基础会计(英文版)(第二版)Chapter10 Accounts for Partnership a

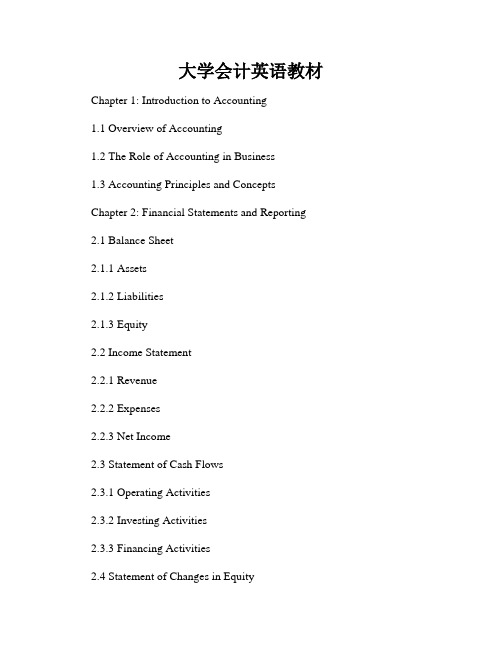

大学会计英语教材

大学会计英语教材Chapter 1: Introduction to Accounting1.1 Overview of Accounting1.2 The Role of Accounting in Business1.3 Accounting Principles and Concepts Chapter 2: Financial Statements and Reporting2.1 Balance Sheet2.1.1 Assets2.1.2 Liabilities2.1.3 Equity2.2 Income Statement2.2.1 Revenue2.2.2 Expenses2.2.3 Net Income2.3 Statement of Cash Flows2.3.1 Operating Activities2.3.2 Investing Activities2.3.3 Financing Activities2.4 Statement of Changes in EquityChapter 3: Analyzing Financial Statements3.1 Ratio Analysis3.1.1 Liquidity Ratios3.1.2 Solvency Ratios3.1.3 Profitability Ratios3.2 Common-Size Analysis3.3 Trend Analysis3.4 DuPont AnalysisChapter 4: Revenue Recognition and Measurement 4.1 Recognition Criteria4.2 Measurement Techniques4.2.1 Sales Revenue4.2.2 Service Revenue4.2.3 Interest Revenue4.3 Revenue Recognition for Specific Industries Chapter 5: Expense Recognition and Measurement5.1 Depreciation and Amortization5.2 Inventory Valuation Methods5.2.1 FIFO5.2.2 LIFO5.2.3 Weighted Average Cost5.3 Impairment of Assets5.4 Leases and Rent Expenses Chapter 6: Accounting for Assets6.1 Cash and Cash Equivalents6.2 Accounts Receivable6.3 Inventory6.4 Property, Plant, and Equipment 6.4.1 Acquisition and Disposal6.4.2 Depreciation and Impairment 6.5 Intangible Assets6.6 InvestmentsChapter 7: Accounting for Liabilities 7.1 Current Liabilities7.2 Long-Term Debt7.3 Contingent Liabilities7.4 Leases and Rent Payable Chapter 8: Accounting for Equity8.1 Share Capital8.2 Retained Earnings8.3 Treasury Stock8.4 Dividends8.5 Other Comprehensive IncomeChapter 9: Financial Statement Analysis and Interpretation9.1 Horizontal Analysis9.2 Vertical Analysis9.3 Ratio Analysis9.4 Common-Size Analysis9.5 Trend Analysis9.6 Limitations of Financial Statement AnalysisChapter 10: International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP)10.1 History and Development of IFRS10.2 Key Principles of IFRS10.3 Comparison with GAAPConclusion:In conclusion, the study of accounting is crucial for students in the field of finance and business. This accounting textbook provides a comprehensiveguide to understanding the principles, concepts, and practices of accounting. Through the mastery of these topics, students will be well-equipped to analyze financial statements, recognize and measure revenues and expenses, account for various assets and liabilities, and conduct financial statement analysis. With the knowledge gained from this textbook, students will be able to navigate the complex world of accounting with confidence and proficiency.。

基础会计(英文版)(第二版)Supplement3 Applications of Present Value

Accounting Applications of the Present Value Concept

Estimating the Value of Goodwill

Good will is an intangible asset of a business. It may be defined as the present value of expected future earnings in excess of the normal return on net identifiable assets. One method of estimating goodwill is to estimate the annual amounts by which earnings are expected to exceed a normal return and then to discount these amounts to their present value.

The Concept of Present Value

Set the future value as 1 yuan. The present value of 1 yuan is : p = 1/ (1+ i )n

Table of present values

The Concept of Present Value

66 634

28 599 95 233

Accounting Applications of the Present Value Concept

Capital Lease

A capital lease is regarded as a sale of the leased asset by the lessor to the lessee.

会计英语—基础会计

owner’s equity 所有者权益

accounting equation 会计平衡公式

会计英语—基础会计

fiscal year 会计年度

transaction 交易,业务

basic accounting elements

基本会计要素

drawing 提款,资本撤回

会计英语—基础会计

transaction 交易,经济业务

investor 投资者

会计英语—基础会计

creditor 债权人

nonprofit organization

非营利性组织

return of (投资)回收

return on (投资)回报,报酬

会计英语—基础会计

cash flow 现金流量

income statement 利润表

balance sheet 资产负债表

statement of cash flows

现金流量表

会计英语—基础会计

financial condition 财务状况

retained earnings 留存收益

accrual-basis 权责发生制

实现原则

客观性原则

会计英语—基础会计

consistency principle materiality

一致性原则

重要性

full disclosure 充分反映

conservatism 稳健性

会计英语—基础会计

Chapter 3

会计英语—基础会计

asset 资产

liability 负债

会计英语—基础会计

Chapter 2

会计英语—基础会计

accounting standard accounting entity

CHAPTER10 《会计英语》

Unit 1 An Overview of Auditing

➢ TYPES OF AUDITS. ➢Operational Audits. ➢An operational audit is a review of any part of an organization's operating procedures and methods for the purpose of evaluating efficiency and effectiveness.

Unit 2 Audit Process

➢ AUDIT OBJECTIVES.

➢There are eight audit objectives:

(1)vali dity,

(2)com (hp6eal)enቤተ መጻሕፍቲ ባይዱmtsiece,nac

(3)own e(7r)schlaips,

(4)valu ation,

Unit 1 An Overview of Auditing

➢DEFINITION OF AUDITING.

Quantifiable Information and Established Criteria. Economic Entity.

Accumulating and Evaluating Evidence. Competent, Independent Person. Reporting.

Special Terms

3. recommendations to management 管理建议书,指审计人员在完成审计 后,就企业内部控制等方面存在的缺陷以书面形式向被审计单位管理当局所提交 的报告。如果提供的是经营审计服务,管理建议书是必不可少的,即使是财务报 表审计,注册会计师一般也要向管理当局提交一份管理建议书。

基础会计学英文版参考资料

Cash Basis

Revenues are recognized when earned and expenses are recognized when incurred.

Revenues are recognized when cash is received and expenses are recorded when cash is paid.

4/8/2020

11

3 - 12

P1

Prepaid (Deferred) Expenses

Resources paid for prior to

receiving the actual benefits.

Here is the check for my 24-month insurance policy.

Summary of Expenses

Rent Gasoline Advertising Salaries Utilities and . . . .

$1,000 500

2,000 3,000

450 ....

Now that we have recognized the revenue, let's see what expenses

artificial time periods

Revenue-Recognition Principle

Revenue recognized in the accounting period in

which it is earned

Matching Principle

Expenses matched with revenues in the same period when efforts are

基础会计(英文版)(第二版)Chapter09 Financial Statements and Closing Entries for a Merchandising Sole

during a fiscal year.

Merchandise inventory turnover = Cost of goods sold Average merchandise inventory

Average merchandise inventory =Beginning inventory + Ending inventory 2

- Purchases Discounts

Cost of Goods Sold = 200 000 + (357 000 - 5 700 - 3 300) - 250 000

= 298 000 yuan

3) the operating expenses section

The operating expenses are those regular expenses involved in doing business. They may be subdivided into a number of different categories, such as selling expenses, and general and administrative expenses, etc.

The Classified Income Statement

The classified income statement for Guangli Furniture Store consists of three basic classifications:

1) the revenue from sales section; 2) the cost of goods sold section; 3) the operating expenses section.

978-7-5654-0926-4会计专业英语教程(第二版)

4.1.2 The Flow of Inventory Costs

22

会计专业英语教程(第二版)

Illustration 4-2

Flow of Costs

23

会计专业英语教程(第二版)

4.2 Costs Included In Inventory

4.2.1 Determining the Ownership of Goods

24

会计专业英语教程(第二版)

Illustration 4-3

The Ownership of the Goods

4.2.2 Product Costs

25

会计专业英语教程(第二版)

4.2.3 The Lower-of-Cost-or-Market (LCM) Rule

26

会计专业英语教程(第二版)

1.4.2 Constraints to the Hierarchy

1.4.2.1 1.4.2.2 1.4.2.3 Benefit / Cost Constraint Materiality Conservatism

13

会计专业英语教程(第二版)

ห้องสมุดไป่ตู้

Chapter 2 Cash and Internal Control over Cash Transaction Chapter Skeleton

Fixed-Percentage-of-Declining-Balance Method Sum-of-the-Years’-Digits Method

5.2.2.4 Depreciation for Fractional Periods

31

会计专业英语教程(第二版)

5.3 Disposal of Plant and Equipment

基础会计(英文版)(第二版)Chapter10 Accounts for Partnership and Distribution of Net Income

Income Summary Guangli, Capital Guanghai, Capital

800 000 440 000 360 000

To close the income summary account by crediting each partner with agreed ratio upon salary allowance and dividing the remaining profits equally

Partnership Accounting

Additional Investments

After three months of operation, the firm was in need of cash for future operation. The two partners of the firm decided to increase their respective investments to 1 000 000 yuan. Cash Gunagli, Captial Guanghai, Capital To record additional investment 330 000 280for Partnership and Distribution of Net Income

Accounts for Partnership

Partnership: a convenient, inexpensive means of combining the capital and the special abilities of two or two partners. Joint venture: the sharing of an operation’s cost, risk, and management with a partner pr partners from overseas.

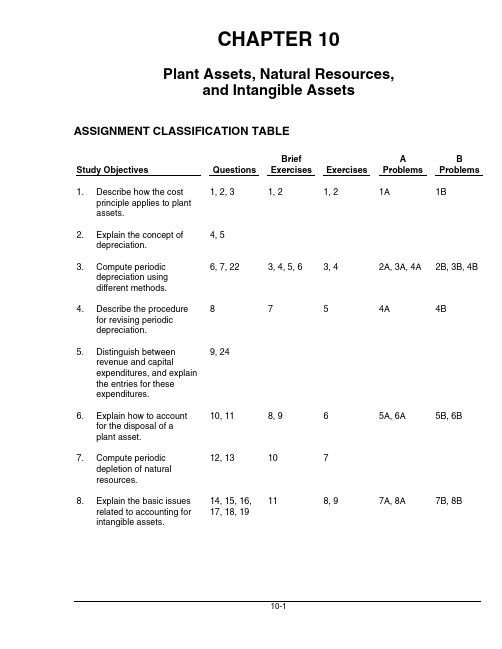

财务会计课后习题答案(英文原版)第10单元

BLOOM'S TAXONOMY TABLE

4.

Describe the procedure for revising periodic depreciation.

5.

Distinguish between revenue and capital expenditures, and explain the entries for these expenditures.

Questions 20, 21, 23

Exercises 10

*10. Explain how to account for the exchange of plant assets.

25, 26, 27

14, 15

11, 12, 13

*Note: All asterisked Questions, Exercises, and Problems relate to material contained in the appendix *to the chapter.

Knowledge Q10-1 Q10-2 Q10-3 Q10-5 Q10-6 Q10-7 Q10-22 Q10-8 P10-4A P10-4B BE10-7 E10-5 Q10-9 Q10-24 Q10-11 BE10-8 BE10-9 E10-6 BE10-10 E10-7 BE10-11 P10-7A P10-8B P10-8A E10-8 P10-7B E10-9 BE10-12 Q10-20 P10-5B BE10-13 Q10-21 P10-7B P10-5A E10-10 P10-7A BE10-14 BE10-15 E10-11 E10-12 E10-13 Communication Group Decision Case Exploring the Web Research Case Financial Interpreting Group Decision Reporting Financial Ethics Case Comp. Analysis Comp. Analysis Sts. Global Focus Cookie Chronicle P10-9A P10-9B P10-5A P10-6A P10-5B P10-6B BE10-3 BE10-4 BE10-5 BE10-6 E10-3 P10-2B E10-4 P10-4B P10-2A P10-4A P10-3A P10-3B Q10-4 E10-1 P10-1A P10-1B BE10-1 BE10-2 E10-2 Comprehension Application Analysis Synthesis Evaluation

基础会计(英文版)(第二版)Supplement3 Applications of Present

Year Expected net Present value of = Present value of

cash flow

1 yuan discounted net cash flows

at 10%

1

100 yuan

.909

90.9 yuan

2

100

.826

82.6

3

100

.751

75.1

Total present value of the investment:

Interest revenue (10 621 500 1%)

106 215

Reduction in lease payments receivable

393 785

Accounting Applications of the Present Value Concept

Capital Lease

Accounting Applications of the Present Value Concept

Market Price of Bonds

Present value of future principal payments:

100 000 yuan due after 6 semiannual periods, discounted at 7% per period: 100 000 .66634 (from table of present values)

Capital Lease

Accounting by the lessor (Nanji Co.) :

Leased Payment Receivable (net)

10 621 500

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Sales Cost of Goods Sold Inventory, Jan.1 Purchases Cost of goods available for sale Less: Inventory, Dec. 31 Cost of Goods Sold Gross Profit on Sales Operating expenses:

Partnership Accounting

Closing the Accounts of a Partnership at Year-end

By the end of the first year operation, Guangyi Company had earned a net income of 600 000 yuan, which was divided equally by the two partners:

Gunagli, Captial

180 000

Guanghai, Capital

200 000

Guangli, Drawing

180 000

Guanghai, Drawing

200 000

To transfer debit balances in partners’ drawing accounts to their

Chapter 10

Accounts for Partnership and Distribution of Net Income

Accounts for Partnership

Partnership: a convenient, inexpensive means of combining the capital and the special abilities of two or two partners.

Salary allowances + A fixed ratio: Salary allowances to the partners, with remaining net income or loss divided in a fixed ratio

Interest allowances + A fixed ratio: Interest allowances on partners’ capital balances, with remaining net income or loss divided in a fixed ratio Salary allowances + Interest allowances + A fixed ratio: Salary allowances to the partners, interest allowances on partners’ capital balances, and remaining net income or loss divided in a fixed ratio

respective capital accounts

Partnership Accounting

Financial Statements of a Partnership at Year-end

Guangyi Company Income Statement For the Year Ended December 31, 200X

950 000 50 000

300 000 1 300 000

200 000 1 100 000

Total

1 670 000 330 000 600 000

2 600 000 380 000

2 220 000

Distribution of Net Income of Partnership

Profits earned by partnership compensate the owners for: Personal services rendered to the business Capital invested in the business Entrepreneurial risk

Selling expenses General expenses Net Income Division of net income: To Guangli (50%) To Guanghai (50%)

160 000 880 000 1 040 000

40 000

200 000 100 000

300 000 300 000

1 900 000 yuan

1 000 000 900 000 300 000 600 000 yuan 600 000 yuan

Partnership Accounting

Financial Statements of a Partnership at Year-end

Guangyi Company Statement of Partners’ Capital For the Year Ended December 31, 200X

Methods of Dividing Partnership Net Income among the Partners

Salaries to Partners, with Remainder in a Fixed Ratio

Division of Net Income

Guangli

Guanghai

Guanghai (50%)

240 000

Total share to each partner

440 000

360 000

Net Income 800 000 yuan 320 000

480 000

480 000 -0- yuan

Income Summary

800 000

Guangli, Capital

Closing the Accounts of a Partnership at Year-end

Withdrawals during the year amounted to 180 000 yuan for Guangli and 200 000 yuan for Guanghai. The entry to close the drawing accounts:

Net income to be divided

Salary allowances to Partners

200 000

120 000

Remaining income after salary

allowances

Allocated in a fixed ratio:

Guangli (50%)

240 000

Guangli

Guanghai

Net income to be divided

Interest allowances on

beginning Capital:

Guangli (650 000 * 30%)

195 000

Guanghai (1 300 000 * 30%)

390 000

Residual loss after interest allowances

Joint venture: the sharing of an operation’s cost, risk, and management with a partner pr partners from overseas.

Partnership Accounting

Opening the accounts of a New Partnership

440 000

Guanghai, Capital

360 000

To close the income summary account by crediting each partner with agreed ratio upon salary allowance and dividing the remaining profits equally

Methods of Dividing Partnership Net Income among the Partners

Interest Allowances on Partners’ Capital, with Remainder in a Fixed Ratio

Division of Net Income

Income Summary

600 000

Gunagli, Captial

300 000

Guanghai, Capital

300 000

To close the income summary account to the partners’ capital account

Partnership Accounting

Methods of Dividing Partnership Net Income among the Partners

Most profit-sharing agreements fall under one of the following types:

A ratio: partners may agree upon any fixed ratio

The journal entries to open the accounts of the partnership (Gunagli’s):

Cash

700 000

Accounts Receivable

100 000

Inventory

90 000

Other Assets

260 000

Accounts Payable

Methods of Dividing Partnership Net Income among the Partners