财务管理专业英语复习题

财务管理英语知识

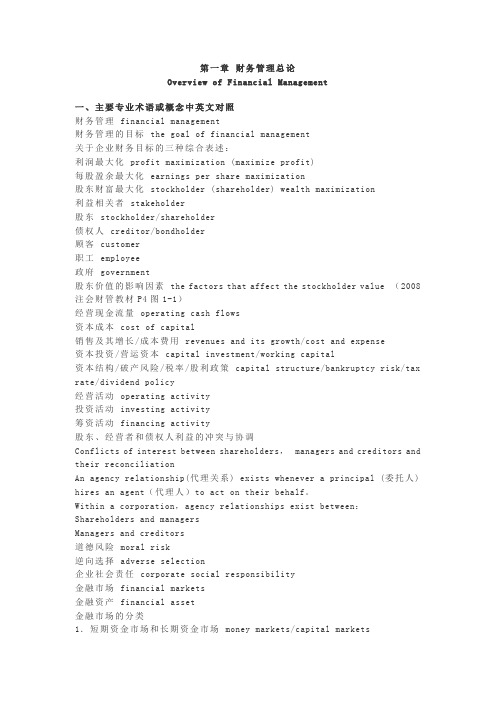

第一章财务管理总论Overview of Financial Man agement一、主要专业术语或概念中英文对照财务管理financial management财务管理的目标the goal of financial management关于企业财务目标的三种综合表述:利润最大化profit maximization (maximize profit)每股盈余最大化earnings per share maximization股东财富最大化stockholder (shareholder) wealth maximization利益相关者stakeholder股东stockholder/shareholder债权人creditor/bondholder顾客customer职工employee政府government股东价值的影响因素the factors that affect the stockholder value (2008注会财管教材P4图1-1)经营现金流量operating cash flows资本成本cost of capital销售及其增长/成本费用revenues and its growth/cost and expense资本投资/营运资本capital investment/working capital资本结构/破产风险/税率/股利政策capital structure/bankruptcy risk/tax rate/dividend policy经营活动operating activity投资活动investing activity筹资活动financing activity股东、经营者和债权人利益的冲突与协调Conflicts of interest between shareholders,managers and creditors and their reconciliationAn agency relationship(代理关系) exists whenever a principal (委托人) hires an agent(代理人)to act on their behalf。

财务管理专业英语 句子及单词翻译

Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity.财务管理是为了实现一个公司总体目标而进行的涉及到获取、融资和资产管理的综合决策过程。

Decisions involving a firm’s short-term assets and liabilities refer to working capital management.决断涉及一个公司的短期的资产和负债提到营运资金管理The firm’s long-term financing decisions concern the right-hand side of the balance sheet.该公司的长期融资决断股份资产负债表的右边。

This is an important decision as the legal structure affects the financial risk faced by the owners of the company.这是一个重要的决定作为法律结构影响金融风险面对附近的的业主的公司。

The board includes some members of top management(executive directors), but should also include individuals from outside the company(non-executive directors).董事会包括有些隶属于高层管理人员(执行董事),但将也包括个体从外公司(非执行董事)。

Maximization of shareholder wealth focuses only on stockholders whereas maximization of firm value encompasses all financial claimholders including common stockholders, debt holders, and preferred stockholders.股东财富最大化只集中于股东,而企业价值最大化包含所有的财务债券持有者,包括普通股股东,债权人和优先股股东。

财务英语试题及答案

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

财务管理专业英语复习题(参考答案)

D. working sheet D. equipment depreciation C. capital budgeting. A. time deposits A. the initial cost of the project can be reduced. C. notes payable B. sunk A. I and III only C. salaries payable D. product producing C. initial public offering (IPO). A. total A. future value D. (1+8%/2)2-1 B. $295,000 D. collecting accounts receivable faster A. m D. common stock A. gross profit margin A. liquidity ratios B. degree to which the net present value reacts to changes in a single variable.B. the transaction is complete and the goods or services delivered.A. Return on equity A. general economic risk D. It does not include depreciation.C. Interest. B.$108 B. $37.62 B. Corporate investment decisions have nothing to do with financial markets,A. Financial management A. double taxation of dividends D. compound interest D. The market is overvaluing the stock.B. approximately 10 B.640,000 D. issue common stock.A. Net profit margin ×Total asset turnover ×Equity multiplier B.bond issuing C. capital budgeting B. marketability A. future value流动比率Current ratio= Current assets/ Current liabilities=1.91速动比率Quick ratio=( Current assets- Inventory)/ Current liabilities=1.27应收账款周转率Accounts receivables turnover ratio=Sales/Accounts receivable=4.37债务比率Debt ratio= Total liabilities/ Total assets=50.3%资产收益率Return on assets= Net income/ Total assets=3.45%Price/earnings ratio= Market price per share/ Earnings per share=45.83Current ratio = Current assets / Current liabilities = 1.1Total debt ratio =(Total assets – Total equity) / Total assets = 0.58Total asset turnover = Sales / Total assets = 0.27Profit margin = Net income / Sales = 0.22Equity multiplier = Total assets / Total equity = 2.375ROA= Net income / Total assets = 0.061ROE= Net income / Total equity = 0.1452) ROE= Profit margin * Equity multiplier * Total assets turnover = 14.56%Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Other names for financial management include managerial finance, corporate finance, and business finance. Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations财务管理是一个通过收购、融资和资产管理来完成一些企业总体目标的综合决策过程。

财务管理专业英语

Analyzing Financial Ratios

Some preliminary comments are warranted:

1. Financial ratios are not standardized.

4.2.1 Current ratio

Excessively high current ratios, however, may indicated a firm may have too much of its long-term investor-supplied capital invested in short-term low-earning current assets.

4.2 Liquidity Ratios

Net working capital to total assets ratio= Net working capital Total assets

净营运资本比总资产比率

4.2.1 Current ratio

Current ratio Current assets Current liabilities

Denominator 分母 Numerator 分子

4.2.1 Current ratio

For example, a current ratio of 1.5 implies that a firm has $1.5 in current assets for every $1 in current liabilities and thus has 1.5 times the current assets, or has its current liabilities covered 1.5 times over.

财务管理专业英语第二章

corporate managers cannot effectively serve many masters. Purposeful behavior requires the existence of

这就是说公司经理不能有效的服务多个目标。 a single-valued objective function. 一个单一的价值目标。

2

The article translation 文章翻译

division of opinion exists on the goal of financial management, two leading contenders are stakeholder 对财务管理的目标存在着很大的分歧, theory and value(wealth) maximization. 理论和价值最大化。 但是两种最主要的理论是利益相关者

Why focus on maximizing share price? First, using stock price maximization as an objective function

2.3.1 Stakeholder Theory 2.3.1 利益相关者理论

Stakeholder theory is the main contender to value maximization as the corporate goal. Stakeholder

作为企业的目标,利益相关者理论是价值最大化理论的主要竞争理论。 理论认为管理者所做的决策要考虑公司所有相关者的利益。 stakeholders. Such stakeholders include not only financial claimholders * but also employees, managers, 这些利益相关者不仅包括所有者还包括员工、管理者、 利益相关者

会计与财务管理专业英语第二版课后答案

会计与财务管理专业英语第二版课后答案1、He _______ walks to school, because he lives near school. [单选题] *A. sometimes(正确答案)B. neverC. doesn’tD. don’t2、( ) My mother told me _____ in bed. [单选题] *A. not readB. not readingC. don’t readD. not to read(正确答案)3、The travelers arrived _______ Xi’an _______ a rainy day. [单选题] *A. at; inB. at; onC. in; inD. in; on(正确答案)4、______! It’s not the end of the world. Let’s try it again.()[单选题] *A. Put upB. Set upC. Cheer up(正确答案)D. Pick up5、_____ of the land in this area _____ covered with forest. [单选题] *A. Two-fifth; isB. Two fifth; areC. Two fifths; is(正确答案)D. Two fifths; are6、The children are playing wildly and making a lot of?_______. [单选题] *A. cryB. voicesC. noises(正确答案)D. music7、A modern city has sprung up in _____was a waste land ten years ago. [单选题] *A.whichC.thatD.where8、40.Star wars is ______ adventure film and it is very interesting. [单选题] *A.aB.an (正确答案)C.theD./9、_____how to do with the trouble of the computer, Tom had to ask his brother for help. [单选题] *A.Not to knowB.Not knowing(正确答案)C.Not knownD.Not know10、Can I _______ your order now? [单选题] *A. makeB. likeC. give11、14.Builders have pulled down many old houses, and they will build a lot of new ________. [单选题] *A.ones (正确答案)B.oneC.the onesD.the one12、The Chinese team are working hard _______ honors in the Olympic Games. [单选题] *A. to win(正确答案)B. winC. winningD. won13、Can you give her some ______ ? [单选题] *A. advice(正确答案)B. suggestionC. advicesD. suggest14、The more he tried to please her, _____she seemed to appreciate it. [单选题] *A.lessB.lesserC.the less(正确答案)D.the lesser15、?I am good at schoolwork. I often help my classmates _______ English. [单选题] *A. atB. toC. inD. with(正确答案)16、28.The question is very difficult. ______ can answer it. [单选题] * A.EveryoneB.No one(正确答案)C.SomeoneD.Anyone17、There ______ a football match and a concert this weekend.()[单选题] *A. isB. haveC. will be(正确答案)D. will have18、Nobody noticed the thief slip into the shop, because the lights happened to _______. [单选题] *A. put outB. turn outC. give outD. go out(正确答案)19、The book is very _______. I’ve read it twice. [单选题] *A. interestB. interestedC. interesting(正确答案)D. interests20、I have to _______ my glasses, without which I can’t read the book. [单选题] *A. put upB. put awayC. put downD. put on(正确答案)21、It seems slow for children to become _____ ,while adults often feel time flies. [单选题] *A. growns-upsB. growns-upC. grown upsD. grown-ups(正确答案)22、People always _____ realize the importance of health _____ they lose it. [单选题] *A. not... untilB. don't... until(正确答案)C. /; untilD. /; not until23、The city is famous _______ its beautiful scenery. [单选题] *A. for(正确答案)B. ofC. asD. to24、78.According to a report on Daily Mail, it’s on Wednesday()people start feeling reallyunhappy. [单选题] *A. whenB. whichC. whatD. that(正确答案)25、Some people were born with a good sense of direction. [单选题] *A. 听觉B. 方向感(正确答案)C. 辨别力D. 抽象思维26、It was()of you to get up early to catch the first bus so that you could avoid the traffic jam. [单选题] *A. senselessB. sensible(正确答案)C. sentimentalD. sensitive27、Many people believe that _________one has, _______ one is, but actually it is not true. [单选题] *A. the more money ; the happier(正确答案)B. the more money ; the more happyC. the less money ; the happierD. the less money ; the more happy28、—Who came to your office today, Ms. Brown?—Sally came in. She hurt ______ in P. E. class. ()[单选题] *A. sheB. herC. hersD. herself(正确答案)29、The manager gave one of the salesgirls an accusing look for her()attitude towards customers. [单选题] *A. impartialB. mildC. hostile(正确答案)D. opposing30、It is reported()three people were badly injured in the traffic accident. [单选题] *A. whichB. that(正确答案)C.whileD.what。

财务管理专业英语

财务管理专业英语financialmanagement 财务管理decision-making 决策,决策得acquire获得,取得publiclytraded corporations公开上市公司公众vice president of finance财务副总裁chief financial officer 首席财务官chief executiveofficer 首席执行官balance sheet资产负债表capital budgeting 资本预算workingcapital management 营运资本管理hurdlerate最低报酬率capital structure资本结构mixof debt andequity负债与股票得组合cash dividend现金股利stockholder股东dividend policy 股利政策dividend-payout ratio股利支付率stock repurchase股票回购stock offering股票发行tradeoff 权衡,折中monstock 普通股current liability 流动负债current asset流动资产marketable security流动性资产,有价证券inventory 存货tangible fixedassets 有形固定资产in tangible fixed assets 无形固定资产patent专利trademark商标creditor债权人stockholds’ equity股东权益financing mix融资组合risk aversion 风险规避volatility 易变性不稳定性allocate 配置capital allocation资本配置business 企业商业业务financialrisk财务风险soleproprietorship 私人业主制企业partnership合伙制企业limitedpartner有限责任合伙人general partner 一般合伙人separation of ownership and control 所有权与经营权分离claim 要求主张要求权managementbuyout 管理层收购tender offer要约收购financial standards 财务准则initial public offering首次公开发行股票privatecorporation 私募公司未上市公司closely heldcorporation 控股公司boardof directors 董事会executove director执行董事non-executove director非执行董事chairperson主席controller 主计长treasurer 司库revenue收入profit 利润earnings per share 每股盈余return回报marketshare 市场份额social good社会福利financial distress 财务困境stakeholder theory 利益相关者理论value (wealth) maximization价值(财富)最大化commonstockholder普通股股东preferred stockholder 优先股股东debt holder债权人well—being福利diversity多样化going concern 持续得agency problem 代理问题free—riding problem 搭便车问题informationasymmetry 信息不对称retailinvestor散户投资者institutional investor 机构投资者agencyrelationship代理关系net present value净现值creativeaccounting 创造性会计stock option 股票期权agency cost代理成本bonding cost 契约成本monitoring costs 监督成本takeover 接管corporate annualreports公司年报balancesheet 资产负债表income statement利润表statement ofcash flows 现金流量表statementofretained earnings 留存收益表fairmarket value 公允市场价值marketable securities油价证券check 支票money order 拨款但、汇款单withdrawal 提款accounts receivable应收账款creditsale赊销inventory 存货property,plant,and equipment 土地、厂房与设备depreciation折旧accumulated depreciation累计折旧liability 负债currentliability流动负债long—term liability 长期负债accounts payout 应付账款note payout 应付票据accrued espense应计费用deferredtax 递延税款preferred stock优先股commonstock普通股book value 账面价值capital surplus资本盈余accumulated retainedearnings 累计留存收益hybrid混合金融工具treasury stock 库藏股historic cost 历史成本current market value 现行市场价值real estate 房地产outstanding 发行在外得aprofit andloss statement 损益表netincome净利润operating income 经营收益earnings per share每股收益simple capital structure 简单资本结构dilutive冲减每股收益得basicearnings per share 基本每股收益complex capital structures 复杂得每股收益diluted earningsper share 稀释得每股收益convertiblesecurities可转换证券warrant 认股权证accrual accounting 应计制会计amortization 摊销accelerated methods加速折旧法straight—line depreciation 直线折旧法statement ofchanges inshareholders’equity股东权益变动表source of cash 现金来源use ofcash 现金运用operating cash flows经营现金流cash flow from operations 经营活动现金流direct method直接法indirectmethod间接法bottom-up approach倒推法investing cash flows 投资现金流cash flow frominvesting 投资活动现金流joint venture合资企业affiliate 分支机构financing cash flows 筹资现金流cash flowsfrom financing 筹资活动现金流timevalue of money货币时间价值simple interest单利debtinstrument债务工具annuity 年金future value 终至present value现值compound interest复利pounding复利计算pricipal 本金mortgage抵押credit card信用卡terminalvalue终值discounting 折现计算discountrate折现率opportunitycost 机会成本required rateofreturn要求得报酬率costof capital资本成本ordinary annuity普通年金annuity due 先付年金financialratio 财务比率deferredannuity 递延年金restrictivecovenants 限制性条款perpetuity 永续年金bond indenture 债券契约facevalue 面值financial analyst 财务分析师coupon rate 息票利率liquidity ratio流动性比率nominal interest rate名义利率current ratio 流动比率ﻩeffective interest rate有效利率window dressing 账面粉饰going—concernvalue持续经营价值marketable securities短期证券liquidationvalue清算价值quick ratio 速动比率ﻩbook value账面价值cash ratio 现金比率marker value市场价值debt management ratios债务管理比率ﻩintrinsicvalue内在价值debtratio债务比率mispricing 给……错定价格debt-to-equity ratio 债务与权益比率valuation approach 估价方法equity multiplier权益乘discounted cash flow valuation 折现现金流量模型long-term ratio 长期比率undervaluation 低估debt—to—total—capital债务与全部资本比率ﻩovervaluation 高估leverageratios杠杆比率option-pricing model 期权定价模型interestcoverage ratio利息保障比率contingent claim valuation或有要求权估价earnings beforeinterest and taxes 息税前利润promissory note 本票cash flow coverage ratio 现金流量保障比率contractual provision契约条款asset management ratios 资产管理比率par value票面价值accounts receivable turnover ratio应收账款周转率maturity value 到期价值inventory turnover ratio 存货周转率coupon息票利息inventory processing period存货周转期coupon payment 息票利息支付accounts payable turnover ratio 应付账款周转率coupon interest rate 息票利率cashconversion cycle现金周转期maturity到期日asset turnover ratio资产周转率term tomaturity到期时间profitability ratio盈利比率ﻩcall provision赎回条款gross profit margin 毛利润ﻩcallprice 赎回价格operatingprofit margin经营利润sinkingfund provision 偿债基金条款net profitmargin 净利润ﻩconversion right转换权return on asset资产收益率ﻩput provision 卖出条款return on total equity ratio全部权益报酬率indenture债务契约return on common equity 普通权益报酬率covenant 条款market-to—book value ratio市场价值与账面价值比率trustee 托管人market valueratios市场价值比率protectivecovenant保护性条款dividendyield股利收益率negative covenant消极条款dividendpayout股利支付率ﻩpositive covenant积极条款financial statement财务报表secured deht担保借款profitability 盈利能力unsecureddeht信用借款viability生存能力ﻩcreditworthiness 信誉solvency偿付能力ﻩcollateral 抵押品collateral trust bonds 抵押信托契约debenture信用债券bond rating 债券评级current yield现行收益yield to maturity 到期收益率default risk 违约风险interest rate risk 利息率风险authorized shares 授权股outstanding shares发行股treasuryshare 库藏股repurchase 回购right to proxy代理权rightto vote 投票权independentauditor 独立审计师straight or majority voting 多数投票制cumulative voting积累投票制liquidation 清算righttotransfer ownership 所有权转移权preemptive right 优先认股权dividenddiscount model股利折现模型capitalassetpricingmodel资本资产定价模型constantgrowthmodel 固定增长率模型growth perpetuity增长年金mortgage bonds 抵押债券portfolio 组合diversifiable risk可分散风险market risk市场风险expected return期望收益volatility 流动性stand-alonerisk 个别风险randomvariable随机变量。

财务管理专业英语复习题(参考答案)

D. working sheet D. equipment depreciation C. capital budgeting. A. time deposits A. the initial cost of the project can be reduced. C. notes payable B. sunk A. I and III only C. salaries payable D. product producing C. initial public offering (IPO). A. total A. future value D. (1+8%/2)2-1 B. $295,000 D. collecting accounts receivable faster A. m D. common stock A. gross profit margin A. liquidity ratios B. degree to which the net present value reacts to changes in a single variable.B. the transaction is complete and the goods or services delivered.A. Return on equity A. general economic risk D. It does not include depreciation.C. Interest. B.$108 B. $37.62 B. Corporate investment decisions have nothing to do with financial markets,A. Financial management A. double taxation of dividends D. compound interest D. The market is overvaluing the stock.B. approximately 10 B.640,000 D. issue common stock.A. Net profit margin ×Total asset turnover ×Equity multiplier B.bond issuing C. capital budgeting B. marketability A. future value流动比率Current ratio= Current assets/ Current liabilities=1.91速动比率Quick ratio=( Current assets- Inventory)/ Current liabilities=1.27应收账款周转率Accounts receivables turnover ratio=Sales/Accounts receivable=4.37债务比率Debt ratio= Total liabilities/ Total assets=50.3%资产收益率Return on assets= Net income/ Total assets=3.45%Price/earnings ratio= Market price per share/ Earnings per share=45.83Current ratio = Current assets / Current liabilities = 1.1Total debt ratio =(Total assets – Total equity) / Total assets = 0.58Total asset turnover = Sales / Total assets = 0.27Profit margin = Net income / Sales = 0.22Equity multiplier = Total assets / Total equity = 2.375ROA= Net income / Total assets = 0.061ROE= Net income / Total equity = 0.1452) ROE= Profit margin * Equity multiplier * Total assets turnover = 14.56%Financial management is an integrated decision-making process concerned with acquiring, financing, and managing assets to accomplish some overall goal within a business entity. Other names for financial management include managerial finance, corporate finance, and business finance. Making financial decisions is an integral part of all forms and sizes of business organizations from small privately-held firms to large publicly-traded corporations财务管理是一个通过收购、融资和资产管理来完成一些企业总体目标的综合决策过程。

财务管理专业英语复习题

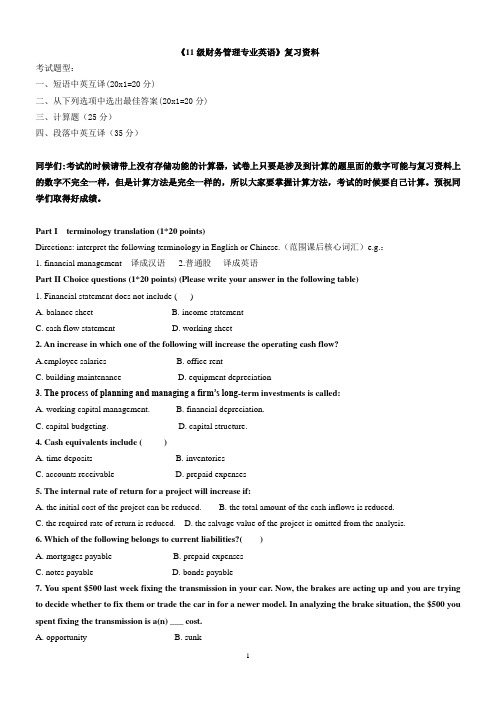

《11级财务管理专业英语》复习资料考试题型:一、短语中英互译(20x1=20分)二、从下列选项中选出最佳答案(20x1=20分)三、计算题(25分)四、段落中英互译(35分)同学们:考试的时候请带上没有存储功能的计算器,试卷上只要是涉及到计算的题里面的数字可能与复习资料上的数字不完全一样,但是计算方法是完全一样的,所以大家要掌握计算方法,考试的时候要自己计算。

预祝同学们取得好成绩。

Part I terminology translation (1*20 points)Directions: interpret the following terminology in English or Chinese.(范围课后核心词汇)e.g.:1. financial management---译成汉语2.普通股----译成英语Part II Choice questions (1*20 points) (Please write your answer in the following table)1. Financial statement does not include ( )A. balance sheetB. income statementC. cash flow statementD. working sheet2. An increase in which one of the following will increase the operating cash flow?A.employee salariesB. office rentC. building maintenanceD. equipment depreciation3. The process of planning and managing a firm’s long-term investments is called:A. working capital management.B. financial depreciation.C. capital budgeting.D. capital structure.4. Cash equivalents include ( )A. time depositsB. inventoriesC. accounts receivableD. prepaid expenses5. The internal rate of return for a project will increase if:A. the initial cost of the project can be reduced.B. the total amount of the cash inflows is reduced.C. the required rate of return is reduced.D. the salvage value of the project is omitted from the analysis.6. Which of the following belongs to current liabilities?( )A. mortgages payableB. prepaid expensesC. notes payableD. bonds payable7. You spent $500 last week fixing the transmission in your car. Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the brake situation, the $500 you spent fixing the transmission is a(n) ___ cost.A. opportunityB. sunkC. incrementalD. fixed8. Which of the following statements are correct concerning diversifiable risks?I. Diversifiable risks can be essentially eliminated by investing in several securities.II. The market rewards investors for diversifiable risk by paying a risk premium.III. Diversifiable risks are generally associated with an individual firm or industry.IV. Beta measures diversifiable risk.A. I and III onlyB. II and IV onlyC. I and IV onlyD. II and III only9. Which of the following is a liability account?()A. prepaid insuranceB. additional paid-in capitalC. salaries payableD. accumulated depreciation10. Accountants employed by large corporations may work in the areas of the following except ( )A. product costing and pricingB. budgetingC. internal auditingD. product producing11. A corporation’s first sale of equity made available to the public is called a(n):()A. share repurchase program.B. private placement.C. initial public offering (IPO).D.seasoned equity offering (SEO).12. Standard deviation measures ____ risk.A. totalB. nondiversifiableC. unsystematicD. systematic13. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market value14. Ellesmere Corporation issues 1 million $1 par value bonds. The stated interest rate is 8% per year and the interest is paid twice a year. What is the real interest rate of the bond? ( )A. 6%B.4%C. 10%D. (1+8%/2)2-115. Your firm purchased a warehouse for $335,000 six years ago. Four years ago, repairs were made to the building which cost $60,000. The annual taxes on the property are $20,000. The warehouse has a current book value of $268,000 and a market value of $295,000. The warehouse is totally paid for and solely owned by your firm. If the company decides to assign this warehouse to a new project, what value, if any, should be included in the initial cash flow of the project for this building? ()A. $268,000B. $295,000C. $395,000D. $515,00016.Which one of the following will decrease the operating cycle?A. paying accounts payable fasterB. discontinuing the discount given for early payment of an accounts receivableC. decreasing the inventory turnover rateD. collecting accounts receivable faster17. Assume that dividends of a common stock will be maintained at D forever, and the required return of the stockholder is r, the par value of the stock is m, the value of the stock is ( )A. mB. m+DC. m+D/rD. D/r18. Which of the following items has the most risk? ( )A. treasury billB. corporate bondC. preferred stockD. common stock19. ( ) equals the gross profit divided by net sales of a firm.A. gross profit marginB. net profit marginC. return on investmentD. return on equity20. ( ) is the ratios that measure a firm’s ability to meet short-term obligationsA. liquidity ratiosB. leverage ratiosC. coverage ratiosD. activity ratios21.Sensitivity analysis helps you determine the:A. range of possible outcomes given possible ranges for every variable.B. degree to which the net present value reacts to changes in a single variable.C. net present value given the best and the worst possible situations.D. degree to which a project is reliant upon the fixed costs.22. According GAAP revenue is recognized as income when: ()A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services delivered.C. payment is received.D. income taxes are paid.E. all of the above.23. ( ) is the result of Net Profit Margin × total asset turnover × (total assets/shareholders’ equity)A. Return on equityB. return on investmentC. current ratioD. quick ratio24. Government tax law adjustment is ( ) to a firm.A. general economic riskB. inflation and deflation riskC. firm-specific risk25.Which of the following statements concerning the income statement is not true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It does not include depreciation.E. it treats interest as an expense.26.Which of the following is not a noncash deduction?A. Depreciation.B. Deferred taxes.C. Interest.D. Two of the aboveE. All of the above.27.Sasha Corp had an ROA of 10%. Sasha’s profit margin was 6% on sales of $180. What are total assets? ()A.$300B.$108C.$48. D$162.28. Calculate net income based on the following information ( )Sales = $200.00Cost of goods sold = $100.00Depreciation = $18.00Interest paid = $25.00Tax rate = 34%A. $16.50B. $37.62C. $34.60D. $4.6029.Which of the following is not true? ()A. Financial markets can be used to adjust consumption patterns over time.B. Corporate investment decisions have nothing to do with financial markets,C. Financial markets deal with cash flows over time.D. Investment decisions rely on the economic principles of financial markets.E. None of the above.30. ( ) is concerned with the acquisition, financing, and management of assets with some overall goal in mind.A. Financial managementB. Profit maximizationC. Agency theoryD. Social responsibility31. A major disadvantage of the corporate form of organization is the ( ).A. double taxation of dividendsB. inability of the firm to raise large sums of additional capitalC. limited liability of shareholdersD. limited life of the corporate form.32. Interest paid (earned) on both the original principal borrowed (lent) and previous interest earned is often referred to as ( ).A. present valueB. simple interestC. future valueD. compound interest33. If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion? ( )A. The stock has a low level of risk.B. The stock offers a high dividend payout ratio.C. The market is undervaluing the stock.D. The market is overvaluing the stock.34. A 250 face value share of preferred stock, pays a 20 annual dividend and investors require a 7% return on this investment. If the security is currently selling for 276, what is the difference (overvaluation) between its intrinsic and market value (rounded to the nearest whole dollar)?A. approximately 26B. approximately 10C. approximately 6D. approximately 135. Felton Farm Supplies, Inc., has an 8 percent return on total assets of 480,000 and a net profit margin of 6percent. What are its sales? ( )A. 3,750,000B.640,000C. 480,000D. 1,500,00036. A company can improve (lower) its debt-to-total asset ratio by doing which of the following?A. Borrow more.B. Shift short-term to long-term debt.C. Shift long-term to short-term debt.D. issue common stock.37. The DuPont Approach breaks down the earning power on shareholders' book value (ROE) as follows: ROE = ( ).A. Net profit margin × Total asset turnover × Equity multiplierB. Total asset turnover × Gross profit margin × Debt ratioC. Total asset turnover × Net profit marginD. Total asset turnover × Gross profit margin × Equity multiplier38. Which of the following items concerns financing decision? ( )A. sales forecastingB. bond issuingC. receivables collectionD. investment project selection39. Which of the following items is the function of a treasurer? ( )A. cost accountingB. internal controlC. capital budgetingD. general ledger40. For financial instruments, ( ) is judged in relation to the ability to sell a significant volume of securities ina short period of time without significant price concession.A. maturityB. marketabilityC. defaultD. inflation41. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market valuePart III: Calculation Questions ( 2*10 points)(注意:要写出计算公式和计算过程,否则不得分;需要用文字描述的问题回答内容要详细,语句正确、完整。

财务管理专业英语练习题

专业英语作业Topic 1:Agency is an area of commercial institution dealing with a contractual or quasi-contractual, or non-contractual set of relationships when a person, called the agent, is authorized to act on behalf of another (called the principal) to create a legal relationship with a third party.Money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames.Capital market is a market for securities (debt or equity), where business enterprises and governments can raise long-term funds. It is defined as a market in which money is provided for periods longer than a year.Spontaneous financing refers to the automatic source of short term funds arising in the normal course of short term course of business. Trade credit and out standing expenses are examples of spontaneous financing.Financial intermediary is a financial institution that connects surplus and deficit agents. Secured loan is a loan in which the borrower pledges some asset as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan.Unsecured Loan A loan that is issued and supported only by the borrower's creditworthiness, rather than by some sort of collateral.Marketability is a measure of the ability of a security to be bought and sold for a price at which similar items are dealling.Perpetuity is an annuity that has no end, or a stream of cash payments that continues forever. Hedge-matching In asset management, the coordination of an organization's cash inflows with cash outflows by matching the maturity of income generating assets (such as certificates of deposit) with the maturity of interest incurring liabilities (debts).Topic 2:美国IBM从1984年左右开始由兴到衰,由年盈利66亿美元到1992年亏损达49.7亿美元。

财务管理英文题库及答案

财务管理英文题库及答案1. Question: What is the primary goal of financial management in a business?Answer: The primary goal of financial management in a business is to maximize the value of the firm to its shareholders by making optimal investment and financing decisions.2. Question: What is the difference between a current asset and a non-current asset?Answer: A current asset is an asset that is expected to be converted to cash or used up within one year or one operating cycle of the business. A non-current asset, on the other hand, is an asset that is not expected to be converted to cash or used up within one year or one operating cycle.3. Question: Explain the concept of Time Value of Money (TVM).Answer: The Time Value of Money (TVM) is a financial concept that states that a sum of money received today isworth more than the same sum received in the future due toits potential earning capacity. This principle is fundamental to finance and is used to evaluate the relative worth of money at different points in time.4. Question: What is the formula for calculating the presentvalue of a future sum of money?Answer: The formula for calculating the present value (PV) of a future sum of money (FV) is: PV = FV / (1 + r)^n, where r is the discount rate and n is the number of periods.5. Question: Define the term 'Leverage' in the context of financial management.Answer: Leverage in financial management refers to the use of borrowed funds to increase the potential return of an investment. It is a strategy that can amplify gains but also increases the risk of losses if the investment does not perform as expected.6. Question: What is the DuPont Identity and how is it usedin financial analysis?Answer: The DuPont Identity is a formula used to break down the return on equity (ROE) into three parts: net profit margin, asset turnover, and financial leverage. It is used in financial analysis to understand the drivers of a company's profitability and to compare it with other companies.7. Question: How does inflation affect a company's financial statements?Answer: Inflation affects a company's financial statements by reducing the purchasing power of money. It can lead to higher costs for raw materials and labor, which can decrease profit margins. Additionally, inflation can cause assets andliabilities to be understated, and it may affect the real value of reported earnings.8. Question: Explain the concept of Capital Budgeting and its importance.Answer: Capital Budgeting is the process of evaluating the profitability of long-term investments or projects. It is important because it helps a company decide which projects to undertake based on their potential to generate returns over time, considering the time value of money and the risks involved.9. Question: What is the difference between a fixed cost anda variable cost?Answer: A fixed cost is a cost that does not change with the level of production or sales, such as rent or salaries. A variable cost, however, changes in direct proportion to the level of production or sales, such as raw materials or direct labor costs.10. Question: Define the term 'Liquidity Ratios' and provide examples.Answer: Liquidity Ratios are financial metrics used to measure a company's ability to pay off its short-term debts. Examples include the Current Ratio (current assets divided by current liabilities) and the Quick Ratio (current assets minus inventory divided by current liabilities). These ratios help assess the liquidity position of a business.。

财务管理专业英语-PDF图书下载-刘媛媛-编-在线阅读-PDF免费电子书下载-第一图书网

财务管理专业英语_PDF图书下载_刘媛媛编_在线阅读_PDF免费电子书下载_第一图书网前言 A journey of a thousand miles begins with a single step. ——Chinese proverb The future is not what it used to be. ——Paul Valery 21世纪是一个竞争激烈、国际化的高科技时代,21世纪的高级专门人才要具备扎实的专业知识、较高的信息素养和能在专业领域用外语进行交流沟通的能力。

作为一名财务管理专业教师,近几年来,我一直采用国外原版教材从事财务管理专业和非财务管理专业的财务管理课程的双语教学。

我深切体会到,虽然学生已经系统学习了大学基础英语,但由于缺乏专业英语基础,财务管理双语课程的教学效果并不尽如人意。

因此,很有必要在财务管理专业教学中设置财务管理专业英语课程。

财务管理专业英语教学,作为从基础英语教学向专业课双语教学过渡的桥梁,是财务管理专业学生从基础英语学习向专业领域英语应用过渡的不可或缺的中间环节。

要对学生进行财务管理专业英语素养的培养,一本合适的财务管理专业英语教材就成为至关重要的因素。

本书从财务管理专业培养目标出发,力求成为一本实用的财务管理专业英语教材,并采用有助于提高学生专业知识和实际运用能力的编写形式,以期能使学生成为满足日益激烈的国际竞争和频繁的国际交流需求的高素质财务管理人才。

本书按财务管理专业主干课程的架构分为12个专题,分别介绍财务管理各个方面的专业英语基础知识。

每一专题均先以“名人名言”和“微型案例”开始,以激发学生的兴趣去主动获取知识、开阔视野。

正文尽量体现财务管理专业的基本理念与核心内容,每一专题还设有“知识扩展”、“相关网址”等,进一步丰富了教学内容。

本书为财务管理专业的学生编写,采用的是导读式的教材风格,而非包罗万象的财务辞典。

根据多年教学经验,我建议财务管理专业英语教师在使用本教材时,除了教会学生如何阅读专业英语文献、掌握专业英语术语和翻译的技巧之外,最主要的任务是培养学生把所学到的专业知识转化为财务管理专业英语的实际运用能力。

(完整版)财务管理专业英语词汇表(很全面)

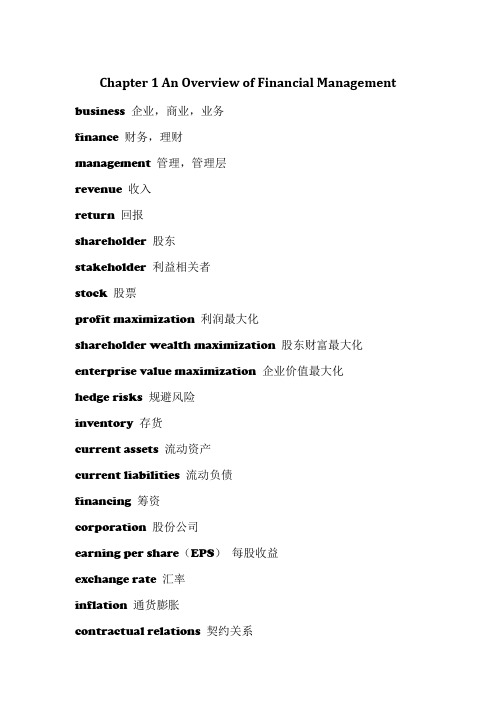

Chapter 1 An Overview of Financial Management business 企业,商业,业务finance 财务,理财management 管理,管理层revenue 收入return 回报shareholder 股东stakeholder 利益相关者stock 股票profit maximization 利润最大化shareholder wealth maximization 股东财富最大化enterprise value maximization 企业价值最大化hedge risks 规避风险inventory 存货current assets 流动资产current liabilities 流动负债financing 筹资corporation 股份公司earning per share(EPS)每股收益exchange rate 汇率inflation 通货膨胀contractual relations 契约关系equity 所有者权益dividend 股利CFO(Chief Financial Officer)首席财务官,财务总监Chapter 2 The Time Value of Money accrued 增值的,应计的annuity 普通年金annuity factor 年金系数compound interest 复利discounting 贴现future value 终值geometric series 等比数列mortgage 抵押ordinary annuity 普通年金perpetuity 永续年金present value 现值principal 本金reinvest 再投资simple interest 单利time value of money 货币时间价值compounding 复利计算Chapter 3 Risk and Rewardcapital asset pricing model(CAPM)资本资产定价模型diversification 分散化efficient capital market 有效资本市场expected return 期望回报market, systematic, or undiversifiable risk 市场风险、系统风险或不可分散风险portfolio 组合reward 收益,溢酬,溢价risk-aversion 风险厌恶risk-neutrality 风险中性risk preference 风险偏好risk premium 风险溢价security markets line(SML)证券市场线semi-strong capital market efficiency 半强式资本市场有效spread out 分散square root 平方根standard deviation 标准差strong capital market efficiency 强式资本市场有效transaction cost 交易成本unique, firm-specific, idiosyncratic, unsystematic, or diversifiable risk 特殊风险、特有风险、虚假风险、非系统风险或可分散风险variance 方差volatility 波动性weak capital market efficiency 弱式资本市场有效Chapter 4 Financial Assets and Their Valuation asset 资产security 证券issue (股票,钞票)分发,发行coupon rate 票面利率,息面利率annual 每年的,年度的,一年一次的obligate 使(某人)负有责任或义务outstanding 未解决的,未偿付的,杰出的calculate 估计,预测compensation 报酬,工资,补偿物perpetual 永久的,永恒的infinite 无限的,无穷的substitute 替代,取代yield 出产,产,出(果实、利润、结果)approximation 相似,近似trial-and-error 试误法illustrate 说明,阐明entitle 使人有权拥有……liability 负债intrinsic value 内在价值asymmetry 不对称constant 不变的,可靠的phase 阶段,时期preferred stock 优先股Chapter 5 Capital Budgeting and Investment Decision capital budgeting 资本预算estimating net present value 预期净现值the average accounting return 平均会计报酬率stand-alone principle 独立原则the internal rate of return 内部收益率the payback rule 回收期法erosion 侵蚀net working capital 净营运资本opportunity cost 机会成本hard rationing 硬约束soft rationing 软约束sunk cost 沉没成本incremental cash flow 增量现金流量pro forma financial statement 预估财务报表forecasting risk 预测风险scenario analysis 情景分析investment criteria 投资决策标准cash flow 现金流量project cash flow 项目现金流量depreciation 折旧capital spending 资本性支出garbage-in garbage-out system 垃圾进、垃圾出系统best case and worst case 最优情形和最差情形Chapter 6 Working Capital Management working capital 营运资本speculative 投机precautionary 预防的buffer 缓冲器invoice 发票deposit 存款disbursement 支付expenditure 消费trade-off 权衡attorney 代理人applicant 申请人utilization 应用dampen 使沮丧ordering cost 订货成本carrying cost 储存成本raw material 原材料insurance 保险linear 线性的bad-debt 坏账Chapter 7 Financing Modes debt financing 债务筹资equity financing 权益投资prospectus 招股说明书the general cash offer 普通现金发行the rights offer 配股发行initial public offering(IPO) 首次公开发行underwriting discount 承销折价the subscription price 认购价格collateral 抵押品mortgage securities 抵押债券debenture 信用债券sinking fund 偿债基金call provision 赎回条款call-protected 赎回保护operating leases 经营性租赁financial leases 融资租赁sale and lease-back 售后租回leveraged leases 杠杆租赁warrants 认股权证convertibles 可转换债券call options 看涨期权straight bond value 纯粹债券价值conversion value 转换价值secured loans 抵押贷款committed lines of credit 承诺式信贷额度compensating balances 补偿性余额trust receipt 信托收据Chapter 8 Capital Structure capital structure 资本结构optimal capital structure 最佳资本结构financial leverage 财务杠杆homemade leverage 自制杠杆payoff 回报proceeds 收益financial risk 财务风险interest tax shield 利息税盾direct bankruptcy costs 直接破产成本indirect bankruptcy costs 间接破产成本liquidation 清偿reorganization 重组absolute priority rule 绝对优先原则qualification 限定条件cost of equity 股权成本business risk 经营风险pie model 饼状模型break-even point 收益均衡点indifference point 无差异点Chapter 9 Dividend Distribution dividend irrelevance theory 股利无关理论retained earnings 留存收益capital surplus 资本公积earned surplus 盈余公积legal surplus 法定盈余公积free surplus reserves 任意盈余公积stockholder meeting 股东会declaration date 宣告日holder-of-record date 股权登记日ex-dividend date 除息日stock split 股票分割stock dividend 股票股利stock repurchase 股票回购declaration date 股利宣布日record date 股权登记日regular dividend 正常股利cash dividend 现金股利stock dividend 股票股利stock price appreciation 股价增值open market 公开市场payment date 股利支付日going concern 持续经营。

财务类英语试题及答案

财务类英语试题及答案一、选择题(每题1分,共10分)1. Which of the following is a common financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. All of the above2. The term "equity" in finance refers to:A. Money owed to a company.B. Money invested in a company.C. Money earned by a company.D. Money spent by a company.3. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) * 100B. ROI = (Total Assets / Net Income) * 100C. ROI = (Net Profit / Cost of Investment) * 100D. ROI = (Cost of Investment / Net Profit) * 1004. The process of forecasting a company's future financial position is known as:A. BudgetingB. ForecastingC. PlanningD. Analysis5. Which of the following is not a type of financial risk?A. Credit riskB. Market riskC. Liquidity riskD. Fixed risk6. The term "leverage" in finance is used to describe:A. The use of borrowed money to increase potential returns.B. The process of selling a financial asset.C. The amount of money a company has in the bank.D. The ratio of a company's equity to its debt.7. What does "EBIT" stand for in financial analysis?A. Earnings Before Interest and TaxesB. Earnings Before Income and TaxesC. Earnings Before Interest and TotalD. Earnings Before Interest, Taxes, and Depreciation8. The "time value of money" concept implies that:A. Money received in the future is worth less than money received today.B. Money received in the past is worth more than money received today.C. Money has no value over time.D. The value of money is constant over time.9. Which of the following is a method of financial analysis?A. SWOT analysisB. PEST analysisC. Ratio analysisD. Porter's Five Forces analysis10. The "break-even point" in finance is the point at which:A. A company's revenue equals its expenses.B. A company's net income is zero.C. A company's assets equal its liabilities.D. A company's cash flow is positive.答案:1. D2. B3. C4. B5. D6. A7. A8. A9. C10. A二、填空题(每题1分,共5分)11. The __________ is a financial statement that shows a company's assets, liabilities, and equity at a particular point in time.Answer: Balance Sheet12. The __________ is the difference between revenue and expenses during a specific period.Answer: Net Income13. In finance, the term "capital" often refers to the__________ of the business.Answer: Owners' Equity14. If a company's current assets are greater than itscurrent liabilities, it is said to have a positive __________. Answer: Working Capital15. The __________ is a measure of how well a company can pay its current debts.Answer: Quick Ratio三、简答题(每题5分,共10分)16. What is the purpose of a financial statement analysis?Answer: The purpose of financial statement analysis is to assess the performance and financial health of a company. It helps investors, creditors, and other stakeholders to make informed decisions about the company's financial stability, profitability, and risk.17. Explain the difference between "operating activities" and "financing activities" in the context of a cash flow statement.Answer: Operating activities in a cash flow statement referto the cash transactions that are directly related to thecore business operations of the company, such as cashreceived from sales and cash paid for expenses. Financing activities, on the other hand, involve cash transactions related to the company's financing arrangements, such as issuing or repaying debt, issuing or buying back shares, and paying dividends.四、计算题(每题5分,共5分)18. If a company has a net profit of $100,000 and a cost of investment of $500,000, what is the ROI?Answer: ROI = (Net Profit / Cost of Investment) * 100ROI = (100,000 / 500,000) * 100ROI = 20%五、论述题(每题10分,共10分)19. Discuss the importance of financial planning in business management.Answer: Financial planning is a critical component of business management as it helps in setting financial goals, allocating resources efficiently, and forecasting。

财务管理专业英语unit8

资本市场是一个中期或长期证券交易的金融市场。

Corporations may raise funds in capital markets by selling bonds, preferred stock ,and common stock. Other capital market instruments include US Treasury notes and bonds, mortgages, term loans, and leases.

Underwriting is the act of buying a new security from a company and reselling it to investors.

承销是指从一家公司购买新证券再出售给投资者的行为。

11.Manipulate 操纵 12.Privately held corporation 私人控股公司

此外,她还是华盛顿邮报 公司的一名董事。

盖茨十大重要时刻

7. 推出Windows 95

Windows 95的营销费 用令人惊异,为了宣传和 推广这款操作系统,微软 估计投入了3亿美元资金, 这还不包括因使用“滚石” 乐队的《Start Me Up》作 为广告音乐付出的数百万 美元版费。最值得一提的 是,就连纽约帝国大厦的 顶上也竖起了闪烁微软 Windows 95商标的霓虹彩 灯。

Words study

Salomon Smith Barney 所罗门美邦投资公司 Morgan Stanley Dean Witter 摩根士丹利-添惠 公司 Goldman Sachs 高盛公司 Merrill Lynch 美林公司

财务管理专业英语

28

1.2.2 Financing Decisions

Does the type of financing used make a difference?

Is the existing capital structure the right one?

How and where should the firm raise money?

(3)

Liabilities and equity (7)

The following information is also available:

Quick ratio = 1.0 time Working capital to sales ratio =

10% Total assets turnover = 2 times Sales = $2 million Debt ratio = 50%

29

1.2.2 Financing Decisions

Should the firm use funds raised through its revenues?

Should the firm raise money from outside the business?

If the firm seeks external financing, should it bring in other owners or borrow the money?

1) Long-term investment decisions

2) Long-term financing decisions 3) Working Capital Management

Decisions

23

1.2.1 Investment Decisions

会计与财务管理专业英语课后答案徐鹿

会计与财务管理专业英语课后答案徐鹿1、The plane arrived at London airport _______ Wednesday morning. [单选题] *A. on(正确答案)B. atC. inD. for2、By the end of this month, all this _____. [单选题] *A. is changedB.will changeC. will have changed(正确答案)D. has changed3、—Excuse me, how long does it ______ to walk to the library? —About 15 minutes, I’m afraid.()[单选题] *A. take(正确答案)B. spendC. costD. pay4、Bob used ______ on the right in China, but he soon got used ______ on the left in England.()[单选题] *A. to drive; to driveB. to drive; drivingC. to driving; to driveD. to drive; to driving(正确答案)5、I?have to?_______ my younger brother on Sunday. [单选题] *A. look after(正确答案)B. look upC. take careD. look out6、The students in that university are not fewer than()in our university. [单选题] *A. the oneB. thatC. themD. those(正确答案)7、--Jimmy, you are supposed to?_______ your toys now.--Yes, mom. [单选题] *A. put upB. put onC. put away(正确答案)D. put down8、( ) It tells what is going on ___the county and all____the world. [单选题] *A. across; over(正确答案)B. all; acrossC. in; inD.to; for9、Don’t forget _______ those books when you are free. [单选题] *A. to read(正确答案)B. readingC. readD. to reading10、If you pass your exams, we’ll have a party to celebrate. [单选题] *A. 宣布B. 发表C. 解放D. 庆祝(正确答案)11、—Mum, could you buy a schoolbag ______ me when you go shopping?—No problem.()[单选题] *A. ofB. toC. inD. for(正确答案)12、Can you tell me how the accident _______? [单选题] *A. came about(正确答案)B. came backC. came downD. came from13、You might not like the way Sam behaves, but please be kind to him. _____, he is your grandfather. [单选题] *A. After all(正确答案)B. Above allC. In allD. At all14、He gathered his courage and went on writing music. [单选题] *A. 从事B. 靠······谋生C. 继续(正确答案)D. 致力于15、He either watches TV _______ reads books in the evening. [单选题] *A. or(正确答案)B. andC. toD. so16、At half past three she went back to the school to pick him up. [单选题] *A. 等他B. 送他(正确答案)C. 抱他D. 接他17、( ) _____ New York _____ London have traffic problems. [单选题] *B. Neither….norC. Both…and(正确答案)D. Either…or18、一Mary wants to invite you to see the movie today. 一I would rather she(B)me tomorrow. [单选题] *A.tellsB. told (正确答案)C. would tellD. had told19、Seldom _____ in such a rude way. [单选题] *A.we have been treatedB. we have treatedC. have we been treated(正确答案)D. have treated20、John is fond of playing _____ basketball and Jack is keen on playing _____ piano. [单选题] *A./…the(正确答案)B.the…/D.the…the21、72.I really don’t know how to thank you , but for your help, I ()my lost necklace.[单选题] *A.couldn’t have found(正确答案)B.mustn’t have foundC.couldn’t findD.wouldn’t find22、69.Online shopping is easy, but ________ in the supermarket usually ________ a lot of time. [单选题] *A.shop; takesB.shopping; takeC.shop; takeD.shopping; takes(正确答案)23、Do not _______ me to help you unless you work harder. [单选题] *A. expect(正确答案)B. hopeC. dependD. think24、—Could you please make the bed?—______.()[单选题] *A. Yes, I wasB. No, I don’tC. Sure, I’ll do it(正确答案)D. No, that’s no problem25、He is a student of _______. [单选题] *A. Class SecondB. the Class TwoC. Class Two(正确答案)D. Second Two26、______ my great joy, I met an old friend I haven' t seen for years ______ my way ______ town. [单选题] *A. To, in, forB. To, on, to(正确答案)C. With, in, toD. For, in, for27、Our school is beautiful. How about _______? [单选题] *A. theirs(正确答案)B. theirC. theyD. them28、33.Will Mary's mother ______ this afternoon? [单选题] *A.goes to see a filmB.go to the filmC.see a film(正确答案)D.goes to the film29、( ) Some students preferred to stay in the toilet ______ do morning exercises. [单选题] *A in order to notB in not order toC in order not to(正确答案)D not in order to30、( ) .Would you please ______me the gifts from your friends? [单选题] *A.to showB. showingC. show(正确答案)D. shown。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

《11级财务管理专业英语》复习资料考试题型:一、短语中英互译(20x1=20分)二、从下列选项中选出最佳答案(20x1=20分)三、计算题(25分)四、段落中英互译(35分)同学们:考试的时候请带上没有存储功能的计算器,试卷上只要是涉及到计算的题里面的数字可能与复习资料上的数字不完全一样,但是计算方法是完全一样的,所以大家要掌握计算方法,考试的时候要自己计算。

预祝同学们取得好成绩。

Part I terminology translation (1*20 points)Directions: interpret the following terminology in English or Chinese.(范围课后核心词汇).:1. financial management---译成汉语2.普通股----译成英语Part II Choice questions (1*20 points) (Please write your answer in the following table)1. Financial statement does not include ( )A. balance sheetB. income statementC. cash flow statementD. working sheet2. An increase in which one of the following will increase the operating cash flow?salaries B. office rentC. building maintenanceD. equipment depreciation3. The process of planning and managing a firm’s long-term investments is called:A. working capital management.B. financial depreciation.C. capital budgeting.D. capital structure.4. Cash equivalents include ( )A. time depositsB. inventoriesC. accounts receivableD. prepaid expenses5. The internal rate of return for a project will increase if:A. the initial cost of the project can be reduced.B. the total amount of the cash inflows is reduced.C. the required rate of return is reduced.D. the salvage value of the project is omitted from the analysis.6. Which of the following belongs to current liabilities?( )A. mortgages payableB. prepaid expensesC. notes payableD. bonds payable7. You spent $500 last week fixing the transmission in your car. Now, the brakes are acting up and you are trying to decide whether to fix them or trade the car in for a newer model. In analyzing the brake situation, the $500 you spent fixing the transmission is a(n) ___ cost.A. opportunityB. sunkC. incrementalD. fixed8. Which of the following statements are correct concerning diversifiable risks?I. Diversifiable risks can be essentially eliminated by investing in several securities.II. The market rewards investors for diversifiable risk by paying a risk premium.III. Diversifiable risks are generally associated with an individual firm or industry.IV. Beta measures diversifiable risk.A. I and III onlyB. II and IV onlyC. I and IV onlyD. II and III only9. Which of the following is a liability account?()A. prepaid insuranceB. additional paid-in capitalC. salaries payableD. accumulated depreciation10. Accountants employed by large corporations may work in the areas of the following except ( )A. product costing and pricingB. budgetingC. internal auditingD. product producing11. A corporation’s first sale of equity made available to the public is called a(n):()A. share repurchase program.B. private placement.C. initial public offering (IPO). equity offering (SEO).12. Standard deviation measures ____ risk.A. totalB. nondiversifiableC. unsystematicD. systematic13. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market value14. Ellesmere Corporation issues 1 million $1 par value bonds. The stated interest rate is 8% per year and the interest is paid twice a year. What is the real interest rate of the bond? ( )A. 6% % C. 10% D. (1+8%/2)2-115. Your firm purchased a warehouse for $335,000 six years ago. Four years ago, repairs were made to the building which cost $60,000. The annual taxes on the property are $20,000. The warehouse has a current book value of $268,000 and a market value of $295,000. The warehouse is totally paid for and solely owned by your firm. If the company decides to assign this warehouse to a new project, what value, if any, should be included in the initial cash flow of the project for this building? ()A. $268,000B. $295,000C. $395,000D. $515,000one of the following will decrease the operating cycle?A. paying accounts payable fasterB. discontinuing the discount given for early payment of an accounts receivableC. decreasing the inventory turnover rateD. collecting accounts receivable faster17. Assume that dividends of a common stock will be maintained at D forever, and the required return of the stockholder is r, the par value of the stock is m, the value of the stock is ( )A. mB. m+DC. m+D/rD. D/r18. Which of the following items has the most risk? ( )A. treasury billB. corporate bondC. preferred stockD. common stock19. ( ) equals the gross profit divided by net sales of a firm.A. gross profit marginB. net profit marginC. return on investmentD. return on equity20. ( ) is the ratios that measure a firm’s ability to meet short-term obligationsA. liquidity ratiosB. leverage ratiosC. coverage ratiosD. activity ratiosanalysis helps you determine the:A. range of possible outcomes given possible ranges for every variable.B. degree to which the net present value reacts to changes in a single variable.C. net present value given the best and the worst possible situations.D. degree to which a project is reliant upon the fixed costs.22. According GAAP revenue is recognized as income when: ()A. a contract is signed to perform a service or deliver a good.B. the transaction is complete and the goods or services delivered.C. payment is received.D. income taxes are paid.E. all of the above.23. ( ) is the result of Net Profit Margin × tot al asset turnover × (total assets/shareholders’ equity)A. Return on equityB. return on investmentC. current ratioD. quick ratio24. Government tax law adjustment is ( ) to a firm.A. general economic riskB. inflation and deflation riskC. firm-specific riskof the following statements concerning the income statement is not true?A. It measures performance over a specific period of time.B. It determines after-tax income of the firm.C. It includes deferred taxes.D. It does not include depreciation.E. it treats interest as an expense.of the following is not a noncash deduction?A. Depreciation.B. Deferred taxes.C. Interest.D. Two of the aboveE. All of the above.Corp had an ROA of 10%. Sasha’s profit margin was 6% on sales of $180. What are total assets? ()A.$300B.$108C.$48. D$162.28. Calculate net income based on the following information ( )Sales = $Cost of goods sold = $Depreciation = $Interest paid = $Tax rate = 34%A. $B. $C. $D. $of the following is not true? ()A. Financial markets can be used to adjust consumption patterns over time.B. Corporate investment decisions have nothing to do with financial markets,C. Financial markets deal with cash flows over time.D. Investment decisions rely on the economic principles of financial markets.E. None of the above.30. ( ) is concerned with the acquisition, financing, and management of assets with some overall goal in mind.A. Financial managementB. Profit maximizationC. Agency theoryD. Social responsibility31. A major disadvantage of the corporate form of organization is the ( ).A. double taxation of dividendsB. inability of the firm to raise large sums of additional capitalC. limited liability of shareholdersD. limited life of the corporate form.32. Interest paid (earned) on both the original principal borrowed (lent) and previous interest earned is often referred to as ( ).A. present valueB. simple interestC. future valueD. compound interest33. If the intrinsic value of a share of common stock is less than its market value, which of the following is the most reasonable conclusion? ( )A. The stock has a low level of risk.B. The stock offers a high dividend payout ratio.C. The market is undervaluing the stock.D. The market is overvaluing the stock.34. A 250 face value share of preferred stock, pays a 20 annual dividend and investors require a 7% return on this investment. If the security is currently selling for 276, what is the difference (overvaluation) between its intrinsic and market value (rounded to the nearest whole dollar)?A. approximately 26B. approximately 10C. approximately 6D. approximately 135. Felton Farm Supplies, Inc., has an 8 percent return on total assets of 480,000 and a net profit margin of 6percent. What are its sales? ( )A. 3,750,000 ,000 C. 480,000 D. 1,500,00036. A company can improve (lower) its debt-to-total asset ratio by doing which of the following?A. Borrow more.B. Shift short-term to long-term debt.C. Shift long-term to short-term debt.D. issue common stock.37. The DuPont Approach breaks down the earning power on shareholders' book value (ROE) as follows: ROE = ( ).A. Net profit margin × Total asset turnover × Equity multiplierB. Total asset turnover × Gross profit margin × Debt ratioC. Total asset turnover × Net profit marginD. Total asset turnover × Gross profit margin × Equity multiplier38. Which of the following items concerns financing decision? ( )A. sales forecastingB. bond issuingC. receivables collectionD. investment project selection39. Which of the following items is the function of a treasurer? ( )A. cost accountingB. internal controlC. capital budgetingD. general ledger40. For financial instruments, ( ) is judged in relation to the ability to sell a significant volume of securities ina short period of time without significant price concession.A. maturityB. marketabilityC. defaultD. inflation41. ( ) is the value at some future time of a present amount of money, or a series of payments, evaluated at a given interest rate.A. future valueB. present valueC. intrinsic valueD. market valuePart III: Calculation Questions ( 2*10 points)(注意:要写出计算公式和计算过程,否则不得分;需要用文字描述的问题回答内容要详细,语句正确、完整。