIAL ACCOUNTING编号成绩true or fault1.R ussll'Retail bought goods at $10000 which are marked up to $12500.What was the gross profit rate?a) $25% b)20% c)12.5% d)15%2.G ooden Company purchased and began depreciating a new truck on April 1,1999.The truck cost $60000,has a five-year service life, and a $12000 residual value. Assuming use of the double-declining method, what is the 1999 depreciation expense?a) $13440 b)$14400 c)$16800 d)$180003.A Co. purchased $8000 of merchandise on July 9 from B Co., FOB shipping point, term 2/10,n/30. Freight charges of $200 were paid by B Co. If A Co. settled the transaction on July 17, the company would pay:a)$7840 b)8040 c)8036 d)82004.Extraordinary items are:a)d isclosed on the statement of retained earnings.b)disclosed as part of income from continuing operationsc)unusual or infrequent in natured)unusual and infrequent in nature5.Accumulated depreciation, as the term is used on financial accounting represents:a)cash set aside to replace plant assets when they are worn outb)earnings retained in the business that will be used to purchase another plant asset when thepresent asset becomes fully depreciatedc) the portion of the cost of an asset that has been written off as expense since acquisitiond)an expense to be shown on the income statementing the data presented below, calculate the cost of goods sold for the ABC Company for 1999.Current ratio 3.5Acid ratio 3Current liabilities 12/31/1999 $600000Inventory 12/31/1998 $500000Inventory turnover 8The cost of goods sold for the ABC Company of 1999 was:a)$1600000 b)$2400000 c)$3200000 d)$64000007.Which of the following transactions would result in an increase in the current ratio if the ratio is presently 2:1?a)r epaid a 90-day loanb)purchased merchandise on accountc)liquidated a long-term liabilityd)received payment of an accounts receivablee)none of the above8.An aging schedule indicated that M Co. had $12500 of uncollectible accounts. Yet, the adjusting entry for bad debts expense was prepared for only $6000. This situation arose because:a)T here was a $6500 debit balance in the Allowance for Bad Debts account prior to adjustment.b) There was a $6500 credit balance in the Allowance for Bad Debts account prior to adjustment.c) The Bad Debts expense account had an existing balance of $6500d) $6500 of uncollectible accounts were written off during the accounting period.9.The LIFO inventory valuation method:a)i s acceptable only if a company sells its newest goods first.b)will result in higher income levels than FIFO in periods of rising prices.c)will result in a match of fairly current inventory cost against recent selling prices on the income statement.d)cannot be used with a periodic inventory system .10.Four years ago, Harrison company invested $500,000,acquired 25% interest equity in M Co. During the next 3 years, M Co. reported earnings of $300,000 and paid dividends of $200,000. In the current year, M Co. reported earnings of $30,000 and paid dividends of $10,000. If Harrison use the equity method, the balance of the investment account and the current income from the investment should be respectively:a) $582,500 and $7500b)$530,000 and $7500c)$530,000 and $2500d)$500000 and $2500Bonds Transactions(15%):ABC company sold $800,000 of its 9%, 20 years bonds on April 1,1999, at 105. The semi-annual interest payment dates are April 1 and October 1.The effective interest rate is 8%. The company fiscal year ends Dec.31. Requirements:Prepare journal entries to record:1.T he bond issuance on April.1, 1999.2.T he first interest payment and amortization of premium on Oct.1(using effective interest method)3.T he amortization of premium and interest expense on Dec.31,1999.(using straight-line method).XYZ Co. was formed on Jan.1999. The company is authorized to issue 100000 shares of $20 par-value common stock and 30000 shares of 6%, $10 par-value preferred stock. The following selected transactions occurred during the year(15%):1.I ssued 80000 shares of common stock at $35 per share.2.I ssued 14000 shares of preferred stock at $12 per share.3.R equired 5000 shares of treasury stock for $40 per share.4.S old 500 shares of treasury stock at $25 per share.5.D eclared cash dividend for $15000.Requirement:Make journal entries based on the information given above(compute the cash dividend for common stock and preferred stock respectively)Statement of cash flow(30%)Paper 1 Accounting ReportsInformation One:Colwell CorporationIncome StatementFor 2003Sales $ 3,000,000Cost of goods sold 1,200,000$ 1,800,000ExpensesSelling &administrative $ 1,455,000Building depreciation 25,000Equipment depreciation 70,000 $ 1,550,000$ 250,000Other revenue (expense)Interest expense $ (200,000)Loss on sale of equipment (5,000)Gains on sale of L-T investment 15,000 (190,000 )Income before income taxes $ 60,000Income taxes 20,000Net income $ 40,000Information Two:Statement of Retained earningFor 2003Retained earnings, 1/1/2003 $ 450,000Add: Net income 40,000$ 490,000Less: Cash dividends 15,000Retained earnings,12/31/2003 $ 475,000Information Three:Colwell CorporationComparative Balance SheetDec.31,2002 and 2003Assets 2003 2002Current assetsCash $ 100,000 $ 50,000Accounts receivable (net) 400,000 375,000Inventory 425,000 450,000Prepaid selling expenses 5,000 4,000Total current assets $ 930,000 $ 879,000Property, plant & equipmentLand $ 200,000 $ 115,000Building 1,450,000 1,250,000Accumulated depreciation: building (50,000) (25,000)Equipment 725,000 800,000Accumulated depreciation: equipment (250,000) (260,000)Total property, plant & equipment $2,075,000 $ 1,880,000Other assetsL--T investment $ 880,000 $ 1,000,000Total assets $ 3,885,000 $ 3,759,000Liabilities & Stockholders' EquityCurrent liabilitiesAccounts payable $ 470,000 $ 340,000Notes payable --- 300,000Income taxes payable 40,000 39,000Total current liabilities $ 510,000 $ 679,000L-T liabilitiesBonds payable $ 2,070,000 $ 2,000,000Stockholders' equityCommon stock, par value $ 1 $ 195,000 $ 130,000Paid-in capital in excess of par 635,000 500,000Retained earnings 475,000 450,000Total stockholders' equity $ 1,305,000 $ 1,080,000Total liabilities &stockholders' equity $ 3,885,000 $ 3,759,000Additional Information extracted from Colwell's accounting records:1.A parcel of land which cost $85,000 was purchased for cash on Oct.19.2.A building having a fair market value of $200,000 was acquired on the last day of the year inexchange for 65,000 shares of the company's $1 par-value common stock.3.Equipment of $100,000 was disposed of for cash on May 1.4.E quipment of $25,000 was purchased on Nov.1.5.T he notes payable relate to money borrowed from First Pacific Trust in late 1998.6.$120,000 of long-term investments was sold for $135,000, generated a gain of $15,000.7.B onds of $70,000 were issued at face value on Feb.14.Requirements:Prepare the Statement of Cash Flow in good form for Colwell Corporation under indirect approach.。

《财会专业英语》期末试卷及答案