高考英语阅读理解一轮限时训练题(5)

三维设计高考英语外研大一轮复习跟踪检测:必修3 Modle 5 含答案

必修三Module 5“阅读+七选五+完形”组合练——练题型(限时:35分钟)Ⅰ.阅读理解(2016·兰州高三诊断)Three-dimensional printers are fast becoming everyday devices in the United States. Three-D printers are used to make everything from automobile parts to bone replacements for human patients. American research scientists are now working on creating replacements for living tissue.Researchers at the Medical University of South Carolina have been working on creating and manufacturing living tissue since 2003. This process is called biofabrication (生物制造). It requires special printing equipment and a special kind of ink.Traditional printers require ink to produce an image or design on a piece of paper. For their three-D printer, the South Carolina researchers prepare complex nutritious solutions they call bio-inks. Bio-inks are made of proteins and glucose (葡萄糖), which normally provides energy for most cells of the body. The researchers also add living cells taken from the animal that will receive the new, printed tissue. The bio-inks are then added to a device that researchers call the Palmetto bio-printer.Sarah Grace Dennis is one of the researchers at the Medical University of South Carolina. She says new technology, like the Palmetto bio-printer, is a great help to the biofabrication process.The bio-inks are placed in three dispensers (分配器), containers, inside the printer. Lasers control both the position of the printing surface and the places where the bio-ink is released.Michael Yost is a leader of the research team. He says the printing process is fully automated — machine-operated. He says that the Palmetto bio-printer makes it possible to create complex tissue types.The researchers say bio-printing is still experimental. But they hope in a few years they may be able to print tissue to replace damaged human organs.But there are still some problems which need to be solved. Some scientists worry about how to get blood to the replacement tissue. The flow of blood is important to keep the printed tissue alive.Michael Yost hopes that more people will believe in the benefits of biofabrication.“Tissue biofabrication is a reality, and it is a reality now, and if you come here and you get to see it. You will get to see it. You can't touch it, but you will see it and think this is real. And this is really human.”语篇解读:本文是一篇说明文。

2017高考英语一轮复习5非谓语动词含解析

………………………………………………………………………………………………基础组A。

单句填空(每小题1.5分,共15分,限时8分钟)1.[2016·武邑中学预测]________ (judge) from his accent, he is from the south of China.答案Judging [句意:从他的口音来判断,他来自中国南方。

Judging from作独立状语。

]2.[2016·衡水二中模拟]________(struggle)with depression,eating disorders and alcohol abuse for years,he now understands how important being healthy is。

答案Having struggled [句意:在与抑郁、进食障碍和酗酒抗争多年后,他现在知道了健康的重要性.此题考查非谓语动词作状语。

struggle与句子主语为逻辑上的主动关系;又因为struggle表示的动作应发生在understands之前,所以用现在分词的完成式,故填Having struggled。

]3.[2016·枣强中学期末]________(give) a push,an object will move forward and do work。

答案Given [句意:施加一个推力,物体就会向前移动并做功。

主语an object与give之间为被动关系,且表示条件,故用过去分词作状语。

]4.[2016·衡水二中仿真]Former Chinese premier Zhu Rongji is said________ (donate) nearly 40 million yuan of all of his book's royalty(版税)income over the past two years.答案to have donated [句意:据说中国前总理朱镕基在过去的两年里捐出了他所有著作版税收入的近4千万元。

高考英语专题突破阅读理解限时精练1.doc

阅读理解限时训练与解析A(5minutes)I found out one time that doing a favor for someone could get you into a lot of trouble. I was in the eighth grade at the time, and we were having a final test. During the test, the girl sitting next to me whispered something, but I didn’t understand. So I leaned over her way and found out that she was trying to ask me if I had an extra pen. She showed me that hers was out of ink and would not write. I happened to have an extra one, so I took it out of my pocket and put it on her desk.Later, after the test papers had been turned in, the teacher asked me to stay in the room when all the other students were dismissed(解散). As soon as we were alone she began to talk to me about what it meant to grow up; she talked about how important it was to stand on your own two feet and be responsible (负责任) for your own acts. For a long time, she talked about honesty and emphasized(强调)the fact that when people do something dishonest, they are really cheating (欺骗)themselves. She made me promise that I would think seriously(认真地)about all the things she had said, and then she told me I could leave. I walked out of the room wondering why she had chosen to talk to me about all those things.Later on, I found out that she thought I had cheated on the test. When she saw me lean over to talk to the girl next to me, it looked as if I was copying answers from the girl’s test paper. I trie d to explain about the pen, but all she could say was it seemed very very strange to her that I hadn’t talked of anything about the pen the day she talked to me right after the test. Even if I tried to explain that I was just doing the girl a favor by letting her use my pen, I am sure she continued(继续)to believe that I had cheated on the test.1. The story took place(发生)exactly ____ .A. in the teacher’s officeB. in an exam roomC. in the schoolD. in the language lab2. The girl wanted to borrow a pen, because ____ .A. she had not brought a pen with herB. she had lost her own on her way to schoolC. there was something wrong with her ownD. her own had been taken away by someone3. The teacher saw all this, so she asked the boy ____ .A. to go on writing his paperB. to stop whisperingC. to leave the room immediatelyD. to stay behind after the exam4. The thing(s) emphasized in her talk was(were) ____ .A. honestyB. sense of dutyC. seriousnessD. all of the above5. The boy knew everything ____ .A. the moment he was asked to stay behindB. when the teacher started talking about honestyC. only some time laterD. when he was walking out of the roomB(7minutes)Some kids start to drink alcohol (酒精) at a young age. They think it is part of becoming an adult. They also think drinking is not that bad because so many people do it. They feel it is not as bad as taking drugs (毒品). It is easy for kids to get liquor (酒精饮料)by using fake identification (伪造证件).Parents may start to notice a change in their child’s behavior if the child starts drinking. Kids who drink sometimes stop doing things they normally liked to do. They may keep telephone calls and meetings a secret and not want anybody to touch their things. They act moody (喜怒无常) and do not have the same eating and sleeping habits.Parents need to stay involved (牵涉) in their kids’ lives. They should talk to their children about their problems to be aware of any changes.Parents can be the best protection. Children who get a lot of love can feel good about themselves. It helps them resist(抵抗)doing bad things even when other kids are doing them. Parents can also help set a good example by not drinking and driving. They can have firm rules in the home that everyone follows.Give the children good ideas on how to say “no” to drinking, even when they are at a party. Try not to overreact or panic (惊慌) if the child tries alcohol. How you handle it can affect their attitude. It may be helpful to talk to other parents about setting up curfews (宵禁令) and rules about parties or other events.1. Which of the following is NOT the reason why some kids have an early start of drinking?A. They want to show their maturity (成熟) by drinking alcohol.B. Drinking alcohol is much cooler than taking drugs.C. They are affected by many other people around them.D. They can get liquor easily.2.According to the passage, what changes may happen to the kids who start drinking?A. Nothing serious will happen to them.B. They keep the same eating and sleeping habits.C. They can control their moods quite well.D. Sometimes they act secretly.3.According to the writer, if parents find their children try alcohol, they had better ________.A. punish them at onceB. ask the police for helpC. ask their children’s friends for helpD. set up curfews and rules about parties or other events with other parents4.Which is the main subject discussed in the passage?A.Teen health.B. Teen education.C.Teen drinkingD. Parents’ worries.C(6minutes)Everyday we go to school and listen to the teacher, and the teacher will ask us some questions. Sometimes, the classmates will ask your opinions of the work of the class. When you are telling others in the class what you have found out about these topics, remember that they must be able to hear what you are saying. You are not taking part in a family conversation or having a chat(闲谈)with friends—you are in a slightly unnatural situation where a large group of people will remain silent, waiting to hear what you have to say. You must speak so that they can hear you—loudly enough and clearly enough but without trying to shout of appearing to force yourself. Remember, too, that it is the same if you are called to an interview whether it is with a professor of your school or a government official who might meet you. The person you are seeing will try to put you at your ease(轻松)but the situation is somewhat(一点儿)different from that of anordinary conversation. You must take special care that you can be heard.1.When you speak to the class, you should speak ________.A.as loudly as possible B.in a low voiceC.loudly D.forcefullyually, when you speak to the class, the class is __________.A.noisy B.quiet C.having a rest D.serious3.The situation in the class is ________ that in your house.A.not very different from B.sometimes the same asC..sometimes not the same as D.not the same as4. If you are having a conversation with an official, the most important thing for you is _______. A.to show your ability B.to be very gentleC. to make sure that you can be heard D.to put the official at ease5.The main idea of this passage is ________.A.that we must use different ways at different situationsB.that we must speak loudlyC.that we must keep silent at any timeD.that we must talk with the classD(6minutes)Computers are very important to modern life.Many people think that in the future computers will be used in lots of everyday life.It is thought that we won’t have to go shopping because we will be able to get most things which are sold in shops on the Internet.There will be no more books because we will be able to get all texts from computers.The Internet will be used to play games, see films and buy food.Most telephone calls will be made by computers, too.Some people are glad about those new ways of shopping and communicating(交流).Others do not think that computers will replace(代替)our old ways.Some people think that one day we will not read books made of paper. Instead, we will buy and read books using computers, which will keep many different books in them at the same time.We won’t need to turn lots of pages and paper will be saved.Computerized (计算机化的) books will be used more and more.While many people say it is a pleasure to go into shops and look at things you want to buy.It is also unlikely that many people will want to read large texts on our computers. Because paper books will perhaps be more friendly.Maybe computers won’t change these two habits.1.Which is the main idea of this passage?A. People like going shoppingB. Reading books is importantC. Computers are importantD. Computer can be used to play games2.There will be no more books because________.A. There is no paper in the future.B. People don’t like reading books.C. They are very expensive.D. We can read passages from computers.3.Which of the following is TRUE?A. We can see films by computers.B. People all like to go shopping by computers.C. We can’t buy anything using computers.D. All the people like reading books from computers.4. Which of the following is mentioned (提到) in the passage?A. Computers can help us e-mail our friends.B. We can chat by using computers.C. Computers can help us make telephone calls.D. We can listen to the music by computers.E(5minutes)1. If an Englishman who has worked in China for 3 years comes to English Newspaper office toask for the job in April, he will _____.A. get the jobB. not get the jobC. be a good editorD. not be useful2. If three adults and six students went to watch the match, the tickets would cost them _____ yuan.A. 165B. 135C. 196D. 2553. Which of the following is NOT TRUE?A. The shopping center is at NO. 6 Xidan road.B. The telephone number of English Newspaper is 3890666.C. The match was between Beijing Team and Guo'an Team.D. Xu Genbao is a coach.【答案及解析】A.1. B 故事发生在考试进行期间,故选B。

全国通用2024高考英语一轮复习Unit2练习牛津译林版必修3

必修三 Unit 2 单元话题语篇训练(每单元3练)练(一) 阅读理解组块专练——练速度(限时:35分钟)Ⅰ.阅读理解A(2024·石家庄模拟)International Competitions in 2024A.Creating the story in English.B.Having the work scanned.C.Paying money for the entry.D.Submitting the work by July.解析:选A 细微环节理解题。

依据The H.G.Wells Short Story Competition部分中的“Entries must be in English and must be entirely your own work”可知,写故事竞赛要求参赛者的作品是用英语写的原创作品,故选A。

2.What is special about “16th Annual Smithsonian Photo Contest”?A.It gives a theme. B.It offers a grand prize.C.It has an age limit. D.It has two categories.解析:选C 细微环节理解题。

依据16th Annual Smithsonian Photo Contest部分中的“Who may enter: Open to photographers who are 18 years old or older”并结合其他三个竞赛的“Who may enter”的信息可知,这个竞赛对参赛者的年龄有肯定的限制,故选C。

3.Who may get Margaret Reid Prize after winning the contest?A.Short story writers. B.Photographers.C.Art designers. D.Poem writers.解析:选D 推理推断题。

高考英语备考 专题18 阅读理解之记叙文

限时训练——阅读理解之记叙文1. 【·卷】What Theresa Loe is doing proves that a large farm isn’t prerequisite for a modern grow-your-own lifestyle. On a mere 1/10 of an acre in Los Angeles, Loe and her family grow, can〔装罐〕and preserve much of the food they consume.Loe is a master food preserver, gardener and canning expert. She also operates a website, where she shares her tips and recipes, with the goal of demonstrating that every has the ability to control what’s on their plate.Loe initially went to school to become an engineer, but she quickly learned that her enthusiasm was mainly about growing and preparing her own food. “I got into cooking my own food and started growing my own herbs (香草) and foods for that fresh flavor,〞she said. Engineer by day, Loe learned cooking at night school. She ultimately purchased a small piece of land with her husband and began growing their own foods.“I teach people how to live farm-fresh without a farm,〞 Loe said. Through her website Loe emphasizes that “anybody can do this anywhere.〞 Got an apartment with a balcony 〔阳台〕? Plant some herbs. A window? Perfect spot for growing. Start with herbs, she recommends, because “they’re very forgiving.〞 Just a little of the herbs “can take your regular cooking to a whole new level,〞she added. “I think it’s a great place to start.〞“Then? Try growing something from a seed, she said, like a tomato or some tea.〞Canning is a natural extension of the planting she does. With every planted food. Loe noted, there’s a moment when it’s bursting with its absolute peak flavor. “I try and keep it in a time capsule in a canning jar,〞Loe said. “Canning for me is about knowing what’s in your food, knowing where it comes from.〞In addition to being more in touch with the food she’s eating, another joy comes from passing this knowledge and this desire for good food to her children: “Influencing them and telling them your opinion on not only being careful what we eat but understanding the bigger picture,〞she said, “that if we don’t take care of the earth, no will.〞1.The underlined word “prerequisite〞(Pare. 1) is closest in meaning to “______〞.A. recipeB. substituteC. requirementD. challenge2.Why does Loe suggest starting with herbs?A. They are used daily.B. They are easy to grow.C. They can grow very tallD. They can be eaten uncooked3.According to Loe, what is the benefit of canning her planted foods?A. It can preserve their best flavorB. It can promote her online salesC. It can better her cooking skillsD. It can improve their nutrition4.What is the“the bigger picture〞 (Para. 6) that Loe wishes her children to understand?A. The knowledge about good foodB. The way to live a grow-our-own lifeC. The joy of getting in touch with foodsD. The responsibility to protect our earth2. 【·】When the dog named Judy spotted the first sheep in her life, she did what comes naturally. The four-year-old dog set off racing after the sheep across several fields and, being a city animal, lost both her sheep and her sense of direction. Then she ran along the edge of cliff( 悬崖) and fell 100 feet, bouncing off a rock into the sea.Her owner Mike Holden panicked and celled the coastguard of Cornwall, who turned up in seconds . Six volunteers slid down the cliff with the help of a rope but gave up all hope of finding her alive after a 90-minute search.Three days later, a hurricane hit the coast near Cornwall. Mr. Holden returned home from his holiday upset and convinced his pet was dead. He comforted himself with the thought she had died in the most beautiful part of the country.For the next two weeks, the Holdens were heartbroken . Then, one day, the phone rang and Steve Tregear, the coastguard of Cornwall, asked Holder if he would likehis dog bark.A birdwatcher, armed with a telescope, found the pet sitting desperately on a rock. While he sounded the alarm, a student from Leeds climbed down the cliff to collect Judy.The dog had initially been knocked unconscious(失去知觉的)but had survived by drinking water from a fresh scream at the base of the cliff. She may have fed on the body of a sheep which had also fallen over the edge. “The dog was very thin and hungry,〞Steve Tregear said , “It was a very dog. She survived because of a plentiful supply of fresh water,〞 he added.It was ,as M r. Holden admitted, “a minor miracle(奇迹)〞.1. The dog Jody fell down the cliff when she was _____________A. rescuing her ownerB. caught in a hurricaneC. blocked by a rockD. running after a sheep2. Who spotted Judy after the accident?A. A birdwatcherB. A student from LeedsC. Six volunteersD. The coastguard of Cornwall3. What can we infer from the text?A. People like to travel with their pets.B. Judy was taken to the fields for hunting.C. Luck plays a vital role in Judy's survival.D. Holden cared little where Judy was buried.4. Which of the following can be the best title for the text?A. Miracle of the Coastguard.B. Surviving a Hurricane.C. Dangers in the WildD. Coming Back from the Dead.3.【·】One day when I was 12, my mother gave me an order: I was to walk to the public library, and borrow at least one book for the summer. This was one more weapon for her to defeat my strange problem — inability to read.In the library, I found my way into the “Children’s Room.〞 I sat down on the floor and pulled a few books off the shelf at random. The cover of a book caught my eye. It presented a picture of a beagle. I had recently had a beagle, the first and only animal companion I ever had as a child. He was my secret sharer, but one morning, he was gone, given away to someone who had the space and the money to care for him. I never forgot my beagle.There on the book’s cover was a beagle which looked identical〔一样的〕 to my dog. I ran my fingers over the picture of the dog on the cover. My eyes ran across the title, Amos, the Beagle with a Plan. Unknowingly, I had read the title. Without opening the book, I borrowed it from the library for the summer.Under the shade of a bush, I started to read about Amos. I read very, very slowly with difficulty. Though pages were turned slowly, I got the main idea of the story about a dog who, like mine, had been separated from his family and who finally found his way back home. That dog was my dog, and I was the little boy in the book. At the end of the story, my mind continued the final scene of reunion, on and on, untilmy own lost dog and I were, in my mind, running together.My mother’s call returned me to the real world. I suddenly realized something: I had read a book, and I had loved reading that book. Everyone knew I could not read. But I had read it. Books could be incredibly wonderful and I was going to read them.I never told my mother about my “miraculous〞 (奇迹般地) experience that summer, but she saw a slow but remarkable improvement in my classroom performance during the next year. And years later, she was proud that her son had read thousands of books, was awarded a PhD in literature, and authored his own books, articles, poetry and fiction. The power of the words has held.1. The author’s mother told him to borrow a book in order to_____.A. encourage him to do more walkingB. let him spend a meaningful summerC. help cure him of his reading problemD. make him learn more about weapons2. The book caught the autho r’s eye because_____.A. it contained pretty pictures of animalsB. it reminded him of his own dogC. he found its title easy to understandD. he liked children’s stories very much3. Why could the author manage to read the book through?A. He was forced by his mother to read it.B. He identified with the story in the book.C. The book told the story of his pet dog.D. The happy ending of the story attracted him.4. What can be inferred from the last paragraph?A. The author has become a successful writer.B. The author’s mother read the same book.C. The author’s mother rewarded him with books.D. The author has had happy summers ever since.5. Which one could be the best title of the passage?A. The Charm of a BookB. Mum’s Strict OrderC. Reunion with My BeagleD. My Passion for Reading4. 【·】At thirteen, I was diagnosed〔诊所〕 with kind of attention disorder. It made school difficult for me. When everyone else in the class was focusing on tasks, I could not.In my first literature class, Mrs.Smith asked us to read a story and then write on it, all within 45 minutes. I raised my hand right away and said,“Mrs.Smith, you see, the doctor said I have attention problems. I might not be able to do it.〞She glanced down at me through her gl asses, “you are no different from your classmates, young man.〞I tried, but I didn’t finish the reading when the bell rang. I had to take it home. In the quietness of my bedroom, the story suddenly all became clear to me. It was about a blind person, Louis Braille. He lived in a time when the blind couldn’t get much education. But Louis didn’t give up. Instead, he invented a reading systemof raised dots〔点〕, which opened up a whole new world of knowledge to the blind. Wasn’t I the “blind〞 in my class, being made to learn like the “sighted〞students? My thoughts spilled out and my pen started to dance. I completed the task within 40 minutes. Indeed, I was no different from others; Ijust needed a quieter place. If Louis could find his way out of his problems, why should I ever give up?I didn’t expect anything when I handled in my paper to Mrs.Smith, so it was quitea surprise when it came back to me the next day- with an“A〞 on it. At the bottom of the paper were these words:“ See what you can do when you keep trying?〞1. The author didn’t finish the reading in class because.A. He was new to the classB. He was tried of literatureC. He had an attention disorderD. He wanted to take the task home2. What do we know about Louis Braille from the passage?A. He had good sightB. He made a great invention.C. He gave up readingD. He learned a lot from school3. What was Mrs.Smith ‘s attitude to the author at the end of the story?A. AngryB. ImpatientC. SympatheticD. Encouraging4. What is the main idea of the passage?A.The disabled should be treated with respect.B.A teacher can open up a new world to students.C. One can find his way out of difficulties with efforts.D. Everyone needs a hand when faced with challenges.励志赠言经典语录精选句;挥动**,放飞梦想。

2022高考英语一轮复习主题训练(二十四)自然灾害与防范安全常识与自我保护(含解析)

主题训练(二十四) 自然灾害与防范,安全常识与自我保护大阅读——提升阅读速度·内化读文规律(满分70分,限时55分钟)Ⅰ.阅读理解(共15小题;每小题2分,满分30分)AClimate change leads to a threat to the world's sandy beaches, and as many as half of them could disappear by 2100, a new study has found.Even by 2050 some coastlines could be unrecognizable from what we see today, with 14% to 15% facing severe erosion (侵蚀).Using updated sea level rise predictions, the researchers analyzed how beaches around the world would be in a future with higher seas and more damaging storms.They also considered natural processes like wave erosion, as well as human factors like coastal building developments, which can affect a beach's health.The study found that sea level rise is expected to outweigh these other factors, and that the mo re heattrapping gases humans put into the atmosphere, the worse the influences on the world's beaches are likely to be.It's hard to overstate just how important the world's beaches are.They cover more than one third of the world's coastlines, and protect coastal areas from storms.Beaches are also important economic engines, supporting relaxation, tourism and other activities.And in some areas, the beach is more than a vacation destination.In places like Australia, life near the coast revolves around the beach for much of the year.Some of the world's most popular beaches are already taking action.Places like Miami Beach are trucking in thousands of tons of sand to patch up (修补) badly eroded shorelines, while others have built sea walls and breakwaters in an attempt to hold precious sand in place.But the financial and environmental costs of these projects are huge, and scientists say rough seas and more powerful storms, supercharged by a warmer climate, will make this a losing battle.However, the researchers did find that humans have some control over what happens to the world's beaches.If the world's governments are able to stick to modest cuts in heattrapping gas pollution, the researchers found that 17% of projected beach losses by 2050 could be prevented, and that number will grow to 40% by 2100 if greenhouse gases are limited.语篇解读:本文是一篇说明文。

高考英语一轮复习读后续写精讲精练:读后续写素材5(场景描写)

高考质量提升是一项系统工程,涉及到多个方面、各个维度,关键是要抓住 重点、以点带面、全面突破,收到事半功倍的效果。

一、备考策略务必精准

高三备考的不同阶段,目标和任务各不相同,就像打仗一样,攻克不同的 山头有不同的打法,只有抓住要领,才能打赢主动仗。 一是细化“作战地图”

从现在到一模考试前,主要任务是过课本、串教材,把基础知识再夯实, 为专题复习奠定坚实基础。各学科组教师要认真学习新课程、新课标、《中国 考试评价体系及说明》和近三年高考原题,把高考考点和试题变化点做成“作战 地图”,平时考试、练习要对照“作战地图”进行选题,并在“作战地图”上一一标 注,确保考点训练无死角、考点覆盖无遗漏。 二是组织集体攻坚

【素材9】It was cool and bright and just right for running.I was in the first few miles of a 10-mile race through some hills.Birds were singing on the trees.The soft wind was brushing my cheeks.I felt rested and springy.Despite the hills, I thought it was going to be a fine run. 天气凉爽明亮,正适合跑步。我参加了一场10英里的山路赛跑,正跑在它的前几英 里。鸟儿在树上唱歌。柔和的风拂过我的脸颊。我感到休息好了,有活力了。尽 管有小山,我认为这将是一次很好的跑步。

【素材3】Grandpa smiled and decided to give it a try so as not to make his grandchildren disappointed.He held the cane in his right hand and the arm of his chair in his left hand.He stood up with strength on his legs.Everyone was surprised and excited to see grandpa stand up.At that moment, Jack noticed a tear coming from the corner of his grandfather’s eye. 爷爷笑了笑,决定试一试,以免让孙子们失望。他右手握着手杖,左手握着椅子的扶 手。他两腿有力气地站了起来。看到爷爷站起来,每个人都感到惊讶和兴奋。就 在那一刻,杰克注意到爷爷的眼角涌出了泪水。

高考英语一轮复习限时阅读训练_42

手惰市安逸阳光实验学校高考英语一轮复习限时阅读训练55Hans was an honest fellow with a funny round good-humored face. Living alone, every day he worked in his garden. In all the countryside there was no garden so lovely as his. All sorts of flowers grew there, blooming in their proper order as the months went by, one flower taking another flower’s place, so that there were always beautiful things to see, and pleasant odors to smell.Hans had many friends, the most devoted being the Miller. So devoted was the rich Miller to Hans t hat he’d never go by his garden without plucking a large bunch of flowers or a handful of sweet herbs, or filling his pockets with fruits. The Miller used to talk about noble ideas, and Hans nodded and smiled, feeling proud of having such a friend.The neighbors thought it strange that the rich Miller never gave Hans anything in return, though he had hundreds of sacks of flour, many cows and sheep, but Hans never troubled his head about these, and nothing gave him greater pleasure than to listen to all the wonderful things about the unselfishness of true friendship.In spring, summer, and autumn Hans was very happy, but when winter came, and he had no fruit or flowers to sell, he suffered from cold and hunger. Though extremely lonely, the Miller never came to see him then.“There’s no good in going to see Hans while the snow lasts.” The Miller said to his wife, “When people are in trouble they shouldn’t be bothered. So I’ll wait till the spring comes when he’s happy to give me flowers.”“You’re certainly very thoughtful,” answered his wife, “It’s quite a treat to hear you talk about friendship.”“Couldn’t we ask Hans up here?” said their son. “I’ll give him half my meal, and show him my white rabbits.”“How silly you are!” cried the Miller. “I really don’t know what’s the use of sending you to school. If Hans came up here, and saw our warm fire, our good supper, and our red wine, he might get envious, and envy is a most terrible thing, and would spoil anybody’s nature.I am his best frien d, and I’ll always watch over him, and see that he’s not led into any temptation. Besides, if Hans came here, he might ask me for some flour. Flour is one thing, and friendship is another, and they shouldn’t be confused. The words are spelt differently, an d mean quite different things. Everybody can see that.” He looked seriously at his son, who felt so ashamed that he hung his head down, and grew quite scared, and began to cry into his tea.Spring coming, the Miller went down to see Hans. Again he talked about friendship. “Hans, friendship never forgets. I’m afraid you don’t understand the poetry of life. See, how lovely your roses are!”Hans said he wanted to sell them in the market to buy back his thingswhich were sold during the hard time of the winter.“I’ll give you many good things. I think being generous is the base of friendship.” said the Miller. “And now, as I’ll give you many good things, I’m sure you’d like to give me some flowers in return. Here’s the basket, and fill it quite ful l.”Poor Hans was afraid to say anything. He ran and plucked all his pretty roses, and filled the Miller’s basket, imagining the many good things promised by the Miller.The next day he heard the Miller calling: “Hans, would you mind carrying this sack of flour for me to market?”“I’m sorry, but I am really very busy today.”“Well,” said the Miller, “considering that I’m going to give you my things, it’s rather unfriendly of you to refuse. Upon my word, you mustn’t mind my speaking quite plainly to you.”Poor Hans was driven by his friendship theory to work hard for his best friend, leaving his garden dry and wasted.One evening Hans was sitting by fire when the Miller came.“Hans,” cried the Miller, “My little boy has fallen off a ladder and hurt himself, and I’m going for the Doctor. But he lives so far away, and it’s such a bad windy night. It has just occurred to me that you can go instead of me. You know I’m going to give you my good things, so you should do something for me in return.”“Certainly,” cried Hans. He struggled into the stormy night, and got the doctor to ride a horse to the Miller’s house in time to save the boy. However, Hans got lost in the darkness, and wandered off into a deep pool, drowned.At Hans’ funeral, the Miller said, “I was his best friend. I should walk at the head of the procession.” Every now and then he wiped his eyes with a handkerchief.16. “Flour is one thing, and friendship is another” can be understood as ___________.A. “Different words may mean quite different things.”B. “Interest is permanent while friendship is flexible.”C. “I’m afraid you don’t understand the poetry of life.”D. “I think being generous is the base of friendship.”17. From the passage, we can learn that Hans ___________.A. was extremely wise and nobleB. was highly valued by the MillerC. admired the Miller very muchD. had a strong desire for fortune18. The author described the Miller’s behavior in order to ___________.A. warn the readers about the danger of a false friendB. show the friendship between Hans and the MillerC. entertain the readers with an incredible joking taleD. persuade people to be as intelligent as the Mille19. What’s the main cause of Hans’ tragedy?A. True friendship between them.B. A lack of formal education.C. A sudden change of weather.D. Blind devotion to a friend.20. From the Miller’s talk at home, we can see he was ___________.A. serious but kindB. selfish and cold-heartedC. caring but strictD. helpful and generous参考答案 16-20:BCADB***********************************************结束AWe live in an age of unprecedented(空前的) opportunity: If you’ve got ambition, drive, and smarts, you can rise to the top of your chosen profession—regardless of where you started out from. But nowadays companies aren’t managing their knowledge workers’ careers. Rather, we must each be our own chief executive officer. Only when you operate from a combination of your strengths and self-knowledge can you achieve true and lasting excellence.To build a life of excellence, begin by asking yourself these questions:“What Are My Strengths?”To accurately identify your strengths, use feedback analysis. Every time you make a key decision, write down the outcome you expect. Several months later, compare the actual results with your expected results. Look for patterns in what you are seeing: What results are you skilled at generating? What unproductive habits are preventing you from creating the outcomes you desire? In identifying opportunities for improvement, don’t waste time developing skill areas wher e you have little competence. Instead, concentrate on and build on your strengths.“What Are My Values?”What are your ethics(道德)? What do you see as your most important responsibilities for living a worthy, ethical life? Do your organization’s ethics reso nate(共鸣) with your own values? If not, your career will be likely to be marked by frustration and poor performance.“Where Do I Belong?”Consider your strengths, preferred work style, and values. Based on these qualities, what kind of work environment would you fit it best? Find the perfect fit, and you’ll transform yourself from a merely acceptable employee into a star performer.“What Can I Contribute?”In earlier eras, companies told businesspeople what their contribution should be. Today, you have choices. To decide how you can best improve your organization’s performance, first ask what the situation requires. Based on your strengths, work style, and values, how might you make the greatest contribution to your organization’s efforts?1. The following steps are all the ways to find and improve your strengths EXCEPT_________.A. writing down your expectationsB. comparing the actual resultsC. finding out your advantagesD. developing your disadvantagesm2. Which of the following comments is NOT true?A. People should find results they are skilled at generating.B. Processing information by hearing others discuss is the most effective way of working.C. People who work in one team should have similar ethics.D. The fit working environment can help the workers work more efficiently.3. What can lead to a life of excellence?A. Self-pity and powers.B. Ambition and smarts.C. Self-awareness and strengths.D. Motives and self-knowledge.4. How might you make the greatest contribution to your organization’s efforts?A. Do what is needed.B. Identify your own strengths.C. Work in your own way.D. Obey the companies’ rules.参考答案 DBCA*******************************************************结束BVincent Van Gogh was not always an artist. In fact, he wanted to be a church minister but was sent to the Belgian mining community of Borinage in 1879. He discovered that the miners there lived with terrible working conditions and received poverty-level wages. Their families were not well fed and struggled simply to survive. He felt concerned that the small salary he received from the church allowed him to live a normal life, which, in contrast to the poor, seemed unfair.A rich family in the community offered him free room and board. But Van Gogh turned down the offer, stating that it was the final temptation he must reject if he was to faithfully serve his community of poor miners. He believed that if he wanted them to trust him, he must become one of them. And if they were to learn of the love of God through him, he must love them enough to share with them.He was fully aware of a wide chasm which can separate words and actions. He knew that people’s lives often speak louder and clearer than their words. Maybe it was that same knowledge that led Francis of Assisi to frequently remind his monks(修士,僧侣), “Wherever you go, preach.Use words if necessary.”There are a million ways to say, “I love you,” without even sayinga word!5. Among the following statements of Vincent Van Gogh, which is Not true?A. He was an artist.B. He wasn’t satisfied with his salaryC. He thought the wages of the minors too low.D. He once worked as a minister.6. From the second paragraph, we know _____________.A. Van Gogh was crazyB. Van Gogh especially loved to teach children artsC. Van Gogh was richD. Van Gogh deeply sympathized with the lower-class7. Vincent Van Gogh rejected the offer because _____.A. it was illegal for a ministerB. he wanted to be a minorC. he was devoted to his jobD. he was dishonest8. The sentence “There are a million ways to say, ‘I love you, withouteven saying a word.” (the last paragraph) implies that ______.A. actions speak louder than wordsB. silence can also show loveC. there are numerous ways to express l oveD. saying “I love you” is useless9. We can infer from the passage ____________.A. our lives always speak louder and clearer than our words[K]B. the miners there worked under excellent working conditionsC. the ministers lived a much better and easier life than the miners at the timeD. Van Gogh himself offered to work in the Belgian mining community of Borinage in 1879.参考答案 BDCAC****************************************************结束。

高考英语一轮复习限时阅读训练1

手惰市安逸阳光实验学校高考英语一轮复习限时阅读训练1AOur listener question this week comes from Vietnam. Quang Khoi asks about Murphy’s Law. Murphy’s Law says: “Everything that can possibly go wrong will go wrong.” Like many other popular sayings, it is difficult to find one explanation for it.Those trying to explain Murphy’s Law agree that it began in the United States Air Force, which says the expression was named after officer Edward Murphy. He was an engineer working on a project in space flight research in 1949. One story says Captain Murphy was commenting about the failure of some equipment he was using in an experiment. He reportedly mentioned the worker responsible by saying: “If there is a way to do it wrong, he will find it.” Another official heard this and called it Murphy’s Law.Another story is found in a book called A History of Murphy’s Law by Nick Spark. It says members of the research team working with Captain Murphy created a similar phrase: “If it can happen, it will happen.” They called this Murphy’s L aw. But Spark later said there are in fact many different explanations about who invented the expression.Still, many stories say the first use of the term Murphy’s Law was at a press conference several weeks later. John Stapp was an Air Force captain at the time. He spoke to reporters about the tests completed by Captain Murphy and his team. Stapp said no one was injured during the tests because the Air Force considered “Murphy’s Law” before carrying out their experiments. He said this meant that they considered everything that could go wrong before a test and planned how to prevent those mistakes from happening.Today, you can find examples of Murphy’s Law in everyday life. For example, you might say that if you drop a slice of buttered bread on the floor, it will always land with the buttered side down.41. The passage is probably taken from______A. a newspaperB. a history textbookC. a radio programmeD.a cultural magazine42. According to the first explanation, we can learn that Murphy was ____the worker responsible.A. pleased withB. dissatisfied withC. familiar withD. concerned about43. According to Nick Spark, we can know that______.A. nobody knows who really invented the expressionB. it was Captain Murphy who invented this expressionC. Murphy’s teammates created this popular expressionD. it is a waste of time to discuss who invented the expression. BIn November of 2007, NBC Universal launched(发起) its first official Green Week. Throughout the week, NBC Universal presented over 150 hours of environmentally themed content across multiple platforms.Now, NBC Universal is proud to present Green Week 2009. With a new theme and message of "Green Your Routine," Here at NBC and we celebrate our talent in the "The More You Know" PSA campaign, presenting green-themed tips in several of our daytime life, among several other features here on the "Green Your Routine" site.Fashion & BeautyThrow a clothes swap party! Dying for that sweater your friend wore the other day? Well, maybe she'll trade for that old T-shirt you have. Here's a website that helps you organize a swap party (), or just plan your own!Go natural with organic make-up. Applying unnatural products directly on your skin wasn't exactly what nature intended. Try switching to a line of organic make-up and cosmetics for a different way to bring out your natural beauty.HomeDrop a brick in your toilet tank! Literally! According to the EPA, flushing(冲洗)makes up 30 percent of a household's water use (about three to six gallons per flush). By placing a brick in your toilet tank, you can help to conserve the amount of water used during each flush. WorkPrint smarter. Printing and copying can be one of the most costly operations in any office. To save on ink and paper costs, print double-sided and try to fit more than one page on a sheet. More printing tips can be found here: Turn off your computer. Do you leave your computer on overnight? If so, you're using up a good amount of electricity. When you can, try turning off your computer and the power strip it's connected to. If you can't, at least shut off your monitor.TransportationOrganize a carpool. There are many benefits to carpooling. You save on gas, reduce wear and tear on your car, and you get to ride in the HOV lanes. Get connected with your neighbours and co-workers to start sharing rides and check out this website for more tips: . Lose the car, get a bike. If you live close to where you work, try taking a bike instead of driving. You'll keep in shape and save on gas! Every small step and effort makes a difference! Be sure to GREEN YOUR ROUTINE!44. NBC Universal holds Green Week activities ___________.A. in a universityB. in a parkC. in an officeD. on the internet45. This year, Green Week welcomes ____________.A. advice on how to improve the websiteB. suggestions about how to make their activities more interestingC. tips on what to do to make our life greenerD. opinions on whether we should have campaigns46. If you want to carpool with somebody, you can find more advice and information at______.C. www. D. www. 47. Which is NOT recommended by Green Week this year?A. Using things like cucumbers to beautify your skin.B. Reducing the room of your toilet tank to save water when flushing.C. Giving away your old clothes to those in need of them.D. Printing and using computers in an economical way.41-43 CBA 44-47 DCBC。

高考英语阅读能力“5 1”训练(1)

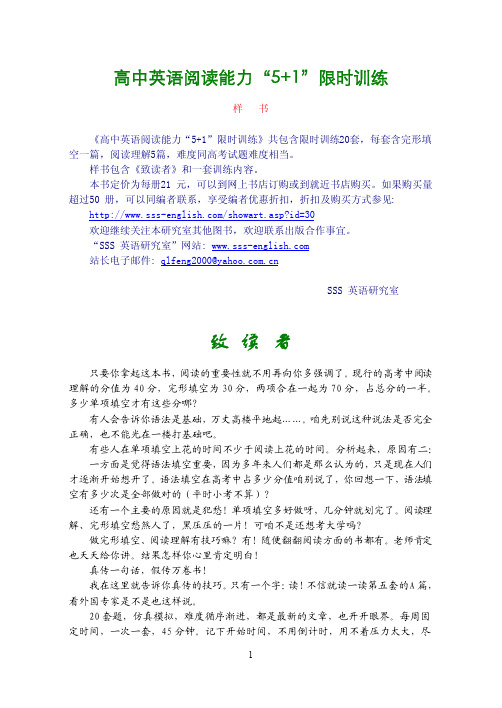

高中英语阅读能力“5+1”限时训练样书《高中英语阅读能力“5+1”限时训练》共包含限时训练20套,每套含完形填空一篇,阅读理解5篇,难度同高考试题难度相当。

样书包含《致读者》和一套训练内容。

本书定价为每册21元,可以到网上书店订购或到就近书店购买。

如果购买量超过50册,可以同编者联系,享受编者优惠折扣,折扣及购买方式参见: /showart.asp?id=30欢迎继续关注本研究室其他图书,欢迎联系出版合作事宜。

“SSS英语研究室”网站:站长电子邮件:qlfeng2000@SSS英语研究室致读者只要你拿起这本书,阅读的重要性就不用再向你多强调了。

现行的高考中阅读理解的分值为40分,完形填空为30分,两项合在一起为70分,占总分的一半。

多少单项填空才有这些分哪?有人会告诉你语法是基础,万丈高楼平地起……。

咱先别说这种说法是否完全正确,也不能光在一楼打基础吧。

有些人在单项填空上花的时间不少于阅读上花的时间。

分析起来,原因有二:一方面是觉得语法填空重要,因为多年来人们都是那么认为的,只是现在人们才逐渐开始想开了。

语法填空在高考中占多少分值咱别说了,你回想一下,语法填空有多少次是全部做对的(平时小考不算)?还有一个主要的原因就是犯愁!单项填空多好做呀,几分钟就划完了。

阅读理解、完形填空愁煞人了,黑压压的一片!可咱不是还想考大学吗?做完形填空、阅读理解有技巧嘛?有!随便翻翻阅读方面的书都有。

老师肯定也天天给你讲。

结果怎样你心里肯定明白!真传一句话,假传万卷书!我在这里就告诉你真传的技巧。

只有一个字:读!不信就读一读第五套的A篇,看外国专家是不是也这样说。

20套题,仿真模拟,难度循序渐进,都是最新的文章,也开开眼界。

每周固定时间,一次一套,45分钟。

记下开始时间,不用倒计时,用不着压力太大,尽量快一点做,什么时候做完算什么时候,除非是集体测试。

做完后总结一下,看看用的时间,正答率。

如果提高了,就奖励一下自己。

2022高考英语一轮复习主题训练(三)语言学习的规律方法等(含解析)

主题训练(三) 语言学习的规律、方法等大阅读——提升阅读速度·内化读文规律(满分70分,限时55分钟)Ⅰ.阅读理解(共15小题;每小题2分,满分30分)A(2021·湖北八校联考)Traveling to a foreign country can make you frightened if you don't know the local language. Mr. Thibault has a number of tips to help travelers manage in a destination when they don't speak the native tongue, based on his own experience. Here are a few of them.●Download a Language Translation AppMr. Thibault tends to rely on Google Translate and suggests that travelers find an app that works for them. Ideally, find one that specializes in the language you need to translate especially if the language uses a character set you're not familiar with, or have difficulty pronouncing.●Speak with Your Hands and HeadPointing with your hands and nodding or shaking your head, Mr. Thibault said, are easy ways to municate with locals in the country you're in. “Gestures are all universally understood,” he said.●Learn a Few Key WordsKnowing basic words and phrases like “hello”,“thank you” and “I'm sorry, I don't speak your language. Do you speak English?” is a must, Mr. Thibault said. Showing that you care enough to learn some of the language before you go, and at least enough to acknowledge that you don't know more, is a form of respect and will go a long way to be liked by locals.●Work with a Local Travel AgentIf you feel particularly unfortable in the country you're headed to, and you have to go anyway, relying on a local travel agent who knows both your and your destination's languages can be incredibly useful.●Hire a Local Tour GuideA tour guide can help you get a better grasp of the local language and is a good person to practice words and phrases with. Whenever Mr. Thibault visits a new country, he books a sightseeing tour with a guide on the first day of his trip. “I use this day to learn about my destination and get familiar with the language,” he said.语篇解读:本文是一篇应用文,针对不会说外语的旅行者到国外旅游提出了几条建议,包括翻译软件、使用肢体语言、出发前学习关键词、利用当地旅行社的帮助以及雇用当地导游。

高考英语复习专题【阅读七选五】限时训练汇编04

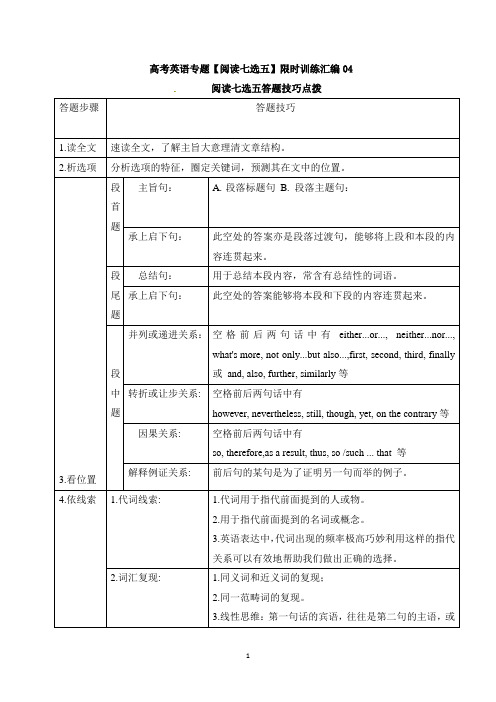

高考英语专题【阅读七选五】限时训练汇编04阅读七选五答题技巧点拨答题步骤答题技巧1.读全文速读全文,了解主旨大意理清文章结构。

2.析选项分析选项的特征,圈定关键词,预测其在文中的位置。

[来源:Zxxk. Com][来源:Zxxk. Com][来源:学科网ZXXK]3.看位置段首题主旨句: A.段落标题句 B. 段落主题句:[来源:学,科,网][来源:学+科+网Z+X+X+K]承上启下句:此空处的答案亦是段落过渡句,能够将上段和本段的内容连贯起来。

段尾题总结句:用于总结本段内容,常含有总结性的词语。

承上启下句:此空处的答案能够将本段和下段的内容连贯起来。

段中题并列或递进关系:空格前后两句话中有either...or..., neither...nor...,what's more, not only...but also...,first, second, third, finally或and, also, further, similarly等转折或让步关系: 空格前后两句话中有however, nevertheless, still, though, yet, on the contrary等因果关系: 空格前后两句话中有so, therefore,as a result, thus, so /such ... that 等解释例证关系: 前后句的某句是为了证明另一句而举的例子。

4.依线索 1.代词线索: 1.代词用于指代前面提到的人或物。

2.用于指代前面提到的名词或概念。

3.英语表达中,代词出现的频率极高巧妙利用这样的指代关系可以有效地帮助我们做出正确的选择。

2.词汇复现: 1.同义词和近义词的复现;2.同一范畴词的复现。

3.线性思维:第一句话的宾语,往往是第二句的主语,或者前后句有相同或重叠的词语。

4.前后句语义的衔接:常以句子中关键词(常为名词、动词、形容词)的同义词、近义词(组)或反义词(组)复现的方式来实现。

2021高考英语一轮课下限时训练及答案(人教新课标必修5Unit 5)

2021高考英语一轮课下限时训练及答案(人教新课标必修5Unit 5)Unit 5First aidⅠ.单项填空1.(2022·太原模考)—We could invite John and Barbara to the Friday night party.—Yes,________?I’ll give them a call right now.A.why not B.what forC.why D.what2.(2022·金陵中学月考)—John,there’s________certain Mrs Myles on________phone for you.—Oh,I’m coming.Thank you.A.a;/B./;/C./;the D.a;the3.Though my dad is very busy,he always________time to attend the teacher-parent meeting.A.leaves out B.squeezes outC.picks out D.points out4.(2022·淄博模拟)—Was it becuase of the terrible weather________his flight was delayed?—Not really.An old lady suffered a heart attack and they had to fly back.A.when B.whyC.how D.that5.(2022·长沙四校二模)She________volleyball regularly for many years when she was young.A.was playing B.playedC.has played D.had played6.(2021·盐城二模)—Why are so many northern Chinese visiting Southeast Asia countries recently?—They are trying to get a________shelter from the cold weather in winter.A.magic B.reliableC.permanent D.temporary7.(2022·江苏两校期中联考)Though________again and again,the young man still drove after drinking,leading to his being fined.A.warn B.to warnC.warned D.warning8.(2022·宁夏银川模拟)Words don’t have the power to hurt you________the person who says them means a lot to you.A.if B.becauseC.unless D.when9.(2022·兰州一中高三检测)—Don’t put so much________on the children.It’s harmful to their health.—OK,I won’t.A.pressure B.strengthC.power D.attention10.(2022·银川一中月考)The number of people,who have access to their own cars,________sharply in the past decade.A.rose B.is risingC.have risen D.has risen11.There is little doubt________you will be able to judge truth and error if you have confidence in yourself.A.that B.whoC.when D.if12.(2022·昆明模拟)They have earned lots of money,so I________believe that the business is a success.A.mildly B.firmlyC.actively D.tightly13.(2022·济宁检测)When doing experiments,one cannot rely too much upon the human senses tomake________observation.A.accurate B.casualC.eventual D.potential14.(2021·天水一中高三模拟)Little Tom,who got burned while he was setting off fireworks,________in hospital now.A.is treating B.was treatedC.has treated D.is being treated15.The boy made the same mistakes________,which,of course,made his parents very angry.A.over and over again B.more or lessC.sooner or later D.here and thereⅡ.阅读理解(2021·江西省高三上学期七校联考)A year ago August,Dave Fuss lost his job driving a truck for a small company in west Michigan.His wife,Gerrie,was still working in the local school cafeteria,but work for Dave was scarce,and the price of everything was rising.The Fusses were at risk of joining the millions of Americans who have lost their homes in recent years.Then Dave and Gerrie received a timely gift—$7,000,a legacy (遗产) from their neighbors Ish and Arlene Hatch who died in an accident.“It really made a difference when we were going under financially,” says Dave.But the Fusses weren’t the only folks in Alto and the neighboring town of Lowell to receive the unexpected legacy from the Hatches.Dozens of other families were touched by the Hatches’ generosity.In some cases,it was a few thousand dollars;in others,it was more than $100,000.It surprised nearly everyone that the Hatches had so much money,more than $3 million—they were an elderly。

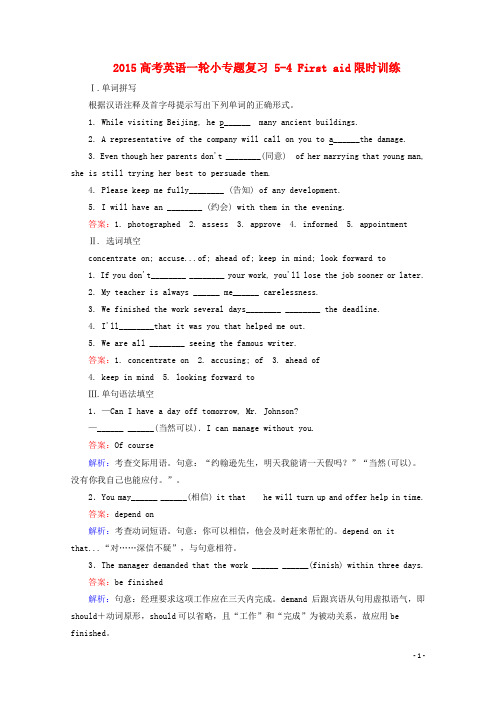

高考英语一轮小专题复习 54 First aid限时训练

2015高考英语一轮小专题复习 5-4 First aid限时训练Ⅰ.单词拼写根据汉语注释及首字母提示写出下列单词的正确形式。

1. While visiting Beijing, he p______ many ancient buildings.2. A representative of the company will call on you to a______the damage.3. Even though her parents don't ________(同意) of her marrying that young man, she is still trying her best to persuade them.4. Please keep me fully________ (告知) of any development.5. I will have an ________ (约会) with them in the evening.答案:1. photographed 2. assess 3. approve 4. informed 5. appointment Ⅱ. 选词填空concentrate on; accuse...of; ahead of; keep in mind; look forward to1. If you don't________ ________ your work, you'll lose the job sooner or later.2. My teacher is always ______ me______ carelessness.3. We finished the work several days________ ________ the deadline.4. I'll________that it was you that helped me out.5. We are all ________ seeing the famous writer.答案:1. concentrate on 2. accusing; of 3. ahead of4. keep in mind5. looking forward toⅢ.单句语法填空1.—Can I have a day off tomorrow, Mr. Johnson?—______ ______(当然可以).I can manage without you.答案:Of course解析:考查交际用语。

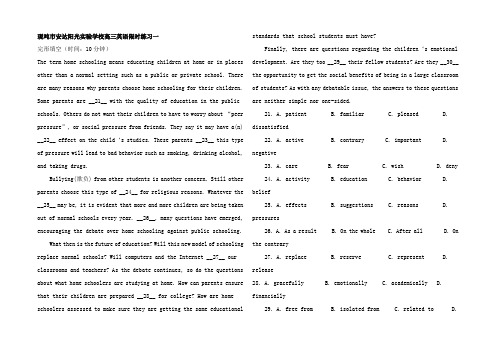

高三英语高考复 习限时训练一(答案及解析)

现吨市安达阳光实验学校高三英语限时练习一完形填空(时间:10分钟)The term home schooling means educating children at home or in places other than a normal setting such as a public or private school. There are many reasons why parents choose home schooling for their children. Some parents are __21__ with the quality of education in the public schools. Others do not want their children to have to worry about “peer pressure”, or social pressure from friends. They say it may have a(n) __22__ effect on the child‘s studies. These parents __23__ this type of pressure will lead to bad behavior such as smoking, drinking alcohol, and taking drugs.Bullying(欺负) from other students is another concern. Still other parents choose this type of __24__ for religious reasons. Whatever the __25__ may be, it is evident that more and more children are being taken out of normal schools every year. __26__, many questions have emerged, encouraging the debate over home schooling against public schooling.What then is the future of education? Will this new model of schooling replace normal schools? Will computers and the Internet __27__ our classrooms and teachers? As the debate continues, so do the questions about what home schoolers are studying at home. How can parents ensure that their children are prepared __28__ for college? How are home schoolers assessed to make sure they are getting the same educational standards that school students must have?Finally, there are questions regarding the children‘s emotional development. Are they too __29__ their fellow students? Are they __30__ the opportunity to get the social benefits of being in a large classroom of students? As with any debatable issue, the answers to these questions are neither simple nor one-sided.21. A. patient B. familiar C. pleased D. dissatisfied22. A. active B. contrary C. important D. negative23. A. care B. fear C. wish D. deny24. A. activity B. education C. behavior D. belief25. A. effects B. suggestions C. reasons D. pressures26. A. As a result B. On the whole C. After all D. On the contrary27. A. replace B. reserve C. represent D. release28. A. gracefully B. emotionally C. academically D. financially29. A. free from B. isolated from C. related to D.close to30. A. providing B. making C. taking D. losing语法填空(时间:10分钟)Carrying Faggots to Put Out a FireIn the last years of the Warring States period, the State of Qin attacked the State of Wei ____31_____ a large scale repeatedly and occupied large areas of land. In 273 B.B., the Qin army launched another attack upon the State of Wei. The king of the State of Wei summoned____32_____officials,and asked with a ____33_____ (worry) look if anyone could propose a way to defeat the Qin army. Most of the officials persuaded the king to sue for peace, at the cost of giving away to the State of Qin the large area of land. However, Su Dai, a counsellor, did not agree. "Once there was a man ____34_____ house was on fire. People told him to put out the fire with water, but he would not listen.____35_____, he carried a faggot to put out the fire, only to make the fire ____36_____ (fierce). That was ____37_____ he didn't knowthat,instead of putting out the fire, faggots could only make it burning more vigorously. Isn't it equal to ____38_____ (carry) faggots to put out a fire if you agree to sue for peace at the cost of the land of the State of Wei?"Though Su Dai's argument was very convincing, the king accepted the ____39_____ (suggest) of those officials and gave away to the State of Qin a large area of the land of the State of Wei. ____40_____ might be expected, the Qin army attacked the State of Wei on a large scale in 225 B.C. The State of Wei was finally destroyed by the State of Qin.积累短语:1. 大规模地_________________________2. 同于做某事___________________________3.带着忧虑的表情______________________________________________________________4. 正如所期盼的________________________________________________________________阅读理解(时间:20分钟)AMany years ago my student asked me the question, "Mrs. Kindred, why do you teach?" Without taking time to reflect, I answered, "Because someday I might say something that might make a difference in someone's life." Even though I was sincere, that wasn't a very good answer and my student didn't let it slide."Let me get this straight," he said, "You went to college for four years so you could come here every day because you have the hope that someday you might say something that will influence someone?" He shook his head as if I were crazy and walked away looking confused. I'm one of those people who look back and wish they had said something smart or witty,or swift.Even though that particular student might no longer wonder why I teach, there are days when I wonder. On those days, I remind myself of the real reasons I teach:It's in my blood. My mother was my most influential teacher, and she was a 6th grade reading teacher until her death in 1990. She instilled(逐渐灌输) in me a love of reading and the knowledge that education opens doors.Teaching is a way to make a difference. If you throw a stone in a pond the ripples go on and on until they reach the shore. You can't have ripples without a "stone." Good teachers throw stones that make a positive difference, and that's what I strive to do.I genuinely love teenagers.I want to share with others what I know and what I have learned through the years. Life is full of ups and downs, and if I can help students avoid some potholes on the road of life, I want to do so. If they'll allow me to celebrate their victories with them, I want to do too.Teaching isn't for everyone, but I know I made the right career choice.41. Why did the student continue to ask the question about the writer’s being a teacher?A. Because he thought her answer was unbelievable.B. Because the writer was insincere.C. Because the student was naughty.D. Because the answer was difficult to understand.42. What do you think of the writer?A. Stupid.B. Honest.C. Conservative.D. Polite.43. According to the text, which of the following is NOT true?A. The writer’s mother has the greatest influence on her.B. The writer’s answer made the student confused.C. In the writer’s opinion, some people in the world are unfit to teach.D. The writer annoyed the student who asked the question.44. We can infer from the text that _________.A. the writer was also a good teacher in schoolB. the writer often plays with her students beside a pondC. the writer devotes herself to teaching and her studentsD. the writer often accompanies the students on their way home45. What’s the main idea of the text?A. A student’s silly question.B. A good teacher who likes students.C. A confused student.D. The reason why I teach.BAmong various programs, TV talk shows have covered every inch of spaceon daytime television. And anyone who watches them regularly knows that each one is different in style. But no two shows are more opposite in content, while at the same time standing out above the rest, than the Jerry Springer and Oprah Winfrey shows.Jerry Springer could easily be considered the king of "rubbish talk". The topics on his show are as surprising as can be. For example, the show takes the ever-common talk show titles of love, sex, cheating, and hate, to a different level. Clearly, the Jerry Springer show is about the dark side of society, yet people are willing to eat up the troubles of other people's lives.Like Jerry Springer, Oprah Winfrey takes the TV talk show to its top. But Oprah goes in the opposite direction. The show is mainly about the improvement of society and different quality of life. Contents are from teaching your children lessons, managing your work week, to getting to know your neighbors.Compared to Oprah, the Jerry Springer show looks like poisonous waste being poured into society. Jerry ends every show with a "final word". He makes a small speech about the entire idea of the show. Hopefully, this is the part where most people will learn something very valuable. Clean as it is, the Oprah show is not for everyone. The show's main audience are middle-class Americans. Most of the people have the time, money and ability to deal with life's tough problems. Jerry Springer, on the other hand, has more of a connection with the young adults of society. These are 18-to 21year-olds whose main troubles in life include love, relationship, sex, money and drug. They are the ones who see some value and lessons to be learned through the show's exploitation.46. Compared with other TV talk shows, both the Jerry Springer and the Oprah Winfrey shows are ______.A. more interestingB. unusually poplarC. more detailedD. more formal47. Though the social problems Jerry Springer talks about appear unpleasant, people who watch the shows ______.A. show disbelief in themB. are ready to face up to themC. remain cold to themD. are willing to get away from them48. Which of the following is likely to be a topic of the Oprah Winfrey show?A. A new type of robot.B. National hatred.C. Family income planning.D. Street accident.49. We can learn from the passage that the two talk shows ____.A. have become the only ones of its kindB. exploit the weaknesses in human natureC. appear at different times of the dayD. attract differentpeople50. What is the advantage of the Jerry Springer show?A. The show exposes the dark sides of society.B. The show pours poisonous waste into society.C. Jerry sums up the whole idea of the show.D. Jerry talks abou the improvement of society.CCan people change their skin colour without suffering like pop king Michael Jackson? Perhaps yes. Scientists have found the gene that determines skin colour.The gene comes in two versions, one of which is found in 99 per cent of Europeans. The other is found in 93 to 100 per cent of Africans, researchers at Pennsylvania State University report in the latest issue of Science.Scientists have changed the colour of a dark-striped zebrafish to uniform gold by inserting a version of the pigment(色素) gene into a young fish. As with humans, zebrafish skin colour is determined by pigment cells, which contain melanosomes(黑色素). The number, size and darkness of melanosomes per pigment cell determines skin colour.It appears that, like the golden zebrafish, light-skinned Europeans also have a mutation(变异) in the gene for melanosome production. This results in less pigmented skin.However, Keith Cheng, leader of the research team, points out that the mutation is different in human and zebrafish genes.Humans acquired dark skin in Africa about 1.5 million years ago to protect bodies from ultra-violet rays of the sun(太阳光紫外线), which can cause skin cancer.But when modern humans leave Africa to live in northern latitudes, they need more sunlight on their skin to produce vitamin D. So the related gene changes, according to Cheng.Asians have the same version of the gene as Africans, so they probably acquired their light skin through the action of some other gene that affects skin colour, said Cheng.The new discovery could lead to medical treatments for skin cancer. It also could lead to research into ways to change skin colour without damaging it like chemical treatment did on Michael Jackson.51. The passage mainly tells us that ________.A. people can not change their skin colour without any painB. the new discovery could lead to search into ways to change skin colour safelyC. pop king Michael Jackson often changed his skin colour as he likedD. scientists have found out that people’s skin colour is determined by the gene52. It can be inferred from the passage that ________.A. nowadays people who want to change their skin colour have to suffer a lot from the damage caused by the chemical treatmentB. Europeans and Africans have the same geneC. the new discovery could help to find medical treatments for skin cancerD. there are two kinds of genes53. Scientists have done an experiment on a dark-striped zebra fish in order to ________.A. find the different genes of humans’B. prove the human s’ skin colour is determined by the pigment geneC. find out the reason why the African s’ skin colour is darkD. find out the ways of changing peopl’s skin colour54. The reason why Europeans are light-skinned is probably that ________.A. they are born light-skinned peopleB. light-skinned Europeans have mutation in the gen for melanosome productionC. they have fewer activities outsideD. they pay much attention to protecting their skin55. The writer’s attitude towards the discovery is ________.A. neutralB. negativeC. positiveD. indifferent参考答案完形填空21-30 DDBBC AACBD语法填空31. on 32. his 33. worried 34. whose 35. Instead 36. fiercer 37. because 38. carrying 39. suggestion40. As阅读理解A 篇:本文主要讲述作者从教的理由。

2009高一英语阅读理解专讲专练05

When someone says, “Well, I guess I’ll have to face the music① ”, it doesn’t mean that he is planning to go to hear a singer or attend a concert. It is something far less unhappy than you are called in by your leader to explain why you did this and that or why you did not do this or that.② At some time or another, every one of us has to “face the music”, especially(尤其) as children. We can all remember father’s angry words “I want to talk to you”. And only because we did not listen to him. What a bad thing it was! In the middle or at the end of every term, we students have to “face the music”. The result of the exam will decide whether we will face the music or not. If...that means parents faces and contempt(轻视) of the teachers and classmates. “To face the music” is well known to every American, young or old. It is at least 100 years old. It really means that you have to do something, no matter(无论) how terrible the whole thing might be, because you know you have no choice. 1. “To face the music” means “to____ ”. A. do something that we don’t like to C. go to the music show A. we don’t do a good job C. the exam is easy B. go to the theatre D. do something that we want to B. we get an “A” in the exam D. the exam is difficult 阅读专项 第 031 页 cold

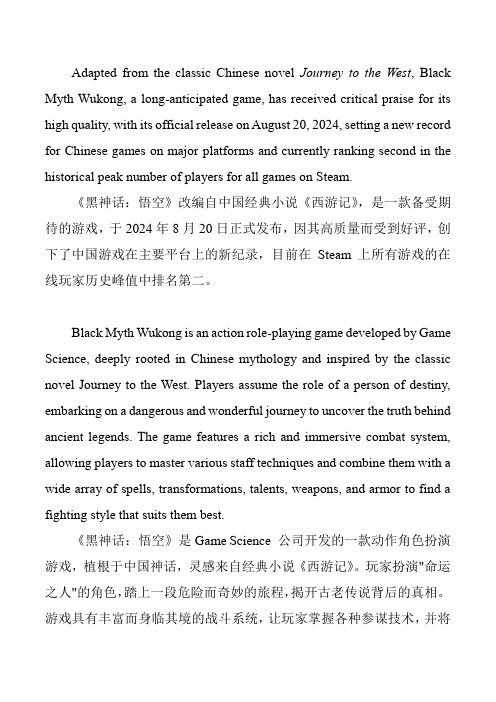

《黑神话:悟空》高中英语双语阅读(5)

Adapted from the classic Chinese novel Journey to the West, Black Myth Wukong, a long-anticipated game, has received critical praise for its high quality, with its official release on August 20, 2024, setting a new record for Chinese games on major platforms and currently ranking second in the historical peak number of players for all games on Steam.《黑神话:悟空》改编自中国经典小说《西游记》,是一款备受期待的游戏,于2024年8月20日正式发布,因其高质量而受到好评,创下了中国游戏在主要平台上的新纪录,目前在Steam上所有游戏的在线玩家历史峰值中排名第二。

Black Myth Wukong is an action role-playing game developed by Game Science, deeply rooted in Chinese mythology and inspired by the classic novel Journey to the West. Players assume the role of a person of destiny, embarking on a dangerous and wonderful journey to uncover the truth behind ancient legends. The game features a rich and immersive combat system, allowing players to master various staff techniques and combine them with a wide array of spells, transformations, talents, weapons, and armor to find a fighting style that suits them best.《黑神话:悟空》是Game Science 公司开发的一款动作角色扮演游戏,植根于中国神话,灵感来自经典小说《西游记》。

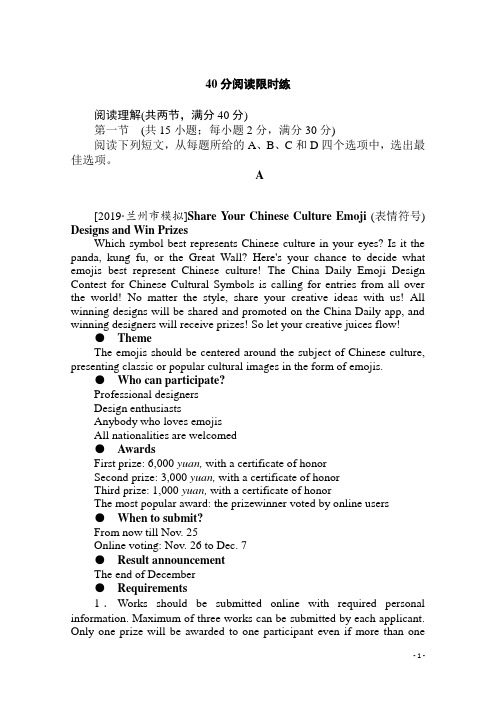

2020年高考英语复习40分阅读理解限时训练

40分阅读限时练阅读理解(共两节,满分40分)第一节(共15小题;每小题2分,满分30分)阅读下列短文,从每题所给的A、B、C和D四个选项中,选出最佳选项。

A[2019·兰州市模拟]Share Your Chinese Culture Emoji (表情符号) Designs and Win PrizesWhich symbol best represents Chinese culture in your eyes? Is it the panda, kung fu, or the Great Wall? Here's your chance to decide what emojis best represent Chinese culture! The China Daily Emoji Design Contest for Chinese Cultural Symbols is calling for entries from all over the world! No matter the style, share your creative ideas with us! All winning designs will be shared and promoted on the China Daily app, and winning designers will receive prizes! So let your creative juices flow!●ThemeThe emojis should be centered around the subject of Chinese culture, presenting classic or popular cultural images in the form of emojis.●Who can participate?Professional designersDesign enthusiastsAnybody who loves emojisAll nationalities are welcomed●AwardsFirst prize: 6,000 yuan, with a certificate of honorSecond prize: 3,000 yuan, with a certificate of honorThird prize: 1,000 yuan, with a certificate of honorThe most popular award: the prizewinner voted by online users●When to submit?From now till Nov. 25Online voting: Nov. 26 to Dec. 7●Result announcementThe end of December●Requirements1.Works should be submitted online with required personal information. Maximum of three works can be submitted by each applicant. Only one prize will be awarded to one participant even if more than onework by the same designer is selected.2.Submitted works must be a group, with 8 to 16 emojis in each group. Formats: jpg/png/gif/jpge. Size:240 × 240px. Each picture should not exceed (超过) 100K, and the size of each group should not exceed 1.6M.3.The work title, designing ideas and cultural meaning should be submitted as required.●OrganizerChina Daily Website体裁:应用文题材:广告主题:设计中国文化表情符号的参赛信息【语篇解读】本文是一篇应用文,主要介绍了设计中国文化表情符号的参赛信息,包括比赛主题、参赛对象、奖品、提交作品时间等。

高考英语阅读理解专项限时训练1

高考英语阅读理解专项限时训练1第一节阅读下列短文,从每题所给的4个选项 (A、B、C和D) 中,选出最佳选项。

AOff-Peak fares are cheaper tickets for traveling on trains that are less busy, offering good value for money. The tickets may require you to travel at specific times of day, days of the week or on a specific route. Where there is more than one Off-Peak fare for a journey, the cheaper fare is called Super Off-Peak.You can buy Off-Peak tickets any time before you travel, either online or at a local station. The travel restrictions for your Off-Peak ticket will depend on the journey you are making. The tickets must be used on the date shown on the ticket. For Off-Peak return tickets, related journeys must be made on the date shown on your ticket as well.Children aged live lo fifteen get a 50% discount for all Off-Peak fares. Up to 2 children under 5 years can travel free with each fare paying adult. Railcard holders get 1/3 off all Standard Class Off Peak fares. Senior, and disabled Railcard holders also get 1/3 off all First Class Off Peak fares. Please note that minimum fares and time restrictions may apply to tickets bought with a Railcard.If you plan on a train trip with friends or your family, you may get group travel discounts. Three or four can travel for the price of just two adults—leaving everyone more money to spend on the day out! If you are traveling in a group of ten or more at Off-Peak times, you may be able to obtain a further discount through the train company you are traveling with. Contact the train company directly and be aware that you may need to book tickets in advance.For more information, please visit www. .1. An Off-Peak ticket differs from other tickets in .A. its good value for moneyB. its convenienceC. the specific trainsD. travel schedules2. Apart from the Off-Peak fares, you may also save money by .A. becoming a VIPB. traveling at rush timeC. buying tickets onlineD. getting group travel discounts3. What type of writing is this text?A. An announcement.B. A ticket booking guide.C. A business report.D. A travel review.BTipping isn’t a big part of British culture, unlike in North America, where waiters and waitresses are paid below minimum wage, Tips are usually appreciated, but offering a tip of some1services can cause confusion.In casual restaurants, where you pay for your order at a counter but food is brought to your table, tipping is uncommon. You are welcome to leave a pound or two if you wish. In restaurants where you place your order with a waiter or a waitress and receive your food and bill at your table, it’s customary to tip around 10 percent. In some restaurants, a service charge may be added 1o the bill automatically, typically 10 or 12.5 percent. In this case, you don’t need to add a further tip. When you pay by credit card, the machine may ask if you want to add a tip. Check your bill to see if a service charge has already been added before paying—if so you don’t need to add a tip on the machine. You can request the service charge be removed from your bill if you are unhappy with the service. In some cases a restaurant may print “service not included” on the bill or menu. This is a request for a tip. You’re not forced to offer anything, but 10 percent would be normal in this situation. Tipping in cafes and fast food restaurant is not expected.If you use a taxi, round the fare up to the nearest pound shown on the meter. On a journey from or to the airport in a booked minicab you might wish to tip 2 or 3 pounds if the driver helps with your bags.Be sure to check a country’s tipping culture before you start your trip. For more information, visit TripAdvisor com.4. According to the text, in British culture.A. it is necessary to tip if you are served in cafesB. it is confusing to tip if you receive your bill at your tableC. it is customary to tip if “service not included” is printed on the billD. it is compulsory to tip even if the service is unsatisfying in some restaurants5. When you pay by credit card, .A. the service charge can be added on the machineB. the service charge must have been included in the bill automatically.C. the service charge can’t be refusedD. the service charge needn’t be checked before you pay6. If the British taxi meter shows 58.4 pounds, you are expected to pay .A. 58.4 poundsB. 59 poundsC. 61poundsD. 64 pounds7. What is the best title for the text?A. Introduction of TripAdvisor. comB. Occasions for TippingC. Advice on Tipping in RestaurantsD. British Ways to TippingCOur perception of how food tastes is influenced by cultery like knives, forks, and spoons, research suggests.“Size, weight, shape and color all have an effect on flavor,” says a University of Oxford team. Cheese tastes saltier when eaten from a knife rather than a fork; while white spoons make yoghurt2taste better, experiments show.The study in the journal Flavour suggests the brain makes judgments on food even before it goes in the mouth.More than 100 students took part in three experiments looking at the influence of weight, color and shape of cutlery on taste. The researchers found that when the weight of the cutlery is consistent with expectations, this had an influence on how the food tastes. For example, food tasted sweeter on the small spoons than are traditionally used to serve desserts.Color contrast was also an important factor—white yoghurt eaten from a white spoon was rated sweeter that white yoghurt tasted on a black spoon. Similarly, when testers were offered cheese on a knife, spoon, fork or toothpick, they found that the cheese on a knife tasted saltiest.“How we experience food is a multisensory experience involving taste, feel of the food in our mouths, pleasant smells, and he feasting of our eyes,” said Pro. Charles Spence and Dr. Vanessa Harrar. “Even before we put food into our mouths, our brains have made a judgment about it, which affects our overall experience.”Past research has shown that china can change our perception of food and drink. For example, people generally eat less when food is served on smaller plates. “The new research into how the brain influences food perception could help dieters or improve gastronomic(美食的)experiences at restaurants,” said Pro. Spence. He told BBC News: “There’s a lot more to food than what’s on the plate. Many things we thought didn’t matter do. We’re going to see a lot more of neuroscience(神经科学)design around mealtimes.”8. According to the text, we know that the cheese used in the experiment is .A. SaltyB. sourC. sweetD. bitter9. What do we know about the weight of the cutlery in paragraph 3?A. It is important for people.B. People usually don’t care about it.C. It affects how the food tastes.D. It is always different from people’s expectation.10. What does the underlined word “multisensory” in Paragraph 5 probably mean?A. Coming from the senses.B. Involving many different senses.C. Able to feel or perceive.D. Easily affected by other feelings.11. What can we learn from the last paragraph?A. Research on cutlery is of great importance.B. Research into food will be continued in the future.C. Research on the effect of nerves and taste of food will be done.D. Research into plates and food will be carried out in the near future.DA “memory pill” that could aid exam revision and help to prevent people forgetting important3anniversaries may soon be available over the counter.The medicine has been designed originally to help treat Alzheimer’s disease, a disease marked by progressive loss of mental capacity resulting from weakening of the brain cells, but could be adapted and licensed for sale in a weaker form within the next few years.One brand of memory-enhancing (增强记忆的) pill is being developed by the multinational company AstraZeneca together with Targacept, an American company, while Epix Pharmaceuticals, also from the US, is developing another.Both have “Cognitive-enhancing (提高认知的) effects which are aimed at treating patients with age-related memory loss.Steven Ferris, a neurologist and former committee member of the Food and Drug Administration in the US, has predicted that a milder version will be available for healthy consumers as a lifestyle pill available over the counter.Dr. Ferris said: “My view is that one could gain approval, provided you showed the drugs to be effective and safe. It could be a huge market.”There is evidence that mind-improving drugs are already being taken in Britain by healthy users.Provigil, which was used to treat narcolepsy, is being taken by some students to help them stay awake. while Adderall XR and Ritalin, treatments for attention deficit disorder(注意力缺乏症), are being used to help promote concentration.A spokesman of Adderall XR said: “We get a lot of calls from college campuses asking about it. “There are risks though. It can raise blood pressure, people shouldn’t do it.”The Department of Health said it was not illegal to buy the medicines over the Internet, but it was not recommended.Barbara Sahakian, professor of clinical neuropsychology at Cambridge, said: “It’s hard to quantify the scale of the phenomenon but it’s definitely catching on. ’“The reality is that we are not always at our best. After being up at night looking after the kids or travelling. Many people would love to have something to refresh them. It’s not prohibited to drink Red Bull. The principle with cognition enhancers is not so different. ”12. The “memory pill”, as is mentioned in the first paragraph, is not sold over the counter now mainly because .A. it is not safe enoughB. it is not efficient enoughC. it has not yet been mass-producedD. it has not yet been tested on humans13. Epix Phamaceuticals is developing a memory-enhancing pill for .A. adolescentsB. middle-aged people4C. senior citizensD. pupils and students14. What do we learn about the manufactures of Adderall XR?A. They were proud that their drug was popular with college students.B. They developed a milder version of the drug for healthy people.C. They suggested that college students should not use the drug.D. They produced the drug for helping promote concentration.15. According to Barbara Sahakian, Red BullA. is not as effective as it is in reality.B. is able to restore people’s energy.C. involves as much risk as cognition enhancers.D. has the same effect as cognition enhancers.第二节根据短文内容, 从短文后的选项中选出能填入空白处的最佳选项, 选项中有两项为多余选项。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。