Valuing Intangible Assets in SMEs THE ISSUE

chap9,Valuation of intangible assets无形资产评估

Valuation of intangible assetsReal Property Valuation⏹Introduction⏹Scope⏹Definitions⏹Relationship to accounting standards ⏹Guidance Notes⏹Effective date1.0 Introduction1.4 Care should be taken by valuers and users of valuation services to distinguish between the value of individual, identifiable intangible assets and going concerns.2.0 Scope3.0 Definitions☐3.1 Bookvalue☐3.1.1 with respect to assets, the capitalised cost of an asset less accumulated depreciation, depletion, or amortisation as it appears on the account books of the business.☐3.1.2 with respect to a business entity, the difference between total assets and total liabilities of a business as they appear on the balance sheet. In this case, book value is synonymous with net book value, net worth, and shareholder`s equity.3.0 Definitions☐3.3 capitalisation☐At a given date, the conversion into the equivalent capital value of net income or a series of net receipts, actual or estimated, over a period.☐3.4 capitalisation factor☐3.5 capitalisation rate3.0 Definitions3.12 GoodwillFuture economic benefits arising from assets that are not capable of being individually identified and separately recognised.3.14.1 rightsRights exist according to the terms of a contract, written or unwritten, that is of economic benefit to the parties.Identification of intangibles3.0 Definitions3.14.5 the accounting profession limits the recognition of individual intangible assets to those that are commonly recognisable, have a statutory or contractual remaining life, and must be individually transferable and separable from the business.3.0 Definitions3.27 value in useThis value type focuses on the value that specific property contributes to the entity of which it is a part without regard to the property`s highest and best use or the monetary amount that might be realized upon its sale, value in use is the value specific property has for a specific use to a specific user and is, therefore, non-market related.4.0 Relationship to accounting standards5.0 Guidance☐5.7 factors to be considered by the intangible asset valuer include:☐5.7.1 the rights, privileges, or conditions that attach to the ownership interest.☐5.7.2 remaining economic life☐5.7.3 the earnings capacity☐5.7.4 the nature and history of the intangible assets☐5.7.5 the economic outlook☐5.7.6 the outlook of the specific industry☐5.7.7 goodwill☐5.7.8 prior transactions5.8 Intangible asset valuation approaches☐Sales comparison☐Income capitalisation⏹Direc capitalisation of income⏹Discounted cash flow analysis☐The cost approach5.9 reconciliation process5.9.2.2 the valuer must use judgment when determining the relative weight to be given to each of the value indications derived during application of the valuation process. The valuer should provide the rationale and justification for the valuation methods used and for the weighting of the methods relied on in reaching the reconciled value conclusion.姜涛山东财经大学21。

中国资产评估准则英文

中国资产评估准则英文Chinese Asset Valuation Standards中国资产评估准则1. IntroductionIntroduction介绍Asset valuation plays a crucial role in the financial decision-making process for businesses and investors. It provides a fair and objective assessment of the value of assets, which is essential for various purposes such as financial reporting, investment analysis, mergers and acquisitions, and loan collateral assessment. In China, asset valuation is governed by a set of standards known as the Chinese Asset Valuation Standards.2. ScopeScope范围The Chinese Asset Valuation Standards apply to the valuation of various types of assets, including but not limited to real estate, machinery and equipment, intangible assets, financial assets, and biological assets. These standards are applicable to both public and private entities and provide guidance on the principles and methodologies to be followed in asset valuation.3. Principles of Asset ValuationPrinciples of Asset Valuation资产评估原则The Chinese Asset Valuation Standards are based on the following principles:3.1 Fair Value Principle: Assets should be valued based on their fair value, which represents the price that would be received to sell an asset in an orderly transaction between market participants at the valuation date.3.2 Objectivity Principle: Asset valuation should be conducted independently and objectively, without any bias or undue influence from outside parties.3.3 Professionalism Principle: Asset valuation should be performed by qualified professionals who possess the necessary knowledge, skills, and experience in valuation techniques and methodologies.4. Valuation MethodologiesValuation Methodologies估值方法The Chinese Asset Valuation Standards provide guidance on different valuation methodologies thatcan be used depending on the nature of the asset being valued. Some of the commonly used methodologies include:4.1 Market Approach: This approach involves comparing the asset being valued to similar assets that have been recently sold in the market to determine its fair value.4.2 Cost Approach: This approach focuses on the cost of replacing the asset or reproducing it with a similar asset, taking into consideration depreciation and obsolescence.4.3 Income Approach: This approach estimates the present value of future cash flows generated by the asset, taking into account factors such as expected returns and risk.5. Documentation and ReportingDocumentation and Reporting文件记录和报告The Chinese Asset Valuation Standards emphasize the importance of maintaining proper documentation and reporting in asset valuation. Valuation reports should be comprehensive and transparent, providing detailed information on the valuation process, assumptions, and methodologies used. The reports should also be prepared in line with relevant accounting and reporting standards. 6. Compliance and EnforcementCompliance and Enforcement合规和执行In order to ensure compliance with the Chinese Asset Valuation Standards, regulatory bodies such as the China Securities Regulatory Commission (CSRC) and the Ministry of Finance (MOF) oversee the valuation process and enforce the standards. Non-compliance may result in penalties and legal consequences for the entities involved.7. ConclusionConclusion总结The Chinese Asset Valuation Standards serve as a comprehensive framework for conducting asset valuation in China. They provide guidance on principles, methodologies, documentation, and reporting to ensure fair and objective valuations. By adhering to these standards, businesses and investors can make informed financial decisions based on accurate asset valuations.。

国际会计准则第36号 资产减值【外文翻译】

外文翻译外文题目International Accounting Standard外文出处London:Cambridge University Press外文作者International accounting committee原文:International Accounting Standard 36 , Impairment of Assets ObjectiveIAS 36 prescribes procedures to ensure that assets are carried at no more than their recoverable amount. The standard specifies when impairment losses are to be recognized and the conditions under which such losses should be reversed. IAS 36 also provides guidance on required disclosures.ScopeIAS 36 specifically scopes out the impairment of certain assets for which guide inventories (IAS 2), assets arising from construction contracts (IAS 11), deferred tax assets (IAS 12), assets arising from employee benefits (IAS 19), financial assets that are within the scope of IAS 39.DefinitionsImpairment refers to the book value of assets exceeds its recoverable amount, to determine whether the impairment of assets, assets may have occurred should be based on some signs of impairment, if there is any indication, companies should conduct a formal estimate of its recoverable amount .Identifying an asset that may be impairedAccording to IAS 36, an asset is impaired if its carrying amount is greater than its recoverable amount. IAS 36 requires that, at each balance-sheet date, an organization must assess whether there are any indications that assets may be impaired. If an indication of impairment exists, the organization is required to estimate the recoverable amount of the asset. Note that with respect to requirements for measuring recoverable amounts (P18–57), and the general requirements for reversing animpairment loss (P109–116), the standard uses the term “assets”; notwithstanding, the requirements apply both to individual assets and to cash-generating units.Fair value less costs to sellParagraphs 25 to 29 provide guidance on determining an asset’s fair value les s costs to sell.Paragraph 25 states “the best evidence of an asset’s fair value less costs to sell is a price in a binding sale agreement in an arm’s length transaction, adjusted for incremental costs that would be directly attributable to the disposal o f the asset.” In the absence of a binding sales agreement, for an asset that is traded in an active market, fair value less costs to sell is the asset’s market price less the costs of disposal. If there is no active market for the asset, the entity uses the best information available. Value in useTo estimate the value in use of an asset, an entity first estimates the future net cash flows to be derived from the asset’s use and ultimate disposal, and then applies the appropriate discount rate to those future cash flows.Paragraph 30 stipulatesthe following elements shall be reflected in the calculation of an asset’s value in use(a) an estimate of the future cash flows the entity expects to derive from the asset;(b) expectations about possible variations in the amount or timing of those future cash flows;(c) the time value of money, represented by the current market risk-free rate of interest;(d) the price for bearing the uncertainty inherent in the asset; and(e) other factors, such as illiquidity, that market participants would reflect in pricing the future cash flows the entity expects to derive from the asset. Estimates of future cash flows include (P39 and 52)a)projections of cash inflows from the continuing use of the assetb) projections of cash outflows incurred to generate the inflows from continuinguse that can be directly attributed, or allocated on a reasonable and consistent basis, to the assetc) net cash flows, if any, to be received (or paid) for the disposal of the asset at the end of its useful life (the amount that an entity expects to obtain from the disposal of the asset in an arm’s-length transaction between knowledgeable, willing parties, after deducting the estimated costs of disposal)The discount rates used to determine value in use must be pre-tax rates that reflect both the time value of money and the risks specific to the asset for which the future cash flow estimates have not been adjusted (P55).Cash flow projections should be based on reasonable and supportable assumptions about the economic conditions that will exist over the remaining useful life of the asset, with greater weight being given to external evidence. An entity should use the most recent budgets and forecasts, which are presumed to not go beyond five years. Beyond five years, an entity extrapolates from the earlier budgets, using a steady or declining growth rate not to exceed the long-term average growth rate for the products, industries, or countries in which.Paragraph 34 requires that management examine the causes of differences cash-flow projections and actual cash flows current cash-flow projections are based are consistent with past actual outcomes. Estimates of future cash flows exclude cash flows that relate to:future restructurings to which the entity is not yet committed (P44) improving or enhancing the asset’s performance (P44) financing activities (P50) income tax receipts or payments (P50)Recognizing and measuring an impairment lossIndividual assets other than goodwillFor individual assets other than goodwill, the requirements are laid out in paragraphs 58 to 64. An impairment loss must be recognized whenever an asset’s recoverable amount is less than its carrying amount (P59). Paragraph 60 requires that the impairment loss be recognized immediately as an expense in the income statement, subject to one exception, asset is carried at a revalued amount inaccordance with another standard. For asset is accounted for under the revaluation model in IAS 16 Property, Plant and Equipment or IAS 38 Intangible Assets, any impairment loss of the revalued asset would be treated as a revaluation decrease in accordance with that other standard. After the recognition of an impairment loss, the amortization expense for the asset is adjusted in future periods to allocate the asset’s revised carrying amount, less its residual value (if any), on a systematic basis over its remaining useful life (P63).Cash-generating unitsRecoverable amounts should be estimated for individual assets, if possible. However, if it is not possible, an entity must determine the recoverable amount of the cash-generating unit to which the asset belongs (P66). To begin this process, judgment is used to determine the smallest group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. Once the asset’s cash-generating unit has been determined, the recoverable amount of the cash-generating unit is estimated based on the guidance already discussed. To determine how to define cash-generating units, an entity considers various factors including how management monitors the entity’s operations (such as by product lines or geographic areas) or how they make decisions about continuing or disposing of the entity’s assets and operations. If an active market exists for the output produced by an asset or group of assets, that asset or group of assets is identified as a cash-generating unit (P70).Paragraph 72 requires that cash-generating units be “identif ied consistently from period to period for the same asset or types of assets, unless a change is justified.”GoodwillIAS 36 acknowledges that goodwill acquired in a business combination sometimes cannot be allocated on a non-arbitrary basis to individual cash-generating units, but only to groups of cash-generating units. This is reflected in paragraph 80, which requires goodwill to be allocated to each of the acquirer’s cash-generating units (or groups of cash-generating units) that are expected to benefit from the synergies of the business combination, regardless of whether other assets or liabilities of theacquire are assigned to those units (or groups of units). Each unit (or group of units) to which the goodwill is allocated must represent the lowest level at which the goodwill is monitored for internal management purposes. In addition, the unit (or group of units) cannot be larger than an operating segment determined under IFRS 8 Operating Segments.Paragraph 90 specifies that a cash-generating unit to which goodwill has been allocated must be tested for impairment annually, and whenever there is an indication of potential impairment. If the recoverable amount of the unit exceeds its carrying amount, the unit and the goodwill allocated to that unit are considered not to be impaired. However, if the carrying amount of the unit exceeds the recoverable amount of the unit, the entity must recognize an impairment loss.Note that the impairment testing of cash-generating units must also consider the corporate assets that can be allocated to the cash-generating unit or group of units under review, as specified in paragraph 102. Corporate assets are assets other than goodwill that do not generate cash inflows independently of other assets or groups of assets and their carrying amount cannot be fully attributed to the cash-generating unit under review. Examples would include group or divisional assets such as a headquarters or divisional building, EDP equipment, or a research centre.The impairment loss on a cash-generating unit is allocated to reduce the carrying amount of the assets of the unit (or group of units) in the following manner (P104): first, reduce the carrying amount of any goodwill that was allocated to the unit (or group of units)second, reduce the carrying amounts of the other assets of the unit (or group of units) pro rata on the basis of the carrying amount of each asset These reductions in carrying amounts are recognized in the same way as impairment losses on individual assets (that is, in accordance with paragraph 60, discussed above). When allocating an impairment loss to the assets in a cash-generating unit, the carrying amount of an asset should not be reduced below the highest of its fair value less costs to sell (if determinable), its value in use (if determinable), and zero. The amount of any unallocated impairment loss that results is applied pro rata to the other assets of theunit (group of units) (P105).Reversal of an impairment lossReversal of an impairment loss for goodwill is prohibited (P124). The logic behind this relates to the fact that if goodwill has previously been impaired and then is regenerated, it is essentially “new” goodwill. This would be considered an internally generated intangible. which cannot be recognized as per IAS 38.For assets or cash-generating units other than goodwill, the requirements for reversing a previously recognized impairment loss follow the same approach as for the identification of impairments. At the end of each reporting period, the entity assesses whether there is an indication that an impairment loss may no longer exist, or may have decreased. Paragraph 1 specifies the minimum external and internal sources of information that are to be considered in assessing the potential of reversal in impairment; these factors parallel those that were listed under paragraph 12 to originally assess whether there has been an impairment loss (for example, changes in market value, environment or interest rates, or better than expected performance).If a potential reversal in impairment is indicated, the recoverable amount of the asset or unit is estimated (P110). If there has been a change in the estimates used to determine the asset’s recoverable amount since the last impairment loss was recognized, the carrying amount of the asset is increased to its recoverable amount (P114). However, the increased carrying amount of an individual asset due to reversal should not be more than the carrying amount that would have been determined (net of amortization) if no impairment loss had been recognized for the asset in prior years (P117).Paragraph 119 requires that the reversal of an impairment loss be recognized immediately a income in the income statement unless the asset is carried at a revalued amount in accordant with another standard (consistent with the treatment of impairment losses, the reversal of such a loss is treated as a revaluation increase in accordance with that other standard). After a reversal of an impairment loss is recognized, amortization is adjusted for future periods (P121).A reversal of an impairment loss for a cash-generating unit is allocated to the assets ofthe unit, other than goodwill, pro rata with the carrying amounts of those assets. These increase in carrying amounts are treated in the same manner as reversals of impairment losses for individual assets (that is, recognized in accordance with paragraph 119) (P122).When allocating a reversal of an impairment loss to the assets in a cash-generating unit, the carrying amount of an asset should not be increased above the lower of its recoverable amount (if determinable) and the carrying amount that would have been determined (net of amortization) if no impairment loss had been recognized for the asset in prior periods. The amount of any unallocated amount that results is applied pro rata to the other assets of the u (except for goodwill) (P123).As a final point in this section, paragraph 116 explains that an asset’s value in use may become greater than its carrying amount simply because the present value of future cash inflows increases as they become closer. However, the service potential of the asset hasn’t changed and, accordingly, no reversal of impairment is recognized based on this “unwindin g of discount.”Foreign source:London:Cambridge University Press,2008 :140-155译文:国际会计准则第36号资产减值(一)目的本准则的目的是,规定企业用以确保其资产以不超过可收回价值的金额进行计量的程序。

银行术语--中英文对照

ABS 资产担保证券(Asset Backed Securities的英文缩写)Accelerated depreciation 加速折旧Acceptor 承兑人;受票人;接受人Acmodation paper 融通票据;担保借据Accounts payable 应付帐款Accounts receivable 应收帐款Accredited Investors 合资格投资者;受信投资人指符合美国证券交易委员(SEC)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者。

Accredit value 自然增长值Accrediting 本金增值适用于多种工具,指名义本金在工具(如上限合约、上下限合约、掉期和互换期权)的期限内连续增长。

Accrual basis 应计制;权责发生制Accrued interest 应计利息ACE 美国商品交易所Acid Test Ratio 酸性测验比率;速动比率Acquisition 收购Across the board 全面一致;全盘的Acting in concert 一致行动;合谋Active assets 活动资产;有收益资产Active capital 活动资本Actual market 现货市场Actual price 现货价Actual useful life 实际可用年期Actuary 精算师;保险统计专家ADB 亚洲开发银行(Asian Development Bank的英文缩写)ADR 美国存股证;美国预托收据;美国存托凭证(参见AmericanDepository Receipt栏目)ADS 美国存托股份(American Depository Share的英文缩写)Ad valorem 从价;按值Ad valorem stamp duty 从价印花税Adjudicator 审裁员Adjustable rate调息按揭mortgage (ARM)Admitted value 认可值Advance 垫款Affiliated pany 关联公司;联营公司After date 发票后,出票后After-hours dealing 收市后交易After-market 后市[股市] 指某只新发行股票在定价和配置后的交易市场。

中级财务会计英文ch07

- cash paid, plus - the current market value of the noncash consideration given.

Intangible Assets Determination of Cost

patents are capitalized.

Patents estion

Batter-Up, Inc. has developed a new device. Patent registration costs consisted of $2,000 in attorney fees and $1,000 in federal registration fees. What is Batter-Up’s amortizable cost?

• Where the intangibles have indefinite useful lives, they are not amortized.

• Acquired intangibles should not be written off at acquisition.

Intangible Assets Amortization of Cost

expensed as incurred. Patents are amortized over the shorter of the

legal life (20 years) or their useful lives. Legal fees incurred to successfully defend

Intangible Assets

注会英语

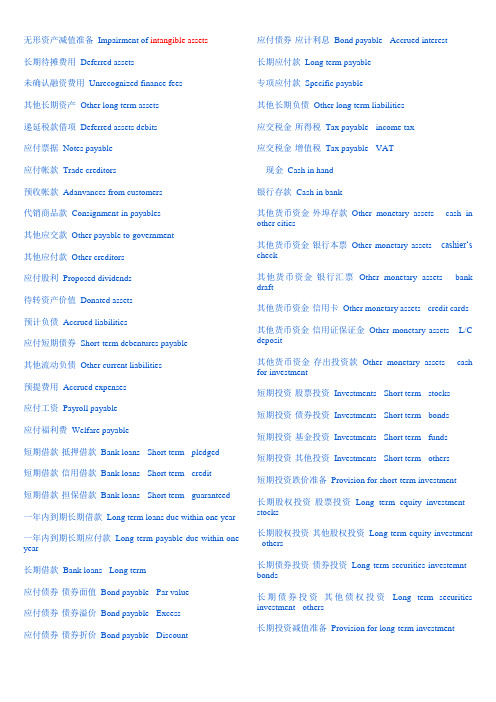

无形资产减值准备Impairment of intangible assets长期待摊费用Deferred assets未确认融资费用Unrecognized finance fees其他长期资产Other long term assets递延税款借项Deferred assets debits应付票据Notes payable应付帐款Trade creditors预收帐款Adanvances from customers代销商品款Consignment-in payables其他应交款Other payable to government其他应付款Other creditors应付股利Proposed dividends待转资产价值Donated assets预计负债Accrued liabilities应付短期债券Short-term debentures payable其他流动负债Other current liabilities预提费用Accrued expenses应付工资Payroll payable应付福利费Welfare payable短期借款-抵押借款Bank loans - Short term - pledged短期借款-信用借款Bank loans - Short term - credit短期借款-担保借款Bank loans - Short term - guaranteed 一年内到期长期借款Long term loans due within one year 一年内到期长期应付款Long term payable due within one year长期借款Bank loans - Long term应付债券-债券面值Bond payable - Par value应付债券-债券溢价Bond payable - Excess应付债券-债券折价Bond payable - Discount 应付债券-应计利息Bond payable - Accrued interest长期应付款Long term payable专项应付款Specific payable其他长期负债Other long term liabilities应交税金-所得税Tax payable - income tax应交税金-增值税Tax payable - VAT现金Cash in hand银行存款Cash in bank其他货币资金-外埠存款Other monetary assets - cash in other cities其他货币资金-银行本票Other monetary assets - cashier‘s check其他货币资金-银行汇票Other monetary assets - bank draft其他货币资金-信用卡Other monetary assets - credit cards 其他货币资金-信用证保证金Other monetary assets - L/C deposit其他货币资金-存出投资款Other monetary assets - cash for investment短期投资-股票投资Investments - Short term - stocks短期投资-债券投资Investments - Short term - bonds短期投资-基金投资Investments - Short term - funds短期投资-其他投资Investments - Short term - others短期投资跌价准备Provision for short-term investment长期股权投资-股票投资Long term equity investment - stocks长期股权投资-其他股权投资Long term equity investment - others长期债券投资-债券投资Long term securities investemnt - bonds长期债券投资-其他债权投资Long term securities investment - others长期投资减值准备Provision for long-term investment应收票据Notes receivable应收股利Dividends receivable应收利息Interest receivable应收帐款Trade debtors坏帐准备- 应收帐款Provision for doubtful debts - trade debtors预付帐款Prepayment应收补贴款Allowance receivable其他应收款Other debtors坏帐准备- 其他应收款Provision for doubtful debts - other debtors其他流动资产Other current assets物资采购Purchase原材料Raw materials包装物Packing materials低值易耗品Low value consumbles材料成本差异Material cost difference自制半成品Self-manufactured goods库存商品Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资Consigned processiong material委托代销商品Consignment-out受托代销商品Consignment-in分期收款发出商品Goods on instalment sales存货跌价准备Provision for obsolete stocks待摊费用Prepaid expenses待处理流动资产损益Unsettled G/L on current assets待处理固定资产损益Unsettled G/L on fixed assets委托贷款-本金Consignment loan - principle 委托贷款-利息Consignment loan - interest委托贷款-减值准备Consignment loan - provision固定资产-房屋建筑物Fixed assets - Buildings固定资产-机器设备Fixed assets - Plant and machinery固定资产-电子设备、器具及家具Fixed assets - Electronic Equipment,furniture and fixtures固定资产-运输设备Fixed assets - Automobiles累计折旧Accumulated depreciation固定资产减值准备Impairment of fixed assets工程物资-专用材料Project material - specific materials工程物资-专用设备Project material - specific equipment 工程物资-预付大型设备款Project material - prepaid for equipment工程物资-为生产准备的工具及器具Project material - tools and facilities for production在建工程Construction in progress在建工程减值准备Impairment of construction in progress 固定资产清理Disposal of fixed assets无形资产-专利权Intangible assets - patent无形资产-非专利技术Intangible assets - industrial property and know-how无形资产-商标权Intangible assets - trademark rights无形资产-土地使用权Intangible assets - land use rights无形资产-商誉Intangible assets - goodwill应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund 利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings,beginning of the year 资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund 盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - reture investment by investment应交税金-营业税Tax payable - business tax应交税金-消费税Tax payable - consumable tax应交税金-其他Tax payable - others递延税款贷项Deferred taxation credit股本Share capital已归还投资Investment returned利润分配-其他转入Profit appropriation - other transfer in 利润分配-提取法定盈余公积Profit appropriation - statutory surplus reserve利润分配-提取法定公益金Profit appropriation - statutory welfare reserve利润分配-提取储备基金Profit appropriation - reserve fund 利润分配-提取企业发展基金Profit appropriation - enterprise development fund利润分配-提取职工奖励及福利基金Profit appropriation - staff bonus and welfare fund利润分配-利润归还投资Profit appropriation - return investment by profit利润分配-应付优先股股利Profit appropriation - preference shares dividends利润分配-提取任意盈余公积Profit appropriation - other surplus reserve利润分配-应付普通股股利Profit appropriation - ordinary shares dividends利润分配-转作股本的普通股股利Profit appropriation - ordinary shares dividends converted to shares期初未分配利润Retained earnings,beginning of the year 资本公积-股本溢价Capital surplus - share premium资本公积-接受捐赠非现金资产准备Capital surplus - donation reserve资本公积-接受现金捐赠Capital surplus - cash donation资本公积-股权投资准备Capital surplus - investment reserve资本公积-拨款转入Capital surplus - subsidiary资本公积-外币资本折算差额Capital surplus - foreign currency translation资本公积-其他Capital surplus - others盈余公积-法定盈余公积金Surplus reserve - statutory surplus reserve盈余公积-任意盈余公积金Surplus reserve - other surplus reserve盈余公积-法定公益金Surplus reserve - statutory welfare reserve盈余公积-储备基金Surplus reserve - reserve fund盈余公积-企业发展基金Surplus reserve - enterprise development fund盈余公积-利润归还投资Surplus reserve - reture investment by investment主营业务收入Sales主营业务成本Cost of sales主营业务税金及附加Sales tax营业费用Operating expenses管理费用General and administrative expenses财务费用Financial expenses投资收益Investment income其他业务收入Other operating income营业外收入Non-operating income补贴收入Subsidy income其他业务支出Other operating expenses营业外支出Non-operating expenses所得税Income tax直接人工成本差异(direct labor variance)直接材料成本差异(direct material variance)在产品计价(work-in-process costing)联产品成本计算(joint products costing)生产成本汇总程序(accumulation process of procluction cost)制造费用差异(manufacturing expenses variance)实际成本与估计成本(actual cost and estimated cost)工资费用分配(salary costs allocation)成本曲线(cost curve)农业生产成本(agriculture production cost)原始成本和重置成本(original cost and replacement cost)工程施工成本直接成本与间接成本(direct cost and indirect cost)可控成本(controllable cost)制造费用分配(manufacturing expenses allocation)理论成本与应用成本(theory cost and practice cost)辅助生产成本分配(auxiliary production cost allocation)期间,费用成本控制程序(procedure of cost control)成本记录(cost entry,cost recorder cost agenda)成本计算分批法(job costing method)主营业务收入Sales直接人工成本差异(direct labor variance)成本控制方法(cost control method)内河运输成本生产费用要素(elements of production expenses)历史成本与未来成本(historical cost and future cost)可避免成本与不可避免成本(avoidable cost and unavoidable cost)成本计算期(cost period)平均成本与个别成本(avorage cost and individual cost)跨期摊提费用分配(inter-period expenses allocation)计划成本(planned cost)数量差异(quantity variance)燃料费用分配(fuel expenses allocation)定额成本控制制度(norm cost control system)定额管理(management norm)可递延成本与不可递延成本(deferrable cost and undeferrable cost)成本控制标准(standard of cost control)副产品成本计算(by-product costing)责任成本(responsibility cost)生产损失核算(production loss accounting)生产成本(production cost)预计成本(predicted cost)成本结构(cost structure)房地产开发成本主要成本与加工成本(prime costs and processing costs)决策成本(cost of decision making)成本计算品种法(category costing method)在产品成本(work-in-process cost)工厂成本(factory cost)成本考核(cost assess )制造费用(manufactruing expenses)动力费用分配(power expenses allocation)趋势分析法(trend analysis approach)成本计算简单法(simple costing method)责任成本层次(levels of responsibility cost)初级会计汇总原始凭证(cumulative source document)汇总记账凭证核算形式(bookkeeping procedure using summary ovchers)工作底稿(working paper)复式记账凭证(mvltiple account titles voucher)复式记账法(Double entry bookkeeping)复合分录(compound entry)划线更正法(correction by drawing a straight ling)汇总原始凭证(cumulative source document)会计凭证(accounting documents)会计科目表(chart of accounts)会计科目(account title)红字更正法(correction by using red ink)会计核算形式(bookkeeping procedures)过账(posting)会计致迹╝ccounting entry)会计循环(accounting cycle)会计账簿(Book of accounts)活页式账簿(loose-leaf book)集合分配账户(clearing accounts)计价对比账户(matching accounts)记账方法(bookkeeping methods)记账规则(recording rules)记账凭证(voucher)记账凭证核算形式(Bookkeeping proced ureusing vouchers)记账凭证汇总表核算形式(bookkeeping procedure using categorized account summary)简单分录(simple entry)结算账户(settlement accounts)结账(closing account)结账分录(closing entry)借贷记账法(debit-credit bookkeeping)通用日记账核算形式(bookkeeping procedure using general journal)外来原始凭证(source document from outside)现金日记账(cash journal)虚账户(nominal accounts)序时账簿(book of chronological entry)一次凭证(single-record document)银行存款日记账(deposit journal)永续盘存制(perpetual inventory system)原始凭证(source document)暂记账户(suspense accounts)增减记账法(increase-decrease bookkeeping)债权结算账户(accounts for settlement of claim)债权债务结算账户(accounts for settlement of claim and debt)债务结算账户(accounts for settlement of debt)账户(account)账户编号(Account number)账户对应关系(debit-credit relationship)账项调整(adjustment of account)专用记账凭证(special-purpose voucher)转回分录(reversing entry)资金来源账户(accounts of sources of funds)资产负债账户(balance sheet accounts)转账凭证(transfer voucher)资金运用账户(accounts of applications of funds)自制原始凭证(internal source document)总分类账簿(general ledger)总分类账户(general account)附加账户(adjunct accounts)付款凭证(payment voucher)分类账簿(ledger)中级会计固定资产(fixed assets)利润总额利益分配(profit distribution)应计费用(accrued expense)商标权(trademarks and tradenames)净利润(net income)应付利润(profit payable)收益债券(income bonds)利息资本化(capitalization of interests)预付账款(advance to supplier)其他应收款(other receivables)现金(cash)公司债券发行(corporate bond floatation)应付工资(wages payable)实收资本(paid-in capital)盈余公积(surplus reserves)股利(dividend)应交税金(taxes payable)负商誉(negative goodwill)费用的确认(recognition of expense)短期投资(temporary investment)专有技术(know-how)专营权(franchises)资本公积(capital reserves)自然资源(natural resources)存货(inventory)偿债基金(sinking fund)。

资产负债表中英文、中韩文对照

负债表:1 资产assets11~ 12 流动资产current assets111 现金及约当现金cash and cash equivalents1111 库存现金cash on hand1112 零用金/周转金petty cash/revolving funds1113 银行存款cash in banks1116 在途现金cash in transit1117 约当现金cash equivalents1118 其它现金及约当现金other cash and cash equivalents112 短期投资short-term investment1121 短期投资-股票short-term investments - stock1122 短期投资-短期票券short-term investments - short-term notes and bills 1123 短期投资-政府债券short-term investments - government bonds1124 短期投资-受益凭证short-term investments - beneficiary certificates 1125 短期投资-公司债short-term investments - corporate bonds1128 短期投资-其它short-term investments - other1129 备抵短期投资跌价损失allowance for reduction of short-term investment to market113 应收票据notes receivable1131 应收票据notes receivable1132 应收票据贴现discounted notes receivable1137 应收票据-关系人notes receivable - related parties1138 其它应收票据other notes receivable1139 备抵呆帐-应收票据allowance for uncollec- tible accounts- notes receivable114 应收帐款accounts receivable1141 应收帐款accounts receivable1142 应收分期帐款installment accounts receivable1147 应收帐款-关系人accounts receivable - related parties1149 备抵呆帐-应收帐款allowance for uncollec- tible accounts - accounts receivable118 其它应收款other receivables1181 应收出售远汇款forward exchange contract receivable1182 应收远汇款-外币forward exchange contract receivable - foreign currencies1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1185 应收退税款income tax refund receivable1187 其它应收款- 关系人other receivables - related parties1188 其它应收款- 其它other receivables - other1189 备抵呆帐- 其它应收款allowance for uncollec- tible accounts - other receivables121~122 存货inventories1211 商品存货merchandise inventory1212 寄销商品consigned goods1213 在途商品goods in transit1219 备抵存货跌价损失allowance for reduction of inventory to market 1221 制成品finished goods1222 寄销制成品consigned finished goods1223 副产品by-products1224 在制品work in process1225 委外加工work in process - outsourced1226 原料raw materials1227 物料supplies1228 在途原物料materials and supplies in transit1229 备抵存货跌价损失allowance for reduction of inventory to market 125 预付费用prepaid expenses1251 预付薪资prepaid payroll1252 预付租金prepaid rents1253 预付保险费prepaid insurance1254 用品盘存office supplies1255 预付所得税prepaid income tax1258 其它预付费用other prepaid expenses126 预付款项prepayments1261 预付货款prepayment for purchases1268 其它预付款项other prepayments128~129 其它流动资产other current assets1281 进项税额VAT paid ( or input tax)1282 留抵税额excess VAT paid (or overpaid VAT)1283 暂付款temporary payments1284 代付款payment on behalf of others1285 员工借支advances to employees1286 存出保证金refundable deposits1287 受限制存款certificate of deposit-restricted1291 递延所得税资产deferred income tax assets1292 递延兑换损失deferred foreign exchange losses1293 业主(股东)往来owners(stockholders) current account1294 同业往来current account with others1298 其它流动资产-其它other current assets - other13 基金及长期投资funds and long-term investments131 基金funds1311 偿债基金redemption fund (or sinking fund)1312 改良及扩充基金fund for improvement and expansion1313 意外损失准备基金contingency fund1314 退休基金pension fund1318 其它基金other funds132 长期投资long-term investments1321 长期股权投资long-term equity investments1322 长期债券投资long-term bond investments1323 长期不动产投资long-term real estate in-vestments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资other long-term investments1329 备抵长期投资跌价损失allowance for excess of cost over market value of long-term investments14~ 15 固定资产property , plant, and equipment141 土地land1411 土地land1418 土地-重估增值land - revaluation increments142 土地改良物land improvements1421 土地改良物land improvements1428 土地改良物-重估增值land improvements - revaluation increments 1429 累积折旧-土地改良物accumulated depreciation - land improvements 143 房屋及建物buildings1431 房屋及建物buildings1438 房屋及建物-重估增值buildings -revaluation increments1439 累积折旧-房屋及建物accumulated depreciation - buildings144~146 机(器)具及设备machinery and equipment1441 机(器)具machinery1448 机(器)具-重估增值machinery - revaluation increments1449 累积折旧-机(器)具accumulated depreciation - machinery151 租赁资产leased assets1511 租赁资产leased assets1519 累积折旧-租赁资产accumulated depreciation - leased assets152 租赁权益改良leasehold improvements1521 租赁权益改良leasehold improvements1529 累积折旧- 租赁权益改良accumulated depreciation - leasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments for equipment1561 未完工程construction in progress1562 预付购置设备款prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipment - revaluation increments1589 累积折旧- 杂项固定资产accumulated depreciation - miscellaneous property, plant, and equipment16 递耗资产depletable assets161 递耗资产depletable assets1611 天然资源natural resources1618 天然资源-重估增值natural resources -revaluation increments1619 累积折耗-天然资源accumulated depletion - natural resources17 无形资产intangible assets171 商标权trademarks1711 商标权trademarks172 专利权patents1721 专利权patents173 特许权franchise1731 特许权franchise174 著作权copyright1741 著作权copyright175 计算机软件computer software1751 计算机软件computer software cost176 商誉goodwill1761 商誉goodwill177 开办费organization costs1771 开办费organization costs178 其它无形资产other intangibles1781 递延退休金成本deferred pension costs1782 租赁权益改良leasehold improvements1788 其它无形资产-其它other intangible assets - other18 其它资产other assets181 递延资产deferred assets1811 债券发行成本deferred bond issuance costs1812 长期预付租金long-term prepaid rent1813 长期预付保险费long-term prepaid insurance1814 递延所得税资产deferred income tax assets1815 预付退休金prepaid pension cost1818 其它递延资产other deferred assets182 闲置资产idle assets1821 闲置资产idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据long-term notes receivable1842 长期应收帐款long-term accounts receivable1843 催收帐款overdue receivables1847 长期应收票据及款项与催收帐款-关系人long-term notes, accounts and overdue receivables- related parties1848 其它长期应收款项other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accounts - long-term notes, accounts and overdue receivables185 出租资产assets leased to others1851 出租资产assets leased to others1858 出租资产-重估增值assets leased to others - incremental value from revaluation1859 累积折旧-出租资产accumulated depreciation - assets leased to others 186 存出保证金refundable deposit1861 存出保证金refundable deposits188 杂项资产miscellaneous assets1881 受限制存款certificate of deposit - restricted1888 杂项资产-其它miscellaneous assets - other2 负债liabilities21~ 22 流动负债current liabilities211 短期借款short-term borrowings(debt)2111 银行透支bank overdraft2112 银行借款bank loan2114 短期借款-业主short-term borrowings - owners2115 短期借款-员工short-term borrowings - employees2117 短期借款-关系人short-term borrowings- related parties2118 短期借款-其它short-term borrowings - other212 应付短期票券short-term notes and bills payable2121 应付商业本票commercial paper payable2122 银行承兑汇票bank acceptance2128 其它应付短期票券other short-term notes and bills payable2129 应付短期票券折价discount on short-term notes and bills payable213 应付票据notes payable2131 应付票据notes payable2137 应付票据-关系人notes payable - related parties2138 其它应付票据other notes payable214 应付帐款accounts pay able2141 应付帐款accounts payable2147 应付帐款-关系人accounts payable - related parties216 应付所得税income taxes payable2161 应付所得税income tax payable217 应付费用accrued expenses2171 应付薪工accrued payroll2172 应付租金accrued rent payable2173 应付利息accrued interest payable2174 应付营业税accrued VAT payable2175 应付税捐-其它accrued taxes payable- other2178 其它应付费用other accrued expenses payable218~219 其它应付款other payables2181 应付购入远汇款forward exchange contract payable2182 应付远汇款-外币forward exchange contract payable - foreign currencies2183 买卖远汇溢价premium on forward exchange contract2184 应付土地房屋款payables on land and building purchased2185 应付设备款Payables on equipment2187 其它应付款-关系人other payables - related parties2191 应付股利dividend payable2192 应付红利bonus payable2193 应付董监事酬劳compensation payable to directors and supervisors 2198 其它应付款-其它other payables - other226 预收款项advance receipts2261 预收货款sales revenue received in advance2262 预收收入revenue received in advance2268 其它预收款other advance receipts227 一年或一营业周期内到期长期负债long-term liabilities -current portion 2271 一年或一营业周期内到期公司债corporate bonds payable - current portion2272 一年或一营业周期内到期长期借款long-term loans payable - current portion2273 一年或一营业周期内到期长期应付票据及款项long-term notes and accounts payable due within one year or one operating cycle2277 一年或一营业周期内到期长期应付票据及款项-关系人long-term notes and accounts payables to related parties - current portion2278 其它一年或一营业周期内到期长期负债other long-term lia- bilities - current portion228~229 其它流动负债other current liabilities2281 销项税额VAT received(or output tax)2283 暂收款temporary receipts2284 代收款receipts under custody2285 估计售后服务/保固负债estimated warranty liabilities2291 递延所得税负债deferred income tax liabilities2292 递延兑换利益deferred foreign exchange gain2293 业主(股东)往来owners current account2294 同业往来current account with others2298 其它流动负债-其它other current liabilities - others23 长期负债long-term liabilities231 应付公司债corporate bonds payable2311 应付公司债corporate bonds payable2319 应付公司债溢(折)价premium(discount) on corporate bonds payable 232 长期借款long-term loans payable2321 长期银行借款long-term loans payable - bank2324 长期借款-业主long-term loans payable - owners2325 长期借款-员工long-term loans payable - employees2327 长期借款-关系人long-term loans payable - related parties2328 长期借款-其它long-term loans payable - other233 长期应付票据及款项long-term notes and accounts payable2331 长期应付票据long-term notes payable2332 长期应付帐款long-term accounts pay-able2333 长期应付租赁负债long-term capital lease liabilities2337 长期应付票据及款项-关系人Long-term notes and accounts payable - related parties2338 其它长期应付款项other long-term payables234 估计应付土地增值税accrued liabilities for land value increment tax2341 估计应付土地增值税estimated accrued land value incremental taxpay-able235 应计退休金负债accrued pension liabilities2351 应计退休金负债accrued pension liabilities238 其它长期负债other long-term liabilities2388 其它长期负债-其它other long-term liabilities - other28 其它负债other liabilities281 递延负债deferred liabilities2811 递延收入deferred revenue2814 递延所得税负债deferred income tax liabilities2818 其它递延负债other deferred liabilities286 存入保证金deposits received2861 存入保证金guarantee deposit received288 杂项负债miscellaneous liabilities2888 杂项负债-其它miscellaneous liabilities损益表:项目ITEMS产品销售收入Sales其中:出口产品销售收入Including:Export sales减:销售折扣与折让Less:Sales discounts and allowances产品销售净额Net sales减:产品销售税金Less:Sales tax产品销售成本Cost of sales其中:出口产品销售成本Including:Cost of export sales产品销售毛利Gross profit减:销售费用Less:Selling expense管理费用General and administrative expense财务费用Financial expense其中:利息支出(减利息收入) Including:Interest expense ( less interest income ) 汇兑损失(减汇兑收益) Exchange loss ( less exchange gain )产品销售利润Income from main operation加:其他业务利润Add:Income from other operations营业利润Operating income加:投资收益Add:Investment income营业外收入Non-operating income减:营业外支出Less:Non-operating expense加:以前年度损益调整Add:Adjustment to prior year\'s income and expense 利润总额Income before tax减:所得税Less:Income tax净利润 NET INCOME납세고지서== 纳税通知单가산금체납금==滞纳金보복관세== 对抗关税报复关税분할납부== 分期付款자산조정==资产重组외자유치==引入外资은행예금==银行存款자기앞수표와유사== 银行本票(은행어음)환어음== 银行汇票신용장개설보증금==信用证保证金단기투자자산==短期投资단기투자자산평가충당금==短期投资跌价准备어음과수표==应收票据미수배당금== 应收股利미수이자== 应收利息매출채권==应收账款기타채권==其他应收款대손충당금==坏账准备선급금==预付账款정부보조금등의미수금== 应收补贴款매입==物资采购내구성소모품==低值易销品재료비차이== 材料成本差异반제품==自制半成品상품과제품==库存商品결산시판매가와매입가와의차이==商品进销差价위탁가공한재료의실제원가== 委托加工物资위탁판매상품==委托代销商品수탁판매상품==受托代销商品재고자산평가충당금==存货跌价准备할부판매상품==分期收款发出商品선급비용==待摊费用장기지분투자==长期股权投资투자주식== 股票投资장기채권투자==长期债权投资투자채권==债权投资투자자산평가충당금==长期投资减值准备원금==本金평가충당금== 减值准备고정자산== 固定资产감가상각누계액==累计折旧고정자산평가충당금==固定资产减值准备건설또는생산준비기간중의구입물품== 工程物资대형설비선급금==预付大型设备款건설가계정==在建工程건설가계정평가충당금==在建工程减值准备고정자산매각시설정하는임시계정== 固定资产清理단기차입금===短期借款지급어음== 应付票据외상매입금==应付帐款수탁상품의매출미지급금==代销商品款미지급급여== 应付工资미지급복리비==应付福利费미지급배당금==应付股利미지급세금== 应缴税金기타미지급금==其他应交款기타미지급부채==其他应付款미지급비용==预提费用장기차입금== 长期借款회사채==应付债券액면발행==债券面值할증발행==债券益加할인발행==债券折价납입자본== 实收资本(股本)투자환급액== 已归还投资자본잉여금== 资本公积비현금자산수증이익== 接受损益非现金资产准备현금수증이익==接受现金损赠외화환산차== 外币资本折算差额이익잉여금== 盈余公积법정적립금== 法定盈余公积임의적립금== 任意盈余公积法定公益金준비금=储备基金企业发展基金이윤으로투자액을환급== 利润归还投资당기순이익==本年利润이윤분배및이윤분배후의잔액== 利润分配우선주배당금== 应负优先股利제조원가==生产成本직접제조원가==基本生产成本간접제조원가==补助生产成本매출원가==主营业务成本자금조달관련비용==财务费用전기손익수정==以前年度损益调整기대이익== 预期利益부가세==增值税자산부채표==资产负债表1. 현금/现金2. 외상매출금/应收帐款3. 선급금/预付帐款4. 미수금/其他应收款5. 미처분비용,선급비용/待摊费用6. 재고자산/存货7. 상품과제품/库存商品8. 완제품/产成品9. 제조원가/生产成本10. 원부자재/原材料11. 부산물,내구성소모품,비품/低值易耗品12. 반성품/半成品13. 유동자산/流动资产14.고정자산/固定资产15. 고정자산원가/固定资产原价16. 감가상각누계액/累计折旧17. 건설가계정/在建工程18. 무형자산/无形资产19. 장기투자/长期投资20.이연자산/递延资产21. 창업비/开办费22. 이연세금/递延税款23.외상매입금/应付帐款24. 미지급금/其他应付款25. 미지급급여/应付工资26.기타예수금/其他应交款27. 예수금/应交税金28. 선수금/预收帐款29. 부채/负债30. 자본/资本31. 자본금/资本金32. 자본공적/资本公积33.당년이익/本年利润34. 미처분이익잉여금/未分配利润35. 자본합계/所有者权益손익계산서/利润表36. 매출액/主营业务收入37. 매출원가/主营业务成本38.매출총이익/主营业务利润39. 판매비/营业费用40. 관리비/管理费用41.재무비/财务费用42. 영업이익/营业利润43. 영업외수입/营业外收入44.영업외지출/营业外支出45. 이익총액/利润总额46. 소득세/所得税47.처분전이익잉여금/可供分配的利润48. 차기이울이익잉여금/未分配利润세금류/税金49. 납세고지서/纳税通知50. 가산금,체납금/滞纳金51. 세수/税收52. 징수/征收53. 과세소득/课税所得54. 세금보완/补缴税金55.조세징수/税收征收56. 세금추징/追缴税金57. 벌금을부과/赋课税金58.자진신고/自觉申报59. 인지세/印花税60. 분할납부/分期付款、기타/其他61. 자산조정/资产重组62. 입금/资金到位63. 비밀유지의무/保密义务64.외자유치/引入外资65. 환어음/银行汇票66. 신용카드/信用卡67.신용장개설보증금/信用证保证金68. 단기투자자산/短期投资69. 주식/股票70. 채권/债券71. 기금/基金72. 단기투자자산평가충당금/短期投资跌价准备73. 어음과수표/应收票据74. 미수배당금/应收股利75. 미수이자/应收利贳76.대손충당금/坏帐准备77. 정부보조금등의미수금/应收补贴款78. 매입/物资采构79. 재료비차이/材料成本差异80. 반제품/自制半成品81. 결산시판매가와매입가와의차이/商品进销差价82. 위탁가공한재료의실제원가/委托加工物资83. 위탁판매상품/委托代销商品84. 수탁판매상품/受托代销商品85. 재고자산평가충당금/存货减値准备86. 할부판매상품/分期收款发出商品87.장기지분투자/长期股权投资88. 주식투자/股票投资89.장기채권투자/长期债权投资90. 채권투자/债权投资91.자산투자평가충당금/长期投资减値准备92. 금융기관을통하여타기업에대출/委托贷款93. 원금/本金94. 이자/利贳95. 평가충당금/减値准备96.고정자산평가충당금/固定资产减値准备97. 건설또는생산준비기간중의구입물품/工程物资98. 대형설비선급금/预付大型设备款99.건설가계정평가충당금/在建工程减値准备100. 단기차입금/短期借款101.고정자산매각시설정하는임시계정/固定资产淸理102. 지급어음/应付票据103.세미나/报告会,讨论会104. 재무제표/财务报表105. 차변/借方106.대변/贷方107.총비용/总费用108.제조원가/制造费用109. 급료/工资110.노무비/劳务费111. 상기업/商业112. 제조기업/工业113. 부채/负债114.총계정원장/总帐115. 거래/往来116. 뺄셈/减117. 증빙자료/原始凭证118.괘선/分线119. 콤마/,(반점)120. 자산/资产121. 분개/分类122. 덧셈/加123. 분개장/分类帐124.전표/凭证125. 숫자/数字126. 정관/ 章程127.입출국관리부처/出入境管理局128. 대체수표/转帐支票129. 경상구좌/结算户。

资产评估英语

资产评估英语第一篇:资产评估英语liabilities evaluation 负债评估restore replacement cost 复原重置成本renewal replacement cost 更新重置成本non-patent technique and know-how 非专利技术和秘诀rate of risk return on investment 风险报酬率personal estate 动产equal expedient method 对等权宜法adjustment coefficient of road condition 车辆行驶路况调整系数purchase cost of vehicle 车辆购置费long term investment evaluation 长期投资评估newness rate 成新率real estate 不动产product and store goods evaluation 产成品和库存商品的评估transfer of property right 产权转让change of property right 产权变动principle of property right interests subject alteration 产权利益主体变动原则reference object 参照物material evaluation 材料评估earning ratio of capital 本金化率quote 报价variable factor adjustment method 变动因素调整法key-point evaluation method 重点评估法engineering process method with recomposed budge 重编预算工程进度法replacement cost calculation method 重置核算法replacement cost method 重置成本法tangible assets 有形资产physical wear 有形损耗Sino-foreign cooperative business operation 中外合作经营Sino-foreign joint venture 中外合资经营intellectual property right 知识产权expected service life 预计使用年限(有效使用寿命)evaluation of construction engineering in process 在建工程评估construction engineering in process 在建工程evaluation of products in process 在产品评估conversion rate 折现率discount to present value 折现enterprise total assets evaluation 整体企业资产评估total assets of enterprise 整体企业资产duties of increase in value 增值税travelled distance 已行驶里程inquiry 询价intangible asset evaluation 无形资产评估earnings of intangible assets 无形资产收益额intangible assets 无形资产moral wear 无形损耗special privilege evaluation 特许权评估special privilege 特许权益inflation rate 通货膨胀率consumption tax 消费税current market price method 现行市价法current market price 现行市价shop survey 现场勘查price index method 物价指数法(指数调整法)price index 物价指数evaluation of right of use land 土地使用权评估right of use land 土地使用权land ownership 土地所有权practical serviced life 实际已使用年限claim 索赔present earning value method 收益现值法present value of earning 收益现值evaluation of trade mark right 商标权评估trade mark 商标trade credit evaluation 商誉评估trade credit 商誉market of equipment transfer 设备调剂市场equipment sublet out 设备租出equipment sublet in 设备租入adjustment coefficient of equipment work condition 设备工作状态调整系数sale of equipment 设备出售equipment purchasing 设备采购installation and test cost of equipment 设备安装调试费transportation cost of equipment 设备运杂费equipment leasing with circulating funds 设备融资租赁life of equipment 设备寿命disposal cost of facilities 设备清理费adjustment coefficient of equipment utilization 设备利用调系数liquidation price method 清算价格法liquidation price 清算价格circulating assets 流动资产nominal serviced life 名义已使用年限book value method 历史成本法(FOB)free on board 离岸价verification and affirmation of assets evaluation 资产评估的验证确认inassignable assets 不可确指的资产devaluation by real degradation 实体性陈旧贬值engineering process method 工程进度法function and cost method 功能成本法devaluation by functional degradation 功能性陈旧贬值fair price 公允价格scale economical profit index analysis method 规模经济效益指数分析法contract 合同rights and interests of contract 合同权益insurance of ocean transportation 海运保险费ocean transportation cost 海运费exchange rate 汇率time value of money 货币时间价值machine equipment evaluation 机器设备评估simple age limit method 简单年限法price adjustment factor 价格调整系数acceptance 接受building 建筑物replacement cost of building 建筑物重置价functional devaluation of building 建筑物功能性贬值economical devaluation of building 建筑物经济性贬值building evaluation 建筑物评估import duties 进口关税economic devaluation 经济性贬值assignable assets 可确指的资产item request of assets evaluation 评估立项申请effective period of assets evaluation 评估有效期base date of assets evaluation 评估基准日links of evaluation 评估环节joint operation of enterprises 企业联营liquidation of enterprise 企业清算sale of enterprise 企业出售joint-stock system operation of enterprise 企业股份制经营annexation of enterprise 企业兼并resources assets 资源性资产resources assets evaluation 资源性资产评估original book value of assets 资产原值net book value assets 资产净值purpose of assets evaluation 资产评估目的 5 salient features of assets evaluation 资产评估特点basis of assets evaluation 资产评估依据subject of assets evaluation 资产评估主体operating procedure of assets evaluation 资产评估[操作]程序(法定程序)work principle of assets evaluation 资产评估[工作]原则written report of assets evaluation 资产评估报告书statutes system of assets evaluation 资产评估法规体系method of assets evaluation 资产评估方法assets evaluation management 资产评估管理assets evaluation organization 资产评估机构hypothesis of assets evaluation 资产评估假设operation principle of assets evaluation 资产评估经济性(操作性)原则object of assets evaluation 资产评估客体(对象)check and arbitration of assets evaluation 资产评估的复核仲裁function of assets evaluation 资产评估的功能assets evaluation files 资产评估档案integrated age limit method 综合年限法integrated remainder life 综合剩余寿命integrated service life 综合服役年限certified public assets estimator 注册资产评估师patent 专利evaluation of patent right 专利权评估assignment of the patent right 专利权转让know-how evaluation 专用技术(诀窍)评估statistical analysis method 点面推算法single assets 单项资产(CIF)cost insurance and freight 到岸价system of land price 地产友情链接现金 Cash in hand银行存款 Cash in bank其他货币资金-外埠存款Other monetary assetscashier‘s check其他货币资金-银行汇票 Other monetary assetscredit cards其他货币资金-信用证保证金Other monetary assetscash for investment短期投资-股票投资 Investmentsstocks短期投资-债券投资 Investmentsbonds短期投资-基金投资 Investmentsfunds短期投资-其他投资 Investmentsothers短期投资跌价准备 Provision for short-term investment长期股权投资-股票投资 Long term equity investmentothers长期债券投资-债券投资 Long term securities investemntothers 长期投资减值准备 Provision for long-term investment应收票据 Notes receivable应收股利 Dividends receivable应收利息 Interest receivable应收帐款 Trade debtors坏帐准备-应收帐款 Provision for doubtful debtsother debtors 其他流动资产 Other current assets物资采购 Purchase原材料 Raw materials包装物 Packing materials低值易耗品 Low value consumbles材料成本差异 Material cost difference自制半成品 Self-manufactured goods库存商品 Finished goods商品进销差价Difference between purchase & sales of commodities委托加工物资 Consigned processiong material委托代销商品 Consignment-out受托代销商品 Consignment-in分期收款发出商品 Goods on instalment sales存货跌价准备 Provision for obsolete stocks待摊费用 Prepaid expenses待处理流动资产损益 Unsettled G/L on current assets待处理固定资产损益 Unsettled G/L on fixed assets委托贷款-本金 Consignment loaninterest委托贷款-减值准备 Consignment loanBuildings固定资产-机器设备Fixed assetsElectronic Equipment,furniture and fixtures固定资产-运输设备 Fixed assetsspecific materials工程物资-专用设备 Project materialprepaid for equipment工程物资-为生产准备的工具及器具 Project materialpatent无形资产-非专利技术 Intangible assetstrademark rights无形资产-土地使用权Intangible assetsShort termShort termShort termLong term应付债券-债券面值 Bond payableExcess应付债券-债券折价 Bond payableAccrued interest长期应付款 Long term payable专项应付款 Specific payable其他长期负债 Other long term liabilities应交税金-所得税 Tax payablebusiness tax应交税金-消费税 Tax payableothers递延税款贷项 Deferred taxation credit股本 Share capital已归还投资 Investment returned利润分配-其他转入Profit appropriationstatutory surplus reserve利润分配-提取法定公益金 Profit appropriationreserve fund利润分配-提取企业发展基金Profit appropriationstaff bonus and welfare fund利润分配-利润归还投资 Profit appropriationpreference shares dividends利润分配-提取任意盈余公积Profit appropriationordinary shares dividends利润分配-转作股本的普通股股利Profit appropriationshare premium资本公积-接受捐赠非现金资产准备Capital surpluscash donation资本公积-股权投资准备 Capital surplussubsidiary资本公积-外币资本折算差额 Capital surplusothers盈余公积-法定盈余公积金Surplus reserveother surplus reserve盈余公积-法定公益金 Surplus reservereserve fund盈余公积-企业发展基金Surplus reservereture investment by investment主营业务收入 Sales 主营业务成本 Cost of sales主营业务税金及附加 Sales tax营业费用 Operating expenses管理费用 General and administrative expenses财务费用 Financial expenses投资收益 Investment income其他业务收入 Other operating income营业外收入 Non-operating income补贴收入 Subsidy income其他业务支出 Other operating expenses营业外支出 Non-operating expenses所得税 Income tax直接人工成本差异(direct labor variance)直接材料成本差异(direct material variance)在产品计价(work-in-process costing)联产品成本计算(joint products costing)生产成本汇总程序(accumulation process of procluction cost)制造费用差异(manufacturing expenses variance)实际成本与估计成本(actual cost and estimated cost)工资费用分配(salary costs allocation)成本曲线(cost curve)农业生产成本(agriculture production cost)原始成本和重置成本(original cost and replacement cost)工程施工成本直接成本与间接成本(direct cost and indirect cost)可控成本(controllable cost)制造费用分配(manufacturing expenses allocation)理论成本与应用成本(theory cost and practice cost)辅助生产成本分配(auxiliary production cost allocation)期间,费用成本控制程序(procedure of cost control)成本记录(cost entry,cost recorder cost agenda)成本计算分批法(job costing method)直接人工成本差异(direct labor variance)成本控制方法(cost control method)内河运输成本生产费用要素(elements of production expenses)历史成本与未来成本(historical cost and future cost)可避免成本与不可避免成本(avoidable cost and unavoidable cost)成本计算期(cost period)平均成本与个别成本(avorage cost and individual cost)跨期摊提费用分配(inter-period expenses allocation)计划成本(planned cost)数量差异(quantity variance)燃料费用分配(fuel expenses allocation)定额成本控制制度(norm cost control system)定额管理(management norm)可递延成本与不可递延成本(deferrable cost and undeferrable cost)成本控制标准(standard of cost control)副产品成本计算(by-product costing)责任成本(responsibility cost)生产损失核算(production loss accounting)生产成本(production cost)预计成本(predicted cost)成本结构(cost structure)房地产开发成本主要成本与加工成本(prime costs and processing costs)决策成本(cost of decision making)成本计算品种法(category costing method)在产品成本(work-in-process cost)工厂成本(factory cost)成本考核(cost assess)制造费用(manufactruing expenses)动力费用分配(power expenses allocation)趋势分析法(trend analysis approach)成本计算简单法(simple costing method)责任成本层次(levels of responsibility cost)对比分析法(comparative analysis approach)约当产量比例法(equivalent units method)原始记录(original record)可比产品成本分析(general product cost analysis)成本计算方法(costing method)成本计算对象(costing objective)成本计算单位(costing unit)成本计划完成情况分析成本计划管理体系(planned management system of cost)成本计划(cost plan)成本会计(cost accounting)成本核算原则(principle of costing)成本核算程序(cost accounting qrocedures)成本核算成本(costing account)成本核算(costing)成本归集(cost accumulation)成本管理(cost management)成本分析(cost analysis)成本分配(ocst allocation)成本分类账(cost ledger)成本分类(cost classifiction)成本费用界限成本调整(cost adjustment)成本差异(cost variance)成本报告(costing report)成本(cost)车间成本(workshop cost)厂内经济核算制(internal business accounting system)厂内结算价格(internal settlement prices)产品寿命周期成本(product life cycle cost)产品成本项目(cost items of product)产品成本技术经济分析产品成本计划(the plan of product costs)产品成本(product cost)汇总原始凭证(cumulative source document)汇总记账凭证核算形式(bookkeeping procedure using summary ovchers)工作底稿(working paper)复式记账凭证(mvltiple account titles voucher)复式记账法(Double entry bookkeeping)复合分录(compound entry)划线更正法(correction by drawing a straight ling)汇总原始凭证(cumulative source document)会计凭证(accounting documents)会计科目表(chart of accounts)会计科目(account title)红字更正法(correction by using red ink)会计核算形式(bookkeeping procedures)过账(posting)会计致迹╝ccounting entry)会计循环(accounting cycle)会计账簿(Book of accounts)活页式账簿(loose-leaf book)集合分配账户(clearing accounts)计价对比账户(matching accounts)记账方法(bookkeeping methods)记账规则(recording rules)记账凭证(voucher)记账凭证核算形式(Bookkeeping proced ureusing vouchers)记账凭证汇总表核算形式(bookkeeping procedure using categorized account summary)简单分录(simple entry)结算账户(settlement accounts)结账(closing account)结账分录(closing entry)借贷记账法(debit-credit bookkeeping)通用日记账核算形式(bookkeeping procedure using general journal)外来原始凭证(source document from outside)现金日记账(cash journal)虚账户(nominal accounts)序时账簿(book of chronological entry)一次凭证(single-record document)银行存款日记账(deposit journal)永续盘存制(perpetual inventory system)原始凭证(source document)暂记账户(suspense accounts)增减记账法(increase-decrease bookkeeping)债权结算账户(accounts for settlement of claim)债权债务结算账户(accounts for settlement of claim and debt)债务结算账户(accounts for settlement of debt)账户(account)账户编号(Account number)账户对应关系(debit-credit relationship)账项调整(adjustment of account)专用记账凭证(special-purpose voucher)转回分录(reversing entry)资金来源账户(accounts of sources of funds)资产负债账户(balance sheet accounts)转账凭证(transfer voucher)资金运用账户(accounts of applications of funds)自制原始凭证(internal source document)总分类账簿(general ledger)总分类账户(general account)附加账户(adjunct accounts)付款凭证(payment voucher)分类账簿(ledger)中级会计固定资产(fixed assets)利润总额利益分配(profit distribution)应计费用(accrued expense)商标权(trademarks and tradenames)净利润(net income)应付利润(profit payable)收益债券(income bonds)利息资本化(capitalization of interests)预付账款(advance to supplier)其他应收款(other receivables)现金(cash)公司债券发行(corporate bond floatation)应付工资(wages payable)实收资本(paid-in capital)盈余公积(surplus reserves)股利(dividend)应交税金(taxes payable)负商誉(negative goodwill)费用的确认(recognition of expense)短期投资(temporary investment)专有技术(know-how)专营权(franchises)资本公积(capital reserves)自然资源(natural resources)存货(inventory)偿债基金(sinking fund)长期应付款(long-term payables)长期投资(long-term investments)长期借款(long-term loans)长期负债(long-term liability of long-term debt)财务费用(financing expenses)拨定留存收益(appropriated retained earnings)标准成本法(standard costing)变动成本法(variable costing)版权(copyrights)高级会计期货交易市场(market of futures transaction)期货交易(futures transaction)举债经营融资租赁(leveraged lease)金融工具(financial instruments)企业集团(business qroup)年度报告(annual report)内部往来(transactions between home office and branches)合伙企业(partnership enterprise)合并资产负债表(consolidated balance sheet)合并主体的所得税会计(accounting for income taxes of consolidated entities)(美)合并现金流量表(consolidated statement of cash flow)合并价差(cost-book value differentials)合并会计报表(consolidated financial statements)购买法(purchase methed)企业整体价值(the value of an enterprise as a whole)权益结合法(pooling of interest method)期内所得税分摊(intraperiod tax allocation)(美)期末存货的未实现损益(unrealized profit in ending inventory)公司间的长期资产业务(intercompany transactions in long-term assets)名义货币保全(maintaining capital in units of money)基金论(the fund theory)功能性货币(functional currency)(汇兑损益(exchange gains or losses)合并财务状况变动表(consolidated statement of changes in financial poition)换算损益(translation gains or losses)举债经营收购(Leveraged buyouts,简称LBC)(美)母公司持股比例变动(change in ownership percentage held by parent)交互分配法(reciprocal allocation approach)(美)货币项(monetary items)合伙清算(partnership liquidation全面分摊法(comprehensive allocation)固定资产投资方向调节税合并费用(expenses related to combinations)间接标价法(indirect quotation)买入汇率(buying rate)期货合约(futrues contract)混合合并(conglomeration)控投公司(holding company)股票指数期货(stock index futrues)横向销售(crosswise sale)固定汇率(fixed rate)纳税影响法(tax effect method)记账汇率(recording rate)横向合并(horizontal integration)合并前股利(preacquisition dividends)可变现净值(net realizable)企业合并会计(accounting for business combination)平仓盈亏(offset gain and loss)卖出汇率(selling rate)金融期货交易(financial futures transaction)会计利润(accounting income)合并损益表(consolidated income statement)公允价值(fair value)期权(options)间接控股(indirect holding)两笔交易观(two-transaction opinion)破产清算(bankrupcy liquidation)企业合并(business combination)企业论(the enterprise theory)商品寄销(consignment)个人所得税(personal income tax)个人财务报表(personal financial state-ments)(美)改组计划(reorganization plan)(美)改组(reorganization)复杂权益法(complex equity method)附属公司(associated company)负权人偿金(dividend)浮动汇率(floating rate)分支机构会计(accounting for branch)推定赎回损益(constructive gains and losses on bonds)推定赎回(constructive retirement)投机(spculation)贴水(discount)特定物价指数(specific price index)分支机构(branch)分期收款销货(installment sales)分次清算(installment liquidation)分部报告(segmental reporting)房地产收入(real estate revenue)房地产成本(cost of real setate)房地产(real estate)多种汇率法(multiply exchange rate)对境外实体的净投资(net investment in foreign entities)订量单位:(units of measurement)递延法(deffered method)当代理论(contemporary theory)单一汇率法(singal method)退休金(pension plan)退休金会计(accounting for pension plan)(美)退休金给付义务(pension benefit obligations)(美)外币(foreign currency)外币业务(foreign currency transaction)吸收合并(merger)物价变动会计(accounting for price changes)无偿债能力(insolvency)完全合并(full consolidation)物价指数(price index)物价变动(price changes)完全应计法(full accrual method)物价总指数(general price index)外汇期货交易(foreign exchange frtrues transaction)下推会计(push-down accounting)(美)先折算后调整法(translation-remeasurement method)现行成本/稳值货币会计(current cost/general purchasing power accountin)现行成本(crurent cost)现行成本会计(current cost accounting)先调整后折算法(remeasurement-translation method)销售代理处(sales agency)相互持股(mutual holdings)相对账户调节(reconciliation of home office and branch accounts)新合伙人入伙(admission of a new parther)向上销售(upstream sale)衍生金融工具(derivative financial instru-ments)销售式融资租赁(sales-type financing lease)向下销售(downstream sale)消费税(consumer tax)一笔交易观(one-transaction opinion)业主权论(the proprietorship theory)一般物价水准会计(general price level accounting)一般购买力单位(units of general purchasing power)招股说明书(prospectus)中间汇率(middle rate)中期报告(interim reporting)重置成本(replacement cost)转租赁(subleases)准改组(quasi-reorbganization)(美)资本保全(capital maintenance)资本化价值(capitalized value)资本因素(capital factor)资产负债法(asset/libility method)存货转让价格(inventory transfer price)创立合并(consolidation)出租人会计(accounting for leases-lessor)持有(产)损益(holding gains losses)持仓盈亏(opsition gain and loss)承租人会计(accounting for leases-leasee)成本回收法(cost recovery method)纵向合并(Vertical integration)综合变动(general change)子公司权益变动(change in ownership of a subsidiary)子公司(subsidiary company)资源税(resources tax)成本法(cost method)财产信托会计(fiduciary accounting)(美)财产税(property tax)部分分摊法(partial allocation)不合并子公司(unconsolidated subsidiaries)最低退休金负债(minimum liability)(美)租赁(leases)租金(rents)企业会计期权市场(option market)期货市场(future market)可转让定期存单市场(negotiable CDmarket)货币市场(money market)黄金市场(gold market)国有独资公司股份有限公司(company limited by shares)股份两合公司(limited pactnership)公司(company)二级市场(security secondary market)独资企业(sole proprietorship)店头市场(over-the-counter-market)承兑市场(acceptance market)拆借市场(lending market)财务制度(financial regulations)财务政策(financial policy)财务预测(financial forecast)财务控制(financial control)金融市场(financial market)财务决策(financial decision)财务监督(financial cupervision)财务计划(financial planning)财务活动(financial activities)财务管理组织(organization of financial management)一级市场(security primary market)无限责任公司(company of unlimited liability)外汇市场(foreign exchange market)贴现市场(dixcount market)企业组织形式(forms of enterprise organization)政府会计期权市场(option market)期货市场(future market)可转让定期存单市场(negotiable CDmarket)货币市场(money market)黄金市场(gold market)国有独资公司股份有限公司(company limited by shares)股份两合公司(limited pactnership)公司(company)二级市场(security secondary market)独资企业(sole proprietorship)店头市场(over-the-counter-market)承兑市场(acceptance market)拆借市场(lending market)财务制度(financial regulations)财务政策(financial policy)财务预测(financial forecast)财务控制(financial control)金融市场(financial market)财务决策(financial decision)财务监督(financial cupervision)财务计划(financial planning)财务活动(financial activities)财务管理组织(organization of financial management)一级市场(security primary market)无限责任公司(company of unlimited liability)外汇市场(foreign exchange market)贴现市场(dixcount market)企业组织形式(forms of enterprise organization)事业单位会计(accounting for non-profit organizations)事业单位固定资产(fixed assets for non-profit organizations)事业单位固定基金(fixed funds non-profit organizations)事业单位负债(liabilities for non-profit organizations)事业单位对外投资(outside investments for non-profit organizations)事业单位财务清算(liquidation of non-profit organization)上缴上级支出(payment to the higher authority)上级补助收入(grant from the higher authority)其他收入(miscellaneous gains)科学事业单位资产(scientific research instifutes‘assets)科学事业单位支出(scientific research institutes‘expenditures)科学事业单位预算(scientific research institutes‘budgeting)科学事业单位收入(scientific research institutes‘revenues)科学事业单位结余(scientific research institutes‘surplus)科学事业单位会计制度(accointing regulations for scientific research instifutes)科学事业单位会计报表分析(scientific research institutes-analysis of accounting statements)科学事业单位会计(sicentific research institute accounting)科学事业单位成本费用管理(scientific research institutes-cost maragement)科学事业单位财务制度(financial regulations for scientific research institutes)经营支出(orerating expense)经营收入(operating revenue)基金预算支出(fund budget expenditure)基金预算收入(fund budget revenue)基金预算结余(surplus of fund budget)国家预算(state budget)国家决算(final accounts of state revenue and expenditure)高等学校资产(colleges and universities assets)高等学校支出(colleges and universities expenditures)高等学校预算管理方式(budget management method of colleges and universities)高等学校收入(colleges and universities revenues)专用基金支出(expenditure on special purpose fund)专用基金收入(proceeds from special purpose fund)中华人民共和国预算法(the budge t law of the people‘s Republic of China)资金调拨支出(expenditure on allocated and transeferred fund)财政收入(public finance-revemue)财政净资产(public finance-net assets)财政负债(public finance-liabilities)财政补助收入(grant from the state)拨入专款(restricted appropriation)第二篇:资产评估《资产评估》考试方案——会计学本科《资产评估》考试方案一、考试目的为了适应资产评估行业对资产评估实践能力要求较高的现实形势,在《资产评估》课程的教学中增加了实习、实践环节的教学内容。

会计常用英语词汇——资产类Assets

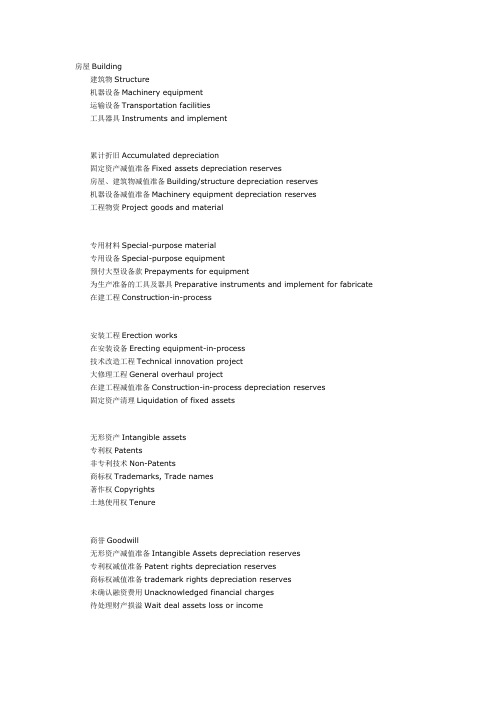

房屋Building建筑物Structure机器设备Machinery equipment运输设备Transportation facilities工具器具Instruments and implement累计折旧Accumulated depreciation固定资产减值准备Fixed assets depreciation reserves房屋、建筑物减值准备Building/structure depreciation reserves机器设备减值准备Machinery equipment depreciation reserves工程物资Project goods and material专用材料Special-purpose material专用设备Special-purpose equipment预付大型设备款Prepayments for equipment为生产准备的工具及器具Preparative instruments and implement for fabricate 在建工程Construction-in-process安装工程Erection works在安装设备Erecting equipment-in-process技术改造工程Technical innovation project大修理工程General overhaul project在建工程减值准备Construction-in-process depreciation reserves固定资产清理Liquidation of fixed assets无形资产Intangible assets专利权Patents非专利技术Non-Patents商标权Trademarks, Trade names著作权Copyrights土地使用权Tenure商誉Goodwill无形资产减值准备Intangible Assets depreciation reserves专利权减值准备Patent rights depreciation reserves商标权减值准备trademark rights depreciation reserves未确认融资费用Unacknowledged financial charges待处理财产损溢Wait deal assets loss or income待处理财产损溢Wait deal assets loss or income待处理流动资产损溢Wait deal intangible assets loss or incom e 待处理固定资产损溢Wait deal fixed assets loss or income流动资产Current assets货币资金Cash and cash equivalents现金Cash银行存款Cash in bank其他货币资金Other cash and cash equivalents外埠存款Other city Cash in bank银行本票Cashier''s cheque银行汇票Bank draft信用卡Credit card信用证保证金L/C Guarantee deposits存出投资款Refundable deposits短期投资Short-term investments股票Short-term investments-stock债券Short-term investments-corporate bonds基金Short-term investments-corporate funds其他Short-term investments-other短期投资跌价准备Short-term investments falling price reserves 应收款Account receivable应收票据Note receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance应收股利Dividend receivable应收利息Interest receivable应收账款Account receivable其他应收款Other notes receivable坏账准备Bad debt reserves预付账款Advance money应收补贴款Cover deficit by state subsidies of receivable库存资产Inventories物资采购Supplies purchasing原材料Raw materials包装物Wrap page低值易耗品Low-value consumption goods材料成本差异Materials cost variance自制半成品Semi-Finished goods库存商品Finished goods商品进销差价Differences between purchasing and selling price委托加工物资Work in process-outsourced委托代销商品Trust to and sell the goods on a commission basis受托代销商品Commissioned and sell the goods on a commission basis 存货跌价准备Inventory falling price reserves分期收款发出商品Collect money and send out the goods by stages待摊费用Deferred and prepaid expenses长期投资Long-term investm ent长期股权投资Long-term investm ent on stocks股票投资Investment on stocks其他股权投资Other investment on stocks长期债权投资Long-term investm ent on bonds债券投资Investment on bonds其他债权投资Other investment on bonds长期投资减值准备Long-term investm ents depreciation reserves股权投资减值准备Stock rights investment depreciation reserves债权投资减值准备B creditor''s rights investment depreciation reserves 委托贷款Entrust loans本金Principal利息Interest减值准备Depreciation reserves固定资产Fixed assets。

无形资产

Chapter 3 Intangible Assets ValuationWisdomIntangible asset valuation is not a science in the same sense that chemistry and physics are sciences. However,intangible asset valuation is a science in the sense that mathematics and economics are sciences.- Robert Reilly & Robert Schwaihs If a man empties his purse into his head,no man can take it away from him,an investment in knowledge always pays the best interest.-Benjamin Franklin Abstract无形资产是一种没有实物形态,但其存在可以给拥有者带来特殊权利和经济利益的非货币性资产。

无形资产评估的应用范围相当广泛,涉及收购、兼并、销售、税务申报、诉讼、破产清算、财务报告等多种经济行为。

评估时需要对元形资产的类型、法律权属和经济利益进行明确界定。

无形资产按其是否独立存在,可以分为可确指无形资产和不可确指无形资产。

一项无形资产如果可以被分离或者可以被独立地销售、转移、出租等,就可以被认定为可确指无形资产;而不可确指无形资产一般是指商誉。

无形资产按照其性质,还可以分为权力型无形资产、关系型无形资产、知识型无形资产和组合型无形产无形资产的评估可以考虑使用三大评估方法。

市场法的使用主要取决于市场的行为,但由于受到无形资产异质性特点的约束,有时难以找到合理科学的交易案例,从而限制了市场法的应用。

成本法主要被用于评估内部生成的未能产生可辨识现金流量的无形资产,如自行开发的软件、网站等。

新会计准则英文版

新会计准则英文版新企业会计准则中英对照(仅供B组小伙伴参考)1.存货 Inventory2.长期股权投资 Long-term Equity Investment3.投资性房地产 Investment Real Estate4.固定资产 Fixed Assets5.生物资产 Biological Assets6.无形资产 Intangible Assets7.非货币性资产交换 Exchange of Non-monetary Assets8.资产减值 Assets Impairment9.职工薪酬 Wages and Salaries of Employees10.企业年金基金 Enterprise Annuity Fund11.股份支付 Share-based Payments12.债务重组 Debt Restructuring13.或有事项 Contingencies14.收入 Revenues15.建造合同 Construction Contracts16.政府补助 Government Grants17.借款费用 Borrowing Costs18.所得税 Income T ax19.外币折算 Foreign Currency Translation20.企业合并 Business Combination21.租赁 Leases22.金融工具确认和计量Recognition and Measurement of Financial Instrument23.金融资产转移 Transfer of Financial Assets24.套期保值 Hedging25.原保险合同 Direct Insurance Contracts26.再保险合同 Reinsurance Contracts27.石油天然气开采 Exploitation of Petroleum and Natural Gas28.会计政策、会计估计变更和差错更正 Changes in Accounting Policies andEstimates and Corrections of Errors29.资产负债表日后事项 Events after the Balance Sheet Date30.财务报表列报 Financial Statement Presentation31.现金流量表 Cash Flow Statement32.中期财务报告 Interim Financial Reporting33.合并财务报表 Consolidate Financial Statement34.每股收益 Earning Per Share/EPS35.分部报告 Segment Reporting36.关联方披露 Disclosure of Related Parties37.金融工具列报 Presentation of Financial Instruments38.首次执行企业会计准则Initial Adoption of Accounting Standard for Enterprises。

财务报表中英文对照

应收分保未决赔偿准备金

Term deposits

定期存款

Available-for-sale securities

可供出售金融资产

Available-for-sale financial assets

持有至到期投资

Held-to-maturity investments

取得投资收益收到的现金

Other cash received relating to investing activities

收到的其他与投资活动有关的现金

Cash inflow from investment activities

投资活动现金流入小计

Cash paid to acquire investments

筹资活动现金流出小计

Net cash flows from financing activities

筹资活动产生的现金流量净额

4.Effect of foreing exchange rate changes on cash

4.汇率变动对现金及现金等价物的影响额

increase in cash and cash equivalents

其他综合收益

7.Total comprehensive income for the year

综合收益总额

Cash flow statement ended 31 December 2012

现金流量表

Local Reporting Currency:RMB

1.Cash flows from operating activities

资产总计

市场法 资产基础法 英文

市场法资产基础法英文Title: The Application and Distinction of Market Approach and Asset-Based Approach in ValuationIn the realm of financial valuation, two primary methods stand out as being particularly useful and widely adopted: the market approach and the asset-based approach. Each approach has its unique strengths and weaknesses, and understanding their application and distinction is crucial for accurate and reliable valuation outcomes.The market approach, also known as the comparative approach, relies on the principle of substitution. It assumes that a buyer would not pay more for an asset than the price of a similar asset in the market. This approach involves comparing the subject asset with similar assets that have been recently sold in the market. The key in this approach lies in finding comparable assets that are similar in terms of size, location, age, condition, and other relevant characteristics. By adjusting the prices of these comparable assets to reflect any differences, an estimated value for the subject asset can be derived.The market approach is often used in the valuation of real estate, securities, and businesses. In real estate, it involves comparing the prices of recently sold properties that are similar to the subject property. In the case of securities, the market approach compares the prices of similar stocks or bonds. And for businesses, it involves comparing the financial performance and multiples of comparable companies in the industry.On the other hand, the asset-based approach, also known as the cost approach, focuses on the reproduction or replacement cost of the asset. It assumes that a buyer would not pay more for an asset than the cost of acquiring or replacing it with a similar asset. This approach involves estimating the value of an asset based on the cost of its individual components, adjusted for any depreciation or obsolescence.The asset-based approach is particularly useful in valuing assets that are unique or have limited comparability in the market. This includes specialized equipment, intellectual property, and other intangible assets. By estimating the cost of replacing or reproducingeach component of the asset, an overall value can be derived.However, it's important to note that the asset-based approach may not always reflect the true economic value of an asset. This is because it focuses solely on the cost of replacement or reproduction, ignoring factors such as market demand, competition, and future growth potential. The distinction between the market approach and the asset-based approach lies in their underlying assumptions and focus. The market approach relies on the prices of comparable assets in the market, assuming that buyers will not pay more than the market price. It's more suitable for assets that have a high degree of comparability in the market, such as real estate and securities.On the contrary, the asset-based approach focuses on the cost of replacing or reproducing the asset, ignoring market factors. It's more appropriate for unique or specialized assets that lack comparability in the market. In practice, the choice between the two approaches often depends on the nature of the asset being valued and the availability of comparable data. Sometimes, acombination of both approaches may be used to arrive at a more accurate and reliable valuation.In conclusion, the market approach and the asset-based approach are two fundamental methods in financial valuation. Each approach has its strengths and weaknesses, and understanding their application and distinction is crucial for accurate and reliable valuation outcomes. The choice between the two often depends on the nature of the assetand the availability of comparable data, and sometimes a combination of both may be the most suitable approach.。

企业估值变化 投资企业会计处理方法

企业估值变化投资企业会计处理方法Valuation of a company is a crucial aspect for both investors and the company itself. It is a method used to determine the worth of a business, and it plays a significant role in various processes, such as investment decisions, mergers and acquisitions, and financial reporting. 企业估值对于投资者和企业本身来说都是至关重要的。

它是一种确定企业价值的方法,而且在投资决策、并购和财务报告等各种流程中起着重要作用。

The valuation of a company can fluctuate over time due to various factors, including changes in the market, company performance, industry trends, and economic conditions. These fluctuations can have a significant impact on the financial health of the company and its attractiveness to potential investors. 企业估值会因市场变化、公司表现、行业趋势和经济状况等各种因素而发生波动。

这些波动可能会对公司的财务状况和吸引投资者的能力产生重大影响。

When a company's valuation changes, it is crucial for the company to adjust its accounting methods accordingly. This is necessary to ensure that the company's financial statements accurately reflect itscurrent value and financial position. 当公司估值发生变化时,公司有必要相应调整其会计处理方法,以确保公司财务报表准确反映其当前价值和财务状况。

资产评估执业准则评估方法超额收益法适用条件

资产评估执业准则评估方法超额收益法适用条件The excess earnings method (EEM) is a commonly used approach in asset valuation practice, especially for closely-held businesses and intangible assets. This method involves estimating the value of a business or asset by capitalizing the excess earnings it generates above a fair return on the identifiable tangible assets. It is commonly used in situations where traditional income or market-based approaches may not be suitable, such as when the asset being valued has unique characteristics or when there is limited market data available.超额收益法(EEM)是资产评估实践中常用的一种方法,特别是对于非上市企业和无形资产。

该方法涉及通过对可识别有形资产产生的超额收益进行资本化来估计企业或资产的价值。

通常在传统的收入或市场为基础的方法不适用的情况下使用,比如要估价的资产具有独特的特征或市场数据有限的情况。

One of the key requirements for applying the excess earnings method is the determination of a fair return on the identifiable tangible assets of the business or asset being valued. This often involves estimating the return that could be achieved if the tangibleassets were used in their next best alternative use, such as in a different business or investment. The excess earnings are then calculated as the earnings in excess of this fair return, and are capitalized to arrive at a value indication for the business or asset.应用超额收益法的关键要求之一是确定被估值企业或资产可识别有形资产的合理回报。

估值的英语单词

估值的英语单词Valuation is an essential concept in finance, representing the process of determining the worth of an asset or a company. It involves various methods, each with its own intricacies and assumptions.Understanding the nuances of valuation is crucial for investors, as it helps them make informed decisions about buying, selling, or holding assets. The art of valuation requires a blend of quantitative analysis and qualitative judgment.In the corporate world, valuation is often used to assess mergers and acquisitions, ensuring that the price paid isfair and in line with the potential future value of the business.For individual investors, learning the vocabulary of valuation can empower them to evaluate stocks and bonds more effectively. Terms like 'discounted cash flow' and 'price-to-earnings ratio' are key to this financial literacy.Moreover, the field of valuation is dynamic, with new models and techniques emerging as markets evolve. Keeping up with these developments can give one an edge in the financial arena.In essence, mastering the language of valuation is notjust about knowing the words; it's about grasping the concepts that drive financial decisions and market outcomes.。

【精品】AssetValuationMarketandInstruments