轻松制汇票

用友ERP-U8功能介绍

用友ERP-U8以“优化资源,提升管理”为核心理念,以快速实施为特点,为中小型企业提供一套满足中国企业特色的,成熟、高效、低成本的ERP全面解决方案。

1.1财务会计

财务会计的主要模块包括:

总账

应收款管理

应付款管理

固定资产

网上报销

网上银行

WEB财务

UFO报表

现金流量表

公司对账

票据通

报账中心

总账

【总账】适用于各类企业进行凭证处理、账簿管理、个人往来款管理、部门管理、项目核算和出纳管理等。

主要功能特点:

由用户根据自己的需要建立财务应用环境,设置适合本单位实际需要的专用模块。

自由定义科目代码长度、科目级次。根据需要增加、删除或修改会计科目或选取行业标准会计科目

用户可选择采用固定汇率方式还是浮动汇率方式计算本币金额。

系统提供简单核算和详细核算两种模式进行应付账款的核算,满足用户的不同需求。

系统以功能权限控制、数据权限控制来提高系统应用的准确性和安全性。

提供票据的跟踪管理,可以随时对票据的计息、结算等操作进行监控。

提供收付款单的批量审核、自动核销功能,并能与网上银行进行数据的交互。

提供总公司和分销处之间数据的导入、导出及其服务功能,为企业提供完整的远程数据通讯方案。

业务流程配置

系统提供单据处理、审批、复核、支付四个流程,其中单据处理、支付是必选的流程,审批和复核可以自由选择。系统支持的流程组合有:单据处理、复核、审批、支付;单据处理、复核、支付;单据处理、支付。

操作权限管理

按对有权限的操作员,可以指定每个账户的录入、审核、支付权限,可以指定审核、支付的金额。对每一涉及金额操作包括录入、审核、支付等操作的时间、人员、金额。

财务实习日记

财务实习日记财务实习日记范文九篇转眼一天又过去了,今天一定有不少的收获吧,是时候用心地写一篇日记了。

为了让您不再为写日记头疼,下面是小编为大家整理的财务实习日记9篇,供大家参考借鉴,希望可以帮助到有需要的朋友。

财务实习日记篇1今天上午王叔一起去税务学习如何购买增值税发票,购票时需携带发票领购簿、IC卡、购票人本人的身份证(必须是在税务机关登记过允许购票的人员)、上次购买的且已用过的最后一张发票的原件及企业公章等,有些小单位还需要带发票一张一张先进行审核,之后带齐合同,缴税凭证等办理购买。

下午填制了产品的汇总帐,就这样慢慢的登了一下午,眼睛都花了,真不容易,总算都弄完了,今天感觉有一些累。

财务实习日记篇23月1日星期四按照上班时间来说这是这个星期的最后几天,虽然一直在按时上班实习,但是实习工作本身就很轻松,加之又是实习还是一个循序渐进的了解、熟悉和学习的阶段,这些天也就很快过去了。

感觉学习了好多东西,是从书本上学不到的,比如,很多原始凭证都是原来书本上没有的,就算书本上印出来但是毕竟不是实物印象还是不是很深刻,手工帐本我们在学校课程设计上也做过,但那些都是A4打印纸上的黑白帐页,当时做的时候也本着交差的心态,做过去了也没什么印象了,在这里可以见到关于不同类型经济行为的原始票据。

这两天满足感很强,原来在学校理论是学了可是实际操作都是纸上谈兵,心里总是觉得空落落的,这两天最基本的实物我都见过了。

快下班时和张师傅聊了一会儿有关在事务所实习的事情,不少人都在会计师事务所实习过一段时间,有些人自认为学到很多东西,也有些人觉得浪费时间的,其实不光是实习,学习、上班等许多方面的事情都有两面性,每个人都有自己的理解,其实关键还是在于自己如何把握!财务实习日记篇3这几天依旧接触整套会计系统的业务,会计业务包括:(1)原始凭证的核签;(2)记账凭证的编制;(3)会计簿记的登记;(4)会计报告的编制、分析与解释;(5)会计用于企业管理各种事项的办理;(6)内部的审核;(7)会计档案的整理保管;(8)其他依照法令及习惯应行办理的会会计事项。

国际贸易三种常见收付方式的风险分析_[全文]

![国际贸易三种常见收付方式的风险分析_[全文]](https://img.taocdn.com/s3/m/edf26aec760bf78a6529647d27284b73f24236bc.png)

国际贸易三种常见收付方式的风险分析国际贸易支付就是国际货物买卖货款的收付。

它直接关系到买卖双方的切身利益,直接影响买卖双方的资金周转和融通,以及各种费用负担。

在交易的过程中,买卖双方应当尽量选择对收付双方都较为公平合理的支付工具和收付方式。

(一)三种收付方式简介在目前的国际贸易结算方式中,最基本的有三种:汇款、托收、信用证。

另外,还有一些延伸的结算方式,如银行保函、备用信用证等。

在实务中,现在还出现了一些比较新的结算方法,如电汇中加入第三方(船方)来控制风险。

汇付(Remittance),是指汇款人(债务人)主动将款项交给银行,委托其使用某种结算工具,通过其在国外的分支行或代理行,将款项付给国外收款人的一种结算方。

其分为:电汇(T/T),票汇(D/D),信汇(M/T),其中电汇使用较其余两种普遍。

托收(Collection),是指由债权人(出口商)开立汇票,委托银行通过其海外分支行或代理行,向国外债务人(进口商)收取货款或劳务价值的一种结算方式。

在国际贸易托收方式下大多采用跟单托收,跟单托收根据交单条件的不同,可以分为付款交单(D/P远期,D/P即期),承兑交单(D/A)。

33></a>.信用证(L/C),信用证支付方式是近年来国际贸易中最常见、最主要的支付方式。

信用证(L/C)是开证行根据买方(开证申请人)的请求,开给卖方的一种保证承担支付货款的书面凭证。

(二)结合案例分析常用支付方式下的风险1.汇付。

汇付的缺点是风险大,资金负担不平衡。

因为以汇付方式结算,可以是货到付款,也可以是预付货款。

预付货款的结算方式有利于出口商,对进口商不利,对于出口商来说,就资金而言,货物运出前已得到一笔货款或称之为无息贷款,出口商可以先收款后购货出运,主动权在出口商的手中,就风险而言,一方面,预付货款的支付对于进口商日后可能出现的违约行为起到了一定的制约作用;另一方面,一旦进口商违约,出口商预付货款抵扣部分货款及费用,减少其损失。

小蜜蜂票据打印

小蜜蜂票据打印小蜜蜂票据专家秉承小蜜蜂软件的13年的悠久历史,本着“轻轻松松”的原则,着力解决各企事业单位票据多样、重复填写、打印烦琐的票据难题。

小蜜蜂票据专家可以精确打印任何票据,包括支票、银行票据、邮政单据、业务单据、各种证件及其信封;软件中内置各大银行(工行、农行、中行、建行、交行、发展行)的支票、进帐单、电汇、信汇凭单等票据样式。

使用小蜜蜂票据专家软件,完全把用户从烦琐而重复的票据工作中彻底解放出来。

与此同时大大提高了用户的工作效率。

主要特点:◆直观、真实的操作界面让用户倍感亲切。

◆简单的操作设置,使您使用起来更加省心。

◆方便、精确的模板设计功能让您自由应付新的票据格式,轻松打印天下票据◆适用面广,采用独特的打印定位方法,适用于任何类型的打印机,使普通打印机升级为超级票据打印机;◆定位精确,0.01毫米的精度无可挑剔,无论票据尺寸大小都能准确打印;◆简化输入,凡是票面上重复的填写内容,只要输入一次;◆智能匹配,输入填写内容时,能对已使用过得内容进行智能匹配。

如第二次给某单位开具支票时只要选定这个单位,其开户行、账号等信息自动匹配。

◆数字格式,对只输入的数值,系统自动生成大写日期、银行支票专用日期格式、大写金额、填格金额;◆数值运算,对于单价×数量=金额以及合计金额等需计算的内容,可定义的运算公式,不需手工计算再填入;◆内容复用,一种票据的内容可以传递给另一种票据,既节省了重复输入的工作量,又减少了出错的可能性;如在打出支票的同时就可打出内容吻合的进账单。

◆实用性强,内置了各大银行(工行、农行、中行、建行、交行、发展行)的支票、进账单、电汇、信汇凭单等;◆统计查询,可对开出的票据按其内容进行分类、分时统计、汇总和查询;◆国际货币,内置国际主要货币符号,完全满足外资和外贸公司的需要;◆支持票据审核制度,可以指定某些票据必须确认审核后才能输出打印;◆严格的权限管理,系统可以将本软件的操作人员针对每一种票据设置查阅、填制、修改、删除、审核、打印等设置操作权限。

中级经济法数字要点口诀

中级经济法数字要点口诀中级经济法这门学科里,数字要点那可真是不少,要想轻松记住它们,还真得有点小口诀。

咱先说公司法律制度这块儿。

有限公司的股东人数,那是 50 个以下,就像一个不大不小的班级,人数不多不少刚刚好。

有限公司成立时的注册资本最低限额,那是 3 万元,这数字就像一道门槛,跨过去公司才能起步。

再看看股份有限公司,发起人的人数 2 到 200 人,这就像一个热闹的聚会,人多但也不能太乱。

股份有限公司的注册资本最低限额 500万元,这可就像是一座高楼的基石,足够坚实才能撑起公司的大厦。

然后是合伙企业法律制度。

普通合伙企业里,合伙人对合伙企业债务承担无限连带责任,这责任可真是重大,就像背上了一个重重的行囊,不能轻易放下。

有限合伙企业里,至少得有一个普通合伙人,这一个普通合伙人就像是队伍里的领队,带着大家往前走。

在合同法里,定金的数额不得超过主合同标的额的 20%,超过部分不产生定金的效力。

这 20%就像是一个黄金比例,多了不行,少了也不行。

我还记得有一次给学生们讲这些数字要点,有个学生一脸苦恼地说:“老师,这么多数字,我怎么记得住啊!”我笑着跟他说:“别着急,咱们把这些数字变成口诀,就像唱歌一样,多唱几遍就记住啦。

”于是我带着他们一起编口诀,一起大声朗读,那场面,可热闹了。

最后考试的时候,大家都因为记住了这些口诀,答题顺顺利利的。

票据法律制度也有不少数字要记。

票据权利时效,持票人对商业汇票的出票人和承兑人的权利,自票据到期日起2 年。

见票即付的汇票、本票,自出票日起 2 年。

持票人对支票出票人的权利,自出票日起 6个月。

这些时间就像一个个小闹钟,提醒着票据的有效期。

在证券法里,首发股票并上市的财务指标,最近 3 个会计年度净利润均为正数且累计超过人民币 3000 万元,这 3000 万元可不是个小数目,得好好努力才能达到。

增值税的税率也是个重点。

13%、9%、6%,不同的税率对应着不同的货物和服务,可不能搞混了。

会计专业认知报告

会计专业认知报告本文为会计专业认知报告范文,让我们通过以下的文章来了解。

一、实践目的通过实践,能够理论联系实际,认识会计凭证、帐簿等实物,并运用所掌握的基本会计知识和理论对企业的基本业务进行会计核算,从而熟练掌握账户和复试借贷记账法,编制会计报表等基本技能,明确财务工作组织方法及其在企业管理中的重要地位和作用。

为以后的专业学识打下良好的基础。

二、实践内容1、了解企业财务工作概况;财务工作岗位设置、人员配备和分工;2、了解企业会计科目的设置和使用情况;了解企业会计准则;3、了解企业会计核算的组织程序;会计档案的装订和保管工作;4、填制、审核原始凭证;认识各种类型的原始凭证;5、正确填制、审核各种原始凭证;登记记帐凭证;认识三种记帐凭证;根据企业基本经济业务填制记帐凭证,注意选用正确的记帐凭证;6、开设账簿,并结转上个月的账户余额;登记各种会计帐簿;了解不同类型的会计帐簿的格式、功能;掌握不同类型帐簿的登记要领;掌握帐簿的结帐方法;能够采用正确的方法对错帐进行更正;7、学会对帐;财产清查;了解财产清查的方法;8、编制试算平衡表;编制财务会计报告编写资产负债表,编写利润表。

9、撰写实践报告。

三、实践总结或体会我是一名来自财务管理专业的大二学生,在新学期开学之际,我们首先开始了为期一周的会计实践周。

这对于我们来说是非常有意义和非常有帮助的。

本次实践让我们把之前在课本上学到的理论知识和具体实际相结合,让我们更好地认识和运用会计这门学科,同时也为我们在以后的学习和工作中打下了坚实的基础提供了宝贵的实践经验。

在本次实践过程中我学会了正确填制、审核各种原始凭证,登记记账凭证,开设账簿,同时掌握账簿的结账方法,能采用正确的方法对错账进行更正,学会了对账,了解了财产清查的方法。

以前,我总以为,当一名出色的会计人员,只要自己的会计理论知识扎实较强,掌握了一定的技术,就可以了。

经过了一个星期的实践,我发现,会计其实更讲究的是它的实际操作性和实践性。

商业银行内部控制案例

ⅩⅩ商业银行内部控制案例第1章案例描述1.1ⅩⅩ银行简介ⅩⅩ市商业银行是在1997年11月经中国人民银行总行批准,由12家城市信用社合并建立了地方性股份制商业银行。

该行是由地方财政、企业法人和自然人三部分组成。

截至2008年12月末,全行存款余额215.4亿元;贷款余额159.6亿元;总资产275.7亿元,其经营规模迅速扩大,是成立之初的6倍。

为了适应经济发展的需要,该行开始寻找境外战略投资者,最后于2008年与香港恒生银行,永隆银行进行合作,开始了增资入股的步伐。

而ⅩⅩ银行是在2009年由ⅩⅩ市商业银行更名而来。

ⅩⅩ银行在成立之初的注册资金为1.28亿元,在先后引进中共华电集团、香港恒生银行和永隆银行作为战略投资者之后,其注册资本已达到20亿元。

ⅩⅩ银行于1997年11月成立之初,注册资金1.28亿元,继2006年引入中国华电集团作为股东后,2008年成功引进了香港恒生银行和永隆银行作为战略投资者,目前注册资本已达20亿元。

经过十余年的发展,总资产由成立时的45亿元增长至275.7亿元,经营规模比成立时增长了6倍,跨入全国大型城商行之列。

1.2ⅩⅩ银行内部控制案例第一篇,支行行长刘维宁携巨款私逃在2012年年初,ⅩⅩ银行爆发了4.36亿元的票据案,使得ⅩⅩ银行内部的其他案件也被公之于众,该案件主要涉及支行行长刘维宁携4.36亿票据外逃。

刘维宁之所以仓皇出逃,是因为ⅩⅩ银行再2011年严格实行了“末位淘汰”制度。

按照规定,按照各支行年末的存款总额进行由高到低的排名,排名倒数第一的支行行长将被淘汰。

其实,该行早在几年之前就已经实施了该项考核制度,而刘维宁所任行长的支行存款数额连续几年都是排名倒数第一,若严格按照该项考核制度来执行的话,刘伟宁早就已经下马了,不可能让他骗走4亿多票据的机会。

但是,由于其与董事长庄永辉存在着密切联系,在庄的庇护下,一直没有被淘汰,反而稳居支行行长之位。

最终,在2011年年底的存款考核制度中,在多家支行行长的一致反对声中,刘伟宁不能够在庄永辉的保护之下如往年一样蒙混过关了,最终对其实施了末位淘汰制。

QAD中国财务系统

QAD中国财务系统概述QAD中国财务系统是QAD公司开发的一款财务管理软件,旨在帮助企业完成财务数据的收集、处理、分析和报告等工作。

该系统具有高度灵活性和可扩展性,可满足不同企业的财务管理需求,提供全面的财务管理功能和报表生成能力。

功能QAD中国财务系统包含以下功能模块:1. 会计核算该模块涵盖了企业的财务核算流程,可以完成会计凭证的录入、凭证的审核、科目余额的查询等功能。

通过该模块,用户可以方便地查看企业的财务状况,并及时获得会计核算相关的报表。

2. 应收应付管理应收应付管理模块可以帮助用户管理和追踪与客户和供应商之间的应收和应付款项。

它可以自动生成客户账单和供应商付款通知,跟踪未付款项和逾期款项,并生成相关的报表,如应收账款余额表和应付账款余额表。

3. 资金管理资金管理模块可以帮助企业实时监控和管理资金流动。

通过该模块,用户可以记录和跟踪银行存款、支票、汇票等资金流动,查询银行余额和银行对账单,并生成资金流量表、现金流量表等相关报表。

4. 固定资产管理固定资产管理模块可以帮助企业管理和跟踪固定资产的购买、领用、报废等过程。

用户可以在系统中登记和查询固定资产的基本信息、折旧费用、净值等数据,并生成相关的固定资产报表。

5. 成本管理成本管理模块可以帮助用户管理和控制企业的成本。

它可以记录和跟踪原材料和人工成本的发生情况,计算和分配制造成本、销售成本等,并生成成本分析报表、成本利润表等相关报表。

6. 税务管理税务管理模块可以帮助用户管理企业的税务事务。

它可以自动生成各类税务申报表格,自动计算各项税款,并提供税务筹划和税务风险管理等功能。

优势QAD中国财务系统具有以下优势:1.全面的功能覆盖:系统提供了涵盖会计核算、应收应付管理、资金管理、固定资产管理、成本管理和税务管理等多个模块,可以满足企业全面的财务管理需求。

2.高度灵活和可扩展:系统可以根据企业的特定需求进行灵活定制,并支持与其他企业应用软件的集成,实现与企业业务流程的无缝对接。

电子汇票承兑流程与注意事项

电子汇票承兑流程与注意事项

以下是 7 条关于电子汇票承兑流程与注意事项的内容:

1. 嘿,你知道电子汇票承兑的第一步是什么吗?那就是要确保你的信息准确无误啊!就好比你出门旅行,不把目的地搞清楚咋行呢?比如说,你得仔细核对汇票上的各种要素,要是有一点差错,那不就麻烦啦!

2. 哇塞,接下来可关键啦!要确认承兑人的身份哟!这就像交朋友,得认清对方是谁呀。

想象一下,如果你都不知道跟谁在打交道,那能放心吗?所以说,一定得把承兑人的情况搞清楚。

3. 然后呀,要注意承兑的时间限制哦!这可不能马虎,就像比赛有个规定时间一样。

要是错过了这个时间,那不就等于输啦?举个例子,如果你到时间了还没完成承兑操作,那就可能会有大问题哟!

4. 嘿呀,在承兑过程中,要随时留意系统的提示和状态呀!这多重要呀,就好像你开车的时候得时刻关注路况。

比如说,突然出现个异常提示,你就得赶紧看看是咋回事呀,可别不当回事儿!

5. 你可千万别小瞧了保存承兑记录啊!这就好比你把珍贵的东西好好收起来一样。

万一哪天需要查看或者有啥问题,你就能轻松找到证据啦!例如,以后要是有啥纠纷,你有记录在手,不就心里有底啦!

6. 还有哦,一定要仔细检查承兑后的结果呀!这就像你完成一项重要任务后要检查一遍。

要是不检查,出了问题都不知道呢!比如说,看看金额对不对,有没有其他异常情况。

7. 最后啊,我想说,电子汇票承兑可不是小事,一定要认真对待每一个环节呀!要不然到时候出了麻烦,后悔都来不及啦!就像建房子,每个步骤都得扎实,房子才牢固嘛!

总之,电子汇票承兑流程要谨慎对待,注意事项一个都不能马虎!。

银行承兑汇票贴现操作流程【单据结算】

银行承兑汇票贴现涉及到银行的相关业务操作,它有着一整套完整的贴现流程。

一、贴现业务受理一、持票人向开户行申请银行承兑汇票贴现,银行市场营销职位客户领导依照持票人提出的业务类型结合自身的贴现业务政策决定是不是同意持票人的业务申请。

二、银行客户领导依据持票人的业务类型、期限、票面情形结合本行制定的相关业务利率向客户作出业务报价。

3、持票人同意业务报价后,银行正式受理业务,通知持票人预备各项办理业务所需的资料。

其中包括:·申请人营业执照副本或正本复印件、企业代码证复印件(第一次办理业务时提供);·经办人授权申办委托书(加盖贴现企业公章及法定代表人私章)·经办人身份证、工作证(无工作证提供介绍信)原件及经办人、法定代表人身份证复印件;·贷款卡原件及复印件;·加盖贴现企业财务专用章和法定代表人私章的预留印鉴卡;更多内容请访问:轻松记账,自己管账理账;免费利用:·填写完整、加盖公章和法定代表人私章的贴现申请书;·加盖与预留印鉴一致的财务专用章的贴现凭证;·银行承兑汇票单据正反面复印件;·单据最后一手背书的单据复印件,填写《银行承兑汇票查询申请书》,由客户领导持银行承兑汇票复印件和填写完整的《银行承兑汇票查询申请书》交清算职位办理查询。

4、清算职位依照承兑行确信的查询方式,属本行的在系统内网上查询,属他行的填写银行承兑汇票一式三联查询书,通过互换向承兑行查询单据的真实性。

如承兑行为民生银行、招商银行、交通银行、华夏银行、光大银行、中信银行、兴业银行、浦东进展银行、广东进展银行、深圳进展银行的,市场营销职位客户领导那么需另行填写特殊业务划拨申请书,向承兑行所属系统在本地的分支机构支付每笔30元的查询费用委托查询。

五、收到结算部门提供的承兑人查复书后,市场营销职位换人进行复查,查对汇票的票面要素,复查无误后通知贴现企业,持贴现所需的资料和已背书完整的承兑汇票前来办理业务。

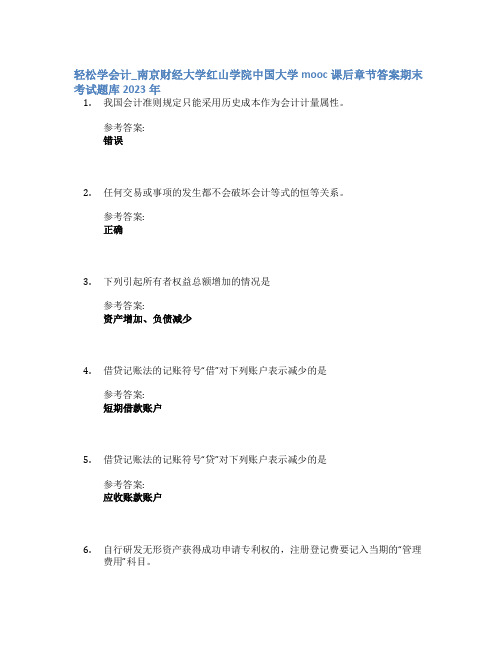

轻松学会计_南京财经大学红山学院中国大学mooc课后章节答案期末考试题库2023年

轻松学会计_南京财经大学红山学院中国大学mooc课后章节答案期末考试题库2023年1.我国会计准则规定只能采用历史成本作为会计计量属性。

参考答案:错误2.任何交易或事项的发生都不会破坏会计等式的恒等关系。

参考答案:正确3.下列引起所有者权益总额增加的情况是参考答案:资产增加、负债减少4.借贷记账法的记账符号“借”对下列账户表示减少的是参考答案:短期借款账户5.借贷记账法的记账符号“贷”对下列账户表示减少的是参考答案:应收账款账户6.自行研发无形资产获得成功申请专利权的,注册登记费要记入当期的“管理费用”科目。

参考答案:错误7.在符合存货定义的前提下,应同时满足与该存货有关的经济利益很可能流入企业以及该存货的成本能够可靠地计量时,才能够对存货进行确认。

参考答案:正确8.生产车间用的固定资产发生的日常修理费用,记入“制造费用”科目。

参考答案:错误9.按年数总和法计提的折旧额,一直都大于按照直线法计提的折旧额。

参考答案:错误10.固定资产的使用寿命、预计净残值一经确定,不得随意变更。

参考答案:正确11.企业购入固定资产发生的运输费、装卸费、安装费等在发生时计入固定资产的成本核算。

参考答案:正确12.某公司自行研发非专利技术共发生支出460万元,其中:研究阶段发生支出160万元;开发阶段发生支出300万元,符合资本化条件的支出为180万元。

不考虑其他因素,下列说法正确的是()参考答案:开发阶段发生的不符合资本化条件的支出120万元(300-180)计入管理费用_开发阶段发生的符合资本化条件的支出180万元应计入无形资产成本_该研发活动应计入当期损益的金额为280万元。

_研究阶段发生的支出160万元计入管理费用13.无论企业发生多少经济业务,都不会破坏会计恒等式的平衡关系。

参考答案:正确14.不能给企业未来带来预期经济利益的资源不能作为企业资产反映。

参考答案:正确15.资产和权益在金额上始终是相等的。

参考答案:正确16.所有经济业务的发生,都会引起会计等式两边要素发生变化。

商业承兑汇票 (10)

商业承兑汇票商业承兑汇票是一种常见的贸易金融工具。

它的作用是在国内或国际贸易交易中给予出口商或进口商在支付方面增加信用保障和灵活性,同时也为各类金融机构提供了一种风险较小的投资工具。

商业承兑汇票本质上是单据和承诺的结合,具备购买力,是支付手段和信用工具。

商业承兑汇票的优点商业承兑汇票是国内外企业在线下贸易中,以增加信用保障的方式解决支付难题的有效途径。

在进出口贸易过程中,商业承兑汇票可以为双方提供许多优势。

1. 商业承兑汇票可以为买卖双方提供可预测的资金流动性。

卖方根据合同条款发出承兑汇票,买方按发货日期、到期日期、发票号码和金额等核实后作出支付决策。

这可以降低风险,从而增加信用保障2. 商业承兑汇票通常是短期凭证,最常见的期限是90天。

买方可以得到更长的支付期,而卖方可以通过商业银行提前实现资金流动性。

3. 商业承兑汇票具有通用性。

它可以与各种信贷配套工具组合使用,如贸易融资、信用承诺等,以提高流动资金。

4. 商业承兑汇票便于流通。

其信用质量通常取决于发票背书人的声誉,因此各类金融机构可以将其加入投资组合,并依据自身需求和目标进行优化或分散投资。

商业承兑汇票的使用在实际操作中,商业承兑汇票通常由卖方在运达的商品、发票以及支付期的基础上,向买方发出承兑汇票以确认支付意愿和态度。

在此基础上,买方可以选择支付也可以选择抵押还款。

如果买方选择抵押还款,他可以拿着承兑汇票去贷款,以获得资金的流动性。

于此同时,承兑汇票持有人也有选择贴现,以从中获得回报。

另外,商业承兑汇票还可以按照特定的结算方式进行分类,包括电汇、信用证、汇票等。

无论采用哪种结算方式,承兑汇票持有人都可以体现专业和诚信,促进双方之间的合作和信任。

商业承兑汇票的风险和风险控制虽然商业承兑汇票具有很多优点,但也存在着一定的风险。

首先,承兑汇票发行方财务状况不佳,无力按期兑付;其次,承兑人撤回授权或倒闭,导致承兑无效,甚至违约。

这些风险带来的后果是各种交易的取消、生产中断甚至违约。

金融宣传口号

金融宣传口号(经典版)编制人:__________________审核人:__________________审批人:__________________编制单位:__________________编制时间:____年____月____日序言下载提示:该文档是本店铺精心编制而成的,希望大家下载后,能够帮助大家解决实际问题。

文档下载后可定制修改,请根据实际需要进行调整和使用,谢谢!并且,本店铺为大家提供各种类型的经典范文,如工作报告、合同协议、心得体会、条据书信、规章制度、礼仪常识、自我介绍、教学资料、作文大全、其他范文等等,想了解不同范文格式和写法,敬请关注!Download tips: This document is carefully compiled by this editor. I hope that after you download it, it can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you!Moreover, our store provides various types of classic sample essays, such as work reports, contract agreements, personal experiences, normative letters, rules and regulations, etiquette knowledge, self introduction, teaching materials, complete essays, and other sample essays. If you want to learn about different sample formats and writing methods, please pay attention!金融宣传口号金融宣传口号在日常的学习、工作、生活中,说到口号,大家肯定都不陌生吧,口号能指导人们有效地开展实践,促进客观事物的发展。

中行新一代汇票背书转让流程

中行新一代汇票背书转让流程中行新一代汇票背书转让呀,这事儿其实没那么复杂,咱就像唠家常一样把它说清楚。

一、汇票背书转让的基础概念。

汇票背书转让呢,就好比你有一个超酷的宝贝(汇票),你想把这个宝贝的一些权益转给别人。

在中行新一代汇票里,这是一种很常见的操作哦。

比如说,你欠了朋友一笔钱,你就可以把汇票通过背书转让的方式给朋友来偿债。

这时候汇票就像一个会传递的小魔法棒,把你的支付义务或者说是权益传递出去啦。

二、需要准备的东西。

在进行中行新一代汇票背书转让之前呀,你得先把一些东西准备好。

你得有那个汇票呀,这是肯定的,就像厨师做菜得有食材一样。

而且呢,你要确定这个汇票是可以转让的哦,有些汇票可能有限制条件的。

另外,你要清楚汇票上的各种信息,像是金额啦、付款人啦、收款人啦这些重要的部分,要是这些信息都是模模糊糊的,那转让起来可就麻烦大了。

三、具体的操作流程。

1. 找到正确的渠道。

2. 登录相关系统。

要是选择网上银行的话,就像登录自己的社交账号一样登录进去。

不过这里登录进去的可是和钱有关的系统,所以要格外小心,确保自己的账号密码啥的都准确无误。

3. 找到汇票管理模块。

登录之后,在一堆菜单里找到汇票管理这个模块。

这个模块就像是一个专门存放汇票的小仓库,你要在这个小仓库里找到你想要转让的那张汇票。

4. 选择要转让的汇票。

找到汇票之后呢,就像在一群小伙伴里选中你要分享糖果的那个小伙伴一样,选中你要进行背书转让的汇票。

然后就会弹出一些关于这张汇票的详细信息,你再仔细检查一遍,确保没选错。

5. 填写背书转让信息。

接下来就到了关键的一步啦。

你要填写背书转让的信息,就像给这个要出发的“小魔法棒”写一个小纸条,告诉它要去哪里。

这里要填写的就是受让人的信息,包括名字、账号之类的。

要写得清清楚楚哦,不然这个“小魔法棒”可能就找不到路啦。

6. 确认并提交。

都填写好之后呢,再仔细看一遍,就像检查自己出门有没有带钥匙一样。

确定没问题了,就点击确认并提交。

2024年做银行承兑汇票的年终总结

一年来,我在财务主管的指点下以及同事们的无私帮助下,我很好的完成了自己分内的工作,再加上自己对工作的用心、热情、好学等因素,我在今年的工作中得到了很大的进步,无论是在工作能力、思想觉悟还是抗压能力上都有着不同程度的加强,并在工作中取得了不错的成绩,在年底的时候还得到的公司颁发的“最努力员工奖”,莫大的荣幸,现在我就将我今年的工作做下总结。

一、问渠那得清如许,为有源头活水来。

人无论从事什么职业,都需要不断学习,在思想、文化、业务诸方面得到鲜活的“源头之水”,只有这样,才能不断进步,保持一渠清泉。

面对信贷员这个岗位,开始我还有些不自信。实地了解客户的基本情况、经营信息,调查掌握客户的贷款用途、还款意愿,分析客户的还款能力等等,这些对于只参加过几天培训的我来说,有很大难度。起初,我总在心里想,如果自己分析错误,把钱放出去还不上怎么办?于是经常打电话给xx总行在培训期间的师傅请教。与他们交流心中的疑惑,在得到细心的答复后,自己思考总结。在实践中学习,让我对信贷工作有了新的认识,也增加了自己的信心。

二、认真仔细,踏踏实实的做好本职工作。

我热爱自己的本职工作,能够正确认真的去对待每一项工作任务,在工作中能够积极主动,认真遵守各项规章制度,能够及时完成领导交给的工作任务。

作为市场营销部副经理,我深感自己肩上担子的分量,稍有疏忽就有可能造成信贷风险。因此,我不断的提醒自己,不断的增强责任心。我深知信贷资产的质量事关邢台银行经营发展大计,责任重于泰山,丝毫马虎不得。

一、加强学习,努力提高业务技能。

一年来,我认真学习信贷知识,阅读相关书籍,经过不懈努力,终于掌握了基本的财务知识和信贷业务技能,第一时间熟悉总行新业务的流程,办理了邢台银行第一笔商品融资贷款,并且与物流监管企业建立了良好的业务合作关系,为我支行以后办理商品融资业务打下基础。

汇票信用证托收谈判案例范文

汇票信用证托收谈判案例范文场景:A公司(出口商,位于中国)和B公司(进口商,位于美国)就一笔货物交易的付款方式进行谈判。

A公司的销售代表小李,B公司的采购代表大卫。

谈判地点:B公司会议室。

小李:(满脸笑容,热情地开场)大卫啊,咱们这生意谈得也差不多了,现在就差这付款方式定下来了。

你知道的,我们希望能够确保收款安全又高效。

大卫:(靠在椅子上,轻松地回应)小李啊,这我理解。

你们有什么想法吗?小李:(拿出一份资料)我们初步考虑汇票或者信用证这两种方式。

汇票呢,简单直接,你们到期付款就行。

不过呢,从我们的角度来看,信用证可能会更保险一点。

大卫:(皱了皱眉头)信用证啊?那可有点麻烦呢。

银行的手续费又高,流程还繁琐。

我们还得交保证金之类的,这对我们的资金流动不太友好啊。

小李:(连忙解释)大卫,你看啊,信用证虽然手续多一点,但是对双方都有保障啊。

我们按照信用证的要求发货、提交单据,你们银行审核无误后就付款。

这样你们不用担心我们不按时按质交货,我们也不用担心你们不付款啊。

就像给这笔交易上了个双保险。

大卫:(思考了一下)话是这么说,但是你也知道,现在市场变化快,有时候信用证的一些条款可能因为各种不可预见的因素导致我们执行起来困难重重。

比如说,货物在运输途中可能因为天气原因稍有延迟,但是信用证要求严格的交货时间,这就很头疼了。

小李:(点头表示理解)这确实是个问题。

那大卫你有什么更好的提议吗?大卫:(眼睛一亮)托收怎么样?D/P(付款交单)或者D/A(承兑交单)。

我们一直以来信誉都很不错的,用托收的话,手续简单很多。

小李:(有些犹豫)托收的话,我们风险就比较大了啊。

D/P还稍微好一点,D/A 的话,你们承兑了就可以拿到单据提货,要是到时候你们资金紧张或者出现什么变故,我们可就钱货两空了。

大卫:(拍了拍小李的肩膀)小李啊,我们公司这么大,怎么会出现这种情况呢?你要对我们有信心嘛。

而且我们也做了这么多年生意了,你还不相信我的人品?小李:(笑了笑)大卫,我当然相信你个人,但是做生意嘛,还是要按照规矩来。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

轻松制汇票汇票(Bill of Exchange,Draft)是出票人签发的,委托付款人在见票时或者在指定日期无条件支付确定的金额给收款人或者持票人的票据。

从以上定义可知,汇票是一种无条件支付的委托,有三个当事人:出票人、付款人和收款人。

汇票是要求别人付款的命令,所以出票人不可能是进口商(买方),必定是出口商(卖方)。

托收,信用证的汇票都是出口方做的。

BILL OF EXCHANGENO.①PLACE AND DATE:②For ③At ④Sight of thisSECOND Bill of Exchange( First of the same tenor and date being unpaid) pay to the order of ⑤the sum of SAY ⑥Drawn under ⑦L/C No. ⑧dated ⑨To ⑩少了一个11,就是出票人,还有出票人的签字。

不可少的。

1、D/P汇票的缮制①汇票号码:一般可以采用发票号码②出票地点和日期:③小写金额:先打货币的代号,紧接以阿拉伯数字表明金额,一般保留两位④支付方式和付款期限:支付方式如D/P 或D/A 应填在at一字的前面,付款期限应填在at 与sight之间。

如60天期限为“at 60 days sight”。

但如果不是见票起算,则须将sight一字划掉。

例如提单日期后90天付款为“at 90 days from date of B/L”⑤收款人:一般填写托收银行(你交单的银行)⑥大写金额⑦不填⑧不填⑨不填第9的“DATED”:是指L/C的日期Payable with interest@ .........% per annum :指年利率。

⑩付款人:在托收汇票中必须打出付款人的全称和详细地址(客户的名称、地址)2、信用证项下汇票的缮制①汇票号码:一般可以采用发票号码②出票地点和日期:③小写金额:先打货币的代号,紧接以阿拉伯数字表明金额,一般保留两位④支付方式和付款期限:看信用证42C 来做,即期的话at ***sight或者远期的话,例如提单日期后90天付款为“at 90 days from date of B/L”,B/L日期应该在汇票上指明,借以确定到期日。

操作见ISBP 45 B⑤收款人:一般填写议付银行(交单银行)⑥大写金额⑦信用证有出票条款就照打,没有可不做或者做成开证行或信用证号码⑧按实际填⑨按实际填⑩付款人:信用证42A 或者42DISBP45. 票期必须与信用证条款一致。

a) 如果汇票不是见票即付或见票后定期付款,则必须能够从汇票自身内容确定到期日。

b)以下是通过汇票内容确定汇票到期日的一个例子。

如果信用证要求汇票的期限为提单日后60天,而提单日为2002年 5月12日,则汇票期限可用下列任一方式表明:i. “提单日2002年5月12日后60天;或,ii.“2002年5月12日后 60 天”;或,ii i.“提单日后60天”,并且汇票表面的其他地方表明“提单日2002年5月12日”;或iv.在出票日期与提单日期相同的汇票上标注“出票后60天”;或v.“2002年 7月11日,即提单日后60天。

c)如果票期指提单日之后XXX天,则装船日期应视为提单日期,即使装船日早于或晚于提单签发日。

d)UCP没有对使用“从……起”(from)和“在……之后”(after)来确定汇票到期日的做法进行规定。

UCP提及的“从……起”和“在……之后”仅用于装运期限。

当用“从……起”确定汇票到期日时,国际标准银行实务做法是不包括提及的日期在内,除非信用证特别规定包括该日。

因此,“从……起”和“在……之后”在用于确定定期汇票到期日时有相同的含义。

到期日的计算从单据日期、装运日期或其他事件日期的次日起起算——即“3月 1日之后或从3月 1日起10日”均按3月11日起算。

e)如果信用证要求远期汇票,例如,于提单日后60天或从提单日起60天付款,而所提交的提单上有多个装船批注,且根据所有装船批注得知,货物是从信用证允许的一个地域或地区的港口装运,则使用其中最早的装船批注日期计算汇票到期日。

例如,信用证要求从欧洲港口装运,提单显示货物于8月16日在都柏林装上A船,于8月18日在鹿特丹装上B船,则汇票到期日应为在欧洲港口的最早装船日,也就是8月16日起的60天。

f)如果信用证要求汇票开立成,例如,提单日后60天或从提单日起60天付款,而一张汇票项下提交了不止一套提单,则最晚的提单日将被用来计算汇票的到期日。

Tenor45) The tenor must be in accordance with the terms of the credit.a) If a draft is drawn at a tenor other than sight, or other than a certain period after sight, it must be possible to establish the maturity date from the data in the draft itself.b) As an example of where it is possible to establish a maturity date from the data in the draft, if a credit calls for drafts at a tenor 60 days after the bill of lading date, where the date of the bill of lading is 12 May 2002, the tenor could be indicated on the draft in one of the following ways:i. "60 days after bill of lading date 12 May 2002", orii. "60 days after 12 May 2002", oriii. "60 days after bill of lading date" and elsewhere on the face of the draft state "bill of lading date 12 May 2002", oriv. "60 days date" on a draft dated the same day as the date of the bill of lading,orv. "11 July 2002", i.e. 60 days after the bill of lading date.c) If the tenor refers to xxx days after the bill of lading date, the on board date is deemed to be the bill of lading date even if the on board date is prior to or later than the date of issuance of the bill of lading.d) The UCP provides no guidance where the words "from" and "after" are used to determine maturity dates of drafts. Reference to "from" and "after" in the UCP refers solely to date terminology for periods of shipment. Where the word "from" is used to establish the maturity date, international standard banking practice would exclude the date mentioned, unless the credit specifically provides that "from" is considered to include the date mentioned. Therefore, for the purposes of determining the maturity date of a time draft, the words "from" and "after" have the same effect. Calculation of the maturity commences the day following the date of the document, shipment, or other event, i.e. 10 days after or from March 1 is March 11.e) If a bill of lading showing more than one on board notation is presented under a credit which requires drafts to be drawn, for example, at 60 days after or from bill of lading date, and the goods according to both or all on board notations were shipped from ports wit hin a permitted geographical area or region, the earliest of these on board dates will be used for calculation of the maturity date. Example: the credit requires shipment from European port and the bill of lading evidences on board vessel "A" from Dublin August 16, and on board vessel "B" from Rotterdam August 18. The draft should reflect 60 days from the earliest on board date in a European port, i.e. August 16.f) If a credit requires drafts to be drawn, for example, at 60 days after or from bill of lading date, and more than one set of bills of lading are presented under one draft, the date of the last bill of lading will be used for the calculation of the maturity date.一般欧洲开过来的付款信用证都没有要求汇票的41A或者41D里面AVAILABLE BY PAYMENT(DEF PAYMENT)那种1. 收款人,我的信用证呢感上好像没写仪付行,只有开证行和通知行,那我要填什么啊2.付款人,信用证41D上写了any bank by negotiation,那我要写什么呢?难道写any bank by negotiat ...1、信用证41D上写了any bank by negotiation,这就是议付行,自由议付的信用证,你在哪家银行议付,就写哪家,2、付款人看信用证42A。